Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FIRST BANCORP /PR/ | d869674d8k.htm |

First

BanCorp Investor Presentation

February 2015

Exhibit 99.1 |

Disclaimer

1

This presentation may contain “forward-looking statements” concerning the

Corporation’s future economic performance. The words or phrases “expect,” “anticipate,” “look forward,”

“should,” “believes” and similar expressions are meant to identify

“forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended, and are subject to the safe harbor

created by such sections. The Corporation wishes to caution readers not to place undue

reliance on any such “forward-looking statements,” which speak only as of the

date made, and to advise readers that various factors, including, but not limited to, the following could

cause actual results to differ materially from those expressed in, or implied by such

forward-looking statements: uncertainty about whether the Corporation and FirstBank will be able to

fully comply with the written agreement dated June 3, 2010 that the Corporation entered into

with the Federal Reserve Bank of New York (the “New York Fed”) and the consent order

dated June 2, 2010 that FirstBank entered into with the FDIC and the Office of the

Commissioner of Financial Institutions of the Commonwealth of Puerto Rico (the “FDIC Order”) that,

among other things, require FirstBank to maintain certain capital levels and reduce its

special mention, classified, delinquent, and non-performing assets; the risk of being subject to

possible additional regulatory actions; uncertainty as to the availability of certain funding

sources, such as brokered CDs; the Corporation’s reliance on brokered CDs and its ability to

obtain, on a periodic basis, approval from the FDIC to issue brokered CDs to fund operations

and provide liquidity in accordance with the terms of the FDIC Order; the risk of not being

able to fulfill the Corporation’s cash obligations or resume paying dividends to the

Corporation’s stockholders in the future due to the Corporation’s inability to receive approval from the

New York Fed or the Board of Governors of the Federal Reserve System (“Federal Reserve

Board”) to receive dividends from FirstBank or FirstBank’s failure to generate sufficient cash flow

to make a dividend payment to the Corporation; the strength or weakness of the real estate

markets and of the consumer and commercial credit sectors and their impact on the credit

quality of the Corporation’s loans and other assets, which has contributed and may

continue to contribute to, among other things, the high levels of non-performing assets, charge-offs,

and provisions and may subject the Corporation to further risk from loan defaults and

foreclosures; the ability of FirstBank to realize the benefit of the deferred tax asset; adverse changes

in general economic conditions in Puerto Rico, the U.S., and the U.S. Virgin Islands and

British Virgin Islands, including the interest rate environment, market liquidity, housing absorption

rates, real estate prices, and disruptions in the U.S. capital markets, which may reduce

interest margins, impact funding sources, and affect demand for all of the Corporation’s products

and services and reduce the Corporation’s revenues, earnings, and the value of the

Corporation’s assets; an adverse change in the Corporation’s ability to attract new clients and retain

existing ones; a decrease in demand for the Corporation’s products and services and lower

revenues and earnings because of the continued recession in Puerto Rico, the current fiscal

problems and budget deficit of the Puerto Rico government and recent credit downgrades of the

Puerto Rico government; a credit default by the Puerto Rico government or any of its

public corporations or other instrumentalities, and recent and/or future downgrades of the

long-term debt ratings of the Puerto Rico government, which could adversely affect economic

conditions in Puerto Rico; the risk that any portion of the unrealized losses in the

Corporation’s investment portfolio is determined to be other-than-temporary, including unrealized losses

on Puerto Rico government obligations; uncertainty about regulatory and legislative changes

for financial services companies in Puerto Rico, the U.S., and the U.S. Virgin Islands and British

Virgin Islands, which could affect the Corporation’s financial condition or performance

and could cause the Corporation’s actual results for future periods to differ materially from prior

results and anticipated or projected results; changes in the fiscal and monetary policies and

regulations of the federal government, including those determined by the Federal Reserve

Board, the New York Fed, the FDIC, government-sponsored housing agencies, and regulators

in Puerto Rico and the U.S. and British Virgin Islands; the risk of possible failure or

circumvention of controls and procedures and the risk that the Corporation’s risk

management policies may not be adequate; the risk that the FDIC may further increase the deposit

insurance premium and/or require special assessments to replenish its insurance fund, causing

an additional increase in the Corporation’s non-interest expenses; the impact on the

Corporation’s results of operations and financial condition of acquisitions and

dispositions; a need to recognize additional impairments on financial instruments, goodwill, or other

intangible assets relating to acquisitions; the risks that downgrades in the credit ratings of

the Corporation’s long-term senior debt will adversely affect the Corporation’s ability to access

necessary external funds; the impact of the Dodd-Frank Wall Street Reform and Consumer

Protection Act on the Corporation’s businesses, business practices, and cost of operations; the

risk of losses in the value of investments in unconsolidated entities that the Corporation

does not control; and general competitive factors and industry consolidation. The Corporation

does not undertake, and specifically disclaims any obligation, to update any

“forward-looking statements” to reflect occurrences or unanticipated events or circumstances after the date

of such statements except as required by the federal securities laws. |

A

turn-around story underscored by steady improvement and organic market share gains in

the core franchise, operating within a challenging macro environment.

Strong, tenured leadership team with a commitment to increasing shareholder value, while

fulfilling our vision to be the most highly regarded financial institution in the markets we

serve.

Improving operating results, together with ongoing efforts to improve efficiencies and further

build-out our core franchise, are our priorities.

Improving our risk profile and maintaining a strong capital position remain central to our

operating philosophy.

Opportunities for additional branch consolidation and market share expansion.

Outlook enhanced by the increasing interest of foreign investment in Puerto Rico and

potential benefits for the underlying economy.

Share price continues to trail capital formation and profitability as TBV ended 4Q14 at

$6.02/share. Our DTA valuation allowance is $516 million.

2

The Value of First BanCorp |

Eastern

Caribbean:

7% of Assets

Franchise Overview

Founded in 1948

Headquartered in San Juan, Puerto

Rico with operations in PR, Eastern

Caribbean (Virgin Islands) and Florida

–

~2,500 FTE employees

(1)

2nd largest financial holding company

in Puerto Rico with attractive business

mix and substantial loan market share

Florida presence with focus on

serving south Florida region

The largest depository institution in

the US Virgin Islands with

approximately 40% market share

164 ATM machines and largest ATM

network in the Eastern Caribbean

Region

(2)

A well diversified operation with over

650,000 retail & commercial

customers

Well diversified with significant competitive strengths

As of December 31, 2014.

1) FTE = Full Time Equivalent.

2) Eastern Caribbean Region or ECR includes United States and British Virgin Islands.

3) Data as of September 30, 2014. Core deposits excludes brokered CDs.

3

10 bank branches

1 Loan Production Office

SE Florida:

11% of Assets

28% of core

deposits

(3)

15% of core

deposits

(3)

12 bank branches

2 First Express branches

Total Assets -

$12.4B

Total Loans -

$9.3B

Total Deposits -

$9.5 |

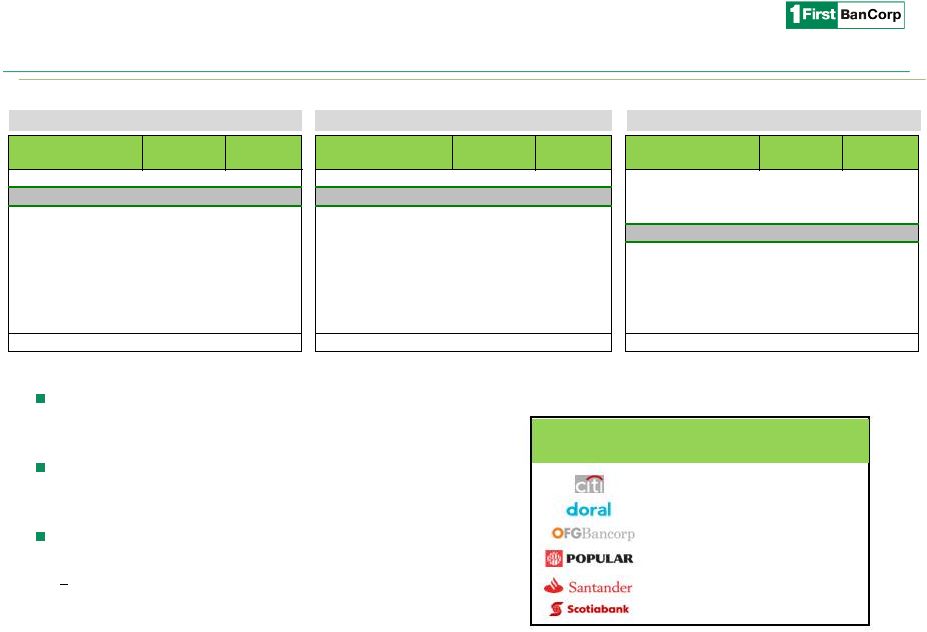

Franchise

Overview ($ in millions)

Well positioned Puerto Rico institution in a consolidating market

Source: PR Market Share Report prepared with data provided by the Commissioner of Financial

Institutions of Puerto Rico as of 9/30/14. 1) Puerto Rico only.

2) Calculated as institution bank branches within a mile of an FBP branch as a percentage of

total institution branches. 3) Alphabetical order.

4

Puerto

Rico

Total

Assets

(1)

Puerto

Rico

Total

Loans

(1)

Puerto

Rico

Deposits,

Net

of

Brokered

(1)

Strong and uniquely positioned franchise in

densely populated regions of core operating

footprint

Strong market share in loan portfolios

facilitates customer relationship expansion and

cross-sell to increase deposit share

Long-term opportunity for additional

consolidation

Branch overlap of greater than 40% with six

Puerto

Rico

institutions

(2)

58

44

100%

40

49

43

Portfolio

Balance

Market

Share

Portfolio

Balance

Market

Share

Portfolio

Balance

Market

Share

1

Banco Popular

$25,164

41.4%

1

Banco Popular

$18,743

40.8%

1

Banco Popular

$18,104

45.8%

2

FirstBank

9,692

16.0%

2

FirstBank

7,735

16.8%

2

Banco Santander

4,803

12.2%

3

Oriental Bank

7,165

11.8%

3

Oriental Bank

4,959

10.8%

3

Oriental Bank

4,408

11.2%

4

Scotiabank

5,925

9.8%

4

Banco Santander

4,603

10.0%

4

FirstBank

4,082

10.3%

5

Banco Santander

5,899

9.7%

5

Scotiabank

4,388

9.5%

5

Scotiabank

3,612

9.1%

6

Doral Bank

3,821

6.3%

6

Other

2,806

6.1%

6

Citibank

2,595

6.6%

7

Citibank

2,501

4.1%

7

Doral Bank

1,994

4.3%

7

Doral Bank

1,449

3.7%

8

Banco Cooperativo

522

0.9%

8

Citibank

583

1.3%

8

Banco Cooperativo

432

1.1%

9

BBU

66

0.1%

9

Banco Cooperativo

168

0.4%

9

BBU

35

0.1%

Total

$60,754

100%

Total

$45,982

100%

Total

$39,520

100%

Institutions

Institutions

Institutions

1-mile

branch

overlap

(3) |

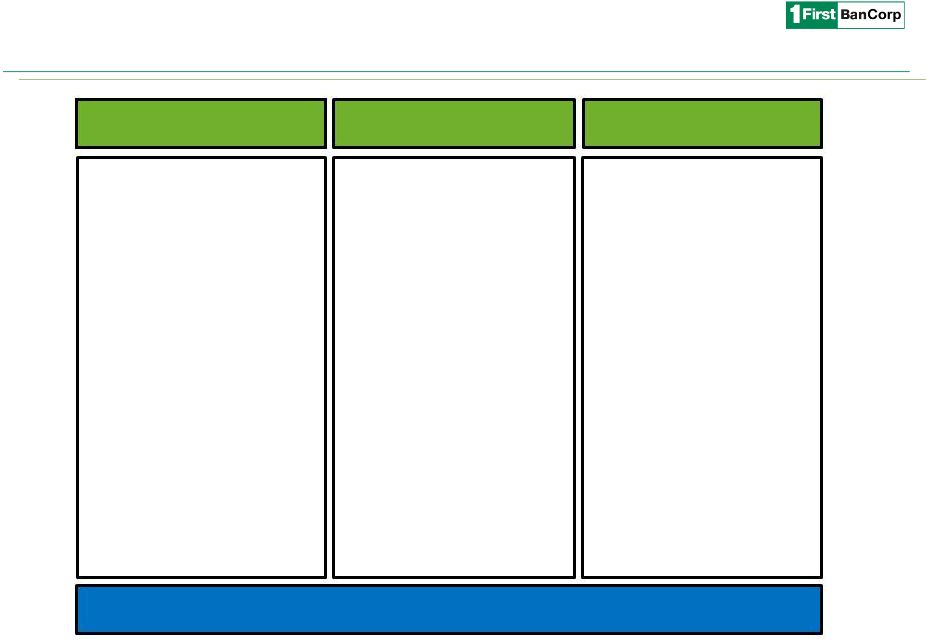

5

Consumer Banking

Mortgage Banking

Commercial Lending

•

Focus on small to middle market

commercial and corporate

borrowers across FBP’s footprint.

Complimented by full suite of

deposit and business products.

•

Balanced risk/return profile to

manage concentration

risk/earnings.

•

Growth opportunities centered in

south Florida region and

expanding lending teams.

•

Building stronger transaction

banking services to target

market share opportunities.

•

Emphasis on cross-sell and core

deposit gathering with recent

launch of new products and

services.

•

Average

origination

(1)

volume

over past 4 quarters of $462

million.

•

Attractive branch network across

densely populated regions in

Puerto Rico, south Florida and the

V.I.

•

Full suite of leading edge deposit

products. Increased emphasis on

transaction processing.

•

Well-diversified, high-yielding

consumer portfolio: auto finance -

#1 market share among banks;

personal loans; and credit card

portfolio.

•

Earnings growth focused on

ongoing market share gains and

product penetration via cross-

selling activities —notably tied to

mortgage, credit cards, personal

loans and auto finance.

•

Average

origination

(1)

volume over

past 4 quarters of $257million.

Diversified business model across all regions

Franchise Overview

1) Originations include purchases, refinancings, and draws from existing revolving and

non-revolving commitments. Strong Governance, Risk Management and Compliance

Culture •

Originate, sale & servicing

model.

•

Production channels centered on

expanding branch network vs.

correspondents/brokers.

•

Target majority conforming

originations .

•

Fannie, Freddie and FHA

Servicer.

•

Recently purchased prime

residential mortgage portfolio

of $192 million from in-market

competitor.

•

Average origination

(1)

volume

over the past 4 quarters of

$159 million. |

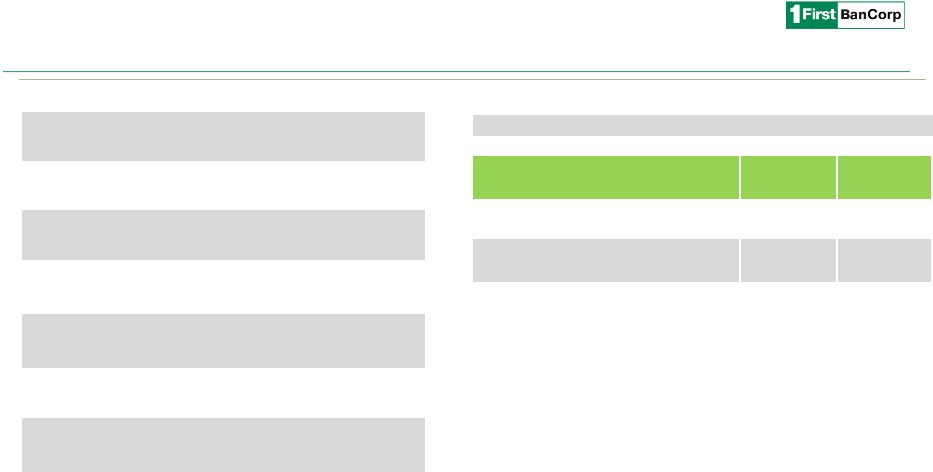

Executing for

Earnings Growth Targeted strategies for growth

6

Puerto Rico Market Share

Puerto Rico

Opportunities for ongoing market share gains

–

Largest opportunity on deposit products, electronic

banking & transaction services

–

Growth in selected loan products for balanced

risk/return to manage risk concentration and diversify

income sources

–

FirstBank-branded credit card portfolio continues to

broaden and deepen relationships, while diversifying

revenue stream

SE Florida

Expansion prospects in Florida given long-term

demographic trends

–

Continue focus in core deposit growth, commercial

and transaction banking and conforming residential

mortgages

–

Lending teams generating growth in loan portfolio

Virgin Islands

Solidify leadership position by further increasing

customer share of wallet

16.8%

16.0%

11.8%

10.3%

21.8%

19.9%

18.9%

17.1%

16.3%

8.4%

18.5%

11.1%

7.3%

4.4%

Total Loans

Total Assets

Branches

Deposits, net of brokered

Small Loans

Commercial Loans

Auto Loans & Leasing

Credit Cards

Residential Mortgage

Personal Loans

POS Terminals

ATM Terminals

Debit Cards

ACH Transactions

2

3Q 2014

4

2

2

2

2

4

2

2

4

2

3

3

6 |

7

Effectively executing strategic plan as we continue to strengthen our core franchise across our

three geographies and further de-risk the balance sheet

Profitability: Achieved our most profitable year since return to

profitability… FY 2014 net income

$87.8 million, or $0.42 share, compared to adjusted 2013 net income of $45.4 million;

Posted a strong pre-tax pre-provision income for 2014 of $206 million compared to $184

million in 2013; Prudently managed expense base reducing non-interest expense by

$24.4 million (excluding impact of 2013 bulk sales); and

Re-aligned branch network for optimal efficiency and made significant investments in a new

technology platform, new products and talent management.

Core Deposits: Continued building product capabilities and deepening

relationships…

According

to

recent

study

(1)

bank

customers

ranked

FirstBank

highest

for

“Likelihood

to

Recommend”

among

PR

banks;

FirstBank also ranked highest among PR banks

(2)

for “Offering attractive products and services”

Increased deposits net of brokered and government by $164 million, or 3%, during 2014;

and Reduced reliance on brokered CDs by $255 million compared to FY 2013.

Loan Originations: Key strength of the franchise… $3.5 billion of originations for 2014 at healthy

levels as we selectively pursue loans in a challenging market and leverage on our

improved franchise in Florida;

Purchased two residential portfolios from a competitor during 2014; and

Continue to build Commercial, Mortgage and Consumer books across our markets.

Asset Quality: Remains our top priority… Stabilized NPA migration, NPAs relatively flat, down

$8 million compared to FYE 2013; NPAs are in a much better disposition state -

commercial NPLs net carrying amount of 58%; and

Continue to focus on options to accelerate disposition of NPAs.

Capital Position:

Continues to grow stronger…

Strong capital position allowing us to continue to address our legacy asset issues and growth

opportunities; U.S. Treasury sold 4.4 million shares during 2014 reducing

ownership stake to 7.2% and continues selling efforts; and TBV/Share grew to $6.02 from

$5.30 in 2013. Fiscal Year 2014

Highlights

(1)

Source: Ipsos Advertising Tracking Study 2nd Wave Oct-Nov 2014

(2)

Source: Financial Behavior of Individuals: Puerto Rico Gaither /

Inmark |

Profitability

•

Net income of $26.3 million, or $0.12 per diluted share, up 13% compared to $23.2 million in

3Q 2014.

•

During 4Q 2014 Net interest margin decreased by 3 basis points to 4.09%.

•

Pre-tax, pre-provision income of $49.6 million compared to $50.8 million in 3Q

2014. Asset Quality

•

Total NPAs decreased by $27.7 million compared to 3Q 2014. No large nonperforming loan sales

were completed during the quarter.

•

Inflows

to

nonperforming

loans

decreased

by

$16.9

million

or

21%

compared

to

3Q

2014.

•

Provision

for

loan

and

lease

losses

of

$23.9

million

compared

to

$27.0

million

in

3Q

2014

a

$3.1

million decline.

•

Net charge-offs of $26.9 million declined from $42.7 million in 3Q 2014, the decrease was

primarily reflected in the commercial and industrial loan portfolio.

Core Deposits

•

Deposits, net of government and brokered, increased by $25.5 million in 4Q 2014.

•

Government deposits decreased $68.0 million in 4Q 2014.

•

Brokered certificates of deposit (CDs) decreased by $176.7 million in 4Q 2014.

Capital

•

4Q 2014 Capital position was further strengthened:

Risk Based Capital Ratio 19.2% compared to 18.6% in 3Q 2014;

Tier 1 Ratio 17.9% compared to 17.3% in 3Q 2014; and

Leverage Ratio 12.5% compared to 12.3% in 3Q 2014.

•

Book value per common share of $6.25 compared to $6.05 in 3Q 2014.

•

Tangible book value per common share of $6.02 compared to $5.81 in 3Q 2014.

•

Deferred Tax Asset valuation allowance of $516 million.

8

Fourth Quarter 2014

Highest Net Income Quarter Since Return to Profitability |

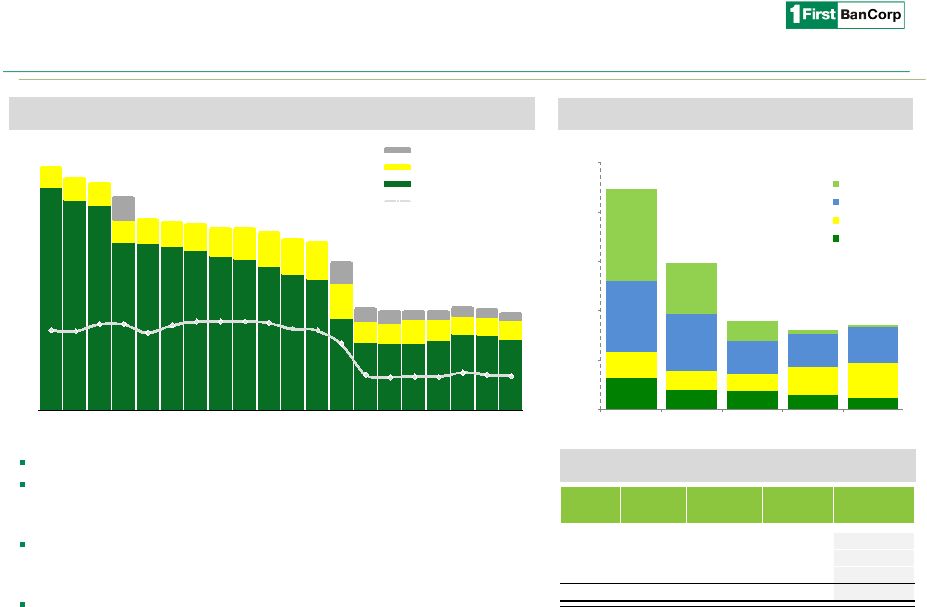

Ongoing

Improvement in Risk Profile 9

Net Charge-offs (NCO)

Non-performing Assets (NPA)

NPAs are down over $1 billion, or 56%, since the peak in 1Q 2010.

Commercial NPLs are being carried at 58.0% of unpaid principal balance,

net of specific reserves. Commercial REOs are carried at approximately

42% of UPB.

Focus remains on controlling migration and the reduction of

nonperforming assets, including the disposition of $192 million of HFS

and OREO.

We continue to move many complex credit cases to a position in which

the asset can be marketed and sold.

(1)

($ in millions)

(2)

Commercial

NPLs

(Includes

HFS)

(3)

Product

Book

Value

Accum.

Charge-offs

Reserves

Net Carrying

Amount

(4)

C&I

$122.5

$51.0

$15.5

61.7%

Const.

77.2

98.5

2.9

42.3%

CRE

155.3

60.9

8.6

67.9%

Total

$355.0

$210.4

$26.9

58.0%

63

39

37

29

23

54

38

35

56

71

142

118

67

68

73

186

101

41

7

5

$445

$296

$180

$160

$172

$-

$100

$200

$300

$400

$500

2010

2011

2012

2013

2014

Construction

Commercial

Consumer

Residential

2010

2011

2012

2013

2014

1,639

1,551

1,506

1,239

1,233

1,208

1,184

1,138

1,119

1,066

1,008

976

683

506

498

496

522

565

560

524

150

150

163

163

172

176

188

194

213

242

251

260

256

151

147

175

154

138

130

138

159

148

95

80

55

55

55

55

55

1,790

1,701

1,669

1,562

1,410

1,390

1,377

1,337

1,332

1,308

1,259

1,238

1,087

752

726

725

731

757

744

717

9.5%

10.0%

9.3%

10.2%

10.2%

9.6%

8.4%

5.7%

5.7%

6.1%

5.9%

5.8%

$0

$400

$800

$1,200

$1,600

$2,000

1Q

2Q

3Q

4Q

1Q

2Q

3Q

4Q

1Q

2Q

3Q

4Q

1Q

2Q

3Q

4Q

1Q

2Q

3Q

4Q

NPLs Held for Sale

Repossessed Assets & Other

Loans Held for Investment

NPAs / Assets

Proactively managing asset quality

1) Excludes $165 million of net charge-offs associated with the bulk sale to CPG in

2010. 2) Excludes $232 million of net-charge offs associated with the bulk

asset sales and transfer of loans in 2013. 3) December 31, 2014.

4) Net Carrying Amount = % of carrying value net of reserves and accumulated charge-offs.

|

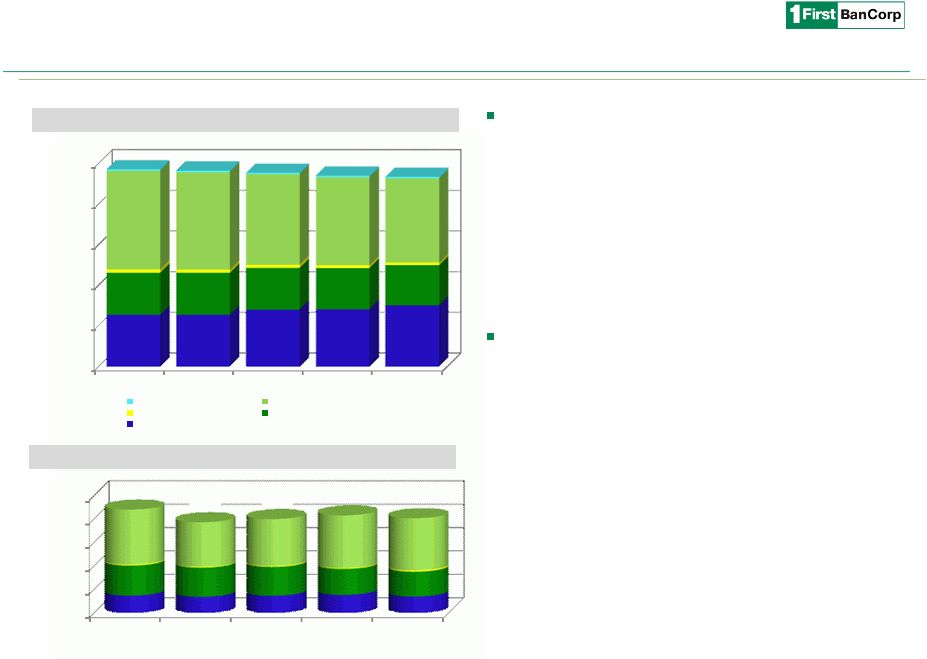

Despite

softening in our market, we continue selectively pursuing high quality loans:

–

Increase in residential mortgages through pool

purchased from competitor.

–

Reduction in the commercial book includes the pay-

off of two commercial loans and the sale of loan

participations as part of our de-risking strategies.

–

Focus on growth opportunities within our markets.

Origination and renewal activity at $891 million for 4Q

2014 at healthy levels compared to prior quarters:

–

Softening consumer demand persists in our main

market.

–

Executing within a more challenging market

environment in Puerto Rico during 2015 and continue

building on Florida growth opportunities.

–

The FL market produced approximately $85 million in

commercial origination volume in 4Q compared to

$71 million in 3Q.

10

Loan Portfolio

1) Originations include purchases, refinancings, and draws from existing revolving and

non-revolving commitments. Business Model Driven by Strong Origination

Capabilities Loan Originations

(1)

($ in millions)

Rebuilding and replacing to achieve higher quality portfolio

Loans Held for Sale

Commercial

Construction

Consumer & Finance Leases

Residential Mortgage

$0

$2,000

$4,000

$6,000

$8,000

$10,000

4Q 2013

1Q 2014

2Q 2014

3Q 2014

4Q 2014

2,549

2,548

2,795

2,820

3,011

2,067

2,072

2,062

2,027

1,983

169

153

148

142

123

4,852

4,794

4,461

4,327

4,145

76

79

72

80

77

$9,712

$9,646

$9,539

$9,395

$9,339

-

$220

$440

$660

$880

$1,100

4Q 2013

1Q 2014

2Q 2014

3Q 2014

4Q 2014

162

151

161

169

154

284

275

272

245

235

9

6

7

7

12

517

421

442

496

490

$972

$853

$882

$917

$891

$ |

2014 Consumer

Loan Composition Well Balanced Loan Portfolio Mix

11

2014 Commercial Loan Composition

2014 Residential Loan by Geography

Diversified sources of revenue

Our well-diversified business model within

commercial, consumer and residential across

three unique regions allows us to be agile when

responding to growth opportunities.

Commercial represents 46%, residential

represents 33% and consumer represents 21%

of the total loan portfolio.

23% of Residential portfolio is located outside of

Puerto Rico

54%

12%

15%

10%

5%

2%

2%

Auto

Lease Finance

Credit Card

Personal Loans

Small Loans

Boat

Other

39%

3%

55%

3%

Commercial Mortgage

Construction

Commercial & Industrial

Floor Plans

77%

12%

11%

Puerto Rico

South Florida

Virgin Islands

1) Loan portfolio mix percentages exclude $77 million loans held for sale. |

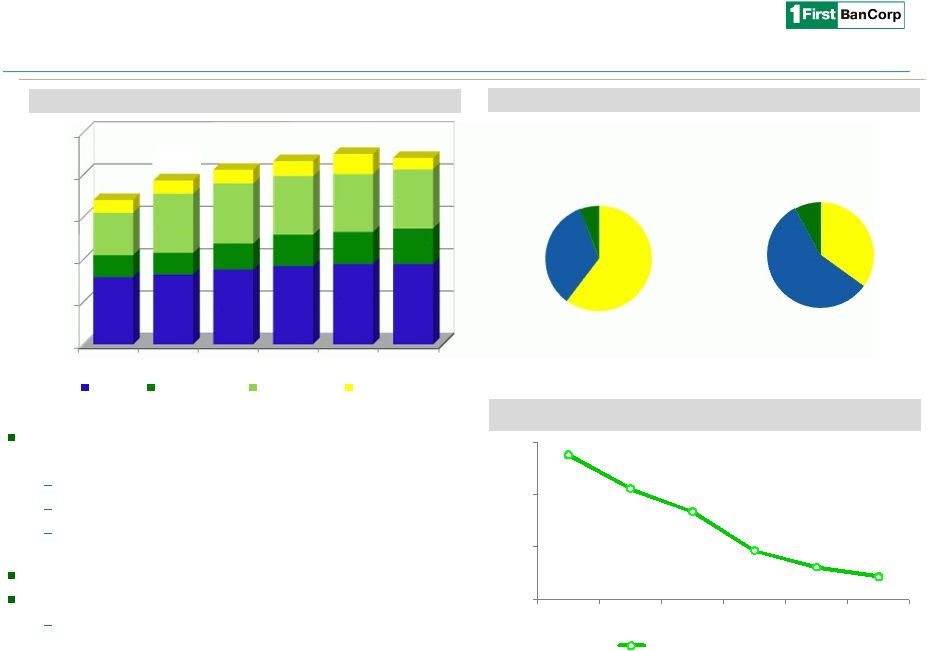

Core deposit

growth strategy continues producing positive results; $1.5 billion since 2009.

Florida continues to be a strong funding source.

Focus remains on cross-selling opportunities.

2014 core deposits declined due to an anticipated

reduction in government deposits.

Cost of deposits, net of brokered CDs, decreased to 0.72%.

Continue to improve by reducing reliance on brokered CDs:

$2.9 billion (30% of deposits) today vs. $7.6 billion

(60%) in 2009.

12

Core

Deposits

(1)

Total Deposit Composition

Cost

of

Deposits

(1)

Brokered CDs

30%

Non-interest

bearing

10%

Interest bearing

60%

4Q 2014

1) Total Deposits excluding Brokered CDs.

Favorable Funding Mix Shift

Successful deposit growth over recent years

Brokered CDs

60%

Non-interest

bearing

6%

Interest bearing

34%

4Q 2009

($ in millions)

1.88%

1.56%

1.34%

0.97%

0.81%

0.72%

0.50%

1.00%

1.50%

2.00%

2009

2010

2011

2012

2013

2014

Total Deposits, Net of Brokered

$-

$1,500

$3,000

$4,500

$6,000

$7,500

2009

2010

2011

2012

2013

2014

2,381

2,477

2,654

2,776

2,842

2,841

774

763

915

1,108

1,136

1,263

1,505

2,090

2,126

2,077

2,054

2,092

448

470

481

529

706

401

$5,108

$5,800

$6,176

$6,490

$6,738

$6,597

Retail

Commercial

CDs & IRAs

Public Funds |

Income

Statement 4Q 2013

1Q 2014

2Q 2014

3Q 2014

4Q 2014

GAAP Net Interest Income

132.7

$

131.3

$

129.9

$

127.7

$

129.2

$

Provision for loan and lease losses

23.0

31.9

26.7

27.0

23.9

Non-interest income

18.4

18.0

16.6

16.2

17.9

Equity in (losses) gains of unconsolidated entities

(5.9)

(6.6)

(0.7)

-

-

Non-interest expense

106.5

92.8

98.1

93.6

94.8

Pre-tax net income

15.6

18.0

21.0

23.3

28.4

Income tax (expense) benefit

(0.8)

(0.9)

0.3

0.1

2.1

Net income

14.8

$

17.1

$

21.2

$

23.2

$

26.3

$

Adjusted Pre-tax pre-provision earnings

47.6

$

56.9

$

48.6

$

50.8

$

49.6

$

Net Interest Margin, (GAAP) (%)

4.25%

4.27%

4.21%

4.14%

4.18%

Net income per common share-basic

0.07

$

0.08

$

0.11

$

0.11

$

0.12

$

Tangible book value per common share

5.30

$

5.48

$

5.72

$

5.81

$

6.02

$

Improving Core Performance

Opportunities for earnings growth

($ in millions, except per share results)

1)

See reconciliation on page 21.

2)

See reconciliation on page 22.

(1)

13

Opportunity for revenue expansion and earnings growth

Potential for NIM expansion as low interest rate environment affects both liquidity

reinvestment and floating rate loan yields. Additional income opportunities through

replacement of NPLs with performing loans and reduced provisioning needs.

Future earnings potential with a reduction in high costs associated with managing NPLs and

OREO. Potential for additional loan growth opportunities as macro environment in Puerto

Rico improves. Long-term potential for value creation from consolidation in Puerto

Rico. Net income of $26.3 million in 4Q 2014; highest net income since

return to profitability.

Pre-tax pre-provision income of $49.6 million

(1)

average 5 quarters of $51 million.

(2) |

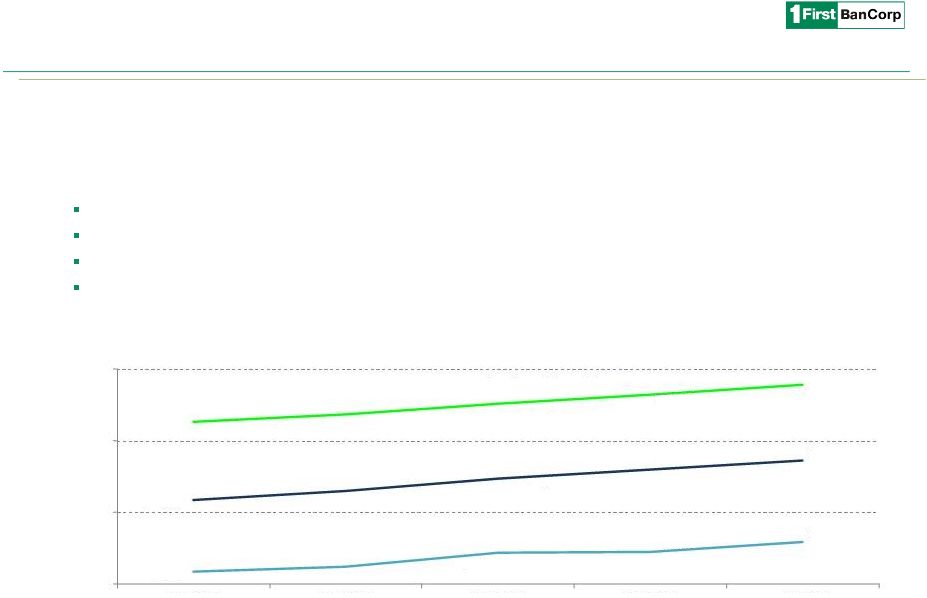

Earnings Continue

to Drive Capital Growth 14

Tier 1 Common of $1.3 billion or 14.9% and Tier 1 capital of 17.9%.

Book value per common share of $6.25 compared to $5.57 in 2013.

Tangible book value per common share of $6.02

(1)

compared to $5.30 in 2013.

Deferred Tax Asset Valuation Allowance of $516m; Adjusted Tangible Book Value

(2)

of $8.44 / share.

17.1%

Total Risk Based Capital

18.6%

19.2%

12.7%

Tier 1 Common

14.4%

14.9%

8.7%

Tangible Common

9.8%

10.4%

8.0%

12.0%

16.0%

20.0%

4Q 2013

1Q 2014

2Q 2014

3Q 2014

4Q 2014

1)

See reconciliation to total equity on page 22. 2)

Assuming 100% reversal of Deferred Tax Asset Valuation Allowance of $516m;

shares outstanding of 213m. See reconciliation to adjusted tangible book value on page 22.

Healthy capital levels |

A

turn-around story underscored by steady improvement and organic market share gains in

the core franchise, operating within a challenging macro environment.

Strong, tenured leadership team with a commitment to increasing shareholder value, while

fulfilling our vision to be the most highly regarded financial institution in the markets we

serve.

Improving operating results, together with ongoing efforts to improve efficiencies and further

build-out our core franchise, are our priorities.

Improving our risk profile and maintaining a strong capital position remain central to our

operating philosophy.

Opportunities for additional branch consolidation and market share expansion.

Outlook enhanced by the increasing interest of foreign investment in Puerto Rico and

potential benefits for the underlying economy.

Share price continues to trail capital formation and profitability as TBV ended 2014 at

$6.05/share. Our DTA valuation allowance is $516 million.

15

The Value of First BanCorp |

Appendix

|

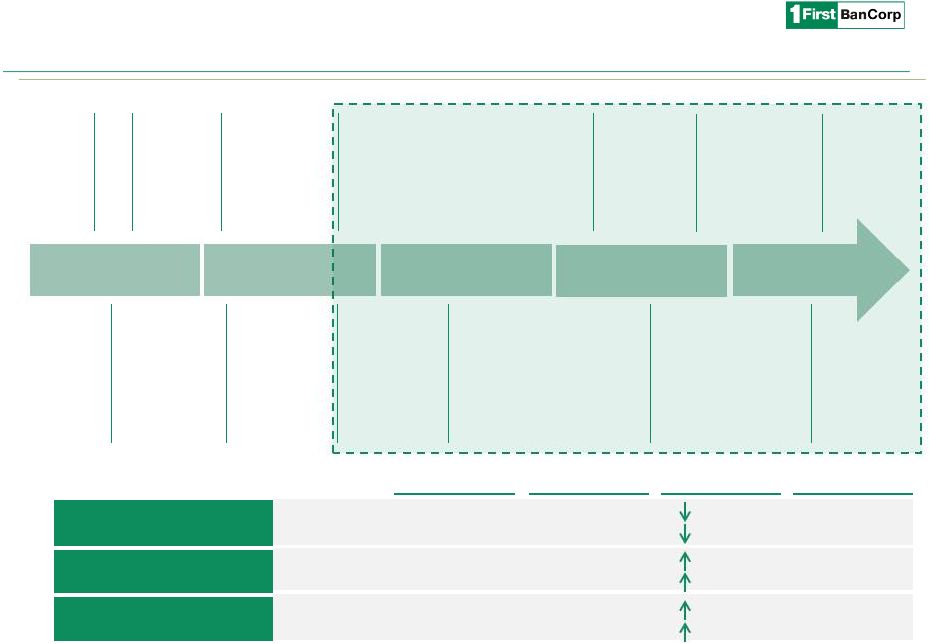

2009

2014

Change ('09-'14)

% improvement

NPAs

$1,711

$717

$994

58%

NPAs/assets

8.7%

5.8%

294 bps

Tier 1 Common

4.1%

14.9%

1083 bps

125%

TCE / TA

3.2%

10.4%

715 bps

105%

Core deposits

$5,108

$6,597

$1,489

29%

NIM

2.69%

4.20%

151 bps

Our Turnaround Story

($ in millions)

De-Risking of Balance Sheet

Capital

Enhanced Franchise Value

17

1) Represents change in dollar amount.

(1)

(1)

(1)

(1)

June 2010:

Written

Agreement

with the FED

and Consent

Order with

FDIC

July 2010:

The U.S.

Treasury

exchanged

TARP for

convertible

preferred

August 2010:

Exchange of

89% Perpetual

Preferred

Stock for

Common

February 2011:

Sale of non-

performing

loans with a

book value of

$269 million

Feb-April 2011:

Sale of $330

million of MBS

and $518

million of

performing

residential

mortgages

March 2013:

Sale of non-performing

loans with a book value

of $217.7 million and

entered two separate

agreements for sale of

NPLs with a book value

of $99 million

2010

2011

2014

October 2011:

Conversion of

the shares held

by the U.S.

Treasury into

32.9 million

shares of

common stock

May 2012:

Acquisition of a

$406 million

portfolio of

FirstBank-

branded credit

cards from FIA

June 2013:

Write-off of $66.6

million collateral

pledged to

Lehman, sale of

NPLs with book

value of $203.8

million and $19.2

million of OREO

October 2011:

Private placement

of $525 million in

common stock.

Lead investors

included Thomas H.

Lee & Oaktree

2012

August 2013:

Completed

secondary

offering reducing

ownership

interest of U S

Treasury and PE

Investors

2013

September 2014:

Achieved five

consecutive

quarters of

profitability.

Average PPPT

income over

five quarters

$51 million

September 2014:

UST announced on

September 9

its

first predefined

written trading

plan, in which it

will be selling it’s

position in FBP.

December 2014:

UST released a

report that as of

12/5/14 it had

sold 4.4 million

shares. UST

ownership at

7.7%.

th |

Non-performing Assets

1) Collateral pledged with Lehman Brothers Special Financing, Inc.

18

($ in thousands)

2009

2010

2011

2012

2013

1Q 2014

2Q 2014

3Q 2014

2014

Non-performing loans held for investment:

Residential mortgage

441,642

$

392,134

$

338,208

$

313,626

$

161,441

$

172,796

$

175,404

$

185,025

$

180,707

$

Commercial mortgage

196,535

217,165

240,414

214,780

120,107

145,535

166,218

169,967

148,473

Commercial & industrial

241,316

317,243

270,171

230,090

114,833

113,996

143,669

130,917

122,547

Construction

634,329

263,056

250,022

178,190

58,866

50,387

38,830

30,111

29,354

Consumer & finance leases

50,041

49,391

39,547

38,875

40,302

39,061

40,510

43,496

42,815

Total non-performing loans held for investment

1,563,863

1,238,989

1,138,362

975,561

495,549

521,775

564,631

559,516

523,896

OREO

69,304

84,897

114,292

185,764

160,193

138,622

121,842

112,803

124,003

Other repossessed property

12,898

14,023

15,392

10,107

14,865

15,587

16,114

17,467

14,229

Other assets

(1)

64,543

64,543

64,543

64,543

-

-

-

-

-

Total non-performing assets, excluding loans held for sale

1,710,608

1,402,452

1,332,589

1,235,975

670,607

675,984

702,587

689,786

662,128

Non-performing loans held for sale

-

159,321

4,764

2,243

54,801

54,755

54,755

54,641

54,641

Total non-performing assets

1,710,608

$

1,561,773

$

1,337,353

$

1,238,218

$

725,408

$

730,739

$

757,342

$

744,427

$

716,769

$ |

Quarterly Migration

Trends ($ in thousands)

19

Residential

Mortgage

Commercial

Mortgage

Commercial &

Industrial

Construction

Consumer

Total

Beginning balance

185,025

$

169,967

$

130,917

$

30,111

$

43,496

$

559,516

$

Plus:

Additions to non-performing

27,554

10,045

5,931

809

19,828

64,167

Less:

Non-performing loans transferred to OREO

(3,829)

(21,120)

(2,194)

(118)

(272)

(27,533)

Non-performing loans charged-off

(4,333)

(3,423)

(2,345)

(78)

(14,284)

(24,463)

Loans returned to accrual status /

collections (23,710)

(6,996)

(9,762)

(1,370)

(5,953)

(47,791)

Ending balance

180,707

$

148,473

$

122,547

$

29,354

$

42,815

$

523,896

$

Residential

Mortgage

Commercial

Mortgage

Commercial &

Industrial

Construction

Consumer

Total

Beginning balance

175,404

$

166,218

$

143,669

$

38,830

$

40,510

$

564,631

$

Plus:

Additions to non-performing

35,645

11,985

13,967

122

19,392

81,111

Less:

Non-performing loans transferred to OREO

(2,216)

(1,058)

(2,124)

(749)

(103)

(6,250)

Non-performing loans

charged-off (4,445)

(2,292)

(17,570)

(7,689)

(13,773)

(45,769)

Loans returned to accrual status /

collections (19,363)

(4,886)

(7,025)

(403)

(2,530)

(34,207)

Ending balance

185,025

$

169,967

$

130,917

$

30,111

$

43,496

$

559,516

$

December 31, 2014

September 30, 2014 |

Puerto Rico

Government Exposure 20

As of December 31, 2014

($ in millions)

Total asset exposure to the Puerto Rico

Government was $400 million of which

$369 million was outstanding as of

December 31, 2014, down $8 million

compared to 3Q 2014 and over $100

million compared to $470 million 4Q

2013.

In addition, there is $133 million of

indirect exposure to the Tourism

Development Fund supporting hotel

projects down from $200 million in 3Q

2014.

Total Government Deposits as of

December 31, 2014 were $227 million.

Time deposits declined $3.4 million

compared to 3Q 2014.

Transaction accounts decreased $20.0

million compared to 3Q 2014.

Total

Government Unit

Outstanding

Investment Portfolio

61.2

$

Central Government:

Commonwealth Appropriations

7.1

Federal Funds

6.1

Total Central Government (2 Loans)

13.2

Public Corporations:

Operating Revenues

89.5

Rental Income

3.9

Total Public Corporations (3 Loans)

93.4

Municipalities (10 Loans)

Property Tax Revenues

201.4

Total Direct Government Exposure

369.2

$

Source of Repayment

Government Unit

Time

Deposits

Transaction

Accounts

Total

Federal Funds

-

$

-

$

-

$

Municipalities

17.7

104.7

122.4

Public Agencies

1.7

101.9

103.6

Public Corporations

-

1.4

1.4

Total Deposits

19.3

$

208.1

$

227.4

$ |

Adjusted

Pre-tax, Pre-provision Income Reconciliation 21

($ in thousands)

4Q 2013

1Q 2014

2Q 2014

3Q 2014

4Q 2014

Income (loss) before income taxes

15,634

$

17,970

$

20,949

$

23,264

$

28,391

$

Add: Provision for loan and lease losses

22,969

31,915

26,744

26,999

23,872

Add: Net loss on investments and impairments

-

-

(291)

245

172

Less: Unrealized gain (loss) on derivatives instruments and

liabilities measured at fair value

(355)

(313)

(262)

(418)

(265)

Less: Prepayment penalty on commercial loan tied to an interest

rate swap

-

-

-

-

(2,546)

Add: Acquisition of mortgage loans from Doral related expenses

-

-

576

659

-

Less: National gross receipt tax - outside Puerto Rico (1)

(473)

-

-

-

-

Add: Branch consolidations and other restructuring

expenses/valuation adjustments

1,421

718

236

-

-

Add: Write-off collateral pledged to Lehman and related expenses

2,500

-

-

-

-

Add: Equity in losses (earnings) of unconsolidated entities

5,893

6,610

670

-

-

Adjusted pre-tax, pre-provision income

47,589

$

56,900

$

48,622

$

50,750

$

49,624

$

Quarter Ended

(1) Represents the impact of the national gross receipt tax related to the trade or business

outside of Puerto Rico that was reversed in the fourth quarter after enactment of Act No. 117. |

4Q 2013

1Q 2014

2Q 2014

3Q 2014

4Q 2014

Tangible equity:

Total equity - GAAP

1,216

$

1,256

$

1,306

$

1,324

$

1,367

$

Preferred equity

(63)

(57)

(36)

(36)

(36)

Goodwill

(28)

(28)

(28)

(28)

(28)

Purchased credit card relationship

(20)

(19)

(18)

(17)

(16)

Core deposit intangible

(7)

(7)

(6)

(6)

(5)

Tangible common equity

1,098

$

1,145

$

1,218

$

1,237

$

1,281

$

Common shares outstanding

207

209

213

213

213

Tangible book value per common share

5.30

$

5.48

$

5.72

$

5.81

$

6.02

$

Deferred tax valuation allowance

523

$

519

$

511

$

505

$

516

$

Deferred tax valuation allowance per share

2.53

2.48

2.40

2.37

2.42

Adjusted tangible book value per share

7.83

$

7.97

$

8.12

$

8.18

$

8.44

$

Tangible Book Value Per Share Reconciliation

22

($ in millions, except for per share data)

1) Assuming 100% recapture of valuation allowance.

(1) |

Stock

Profile 23

Trading Symbol:

•

FBP

Exchange:

•

NYSE

Share

Price

(2/6/15):

•

$6.30

Shares Outstanding

(as of December 31, 2014): •

213,004,449

Market Capitalization

(2/6/15):

•

$1.3 billion

1 Yr. Average Daily Volume:

•

811,3488

Price

(2/6/15)

to

Tangible

Book

(12/31/14):

•

1.05x

5% of more Beneficial Ownership

Beneficial Owner

Amount

Percent of

Class

Entities affiliated with Thomas H. Lee

Partners, L.P.

41,851,067

19.6%

Entities managed by Oaktree Capital

Management, L.P.

41,851,066

19.6%

United States Department of the

Treasury

(1)

16,577,452

7.7%

1) Includes the U.S. Treasury warrant that entitles it to purchase up to 1,285,899 shares of

Common Stock at an exercise price of $3.29 per share, as adjusted as a result of the issuance of

shares of Common Stock in the Corporation’s $525m private placement of Common Stock

completed in October 2011. The exercise price and the number of shares issuable upon exercise

of the warrant are subject to further adjustments under certain circumstances to prevent

dilution. The warrant has a 10-year term from its issue date and is exercisable in whole or in part

at any time. On December 9, 2014, the UST released a report showing that it had

sold 4.4 million shares through its First Predefined Written Trading Plan announced on September 9,

2014 and lasting 90 days. The reduction is reflected in the total. |