Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Citizens Community Bancorp Inc. | a8kinvslidepresentation201.htm |

Exhibit 99.1 Citizens Community Bancorp, Inc.

Cautionary Note Regarding Forward Looking Statements This presentation includes forward-looking statements about the financial condition, results of operations and business of Citizens Community Bancorp, Inc. and its wholly owned subsidiary, Citizens Community Federal N.A. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. These statements may be identified by the use of forward-looking words or phrases such as “anticipate,” “believe,” “could,” “expect,” “intend,” “may,” “planned,” “potential,” “should,” “will,” “would” or the negative of those terms or other words of similar meaning. These forward-looking statements are intended to be covered by the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements in this presentation are inherently subject to many uncertainties in our operations and business environment. These uncertainties include general economic conditions, in particular, relating to consumer demand for our products and services; our ability to maintain current deposit and loan levels at current interest rates; deteriorating credit quality, including changes in the interest-rate environment reducing interest margins; prepayment speeds, loan origination and sale volumes, charge-offs and loan loss provisions; and other matters described in the Company's SEC filings, including under the section "Risk Factors" in Item 1A of the Company's Form 10-K Report for the fiscal year ending September 30, 2014. Shareholders, potential investors and other readers are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements made herein are only made as of the date of this presentation and we undertake no obligation to publicly update such forward- looking statements to reflect subsequent events or circumstances occurring after the date of this presentation. The Freedom to Simply BankTM

Mission Statement Be an independent community bank known for integrity, providing high-quality financial services to our clients and promoting growth and stability in the communities we serve. The Freedom to Simply BankTM

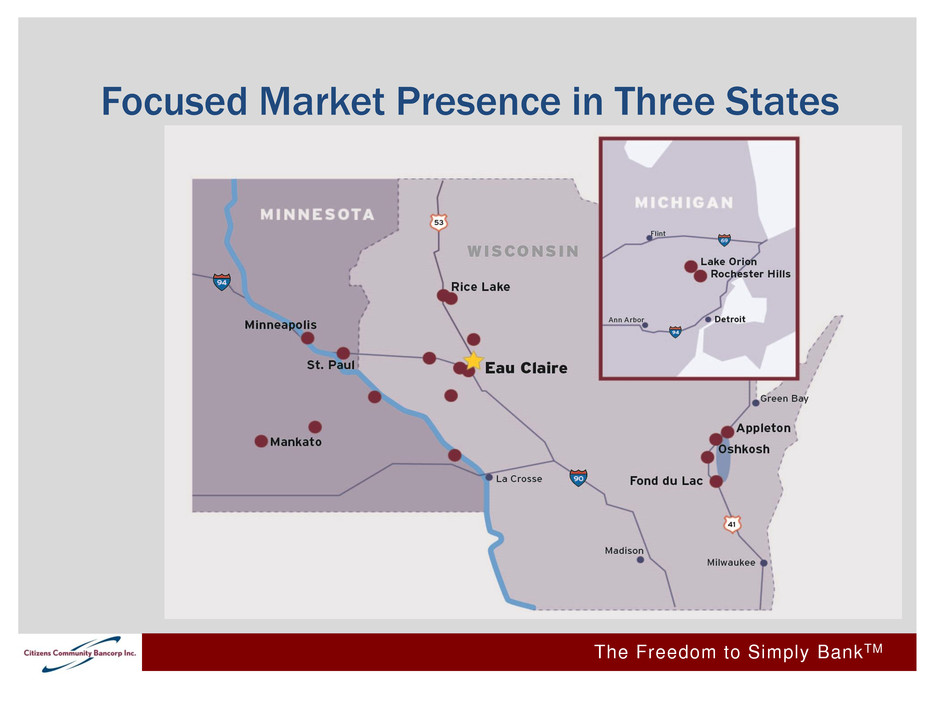

Overview • Based in Eau Claire County, Wis., Citizens Community Federal N.A. serves more than 50,000 customers in Wisconsin, Minnesota and Michigan • 20 branches, including 11 locations in Walmart Supercenters • Key markets include: – Eau Claire/Rice Lake, Wis. MSA – Fox Valley Wisconsin MSA – Mankato, Minn. MSA – Minneapolis/St. Paul MSA – Oakland County Michigan MSA • Full service retail and commercial banking The Freedom to Simply BankTM

Focused Market Presence in Three States The Freedom to Simply BankTM

Aligning Our Company for Growth • Building our core business through product enhancement and efficiency improvements • Expand our presence in attractive growth markets • Trim unproductive assets, “rightsizing” our branch network • Maintain balance sheet strength through high quality credit and underwriting standards • New Rice Lake, Wis. branch strengthens presence in key market (opened December 2013) • New Mankato, Minn. full-service branch to generate retail, commercial banking opportunities in regional hub (scheduled to open July 2015) The Freedom to Simply BankTM

-40% -20% 0% 20% 40% 60% 80% 100% 120% CZWI NASDAQ Bank SNL U.S. Bank $500M-$1B 5-Year CZWI Price Reflects Performance The Freedom to Simply BankTM

Accelerating Financial Trends • Net Income • Interest Income • Margin and Cost of Funds • Loan and Deposit Expansion • Asset Quality The Freedom to Simply BankTM

$193 $206 $1,047 $1,783 $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 $1,800 $2,000 FY2011 FY2012 FY2013 FY2014 (In $000) Net Income Demonstrates Focus on Profitability The Freedom to Simply BankTM

$14,987 $16,054 $16,120 $17,848 $13,000 $14,000 $15,000 $16,000 $17,000 $18,000 FY2011 FY2012 FY2013 FY2014 (In $000) Net Interest Income After Provision The Freedom to Simply BankTM

$2,528 $2,761 $3,296 $3,662 $0 $1,000 $2,000 $3,000 $4,000 FY2011 FY2012 FY2013 FY2014 (In $000) Total Non-interest Income (net of impairment and gain/loss on sale of AFS securities) The Freedom to Simply BankTM

3.77% 3.94% 3.62% 3.61% 1.72% 1.39% 1.10% 0.85% 0.50% 1.50% 2.50% 3.50% 4.50% FY2011 FY2012 FY2013 FY2014 Net Interest Margin Cost of Funds Cost of Funds / Net Interest Margin The Freedom to Simply BankTM

$448,973 $422,058 $447,398 $449,767 $400,000 $410,000 $420,000 $430,000 $440,000 $450,000 $460,000 FY2011 FY2012 FY2013 FY2014 (In $000) Total Deposits The Freedom to Simply BankTM

Demand & Savings Account Growth $0 $15,000 $30,000 $45,000 $60,000 $75,000 FY2011 FY2012 FY2013 FY2014 The Freedom to Simply BankTM $51,310 $54,446 $62,260 $66,642 (In $000)

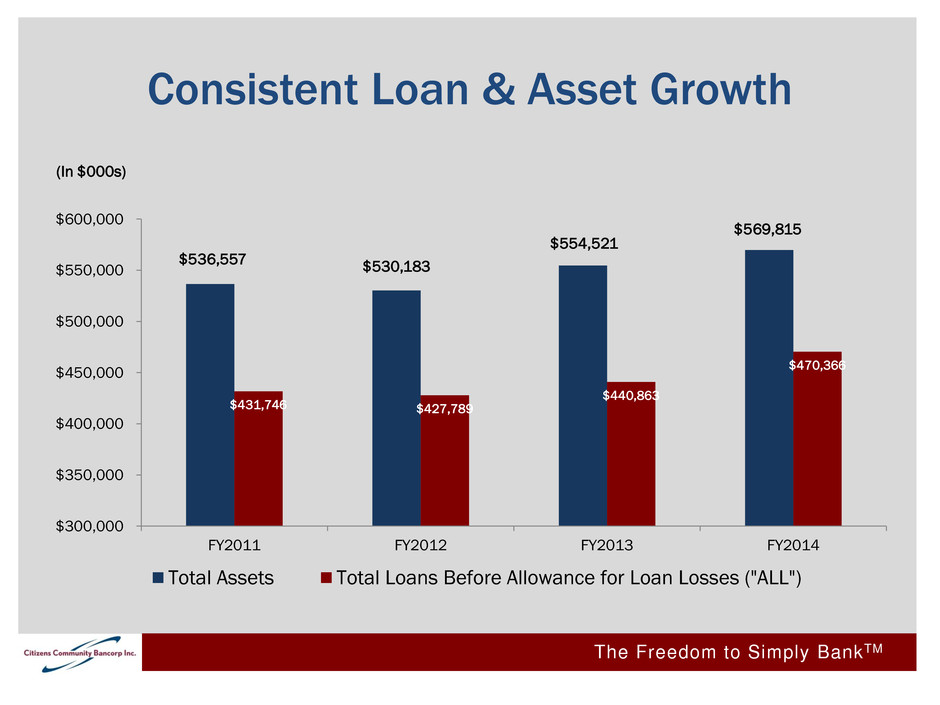

Consistent Loan & Asset Growth $536,557 $530,183 $554,521 $569,815 $431,746 $427,789 $440,863 $470,366 $300,000 $350,000 $400,000 $450,000 $500,000 $550,000 $600,000 FY2011 FY2012 FY2013 FY2014 Total Assets Total Loans Before Allowance for Loan Losses ("ALL") The Freedom to Simply BankTM (In $000s)

Loan Portfolio Diversification $0 $50,000 $100,000 $150,000 $200,000 $250,000 $300,000 $350,000 $400,000 $450,000 $500,000 FY2011 FY2012 FY2013 FY2014 Total Loans Before ALL Consumer Real Estate Consumer Non-Real Estate Commercial/Agricultural Loans The Freedom to Simply BankTM (In $000s)

Balance Sheet Quality, Capital Position • Asset Quality • Credit Quality • Capital Strength The Freedom to Simply BankTM

1.07% 0.95% 0.66% 0.46% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% FY2011 FY2012 FY2013 FY2014 NPAs / Total Assets Ratio The Freedom to Simply BankTM

$0 $1,000 $2,000 $3,000 $4,000 $5,000 FY2011 FY2012 FY2013 FY2014 (In $000) Nonaccrual Loans Nonperforming Loans Nonaccrual / Nonperforming Loans The Freedom to Simply BankTM

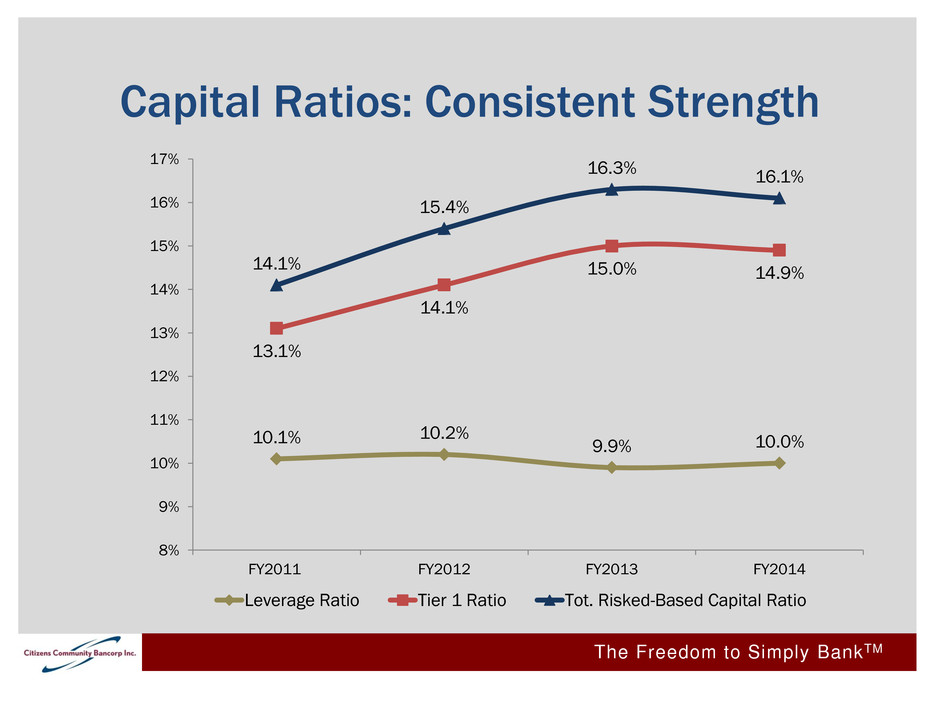

10.1% 10.2% 9.9% 10.0% 13.1% 14.1% 15.0% 14.9% 14.1% 15.4% 16.3% 16.1% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% FY2011 FY2012 FY2013 FY2014 Leverage Ratio Tier 1 Ratio Tot. Risked-Based Capital Ratio Capital Ratios: Consistent Strength The Freedom to Simply BankTM

Delivering, Building Shareholder Value • Consistent Tangible Book Value • Stock Price Closing the Gap • Market and Investor Recognition • Investment Appeals • Looking Ahead: Growth Opportunities The Freedom to Simply BankTM

Key Data at a Glance (FY2014) • Net Income $1.78 million • EPS (diluted) $0.34 • ROAA 0.32% • ROAE 3.20% • Price at 9/30/14 $ 8.85 • Tangible Book Value $11.09 • Price/LTM EPS 26x • Price/Tangible Book 80% • Avg. Dil. Shares Out. 5,196,706 The Freedom to Simply BankTM

$4.43 $5.00 $5.90 $7.25 $8.85 $9.75 $10.30 $10.73 $10.51 $11.09 $0.00 $3.00 $6.00 $9.00 $12.00 FY2010 FY2011 FY2012 FY2013 FY2014 Year End Price Reported Tangible Book/Share Price/ TBV 48.5% Price/ TBV 55.0% Price/ TBV 69.0% Price/ TBV 79.8% Below-Book Value Investing Opportunity Remains; Stock Price Closing the Gap to Tangible Book Value The Freedom to Simply BankTM Price/ TBV 45.4%

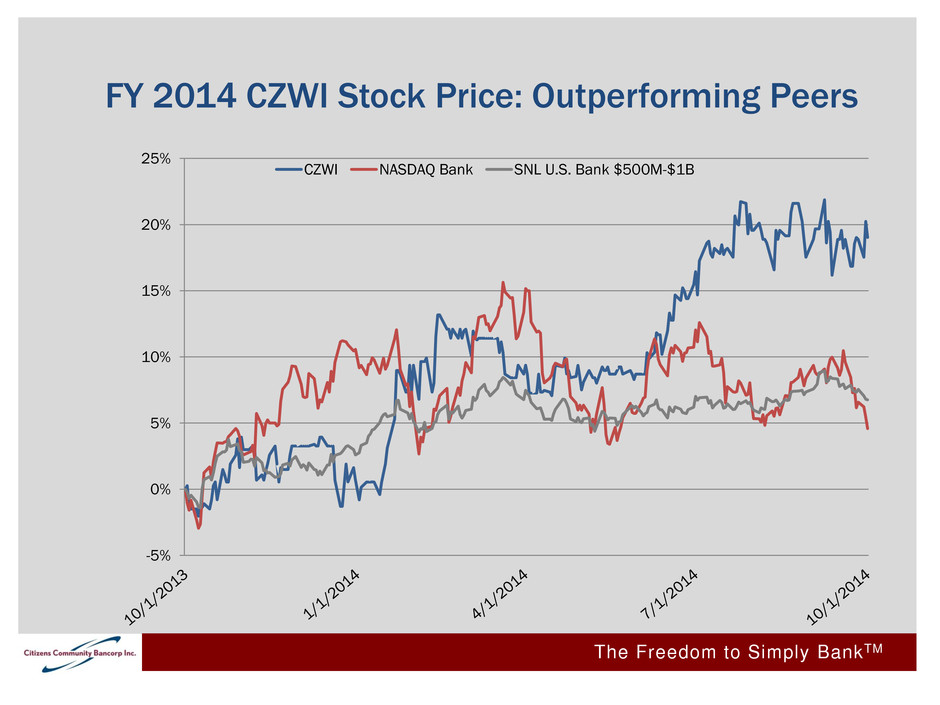

-5% 0% 5% 10% 15% 20% 25% CZWI NASDAQ Bank SNL U.S. Bank $500M-$1B FY 2014 CZWI Stock Price: Outperforming Peers The Freedom to Simply BankTM

Investment Appeals • Positioned for Profitable Growth in Our Market Footprint • Accelerating Commercial Banking Business • Diversified Income Stream • Focus on Productivity, Disciplined Expense Management • Proven Financial Performance • Annual Cash Dividend Initiated in 2013 and Increased in 2014 • CZWI Shares Present Value Opportunity The Freedom to Simply BankTM

Looking Ahead: Positioned for the Future • Organic Profitable Growth – Revenue Growth From Core Assets – Focus on Productivity – Historical Ability to Increase Loans while Diversifying Loan Portfolio • Actively Seeking Acquisitions – Strategic In-Market Opportunities – Strategic Contiguous Markets Matching Our Target Profile – Banks, Branches up to $200 Mil. Assets – Assets That Complement Our Balance Sheet The Freedom to Simply BankTM

Citizens Community Bancorp, Inc.