Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - Recro Pharma, Inc. | d858738dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on February 13, 2015

Registration Statement No. 333-201841

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

RECRO PHARMA, INC.

(Exact name of registrant as specified in its charter)

| Pennsylvania | 2834 | 26-1523233 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

490 Lapp Road

Malvern, PA 19355

(484) 395-2400

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Gerri A. Henwood

President and Chief Executive Officer

Recro Pharma, Inc.

490 Lapp Rd

Malvern, PA 19355

(484) 395-2400

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Justin P. Klein, Esq.

Katayun I. Jaffari, Esq.

Ballard Spahr LLP

1735 Market Street, 51st Floor

Philadelphia, PA 19103

(215) 665-8500

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x | |||

The registrant is an “emerging growth company,” as defined in Section 2(a) of the Securities Act. This registration statement complies with the requirements that apply to an issuer that is an emerging growth company.

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered(1) |

Proposed Maximum Offering Price Per Unit(2) |

Proposed Maximum Aggregate Offering Price |

Amount of Registration Fee | ||||

| Common Stock, $0.01 par value |

2,500,000 | $2.95 |

$7,375,000 |

$857 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Pursuant to Rule 416, under the Securities Act of 1933, as amended, this registration statement also covers such indeterminate number of additional shares of common stock that become issuable by reason of any stock dividend, stock split or other similar transactions. |

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) under the Securities Act of 1933, as amended, based upon the average of the high and low prices of the common stock on The NASDAQ Capital Market on February 2, 2015. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. The selling shareholder may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and the selling shareholder is not soliciting offers to buy these securities in any state where the offer or sale of these securities is not permitted.

PROSPECTUS, SUBJECT TO COMPLETION, DATED [ ], 2015

2,500,000 Shares

Common Stock

This prospectus relates to the sale of up to 2,500,000 shares of our common stock by Aspire Capital Fund, LLC. Aspire Capital is also referred to in this prospectus as the selling shareholder. The prices at which the selling shareholder may sell the shares will be determined by the prevailing market price for the shares or in negotiated transactions. We will not receive proceeds from the sale of the shares by the selling shareholder. However, we may receive proceeds of up to $10.0 million from the sale of our common stock to the selling shareholder, pursuant to a common stock purchase agreement entered into with the selling shareholder on February 2, 2015, once the registration statement, of which this prospectus is a part, is declared effective.

The selling shareholder is an “underwriter” within the meaning of the Securities Act of 1933, as amended. We will pay the expenses of registering these shares, but all selling and other expenses incurred by the selling shareholder will be paid by the selling shareholder.

Our common stock trades on the NASDAQ Capital Market, or NASDAQ, under the ticker symbol “REPH”. On February 2, 2015, the last reported sale price per share of our common stock was $2.81 per share.

You should read this prospectus and any prospectus supplement, together with additional information described under the heading “Where You Can Find More Information,” carefully before you invest in any of our securities.

Investing in our securities involves a high degree of risk. See “Risk Factors” on page 8 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is [ ], 2015.

Table of Contents

| 1 | ||||

| 8 | ||||

| 37 | ||||

| 38 | ||||

| 42 | ||||

| 42 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

43 | |||

| 50 | ||||

| 78 | ||||

| 85 | ||||

| 91 | ||||

| 94 | ||||

| 97 | ||||

| 98 | ||||

| 102 | ||||

| 103 | ||||

| 105 | ||||

| 105 | ||||

| 105 | ||||

| F-1 |

We have not authorized anyone to provide any information other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We take no responsibility for, or can provide any assurance as to the reliability of, any other information that others may give you. We are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where such offers and sales are permitted. The information in this prospectus or any free writing prospectus is accurate only as of its date, regardless of its time of delivery or of any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

Unless otherwise indicated, information contained in this prospectus concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity and market share, is based on information from our own management estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third parties. Management estimates are derived from publicly available information, our knowledge of our industry and assumptions based on such information and knowledge, which we believe to be reasonable. In addition, assumptions and estimates of our and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.” These and other factors could cause our future performance to differ materially from our assumptions and estimates. See “Special Note Regarding Forward-Looking Statements.”

This prospectus includes trademarks, tradenames and service marks that are the property of other organizations. Solely for convenience, trademarks and tradenames referred to in this prospectus appear without the ® and ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or that the applicable owner will not assert its rights, to these trademarks and tradenames.

Table of Contents

This summary highlights certain information about us, this offering and selected information contained in the prospectus. This summary is not complete and does not contain all of the information that you should consider before deciding whether to invest in our common stock. For a more complete understanding of our company and this offering, we encourage you to read and consider the more detailed information in the prospectus, including “Risk Factors” and the financial statements and related notes. Unless we specify otherwise, all references in this prospectus to “Recro,” “Recro Pharma,” “we,” “our,” “us,” “the Company,” and “our company” refer to Recro Pharma, Inc.

Overview

Our Business

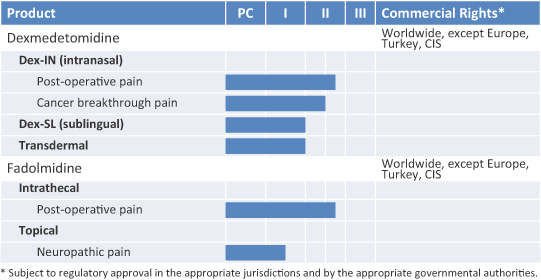

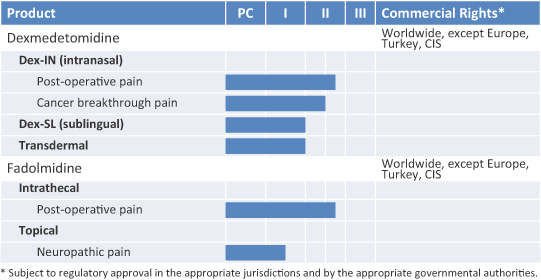

We are a clinical stage specialty pharmaceutical company developing non-opioid therapeutics for the treatment of pain, initially for acute pain following surgery. Our lead product, an intranasal formulation of Dexmedetomidine, or Dex, has completed a placebo controlled trial demonstrating effective pain relief in chronic lower back pain patients. We have studied various dosage forms of Dex in nine completed clinical trials, including two Phase Ib and one Phase II placebo controlled trials. Dex-IN, our proprietary intranasal formulation, is currently being studied in a Phase II clinical trial for acute pain following surgery. Dex, which is in a class of drugs called alpha-2 adrenergic agonists, is a Food and Drug Administration, or FDA, approved and commercial injectable drug sold by Hospira, Inc. in the United States under the brand name Precedex® and by Orion Corporation, or Orion, in Europe under the brand name Dexdor®. As Dex is not in the opioid class of drugs, we believe it will overcome many of the side effects associated with commonly prescribed opioid therapeutics, including addiction, constipation and respiratory distress while maintaining analgesic, or pain relieving, effect. If we are successful in obtaining approval of Dex-IN for post-operative pain, we may elect to pursue an additional approval for cancer breakthrough pain. Upon regulatory approval, our license with Orion and our ownership rights with respect to dosage forms for our product candidates will provide us worldwide commercial rights related to Dex, except in Europe, Turkey and the Commonwealth of Independent States, or CIS, for use in the treatment of pain in humans.

Overview of Dex

Dex is in a class of drugs called alpha-2 adrenergic agonists, which produce their effects by selectively activating the alpha-2 adrenergic receptors in the body and produce a broad range of effects depending on the specific drug and the alpha-receptors it activates, including anti-hypertensive, analgesic and sedative effects. In particular, Dex has demonstrated sedative, analgesic and anxiolytic properties in multiple preclinical and clinical studies, including the new drug application, or NDA, studies for Precedex®. We are currently pursuing a Section 505(b)(2) regulatory strategy for Dex-IN, which allows us to leverage the existing safety data from the NDA of Precedex® and Dexdor® in pursuing a program for a NDA for post-operative pain.

Post-Operative Pain Market

Based upon statistics from the National Center for Health Statistics, it is estimated that there are over 100 million surgeries performed in the United States each year. Of these surgeries, we believe at least 50 million procedures require post-operative pain medication. While opioids are generally considered the most effective and commonly prescribed treatment for post-operative pain, they are known to raise serious concerns due to addiction, respiratory depression and other side effects, including constipation, nausea, vomiting, tolerance and illicit use. Due to their addictive potential, opioids are regulated as controlled substances and are listed on Schedule II and III by the U.S. Drug Enforcement Administration, or DEA. According to the Centers for Disease

1

Table of Contents

Control and Prevention, or CDC, overdose deaths from prescription painkillers have increased significantly over the past 10 years. Prescription painkillers, as defined by the CDC, refers to opioid or narcotic pain relievers, including drugs such as Vicodin® (hydrocodone), OxyContin® (oxycodone), Opana® (oxymorphone), and methadone.

All of these concerns limit the use of opioids and contribute to at least 40% of post-operative patients reporting inadequate pain relief. This reduces the quality of life for individuals and creates an economic burden estimated to be at least $560 to $635 billion a year in medical costs and lost productivity. Accordingly, we believe that physicians and third-party payors, including Medicare and Medicaid, are highly interested in new pain therapies that provide effective pain relief but overcome the concerns and issues associated with opioids.

Clinical and Competitive Advantages of Dex versus Opioids

We believe there is a clear unmet need for effective, well tolerated, non-opioid analgesics that can be used as a component of an effective pain management program. We are initially developing Dex-IN for post-operative pain, such as relief of pain following orthopedic and intra-abdominal surgeries. Based on the profile and labeling for the marketed Dex product, we believe our lead candidate has the potential to offer the following advantages over opioid analgesics:

| • | Dex is not considered a Schedule II nor Schedule III controlled substance as opioid therapeutics are designated; |

| • | Dex has not demonstrated habituative effects, based upon the NDA studies for Precedex®; |

| • | Dex does not cause respiratory depression, a well-documented side effect of opioid use; |

| • | Dex is not associated with constipation, nausea, or vomiting, side effects commonly seen with opioid use, which can lead to poor pain management; |

| • | Dex has been observed to lower morphine requirements while maintaining adequate pain management as demonstrated by the NDA and independent studies; |

| • | Patients utilizing Dex have been observed to be cognitively intact, while patients utilizing opioid analgesics have been reported to become cognitively impaired; and |

| • | Dex has demonstrated anxiolytic properties that help lessen anxiety, which may help with pain management. |

We believe these advantages will translate well into pain indications, some of which we expect to pursue subsequent to receiving FDA approval for Dex-IN for post-operative pain.

Pipeline

Our lead product candidate is Dex-IN, our intranasal formulation of Dex. We are also evaluating multiple formulations of Dex to target a range of pain indications, including breakthrough cancer pain in addition to post-operative pain. In addition to Dex, we have a second alpha-2 agonist candidate under development, Fadolmidine, or Fado, which we believe shows significant promise in neuropathic pain.

2

Table of Contents

Our Completed Clinical Trials of Dex

We have evaluated multiple formulations of Dex in nine completed studies in over 200 subjects, including two Phase Ib and one Phase II placebo-controlled studies, described below, to evaluate the analgesic efficacy, safety and pharmacokinetics of Dex. Based upon the results of these trials, we believe that our formulations of Dex have demonstrated their potential as an analgesic for pain relief. We have chosen to develop Dex-IN over other formulations since it has a faster onset of action while still maintaining analgesic affect, which makes it best suited for post-operative pain and breakthrough pain.

Clinical Study REC-14-013. Our current study of Dex-IN is a Phase II clinical trial in approximately 200 to 250 post-surgical patients. The study is a randomized, multicenter, double-blind, placebo-controlled study to evaluate the efficacy and safety of Dex-IN in adult patients undergoing bunionectomy surgery, initiating dosing of study medication on post-operative day 1, or Post Op Day 1. Following the beginning of treatment, patients will remain under observation for 48 hours at study centers. Patients will be followed for 7 days after the initial dose of study medication. An interim analysis for sample size is planned when approximately half of evaluable patients have been enrolled. We expect to report top-line results by mid-year 2015.

Clinical Study REC-13-012. Our most recently completed study utilized Dex-IN in a double-blind, placebo-controlled study of post-operative patients undergoing bunionectomy surgery beginning on post-operative day 0, or Post Op Day 0. While analgesia and a reduction in opioid use were observed in a subset of patients, we elected to discontinue the study as it was not expected to reach statistical significance. In this study, Dex-IN was well tolerated with no serious adverse events reported. Based on the observations from this study, the input of our advisors in post-operative pain and results observed in earlier Dex pain studies, we believe that an effective clinical strategy would be to study Dex-IN in the management of post-operative pain starting on Post Op Day 1 following bunionectomy surgery. As a result of this belief, we initiated our current study, REC-14-013.

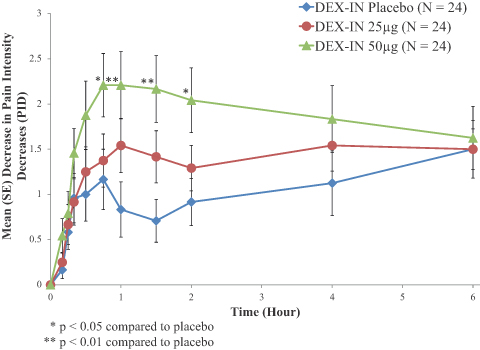

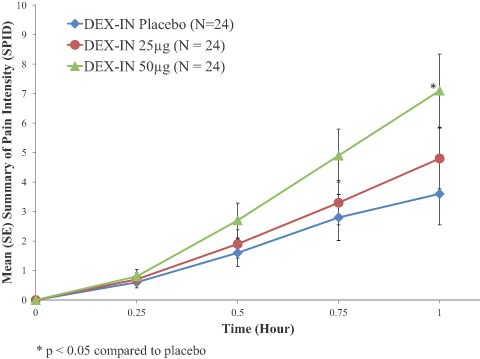

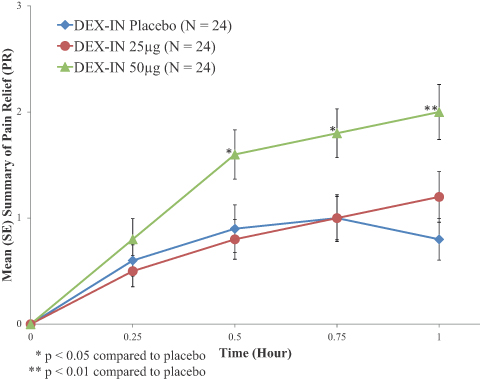

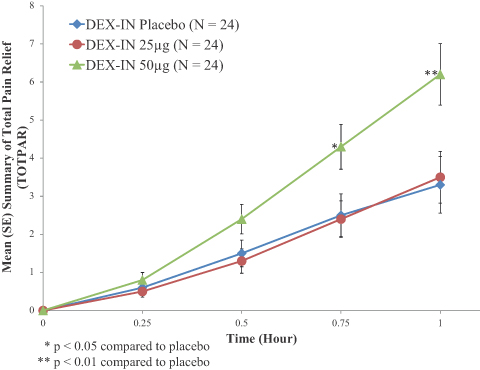

Clinical Study REC-11-010. We previously completed a study utilizing Dex-IN in 24 chronic lower back pain patients. This design was a Phase Ib, randomized, double-blind, placebo-controlled, three-period, cross-over study evaluating the safety, efficacy, and pharmacokinetics of Dex-IN. The patients in this study included both chronic opioid users and opioid-naïve patients. The study compared single doses of placebo, 25mcg of Dex and 50mcg of Dex, all administered using a single-use device.

3

Table of Contents

Generally in this study, a dose of 50mcg of Dex resulted in a rapid onset of analgesia, reaching statistically significant improvement in pain symptoms within 30 minutes of administration and sustained improvement in pain symptoms for up to four hours. The 25mcg dose of Dex also resulted in improved pain symptoms, although it did not statistically differentiate itself from placebo. Doses of Dex were well tolerated in this study. Adverse events, or AEs, were generally mild in intensity and were consistent with the AE profile of Dex in previous studies via intranasal and other routes of administration. The most frequently reported AEs included somnolence, dizziness, nausea, headache, and hypotension. These AEs were not significant enough to cause any subjects to discontinue their participation in the study.

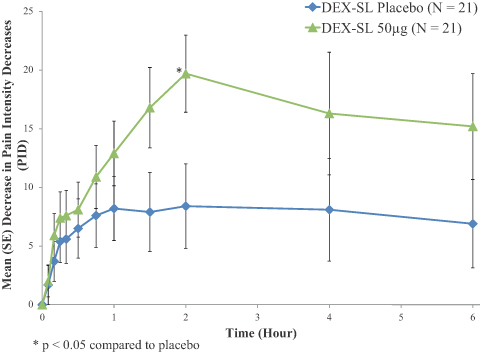

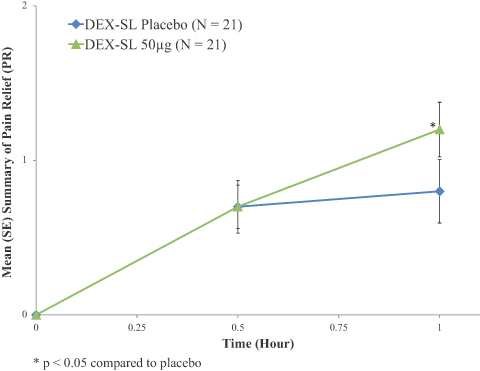

Clinical Study REC-09-003. We utilized a proprietary sublingual formulation of Dex, Dex-SL, in another completed, placebo-controlled study. This study design was a Phase Ib, double-blind, placebo-controlled, two-period, cross-over evaluation of the safety, efficacy, and pharmacokinetics of Dex-SL in 21 chronic lower back pain subjects. This study also included an open-label, repeat dose period to evaluate the safety of two sublingual Dex doses separated by six hours.

In this study, a 50mcg dose of Dex was administered as a spray under the tongue. Similar to our REC-11-010 trial, Dex-SL produced statistically significant improvement in pain symptoms by 60 minutes after administration for chronic lower back pain subjects. Dex-SL produced sustained improvement in pain symptoms for up to six hours after dosing compared to a placebo. AEs experienced in this study were typically mild in severity. In the single-dose, cross-over periods, the most frequently reported AEs were dizziness, nasal congestion and hypotension. In the repeat dosing period, the most frequently reported AEs were orthostatic hypotension, headache and dizziness.

Our Strategy

Our corporate strategy is to further develop our non-opioid therapeutic candidates for multiple pain indications. Our strategy includes:

| • | Focusing on the development of Dex-IN for post-operative pain; |

| • | Developing our candidates through FDA approval and retaining U.S. rights to maximize their potential value; |

| • | Leveraging our management’s development experience for other indications and product candidates; and |

| • | Entering into strategic partnerships to maximize the potential of our product candidates outside of the United States. |

Our Intellectual Property

We have an exclusive license from Orion to commercialize Dex as therapeutically active ingredients for use in the treatment of pain in humans in any dosage form for a variety of delivery vehicles (except for administration by injection or infusion) in the United States, Canada and other countries and territories worldwide other than Europe, Turkey, and the CIS. We also have an exclusive license from Orion for Fado for use in humans in any dose form. Our intellectual property portfolio currently consists of two families: one for Dex and one for Fado. One focus of our claims strategy is on formulation claims and method of treatment claims. The Dex patent application family includes three portfolios of pending patent applications, one for each of sublingual, topical/transdermal, and intranasal formulations of Dex. The Company’s strategy, if successful in obtaining patent protection, could lead to protection of our product candidates through 2030 subject to any extensions or disclaimers. See the “Business — Intellectual Property” section of this prospectus for more information.

Risks Associated with Our Business

Our business is subject to a number of risks of which you should be aware before making an investment decision. See the “Risk Factors” section of this prospectus for a discussion of such risks.

4

Table of Contents

Corporate Information

Our principal executive offices are located at 490 Lapp Road, Malvern, PA 19355, and our telephone number is (484) 395-2470. Our website address is www.recropharma.com. The information contained in, or accessible through, our website does not constitute part of this prospectus.

Implications of Being an Emerging Growth Company

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As an emerging growth company, we may take advantage of specified reduced disclosure and other requirements that are otherwise applicable generally to public companies. These provisions include:

| • | requirement to provide only two years of audited financial statements in addition to any required unaudited interim financial statements with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure; |

| • | reduced disclosure about our executive compensation arrangements; |

| • | no non-binding advisory votes on executive compensation or golden parachute arrangements; and |

| • | exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting under Section 404(b) of the Sarbanes Oxley Act of 2002. |

We have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1) of the JOBS Act. This election allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. As a result of this election, our financial statements may not be comparable to companies that comply with public company effective dates.

We may take advantage of these provisions for up to five years or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company on the date that is the earlier of (1) the last day of the fiscal year in which we have total annual gross revenues of $1 billion or more; (2) the last day of our fiscal year following the fifth anniversary of the date of the completion of our initial public offering of our common stock, or our IPO, which we completed March 12, 2014; (3) the date on which we have issued more than $1 billion in nonconvertible debt during the previous three years; or (4) the date on which we are deemed to be a large accelerated filer under the rules of the Securities and Exchange Commission, or the SEC.

To the extent that we continue to qualify as a “smaller reporting company,” as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, or the Exchange Act, after we cease to qualify as an emerging growth company, certain of the exemptions available to us as an emerging growth company may continue to be available to us as a smaller reporting company, including: (1) not being required to comply with the auditor attestation requirements of our internal control over financial reporting under Section 404(b) of the Sarbanes Oxley Act of 2002; (2) scaled executive compensation disclosures; and (3) the requirement to provide only two years of audited financial statements, instead of three years.

5

Table of Contents

The Offering

| Common stock offered by the selling shareholder |

Up to 2,500,000 shares |

| Common stock outstanding |

7,707,600 shares (as of January 28, 2015) |

| Use of proceeds |

The selling shareholder will receive all of the proceeds from the sale of the shares offered for sale by it under this prospectus. We will not receive proceeds from the sale of the shares by the selling shareholder. However, we may receive up to $10.0 million in proceeds from the sale of our common stock to the selling shareholder under the common stock purchase agreement described below. Any proceeds from the selling shareholder that we receive under the purchase agreement are expected be used for working capital and general corporate purposes. |

| NASDAQ Capital Market symbol |

REPH |

| Risk Factors |

Investing in our securities involves a high degree of risk. You should carefully review and consider the “Risk Factors” section of this prospectus for a discussion of factors to consider before deciding to invest in shares of our common stock. |

The number of shares of our common stock outstanding excludes 1,033,300 shares of our common stock issuable upon the exercise of stock options outstanding as of January 28, 2015 at a weighted-average exercise price of $5.77 per share; 174 additional shares of our common stock available for future issuance as of January 28, 2015 under our 2008 Stock Option Plan; 10,526 shares of our common stock available for future issuance under our 2013 Equity Incentive Plan, not including 247,000 shares of common stock which are subject to shareholder approval; and 150,000 shares of our common stock issuable upon the exercise of outstanding warrants with an exercise price of $12.00 per share.

Unless otherwise indicated, all information in this prospectus assumes no exercise of the outstanding options or warrants described above.

On February 2, 2015, we entered into a common stock purchase agreement (referred to in this prospectus as the Purchase Agreement), with Aspire Capital Fund, LLC, an Illinois limited liability company (referred to in this prospectus as Aspire Capital or the selling shareholder), which provides that, upon the terms and subject to the conditions and limitations set forth therein, Aspire Capital is committed to purchase up to an aggregate of $10.0 million of our shares of common stock over the approximately 24-month term of the Purchase Agreement. In consideration for entering into the Purchase Agreement, concurrently with the execution of the Purchase Agreement, we issued to Aspire Capital 96,463 shares of our common stock as a commitment fee (referred to in this prospectus as the Commitment Shares). Concurrently with entering into the Purchase Agreement, we also entered into a registration rights agreement with Aspire Capital (referred to in this prospectus as the Registration Rights Agreement), in which we agreed to file one or more registration statements, including the registration statement of which this prospectus is a part, as permissible and necessary to register under the Securities Act of 1933, as amended, or the Securities Act, the sale of the shares of our common stock that have been and may be issued to Aspire Capital under the Purchase Agreement.

As of January 28, 2015, there were 7,707,600 shares of our common stock outstanding (4,386,114 shares held by non-affiliates). If all of the 2,500,000 shares of our common stock offered hereby were issued and

6

Table of Contents

outstanding as of the date hereof, such shares would represent 24.5% of the total common stock outstanding or 36.3% of the non-affiliate shares of common stock outstanding as of the date hereof. The aggregate number of shares that we can issue to Aspire Capital under the Purchase Agreement may in no case exceed 1,540,749 shares of our common stock (which is equal to approximately 19.99% of the common stock outstanding on the date of the Purchase Agreement), unless (i) shareholder approval is obtained to issue more, in which case this 1,540,749 share limitation, will not apply, or (ii) shareholder approval has not been obtained and at any time the 1,540,749 share limitation is reached and at all times thereafter the average price paid for all shares issued under the Purchase Agreement (including the Commitment Shares) is equal to or greater than $2.81, the Minimum Price, a price equal to the closing sale price of our common stock on the business date of the execution of the Purchase Agreement; provided that at no point in time shall Aspire Capital (together with its affiliates) beneficially own more than 19.99% of our common stock.

Pursuant to the Purchase Agreement and the Registration Rights Agreement, we are registering 2,500,000 shares of our common stock under the Securities Act, which includes the Commitment Shares that have already been issued to Aspire Capital and 2,403,537 shares of common stock which we may issue to Aspire Capital after this registration statement is declared effective under the Securities Act. All 2,500,000 shares of common stock are being offered pursuant to this prospectus. Under the Purchase Agreement, we have the right but not the obligation to issue more than the 2,500,000 shares of common stock included in this prospectus to Aspire Capital. As of the date hereof, we do not have any plans or intent to issue to Aspire Capital any shares of common stock in addition to the 2,500,000 shares of common stock offered hereby.

After the Securities and Exchange Commission, or the SEC, has declared effective the registration statement of which this prospectus is a part, on any trading day on which the closing sale price of our common stock exceeds $0.50, we have the right, in our sole discretion, to present Aspire Capital with a purchase notice, each a Purchase Notice, directing Aspire Capital (as principal) to purchase up to 50,000 shares of our common stock per trading day, provided that the aggregate price of such purchase shall not exceed $500,000 per trading day, up to $10.0 million of our common stock in the aggregate at a per share price, or the Purchase Price, calculated by reference to the prevailing market price of our common stock (as more specifically described below).

In addition, on any date on which we submit a Purchase Notice for 50,000 shares to Aspire Capital and the closing sale price of our stock is equal to or greater than $0.50 per share of Common Stock , we also have the right, in our sole discretion, to present Aspire Capital with a volume-weighted average price purchase notice, each, a VWAP Purchase Notice, directing Aspire Capital to purchase an amount of stock equal to up to 30% of the aggregate shares of the Company’s common stock traded on the NASDAQ on the next trading day, or the VWAP Purchase Date, subject to a maximum number of shares we may determine, or the VWAP Purchase Share Volume Maximum and a minimum trading price, or the VWAP Minimum Price Threshold, (as more specifically described below). The purchase price per Purchase Share pursuant to such VWAP Purchase Notice, or the VWAP Purchase Price is calculated by reference to the prevailing market price of our common stock (as more specifically described below).

The Purchase Agreement provides that the Company and Aspire Capital shall not effect any sales under the Purchase Agreement on any purchase date where the closing sale price of our common stock is less than $0.50 per share, or the Floor Price. The Floor Price and the respective prices and share numbers in the preceding paragraphs shall be appropriately adjusted for any reorganization, recapitalization, non-cash dividend, stock split, reverse stock split or other similar transaction. There are no trading volume requirements or restrictions under the Purchase Agreement, and we will control the timing and amount of any sales of our common stock to Aspire Capital. Aspire Capital has no right to require any sales by us, but is obligated to make purchases from us as we direct in accordance with the Purchase Agreement. There are no limitations on use of proceeds, financial or business covenants, restrictions on future fundings, rights of first refusal, participation rights, penalties or liquidated damages in the Purchase Agreement. The Purchase Agreement may be terminated by us at any time, at our discretion, without any penalty or cost to us.

7

Table of Contents

You should carefully consider the following information about risks, together with the other information contained in this prospectus, before making an investment in our common stock. If any of the circumstances or events described below actually arises or occurs, our business, results of operations, cash flows and financial condition could be harmed. In any such case, the market price of our common stock could decline, and you may lose all or part of your investment.

Risks Related to Our Finances and Capital Requirements

We have incurred significant losses since our inception and anticipate that we will continue to incur significant losses for the foreseeable future.

We are a development stage company with limited operating history. To date, we have focused primarily on developing our lead product candidate, Dex-IN. In addition, we have other product candidates, Dex-SL and Fado, in development. We have incurred significant net losses in each year since our inception in November 2007, including net losses of approximately $12.7 million for the nine months ended September 30, 2014, and $1.5 million and $2.0 million for fiscal years 2012 and 2013, respectively. As of September 30, 2014, we had an accumulated deficit of $30.6 million.

We have devoted most of our financial resources to research and development, including our non-clinical and formulation development activities, manufacturing and clinical trials. To date, we have financed our operations exclusively through the sale of debt and equity securities. The size of our future net losses will depend, in part, on the rate of future expenditures and our ability to generate revenues. To date, none of our product candidates have been commercialized, and if our product candidates are not successfully developed or commercialized, or if revenues are insufficient following marketing approval we will not achieve profitability and our business may fail. Even if we successfully obtain regulatory approval to market our product candidates in the United States, our revenues are also dependent upon the size of the markets outside of the United States, as well as our ability to obtain market approval and achieve commercial success.

We expect to continue to incur substantial and increased expenses as we expand our research and development activities and advance our clinical programs. We also expect an increase in our expenses associated with creating additional infrastructure to support operations as a public company. As a result of the foregoing, we expect to continue to incur significant and increasing losses and negative cash flows from operations for the foreseeable future.

We have never generated any revenue and may never be profitable.

Our ability to generate revenue and achieve profitability depends on our ability, alone or with collaborators, to successfully complete the development of, obtain the necessary regulatory approvals for, and commercialize our product candidates. We do not anticipate generating revenues from sales of our product candidates for the foreseeable future, if ever. Our ability to generate future revenues from product sales depends heavily on our success in:

| • | completing the clinical development of Dex-IN, initially for the treatment of acute pain following surgery; |

| • | obtaining regulatory approval for Dex-IN for the treatment of acute pain; |

| • | launching and commercializing Dex-IN through either building a specialty sales force or collaborating with third parties; |

| • | obtaining and maintaining patent protection; and |

| • | completing the clinical development, obtaining regulatory approval, launching and commercializing other Dex product candidates and our other product candidate, Fado. |

8

Table of Contents

Because of the numerous risks and uncertainties associated with pharmaceutical product development, we are unable to predict the timing or amount of increased expenses, and when, or if, we will be able to achieve or maintain profitability. For example, our expenses could increase beyond expectations if we are required by the FDA to perform studies in addition to those that we currently anticipate.

Even if one or more of our product candidates is approved for commercial sale, we anticipate incurring significant costs associated with commercializing any approved product candidate unless we enter into a strategic partnership for the launch and commercialization of our product candidates. Even if we are able to generate revenues from the sale of our products, we may not become profitable and may need to obtain additional funding to continue operations.

We have a limited operating history which may make it difficult to predict our future performance or evaluate our business and prospects.

We were incorporated in 2007. Since inception, our operations have been primarily limited to developing our technology and undertaking non-clinical studies and clinical trials for our product candidates. We have not yet obtained regulatory approval for any of our product candidates. Consequently, we have a very limited amount of information to use in evaluating the potential future success or viability of our business and any such evaluation of our business and prospects may not be accurate.

Our operating results may fluctuate significantly.

We expect our operating results to be subject to quarterly and annual fluctuations. Prior to commercializing any of our product candidates, we expect that any expenses or potential revenues we generate will fluctuate from quarter to quarter and year to year as a result of the timing and amount of development milestones and royalty revenues received or paid under our collaboration license agreements, as these revenues or payments from the arrangements are principally based on the achievement of clinical and commercial milestones outside of our control.

If we commercialize one or more of our products, our operating results will be affected by numerous factors, including:

| • | variations in the level of expenses related to our development programs; |

| • | the success of our clinical trials through all phases of clinical development; |

| • | any delays in regulatory review and approval of product candidates in clinical development; |

| • | potential side effects of our future products that could delay or prevent commercialization or cause an approved drug to be taken off the market; |

| • | any intellectual property infringement lawsuit in which we may become involved; |

| • | our ability to obtain and maintain patent protection; |

| • | our ability to establish an effective sales and marketing infrastructure; |

| • | our dependency on third parties to supply and manufacture our product candidates and delivery devices; |

| • | competition from existing products or new products that may emerge; |

| • | regulatory developments affecting our products and product candidates, which are not limited to but could include the imposition of a Risk Evaluation and Mitigation Strategy, or REMS, program as a condition of approval; |

9

Table of Contents

| • | our execution of any collaborative, licensing or similar arrangements, and the timing of payments we may make or receive under these arrangements; |

| • | the achievement and timing of milestone payments under our existing collaboration and license agreements; and |

| • | the level of market acceptance for any approved product candidates and underlying demand for that product and wholesalers’ buying patterns. |

Due to the various factors mentioned above, and others, the results of any prior quarterly period should not be relied upon as an indication of our future operating performance. If our quarterly operating results fall below the expectations of investors or securities analysts, the price of our common stock could decline substantially. Furthermore, any quarterly fluctuations in our operating results may, in turn, cause the price of our stock to fluctuate substantially.

If we fail to obtain sufficient additional financing, we would be forced to delay, reduce or eliminate our product development programs.

Developing pharmaceutical products, including conducting preclinical studies and clinical trials, is expensive. We expect our research and development expenses to substantially increase in connection with our ongoing activities, particularly as we advance our clinical programs. As of September 30, 2014, we had working capital of approximately $22.2 million. We will need to raise additional funds to support our future operations, and such funding may not be available to us on acceptable terms, or at all.

On March 12, 2014, we closed the IPO of 4,312,500 shares of common stock, including the full exercise of the underwriters’ over-allotment at a public offering price of $8.00 per share. Total gross proceeds from the IPO were $34.5 million before deducting underwriting discounts and commissions and other offering expenses payable by us, resulting in net proceeds of $30.3 million. We expect our existing cash and cash equivalents, together with interest, will be sufficient to fund our current operations through March 31, 2016. However, changing circumstances beyond our control may cause us to consume capital more rapidly than we currently anticipate. For example, our clinical trials may encounter technical, enrollment or other difficulties that could increase our development costs more than we expect. We will need to raise additional funding to file an NDA for Dex-IN or otherwise enter into collaborations to launch and commercialize Dex-IN after receipt of FDA approval, if received, and, if we choose, to initiate clinical trials for additional uses of Dex-IN or for our other product candidates, including Fado. In any event, we will require additional capital to obtain regulatory approval for, and to commercialize, our product candidates.

Securing additional financing may divert our management from our day-to-day activities, which may adversely affect our ability to develop and commercialize our product candidates. In addition, we cannot guarantee that future financing will be available in sufficient amounts or on terms acceptable to us, if at all. If we are unable to raise additional capital when required or on acceptable terms, we may be required to:

| • | significantly delay, scale back or discontinue the development or commercialization of our product candidates; |

| • | seek corporate partners for Dex-IN at an earlier stage than otherwise would be desirable or on terms that are less favorable than might otherwise be available; or |

| • | relinquish or license, on unfavorable terms, our rights to technologies or product candidates that we otherwise would seek to develop or commercialize ourselves. |

If we are unable to raise additional capital in sufficient amounts or on terms acceptable to us, we will be prevented from pursuing development and commercialization efforts, which will have a material adverse effect on our business, operating results and prospects.

10

Table of Contents

The extent to which we utilize the Purchase Agreement with Aspire Capital as a source of funding will depend on a number of factors, including the prevailing market price of our common stock, the volume of trading in our common stock and the extent to which we are able to secure funds from other sources as described above. The number of shares that we may sell to Aspire Capital under the Purchase Agreement on any given day and during the term of the agreement is limited. See “The Aspire Capital Transaction” section of this prospectus for additional information. Additionally, we and Aspire Capital may not affect any sales of shares of our common stock under the Purchase Agreement during the continuance of an event of default or on any trading day that the closing sale price of our common stock is less than $0.50 per share. Even if we are able to access the full $10.0 million under the Purchase Agreement, we will still need additional capital to fully implement our business, operating and development plans, as described above.

We may sell additional equity or debt securities to fund our operations, which would result in dilution to our shareholders and impose restrictions on our business.

In order to raise additional funds to support our operations, we may sell additional equity or debt securities, which would result in dilution to all of our shareholders or impose restrictive covenants that adversely impact our business. The incurrence of indebtedness would result in payment obligations and could also result in certain restrictive covenants, such as limitations on our ability to incur additional debt, limitations on our ability to acquire, sell or license intellectual property rights and other operating restrictions that could adversely impact our ability to conduct our business. If we are unable to expand our operations or otherwise capitalize on our business opportunities, our business, financial condition and results of operations could be materially adversely affected and we may not be able to meet our obligations.

Risks Related to Clinical Development and Regulatory Approval

We depend substantially on the success of our product candidate, Dex-IN, which is still under clinical development, and which may not obtain regulatory approval or be successfully commercialized.

We have not marketed, distributed or sold any products. The success of our business depends primarily upon our ability to develop and commercialize Dex-IN for use in treating acute pain following surgery. We have completed two Phase Ib placebo-controlled clinical trials with two different dosage forms of Dex in chronic lower back pain subjects. We closed our Post Op Day 0 Phase II clinical trial for Dex-IN in post-operative patients in the third quarter of 2014. Based upon the results of that trial, we commenced a Post Op Day 1 Phase II clinical trial of Dex-IN in post-operative patients in the fourth quarter of 2014. Assuming completion of a successful clinical trial, we expect to complete two Phase III pivotal clinical trials with Dex-IN in acute pain following surgery. We intend to use these trials as a basis to submit an NDA for Dex-IN for acute pain. There is no guarantee that our clinical trials will be completed, or if completed, will be successful. Any delay in obtaining, or inability to obtain, regulatory approval would prevent us from commercializing Dex-IN, generating revenues and achieving profitability. If this were to occur, we may be forced to abandon our development efforts for Dex-IN, which would have a material adverse effect on our business and could potentially cause us to cease operations. Because of the license from Orion, we expect to cross-reference the approved NDA for Dex in our 505(b)(2) NDA for Dex-IN. If the FDA disagrees with this strategy and determines we cannot pursue this pathway, we could incur significant time, resources, and delay, particularly if the FDA requires more clinical data than we expect.

We depend substantially on the successful completion of Phase II and III clinical trials for our product candidates. The positive clinical results obtained for our product candidates in earlier clinical studies may not be repeated in Phase II or III and, thus, we may never receive regulatory approval of our product candidates.

We have completed multiple clinical studies utilizing Dex-IN. After an interim analysis in September 2014, we closed our first Phase II clinical trial of Dex-IN in the treatment of acute post-operative (Day 0) pain following bunionectomy surgery as the trial was not expected to reach statistical significance. We initiated a Post Op Day 1 Phase II clinical trial for Dex-IN in post-operative patients in October 2014, which will be completed

11

Table of Contents

before proceeding to Phase III, pivotal trials for Dex-IN. Our product candidates are subject to the risks of failure inherent in pharmaceutical development. Before obtaining regulatory approval for the commercial sale of any product candidate, we must successfully complete Phase III clinical trials. Negative or inconclusive results of a Phase III clinical study could cause the FDA to require that we repeat it or conduct additional clinical studies. Any regulatory delays or request for additional clinical data will lead to new and costly expenditures and could cause delays in our drug development. There is no guarantee that our clinical trials will be completed, or if completed, will be successful.

To date, we have completed multiple Phase Ib clinical trials with Dex in chronic lower back pain patients. However, there is no certainty that the results we have seen in these studies and patient population nor the trend toward analgesia in a subset of patients in our closed Day 0 Phase II clinical trial will be similar in patients with acute pain following surgery in our ongoing and future expected clinical trials. We cannot be certain that positive results will be duplicated when Dex-IN is tested in a larger number of patients in our Phase II and Phase III clinical trials. Unexpected results could require us to redo clinical studies in the same or different patient populations or discontinue clinical development of Dex-IN. If we are forced to discontinue development of Dex-IN because of unsuccessful clinical trials, we will not be able to commercialize Dex-IN, our lead product candidate, and our business, financial condition and results of operations may be materially adversely affected.

Delays in clinical trials are common and have many causes, and any delay could result in increased costs to us and jeopardize or delay our ability to obtain regulatory approval and commence product sales.

We may experience delays in clinical trials of our product candidates or the time required to complete clinical trials for our product candidates may be longer than anticipated. In September 2014, we discontinued REC-13-012 Post Op Day 0 Phase II clinical trial, as that was not expected to reach statistical significance, and we initiated a Post Op Day 1 Phase II clinical trial for Dex-IN in post-operative patients in October 2014. Our planned clinical trials may not begin on time, have an effective design, enroll a sufficient number of patients, or be completed on schedule, if at all. Our clinical trials can be delayed for a variety of reasons, including, but not limited to:

| • | inability to raise funding necessary to initiate or continue a trial; |

| • | delays in the Phase II study required prior to Phase III initiation; |

| • | delays caused by toxicology studies required prior to Phase III initiation; |

| • | delays caused by unexpected results or unforeseen problems with the Phase II or any other clinical trials; |

| • | delays in obtaining regulatory approval to commence a trial; |

| • | delays in reaching agreement with the FDA on final trial design or the scope of the development program; |

| • | import delays; |

| • | imposition of a clinical hold following an inspection of our clinical trial operations or trial sites by the FDA or other regulatory authorities; |

| • | delays in reaching agreement on acceptable terms with prospective contract research organizations, or CROs, and clinical trial sites; |

| • | delays in obtaining required institutional review board approval at each site; |

| • | delays in recruiting suitable patients to participate in a trial; |

| • | delays in the testing, validation, manufacturing and delivery of the device components of our product candidates; |

12

Table of Contents

| • | delays in having patients complete participation in a trial or return for post-treatment follow-up; |

| • | clinical sites dropping out of a trial to the detriment of enrollment; |

| • | time required to add new clinical sites; |

| • | delays by our contract manufacturers to produce and deliver a sufficient supply of clinical trial materials; or |

| • | delays or problems caused by third parties who market Dex for other indications. |

If completion of the Post Op Day 1 Phase II trial or initiation or completion of the Phase III trials are delayed for Dex-IN or other product candidates for any of the above reasons or other reasons, our development costs may increase, our approval process could be delayed and our ability to commercialize Dex-IN or other product candidates could be materially harmed, which could have a material adverse effect on our business, financial condition or results of operations.

Our product candidates may cause adverse events or have other properties that could delay or prevent their regulatory approval or limit the scope of any approved label or market acceptance.

Adverse events, or AEs, caused by our product candidates could cause us, other reviewing entities, clinical study sites or regulatory authorities to interrupt, delay or halt clinical studies and could result in the denial of regulatory approval. Clinical studies conducted by us with Dex have generated some AEs, but no serious adverse events, or SAEs, as those terms are defined by the FDA in its regulations. For example, AEs have included higher incidences of somnolence and hypotension observed in patients receiving Dex over patients receiving placebo. If SAEs are observed in any of our clinical studies, our ability to obtain regulatory approval for our product candidates may be adversely impacted. Further, if our products cause serious or unexpected side effects after receiving market approval, a number of potentially significant negative consequences could result, including:

| • | regulatory authorities may withdraw their approval of the product or impose restrictions on its distribution in a form of a modified REMS; |

| • | regulatory authorities may require the addition of labeling statements, such as warnings or contraindications; |

| • | we may be required to change the way the product is administered or conduct additional clinical studies; |

| • | we could be sued and held liable for harm caused to patients; and/or |

| • | our reputation may suffer. |

Any of these events could prevent us from achieving or maintaining market acceptance of the affected product candidate and could substantially increase the costs of commercializing our product candidates.

Additional time may be required to obtain regulatory approval for Dex-IN because the FDA may consider it a drug/device combination.

Our lead product candidate, Dex-IN, may be considered by the FDA to be a drug/device combination. While we have filed an investigational new drug application, or IND, for Dex-IN, we cannot guarantee that the FDA will not require a separate device review. There are a number of drugs such as Zecuity® and Sprix® that employ a device that have received approval as drugs. The third party device we intend to use has previously received a device authorization. We have not taken any action, and although we plan to address such matter with the FDA in the future, we do not have a targeted date to do so, since we believe our device will be treated similarly to such other drugs. Because we cannot guarantee this result, however, we may experience delays in regulatory approval for Dex-IN due to potential uncertainties in the approval process, in particular as it could relate to possible device authorization by the FDA as well as a drug approval under an NDA. As a result, product launch and commercialization may be delayed or may not occur, which could have an adverse effect on our business.

13

Table of Contents

After the completion of our clinical trials, we cannot predict whether or when we will obtain regulatory approval to commercialize Dex-IN and we cannot, therefore, predict the timing of any future revenue from Dex-IN.

We cannot commercialize Dex-IN until the appropriate regulatory authorities, such as the FDA, have reviewed and approved the product candidate. The regulatory authorities may not complete their review processes in a timely manner, or they may not provide regulatory approval for Dex-IN. Additional delays may result if Dex-IN is taken before an FDA Advisory Committee which may recommend restrictions on approval or recommend non-approval. In addition, we may experience delays or rejections based upon additional government regulation from future legislation or administrative action, or changes in regulatory authority policy during the period of product development, clinical studies and the review process. Such delays or rejections could have an adverse effect on our business.

Even if we obtain regulatory approval, we cannot be certain that we will be able to successfully commercialize our product candidates, in which case we may be unable to generate sufficient revenues to sustain our business.

Our ability to successfully commercialize any of our products candidates will depend on, among other things, our ability to:

| • | successfully complete our clinical trials; |

| • | receive marketing approvals from the FDA and similar foreign regulatory authorities; |

| • | obtain and maintain patent protection; |

| • | produce, through a validated process, sufficiently large quantities of our product candidates to permit successful commercialization; |

| • | establish commercial manufacturing arrangements with third-party manufacturers; |

| • | build and maintain strong U.S.-based sales, distribution and marketing capabilities sufficient to launch commercial sales of our product candidates or build collaborations with third parties for the commercialization of our product candidates within the United States; |

| • | establish collaborations with third parties for the commercialization of our product candidates in countries outside the United States, and such collaborators’ ability to obtain regulatory and reimbursement approvals in such countries; |

| • | secure acceptance of our product candidates by physicians, health care payors, patients and the medical community; and |

| • | manage our spending as costs and expenses increase due to commercialization and clinical trials. |

There are no guarantees that we will be successful in completing these tasks. If we are unable to successfully complete these tasks, we may not be able to commercialize any of our product candidates in a timely manner, or at all, in which case we may be unable to generate sufficient revenues to sustain and grow our business. In addition, if we experience unanticipated delays or problems, development costs could substantially increase and our business, financial condition and results of operations will be adversely affected.

Even if we obtain regulatory approval for Dex-IN and our other product candidates, we will still face extensive regulatory requirements and our products may face future development and regulatory difficulties.

Even if we obtain regulatory approval in the United States, the FDA and state regulatory authorities may still impose significant restrictions on the indicated uses or marketing of our product candidates, or impose ongoing requirements for potentially costly post-approval studies or post-market surveillance. For example, the labeling ultimately approved for Dex-IN and our other product candidates will likely include restrictions

14

Table of Contents

regarding, among other items, the number of doses to be dispensed or the number of permissible distribution routes, until we have satisfied all FDA requests for additional data to support broader usage. Dex-IN and our other product candidates will also be subject to ongoing FDA requirements governing the labeling, packaging, storage, distribution, safety surveillance, advertising, promotion, record-keeping and reporting of safety and other post-market information. The holder of an approved NDA is obligated to monitor and report AEs and any failure of a product to meet the specifications in the NDA. The holder of an approved NDA must also submit new or supplemental applications and obtain FDA approval for certain changes to the approved product, product labeling or manufacturing process. Advertising and promotional materials must comply with FDA rules and are subject to FDA review, in addition to other potentially applicable federal and state laws.

In addition, manufacturers of drug products and their facilities are subject to payment of substantial user fees and continual review and periodic inspections by the FDA and other regulatory authorities for compliance with current good manufacturing practices, or cGMP, and adherence to commitments made in the NDA. If we, or a regulatory authority, discover previously unknown problems with a product, such as AEs of unanticipated severity or frequency, or problems with the facility where the product is manufactured, a regulatory authority may impose restrictions relative to that product or the manufacturing facility, including requiring recall or withdrawal of the product from the market, suspension of manufacturing, or other FDA action.

If we fail to comply with applicable regulatory requirements following approval of our product candidate, a regulatory authority may:

| • | issue a warning letter asserting that we are in violation of the law; |

| • | seek an injunction or impose civil or criminal penalties or monetary fines; |

| • | suspend or withdraw regulatory approval; |

| • | suspend any ongoing clinical trials; |

| • | refuse to approve a pending NDA or supplements to an NDA submitted by us; |

| • | seize our product candidate; and/or |

| • | refuse to allow us to enter into supply contracts, including government contracts. |

Any government investigation of alleged violations of law could require us to expend significant time and resources in response and could generate negative publicity in addition to the aforementioned potential regulatory actions. The occurrence of any event or penalty described above may inhibit our ability to commercialize our products and generate revenues which would have a material adverse effect on our business, financial condition and results of operations.

The FDA may require us to provide more dosing data regarding Dex-IN or our other product candidates.

The FDA may require us to provide additional dosing data beyond current data and data from our Phase II clinical trial and to establish the proper dosage or dose frequency for Dex-IN before it approves this product candidate. The preparation of this additional data may be costly and may delay the approval of Dex-IN or any of our other product candidates for which we receive this request. If we cannot satisfy the FDA requirements, we might not be able to obtain marketing approval.

Dex-IN and our other product candidates may require REMS, which may significantly increase our costs.

The FDA Amendments Act of 2007 implemented safety-related changes to product labeling and requires the adoption of REMS for certain products. Based on the FDA’s actions with many products, our product candidates may require REMS. The REMS may include requirements for special labeling or medication guides for patients, special communication plans to health care professionals and restrictions on distribution and use. We cannot predict the specific scope or magnitude of REMS to be required as part of the FDA’s approval of Dex-IN.

15

Table of Contents

Depending on the extent of the REMS requirements, our costs to commercialize Dex-IN may increase significantly and distribution restrictions could limit sales. Our other product candidates, if approved, may also require REMS programs that may increase our costs to commercialize these product candidates or limit sales.

We will need to obtain FDA approval of any proposed product trade names, and any failure or delay associated with such approval may adversely impact our business.

Any trade name we intend to use for our product candidates will require approval from the FDA, regardless of whether we have secured a formal trademark registration from the United States Patent and Trademark Office, or USPTO. The FDA typically conducts a review of proposed product names, including an evaluation of potential for confusion with other product names and/or medication or prescribing errors. The FDA may also object to any product name we submit if it believes the name inappropriately implies medical claims. If the FDA objects to any of our proposed product names, we may be required to adopt an alternative name for our product candidates. If we adopt an alternative name, we would lose the benefit of our existing trademark applications for such product candidate, and may be required to expend significant additional resources in an effort to identify a suitable product name that would qualify under applicable trademark laws, not infringe the existing rights of third parties and be acceptable to the FDA. We may be unable to build a successful brand identity for a new trademark in a timely manner or at all, which would limit our ability to commercialize our product candidates.

Even if we obtain FDA approval for Dex-IN in the United States, we may never obtain approval for or commercialize our products outside of the United States, which would limit our ability to realize their full market potential.

In order to market any products outside of the United States, we must establish and comply with numerous and varying regulatory requirements of other countries regarding safety and efficacy. Clinical trials conducted in one country may not be accepted by regulatory authorities in other countries, and regulatory approval in one country does not mean that regulatory approval will be obtained in any other country. Approval processes vary among countries and can involve additional product testing and validation and additional administrative review periods. Seeking foreign regulatory approval could result in difficulties and costs for us and require additional non-clinical studies or clinical trials, which could be costly and time consuming. Regulatory requirements can vary widely from country to country and could delay or prevent the introduction of our products in those countries. While our management has experience in obtaining foreign regulatory approvals, we do not have any product candidates approved for sale in any jurisdiction, including international markets, and we, as a company, do not have experience in obtaining regulatory approval in international markets. If we fail to comply with regulatory requirements in international markets or to obtain and maintain required approvals, or if regulatory approval in international markets is delayed, our target market will be reduced and our ability to realize the full market potential of our products will be adversely affected.

Risks Related to Our Reliance on Third Parties

We rely on third party manufacturers to produce our preclinical and clinical drug supplies and delivery devices, and we intend to rely on third parties to produce commercial supplies of any approved product candidates.

Reliance on third party manufacturers entails certain risks to which we would not be subject if we manufactured the pharmaceutical and device aspects of our product candidates ourselves, including, but not limited to:

| • | the inability to meet our product specifications and quality requirements consistently; |

| • | a delay or inability to procure or expand sufficient manufacturing capacity; |

| • | manufacturing and product quality issues related to scale-up of manufacturing; |

| • | costs and validation of new equipment and facilities required for scale-up; |

16

Table of Contents

| • | a failure to comply with cGMP and similar foreign standards; |

| • | the inability to negotiate manufacturing agreements with third parties under commercially reasonable terms; |

| • | termination or nonrenewal of manufacturing agreements with third parties in a manner or at a time that is costly or damaging to us; |

| • | the reliance on a limited number of sources, and in some cases, single sources for product components, such that if we are unable to secure a sufficient supply of these product components, we will be unable to manufacture and sell our product candidates in a timely fashion, in sufficient quantities or under acceptable terms; |

| • | the lack of qualified backup suppliers for those components that are currently purchased from a sole or single source supplier; |

| • | disruption of operations of our third party manufacturers or suppliers by conditions unrelated to our business or operations, including the bankruptcy of the manufacturer or supplier; |

| • | carrier disruptions or increased costs that are beyond our control; and/or |

| • | the failure to deliver our products under specified storage conditions and in a timely manner. |

Any of these events could lead to clinical study delays or failure to obtain regulatory approval or could impact our ability to successfully commercialize our products. Some of these events could be the basis for FDA action, including, but not limited to, clinical hold, corrective action, injunction, recall, seizure, or total or partial suspension of production.

We rely on limited sources of supply for the drug component of our product candidates and any disruption in the chain of supply may cause delay in developing and commercializing our product candidates.

Orion is currently our sole source of the active pharmaceutical ingredient, or API, for Dex. Although the API supply agreement that we have with Orion allows us to qualify and purchase API from an alternative supplier in certain circumstances, it would be time-consuming and expensive for us to do so, and there can be no assurance that an alternative supplier could be found. Currently, Orion is the only established supplier of the Dex API.

We expect that the drug product (dosage form that is the final product) will be manufactured by a CMO, but there are only a small number of manufacturers with the capability to produce the Dex-IN product and fill the intranasal sprayers that are needed for the product. We expect to enter into an agreement with an intranasal delivery device company that will supply the components of the intranasal sprayer to the CMO for filling after they have made the formulated drug product. Currently, there is only one supplier for the filled and finished intranasal sprayer that we intend to use.

If supply from Orion, the CMO or the device component suppliers is interrupted, there could be a significant disruption in commercial supply. The FDA, state regulatory authorities or other regulatory authorities outside of the United States may also require additional studies if a new supplier is relied upon for commercial production. In addition, failure of our suppliers or vendors to comply with applicable regulations may result in delays and interruptions to our product candidate supply while we seek to secure other suppliers that meet all regulatory requirements.

These factors could cause the delay of clinical trials, regulatory submissions, required approvals or commercialization of our product candidates, cause us to incur higher costs and prevent us from commercializing them successfully. Furthermore, if our suppliers fail to deliver the required quantities of product components on a timely basis and at reasonable prices, and we are unable to secure one or more replacement suppliers capable of production at a substantially equivalent cost, our clinical trials may be delayed or we could lose potential revenue.

17

Table of Contents

Manufacture of Dex-IN requires specialized equipment and expertise, the disruption of which may cause delays and increased costs.

There are a limited number of machines and facilities that can accommodate our filling and assembly process, and for certain parts of the process, we need to use dedicated or disposable equipment throughout development and commercial manufacturing. If this equipment breaks down or needs to be repaired or replaced, it may cause significant disruption in clinical or commercial supply, which could result in delay in the process of obtaining approval for or sale of our products. Any problems with our existing third party manufacturing facility or equipment may delay or impair our ability to complete our clinical trials or commercialize our product candidates and increase our costs.

Manufacturing issues may arise that could increase product and regulatory approval costs or delay commercialization.

As we scale up manufacturing of our product candidates and conduct required stability testing, product-packaging, equipment and process-related issues may require refinement or resolution in order to proceed with our planned clinical trials and to obtain regulatory approval for commercial marketing. We may identify issues in our product or delivery devices, which could result in increased scrutiny by regulatory authorities, delays in our clinical program and regulatory approvals, increases in our operating expenses, or failure to obtain or maintain approval for our products.

We have limited experience in clinical manufacturing of Dex-IN and no experience with commercial manufacturing and do not own or operate a manufacturing facility.

We have relied on contract manufacturers and secondary service providers to produce Dex-IN devices for clinical trials. As we do not own or operate a manufacturing facility, we currently outsource manufacturing of our products and filling and assembly of the Dex-IN sprayer to third parties and intend to continue to do so. We may encounter unanticipated problems in the scale-up that will result in delays in the manufacturing of the Dex-IN and/or the intranasal sprayer.

We do not currently have any commercial agreements with third party manufacturers for the manufacture of the drug product and the intranasal sprayer. We may not be able to enter into agreements for commercial manufacturing of Dex-IN and/or the intranasal sprayers with third party manufacturers, or may be unable to do so on acceptable terms. Any third party manufacturers that we engage will be subject to FDA regulations requiring that any materials produced meet cGMPs or quality systems regulations, or QSR, and be subject to ongoing inspections by regulatory authorities. Failure by any of our suppliers to comply with applicable regulations may result in delays and interruptions to our product candidate supply while we seek to secure another supplier that meets all regulatory requirements.

Reliance on third party manufacturers entails risks to which we would not be subject if we manufactured the product candidates ourselves, including the possible breach of the manufacturing agreements by the third parties because of factors beyond our control, and the possibility of termination or nonrenewal of the agreements by the third parties because of our breach of the manufacturing agreement or based on their own business priorities.

We rely on Malvern Consulting Group, Inc., an entity with which our management is affiliated, and other third parties to conduct, supervise and monitor our clinical studies, and if those third parties perform in an unsatisfactory manner, it may harm our business.