Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT OF PRICEWATERHOUSECOOPERS LLP - MPM Holdings Inc. | d829674dex231.htm |

| EX-10.47 - SECOND AMENDED AND RESTATED SHARED SERVICES AGREEMENT - MPM Holdings Inc. | d829674dex1047.htm |

Table of Contents

As filed with the Securities and Exchange Commission on February 13, 2015

Registration No. 333-201338

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

MPM HOLDINGS INC.

(Exact name of registrant as specified in its charter)

| Delaware | 2860 | 47-1756080 | ||

| (State or other jurisdiction of Incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

260 Hudson River Road

Waterford, NY 12188

(518) 237-3330

(Address, including zip code, and telephone number, including area code, of Registrant’s Principal Executive Offices)

Stephen J. Psutka, Esq.

MPM Holdings Inc.

260 Hudson River Road

Waterford, NY 12188

(518) 237-3330

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With a copy to:

David S. Huntington, Esq.

Paul, Weiss, Rifkind, Wharton & Garrison LLP

1285 Avenue of the Americas

New York, New York 10019-6064

(212) 373-3000

Approximate date of commencement of proposed sale to public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of each Class of Securities to be Registered |

Amount to be Registered(1) |

Proposed Maximum Offering Price Per Share(2) |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee(2) | ||||

| Common stock, par value $0.01 per share |

39,305,466 shares | $20.33 | $799,080,124 | $92,854(3) | ||||

|

| ||||||||

|

| ||||||||

| (1) | The shares will be offered for resale by selling stockholders pursuant to the shelf prospectus contained herein. |

| (2) | Estimated solely for purposes of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended (the “Securities Act”). Our common stock is not traded on any national exchange and in accordance with Rule 457, the offering price per share is by the price set for shares in the Joint Chapter 11 Plan of Reorganization for Momentive Performance Materials Inc. and its Affiliated Debtors as approved by the United States Bankruptcy Court, Southern District of New York. |

| (3) | Previously paid. |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus dated February 13, 2015

PROSPECTUS

39,305,466 Shares

MPM Holdings Inc.

Common Stock

This prospectus relates to the offer and resale of up to an aggregate of 39,305,466 shares of common stock of MPM Holdings Inc. by the selling stockholders identified in this prospectus. We are not selling any shares under this prospectus. We will not receive any proceeds from the sale of shares being offered by the selling stockholders.

The selling stockholders may offer shares of our common stock from time to time, if and to the extent as they may determine, through public or private transactions or through other means described under “Plan of Distribution” at prevailing market prices, at prices different than prevailing market prices or at privately negotiated prices. The selling stockholders may sell shares through agents they select or through underwriters and dealers they select. The selling stockholders also may sell shares directly to investors. If the selling stockholders use agents, underwriters or dealers to sell the shares, we will name such agents, underwriters or dealers and describe any applicable commissions or discounts in a supplement to this prospectus if required.

Our common stock is not listed on any national securities exchange and no public market currently exists for our common stock.

Investing in our common stock involves risks. See “Risk Factors” beginning on page 12 of this prospectus for a discussion of certain risks that you should consider before buying shares of our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Prospectus dated , 2015.

Table of Contents

You should rely only on the information contained in this prospectus or to which we have referred you. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: We have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus outside of the United States.

i

Table of Contents

PRESENTATION OF FINANCIAL INFORMATION

Prior to October 24, 2014, the date we emerged from bankruptcy (the “Emergence Date”), MPM Holdings Inc. (“MPM Holdings”) had not conducted any business operations. Accordingly, unless otherwise noted or suggested by context, all financial information and data and accompanying financial statements and corresponding notes, as of and prior to the Emergence Date, as contained in this prospectus, reflect the actual historical consolidated results of operations and financial condition of Momentive Performance Materials Inc. (“MPM”) for the periods presented and do not give effect to the Plan of Reorganization (as defined below) or any of the transactions contemplated thereby or the adoption of “fresh-start” accounting. Thus, such financial information may not be representative of our performance or financial condition after the Emergence Date. Except with respect to such historical financial information and data and accompanying financial statements and corresponding notes or as otherwise noted or suggested by the context, all other information contained in this prospectus relates to MPM Holdings and its subsidiaries following the Emergence Date. When we use the terms “MPM Holdings,” “we,” the “Company,” “us,” “our” or similar words in this prospectus, unless the context otherwise requires, we are referring to MPM Holdings Inc. and its subsidiaries following emergence from the Bankruptcy Cases (as defined below).

MARKET AND INDUSTRY DATA AND FORECASTS

This prospectus includes estimates of market share and industry data and forecasts that we obtained from industry publications and surveys and/or internal company sources. Industry publications and surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy or completeness of included information. We have not independently verified any of the data from third-party sources, nor have we ascertained the underlying economic assumptions relied upon therein. Similarly, while we believe our internal estimates with respect to our industry are reliable, our estimates have not been verified by any independent sources. While we are not aware of any misstatements regarding any industry data presented in this prospectus, our estimates, in particular as they relate to market share and our general expectations, involve risks and uncertainties and are subject to change based on various factors, including those discussed under the section entitled “Risk Factors.” Unless otherwise noted, all information regarding our market share is based on the latest market data currently available to us, and all market share data is based on net sales in the applicable market.

We have proprietary rights to or are exclusively licensed to use a number of registered and unregistered trademarks that we believe are important to our business, including, without limitation, Momentive. We attempt to obtain registration of our key trademarks whenever possible or practicable and pursue any infringement of those trademarks. Solely for convenience, the trademarks, service marks and tradenames referred to in this prospectus are without the “®” and “TM” symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, service marks and tradenames.

ii

Table of Contents

This summary highlights the more detailed information contained elsewhere in this prospectus. This summary may not contain all the information that may be important to you. You should carefully read the entire prospectus before making an investment decision, especially the information presented under the heading “Risk Factors.” In this prospectus, except as otherwise indicated herein, or as the context may otherwise require, all references to “MPM Holdings,” the “Company,” “we,” “us” and “our” refer to MPM Holdings Inc. and its subsidiaries and “MPM” refers to Momentive Performance Materials Inc.

Our Company

We believe we are one of the world’s largest producers of silicones and silicone derivatives and a global leader in the development and manufacture of products derived from quartz and specialty ceramics. Silicones are a multi-functional family of materials used in a wide variety of products, and serve as a critical ingredient in many construction, transportation, healthcare, personal care, electronic, consumer and agricultural uses. Silicones are generally used as an additive to a wide variety of end products in order to provide or enhance certain of their attributes, such as resistance (heat, ultraviolet light and chemical), lubrication, adhesion or viscosity. Some of the most well-known end-use product applications include bath and shower caulk, pressure-sensitive adhesive labels, foam products, cosmetics and tires. Due to the versatility and high-performance characteristics of silicones, they are increasingly being used as a substitute for other materials. Our Quartz division manufactures quartz, specialty ceramics and crystal products for use in a number of high-technology industries, which typically require products made to precise specifications. The cost of our products typically represents a small percentage of the overall cost of our customers’ products.

We believe that our scale and global reach provide significant efficiencies in our fixed and variable cost structure and that our breadth of related products provides significant operational, technological and commercial advantages. Our manufacturing capacity at our internal sites and our joint venture in China is sufficient to produce the substantial majority of one of our key intermediates, siloxane, which facilitates a low-cost operating structure and security of supply.

We are one of two producers in the silicones market with global siloxane production capacity. We currently have 22 production sites strategically located around the world, which allows us to produce the substantial majority of our key products locally in the Americas, Europe and Asia. Through this worldwide network of production facilities, we serve more than 4,500 customers between our Silicones and Quartz businesses in over 100 countries. Our customers include leading companies in their respective industries, such as Procter & Gamble, Avery, Continental Tire, Saint Gobain, Unilever, BASF, The Home Depot and Lowe’s.

We believe we have created a value-added, technical service-oriented business model that enables us to target and participate in high-margin and high-growth specialty markets. These specialty markets account for the majority of our revenues and continue to be a growing part of our business.

Revenue and Segment EBITDA, as defined elsewhere within this Prospectus Summary, for the nine months ended September 30, 2014 were $1,873 million and $177 million, respectively, and for the year ended December 31, 2013 were $2,398 million and $238 million, respectively. Net loss attributable to Momentive Performance Materials Inc. for the nine months ended September 30, 2014 was $361 million and for the year ended December 31, 2013 was $464 million. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Reconciliation of Segment EBITDA to Net Loss” for a reconciliation of Segment EBITDA to net loss attributable to Momentive Performance Materials Inc.

1

Table of Contents

Our Strengths

Our company has the following competitive strengths:

Leading Global Silicones Producer. We believe we are one of the world’s largest producers of silicones and silicone derivatives, with leading positions in various product lines and geographic areas. We believe our scale, global reach and breadth of product offerings provide us with significant advantages over many of our competitors by allowing us to serve global customers with precise specifications, particularly those expanding production in developing nations.

Attractive Industry Growth Profile. The broad molecular characteristics of silicones continually lead to new uses and applications, which have led to worldwide industry growth in excess of GDP over the past 20 years. Drivers of growth include end-market growth and increased market penetration, with silicones increasingly being used as a value-added substitute for traditional materials or as a functional additive, which yields new properties for our customers’ products. For instance, silicones act as the conditioning ingredient in “2-in-1” shampoo.

Broad-Based Diversification.

Industry Diversification. Our Silicones business has a diversified revenue base across a variety of end-markets, reducing our vulnerability to industry trends. Furthermore, our products are often used in niche applications that represent a small portion of our customers’ material costs. Our leading end-markets are building and construction, which consists of industrial and infrastructure construction and repair, urethane foam additives, and a number of other specialty products.

Customer Diversification. We have a diverse customer base of more than 4,500 customers between our Silicones and Quartz businesses and are well balanced across multiple geographies. In 2013, our top 20 customers accounted for less than 22% of our total revenues, and no single customer accounted for more than 3% of our net sales. We have maintained long-standing relationships with many of our customers.

Geographic Diversification. We have a global sales presence, with approximately 39%, 28% and 33% of our 2013 revenues generated in the Americas, Europe and Asia, respectively.

Global Infrastructure. We are a global company with significant manufacturing capacity in each of the Americas, Europe and Asia. We have 22 production facilities located around the world, R&D centers on three continents and sales to customers in over 100 countries. The Silicones business has three siloxane production facilities located in Waterford, New York, Ohta, Japan and Leverkusen, Germany, as well as a siloxane manufacturing joint venture in Jiande, China, and two silanes production facilities in Sistersville, West Virginia and Termoli, Italy. The Quartz production sites are located in Ohio, Geesthacht, Germany, Kozuki, Japan and Wuxi, China.

We use our global platform to deliver products to companies efficiently on a worldwide basis. Many of our customers are expanding internationally to serve developing areas in Asia, Eastern Europe, Latin America, India and Russia. Maintaining close proximity to our international customers allows us to serve them more quickly and efficiently and thus build strong relationships.

Attractive Intermediate Position. We produce siloxane, the key intermediate required to manufacture silicones, in the United States, Germany and Japan, and source siloxane from a joint venture in China. This manufacturing capacity is sufficient to meet the substantial majority of our current requirements for siloxane. We also source a portion of our requirements through long-term and/or supply agreements. We believe this combination of siloxane supply, along with our ability to purchase siloxane from other suppliers when pricing is advantageous, reduces our overall cost structure and strengthens our overall competitiveness.

2

Table of Contents

Leading Fused Quartz and Specialty Ceramics Producer. We believe we are a global leader in the fused quartz and ceramics product markets in which we compete. In particular, we believe we are the largest manufacturer of quartz products for the semiconductor end-market and the second largest manufacturer of quartz products for fiber optics. Our leadership position and profitability are driven by several factors, including strong customer relationships and the precise quality and purity specifications of our products. Additionally, we believe we are a leader in several ceramic materials end-markets, including cosmetic additives.

Conservative Capital Structure with Stable Free Cash Flow Profile. With a long-dated debt maturity profile and no significant debt maturities due until 2021, we believe we have a conservative capital structure. We also have a modest fixed annual interest expense, as adjusted for the impact of restructuring our capital structure. We believe our stable free cash flow profile will support our long-term growth programs.

Strategy

We believe that we have opportunities for growth through the following long-term strategies:

Expand Our Global Reach in Faster Growing Regions. We intend to continue to grow internationally by expanding our sales presence around the world. Specifically, we are focused on growing our business in the high growth regions of Asia-Pacific, Eastern Europe, Latin America, India and the Middle East, where the usage of our products is increasing. For example, we recently commissioned new liquid silicone rubber and release coating production capabilities at our Rayong, Thailand site to serve the growing Asian Pacific market.

Develop and Market New Products. We will continue our efforts to expand our product offerings through research and development initiatives and research partnership formations with third parties. Through these innovation initiatives we expect to create new generations of products and services which will drive revenue and earnings growth over the long term. In 2013, 2012 and 2011, we invested $70 million, $69 million and $78 million, respectively, in research and development. In 2013, approximately 14% of our sales came from new products developed over the last five years as a result of our targeted new product development efforts. We also recently expanded our technology center in Seoul, Korea, and opened a new research and development facility in Bangalore, India, which further complements our network of key innovation centers strategically located near our global customers.

Increase Shift to High-Margin Specialty Products. We continue to proactively manage our product portfolio with a focus on specialty, high-margin applications. As a result of this capital allocation strategy and anticipated end market growth underlying these specialty segments, we believe high-margin specialty materials will continue to be a larger part of our broader portfolio. For instance, we are investing in our NXT* Silane manufacturing network through the expansion of our Termoli, Italy, site. NXT is an innovative product used in the production of tires, and can offer tire manufacturers the ability to reduce rolling resistance without loss of wet traction, as well as deliver benefits in the tire manufacturing process.

Continue Portfolio Optimization and Pursue Targeted Add-On Acquisitions and Joint Ventures. As a large manufacturer of performance materials with leadership in the production of silicone, silicone derivatives, quartz and specialty ceramics, we have an advantage in pursuing add-on acquisitions and joint ventures in areas that allow us to build upon our core strengths, expand our product, technology and geographic portfolio, and better serve our customers. We believe we may have the opportunity to consummate acquisitions at relatively attractive valuations due to the scalability of our existing global operations and deal-related synergies. In addition, we have and will continue to monitor the strategic landscape for opportunistic divestments consistent with our broader specialty strategy.

Implement Strategic Cost Reduction Initiatives. In July 2012, we approved certain restructuring actions in connection with the realignment of our businesses globally. As of September 31, 2014, we had realized

3

Table of Contents

approximately $34 million in cost savings as a result of these restructuring initiatives, and have approximately $2 million of in-process cost savings in connection with these initiatives that we expect to achieve over the next 9 to 12 months. We also continue to evaluate other actions that could lead to further savings.

Leverage Cost Savings from the Shared Services Agreement. The Shared Services Agreement with Hexion Inc. (formerly known as Momentive Specialty Chemicals Inc., “Hexion”) has resulted in significant synergies for us, including shared services and logistics optimization, best-of-source contractual terms, procurement savings, regional site rationalization and administrative and overhead savings. As of September 30, 2014, we have realized cumulative cost savings of $65 million as a result of the Shared Services Agreement. The Shared Services Agreement remains in place between us and Hexion following completion of our balance sheet restructuring, and both companies will continue to benefit from the optimized cost structure and services that it provides.

Risks Associated with our Business

Investing in our common stock involves a number of risks, including:

| • | Our substantial debt could adversely affect our operations and prevent us from satisfying our obligations under our debt obligations, and may have an adverse effect on our stock price. As of September 30, 2014, after giving pro forma effect to the Emergence, we would have had $1,203 million of consolidated outstanding indebtedness, and, based on our consolidated indebtedness after giving pro forma effect to the Emergence (as defined below), our annualized cash interest expense would be projected to be approximately $60 million based on interest rates at September 30, 2014; |

| • | The Chapter 11 proceedings may have disrupted our business and may have materially and adversely affected our operations; |

| • | If global economic conditions weaken again, it will negatively impact our business, results of operations and financial condition; |

| • | We may be unable to achieve the cost savings or synergies that we expect to achieve from our strategic initiatives, which would adversely affect our profitability and financial condition; |

| • | Fluctuations in direct or indirect raw material costs could have an adverse impact on our business; and |

| • | We depend on certain of our key executives and our ability to attract and retain qualified employees. |

For a discussion of the significant risks associated with our business, our industry and investing in our common stock, you should read the section entitled “Risk Factors.”

Emergence from Chapter 11 Proceedings

MPM Holdings was formed to serve as the parent holding company for certain subsidiaries of Momentive Performance Materials Holdings Inc. (“Old MPM Holdings”) after completion of proceedings under Chapter 11 of Title 11 of the United States Bankruptcy Code. Old MPM Holdings and certain of its domestics subsidiaries were debtors (the “Debtors”) in jointly administered bankruptcy cases in the United States Bankruptcy Court in the Southern District of New York (the “Court”) (the “Bankruptcy Cases”). Other subsidiaries of Old MPM Holdings were not involved in the Bankruptcy Cases. On September 11, 2014, the Bankruptcy Court confirmed our Joint Chapter 11 Plan of Reorganization for Momentive Performance Materials Inc. and its Affiliated Debtors (the “Plan of Reorganization”) and the Debtors emerged from bankruptcy on October 24, 2014 (the “Emergence Date”).

4

Table of Contents

On the Emergence Date, the Plan of Reorganization became effective and the Debtors emerged from the Chapter 11 proceedings (the “Emergence”). On or following the Emergence Date, and pursuant to the terms of the Plan of Reorganization, the following occurred:

| • | payment in full in cash to general unsecured creditors (including trade creditors) and holders of claims arising from the $75 million senior secured revolving credit facility (the “Cash Flow Facility”) and the $300 million senior secured debtor-in-possession term loan facility (the “DIP Term Loan Facility”); |

| • | conversion of our then-existing asset-based revolving facility into an exit $270 million asset-based revolving facility (the “ABL Facility”); |

| • | issuance of new 3.88% First-Priority Senior Secured Notes due 2021 (the “First Lien Notes”) and new 4.69% Second-Priority Senior Secured Notes due 2022 (the “Second Lien Notes”) to holders of MPM’s 8.875% First-Priority Senior Secured Notes due 2020 (the “Old First Lien Notes”) and 10% Senior Secured Notes due 2020 (the “Old Secured Notes”), respectively, and the cancellation of the Old First Lien Notes and the Old Secured Notes; |

| • | conversion of MPM’s 9.00% Second-Priority Springing Lien Notes due 2021 and 9.50% Second-Priority Springing Lien Notes due 2021 (collectively, “Old Second Lien Notes”) into the new equity of post-Emergence Date MPM (resulting in the issuance of 11,791,126 shares of MPM common stock), subject to dilution by the management incentive plan and common stock issued in the rights offerings; |

| • | issuance of 36,197,874 shares of post-Emergence Date MPM common stock (including shares issued in connection with the backstop commitment of the rights offerings (the “Backstop Commitment”)) resulting from the exercise of subscription rights issued to holders of the Old Second Lien Notes in $600 million rights offerings and the “commitment premium” paid in shares to the backstop parties in respect of their backstop commitment; |

| • | exchange of all shares of post-Emergence Date MPM common stock for common stock of MPM Holdings and the contribution by MPM Holdings of all shares of the post-Emergence Date MPM common stock to its wholly-owned subsidiary, MPM Intermediate Holdings Inc., a result of which MPM became a wholly owned subsidiary of MPM Intermediate Holdings Inc.; |

| • | cancellation of the equity of pre-Emergence Date MPM; |

| • | cancellation of MPM’s 11.5% Senior Subordinated Notes due 2016 (the “Subordinated Notes”); |

| • | a recovery to the holders of Old MPM Holdings’ 11% Senior Discount Note due June 4, 2017 (“PIK Notes”) of $9 million, which represents the amount of the cash available at Old MPM Holdings as of the Emergence Date, after taking into account administrative expenses; and |

| • | appointment of a new chief executive officer, chief financial officer and general counsel. |

5

Table of Contents

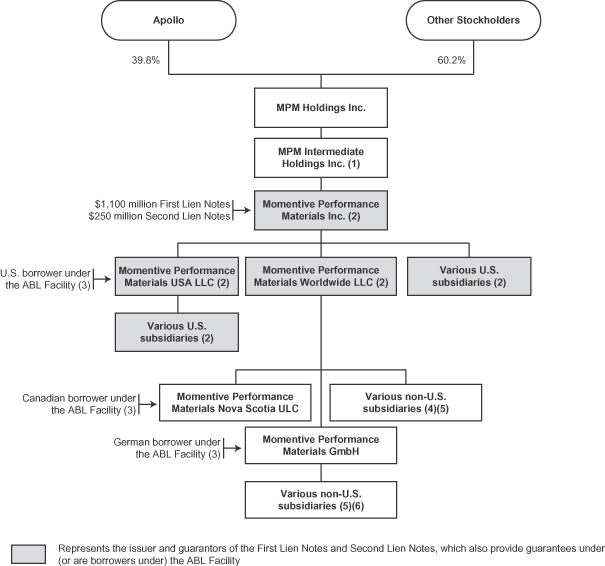

Organizational Structure

The chart below is a summary of the organizational structure of the Company and illustrates the long-term debt outstanding as of the date of this prospectus.

| (1) | Guarantor under the ABL Facility. |

| (2) | MPM and the guarantors also provide guarantees under (or are borrowers under) the ABL Facility. As of and for the nine-month period ended September 30, 2014, MPM (excluding its subsidiaries) and the guarantors collectively represented 33% of our total assets and 32% of our net sales, after intercompany eliminations. |

| (3) | Total estimated availability of $270 million, subject to borrowing base availability, of which approximately $133 million would have been available as of September 30, 2014, after giving effect to $63 million of outstanding borrowings and $74 million of outstanding letters of credit. The ABL Facility covenants include |

6

Table of Contents

| a fixed charge coverage ratio of 1.0 to 1.0 that will only apply if our availability is less than the greater of (a) 12.5% of the lesser of the borrowing base and the total ABL Facility commitments at such time and (b) $27 million. |

| (4) | Two indirect non-U.S. subsidiaries hold interests in Momentive Performance Materials (Nantong) Co., Ltd. (“MPM Nantong”), which, as of September 30, 2014, had approximately $37 million in long-term debt outstanding. One loan is denominated in Chinese renminbi and collateralized by certain assets of MPM Nantong. The interest rate on the loan as of September 30, 2014 was 6.46%, and $15 million was outstanding as of September 30, 2014. The loan is non-recourse to us and the guarantors and MPM Nantong is an unrestricted subsidiary under MPM’s indentures. MPM Nantong also has two working capital loan facilities providing for revolving secured loans of up to $16 million (subject to exchange rates), $15 million of which was outstanding as of September 30, 2014. These revolving loans, which are denominated in U.S. dollars and Chinese renminbi, must be paid down and renewed annually. The interest rates on these loans as of September 30, 2014 ranged from 4.0% to 6.0%. In addition, MPM Nantong entered into another working capital loan agreement with JiangSu Bank of China providing for revolving unsecured loans up to $15 million (subject to exchange rates), $7 million of which was outstanding as of September 30, 2014. This revolving loan is denominated in Chinese renminbi. The interest rate on this loan as of September 30, 2014 was 6.0%. |

| (5) | Certain of our non-U.S. subsidiaries provide guarantees under the ABL Facility but do not guarantee the First Lien Notes or the Second Lien Notes. |

| (6) | An indirect subsidiary owns Momentive Performance Materials (India) Private Limited, which, as of September 30, 2014, had approximately $3 million in long-term debt outstanding. |

Additional Information

MPM Holdings was incorporated under the laws of the State of Delaware on September 2, 2014. Our principal executive offices are located at 260 Hudson River Road, Waterford, NY 12188, and our telephone number is (518) 233-3370. The address of our Internet site is www.momentive.com. This Internet address is provided for informational purposes only and is not intended to function as a hyperlink. Accordingly, no information contained in this Internet address is included or incorporated by reference herein.

7

Table of Contents

The Offering

The following summary highlights all material information contained elsewhere in this prospectus but does not contain all the information that you should consider before investing in our common stock. We urge you to read this entire prospectus, including the “Risk Factors” section and the consolidated financial statements and related notes.

| Issuer |

MPM Holdings Inc. |

| Common stock offered by the selling stockholders |

Up to 39,305,466 shares of common stock. |

| Common stock outstanding as of December 18, 2014 |

47,989,000 shares of common stock. |

| Use of proceeds |

We will not receive any of the proceeds from the sale of shares offered by the selling stockholders. |

| Dividend policy |

We have not paid any dividends on our common stock. We do not intend to declare or pay any cash dividends on our common stock for the foreseeable future. |

| No current market |

Our common stock is not listed on any national securities exchange. |

| Risk factors |

You should carefully consider all of the information set forth in this prospectus and, in particular, the information under “Risk Factors” beginning on page 12 of this prospectus, prior to purchasing shares of our common stock offered hereby. |

Unless we specifically state otherwise, all share information in this prospectus is based on 47,989,000 shares outstanding as of December 18, 2014.

8

Table of Contents

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL DATA OF MPM

The following table presents MPM’s summary historical financial information as of and for the periods presented. Prior to the Emergence Date, MPM Holdings had not conducted any business operations. Accordingly, unless otherwise noted or suggested by context, all financial information and data and accompanying financial statements and corresponding notes, as of and prior to the Emergence Date, as contained in this prospectus, reflect the actual historical consolidated results of operations and financial condition of MPM for the periods presented and do not give effect to the Plan of Reorganization or any of the transactions contemplated thereby or the adoption of “fresh-start” accounting.

The summary historical financial information as of December 31, 2013 and 2012 and for the years ended December 31, 2013, 2012 and 2011 have been derived from, and should be read in conjunction with, MPM’s audited financial statements, included elsewhere in this prospectus. The financial data as of December 31, 2011 has been derived from MPM’s audited consolidated financial statements and related notes thereto. The summary historical financial information as of September 30, 2014 and for the nine-month periods ended September 30, 2014 and September 30, 2013 has been derived from, and should be read in conjunction with, MPM’s unaudited condensed consolidated financial statements, included elsewhere in this prospectus. In the opinion of management, all adjustments consisting of normal recurring accruals considered necessary for a fair presentation have been included.

The results of operations for interim periods are not necessarily indicative of the operating results that may be expected for the entire year or any future period.

9

Table of Contents

| (dollars in millions, except per share data)

|

As of and for the nine-month period ended |

As of and for the year

ended December 31, |

||||||||||||||||||

| September 30, | September 30, | |||||||||||||||||||

| 2014 | 2013 | 2013 | 2012 | 2011 | ||||||||||||||||

| Statements of Operations |

||||||||||||||||||||

| Net sales |

$ | 1,873 | $ | 1,784 | $ | 2,398 | $ | 2,357 | $ | 2,637 | ||||||||||

| Costs and expenses: |

||||||||||||||||||||

| Cost of sales, excluding depreciation and amortization |

1,339 | 1,277 | 1,732 | 1,705 | 1,798 | |||||||||||||||

| Selling, general and administrative expense |

417 | 276 | 373 | 392 | 389 | |||||||||||||||

| Depreciation and amortization expense |

137 | 129 | 171 | 187 | 197 | |||||||||||||||

| Research and development expense |

58 | 51 | 70 | 69 | 78 | |||||||||||||||

| Restructuring and other costs |

20 | 17 | 21 | 43 | 33 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating (loss) income |

(98 | ) | 34 | 31 | (39 | ) | 142 | |||||||||||||

| Other expenses (income) |

||||||||||||||||||||

| Interest expense, net |

153 | 234 | 394 | 277 | 256 | |||||||||||||||

| Other non-operating income, net |

— | — | — | (11 | ) | — | ||||||||||||||

| Loss (gain) on extinguishment and exchange of debt |

— | — | — | 57 | (7 | ) | ||||||||||||||

| Reorganization items, net |

114 | — | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loss before income tax and earnings (losses) from unconsolidated entities |

(365 | ) | (200 | ) | (363 | ) | (362 | ) | (107 | ) | ||||||||||

| Income tax (benefit) expense |

(2 | ) | — | 104 | 8 | 27 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loss before earnings (losses) from unconsolidated entities |

(363 | ) | (200 | ) | (467 | ) | (370 | ) | (134 | ) | ||||||||||

| Earnings (losses) from unconsolidated entities, net of taxes |

2 | 2 | 3 | 5 | (6 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss |

(361 | ) | (198 | ) | (464 | ) | (365 | ) | (140 | ) | ||||||||||

| Net income attributable to noncontrolling interest |

— | — | — | — | (1 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss attributable to Momentive Performance Materials Inc. |

$ | (361 | ) | $ | (198 | ) | $ | (464 | ) | $ | (365 | ) | $ | (141 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loss per share—basic and diluted |

$ | (3,610,000 | ) | $ | (1,980,000 | ) | $ | (4,640,000 | ) | $ | (3,650,000 | ) | $ | (1,410,000 | ) | |||||

| Balance Sheet Data (at period end): |

||||||||||||||||||||

| Cash and cash equivalents |

$ | 139 | $ | 94 | $ | 110 | $ | 199 | ||||||||||||

| Adjusted working capital(1) |

1 | 192 | 290 | 378 | ||||||||||||||||

| Total assets |

2,664 | 2,694 | 2,904 | 3,161 | ||||||||||||||||

| Adjusted total long-term debt(2) |

3,084 | 3,083 | 3,081 | 2,895 | ||||||||||||||||

| Total net debt(3) |

3,365 | 3,163 | 3,006 | 2,735 | ||||||||||||||||

| Total liabilities |

4,491 | 4,174 | 4,052 | 3,901 | ||||||||||||||||

| Total deficit |

(1,827 | ) | (1,480 | ) | (1,148 | ) | (736 | ) | ||||||||||||

| Cash Flow provided by (used in): |

||||||||||||||||||||

| Operating activities |

$ | (125 | ) | $ | (129 | ) | $ | (150 | ) | $ | (95 | ) | $ | 106 | ||||||

| Investing activities |

(9 | ) | (63 | ) | (88 | ) | (102 | ) | (120 | ) | ||||||||||

| Financing activities |

184 | 176 | 220 | 111 | (41 | ) | ||||||||||||||

| Other Financial Data: |

||||||||||||||||||||

| Capital expenditures(4) |

53 | 51 | 91 | 98 | 116 | |||||||||||||||

| Adjusted EBITDA(5) |

229 | 228 | 385 | |||||||||||||||||

| Segment EBITDA(6) |

177 | 186 | 238 | 214 | 379 | |||||||||||||||

10

Table of Contents

| (1) | Working capital is defined as current assets net of current liabilities. In order to make period to period comparisons more meaningful, solely for the purposes of the summary historical financial information and not in the audited and unaudited financial statements, certain current and long-term liabilities were reclassified for the working capital calculation as of September 30, 2014 and as of December 31, 2013. Specifically, as of September 30, 2014 and as of December 31, 2013, Debt payable within one year of $1,350 million and $3,076 million, respectively, has been reclassified as long-term debt. In addition, as of September 30, 2014, $128 million has been reclassified from liabilities subject to compromise to current liabilities. The presentation is a non-GAAP measure. |

The following table reconciles adjusted working capital to working capital:

| September 30, 2014 |

December 31, 2013 |

|||||||

| Adjusted working capital |

$ | 1 | $ | 192 | ||||

| Long-term debt classified as current due to event of default |

(1,350 | ) | (3,076 | ) | ||||

| Current liabilities classified as liabilities subject to compromise |

128 | — | ||||||

|

|

|

|

|

|||||

| Working capital |

$ | (1,221 | ) | $ | (2,884 | ) | ||

|

|

|

|

|

|||||

| (2) | In order to make period to period comparisons more meaningful, solely for the purposes of the summary historical financial information and not in the audited and unaudited financial statements, certain current and long-term liabilities were reclassified as of September 30, 2014 and as of December 31, 2013. Specifically, as of September 30, 2014 and as of December 31, 2013, Debt payable within one year of $1,350 million and $3,076 million, respectively, has been reclassified as long-term debt. The presentation is a non-GAAP measure. |

The following table reconciles adjusted total long-term debt to total long-term debt:

| September 30, 2014 |

December 31, 2013 |

|||||||

| Adjusted total long-term debt |

$ | 3,084 | $ | 3,083 | ||||

| Long-term debt classified as current due to event of default |

(1,350 | ) | (3,076 | ) | ||||

| Long-term debt classified as liabilities subject to compromise |

(1,727 | ) | — | |||||

|

|

|

|

|

|||||

| Total long-term debt |

$ | 7 | $ | 7 | ||||

|

|

|

|

|

|||||

| (3) | Total net debt is defined as long-term debt plus short-term debt, less cash and cash equivalents. |

| (4) | Capital expenditures are presented on an accrual basis. |

| (5) | Adjusted EBITDA is defined in the instruments that govern our indebtedness. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Covenants under our Debt Instruments” for a discussion of Adjusted EBITDA and a reconciliation of net loss attributable to Momentive Performance Materials Inc. to Adjusted EBITDA. |

| (6) | We have provided Segment EBITDA in this prospectus because it is the primary performance measure used by our senior management, the chief operating decision-maker and the board of directors to evaluate operating results and allocate capital resources among businesses. Segment EBITDA is also the profitability measure used to set management and executive incentive compensation goals. Segment EBITDA is the aggregate of the Segment EBITDA for our Silicones business and the Segment EBITDA for our Quartz business, less Other, which is primarily general and administrative expenses that are not allocated to the businesses. Segment EBITDA is not a presentation made in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”) and our use of the term Segment EBITDA may vary from that of others in our industry. Segment EBITDA should not be considered as an alternative to net income, operating income or any other performance measures derived in accordance with GAAP or as measures of liquidity derived in accordance with GAAP. Segment EBITDA has important limitations as an analytical tool, including with respect to measuring our operating performance and our liquidity, and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP. For example, Segment EBITDA excludes certain tax payments that may represent a reduction in cash available to us; does not reflect any cash requirements for the assets being depreciated and amortized that may have to be replaced in the future; does not reflect changes in, or cash requirements for, our working capital needs; does not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on our indebtedness; and does not include certain non-cash and certain other income and expenses. Non-cash charges primarily represent stock-based compensation expense, unrealized derivative and foreign exchange gains and losses and asset disposal gains and losses. Restructuring and other costs primarily include expenses from MPM’s restructuring and cost optimization programs and management fees paid to its owner. |

See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for a reconciliation of Segment EBITDA to net loss attributable to Momentive Performance Materials Inc.

11

Table of Contents

You should carefully consider the risk factors set forth below, as well as the other information contained in this prospectus. The risks described below are not the only risks facing us. Any of the following risks could materially and adversely affect our business, financial condition or operating results. In such a case, you may lose all or a part of your original investment.

Risks Relating to Our Bankruptcy Cases and Emergence

Our actual financial results may vary significantly from the projections that were filed with the Bankruptcy Court.

In connection with MPM’s disclosure statement relating to the Plan of Reorganization (the “Disclosure Statement”), and the hearing to consider confirmation of the Plan of Reorganization, MPM prepared projected financial information to demonstrate to the Bankruptcy Court the feasibility of the Plan of Reorganization and MPM’s ability to continue operations upon our emergence from the Bankruptcy Cases. This projected financial information was prepared by, and is the responsibility of, management of MPM. PricewaterhouseCoopers LLP neither examined, compiled nor performed any procedures with respect to the projected financial information and, accordingly, PricewaterhouseCoopers LLP does not express an opinion or any other form of assurance with respect thereto. The PricewaterhouseCoopers LLP report included in this document relates to the historical financial information of MPM. It does not extend to the projected financial information prepared for the Bankruptcy Court and should not be read to do so. Those projections were prepared solely for the purpose of the Bankruptcy Cases and have not been, and will not be, updated on an ongoing basis. Those projections are not included in this prospectus and have not been incorporated by reference into this prospectus and should not be relied upon in connection with the purchase or sale of common stock. At the time they were prepared, the projections reflected numerous assumptions concerning MPM’s anticipated future performance and with respect to prevailing and anticipated market and economic conditions that were and remain beyond our control and that may not materialize. Projections are inherently subject to substantial and numerous uncertainties and to a wide variety of significant business, economic and competitive risks and the assumptions underlying the projections and/or valuation estimates may prove to be wrong in material respects. Actual results may vary significantly from those contemplated by the projections that were prepared in connection with the Disclosure Statement and the hearing to consider confirmation of the Plan of Reorganization.

Our financial condition or results of operations will not be comparable to the financial condition or results of operations reflected in our historical financial statements.

Since October 24, 2014, we have been operating under a new capital structure. In addition, as required by fresh-start accounting, at October 24, 2014 our assets and liabilities were recorded at fair value, based on values determined in connection with the implementation of our Plan of Reorganization, which are significantly different than amounts in MPM’s historical financial statements. Accordingly, our financial condition and results of operations from and after the Emergence Date are not comparable to the financial condition or results of operations reflected in MPM’s historical financial statements included elsewhere in this prospectus.

The Chapter 11 proceedings may have disrupted our business and may have materially and adversely affected our operations.

We have attempted to minimize the adverse effect of our Chapter 11 reorganization on our relationships with our employees, suppliers, customers and other parties. Nonetheless, our relationships with our customers, suppliers, certain liquidity providers and employees may have been adversely impacted and our operations, currently and going forward, could have been materially and adversely affected.

12

Table of Contents

Risks Related to Our Business

If global economic conditions remain weak or deteriorate, it will negatively impact our business, results of operations and financial condition.

Global economic and financial market conditions, including severe market disruptions, for example, those that occurred in late 2008 and 2009 and the potential for a significant and prolonged global economic downturn, could impact our business operations in a number of ways including, but not limited to, the following:

| • | reduced demand in key customer segments, such as automotive, building, construction and electronics, compared to prior years; |

| • | payment delays by customers and reduced demand for our products caused by customer insolvencies and/or the inability of customers to obtain adequate financing to maintain operations. This situation could cause customers to terminate existing purchase orders and reduce the volume of products they purchase from us and further impact our customers’ ability to pay our receivables, requiring us to assume additional credit risk related to these receivables or limit our ability to collect receivables from that customer; |

| • | insolvency of suppliers or the failure of suppliers to meet their commitments resulting in product delays; |

| • | more onerous credit and commercial terms from our suppliers such as shortening the required payment period for outstanding accounts receivable or reducing or eliminating the amount of trade credit available to us; and |

| • | potential delays in accessing our ABL Facility or obtaining new credit facilities on terms we deem commercially reasonable or at all, and the potential inability of one or more of the financial institutions included in our ABL Facility to fulfill their funding obligations. Should a bank in our ABL Facility be unable to fund a future draw request, we could find it difficult to replace that bank in the facility. |

Global economic conditions may remain weak or deteriorate. In such event, the negative effects described above would likely be exacerbated and our liquidity, as well as our ability to maintain compliance with the financial maintenance covenants in our secured revolving credit facilities, could be significantly affected. See “Risks Related to Our Indebtedness—We may be unable to generate sufficient cash flows from operations to meet our consolidated debt service payments.” and “—We may be unable to maintain compliance with the financial maintenance or other covenants in the ABL Facility, which could result in an event of default under the credit agreement governing such facility that, if not cured or waived, would have a material adverse effect on our business, financial condition and results of operations.” As a result, it may cause us to defer needed capital expenditures, reduce research and development or other spending, defer costs to achieve productivity and synergy programs, sell assets or incur additional borrowings which may not be available or may only be available on terms significantly less advantageous than our current credit terms and could result in a wide-ranging and prolonged impact on general business conditions, thereby negatively impacting our business, results of operations and financial condition. In addition, if the global economic environment deteriorates or remains slow for an extended period of time, the fair value of our reporting units could be more adversely affected than we estimated in our analysis of reporting unit fair values at October 1, 2013. This could result in goodwill or other asset impairments, which could negatively impact our business, results of operations and financial condition.

Fluctuations in direct or indirect raw material costs could have an adverse impact on our business.

The prices of our direct and indirect raw materials have been, and we expect them to continue to be, volatile. If the cost of direct or indirect raw materials increases significantly and we are unable to offset the increased costs with higher selling prices, our profitability will decline. Increases in prices for our products could also hurt our ability to remain both competitive and profitable in the markets in which we compete.

13

Table of Contents

Although some of our materials contracts include competitive price clauses that allow us to buy outside the contract if market pricing falls below contract pricing, and certain contracts have minimum-maximum monthly volume commitments that allow us to take advantage of spot pricing, we may be unable to purchase raw materials at market prices. In addition, some of our customer contracts have fixed prices for a certain term, and as a result, we may not be able to pass on raw material price increases to our customers immediately, if at all. Due to differences in timing of the pricing trigger points between our sales and purchase contracts, there is often a “lead-lag” impact that can negatively impact our margins in the short term in periods of rising raw material prices and positively impact them in the short term in periods of falling raw material prices. Future raw material prices may be impacted by new laws or regulations, suppliers’ allocations to other purchasers, changes in our supplier manufacturing processes as some of our products are byproducts of these processes, interruptions in production by suppliers, natural disasters, volatility in the price of crude oil and related petrochemical products and changes in exchange rates.

An inadequate supply of direct or indirect raw materials and intermediate products could have a material adverse effect on our business.

Our manufacturing operations require adequate supplies of raw materials and intermediate products on a timely basis. The loss of a key source or a delay in shipments could have a material adverse effect on our business. Raw material availability may be subject to curtailment or change due to, among other things:

| • | new or existing laws or regulations; |

| • | suppliers’ allocations to other purchasers; |

| • | interruptions in production by suppliers; and |

| • | natural disasters. |

Many of our raw materials and intermediate products are available in the quantities we require from a limited number of suppliers.

For example, our silicones business is highly dependent upon access to silicon metal, a key raw material, and siloxane, an intermediate product that is derived from silicon metal. While silicon is itself abundant, silicon metal is produced through a manufacturing process and, in certain geographic areas, is currently available through a limited number of suppliers. In North America, there are only two significant silicon metal suppliers. In 2009 and 2010, two of our competitors acquired silicon metal manufacturing assets in North America and Europe, respectively, becoming vertically integrated in silicon metal for a portion of their supply requirements and reducing the manufacturing base of certain independent silicon metal producers. In addition, silicon metal producers face a number of regulations that affect the supply or price of silicon metal in some or all of the jurisdictions in which we operate. For example, significant anti-dumping duties of up to 139.5% imposed by the U.S. Department of Commerce and the International Trade Commission against producers of silicon metal in China and Russia effectively block the sale by all or most producers in these jurisdictions to U.S. purchasers, which restricts the supply of silicon metal and results in increased prices. We currently purchase silicon metal under multi-year, one-year or short-term contracts and in the spot market. We typically purchase silicon metal under contracts in the United States and Europe and in the spot market in Asia Pacific.

Our silicones business also relies heavily on siloxane as an intermediate product. Our manufacturing capacity at our internal sites and our joint venture in China is sufficient to meet the substantial majority of our current siloxane requirements. We also source a portion of our requirements from ASM under an existing purchase and sale agreement. In addition, from time to time we enter into supply agreements with other third parties to take advantage of favorable pricing and minimize our cost. There are also a limited number of third-party siloxane providers, and the supply of siloxane may be limited from time to time. In addition, regulation of siloxane producers can also affect the supply of siloxane. For example, in January 2006, the Ministry of Commerce of the People’s Republic of China issued a final determination of an anti-dumping investigation that imposed anti-dumping duties on all siloxane manufacturers, including us, ranging from 13% to 22%. These

14

Table of Contents

duties were terminated in January 2011. In late May 2009, China’s Ministry of Commerce also concluded an anti-dumping investigation of siloxane manufacturers in Thailand and South Korea, which resulted in an imposition of a 5.4% duty against our supplier, ASM, in Thailand, a 21.8% duty against other Thailand companies and a 25.1% duty against Korean companies.

Our quartz production relies heavily on naturally occurring quartz sand, which is currently available from a limited number of suppliers. A significant amount of the market for this sand is controlled by Unimin. Our long term purchase agreement with Unimin expired on December 31, 2012, and we are currently negotiating the terms of a new long term supply agreement with Unimin. While we expect to enter into a new agreement with Unimin within the first quarter of 2015, there can be no assurance that we will enter into such an agreement. Since the expiration of our agreement with Unimin, purchases from Unimin have been handled through purchase orders without disruption of supply to our Quartz business. We expect that process to continue if we are unable to enter into a new agreement, though no assurance can be made that this process will continue.

Should any of our key suppliers fail to deliver these or other raw materials or intermediate products to us or no longer supply us, we may be unable to purchase these materials in necessary quantities, which could adversely affect our volumes, or may not be able to purchase them at prices that would allow us to remain competitive. During the past several years, certain of our suppliers have experienced force majeure events rendering them unable to deliver all, or a portion of, the contracted-for raw materials. On these occasions, we were forced to purchase replacement raw materials in the open market at significantly higher costs or place our customers on an allocation of our products. In addition, we cannot predict whether new regulations or restrictions may be imposed in the future on silicon metal, siloxane or other key materials, which may result in reduced supply or further increases in prices. We cannot assure investors that we will be able to renew our current materials contracts or enter into replacement contracts on commercially acceptable terms, or at all. Fluctuations in the price of these or other raw materials or intermediate products, the loss of a key source of supply or any delay in the supply could result in a material adverse effect on our business.

Our production facilities are subject to significant operating hazards which could cause environmental contamination, personal injury and loss of life, and severe damage to, or destruction of property and equipment.

Our production facilities are subject to hazards associated with the manufacturing, handling, storage and transportation of chemical materials and products, including human exposure to hazardous substances, pipeline and equipment leaks and ruptures, explosions, fires, inclement weather and natural disasters, mechanical failures, unscheduled downtime, transportation interruptions, remedial complications, chemical spills, discharges or releases of toxic or hazardous substances or gases, storage tank leaks and other environmental risks. Additionally, a number of our operations are adjacent to operations of independent entities that engage in hazardous and potentially dangerous activities. Our operations or adjacent operations could result in personal injury or loss of life, severe damage to or destruction of property or equipment, environmental damage, or a loss of the use of all or a portion of one of our key manufacturing facilities. Such events at our facilities or adjacent third-party facilities, could have a material adverse effect on us.

We may incur losses beyond the limits or coverage of our insurance policies for liabilities that are associated with these hazards. In addition, various kinds of insurance for companies in the chemical industry have not been available on commercially acceptable terms, or, in some cases, have been unavailable altogether. In the future, we may not be able to obtain coverage at current levels, and our premiums may increase significantly on coverage that we maintain.

Environmental obligations and liabilities could have a substantial negative impact on our financial condition, cash flows and profitability.

Our operations involve the use, handling, processing, storage, transportation and disposal of hazardous materials and are subject to extensive and complex U.S. federal, state, local and non-U.S. supra-national, national, provincial, and local environmental, health and safety laws and regulations. These environmental laws and regulations include those that govern the discharge of pollutants into the air and water, the generation, use,

15

Table of Contents

storage, transportation, treatment and disposal of hazardous materials and wastes, the cleanup of contaminated sites, occupational health and safety and those requiring permits, licenses, or other government approvals for specified operations or activities. Our products are also subject to a variety of international, national, regional, state, and provincial requirements and restrictions applicable to the manufacture, import, export or subsequent use of such products. In addition, we are required to maintain, and may be required to obtain in the future, environmental, health and safety permits, licenses, or government approvals to continue current operations at most of our manufacturing and research facilities throughout the world.

Compliance with environmental, health and safety laws and regulations, and maintenance of permits, can be costly and complex, and we have incurred and will continue to incur costs, including capital expenditures and costs associated with the issuance and maintenance of letters of credit, to comply with these requirements. In 2013, we incurred capital expenditures of $18 million to comply with environmental laws and regulations and to make other environmental improvements. If we are unable to comply with environmental, health and safety laws and regulations, or maintain our permits, we could incur substantial costs, including fines and civil or criminal sanctions, third party property damage or personal injury claims or costs associated with upgrades to our facilities or changes in our manufacturing processes in order to achieve and maintain compliance, and may also be required to halt permitted activities or operations until any necessary permits can be obtained or complied with. In addition, future developments or increasingly stringent regulations could require us to make additional unforeseen environmental expenditures, which could have a material adverse effect on our business.

Actual and alleged environmental violations have been identified at our facility in Waterford, New York. We are cooperating with the New York State Department of Environmental Conservation (the “NYSDEC”) and the U.S. Environmental Protection Agency (the “USEPA”) and the U.S. Department of Justice in their respective investigations of that facility’s compliance with certain applicable environmental requirements, including certain requirements governing the operation of the facility’s hazardous waste incinerators. Although we currently believe that the costs and potential penalties associated with these investigations will not have a material adverse impact on our business, these investigations may result in administrative, civil or criminal enforcement by the State of New York and/or the United States and resolution of such enforcement actions will likely require payment of a monetary penalty and/or the imposition of other civil or criminal sanctions.

Environmental, health and safety requirements change frequently and have tended to become more stringent over time. We cannot predict what environmental, health and safety laws and regulations or permit requirements will be enacted or amended in the future, how existing or future laws or regulations will be interpreted or enforced or the impact of such laws, regulations or permits on future production expenditures, supply chain or sales. Our costs of compliance with current and future environmental, health and safety requirements could be material. Such future requirements include legislation designed to reduce emissions of carbon dioxide and other substances associated with climate change (“greenhouse gases”). The European Union has enacted greenhouse gas emissions legislation, and continues to expand the scope of such legislation. The USEPA has promulgated regulations applicable to projects involving greenhouse gas emissions above a certain threshold, and the United States and certain states within the United States have enacted, or are considering, limitations on greenhouse gas emissions. These requirements to limit greenhouse gas emissions could significantly increase our energy costs, and may also require us to incur material capital costs to modify our manufacturing facilities.

In addition, we are subject to liability associated with hazardous substances in soil, groundwater and elsewhere at a number of sites. These include sites that we formerly owned or operated and sites where hazardous wastes and other substances from our current and former facilities and operations have been sent, treated, stored or disposed of, as well as sites that we currently own or operate. Depending upon the circumstances, our liability may be strict, joint and several, meaning that we may be held responsible for more than our proportionate share, or even all, of the liability involved regardless of our fault or whether we are aware of the conditions giving rise to the liability. Environmental conditions at these sites can lead to environmental cleanup liability and claims against us for personal injury or wrongful death, property damages and natural resource damages, as well as to claims and obligations for the investigation and cleanup of environmental conditions. The extent of any of these liabilities is difficult to predict, but in the aggregate such liabilities could be material.

16

Table of Contents

We have been notified that we are or may be responsible for environmental remediation at certain sites in the United States. As the result of former, current or future operations, there may be additional environmental remediation or restoration liabilities or claims of personal injury by employees or members of the public due to exposure or alleged exposure to hazardous materials in connection with our operations, properties or products. Sites sold by us in past years may have significant site closure or remediation costs and our share, if any, may be unknown to us at this time. These environmental liabilities or obligations, or any that may arise or become known to us in the future, could have a material adverse effect on our financial condition, cash flows and profitability.

In addition, in the normal course of our business, we are required to provide financial assurances for contingent future costs associated with certain hazardous waste management and remedial activities. Pursuant to financial assurance requirements set forth in state hazardous waste permit regulations applicable to our manufacturing facilities in Waterford, NY and Sistersville, WV, we have provided letters of credit in the following amounts: $25 million for closure and post-closure care for the Waterford and the Sistersville facilities; and $10 million (annual aggregate) for accidental occurrences at the Waterford and Sistersville facilities. We are currently in discussions with the NYSDEC regarding the renewal of our Waterford facility’s hazardous waste permit. We have recently been advised by the NYDEC that the draft renewal permit will require $26 million in financial assurances for our Waterford facility, an increase to the amount currently being provided of approximately $8 million. We believe that the draft permit will also require a re-evaluation of the financial assurance amount within the next 3 years. One or more of our facilities may also in the future be subject to additional financial assurance requirements imposed by governmental authorities, including the USEPA. In this regard, the USEPA has identified chemical manufacturing as an industry for which it plans to develop, as necessary, proposed regulations identifying appropriate financial assurance requirements pursuant to §108(b) of CERCLA. Any increase in financial assurances required for our facilities in connection with environmental, health and safety laws or regulations or the maintenance of permits would likely increase our costs and could also materially impact our financial position. For example, to the extent we issue letters of credit under our ABL Facility to satisfy any financial assurance requirements, we would incur fees for the issuance and maintenance of these letters of credit and the amount of borrowings that would otherwise be available to us under such facility would be reduced.

Future chemical regulatory actions may decrease our profitability.

Several governmental entities have enacted, are considering or may consider in the future, regulations that may impact our ability to sell certain chemical products in certain geographic areas. In December 2006, the European Union enacted a regulation known as REACH. This regulation requires manufacturers, importers and consumers of certain chemicals manufactured in, or imported into, the European Union to register such chemicals and evaluate their potential impacts on human health and the environment. The implementing agency is currently in the process of determining if any chemicals should be further tested, regulated, restricted or banned from use in the European Union. Other countries have implemented, or are considering implementation of, similar chemical regulatory programs. When fully implemented, REACH and other similar regulatory programs may result in significant adverse market impacts on the affected chemical products. If we fail to comply with REACH or other similar laws and regulations, we may be subject to penalties or other enforcement actions, including fines, injunctions, recalls or seizures, which would have a material adverse effect on our financial condition, cash flows and profitability.

Similarly, the Canadian government is implementing an initiative to review certain chemical products for potential environmental and human health and safety impacts. The list of products being reviewed includes several chemicals sold by us. We are part of an industry organization that is working with the Canadian government to develop relevant data and information. Upon review of such data and information, the Canadian government may enact regulations that would limit our ability to sell the affected chemicals in Canada. As part of this initiative, based upon modeled potential impacts on the aquatic environment, the Canadian government has listed as environmentally toxic octamethylcyclotetrasiloxane, or D4, a chemical substance that we manufacture.

17

Table of Contents

The Canadian government has issued regulations to minimize the discharge of D4 from industrial facilities into the aquatic environment. We cannot at this time estimate the effect of these regulations on us or our financial condition, cash flows and profitability, but it could be material. The European Union is also reviewing D4, as well as decamethylcyclopentasiloxane, or D5, another chemical substance we manufacture, and may, pursuant to REACH, regulate the manufacture, import and/or use of these two chemical substances in the European Union. The USEPA has also stated that they are reviewing the potential environmental risks posed by these two substances to determine whether regulatory measures are warranted, and we and other silicones industry members have entered into a consent order with the USEPA to conduct certain studies to obtain relevant data. Finally, the Norwegian Climate and Pollution Agency has published a November 2011 study that identifies D4 and D5 as potential candidates for listing as persistent organic pollutants pursuant to the Stockholm Convention on Persistent Organic Pollutants (the “Stockholm Convention”), an international treaty aimed at eliminating or minimizing the release of organic chemicals that are toxic, resistant to degradation in the environment, and transported and deposited far from the point of release. Regulation of our products containing such substances by the European Union, Canada, the United States, parties to the Stockholm Convention and/or other jurisdictions would likely reduce our sales within the jurisdiction and possibly in other geographic areas as well. These reductions in sales could be material depending upon the extent of any such additional regulations.

We participate with other companies in trade associations and regularly contribute to the research and study of the safety and environmental impact of our products and raw materials, including siloxanes. These programs are part of a program to review the environmental impacts, safety and efficacy of our products. In addition, government and academic institutions periodically conduct research on potential environmental and health concerns posed by various chemical substances, including substances we manufacture and sell. These research results are periodically reviewed by state, national and international regulatory agencies and potential customers. Such research could result in future regulations restricting the manufacture or use of our products, liability for adverse environmental or health effects linked to our products, and/or de-selection of our products for specific applications. These restrictions, liability, and product de-selection could have a material adverse effect on our business, our financial condition and/or liquidity.

Scientists periodically conduct studies on the potential human health and environmental impacts of chemicals, including products we manufacture and sell. Also, nongovernmental advocacy organizations and individuals periodically issue public statements alleging human health and environmental impacts of chemicals, including products we manufacture and sell. Based upon such studies or public statements, our customers may elect to discontinue the purchase and use of our products, even in the absence of any government regulation. Such actions could significantly decrease the demand for our products and, accordingly, have a material adverse effect on our business, financial condition, cash flows and profitability.

We are subject to certain risks related to litigation filed by or against us, and adverse results may harm our business.