Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Viatar CTC Solutions Inc. | Financial_Report.xls |

| EX-5.1 - EXHIBIT 5.1 - Viatar CTC Solutions Inc. | s100749_ex5-1.htm |

| EX-23.1 - EXHIBIT 23.1 - Viatar CTC Solutions Inc. | s100749_ex23-1.htm |

| XML - IDEA: XBRL DOCUMENT - Viatar CTC Solutions Inc. | R9999.htm |

As filed with the Securities and Exchange Commission on February 12, 2015

Registration No. 333-199619

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| FORM S-1/A (Amendment No. 4) |

| REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 |

| Viatar CTC Solutions Inc. |

| (Exact name of Registrant as specified in its charter) |

| Delaware | 3841 | 26-1581305 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

| 116 John Street, Suite 10, Lowell, Massachusetts 01852 |

| (617) 299-6590 |

| (Address, including zip code, and telephone number, |

| including area code, of Registrant’s principal executive offices) |

| Ilan Reich |

| Chief Executive Officer |

| Viatar CTC Solutions Inc. |

| 116 John Street, Suite 10 |

| Lowell, Massachusetts 01852 |

| (617) 299-6590 |

| (Name, address, including zip code, and telephone number, including area code, of agent for service) |

Copies to:

Gregory Sichenzia, Esq.

Darrin M. Ocasio, Esq.

Sichenzia Ross Friedman Ference LLP

61 Broadway, 32nd Floor

New York, NY 10006

(212) 930-9700

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ | |||

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company x |

| CALCULATION OF REGISTRATION FEE |

| Title of Each Class of Securities to Be Registered | Amount to Be Registered | Proposed Maximum Offering Price Per Unit (1) | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee | ||||||||||||

| Common Stock (2) | 1,199,571 | $ | 3.50 | $ | 4,198,499 | $ | 487.86 | |||||||||

| Common Stock underlying Warrants (2) | 100,000 | $ | 3.50 | $ | 350,000 | $ | 40.67 | |||||||||

| Subtotal | 1,299,571 | $ | 528.53 | |||||||||||||

| Common Stock underlying Warrants(2) | 50,000 | $ | 3.50 | $ | 175,000 | $ | 20.34 | |||||||||

| Total | 1,349,571 | $ | 548.87 | (3) | ||||||||||||

| (1) | Pursuant to Rule 416 under the Securities Act of 1933, this Registration Statement also covers any additional securities that may be offered or issued in connection with any stock split, stock dividend or similar transaction. |

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(a) under the Securities Act of 1933, as amended. |

| (3) | Previously paid. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the Securities and Exchange Commission (the “SEC”) declares our registration statement effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, dated February 12, 2015

Prospectus

Viatar CTC Solutions Inc.

1,349,571 Shares of Common Stock

The selling stockholders identified in this prospectus are offering 1,349,571 shares of common stock, par value $0.001 per share (“Common Stock”) of Viatar CTC Solutions Inc.(the “Company,” “we,” “us,” or “our”)including 1,199,571 shares of Common Stock and 150,000 shares of Common Stock issuable upon exercise of certain warrants of the Company.

These securities will be offered for sale by the selling stockholders identified in this prospectus in accordance with the methods and terms described in the section of this prospectus titled “Plan of Distribution.” We will not receive any of the proceeds from the sale of these shares. The selling stockholders will offer and sell the shares at $3.50 per share until the price of our Common Stock is quoted on the OTCQX or OTCQB marketplace of OTC Link ATS or on the OTC Bulletin Board (collectively, the “OTC Markets”) and thereafter at prevailing market prices or privately negotiated prices. The selling stockholders may be deemed “underwriters” within the meaning of the Securities Act of 1933, as amended, in connection with the sale of their Common Stock under this prospectus. We will pay all the expenses incurred in connection with the offering described in this prospectus, with the exception of brokerage expenses, fees, discounts and commissions, which will all be paid by the selling stockholders. Our Common Stock is more fully described in the section of this prospectus titled “Description of Securities.”

No public market currently exists for our Common Stock. Although we intend to request a registered broker-dealer apply to have our Common Stock quoted on the OTC Markets, public trading of our Common Stock may never materialize or even if materialized, be sustained.

We are an “emerging growth company” under the federal securities laws and are subject to reduced public company reporting requirements. Investing in our Common Stock involves a high degree of risk. You may lose your entire investment. See “Risk Factors” beginning on page 3. You should read the entire prospectus before making an investment decision.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is ________________, 2015

TABLE OF CONTENTS

This summary highlights information contained in greater detail elsewhere in this prospectus. You should read the entire prospectus carefully before making an investment in our Common Stock. You should carefully consider, among other things, our consolidated financial statements and the related notes and the sections entitled “Risk Factors,” “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus. Unless the context otherwise requires, the terms “Viatar,” “the Company,” “we,” “us” and “our” in this prospectus refer to Viatar CTC Solutions Inc., and its subsidiaries.

Overview

We were a limited liability company organized in the State of Delaware on December 18, 2007 under the name “Vizio Medical Devices LLC” and converted into a Delaware corporation on February 25, 2014 upon filing a certificate of conversion and a certificate of incorporation under the name “Viatar CTC Solutions Inc.”

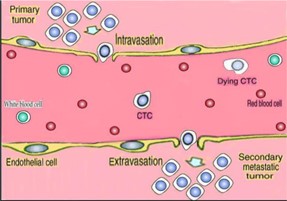

We are a medical technology company focused on cancer molecular diagnostics and cancer therapy, both based on the principle of removing blood-borne circulating tumor cells. We are a development stage company which is conducting research and planning to commercialize two products that utilize our proprietary blood-borne circulating tumor cells removal technology:

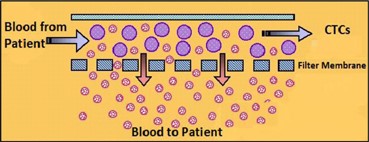

| · | The ViatarTM Collection System for Molecular Analysis is designed to collect and purify a statistically significant quantity of blood-borne circulating tumor cells from up to 50 mL of blood and these circulating tumor cells collected in our device are then used in subsequent, downstream applications, like DNA sequencing and other genetic analysis technologies used primarily for research. |

| · | The ViatarTM Therapeutic Oncopheresis System is designed to remove blood-borne circulating tumor cells from a patient’s blood as a new cancer therapy for metastatic disease, which occurs when cancers spreads from one organ to another not directly connected with it. |

We anticipate launching the ViatarTM Collection System for Molecular Analysis during 2016 once we receive the following regulatory clearances: first, a CE Mark in Europe and Canada, which is the foreign equivalent of compliance with United States Food and Drug Administration clearance to commercially market a medical device; and, second, a 510(k) designation in the United States from the United States Food and Drug Administration, which is needed to market the new medical device. We are currently engaged in research collaborations with several blood-borne circulating tumor cells technology platform companies with the goal of marketing and selling the ViatarTM Collection System for Molecular Analysis through private label and distribution arrangements. We anticipate launching the ViatarTM Therapeutic Oncopheresis System during 2016 with a CE Mark in Europe and Canada. Introduction in the United States will take several years, based on the anticipated Premarket Approval classification by the United States Food and Drug Administration, which requires us to submit an exhaustive application to the United States Food and Drug Administration and receive approval prior to beginning commercial marketing of the device. The Premarket Approval application includes information on how the device was designed and manufactured, as well as preclinical and clinical studies, demonstrating that it is safe and effective for its intended use. We anticipate marketing and selling the ViatarTM Therapeutic Oncopheresis System on a direct basis through our own dedicated sales force in key large markets (such as the United States, Germany, France, Italy, UK and Japan), and through distributors in other markets.

Both of our oncology products are in the development stage, with significant design, materials validation, manufacturing scale-up and preclinical testing necessary before they can be used in human clinical trials. None of the capabilities of our two oncology products have been demonstrated yet in statistically significant clinical trials.

An investment in our Common Stock involves a high degree of risk. You should carefully consider the risks summarized below. The risks are discussed more fully in the “Risk Factors” section of this prospectus on page 3. These risks include, but are not limited to, the following:

| • | we are an early-stage company with total net losses of $18.02 million from inception (December 18, 2007) to September 30, 2014. Before 2011, we were also pursuing a business plan relating to ambulatory removal of excess fluids for kidney failure and congestive heart failure patients. We discontinued that program due to technical difficulties and the scarcity of funds. The portion of our accumulated deficit that relates to those activities for the period from inception through December 30, 2010 is approximately $9 million. |

| • | we may never achieve sustained profitability; |

| • | our business depends upon our ability to complete product development activities and achieve sales of our two oncology applications; |

| • | our current cash resources are insufficient to fund our operations for an extended period of time; |

| • | our business depends on executing our business strategy, developing collaboration relationships with other life science companies and major cancer research centers, and gaining acceptance of our products in the market; |

| 1 |

| • | our business depends on satisfying any applicable United States (including Food and Drug Administration) and international regulatory requirements with respect to new medical devices including validation studies of the materials and manufacturing processes used in our devices and pre-clinical testing to demonstrate safety in animals, as well human clinical studies to demonstrate efficacy for specific disease conditions; | |

| • | our business depends on our ability to effectively compete with other therapies, technologies and services that now exist or may hereafter be developed; | |

| • | we depend on our chief executive officer; | |

| • | we depend on our ability to attract and retain scientists, clinicians and sales personnel with extensive experience in oncology, who are in short supply; | |

| • | we need to obtain or maintain patents or other appropriate protection for the intellectual property utilized in our current and planned products; and | |

| • | Our largest stockholder, chief executive officer and chairman of the board, Mr. Ilan Reich, has the ability to control our business direction and could delay or prevent a change in corporate control. |

Company Information

We maintain our principal executive offices at 116 John Street, Suite 10, Lowell, Massachusetts 01852. Our telephone number is (617) 299-6590 and our website address is www.viatarctcsolutions.com. The information contained in, or that can be accessed through, our website is not incorporated into and is not part of this prospectus. We were incorporated in Delaware on December 18, 2007 as a limited liability company and converted to a corporation on February 25, 2014.

Implications of Being an Emerging Growth Company

As a company with less than $1 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, or JOBS Act, enacted in April 2012, and may take advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

| • | being permitted to present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations in our SEC filings; |

| • | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act; |

| • | reduced disclosure obligations regarding executive compensation in periodic reports, proxy statements and registration statements; and |

| • | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. |

We may take advantage of these provisions until the last day of our fiscal year following the fifth anniversary of the date of the first sale of our common equity securities pursuant to an effective registration statement under the Securities Act. However, if certain events occur before the end of such five-year period, including if we become a “large accelerated filer,” our annual gross revenues exceed $1 billion or we issue more than $1 billion of non-convertible debt in any three-year period, we will cease to be an emerging growth company before the end of such five-year period.

In addition, Section 107 of the JOBS Act provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. We have elected to take advantage of the extended transition period for complying with new or revised accounting standards.

Going Concern

As described in auditor’s report on our financial statements, our auditors have included a “going concern” provision in their opinion on our financial statements, expressing substantial doubt that we can continue as an ongoing business for the next twelve months.

The Offering

| Common Stock offered by the selling stockholders | 1,349,571 shares of Common Stock, including 1,199,157 shares of Common Stock and 150,000 shares of Common Stock issuable upon exercise of certain warrants of the Company | |

| Common Stock Outstanding before this offering | 17,202,372 shares | |

| Common stock to be outstanding after this offering assuming exercise of all the warrants being offered herein) | 17,352,372 shares | |

| 2 |

| Use of proceeds | We will not receive any of the proceeds from the sale of shares to be offered by the selling stockholders. See “Use of Proceeds.” | |

| Risk factors | You should carefully consider the information set forth in this prospectus and, in particular, the specific factors set forth in the “Risk Factors” section beginning on page 3 of this prospectus before deciding whether or not to invest in shares of our Common Stock. | |

Investing in our Common Stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below, together with all of the other information in this prospectus, including our consolidated financial statements and related notes, before investing in our Common Stock. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties that we are unaware of, or that we currently believe are not material, may also become important factors that affect us. If any of the following risks occur, our business, financial condition, operating results, and prospects could be materially harmed. In that event, you could lose part or all of your investment.

Risks Relating to Our Financial Condition and Capital Requirements

We are an early stage company with a history of net losses; we expect to incur net losses in the future, and we may never achieve sustained profitability.

We have historically incurred substantial net losses, including net losses of $4.39 million in 2012 and $1.06 million in 2013, and we have never been profitable. At September 30, 2014, our total net loss since inception was approximately $18.02 million. Before 2011, we were pursuing a business plan relating to an ambulatory device for removal of excess fluids from kidney failure and congestive heart failure patients, which was unrelated to oncology. The portion of our accumulated deficit that relates to those activities during the period from inception through December 31, 2010 is approximately $9 million.

We expect our losses to continue as a result of costs relating to our research and development, clinical and regulatory activities, as well as sales and marketing costs. These losses have had, and will continue to have, an adverse effect on our working capital, total assets and stockholders’ equity. Because of the numerous risks and uncertainties associated with our commercialization efforts, we are unable to predict when we will become profitable, and we may never become profitable. Even if we do achieve profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis. Our inability to achieve and then maintain profitability would negatively affect our business, financial condition, results of operations and cash flows.

Our independent registered public accounting firm has expressed substantial doubt about our ability to continue as a going concern.

As described in auditor’s report on our financial statements, our auditors have included a “going concern” provision in their opinion on our financial statements, expressing substantial doubt that we can continue as an ongoing business for the next twelve months. Our financial statements do not include any adjustments that may result from the outcome of this uncertainty. If we cannot secure the financing needed to continue as a viable business, our stockholders may lose some or all of their investment in us.

| 3 |

We will need to raise additional capital.

We believe our current cash resources and committed borrowing capacity are insufficient to satisfy our liquidity requirements at our current level of operations. We expect that we will need to raise additional financing during the first quarter of 2015. Such financing may not be available to us on favorable terms, if at all. Without that new financing, we would need to scale back our general and administrative activities and certain of our research and development activities. Our forecast pertaining to the adequacy of our current financial resources supporting our current and anticipated level of operations is a forward-looking statement and involves risks and uncertainties.

We will also need to raise additional capital to expand our business to meet our long-term business objectives. Additional financing, which is not in place at this time, may be from the sale of equity or convertible or other debt securities in a public or private offering, from an additional credit facility or strategic partnership coupled with an investment in us or a combination of both. We may be unable to raise sufficient additional financing on terms that are acceptable to us, if at all. Failure to raise additional capital in sufficient amounts would significantly impact our ability to expand our business. For further discussion of our liquidity requirements as they relate to our long-term plans, see the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources.”

Risks Relating to Our Business and Strategy

If we are unable to generate sufficient sales for our two oncology products once commercialized, our revenues will be insufficient for us to achieve profitability.

We are in varying stages of research and development for our two oncology products and have not commenced any sales of our products. If we are unable to generate sufficient sales for those products once they are commercialized, we will not produce sufficient revenues to become profitable.

If we are unable to execute our sales and marketing strategy for our two oncology products and are unable to gain acceptance in the market, we may be unable to generate sufficient revenue to sustain our business.

Although we believe that our two oncology products represent a promising commercial opportunity, our products may never gain significant acceptance in the marketplace and therefore may never generate substantial revenue or profits for us. We will need to establish a market and build that market through collaborations with other companies, physician education, awareness programs and the publication of clinical trial results. Gaining acceptance in medical communities requires publication in leading peer-reviewed journals of results from studies using our planned products. The process of publication in leading medical journals is subject to a peer review process and peer reviewers may not consider the results of our studies sufficiently novel or worthy of publication. Failure to have our studies published in peer-reviewed journals would limit the adoption of our two oncology products.

Our ability to successfully market our two oncology products will depend on numerous factors, including:

| • | conducting clinical studies with our two medical devices in collaboration with key thought leaders to demonstrate their use and value in important medical decisions; |

| • | whether our potential collaboration partners vigorously support our offerings; |

| • | the success of the sales force which we intend to hire; |

| • | whether healthcare providers believe our two oncology products provide clinical or therapeutic utility; |

| • | whether the medical community accepts that such products are sufficiently meaningful in patient care and treatment decisions; and |

| • | whether health insurers, government health programs and other third-party payors will cover and pay for such products and, if so, whether they will adequately reimburse us. |

Failure to achieve widespread market acceptance of our two oncology products would materially harm our business, financial condition and results of operations.

| 4 |

If we cannot develop new products to keep pace with rapid advances in technology, medicine and science, our operating results and competitive position could be harmed.

In recent years, there have been numerous advances in technologies relating to the diagnosis and treatment of cancer. Several new cancer drugs have been approved, and a number of new drugs in clinical development may increase patient survival time. There have also been advances in methods used to identify patients likely to benefit from these drugs based on analysis of biomarkers and DNA sequencing. We must continuously develop new oncology products and enhance any existing products to keep pace with evolving standards of care. Our products could become obsolete unless we continually innovate and expand them to demonstrate benefit in the diagnosis and treatment of patients with cancer, which would have a material adverse effect on our business, financial condition and results of operations.

If our two oncology products do not continue to perform as expected, our operating results, reputation and business will suffer.

Our success depends on the market’s confidence that we can continue to provide reliable, high-quality products. We believe that our customers are likely to be particularly sensitive to safety issues, defects and errors. As a result, the failure of our two oncology products to perform as expected would significantly impair our reputation and public image, and we may be subject to legal claims arising from any safety issues, defects or errors.

If our sole facility becomes damaged or inoperable, or we are required to vacate the facility, our ability to sell and provide our two oncology products and pursue our research and development efforts may be jeopardized.

We currently conduct virtually all of our business from our facility in Lowell, Massachusetts. We do not have any other facilities. Our facility and equipment could be harmed or rendered inoperable by natural or man-made disasters, including fire, storm, earthquake, flooding and power outages, which may render it difficult or impossible for us to run our business. This may result in the loss of customers or harm to our reputation or relationships with scientific or clinical collaborators, and we may be unable to regain those customers or repair our reputation in the future. Furthermore, our facility and the equipment we use to perform our research and development work could be costly and time-consuming to repair or replace. We carry insurance for damage to our property and the disruption of our business, but this insurance may not be sufficient to cover all of our potential losses and may not continue to be available to us on acceptable terms, if at all.

If we cannot compete successfully with our competitors, we may be unable to increase or sustain our revenues or achieve and sustain profitability.

Our principal competition comes from mainstream diagnostic methods, used by pathologists and oncologists for many years, which focus on tumor tissue analysis. It may be difficult to change the methods or behavior of oncologists to incorporate our CTC molecular diagnostic system in their practices in conjunction with or instead of tissue biopsies and analysis. In addition, companies offering capital equipment and kits or reagents to local pathology laboratories represent another source of potential competition. These kits are used directly by the pathologist, which can facilitate adoption.

While virtually all of the companies which offer molecular diagnostic tests are potential customers and/or collaboration partners for our molecular diagnostic system, CTC analysis is a new area of science and we cannot predict what tests or technologies others will develop that may compete with or provide results similar or superior to the results we are able to achieve with our product. Currently, among the category of companies which we regard as potential customers and/or collaboration partners are Janssen Diagnostics, LLC (a unit of Johnson & Johnson), which markets its CellSearch® test; Atossa Genetics markets its ArgusCYTE® test, as well as public companies such as Alere (Adnagen) and Illumina as well as many private companies, including Apocell, EPIC Sciences, Clearbridge Biomedics, Cynvenio Biosystems, Fluxion Biosciences, RareCells, ScreenCell and Silicon Biosystems. Many of these groups, in addition to operating research and development laboratories, are establishing CLIA-certified testing laboratories while others are focused on selling equipment and reagents.

CTC removal via therapeutic oncopheresis is a new field and we cannot predict whether oncologists will accept it as a valid treatment methodology for metastatic cancers; or whether pharmaceutical and biopharmaceutical companies will develop targeted drugs or vaccines that achieve similar or better outcomes. Mechanical separation of one species of cells from the blood is a long-established technology, and several research groups are investigating methods of using leukapheresis (either alone or in conjunction with a separation medium such as beads) to remove CTCs from a cancer patient’s blood. Although we believe that those methods will be too cumbersome, expensive and have adverse side effects, there can be no assurance that other technologies will be developed which compete effectively against our therapeutic oncopheresis system.

| 5 |

We expect that pharmaceutical and biopharmaceutical companies will increasingly focus attention and resources on the personalized cancer diagnostic sector as the potential and prevalence of molecularly targeted oncology therapies approved by the FDA along with companion diagnostics increases. For example, the FDA has recently approved three such agents—Xalkori® from Pfizer Inc. along with its companion anaplastic lymphoma kinase FISH test from Abbott Laboratories, Inc., Zelboraf® from Daiichi-Sankyo/Genentech/Roche along with its companion B-raf kinase V600 mutation test from Roche Molecular Systems, Inc. and Tafinlar® from GlaxoSmithKline along with its companion B-raf kinase V600 mutation test from bioMerieux. These recent FDA approvals are only the second, third and fourth instances of simultaneous approvals of a drug and companion diagnostic, the first being the 1998 approval of Genentech’s Herceptin® for HER2 positive breast cancer along with the HercepTest from partner Dako A/S.

There are a number of companies which are focused on the oncology diagnostic market, such as Biodesix, Caris, Clarient, Foundation Medicine, Neogenomics, Response Genetics, Agendia, Genomic Health, and Genoptix, who while not currently offering CTC tests are selling to the medical oncologists and pathologists and could develop or offer CTC tests. Large laboratory services companies, such as Sonic USA, Quest and LabCorp, provide more generalized cancer diagnostic testing.

Additionally, projects related to cancer diagnostics and particularly genomics have received increased government funding, both in the United States and internationally. As more information regarding cancer genomics becomes available to the public, we anticipate that more products aimed at identifying targeted treatment options will be developed and that these products may compete with ours. In addition, competitors may develop their own versions of our current or planned products in countries where we did not apply for patents or where our patents have not issued and compete with us in those countries, including encouraging the use of their test by physicians or patients in other countries.

Some of our present and potential competitors have widespread brand recognition and substantially greater financial and technical resources and development, production and marketing capabilities than we do. Others may develop lower-priced CTC-based tests that payors, pathologists and oncologists could view as functionally equivalent to the benefits that can be obtained using our molecular diagnostic system and DNA sequencing, which could force us to lower the list price of our medical device and impact our operating margins and our ability to achieve and maintain profitability. In addition, technological innovations that result in the creation of enhanced diagnostic tools that are more sensitive or specific than DNA sequencing may enable other clinical laboratories, hospitals, physicians or medical providers to provide specialized diagnostic tests in a more patient-friendly, efficient or cost-effective manner than is currently possible. If we cannot compete successfully against current or future competitors, we may be unable to increase or create market acceptance and sales of our current or planned medical devices, which could prevent us from increasing or sustaining our revenues or achieving or sustaining profitability.

We expect to continue to incur significant expenses to develop and market oncology products, which could make it difficult for us to achieve and sustain profitability.

In recent years, we have incurred significant costs in connection with the development of our oncology products. For the year ended December 31, 2012, our research and development expenses were $4.23 million. For the year ended December 31, 2013, our research and development expenses were $0.68 million. We expect our expenses to increase from that level for the foreseeable future as we conduct studies of our two oncology tests, establish a sales and marketing organization, drive adoption of and reimbursement for those products and develop new oncology products. As a result, we need to generate significant revenues in order to achieve sustained profitability.

| 6 |

Clinical studies are important in demonstrating to both customers and payors a medical device’s clinical relevance and value. If we are unable to identify collaborators willing to work with us to conduct clinical studies, or the results of those studies do not demonstrate that a medical device provides clinically meaningful health outcomes and value, commercial adoption of such device may be slow, which would negatively impact our business.

Clinical studies show when and how to use a given medical device, and describe the particular clinical situations or settings in which it can be applied and the expected results. Clinical studies also show the impact of the results on patient care and management. Clinical studies are typically performed with collaborating oncologists at medical centers and hospitals, and generally result in peer-reviewed publications. Sales and marketing representatives use these publications to demonstrate to customers how to use a medical device, as well as why they should use it. These publications are also used with payors to obtain coverage for a procedure or test utilizing a medical device, helping to assure there is appropriate reimbursement.

We will need to conduct clinical studies for our two oncology products to drive adoption in the marketplace and reimbursement. Should we not be able to perform these studies, or should their results not provide clinically meaningful data and value for oncologists, adoption of our tests could be impaired and we may not be able to obtain reimbursement for them.

The loss of key members of our executive management team could adversely affect our business.

Our success in implementing our business strategy depends largely on the skills, experience and performance of key members of our executive management team, including Ilan Reich, our Chief Executive Officer. The collective efforts of each of these persons and others working with them as a team are critical to us as we continue to develop our technologies, tests and research and development and sales programs. As a result of the difficulty in locating qualified new management, the loss or incapacity of existing members of our executive management team could adversely affect our operations.. We do not maintain “key person” life insurance on any of our employees.

In addition, we rely on collaborators, consultants and advisors, including scientific and clinical advisors, to assist us in formulating our research and development and commercialization strategy. Our collaborators, consultants and advisors are generally employed by employers other than us and may have commitments under agreements with other entities that may limit their availability to us.

The loss of a key member of our management team, the failure of a key member of our management team to perform in his or her current position or our inability to attract and retain skilled employees could result in our inability to continue to grow our business or to implement our business strategy.

There is a scarcity of experienced professionals in our industry. If we are not able to retain and recruit personnel with the requisite technical skills, we may be unable to successfully execute our business strategy.

The specialized nature of our industry results in an inherent scarcity of experienced personnel in the field. Our future success depends upon our ability to attract and retain highly skilled personnel, including scientific, technical, commercial, business, regulatory and administrative personnel, necessary to support our anticipated growth, develop our business and perform certain contractual obligations. Given the scarcity of professionals with the scientific knowledge that we require and the competition for qualified personnel among life science businesses, we may not succeed in attracting or retaining the personnel we require to continue and grow our operations.

| 7 |

Our inability to attract, hire and retain a sufficient number of qualified sales professionals in key large markets, and engage qualified distributors in small markets, would hamper our sales for our molecular diagnostic system and our therapeutic oncopheresis system, as well as our ability to expand geographically and to successfully commercialize any other products or services we may develop.

To succeed in selling our two oncology products, we must build a sales force in key large markets and engage qualified distributors in small markets. These personnel and entities need to have extensive experience in oncology and close relationships with medical oncologists, nurses, pathologists and other hospital personnel. To achieve our marketing and sales goals, we will need to build our sales and commercial infrastructure, with which to date we have had little experience. Sales professionals with the necessary technical and business qualifications are in high demand, and there is a risk that we may be unable to attract, hire and retain the number of sales professionals with the right qualifications, scientific backgrounds and relationships with decision-makers at potential customers needed to achieve our sales goals. We expect to face competition from other companies in our industry, some of whom are much larger than us and who can pay greater compensation and benefits than we can, in seeking to attract and retain qualified sales and marketing employees. If we are unable to hire and retain qualified sales and marketing personnel, and engage qualified distributors, our business will suffer.

Our dependence on commercialization partners for sales of tests could limit our success in realizing revenue growth.

We intend to grow our business through the use of commercialization partners for the sales and marketing of our two oncology products, and to do so we must enter into agreements with these partners to sell, market or commercialize our medical devices. These agreements may contain exclusivity provisions and generally cannot be terminated without cause during the term of the agreement. We may need to attract additional partners to expand the markets in which we sell our medical devices. These partners may not commit the necessary resources to market and sell our two oncology products to the level of our expectations, and we may be unable to locate suitable alternatives should we terminate our agreement with such partners or if such partners terminate their agreement with us. Any relationships we form with commercialization partners are subject to change over time. If we cannot replace any diminution in revenues from a given distributor, our results will be weakened.

If current or future commercialization partners do not perform adequately, or we are unable to locate commercialization partners, we may not realize revenue growth.

We depend on third parties for the supply of blood samples and other biological materials that we use in our research and development efforts. If the costs of such samples and materials increase or our third party suppliers terminate their relationship with us, our business may be materially harmed.

We have relationships with suppliers and institutions that provide us with blood samples and other biological materials that we use in developing and validating our current test and our planned future tests. If one or more suppliers terminate their relationship with us or are unable to meet our requirements for samples, we will need to identify other third parties to provide us with blood samples and biological materials, which could result in a delay in our research and development activities and negatively affect our business. In addition, as we grow, our research and academic institution collaborators may seek additional financial contributions from us, which may negatively affect our results of operations.

We currently rely on third-party suppliers for critical materials needed to build our two oncology products, and any problems experienced by them could result in a delay or interruption of their supply to us.

We currently purchase raw materials for the single-use filter circuits in both of our oncology products under purchase orders and do not have long-term contracts with the supplier of these materials. If suppliers were to delay or stop producing our materials, or if the prices they charge us were to increase significantly, or if they elected not to sell to us, we would need to identify other suppliers. We could experience delays in manufacturing critical components while finding another acceptable supplier, which could impact our results of operations. The changes could also result in increased costs associated with qualifying the new materials and in increased operating costs. Further, any prolonged disruption in a supplier’s operations could have a significant negative impact on our ability to manufacture those filter circuits in a timely manner.

Some of the components used in our current or planned products are currently sole-source, and substitutes for these components might not be able to be obtained easily or may require substantial design or manufacturing modifications. Any significant problem experienced by one of our sole source suppliers may result in a delay or interruption in the supply of components to us until that supplier cures the problem or an alternative source of the component is located and qualified. Any delay or interruption would likely lead to a delay or interruption in our manufacturing operations. The inclusion of substitute components must meet our product specifications and could require us to qualify the new supplier with the appropriate government regulatory authorities.

| 8 |

If we were sued for product liability or professional liability, we could face substantial liabilities that exceed our resources.

The marketing, sale and use of our two oncology products and any future products could lead to the filing of product liability claims against us if someone alleges that our medical devices failed to perform as designed. We may also be subject to liability for errors in the results we provide directly or indirectly to physicians or for a misunderstanding of, or inappropriate reliance upon, the information we provide. A product liability or professional liability claim could result in substantial damages and be costly and time-consuming for us to defend.

Although we believe that our existing product and professional liability insurance is adequate, our insurance may not fully protect us from the financial impact of defending against product liability or professional liability claims. Any product liability or professional liability claim brought against us, with or without merit, could increase our insurance rates or prevent us from securing insurance coverage in the future. Additionally, any product liability lawsuit could damage our reputation; result in the recall of medical devices; or cause current partners to terminate existing agreements and potential partners to seek other partners. Any of these outcomes could impact our results of operations.

We may acquire other businesses or form joint ventures or make investments in other companies or technologies that could harm our operating results, dilute our stockholders’ ownership, increase our debt or cause us to incur significant expense.

As part of our business strategy, we may pursue acquisitions of businesses and assets. We also may pursue strategic alliances and joint ventures that leverage our core technology and industry experience to expand our offerings or distribution. We have no experience with acquiring other companies and limited experience with forming strategic alliances and joint ventures. We may not be able to find suitable partners or acquisition candidates, and we may not be able to complete such transactions on favorable terms, if at all. If we make any acquisitions, we may not be able to integrate these acquisitions successfully into our existing business, and we could assume unknown or contingent liabilities. Any future acquisitions also could result in significant write-offs or the incurrence of debt and contingent liabilities, any of which could have a material adverse effect on our financial condition, results of operations and cash flows. Integration of an acquired company also may disrupt ongoing operations and require management resources that would otherwise focus on developing our existing business. We may experience losses related to investments in other companies, which could have a material negative effect on our results of operations. We may not identify or complete these transactions in a timely manner, on a cost-effective basis, or at all, and we may not realize the anticipated benefits of any acquisition, technology license, strategic alliance or joint venture.

To finance any acquisitions or joint ventures, we may choose to issue shares of our Common Stock or preferred stock as consideration, which would dilute the ownership of our stockholders. If the price of our Common Stock is low or volatile, if such a market for our Common Stock exists, we may not be able to acquire other companies or fund a joint venture project using our stock as consideration. Alternatively, it may be necessary for us to raise additional funds for acquisitions through public or private financings. Additional funds may not be available on terms that are favorable to us, or at all.

If we cannot support demand for our two oncology products once they achieve commercialization, including successfully managing the evolution of our technology and manufacturing platforms, our business could suffer.

As our volume of medical devices and single-use fluid circuits grows, we will need to increase our manufacturing capacity, implement automation, increase our scale and related processing, customer service, billing, collection and systems process improvements and expand our internal quality assurance program and technology to support those functions on a larger scale. Any increases in scale, related improvements and quality assurance may not be successfully implemented and appropriate personnel may not be available. As additional medical devices are commercialized, we may need to bring new equipment on line, implement new systems, technology, controls and procedures and hire personnel with different qualifications. Failure to implement necessary procedures or to hire the necessary personnel could result in a higher cost of processing or an inability to meet market demand. We cannot assure you that we will be able to manufacture our products once they achieve commercialization on a timely basis at a level consistent with demand, that our efforts to scale our commercial operations will not negatively affect the quality of our products or that we will respond successfully to the growing complexity of our business as it grows. If we encounter difficulty meeting market demand or quality standards for our two oncology products once they achieve commercialization, our reputation could be harmed and our future prospects and business could suffer, which may have a material adverse effect on our financial condition, results of operations and cash flows.

| 9 |

We may encounter manufacturing problems or delays that could result in lost revenue.

We currently manufacture our medical devices on a small scale basis at our Lowell facility and intend to continue to do so. We believe we currently have adequate manufacturing capacity for the first two years after commercialization. If demand for our medical devices increases significantly, we will need to either expand our manufacturing capabilities or outsource to other manufacturers. If we or third party manufacturers engaged by us fail to manufacture and deliver our medical devices in a timely manner, our relationships with our customers could be seriously harmed. We cannot assure you that manufacturing or quality control problems will not arise as we attempt to increase the production or that we can increase our manufacturing capabilities and maintain quality control in a timely manner or at commercially reasonable costs. If we cannot manufacture our medical devices consistently on a timely basis because of these or other factors, it could have a significant negative impact on our ability to perform tests and generate revenues.

International expansion of our business would expose us to business, regulatory, political, operational, financial and economic risks associated with doing business outside of the United States.

Our business strategy contemplates international expansion, including partnering with cancer researchers and companies outside the United States, in particular Europe and Canada. Doing business internationally involves a number of risks, including:

| • | multiple, conflicting and changing laws and regulations such as tax laws, export and import restrictions, employment laws, regulatory requirements and other governmental approvals, permits and licenses; |

| • | failure by us or our distributors to obtain regulatory approvals for the sale or use of our current test and our planned future tests in various countries; |

| • | difficulties in managing foreign operations; |

| • | complexities associated with managing government payor systems, multiple payor-reimbursement regimes or self-pay systems; |

| • | logistics and regulations associated with shipping products manufactured in one country to another, including infrastructure conditions and transportation delays; |

| • | limits on our ability to penetrate international markets; |

| • | financial risks, such as longer payment cycles, difficulty enforcing contracts and collecting accounts receivable and exposure to foreign currency exchange rate fluctuations; |

| • | reduced protection for intellectual property rights, or lack of them in certain jurisdictions, forcing more reliance on our trade secrets, if available; |

| • | natural disasters, political and economic instability, including wars, terrorism and political unrest, outbreak of disease, boycotts, curtailment of trade and other business restrictions; and |

| • | failure to comply with the Foreign Corrupt Practices Act, including its books and records provisions and its anti-bribery provisions, by maintaining accurate information and control over sales activities and distributors’ activities. |

Any of these risks, if encountered, could significantly harm our future international expansion and operations and, consequently, have a material adverse effect on our financial condition, results of operations and cash flows.

Declining general economic or business conditions may have a negative impact on our business.

Continuing concerns over United States health care reform legislation and energy costs, geopolitical issues, the availability and cost of credit and government stimulus programs in the United States and other countries have contributed to increased volatility and diminished expectations for the global economy. These factors, combined with low business and consumer confidence and high unemployment, precipitated an economic slowdown and recession. If the economic climate does not improve, or it deteriorates, our business, including our access to patient samples and the addressable market for diagnostic tests that we may successfully develop, as well as the financial condition of our suppliers and our third-party payors, could be adversely affected, resulting in a negative impact on our business, financial condition and results of operations.

| 10 |

Intrusions into our computer systems could result in compromise of confidential information.

Despite the implementation of security measures, our technology or systems that we interface with, including the Internet and related systems, may be vulnerable to physical break-ins, hackers, improper employee or contractor access, computer viruses, programming errors, or similar problems. Any of these might result in confidential medical, business or other information of other persons or of ourselves being revealed to unauthorized persons.

There are a number of state, federal and international laws protecting the privacy and security of health information and personal data. As part of the American Recovery and Investment Act 2009, or ARRA, Congress amended the privacy and security provisions of the Health Insurance Portability and Accountability Act, or HIPAA. HIPAA imposes limitations on the use and disclosure of an individual’s healthcare information by healthcare providers, healthcare clearinghouses, and health insurance plans, collectively referred to as covered entities. The HIPAA amendments also impose compliance obligations and corresponding penalties for non-compliance on individuals and entities that provide services to healthcare providers and other covered entities, collectively referred to as business associates. ARRA also made significant increases in the penalties for improper use or disclosure of an individual’s health information under HIPAA and extended enforcement authority to state attorneys general. The amendments also create notification requirements for individuals whose health information has been inappropriately accessed or disclosed: notification requirements to federal regulators and in some cases, notification to local and national media. Notification is not required under HIPAA if the health information that is improperly used or disclosed is deemed secured in accordance with encryption or other standards developed by the U.S. Department of Health and Human Services, or HHS. Most states have laws requiring notification of affected individuals and state regulators in the event of a breach of personal information, which is a broader class of information than the health information protected by HIPAA. Many state laws impose significant data security requirements, such as encryption or mandatory contractual terms to ensure ongoing protection of personal information. Activities outside of the United States implicate local and national data protection standards, impose additional compliance requirements and generate additional risks of enforcement for non-compliance. We may be required to expend significant capital and other resources to ensure ongoing compliance with applicable privacy and data security laws, to protect against security breaches and hackers or to alleviate problems caused by such breaches.

We depend on our information technology and telecommunications systems, and any failure of these systems could harm our business.

We depend on information technology and telecommunications systems for significant aspects of our operations. In addition, third-party vendors we may utilize for billing and collections may depend upon telecommunications and data systems provided by outside vendors and information we provide on a regular basis. These information technology and telecommunications systems support a variety of functions, including manufacturing, product tracking, quality control, customer service and support, billing and reimbursement, research and development activities, sales and marketing activities, regulatory and clinical activities, and our general and administrative activities. Information technology and telecommunications systems are vulnerable to damage from a variety of sources, including telecommunications or network failures, malicious human acts and natural disasters. Moreover, despite network security and back-up measures, some of our servers are potentially vulnerable to physical or electronic break-ins, computer viruses and similar disruptive problems. Despite the precautionary measures we have taken to prevent unanticipated problems that could affect our information technology and telecommunications systems, failures or significant downtime of our information technology or telecommunications systems or those used by our third-party service providers could prevent us from manufacturing our products or managing our business operations. Any disruption or loss of information technology or telecommunications systems on which critical aspects of our operations depend could have an adverse effect on our business.

| 11 |

Regulatory Risks Relating to Our Business

Healthcare policy changes, including recently enacted legislation reforming the U.S. health care system, may have a material adverse effect on our financial condition, results of operations and cash flows.

The 2010 Patient Protection and Affordable Care Act, as amended by the Health Care and Education Reconciliation Act, or collectively the ACA, makes a number of substantial changes in the way health care is financed by both governmental and private insurers. Among other things, the ACA:

| • | Mandates a reduction in payments for clinical laboratory services paid under the Medicare Clinical Laboratory Fee Schedule annual Consumer Price Index update of 1.75% for the years 2011 through 2015. In addition, a permanent productivity adjustment is made to the fee schedule payment amount, which could range from 1.1% to 1.4% each year over the next 10 years. These changes in payments may apply to some or all of the tests based on DNA sequencing which utilize our molecular diagnostic system which is furnished to Medicare beneficiaries. |

| • | Establishes an Independent Payment Advisory Board to reduce the per capita rate of growth in Medicare spending if spending exceeds a target growth rate. The Independent Payment Advisory Board has broad discretion to propose policies, which may have a negative impact on payment rates for services, including clinical laboratory services and therapeutic treatments such as our therapeutic oncopheresis system, beginning in 2016, and for hospital services beginning in 2020. |

| • | Requires each medical device manufacturer to pay an excise tax equal to 2.3% of the price for which such manufacturer sells its medical devices, beginning in 2013. We believe that at this time this tax does not apply to our current test or to our products that are in development; nevertheless, this could change in the future if either the FDA or the Internal Revenue Service, which regulates the payment of this excise tax, changes its position. |

Although some of these provisions may negatively impact payment rates for clinical laboratory tests and therapeutic treatments, the ACA also extends coverage to over 30 million previously uninsured people, which may result in an increase in the demand for our two oncology products. The mandatory purchase of insurance has been strenuously opposed by a number of state governors, resulting in lawsuits challenging the constitutionality of certain provisions of the ACA. In 2012, the Supreme Court upheld the constitutionality of the ACA, with the exception of certain provisions dealing with the expansion of Medicaid coverage under the law. Therefore, most of the law’s provisions are going into effect in 2013 and 2014. Congress has also proposed a number of legislative initiatives, including possible repeal of the ACA. At this time, it remains unclear whether there will be any changes made to the ACA, whether in part or in its entirety.

In addition, other legislative changes have been proposed and adopted since the ACA was enacted. The Budget Control Act of 2011, among other things, created the Joint Select Committee on Deficit Reduction to recommend proposals in spending reductions to Congress. The Joint Select Committee did not achieve a targeted deficit reduction of at least $1.2 trillion for the years 2013 through 2021, triggering the legislation’s automatic reduction to several government programs. This includes aggregate reductions to Medicare payments to providers and suppliers of up to 2% per fiscal year, starting in 2013. The full impact on our business of the ACA and the sequester law is uncertain. In addition, the Middle Class Tax Relief and Job Creation Act of 2012, or MCTRJCA, mandated an additional change in Medicare reimbursement for clinical laboratory tests and therapeutic treatments. This legislation requires a rebasing of the Medicare Clinical Laboratory Fee Schedule to effect a 2% reduction in payment rates otherwise determined for 2013. This will serve as a base for 2014 and subsequent years. In January 2013, as a result of the changes mandated by the ACA and MCTRJCA, the Centers for Medicare & Medicaid Services, or CMS, reduced its reimbursement for laboratory tests for 2013 by approximately 3%.

Some of the tests and treatments that might utilize our two oncology products are subject to the Medicare Physician Fee Schedule and, under the current statutory formula, the rates for these services are updated annually. For the past several years, the application of the statutory formula would have resulted in substantial payment reductions if Congress failed to intervene. In the past, Congress passed interim legislation to prevent the decreases. On November 1, 2013, the CMS issued its 2014 Physician Fee Schedule Final Rule, or the 2014 Final Rule. In the 2014 Final Rule, CMS called for a reduction of approximately 23.7% in the 2014 conversion factor that is used to calculate physician reimbursement. If in future years Congress does not adopt interim legislation to block or offset, and/or CMS does not moderate, any substantial CMS-proposed reimbursement reductions, the resulting decrease in payments from Medicare could adversely impact our revenues and results of operations.

| 12 |

In addition, many of the Current Procedure Terminology, or CPT, codes that healthcare providers would use to bill for tests and treatments using our two oncology products once they are commercialized are subject to periodic revision. We cannot predict whether future health care initiatives will be implemented at the federal or state level, or how any future legislation or regulation may affect us. The expansion of government’s role in the U.S. health care industry as a result of the ACA’s implementation as well as changes to the reimbursement amounts paid by Medicare or other payors for our current test and our planned future cancer diagnostic tests may reduce our profits, if any and have a materially adverse effect on our business, financial condition, results of operations and cash flows.

Our commercial success could be compromised if third-party payors, including managed care organizations and Medicare, do not provide coverage and reimbursement, breach, rescind or modify their contracts or reimbursement policies or delay payments for our two oncology products once they are commercialized.

Oncologists may not utilize our two oncology products once they are commercialized unless third-party payors, such as managed care organizations and government payors such as Medicare and Medicaid, pay a substantial portion of the price. Coverage and reimbursement by a third-party payor may depend on a number of factors, including a payor’s determination that tests or treatments using our technologies are:

| • | not experimental or investigational; |

| • | medically necessary; |

| • | appropriate for the specific patient; |

| • | cost-effective; |

| • | supported by peer-reviewed publications; and |

| • | included in clinical practice guidelines. |

Uncertainty surrounds third-party payor reimbursement of any test or treatment incorporating new technology, including our two oncology products. Technology assessments of new medical devices conducted by research centers and other entities may be disseminated to interested parties for informational purposes. Third-party payors and health care providers may use such technology assessments as grounds to deny coverage for a test or procedure which uses those medical devices. Technology assessments can include evaluation of clinical studies, which define how a medical device is used in a particular clinical setting or situation.

Because each payor generally determines for its own enrollees or insured patients whether to cover or otherwise establish a policy to reimburse our two oncology products once they are commercialized, seeking payor approvals is a time-consuming and costly process. We cannot be certain that coverage for our two oncology products will be provided in the future. If we cannot obtain coverage and reimbursement from private and governmental payors such as Medicare and Medicaid for our two oncology products once they are commercialized, our ability to generate revenues could be limited, which may have a material adverse effect on our financial condition, results of operations and cash flow.

We will indirectly depend on Medicare and a limited number of private payors for a significant portion of our revenues and if these or other payors stop providing reimbursement or decrease the amount of reimbursement for our two oncology products once they are commercialized, our revenues could suffer.

We believe that our two oncology products once they are commercialized will be used by a significant number of patients with Medicare coverage. While we will sell our medical devices to healthcare providers or clinical testing services, who in turn will bill Medicare for tests or treatments that utilize our medical devices, we cannot provide you with assurance that Medicare and other third-party payors will not change their coverage policies or cancel future contracts with such healthcare providers at any time, review and adjust the rate of reimbursement or stop paying for our medical devices altogether, which would reduce our total revenues.

| 13 |

Payors have increased their efforts to control the cost, utilization and delivery of health care services. In the past, measures have been undertaken to reduce payment rates for and decrease utilization of the clinical laboratory testing and therapeutic treatments generally. Because of the cost-trimming trends, third-party payors that may cover and provide reimbursement for our two oncology products may suspend, revoke or discontinue coverage at any time, or may reduce the reimbursement rates payable to healthcare providers who might utilize our medical devices. Any such action could have a negative impact on our revenues, which may have a material adverse effect on our financial condition, results of operations and cash flows.

Long payment cycles of Medicare, Medicaid and/or other third-party payors, or other payment delays, could hurt our cash flows and increase our need for working capital.

Medicare and Medicaid have complex billing and documentation requirements that the healthcare providers and clinical testing services who might utilize our medical devices must satisfy in order to receive payment, and the programs can be expected to carefully audit and monitor their compliance with these requirements. Those healthcare providers must also comply with numerous other laws applicable to billing and payment for healthcare services, including privacy laws. Failure to comply with these requirements may result in non-payment, refunds, exclusion from government healthcare programs, and civil or criminal liabilities, any of which may have a material adverse effect on our revenues and earnings. In addition, failure by third-party payors to properly process payment claims to those healthcare providers or clinical testing services in a timely manner could delay our receipt of payment for our products, which may have a material adverse effect on our cash flows.

If we do not receive regulatory approvals, we may not be able to commercialize our technology.

We will need FDA approval to market our products in the United States and approvals from foreign regulatory authorities to market products outside the United States including validation studies of the materials and manufacturing processes used in our devices and pre-clinical testing to demonstrate safety in animals, as well human clinical studies to demonstrate efficacy for specific disease conditions. We have not yet filed an application with the FDA to obtain approval to market any of our proposed products. If we fail to obtain regulatory approval for the marketing of products, we will be unable to sell such products and will not be able to sustain operations.

If we seek to market our two oncology products in Europe, we need to receive a CE Mark. If we do not obtain a CE Mark for our products, we will be unable to sell these products in Europe and countries that recognize the CE Mark.

The regulatory review and approval process, which may include evaluation of preclinical studies and clinical trials of products, as well as the evaluation of manufacturing processes, is lengthy, expensive and uncertain. Securing regulatory approval for our oncology products may require the submission of extensive preclinical and clinical data and supporting information to regulatory authorities to establish such products’ safety and effectiveness for each indication.

Regulatory authorities generally have substantial discretion in the approval process and may either refuse to accept an application, or may decide after review of an application that the data submitted is insufficient to allow approval of the product. If regulatory authorities do not accept or approve our applications, they may require that we conduct additional clinical, preclinical or manufacturing studies and submit that data before regulatory authorities will reconsider such application. We may need to expend substantial resources to conduct further studies to obtain data that regulatory authorities believe is sufficient. Depending on the extent of these studies, approval of applications may be delayed by several years, or may require us to expend more resources than we may have available. It is also possible that additional studies may not suffice to make applications approvable. If any of these outcomes occur, we may be forced to abandon our applications for approval, which might cause us to cease operations.

We are subject to federal and state healthcare fraud and abuse laws and regulations and could face substantial penalties if we are unable to fully comply with such laws.

We are subject to health care fraud and abuse regulation and enforcement by both the federal government and the states in which we conduct our business. These health care laws and regulations include, for example:

| 14 |

| • | the federal Anti-Kickback Statute, which prohibits, among other things, persons or entities from soliciting, receiving, offering or providing remuneration, directly or indirectly, in return for or to induce either the referral of an individual for, or the purchase order or recommendation of, any item or services for which payment may be made under a federal health care program such as the Medicare and Medicaid programs; |

| • | the federal physician self-referral prohibition, commonly known as the Stark Law, which prohibits physicians from referring Medicare or Medicaid patients to providers of “designated health services” with whom the physician or a member of the physician’s immediate family has an ownership interest or compensation arrangement, unless a statutory or regulatory exception applies; |

| • | the federal Health Insurance Portability and Accountability Act of 1996, or HIPAA, which established federal crimes for knowingly and willfully executing a scheme to defraud any health care benefit program or making false statements in connection with the delivery of or payment for health care benefits, items or services; |

| • | federal false claims laws, which, prohibit, among other things, individuals or entities from knowingly presenting, or causing to be presented, false or fraudulent claims for payment to the federal government; and |

| • | state law equivalents of each of the above federal laws, such as anti-kickback and false claims laws, which may apply to items or services reimbursed by any third-party payor, including commercial insurers. |

The risk of our being found in violation of these laws and regulations is increased by the fact that many of them have not been fully interpreted by the regulatory authorities or the courts, and their provisions are open to a variety of interpretations. Further, the ACA, among other things, amends the intent requirement of the federal Anti-Kickback Statute and certain criminal health care fraud statutes. Where the intent requirement has been lowered, a person or entity no longer needs to have actual knowledge of this statute or specific intent to violate it. In addition, because of amendments enacted in 2009 as part of the Fraud Enforcement and Recovery Act, the government may now assert that a claim including items or services resulting from a violation of the federal Anti-Kickback Statute constitutes a false or fraudulent claim for purposes of the false claims statutes. Any action brought against us for violation of these laws or regulations, even if we successfully defend against it, could cause us to incur significant legal expenses and divert our management’s attention from the operation of our business. If our operations are found to be in violation of any of these laws and regulations, we may be subject to any applicable penalty associated with the violation, including civil and criminal penalties, damages and fines, and/or exclusion from participation in Medicare or state or federal health care programs, we could be required to refund payments received by us, and we could be required to curtail or cease our operations. Any of the foregoing consequences could seriously harm our business and our financial results.

Clinical research is heavily regulated and failure to comply with human subject protection regulations may disrupt our research program leading to significant expense, regulatory enforcement, private lawsuits and reputational damage.

Clinical research is subject to federal, state and, for studies conducted outside of the United States, international regulation. At the federal level, the FDA imposes regulations for the protection of human subjects and requirements such as initial and ongoing institutional board review; informed consent requirements, adverse event reporting and other protections to minimize the risk and maximize the benefit to research participants. Many states impose human subject protection laws that mirror or in some cases exceed federal requirements. HIPAA also regulates the use and disclosure of Protected Health Information in connection with research activities. Research conducted overseas is subject to a variety of national protections such as mandatory ethics committee review, as well as laws regulating the use, disclosure and cross-border transfer of personal data. The costs of compliance with these laws may be significant and compliance with regulatory requirements may result in delay. Noncompliance may disrupt our research and result in data that is unacceptable to regulatory authorities, data lock or other sanctions that may significantly disrupt our operations.

| 15 |

Intellectual Property Risks Related to Our Business

Our collaborators may assert ownership or commercial rights to inventions we develop from our use of the biological materials which they provide to us, or otherwise arising from the collaboration.