Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BNC BANCORP | form8-kforpresentation.htm |

2015 Sterne Agee Financial Institutions Investor Conference

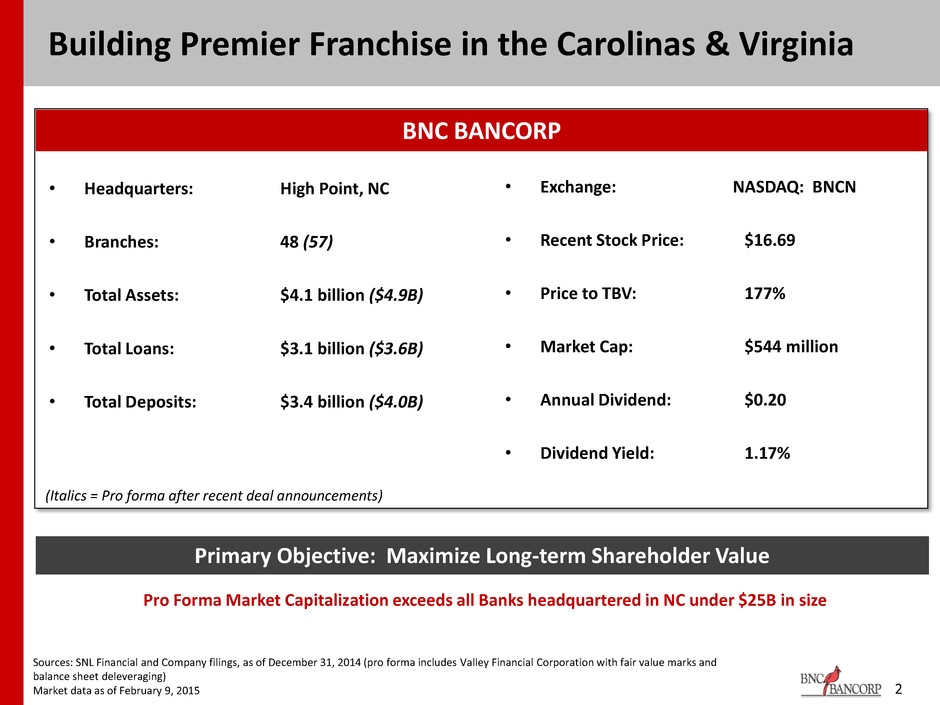

Building Premier Franchise in the Carolinas & Virginia 2 • Exchange: • Recent Stock Price: • Price to TBV: • Market Cap: • Annual Dividend: • Dividend Yield: NASDAQ: BNCN $16.69 177% $544 million $0.20 1.17% Pro Forma Market Capitalization exceeds all Banks headquartered in NC under $25B in size Primary Objective: Maximize Long-term Shareholder Value Sources: SNL Financial and Company filings, as of December 31, 2014 (pro forma includes Valley Financial Corporation with fair value marks and balance sheet deleveraging) Market data as of February 9, 2015 (Italics = Pro forma after recent deal announcements) BNC BANCORP • Headquarters: • Branches: • Total Assets: • Total Loans: • Total Deposits: High Point, NC 48 (57) $4.1 billion ($4.9B) $3.1 billion ($3.6B) $3.4 billion ($4.0B)

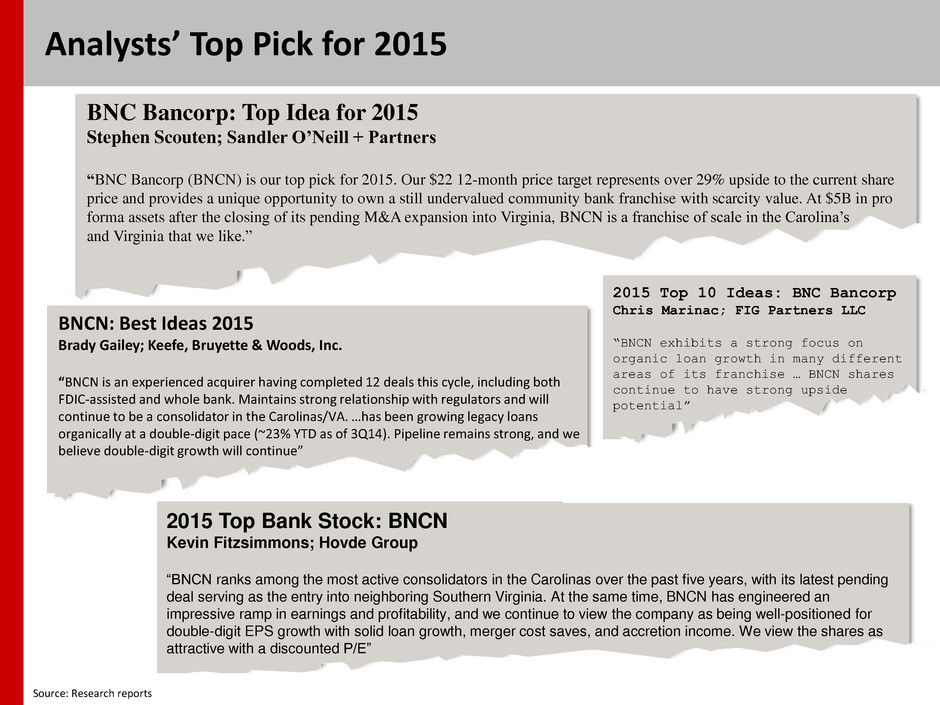

3 Analysts’ Top Pick for 2015 BNC Bancorp: Top Idea for 2015 Stephen Scouten; Sandler O’Neill + Partners “BNC Bancorp (BNCN) is our top pick for 2015. Our $22 12-month price target represents over 29% upside to the current share price and provides a unique opportunity to own a still undervalued community bank franchise with scarcity value. At $5B in pro forma assets after the closing of its pending M&A expansion into Virginia, BNCN is a franchise of scale in the Carolina’s and Virginia that we like.” BNCN: Best Ideas 2015 Brady Gailey; Keefe, Bruyette & Woods, Inc. “BNCN is an experienced acquirer having completed 12 deals this cycle, including both FDIC-assisted and whole bank. Maintains strong relationship with regulators and will continue to be a consolidator in the Carolinas/VA. …has been growing legacy loans organically at a double-digit pace (~23% YTD as of 3Q14). Pipeline remains strong, and we believe double-digit growth will continue” 2015 Top Bank Stock: BNCN Kevin Fitzsimmons; Hovde Group “BNCN ranks among the most active consolidators in the Carolinas over the past five years, with its latest pending deal serving as the entry into neighboring Southern Virginia. At the same time, BNCN has engineered an impressive ramp in earnings and profitability, and we continue to view the company as being well-positioned for double-digit EPS growth with solid loan growth, merger cost saves, and accretion income. We view the shares as attractive with a discounted P/E” Source: Research reports 2015 Top 10 Ideas: BNC Bancorp Chris Marinac; FIG Partners LLC “BNCN exhibits a strong focus on organic loan growth in many different areas of its franchise … BNCN shares continue to have strong upside potential”

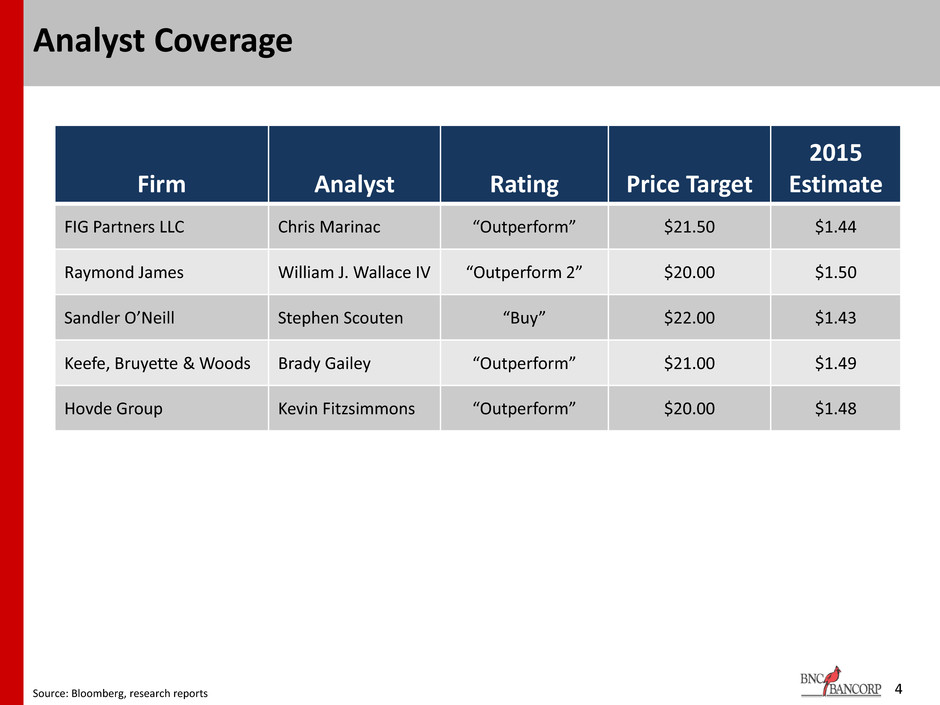

4 Analyst Coverage Firm Analyst Rating Price Target 2015 Estimate FIG Partners LLC Chris Marinac “Outperform” $21.50 $1.44 Raymond James William J. Wallace IV “Outperform 2” $20.00 $1.50 Sandler O’Neill Stephen Scouten “Buy” $22.00 $1.43 Keefe, Bruyette & Woods Brady Gailey “Outperform” $21.00 $1.49 Hovde Group Kevin Fitzsimmons “Outperform” $20.00 $1.48 Source: Bloomberg, research reports

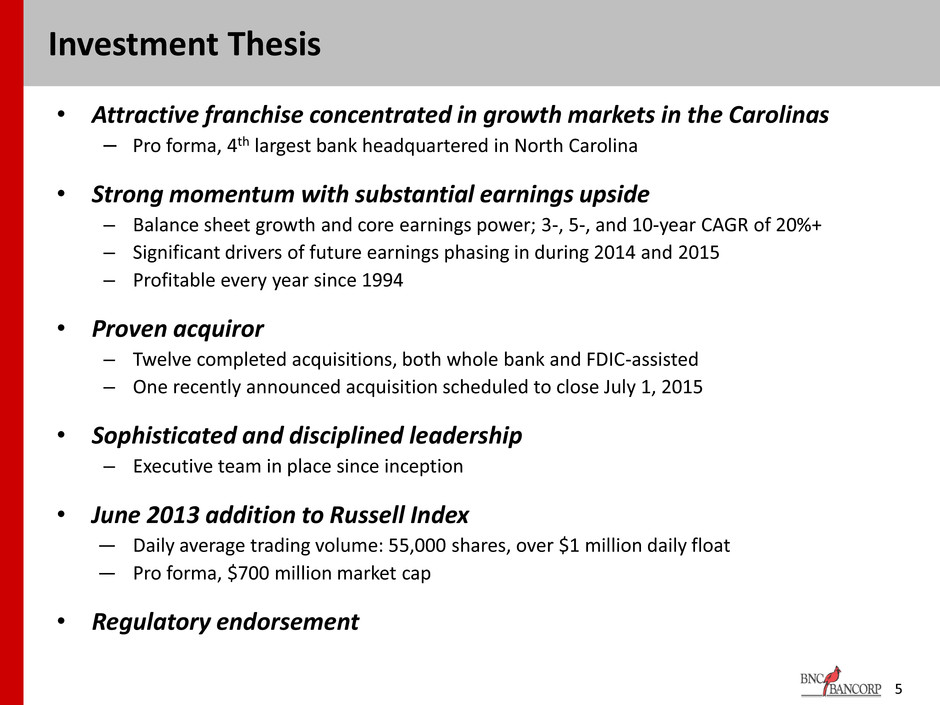

• Attractive franchise concentrated in growth markets in the Carolinas – Pro forma, 4th largest bank headquartered in North Carolina • Strong momentum with substantial earnings upside – Balance sheet growth and core earnings power; 3-, 5-, and 10-year CAGR of 20%+ – Significant drivers of future earnings phasing in during 2014 and 2015 – Profitable every year since 1994 • Proven acquiror – Twelve completed acquisitions, both whole bank and FDIC-assisted – One recently announced acquisition scheduled to close July 1, 2015 • Sophisticated and disciplined leadership – Executive team in place since inception • June 2013 addition to Russell Index ― Daily average trading volume: 55,000 shares, over $1 million daily float ― Pro forma, $700 million market cap • Regulatory endorsement 5 Investment Thesis

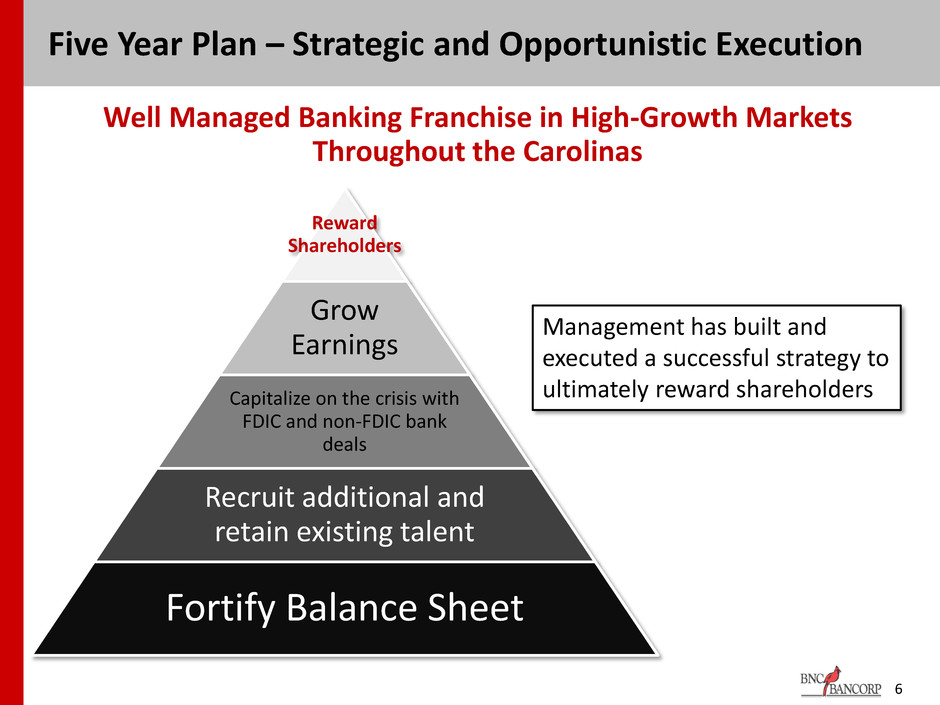

Well Managed Banking Franchise in High-Growth Markets Throughout the Carolinas Five Year Plan – Strategic and Opportunistic Execution 6 Reward Shareholders Grow Earnings Capitalize on the crisis with FDIC and non-FDIC bank deals Recruit additional and retain existing talent Fortify Balance Sheet Management has built and executed a successful strategy to ultimately reward shareholders

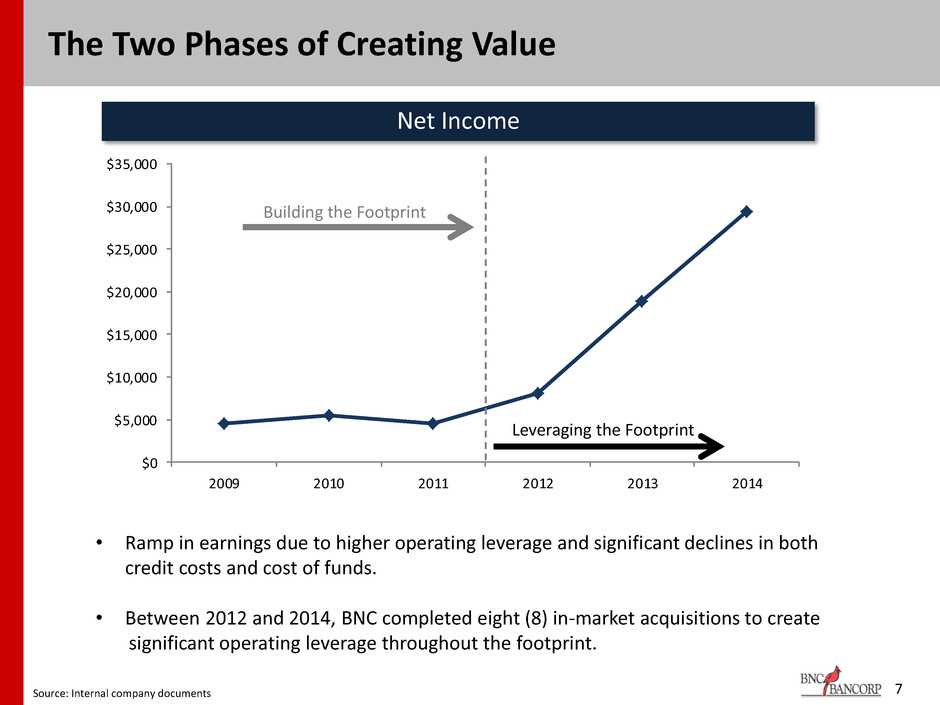

$0 $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 $35,000 2009 2010 2011 2012 2013 2014 7 The Two Phases of Creating Value • Ramp in earnings due to higher operating leverage and significant declines in both credit costs and cost of funds. • Between 2012 and 2014, BNC completed eight (8) in-market acquisitions to create significant operating leverage throughout the footprint. Building the Footprint Leveraging the Footprint Net Income Source: Internal company documents

Attractive Franchise Concentrated in Growth Markets throughout the Carolinas and Virginia

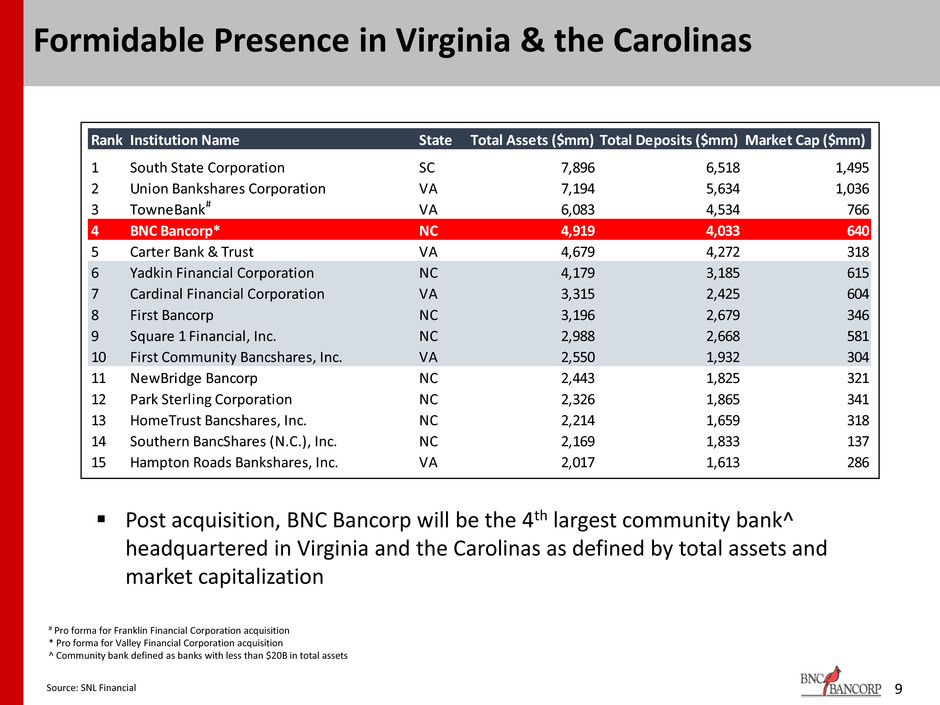

9 Formidable Presence in Virginia & the Carolinas Post acquisition, BNC Bancorp will be the 4th largest community bank^ headquartered in Virginia and the Carolinas as defined by total assets and market capitalization # Pro forma for Franklin Financial Corporation acquisition * Pro forma for Valley Financial Corporation acquisition ^ Community bank defined as banks with less than $20B in total assets Source: SNL Financial Rank Institution Name State Total Assets ($mm) Total Deposits ($mm) Market Cap ($mm) 1 South State Corporation SC 7,896 6,518 1,495 2 Union Bankshares Corporation VA 7,194 5,634 1,036 3 TowneBank# VA 6,083 4,534 766 4 BNC Bancorp* NC 4,919 4,033 640 5 Carter Bank & Trust VA 4,679 4,272 318 6 Yadkin Financial Corporation NC 4,179 3,185 615 7 Cardinal Financial Corporation VA 3,315 2,425 604 8 First Bancorp NC 3,196 2,679 346 9 Square 1 Financial, Inc. NC 2,988 2,668 581 10 First Community Bancshares, Inc. VA 2,550 1,932 304 11 NewBridge Bancorp NC 2,443 1,825 321 12 Park Sterling Corporation NC 2,326 1,865 341 13 HomeTrust Bancshares, Inc. NC 2,214 1,659 318 14 Southern BancShares (N.C.), Inc. NC 2,169 1,833 137 15 Hampton Roads Bankshares, Inc. VA 2,017 1,613 286

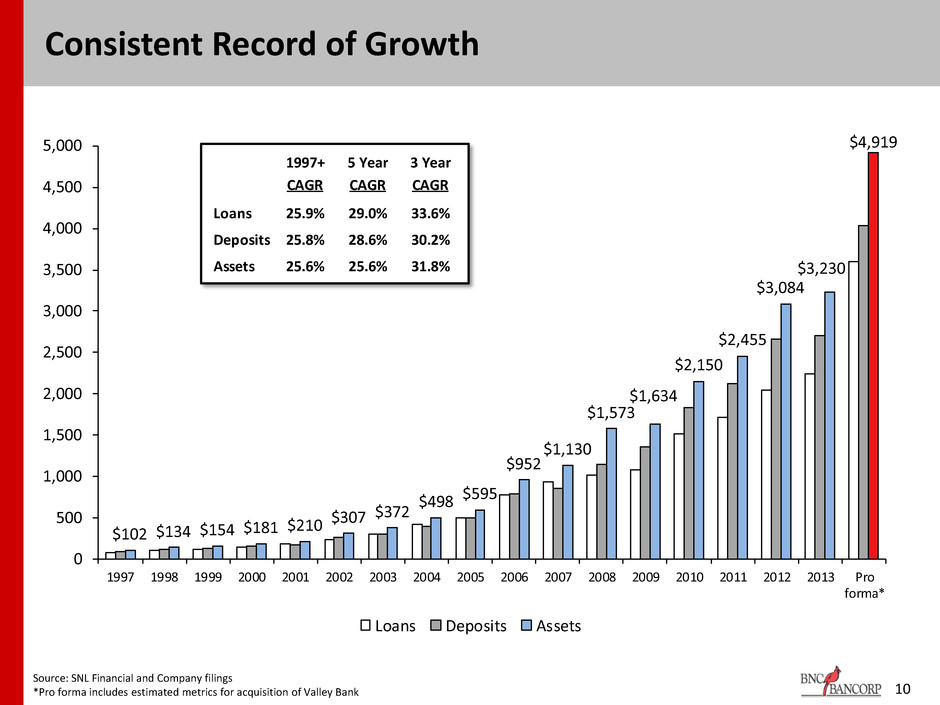

$102 $134 $154 $181 $210 $307 $372 $498 $595 $952 $1,130 $1,573 $1,634 $2,150 $2,455 $3,084 $3,230 $4,919 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4,500 5,000 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Pro forma* Loans Deposits Assets Source: SNL Financial and Company filings *Pro forma includes estimated metrics for acquisition of Valley Bank 10 Consistent Record of Growth 1997+ 5 Year 3 Year CAGR CAGR CAGR Loans 25.9% 29.0% 33.6% Deposits 25.8% 28.6% 30.2% Assets 25.6% 25.6% 31.8%

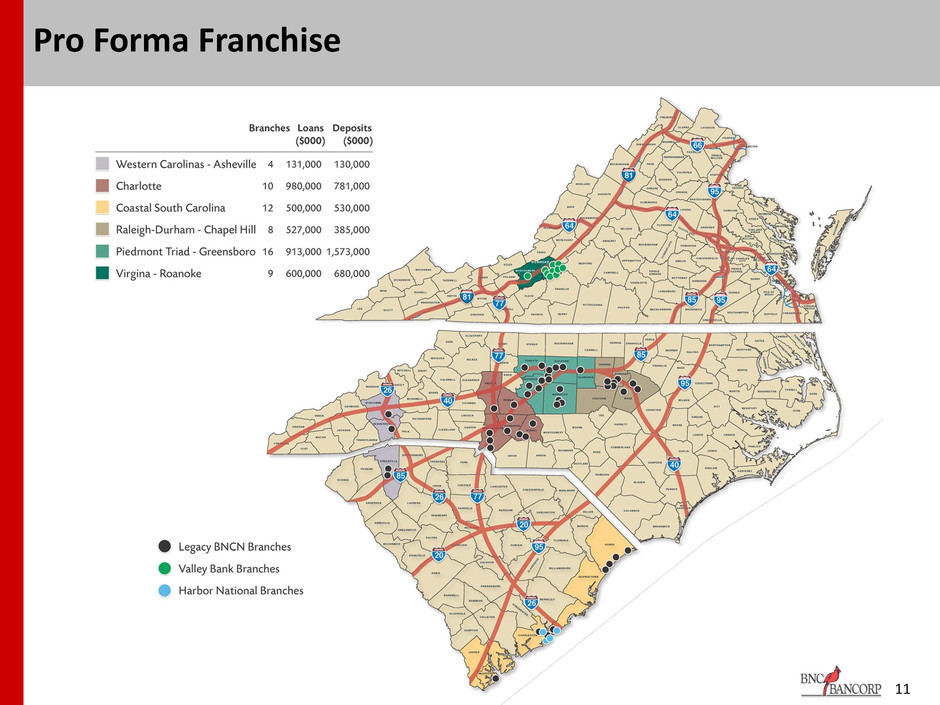

Pro Forma Franchise 11

12 Attractive Markets • 3+ million people to be added in NC by 2030; over 1 million in SC • NC is the #1 state for corporate relocations and has been for the past 8 of 9 years • The Roanoke MSA was ranked in the top 15% of the best cities in the Balanced Economy and Growth category by Inc. Magazine • Pro forma footprint reaches key locations in NC, SC, and now VA • In 11 of the top 15 cities in NC • In 5 of the top 10 cities in SC • NC’s two largest metro areas, Charlotte and the Triangle, account for nearly 70% of new jobs statewide Sources: US Census Bureau and Charlotte Business Journal, April 2014 0% 10% 20% 30% 40% 50% 60% 70% 1990s Mid-2000s 2010+ Durham Raleigh Charlotte Share of Employment Gains in NC (%) 10.5% 10.7% 5.4% 2.6% 3.3% 5.5% 8.1% 10.1% 5.6% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% Projected Median HH Income Growth (2014 - 2019) Projected Per Capita Income Growth (2014 - 2019) Unemployment Rate (Sep. 2014) Roanoke MSA Richmond MSA VA Beach/Norfolk MSA Demographic Highlights in VA

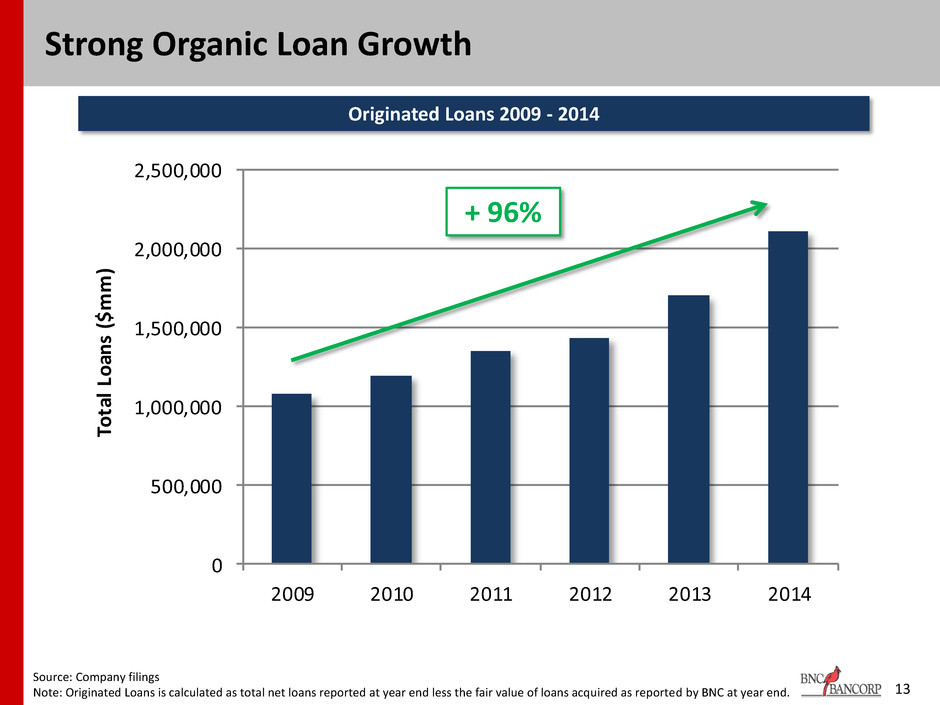

0 500,000 1,000,000 1,500,000 2,000,000 2,500,000 2009 2010 2011 2012 2013 2014 To tal Lo an s ( $m m) 13 Strong Organic Loan Growth Source: Company filings Note: Originated Loans is calculated as total net loans reported at year end less the fair value of loans acquired as reported by BNC at year end. + 96% Originated Loans 2009 - 2014

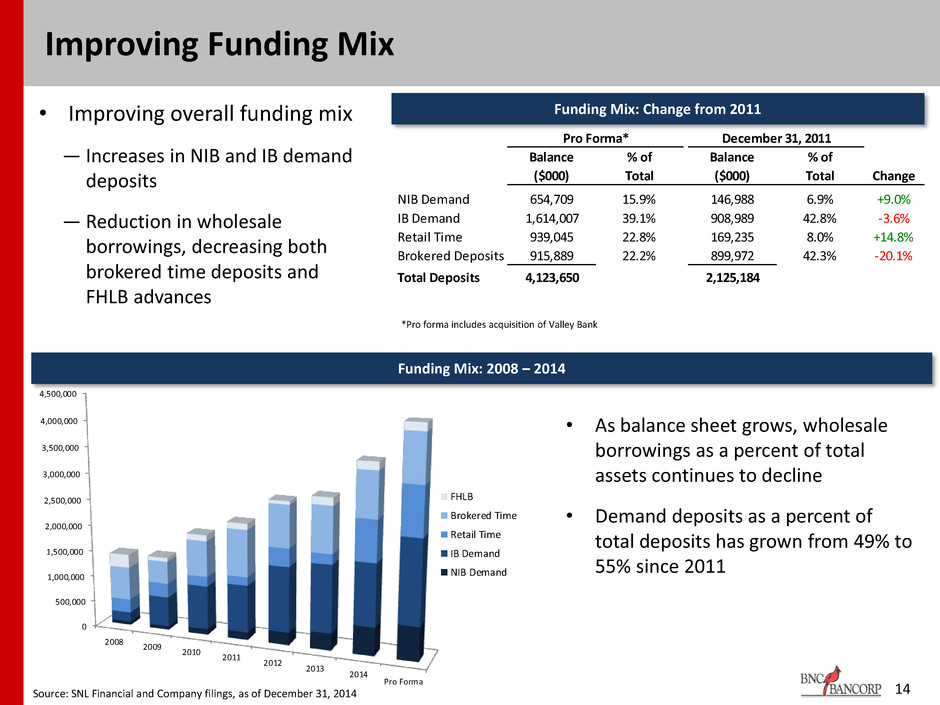

14 Improving Funding Mix Funding Mix: 2008 – 2014 Funding Mix: Change from 2011 • Improving overall funding mix ― Increases in NIB and IB demand deposits ― Reduction in wholesale borrowings, decreasing both brokered time deposits and FHLB advances • As balance sheet grows, wholesale borrowings as a percent of total assets continues to decline • Demand deposits as a percent of total deposits has grown from 49% to 55% since 2011 Source: SNL Financial and Company filings, as of December 31, 2014 *Pro forma includes acquisition of Valley Bank Noninterest Bearing Demand Interest Bearing Demand Brokered Deposits Retail Time Deposits Deposits 0 500,000 1,000,000 1,500,000 2,000,000 2,500,000 3,000,000 3,500,000 4,000,000 4,500,000 2008 2009 2010 2011 2012 2013 2014 Pro Forma FHLB Brokered Time Retail Time IB Demand NIB Demand Pro Forma* December 31, 2011 Balance % of Balance % of ($000) Total ($000) Total Change NIB Demand 654,709 15.9% 146,988 6.9% +9.0% IB Demand 1,614,007 39.1% 908,989 42.8% -3.6% Retail Time 939,045 22.8% 169,235 8.0% +14.8% Brokered Deposits 915,889 22.2% 899,972 42.3% -20.1% Total Deposits 4,123,650 2,125,184

Strong Earnings Momentum

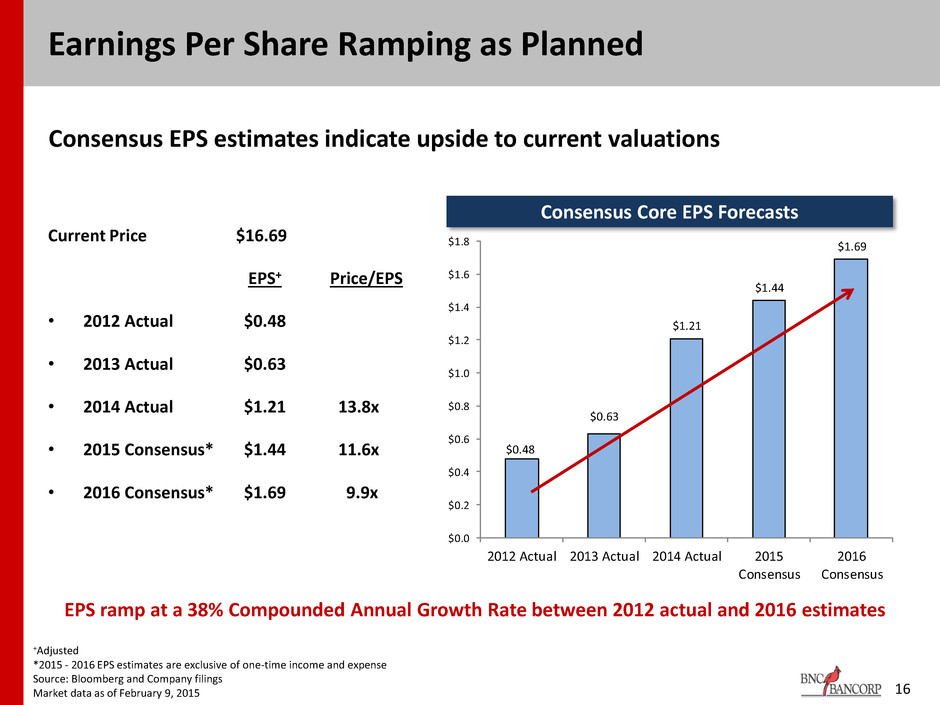

Earnings Per Share Ramping as Planned Current Price $16.69 EPS+ Price/EPS • 2012 Actual $0.48 • 2013 Actual $0.63 • 2014 Actual $1.21 13.8x • 2015 Consensus* $1.44 11.6x • 2016 Consensus* $1.69 9.9x Consensus EPS estimates indicate upside to current valuations +Adjusted *2015 - 2016 EPS estimates are exclusive of one-time income and expense Source: Bloomberg and Company filings Market data as of February 9, 2015 16 EPS ramp at a 38% Compounded Annual Growth Rate between 2012 actual and 2016 estimates Consensus Core EPS Forecasts $0.48 $0.63 $1.21 $1.44 $1.69 $0.0 $0.2 $0.4 $0.6 $0.8 $1.0 $1.2 $1.4 $1.6 $1.8 2012 Actual 2013 Actual 2014 Actual 2015 Consensus 2016 Consensus

17 Outstanding Net Interest Margin Net interest margin remains well above peers, even without fair value accretion Source: SNL Financial and Company filings, as of December 31, 2014 Regional peers include banks in NC, SC, and VA with total assets between $1.0bn and $5.0bn 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% Yield on Earning Assets Cost of Funds NIM NIM excl Fair Value Accretion 5.18% 0.62% 4.56% 4.09% 4.31% 0.44% 3.91% BNCN Peers

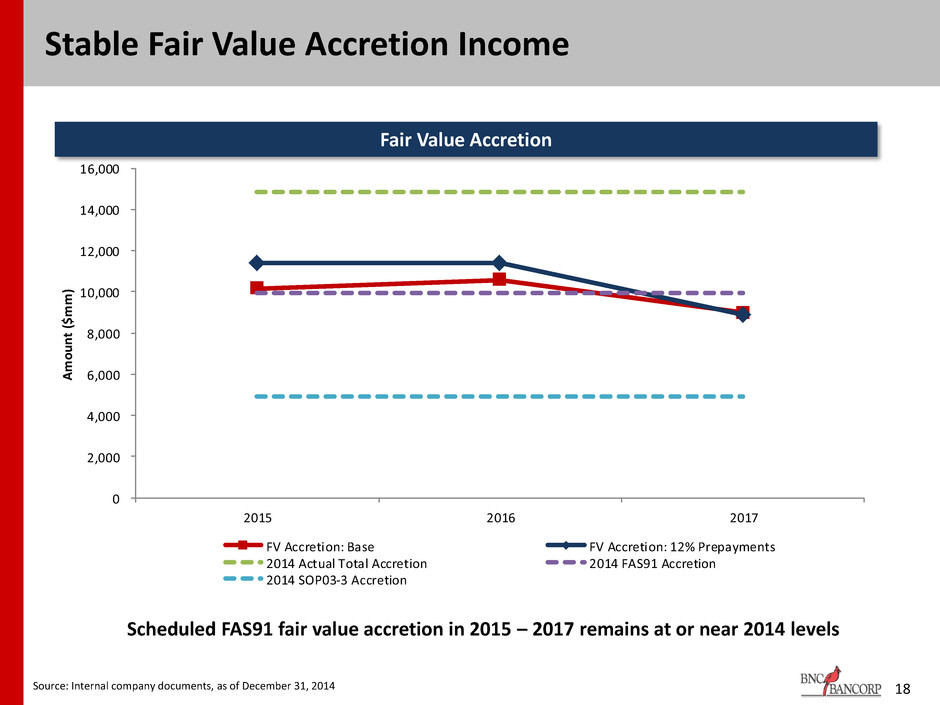

18 Stable Fair Value Accretion Income 0 2,000 4,000 6,000 8,000 10,000 12,000 14,000 16,000 2015 2016 2017 Am ou nt ($m m) FV Accretion: Base FV Accretion: 12% Prepayments 2014 Actual Total Accretion 2014 FAS91 Accretion 2014 SOP03-3 Accretion Source: Internal company documents, as of December 31, 2014 Fair Value Accretion Scheduled FAS91 fair value accretion in 2015 – 2017 remains at or near 2014 levels

“Acquiror of Choice”

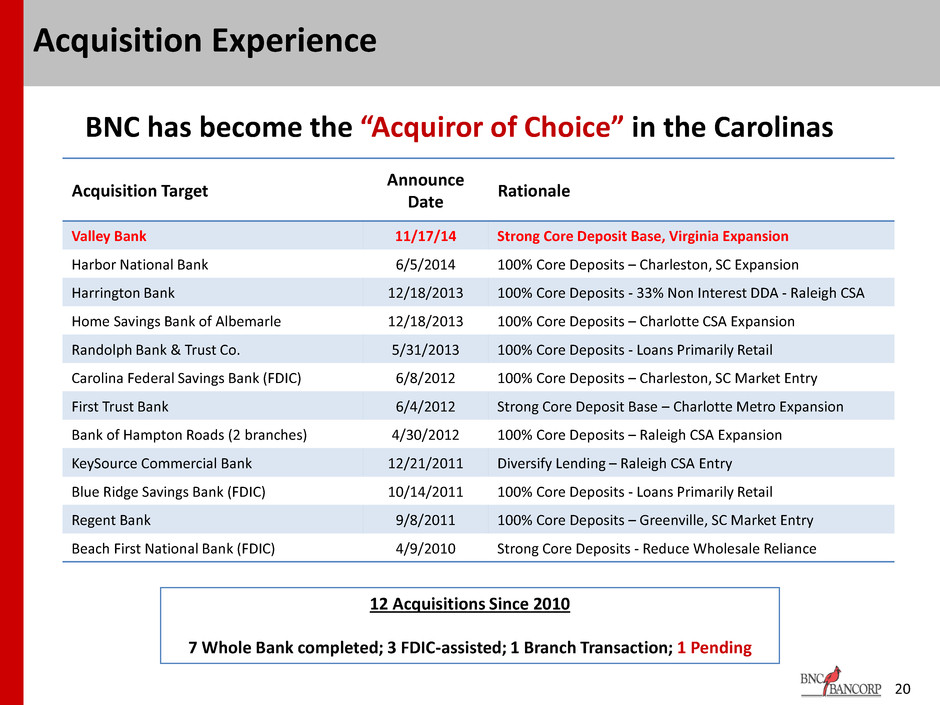

20 Acquisition Experience 12 Acquisitions Since 2010 7 Whole Bank completed; 3 FDIC-assisted; 1 Branch Transaction; 1 Pending Acquisition Target Announce Date Rationale Valley Bank 11/17/14 Strong Core Deposit Base, Virginia Expansion Harbor National Bank 6/5/2014 100% Core Deposits – Charleston, SC Expansion Harrington Bank 12/18/2013 100% Core Deposits - 33% Non Interest DDA - Raleigh CSA Home Savings Bank of Albemarle 12/18/2013 100% Core Deposits – Charlotte CSA Expansion Randolph Bank & Trust Co. 5/31/2013 100% Core Deposits - Loans Primarily Retail Carolina Federal Savings Bank (FDIC) 6/8/2012 100% Core Deposits – Charleston, SC Market Entry First Trust Bank 6/4/2012 Strong Core Deposit Base – Charlotte Metro Expansion Bank of Hampton Roads (2 branches) 4/30/2012 100% Core Deposits – Raleigh CSA Expansion KeySource Commercial Bank 12/21/2011 Diversify Lending – Raleigh CSA Entry Blue Ridge Savings Bank (FDIC) 10/14/2011 100% Core Deposits - Loans Primarily Retail Regent Bank 9/8/2011 100% Core Deposits – Greenville, SC Market Entry Beach First National Bank (FDIC) 4/9/2010 Strong Core Deposits - Reduce Wholesale Reliance BNC has become the “Acquiror of Choice” in the Carolinas

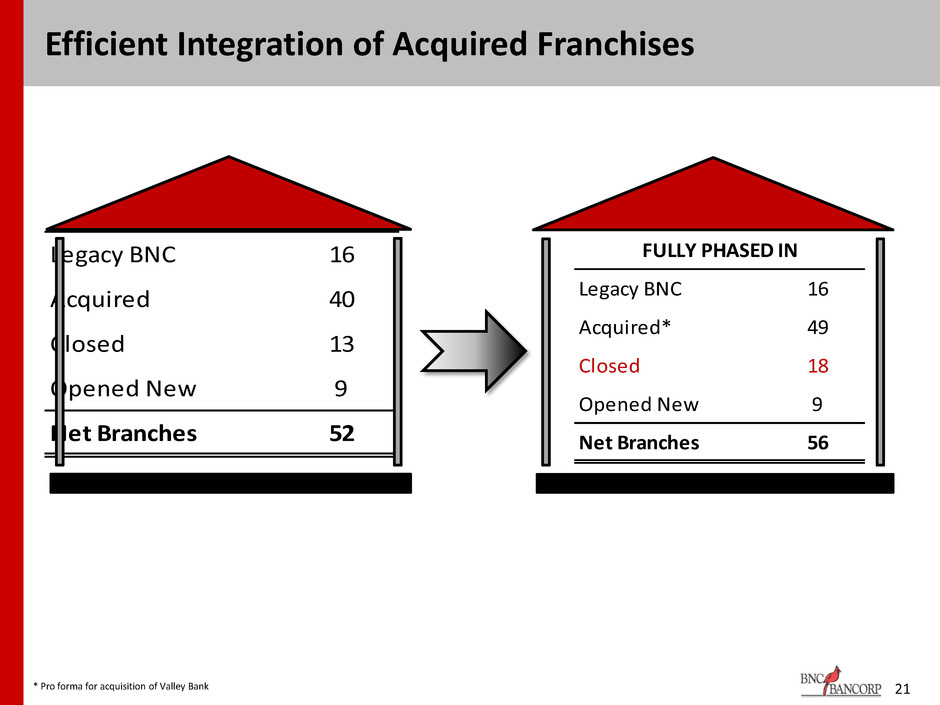

21 Efficient Integration of Acquired Franchises CURRENT NETWORK Legacy BNC 16 Acquired 40 Closed 13 Opened New 9 Net Branches 52 FULLY PHASED IN Legacy BNC 16 Acquired* 49 Closed 18 Opened New 9 Net Branches 56 * Pro forma for acquisition of Valley Bank

22 Investment in Talent to Support Growth • Chief Information and Operations Officer • Chief Enterprise Risk Officer • Director of Human Resources • Director of Marketing • Chief Accounting Officer • Director of Mortgage Banking • Four Regional Presidents • Director of Wealth, Private Banking, and Business Services • Director of Retail Banking • Chief Compliance Officer Conversion and Integration • Director of Internal Audit • Seasoned Director of Special Assets • CRE, Single Family, and C&I Credit Specialists • Controller of Mortgage Division • Accounting Policy and SEC Reporting Manager • Asset/Liability Manager and Balance Sheet Strategist Risk and Reporting • Conversion and Merger Integration Project Coordinator • Internal Performance Manager • Loss Share/ Fair Value Loan Reporting Specialist •Merger, Conversion, and Integration Team Leadership and Management

Recent Acquisitions

• Nine branches in attractive Roanoke, Virginia market • #1 Deposit market share among independent banks in Roanoke MSA • Respected and seasoned leadership and lending team • Estimated accretion to BNCN 2015 EPS of 5.0%+* • Estimated tangible book value dilution earned-back in under 2.5 years* • Transaction, savings and MMDA accounts represent 73% of deposits 24 * Does not include fair value accretion or revenue synergies Recently Announced Transaction Benefits

25 Transaction Assumptions Cost savings: 30% of VYFC LTM non-interest expense Revenue synergies: None modeled One-time costs: $8mm, pretax Core deposit intangible: $6mm Credit mark: 3.3% aggregate mark on loans and 26% mark on OREO Capital: None required to complete the transaction Valley balance sheet restructuring: Sale of low yielding securities Retirement of high-cost wholesale funding Valley Financial Corporation

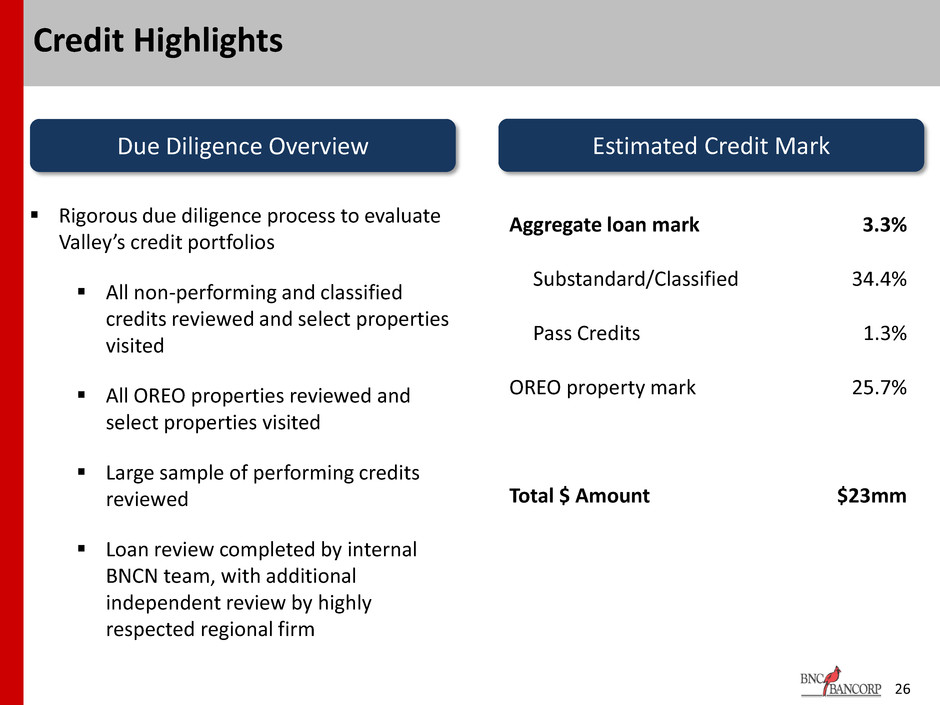

26 Credit Highlights Due Diligence Overview Estimated Credit Mark Rigorous due diligence process to evaluate Valley’s credit portfolios All non-performing and classified credits reviewed and select properties visited All OREO properties reviewed and select properties visited Large sample of performing credits reviewed Loan review completed by internal BNCN team, with additional independent review by highly respected regional firm Aggregate loan mark 3.3% Substandard/Classified 34.4% Pass Credits 1.3% OREO property mark 25.7% Total $ Amount $23mm

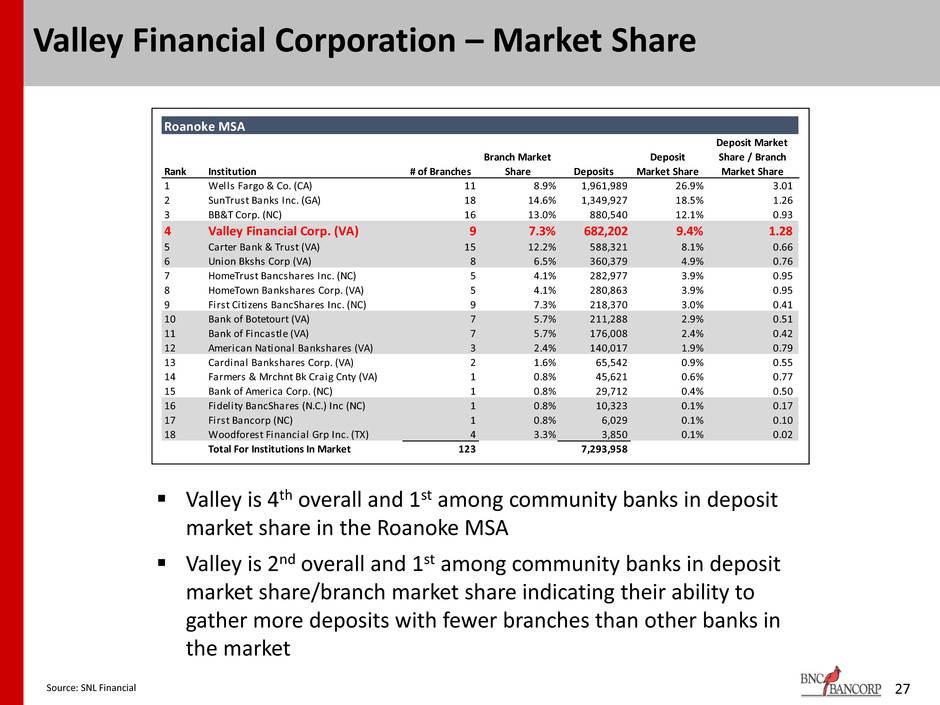

27 Valley Financial Corporation – Market Share Valley is 4th overall and 1st among community banks in deposit market share in the Roanoke MSA Valley is 2nd overall and 1st among community banks in deposit market share/branch market share indicating their ability to gather more deposits with fewer branches than other banks in the market Roanoke MSA Rank Institution # of Branches Branch Market Share Deposits Deposit Market Share Deposit Market Share / Branch Market Share 1 Wells Fargo & Co. (CA) 11 8.9% 1,961,989 26.9% 3.01 2 SunTrust Banks Inc. (GA) 18 14.6% 1,349,927 18.5% 1.26 3 BB&T Corp. (NC) 16 13.0% 880,540 12.1% 0.93 4 Valley Financial Corp. (VA) 9 7.3% 682,202 9.4% 1.28 5 Carter Bank & Trust (VA) 15 12.2% 588,321 8.1% 0.66 6 Union Bkshs Corp (VA) 8 6.5% 360,379 4.9% 0.76 7 HomeTrust Bancshares Inc. (NC) 5 4.1% 282,977 3.9% 0.95 8 HomeTown Bankshares Corp. (VA) 5 4.1% 280,863 3.9% 0.95 9 First Citizens BancShares Inc. (NC) 9 7.3% 218,370 3.0% 0.41 10 Bank of Botetourt (VA) 7 5.7% 211,288 2.9% 0.51 11 Bank of Fincastle (VA) 7 5.7% 176,008 2.4% 0.42 12 American National Bankshares (VA) 3 2.4% 140,017 1.9% 0.79 13 Cardinal Bankshares Corp. (VA) 2 1.6% 65,542 0.9% 0.55 14 Farmers & Mrchnt Bk Craig Cnty (VA) 1 0.8% 45,621 0.6% 0.77 15 Bank of America Corp. (NC) 1 0.8% 29,712 0.4% 0.50 16 Fidelity BancShares (N.C.) Inc (NC) 1 0.8% 10,323 0.1% 0.17 17 First Bancorp (NC) 1 0.8% 6,029 0.1% 0.10 18 Woodforest Financial Grp Inc. (TX) 4 3.3% 3,850 0.1% 0.02 Total For Institutions In Market 123 7,293,958 Source: SNL Financial

Financial Appendix

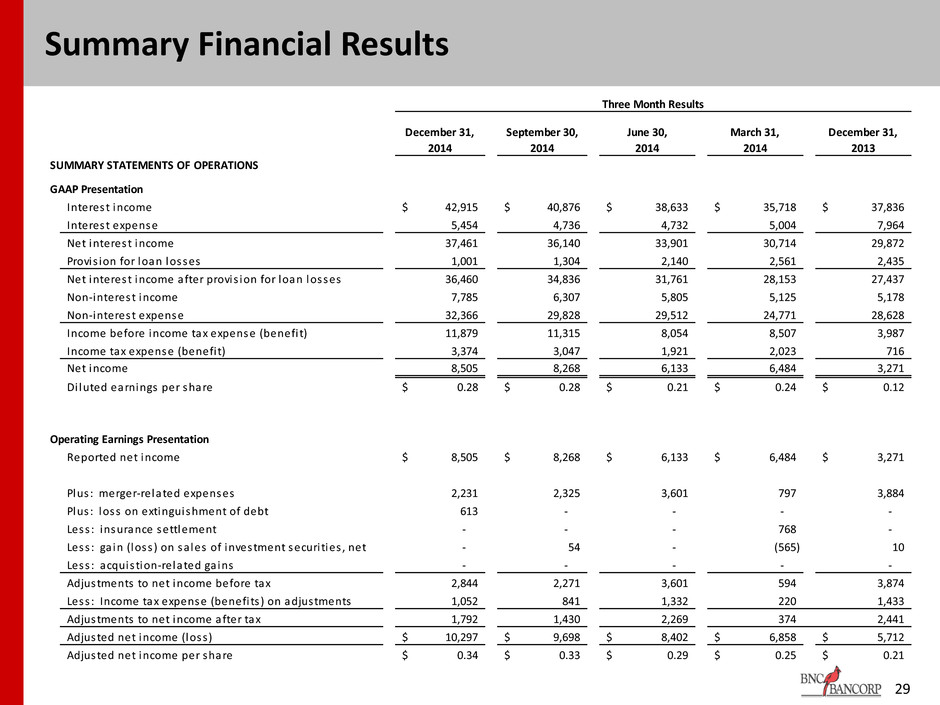

29 Summary Financial Results December 31, 2014 September 30, 2014 June 30, 2014 March 31, 2014 December 31, 2013 GAAP Presentation Interest income 42,915$ 40,876$ 38,633$ 35,718$ 37,836$ Interest expense 5,454 4,736 4,732 5,004 7,964 Net interest income 37,461 36,140 33,901 30,714 29,872 Provis ion for loan losses 1,001 1,304 2,140 2,561 2,435 Net interest income after provis ion for loan losses 36,460 34,836 31,761 28,153 27,437 Non-interest income 7,785 6,307 5,805 5,125 5,178 Non-interest expense 32,366 29,828 29,512 24,771 28,628 Income before income tax expense (benefi t) 11,879 11,315 8,054 8,507 3,987 Income tax expense (benefi t) 3,374 3,047 1,921 2,023 716 Net income 8,505 8,268 6,133 6,484 3,271 Di luted earnings per share 0.28$ 0.28$ 0.21$ 0.24$ 0.12$ Operating Earnings Presentation Reported net income 8,505$ 8,268$ 6,133$ 6,484$ 3,271$ Plus : merger-related expenses 2,231 2,325 3,601 797 3,884 Plus : loss on extinguishment of debt 613 - - - - Less : insurance settlement - - - 768 - Less : ga in (loss ) on sa les of investment securi ties , net - 54 - (565) 10 Less : acquis tion-related ga ins - - - - - Adjustments to net income before tax 2,844 2,271 3,601 594 3,874 Less : Income tax expense (benefi ts ) on adjustments 1,052 841 1,332 220 1,433 Adjustments to net income after tax 1,792 1,430 2,269 374 2,441 Adjusted net income (loss ) 10,297$ 9,698$ 8,402$ 6,858$ 5,712$ Adjusted net income per share 0.34$ 0.33$ 0.29$ 0.25$ 0.21$ Three Month Results SUMMARY STATEMENTS OF OPERATIONS

3.93% 3.85% 4.29% 4.56% 3.20% 3.40% 3.60% 3.80% 4.00% 4.20% 4.40% 4.60% 4.80% 2011Y 2012Y 2013Y 2014Y BNCN Regional Peers 76.2% 77.1% 70.7% 68.1% 50.00% 55.00% 60.00% 65.00% 70.00% 75.00% 80.00% 2011Y 2012Y 2013Y 2014Y BNCN Regional Peers 0.53% 0.66% 0.71% 0.61% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 1.60% 2011Y 2012Y 2013Y 2014Y BNCN Regional Peers Note: Excludes bargain purchase gains 30 Source: SNL Financial and Company filings, as of December 31, 2014 Regional peers include banks in NC, SC, and VA with total assets between $1.0bn and $5.0bn Performance Metrics Net Interest Margin Efficiency Ratio Non Interest Income / Total Assets

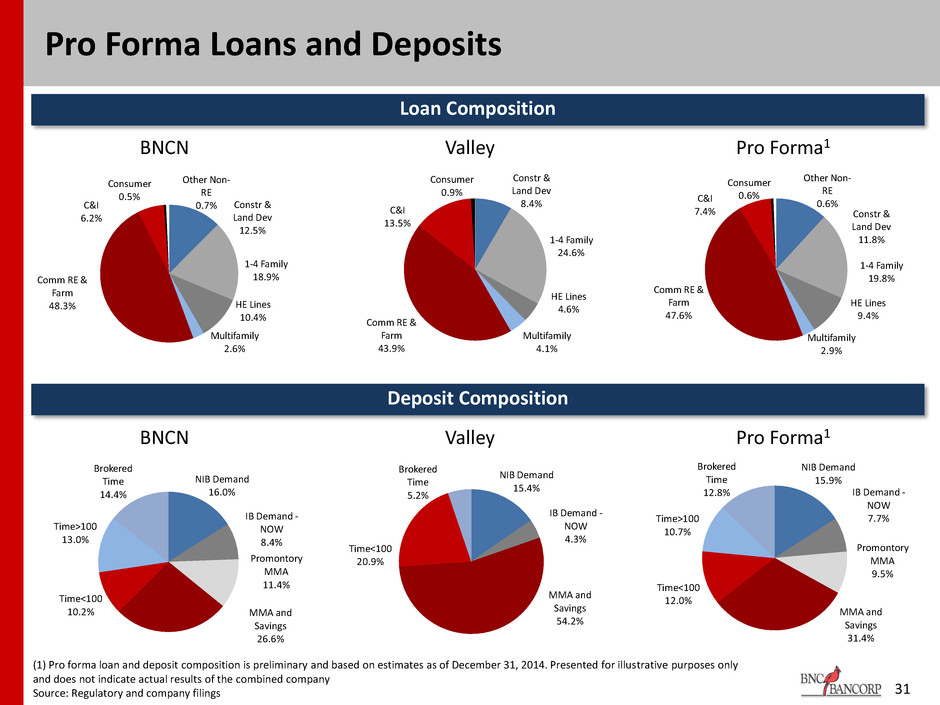

Pro Forma Loans and Deposits Loan Composition 31 (1) Pro forma loan and deposit composition is preliminary and based on estimates as of December 31, 2014. Presented for illustrative purposes only and does not indicate actual results of the combined company Source: Regulatory and company filings Constr & Land Dev 12.5% 1-4 Family 18.9% HE Lines 10.4% Multifamily 2.6% Comm RE & Farm 48.3% C&I 6.2% Consumer 0.5% Other Non- RE 0.7% Constr & Land Dev 11.8% 1-4 Family 19.8% HE Lines 9.4% Multifamily 2.9% Comm RE & Farm 47.6% C&I 7.4% Consumer 0.6% Other Non- RE 0.6% Constr & Land Dev 8.4% 1-4 Family 24.6% HE Lines 4.6% Multifamily 4.1% Comm RE & Farm 43.9% C&I 13.5% Consumer 0.9% BNCN Valley Pro Forma1 Deposit Composition BNCN Valley Pro Forma1 NIB Demand 15.9% IB Demand - NOW 7.7 Promontory MMA 9.5% MMA and Savings 31.4% Time<100 12.0% Ti e>100 10.7% Brokered Time 12.8% NIB Demand 16.0% IB Demand - NOW 8.4% Promontory MMA 11.4% MMA and Savings 26.6% Time<100 10.2% Time>100 13.0% Brokered Time 14.4% NIB Demand 15.4% IB Demand - NOW 4.3% MMA and Savings 54.2% Time<100 20.9% Brokered Time 5.2%

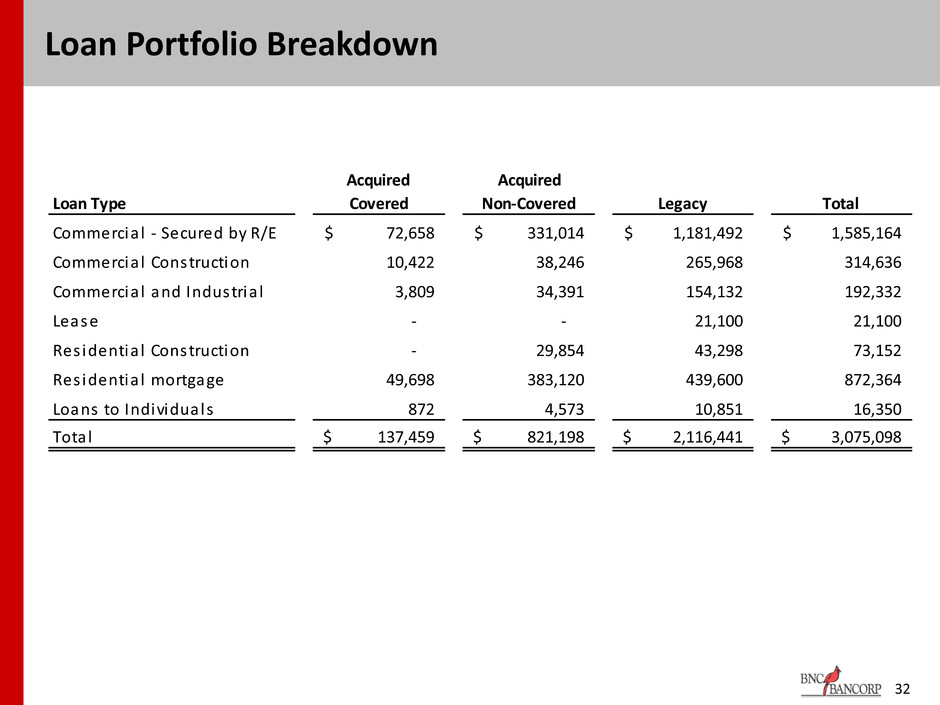

32 Loan Portfolio Breakdown Acquired Covered Acquired Non-Covered Legacy Total Commercia l - Secured by R/E 72,658$ 331,014$ 1,181,492$ 1,585,164$ Commercia l Construction 10,422 38,246 265,968 314,636 Commercia l and Industria l 3,809 34,391 154,132 192,332 Lease - - 21,100 21,100 Res identia l Construction - 29,854 43,298 73,152 Res identia l mortgage 49,698 383,120 439,600 872,364 Loans to Individuals 872 4,573 10,851 16,350 137,459$ 821,198$ 2,116,441$ 3,075,098$ Loan Type Total

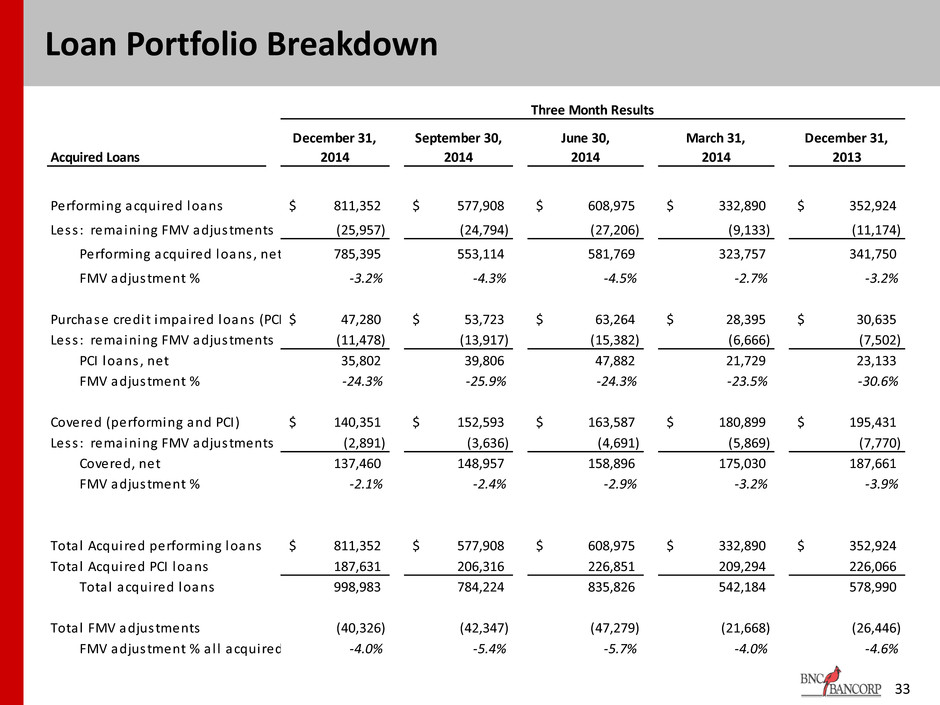

33 Loan Portfolio Breakdown December 31, 2014 September 30, 2014 June 30, 2014 March 31, 2014 December 31, 2013 Performing acquired loans 811,352$ 577,908$ 608,975$ 332,890$ 352,924$ Less : remaining FMV adjustments (25,957) (24,794) (27,206) (9,133) (11,174) Performing acquired loans , net 785,395 553,114 581,769 323,757 341,750 FMV adjustment % -3.2% -4.3% -4.5% -2.7% -3.2% Purchase credit impaired loans (PCI) 47,280$ 53,723$ 63,264$ 28,395$ 30,635$ Less : remaining FMV adjustments (11,478) (13,917) (15,382) (6,666) (7,502) PCI loans , net 35,802 39,806 47,882 21,729 23,133 FMV adjustment % -24.3% -25.9% -24.3% -23.5% -30.6% Covered (performing and PCI) 140,351$ 152,593$ 163,587$ 180,899$ 195,431$ Less : remaining FMV adjustments (2,891) (3,636) (4,691) (5,869) (7,770) Covered, net 137,460 148,957 158,896 175,030 187,661 FMV adjustment % -2.1% -2.4% -2.9% -3.2% -3.9% Total Acquired performing loans 811,352$ 577,908$ 608,975$ 332,890$ 352,924$ Total Acquired PCI loans 187,631 206,316 226,851 209,294 226,066 Total acquired loans 998,983 784,224 835,826 542,184 578,990 Total FMV adjustments (40,326) (42,347) (47,279) (21,668) (26,446) FMV adjustment % a l l acquired loans -4.0% -5.4% -5.7% -4.0% -4.6% Acquired Loans Three Month Results

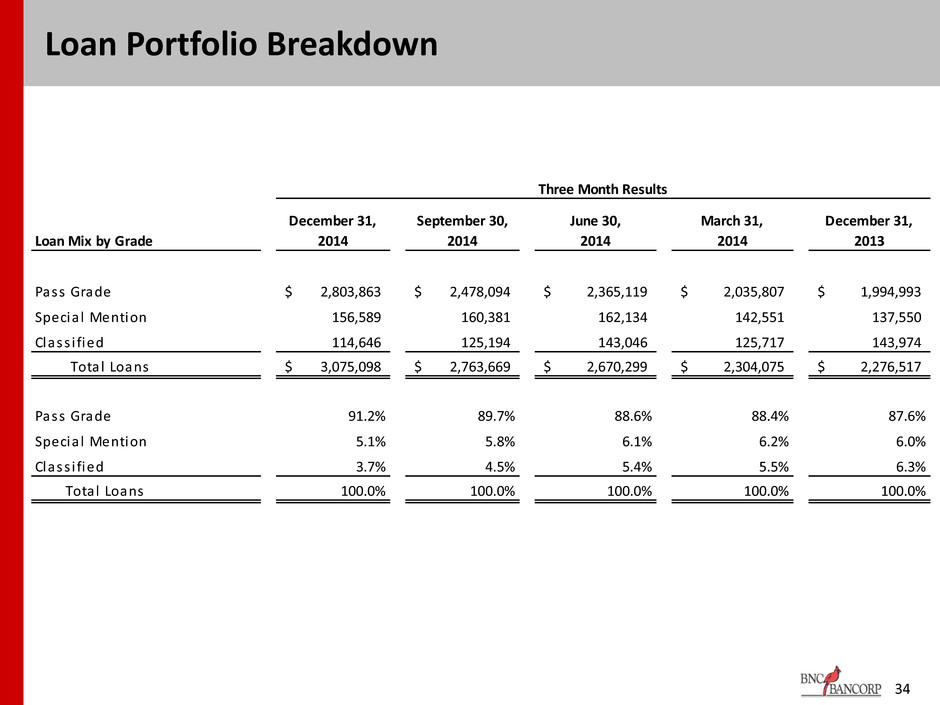

34 Loan Portfolio Breakdown December 31, 2014 September 30, 2014 June 30, 2014 March 31, 2014 December 31, 2013 Pass Grade 2,803,863$ 2,478,094$ 2,365,119$ 2,035,807$ 1,994,993$ Specia l Mention 156,589 160,381 162,134 142,551 137,550 Class i fied 114,646 125,194 143,046 125,717 143,974 Total Loans 3,075,098$ 2,763,669$ 2,670,299$ 2,304,075$ 2,276,517$ Pass Grade 91.2% 89.7% 88.6% 88.4% 87.6% Specia l Mention 5.1% 5.8% 6.1% 6.2% 6.0% Class i fied 3.7% 4.5% 5.4% 5.5% 6.3% Total Loans 100.0% 100.0% 100.0% 100.0% 100.0% Loan Mix by Grade Three Month Results

35 Forward Looking Statements This presentation contains certain forward-looking information about BNC Bancorp and subsidiaries (collectively, “BNCN”) that is intended to be covered by the safe harbor for “forward-looking statements” provided by the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact, are forward-looking statements. In some cases, you can identify forward-looking statements by words such as “may,” “hope,” “will,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “potential,” “continue,” “could,” “future” or the negative of those terms or other words of similar meaning. You should carefully read forward-looking statements, including statements that contain these words, because they discuss the future expectations or state other “forward-looking” information about BNCN. Such statements involve inherent risks and uncertainties, many of which are difficult to predict and are generally beyond the control of BNCN. Forward-looking statements speak only as of the date they are made and BNCN assumes no duty to update such statements. In addition to factors previously disclosed in reports filed by BNCN with the Securities and Exchange Commission (“SEC”), additional risks and uncertainties may include, but are not limited to: the possibility that any of the anticipated benefits of the proposed mergers will not be realized or will not be realized within the expected time period; the risk that integration of operations with those of BNCN will be materially delayed or will be more costly or difficult than expected; the inability to complete the mergers due to the failure of shareholder approval to adopt the respective merger agreements; the failure to satisfy other conditions to completion of the mergers, including receipt of required regulatory and other approvals; the failure of the proposed mergers to close for any other reason; the effect of the announcement of the mergers on customer relationships and operating results; the possibility that the mergers may be more expensive to complete than anticipated, including as a result of unexpected factors or events; and general competitive, economic, political and market conditions and fluctuations. As stated previously, additional factors affecting BNCN are discussed in BNCN’s Annual Report on Form 10-K, its Quarterly Reports on Form 10-Q and its Current Reports on Form 8-K, filed with the SEC. Please refer to the SEC’s website at www.sec.gov where you can review those documents.