Attached files

EXHIBIT 99.2

Fourth Quarter 2014 Conference Call February 17, 2015 Built for success, positioned for growth

Built for success, positioned for growth This presentation contains forward-looking statements that involve risks, uncertainties and assumptions that could cause our results to differ materially from those expressed or implied by such forward-looking statements. All statements, other than statements of historical fact, are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, including, without limitation, any statements regarding our strategy; any statements regarding future utilization; any projections of financial items; future operations expenditures; any statements regarding the plans, strategies and objectives of management for future operations; any statement concerning developments; any statements regarding future economic conditions or performance; any statements of expectation or belief; and any statements of assumptions underlying any of the foregoing. The forward-looking statements are subject to a number of known and unknown risks, uncertainties and other factors including but not limited to the performance of contracts by suppliers, customers and partners; actions by governmental and regulatory authorities; operating hazards and delays; our ultimate ability to realize current backlog; employee management issues; complexities of global political and economic developments; geologic risks; volatility of oil and gas prices and other risks described from time to time in our reports filed with the Securities and Exchange Commission ("SEC"), including the Company's most recently filed Annual Report on Form 10-K and in the Company’s other filings with the SEC, which are available free of charge on the SEC’s website at www.sec.gov. We assume no obligation and do not intend to update these forward-looking statements except as required by the securities laws. Social Media From time to time we provide information about Helix on Twitter (@Helix_ESG) and LinkedIn (www.linkedin.com/company/helix-energy-solutions-group). * Forward-Looking Statements

Built for success, positioned for growth Executive Summary (pg. 4) Operational Highlights by Segment (pg. 8) Key Balance Sheet Metrics (pg. 13) 2015 Outlook (pg. 16) Non-GAAP Reconciliations (pg. 22) Questions & Answers Work class ROV XLX – 88 * Presentation Outline

Built for success, positioned for growth * Executive Summary Q5000 under construction in Singapore

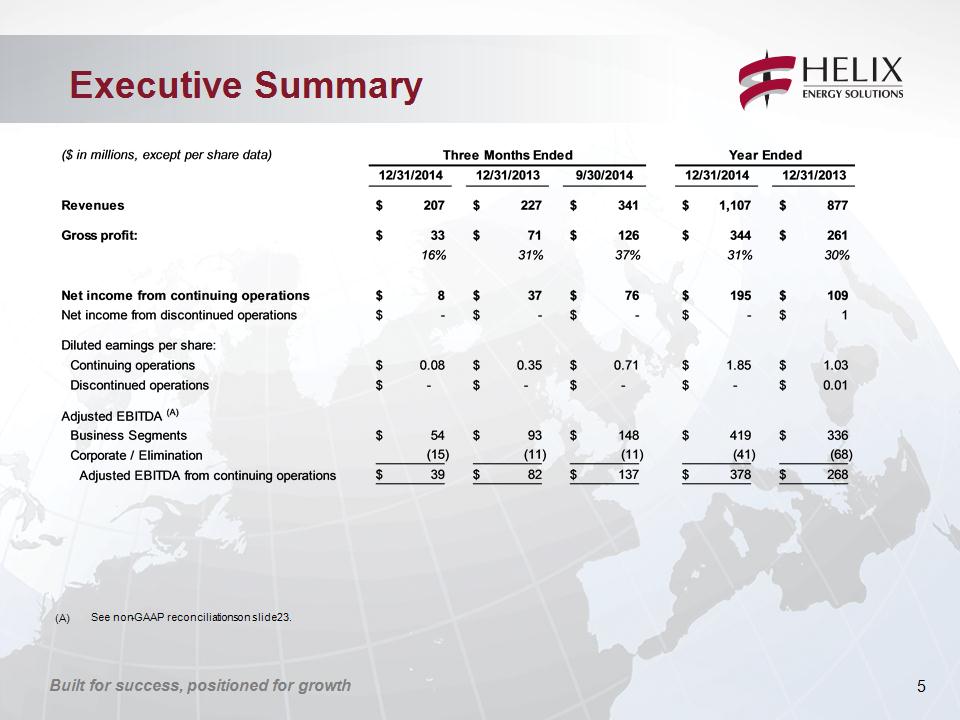

Built for success, positioned for growth See non-GAAP reconciliations on slide 23. * Executive Summary

Built for success, positioned for growth Q4 2014 earnings per diluted share of $0.08 per diluted share compared to $0.71 per diluted share in Q3 2014 67% utilization of well intervention vessels in the fourth quarter Q4000 at 86% utilization for Q4 primarily due to mechanical problems related to the redeployment of its intervention riser system The vessel also worked at reduced rates after downtime due to repairs incurred after being struck by a supply boat H534 utilized 42% during Q4; vessel was idle for 39 days and out of service an additional 14 days for regulatory inspection Combined utilization of 69% across North Sea well intervention fleet during the quarter Skandi Constructor completed regulatory dry dock Seawell entered dry dock in December, which is expected to continue into April 2015 Robotics vessels and ROVs utilized 79% and 73%, respectively, during the fourth quarter * Executive Summary

Built for success, positioned for growth Balance sheet Liquidity* of $1.1 billion at 12/31/2014 Cash and cash equivalents totaled $476 million at 12/31/2014 Net debt of $75 million at 12/31/2014 See updated debt maturity profile on slide 14 We define liquidity as the total of cash and cash equivalents ($476 million) plus unused capacity under our revolving credit facility ($584 million). * Executive Summary

Built for success, positioned for growth Operational Highlights *

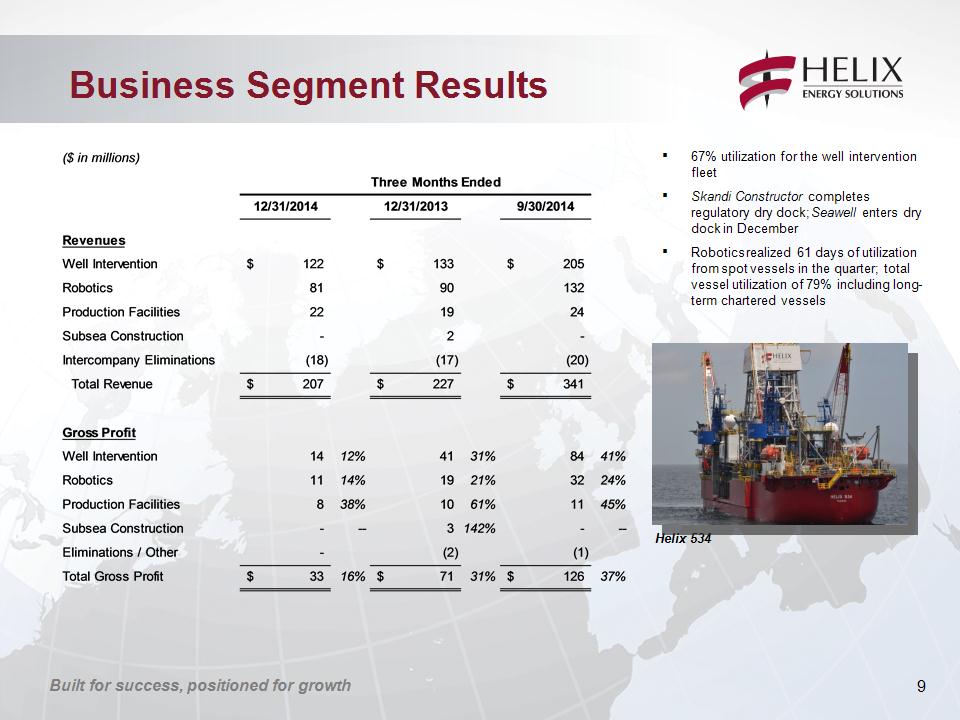

Built for success, positioned for growth 67% utilization for the well intervention fleet Skandi Constructor completes regulatory dry dock; Seawell enters dry dock in December Robotics realized 61 days of utilization from spot vessels in the quarter; total vessel utilization of 79% including long-term chartered vessels * Business Segment Results Helix 534

Built for success, positioned for growth Gulf of Mexico Q4000 was 86% utilized during Q4 due to mechanical problems with its intervention riser system; the vessel also worked at reduced rates while making minor repairs as a result of being struck by a supply boat Helix 534 was 42% utilized during the quarter – vessel was idle for 39 days, plus an additional 14 days out of service for regulatory inspection IRS no. 2 on hire for the entire quarter North Sea Combined utilization of 69% across all three vessels during Q4 on a variety of well intervention projects Seawell fully utilized until entering dry dock in December for refit Skandi Constructor completed its regulatory dry dock in December for recertification Well Enhancer engaged in North Sea projects until departure to Spain for first ever well intervention project in the Mediterranean * Well Intervention NOV tower being installed on the Q5000

Built for success, positioned for growth 79% chartered vessel fleet utilization in Q4 61 days utilized on spot vessels 73% utilization for ROVs, trenchers and ROVDrill Olympic Canyon fully utilized in India during Q4 REM Installer transited to the GOM in October and performed 40 days of ROV support projects for multiple clients during the remainder of the quarter Grand Canyon I completed a cable burial project in the German sector of the North Sea with i-Trencher and T1200; then transited to the Middle East and commenced a multi-month cable burial project offshore Qatar in December Deep Cygnus completed crane maintenance in October, mobilized T1500 and performed 57 days of trenching scopes during the quarter Maersk Responder and Maersk Lifter (spot vessels) completed 2014 trenching campaigns in the North Sea, demobilized and were returned to vessel owners in October * Robotics T-1200 Trencher ROVDrill at Apache 1

Built for success, positioned for growth Olympic Canyon (1) Deep Cygnus (1) Olympic Triton (1,2) Grand Canyon (1) REM Installer (1) Spot vessels (1,3) Seawell Well Enhancer Q4000 Skandi Constructor (1) H534 50 ROVs 2 ROVDrill Units 5 Trenchers Chartered vessel Vessel returned to owner in September 2014. Robotics chartered various spot vessels during Q4 of 2014 for a total of 61 days. * Utilization

Built for success, positioned for growth * Key Balance Sheet Metrics

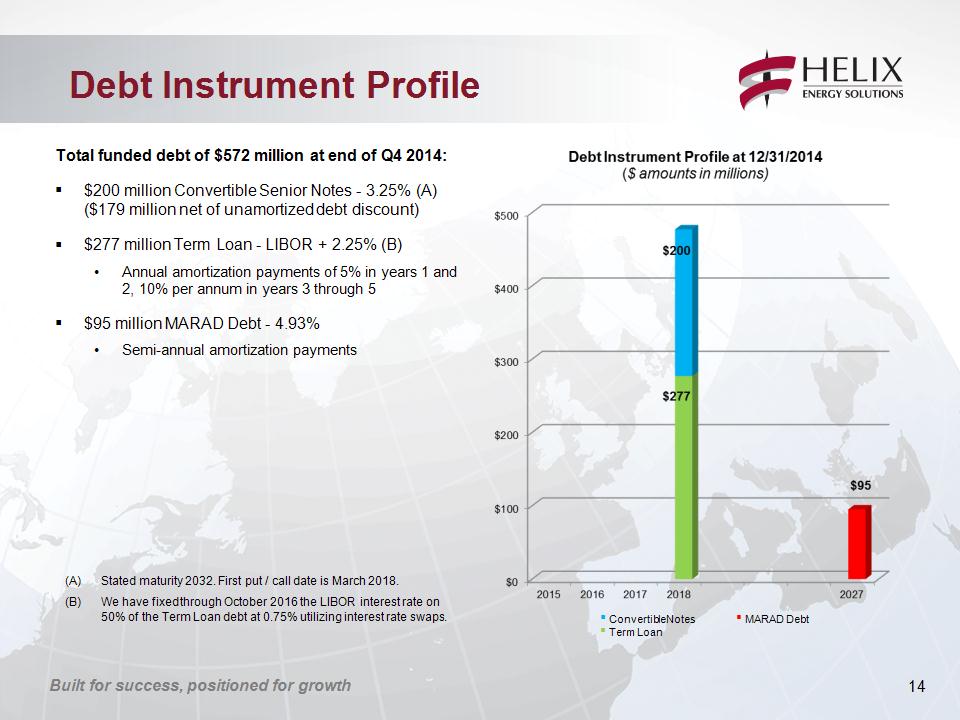

Built for success, positioned for growth Total funded debt of $572 million at end of Q4 2014: $200 million Convertible Senior Notes – 3.25% (A) ($179 million net of unamortized debt discount) $277 million Term Loan – LIBOR + 2.25% (B) Annual amortization payments of 5% in years 1 and 2, 10% per annum in years 3 through 5 $95 million MARAD Debt – 4.93% Semi-annual amortization payments Convertible Notes Term Loan MARAD Debt Stated maturity 2032. First put / call date is March 2018. We have fixed through October 2016 the LIBOR interest rate on 50% of the Term Loan debt at 0.75% utilizing interest rate swaps. * Debt Instrument Profile

Built for success, positioned for growth Liquidity of approximately $1.1 billion at 12/31/2014 ($ amounts in millions) Includes impact of unamortized debt discount under our convertible senior notes. We define liquidity as the total of cash and cash equivalents ($476 million) plus unused capacity under our revolving credit facility ($584 million). * Debt and Liquidity Profile

Built for success, positioned for growth 2015 Outlook *

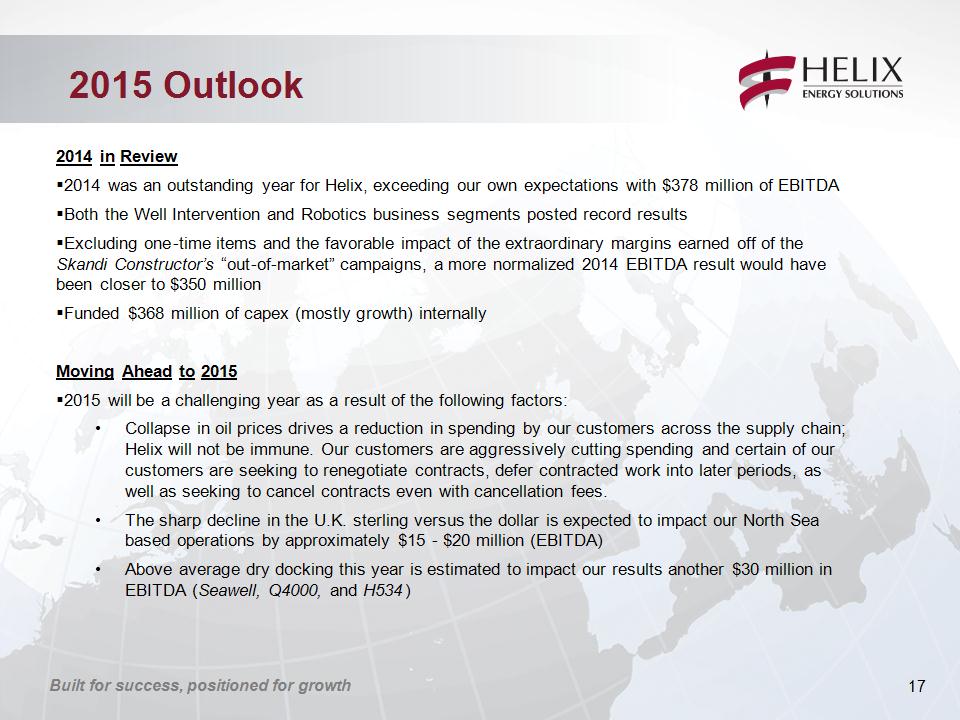

Built for success, positioned for growth * 2015 Outlook 2014 in Review 2014 was an outstanding year for Helix, exceeding our own expectations with $378 million of EBITDA Both the Well Intervention and Robotics business segments posted record results Excluding one-time items and the favorable impact of the extraordinary margins earned off of the Skandi Constructor’s “out-of-market” campaigns, a more normalized 2014 EBITDA result would have been closer to $350 million Funded $368 million of capex (mostly growth) internally Moving Ahead to 2015 2015 will be a challenging year as a result of the following factors: Collapse in oil prices drives a reduction in spending by our customers across the supply chain; Helix will not be immune. Our customers are aggressively cutting spending and certain of our customers are seeking to renegotiate contracts, defer contracted work into later periods, as well as seeking to cancel contracts even with cancellation fees. The sharp decline in the U.K. sterling versus the dollar is expected to impact our North Sea based operations by approximately $15 – $20 million (EBITDA) Above average dry docking this year is estimated to impact our results another $30 million in EBITDA (Seawell, Q4000, and H534)

Built for success, positioned for growth * 2015 Outlook Moving Ahead to 2015 – cont’d Lower oil prices will reduce our “tolling” revenues from the Production Facilities business by an estimated $10 million Q5000 expected to be completed in Q1 and available for service in Q3 of 2015 The current market environment with the collapse in oil prices renders the 2015 outlook challenging, as well as impossible to forecast with any degree of clarity. The combination of factors cited above will produce a 2015 year below 2014 results. We caution that the market situation is very dynamic and therefore we cannot quantify with any degree of certainty, but to say that 2015 is likely to be well below 2014 results.

Built for success, positioned for growth Total backlog as of December 31, 2014 was approximately $2.3 billion, of which approximately $2.1 billion is associated with our Well Intervention and Robotics businesses(1) Both the Q4000 (excluding dry dock) and the Well Enhancer are expected to have good utilization in 2015 A recent customer cancellation (with penalty) for the H534 has left a gap in its schedule; however there is work for the vessel in Q2 / Q3 The Seawell and Skandi Constructor are expected to have lower levels of utilization in 2014 * 2015 Outlook (1) This year end number is subject to customer cancellation and other modifications which is more likely in the current industry environment.

Built for success, positioned for growth Robotics market impacted by the same macro conditions impacting energy markets; record 2014 unlikely to be matched in 2015 Olympic Canyon to continue operations offshore India under firm commitment through June, with two 6-month options remaining on current contract with customer in India Grand Canyon I, T1200 and i-Trencher to complete current cable burial project offshore Qatar Q2 2015 and has backlog for several trenching projects during the summer season Lower activity associated with spot market vessels, as the long-term chartered fleet increases to six vessels by Q3 2015 with Grand Canyon II and III entering the fleet Vessels serving this segment of the market are well over-supplied, but our trenching capabilities provide some stability While we don’t expect Robotics to achieve 2014 record performance, 2015 results should still produce decent results, somewhere between 2013 and 2014 numbers * 2015 Outlook

Built for success, positioned for growth 2015 capex budget of approximately $400 million consisting of the following(1): $305 million in growth capital; primarily for newbuilds currently underway, including: $170 million for Q5000 (includes $15 million contingency) $40 million for Q7000 $65 million for Siem Helix #1 and 2 monohull vessels $15 million in Robotics $15 million for new subsea equipment, including jointly owned with OneSubea $35 million remaining on the Seawell refit in 2015 $60 million in maintenance capital $35 million for the Q4000 and H534 dry dock $20 million in IRS maintenance, spares and upgrades $3 million in Robotics maintenance $2 million in other * 2015 Outlook – Capex (1) Although we have budgeted $400 million, we are seeking to reduce aggregate capex in 2015 whenever possible.

Built for success, positioned for growth Non-GAAP Reconciliations *

Built for success, positioned for growth We calculate Adjusted EBITDA from continuing operations as earnings before net interest expense and other, taxes, depreciation and amortization. This non-GAAP measure is useful to investors and other internal and external users of our financial statements in evaluating our operating performance; it is widely used by investors in our industry to measure a company’s operating performance without regard to items which can vary substantially from company to company, and help investors meaningfully compare our results from period to period. Adjusted EBITDA from continuing operations should not be considered in isolation or as a substitute for, but instead is supplemental to, income from operations, net income and other income data prepared in accordance with GAAP. Non-GAAP financial measures should be viewed in addition to, and not as an alternative to our reported results prepared in accordance with GAAP. Users of this financial information should consider the types of events and transactions which are excluded from this measure. * Non-GAAP Reconciliations

Built for success, positioned for growth Follow Helix on Twitter: @Helix_ESG Join the discussion on LinkedIn: www.linkedin.com/company/helix