Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TEXAS CAPITAL BANCSHARES INC/TX | d870438d8k.htm |

| Exhibit 99.1

|

Sterne Agee

Financial Institutions Investor Conference

February 12, 2015 Keith Cargill, President and CEO

Peter Bartholow, Chief Operating Officer and CFO

|

|

Certain matters discussed on this call may contain “forward-looking statements” as defined in federal securities laws, which are subject to risks and uncertainties and are based on Texas Capital’s current estimates or expectations of future events or future results. These statements are not historical in nature and can generally be identified by such words as “believe,” “expect,” “estimate,” “anticipate,” “plan,” “may,” “will,” “intend” and similar expressions. A number of factors, many of which are beyond Texas Capital’s control, could cause actual results to differ materially from future results expressed or implied by our forward-looking statements. These risks and uncertainties include the risk of adverse impacts from general economic conditions, the effects of recent declines in oil and gas prices on our customers, competition, changes in interest rates and exposure to regulatory and legislative changes. These and other factors that could cause results to differ materially from those described in the forward-looking statements, as well as a discussion of the risks and uncertainties that may affect Texas Capital’s business, can be found in our Annual Report on Form 10-K and other filings made by Texas Capital with the Securities and Exchange Commission. Forward-looking statements speak only as of the date of this call. Texas Capital is under no obligation, and expressly disclaims any obligation, to update, alter or revise its forward-looking statements, whether as a result of new information, future events or otherwise.

2

|

|

Overview and Strategy

Texas Capital is a commercially-focused bank operating in the five largest MSAs in Texas and throughout the U.S.

All five Texas markets highly ranked in U.S. in terms of job and economic growth, now with major business relocations to Texas

Substantial commercial businesses with national footprint

Focus on middle market businesses and entrepreneurs

Clients with borrowing needs of $2 to $15MM Fort Dallas

Growth Strategy

Organic growth model – no bank acquisitions

Growth in loans and deposits driven by recruiting, acclimating and retaining highly experienced bankers with established relationships and industry expertise

Exceptional growth opportunities with small market share in Texas and leading position in businesses outside of Texas

Strong Credit Culture

Critical focus on credit quality and risk management

Business model predicted and demonstrated success of focus

3

|

|

Opening Remarks & Financial Highlights

Strong Balanced Growth

Exceptional growth in traditional LHI balances despite highly competitive C&I market, with increase in Q4-2014 average balances of $498 million compared to Q3-2014

Growth in mortgage finance loans (MFLs) with little evidence of seasonality in Q4-2014

Continued strong growth in demand and total deposits

Asset sensitivity position increased with extended duration of low-cost funding

Core Earnings Power

Growth in total loans continues to produce strong net revenue

Operating leverage improved with rate of growth in net revenue greater than NIE for full year

Business model focused on organic growth demonstrates ability to produce high returns on invested capital

Credit Quality

Credit metrics remain strong with nominal increase in NPAs

NCOs at 5 bps in Q4-2014 and 7 bps YTD

High allowance coverage ratios

Provision primarily related to growth in core LHI

4

|

|

Energy Commentary

TCBI has deep experience in energy lending

Executives, lenders, credit policy and engineers have more than three decades of experience

All lending authority rests with Credit Policy, not the line of business and most exposures require approval of the Chief Credit and Chief Risk Officer and the Chief Lending Officer

Engineering team reports to Credit Policy and is responsible for review of credits independent of the line of business

Since our inception there have been five corrections in energy commodity prices, with no significant consequences

Cumulative energy losses < $300,000 in 15 years

Outstanding loans in energy portfolio 6% of total loans

Exposure to oil service less than 1% of total loans

Service exposure generally limited to production, not the higher risk drilling and completion

| 5 |

|

|

|

Energy Portfolio Review

We have completed review of our portfolio and see no significant exposure to loan losses, assuming prices comparable to the forward strip of oil and natural gas prices

Anticipate potential for some downgrades

Nothing currently expected that would drive significant allocation of loan loss reserves

The ability to control the borrowing base and require loan pay-down or pledge of additional collateral provides protection against credit exposure if commodity prices decline

Price decks are dynamic, but our underwriting standards have not changed since inception

Average credit line is approximately 60% funded

Agreements generally provide unilateral discretion to reduce borrowing bases as necessary

Over 90% of oil-weighted outstandings are hedged

Hedged prices are much higher than lifting costs, providing significant cash flow to reduce debt

In combination with hedges, collateral comprised of long-lived reserves provides capacity to absorb commodity price swings

| 6 |

|

|

|

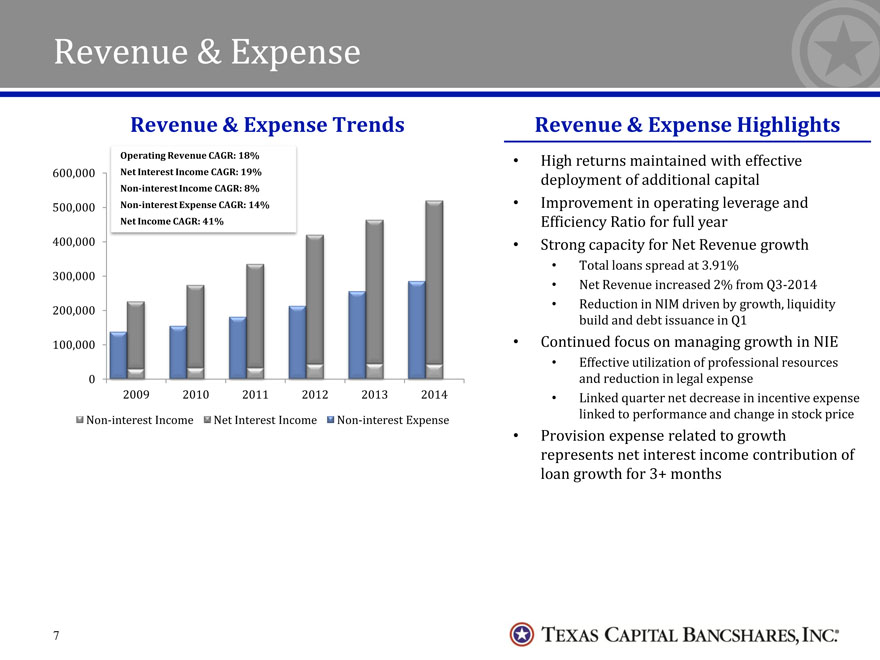

Revenue & Expense

| Revenue |

|

& Expense Trends |

Operating Revenue CAGR: 18%

Net Interest Income CAGR: 19%

Non-interest Income CAGR: 8%

Non-interest Expense CAGR: 14%

Net Income CAGR: 41%

0 100,000 200,000 300,000

400,000 500,000 600,000

2009 2010

2011

2012

2013

2014

Non-interest Income

Net Interest Income

Non-interest Expense

High returns maintained with effective deployment of additional capital

Improvement in operating leverage and Efficiency Ratio for full year

Strong capacity for Net Revenue growth

Total loans spread at 3.91%

Net Revenue increased 2% from Q3-2014

Reduction in NIM driven by growth, liquidity build and debt issuance in Q1

Continued focus on managing growth in NIE

Effective utilization of professional resources and reduction in legal expense

Linked quarter net decrease in incentive expense linked to performance and change in stock price

Provision expense related to growth represents net interest income contribution of loan growth for 3+ months

Revenue & Expense Highlights

| 7 |

|

|

|

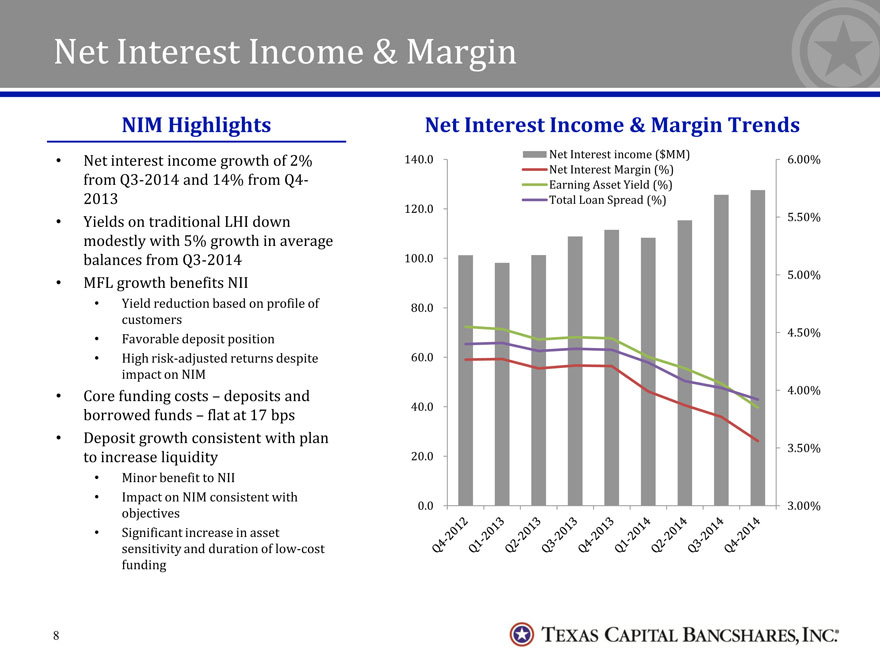

Net Interest Income & Margin

NIM Highlights

Net interest income growth of 2% from Q3-2014 and 14% from Q4-2013

Yields on traditional LHI down modestly with 5% growth in average balances from Q3-2014

MFL growth benefits NII

Yield reduction based on profile of customers

Favorable deposit position

High risk-adjusted returns despite impact on NIM

Core funding costs – deposits and borrowed funds – flat at 17 bps

Deposit growth consistent with plan to increase liquidity

Minor benefit to NII

Impact on NIM consistent with objectives

Significant increase in asset sensitivity and duration of low-cost funding

Net Interest Income & Margin Trends

Net Interest income ($MM) Net Interest Margin (%) Earning Asset Yield (%) Total Loan Spread (%)

0.0 20.0 40.0 60.0

80.0

100.0

120.0 140.0

3.00% 3.50% 4.00% 4.50%

5.00%

5.50%

6.00%

8

|

|

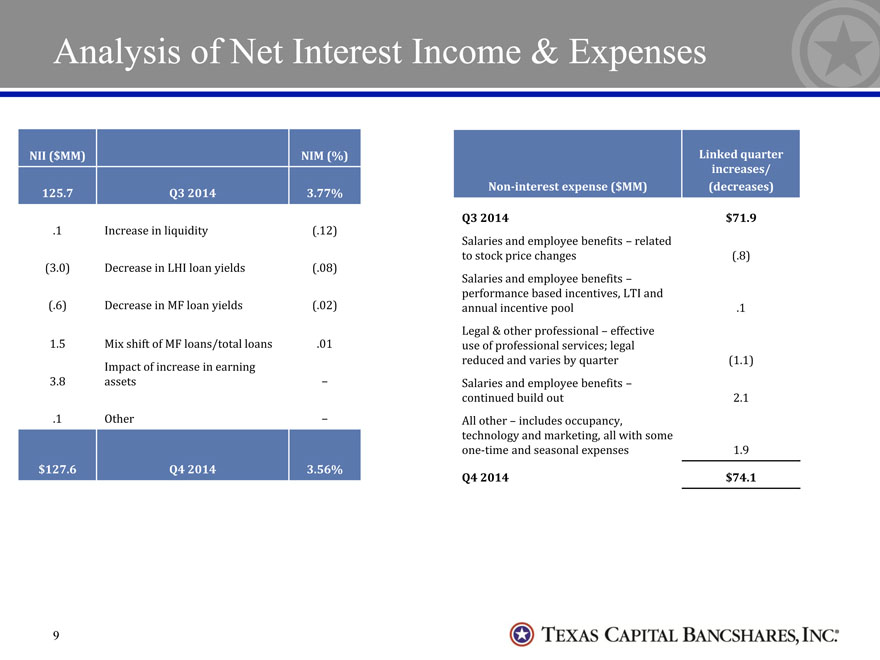

Analysis of Net Interest Income & Expenses

NII ($MM) NIM (%)

125.7 Q3 2014 3.77%

.1 Increase in liquidity (.12)

(3.0) Decrease in LHI loan yields (.08)

(.6) Decrease in MF loan yields (.02)

1.5 Mix shift of MF loans/total loans .01

3.8 Impact of increase in earning assets –

.1 Other –

$127.6 Q4 2014 3.56%

Non-interest expense ($MM) Linked quarter increases/

(decreases)

Q3 2014 $71.9

Salaries and employee benefits – related to stock price changes (.8)

Salaries and employee benefits – performance based incentives, LTI and annual incentive pool .1

Legal & other professional – effective use of professional services; legal reduced and varies by quarter (1.1)

Salaries and employee benefits – continued build out 2.1

All other – includes occupancy, technology and marketing, all with some one-time and seasonal expenses 1.9

Q4 2014 $74.1

9

|

|

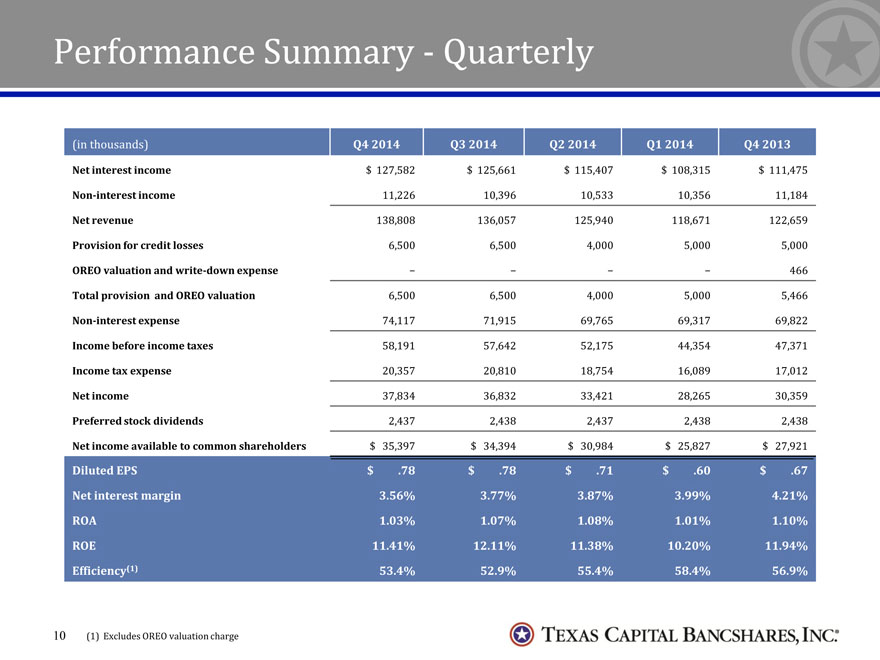

Performance Summary—Quarterly

(in thousands) Q4 2014 Q3 2014 Q2 2014 Q1 2014 Q4 2013

Net interest income $ 127,582 $ 125,661 $ 115,407 $ 108,315 $ 111,475

Non-interest income 11,226 10,396 10,533 10,356 11,184

Net revenue 138,808 136,057 125,940 118,671 122,659

Provision for credit losses 6,500 6,500 4,000 5,000 5,000

OREO valuation and write-down expense — — 466

Total provision and OREO valuation 6,500 6,500 4,000 5,000 5,466

Non-interest expense 74,117 71,915 69,765 69,317 69,822

Income before income taxes 58,191 57,642 52,175 44,354 47,371

Income tax expense 20,357 20,810 18,754 16,089 17,012

Net income 37,834 36,832 33,421 28,265 30,359

Preferred stock dividends 2,437 2,438 2,437 2,438 2,438

Net income available to common shareholders $ 35,397 $ 34,394 $ 30,984 $ 25,827 $ 27,921

Diluted EPS $ .78 $ .78 $ .71 $ .60 $ .67

Net interest margin 3.56% 3.77% 3.87% 3.99% 4.21%

ROA 1.03% 1.07% 1.08% 1.01% 1.10%

ROE 11.41% 12.11% 11.38% 10.20% 11.94%

Efficiency(1) 53.4% 52.9% 55.4% 58.4% 56.9%

10 (1) Excludes OREO valuation charge

|

|

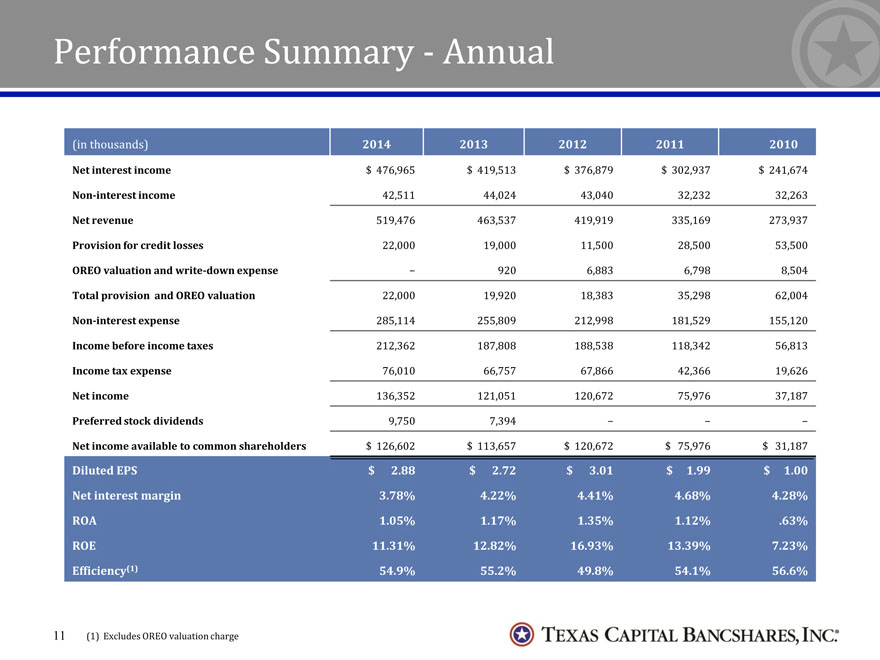

Performance Summary—Annual

(in thousands) 2014 2013 2012 2011 2010

Net interest income $ 476,965 $ 419,513 $ 376,879 $ 302,937 $ 241,674

Non-interest income 42,511 44,024 43,040 32,232 32,263

Net revenue 519,476 463,537 419,919 335,169 273,937

Provision for credit losses 22,000 19,000 11,500 28,500 53,500

OREO valuation and write-down expense—920 6,883 6,798 8,504

Total provision and OREO valuation 22,000 19,920 18,383 35,298 62,004

Non-interest expense 285,114 255,809 212,998 181,529 155,120

Income before income taxes 212,362 187,808 188,538 118,342 56,813

Income tax expense 76,010 66,757 67,866 42,366 19,626

Net income 136,352 121,051 120,672 75,976 37,187

Preferred stock dividends 9,750 7,394 —— —

Net income available to common shareholders $ 126,602 $ 113,657 $ 120,672 $ 75,976 $ 31,187

Diluted EPS $ 2.88 $ 2.72 $ 3.01 $ 1.99 $ 1.00

Net interest margin 3.78% 4.22% 4.41% 4.68% 4.28%

ROA 1.05% 1.17% 1.35% 1.12% .63%

ROE 11.31% 12.82% 16.93% 13.39% 7.23%

Efficiency(1) 54.9% 55.2% 49.8% 54.1% 56.6%

11 (1) Excludes OREO valuation charge

|

|

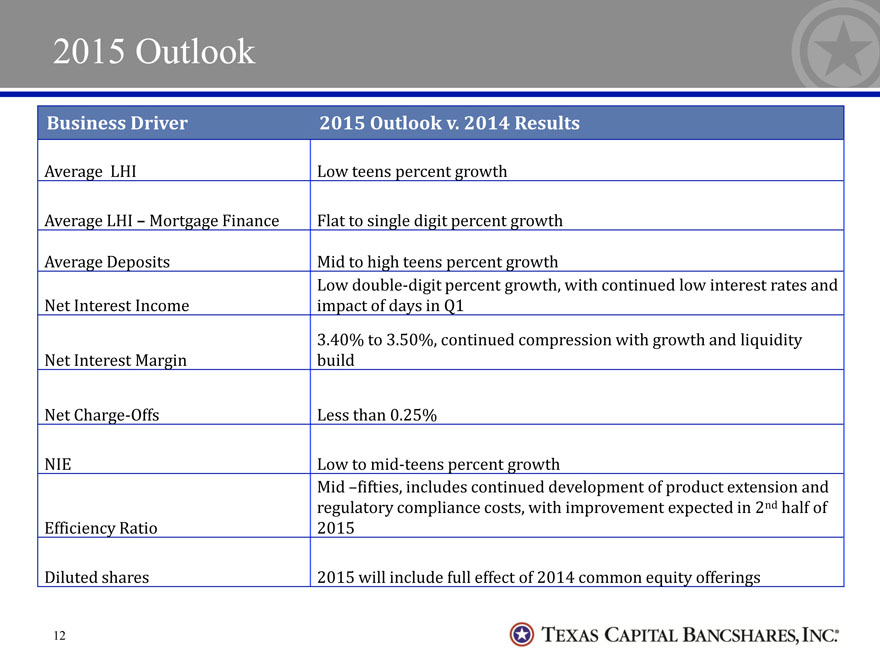

2015 Outlook

Business Driver 2015 Outlook v. 2014 Results

Average LHI Low teens percent growth

Average LHI – Mortgage Finance Flat to single digit percent growth

Average Deposits Mid to high teens percent growth

Low double-digit percent growth, with continued low interest rates and Net Interest Income impact of days in Q1 3.40% to 3.50%, continued compression with growth and liquidity Net Interest Margin build

Net Charge-Offs Less than 0.25%

NIE Low to mid-teens percent growth

Mid –fifties, includes continued development of product extension and regulatory compliance costs, with improvement expected in 2nd half of Efficiency Ratio 2015

Diluted shares 2015 will include full effect of 2014 common equity offerings

12

|

|

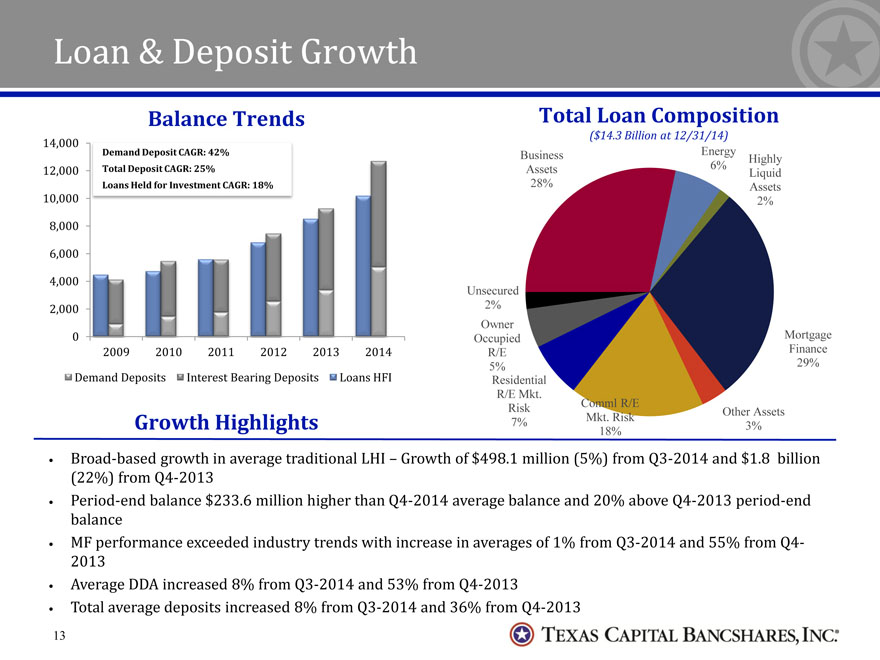

Loan & Deposit Growth

Balance Trends

Demand Deposit CAGR: 42%

Total Deposit CAGR: 25%

Loans Held for Investment CAGR: 18%

14,000

12,000

10,000

8,000

6,000

4,000

2,000

0

2009

2010 2011 2012

2013

2014

Demand Deposits Interest Bearing Deposits Loans HFI

Total Loan Composition ($14.3 Billion at 12/31/14)

Business Assets 28%

Energy 6%

Highly Liquid Assets 2%

Unsecured 2%

Owner Occupied R/E 5%

Residential R/E Mkt. Risk 7%

Comml R/E Mkt. Risk 18%

Other Assets 3%

Mortgage Finance 29%

Growth Highlights

Broad-based growth in average traditional LHI – Growth of $498.1 million (5%) from Q3-2014 and $1.8 billion (22%) from Q4-2013

Period-end balance $233.6 million higher than Q4-2014 average balance and 20% above Q4-2013 period-end balance

MF performance exceeded industry trends with increase in averages of 1% from Q3-2014 and 55% from Q4-2013

Average DDA increased 8% from Q3-2014 and 53% from Q4-2013

Total average deposits increased 8% from Q3-2014 and 36% from Q4-2013

13

|

|

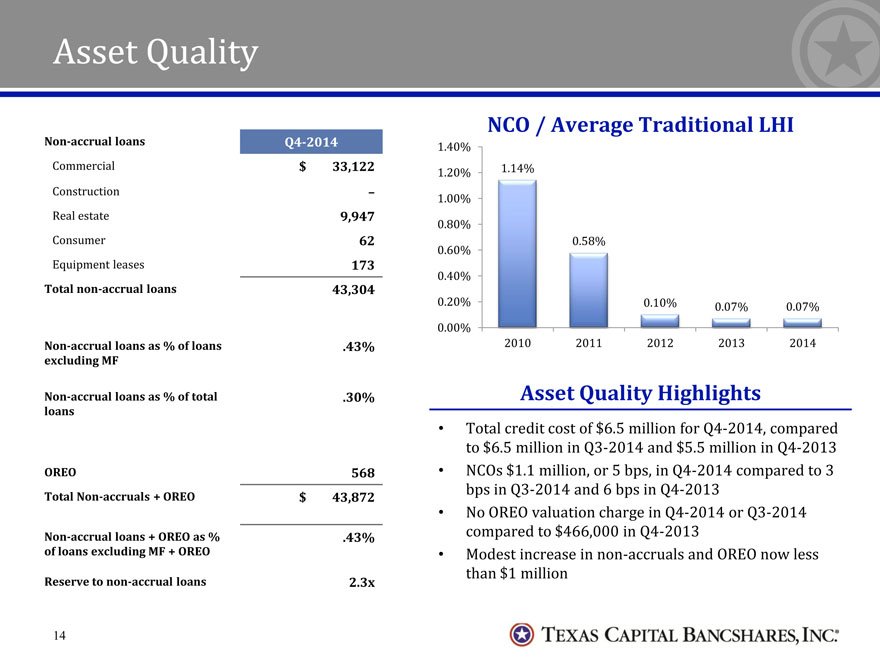

ASSET QUALITY

NON-ACCRUAL LOANS Q4-2014

COMMERCIAL $ 33,122

CONSTRUCTION –

REAL ESTATE 9,947

CONSUMER 62

EQUIPMENT LEASES 173

TOTAL NON-ACCRUAL LOANS 43,304

NON-ACCRUAL LOANS AS % OF LOANS EXCLUDING MF .43%

NON-ACCRUAL LOANS AS % OF TOTAL LOANS .30%

OREO 568

TOTAL NON-ACCRUALS + OREO $ 43,872

NON-ACCRUAL LOANS + OREO AS % OF LOANS EXCLUDING MF + OREO .43%

RESERVE TO NON-ACCRUAL LOANS 2.3X

NCO / AVERAGE TRADITIONAL LHI

1.14% 0.58%

0.10%

0.07%

0.07%

0.00% 0.20%

0.40%

0.60%

0.80% 1.00%

1.20%

1.40%

2010 2011 2012

2013 2014

ASSET QUALITY HIGHLIGHTS

TOTAL CREDIT COST OF $6.5 MILLION FOR Q4-2014, COMPARED TO $6.5 MILLION IN Q3-2014 AND $5.5 MILLION IN Q4-2013

NCOS $1.1 MILLION, OR 5 BPS, IN Q4-2014 COMPARED TO 3 BPS IN Q3-2014 AND 6 BPS IN Q4-2013

NO OREO VALUATION CHARGE IN Q4-2014 OR Q3-2014 COMPARED TO $466,000 IN Q4-2013

MODEST INCREASE IN NON-ACCRUALS AND OREO NOW LESS THAN $1 MILLION

14

|

|

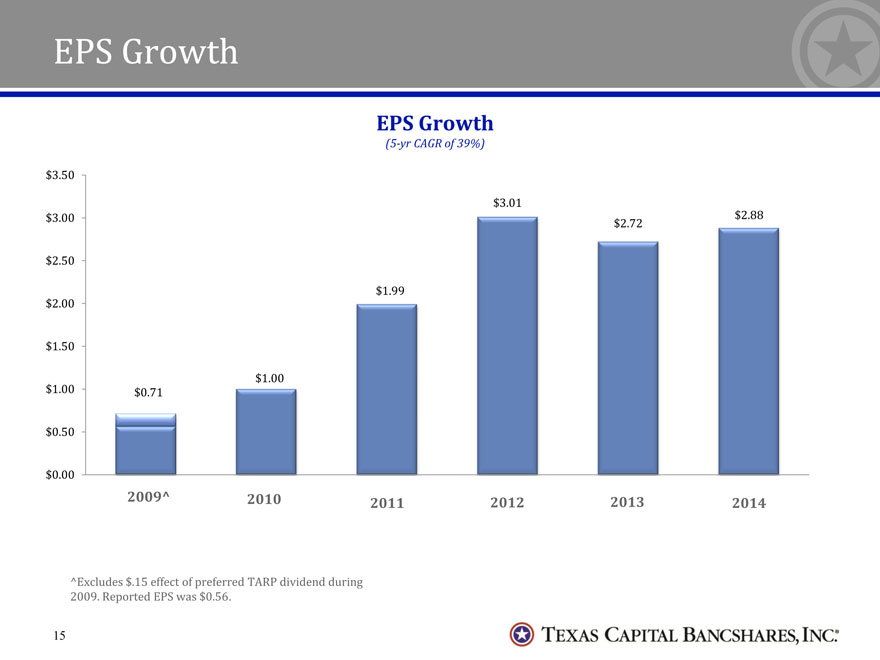

EPS Growth

EPS Growth

(5-yr CAGR of 39%)

$3.50

$3.01

$3.00 $2.88

$2.72

$2.50

$1.99

$2.00

$1.50

$1.00

$1.00 $0.71

$0.50

$0.00

2009^ 2010 2011 2012 2013 2014

^Excludes $.15 effect of preferred TARP dividend during

2009. Reported EPS was $0.56.

15

|

|

Closing Comments

Proven organic growth business model continues to produce in key lines of business with improvements in operating leverage

Solid core earnings power and strong asset growth experienced in 2014; 2015 expected to be challenging year for asset growth

Despite drop in energy prices, remain confident about underwriting standards and performance of energy portfolio

Continue to have critical focus on maintaining excellent credit quality which could limit C&I growth

Continued success in building liquidity which will continue in 2015

Remain highly asset sensitive based on how we run our business; now better positioned to take advantage of increases in short-term rates

Successful track record of talent acquisition and being opportunistic with hires

No real seasonality experienced in Q4-2014 as Mortgage Finance continues to exceed industry trends with improved market position

Strong build out in 2014 and the first half of 2015 positions us for improving earnings trajectory in 2016

16

|

|

Q&A

17

|

|

Appendix

18

|

|

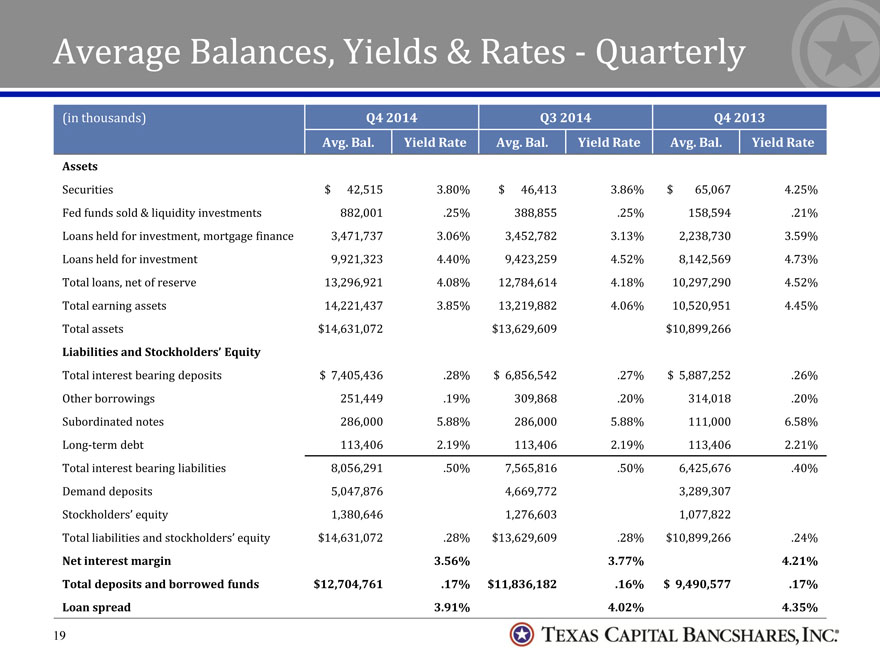

Average Balances, Yields & Rates—Quarterly

(in thousands) Q4 2014 Q3 2014 Q4 2013 Avg. Bal. Yield Rate Avg. Bal. Yield Rate Avg. Bal. Yield Rate

Assets

Securities $ 42,515 3.80% $ 46,413 3.86% $ 65,067 4.25%

Fed funds sold & liquidity investments 882,001 .25% 388,855 .25% 158,594 .21%

Loans held for investment, mortgage finance 3,471,737 3.06% 3,452,782 3.13% 2,238,730 3.59%

Loans held for investment 9,921,323 4.40% 9,423,259 4.52% 8,142,569 4.73%

Total loans, net of reserve 13,296,921 4.08% 12,784,614 4.18% 10,297,290 4.52%

Total earning assets 14,221,437 3.85% 13,219,882 4.06% 10,520,951 4.45%

Total assets $14,631,072 $13,629,609 $10,899,266

Liabilities and Stockholders’ Equity

Total interest bearing deposits $ 7,405,436 .28% $ 6,856,542 .27% $ 5,887,252 .26%

Other borrowings 251,449 .19% 309,868 .20% 314,018 .20%

Subordinated notes 286,000 5.88% 286,000 5.88% 111,000 6.58%

Long-term debt 113,406 2.19% 113,406 2.19% 113,406 2.21%

Total interest bearing liabilities 8,056,291 .50% 7,565,816 .50% 6,425,676 .40%

Demand deposits 5,047,876 4,669,772 3,289,307 Stockholders’ equity 1,380,646 1,276,603 1,077,822

Total liabilities and stockholders’ equity $14,631,072 .28% $13,629,609 .28% $10,899,266 .24%

Net interest margin 3.56% 3.77% 4.21%

Total deposits and borrowed funds $12,704,761 .17% $11,836,182 .16% $ 9,490,577 .17%

Loan spread 3.91% 4.02% 4.35%

19

|

|

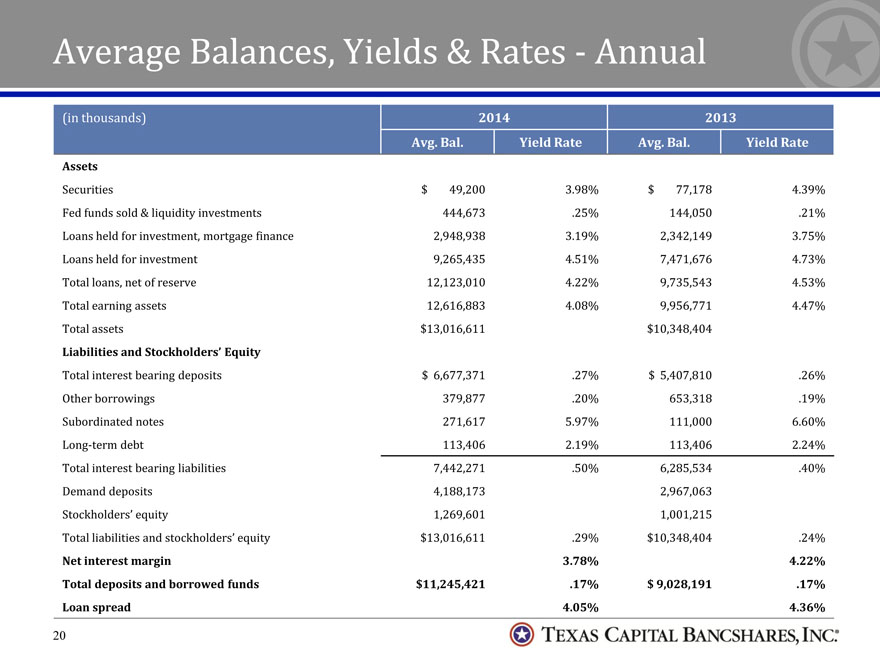

Average Balances, Yields & Rates—Annual

(in thousands) 2014 2013

Avg. Bal. Yield Rate Avg. Bal. Yield Rate

Assets

Securities $ 49,200 3.98% $ 77,178 4.39%

Fed funds sold & liquidity investments 444,673 .25% 144,050 .21%

Loans held for investment, mortgage finance 2,948,938 3.19% 2,342,149 3.75%

Loans held for investment 9,265,435 4.51% 7,471,676 4.73%

Total loans, net of reserve 12,123,010 4.22% 9,735,543 4.53%

Total earning assets 12,616,883 4.08% 9,956,771 4.47%

Total assets $13,016,611 $10,348,404

Liabilities and Stockholders’ Equity

Total interest bearing deposits $ 6,677,371 .27% $ 5,407,810 .26%

Other borrowings 379,877 .20% 653,318 .19%

Subordinated notes 271,617 5.97% 111,000 6.60%

Long-term debt 113,406 2.19% 113,406 2.24%

Total interest bearing liabilities 7,442,271 .50% 6,285,534 .40%

Demand deposits 4,188,173 2,967,063

Stockholders’ equity 1,269,601 1,001,215

Total liabilities and stockholders’ equity $13,016,611 .29% $10,348,404 .24%

Net interest margin 3.78% 4.22%

Total deposits and borrowed funds $11,245,421 .17% $ 9,028,191 .17%

Loan spread 4.05% 4.36%

20

|

|

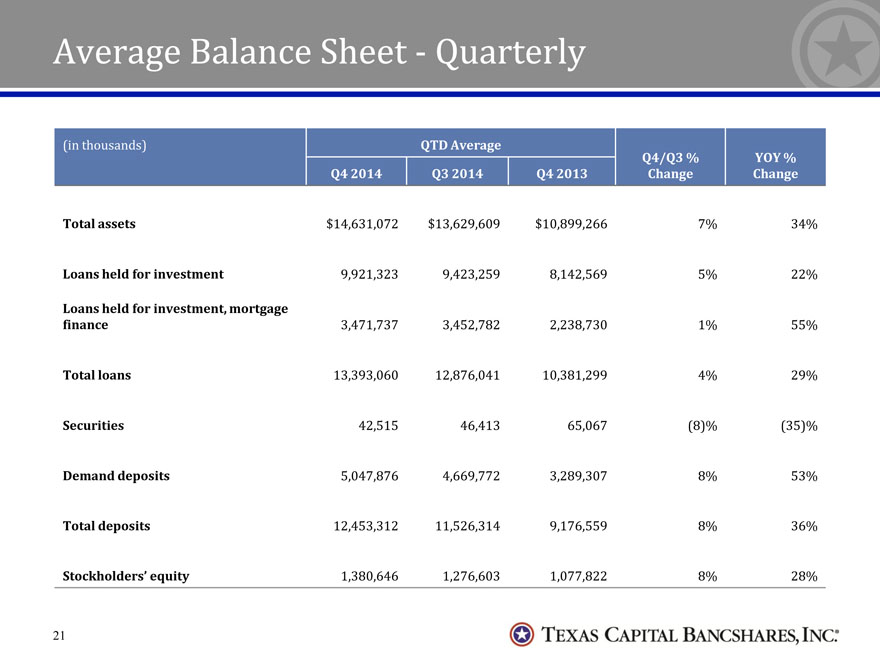

Average Balance Sheet—Quarterly

(in thousands) QTD Average Q4/Q3 % YOY % Q4 2014 Q3 2014 Q4 2013 Change Change

Total assets $14,631,072 $13,629,609 $10,899,266 7% 34%

Loans held for investment 9,921,323 9,423,259 8,142,569 5% 22%

Loans held for investment, mortgage finance 3,471,737 3,452,782 2,238,730 1% 55%

Total loans 13,393,060 12,876,041 10,381,299 4% 29%

Securities 42,515 46,413 65,067 (8)% (35)%

Demand deposits 5,047,876 4,669,772 3,289,307 8% 53%

Total deposits 12,453,312 11,526,314 9,176,559 8% 36%

Stockholders’ equity 1,380,646 1,276,603 1,077,822 8% 28%

21

|

|

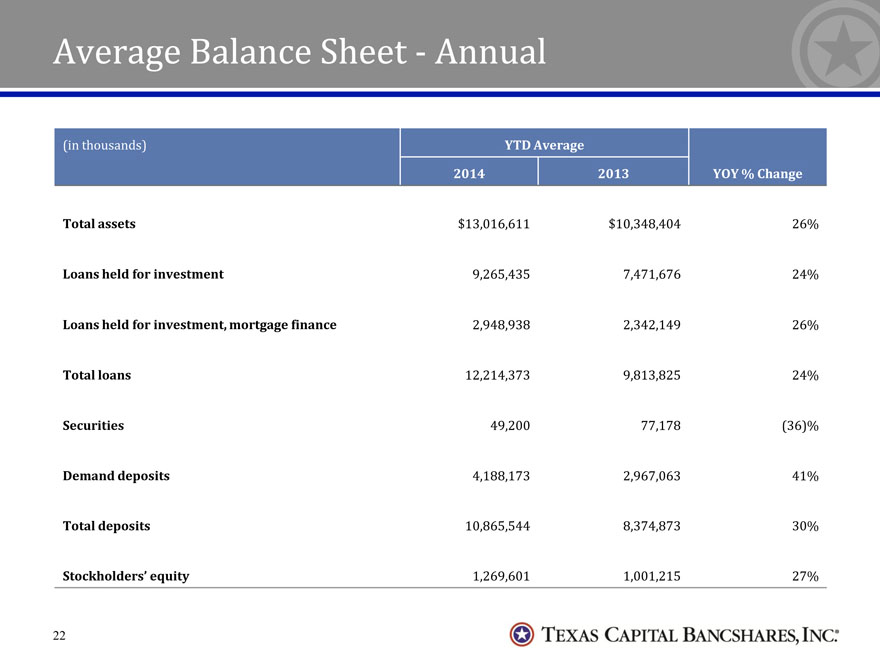

Average Balance Sheet—Annual

(in thousands) YTD Average

2014 2013 YOY % Change

Total assets $13,016,611 $10,348,404 26%

Loans held for investment 9,265,435 7,471,676 24%

Loans held for investment, mortgage finance 2,948,938 2,342,149 26%

Total loans 12,214,373 9,813,825 24%

Securities 49,200 77,178 (36)%

Demand deposits 4,188,173 2,967,063 41%

Total deposits 10,865,544 8,374,873 30%

Stockholders’ equity 1,269,601 1,001,215 27%

22

|

|

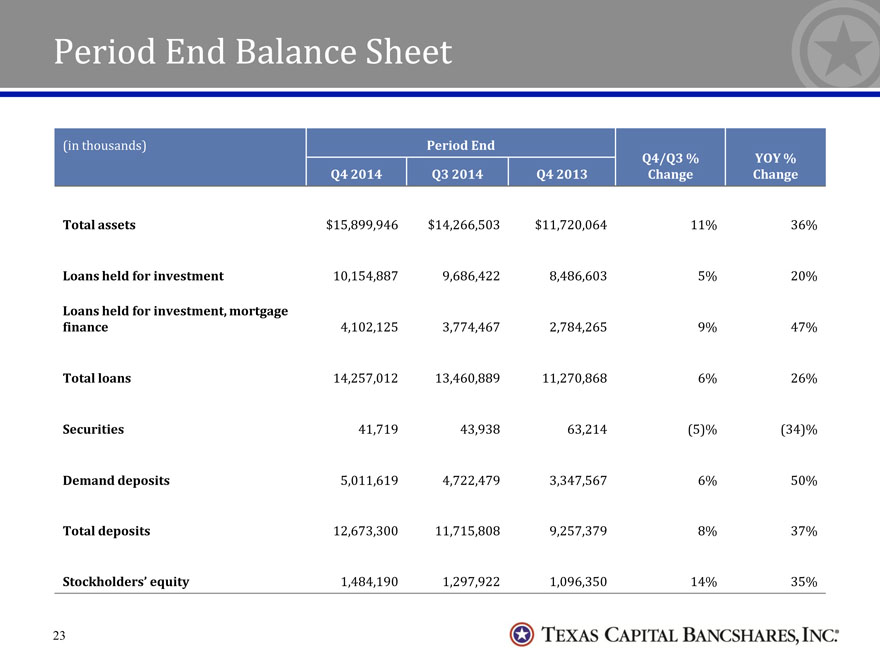

Period End Balance Sheet

(in thousands) Period End Q4/Q3 % YOY % Q4 2014 Q3 2014 Q4 2013 Change Change

Total assets $15,899,946 $14,266,503 $11,720,064 11% 36%

Loans held for investment 10,154,887 9,686,422 8,486,603 5% 20%

Loans held for investment, mortgage finance 4,102,125 3,774,467 2,784,265 9% 47%

Total loans 14,257,012 13,460,889 11,270,868 6% 26%

Securities 41,719 43,938 63,214 (5)% (34)%

Demand deposits 5,011,619 4,722,479 3,347,567 6% 50%

Total deposits 12,673,300 11,715,808 9,257,379 8% 37%

Stockholders’ equity 1,484,190 1,297,922 1,096,350 14% 35%

23