Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Southern Concepts Restaurant Group, Inc. | ribs_8k.htm |

Exhibit 99.1

VALUATION ANALYSIS

Subject Issuer:

Bourbon Brothers Holding Corporation

(OTC Stock Symbol: RIBS)

Date 02/10/15

Prepared By:

David L. Lavigne

Senior Analyst, Managing Partner

Touch 4 Partners, LLC

Company History

Like many small emerging enterprises, Bourbon Brothers Holding Corp. has experienced a variety of challenges and iterations to arrive at its current posture. Moreover, the background including some of those challenges and iterations is in my view topical to understanding the current opportunity.

BBHC was started as Southern Hospitality Development Corp. (“SHDC”), which was initially formed to franchise, develop and operate 30 Southern Hospitality restaurants in various cities across the United States.

The Southern Hospitality restaurant concept was developed in 2007 by three individuals; Eytan Sugerman, Justin Timberlake and Trace Ayala. Over the past 15 years, Mr. Sugarman has been instrumental in the development of a handful of restaurants, bars and night clubs throughout New York City including an Italian restaurant opened in 2005 called Destino. Destino was the first Sugerman concept that Timberlake and Ayala were involved in.

Justin Timberlake and Trace Ayala grew up together near Memphis, Tennessee. As an extension of that friendship, Ayala served as Timberlake’s personal assistant early in Timerlake’s meteoric entertainment career, and later the two collaborated on other entrepreneurial ventures aided in part by Timberlake’s celebrity status. One of those endeavors was their partnership with Sugarman in the above mentioned Destino’s. That Destino endeavor lead to the creation of their Southern Hospitality concept, which was developed around Timberlake’s and Ayala’s Memphis roots. Southern Hospitality embodies applicable Memphis barbeque/rock and roll theme(s). As noted, their first “trial balloon” store was launched in 2007 on New York’s Upper East Side. After apparently getting comfortable that the concept was viable, they opened their (current) store in New York’s iconic Hell’s Kitchen and in doing so, the store attracted some additional investors, one of whom was a friend of Mr. Timberlake’s by the name of Ryan Tedder. Like Timberlake, Ryan Tedder is also an entertainer and while known as the front man for the band OneRepublic, he is perhaps better recognized within the industry as a songwriter and producer. Mr. Tedder has written and/or produced music for artists including U2, Adele, Beyoncé, Gavin DeGraw and many others. It was Mr. Tedder’s involvement as an investor in the New York Southern Hospitality store that lead to the formation of Southern Hospitality Development Corp., which eventually became today’s Bourbon Brother’s Holding Corp.

In late 2010, Ryan Tedder had a lunch meeting in Denver, Colorado with his father Gary Tedder, and two of his father’s business associates. At that meeting, he introduced the Southern Hospitality concept, as well as some financial results from the Hell’s Kitchen store and he did so with the notion that he was interested in exploring the possibility of opening one of the restaurants in Denver. There was some local motivation behind that idea because Ryan Tedder grew up in nearby Colorado Springs, and now resides in Denver. He suspected the concept would do well in Colorado, however, he was a songwriter and musician, not a restaurateur, so his vision required some support. Tedder’s father Gary along with the associates who attended the meeting had been collectively involved in a considerable number of startup ventures on a variety of levels including development, capitalization, operations and others. They were a relevant group for Mr. Tedder to pitch the idea to. The short story is that as a result of that meeting, Ryan Tedder’s involvement and relationships to Southern Hospitality and the aptitudes of the others attending the meeting, SHDC was formed and subsequently signed a franchise agreement with Southern Hospitality granting SHDC the franchise rights to 30 cities across the U.S. including Denver, Colorado. (Throughout the balance of this report, we will refer to Southern Hospitality which is the originator of the concept and the franchisor or as “SHNY”).

With the afore mentioned agreement in hand, SHDC embarked on the process of attracting their own investors to capitalize SHDC and to identify and develop the first Southern Hospitality franchise restaurant which would be located in Denver, Colorado. Those efforts commenced in May 2012 when the Company formed a wholly owned subsidiary, capitalizing it with approximately $1 million. Shortly thereafter, the Company formed a separate LLC (“Southern Hospitality Denver, LLC”) for the purpose of capitalizing and ultimately owning 49% of the first Denver franchise store. After investing approximately $900,000, today Southern Hospitality Denver LLC owns 49% of the Denver, Colorado Southern Hospitality franchise restaurant, and the Company owns the remaining 51%. That type of store level financing is germane to the Company’s future financing plans, so I will revisit that issue later in this report.

Beyond the initial store level financing of the downtown Denver location, SHDC recognized that expansion would require considerable capital. As a result, in mid-November 2012, the Company completed a merger with a pubic operating company. That transaction effectively brought SHDC public as the surviving operating entity of the merger. The Company’s rationale for that merger centered on the notion that being a public company would provide them with more flexibility and opportunity to utilize the public markets to achieve their ongoing financing goals. As a result of the merger, the SHDC shareholders retained ownership of approximately 89% of the newly merged enterprise, which at that point consisted of their franchise agreement and their 51% ownership in the Denver location that was in the process of completion.

After nearly one year of planning, development and construction, the Denver, Colorado Southern Hospitality restaurant opened in February 2013 in Denver’s restored lower downtown district (referred to locally as “LoDo”) in what was once the historic St. Elmo Hotel, located approximately two blocks from Coors Field, the city’s Major League Baseball park. The final cost of developing and completing this first store was approximately $5 million.

To clarify, downtown Denver, Colorado, is a robust and relatively concentrated hub for financial, business and entertainment activities across the Colorado Front Range. As a result, the restaurant business is highly competitive, which includes competition for favorable locations in the most attractive retail portions of the city. Moreover, as with many metropolitan areas, the city’s permitting, building code and other applicable requirements are rigorous, and are further complicated in instances involving older (historic) buildings and/or architecture. In short, the process of identifying, leasing and ultimately building out the first Southern Hospitality in Denver was expensive and challenging. However, the principals of SHDC believed at the time that the “flagship” store needed to be a showcase property that could serve as a cornerstone to build out a considerably larger franchise footprint. The principals of SHDC’s vision was that as the franchisor built additional company owned stores in high profile markets (Los Angeles and Las Vegas for example) and those efforts were augmented by marketing contributions from their respective celebrity supporters (Timberlake and Tedder), the brand would garner considerable recognition which would in turn support a variety of aspects associated with their own efforts to build the franchise base. Again, the Denver Colorado store represented the launch of those efforts.

Following the opening of the Denver store, SHDC began the process of identifying a location for their second store. However, the expansion process became compromised by differences between the then leadership of SHDC and the franchisor (SHNY) regarding fees and responsibilities of the respective parties. The result of those differences was that SHDC opted to search for opportunities away from the franchised Southern Hospitality brand. Consequently, in April 2013, the Company changed its name from Southern Hospitality Development Corp. to Smokin Concepts Development Corp. (“SCDC”) to better reflect the new strategy.

In early 2014, SCDC merged with Colorado Springs based Bourbon Brothers Holding Company LLC (“BBHC”). A few days later BBHC opened their first restaurant in the new Copper Ridge development in north Colorado Springs, Colorado called Bourbon Brothers Southern Kitchen. (The restaurant is located across the street from one of Bass Pro Shops newest retail stores. The Company viewed this location as ideal due to the high historic traffic generated by Bass Pro stores in general, as well as the more qualitative notion that the two respective businesses likely shared a considerable common demographic. Moreover, the new development was also to attract a new hotel/resort, which is to be built next to the Bass Pro facility, and also across the street from Bourbon Brothers Sothern Kitchen). BBHC and SCDC completed the merger, and (again) renamed the public entity Bourbon Brothers Holding Corporation. The post-merger enterprise now consisted of two stores; a Southern Hospitality franchise store in Denver, and a Bourbon Brothers Southern Kitchen store in Colorado Springs. Due to the store level financing used to build each store, the public entity owned (owns) 51% of each of these stores. At this particular point in time, the Company’s strategy was to pursue the build out of additional Bourbon Brothers Southern Kitchen restaurants in close proximity to new Bass Pro and/or Cabela’s expansion(s), throughout Colorado and perhaps eventually beyond.

Through the first half of 2014, the principals of BBHC learned a great deal about the restaurant business and those lessons afforded them some significant data points. First and foremost, they went through a variety of operating challenges getting the product and service at both locations to levels that they viewed as necessary for success. Moreover, they also learned a thing or two about issues such as occupancy costs and optimal facility capacity, labor and food costs and a host of others. Recognize, that each of the two facilities (Denver and Colorado Springs) was opened under the auspices that each would represent a “flagship” store in two different and initially unrelated endeavors. (Translation: combining the two brands was never the initial plan in either case). As a result, it became abundantly clear that while the expense associated with building these first stores was both extraordinary and necessary, future sites would require lower build out and startup budgets that would ultimately manifest themselves in lower occupancy costs. That factor caused the Company to again reconsider its strategy and direction. Just to translate, the first 6 to 9 months of 2014 provided the Company with a number of data points both from the macro and the micro views of the business that essentially forced the Company to rethink its strategy with respect to growing the business. Here are a few of those data points and the takeaways they were able to garner from them.

|

1)

|

The strategy to “follow” Bass Pro and/or Cabela’s had its “pros and cons”.

|

|

a.

|

The lessons from Copper Ridge at least through the first several months of operations, were that being next door to one of these stores was indeed beneficial. However, it is/was difficult to gage the extent of that value. On one hand, there were reasons to believe that at least some of the demographic assumptions about the respective target customer(s) of each business were accurate, and the Company still believes that notion will be supportive to the success of the Colorado Springs store. On the other hand, they also tend to believe that the rapid expansion(s) of both Bass Pro and Cabela’s has led to some cannibalization of their business plan, at least with respect to the stores being the “destination” type retail stores they once were. For example, (and this is admittedly anecdotal but still topical in my view), in Cabela’s most recent 10Q filing (period ending 9/30-/14), they reflected companywide retail merchandise sales of $599 million versus $551 million in the same quarter. These results were generated from 64 and 48 stores respectively. That would indicate quarterly merchandise sales per store of $9.35 million versus $11.48 or a decline of 18.5%. It may be reasonable to assume that information regarding historic per store traffic may overstate actual future per store traffic numbers, which would be important to those building businesses around those new locations. Additionally, the Bass Pro results (although they are not a public entity some it’s more difficult to confirm) may illustrate a similar scenario. For instance, as of 02.05.15, company press releases indicate that Bass Pro has “90 retail stores and Tracker Marine Centers across America and Canada that are visited by more than 120 million people every year”. That would indicate approximately 1.33 million visitors per year per store. However, in an October 2013 release, they indicated they had “78 retail stores and Tracker Marine Centers across America and Canada that are visited by more than 116 million people every year” implying 1.49 million visitors per store per year. That would suggest a decrease of about 11% per store over the past 14 months. Again, I submit that this is anecdotal and perhaps it is simply a matter of them using round numbers. Moreover, I am not intending to pass judgment on the success of either enterprise’s expansion plans. However, I would stand by the notion that it may be reasonable to assume that future stores may logically prove to be less visited than many of the legacy stores.

|

|

b.

|

As an extension to the above, as the Company performed due diligence on potential locations in reasonable proximity to either newly constructed or planned Bass Pro and/or Cabela stores along the Colorado Front Range, it became evident that the notion that establishing a complimentary business alongside these new stores was apparently not lost on other business people. In short the properties were expensive, which ultimately impacted potential occupancy rates and in turn the favorability of the strategy in general. Specifically, the capital requirements and the time constraints involved with the strategy were also prohibitive.

|

|

2)

|

Occupancy Costs are Important.

|

The reality of the above data points forced the Company to (again) rethink the strategy of how to best grow the Bourbon Brothers brand. That reality lead to the development of a new approach; seeking second generation restaurant space along the Colorado Front Range in locations that might be favorable to the BBSK brand. To edify, second generation restaurants are typically vacant buildings that once housed a restaurant that for one reason or another shut the doors. (Believe it or not, that reason is not always a matter of the business itself failing). Depending on economic cycles, regional demographics and a host of other inputs, these facilities can sometimes be brought on line in relatively short periods of time and with considerably less capital than constructing a new building. That translates into not only the ability to open stores faster, but also to open stores with markedly lower occupancy costs. The trick is to find locations that will provide viable amounts of traffic to support the concept.

|

3)

|

With Restaurants, Size matters But One Size Does Not Necessarily Fit All.

|

Have you ever noticed that many restaurants in terms of size and architecture (once you remove signage and other accoutrements) look largely similar? There is a reason for that, and the reason is typically that the landlord likes it that way because if one tenant (a particular restaurant concept) doesn’t work, the space is still highly functional for another. It makes keeping the place rented more likely. That, in a nutshell, is why second generation restaurant buildings are often available. With that said, there are still other variables that make one location better than another and some of that is a matter of the concept itself. For example, a restaurant concept that is more geared towards a high end lunch/dinner business might be more interested in a second generation building that sits in the middle of a business district full of lawyers and executives, than a facility located next to a high school full of kids looking for “fast food”. More specifically, the concept largely determines the “optimal” location criteria, and the trick in utilizing a second generation strategy is being able to identify enough locations that fit the optimal criteria.

The above said, the Company chose to pursue a second generation location strategy to build the BBSK brand with the underlying assumption being that they could identify a retrofit a meaningful number of locations applicable to the BBSK brand and those locations would provide them with enough favorable demographic and occupancy variables to “fit” the business plan. In that regard, the Company identified its first viable location for a second BBSK in an upper middle class area located southwest of downtown Denver (known locally as “Lone Tree”) within earshot of two successful restaurant/bar concepts. The Company signed the lease and prepared to develop the second site. Having read the history of the company to this point, true to form, the road took another turn…

One of the “successful restaurant/bar concepts within earshot of the new location” happened to have a common word (“brother”) in its name. That resulted in that entity utilizing some legal remedies to prevent the Company from building a restaurant with a “similar” name within a particular geographic footprint. That forced the Company to do one of two things; fight the legal challenge, or change the name of the restaurant. Neither was a particularly good option.

Given the above challenge, the Company had to rethink the concept for the building (which they believed at the time and continue to believe) represented a favorable location. The decisions were this; fight the legal challenge (which meant paying attorneys to do so), establish yet another concept/brand to utilize the space or revisit the Southern Hospitality brand they had already established in downtown Denver (and was beginning to gather operating momentum). The company considered each of these options in earnest, and even considered an entirely new concept. However, as a result of these “choices” the executives of the Company decided to approach the Southern Hospitality franchisor group about the possibility of revisiting the entire franchise agreement.

To backtrack once again, in the midst of the above quandary, the Company was also developing a fast-casual-restaurant (“FCR”) concept that was actually related to the new concept option they were contemplating at the Lone Tree location. The FCR approach is essentially the assembly line service approach deployed by brands such as Chipotle. This concept, along with being highly popular these days, also involves favorable margin attributes related to lower labor and food preparation costs as well as other elements.

Ultimately, the Company was successful in revisiting the original franchise agreement with the Southern Hospitality franchisor. The success of those efforts were probably the result of many factors, which included some new personalities on the BBHC side, but regardless of the reasons, the two parties were able to arrive at some new arrangements going forward with respect to the use of the Southern Hospitality brand. Succinctly, BBHC has been granted a more favorable franchise arrangement with respect to new full service Southern Hospitality restaurants. Moreover, BBHC has also developed a new FCR concept around the Southern Hospitality brand that will encompass the (Chipotle) assembly line service approach, with the same high quality smoked protein barbeque menu featured at Southern Hospitality’s full service locations. This arrangement with the franchisor actually involves a licensing agreement that recognizes contributions from each side that is designed to be symbiotic.

Tying together the prior five pages of Company history illustrated above, the recent developments with the Southern Hospitality franchisor has set the stage for the Company to pursue the following. They will now proceed under a single brand (Southern Hospitality). That brand will include full service restaurants such as the flagship store in lower downtown Denver, as well as the new Lone Tree location. Those (and additional) stores will operate under a modified (more favorable) franchise agreement. The new FCR concept will be rolled out under the same brand (Southern Hospitality) but will be subject to the new licensing agreement arrived at between the two parties. While I suspect the Company’s growth will be more focused on the FCR options, I also believe they will continue to pursue additional full service options. I am confident that 2015 will entail additions of both approaches. Lastly, while the road to this point has been “long and winding”, it is my view that the new arrangements the Company has managed with the original franchisor of Southern Hospitality has provided reasonable incentive for the Company to grow the brand, and the consolidation of their efforts into that single brand should provide measurable economies going forward, especially as the initial growth phase is concentrated along the Colorado Front Range.

Industry Overview and Comparative Analysis

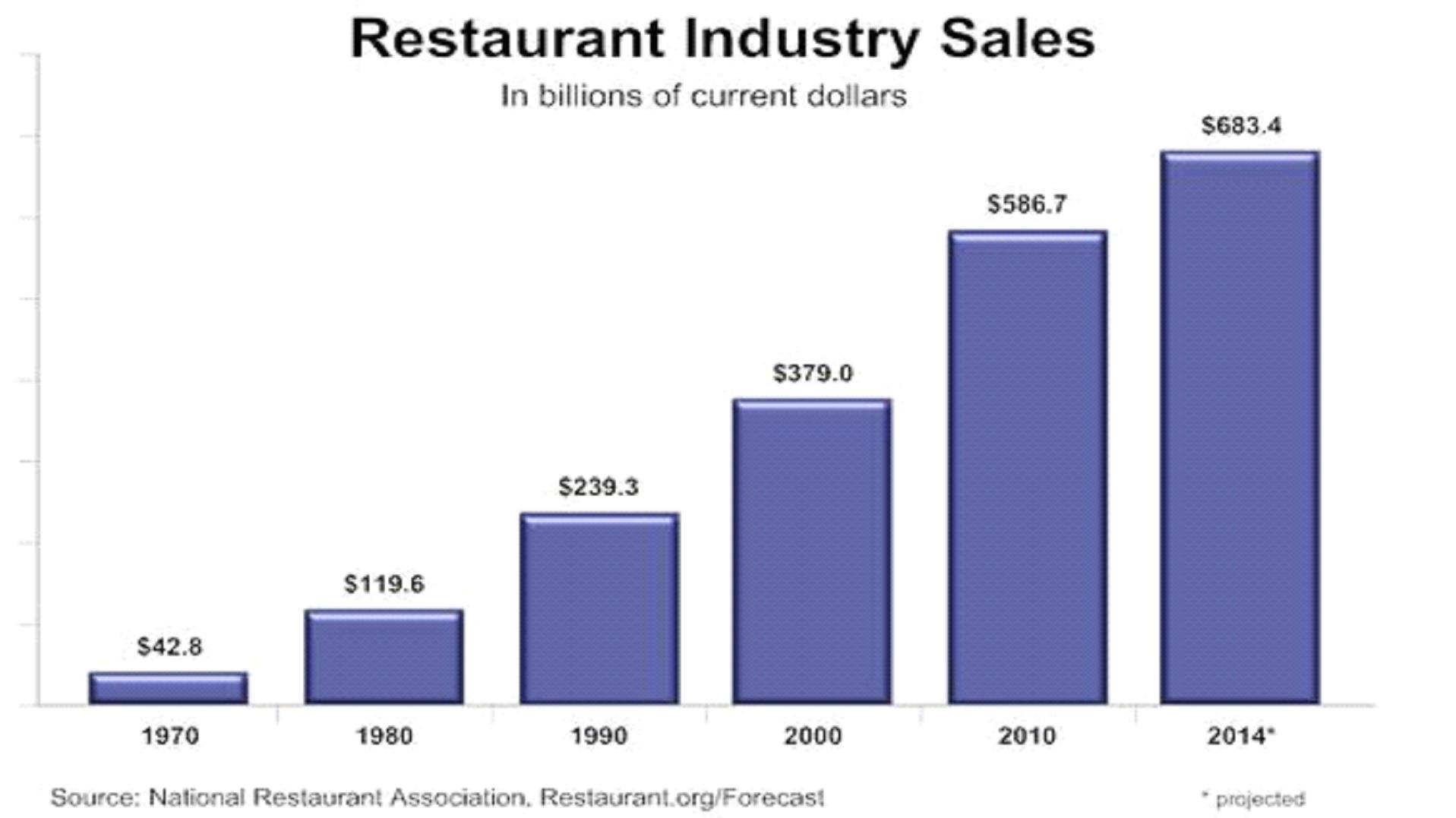

Over the past 60 years, the restaurant industry has almost doubled its share of every dollar spent on food in the United States, from 25% in 1955 to 47% today. This growing portion of consumer spending on food has led to the restaurant industry creating jobs at a faster rate than the overall economy for the 15th consecutive year. The megatrend toward consumers eating out more often should come as no surprise, but it is often useful to point out these statistics as a reminder of the huge opportunity for successful restaurant concepts. For those that prefer a visual, the sales trend of the overall restaurant industry illustrates this tremendous growth:

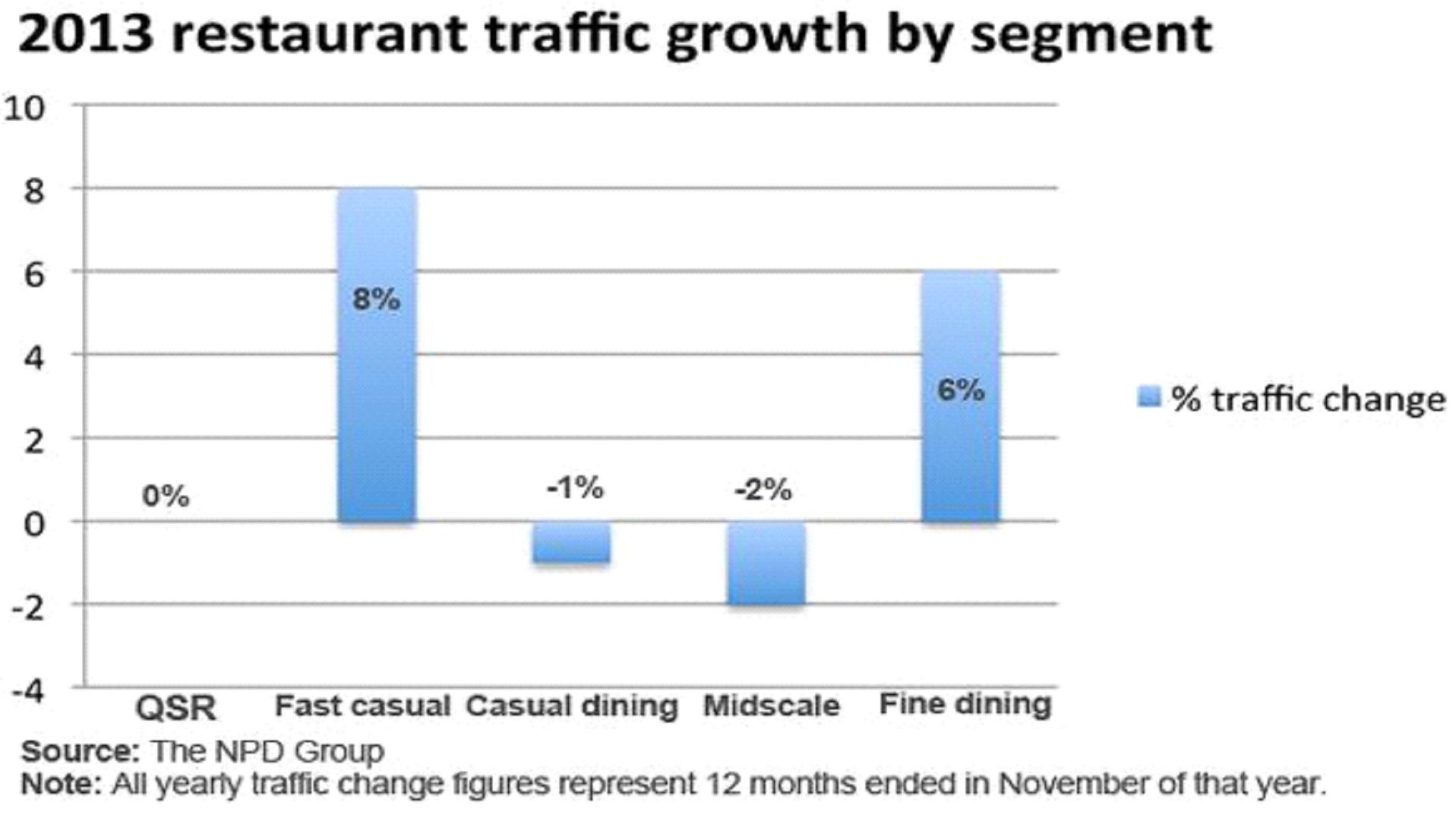

Within the larger trend of restaurant growth is an equally powerful sub-trend favoring fast casual restaurants. These restaurants, led by companies such as Chipotle Mexican Grill (NYSE: CMG) and Panera Bread (NASDAQ: PNRA), hit the sweet spot for consumers by providing quality food, reasonable prices, and quick service. This value proposition resonates with many consumers that are looking for a quick meal that is healthier than the fast food brands and less expensive than casual and fine dining options.

For five consecutive years, traffic at fast casual restaurants has outpaced all other classes. In 2013, this growth in traffic was a strong 8% as illustrated below. Fast casual leads the pack within a growing industry:

Customers are flocking to fast casual restaurants, which has allowed this subset of the industry to experience explosive growth. Chipotle opened 185 restaurants in 2013 to end the year with 1,595 locations; the company expects to repeat that growth with new store openings of 180-195 in 2014.

Panera experienced solid growth as well during 2013, opening 133 locations and finishing the year with 1,777 restaurants. Management provided an estimate that 115-125 locations will be opened during 2014.

Noodles & Company is much earlier in its expansion; the company had only 380 stores at the end of 2013, of which 53 were opened during the year. Management is forecasting 42-50 openings during 2014.

Each of these companies is expected to outpace industry wide growth for the foreseeable future.

http://www.fool.com/investing/high-growth/2014/03/24/fast-casual-continues-to-dominate-restaurant-growt.aspx

The above is an excerpt from some industry information that I thought was germane to the topic. The bottom line here with respect to the Company is probably twofold. From the macro view, it is clear that eating outside of the home is a growing reality, so much so that it has almost become cultural, which means that consumers will likely continue to consume a significant portion of their overall sustenance from food service venues of one type or another, which probably bodes well for the restaurant space in general. That said, the micro view of this story is focused on the specific trends, concepts and brands that will capitalize on that paradigm.

To that point, fast casual has emerged as a significant challenge to legacy elements of the restaurant space. At its base level, the proof of that probably lies in charts above, but more specifically, we are beginning to see it in the performance of the 800 pound gorillas in the fast food space. To that end, the above charts provide potentially conflicting views of what is happening in the food service space. The first chart suggests that the market itself is simply growing…expanding the market share pie for “all” players in the restaurant space. In contrast, the second chart suggests that some are faring better than others. On the face, the weak results from companies like McDonalds raises the specter of changing consumer attitudes about what they eat, how they get it and what they are willing to pay for it. The recent data suggests that those attitudes are creating openings for new concepts and new brands in the space. I would submit, in the case of the Company specifically, some of their enthusiasm stems from a more local notion; the state of Colorado, and by extension the Colorado Front Range represents one of the most robust geographic area in the U.S. in terms of economic growth. For instance, a 2014 survey by Business Insider (http://www.businessinsider.com/state-economic-growth-rankings-2014-8?op=1#ixzz3RDZMXjfD) ranked each state in the union’s economic growth based on how eight economic measures have grown or shrunk in recent years. The metrics used were as follows: the unemployment rate, the number of non-farm payroll jobs, gross domestic product, average wages, the working age (18-64) population, value of international exports, house prices, and auto sales. Colorado ranked number 1 in the country via their methodology. My point is, while the industry itself, and the fast casual subset provide a favorable backdrop for the Company’s strategy, the geography of at least their initial expansion may provide an equally compelling leg to the story. There is a reason why several highly successful FCR concepts originated in Denver (Chipotle, Noodles & Company, Smashburger …).

Lastly, I want to provide some comparative analysis to illustrate the valuation premiums that can sometime accompany success in the space. Recently, I stood in awe at the opening trading activity of the Initial Public Offering of Shake Shack, Inc. (NYSE: SHAK). Shake Shack opened trading on January 30, 2015. The initial public offering price was $21.00 yet it closed the first day of trading at $45.90, marking a single day return of 118%. Moreover, I believe the Company has about 35.5 million share outstanding (post IPO) giving it a current market cap (based on the recent closing price of about $42.00) of just under $1.5 billion. That company at the IPO price was valued at $735 million. Below is a chart with some of their metrics at the time of their S-1 filing:

Keep in mind, SHAK has both Company owned stores (31), which it operates, and other licensed stores (32), which it does not. Per their filings, their operating stores generated sales of just under $80 million for the 39 months ended September 30, 2014. That number annualizes to approximately $107 million for the year, or revenues of about $3.45 million per store. Moreover, during the same period, they reflected operating profits of about $650,000 less than their licensing revenues (translation: the stores they operate on their own may be breaking even after corporate overhead). Notice, between 2010 and the first 9 months of 2014 (nearly 4 years), they opened 20 company stores. Interestingly enough that is a similar trajectory to that which BBHC has planned for the current Colorado Front Range rollout. To reiterate, the SHAK valuation at the IPO offering price was $735 million. In contrast, the current market cap of BBHC is approximately $12.5 million making the SHAK valuation nearly 60X that of BBHC. I am not suggesting that BBHC will over the next 4 years grow its business as large or as profitably as SHAK (although it could certainly approach those metrics). I am also not suggesting that BBHC will ever garner the same market premium as the ever popular SHAK (although with its celebrity element it could) nor am I suggesting that SHAK’s valuation is reasonable (just as I am not suggesting that it isn’t). I am suggesting this; they have some similar attributes and if BBHC management is successful in executing the plan in proximity to my model assumptions BBHC should be able to achieve a valuation that is much closer to that of SHAK than 1/58th of the IPO value and 1/117th of tis current value. Put another way, there is a big difference between $.12.5 million and $1.5 billion. I think many of the FCR industry comps bode well for BBHC if they are able to execute timely and profitably.

Operating Overview

As we touched on above, the Company’s path to this point has involved some complexity that has in part been related to the typical challenges associated with starting and growing a new business, but also to differences between the Company and the Southern Hospitality franchisor. To reiterate, those differences included a variety of issues, but the good news is that the two sides have been able recognize the value/benefits the each may have to the success of the brand, and in turn have come up with an arrangement that looks like it may work to achieve that end. One of the more important aspects of their new arrangement is that it will allow the Company to expand under a single brand/concept. At this point in the Company’s development there are a number of advantages as well as considerable leverage in a single brand approach, and that leverage is present across multiple aspects of the business, which includes its ability to attract capital, which is paramount to the Company’s success.

Specifically, the original franchise agreement has been modified to reflect a more favorable cost structure for the Company. More importantly, the Company has developed a new “fast casual” iteration of the Southern Hospitality brand that will likely represent the preponderance (but not all) of their growth activities going forward. The fast casual iteration actually involves a relatively modest licensing agreement between the Company and the Southern Hospitality franchise. For the sake of brevity, the licensing agreement addresses both the Company use of the brand as well as use (by both entities) of the new fast casual “system”, and should give the Company the flexibility to grow the business well beyond positive cash flow and positive earnings provided the new stores perform as anticipated. To the notion of the arrangements between the respective parties, I think it is important to note (if it’s not abundantly clear at this point) that the franchisor and owner of the of the Southern Hospitality brand, trademark et al., is probably more interested in creating business arrangements around that asset that are more of a licensing nature. That is, they do not appear to be particularly interested in building and operating new restaurants under the mark. That by the way is just my observation. On the other hand, the Company has demonstrated a clear desire to develop and operate restaurants. Obviously, those approaches are two dichotomous but on the face potentially symbiotic directions. Just to be clear, I believe the new arrangement between the two parties should give the Company a visible pathway to profitability. What the arrangement leads to beyond that will likely depend on a variety of things.

The above said, I think we can expect the Company to spend the next 12 to 24 months continuing to build out a handful of additional full service sites much like the downtown Denver location, and per their new licensing agreement, adding at least 5 new fast casual restaurants along the Colorado Front Range and largely in the Denver metro area. Here is a bit more color on that potential rollout, including some metrics that I used to develop my valuation model.

Today, the Company operates two full service restaurants:

The first is a Southern Hospitality located in lower downtown Denver, Colorado. It has been in operation for approximately two years and is now consistently operating profitably at the store level. My view is that the location can achieve same store growth through 2015 of something between 10% and 15%, which should allow it to make a meaningful contribution towards the eventual profitability of the whole in both 2015 and beyond.

The second operating store is Bourbon Brothers Southern Kitchen in Colorado Springs, Colorado and it has been in operating for approximately one year. This is a large restaurant with a high occupancy cost, which has impacted its profitability. Recall, the facility is located across from the Colorado Springs Bass Pro store, as well the future location of a new resort that I anticipate will bring marked traffic to the restaurant once it is completed. Delays in the construction of the resort have negatively impacted the potential of this particular restaurant to this point, but ultimately, I think the space will prove highly valuable as entire development grows. Obviously getting the resort in is a big part of that and it is anticipated to be completed in early 2016. In spite of the challenges, this space has experienced periods of store level profitability, and here again, I view year-over-year growth of 10% to 15% as a reasonable expectation, which should put it on a consistently profitable run rate at the store level. Moreover, in line with the notion of focusing on a single brand, the Company intends to convert the restaurant to the Southern Hospitality brand over the next few months. That transition could impact my assertion about year-over-year growth, but I don’t think the changes will be so stark as to chase off repeat customers. As I understand it, this store will actually be called Southern Hospitality Southern Kitchen, which will provide some differentiation from the Downtown Denver store (as well as future full service locations). In that regard, several key elements of Bourbon Brothers Southern Kitchen (the salad bar and Sunday brunch buffet for example) will remain. Recognize, each of these businesses is owned 51% by the Company and 49% by individual investor groups. I will revisit that notion in a moment.

The Company is currently in the process of building out its third full service restaurant, which should commence operations in mid-April 2015. This store is located in an area referred to as Lone Tree, Colorado which sits southeast of Downtown Denver, and northwest of Colorado Springs. The location sits in close proximity to some relatively high income neighborhoods and dense business areas, and is buttressed by two other successful restaurant concepts. My sense is that this location should exit 2015 on a profitable store level run rate, and should be a major contributor to the Company’s overall profitability once it is established. At this point, my guess is that this location will be one of the few 100% company owned stores in the portfolio.

On the fast casual side, the Company’s first store is slated for opening around mid-2015. This location sits in one of the busiest districts of the Denver metro footprint. This should be an optimal location from which to launch the new fast casual concept as there are other highly successful store from other emerging brands in close proximity to the store (Mod Market and Smashburger for example). The company has identified one specific location for the second FCR, which they hope to open in mid-October 2015 and they are in the process of reviewing additional locations for three additional stores in the first half of 2016.

The Company anticipates that each of these new FCR’s (and frankly, the bulk of any additional full service stress beyond Lone Tree) will be financed at the store level. What that means, is that the Company will seek to identify investors to put up the money to open these stores in exchange for 49% of the profits they generate. Obviously, this is a nuance I have worked into the valuation model. Some may have a mixed view of this approach (giving up half of the profits from each store) however, it is important to recognize a few salient points with respect to this approach. First, like many small startup enterprises, the Company has sold equity along the way to finance the operations to this point. That is a typical approach for many small (especially public) companies. However, from my standpoint as a microcap analyst, I would argue that one of the most concerning issues for investors in these companies, is the dilution required to capitalize the businesses to the point of profitability and even considerable growth beyond. I have seen many investors participate in companies that ultimately succeeded in growing their companies to sizable profitability, but the dilution it required prohibited early investors from getting profitable on their early investments. The store level financing approach, is aimed at financing the growth of the Company yet limiting the amount of dilution to shareholders as much as possible. Granted, that approach means effectively giving up ½ of the profitability of the restaurants, but, management’s analysis is that the approach will lead to more reliable and ultimately cheaper financing than the alternative. Again, keep in mind that I have built my valuation model around this sorter level financing assumption. As an aside, given the illiquid nature of the public stock at least at this point, I think the store level financing approach will likely be significantly more optimal than the alternative. On the other hand, there is nothing keeping the Company from adding 100% owned company stores in the future.

Along with the anticipated store level financing, here are a few more operating metrics that I am employing in my model that will determine the success/failure of my assumptions vis-à-vis the actual operating results going forward.

Due to lower costs in multiple categories (aggregate occupancy costs, unit labor etc.), I believe the FSR approach could yield annual per store revenues in the $2 million range, with net profits around 15%. For the sake of comparison, Chipotle, (the king of FSR) generally reflects net operating margins in the 16.5% to 17.5% range. Obviously, the Company’s success in driving those types of revenues and managing margins will have a considerable impact on the value of the Company and its underlying stock price.

I am looking for full service stores to generate annual revenues between $2.5 million and $3 million, with net operating margins in the 8.5% to 9% range. I don’t believe that either of these assumptions is particular aggressive (the two current stores should generate revenues in these ranges or better in the case of Colorado Springs), and I believe the margins are achievable given the work the company has done to drive down costs. Also, these numbers are in line with other comparable businesses. I remain open to the notion that some of these locations could do better than that. Recognize, there is considerable leverage in the operating model, so incremental increases in revenues should have markedly positive impact on operating margins as well.

Given some of the challenges along the way, the Company’s corporate overhead has been substantial. While being a public Company on the face entails its own set of expenses that are not insignificant I anticipate annual corporate overhead (SG&A et al.) including debt service to decrease in the aggregate through 2015 and beyond (relative to 2014). Granted, the transition to a larger operating enterprise will entail some new expenses, which may make these initial assumptions hard to nail down, but I think annual SG&A, debt service and depreciation/amortization in the $1.8 million range, should be more likely. That would represent a considerable reduction from 2014 levels, which should make the hill to profitability a little easier to climb. Obviously, they need to get more contributing restaurants on line to cover that burn. They should be able to significantly reduce overhead as a percentage of revenue to a run rate under 10% through 2015.

Also, I am not expecting marked increases in share counts beyond what has already occurred due to the store level financing assumed above. Clearly, that notion could change if the Company adopts a different financing strategy.

Risk and Caveats

First and foremost, readers need to recognize that I am one of the founders of both Southern Hospitality Franchise Holding Corporation and Bourbon Brothers Holding Company. I am currently a director of the public company (BBHC) although I will not be standing for reelection at the upcoming March 2015 shareholder meeting. I am one of the largest shareholders in the public company. I am also part of the investor group that owns the Bourbon Brothers Southern Kitchen land and building. I have very clear conflicts with respect to the publication of this document. With that said, I am also NOT a restaurateur, and in fact I am not even really an entrepreneur, at least not to the degree of most people who are labeled as such. I am however, a microcap stock analyst. I have been involved professionally in the microcap space (in various capacities including research) since 1984 and I have spent the past 16 years almost exclusively in the research end of this. I have written dozens of research reports and have engaged in the analysis of 100’s of microcap and small cap companies. I am unequivocally qualified to provide this analysis. Readers will need to decide for themselves, given my disclosures, whether or not I am unbiased enough to provide this analysis. That may not represent a risk to the company, but it is germane to the conclusions herein.

I touched on dilution above, but it is important so I will cover it again. Access to capital is among the most critical challenges to any small venture, especially those looking to grow their businesses rapidly. Moreover, some businesses are more capital intensive than others. The success of the Company still depends on its ability to access capital at reasonable valuations. The worst case scenario (outside of not being able to raise capital at all) is their having to raise capital in configurations that lead to significant dilution of the equity position of exiting or even future shareholders.

Microcap stocks are often quite illiquid. Unfortunately, that applies even to companies that are executing on their business plans, growing their businesses, generating revenues and even generating profits. While management is well versed in the nuances of the public microcap markets, and as such, they recognize the importance of liquidity to shareholders in public enterprises, they may not be able to significantly impact that reality. That is another way of suggesting that shareholders could consider this as an investment that they are willing to purchase and hold onto until the visibility of the valuation becomes apparent. There is no metric to determine that time frame, but typically it ends up being later rather than sooner, and typically longer than most involved expect.

I have made some assumptions in my analysis regarding the future performance of the Company. These variables largely turn on a handful of notions; can they grow as quickly as they think, can they perform as well as they plan, can they do it all with the amount of capital they have assumed and can they raise that capital in the first place? Obviously any shortfall in any of these areas, will likely result in outcomes that underperform those that the Company is anticipating. Significantly lower results in any of these areas could lead to the failure of the Company. Recognize, the industry in which the Company competes is highly competitive and that reality is perhaps most challenging to new entrants in the space.

At this point, the Company depends on the guidance and aptitudes of a very small handful of people. While the Company is attempting to mitigate this risk to the best of its ability, it is likely to remain a part of the story for the foreseeable future. The loss of certain key players could significantly mitigate the Company’s chances for success.

These are just a few of the more obvious risks in the business. I am sure there are several others I have failed to identify and or mention here. There is clear risk associated with this venture, several of which simply cannot be mitigated or otherwise diversified away at this juncture.

Valuation Summary and Conclusion

In my view, there are three primary variables that will largely determine the success of the Company over the next 12 to 18 months. The Company’s success/failure will almost certainly be determined by their ability to execute on all three of these fronts. The first of these is their access to capital. The Company recently completed a debt financing and continues to raise equity through its current offering and that combination should allow them to complete the new Lone Tree location, as well as the first FCR. Going forward, while they will remain focused on selling enough equity to support working capital until the new stores can get them to positive cash flow at the corporate level, the greater capital requirements will be on the capex end of things in terms of identifying and ultimately opening new locations. As I said, I believe their strategy to finance future stores at the store level (by selling 49% of the operations of those locations) should make securing growth capital easier.

In retrospect, as with most small emerging enterprises, raising the capital to execute the business plan is perhaps the most critical and probably the hardest part of the equation. Frankly, while equity markets are trading at or near all-time highs, the microcap equity markets have struggled, especially on the investment banking end. As I suggested above, I have been on this side of the market for 30 years and I know many people involved in the financing of small companies, and I can attest that in spite of robust domestic equity markets, raising capital for small companies has been very difficult over the past year or two. The Company has experienced that difficulty, and it remains a challenge, however, their visibility in terms of identifying viable capital sources appears to be improving especially as it pertains to (or perhaps because of) their new store level financing strategy. While it is difficult to quantify specifically, my sense is that the risks associated with the Company’s access to capital (or lack thereof) are probably lower today than they have been in some time. That is not to say that those risks no longer exist, but I do think they have a lower profile than at times in even the recent past.

The second important variables that will determine the Company’s success in the coming 12 to 18 months (and beyond) are the rate at which they can actually add new stores, and the performance of those stores individually Succinctly, finding favorable locations is also a big challenge for this model. Moreover, securing those locations with favorable occupancy rates is difficult as well. Beyond that, the logistics of open a new location adds to the complexity. These are all things the Company has learned a thing or two about over the past two years, so they go into that process with some valuable tribal knowledge. Nonetheless, adding new stores is paramount to the success of the model.

Lastly, in addition to adding new stores, they will need make sure that the stores they have (and those they add) perform in line with expectations. Here again, since its inception, the Company has refined its ability to operate restaurants profitably at the store level, but in order to build valuation in the stock, they will need to operate restaurants very profitably at the store level. I believe some of that is a function of the strategy, for example, some concepts are more conducive to lower labor costs and/or food costs than others. In fact, I think these type of variables have actually shaped the concepts they have developed, which is positive. However, there are plenty of successful restaurant concepts with higher food and labor costs than those the Company experiences. That is another way of suggesting that success in the space clearly involves other aspects that go beyond costs. My view is that those “other aspects” boil down to people and that includes all of the people in the organization, which in turn comes down to a management group that can assemble and lead a team that can be successful. Here again, in retrospect, at times the Company has struggled with this issue as well, especially at the store level. However, I also believe that as it sits today, the Company is better positioned with respect to this issue than at any time in its past.

Given the importance of the above issues (access to capital, store growth and store performance) in terms of their impact on the ultimate valuation of the Company, I have prepared a valuation matrix that attempts to assess what I believe would represent fair valuations for the Company (in terms of stock price) given different iterations in the store count/growth and the store performance. Basically, the vertical axis of the matrix assumes a range of (blended) margins between the existing and assumed new stores. Better margins will lead to better results, and the matrix reflects these iterations from best to worst, (lower margins and those lower valuations are at the bottom of the matrix). The horizontal axis of the matrix reflects the number of assumed stores in service over the next four years. Incidentally, I have chosen 4 years because it coincides with the Shake Shack comparable analysis I used above, so it provides some realistic basis (it’s been done before) to the model. Also, recognize that the framework I am utilizing here for valuation is a discounted cash flow application. That is my typical approach to valuation. In that regard I utilize my sense of proper discounts and terminal values to arrive at specific valuations. In this case for example, given the challenges the Company faces raising capital and by extension the impact that has on their ultimate cost of capital, I utilize relatively high discounts rates in generating the valuations. Conceptually, that actually leaves room for higher intrinsic values for the stock if the Company is able to raise capital more efficiently than I model. The opposite of that would be true as well.

Lastly, while readers can certainly look over the matrix and make up their own minds about what they think the most likely combination of growth and profitability will be, I have attempted to highlight what I believe the most likely scenario(s) will be. To clarify, brighter highlights suggest a higher probability of that particular outcome in my view. Just to reiterate, I have a (big) dog in this fight, I am a major shareholder, at the time of this writing and until the March shareholder meeting I am a director, and I am also one of the landlords at the Colorado Springs location. However, I have attempted to prepare this analysis with the same scrutiny I would any other piece of analysis I might do in my capacity as an analyst. With that said, as I noted, the highlighted section of the attached matrix reflects my assessment of the most reasonable assumed outcomes/valuations, that assessment should not in any way be construed as guidance by the Company. This assessment is my assessment alone. It is not the Company’s assessment, and that includes any inferences associated with the provided matrix. To clarify for those who might find the matrix confusing, my assessment is that if the Company can execute in the three areas discussed above and they can do so to the level that I view as a reasonable expectation, then I would expect the stock over the next 12-18 months to approach the value range I have highlighted in the matrix ($.91 - $1.02).

To summarize, there are clear risks that remain here and considerable work to be done. This will not be a simple task On the other hand, in my view the Company has established a viable beachhead from which to build a successful brand along the Colorado Front Range, and I believe that success in that regard would result in a markedly positive valuation event from current levels in the stock.

|

General Disclaimer:

T4 Partners is a member based venture capital research and management firm. We produce and publish independent research, due diligence and analysis for distribution to our membership base. Our publications are for information purposes only. Readers should review all available information on any company mentioned in our reports or updates, including, but not limited to, the company’s annual report, quarterly report, press releases, as well as other regulatory filings. T4 Partners is not registered as a securities broker-dealer or an investment advisor either within the U.S. Securities and Exchange Commission or with any state securities regulatory authority. Readers should consult with their own independent tax, business and financial advisors with respect to any reported company. T4 Partners and/or its officers and employees, and/or members of their families may have a long/short position in the securities mentioned in our research and analysis and may make purchases and/or sales for their own account of those securities.

Reproduction of any portion of T4 Partner’s reports, updates or other publications without written permission of T4 Partners is prohibited. All rights reserved. Portions of this publication excerpted from company filings or other sources are noted in italics and referenced at the bottom of this report.

|

||