Attached files

| file | filename |

|---|---|

| EX-23.1 - Mr. Amazing Loans Corp | ex23-1.htm |

| EX-10.6 - Mr. Amazing Loans Corp | ex10-6.htm |

As filed with the Securities and Exchange Commission February 13, 2015

Registration Statement No. 333- 200918

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

A mendment No. 1

to

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

IEG Holdings Corporation

(Exact name of registrant as specified in its charter)

| Florida | 6141 | 65-0888146 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

6160 West Tropicana Ave, Suite E-13

Las Vegas, NV 89103

(702) 227-5626

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Paul Mathieson

Chief Executive Officer

6160 West Tropicana Ave, Suite E-13

Las Vegas, NV 89103

(702) 227-5626

(Name, address and telephone number of agent for service)

With copies to:

Laura Anthony, Esq.

Legal & Compliance, LLC

330 Clematis Street, Suite 217

West Palm Beach, FL 33401

Phone: (800) 341-2684

Approximate date of proposed sale to public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on the Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier registration statement for the same offering: [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier registration statement for the same offering: [ ]

Indicate by check mark whether registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | [ ] | Accelerated filer | [ ] |

| Non-accelerated filer | [X] (Do not check if a smaller reporting company) | Smaller reporting company | [ ] |

CALCULATION OF REGISTRATION FEE

| Title

of Each Class of Securities to be Registered | Amount

to be Registered | Proposed Maximum Offering Price per Share | Proposed Maximum Aggregate Offering Price (2) | Amount

of Registration Fee | ||||||||||||

| Common stock, par value $0.001 per share, by Selling Stockholders | 183,175,591 | (1) | $ | 0.50 | (2) | $ | 91,587,795.50 | $ | 10,642.50 | |||||||

| (1) | Represents shares offered for resale by certain selling stockholders. |

| (2) | Estimated solely for purposes of calculating the registration fee in accordance with Rule 457 of the Securities Act of 1933, as amended. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to Section 8(a) may determine.

The information in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION, DATED FEBRUARY 13, 2015 |

183,175,591 Shares

IEG Holdings Corporation

Common Stock

This prospectus relates to the resale of up to 183,175,591 shares of our common stock by the selling stockholders named in this prospectus. This prospectus may be used by the selling stockholders named herein to resell, from time to time, those shares of our common stock included herein. For information about the selling stockholders see “Principal and Selling Stockholders” on page 29. Our common stock is presently quoted on the Pink Current Information tier of the OTC Markets Group, Inc. under the trading symbol “IEGH”. On February 10, 2015 , the last sale price of our common stock as reported by the OTC Markets was $0.45 per share with respect to an insignificant volume of shares .

We will not receive any of the proceeds from the sale of the shares of common stock by the selling stockholders. The selling stockholders will sell their shares at a fixed price of $0.50 per share; provided, however, that (i) if and when our common stock is quoted on the OTCQB Marketplace or the OTCQX Marketplace, or is traded on The Nasdaq Stock Market, Inc. (“Nasdaq”) or another exchange, the selling stockholders may sell their shares at prevailing market prices or privately negotiated prices; and (ii) to the extent that we effect a reverse stock split after the date of this prospectus, the per share fixed price of the selling stockholders’ shares offered hereby will be adjusted in accordance with the reverse stock split ratio. See “Determination of Offering Price” and “Plan of Distribution.”

The selling stockholders, and any participating broker-dealers, may be deemed to be “underwriters” within the meaning of the Securities Act of 1933, as amended (the “Securities Act”), and any commissions or discounts given to any such broker-dealer may be regarded as underwriting commissions or discounts under the Securities Act. The selling stockholders have informed us that they do not have any agreement or understanding, directly or indirectly, with any person to distribute their common stock. We will be responsible for all fees and expenses incurred in connection with the preparation and filing of the registration statement of which this prospectus is a part; provided, however, that we will not be required to pay any underwriters’ discounts or commissions relating to the securities covered by the registration statement.

We are an “emerging growth company” as defined in the Securities and Exchange Commission (“SEC”) rules and we will be subject to reduced public reporting requirements. See “Emerging Growth Company Status.” Our common stock is subject to the “penny stock” rules of the SEC.

Persons effecting transactions in the shares should confirm the registration of these securities under the securities laws of the states in which transactions occur or the existence of applicable exemptions from such registration.

THE SHARES BEING OFFERED ARE HIGHLY SPECULATIVE AND INVOLVE A HIGH DEGREE OF RISK. THEY SHOULD BE CONSIDERED ONLY BY PERSONS WHO CAN AFFORD THE LOSS OF THEIR ENTIRE INVESTMENT. SEE “RISK FACTORS” BEGINNING ON PAGE 7 OF THIS PROSPECTUS FOR A DISCUSSION OF INFORMATION THAT SHOULD BE CONSIDERED IN CONNECTION WITH AN INVESTMENT IN OUR SECURITIES.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

You should rely only on the information contained in this prospectus. We have not, and the selling stockholders have not, authorized anyone to provide you with different information from that contained in this prospectus or in any free writing prospectus that we may authorize. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock. This prospectus does not constitute an offer to sell, or a solicitation of an offer to buy the securities in any circumstances under which the offer or solicitation is unlawful. Neither the delivery of this prospectus nor any distribution of securities in accordance with this prospectus shall, under any circumstances, imply that there has been no change in our affairs since the date of this prospectus.

The date of this prospectus is ______________, 2015 .

| i |

TABLE OF CONTENTS

No dealer, salesperson or other individual has been authorized to give any information or to make any representation other than those contained in this prospectus in connection with the offer made by this prospectus and, if given or made, such information or representations must not be relied upon as having been authorized by us or the selling stockholders. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities in any jurisdiction in which such an offer or solicitation is not authorized or in which the person making such offer or solicitation is not qualified to do so, or to any person to whom it is unlawful to make such offer or solicitation. Neither the delivery of this prospectus nor any sale made hereunder shall, under any circumstances, create any implication that there has been no change in our affairs or that information contained herein is correct as of any time subsequent to the date hereof.

For investors outside the United States: We have not and the selling stockholders have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves, and observe any restrictions relating to, the offering of the shares of our common stock and the distribution of this prospectus outside the United States.

| 2 |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus includes “forward-looking statements” within the meaning of the federal securities laws that involve risks and uncertainties. Forward-looking statements include statements we make concerning our plans, objectives, goals, strategies, future events, future revenues or performance, capital expenditures, financing needs and other information that is not historical information. Some forward-looking statements appear under the headings “Prospectus Summary,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations’” and “Business.” When used in this prospectus, the words “estimates,” “expects,” “anticipates,” “projects,” “forecasts,” “plans,” “intends,” “believes,” “foresees,” “seeks,” “likely,” “may,” “might,” “will,” “should,” “goal,” “target” or “intends” and variations of these words or similar expressions (or the negative versions of any such words) are intended to identify forward-looking statements. All forward-looking statements are based upon information available to us on the date of this prospectus.

These forward-looking statements are subject to risks, uncertainties and other factors, many of which are outside of our control, that could cause actual results to differ materially from the results discussed in the forward-looking statements, including, among other things, the matters discussed in this prospectus in the sections captioned “Prospectus Summary,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations’” and “Business.” Some of the factors that we believe could affect our results include:

| ● | limitations on our ability to continue operations and implement our business plan; | |

| ● | our history of operating losses; | |

| ● | the timing of and our ability to obtain financing on acceptable terms; | |

| ● | the effects of changing economic conditions; | |

| ● | the loss of members of the management team or other key personnel; | |

| ● | competition from larger, more established companies with greater economic resources than we have; | |

| ● | costs and other effects of legal and administrative proceedings, settlements, investigations and claims, which may not be covered by insurance; | |

| ● | costs and damages relating to pending and future litigation; | |

| ● | control by our principal equity holders; and | |

| ● | the other factors set forth herein, including those set forth under “Risk Factors.” |

There are likely other factors that could cause our actual results to differ materially from the results referred to in the forward-looking statements. All forward-looking statements attributable to us in this prospectus apply only as of the date of this prospectus and are expressly qualified in their entirety by the cautionary statements included in this prospectus. We undertake no obligation to publicly update or revise forward-looking statements to reflect events or circumstances after the date made or to reflect the occurrence of unanticipated events, except as required by law.

We are responsible for the disclosure in this prospectus. However, this prospectus includes industry data that we obtained from internal surveys, market research, publicly available information and industry publications. The market research, publicly available information and industry publications that we use generally state that the information contained therein has been obtained from sources believed to be reliable. The information therein represents the most recently available data from the relevant sources and publications and we believe remains reliable. We did not fund and are not otherwise affiliated with any of the sources cited in this prospectus. Forward-looking information obtained from these sources is subject to the same qualifications and additional uncertainties regarding the other forward-looking statements in this prospectus.

| 3 |

This summary highlights material information concerning our business and this offering . This summary is not complete and does not contain all of the information that you should consider before making your investment decision. You should carefully read the entire prospectus and the information incorporated by reference into this prospectus, including the information presented under the section entitled “Risk Factors” and the financial data and related notes, before making an investment decision. This summary contains forward-looking statements that involve risks and uncertainties. Our actual results may differ significantly from future results contemplated in the forward-looking statements as a result of factors such as those set forth in “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements.” All historical information in this prospectus has been adjusted to reflect the 1-for-6 reverse stock split of our common stock that was effective February 22, 2013.

In this prospectus, unless the context indicates otherwise, “IEG Holdings,” the “Company,” “we,” “our,” “ours” or “us” refer to IEG Holdings Corporation, a Florida corporation, and its subsidiaries.

Our Company

We were organized as a Florida corporation on January 21, 1999, under the name Interact Technologies, Inc. (“Interact”). Interact was formed for the purpose of acquiring certain medical technology. On February 18, 1999, we changed our name to Fairhaven Technologies, Inc. (“Fairhaven”). Fairhaven’s business plan continued to involve the acquisition of certain medical technology. By June 1999, Fairhaven abandoned its business plan and had no operations until December 2001. On December 14, 2001, we changed our name to Ideal Accents, Inc. Ideal Accents, Inc. was engaged primarily in the business of accessorizing cars and trucks at the new vehicle dealer level. Ideal Accents, Inc. ceased operations in 2005. We changed our name to IEG Holdings Corporation in February 2013. Since March 2013, we have been engaged in the business of providing unsecured consumer loans ranging from $2,000 - $10,000 and offer loans online under the consumer brand “Mr. Amazing Loans”. Beginning in 2014, the Company changed its loan terms, such that it offers loans ranging from $5,000 to $10,000. The Company is headquartered in Las Vegas, Nevada and currently originates direct consumer loans in the states of Arizona, Florida, Georgia, Illinois, Missouri, New Jersey, Nevada, Oregon, Pennsylvania, Texas, Utah and Virginia via its website and online distribution network. The Company is a fully licensed consumer installment loan provider in the 12 states in which it operates and offers all loans within the prevailing statutory rates.

We have five wholly owned subsidiaries, each of which is described below:

| ● | Investment Evolution Global Corporation (“IEGC”) : Our subsidiary that holds our intellectual property and global rights to the Mr. Amazing Loans business. | |

| ● | Investment Evolution Corporation (“IEC”) : Our U.S. operating entity that holds all state licenses, leases, employee contracts and other operating and administrative expenses. | |

| ● | IEC SPV, LLC (“SPV”) : A bankruptcy remote special purpose vehicle that holds the Company’s U.S. loan receivables. | |

| ● | Investment Evolution Australia Corporation (“IE Australia”) : Our Australian operating entity. To date, this entity has no operations. | |

| ● | Investment Evolution Canada Corporation (“IE Canada”) : Our Canadian operating entity formed on January 2, 2015. The entity is currently dormant, with plans to be used upon establishing online operations for Canada. |

On January 28, 2013, Investment Evolution Global Corporation (“IEGC”) entered into a stock exchange agreement (the “Stock Exchange Agreement”) among IEGC, its sole shareholder IEG Holdings Limited, an Australian company (“IEG”) , and our company. Under the terms of the Stock Exchange Agreement, we agreed to acquire a 100% interest in IEGC for 272,447,137 shares of our common stock after giving effect to a 1-for-6 reverse stock split. On February 14, 2013 , we filed amended articles of incorporation (the “Amended Articles”) with the Secretary of State of Florida which had the effect of:

| ● | changing our name from Ideal Accents, Inc. to IEG Holdings Corporation, | |

| ● | increasing the number of shares of our authorized common stock to 1,000,000,000, $.001 par value, | |

| ● | creating 50,000,000 shares of “blank-check” preferred stock, and | |

| ● | effecting a 1-for-6 reverse stock split of our issued and outstanding common stock (the “Reverse Stock Split”) pursuant to the terms of the Stock Exchange Agreement. |

FINRA approved our Amended Articles on March 11, 2013.

On March 13, 2013, we completed the acquisition of IEGC under the terms of the Stock Exchange Agreement and issued to IEG 272,447,137 shares of our common stock after giving effect to the Reverse Stock Split whereby we acquired a 100% interest in IEGC. The stock exchange agreement between IEGC, IEG and the Company resulted in a reverse acquisition with a public shell, with IEGC being the accounting acquirer. The Company issued 90,815 shares of its common stock to the shareholders of IEG (IEG transferred its ownership in IEGC to its shareholders, which is why the shares were issued to the ultimate shareholders of IEG rather than to IEG itself) for each share of IEGC, in exchange for 100% ownership interest in IEGC. We determined that IEGC was the accounting acquirer because of the following facts and circumstances:

| 1. | After consummation of the transaction, the ultimate shareholders of IEGC own 99.1% of the outstanding shares of the Company; | |

| 2. | The board of directors of the Company immediately after the transaction is comprised exclusively of former directors of IEGC; and | |

| 3. | The operations of the Company immediately after the transaction are those of IEGC. |

During 2013, we issued 12,491,916 shares of our common stock at a price of $0.02 and $0.03 per share, and 664,299,127 shares at $0.005 per share in private placements to pre-merger existing stockholders of the Company.

During the fiscal year ended December 31, 2013, we generated revenue of $62,949, and had a net loss of $4,477,975. During the nine months ended September 30, 2014, we generated revenue of $239,832, and had a net loss of $4,308,962. Our accountants have raised substantial doubt regarding our ability to continue as a going concern. As noted in our consolidated financial statements, we had an accumulated stockholders’ deficit of approximately $9.28 million and recurring losses from operations as of December 31, 2013. We also had a working capital deficit of approximately $0.28 million as of December 31, 2013 and debt with maturities within the fiscal year 2014 in the amount of approximately $0.25 million. See “Risk Factors—Our accountants have raised substantial doubt regarding our ability to continue as a going concern.”

Emerging Growth Company Status

We are an “emerging growth company” as defined in Section 2(a)(19) of the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As such, we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”), reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. We intend to take advantage of all of these exemptions.

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards, and delay compliance with new or revised accounting standards until those standards are applicable to private companies. We have elected to take advantage of the benefits of this extended transition period.

| 4 |

We could be an emerging growth company until the last day of the first fiscal year following the fifth anniversary of our first common equity offering, although circumstances could cause us to lose that status earlier if our annual revenues exceed $1.0 billion, if we issue more than $1.0 billion in non-convertible debt in any three-year period or if we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) .

Company Information

Our principal office is located at 6160 West Tropicana Ave, Suite E-13, Las Vegas, NV 89103 and our phone number is (702) 227-5626. Our corporate website address is www.investmentevolution.com. Information contained on, or accessible through, our website is not a part of, and is not incorporated by reference into, this prospectus.

The Offering

| Issuer | IEG Holdings Corporation | |

| Common stock offered by the selling stockholders | 183,175,591 shares | |

| Common stock outstanding before this offering | 2,158,110,323 shares | |

| Common stock to be outstanding after this offering | 2,158,110,323 shares | |

| Offering price per share | $0.50; provided, however, that (i) if and when our common stock is quoted on the OTCQB Marketplace or the OTCQX Marketplace, or is traded on Nasdaq or another exchange, the selling stockholders may sell their shares at prevailing market prices or privately negotiated prices; and (ii) to the extent that we effect a reverse stock split after the date of this prospectus, the per share fixed price of the selling stockholders’ shares offered hereby will be adjusted in accordance with the reverse stock split ratio. See “Determination of Offering Price” and “Plan of Distribution.” | |

| Use of proceeds | We will not receive any proceeds from the sale of common stock by the selling stockholders in this offering. See “Use of Proceeds” and “Principal and Selling Stockholders.” | |

| Risk factors | See “Risk Factors” beginning on page 7 of this prospectus for a discussion of some of the factors you should carefully consider before deciding to invest in our common stock. | |

| OTC trading symbol | IEGH |

| 5 |

SUMMARY HISTORICAL FINANCIAL DATA

The following table presents our summary historical financial data for the periods indicated. The summary historical financial data for the years ended December 31, 2013 and 2012 and the balance sheet data as of December 31, 2013 and 2012 are derived from the audited financial statements. The summary historical financial data for the nine months ended September 30, 2014 and 2013 and the balance sheet data as of September 30, 2014 and 2013 are derived from the unaudited financial statements included herein. The unaudited financial statements include, in the opinion of management, all adjustments consisting of only normal recurring adjustments, that management considers necessary for the fair presentation of the financial information set forth in those statements.

Historical results are included for illustrative and informational purposes only and are not necessarily indicative of results we expect in future periods, and results of interim periods are not necessarily indicative of results for the entire year. You should read the following summary financial data in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes appearing elsewhere in this prospectus.

| Year Ended December 31, | Nine Months Ended September 30, | |||||||||||||||

| 2013 | 2012 | 2014 | 2013 | |||||||||||||

| Statement of Operations Data | ||||||||||||||||

| Total revenues | $ | 56,585 | $ | 28,950 | $ | 239,832 | $ | 38,453 | ||||||||

| Total operating expenses | 4,345,539 | 2,494,321 | 4,151,932 | 3,346,164 | ||||||||||||

| Loss from operations | (4,282,590 | ) | (2,456,542 | ) | (3,912,100 | ) | (3,307,711 | ) | ||||||||

| Total other income (expense) | (195,385 | ) | (50,980 | ) | (396,862 | ) | (143,726 | ) | ||||||||

| Net loss | $ | (4,477,975 | ) | $ | (2,507,522 | ) | (4,308,962 | ) | (3,451,437 | ) | ||||||

| Net loss per share, basic and diluted | $ | (0.01 | ) | $ | (0.01 | ) | $ | (0.00 | ) | $ | (0.01 | ) | ||||

| Balance Sheet Data (at period end) | ||||||||||||||||

| Cash and cash equivalents | $ | 281,879 | $ | 178,601 | $ | 2,367,308 | $ | 134,579 | ||||||||

| Working capital (1) | (280,786 | ) | (1,207,909 | ) | 2,497,574 | (1,456,708 | ) | |||||||||

| Total assets | 922,140 | 791,196 | 5,093,570 | 574,141 | ||||||||||||

| Total liabilities | (2,923,596 | ) | (1,858,111 | ) | (4,143,010 | ) | 2,298,801 | |||||||||

| Stockholders’ equity (deficit) | (2,001,456 | ) | (1,066,915 | ) | 950,560 | (1,724,660 | ) |

(1) Working capital represents total current assets less total current liabilities.

| 6 |

Investment in our common stock involves a number of substantial risks. You should not invest in our stock unless you are able to bear the complete loss of your investment. In addition to the risks and investment considerations discussed elsewhere in this prospectus, the following factors should be carefully considered by anyone purchasing the securities offered through this prospectus. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations. If any of the following risks actually occur, our business could be harmed. In such case, the trading price of our common stock could decline and investors could lose all or a part of the money paid to buy our common stock.

Risks Related to Our Business and Industry

Our limited operating history and our failure since inception to achieve an operating profit makes our future prospects and financial performance unpredictable, and the current scale of our operations is insufficient to achieve profitability.

We commenced operations in 2010 and as a result, we have a limited operating history upon which a potential investor can evaluate our prospects and the potential value of an investment in our company. In addition, we have not made an operating profit since our incorporation. We remain subject to the risks inherently associated with new business enterprises in general and, more specifically, the risks of a new financial institution and, in particular, a new Internet-based financial institution. Our prospects are subject to the risks and uncertainties frequently encountered by companies in their early stages of development, including the risk that we will not be able to implement our business strategy. The current scale of our operations is insufficient to achieve profitability. If we are unable to implement our business strategy and grow our business, our business will be materially adversely affected.

We are highly dependent on our credit facility.

We are highly dependent on our credit facility with BFG Loan Holdings, LLC to execute on our growth plans and operate our business. An amendment to the credit facility loan agreement was made effective on June 30, 2014 which extended the Term Conversion Date past June 30, 2014 and allows us to continue drawing down from the facility to fund our loan originations. Under the amended agreement, the Term Conversion Date is at the discretion of the lender and there is no guarantee when the lender will convert the facility to a term loan. It would be very difficult to find a financing source to replace our current lender if it elected not to lend any additional amounts in our company. The loss of our credit facility or future renewals of that financing arrangement could have a material adverse effect on our business. Upon conversion to a term loan, monthly principal and interest payments equal to 100% of the consumer loan proceeds will be due. This credit facility terminates on June 1, 2016.

Because our officers and board of directors will make all management decisions, you should only purchase our common stock if you are comfortable entrusting our directors to make all decisions.

Our board of directors will have the sole right to make all decisions with respect to our management. Investors will not have an opportunity to evaluate the specific projects that will be financed with future operating income. You should not purchase our common stock unless you are willing to entrust all aspects of our management to our officers and directors.

We may not be able to implement our plans for growth successfully, which could adversely affect our future operations.

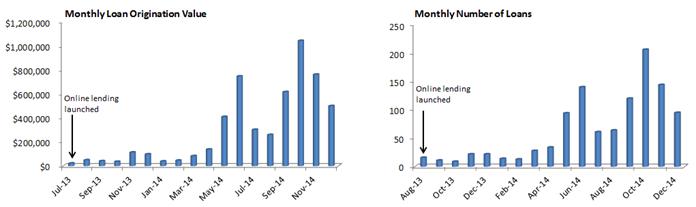

Since launching online lending in July 2013, the amount we have lent to borrowers (our loan book) has grown 2040% from $237,000 at June 30, 2013 to $5,071,022 at November 28, 2014. We expect to continue to grow our loan book and number of customers at an accelerated rate following completion of this offering. Our future success will depend in part on our continued ability to manage our growth. We may not be able to achieve our growth plans, or sustain our historical growth rates or grow at all. Various factors, such as economic conditions, regulatory and legislative considerations and competition, may also impede our ability to expand our market presence. If we are unable to grow as planned, our business and prospects could be adversely affected.

Our inability to manage our growth could harm our business.

We anticipate that our loan book and customer base will continue to grow significantly over time. To manage the expected growth of our operations and personnel, we will be required to, among other things:

| ● | improve existing and implement new transaction processing, operational and financial systems, procedures and controls; | |

| ● | maintain effective credit scoring and underwriting guidelines; and | |

| ● | increase our employee base and train and manage this growing employee base. |

If we are unable to manage growth effectively, our business, prospects, financial condition and results of operations could be adversely affected.

| 7 |

We may need to raise additional capital that may not be available, which could harm our business.

Our growth will require that we generate additional capital either through retained earnings or the issuance of additional debt or equity securities. Additional capital may not be available on terms acceptable to us, if at all. Any equity financings could result in dilution to our stockholders or reduction in the earnings available to our common stockholders. If adequate capital is not available or the terms of such capital are not attractive, we may have to curtail our growth and our business, and our business, prospects, financial condition and results of operations could be adversely affected.

As an online consumer loan company whose principal means of delivering personal loans is the Internet, we are subject to risks particular to that method of delivery.

We are predominantly an online consumer loan company and there are a number of unique factors that Internet-based loan companies face. These include concerns for the security of personal information, the absence of personal relationships between lenders and customers, the absence of loyalty to a conventional hometown branch, customers’ difficulty in understanding and assessing the substance and financial strength of an online loan company, a lack of confidence in the likelihood of success and permanence of online loan companies and many individuals’ unwillingness to trust their personal details and financial future to a relatively new technological medium such as the Internet. As a result, some potential customers may be unwilling to establish a relationship with us.

Conventional “brick and mortar” consumer loan companies, in growing numbers, are offering the option of Internet-based lending to their existing and prospective customers. The public may perceive conventional established loan companies as being safer, more responsive, more comfortable to deal with and more accountable as providers of their lending needs. We may not be able to offer Internet-based lending that has sufficient advantages over the Internet-based lending services and other characteristics of conventional “brick and mortar” consumer loan companies to enable us to compete successfully.

We may not be able to make technological improvements as quickly as some of our competitors, which could harm our ability to compete with our competitors and adversely affect our results of operations, financial condition and liquidity.

Both the Internet and the financial services industry are undergoing rapid technological changes, with frequent introductions of new technology-driven products and services. In addition to improving the ability to serve customers, the effective use of technology increases efficiency and enables financial institutions to reduce costs. Our future success will depend in part upon our ability to address the needs of our customers by using technology to provide products and services that will satisfy customer demands, as well as to create additional efficiencies in our operations. We may not be able to effectively implement new technology-driven products and services or be successful in marketing these products and services to our customers. If we are unable, for technical, legal, financial or other reasons, to adapt in a timely manner to changing market conditions, customer requirements or emerging industry standards, our business, prospects, financial condition and results of operations could be adversely affected.

A significant disruption in our computer systems or a cyber security breach could adversely affect our operations.

We rely extensively on our computer systems to manage our loan origination and other processes. Our systems are subject to damage or interruption from power outages, computer and telecommunications failures, computer viruses, cyber security breaches, vandalism, severe weather conditions, catastrophic events and human error, and our disaster recovery planning cannot account for all eventualities. If our systems are damaged, fail to function properly or otherwise become unavailable, we may incur substantial costs to repair or replace them, and may experience loss of critical data and interruptions or delays in our ability to perform critical functions, which could adversely affect our business and results of operations. Any compromise of our security could also result in a violation of applicable privacy and other laws, significant legal and financial exposure, damage to our reputation, loss or misuse of the information and a loss of confidence in our security measures, which could harm our business.

Our unsecured loans generally have delinquency and default rates higher than secured loans, which could result in higher loan losses.

We are in the business of originating unsecured personal loans. Unsecured personal loans generally have higher delinquency and default rates than secured loans. Delinquency interrupts the flow of projected interest income from a loan, and default can ultimately lead to a loss. We attempt to manage these risks with risk-based loan pricing and appropriate management policies. However, we cannot assure you that such management policies will prevent delinquencies or defaults and, if such policies and methods are insufficient to control our delinquency and default risks and do not result in appropriate loan pricing, our business, financial condition, liquidity and results of operations could be harmed.

If our estimates of loan receivable losses are not adequate to absorb actual losses, our provision for loan receivable losses would increase, which would adversely affect our results of operations.

We maintain an allowance for loans receivable losses. To estimate the appropriate level of allowance for loan receivable losses, we consider known and relevant internal and external factors that affect loan receivable collectability, including the total amount of loan receivables outstanding, historical loan receivable charge-offs, our current collection patterns, and economic trends. If customer behavior changes as a result of economic conditions and if we are unable to predict how the unemployment rate, housing foreclosures, and general economic uncertainty may affect our allowance for loan receivable losses, our provision may be inadequate. Our allowance for loan receivable losses is an estimate, and if actual loan receivable losses are materially greater than our allowance for loan receivable losses, our financial position, liquidity, and results of operations could be adversely affected.

| 8 |

Our risk management efforts may not be effective.

We could incur substantial losses and our business operations could be disrupted if we are unable to effectively identify, manage, monitor, and mitigate financial risks, such as credit risk, interest rate risk, prepayment risk, liquidity risk, and other market-related risks, as well as operational risks related to our business, assets and liabilities. Our risk management policies, procedures, and techniques, including our scoring methodology, may not be sufficient to identify all of the risks we are exposed to, mitigate the risks we have identified or identify additional risks to which we may become subject in the future.

We face strong competition for customers and may not succeed in implementing our business strategy.

Our business strategy depends on our ability to remain competitive. There is strong competition for customers from personal loan companies and other types of consumer lenders, including those that use the Internet as a medium for lending or as an advertising platform. Our competitors include:

| ● | large, publicly-traded, state-licensed personal loan companies such as SpringLeaf Holdings, World Acceptance Corporation, and OneMain Financial, a subsidiary of CitiGroup; | |

| ● | peer-to-peer lending companies such as Lending Club and Prosper | |

| ● | recent startup state-licensed personal loan companies such as Avant Credit; | |

| ● | “brick and mortar” personal loan companies, including those that have implemented websites to facilitate online lending; and | |

| ● | payday lenders, tribal lenders and other online consumer loan companies. |

Some of these competitors have been in business for a long time and have name recognition and an established customer base. Most of our competitors are larger and have greater financial and personnel resources. In order to compete profitably, we may need to reduce the rates we offer on loans, which may adversely affect our business, prospects, financial condition and results of operations. To remain competitive, we believe we must successfully implement our business strategy. Our success depends on, among other things:

| ● | having a large and increasing number of customers who use our loans for financing needs; | |

| ● | our ability to attract, hire and retain key personnel as our business grows; | |

| ● | our ability to secure additional capital as needed; | |

| ● | our ability to offer products and services with fewer employees than competitors; | |

| ● | the satisfaction of our customers with our customer service; | |

| ● | ease of use of our websites; and | |

| ● | our ability to provide a secure and stable technology platform for providing personal loans that provides us with reliable and effective operational, financial and information systems. |

If we are unable to implement our business strategy, our business, prospects, financial condition and results of operations could be adversely affected.

We depend on third-party service providers for our core operations including online lending and loan servicing, and interruptions in or terminations of their services could materially impair the quality of our services.

We rely substantially upon third-party service providers for our core operations, including online web lending and marketing and vendors that provide systems that automate the servicing of our loan portfolios which allow us to increase the efficiency and accuracy of our operations. These systems include tracking and accounting of our loan portfolio as well as customer relationship management, collections, funds disbursement, security and reporting. This reliance may mean that we will not be able to resolve operational problems internally or on a timely basis, which could lead to customer dissatisfaction or long-term disruption of our operations. If these service arrangements are terminated for any reason without an immediately available substitute arrangement, our operations may be severely interrupted or delayed. If such interruption or delay were to continue for a substantial period of time, our business, prospects, financial condition and results of operations could be adversely affected.

If we lose the services of any of our key management personnel, our business could suffer.

Our future success significantly depends on the continued service and performance of our Chief Executive Officer, Paul Mathieson and our Chief Operating Officer, Carla Cholewinski. Competition for these employees is intense and we may not be able to attract and retain key personnel. We do not maintain any “key man” or other related insurance. The loss of the service of our Chief Executive Officer or our Chief Operating Officer, or the inability to attract additional qualified personnel as needed, could materially harm our business.

| 9 |

We will incur increased costs as a result of being a public reporting company.

Once the registration statement, of which this prospectus forms a part, is declared effective by the SEC, we will be a public reporting company. As a public reporting company, we will incur significant legal, accounting and other expenses that we did not incur as a non-reporting company, including costs associated with our SEC reporting requirements. We expect that the additional reporting and other obligations imposed on us under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) will increase our legal and financial compliance costs and the costs of our related legal, accounting and administrative activities significantly. Management estimates that compliance with the Exchange Act reporting requirements as a reporting company will cost in excess of $150,000 annually. Given our current financial resources, these additional compliance costs could have a material adverse impact on our financial position and ability to achieve profitable results. These increased costs will require us to divert money that we could otherwise use to expand our business and achieve our strategic objectives.

We operate in a highly competitive market, and we cannot ensure that the competitive pressures we face will not have a material adverse effect on our results of operations, financial condition and liquidity.

The consumer finance industry is highly competitive. Our success depends, in large part, on our ability to originate consumer loan receivables. We compete with other consumer finance companies as well as other types of financial institutions that offer similar products and services in originating loan receivables. Some of these competitors may have greater financial, technical and marketing resources than we possess. Some competitors may also have a lower cost of funds and access to funding sources that may not be available to us. While banks and credit card companies have decreased their lending to non-prime customers in recent years, there is no assurance that such lenders will not resume those lending activities. Further, because of increased regulatory pressure on payday lenders, many of those lenders are starting to make more traditional installment consumer loans in order to reduce regulatory scrutiny of their practices, which could increase competition in markets in which we operate.

Our business is subject to extensive regulation in the jurisdictions in which we conduct our business.

Our operations are subject to regulation, supervision and licensing under various federal, state and local statutes, ordinances and regulations. In most states in which we operate, a consumer credit regulatory agency regulates and enforces laws relating to consumer lenders such as us. These rules and regulations generally provide for licensing as a consumer lender, limitations on the amount, duration and charges, including interest rates, for various categories of loans, requirements as to the form and content of finance contracts and other documentation, and restrictions on collection practices and creditors’ rights. In certain states, we are subject to periodic examination by state regulatory authorities. Some states in which we operate do not require special licensing or provide extensive regulation of our business.

We are also subject to extensive federal regulation, including the Truth in Lending Act, the Equal Credit Opportunity Act and the Fair Credit Reporting Act. These laws require us to provide certain disclosures to prospective borrowers and protect against discriminatory lending and leasing practices and unfair credit practices. The principal disclosures required under the Truth in Lending Act include the terms of repayment, the total finance charge and the annual percentage rate charged on each contract or loan. The Equal Credit Opportunity Act prohibits creditors from discriminating against credit applicants on the basis of race, color, religion, national origin, sex, age or marital status. According to Regulation B promulgated under the Equal Credit Opportunity Act, creditors are required to make certain disclosures regarding consumer rights and advise consumers whose credit applications are not approved of the reasons for the rejection. In addition, the credit scoring system used by us must comply with the requirements for such a system as set forth in the Equal Credit Opportunity Act and Regulation B. The Fair Credit Reporting Act requires us to provide certain information to consumers whose credit applications are not approved on the basis of a report obtained from a consumer reporting agency and to respond to consumers who inquire regarding any adverse reporting submitted by us to the consumer reporting agencies. Additionally, we are subject to the Gramm-Leach-Bliley Act, which requires us to maintain the privacy of certain consumer data in our possession and to periodically communicate with consumers on privacy matters. We are also subject to the Service members Civil Relief Act, which requires us, in most circumstances, to reduce the interest rate charged to customers who have subsequently joined, enlisted, been inducted or called to active military duty.

A material failure to comply with applicable laws and regulations could result in regulatory actions, lawsuits and damage to our reputation, which could have a material adverse effect on our results of operations, financial condition and liquidity.

Our accountants have raised substantial doubt regarding our ability to continue as a going concern.

As noted in our consolidated financial statements, we had an accumulated stockholders’ deficit of approximately $9.28 million and recurring losses from operations as of December 31, 2013. We also had a working capital deficit of approximately $0.28 million as of December 31, 2013 and debt with maturities within the fiscal year 2014 in the amount of approximately $0.25 million. We intend to fund operations through raising additional capital through debt financing and equity issuances and increased lending activities which may be insufficient to fund our capital expenditures, working capital or other cash requirements for the year ending December 31, 2014. We are continuing to seek additional funds to finance our immediate and long term operations. The successful outcome of future financing activities cannot be determined at this time and there is no assurance that if achieved, we will have sufficient funds to execute our intended business plan or generate positive operating results. These factors, among others, raise substantial doubt about our ability to continue as a going concern. The audit report of Rose, Snyder & Jacobs LLP for the fiscal years ended December 31, 2013 and 2012 contain a paragraph that emphasizes the substantial doubt as to our continuance as a going concern. This is a significant risk that we may not be able to remain operational for an indefinite period of time.

| 10 |

Risks Relating to the Offering

Provisions of our articles of incorporation and bylaws may delay or prevent a take-over which may not be in the best interests of our shareholders.

Provisions of our articles of incorporation and bylaws may be deemed to have anti-takeover effects, which include when and by whom special meetings of our shareholders may be called, and may delay, defer or prevent a takeover attempt. In addition, certain provisions of the Florida Business Corporations Act also may be deemed to have certain anti-takeover effects which include that control of shares acquired in excess of certain specified thresholds will not possess any voting rights unless these voting rights are approved by a majority of a corporation’s disinterested shareholders. Further, our articles of incorporation authorizes the issuance of up to 50,000,000 shares of preferred stock with such rights and preferences as may be determined from time to time by our board of directors in their sole discretion. Our board of directors may, without shareholder approval, issue series of preferred stock with dividends, liquidation, conversion, voting or other rights that could adversely affect the voting power or other rights of the holders of our common stock.

The tradability of our common stock is limited under the penny stock regulations which may cause the holders of our common stock difficulty should they wish to sell the shares.

Because the quoted price of our common stock is less than $5.00 per share, our common stock is considered a “penny stock,” and trading in our common stock is subject to the requirements of Rule 15g-9 under the Exchange Act. Under this rule, broker-dealers who recommend low-priced securities to persons other than established customers and accredited investors must satisfy special sales practice requirements. The broker-dealer must make an individualized written suitability determination for the purchaser and receive the purchaser’s written consent prior to the transaction. SEC regulations also require additional disclosure in connection with any trades involving a “penny stock,” including the delivery, prior to any penny stock transaction, of a disclosure schedule explaining the penny stock market and its associated risks. These requirements severely limit the liquidity of securities in the secondary market because few broker or dealers are likely to undertake these compliance activities and this limited liquidity will make it more difficult for an investor to sell his shares of our common stock in the secondary market should the investor wish to liquidate the investment. In addition to the applicability of the penny stock rules, other risks associated with trading in penny stocks could also be price fluctuations and the lack of a liquid market.

As an “emerging growth company” under the JOBS Act, we are permitted to rely on exemptions from certain disclosure requirements.

We qualify as an “emerging growth company” under the JOBS Act. As a result, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements. For so long as we are an emerging growth company, we will not be required to:

| ● | have an auditor report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act; | |

| ● | comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the consolidated financial statements (i.e., an auditor discussion and analysis); | |

| ● | submit certain executive compensation matters to stockholder advisory votes, such as “say-on-pay” and “say-on-frequency”; and | |

| ● | disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the chief executive officer’s compensation to median employee compensation. |

In addition, Section 102 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended transition period. Our consolidated financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards.

We will remain an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our total annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our ordinary shares that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

Until such time, however, we cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

If the selling stockholders sell a substantial number of shares all at once or in large blocks, the market price of our shares would most likely decline.

The selling stockholders may offer and sell up to 183,175,591 shares of our common stock through this prospectus. As of the date of this prospectus, this represents approximately 8.5% of our outstanding common stock. Our common stock is presently quoted on the OTC Markets and any sale of shares at a price below the current market price at which the common stock is trading will cause that market price to decline. Moreover, the offer or sale of a large number of shares at any price may cause the market price to fall. We cannot predict the effect, if any, that future sales of shares of our common stock into the market will have on the market price of our common stock. Sales of substantial amounts of common stock or the perception that such transactions could occur, may materially and adversely affect prevailing markets prices for our common stock.

Trading on the OTC Markets is volatile and sporadic, which could depress the market price of our common stock and make it difficult for our stockholders to resell their shares.

Our common stock is quoted on the Pink Current Information tier of the OTC Markets. Trading in stock quoted on the OTC Markets is often thin and characterized by wide fluctuations in trading prices, due to many factors, some of which may have little to do with our operations or business prospects. This volatility could depress the market price of our common stock for reasons unrelated to operating performance. Moreover, the OTC Markets is not a stock exchange, and trading of securities on the OTC Markets is often more sporadic than the trading of securities listed on a quotation system like NASDAQ or a stock exchange like the New York Stock Exchange. These factors may result in investors having difficulty reselling any shares of our common stock.

Our stock price is likely to be highly volatile because of several factors, including a limited public float.

The market price of our common stock has been volatile in the past and is likely to be highly volatile in the future because there has been a relatively thin trading market for our stock, which causes trades of small blocks of stock to have a significant impact on our stock price. You may not be able to resell shares of our common stock following periods of volatility because of the market’s adverse reaction to volatility.

| 11 |

Other factors that could cause such volatility may include, among other things:

| ● | actual or anticipated fluctuations in our operating results; | |

| ● | the absence of securities analysts covering us and distributing research and recommendations about us; | |

| ● | we may have a low trading volume for a number of reasons, including that a large portion of our stock is closely held; | |

| ● | overall stock market fluctuations; | |

| ● | announcements concerning our business or those of our competitors; | |

| ● | actual or perceived limitations on our ability to raise capital when we require it, and to raise such capital on favorable terms; | |

| ● | conditions or trends in the industry; | |

| ● | litigation; | |

| ● | changes in market valuations of other similar companies; | |

| ● | future sales of common stock; | |

| ● | departure of key personnel or failure to hire key personnel; and | |

| ● | general market conditions. |

Any of these factors could have a significant and adverse impact on the market price of our common stock. In addition, the stock market in general has at times experienced extreme volatility and rapid decline that has often been unrelated or disproportionate to the operating performance of particular companies. These broad market fluctuations may adversely affect the trading price of our common stock, regardless of our actual operating performance.

The arbitrary offering price of the shares being offered by the selling stockholders pursuant to this prospectus may result in a loss of value of shares of our common stock.

The offering price of the shares bears no relation to book value, assets, earnings or any other objective criteria of value. It has been arbitrarily determined by the selling stockholders. There can be no assurance that the shares will attain market values commensurate with the offering price.

We have never paid dividends on our common stock and have no plans to do so in the future.

Holders of shares of our common stock are entitled to receive such dividends as may be declared by our board of directors. To date, we have paid no cash dividends on our shares of common stock and we do not expect to pay cash dividends on our common stock in the foreseeable future. We intend to retain future earnings, if any, to provide funds for operations of our business. Therefore, any return investors in our common stock may have will be in the form of appreciation, if any, in the market value of their shares of common stock. See “Dividend Policy.”

We will not receive any proceeds from the sale of common stock by the selling stockholders in this offering. See “Principal and Selling Stockholders.”

DETERMINATION OF OFFERING PRICE

The shares being offered by the selling stockholders will be sold at a fixed price of $0.50; provided, however, that (i) if and when our common stock is quoted on the OTCQB Marketplace or the OTCQX Marketplace, or is traded on Nasdaq or another exchange, the selling stockholders may sell their shares at prevailing market prices or privately negotiated prices; and (ii) to the extent that we effect a reverse stock split after the date of this prospectus, the per share fixed price of the selling stockholders’ shares offered hereby will be adjusted in accordance with the reverse stock split ratio. For example, if our board and our stockholders approve an amendment to our amended and restated articles of incorporation which effects a 1-for-100 reverse stock split, the fixed price for the shares of common stock offered by the selling stockholders pursuant to this prospectus would increase from $0.50 per share to $5.00 per share. As of the date of this prospectus, our board has not approved a reverse stock split, but may do so in the future. No reverse stock split may be effected without board and stockholder approval. There can be no assurance that our shares will be quoted on the OTCQB Marketplace or OTCQX Marketplace, or traded on an exchange, or, if quoted or traded, that a viable public market will materialize. The offering price of the shares bears no relation to book value, assets, earnings, or any other objective criteria of value. It has been arbitrarily determined by the selling stockholders.

This prospectus relates to 183,175,591 shares of our common stock offered by the selling stockholders. The selling stockholders and any of their respective pledges, donees, assignees and other successors-in-interest may, from time to time, sell any or all of their shares of common stock on any stock exchange, market or trading facility on which the shares are traded or in private transactions. These shares shall be sold at a fixed price of $0.50; provided, however, that (i) if and when our common stock is quoted on the OTCQB Marketplace or the OTCQX Marketplace, or is traded on Nasdaq or another exchange, the selling stockholders may sell their shares at prevailing market prices or privately negotiated prices; and (ii) to the extent that we effect a reverse stock split after the date of this prospectus, the per share fixed price of the selling stockholders’ shares offered hereby will be adjusted in accordance with the reverse stock split ratio. For example, if our board and our stockholders approve an amendment to our amended and restated articles of incorporation which effects a 1-for-100 reverse stock split, the fixed price for the shares of common stock offered by the selling stockholders pursuant to this prospectus would increase from $0.50 per share to $5.00 per share. As of the date of this prospectus, our board has not approved a reverse stock split, but may do so in the future. No reverse stock split may be effected without board and stockholder approval. There can be no assurance that our shares will be quoted on the OTCQB Marketplace or OTCQX Marketplace, or traded on an exchange, or, if quoted or traded, that a viable public market will materialize. The offering price of the shares bears no relation to book value, assets, earnings, or any other objective criteria of value. It has been arbitrarily determined by the selling stockholders.

The selling stockholders may use any one or more of the following methods when selling shares:

| ● | ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; | |

| ● | block trades in which the broker-dealer will attempt to sell the shares as agent, but may position and resell a portion of the block as principal to facilitate the transaction; | |

| ● | purchases by a broker-dealer as principal and resale by the broker-dealer for its account; | |

| ● | an exchange distribution in accordance with the rules of the applicable exchange; | |

| ● | privately negotiated transactions; | |

| ● | short sales after the registration statement of which this prospectus forms a part becomes effective; |

| 12 |

| ● | broker-dealers may agree with the selling stockholders to sell a specified number of such shares at a stipulated price per share; | |

| ● | through the writing of options on the shares; | |

| ● | a combination of any such methods of sale; and | |

| ● | any other method permitted pursuant to applicable law. |

The selling stockholders or any of their respective pledgees, donees, transferees or other successors-in-interest, may also sell the shares directly to market makers acting as principals and/or broker-dealers acting as agents for themselves or their customers. Such broker-dealers may receive compensation in the form of discounts, concessions or commissions from the selling stockholders and/or the purchasers of shares for whom such broker-dealers may act as agents or to whom they sell as principal or both, which compensation as to a particular broker-dealer might be in excess of customary commissions. Before any such agent, or broker-dealer sells any of the shares that are the subject of this prospectus, a post-effective amendment to the registration statement of which this prospectus forms a part will be filed to name anyone receiving compensation for selling the shares before any sales take place. Market makers and block purchasers purchasing the shares will do so for their own account and at their own risk. It is possible that a selling stockholder will attempt to sell shares of common stock in block transactions to market makers or other purchasers at a fixed price which may be below or above the then market price. The selling stockholders and any brokers, dealers or agents, upon effecting the sale of any of the shares offered in this prospectus, are “underwriters” as that term is defined under the Securities Act, or the Exchange Act or the rules and regulations under such acts. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act.

Discounts, concessions, commissions and similar selling expenses, if any, attributable to the sale of shares will be borne by the respective selling stockholder. A selling stockholder may agree to indemnify any agent, dealer or broker-dealer that participates in transactions involving sales of the shares if liabilities are imposed on that person under the Securities Act.

The selling stockholders may from time to time pledge or grant a security interest in some or all of the shares of common stock owned by them and, if a selling stockholder defaults in the performance of its secured obligations, the pledgee or secured parties may offer and sell the shares of common stock from time to time under this prospectus after we have filed an amendment to this prospectus under Rule 424(b)(3) or any other applicable provision of the Securities Act amending the list of selling stockholders to include the pledgee, transferee or other successors-in-interest as selling stockholders under this prospectus.

The selling stockholders also may transfer their shares of common stock in other circumstances, in which case the transferees, pledgees or other successors-in-interest will be the selling beneficial owners for purposes of this prospectus and may sell the shares of common stock from time to time under this prospectus after we have filed an amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act amending the list of selling stockholders to include the pledgee, transferee or other successors-in-interest as selling stockholders under this prospectus.

We are required to pay all fees and expenses incident to the registration of the shares of common stock. We have agreed to indemnify the selling stockholders against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

The selling stockholders acquired the securities offered hereby in the ordinary course of business and have advised us that they have not entered into any agreements, understandings or arrangements with any underwriters or broker-dealers regarding the sale of their shares of common stock, nor is there an underwriter or coordinating broker acting in connection with a proposed sale of shares of common stock by any selling stockholder. If we are notified by any selling stockholder that any material arrangement has been entered into with a broker-dealer for the sale of shares of common stock, if required, we will file a supplement to this prospectus.

If a selling stockholder uses this prospectus for any sale of the shares of common stock, it will be subject to the prospectus delivery requirements of the Securities Act.

The anti-manipulation rules of Regulation M under the Securities Exchange Act may apply to sales of our common stock and activities of the selling stockholders.

We have not paid any cash dividends on our common stock and do not currently anticipate paying cash dividends in the foreseeable future. The agreements into which we may enter in the future, including indebtedness, may impose limitations on our ability to pay dividends or make other distributions on our capital stock. Payment of future dividends on our common stock, if any, will be at the discretion of our board of directors and will depend on, among other things, our results of operations, cash requirements and surplus, financial condition, contractual restrictions and other factors that our board of directors may deem relevant. We intend to retain future earnings, if any, for reinvestment in the development and expansion of our business.

As of February 10, 2015, we had 1,000,000 and 1,400,000 shares of Series A and Series F preferred stock, respectively, issued and outstanding , and no shares of Series B, Series C, Series D and Series E preferred stock issued and outstanding. Shares of Series A, Series B, Series C, Series D, Series E and Series F preferred stock accrue dividends at the rate of 12% per annum based on a stated value of $1.00 per preferred share and is paid monthly.

| 13 |

Business Overview

We provide online unsecured consumer loans ranging from $ 5 ,000 to $10,000 under the consumer brand Mr. Amazing Loans via our website and online application portal at www.mramazingloans.com. We commenced business in 2010, opening our first office in Las Vegas, Nevada. We have since obtained additional state lending licenses and are currently licensed and originating direct consumer loans in the states of Arizona, Florida, Georgia, Illinois, Missouri, New Jersey, Nevada, Oregon, Pennsylvania, Texas, Utah and Virginia . Loans are now provided to residents of these states via our online application and distribution network, with all loans originated, processed and serviced out of our centralized Las Vegas head office thereby eliminating the need for physical offices in the states where we are licensed to operate.

Our strategy is to address the market needs of underbanked consumers that tend to be ignored by mainstream institutional credit providers such as banks and credit unions, and charged excessive fees and interest by fringe lenders such as payday lenders. In the current global environment, we believe there is a substantial need and opportunity for the small personal loans we offer.

All of our personal loans are offered at prevailing statutory rates with fixed affordable repayments and no hidden fees or prepayment penalties. We conduct full underwriting on all applications including credit checks and review of bank statements to ensure customers have capacity to repay their loans, and have designed our loans to help customers reach a stronger financial position.

We plan to continue expanding our state coverage in early 2015 by obtaining state lending licenses in 16 additional states, increasing our coverage to 25 states and approximately 250 million people. As soon as we receive new state licenses we will turn on our existing online marketing and distribution channels which we expect will generate immediate business at a customer acquisition cost within our desired budget.

In addition, we plan to begin funding five-year AUD $5,000 and AUD $10,000 unsecured consumer loans in Australia in March or April 2015 at 39.9% per annum APR (upon finalization of outsourced servicing contracts) via our re-launched, fully operational www.mramazingloans.com.au website with centralized marketing and funding provided from the Las Vegas office. As of the date of this prospectus, we have not provided any loans in Australia. We are also planning online expansion globally into Canada, the United Kingdom, the Philippines and India in 2015.

Market

We operate in the consumer finance industry serving the large and growing population of consumers who have limited access to credit from banks, credit card companies and other lenders. According to the Federal Deposit Insurance Corporation, there were approximately 51 million adults living in under-banked households in the United States in 2011, and one quarter of United States households had used at least one alternative financial services product in the past year. According to the Center for Financial Services Innovation’s 2011 Underbanked Market Sizing Study, the underbanked marketplace generated approximately $78 billion in fee and interest revenue in 2011 from a volume of $682 billion in principal loaned, funds transacted, deposits held and services rendered. The underbanked marketplace encompasses close to two dozen products across personal loans, vehicle loans and leases, credit cards, home equity lines of credit and student loans, and in 2011 comprised over 68 million consumers.

Installment lending to non-prime consumers is one of the most highly fragmented sectors of the consumer finance industry. We are a state-licensed Internet-based personal loan company serving in the consumer installment lending industry. Our online lending platform provides the distribution network to efficiently address this growing market of consumers without the significant costs and overhead associated with an extensive branch network. We believe we are well positioned to capitalize on the significant growth and expansion opportunity created by the continued shift of consumers to online services, such as online banking and in our case online personal loans.

We are currently licensed and providing loans online to residents of Arizona, Florida, Georgia, Illinois, Missouri, New Jersey, Nevada, Oregon, Pennsylvania, Texas, Utah and Virginia, with plans to continue to expand across the United States by acquiring additional state lending licenses. The following is a breakdown of our loan origination amounts in each licensed state for our current active loan portfolio as at December 31, 2014:

| State | Origination Volume ($) | Current Principal ($) | Number of Loans | |||||||||

| Arizona | 528,000 | 492,506 | 113 | |||||||||

| Florida | 1,263,000 | 1,206,138 | 277 | |||||||||

| Georgia | 530,021 | 517,179 | 106 | |||||||||

| Illinois | 621,000 | 596,336 | 127 | |||||||||

| Missouri | 143,000 | 135,960 | 28 | |||||||||

| Nevada | 887,000 | 827,859 | 192 | |||||||||

| New Jersey | 708,000 | 689,573 | 133 | |||||||||

| Oregon | 0 | 0 | 0 | |||||||||

| Pennsylvania | 0 | 0 | 0 | |||||||||

| Texas | 10,000 | 9,981 | 1 | |||||||||

| Utah | 0 | 0 | 0 | |||||||||

| Virginia | 447,000 | 435,778 | 85 | |||||||||

| 5,137,021 | 4,911,309 | 1,062 | ||||||||||

Note: Oregon, Pennsylvania and Utah are newly licensed states which went live in the first quarter of 2015, and Texas was the most recently licensed state before that which went live in December 2014.

We also have plans to expand internationally, with Australia and Canada being the next markets in which we expect to offer our loan products.

Business Strategy

Our business strategy is to lower the cost of providing consumer loans by leveraging our online lending platform and distribution network, while continuing to obtain additional state licenses to enable further loan book growth and portfolio diversification. Our strategy includes a number of key elements: