Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Premier, Inc. | d869182d8k.htm |

| EX-99.1 - EX-99.1 - Premier, Inc. | d869182dex991.htm |

| EX-99.2 - EX-99.2 - Premier, Inc. | d869182dex992.htm |

SECOND-QUARTER FISCAL 2015

FINANCIAL RESULTS AND UPDATE

February 9, 2015

Exhibit 99.3 |

Forward-looking statements and Non-GAAP financial measures

2

PREMIER, INC.

Forward-looking statements—Certain statements included in this presentation,

including, but not limited to, those related to our financial and business outlook, strategy and

growth drivers, member retention rates and revenue visibility, cross and upsell opportunities,

acquisition activities and pipeline, revenue available under contract, and 2015 financial guidance

and related assumptions, are “forward-looking statements” within the meaning of the

federal securities laws. Forward-looking statements may involve known and unknown risks,

uncertainties and other factors that may cause the actual results of Premier to be materially

different from historical results or from any future results or projections expressed or implied

by such forward-looking statements. Accordingly, readers should not place undue reliance on

any forward looking statements. Readers are urged to consider statements in the conditional or

future tenses or that include terms such as “believes,” “belief,”

“expects,” “estimates,” “intends “anticipates” or

“plans” to be uncertain and forward-looking. Forward-looking statements may

include comments as to Premier’s beliefs and expectations as to future events and trends

affecting its business and are necessarily subject to uncertainties, many of which are outside

Premier’s control. More information on potential risks and other factors that could affect

Premier’s financial results is included, and updated, from time to time, in Premier’s periodic

and current filings with the SEC, including Premier’s most recent Form 10-K for the year

ended June 30, 2014. Forward-looking statements speak only as of the date they are made.

Premier undertakes no obligation to publicly update or revise any forward-looking statements.

Non-GAAP financial measures—This presentation includes certain “non-GAAP

financial measures” as defined in Regulation G under the Securities Exchange Act of 1934.

Schedules are attached that reconcile the non-GAAP financial measures included in this

presentation to the most directly comparable financial measures calculated and presented in

accordance with Generally Accepted Accounting Principles in the United States. Our Form 10-Q

for the quarter ended December 31, 2014, to be filed shortly hereafter, provides further

explanation and disclosure regarding our use of non-GAAP financial measures and should be

read in conjunction with this presentation. |

Overview and Business

Update

Susan DeVore

President & CEO

PREMIER, INC.

3 |

Second-quarter

highlights

1

(1) Comparisons are with year-ago non-GAAP pro forma information that

reflects the impact of the company’s reorganization and initial public offering. See

Adjusted EBITDA, Segment Adjusted EBITDA and Adjusted Fully Distributed Net Income

reconciliations to GAAP equivalents in Appendix. 4

Strong overall financial performance; raising full-year

consolidated guidance

Net revenue up 19% from prior year, driven by double-

digit growth in both business segments

SCS revenue exceeded and PS revenue in-line with

company expectations

Adjusted EBITDA rose 18% from prior year

Adjusted fully distributed earnings per share of $0.36,

increased 18% from prior year

Acquired assets providing value and growth

PREMIER, INC. |

Supply

Chain Services revenue growth drivers »

Strong GPO net administrative fees revenue

growth, up 10.3% year-over-year on a pro

forma non-GAAP basis

»

Products revenue up 37% year-over year

5

PREMIER, INC. |

Performance Services revenue growth drivers

»

20% revenue growth consistent with

second-quarter expectations, driven by:

»

SaaS-based subscription growth,

particularly from PremierConnect

®

Enterprise and Population Health

Management

»

First full quarter of revenue from TheraDoc

and Aperek acquisitions

6

PREMIER, INC. |

Raising fiscal 2015 full-year financial outlook*

Increasing full-year consolidated net revenue outlook

and raising lower end of original ranges for

consolidated adjusted EBITDA and adjusted fully

distributed earnings per share

PREMIER, INC.

7

»

Raised outlook for Supply Chain Services segment

based on net administrative fee and product revenue

growth expectations

»

Continuing contract penetration

»

Contract conversion of new members

»

Higher utilization trends

»

More moderate growth in Performance Services driven

by two factors confined within Advisory Services

»

Remainder of Performances Services expected to

perform in-line with original expectations

»

SaaS-based business remains strong

»

PremierConnect

®

Enterprise and population health

management on track

*As provided in 2Q’15 earnings press release dated February 9, 2015

|

Positioned to address industry needs

PREMIER, INC.

8

Scale

Co-innovation

Intelligence to transform

from the inside

Leadership in population

health

Shared infrastructure

Total cost reduction

Quality improvement

across the continuum

Evolving delivery and

payment models

Actionable data and

information

Member and

Industry Needs

Premier Strategic

Differentiation

“U.S. Department of Health and Human Services’ recent announcement to accelerate Medicare

reimbursement to alternate payment models… is the clearest signal to date of the

transformative changes gaining momentum within our industry.” –

Susan Devore, Premier CEO |

Recognized leader in population health management

»

Premier Population Health Management

Advisory Services and Theradoc clinical

surveillance solution ranked #1 by KLAS

»

Pioneered performance improvement

collaboratives focused on:

»

Alternate payment models

»

Accountable Care Organizations

»

Close partnerships with federal healthcare

programs and government policy makers to

build and demonstrate pay-for-performance

models

9

PREMIER, INC. |

Unique business model drives innovation and growth

PREMIER, INC.

10

INTEGRATED SALES/FIELD FORCE

& PLATFORM

Become the data analytics “backbone”

with wrap-around services for cost and

quality improvement over the short term

and population health management

solutions over the long term

Change the game in supply chain,

uncover unmatched savings and value,

and lead the disruption of the industry

»

SaaS-based offerings

»

PremierConnect

®

Enterprise

»

Advisory services

»

Performance improvement

collaboratives

»

Group purchasing

»

Direct sourcing

»

Specialty pharmacy

»

Capital planning

Supply Chain Services

Performance Services |

Targeted and disciplined acquisition strategy

PREMIER, INC.

11

»

Acquisition strategy plays a major role in providing

solutions that position member health systems to

thrive in the healthcare environment of tomorrow

»

Financial performance and capital structure provide

access to more than $1.2 billion in cash and debt for

acquisitions and growth strategy

»

Continue to evaluate larger, transformative

acquisitions in areas that closely align with the

needs of our member health systems |

Operations Update

Michael Alkire

Chief Operating Officer

PREMIER, INC.

12 |

Second-quarter operational highlights

»

Winning and expanding member relationships

»

Continued momentum with larger offerings

»

Acquired assets providing value and growth

13

PREMIER, INC. |

Winning and expanding member relationships

»

MultiCare Health Systems

»

“All-in”

engagement

»

Unity Point Health

»

PremierConnect Quality

»

Catholic Health Initiatives

»

PremierConnect Quality

»

PremierConnect Theradoc Safety

»

The Medicines Company

»

Advisory Services

14

PREMIER, INC. |

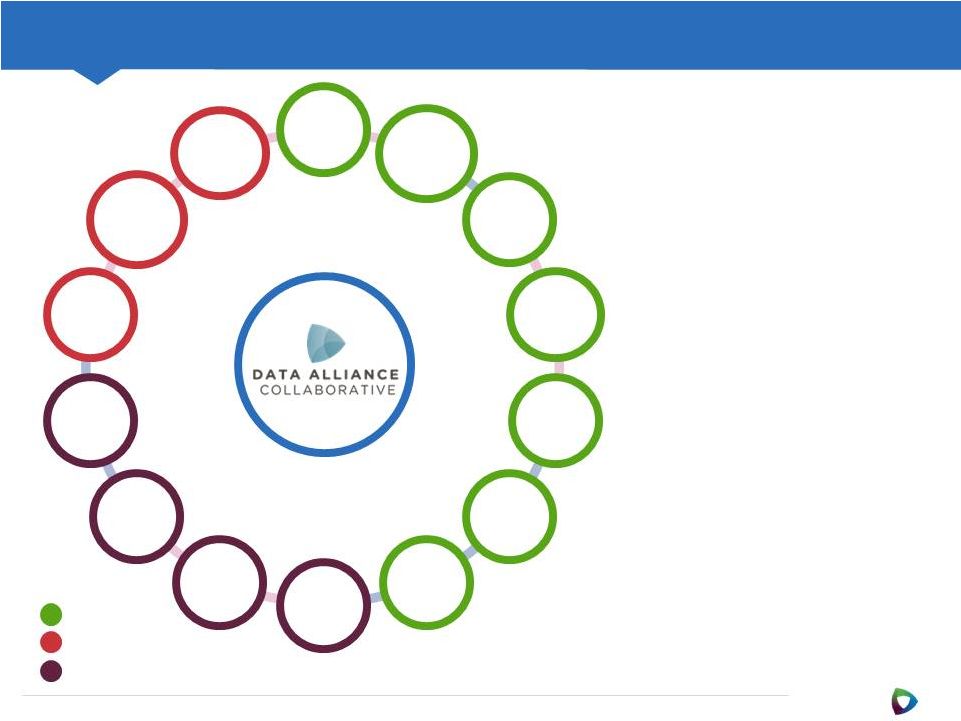

PremierConnect

®

Enterprise & Data Alliance Collaborative

»

Clinical utilization effectiveness

»

Harm reporting

»

Community health & equity reporting

»

Ambulatory quality measures

»

Claims analytics

»

Total cost of care

»

Operational reporting

»

Predictive model for readmissions

»

Population health analytics

»

ACO reporting

»

Referral analytics

»

H&V procedural analytics

»

Readmissions metrics & management

»

Population health

»

Throughput analytics

»

Operations & throughput modeling

»

Population stratification

»

Disease modeling

PREMIER, INC.

15

Texas

Health

Resources

Carolinas

HealthCare

System

Carilion

Clinic

Phytel

Verisk

Health

UNCC

IBM

Bon

Secours

Health

System

University

Hospitals

Baystate

Innovation

Center

Doctors

Hospital at

Renaissance

Mercy

Health

Baystate

Health

Fairview

Health

Services

PCE

Private Warehouse

Partners

*PremierConnect Enterprise and Data Alliance Collaborative as of September 30, 2014. |

16

Strategic acquisitions address member needs

(Closed July 2013)

(Closed October 2013)

(Closed April 2014)

(Closed August 2014)

(Closed September 2014)

Company

Clinical & physician

preference cost reduction

Data acquisition from

multiple technologies

Health system capital

expenditure cost reduction

Supply chain technology

enablement

Quality & safety

improvement

Strategic Need

Direct sourcing

(Closed February 2015

1

)

(1) Purchased initial 60% ownership in 2011. Remaining 40% minority interest

purchased on February 2, 2015. PREMIER, INC.

|

Financial Review

Craig McKasson

Chief Financial Officer

PREMIER, INC.

17 |

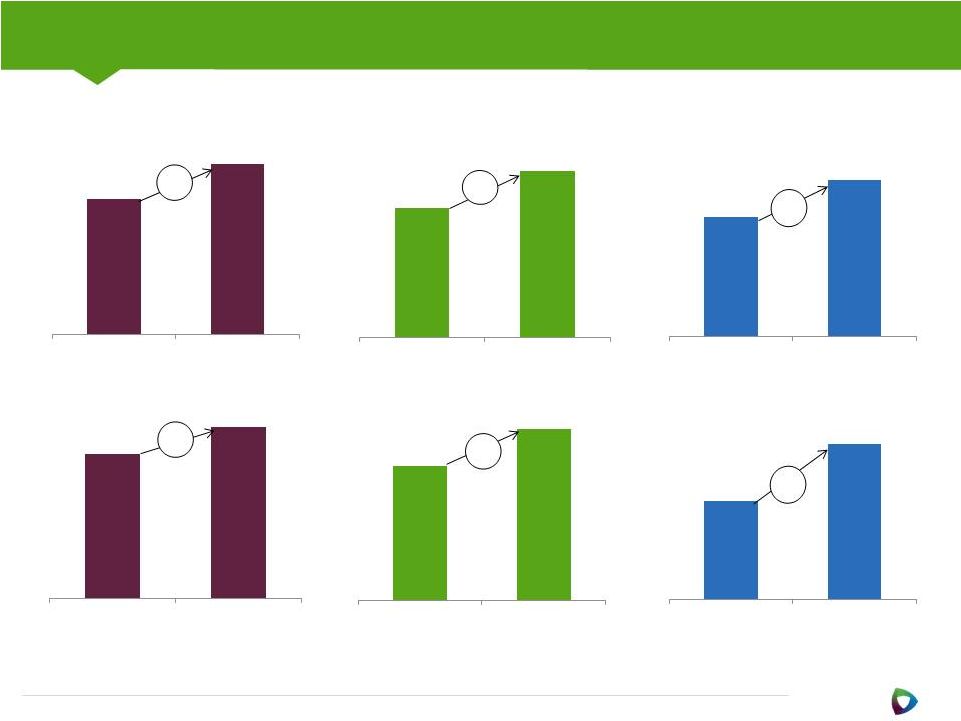

the

Second-quarter

consolidated

and

segment

highlights

1

Consolidated

Net revenue (millions)

Supply Chain Services

Net revenue (millions)

Performance Services

Net revenue (millions)

Adjusted EBITDA

(millions)

Adjusted EBITDA (millions)

Adjusted EBITDA (millions)

18

$208.9

$249.4

Q2'14

Q2'15

19%

$150.9

$179.6

Q2'14

Q2'15

19%

20%

Q2'14

Q2'15

$58.0

$69.8

$83.4

$98.8

$85.1

$97.3

$17.7

$23.2

18%

14%

31%

Q2'14

Q2'15

Q2'14

Q2'15

Q2'14

Q2'15

Supply Chain Services

(1) See non-GAAP Adjusted EBITDA and non-GAAP Segment Adjusted EBITDA reconciliations to GAAP

equivalents in Appendix.

PREMIER, INC. |

Second-quarter

non-GAAP

adjusted

fully

distributed

net

income

1

$0.31

$0.36

Non-GAAP earnings per share on fully distributed

net income

(1) See non-GAAP adjusted fully distributed net income and non-GAAP

earnings per share on fully distributed net income reconciliations to GAAP

equivalents in Appendix »

Calculates income taxes at

40% on pre-tax income,

assuming taxable C corporate

structure

»

Calculates adjusted fully

distributed earnings per

share, assuming total Class A

and B common shares held

by public

19

Q2'14

Q2'15

(in millions, except per share data)

$44.4

$52.1

17%

PREMIER, INC. |

Cash

flow and capital flexibility at December 31, 2014 PREMIER, INC.

20

»

Year-to-date cash flow from operations of

$153.7 million

»

Second-quarter free cash flow

of $67.1

million

1

»

Cash, cash equivalents and marketable

securities of $469.5 million

»

No outstanding borrowings on $750 million

five-year unsecured revolving credit facility

(1)

Three

months

ended

December

31,

2014.

Company

defines

free

cash

flow

as

cash

provided

by

operating

activities

less

distributions

to

limited

partners and purchases of property and equipment. See non-GAAP free cash

flow reconciliation to GAAP equivalent in Appendix. AMPLE CAPITAL

FLEXIBILITY FOR FUTURE

ACQUISITIONS AND

BUSINESS GROWTH

CONSIDERABLE CASH AND

DEBT CAPACITY

AVAILABLE |

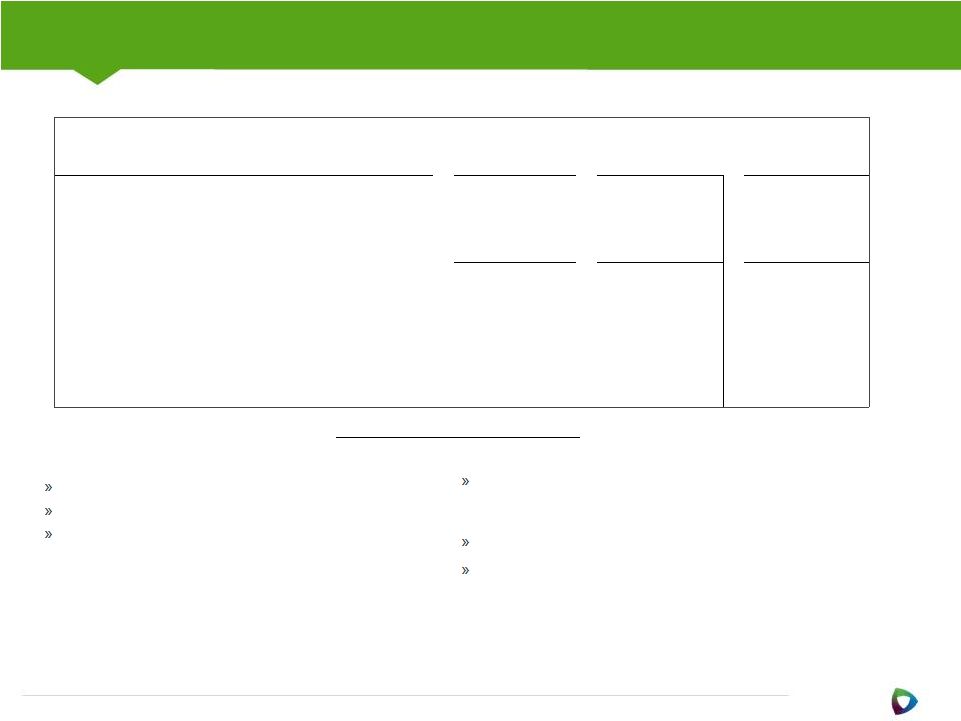

Fiscal 2015 annual guidance

1

PREMIER, INC.

21

Financial guidance for year ending June 30, 2015:

Moderating net administrative fee revenue growth

Continuation of high GPO retention rates

20% -

30% product growth

Guidance Assumptions:

Continued demand for integrated offerings of SaaS-based

subscription and licensed products, advisory services and

collaboratives

Continuation of high SaaS institutional renewal rates

Reduction in advisory services revenue expectations tied to

Partnership for Patients contract and repositioning of research

business

Updated

Pro Forma

Previous

(in millions, except per share data)

FY 2015

% YoY Change

FY 2015

Net Revenue:

Supply Chain Services segment

$706 -

$725

11% -

14%

$688 -

$707

Performance Services segment

$268 -

$275

15% -

18%

$281 -

$288

Total Net Revenue

$974 -

$1,000

12% -

15%

$969 -

$995

Non-GAAP adjusted EBITDA

$382 -

$390

9% -

11%

$379 -

$390

Non-GAAP adjusted fully distributed EPS

$1.40 -

$1.44

8% -

11%

$1.39 -

$1.44

Performance Services growth driven by:

Supply Chain Services growth driven by:

Guidance is based on comparisons with prior-year non-GAAP pro forma

results, which have been adjusted to reflect the impact of the company’s reorganization

and IPO. The Company does not reconcile guidance for adjusted EBITDA and non-GAAP adjusted fully distributed net income per-share to net

income (loss) or GAAP earnings per share because the Company does not provide guidance for reconciling

items between net income (loss) and adjusted EBITDA and non-GAAP adjusted fully distributed

earnings per share. The Company is unable to provide guidance for these reconciling items since certain items

that impact net income (loss) are outside of the Company’s control and cannot be reasonably

predicted. Accordingly, a reconciliation to net income (loss) or GAAP earnings per share is not

available without unreasonable effort. (1) |

Exchange update

»

Approximately 398,800 Class B units initially

indicated for exchange into Class A shares on

February 2, 2015

»

Following right to retract intention to exchange

and right of first refusal, approximately 257,000

Class B Units were exchanged for Class A

common shares on 1-for-1 basis

»

Next

exchange

on

April

30

th

,

2015

22

PREMIER, INC. |

Well

positioned to lead in a world of constant and rapid change »

Premier plays a critical role in helping health

systems achieve improvements in cost, quality,

safety and population health management

»

Diverse revenue drivers enable Premier to

capitalize on evolving industry dynamics

»

Size, scale and aligned member channel provide

opportunities to lead

»

Uniquely positioned to innovate and drive

change

23

PREMIER, INC. |

Thank you

FOR MORE INFORMATION CONTACT:

Jim Storey

Vice President, Investor Relations

Premier, Inc.

704-816-5958

jim_storey@premierinc.com

PREMIER, INC.

24 |

Questions

PREMIER, INC.

25 |

Appendix

PREMIER, INC.

26 |

Fiscal

2015 and fiscal 2014 non-GAAP reconciliations PREMIER, INC.

27

2014*

2013*

2014*

2013

Reconciliation of Pro Forma Net Revenue to Net Revenue:

Pro Forma Net Revenue

249,445

$

208,909

$

478,753

$

408,222

$

Pro forma adjustment for revenue share post-IPO

—

—

—

41,263

Net Revenue

249,445

$

208,909

$

478,753

$

449,485

$

Net income

65,808

$

51,477

$

130,695

$

164,005

$

Pro forma adjustment for revenue share post-IPO

—

—

—

(41,263)

Interest and investment income, net

(122)

(21)

(313)

(241)

Income tax expense

4,270

14,284

10,081

15,048

Depreciation and amortization

11,262

9,198

21,570

17,556

Amortization of purchased intangible assets

3,141

755

4,044

1,356

EBITDA

84,359

75,693

166,077

156,461

Stock-based compensation

7,405

6,494

13,844

6,819

Acquisition related expenses

2,267

177

3,545

319

Strategic and financial restructuring expenses

1,183

1,041

1,279

2,881

Adjustment to tax receivable agreement liability

—

—

(1,073)

—

Acquisition related adjustment - deferred revenue

3,596

—

5,661

—

Other income, net

(2)

—

(7)

(4)

Adjusted EBITDA

98,808

$

83,405

$

189,326

$

166,476

$

Segment Adjusted EBITDA:

Supply Chain Services

97,342

$

85,119

$

188,610

$

210,599

$

Pro forma adjustment for revenue share post-IPO

—

—

—

(41,263)

Supply Chain Services

(including pro forma adjustment)

97,342

$

85,119

$

188,610

$

169,336

$

Performance Services

23,189

17,731

41,551

34,060

Corporate

(21,723)

(19,445)

(40,835)

(36,920)

Adjusted EBITDA

98,808

$

83,405

$

189,326

$

166,476

$

Depreciation and amortization

(11,262)

(9,198)

(21,570)

(17,556)

Amortization of purchased intangible assets

(3,141)

(755)

(4,044)

(1,356)

Stock-based compensation

(7,405)

(6,494)

(13,844)

(6,819)

Acquisition related expenses

(2,267)

(177)

(3,545)

(319)

Strategic and financial restructuring expenses

(1,183)

(1,041)

(1,279)

(2,881)

Adjustment to tax receivable agreement liability

—

—

1,073

—

Acquisition related adjustment - deferred revenue

(3,596)

—

(5,661)

—

Equity in net income of unconsolidated affiliates

(4,749)

(4,491)

(9,615)

(8,605)

Deferred compensation plan expense

460

—

969

—

65,665

61,249

131,810

128,940

Pro forma adjustment for revenue share post-IPO

—

—

—

41,263

Operating income

65,665

$

61,249

$

131,810

$

170,203

$

Equity in net income of unconsolidated affiliates

4,749

4,491

9,615

8,605

Interest and investment income, net

122

21

313

241

Other (expense) income, net

(458)

—

(962)

4

Income before income taxes

70,078

$

65,761

$

140,776

$

179,053

$

Three Months Ended

December 31,

Six Months Ended

December 31,

Supplemental Financial Information - Reporting of Pro Forma Adjusted

EBITDA (Unaudited)

(In thousands)

Reconciliation of Selected Non-GAAP Measures to GAAP Measures

and Non-GAAP Adjusted Fully Distributed Net Income

Reconciliation of Net Income to Adjusted EBITDA and Reconciliation of

Segment Adjusted EBITDA to Income Before Income Taxes: |

Fiscal 2015 and fiscal 2014 non-GAAP reconciliations

PREMIER, INC.

28

2014*

2013*

2014*

2013

Reconciliation of Non-GAAP Pro Forma Adjusted Fully Distributed Net

Income: Net income attributable to shareholders

9,271

$

6,404

$

18,544

$

5,928

$

Pro forma adjustment for revenue share post-IPO

—

—

—

(41,263)

Income tax expense

4,270

14,284

10,081

15,048

Stock-based compensation

7,405

6,494

13,844

6,819

Acquisition related expenses

2,267

177

3,545

319

Strategic and financial restructuring expenses

1,183

1,041

1,279

2,881

Adjustment to tax receivable agreement liability

—

—

(1,073)

—

Acquisition related adjustment - deferred revenue

3,596

—

5,661

—

Amortization of purchased intangible assets

3,141

755

4,044

1,356

Net income attributable to noncontrolling interest in Premier LP

55,751

44,916

110,567

158,130

Non-GAAP pro forma adjusted fully distributed income before income

taxes 86,884

74,071

166,492

149,218

Income tax expense on fully distributed income before income

taxes 34,754

29,628

66,597

59,687

Non-GAAP Pro Forma Adjusted Fully Distributed Net Income

52,130

$

44,443

$

99,895

$

89,531

$

* Note that no pro forma adjustments were made for the three and six

months ended December 31, 2014 and the three months ended December

31, 2013; as such, actual results are presented for each of these

periods. Three Months Ended

December 31,

Six Months Ended

December 31,

Supplemental Financial Information - Reporting of Pro Forma Adjusted

EBITDA (Unaudited)

(In thousands)

Reconciliation of Selected Non-GAAP Measures to GAAP Measures

and Non-GAAP Adjusted Fully Distributed Net Income

|

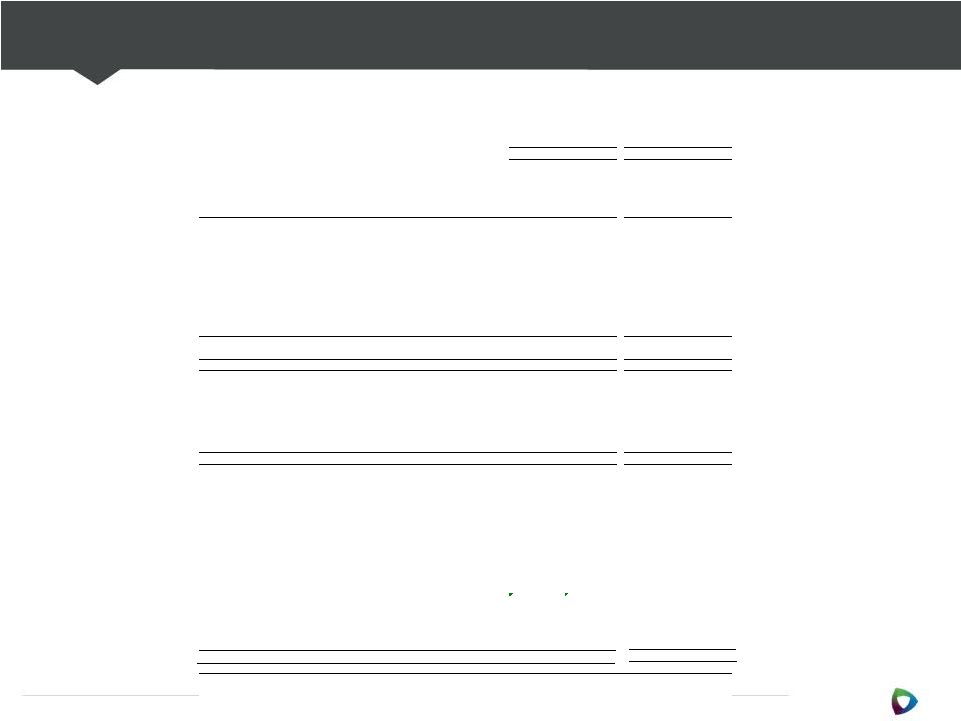

Fiscal 2015 and fiscal 2014 non-GAAP reconciliations

PREMIER, INC.

29

2014

2013

Reconciliation of Non-GAAP Free Cash Flow to Net Cash Provided by

Operating Activities: Net cash provided by operating

activities 107,842

$

131,726

$

Purchases of property and equipment

(18,051)

(13,720)

Distributions to limited partners

(22,691)

(72,645)

Non-GAAP free cash flow

67,100

$

45,361

$

Supplemental Financial Information - Reporting of Non-GAAP Free

Cash Flow Reconciliation of Selected Non-GAAP Measures to GAAP

Measures (Unaudited)

(In thousands)

Three Months Ended

December 31, |

Fiscal 2015 and fiscal 2014 non-GAAP reconciliations

PREMIER, INC.

30

2014*

2013*

2014*

2013

Reconciliation of numerator for GAAP EPS to Non-GAAP EPS on Adjusted

Fully Distributed Net Income Net loss attributable to

shareholders after adjustment of redeemable limited partners'

capital to redemption amount (32,979)

$

(3,713,408)

$

(406,363)

$

(3,713,884)

$

Adjustment of redeemable limited partners' capital to redemption

amount

42,250

3,719,812

424,907

3,719,812

Net income attributable to shareholders

9,271

6,404

18,544

5,928

Pro forma adjustment for revenue share post-IPO

—

—

—

(41,263)

Income tax expense

4,270

14,284

10,081

15,048

Stock-based compensation

7,405

6,494

13,844

6,819

Acquisition related expenses

2,267

177

3,545

319

Strategic and financial restructuring expenses

1,183

1,041

1,279

2,881

Adjustment to tax receivable agreement liability

—

—

(1,073)

—

Acquisition related adjustment -

deferred revenue

3,596

—

5,661

—

Amortization of purchased intangible assets

3,141

755

4,044

1,356

Net income attributable to noncontrolling interest in Premier LP

55,751

44,916

110,567

158,130

Non-GAAP pro forma adjusted fully distributed income before income

taxes 86,884

74,071

166,492

149,218

Income tax expense on fully distributed income before income

taxes 34,754

29,628

66,597

59,687

Non-GAAP pro forma adjusted fully distributed net income

52,130

$

44,443

$

99,895

$

89,531

$

Reconciliation of denominator for GAAP EPS to Non-GAAP Adjusted Fully

Distributed Net Income Weighted Average:

Common shares used for basic and diluted earnings per share

35,589

32,375

33,965

19,001

Potentially dilutive shares

948

110

785

58

Class A common shares outstanding

-

-

-

13,374

Conversion of Class B common units

108,674

112,608

110,396

112,608

Weighted average fully distributed shares outstanding -

diluted

145,211

145,093

145,146

145,041

Reconciliation of GAAP EPS to Adjusted Fully Distributed EPS

GAAP loss per share

$

(0.93) $ (114.70)

$ (11.96)

$ (195.46)

Impact of adjustment of redeemable limited partners' capital to

redemption amount

$

1.19 $

114.90

$ 12.51

$ 195.77

Impact of additions:

Pro forma adjustment for revenue share post-IPO

$

-

$

-

$

-

$

(2.17) Income tax expense

$

0.12

$

0.44

$

0.30

$

0.79 Stock-based compensation

$

0.21

$

0.20

$

0.41

$

0.36 Acquisition related expenses

$

0.06

$

0.01

$

0.10

$

0.02 Strategic and financial restructuring expenses

$

0.03

$

0.03

$

0.04

$

0.15 Adjustment to tax receivable agreement

liability

$

-

$

-

$

(0.03)

$

- Acquisition related

adjustment - deferred revenue

$

0.10

$

-

$

0.17

$

- Amortization of purchased

intangible assets

$

0.09

$

0.02

$

0.12

$

0.07 Net income attributable to noncontrolling interest in

Premier LP

$

1.57

$

1.39

$

3.25

$

8.32 Impact of corporation taxes

$

(0.98)

$

(0.92)

$

(1.96)

$

(3.14) Impact of increased share count

$

(1.11)

$

(1.07)

$

(2.26)

$

(4.09) Non-GAAP earnings per share on adjusted fully

distributed net income -

diluted

$

0.36 $

0.31

$ 0.69

$ 0.62

* Note that no pro forma adjustments were made for the three

and six months ended December 31, 2014 and the three months ended

December 31, 2013; as such, actual results are presented for

each of these periods. Three Months Ended

December 31,

Six Months Ended

December 31,

Supplemental Financial Information -

Reporting of Net Income and Earnings Per Share

(Unaudited)

(In thousands, except per share data)

Reconciliation of Selected Non-GAAP Measures to GAAP Measures

|