Attached files

| file | filename |

|---|---|

| 8-K - 8-K - RENASANT CORP | form8-k_1q15investorpresen.htm |

First Quarter 2015 Investor Presentation

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Congress passed the Private Securities Litigation Act of 1995 in an effort to encourage corporations to provide information about companies’ anticipated future financial performance. This act provides a safe harbor for such disclosure, which protects the companies from unwarranted litigation if actual results are different from management expectations. This news release may contain, or incorporate by reference, statements which may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward looking statements usually include words such as “expects,” “projects,” “anticipates,” “believes,” “intends,” “estimates,” “strategy,” “plan,” “potential,” “possible” and other similar expressions. Prospective investors are cautioned that any such forward-looking statements are not guarantees for future performance and involve risks and uncertainties, and that actual results may differ materially from those contemplated by such forward-looking statements. Important factors currently known to management that could cause actual results to differ materially from those in forward-looking statements include significant fluctuations in interest rates, inflation, economic recession, significant changes in the federal and state legal and regulatory environment, significant underperformance in our portfolio of outstanding loans, and competition in our markets. We undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time. 2

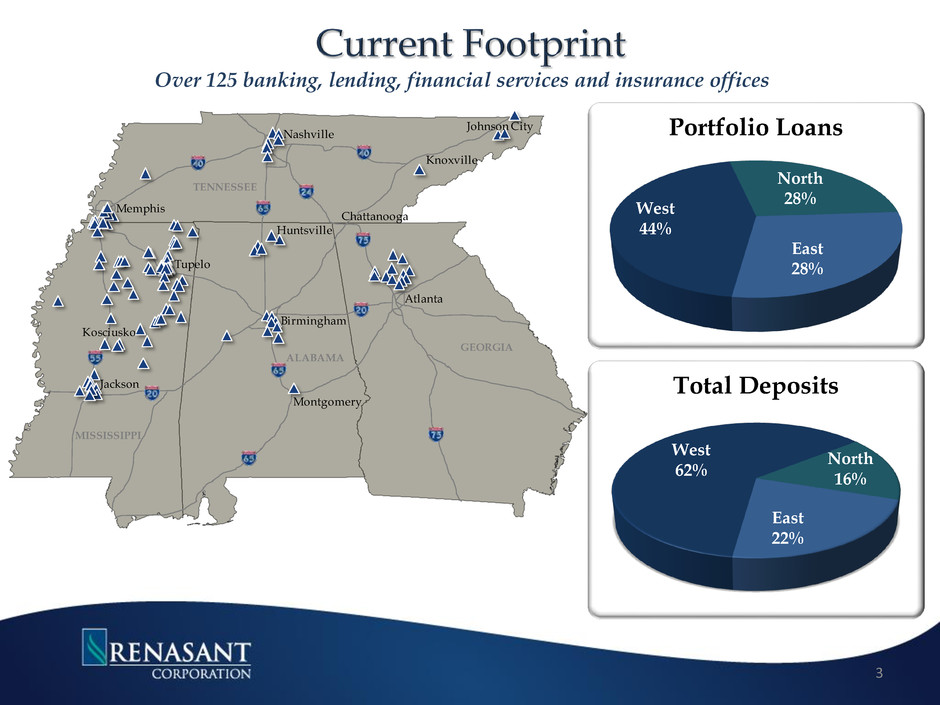

Over 125 banking, lending, financial services and insurance offices 3 West 44% North 28% East 28% Portfolio Loans West 62% North 16% East 22% Total Deposits Tupelo Nashville Atlanta Birmingham Huntsville Montgomery Jackson Memphis Kosciusko Chattanooga Johnson City Knoxville GEORGIA ALABAMA MISSISSIPPI TENNESSEE

4 Enhance Profitability Capitalize on Opportunities Aggressively Manage Problem Credits Build Capital Ratios • Focus on highly-accretive acquisition opportunities • Leverage existing markets • Seek new markets • New lines of business • Selective balance sheet growth • Maintain dividend • Prudently manage capital • Identify problem assets and risks early • Quarantine troubled assets • Superior returns • Revenue growth / Expense control • Net interest margin expansion / mitigate interest rate risk • Loan growth • Core deposit growth

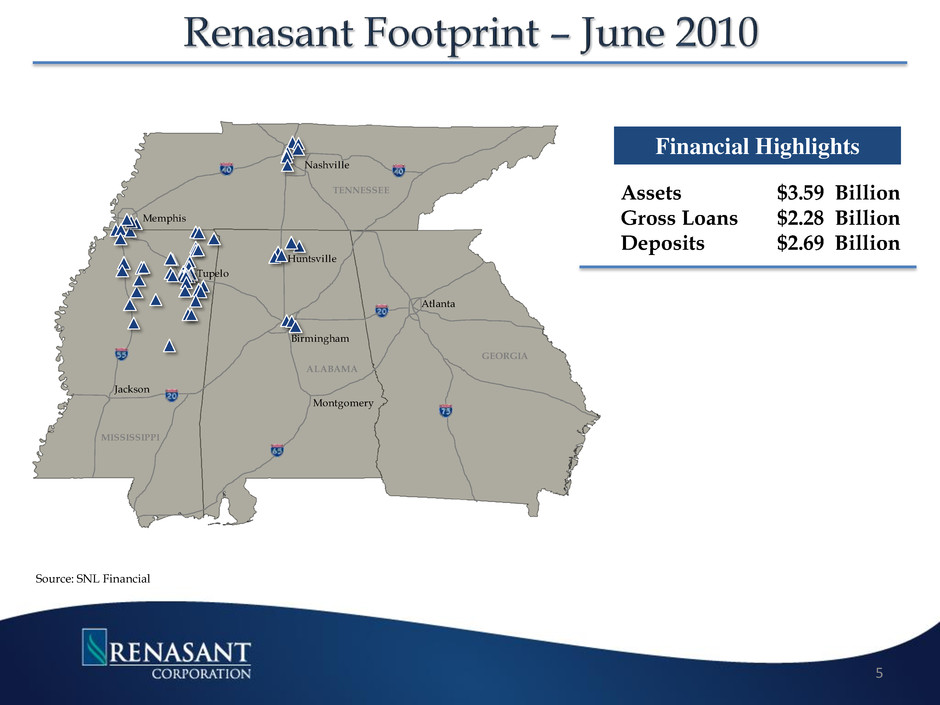

Nashville Memphis TENNESSEE Tupelo Jackson MISSISSIPPI Birmingham Huntsville Montgomery Atlanta GEORGIA ALABAMA Source: SNL Financial 5 Financial Highlights Assets $3.59 Billion Gross Loans $2.28 Billion Deposits $2.69 Billion

6 De novo expansion: Columbus, MS 2010 De novo expansion: Montgomery, AL Starkville, MS Tuscaloosa, AL De novo expansion: Maryville, TN Jonesborough, TN FDIC-Assisted Transaction: Crescent Bank and Trust Jasper, GA Assets: $1.0 billion FDIC-Assisted Transaction: American Trust Bank Roswell, GA Assets: $145 million Trust Acquisition: RBC (USA) Trust Unit Birmingham, AL Assets: $680 million Whole Bank Transaction: First M&F Corporation Kosciusko, MS Assets: $1.6 billion 2011 2013 De novo expansion: Bristol, TN Johnson City, TN 2014 Whole Bank Transaction Announcement: Heritage Financial Group, Inc. Albany, GA Assets: $1.8 billion 2012

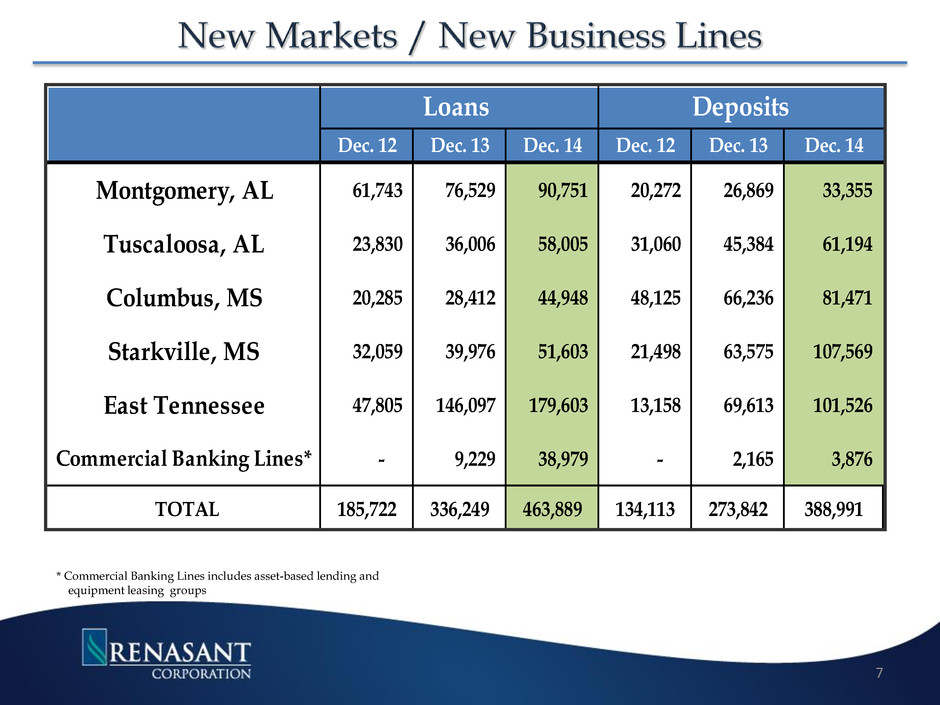

7 Dec. 12 Dec. 13 Dec. 14 Dec. 12 Dec. 13 Dec. 14 Montgomery, AL 61,743 76,529 90,751 20,272 26,869 33,355 Tuscaloosa, AL 23,830 36,006 58,005 31,060 45,384 61,194 Columbus, MS 20,285 28,412 44,948 48,125 66,236 81,471 Starkville, MS 32,059 39,976 51,603 21,498 63,575 107,569 East Tennessee 47,805 146,097 179,603 13,158 69,613 101,526 Commercial Banking Lines* - 9,229 38,979 - 2,165 3,876 TOTAL 185,722 336,249 463,889 134,113 273,842 388,991 Loans Deposits * Commercial Banking Lines includes asset-based lending and equipment leasing groups

Pending Merger with Heritage Financial Group, Inc. (HBOS) 8

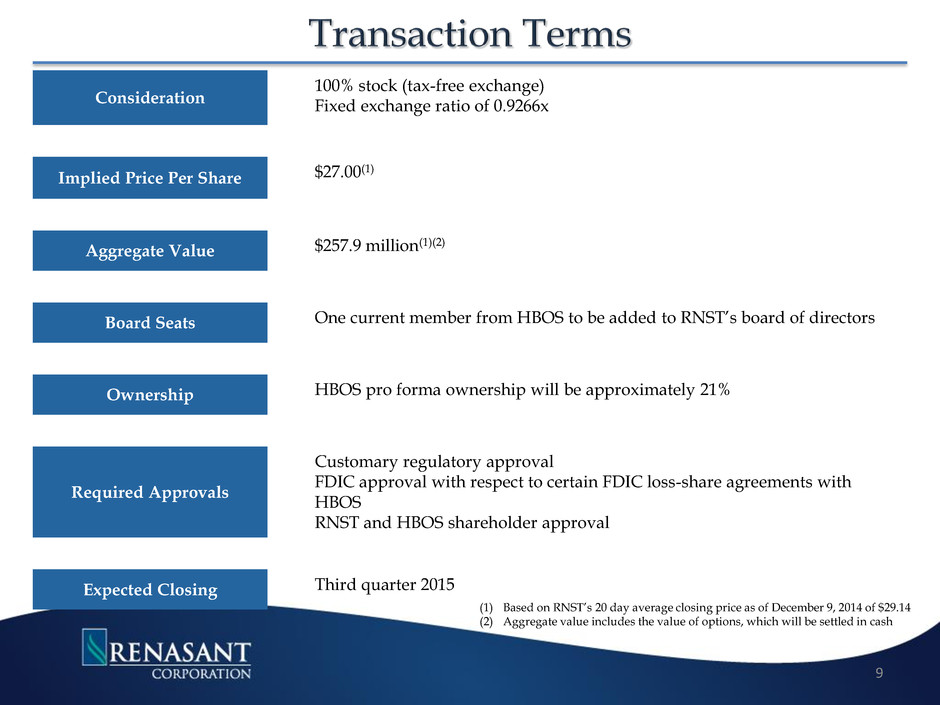

Consideration 100% stock (tax-free exchange) Fixed exchange ratio of 0.9266x Implied Price Per Share $27.00 (1) Aggregate Value $257.9 million (1)(2) Board Seats One current member from HBOS to be added to RNST’s board of directors Ownership HBOS pro forma ownership will be approximately 21% Required Approvals Customary regulatory approval FDIC approval with respect to certain FDIC loss-share agreements with HBOS RNST and HBOS shareholder approval Expected Closing Third quarter 2015 (1) Based on RNST’s 20 day average closing price as of December 9, 2014 of $29.14 (2) Aggregate value includes the value of options, which will be settled in cash 9

Implied Price Per Share $27.00(1) Price / TBVPS 169% Price / LTM Core EPS 19.6x Price / 2016 EPS(2) 12.4x Core Deposit Premium 10.9% Premium to Current Price(3) 24.5% (1) Based on RNST’s 20 day average closing price as of December 9, 2014 of $29.14 and an exchange ratio of 0.9266x (2) Based on analyst estimates (3) Based on HBOS closing price on December 9, 2014 of $21.69 10

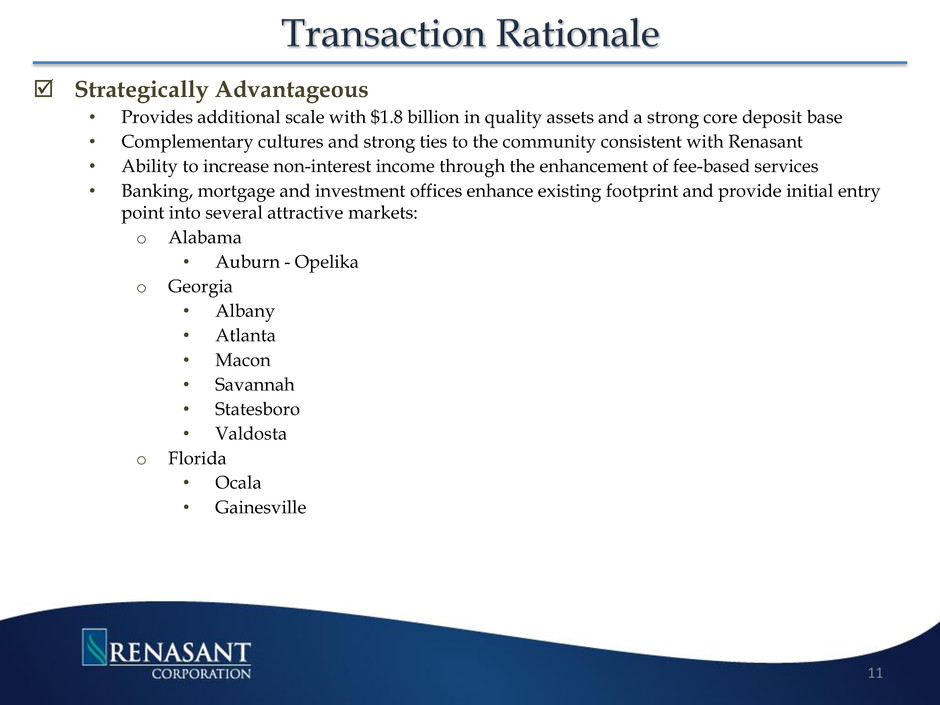

Strategically Advantageous • Provides additional scale with $1.8 billion in quality assets and a strong core deposit base • Complementary cultures and strong ties to the community consistent with Renasant • Ability to increase non-interest income through the enhancement of fee-based services • Banking, mortgage and investment offices enhance existing footprint and provide initial entry point into several attractive markets: o Alabama • Auburn - Opelika o Georgia • Albany • Atlanta • Macon • Savannah • Statesboro • Valdosta o Florida • Ocala • Gainesville 11

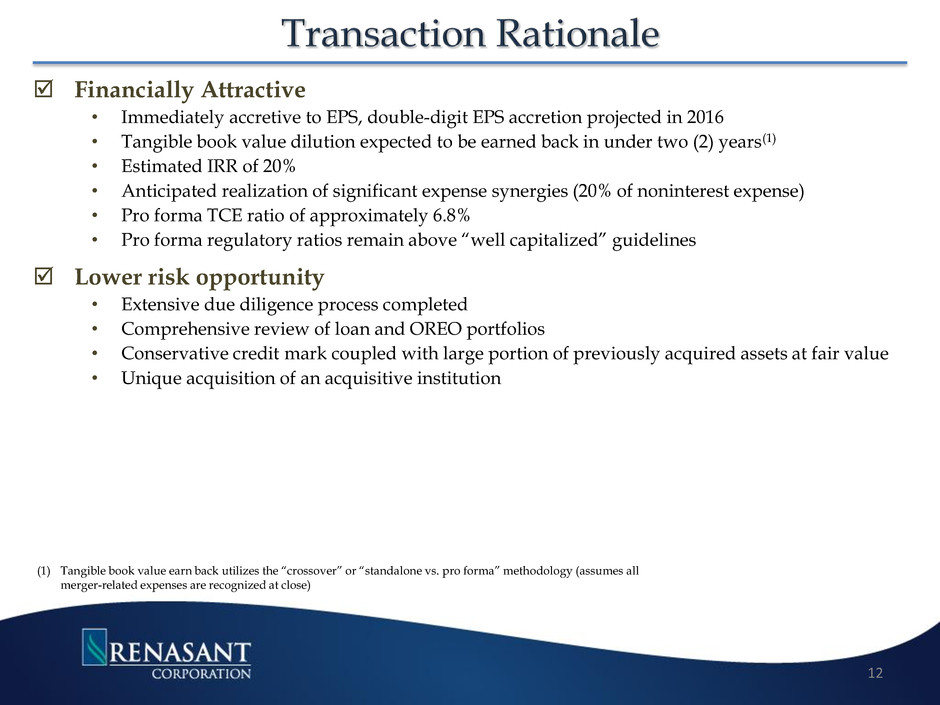

Financially Attractive • Immediately accretive to EPS, double-digit EPS accretion projected in 2016 • Tangible book value dilution expected to be earned back in under two (2) years(1) • Estimated IRR of 20% • Anticipated realization of significant expense synergies (20% of noninterest expense) • Pro forma TCE ratio of approximately 6.8% • Pro forma regulatory ratios remain above “well capitalized” guidelines Lower risk opportunity • Extensive due diligence process completed • Comprehensive review of loan and OREO portfolios • Conservative credit mark coupled with large portion of previously acquired assets at fair value • Unique acquisition of an acquisitive institution (1) Tangible book value earn back utilizes the “crossover” or “standalone vs. pro forma” methodology (assumes all merger-related expenses are recognized at close) 12

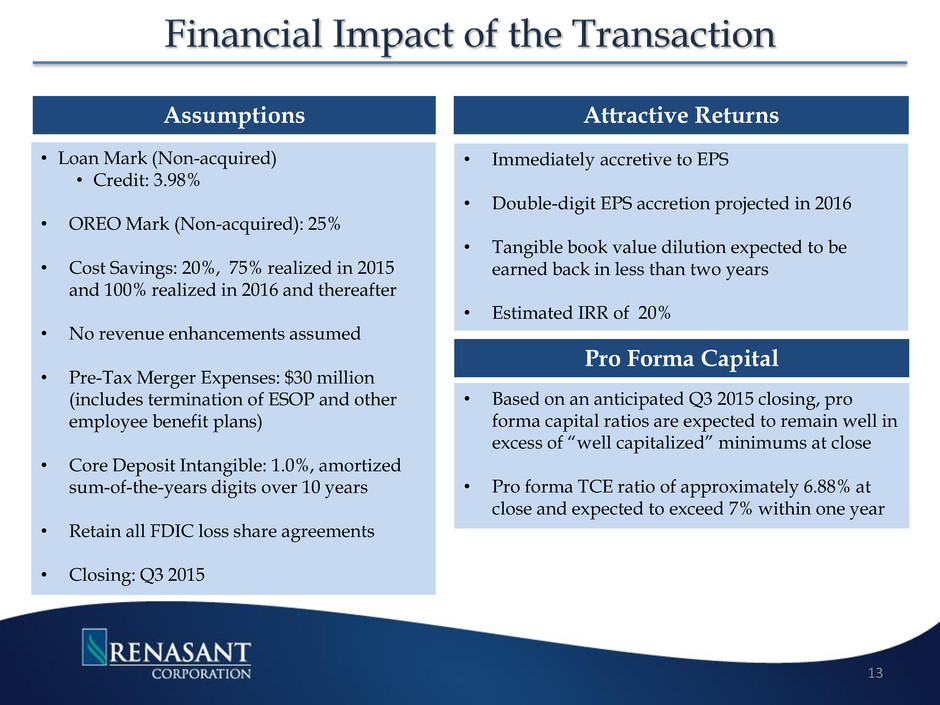

Assumptions • Loan Mark (Non-acquired) • Credit: 3.98% • OREO Mark (Non-acquired): 25% • Cost Savings: 20%, 75% realized in 2015 and 100% realized in 2016 and thereafter • No revenue enhancements assumed • Pre-Tax Merger Expenses: $30 million (includes termination of ESOP and other employee benefit plans) • Core Deposit Intangible: 1.0%, amortized sum-of-the-years digits over 10 years • Retain all FDIC loss share agreements • Closing: Q3 2015 Attractive Returns • Immediately accretive to EPS • Double-digit EPS accretion projected in 2016 • Tangible book value dilution expected to be earned back in less than two years • Estimated IRR of 20% Pro Forma Capital • Based on an anticipated Q3 2015 closing, pro forma capital ratios are expected to remain well in excess of “well capitalized” minimums at close • Pro forma TCE ratio of approximately 6.88% at close and expected to exceed 7% within one year 13

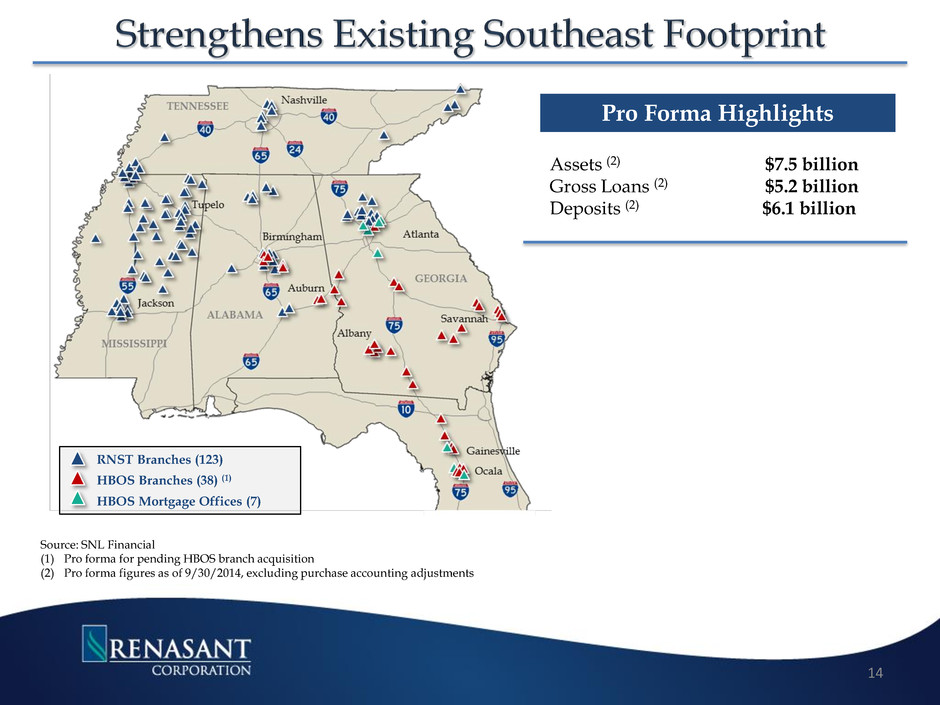

Assets (2) $7.5 billion Gross Loans (2) $5.2 billion Deposits (2) $6.1 billion RNST Branches (123) HBOS Branches (38) (1) HBOS Mortgage Offices (7) Source: SNL Financial (1) Pro forma for pending HBOS branch acquisition (2) Pro forma figures as of 9/30/2014, excluding purchase accounting adjustments 14 Pro Forma Highlights

15 Enhance Profitability Capitalize on Opportunities Aggressively Manage Problem Credits Build Capital Ratios • Focus on highly-accretive acquisition opportunities • Leverage existing markets • Seek new markets • New lines of business • Selective balance sheet growth • Maintain dividend • Prudently manage capital • Identify problem assets and risks early • Quarantine troubled assets • Superior returns • Revenue growth / Expense control • Net interest margin expansion / mitigate interest rate risk • Loan growth • Core deposit growth

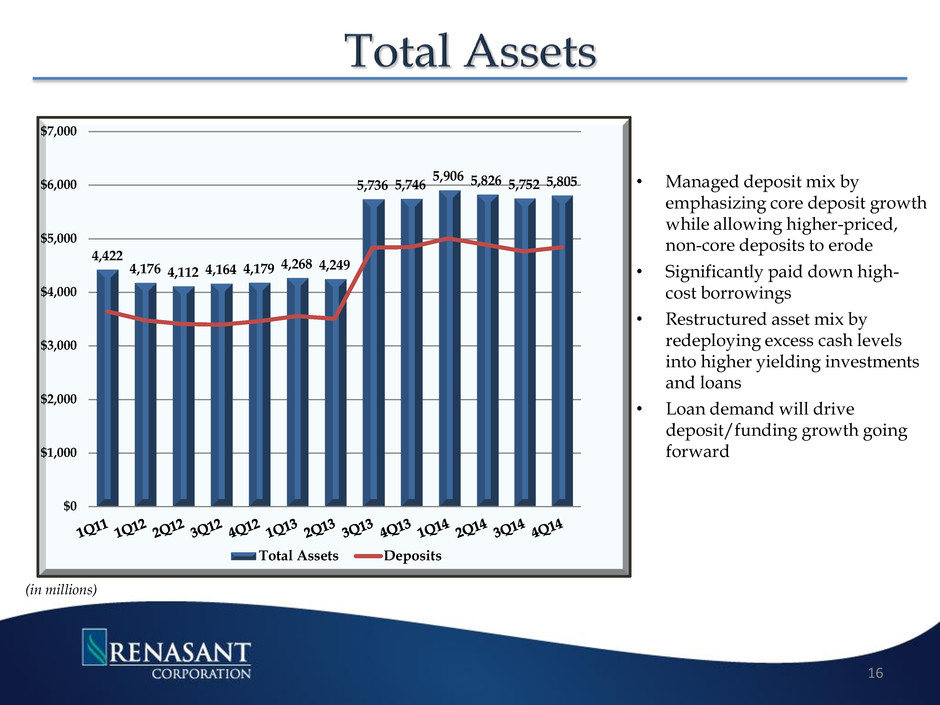

• Managed deposit mix by emphasizing core deposit growth while allowing higher-priced, non-core deposits to erode • Significantly paid down high- cost borrowings • Restructured asset mix by redeploying excess cash levels into higher yielding investments and loans • Loan demand will drive deposit/funding growth going forward (in millions) 16 4,422 4,176 4,112 4,164 4,179 4,268 4,249 5,736 5,746 5,906 5,826 5,752 5,805 $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 Total Assets Deposits

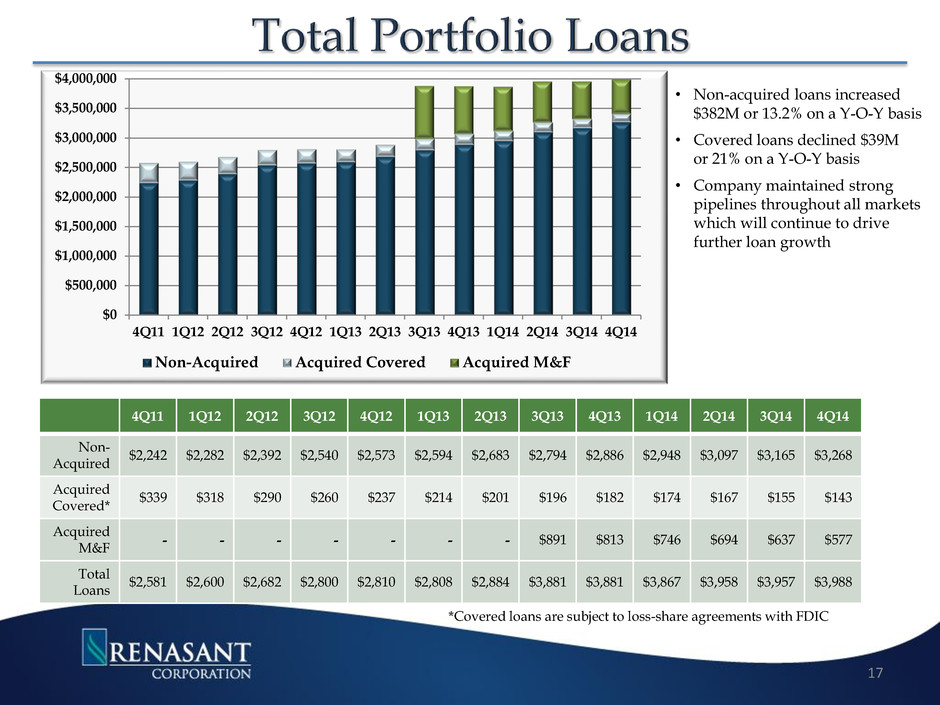

4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 Non- Acquired $2,242 $2,282 $2,392 $2,540 $2,573 $2,594 $2,683 $2,794 $2,886 $2,948 $3,097 $3,165 $3,268 Acquired Covered* $339 $318 $290 $260 $237 $214 $201 $196 $182 $174 $167 $155 $143 Acquired M&F - - - - - - - $891 $813 $746 $694 $637 $577 Total Loans $2,581 $2,600 $2,682 $2,800 $2,810 $2,808 $2,884 $3,881 $3,881 $3,867 $3,958 $3,957 $3,988 • Non-acquired loans increased $382M or 13.2% on a Y-O-Y basis • Covered loans declined $39M or 21% on a Y-O-Y basis • Company maintained strong pipelines throughout all markets which will continue to drive further loan growth $0 $500,000 $1,000,000 $1,500,000 $2,000,000 $2,500,000 $3,000,000 $3,500,000 $4,000,000 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 Non-Acquired Acquired Covered Acquired M&F 17 *Covered loans are subject to loss-share agreements with FDIC

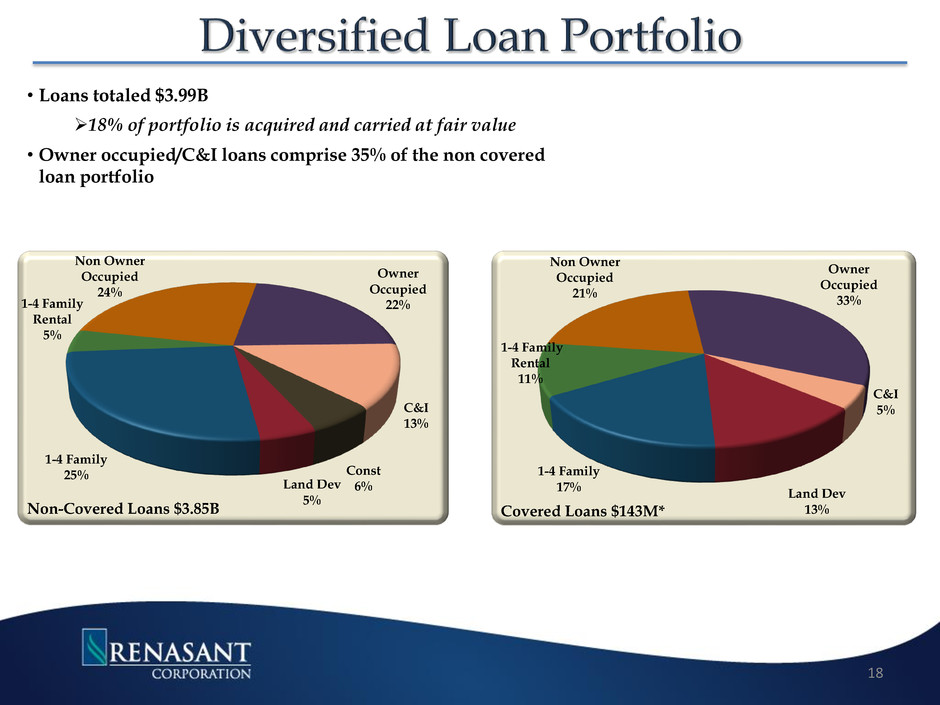

• Loans totaled $3.99B 18% of portfolio is acquired and carried at fair value • Owner occupied/C&I loans comprise 35% of the non covered loan portfolio Const 6% Land Dev 5% 1-4 Family 25% 1-4 Family Rental 5% Non Owner Occupied 24% Owner Occupied 22% C&I 13% Non-Covered Loans $3.85B Land Dev 13% 1-4 Family 17% 1-4 Family Rental 11% Non Owner Occupied 21% Owner Occupied 33% C&I 5% Covered Loans $143M* 18

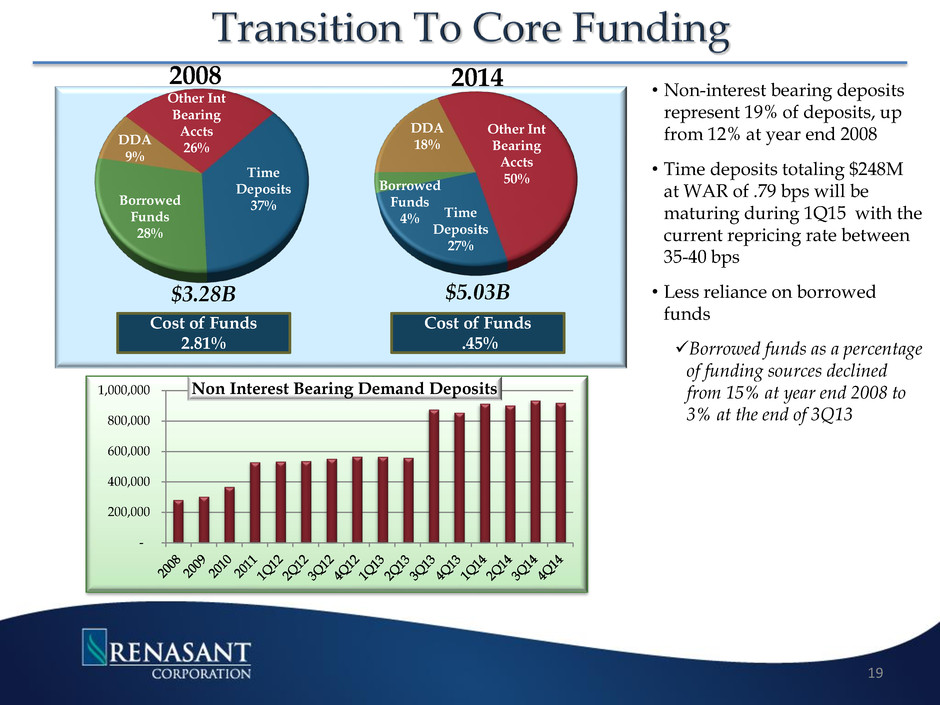

DDA 9% Other Int Bearing Accts 26% Time Deposits 37% Borrowed Funds 28% 2008 Cost of Funds 2.81% $3.28B DDA 18% Other Int Bearing Accts 50% Time Deposits 27% Borrowed Funds 4% 2014 $5.03B Cost of Funds .45% - 200,000 400,000 600,000 800,000 1,000,000 Non Interest Bearing Demand Deposits • Non-interest bearing deposits represent 19% of deposits, up from 12% at year end 2008 • Time deposits totaling $248M at WAR of .79 bps will be maturing during 1Q15 with the current repricing rate between 35-40 bps • Less reliance on borrowed funds Borrowed funds as a percentage of funding sources declined from 15% at year end 2008 to 3% at the end of 3Q13 19

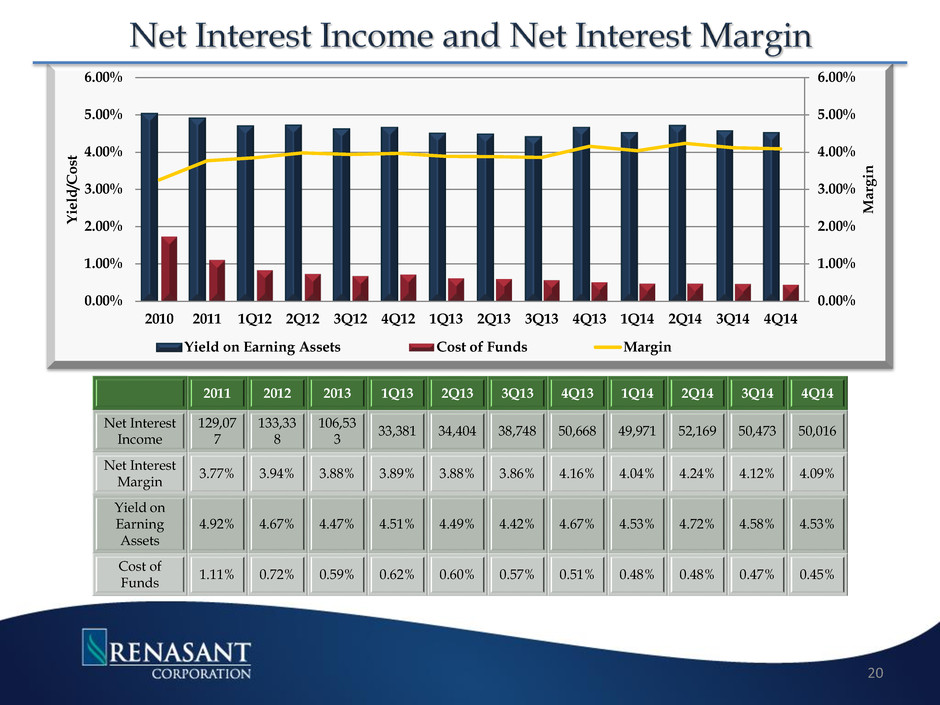

0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 2010 2011 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 Marg in Y ie ld /C os t Yield on Earning Assets Cost of Funds Margin 2011 2012 2013 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 Net Interest Income 129,07 7 133,33 8 106,53 3 33,381 34,404 38,748 50,668 49,971 52,169 50,473 50,016 Net Interest Margin 3.77% 3.94% 3.88% 3.89% 3.88% 3.86% 4.16% 4.04% 4.24% 4.12% 4.09% Yield on Earning Assets 4.92% 4.67% 4.47% 4.51% 4.49% 4.42% 4.67% 4.53% 4.72% 4.58% 4.53% Cost of Funds 1.11% 0.72% 0.59% 0.62% 0.60% 0.57% 0.51% 0.48% 0.48% 0.47% 0.45% 20

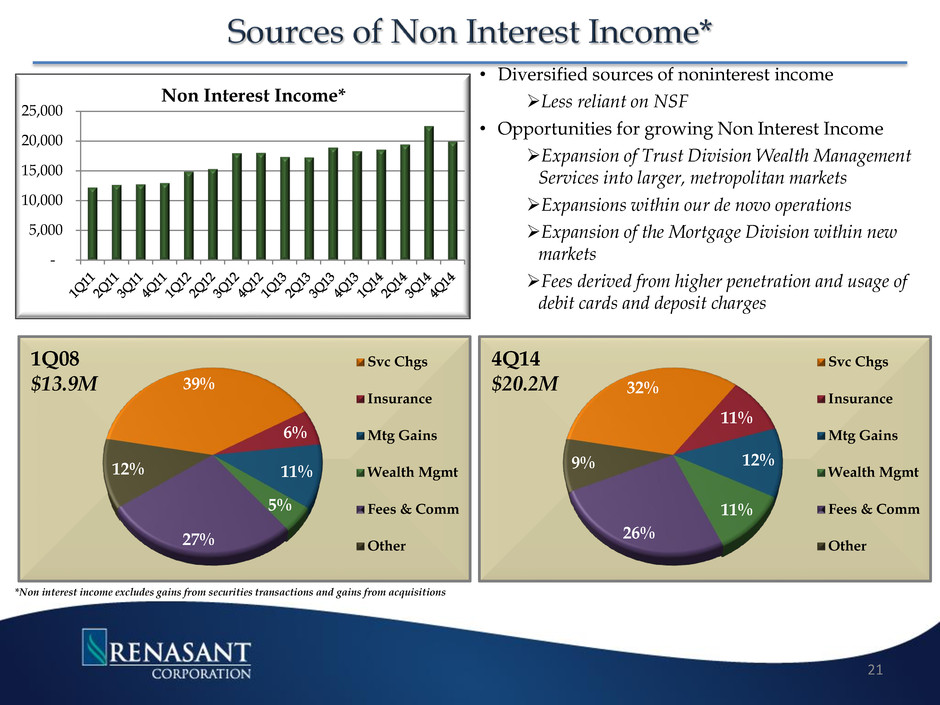

32% 11% 12% 11% 26% 9% 4Q14 $20.2M Svc Chgs Insurance Mtg Gains Wealth Mgmt Fees & Comm Other • Diversified sources of noninterest income Less reliant on NSF • Opportunities for growing Non Interest Income Expansion of Trust Division Wealth Management Services into larger, metropolitan markets Expansions within our de novo operations Expansion of the Mortgage Division within new markets Fees derived from higher penetration and usage of debit cards and deposit charges *Non interest income excludes gains from securities transactions and gains from acquisitions 39% 6% 11% 5% 27% 12% 1Q08 $13.9M Svc Chgs Insurance Mtg Gains Wealth Mgmt Fees & Comm Other - 5,000 10,000 15,000 20,000 25,000 Non Interest Income* 21

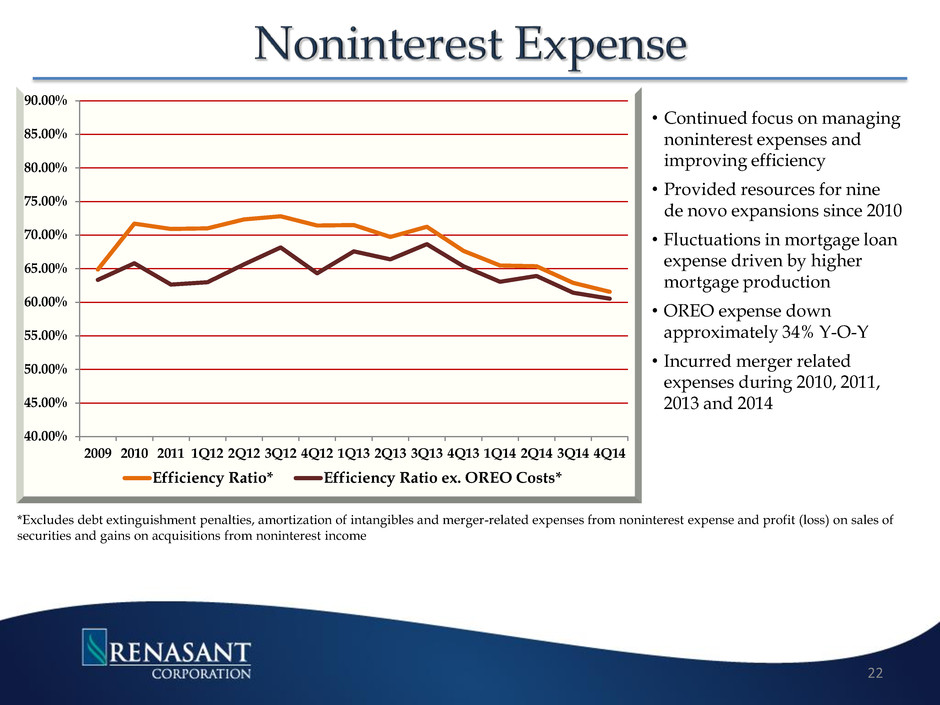

• Continued focus on managing noninterest expenses and improving efficiency • Provided resources for nine de novo expansions since 2010 • Fluctuations in mortgage loan expense driven by higher mortgage production • OREO expense down approximately 34% Y-O-Y • Incurred merger related expenses during 2010, 2011, 2013 and 2014 22 40.00% 45.00% 50.00% 55.00% 60.00% 65.00% 70.00% 75.00% 80.00% 85.00% 90.00% 2009 2010 2011 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 Efficiency Ratio* Efficiency Ratio ex. OREO Costs* *Excludes debt extinguishment penalties, amortization of intangibles and merger-related expenses from noninterest expense and profit (loss) on sales of securities and gains on acquisitions from noninterest income

23 Enhance Profitability Capitalize on Opportunities Aggressively Manage Problem Credits Build Capital Ratios • Focus on highly-accretive acquisition opportunities • Leverage existing markets • Seek new markets • New lines of business • Selective balance sheet growth • Maintain dividend • Prudently manage capital • Identify problem assets and risks early • Quarantine troubled assets • Superior returns • Revenue growth / Expense control • Net interest margin expansion / mitigate interest rate risk • Loan growth • Core deposit growth

34% of total NPAs are covered under FDIC loss share Non-acquired NPAs approaching pre-credit cycle levels. 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 2008 2009 2010 2011 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 Non-Acquired Acquired Covered Acquired M&F 109 99 81 106 115 83 75 22 As a percentage of total assets 65 126 105 95 88 104 137 75 68 83 24 Non- Acquired Acquired Covered Acquired M&F NPL’s $20.2M $24.2M $10.7M ORE $17.1M $ 6.4M $11.0M Total NPA’s $37.3M $30.6M $21.7M 83 56 49 67 104 47 62 22 45 56 22 21 21 45 49 21 20 39 47 22 31 37

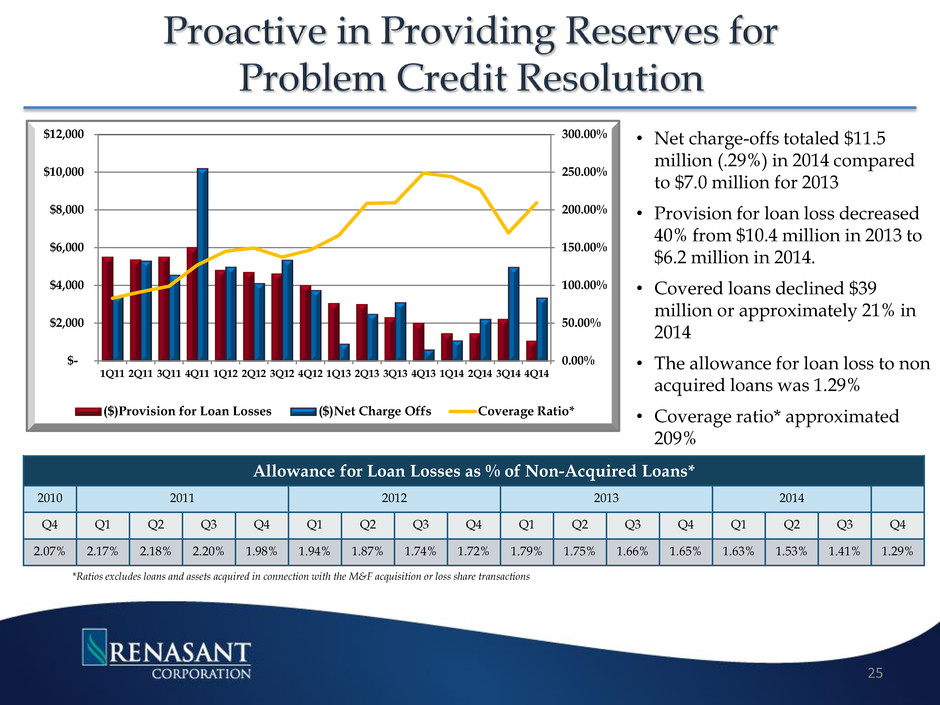

*Ratios excludes loans and assets acquired in connection with the M&F acquisition or loss share transactions 0.00% 50.00% 100.00% 150.00% 200.00% 250.00% 300.00% $- $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 ($)Provision for Loan Losses ($)Net Charge Offs Coverage Ratio* • Net charge-offs totaled $11.5 million (.29%) in 2014 compared to $7.0 million for 2013 • Provision for loan loss decreased 40% from $10.4 million in 2013 to $6.2 million in 2014. • Covered loans declined $39 million or approximately 21% in 2014 • The allowance for loan loss to non acquired loans was 1.29% • Coverage ratio* approximated 209% Allowance for Loan Losses as % of Non-Acquired Loans* 2010 2011 2012 2013 2014 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 2.07% 2.17% 2.18% 2.20% 1.98% 1.94% 1.87% 1.74% 1.72% 1.79% 1.75% 1.66% 1.65% 1.63% 1.53% 1.41% 1.29% 25

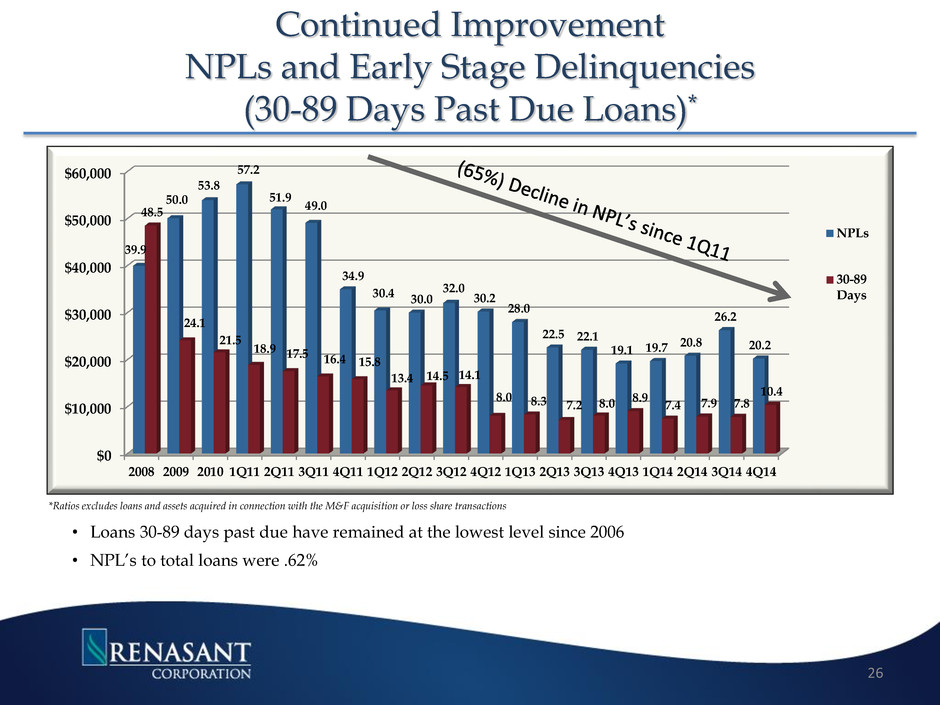

$0 $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 2008 2009 2010 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 39.9 50.0 53.8 57.2 51.9 49.0 34.9 30.4 30.0 32.0 30.2 28.0 22.5 22.1 19.1 19.7 20.8 26.2 20.2 48.5 24.1 21.5 18.9 17.5 16.4 15.8 13.4 14.5 14.1 8.0 8.3 7.2 8.0 8.9 7.4 7.9 7.8 10.4 NPLs 30-89 Days Continued Improvement NPLs and Early Stage Delinquencies (30-89 Days Past Due Loans)* • Loans 30-89 days past due have remained at the lowest level since 2006 • NPL’s to total loans were .62% 26 *Ratios excludes loans and assets acquired in connection with the M&F acquisition or loss share transactions

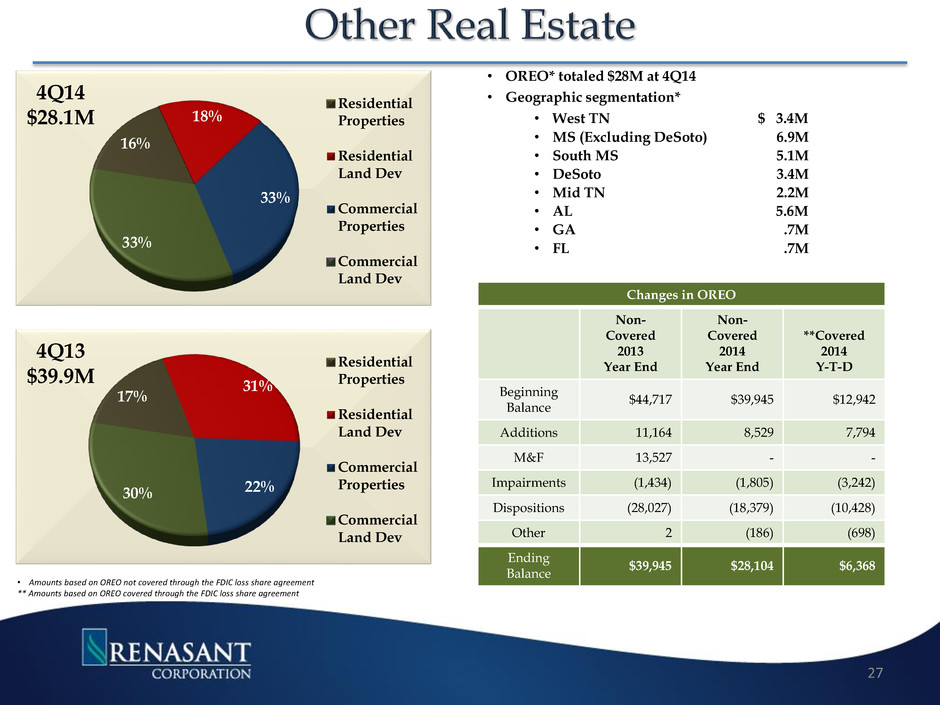

17% 31% 22% 30% 4Q13 $39.9M Residential Properties Residential Land Dev Commercial Properties Commercial Land Dev • OREO* totaled $28M at 4Q14 • Geographic segmentation* • West TN $ 3.4M • MS (Excluding DeSoto) 6.9M • South MS 5.1M • DeSoto 3.4M • Mid TN 2.2M • AL 5.6M • GA .7M • FL .7M Changes in OREO Non- Covered 2013 Year End Non- Covered 2014 Year End **Covered 2014 Y-T-D Beginning Balance $44,717 $39,945 $12,942 Additions 11,164 8,529 7,794 M&F 13,527 - - Impairments (1,434) (1,805) (3,242) Dispositions (28,027) (18,379) (10,428) Other 2 (186) (698) Ending Balance $39,945 $28,104 $6,368 • Amounts based on OREO not covered through the FDIC loss share agreement ** Amounts based on OREO covered through the FDIC loss share agreement 27 16% 18% 33% 33% 4Q14 $28.1M Residential Properties Residential Land Dev Commercial Properties Commercial Land Dev

28 Enhance Profitability Capitalize on Opportunities Aggressively Manage Problem Credits Build Capital Ratios • Focus on highly-accretive acquisition opportunities • Leverage existing markets • Seek new markets • New lines of business • Selective balance sheet growth • Maintain dividend • Prudently manage capital • Identify problem assets and risks early • Quarantine troubled assets • Superior returns • Revenue growth / Expense control • Net interest margin expansion / mitigate interest rate risk • Loan growth • Core deposit growth

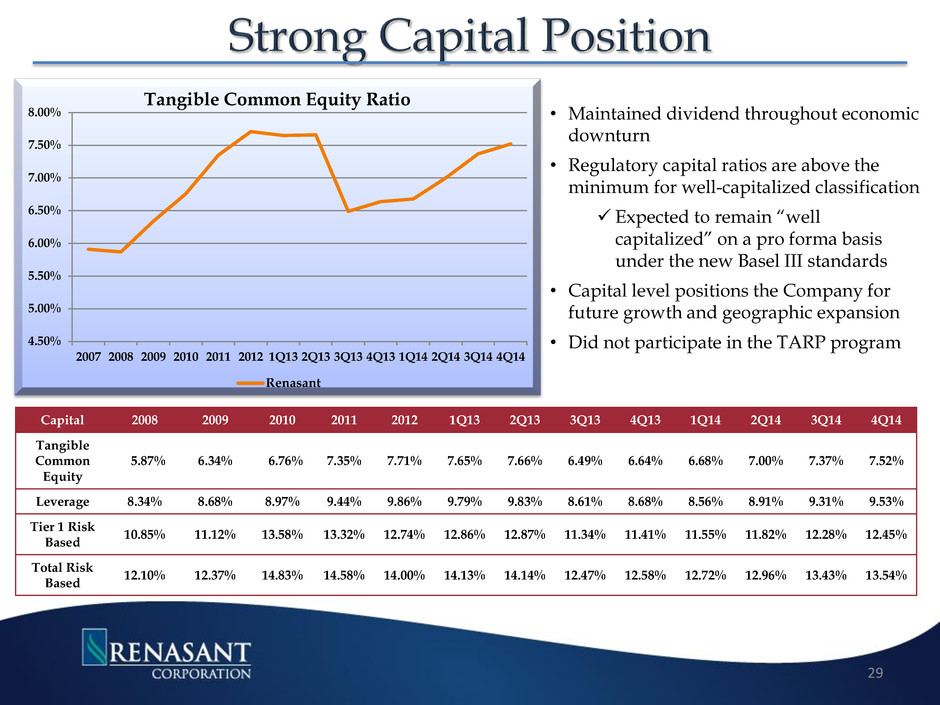

4.50% 5.00% 5.50% 6.00% 6.50% 7.00% 7.50% 8.00% 2007 2008 2009 2010 2011 2012 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 Tangible Common Equity Ratio Renasant Capital 2008 2009 2010 2011 2012 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 Tangible Common Equity 5.87% 6.34% 6.76% 7.35% 7.71% 7.65% 7.66% 6.49% 6.64% 6.68% 7.00% 7.37% 7.52% Leverage 8.34% 8.68% 8.97% 9.44% 9.86% 9.79% 9.83% 8.61% 8.68% 8.56% 8.91% 9.31% 9.53% Tier 1 Risk Based 10.85% 11.12% 13.58% 13.32% 12.74% 12.86% 12.87% 11.34% 11.41% 11.55% 11.82% 12.28% 12.45% Total Risk Based 12.10% 12.37% 14.83% 14.58% 14.00% 14.13% 14.14% 12.47% 12.58% 12.72% 12.96% 13.43% 13.54% • Maintained dividend throughout economic downturn • Regulatory capital ratios are above the minimum for well-capitalized classification Expected to remain “well capitalized” on a pro forma basis under the new Basel III standards • Capital level positions the Company for future growth and geographic expansion • Did not participate in the TARP program 29

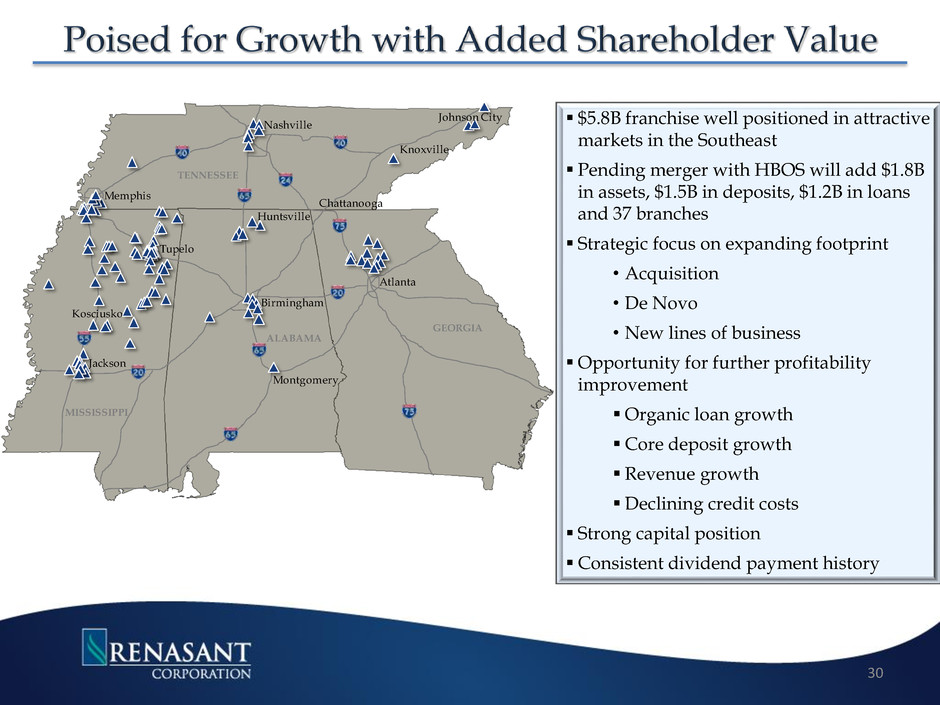

$5.8B franchise well positioned in attractive markets in the Southeast Pending merger with HBOS will add $1.8B in assets, $1.5B in deposits, $1.2B in loans and 37 branches Strategic focus on expanding footprint • Acquisition • De Novo • New lines of business Opportunity for further profitability improvement Organic loan growth Core deposit growth Revenue growth Declining credit costs Strong capital position Consistent dividend payment history 30 Tupelo Nashville Atlanta Birmingham Huntsville Montgomery Jackson Memphis Kosciusko Chattanooga Johnson City Knoxville GEORGIA ALABAMA MISSISSIPPI TENNESSEE

Appendix 31

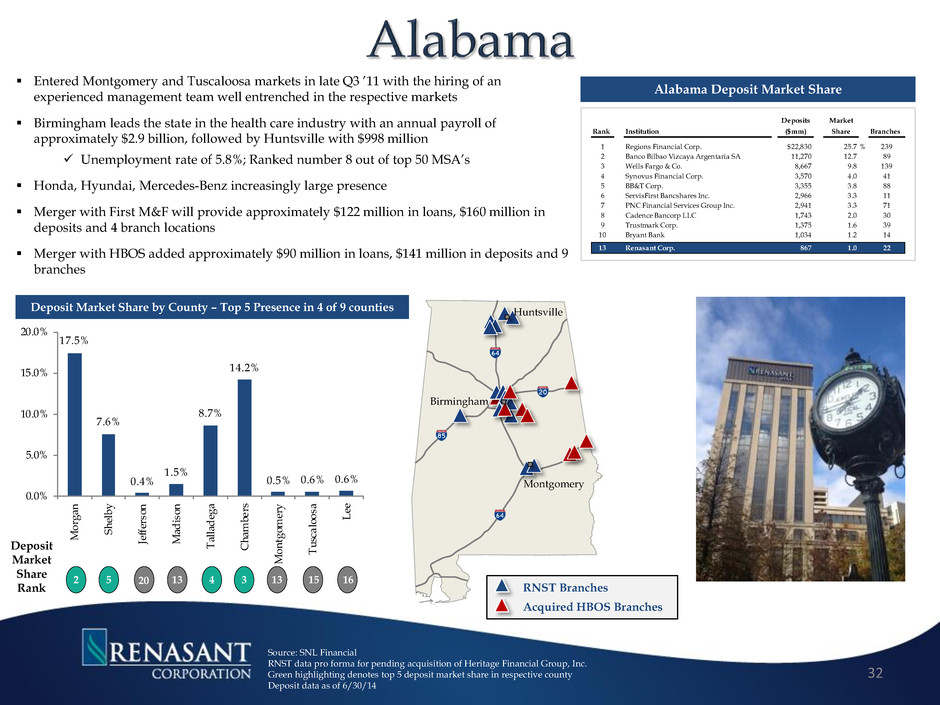

Montgomery Huntsville Birmingham Entered Montgomery and Tuscaloosa markets in late Q3 ’11 with the hiring of an experienced management team well entrenched in the respective markets Birmingham leads the state in the health care industry with an annual payroll of approximately $2.9 billion, followed by Huntsville with $998 million Unemployment rate of 5.8%; Ranked number 8 out of top 50 MSA’s Honda, Hyundai, Mercedes-Benz increasingly large presence Merger with First M&F will provide approximately $122 million in loans, $160 million in deposits and 4 branch locations Merger with HBOS added approximately $90 million in loans, $141 million in deposits and 9 branches 17.5% 7.6% 0.4% 1.5% 8.7% 14.2% 0.5% 0.6% 0.6% 0.0% 5.0% 10.0% 15.0% 20.0% M or ga n Sh el by Je ffe rs on M ad is on Ta lla de ga C ha m be rs M on tg om er y Tu sc al oo sa Le e 32 Deposit Market Share by County – Top 5 Presence in 4 of 9 counties 2 5 4 3 Deposit Market Share Rank 20 13 13 15 16 Deposits Market Rank Institution ($mm) Share Branches 1 Regions Financial Corp. $22,830 25.7 % 239 2 Banco Bilbao Vizcaya Argentaria SA 11,270 12.7 89 3 Wells Fargo & Co. 8,667 9.8 139 4 Synovus Financial Corp. 3,570 4.0 41 5 BB&T Corp. 3,355 3.8 88 6 ServisFirst Bancshares Inc. 2,966 3.3 11 7 PNC Financial Services Group Inc. 2,941 3.3 71 8 Cadence Bancorp LLC 1,743 2.0 30 9 Trustmark Corp. 1,375 1.6 39 10 Bryant Bank 1,034 1.2 14 13 Renasant Corp. 867 1.0 22 Alabama Deposit Market Share Source: SNL Financial RNST data pro forma for pending acquisition of Heritage Financial Group, Inc. Green highlighting denotes top 5 deposit market share in respective county Deposit data as of 6/30/14 RNST Branches Acquired HBOS Branches

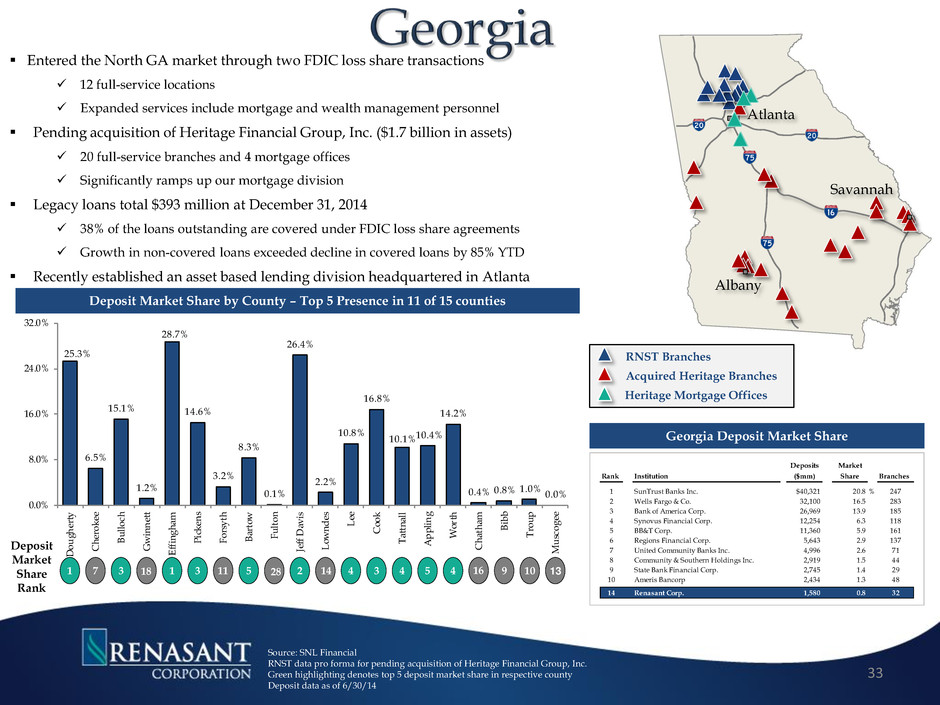

Entered the North GA market through two FDIC loss share transactions 12 full-service locations Expanded services include mortgage and wealth management personnel Pending acquisition of Heritage Financial Group, Inc. ($1.7 billion in assets) 20 full-service branches and 4 mortgage offices Significantly ramps up our mortgage division Legacy loans total $393 million at December 31, 2014 38% of the loans outstanding are covered under FDIC loss share agreements Growth in non-covered loans exceeded decline in covered loans by 85% YTD Recently established an asset based lending division headquartered in Atlanta 33 25.3% 6.5% 15.1% 1.2% 28.7% 14.6% 3.2% 8.3% 0.1% 26.4% 2.2% 10.8% 16.8% 10.1%10.4% 14.2% 0.4% 0.8% 1.0% 0.0% 0.0% 8.0% 16.0% 24.0% 32.0% Do ug he rty Ch ero kee Bu llo ch Gw inn ett Eff ing ham Pic ken s Fo rsy th Ba rto w Fu lto n Jef f D avi s Lo wn de s Le e Co ok Ta ttn all Ap pli ng Wo rth Ch ath am Bib b Tro up Mu sco gee Deposit Market Share by County – Top 5 Presence in 11 of 15 counties 1 7 3 1 3 5 2 4 3 4 5 4 9 Deposit Market Share Rank 18 11 28 14 16 10 13 Deposits Market Rank Institution ($mm) Share Branches 1 SunTrust Banks Inc. $40,321 20.8 % 247 2 Wells Fargo & Co. 32,100 16.5 283 3 Bank of America Corp. 26,969 13.9 185 4 Synovus Financial Corp. 12,254 6.3 118 5 BB&T Corp. 11,360 5.9 161 6 Regions Financial Corp. 5,643 2.9 137 7 U ited Community Banks Inc. 4,996 2.6 71 8 Community & Southern Holdings Inc. 2,919 1.5 44 9 State Bank Financial Corp. 2,745 1.4 29 10 Ameris Bancorp 2,434 1.3 48 14 Renasant Corp. 1,580 0.8 32 Georgia Deposit Market Share Atlanta Source: SNL Financial RNST data pro forma for pending acquisition of Heritage Financial Group, Inc. Green highlighting denotes top 5 deposit market share in respective county Deposit data as of 6/30/14 RNST Branches Acquired Heritage Branches Heritage Mortgage Offices Savannah Albany

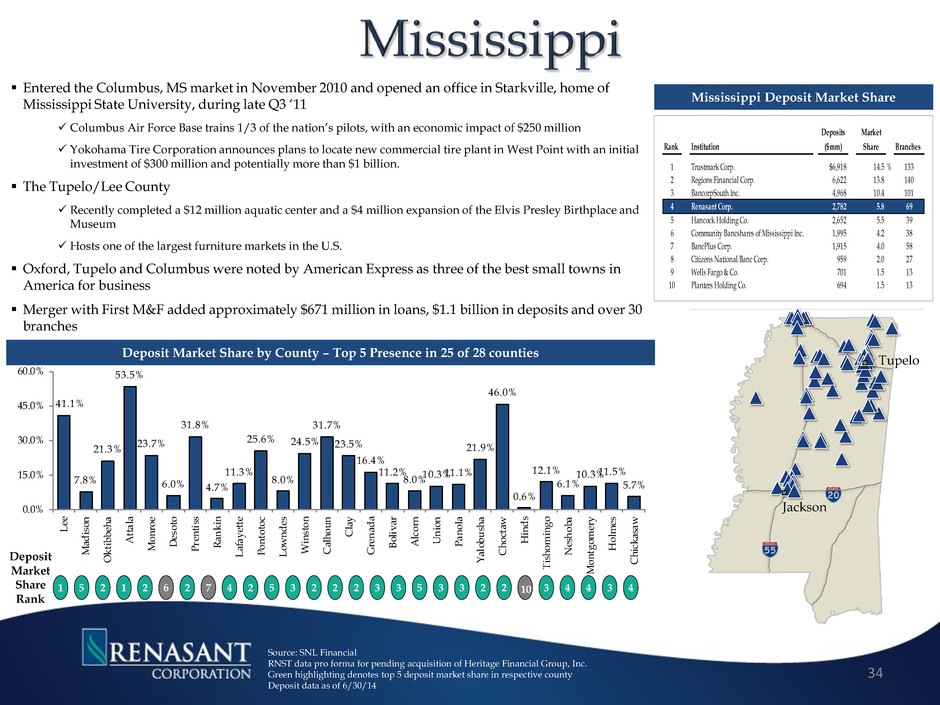

34 Jackson Tupelo 41.1% 7.8% 21.3% 53.5% 23.7% 6.0% 31.8% 4.7% 11.3% 25.6% 8.0% 24.5% 31.7% 23.5% 16.4% 11.2% 8.0% 10.3%11.1% 21.9% 46.0% 0.6% 12.1% 6.1% 10.3%11.5% 5.7% 0.0% 15.0% 30.0% 45.0% 60.0% Lee Mad ison Okt ibbe ha Atta la Mo nro e Des oto Pre ntis s Ran kin Lafa yett e Pon toto c Low nde s Win ston Cal hou n Cla y Gre nad a Boli var Alc orn Uni on Pan ola Yal obu sha Cho ctaw Hin ds Tish om ingo Nes hob a Mo ntg ome ry Hol mes Chi cka saw Deposit Market Share by County – Top 5 Presence in 25 of 28 counties 1 5 Entered the Columbus, MS market in November 2010 and opened an office in Starkville, home of Mississippi State University, during late Q3 ‘11 Columbus Air Force Base trains 1/3 of the nation’s pilots, with an economic impact of $250 million Yokohama Tire Corporation announces plans to locate new commercial tire plant in West Point with an initial investment of $300 million and potentially more than $1 billion. The Tupelo/Lee County Recently completed a $12 million aquatic center and a $4 million expansion of the Elvis Presley Birthplace and Museum Hosts one of the largest furniture markets in the U.S. Oxford, Tupelo and Columbus were noted by American Express as three of the best small towns in America for business Merger with First M&F added approximately $671 million in loans, $1.1 billion in deposits and over 30 branches 2 1 2 6 2 7 4 2 Deposit Market Share Rank 5 3 2 2 2 3 3 5 3 3 2 2 3 4 4 4 3 10 Mississippi Deposit Market Share Source: SNL Financial RNST data pro forma for pending acquisition of Heritage Financial Group, Inc. Green highlighting denotes top 5 deposit market share in respective county Deposit data as of 6/30/14 Deposits Market Rank Institution ($mm) Share Branches 1 Trustmark Corp. $6,918 14.5 % 133 2 Regions Financial Corp. 6,622 13.8 140 3 BancorpSouth Inc. 4,968 10.4 101 4 Renasant Corp. 2,782 5.8 69 5 Hancock Holding Co. 2,652 5.5 39 6 Community Bancshares of Mississippi Inc. 1,995 4.2 38 7 BancPlus Corp. 1,915 4.0 58 8 Citizens National Banc Corp. 959 2.0 27 9 Wells Fargo & Co. 701 1.5 13 10 Planters Holding Co. 694 1.5 13

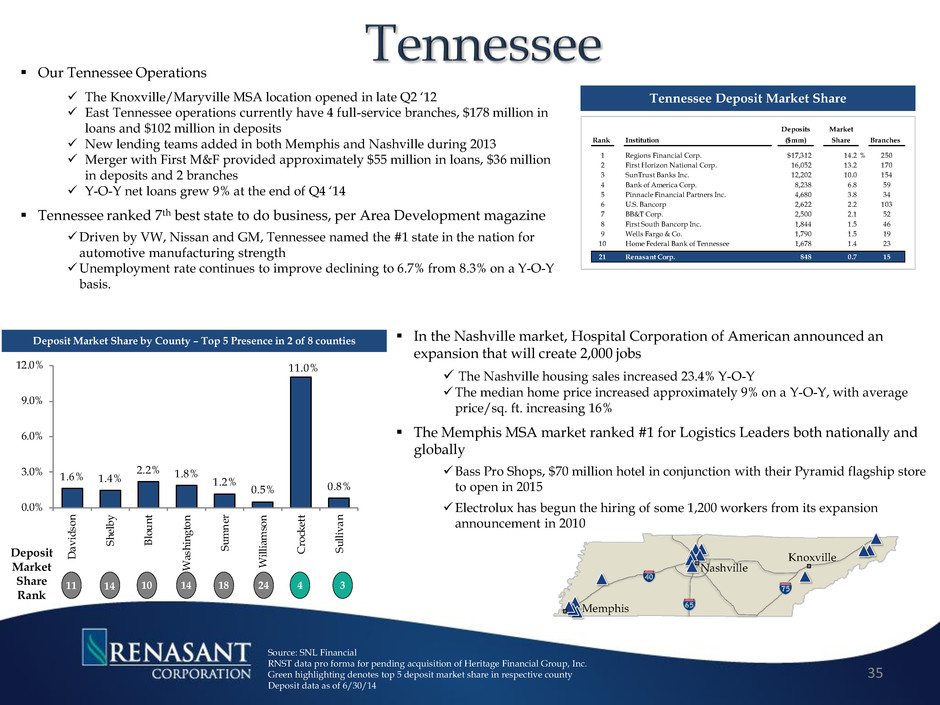

Our Tennessee Operations The Knoxville/Maryville MSA location opened in late Q2 ‘12 East Tennessee operations currently have 4 full-service branches, $178 million in loans and $102 million in deposits New lending teams added in both Memphis and Nashville during 2013 Merger with First M&F provided approximately $55 million in loans, $36 million in deposits and 2 branches Y-O-Y net loans grew 9% at the end of Q4 ‘14 Tennessee ranked 7th best state to do business, per Area Development magazine Driven by VW, Nissan and GM, Tennessee named the #1 state in the nation for automotive manufacturing strength Unemployment rate continues to improve declining to 6.7% from 8.3% on a Y-O-Y basis. In the Nashville market, Hospital Corporation of American announced an expansion that will create 2,000 jobs The Nashville housing sales increased 23.4% Y-O-Y The median home price increased approximately 9% on a Y-O-Y, with average price/sq. ft. increasing 16% The Memphis MSA market ranked #1 for Logistics Leaders both nationally and globally Bass Pro Shops, $70 million hotel in conjunction with their Pyramid flagship store to open in 2015 Electrolux has begun the hiring of some 1,200 workers from its expansion announcement in 2010 35 Nashville Memphis Knoxville 1.6% 1.4% 2.2% 1.8% 1.2% 0.5% 11.0% 0.8% 0.0% 3.0% 6.0% 9.0% 12.0% Da vi ds on Sh elb y Bl ou nt W as hi ng to n Su m ne r W ill iam so n Cr oc ke tt Su lli va n Deposit Market Share by County – Top 5 Presence in 2 of 8 counties 4 3 Deposit Market Share Rank 14 10 14 18 24 11 Tennessee Deposit Market Share Deposits Market Rank Institution ($mm) Share Branches 1 Regions Financial Corp. $17,312 14.2 % 250 2 First Horizon National Corp. 16,052 13.2 170 3 SunTrust Banks Inc. 12,202 10.0 154 4 Bank of America Corp. 8,238 6.8 59 5 Pinnacle Financial Partners Inc. 4,680 3.8 34 6 U.S. Bancorp 2,622 2.2 103 7 BB&T Corp. 2,500 2.1 52 8 First South Bancorp Inc. 1,844 1.5 46 9 Wells Fargo & Co. 1,790 1.5 19 10 Home Federal Bank of Tennessee 1,678 1.4 23 21 Renasant Corp. 848 0.7 15 Source: SNL Financial RNST data pro forma for pending acquisition of Heritage Financial Group, Inc. Green highlighting denotes top 5 deposit market share in respective county Deposit data as of 6/30/14

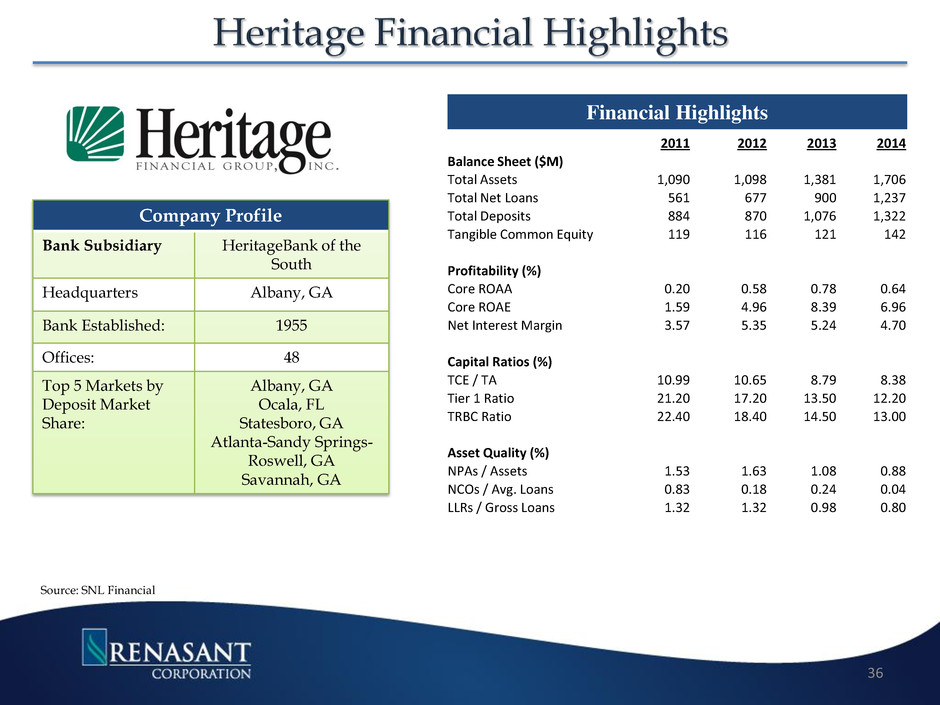

Company Profile Bank Subsidiary HeritageBank of the South Headquarters Albany, GA Bank Established: 1955 Offices: 48 Top 5 Markets by Deposit Market Share: Albany, GA Ocala, FL Statesboro, GA Atlanta-Sandy Springs- Roswell, GA Savannah, GA Source: SNL Financial Financial Highlights 36 2011 2012 2013 2014 Balance Sheet ($M) Total Assets 1,090 1,098 1,381 1,706 Total Net Loans 561 677 900 1,237 Total Deposits 884 870 1,076 1,322 Tangible Common Equity 119 116 121 142 Profitability (%) Core ROAA 0.20 0.58 0.78 0.64 Core ROAE 1.59 4.96 8.39 6.96 Net Interest Margin 3.57 5.35 5.24 4.70 Capital Ratios (%) TCE / TA 10.99 10.65 8.79 8.38 Tier 1 Ratio 21.20 17.20 13.50 12.20 TRBC Ratio 22.40 18.40 14.50 13.00 Asset Quality (%) NPAs / Assets 1.53 1.63 1.08 0.88 NCOs / Avg. Loans 0.83 0.18 0.24 0.04 LLRs / Gross Loans 1.32 1.32 0.98 0.80

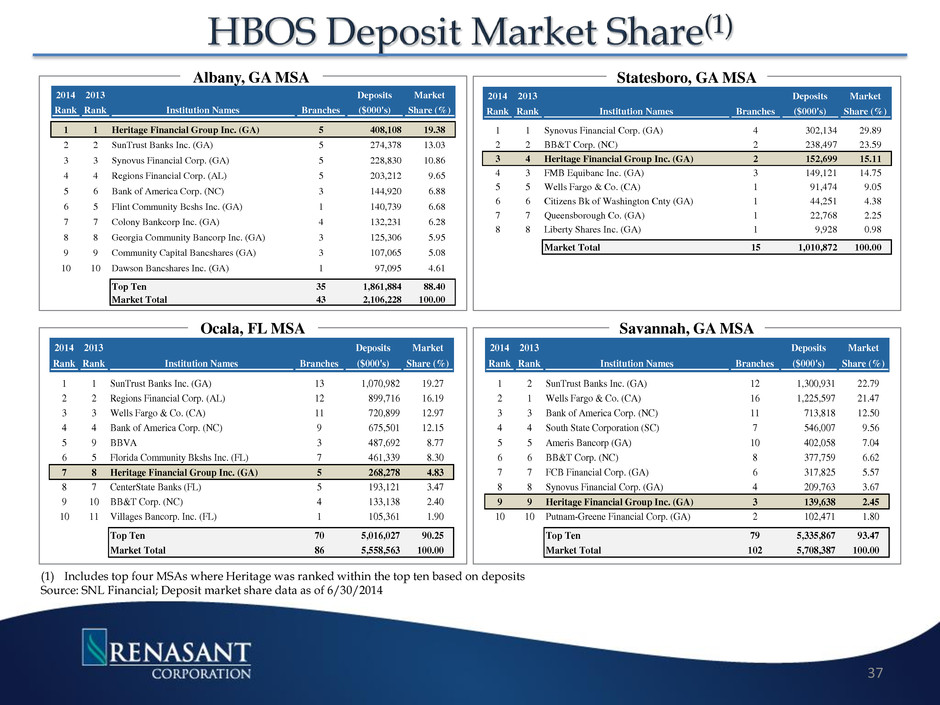

Albany, GA MSA Statesboro, GA MSA Savannah, GA MSA Ocala, FL MSA (1) Includes top four MSAs where Heritage was ranked within the top ten based on deposits Source: SNL Financial; Deposit market share data as of 6/30/2014 2014 Rank 2013 Rank Institution Names Branches Deposits ($000's) Market Share (%) 1 1 Heritage Financial Group Inc. (GA) 5 408,108 19.38 2 2 SunTrust Banks Inc. (GA) 5 274,378 13.03 3 3 Synovus Financial Corp. (GA) 5 228,830 10.86 4 4 Regions Financial Corp. (AL) 5 203,212 9.65 5 6 Bank of America Corp. (NC) 3 144,920 6.88 6 5 Flint Community Bcshs Inc. (GA) 1 140,739 6.68 7 7 Colony Bankcorp Inc. (GA) 4 132,231 6.28 8 8 Georgia Community Bancorp Inc. (GA) 3 125,306 5.95 9 9 Community Capital Bancshares (GA) 3 107,065 5.08 10 10 Dawson Bancshares Inc. (GA) 1 97,095 4.61 Top Ten 35 1,861,884 88.40 Market Total 43 2,106,228 100.00 2014 Rank 2013 Rank Institution Names Branches Deposits ($000's) Market Share (%) 1 1 SunTrust Banks Inc. (GA) 13 1,070,982 19. 7 2 2 Regions Financial Corp. (AL) 12 899,716 16.19 3 3 Wells Fargo & Co. (CA) 11 720,899 12.97 4 4 Bank of America Corp. (NC) 9 675,501 12.15 5 9 BBVA 3 487,692 8.77 6 5 Florida Community Bkshs Inc. (FL) 7 461,339 8.30 7 8 Heritage Financial Group Inc. (GA) 5 268,278 4.83 8 7 CenterState Banks (FL) 5 193,121 3.47 9 10 BB&T Corp. (NC) 4 133,138 2.40 10 11 Villages Bancorp. Inc. (FL) 1 105,361 1.90 Top Ten 70 5,016,027 90.25 Market Total 86 5,558,563 100.00 2014 Rank 2013 Ra k Institution Names Branches Deposits ($000's) Market Share (%) 1 2 SunTrust Banks Inc. (GA) 1 1,300,931 22.79 2 1 Wells Fargo & Co. (CA) 1,225,597 21.47 3 3 Bank of America Corp. (NC) 11 713,818 12.50 4 4 South State Corporation (SC) 7 546,007 9.56 5 5 Ameris Bancorp (GA) 10 402,058 7.04 6 6 BB&T Corp. (NC) 8 377,759 6.62 7 7 FCB Financial Corp. (GA) 6 317,825 5.57 8 8 Synovus Financial Corp. (GA) 4 209,763 3.67 9 9 Heritage Financial Group Inc. (GA) 139,638 2.45 10 10 Putnam-Greene Financial Corp. (GA) 2 102,471 1.80 Top Ten 79 5,335,867 93.47 Market Total 102 5,708,387 100.00 2014 Rank 2013 Rank Institution Names Branches Deposits ($000's) Market Share (%) 1 1 Synovus Financial Corp. (GA) 4 302,134 29.89 2 2 BB&T Corp. (NC) 2 238,497 23.59 3 4 Heritage Financial Group Inc. (GA) 2 152,699 15.11 4 3 FMB Equibanc Inc. (GA) 3 149,121 14.75 5 5 ells Fargo o. ( ) 1 91,474 9.05 6 6 Citizens Bk of Washington Cnty (GA) 44,251 4.38 7 7 Queensborough Co. (GA) 22,768 2.25 8 8 Liberty Shares Inc. (GA) 1 9,928 0.98 Market Total 15 1,010,872 100.00 37

$52.8 $119.2 $214.8 $46.5 $288.3 $808.2 $0.0 $300.0 $600.0 $900.0 $1,200.0 H2 '12 2013 2014 Refinanced Purchased 53% 29% 21% 47% 71% 79% 0.0% 25.0% 50.0% 75.0% 100.0% H2 '12 2013 2014 Refinanced Purchased Total Production ($mm) Refinance vs. Purchases (% of Total Production) $99.3 $407.4 $1,023.0 • Mortgage team started in 2012 and currently consists of 88 bankers • Headquartered in the attractive Buckhead market 38

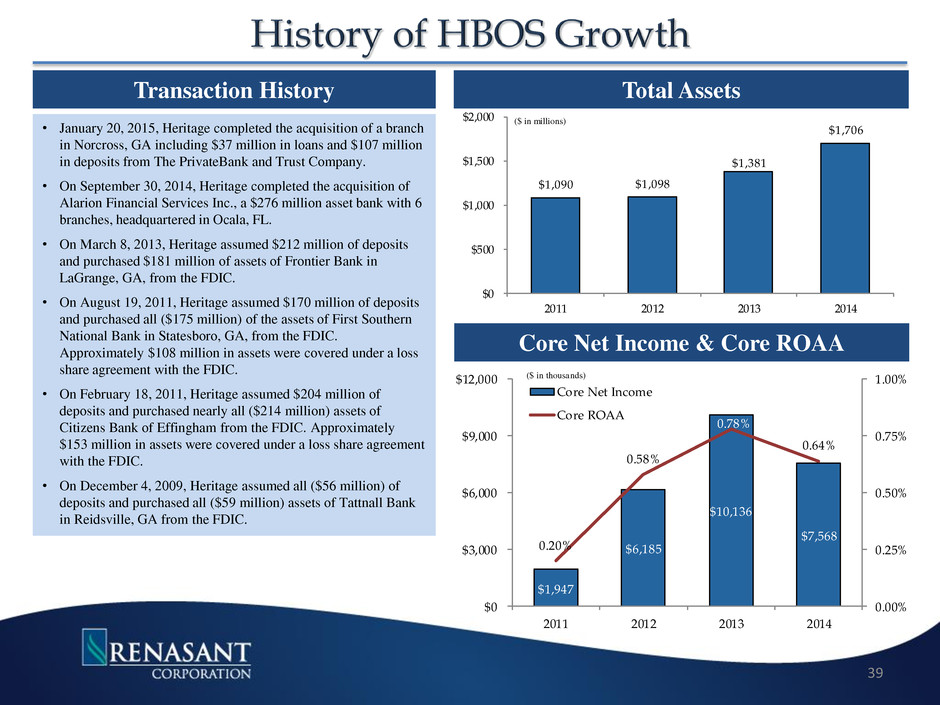

$1,947 $6,185 $10,136 $7,568 0.20% 0.58% 0.78% 0.64% 0.00% 0.25% 0.50% 0.75% 1.00% $0 $3,000 $6,000 $9,000 $12,000 2011 2012 2013 2014 Core Net Income Core ROAA $1,090 $1,098 $1,381 $1,706 $0 $500 $1,000 $1,500 $ ,00 2011 2012 2013 2014 Transaction History • January 20, 2015, Heritage completed the acquisition of a branch in Norcross, GA including $37 million in loans and $107 million in deposits from The PrivateBank and Trust Company. • On September 30, 2014, Heritage completed the acquisition of Alarion Financial Services Inc., a $276 million asset bank with 6 branches, headquartered in Ocala, FL. • On March 8, 2013, Heritage assumed $212 million of deposits and purchased $181 million of assets of Frontier Bank in LaGrange, GA, from the FDIC. • On August 19, 2011, Heritage assumed $170 million of deposits and purchased all ($175 million) of the assets of First Southern National Bank in Statesboro, GA, from the FDIC. Approximately $108 million in assets were covered under a loss share agreement with the FDIC. • On February 18, 2011, Heritage assumed $204 million of deposits and purchased nearly all ($214 million) assets of Citizens Bank of Effingham from the FDIC. Approximately $153 million in assets were covered under a loss share agreement with the FDIC. • On December 4, 2009, Heritage assumed all ($56 million) of deposits and purchased all ($59 million) assets of Tattnall Bank in Reidsville, GA from the FDIC. Total Assets Core Net Income & Core ROAA ($ in millions) ($ in thousands) 39

Renasant and Heritage will be filing a joint proxy statement/prospectus, and other relevant documents concerning the merger with the Securities and Exchange Commission (the “SEC”). This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. INVESTORS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE MERGER OR INCORPORATED BY REFERENCE IN THE JOINT PROXY STATEMENT/PROSPECTUS BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT RENASANT, HERITAGE AND THE PROPOSED MERGER. When available, the joint proxy statement/prospectus will be mailed to shareholders of both Renasant and Heritage. Investors will also be able to obtain copies of the joint proxy statement/prospectus and other relevant documents (when they become available) free of charge at the SEC’s Web site (www.sec.gov). In addition, documents filed with the SEC by Renasant will be available free of charge from Kevin Chapman, Chief Financial Officer, Renasant Corporation, 209 Troy Street, Tupelo, Mississippi 38804-4827, telephone: (662) 680-1450. Renasant, Heritage and certain of their directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from the shareholders of Renasant and Heritage in connection with the proposed merger. Information about the directors and executive officers of Renasant is included in the proxy statement for its 2014 annual meeting of shareholders, which was filed with the SEC on March 11, 2014. Information about the directors and executive officers of Heritage is included in the proxy statement for its 2014 annual meeting of shareholders, which was filed with the SEC on April 25, 2014. Additional information regarding the interests of such participants and other persons who may be deemed participants in the transaction will be included in the joint proxy statement/prospectus and the other relevant documents filed with the SEC when they become available. 40

E. Robinson McGraw Chairman, President and Chief Executive Officer Kevin D. Chapman Executive Vice President and Chief Financial Officer 209 TROY STREET TUPELO, MS 38804-4827 PHONE: 1-800-680-1601 FACSIMILE: 1-662-680-1234 WWW.RENASANT.COM WWW.RENASANTBANK.COM 41