Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Noranda Aluminum Holding CORP | a2014q4earningsrelease8-k.htm |

| EX-99.3 - EXHIBIT 99.3 - Noranda Aluminum Holding CORP | a2014q4dividendreleaseexhi.htm |

| EX-99.1 - EXHIBIT 99.1 - Noranda Aluminum Holding CORP | a2014q4earningsreleaseexhi.htm |

4th Quarter 2014 Earnings Conference Call Noranda Aluminum Holding Corp February 18, 2015 10:00 AM Eastern Exhibit 99.2

The presentation and comments made by Noranda’s management on the quarterly conference call contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements about future, not past, events and involve certain important risks and uncertainties, any of which could cause the Company’s actual results to differ materially from those expressed in forward-looking statements, including, without limitation: the cyclical nature of the aluminum industry and fluctuating commodity prices, which cause variability in earnings and cash flows; a downturn in general economic conditions, including changes in interest rates, as well as a downturn in the end-use markets for certain of the Company’s products; fluctuations in the relative cost of certain raw materials and energy compared to the price of primary aluminum and aluminum rolled products; the effects of competition in Noranda’s business lines; Noranda’s ability to retain customers, a substantial number of which do not have long-term contractual arrangements with the Company; the ability to fulfill the business’ substantial capital investment needs; labor relations (i.e. disruptions, strikes or work stoppages) and labor costs; unexpected issues arising in connection with Noranda’s operations outside of the United States; the ability to retain key management personnel; and Noranda’s expectations with respect to its acquisition activity, or difficulties encountered in connection with acquisitions, dispositions or similar transactions. Forward-looking statements contain words such as “believes,” “expects,” “may,” “should,” “seeks,” “approximately,” “intends,” “plans,” “estimates,” “anticipates” or similar expressions that relate to Noranda’s strategy, plans or intentions. All statements Noranda makes relating to its estimated and projected earnings, margins, costs, expenditures, cash flows, growth rates and financial results or to the Company’s expectations regarding future industry trends are forward-looking statements. Noranda undertakes no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they are made and which reflect management's current estimates, projections, expectations or beliefs. For a discussion of additional risks and uncertainties that may affect the future results of Noranda, please see the Company’s filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Forward-Looking Statements & Non-GAAP Measures This presentation contains non-GAAP financial measures as defined by SEC rules. We believe these measures are helpful to investors in measuring our financial performance and comparing our performance to our peers. However, our non-GAAP financial measures may not be comparable to similarly titled non-GAAP financial measures used by other companies. These non-GAAP financial measures have limitations as an analytical tool and should not be considered in isolation or as a substitute for U.S. GAAP financial measures. To the extent we disclose any non-GAAP financial measures, a reconciliation of each measure to the most directly comparable U.S. GAAP measure is available in the Press Release included as an exhibit to the Current Report on Form 8-K to which this presentation is also an exhibit. As such, this presentation should be read in conjunction with our Press Release. 2

Key Takeaways • 4Q-14 reflects sequential and year-over- year improvement • We are on track to return the Smelter to full production by the end of 1Q-15 • We have taken actions to improve our performance and cash flow, while also investing in the business – Substantially completed important phase of expanding port in Jamaica – Continuing to improve reliability by strengthening technical & process talent – Currently working to secure electricity rate reduction at New Madrid • Our key operating metrics for 2015 reflect improved performance and reliability Financial Overview • Total segment profit—$49.6 million(1) • Net income, excluding special items— $0.14 per share • Average realized Midwest Transaction Price—$1.12/pound • Net Cash Cost—$0.80/lb • Operating cash flow—$26.4 million; Cash used in investing activities—$33.5 million • Total liquidity(2)— $158.3 million 4th Quarter 2014 Summary (1) Segment profit (in which certain items, primarily non-recurring costs or non-cash expenses, are not allocated to the segments and in which certain items, primarily the income statement effects of current period cash settlements of hedges, are allocated to the segments) is a measure used by management as a basis for resource allocation. See slide 13 for a reconciliation of segment profit to net loss, excluding special items. (2) Liquidity includes $137.8 million available borrowing capacity under the revolving credit facility plus $20.5 million cash. 3

US Aluminum Demand Growth Outlook Sector Noranda Product End-Use Applications US Demand Growth Outlook 1 Building & construction • Doors and windows • Curtain wall and store fronts • Shower and tub enclosures • Stadium seating 4% to 7% Electrical • Power transmission units and lines • Electrical wire • Various types of cable 4% to 6% Consumer durables • HVAC equipment • Recreational equipment (boats, golf-carts, etc.) 3% to 7% Foil & packaging • Semi-rigid containers • Flexible packaging • Household foil Flat Transportation • Component parts • Automotive HVAC • Trailers and semi’s • High purity for aerospace 8% to 11% 1 Based on CRU forecasts of US semi-finished goods consumption from 2015 to 2019; source: CRU Aluminum Market Outlook, January 2015 4 Strong demand provides opportunities to grow with our current customers and to follow the spread of aluminum into new applications.

Restarted; 14% Expect to restart before 2017; 30% Possible restart after 2016; 15% Likely to be permanent; 41% Majority of 5.5 MMT of 2013 & 2014 Closures Unlikely to Restart in Near-Term Aluminum’s demand fundamentals continue to be strong • Global economy continues to become more aluminum-intensive • Medium/long term outlook for aluminum demand remains attractive: – Aluminum market share gains in the auto sector – Positive demographics and income growth in the Emerging World (excluding China) Improved global supply-side dynamics appear sustainable • 5.5 MMT of smelting capacity curtailed in 2013 and 2014 • Potential capacity restarts are not a significant factor – ~85% of capacity curtailed in 2013 and 2014 remains closed – Only 35% of remainder expected to restart before 2017 • Additional Chinese smelter closures are expected as regional governments lack resources to support high cost smelters • Lack of greenfield projects outside China indicates production growth will be modest over the next ten years Macro-economic conditions will drive volatility, but do not change favorable underlying fundamentals • Strong appreciation in the US dollar has had negative impact on aluminum prices • Slower Chinese growth and growing aluminum surplus in China likely to weigh on prices throughout 2015 Aluminum Fundamentals 5 Aluminum’s demand fundamental continue to be strong, and improved global supply-side dynamics appear sustainable. Macro- economic headlines will continue to drive near-term volatility, but do not change positive underlying fundamentals. Source: CRU Aluminum Market Outlook, January 2015 Source: CRU Aluminum Market Outlook, January 2015 3.3 2.1 2.7 3.5 4.2 1.5 2.5 3.5 4.5 1970 1980 1990 2000 2010 2020 2030 2040 (thou sand tons of a lu m in u m c onsu m pt ion p e r bi ll io n do ll ar o f g loba l WAP I) The Global Economy Continues to Become More Aluminum-Intensive Source: Harbor Aluminum, February 2015

Primary Aluminum Shipments Bauxite Shipments Quarterly Shipment Information Flat-Rolled Product Shipments Alumina Shipments 6 Primary and Flat-Rolled aluminum products demand remains strong. Aluminum reduction cell issues at smelter negatively affected primary shipments in 2H-2014, but are on improving trend with full production expected by end of 1Q-15.

Progress on Transformation Path 7 These transformational productivity projects target $85 million incremental segment profit over 2013, independent of aluminum price and other commodity price impact. • December 2013 companywide workforce reduction complete, and is primary source of incremental productivity through December 2014. • Evaluating potential for further reductions. Labor Efficiency & Headcount Reductions ~$15 million or more/year EBITDA impact • Currently working to achieve sustainable electricity rate for the Smelter through general rate case. • Collaborating with Ameren and consumer groups to develop a global settlement that would include a reduction New Madrid's electricity rate. • Rate case decision expected in May 2015, with effective date of June 1, 2015. New Madrid Electricity Rate Reduction ~$40 million/year EBITDA impact • Completed project to increase depth of dock berth and shipping channel in Jamaica (affects Alumina, Bauxite): $11 million investment. • Construct new rod mill at New Madrid: $54-$57 million cost, with 4Q-15 completion. • Reconfigure bauxite unloading infrastructure at Gramercy (affects Alumina): $12 million investment; expect completion by end of 2015. In-Process Capital Projects ~$20 million/year EBITDA impact • Bauxite and Alumina: Improve usage rates and eliminate cost activities, improve operational predictability. • Primary: Identify alternative sources and more favorable pricing for key inputs, improve usage rates and eliminate cost activities. • Flat-Rolled: Grow capacity by improving utilization & de-bottlenecking, improve operational predictability. Other ~$10+ million/year EBITDA impact

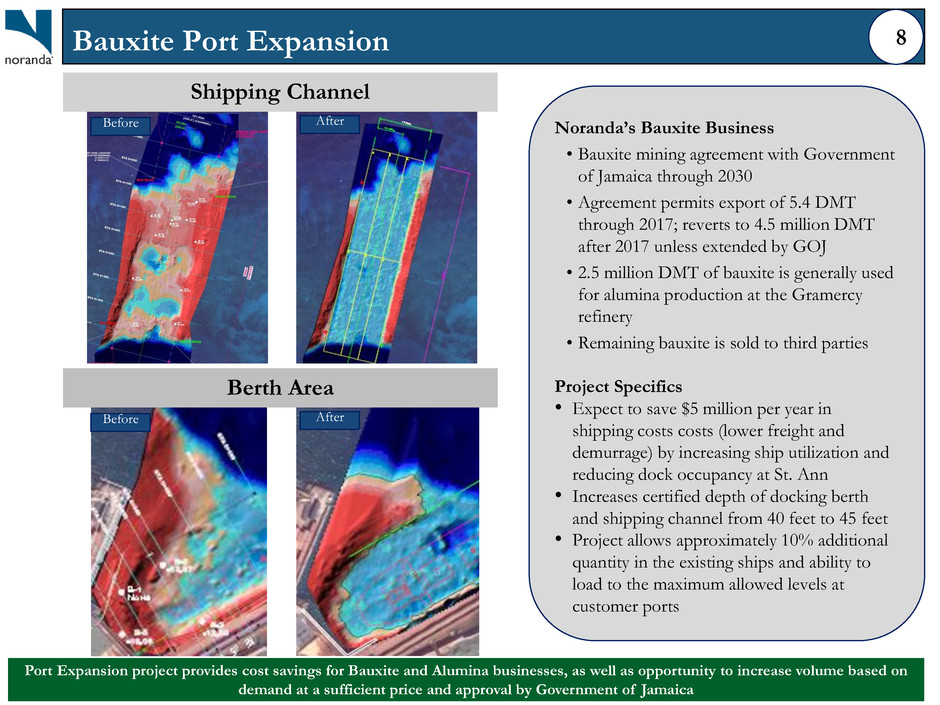

Bauxite Port Expansion 8 Port Expansion project provides cost savings for Bauxite and Alumina businesses, as well as opportunity to increase volume based on demand at a sufficient price and approval by Government of Jamaica Noranda’s Bauxite Business • Bauxite mining agreement with Government of Jamaica through 2030 • Agreement permits export of 5.4 DMT through 2017; reverts to 4.5 million DMT after 2017 unless extended by GOJ • 2.5 million DMT of bauxite is generally used for alumina production at the Gramercy refinery • Remaining bauxite is sold to third parties Project Specifics • Expect to save $5 million per year in shipping costs costs (lower freight and demurrage) by increasing ship utilization and reducing dock occupancy at St. Ann • Increases certified depth of docking berth and shipping channel from 40 feet to 45 feet • Project allows approximately 10% additional quantity in the existing ships and ability to load to the maximum allowed levels at customer ports Shipping Channel Berth Area Before After Before After

Segment Profit Summary 9 Segment profit improvement is a result of (i) higher integrated upstream margin per pound, driven by improved aluminum prices, (ii) strong flat-rolled product volumes and margin, and (iii) lower corporate costs. Quarterly Results Annual Results (amounts in millions except per pound data) Q4-13 Q3-14 Q4-14 2013 2014 Integrated Upstream Business Primary shipments (lbs) 150.5 140.9 131.4 589.2 557.4 Integrated Upstream margin/lb: Midwest Transaction Price/lb $ 0.90 $ 1.08 $ 1.12 0.95 1.03 Integrated net cash cost /lb 0.78 0.90 0.80 0.83 0.86 0.13 0.18 0.32 0.13 0.17 Integrated Upstream segment profit $ 19.2 $ 25.0 $ 42.3 $ 74.2 $ 96.4 Flat-Rolled Products Business Flat-Rolled shipments (lbs) 76.6 103.0 85.7 372.5 383.0 EBITDA margin/lb $ 0.11 $ 0.17 $ 0.14 $ 0.13 $ 0.15 Flat-Rolled Products segment profit $ 8.4 $ 17.6 $ 12.3 $ 50.0 $ 55.9 Corporate Cost $ (6.8) $ (6.0) $ (5.0) $ (31.1) $ (25.0) Total segment profit $ 20.8 $ 36.6 $ 49.6 $ 93.1 $ 127.3

Sequential Net Cash Cost and Segment Profit Bridges $0.75 $0.80 $0.12 $0.01 $0.01 $0.05 $0.87 3Q14 Net Cash Cost, Excluding Primary Production Issues Season Peak Power Surcharge (New Madrid) LME Price for 3rd Party Alumina Shipments Commodity-based and Other 4Q14 Net Cash Cost, Excluding Primary Production Issues Primary Production Issues 4Q14 Net Cash Cost Net Cash Cost Per Pound $60.5 $49.6 $3.0 $10.9 $15.1 $6.4 $42.0 3Q14 Segment Profit, excluding Primary Production Issues Seasonal Peak Power Surcharge (New Madrid) LME & MWP Impact Seasonal Decline in Flat-Rolled Products Volumes, Other 4Q14 Segment Profit, excluding Primary Production Issues Primary Production Issues 4Q 2014 Segment Profit Segment Profit (in millions) 10 Sequential quarter improvement in segment profit driven by higher aluminum prices and relief from seasonal peak-power surcharges in the Primary segment.

Full Year Net Cash Cost and Segment Profit Bridges $0.82 $0.86 $0.02 $0.01 $0.02 $0.02 $0.02 $0.83 2013 Net Cash Cost Natural Gas Price Commodity-Based Input Prices and other Productivity 2014 Net Cash Cost (Ex. Disruptions) 1H-14 Alumina/Primary Weather-Related Disruptions Lower 2H-14 Primary Production Levels 2014 Net Cash Cost Net Cash Cost Per Pound $160.1 $127.3 $14.5 $16.5 $16.3 $46.6 $18.6 $16.3 $93.1 2013 Segment Profit LME & Mid-West Premium Impact Natural Gas Price Commodity-Based Input Prices and Other Productivity 2014 Segment Profit (Ex. Disruptions) 1H-14 Alumina/Primary Weather-Related Disruptions 2H-14 Primary Production Issues 2014 Segment Profit Total Segment Profit (in millions) 11 Segment profit improvement from 2013 to 2014 driven by higher aluminum prices and productivity gains.

(amounts in millions) Q4 2013 Q3 2014 Q4 2014 Segment profit $ 20.8 $ 36.6 $ 49.6 LIFO/LCM 3.7 (2.2) (1.7) Other recurring non-cash items (2.1) (3.7) (1.6) EBITDA, excluding special items 22.4 30.7 45.7 Depreciation & amortization (25.1) (21.7) (23.8) Interest expense, net (12.6) (12.6) (12.7) Pre-tax income (loss), excluding special items (15.3) (3.6) 10.1 Income tax (benefit), expense (5.1) (0.8) 0.5 Net income (loss), excluding special items $ (10.2) $ (2.8) $ 9.6 Bridge of Segment Profit to Net Income, Ex. Special Items 12 The $12.4 million sequential increase in net income (ex. special items) reflects improved segment profit. The $19.8 million year-over- year increase reflects improved segment profit, partially offset by a change in LIFO impact.

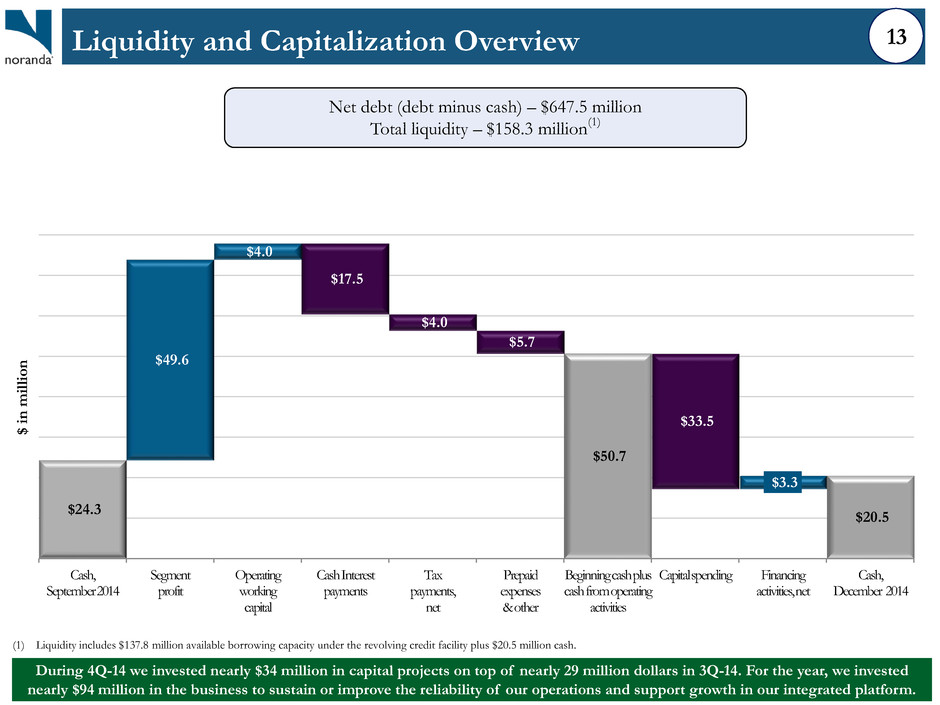

Liquidity and Capitalization Overview $50.7 $20.5 $17.5 $4.0 $5.7 $33.5 $49.6 $4.0 $3.3 $24.3 Cash, September 2014 Segment profit Operating working capital Cash Interest payments Tax payments, net Prepaid expenses & other Beginning cash plus cashfrom operating activities Capital spending Financing activities, net Cash, December 2014 $ in m illi o n (1) Liquidity includes $137.8 million available borrowing capacity under the revolving credit facility plus $20.5 million cash. Net debt (debt minus cash) – $647.5 million Total liquidity – $158.3 million (1) 13 During 4Q-14 we invested nearly $34 million in capital projects on top of nearly 29 million dollars in 3Q-14. For the year, we invested nearly $94 million in the business to sustain or improve the reliability of our operations and support growth in our integrated platform.

2 0 14 Ou tloo k Key 2015 Expectations Driver Annual Outlook Comments Primary Aluminum • Shipments • Integrated Net Cash Cost • 572 to 575 million pounds Excluding power rate relief • $0.75 to $0.78 per pound(1,2) Including power rate relief • $0.70 to $0.73 per pound(3) • Quarterly expectations vs. straight average: Q1 -9%, Q2 +1%, Q3 +3%, Q4 +5% • Additional LME sensitivity: $0.03 decrease for each $0.10 cent increase in LME • Excluding power rate relief, quarterly trends above (below) annual level: Q1 +1%, Q2 -1%, Q3 +4% Q4: -4% • Quarterly impact of rate relief, per pound: Q2 $0.04, Q3 $0.11, Q4: $0.05 Flat-Rolled Products • Shipments • Margin • 385 to 389 million pounds • $0.13 to $0.14 per pound • Quarterly seasonality comparable to 2014 actuals Corporate • $28 to $31 million • Evenly across quarters Other recurring non-cash P&L • $17 to $20 million Non-LIFO • $3 to $5 million LIFO(1) • Total $20 to $25 million • Non-LIFO generally ratable • LIFO sensitive to changes in inventory levels, LME, input costs Capex • $70 to $75 million sustaining • $20 to $25 million incremental growth/productivity spending • Majority of growth/productivity spending capital will be funded by project-specific financing See slide 2 for important information about forward looking statements (1) Based on $0.90 per pound 3-month LME aluminum price (2) Natural gas prices based on $4.25/mmbtu; each $1 change in price = $18.4 million segment profit impact, ~85% of which is in Upstream (3) Based on Noranda’s proposed structure as of December 19, 2014 ($32.50/MWH). 14 Our expected key 2015 operating metrics reflect improved performance and reliability, which we expect to produce further improvements to our cash flow and earnings.

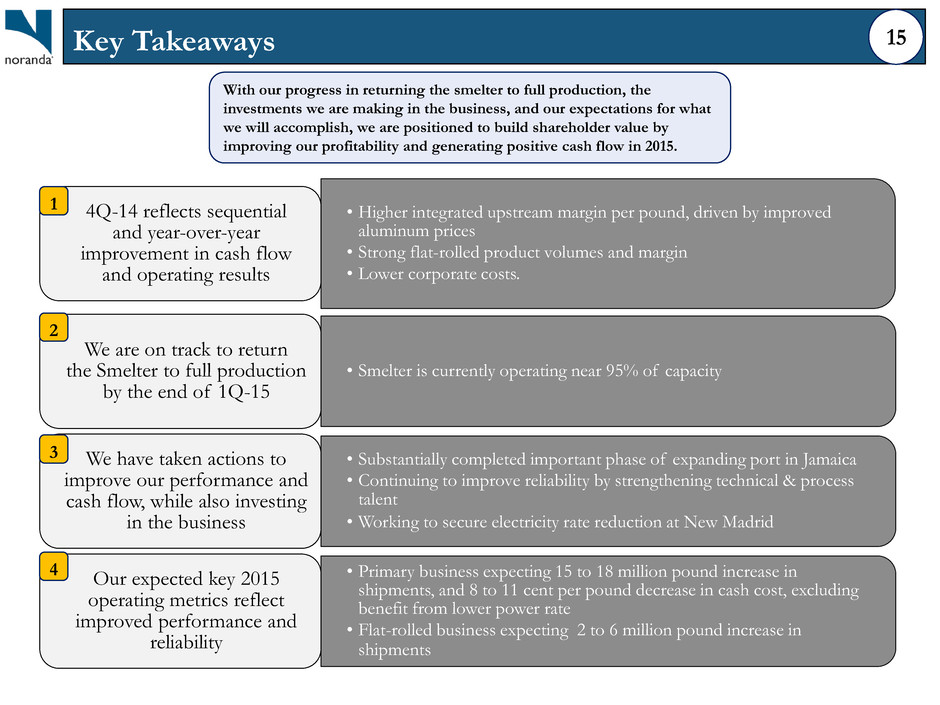

Key Takeaways 15 • Higher integrated upstream margin per pound, driven by improved aluminum prices • Strong flat-rolled product volumes and margin • Lower corporate costs. 4Q-14 reflects sequential and year-over-year improvement in cash flow and operating results • Smelter is currently operating near 95% of capacity We are on track to return the Smelter to full production by the end of 1Q-15 • Substantially completed important phase of expanding port in Jamaica • Continuing to improve reliability by strengthening technical & process talent • Working to secure electricity rate reduction at New Madrid We have taken actions to improve our performance and cash flow, while also investing in the business • Primary business expecting 15 to 18 million pound increase in shipments, and 8 to 11 cent per pound decrease in cash cost, excluding benefit from lower power rate • Flat-rolled business expecting 2 to 6 million pound increase in shipments Our expected key 2015 operating metrics reflect improved performance and reliability With our progress in returning the smelter to full production, the investments we are making in the business, and our expectations for what we will accomplish, we are positioned to build shareholder value by improving our profitability and generating positive cash flow in 2015. 1 2 3 4