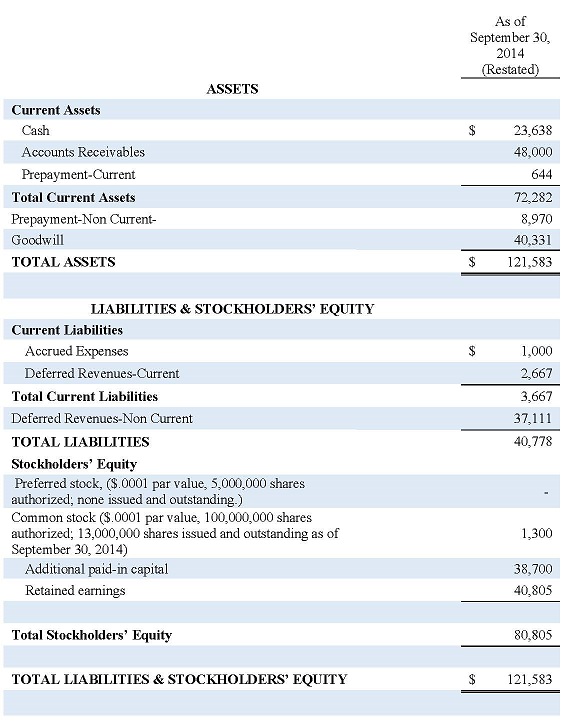

See Notes to Financial Statements.

Page 5

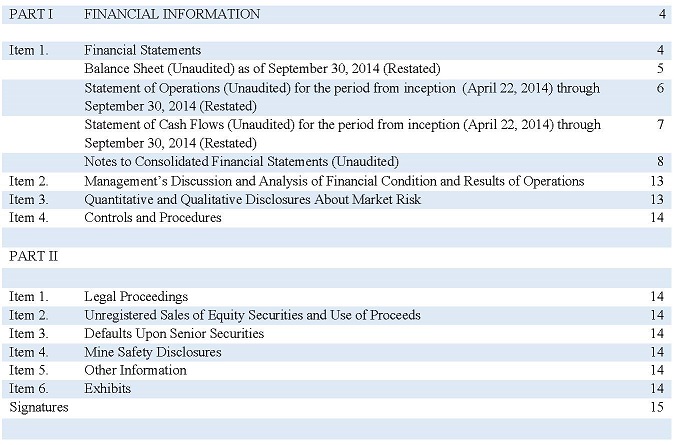

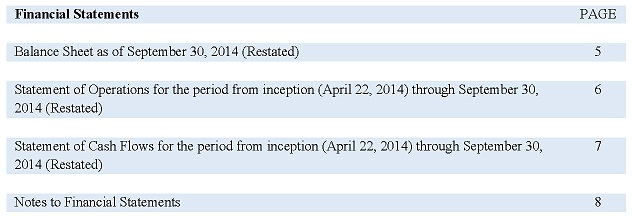

AMERICATOWNE Inc.

(A Development Stage Company)

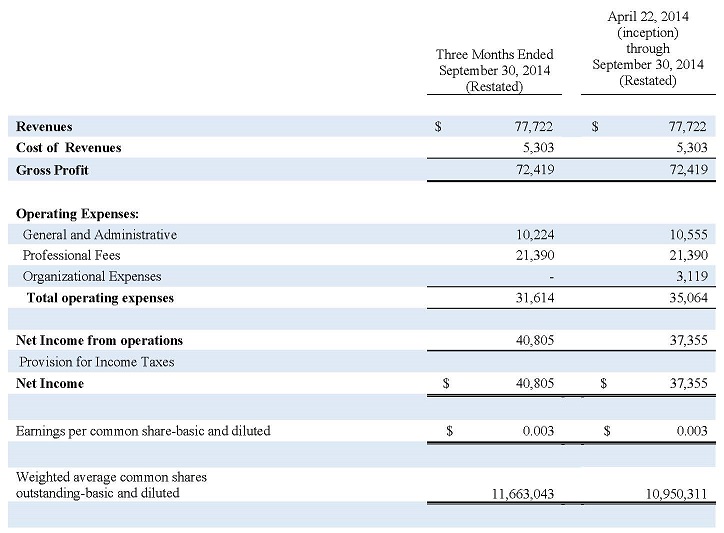

Statement of Operations

(Unaudited)

See Notes to Financial Statements.

Page 6

AMERICATOWNE Inc.

(A Development Stage Company)

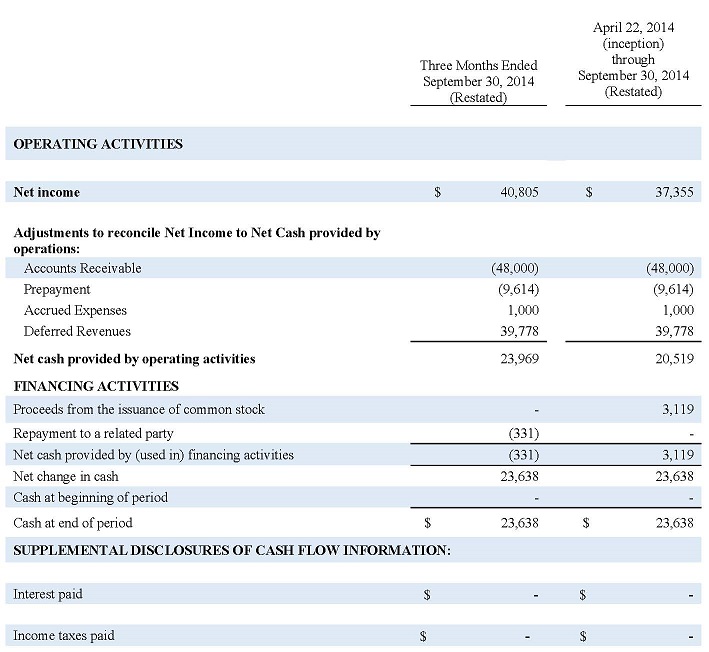

Statement of Cash Flows

(Unaudited)

See Notes to Financial Statements.

Page 7

AMERICATOWNE Inc.

(A Development Stage Company)

Notes to Financial Statements

For the Period from April 22, 2014 (inception) to September 30, 2014

(Unaudited)

NOTE 1. ORGANIZATION AND DESCRIPTION OF BUSINESS

AmericaTowne, Inc. (the "Company") was incorporated under the laws of the State of Delaware on April 22, 2014 and has been inactive since inception. The Company intends to serve as a vehicle to effect an asset acquisition, merger, exchange of capital stock or other business combination with a domestic or foreign business.

On June 18, 2014, the sole officer and director of the Company, Richard Chiang, entered into a Share Purchase Agreement (the "SPA") pursuant to which he entered into an agreement to sell an aggregate of 10,000,000 shares of his shares of the Company's common stock to Yilaime Corporation ("Yilaime") at an aggregate purchase price of $40,000. These shares represent 100% of the Company's issued and outstanding common stock. Effective upon the closing date of the Share Purchase Agreement, June 26, 2014, Richard Chiang executed the agreement and owned no shares of the Company's stock and Yilaime was the sole majority stockholder of the Company.

Yilaime was incorporated on January 1, 2013 in Las Vegas, Nevada. Yilaime provides "innovative solutions for global trade and business" focusing on exporting to China goods and services.

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

These financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America ("U.S. GAAP").

These financial statements have been prepared in accordance with U.S. GAAP for interim financial information and the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by U.S. GAAP for complete financial statements. In the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation of the financial position, results of operations and cash flows for the interim periods have been included. Interim results are not necessarily indicative of the results for the full year.

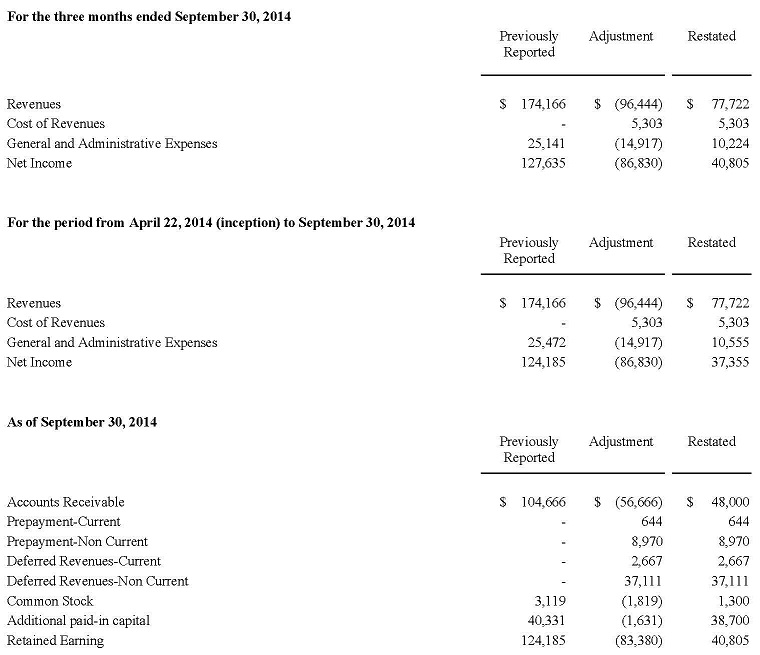

Restatement of third quarter 2014 previously-filed interim financial statements

On February 11, 2015, the Company reported that it had reached a determination to restate its previously-filed interim financial statements for the quarterly period ended September 30, 2014. The restatement had the effect of reducing the Company's reported net income for the three months ended September 30, 2014 and for the period from April 22, 2014 (inception) to September 30 2014 by $86,830. The restatement relates to correction of accounting policy to recognize revenue of "License Fee" over the term of the agreement. We previously recognized revenue of "License Fee" upon signing of the agreement, In addition, we revised APIC and Retained Earnings balances to reflect the application of push-down accounting, including the elimination of accumulated deficit upon acquisition.

The Company reached the determination to restate following receipt of comment letters dated November 20, 2014 and December 30, 2014 from Securities and Exchange Commission stating concerns on the above issues. Management also determined that a material weakness existed in the Company's internal control over financial reporting as of September 30, 2014.

Page 8

The following summarizes the effects of restatement:

Accounting Method

The Company's financial statements are prepared using the accrual method of accounting. The Company has elected a fiscal year ending on December 31.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. In the opinion of management, all adjustments necessary in order to make the financial statements not misleading have been included. Actual results could differ from those estimates.

Page 9

Cash Equivalents

The Company considers all highly liquid investments with maturity of three months or less when purchased to be cash equivalents.

Income taxes are provided in accordance with Statement of Financial Accounting Standards ASC 740 Accounting for Income Taxes. A deferred tax asset or liability is recorded for all temporary differences between financial and tax reporting and net operating loss carry forwards. Deferred tax expense (benefit) results from the net change during the year of deferred tax assets and liabilities. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion of all of the deferred tax assets will be realized. Deferred tax assets and liabilities are adjusted for the effects of changes in tax laws and rates on the date of enactment. There were no current or deferred Income tax expenses or benefits due to the Company not having any material operations for period ended September 30, 2014.

Basic Earnings (Loss) per Share

In February 1997, the FASB issued ASC 260, "Earnings per Share", which specifies the computation, presentation and disclosure requirements for earnings (loss) per share for entities with publicly held common stock. ASC 260 supersedes the provisions of APB No. 15, and requires the presentation of basic earnings (loss) per share and diluted earnings (loss) per share. The Company has adopted the provisions of ASC 260 effective (inception).

Basic earnings and net loss per share amounts are computed by dividing the net income by the weighted average number of common shares outstanding. Diluted earnings per share are the same as basic earnings per share due to the lack of dilutive items in the Company.

Segment Information

The standard, "Disclosures about Segments of an Enterprise and Related Information", codified with ASC 280, requires certain financial and supplementary information to be disclosed on an annual and interim basis for each reportable segment of an enterprise. The Company believes that it operates in business segment of marketing and sales in China while the Company's general administration function is performed in the United States. On September 30, 2014, all assets and liabilities are located in the United States where the income and expense has been incurred since inception to September 30, 2014.

Impact of New Accounting Standards

The Company does not expect the adoption of recently issued accounting pronouncements to have a significant impact on the Company's results of operations, financial position, or cash flow.

Pushdown Accounting and Goodwill

Pursuant to applicable rules (FASB ASC 805-50-S99) the Company used push down accounting to reflect Yilaime Corporation's purchase of 100% of the shares of the Company's common stock. Richard Chiang, the Company's prior sole shareholder entered into an agreement to sell an aggregate of 10,000,000 shares of the Company's common stock to Yilaime Corporation effective upon the closing date of the Share Purchase Agreement dated June 26, 2014. Richard Chiang executed the agreement and owned no shares of the Company's common stock. This transaction resulted in Yilaime Corporation retaining rights, title and interest to all issued and outstanding shares of common stock in the Company.

Page 10

The purchase cost for the agreement was $40,000. The Company used $40,000 as a new accounting basis for its net assets. Since there was no assets on the company's book on June 26, 2014, to make the company's net assets $40,000, the Company recorded $40,331 in goodwill ($40,331-$331=$40,000; $331 was a liability due to a related party). Therefore, in recognizing push down accounting, the Company's net asset increased by the amount reflected by Goodwill.

Change in Policy on Recognizing Revenue

We have adjusted the financial statements and policy on Revenue Recognition to reflect the changes made in recognizing Revenue.

Revenue Recognition

The Company's revenue recognition policies comply with FASB ASC Topic 605. Revenue is recognized at the date of delivery to customers when a formal arrangement exists, the price is fixed or determinable, the delivery is completed, no other significant obligations of the Company exist and collectability is reasonably assured.

Pursuant to ASC 605-25-25 and ASC 605-25-50, in considering the appropriate timing of revenue recognition as well as accounting units, we consider the AmericaTowne Platform provided after the agreement has been signed as deliverables and a separate accounting unit. The AmericaTowne Platform accounting unit is different from the Services provided by Yilaime for market research and analysis during program entry. Services provided by Yilaime are recognized upon entry into the program. Services offered solely by AmericaTowne's through its Platform in China are provided as a separate accounting unit and meet the criteria as outlined in ASC 605-25-25.

According to ASC 605-25-25 Revenue arrangements with multiple deliverables shall be divided into separate units of accounting if the deliverables in the arrangement meet certain criteria as stipulated in ASC 605-25-25-5.

In an arrangement with multiple deliverables, the delivered item or items shall be considered a separate multiple accounting units if: a) the delivered item or items have a value to the customer on a stand-alone basis. The items or items have a value on a stand-alone basis if any vendor can sell them separately or the customer could resell the delivered item on a stand-alone basis. The stand-alone basis doses not require the existence of an observable market for the deliverables; and b) the arrangement includes a general right of return relative to the delivered item, delivery or performance of the undelivered item or items is considered probable and substantially.

AmericaTowne Platform services provided directly by AmericaTowne, meets the first criteria because it is considered to have stand alone value because the customer could resell the services offered on a stand-alone basis. There are other International Trade Centers in China. While not providing US made goods and services, they do offer comparable services indicating that services could be resold to another customer. Additionally, the second criterion is met because there are no refund rights general or otherwise in the arrangement.

The Service Fees provided through Yilaime Corporation, and the Transaction Fees for services provided by AmericaTowne for services rendered during the export life cycle are considered separate units of accounting in the arrangement.

Service Fees are an independent accounting unit resulting from services provided through Yilaime contractual agreements. Service Fees are realized after delivery of the product and services focusing on market analysis and demand. AmericaTowne charges Transaction Fees - a separate accounting unit. AmericaTowne realizes Transaction Fees after the customer has participated in the Export Platform, and the export life cycle is complete. This means we have a buyer; terms negotiated; funding verified; goods delivered; and payments made. Afterwards, a Transaction fee is charged.

In accordance with ASC 605-25-50, the company recognizes its responsibility to fully disclose in the accounting notes as well as elsewhere in its filings as appropriate, the separate accounting units; the nature of multiple delivery arrangements; the general timing of revenue recognition; the significant deliverables within the arrangements; performance, termination, cancellation, and refund type provisions.

Page 11

Yilaime provides some - but not all of the services underlying the arrangements. In general terms, Yilaime provides services up to the point the customer enter the exporting cycle. Afterwards, AmericaTowne Inc. provides the majority of services and work through its operations in China. The Company is developing a US International Import Trade Center Platform located on Meishan Island, Ningbo China. The facility will house AmericaTowne's Platform in an 18,000 square foot display facility. The facility is designed to assist exporters in completing the exporting life cycle. The costs of doing business after the agreement is signed through the AmericaTowne Platform will be reflected in the costs incurred by the Company's subsidiary in China.

The Company recognizes and confirms the requirements in ASC 225-10-S99-4/SAB Topic 5:T Accounting for Expenses or Liabilities Paid by Principal Stockholder(s). All costs of the Company doing business including any costs incurred on its behalf by its shareholder or other economic interests reported pursuant to ASC 225-10-S99-4/SAB Topic 5:T.

There are two customer agreements currently offered to AmericaTowne clients - (a) Licensing, Lease and Use Agreement, and (b) Exporter Services Agreement, both of which are detailed in the Company's September 15, 2014 Form 8-K.

On two of its agreements involving the License fee, we have adjusted the agreements to reflect revenue recognition over the course of the term. Going forward, management will adjust its Occupancy agreement to reflect three specific fees: Service Fees, License Fees; and Royalty fees. These fees adequately address all cost associated with conducting business under the Occupancy Agreement.

Deferred revenues represent cash received.

The reverse of accounts receivable and related revenue is due to change of accounting policy for time to recognize revenue. This portion will be recognized over the term of the agreement rather than upon signing of the agreement.

Revenue is recognized for AmericaTowne Platform Services through Transaction Fees, which are realized after the customer has participated in the Export Platform, and the export life cycle is complete. At the time an arrangement is signed, no platform related revenues are recognized. In addition, there is revenue stemming from the Service Fees provided for the benefit of the Company through its relationship with Yilaime. We confirm that we defer recognition of items delivered at a later date, such as access to and participation in the Sample and Test Market program.

The recognition of the Company's Service Fee and Transaction Fee is not the typical Multiple-Deliverable Revenue Arrangement since each event has a separate fee (unlike the example above where this is one fixed fee). Revenue is recognized for the Transaction Fee and the Service Fee in their respective amounts at the time of the deliverable.

For guidance, the Company relies on the following links in support of its disclosures hereto:

https://www.youtube.com/watch?v=HxzpYLTMJQo

http://www.sec.gov/Archives/edgar/data/720005/000072000513000046/filename1.htm

Yilaime is an independent contractor to the Company. Yilaime is responsible for establishing the Company's costs to conduct business, which the Company's management assumes includes the costs for both successful as well as unsuccessful entrants. Since the Company earned revenue of "Service Fee" as an agent for service provided by Yilaime, it does not recognize cost incurred by Yilaime related to unconsummated arrangements. The Company recognizes revenue of "Service Fee" on a net basis.

The Company, either directly or through its facility in Meishan Island Ningbo China (as disclosed in prior filings), provides services that result in the realization of revenue for Transaction Fees and Licensing Fees. The Company recognized revenue of both on a gross basis since it earns revenue from sales of service.

Page 12

The Company expects to realize revenue for export funding and support, and franchise and license fees for United States support locations. Additionally, if and when the Company further develops AmericaTowne, revenues would be expected to be recognized for (a) villa sales, rentals, timeshare and leasing; (b) hotel leasing and or operational revenues and sales; (c) theme park and performing art center operations, sales and/or leasing; and (d) senior care facilities, operations and or sales.

Sales returns and allowances was $0 for the three months ended September 30, 2014. The Company does not provide unconditional right of return, price protection or any other concessions to its customers.

Valuation of Goodwill

We assess goodwill for potential impairments at the end of each fiscal year, or during the year if an event or other circumstance indicates that we may not be able to recover the carrying amount of the asset. In evaluating goodwill for impairment, we first assess qualitative factors to determine whether it is more likely than not (that is, a likelihood of more than 50 percent) that the fair value of a reporting unit is less than its carrying amount. If we conclude that it is not more likely than not that the fair value of a reporting unit is less than its carrying value, then no further testing of the goodwill assigned to the reporting unit is required. However, if we conclude that it is more likely than not that the fair value of a reporting unit is less than its carrying value, then we perform a two-step goodwill impairment test to identify potential goodwill impairment and measure the amount of goodwill impairment to be recognized, if any.

In the first step of the review process, we compare the estimated fair value of the reporting unit with its carrying value. If the estimated fair value of the reporting unit exceeds its carrying amount, no further analysis is needed. If the estimated fair value of the reporting unit is less than its carrying amount, we proceed to the second step of the review process to calculate the implied fair value of the reporting unit goodwill in order to determine whether any impairment is required. We calculate the implied fair value of the reporting unit goodwill by allocating the estimated fair value of the reporting unit to all of the assets and liabilities of the reporting unit as if the reporting unit had been acquired in a business combination. If the carrying value of the reporting unit's goodwill exceeds the implied fair value of the goodwill, we recognize an impairment loss for that excess amount. In allocating the estimated fair value of the reporting unit to all of the assets and liabilities of the reporting unit, we use industry and market data, as well as knowledge of the industry and our past experiences.

We base our calculation of the estimated fair value of a reporting unit on the income approach. For the income approach, we use internally developed discounted cash flow models that include, among others, the following assumptions: projections of revenues and expenses and related cash flows based on assumed long-term growth rates and demand trends; expected future investments to grow new units; and estimated discount rates. We base these assumptions on our historical data and experience, third-party appraisals, industry projections, micro and macro general economic condition projections, and our expectations.

We have had no goodwill impairment charges for the last three fiscal years, and as of the date of each of the most recent detailed tests, the estimated fair value of each of our reporting units exceeded its' respective carrying amount by more than 100 percent based on our models and assumptions.

NOTE 3. GOING CONCERN

The Company's financial statements are prepared using accounting principles generally accepted in the United States of America applicable to a going concern that contemplates the realization of assets and liquidation of liabilities in the normal course of business. The Company is still in development stage and there is no assurance the Company will obtain revenue producing contracts or financing to cover any operating losses it may incur. These factors raise substantial doubt about the

ability of the Company to continue as a going concern. The financial statements have been prepared on a going basis and do not include any adjustments that might result from the outcome of this uncertainty.

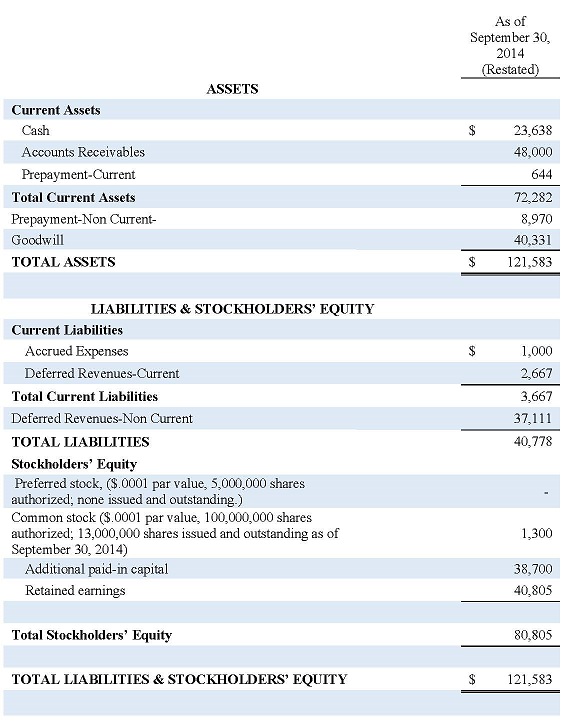

NOTE 4. SHAREHOLDER'S EQUITY

The Company incorporates by reference all prior disclosures for the period identified herein. See Part II, Item 6. The stockholders' equity section of the Company contains the following classes of capital stock as of September 30, 2014:

- Common stock, $ 0.0001 par value: 100,000,000 shares authorized; 13,000,000 shares issued and outstanding

- Preferred stock, $ 0.0001 par value: 5,000,000 shares authorized; but not issued and outstanding.

NOTE 5. SUBSEQUENT EVENTS

The Company incorporates by reference all prior disclosures for the period identified herein. See Part II, Item 6.

ITEM 2.

Management's Discussion and Analysis of Financial Condition and Results of Operations.

FORWARD LOOKING STATEMENTS

Certain statements in this report, including statements of our expectations, intentions, plans and beliefs, including those contained in or implied by "Management's Discussion and Analysis" and the Notes to Financial Statements, are "forward-looking statements", within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), that are subject to certain events, risks and uncertainties that may be outside our control. The words "believe", "expect", "anticipate", "optimistic", "intend", "will", and similar expressions identify forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. We undertake no obligation to update or revise any forward-looking statements. These forward-looking statements include statements of management's plans and objectives for our future operations and statements of future economic performance, information regarding our expansion and possible results from expansion, our expected growth, our capital budget and future capital requirements, the availability of funds and our ability to meet future capital needs, the realization of our deferred tax assets, and the assumptions described in this report underlying such forward-looking statements. Actual results and developments could differ materially from those expressed in or implied by such statements due to a number of factors, including, without limitation, those described in the context of such forward-looking statements.

General Description of Business

The Company incorporates by reference all prior disclosures for the period identified herein. See Part II, Item 6.

Off-Balance Sheet Arrangements

We have not entered into any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources.

Item 3. Quantitative and Qualitative Disclosures About Market Risk.

None.

Page 13

Item 4. Controls and Procedures.

Disclosure Controls and Procedures

As required by Rule 13a-15 of the Securities Exchange Act of 1934, our principal executive officer and principal financial officer evaluated our company's disclosure controls and procedures (as defined in Rules 13a-15(e) of the Securities Exchange Act of 1934) as of the end of the period covered by this report. Based on this evaluation, our principal executive officer and principal financial officer concluded that as of the end of the period covered by this report, these disclosure controls and procedures were not effective to ensure that the information required to be disclosed by our company in reports it files or submits under the Securities Exchange Act of 1934 is recorded, processed, summarized and reported within the time periods specified in the rules and forms of the Securities Exchange Commission and to ensure that such information is accumulated and communicated to our company's management, including our principal executive officer and principal financial officer, to allow timely decisions regarding required disclosure. The conclusion that our disclosure controls and procedures were not effective was due to the presence of the following material weaknesses in internal control over financial reporting which are indicative of many small companies with small staff: (i) inadequate segregation of duties and effective risk assessment; and (ii) insufficient written policies and procedures for accounting and financial reporting with respect to the requirements and application of both United States generally accepted accounting principles and Securities and Exchange Commission guidelines. Management anticipates that such disclosure controls and procedures will not be effective until the material weaknesses are remediated.

As described in Basis of Presentation on page 9 of this Amendment to the Third Quarter Report, the Company recently determined that a material weakness existed in the Firm's internal control over financial reporting (as defined in Rule 13a-15(f) under the Securities Exchange Act of 1934) at September 30, 2014. A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of the annual or interim financial statements will not be prevented or detected on a timely basis.

As a result of that determination, the Company's Chief Executive Officer and Chief Financial Officer have since concluded that the Firm's disclosure controls and procedures were not effective at September 30, 2014.

We plan to take steps to enhance and improve the design of our internal controls over financial reporting. During the period covered by this quarterly report on Form 10-Q, we have not been able to remediate the material weaknesses identified above. To remediate such weaknesses, we plan to implement the following changes during our fiscal year ending December 31, 2014, subject to obtaining additional financing: (i) appoint additional qualified personnel to address inadequate segregation of duties and ineffective risk management; and (ii) adopt sufficient written policies and procedures for accounting and financial reporting. The remediation efforts set out above are largely dependent upon our securing additional financing to cover the costs of implementing the changes required. If we are unsuccessful in securing such funds, remediation efforts may be adversely affected in a material manner.

Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues, if any, within our company have been detected. These inherent limitations include the realities that judgments in decision-making can be faulty and that breakdowns can occur because of simple error or mistake.

Changes in Internal Control over Financial Reporting

There were no changes in our internal control over financial reporting during the quarter ended September 30, 2014 that have materially affected or are reasonably likely to materially affect, our internal control over financial reporting.

PART II - OTHER INFORMATION

Item 1. Legal Proceedings.

There are not presently any material pending legal proceedings to which the Registrant is a party or as to which any of its property is subject, and no such proceedings are known to the Registrant to be threatened or contemplated against it.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds.

The Company incorporates by reference all prior disclosures for the period identified herein. See Part II, Item 6.

Item 3. Defaults Upon Senior Securities

None.

Item 4. Mine Safety Disclosures

Not applicable.

Item 5. Other Information.

On September 30, 2014, upon approval of the Company's majority shareholder, the Company entered into an agreement for consulting services with Stanek & Company, CPAs P.C. The agreement provides services related to financial accounting preparation for the Company's exchange act filing requirements. The terms are month to month and the compensation is $75.00 dollars to $185.00 dollars per hour based upon the complexity of services provided. See Exhibit 10.7. The Company incorporates by reference all prior disclosures for the period identified herein. See Part II, Item 6.

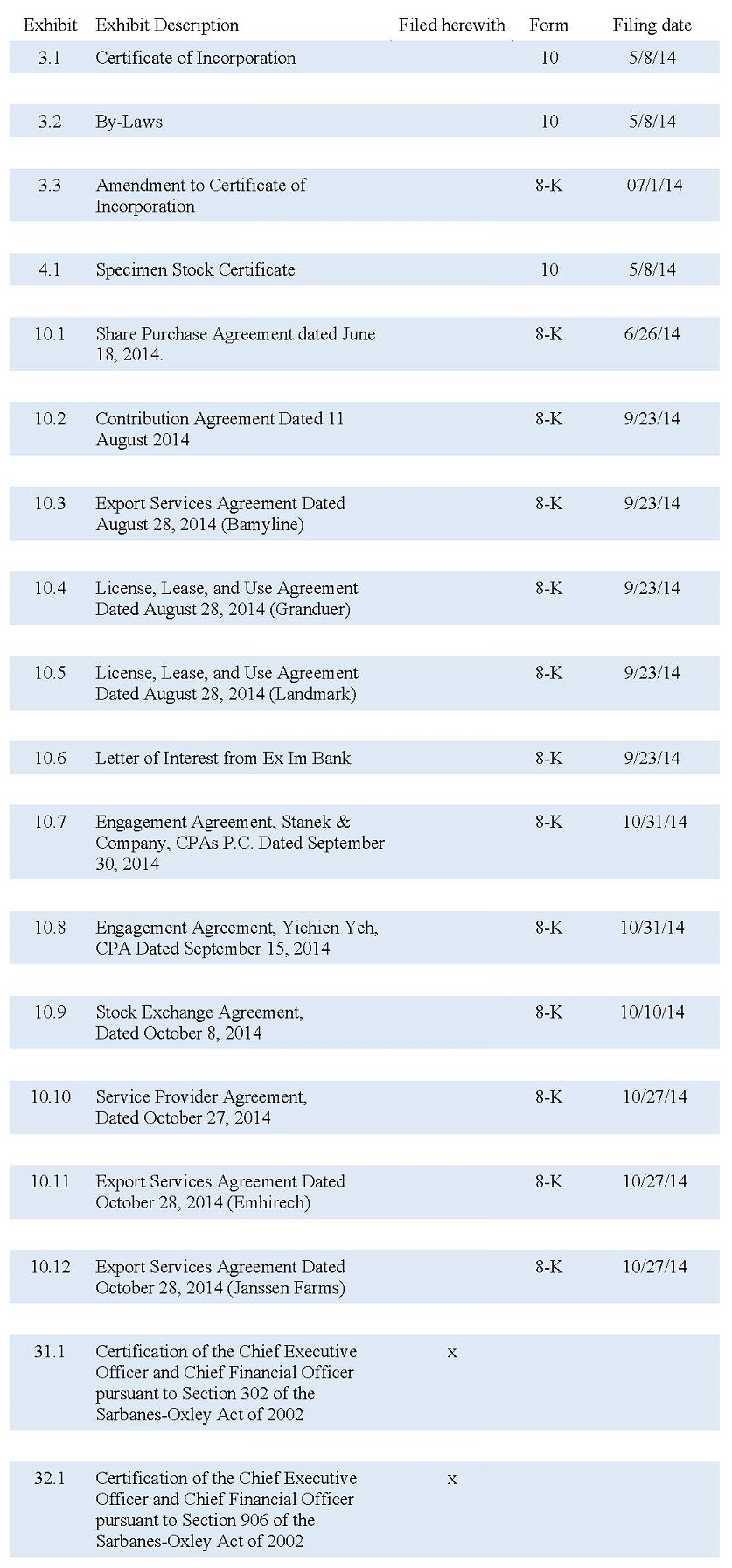

Item 6. Exhibits

Page 14

SIGNATURES

In accordance with the requirements of the Exchange Act, the Registrant caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

AMERICATOWNE Inc.

Dated: February 11, 2015

By: /s/ Alton Perkins

Alton Perkins

Chairman of the Board, President, Chief Executive Officer, Chief Financial Officer, Secretary

(Principal Executive Officer, Principal Financial Officer)

Page 15