Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Terreno Realty Corp | Financial_Report.xls |

| EX-21 - EX-21 - Terreno Realty Corp | d854283dex21.htm |

| EX-23 - EX-23 - Terreno Realty Corp | d854283dex23.htm |

| EX-32.1 - EX-32.1 - Terreno Realty Corp | d854283dex321.htm |

| EX-31.2 - EX-31.2 - Terreno Realty Corp | d854283dex312.htm |

| EX-31.3 - EX-31.3 - Terreno Realty Corp | d854283dex313.htm |

| EX-12.1 - EX-12.1 - Terreno Realty Corp | d854283dex121.htm |

| EX-32.3 - EX-32.3 - Terreno Realty Corp | d854283dex323.htm |

| EX-31.1 - EX-31.1 - Terreno Realty Corp | d854283dex311.htm |

| EX-32.2 - EX-32.2 - Terreno Realty Corp | d854283dex322.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-34603

Terreno Realty Corporation

(Exact Name of Registrant as Specified in Its Charter)

| Maryland | 27-1262675 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification Number) | |

| 101 Montgomery Street, Suite 200 San Francisco, CA |

94104 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (415) 655-4580

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Exchange on Which Registered | |

| Common Stock, $0.01 par value per share 7.75% Series A Cumulative Redeemable Preferred Stock, $0.01 par value per share |

New York Stock Exchange New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the closing price, as reported by the New York Stock Exchange, at which the common equity was last sold, as of June 30, 2014, the last business day of the Registrant’s most recently completed second fiscal quarter: $622,488,339. (For this computation, the Registrant has excluded the market value of all shares of its common stock reported as beneficially owned by executive officers and directors of the Registrant).

The registrant had 42,869,463 shares of its common stock, $0.01 par value per share, outstanding as of February 10, 2015.

Documents Incorporated by Reference

Part III of this Annual Report on Form 10-K incorporates by reference portions of Terreno Realty Corporation’s Proxy Statement for its 2015 Annual Meeting of Stockholders, which the registrant anticipates will be filed with the Securities and Exchange Commission no later than 120 days after the end of its 2014 fiscal year pursuant to Regulation 14A.

Table of Contents

Terreno Realty Corporation

Annual Report on Form 10-K

for the Year Ended December 31, 2014

| Part I: |

||||||||

| Item 1 |

2 | |||||||

| Item 1A |

7 | |||||||

| Item 1B |

29 | |||||||

| Item 2 |

29 | |||||||

| Item 3 |

32 | |||||||

| Item 4 |

32 | |||||||

| Part II: |

||||||||

| Item 5 |

33 | |||||||

| Item 6 |

36 | |||||||

| Item 7 |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

37 | ||||||

| Item 7A |

59 | |||||||

| Item 8 |

59 | |||||||

| Item 9 |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

59 | ||||||

| Item 9A |

60 | |||||||

| Item 9B |

62 | |||||||

| Part III: |

||||||||

| Item 10 |

62 | |||||||

| Item 11 |

62 | |||||||

| Item 12 |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

62 | ||||||

| Item 13 |

Certain Relationships and Related Transactions, and Director Independence |

62 | ||||||

| Item 14 |

62 | |||||||

| Part IV: |

||||||||

| Item 15 |

63 | |||||||

| 63 | ||||||||

Table of Contents

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We caution investors that forward-looking statements are based on management’s beliefs and on assumptions made by, and information currently available to, management. When used, the words “anticipate”, “believe”, “estimate”, “expect”, “intend”, “may”, “might”, “plan”, “project”, “result”, “should”, “will”, “seek”, “target”, “see”, “likely”, “position”, “opportunity”, and similar expressions which do not relate solely to historical matters are intended to identify forward-looking statements. These statements are subject to risks, uncertainties, and assumptions and are not guarantees of future performance, which may be affected by known and unknown risks, trends, uncertainties, and factors, that are beyond our control. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, estimated, or projected. We expressly disclaim any responsibility to update our forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law. Accordingly, investors should use caution in relying on past forward-looking statements, which are based on results and trends at the time they are made, to anticipate future results or trends.

Some of the risks and uncertainties that may cause our actual results, performance, or achievements to differ materially from those expressed or implied by forward-looking statements include, among others, the following:

| • | the factors included in this Annual Report on Form 10-K, including those set forth under the headings “Risk Factors”, and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”; |

| • | our ability to identify and acquire industrial properties on terms favorable to us; |

| • | general volatility of the capital markets and the market price of our common stock; |

| • | adverse economic or real estate conditions or developments in the industrial real estate sector and/or in the markets in which we acquire properties; |

| • | our dependence on key personnel and our reliance on third parties to property manage the majority of our industrial properties; |

| • | our inability to comply with the laws, rules and regulations applicable to companies, and in particular, public companies; |

| • | our ability to manage our growth effectively; |

| • | tenant bankruptcies and defaults on or non-renewal of leases by tenants; |

| • | decreased rental rates or increased vacancy rates; |

| • | increased interest rates and operating costs; |

| • | declining real estate valuations and impairment charges; |

| • | our expected leverage, our failure to obtain necessary outside financing, and future debt service obligations; |

| • | our ability to make distributions to our stockholders; |

| • | our failure to successfully hedge against interest rate increases; |

| • | our failure to successfully operate acquired properties; |

| • | our failure to qualify or maintain our status as a real estate investment trust (“REIT”) and possible adverse changes to tax laws; |

| • | uninsured or underinsured losses relating to our properties; |

| • | environmental uncertainties and risks related to natural disasters; |

1

Table of Contents

| • | financial market fluctuations; and |

| • | changes in real estate and zoning laws and increases in real property tax rates. |

PART I

| Item 1. | Business |

Overview

Terreno Realty Corporation (“Terreno”, and together with its subsidiaries, “we”, “us”, “our”, “our company” or “the company”) acquires, owns and operates industrial real estate in six major coastal U.S. markets: Los Angeles; Northern New Jersey/New York City; San Francisco Bay Area; Seattle; Miami; and Washington, D.C./Baltimore. We invest in several types of industrial real estate, including warehouse/distribution (approximately 88.8% of our total portfolio square footage as of December 31, 2014), flex (including light industrial and research and development, or R&D) (approximately 9.4%) and trans-shipment (approximately 1.8%). We target functional buildings in infill locations that may be shared by multiple tenants and that cater to customer demand within the various submarkets in which we operate. Infill locations are geographic locations surrounded by high concentrations of already developed land and existing buildings. As of December 31, 2014, we owned 126 buildings (including one building held for sale) aggregating approximately 9.3 million square feet and two improved land parcels consisting of 3.5 acres, which we purchased for an aggregate purchase price of approximately $851.5 million, including the assumption of mortgage loans payable of approximately $63.9 million, which includes mortgage premiums of approximately $1.9 million. As of December 31, 2014, our properties were approximately 93.7% leased to 299 customers, the largest of which accounted for approximately 5.3% of our total annualized base rent.

We are an internally managed Maryland Corporation. We were incorporated in November 2009 and on February 16, 2010 we completed our initial public offering of 8,750,000 shares of our common stock and a concurrent private placement of an aggregate of 350,000 shares of our common stock to our executive officers at a price per share of $20.00. The net proceeds of our initial public offering were approximately $162.8 million after deducting the full underwriting discount of approximately $10.5 million and other offering expenses of approximately $1.7 million. We received net proceeds of approximately $7.0 million from our concurrent private placement.

On January 13, 2012, we completed a public follow-on offering of 4,000,000 shares of our common stock, including 93,000 shares purchased by our senior management and directors, at a price per share of $14.25. On February 13, 2012, we sold an additional 61,853 shares of our common stock at a price per share of $14.25 upon the exercise by the underwriters of their option to purchase additional shares. No underwriting discount or commission was paid on the shares sold to such officers and directors. The net proceeds of the offering, after deducting the underwriting discount and offering costs, were approximately $54.7 million. We used approximately $41.0 million of the net proceeds to repay outstanding borrowings under our revolving credit facility on January 13, 2012 and used the remainder of the net proceeds to invest in industrial properties and for general business purposes.

On July 19, 2012, we completed a public offering of 1,840,000 shares of our 7.75% Series A Cumulative Redeemable Preferred Stock (the “Series A Preferred Stock”), including 240,000 shares sold upon the exercise by the underwriters of their option to purchase additional shares, at a price per share of $25.00. The net proceeds of the offering were approximately $44.3 million after deducting the underwriting discount and other offering expenses of approximately $1.7 million. We used the net proceeds to reduce outstanding borrowings under our revolving credit facility.

On February 19, 2013, we completed a public follow-on offering of 5,750,000 shares of our common stock at a price per share of $16.60, including 90,325 shares that were sold in the offering to our executive and senior officers and members of our board of directors. No underwriting discount or commission was paid on the shares

2

Table of Contents

sold to such officers and directors. The net proceeds of the offering, after deducting the underwriting discount and offering costs, were approximately $90.8 million. We used approximately $65.4 million of the net proceeds to repay outstanding borrowings under our revolving credit facility and the remaining net proceeds to invest in industrial properties and for general business purposes.

On July 11, 2013, we completed a public follow-on offering of 5,750,000 shares of our common stock at a price per share of $18.25, including 43,250 shares that were sold in the offering to our executive and senior officers and members of our board of directors. No underwriting discount or commission was paid on the shares sold to such officers and directors. The net proceeds of the offering were approximately $99.9 million after deducting the underwriting discount and offering costs of approximately $5.0 million. We used approximately $6.5 million of the net proceeds to repay outstanding borrowings under our revolving credit facility and the remaining net proceeds to acquire industrial properties and for general business purposes.

On May 22, 2014, we completed a public follow-on offering of 8,050,000 shares of our common stock at a price per share of $17.75. The net proceeds of the follow-on offering were approximately $136.5 million after deducting the underwriting discount and offering costs of approximately $6.4 million. We used approximately $100.0 million of the net proceeds to repay outstanding borrowings under our revolving credit facility and the remaining net proceeds to acquire industrial properties and for general business purposes.

On December 9, 2014, we completed a public follow-on offering of 9,775,000 shares of our common stock at a price per share of $19.60. The net proceeds of the follow-on offering were approximately $183.0 million after deducting the underwriting discount and offering costs of approximately $8.6 million. We intend to use the net proceeds to acquire industrial properties and for general corporate purposes.

We elected to be taxed as a REIT under Sections 856 through 860 of the Internal Revenue Code of 1986, as amended, or the Code, commencing with our taxable year ended December 31, 2010.

Our Investment Strategy

We invest in industrial properties in six major coastal U.S. markets: Los Angeles; Northern New Jersey/New York City; San Francisco Bay Area; Seattle; Miami; and Washington, D.C./Baltimore.

As described in more detail in the table below, we invest in several types of industrial real estate, including warehouse/distribution, flex (including light industrial and R&D) and trans-shipment. We target functional buildings in infill locations that may be shared by multiple tenants and that cater to customer demand within the various submarkets in which we operate.

Industrial Facility General Characteristics

Warehouse / distribution (approximately 88.8% of our total portfolio square footage as of December 31, 2014)

| • | Single and multiple tenant facilities that typically serve tenants greater than 30,000 square feet of space |

| • | Generally less than 20% office space |

| • | Typical clear height from 18 feet to 36 feet |

| • | May include production/manufacturing areas |

| • | Interior access via dock high and/or grade level doors |

| • | Truck court for large and small truck distribution options, possibly including staging for a high volume of truck activity and/or trailer storage |

3

Table of Contents

Flex (including light industrial and R&D, approximately 9.4% of our total portfolio square footage as of December 31, 2014)

| • | Single and multiple tenant facilities that typically serve tenants less than 30,000 square feet of space |

| • | Facilities generally accommodate both office and warehouse/manufacturing activities |

| • | Typically has a larger amount of office space and shallower bay depths than warehouse/distribution facilities |

| • | Parking consistent with increased office use |

| • | Interior access via grade level and/or dock high doors |

| • | Staging for moderate truck activity |

| • | May include a showroom, service center, or assembly/light manufacturing component |

| • | Enhanced landscaping |

Trans-shipment (approximately 1.8% of our total portfolio square footage as of December 31, 2014)

| • | Includes truck terminals and airport on-tarmac facilities, which serve both single and multiple tenants |

| • | Typically has a high number of dock high doors, shallow bay depth and lower clear height |

| • | Staging for a high volume of truck activity and trailer storage |

We selected our target markets by drawing upon the experience of our executive management investing and operating in over 50 global industrial markets located in North America, Europe and Asia, the fundamentals of supply and demand, and in anticipation of trends in logistics patterns resulting from population changes, regulatory and physical constraints, changes in technology, potential long term increases in carbon prices and other factors. We believe that our target markets have attractive long term investment attributes. We target assets with characteristics that include, but are not limited to, the following:

| • | Located in high population coastal markets; |

| • | Close proximity to transportation infrastructure (such as sea ports, airports, highways and railways); |

| • | Situated in supply-constrained submarkets with barriers to new industrial development, as a result of physical and/or regulatory constraints; |

| • | Functional and flexible layout that can be modified to accommodate single and multiple tenants; |

| • | Acquisition price at a discount to the replacement cost of the property; |

| • | Potential for enhanced return through re-tenanting or operational or physical improvements; and |

| • | Opportunity for higher and better use of the property over time. |

In general, we prefer to utilize local third party property managers for day-to-day property management. We believe outsourcing property management is cost effective and provides us with operational flexibility and is a source of acquisition opportunities. We currently manage one of our properties directly and may directly manage other properties in the future if we determine such direct property management is in our best interest.

We have no current intention to acquire undeveloped industrial land or to pursue ground up development. However, we may pursue redevelopment opportunities of properties that we own or acquire adjacent land to expand our existing facilities.

We expect that we will continue to acquire the significant majority of our investments as equity interests in individual properties or portfolios of properties. We may also acquire industrial properties through the acquisition of other corporations or entities that own industrial real estate. We will opportunistically target

4

Table of Contents

investments in debt secured by industrial real estate that would otherwise meet our investment criteria with the intention of ultimately acquiring the underlying real estate. We currently do not intend to target specific percentages of holdings of particular types of industrial properties. This expectation is based upon prevailing market conditions and may change over time in response to different prevailing market conditions.

The properties we acquire may be stabilized (fully leased) or unstabilized (have near term lease expirations or be partially or fully vacant). During the period from February 16, 2010 to December 31, 2014, we acquired 37 unstabilized properties of which 24 have been stabilized.

We may sell properties from time to time when we believe the prospective total return from a property is particularly low relative to its market value or the market value of the property is significantly greater than its estimated replacement cost. Capital from such sales will be reinvested into properties that are expected to provide better prospective returns or returned to shareholders. We have disposed of two properties since inception for a cumulative sales price of approximately $36.0 million and a total gain of approximately $6.8 million.

Competitive Strengths

We believe we distinguish ourselves from our competitors through the following competitive advantages:

| • | Focused Investment Strategy. We invest exclusively in six major coastal U.S. markets and focus on infill locations. We selected our six target markets based upon the experience of our executive management investing and operating in over 50 global industrial markets located in North America, Europe and Asia, the fundamentals of supply and demand, and in anticipation of trends in logistics patterns resulting from population changes, regulatory and physical constraints, changes in technology, potential long term increases in carbon prices and other factors. We have no current intention to acquire undeveloped land or pursue ground up development. |

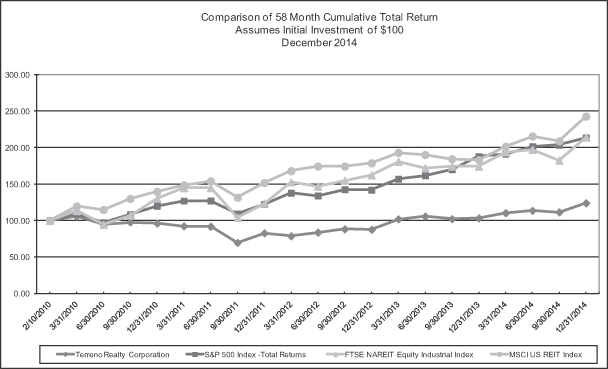

| • | Highly Aligned Compensation Structure. We believe that executive compensation should be closely aligned with long-term stockholder value creation. As a result, all of the long-term equity incentive compensation of our executive and senior officers is based solely on our total shareholder return exceeding the total shareholder return of the MSCI U.S. REIT Index or the FTSE NAREIT Equity Industrial Index. |

| • | Commitment to Strong Corporate Governance. We are committed to strong corporate governance, as demonstrated by the following: |

| • | all members of our board of directors serve annual terms; |

| • | we have adopted a majority voting standard in non-contested director elections; |

| • | we have opted out of two Maryland anti-takeover provisions and, in the future, we may not opt back in to these provisions without stockholder approval; |

| • | we designed our ownership limits solely to protect our status as a REIT and not for the purpose of serving as an anti-takeover device; and |

| • | we have no stockholder rights plan. In the future, we will not adopt a stockholder rights plan unless our stockholders approve in advance the adoption of such a plan or, if adopted by our board of directors, we will submit the stockholder rights plan to our stockholders for a ratification vote within 12 months of adoption or the plan will terminate. |

Our Financing Strategy

The primary objective of our financing strategy is to maintain financial flexibility with a conservative capital structure using retained cash flows, long-term debt and the issuance of common and perpetual preferred stock to finance our growth. Over the long term, we intend to:

| • | limit the sum of the outstanding principal amount of our consolidated indebtedness and the liquidation preference of any outstanding perpetual preferred stock to less than 40% of our total enterprise value; |

5

Table of Contents

| • | maintain a fixed charge coverage ratio in excess of 2.0x; |

| • | limit the principal amount of our outstanding floating rate debt to less than 20% of our total consolidated indebtedness; and |

| • | have staggered debt maturities that are aligned to our expected average lease term (5-7 years), positioning us to re-price parts of our capital structure as our rental rates change with market conditions. |

We intend to preserve a flexible capital structure with a long-term goal to obtain an investment grade rating and be in a position to issue unsecured debt and additional perpetual preferred stock. Prior to attaining an investment grade rating, we intend to primarily utilize credit facilities, recourse bank term loans, or non-recourse debt secured by individual properties or pools of properties with a targeted maximum loan-to-value of 65% at the time of financing, and perpetual preferred stock. We may also assume debt in connection with property acquisitions which may have a higher loan-to-value.

Our Corporate Structure

We are a Maryland corporation formed on November 6, 2009 and have been publicly held and subject to U.S. Security and Exchange Commission, or SEC, reporting obligations since 2010. We are not structured as an Umbrella Partnership Real Estate Investment Trust, or UPREIT. We currently own our properties indirectly through subsidiaries and may utilize one or more taxable REIT subsidiaries as appropriate.

Our Tax Status

We elected to be taxed as a REIT under Sections 856 through 860 of the Code commencing with our taxable year ended December 31, 2010. We believe that our organization and method of operation has enabled and will continue to enable us to meet the requirements for qualification and taxation as a REIT for federal income tax purposes. To maintain REIT status we must meet a number of organizational and operational requirements, including a requirement that we annually distribute at least 90% of our net taxable income to our stockholders, excluding net capital gains. As a REIT, we generally will not be subject to federal income tax on REIT taxable income we currently distribute to our stockholders. If we fail to qualify as a REIT in any taxable year, we will be subject to federal income tax at regular corporate rates. Even if we qualify for taxation as a REIT, we may be subject to some federal, state and local taxes on our income or property and the income of our taxable REIT subsidiaries, if any, will be subject to taxation at regular corporate rates. We do not currently own any taxable REIT subsidiaries but may in the future.

Competition

We believe the current market for industrial real estate acquisitions to be competitive. We compete for real property investments with pension funds and their advisors, bank and insurance company investment accounts, other public and private real estate investment companies, including other REITs, real estate limited partnerships, owner-users, individuals and other entities engaged in real estate investment activities, some of which have greater financial resources than we do. In addition, we believe the leasing of real estate to be highly competitive. We experience competition for customers from owners and managers of competing properties. As a result, we may have to provide free rental periods, incur charges for tenant improvements or offer other inducements, all of which may have an adverse impact on our results of operations.

Environmental Matters

The industrial properties that we own and will acquire are subject to various federal, state and local environmental laws. Under these laws, courts and government agencies have the authority to require us, as owner of a contaminated property, to clean up the property, even if we did not know of or were not responsible for the

6

Table of Contents

contamination. These laws also apply to persons who owned a property at the time it became contaminated, and therefore it is possible we could incur these costs even after we sell some of our properties. In addition to the costs of cleanup, environmental contamination can affect the value of a property and, therefore, an owner’s ability to borrow using the property as collateral or to sell the property. Under applicable environmental laws, courts and government agencies also have the authority to require that a person who sent waste to a waste disposal facility, such as a landfill or an incinerator, pay for the clean-up of that facility if it becomes contaminated and threatens human health or the environment.

Furthermore, various court decisions have established that third parties may recover damages for injury caused by property contamination. For instance, a person exposed to asbestos at one of our properties may seek to recover damages if he or she suffers injury from the asbestos. Lastly, some of these environmental laws restrict the use of a property or place conditions on various activities. An example would be laws that require a business using chemicals to manage them carefully and to notify local officials that the chemicals are being used.

We could be responsible for any of the costs discussed above. The costs to clean up a contaminated property, to defend against a claim, or to comply with environmental laws could be material and could adversely affect the funds available for distribution to our stockholders. We generally obtain “Phase I environmental site assessments”, or ESAs, on each property prior to acquiring it. However, these ESAs may not reveal all environmental costs that might have a material adverse effect on our business, assets, results of operations or liquidity and may not identify all potential environmental liabilities.

In general, we utilize local third party property managers for day-to-day property management and will rely on these third parties to operate our industrial properties in compliance with applicable federal, state and local environmental laws in their daily operation of the respective properties and to promptly notify us of any environmental contaminations or similar issues. As a result, we may become subject to material environmental liabilities of which we are unaware. We can make no assurances that (1) future laws or regulations will not impose material environmental liabilities on us, or (2) the environmental condition of our industrial properties will not be affected by the condition of the properties in the vicinity of our industrial properties (such as the presence of leaking underground storage tanks) or by third parties unrelated to us. We were not aware of any significant or material exposures as of December 31, 2014 and 2013.

Employees

As of February 11, 2015, we have 18 employees. None of our employees is a member of any union.

Available Information

We maintain an internet website at the following address: http://terreno.com. The information on our website is neither part of nor incorporated by reference in this Annual Report on Form 10-K. We make available, free of charge, on or through our website certain reports and amendments to those reports that we file with or furnish to the SEC in accordance with the Exchange Act. These include our annual reports on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K and exhibits and amendments to these reports, and Section 16 filings. Our Code of Business Conduct and Ethics is also available on our website. We intend to disclose any amendments or waivers to our Code of Business Conduct and Ethics that apply to any of our executive officers on our website. We make this information available on our website free of charge as soon as reasonably practicable after we electronically file the information with, or furnish it to, the SEC. You may also obtain our reports by accessing the EDGAR database at the SEC’s website at http://www.sec.gov.

| Item 1A. | Risk Factors. |

The following risk factors and other information included in this Annual Report on Form 10-K should be carefully considered. The risks and uncertainties described below are not the only ones that we face. Additional risks and uncertainties not presently known to us or that we may currently deem immaterial also may impair our

7

Table of Contents

business operations. If any of the following risks occur, our business, financial condition, operating results and cash flows could be adversely affected. Investors should also refer to our quarterly reports on Form 10-Q and current reports on Form 8-K for updates to these risk factors.

Risks Related to Our Business and Our Properties

Our long-term growth will depend upon future acquisitions of properties, and we may be unable to consummate acquisitions on advantageous terms, the acquired properties may not perform as we expect, or we may be unable to quickly and efficiently integrate our new acquisitions into our existing operations.

We intend to continue to acquire industrial properties in our six target markets. The acquisition of properties entails various risks, including the risks that our investments may not perform as well as we had expected, that we may be unable to quickly and efficiently integrate our new acquisitions into our existing operations and that our cost estimates for bringing an acquired property up to market standards may prove inaccurate. In addition, we cannot assure you of the availability of investment opportunities in our targeted markets at attractive pricing levels or at all. In the event that such opportunities are not available in our targeted markets as we expect, our ability to execute our business plan and realize our projections for growth may be materially adversely affected. Further, we face significant competition for attractive investment opportunities from other well-capitalized real estate investors, including pension funds and their advisors, bank and insurance company investment accounts, other public and private real estate investment companies, including other REITs, real estate limited partnerships, owner-users, individuals and other entities engaged in real estate investment activities, some of which have a history of operations, greater financial resources than we do and a greater ability to borrow funds to acquire properties. This competition increases as investments in real estate become increasingly attractive relative to other forms of investment. As a result of competition, we may be unable to acquire properties as we desire or the purchase price may be significantly elevated.

In addition, we expect to finance future acquisitions through a combination of borrowings under our revolving credit facility, term loans, debt secured by individual properties or pools of properties, the use of retained cash flows and the issuance of a combination of long-term debt and common and perpetual preferred stock, which may not be available at all or on advantageous terms and which could adversely affect our cash flows. Any of the above risks could adversely affect our financial condition, results of operations, cash flows and ability to pay distributions on, and the market price of, our common stock and our preferred stock.

We may make acquisitions that pose integration and other risks that could harm our business.

We may be required to incur debt and expenditures and issue additional shares of our common stock or preferred stock to pay for industrial properties that we may acquire, which may dilute our stockholders’ ownership interests and may reduce or eliminate our profitability. These acquisitions may also expose us to risks such as:

| • | the possibility that we may not be able to successfully integrate acquired properties into our operations; |

| • | the possibility that additional capital expenditures may be required; |

| • | the possibility that senior management may be required to spend considerable time negotiating agreements and integrating acquired properties; |

| • | the possible loss or reduction in value of acquired properties; |

| • | the possibility of pre-existing undisclosed liabilities regarding acquired properties, including but not limited to environmental or asbestos liability, of which our insurance may be insufficient or for which we may be unable to secure insurance coverage; |

| • | the possibility that a concentration of our industrial properties in Los Angeles, the San Francisco Bay Area and Seattle may increase our exposure to seismic activity, especially if these industrial properties are located on or near fault zones; and |

8

Table of Contents

| • | the possibility that we may not meet our estimated forecasts related to stabilized cap rates. |

We expect acquisition costs, including capital expenditures required to render industrial properties operational, to increase in the future. If our revenue does not keep pace with these potential acquisition costs, we may not be able to maintain our current or expected earnings as we absorb these additional expenses. There is no assurance we would successfully overcome these risks or any other problems encountered with these acquisitions.

If we cannot obtain additional financing, our growth will be limited.

If adverse conditions in the credit markets — in particular with respect to real estate — materially deteriorate, our business could be materially and adversely affected. Our long-term ability to grow through investments in industrial properties, including our ability to realize our projections for growth will be limited if we cannot obtain additional financing on favorable terms or at all. In the future, we will rely on equity and debt financing, including issuances of common and perpetual preferred stock, borrowings under our revolving credit facility, term loans, issuances of unsecured debt securities and debt secured by individual properties or pools of properties, to finance our acquisition activities and for working capital. If we are unable to obtain equity or debt financing from these or other sources, or to refinance existing indebtedness upon maturity, our financial condition and results of operations would likely be adversely affected. Market conditions may make it difficult to obtain additional financing, and we cannot assure you that we will be able to obtain additional debt or equity financing or that we will be able to obtain it on favorable terms.

In addition, to qualify as a REIT, we are required to distribute at least 90% of our taxable income (determined before the deduction for dividends paid and excluding any net capital gains) each year to our stockholders, and we generally expect to make distributions in excess of such amount. As a result, our ability to retain earnings to fund acquisitions, redevelopment and expansion, if any, or other capital expenditures will be limited. We have a $100.0 million revolving credit facility to finance acquisitions and for working capital requirements. Terreno guarantees the obligations of the borrower (a wholly-owned subsidiary) under the revolving credit facility. The revolving credit facility matures in May 2018 and provides for one 12-month extension option exercisable by us, subject, among other things, to there being an absence of an event of default and to our payment of an extension fee. As of December 31, 2014, there were no borrowings outstanding on the revolving credit facility.

The availability and timing of cash distributions is uncertain.

In 2013 and 2014, we made quarterly distributions (which we also refer to as dividends, in this Report on Form 10-K and in the other documents we file with the Securities and Exchange Commission) to holders of our common stock and preferred stock and we intend to continue to pay regular quarterly distributions. However, we bear all expenses incurred by our operations, and the funds generated by our operations, after deducting these expenses, may not be sufficient to cover desired levels of distributions to our stockholders. In addition, our board of directors, in its discretion, may retain any portion of such cash for working capital. Our ability to make distributions to our stockholders also will depend on our levels of retained cash flows, which we intend to use as a source of investment capital. We cannot assure our stockholders that sufficient funds will be available to pay distributions. Our corporate strategy is to fund the payment of quarterly distributions to our stockholders entirely from distributable cash flows. However, we may fund our quarterly distributions to our stockholders from a combination of available cash flows, net of recurring capital expenditures, and proceeds from borrowings and property dispositions. In the event we are unable to consistently fund future quarterly distributions to our stockholders entirely from distributable cash flows the value of our shares may be negatively impacted.

We depend on key personnel.

Our success depends to a significant degree upon the contributions of certain key personnel including, but not limited to, our chairman and chief executive officer and our president, each of whom would be difficult to replace. If any of our key personnel were to cease employment with us, our operating results could suffer. Our

9

Table of Contents

ability to retain our senior management group or to attract suitable replacements should any members of the senior management group leave is dependent on the competitive nature of the employment market. The loss of services from key members of the management group or a limitation in their availability could adversely impact our financial condition and cash flows. Further, such a loss could be negatively perceived in the capital markets. We have not obtained and do not expect to obtain key man life insurance on any of our key personnel.

We also believe that, as we expand, our future success depends, in large part, upon our ability to hire and retain highly skilled managerial, investment, financial and operational personnel. Competition for such personnel is intense, and we cannot assure our stockholders that we will be successful in attracting and retaining such skilled personnel.

Failure of the projected improvement in industrial operating fundamentals may adversely affect our ability to execute our business plan.

A substantial part of our business plan is based on our belief that industrial operating fundamentals are expected to improve over the next several years. We cannot assure you as to whether or when industrial operating fundamentals will in fact improve or to what extent they improve. In the event conditions in the industry do not improve when and as we expect, or deteriorate, our ability to execute our business plan may be adversely affected.

Our investments are concentrated in the industrial real estate sector, and our business would be adversely affected by an economic downturn in that sector.

Our investments in real estate assets are concentrated in the industrial real estate sector. This concentration may expose us to the risk of economic downturns in this sector to a greater extent than if our business activities included a more significant portion of other sectors of the real estate industry.

Events or occurrences that affect areas in which our properties are located may materially adversely impact our financial results.

In addition to general, regional, national and international economic conditions that may materially adversely affect our business and financial results, our operating performance will be materially adversely impacted by adverse economic conditions in the specific markets in which we operate and particularly in the markets in which we have significant concentrations of properties. Any downturn in the economy in the real estate market or any of our markets and any failure to accurately predict the timing of any economic improvement in these markets could cause our operations and our revenue and cash available for distribution, including cash available to pay distributions to our stockholders, to be materially adversely affected. For example, as of December 31, 2014, approximately 28.1% of our rentable square feet was located in Northern New Jersey / New York City, representing approximately 27.9% of our total annualized base rent. See “Item 2 – Properties” in this Annual Report on Form 10-K for additional information regarding our ownership of properties in our markets.

We may be unable to renew leases, lease vacant space, including vacant space resulting from tenant defaults, or re-lease space as leases expire.

We cannot assure you that leases at our properties will be renewed or that such properties will be re-leased at net effective rental rates equal to or above the then current average net effective rental rates. In addition, we may be required to grant concessions or fund improvements. If the rental rates for our properties decrease, our tenants do not renew their leases or we do not re-lease a significant portion of our available space, including vacant space resulting from tenant defaults, and space for which leases are scheduled to expire, our financial condition, results of operations, cash flows, cash available for distribution to stockholders, per share trading price of our common stock and preferred stock and our ability to satisfy our debt service obligations could be materially adversely affected. In addition, if we are unable to renew leases or re-lease a property, the resale value of that property could be diminished because the market value of a particular property will depend in part upon the value of the leases of such property.

10

Table of Contents

We face potential adverse effects from the bankruptcies or insolvencies of tenants or from tenant defaults generally.

We are dependent on tenants for our revenues, including certain significant tenants. Moreover, certain of our properties are occupied by a single tenant, and the income produced by these properties depends on the financial stability of that tenant. The bankruptcy or insolvency of the tenants at our properties, or tenant defaults generally, may adversely affect the income produced by our properties. The tenants, particularly those that are highly leveraged, could file for bankruptcy protection or become insolvent in the future. Under bankruptcy law, a tenant cannot be evicted solely because of its bankruptcy. On the other hand, a bankrupt tenant may reject and terminate its lease with us. In such case, our claim against the bankrupt tenant for unpaid and future rent would be subject to a statutory cap that might be substantially less than the remaining rent actually owed under the lease, and, even so, our claim for unpaid rent would likely not be paid in full. This shortfall could adversely affect our cash flows and results of operations and could cause us to reduce the amount of distributions to stockholders.

A default by a tenant on its lease payments could force us to find an alternative source of revenues to pay any mortgage loan or operating expenses on the property. In the event of a tenant default, we may experience delays in enforcing our rights as landlord and may incur substantial costs, including litigation and related expenses, in protecting our investment and re-leasing our property.

Declining real estate valuations and impairment charges could adversely affect our earnings and financial condition.

We review the carrying value of our properties when circumstances, such as adverse market conditions, indicate potential impairment may exist. We base our review on an estimate of the future cash flows (excluding interest charges) expected to result from the real estate investment’s use and eventual disposition. We consider factors such as future operating income, trends and prospects, as well as the effects of leasing demand, competition and other factors. If our evaluation indicates that we may be unable to recover the carrying value of a real estate investment, an impairment loss will be recorded to the extent that the carrying value exceeds the estimated fair value of the property. These losses would have a direct impact on our net income because recording an impairment loss results in an immediate negative adjustment to net income. The evaluation of anticipated cash flows is highly subjective and is based in part on assumptions regarding future occupancy, rental rates and capital requirements that could differ materially from actual results in future periods. A worsening real estate market may cause us to reevaluate the assumptions used in our impairment analysis. Impairment charges could adversely affect our financial condition, results of operations, cash available for distribution, including cash available for us to pay distributions to our stockholders and per share trading price of our common stock and preferred stock.

We utilize local third party managers for day-to-day property management for the majority of our properties.

In general, we prefer to utilize local third party managers for day-to-day property management, although we currently manage one of our properties directly and may directly manage more of our properties in the future. To the extent we utilize third party managers, our cash flows from our industrial properties may be adversely affected if our managers fail to provide quality services. In addition, our managers or their affiliates may manage, and in some cases may own, invest in or provide credit support or operating guarantees to industrial properties that compete with our industrial properties, which may result in conflicts of interest and decisions regarding the operation of our industrial properties that are not in our best interests.

Our real estate redevelopment or expansion strategies may not be successful.

In connection with our business strategy, we may pursue redevelopment opportunities or construct expansions or improvements of industrial properties that we own. We will be subject to risks associated with our redevelopment, renovation and expansion activities that could adversely affect our financial condition, results of operations, cash flows and ability to pay distributions on, and the market price of, our common stock and preferred stock.

11

Table of Contents

We may be required to fund future tenant improvements and we may not have funding for those improvements.

When a tenant at one of our properties does not renew its lease or otherwise vacates its space in one of our buildings in the future, it is likely that, in order to attract one or more new tenants, we will be required to expend funds to construct new tenant improvements in the vacated space. We may also be required to fund tenant improvements to retain tenants. Although we intend to manage our cash position or financing availability to pay for any improvements required for re-leasing, we cannot assure our stockholders that we will have adequate sources of funding available to us for such purposes in the future.

Debt service obligations could adversely affect our overall operating results, may require us to sell industrial properties and could adversely affect our ability to make distributions to our stockholders and the market price of our shares of common stock and preferred stock.

Our business strategy contemplates the use of both non-recourse secured debt and unsecured debt to finance long-term growth. As of December 31, 2014, we had total debt outstanding of approximately $304.5 million, which consisted of our $200.0 million of term loans and mortgage loans payable. While over the long-term we intend to limit the sum of the outstanding principal amount of our consolidated indebtedness and the liquidation preference of any outstanding shares of preferred stock to less than 40% of our total enterprise value, our governing documents contain no limitations on the amount of debt that we may incur, and our board of directors may change our financing policy at any time without stockholder approval. Over the long-term, we also intend to maintain a fixed charge coverage ratio in excess of 2.0x and limit the principal amount of our outstanding floating rate debt to less than 20% of our total consolidated indebtedness. Our board of directors may modify or eliminate these limitations at any time without the approval of our stockholders. As a result, we may be able to incur substantial additional debt, including secured debt, in the future. Our existing debt, and the incurrence of additional debt, could subject us to many risks, including the risks that:

| • | our cash flows from operations will be insufficient to make required payments of principal and interest; |

| • | our debt may increase our vulnerability to adverse economic and industry conditions; |

| • | we may be required to dedicate a substantial portion of our cash flows from operations to payments on our debt, thereby reducing cash available for distribution to our stockholders, funds available for operations and capital expenditures, future business opportunities or other purposes; |

| • | the terms of any refinancing will not be as favorable as the terms of the debt being refinanced; and |

| • | the use of leverage could adversely affect our ability to make distributions to our stockholders and the market price of our shares of common stock and preferred stock. |

If we do not have sufficient funds to repay existing or future debt, including debt under our credit facility, it may be necessary to refinance the debt through additional debt or additional equity financings. If, at the time of any refinancing, prevailing interest rates or other factors result in higher interest rates on refinancings, increases in interest expense would adversely affect our cash flows, and, consequently, cash available for distribution to our stockholders. If we are unable to refinance our debt on acceptable terms, we may be forced to dispose of industrial properties on disadvantageous terms, potentially resulting in losses. We may place mortgages on our properties that we own to secure a revolving credit facility or other debt. To the extent we cannot meet any future debt service obligations, we will risk losing some or all of our industrial properties that may be pledged to secure our obligations to foreclosure. Also, covenants applicable to any future debt could impair our planned investment strategy and, if violated, result in a default.

Higher interest rates could increase debt service requirements on any floating rate debt that we incur and could reduce the amounts available for distribution to our stockholders, as well as reduce funds available for our operations, future business opportunities, or other purposes. In addition, an increase in interest rates could decrease the amount third parties are willing to pay for our assets, thereby limiting our ability to change our

12

Table of Contents

portfolio promptly in response to changes in economic or other conditions. Adverse economic conditions could cause the terms on which we borrow to be unfavorable. We could be required to liquidate one or more of our industrial properties in order to meet our debt service obligations at times which may not permit us to receive an attractive return on our investments.

Our revolving credit facility, our $200.0 million of term loans and certain of our existing mortgage loans payable contain, and we expect that our future indebtedness will contain, covenants that could limit our operations and our ability to make distributions to our stockholders.

We have a credit facility, which consists of a $100.0 million revolving credit facility, a five-year $50.0 million term loan, a seven-year $50.0 million term loan and a five-year $100.0 million term loan. We have agreed to guarantee the obligations of the borrower (a wholly-owned subsidiary) under our revolving credit facility and our term loans. Our revolving credit facility and our term loans and certain of our existing mortgage loans payable contain, and we expect that our future indebtedness will contain, financial and operating covenants, such as fixed charge coverage and debt ratios and other limitations that will limit or restrict our ability to make distributions or other payments to our stockholders and may restrict our investment activities. For example, our credit facility restricts distributions if we are in default and otherwise limits our fiscal year distributions to 95% of our funds from operations. The covenants in our debt agreements may restrict our ability to engage in transactions that we believe would otherwise be in the best interests of our stockholders. Failure to meet our financial covenants could result from, among other things, changes in our results of operations, the incurrence of debt or changes in general economic conditions. In addition, the failure of at least one of our chief executive officer and our president or any successors approved by the administrative agent to continue to be active in our day-to-day management constitutes an event of default under our credit facility. We have 120 days under our revolving credit facility to hire a successor executive reasonably satisfactory to the administrative agent in the event that both our chief executive officer and our president or any successors cease to be active in our management. If we violate covenants or if there is an event of default under our credit facility, our existing mortgage loans payable or in our future agreements, we could be required to repay all or a portion of our indebtedness before maturity at a time when we might be unable to arrange financing for such repayment on attractive terms, if at all.

In addition, any unsecured debt agreements we enter into may contain specific cross-default provisions with respect to specified other indebtedness, giving the unsecured lenders the right to declare a default if we are in default under other loans in some circumstances. Defaults under our debt agreements could materially and adversely affect our financial condition and results of operations.

We may acquire outstanding debt secured by an industrial property, which may expose us to risks.

We may acquire outstanding debt secured by an industrial property from lenders and investors if we believe we can acquire ownership of the underlying property in the near-term through foreclosure, deed-in-lieu of foreclosure or other means. However, if we do acquire such debt, borrowers may seek to assert various defenses to our foreclosure or other actions and we may not be successful in acquiring the underlying property on a timely basis, or at all, in which event we could incur significant costs and experience significant delays in acquiring such properties, all of which could adversely affect our financial performance and reduce our expected returns from such investments. In addition, we may not earn a current return on such investments particularly if the loan that we acquire is in default.

Adverse changes in our credit ratings could negatively affect our financing activity.

The credit ratings of the senior unsecured long-term debt that we may incur in the future and preferred stock we may issue in the future will be based on our operating performance, liquidity and leverage ratios, overall financial position and other factors employed by the credit rating agencies in their rating analyses of us. Our credit ratings can affect the amount of capital we can access, as well as the terms and pricing of any debt we may incur. There can be no assurance that we will be able to obtain or maintain our credit ratings, and in the event our

13

Table of Contents

credit ratings are downgraded, we would likely incur higher borrowing costs and may encounter difficulty in obtaining additional financing. Also, a downgrade in our credit ratings may trigger additional payments or other negative consequences under our future credit facilities and debt instruments. For example, if our credit ratings of any future senior unsecured long-term debt are downgraded to below investment grade levels, we may not be able to obtain or maintain extensions on certain of our then existing debt. Adverse changes in our credit ratings could negatively impact our refinancing activities, our ability to manage our debt maturities, our future growth, our financial condition, the market price of our stock, and our acquisition activities.

Failure to hedge effectively against interest rate changes may adversely affect results of operations.

We may seek to manage our exposure to interest rate volatility by using interest rate hedging arrangements, such as cap contracts and swap agreements. For example, we have executed an interest rate cap to hedge the variable cash flows associated with our existing seven-year $50.0 million variable-rate term loan. These agreements have costs and involve the risks that these arrangements may not be effective in reducing our exposure to interest rate changes and that a court could rule that such agreements are not legally enforceable. Hedging may reduce overall returns on our investments. Failure to hedge effectively against interest rate changes may materially adversely affect our results of operations.

Our property taxes could increase due to property tax rate changes or reassessment, which would impact our cash flows.

Even if we qualify as a REIT for federal income tax purposes, we will be required to pay some state and local taxes on our properties. The real property taxes on our properties may increase as property tax rates change or as our properties are assessed or reassessed by taxing authorities. Therefore, the amount of property taxes we pay in the future may increase substantially. If the property taxes we pay increase, our cash flows will be impacted, and our ability to pay expected distributions to our stockholders could be adversely affected.

Actions of our joint venture partners could negatively impact our performance.

We may acquire and/or redevelop properties through joint ventures, limited liability companies and partnerships with other persons or entities when warranted by the circumstances. Such partners may share certain approval rights over major decisions. Such investments may involve risks not otherwise present with other methods of investment in real estate. We generally will seek to maintain sufficient control of our partnerships, limited liability companies and joint ventures to permit us to achieve our business objectives; however, we may not be able to do so, and the occurrence of one or more of the events described above could adversely affect our financial condition, results of operations, cash flows and ability to pay distributions on, and the market price of, our common stock and our preferred stock.

If we invest in a limited partnership as a general partner, we could be responsible for all liabilities of such partnership.

In some joint ventures or other investments we may make, if the entity in which we invest is a limited partnership, we may acquire all or a portion of our interest in such partnership as a general partner. As a general partner, we could be liable for all the liabilities of such partnership. Additionally, we may be required to take our interests in other investments as a non-managing general partner. Consequently, we would be potentially liable for all such liabilities without having the same rights of management or control over the operation of the partnership as the managing general partner or partners may have. Therefore, we may be held responsible for all of the liabilities of an entity in which we do not have full management rights or control, and our liability may far exceed the amount or value of the investment we initially made or then had in the partnership.

The conflict of interest policies we have adopted may not adequately address all of the conflicts of interest that may arise with respect to our activities.

In order to avoid any actual or perceived conflicts of interest with our directors, officers or employees, we have adopted certain policies to specifically address some of the potential conflicts relating to our activities. In

14

Table of Contents

addition, our board of directors is subject to certain provisions of Maryland law, which are also designed to eliminate or minimize conflicts. Although under these policies the approval of a majority of our disinterested directors is required to approve any transaction, agreement or relationship in which any of our directors, officers or employees has an interest, there is no assurance that these policies will be adequate to address all of the conflicts that may arise or will address such conflicts in a manner that is favorable to us.

Our business could be adversely impacted if we have deficiencies in our disclosure controls and procedures or internal controls over financial reporting.

The design and effectiveness of our disclosure controls and procedures and internal controls over financial reporting may not prevent all errors, misstatements or misrepresentations. While management will continue to review the effectiveness of our disclosure controls and procedures and internal controls over financial reporting, there can be no guarantee that our internal controls over financial reporting will be effective in accomplishing all control objectives all of the time. Deficiencies, including any material weakness, in our internal controls over financial reporting which may occur in the future could result in misstatements of our results of operations, restatements of our financial statements, a decline in our stock price, or otherwise materially adversely affect our business, reputation, results of operations, financial condition or liquidity.

Volatility in the capital and credit markets could materially and adversely impact us.

The capital and credit markets have experienced extreme volatility and disruption in recent years, which has at times made it more difficult to borrow money or raise equity capital. Market volatility and disruption could hinder our ability to obtain new debt financing or refinance our maturing debt on favorable terms or at all. In addition, our future access to the equity markets could be limited. Any such financing or refinancing issues could materially and adversely affect us. Market turmoil and tightening of credit which have occurred in recent years, can lead to an increased lack of consumer confidence and widespread reduction of business activity generally, which also could materially and adversely impact us, including our ability to acquire and dispose of assets on favorable terms or at all. Volatility in capital and credit markets may also have a material adverse effect on the market price of our common stock and preferred stock.

We may not acquire or sell the industrial properties that we have entered into agreements to acquire or sell or with respect to which we have entered into non-binding letters of intent.

We have entered into agreements with third-party sellers to acquire five properties containing 641,593 square feet, a non-binding letter of intent with a third-party seller to acquire one industrial property containing 34,200 square feet and an agreement with a third-party purchaser to sell one property containing 84,961 square feet as more fully described under the heading “Contractual Obligations” in this Annual Report on Form 10-K. There is no assurance that we will acquire or sell the properties under contract or non-binding letter of intent because the proposed acquisitions and disposition are subject to the completion of satisfactory due diligence, various closing conditions and with respect to one of the properties, the consent of the mortgage lender, and, in addition, with respect to the property under non-binding letter of intent, our entry into a purchase and sale agreement. There is no assurance that such proposed acquisitions and disposition, if completed, will be completed on the timeframe we expect. If we do not complete the acquisition or disposition of the properties under contract and letter of intent, we will have incurred expenses without our stockholders realizing any benefit from the acquisition or disposition of such properties.

We face risks associated with security breaches through cyber-attacks, cyber intrusions or otherwise, as well as other significant disruptions of our information technology (IT) networks and related systems.

We face risks associated with security breaches, whether through cyber-attacks or cyber intrusions over the Internet, malware, computer viruses, attachments to e-mails, people with access or who gain access to our systems and other significant disruptions of our IT networks and related systems. The risk of a security breach or disruption, particularly through cyber-attack or cyber intrusion, including by computer hackers, foreign

15

Table of Contents

governments and cyber terrorists, has generally increased as the number, intensity and sophistication of attempted attacks and intrusions from around the world have increased. Our IT networks and related systems are essential to the operation of our business and our ability to perform day-to-day operations and, in some cases, may be critical to the operations of certain of our tenants. Although we make efforts to maintain the security and integrity of our IT networks and related systems, and we have implemented various measures to manage the risk of a security breach or disruption, there can be no assurance that our security efforts and measures will be effective or that attempted security breaches or disruptions would not be successful or damaging. Even the most well protected information, networks, systems and facilities remain potentially vulnerable because the techniques used in such attempted security breaches evolve and generally are not recognized until launched against a target, and in some cases are designed to not be detected and, in fact, may not be detected. Accordingly, we may be unable to anticipate these techniques or to implement adequate security barriers or other preventative measures.

A security breach or other significant disruption involving our IT networks and related systems could significantly disrupt the proper functioning of our networks and systems and significantly disrupt our operations, which could ultimately have a material adverse effect on our financial condition, results of operations, cash flows and ability to pay distributions on, and the market price of, our common stock and our preferred stock.

Risks Related to the Real Estate Industry

Our performance and value are subject to general economic conditions and risks associated with our real estate assets.

The investment returns available from equity investments in real estate depend on the amount of income earned and capital appreciation generated by the properties, as well as the expenses incurred in connection with the properties. If our properties do not generate income sufficient to meet operating expenses, including debt service and capital expenditures, then our ability to pay distributions to our stockholders could be adversely affected. In addition, there are significant expenditures associated with an investment in real estate (such as mortgage payments, real estate taxes and maintenance costs) that generally do not decline when circumstances reduce the income from the property. Income from and the value of our properties may be adversely affected by:

| • | downturns in national, regional and local economic conditions (particularly increases in unemployment); |

| • | the attractiveness of our properties to potential tenants and competition from other industrial properties; |

| • | changes in supply of or demand for similar or competing properties in an area; |

| • | bankruptcies, financial difficulties or lease defaults by the tenants of our properties; |

| • | adverse capital and credit market conditions, which may restrict our operating activities; |

| • | changes in interest rates, availability and terms of debt financing; |

| • | changes in operating costs and expenses and our ability to control rents; |

| • | changes in, or increased costs of compliance with, governmental rules, regulations and fiscal policies, including changes in tax, real estate, environmental and zoning laws, and our potential liability thereunder; |

| • | our ability to provide adequate maintenance and insurance; |

| • | changes in the cost or availability of insurance, including coverage for mold or asbestos; |

| • | unanticipated changes in costs associated with known adverse environmental conditions or retained liabilities for such conditions; |

| • | periods of high interest rates; |

| • | tenant turnover; |

16

Table of Contents

| • | re-leasing that may require concessions or reduced rental rates under the new leases due to reduced demand; |

| • | general overbuilding or excess supply in the market area; |

| • | disruptions in the global supply chain caused by political, regulatory or other factors including terrorism; and |

| • | the effects of deflation, including credit market dislocation, weakened consumer demand and a decline in general price levels. |

In addition, periods of economic slowdown or recession, rising interest rates or declining demand for real estate, or public perception that any of these events may occur, would result in a general decrease in rents or an increased occurrence of defaults under existing leases, which would adversely affect our financial condition and results of operations. Future terrorist attacks may result in declining economic activity, which could reduce the demand for, and the value of, our properties. To the extent that future attacks impact the tenants of our properties, their businesses similarly could be adversely affected, including their ability to continue to honor their existing leases. For these and other reasons, we cannot assure our stockholders that we will be profitable or that we will realize growth in the value of our real estate properties.

Actions by our competitors may decrease or prevent increases in the occupancy and rental rates of our properties.

We compete with other developers, owners and operators of real estate, some of which own properties similar to our properties in the same markets and submarkets in which the properties we own are located. If our competitors offer space at rental rates below current market rates or below the rental rates we will charge the tenants of our properties, we may lose existing or potential tenants, and we may be pressured to reduce our rental rates or offer tenant concessions or favorable lease terms in order to retain tenants when such tenants’ leases expire or attract new tenants. In addition, if our competitors sell assets similar to assets we intend to divest in the same markets and/or at valuations below our valuations for comparable assets, we may be unable to divest our assets at all or at favorable pricing or on favorable terms. As a result of these actions by our competitors, our financial condition, cash flows, cash available for distribution, trading price of our common stock and preferred stock and ability to satisfy our debt service obligations could be materially adversely affected.

Real estate investments are not as liquid as other types of assets, which may reduce economic returns to investors.

Real estate investments are not as liquid as other types of investments, and this lack of liquidity may limit our ability to react promptly to changes in economic, financial, investment or other conditions. In addition, significant expenditures associated with real estate investments, such as mortgage payments, real estate taxes and maintenance costs, are generally not reduced when circumstances cause a reduction in income from the investments. In addition, we intend to comply with the safe harbor rules relating to the number of properties that can be disposed of in a year, the tax bases and the costs of improvements made to these properties, and meet other tests which enable a REIT to avoid punitive taxation on the sale of assets. Thus, our ability at any time to sell assets or contribute assets to property funds or other entities in which we have an ownership interest may be restricted. This lack of liquidity may limit our ability to vary our portfolio promptly in response to changes in economic, financial, investment or other conditions and, as a result, could adversely affect our financial condition, results of operations, cash flows and our ability to pay distributions on, and the market price of, our common stock and preferred stock.

Uninsured or underinsured losses relating to real property may adversely affect our returns.

We will attempt to ensure that all of our properties are adequately insured to cover casualty losses. However, there are certain losses, including losses from floods, hurricanes, fires, earthquakes and other natural

17

Table of Contents