Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - STONERIDGE INC | v401052_8-k.htm |

| EX-99.1 - EXHIBIT 99.1 - STONERIDGE INC | v401052_ex99-1.htm |

Exhibit 99.2

BB&T Capital Markets February 11, 2015 TECHNOLOGIES IN MOTION Exhibit 99.2

2 STONERIDGE FORWARD LOOKING STATEMENTS Statements in this presentation that are not historical facts are forward - looking statements, which involve risks and uncertainties that could cause actual events or results to differ materially from those expressed or implied by the statements. Important factors that may cause actual re sul ts to differ materially from those in the forward - looking statements include, among other factors, the loss or bankruptcy of a major customer; the costs and timing of facility closures, business realignment or similar actions; a significant change in medium - and heavy - duty truck, automotive or agricultural and off - highway vehicle production; our ability to achieve cost reductions that offset or exceed customer - mandated selling price reductions; a significant change in general econom ic conditions in any of the various countries in which Stoneridge operates; labor disruptions at Stoneridge’s facilities or at any of Stoneridge’s signif ica nt customers or suppliers; the ability of suppliers to supply Stoneridge with parts and components at competitive prices on a timely basis; the amount of Stoneridge ’s indebtedness and the restrictive covenants contained in the agreements governing its indebtedness, including its asset - based credit facility and senior secured n otes; customer acceptance of new products; capital availability or costs, including changes in interest rates or market perceptions; the failure to achiev e s uccessful integration of any acquired company or business; the occurrence or non - occurrence of circumstances beyond Stoneridge’s control; and the items described in “ Risk Factors” and other uncertainties or risks discussed in Stoneridge’s periodic and current reports filed with the Securities and Exchange Commissi on. Important factors that could cause the performance of the commercial vehicle and automotive industry to differ materially fro m t hose in the forward - looking statements include factors such as (1) continued economic instability or poor economic conditions in the United States and gl oba l markets, (2) changes in economic conditions, housing prices, foreign currency exchange rates, commodity prices, including shortages of and increases or volatility in the price of oil, (3) changes in laws and regulations, (4) the state of the credit markets, (5) political stability, (6) international conflicts an d ( 7) the occurrence of force majeure events. These factors should not be construed as exhaustive and should be considered with the other cautionary statements in Stonerid ge’ s filings with the Securities and Exchange Commission. Forward - looking statements are not guarantees of future performance; Stoneridge’s actual results of operations, financial condit ion and liquidity, and the development of the industry in which Stoneridge operates may differ materially from those described in or suggested by the fo rwa rd - looking statements contained in this presentation. In addition, even if Stoneridge’s results of operations, financial condition and liquidity, a nd the development of the industry in which Stoneridge operates are consistent with the forward - looking statements contained in this presentation, those results or de velopments may not be indicative of results or developments in subsequent periods. This presentation contains time - sensitive information that reflects management’s best analysis only as of the date of this prese ntation. Any forward - looking statements in this presentation speak only as of the date of this presentation, and Stoneridge undertakes no obligation to up dat e such statements. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performan ce, unless expressed as such, and should only be viewed as historical data. Stoneridge does not undertake any obligation to publicly update or revise any forward - looking statement as a result of new infor mation, future events or otherwise, except as otherwise required by law. Rounding Disclosure : There may be slight non - material differences between figures represented in our public filings compared to what is shown in t his presentation. The differences are the a result of rounding due to the representation of values in millions rather than thous and s in public filings.

TECHNOLOGIES IN MOTION STONERIDGE OVERVIEW 3 Serving Expanding Markets with Innovative Technologies Demonstrated Organic Growth / Strong Order Book Global Growth with Customers of Choice Leverage of Low Cost Regional Advantages Strong Cash Position for Growth & Acquisitions

4 STONERIDGE OVERVIEW Stoneridge designs and manufactures highly engineered sensing, communication, and c ontrol technologies to satisfy the global vehicle market needs for lower emissions, improved fuel economy, safety, security and information. We are Fast, Focused and Flexible.

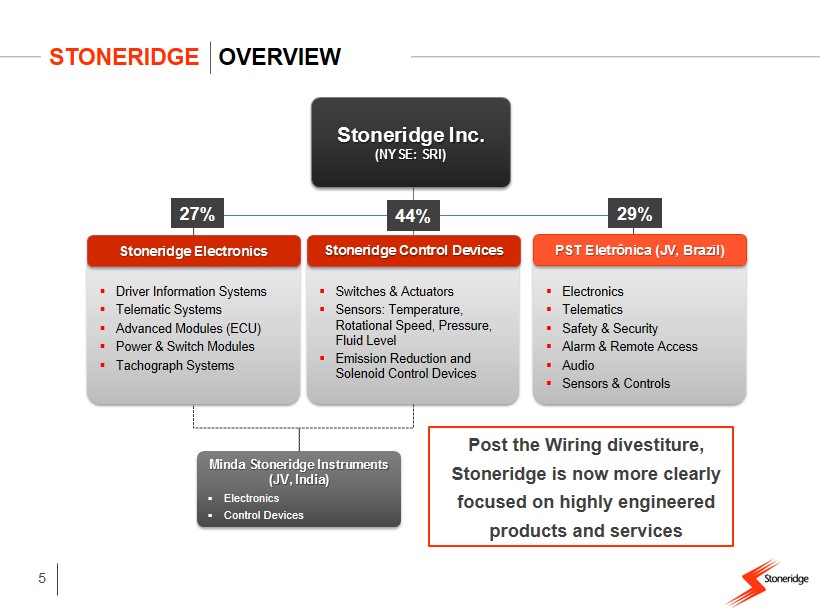

5 ▪ Switches & Actuators ▪ Sensors: Temperature, Rotational Speed, Pressure, Fluid Level ▪ Emission Reduction and Solenoid Control Devices ▪ Driver Information Systems ▪ Telematic Systems ▪ Advanced Modules (ECU) ▪ Power & Switch Modules ▪ Tachograph Systems Minda Stoneridge Instruments (JV, India) ▪ Electronics ▪ Control Devices Stoneridge Electronics Stoneridge Control Devices ▪ Electronics ▪ Telematics ▪ Safety & Security ▪ Alarm & Remote Access ▪ Audio ▪ Sensors & Controls PST Eletrônica (JV, Brazil) STONERIDGE OVERVIEW Post the Wiring divestiture, Stoneridge is now more clearly focused on highly engineered products and services Stoneridge Inc. (NYSE: SRI ) 44% 29% 27%

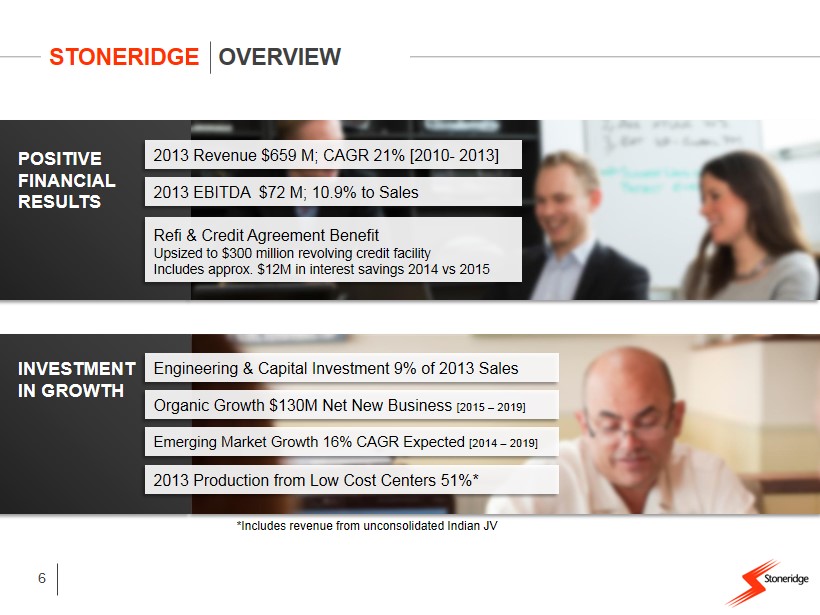

STONERIDGE OVERVIEW 2013 Revenue $ 659 M ; CAGR 21% [2010 - 2013] 2013 EBITDA $72 M; 10.9% to Sales POSITIVE FINANCIAL RESULTS Engineering & Capital Investment 9% of 2013 Sales Organic Growth $130M Net New Business [2015 – 2019] Emerging Market Growth 16% CAGR Expected [2014 – 2019] INVESTMENT IN GROWTH Refi & Credit Agreement Benefit Upsized to $300 million revolving credit facility Includes approx. $12M in interest savings 2014 vs 2015 2013 Production from Low Cost Centers 51%* 6 *Includes revenue from unconsolidated Indian JV

STONERIDGE MACRO TRENDS FUEL EFFICIENCY/ EMISSIONS REGULATIONS SAFETY & SECURITY TRENDS & REGULATIONS VEHICLE ELECTRONICS CONTENT EMERGING MARKETS DRIVING GROWTH 7 MAJOR EXTERNAL TRENDS INFLUENCING STONERIDGE

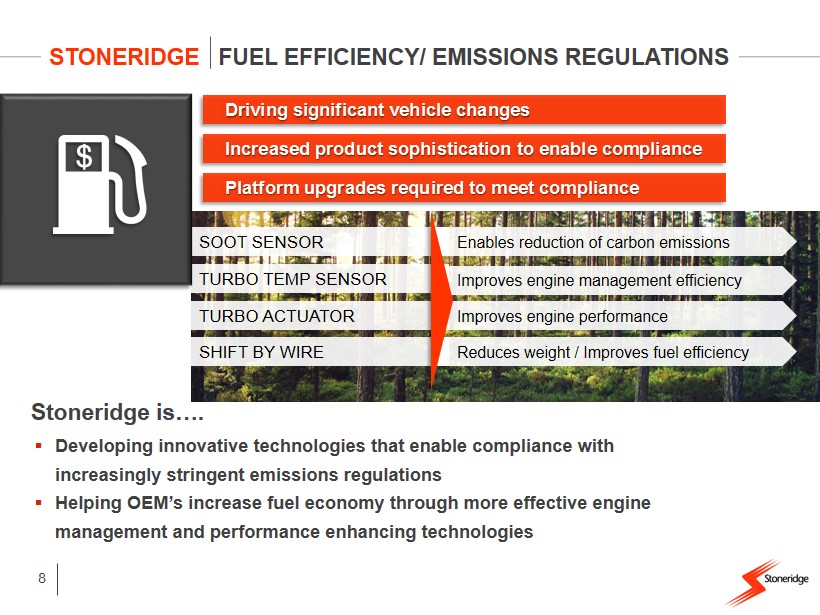

STONERIDGE FUEL EFFICIENCY/ EMISSIONS REGULATIONS TURBO ACTUATOR SOOT SENSOR TURBO TEMP SENSOR SHIFT BY WIRE 8 Improves engine performance Enables reduction of carbon emissions Improves engine management efficiency Reduces weight / Improves fuel efficiency Stoneridge is…. ▪ Developing innovative technologies that enable compliance with increasingly stringent emissions regulations ▪ Helping OEM’s increase fuel economy through more effective engine management and performance enhancing technologies Driving significant vehicle changes Increased product sophistication to enable compliance Platform upgrades required to meet compliance

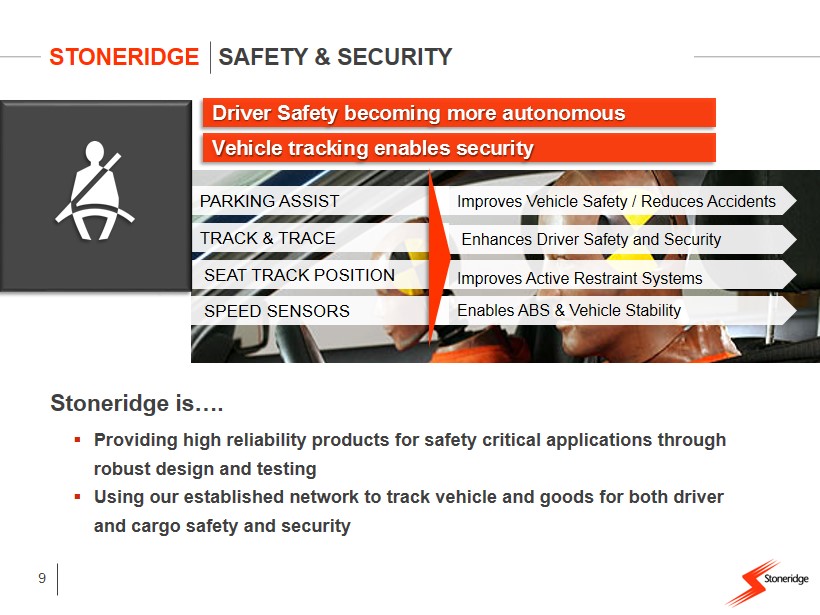

STONERIDGE SAFETY & SECURITY SEAT TRACK POSITION PARKING ASSIST TRACK & TRACE SPEED SENSORS 9 Improves Vehicle Safety / Reduces Accidents Enhances Driver Safety and Security Improves Active Restraint Systems Enables ABS & Vehicle Stability Stoneridge is…. ▪ Providing high reliability products for safety critical applications through robust design and testing ▪ Using our established network to track vehicle and goods for both driver and cargo safety and security Driver Safety becoming more autonomous Vehicle tracking enables security

MIRROR REPLACEMENT TELEMATICS EMERGING MARKET INSTR. TACHOGRAPH 10 Reduces fuel consumption / Improves visibility Enhances vehicle diagnostics & efficiency Improve vehicle performance & endurance Reduces accidents & costs Stoneridge is…. ▪ Applying our electronics hardware and software integration into adaptive systems ▪ Applying innovative display and communications solutions ▪ Helping customers move from electromechanical to electronic solutions that can leverage digital advantages STONERIDGE VEHICLE ELECTRONICS CONTENT Strong historical & forecasted growth in electronics value / vehicle Electronics & Software enable systems

STONERIDGE EMERGING MARKETS DRIVING GROWTH Significant growth in planning horizon Servicing Global Platforms in region 11 Stoneridge is…. ▪ Expanding our presence in emerging markets (China, India..) through local technical and manufacturing support ▪ Developing products that are adapted to the needs of the local market ▪ Deploying consistent product results on global platform designs

STONERIDGE MACRO TRENDS 12 External trends drive Stoneridge global product, technology and applications focus

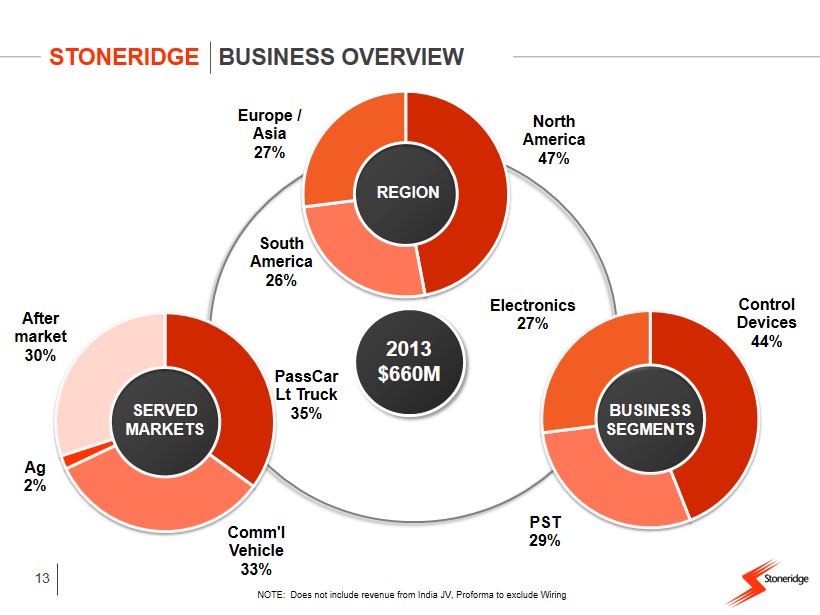

13 STONERIDGE BUSINESS OVERVIEW North America 47% South America 26% Europe / Asia 27% REGION 2013 $660M NOTE: D oes not include revenue from India JV, Proforma to exclude Wiring PassCar Lt Truck 35% Comm'l Vehicle 33% Ag 2% After market 30% SERVED MARKETS Control Devices 44% PST 29% Electronics 27% BUSINESS SEGMENTS

Sensors ▪ Temperature ▪ Speed ▪ Position ▪ Power Take - Off Unit ▪ Front Axel Disconnect ▪ Shift - By - Wire ▪ Turbo Charger Actuator Electronic Actuators ▪ Fluid Level ▪ Pressure ▪ Interior ▪ Exterior ▪ Hidden Switches ▪ Canister Vent Solenoid (CVS) ▪ CVS Gen2 ▪ Fuel Tank Isolation Valve (FTIV) ▪ 3 - Port CVS Solenoid Valves ▪ Torque ▪ Soot ▪ (NOx) STONERIDGE CONTROL DEVICES 14

STONERIDGE CONTROL DEVICES 15 ▪ Lowered B/E point achieved through restructuring the business during the industry downturn in 2009. Leveraged advantage. ▪ Continued execution of Low Cost Manufacturing strategy coupled with regional supply chain development to further reduce costs ▪ Product portfolio transformed through a robust Product Lifecycle Management and Strategic Marketing process ▪ Sensing & Control business that is focused on compelling growth markets of Emissions, Fuel Economy and Safety requiring highly engineered solutions ▪ Innovative technology developed organically and being deployed globally being positively received by customers. ▪ Higher value offered through increased integration of electronics and software content in new products

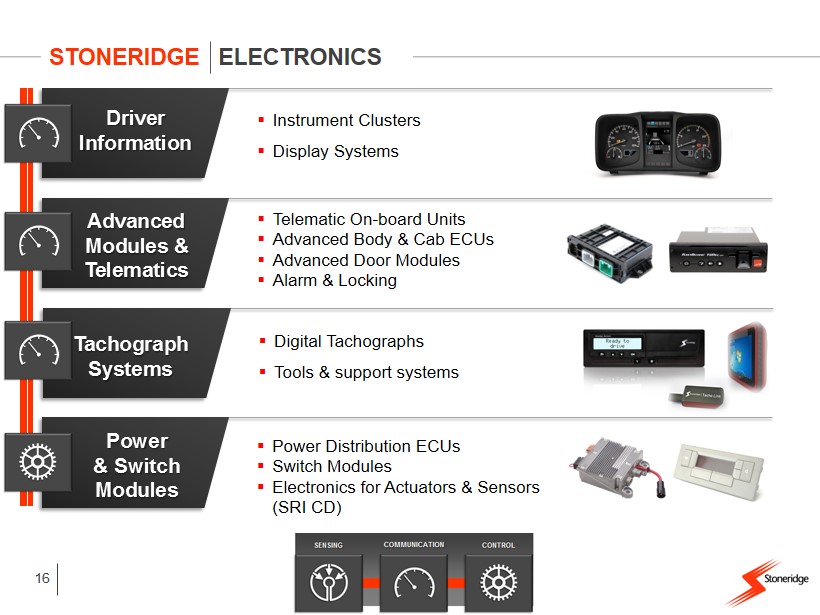

Driver Information ▪ Instrument Clusters ▪ Display Systems ▪ Power Distribution ECUs ▪ Switch Modules ▪ Electronics for Actuators & Sensors (SRI CD) Tachograph Systems ▪ Telematic On - board Units ▪ Advanced Body & Cab ECUs ▪ Advanced Door Modules ▪ Alarm & Locking Advanced Modules & Telematics Power & Switch Modules ▪ Digital Tachographs ▪ Tools & support systems STONERIDGE ELECTRONICS 16

STONERIDGE ELECTRONICS 17 ▪ A strategic partner to leading Commercial Vehicle manufacturers, workshops and vehicle owners ▪ Enhanced core competency in vehicle electrical architectures ▪ Apply leading technology integrating hardware and software ▪ Develop cost efficient, flexible, high performing products ▪ Global technology, platform development / deployment and product lifecycle management ▪ Expanded regional engineering providing local technical support to global customers ▪ Low cost manufacturing and global supply enable regional growth and competitiveness

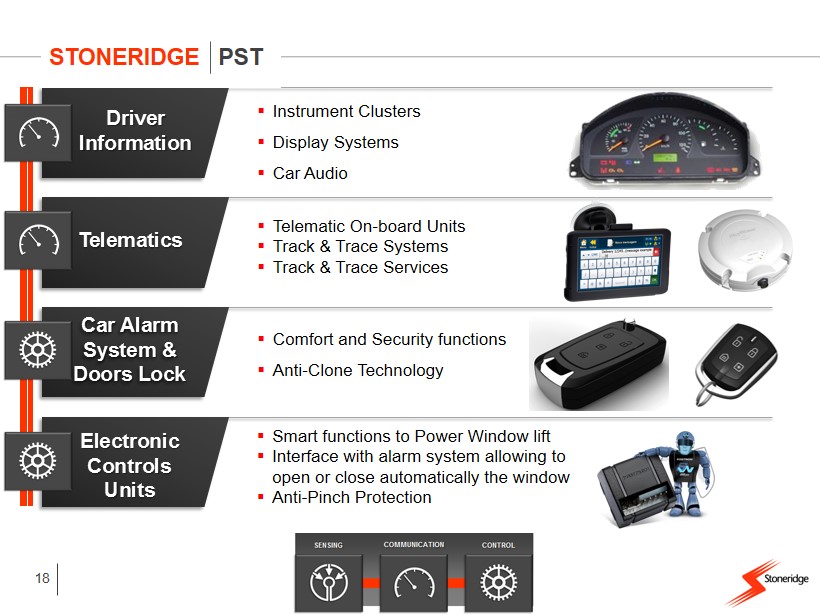

▪ Instrument Clusters ▪ Display Systems ▪ Car Audio ▪ Smart functions to Power Window lift ▪ Interface with alarm system allowing to open or close automatically the window ▪ Anti - Pinch Protection Electronic Controls Units ▪ Telematic On - board Units ▪ Track & Trace Systems ▪ Track & Trace Services Telematics ▪ Comfort and Security functions ▪ Anti - Clone Technology Car Alarm System & Doors Lock STONERIDGE PST 18 Driver Information

STONERIDGE PST 19 ▪ Electronics business with innovative technical and service solutions ▪ Track & Trace network covers Brazil with unique advantages ▪ Aftermarket business today is expanding in Infotainment ▪ Restructured in Q2 - 14 & Q3 - 14 to respond to the economic conditions in Brazil ▪ Economic outlook is stabilizing ▪ Localization of OEM’s in region provides additional opportunities ▪ Emerging OEM business complements strong brand in Aftermarket

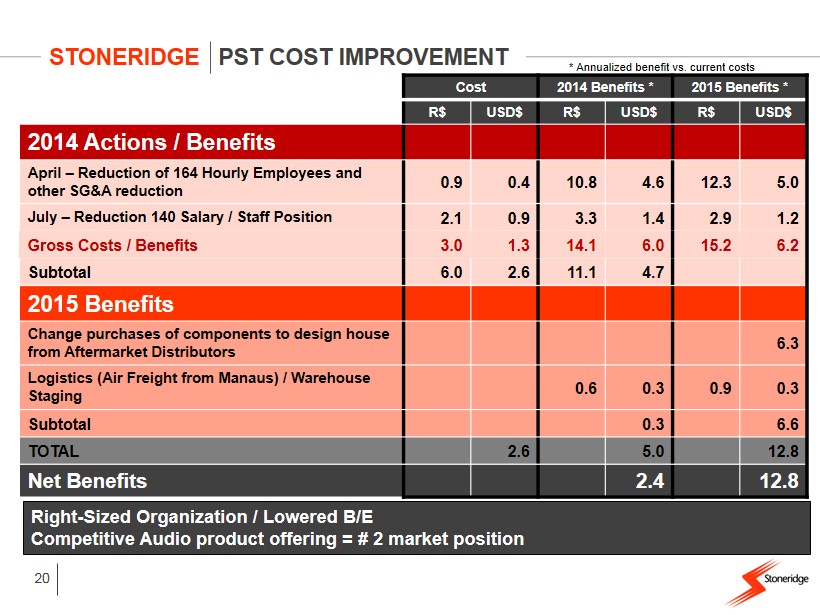

STONERIDGE PST COST IMPROVEMENT 20 Right - Sized Organization / Lowered B/E Competitive Audio product offering = # 2 market position * Annualized benefit vs. current costs Cost 2014 Benefits * 2015 Benefits * R$ USD$ R$ USD$ R$ USD$ 2014 Actions / Benefits April – Reduction of 164 Hourly Employees and other SG&A reduction 0.9 0.4 10.8 4.6 12.3 5.0 July – Reduction 140 Salary / Staff Position 2.1 0.9 3.3 1.4 2.9 1.2 Gross Costs / Benefits 3.0 1.3 14.1 6.0 15.2 6.2 Subtotal 6.0 2.6 11.1 4.7 2015 Benefits Change purchases of components to design house from Aftermarket Distributors 6.3 Logistics (Air Freight from Manaus ) / Warehouse Staging 0.6 0.3 0.9 0.3 Subtotal 0.3 6.6 TOTAL 2.6 5.0 12.8 Net Benefits 2.4 12.8

STONERIDGE PST GROWTH OPPORTUNITES 21 Export 5.5% OEM/OES 19.0% Mass Merchandisers 18.7% Aftermarket 29.4% Track & Trace 27.4% 2015 E Growth 25 - 30% ▲ 8 - 10 % ▲ 20 - 30% ▲ 3 - 4% ▲ (3%) * ▼ PST Growth 10 to 15% In local currency % of PST Sales Volume Major Growth Drivers Track & Trace • Serves Retail and Corporate Accounts • Retail – Solutions for Protection and Safety of Families • Corporate – Transport and Fleet Market • Products • GSM Tracking 900MHz – anti Jamming Capabilities (only system in Brazil) • Vehicles, Driver and Cargo • Control and Safety of Vehicle • Cargo Tracking (50% of Growth in 2015) Aftermarket • Maintain Alarm Systems Market Leadership • Continue Launching New Technology • Growing with Regional Distribution • Position Strong Brand Name Mass Merchandisers • Have Redesigned Complete Audio Product Line - # 2 market position • Substantially Improved Cost Position With Design House from China • Lower Cost Makes PST Competitive at All Price Points Across the Product Line OEM / OES • Market will continue to be flat for 2015 • Used Car sales grew by 7% in 2014. Trend will continue * FX Impact

22 STONERIDGE GLOBAL SYSTEM CAPABILITY Vehicle Interface Driver Interface Information Processing Sensing Control Communication Stoneridge offers unique capability throughout the value chain Integrated Solutions Powered By Electronics & Software

23 STONERIDGE GLOBAL REACH 13 Manufacturing Sites 20 Engineering & Technical Support Centers Includes India JV

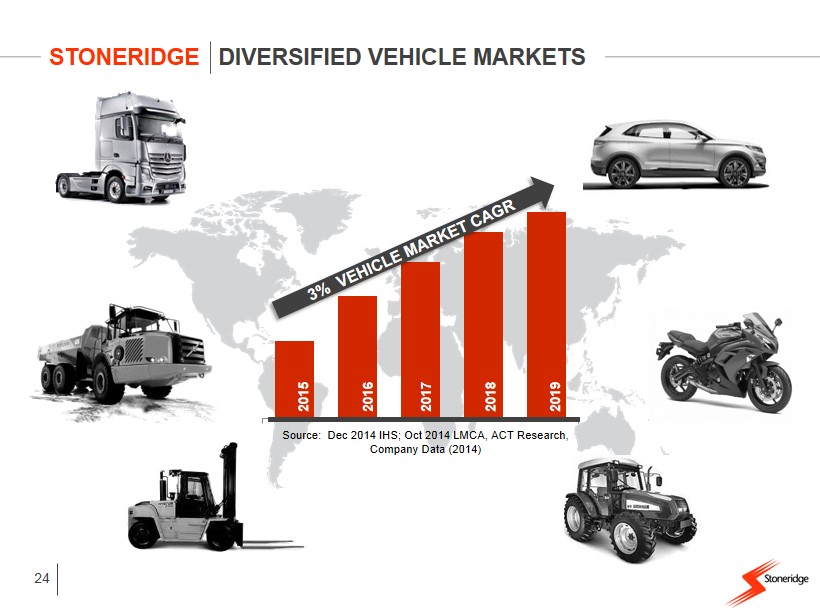

STONERIDGE DIVERSIFIED VEHICLE MARKETS 24 Source: Dec 2014 IHS; Oct 2014 LMCA, ACT Research, Company Data (2014) 2015 2016 2017 2018 2019

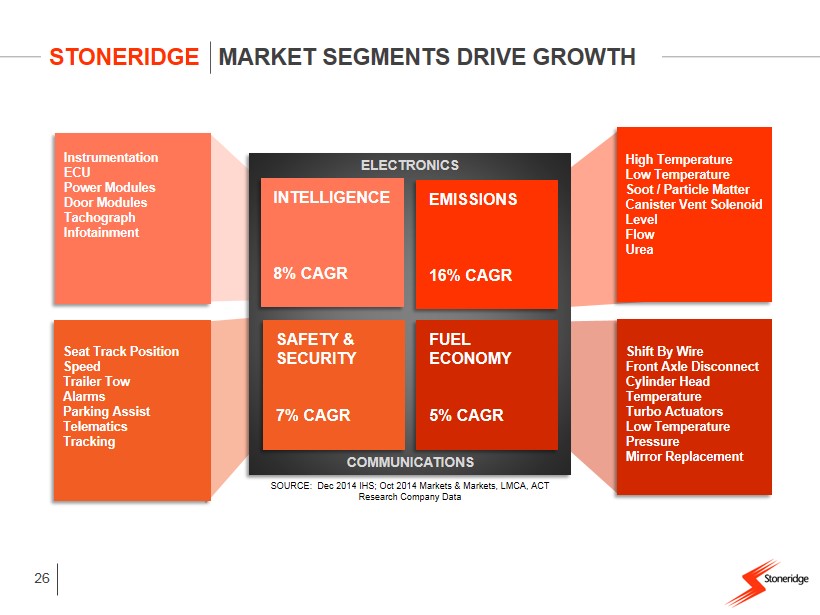

STONERIDGE MARKET SEGMENTS DRIVE GROWTH INTELLIGENCE 8% CAGR SAFETY & SECURITY 7% CAGR EMISSIONS 16% CAGR FUEL ECONOMY 5% CAGR 25 ELECTRONICS COMMUNICATIONS We are focused on growth markets Stoneridge Sales Growth NOTE: Excludes Wiring 2014 TTM 2015 2016 2017 2018 2019 SOURCE: Dec 2014 IHS; Oct 2014 Markets & Markets, LMCA, ACT Research Company Data

STONERIDGE MARKET SEGMENTS DRIVE GROWTH INTELLIGENCE 8% CAGR SAFETY & SECURITY 7% CAGR EMISSIONS 16% CAGR FUEL ECONOMY 5% CAGR 26 ELECTRONICS COMMUNICATIONS Instrumentation ECU Power Modules Door Modules Tachograph Infotainment Seat Track Position Speed Trailer Tow Alarms Parking Assist Telematics Tracking High Temperature Low Temperature Soot / Particle Matter Canister Vent Solenoid Level Flow Urea Shift By Wire Front Axle Disconnect Cylinder Head Temperature Turbo Actuators Low Temperature Pressure Mirror Replacement SOURCE: Dec 2014 IHS; Oct 2014 Markets & Markets, LMCA, ACT Research Company Data

27 STONERIDGE CONTENT PER VEHICLE 2014 2015 2016 2017 2018 2019 MEDIUM / HD CAR / LT TRUCK SOURCE: Company Estimates

10% 8% 6% 6% 5% 4% 3% 3% 2% 18% 24% STONERIDGE CUSTOMERS 28 FORD SCANIA GM DAIMLER TRACK & TRACE SERVICES (PST) OTHER OEMS TIER 1’s & AFTERMARKET NAVISTAR VOLVO MAN FIAT CHRYSLER PST: OTHER PRODUCTS 2013 Revenue (excludes Wiring) CUSTOMERS OF CHOICE

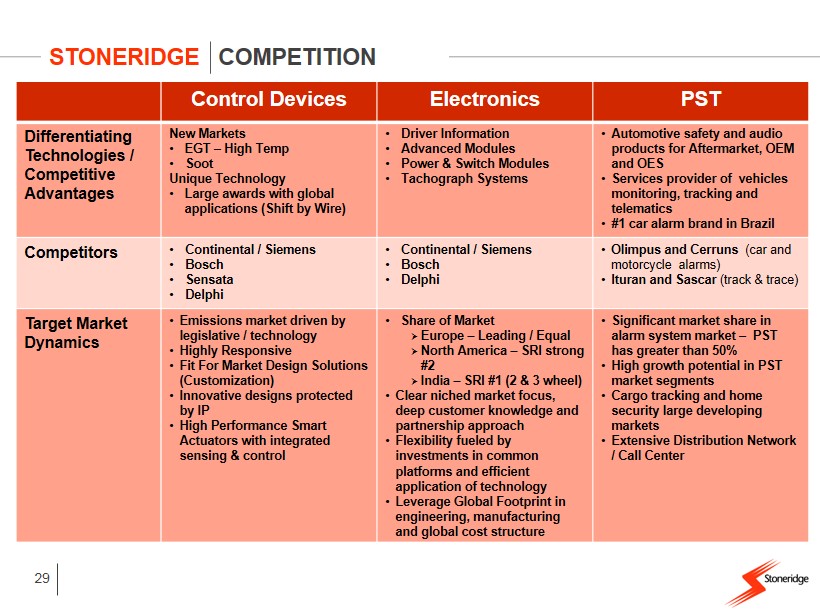

29 STONERIDGE COMPETITION Control Devices Electronics PST Differentiating Technologies / Competitive Advantages New Markets • EGT – High Temp • Soot Unique Technology • Large awards with global applications (Shift by Wire) • Driver Information • Advanced Modules • Power & Switch M odules • Tachograph Systems • Automotive safety and audio products for Aftermarket, OEM and OES • Services provider of vehicles monitoring, tracking and telematics • #1 car alarm brand in Brazil Competitors • Continental / Siemens • Bosch • Sensata • Delphi • Continental / Siemens • Bosch • Delphi • Olimpus and Cerruns (car and motorcycle alarms) • Ituran and Sascar (track & trace ) Target Market Dynamics • Emissions market driven by legislative / technology • Highly Responsive • Fit For Market Design Solutions (Customization) • Innovative designs protected by IP • High Performance Smart Actuators with integrated sensing & control • Share of Market » Europe – Leading / Equal » North America – SRI strong #2 » India – SRI #1 (2 & 3 wheel) • Clear niched market focus, deep customer knowledge and partnership approach • Flexibility fueled by investments in common platforms and efficient application of technology • Leverage Global Footprint in engineering, manufacturing and global cost structure • Significant market share in alarm system market – PST has greater than 50% • High growth potential in PST market segments • Cargo tracking and home security large developing markets • Extensive Distribution Network / Call Center

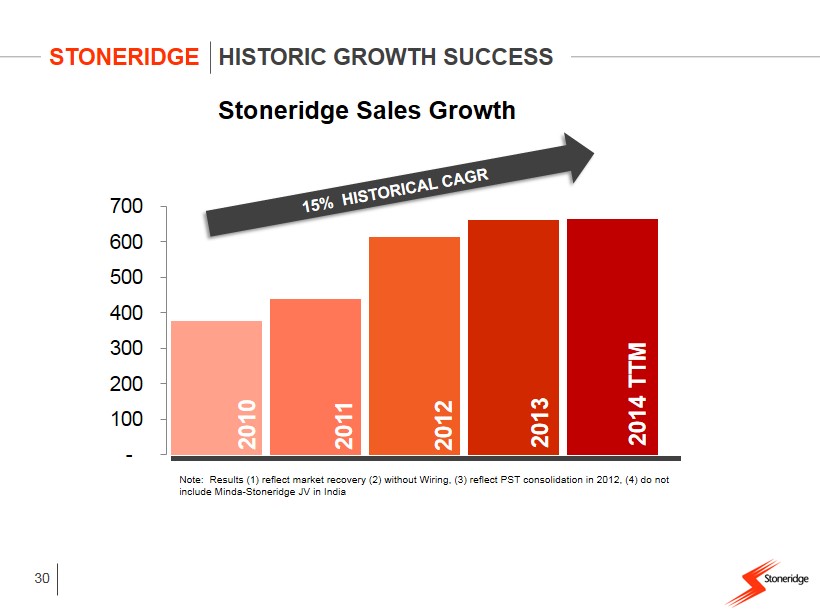

STONERIDGE HISTORIC GROWTH SUCCESS 2012 30 Note: Results (1) reflect market recovery (2) without Wiring, (3) reflect PST consolidation in 2012, (4) do not include Minda - Stoneridge JV in India 2014 2010 2011 2013 - 100 200 300 400 500 600 700 Stoneridge Sales Growth 2013 2014 TTM 2012 2011 2010

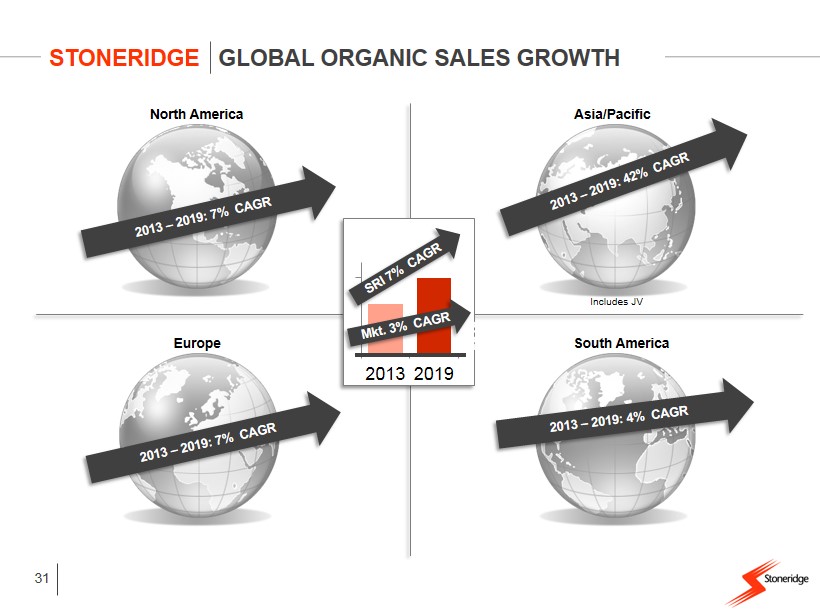

2013 2019 North America Europe South America Asia/Pacific Includes JV STONERIDGE GLOBAL ORGANIC SALES GROWTH 2019 31

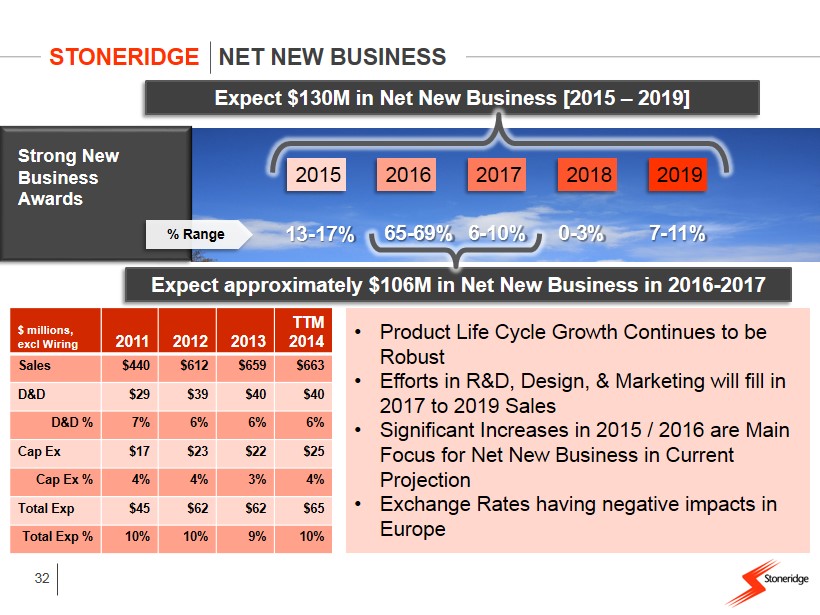

32 STONERIDGE NET NEW BUSINESS Strong New Business Awards 2015 2016 2017 2018 2019 13 - 17% % Range 65 - 69% 6 - 10% 0 - 3% 7 - 11% Expect approximately $106M in Net New Business in 2016 - 2017 Expect $130M in Net New Business [2015 – 2019] $ millions, excl Wiring 2011 2012 2013 TTM 2014 Sales $440 $612 $659 $663 D&D $29 $39 $40 $40 D&D % 7% 6% 6% 6% Cap Ex $17 $23 $22 $25 Cap Ex % 4% 4% 3% 4% Total Exp $45 $62 $62 $65 Total Exp % 10% 10% 9% 10% • Product Life Cycle Growth Continues to be Robust • Efforts in R&D, Design, & Marketing will fill in 2017 to 2019 Sales • Significant Increases in 2015 / 2016 are Main Focus for Net New Business in Current Projection • Exchange Rates having negative impacts in Europe

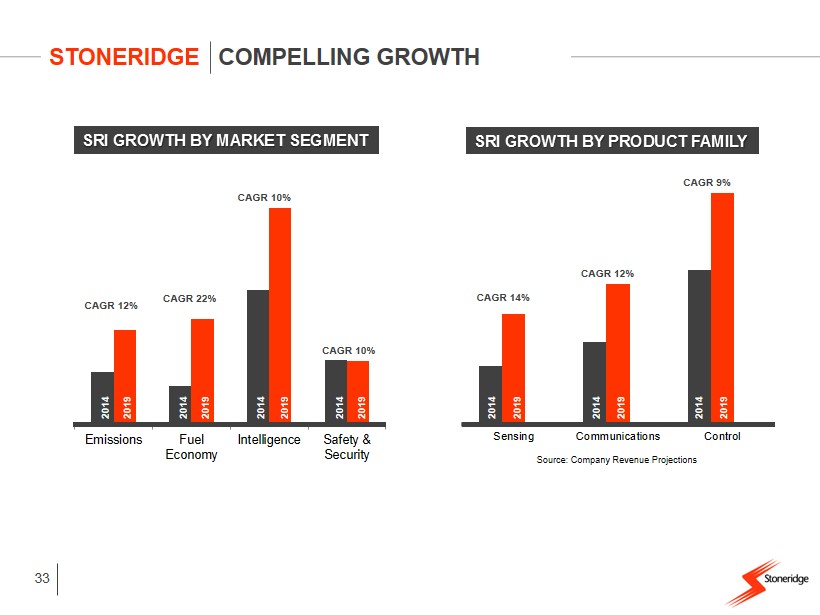

Sensing Communications Control Emissions Fuel Economy Intelligence Safety & Security SRI GROWTH BY MARKET SEGMENT SRI GROWTH BY PRODUCT FAMILY STONERIDGE COMPELLING GROWTH 2014 2019 2014 2019 2014 2019 2014 2019 2014 2019 2014 2019 2014 2019 33 Source: Company Revenue Projections CAGR 10 % CAGR 22% CAGR 12% CAGR 10 % CAGR 14% CAGR 12% CAGR 9%

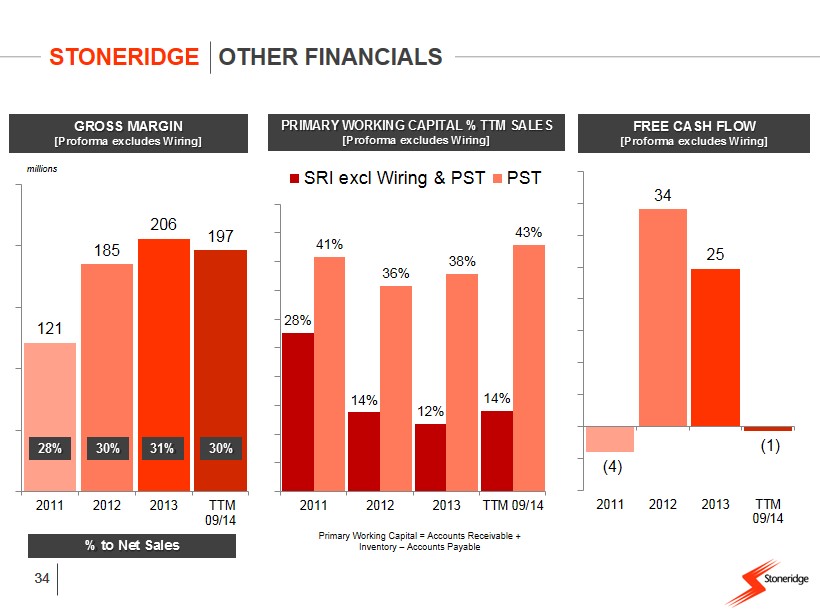

STONERIDGE OTHER FINANCIALS 34 121 185 206 197 2011 2012 2013 TTM 09/14 GROSS MARGIN [ Proforma excludes Wiring] millions PRIMARY WORKING CAPITAL % TTM SALES [ Proforma excludes Wiring] 28% 14% 12% 14% 41% 36% 38% 43% 2011 2012 2013 TTM 09/14 SRI excl Wiring & PST PST (4) 34 25 (1) 2011 2012 2013 TTM 09/14 FREE CASH FLOW [ Proforma excludes Wiring] 28% % to Net Sales 30% 31% 30% Primary Working Capital = Accounts Receivable + Inventory – Accounts Payable 34

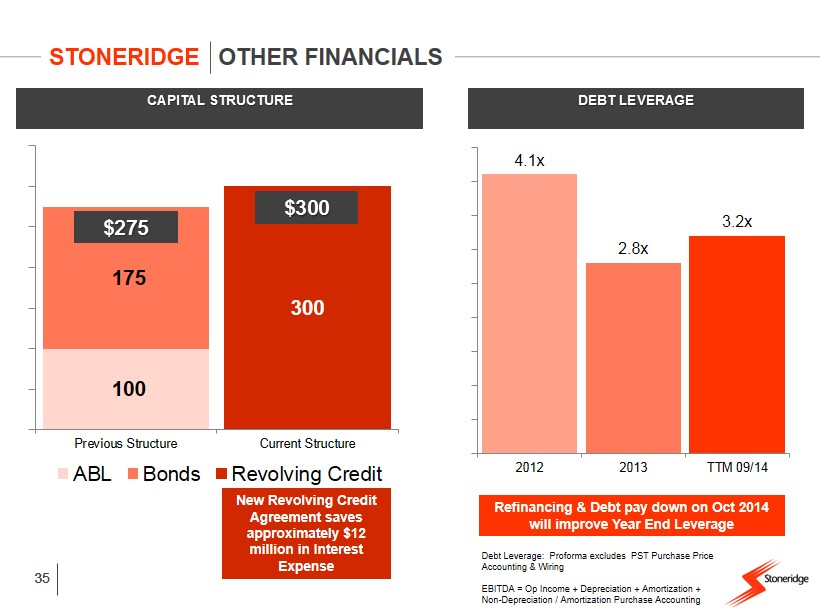

STONERIDGE OTHER FINANCIALS 35 DEBT LEVERAGE 4.1x 2.8x 3.2x 2012 2013 TTM 09/14 Debt Leverage: Proforma excludes PST Purchase Price Accounting & Wiring EBITDA = Op Income + Depreciation + Amortization + Non - Depreciation / Amortization Purchase Accounting 100 175 300 Previous Structure Current Structure ABL Bonds Revolving Credit CAPITAL STRUCTURE $275 $300 New Revolving Credit Agreement saves approximately $12 million in Interest Expense Refinancing & Debt pay down on Oct 2014 will improve Year End Leverage 35

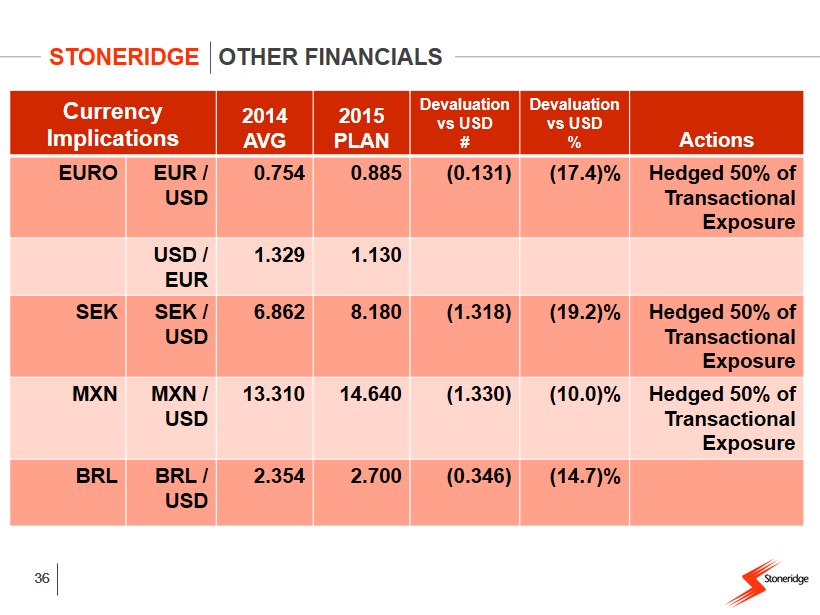

STONERIDGE OTHER FINANCIALS 36 Currency Implications 2014 AVG 2015 PLAN Devaluation vs USD # Devaluation vs USD % Actions EURO EUR / USD 0.754 0.885 (0.131) (17.4)% Hedged 50% of Transactional Exposure USD / EUR 1.329 1.130 SEK SEK / USD 6.862 8.180 (1.318) (19.2)% Hedged 50% of Transactional Exposure MXN MXN / USD 13.310 14.640 (1.330) (10.0)% Hedged 50% of Transactional Exposure BRL BRL / USD 2.354 2.700 (0.346) (14.7)% 36

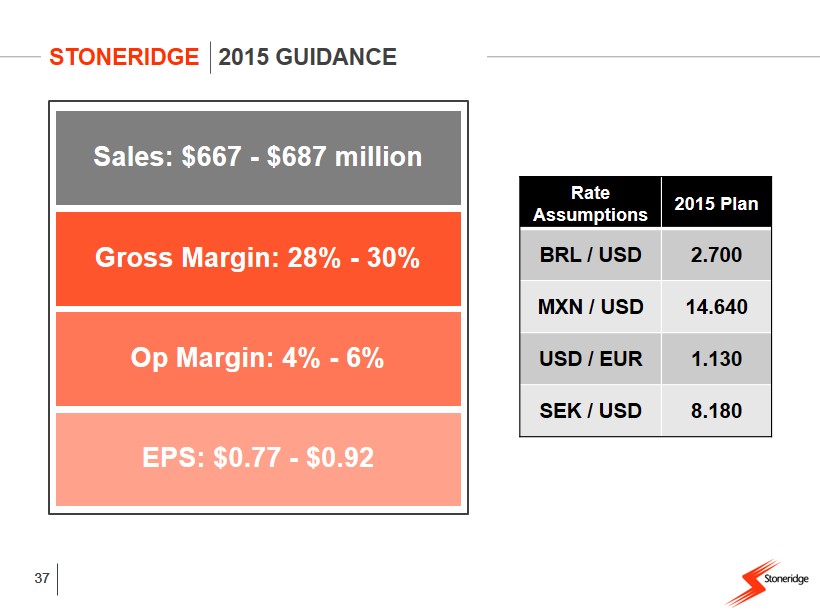

STONERIDGE 2015 GUIDANCE 37 Sales: $667 - $687 million Gross Margin: 28% - 30% Op Margin: 4% - 6% EPS: $0.77 - $0.92 Rate Assumptions 2015 Plan BRL / USD 2.700 MXN / USD 14.640 USD / EUR 1.130 SEK / USD 8.180 37

TECHNOLOGIES IN MOTION STONERIDGE VALUE PROPOSITION 38 Serving Expanding Markets with Innovative Technologies Demonstrated Organic Growth / Strong Order Book Global Growth with Customers of Choice Leverage of Low Cost Regional Advantages Strong Cash Position for Growth & Acquisitions