Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - Inovalon Holdings, Inc. | a2222935zex-23_1.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on February 10, 2015

Registration No. 333-201321

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

AMENDMENT NO. 5 TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Inovalon Holdings, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 7374 | 47-1830316 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

4321 Collington Road

Bowie, MD 20716

(301) 809-4000

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Keith R. Dunleavy, M.D.

Chief Executive Officer and Chairman

Inovalon Holdings, Inc.

4321 Collington Road

Bowie, MD 20716

(301) 809-4000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| David P. Slotkin Spencer D. Klein Justin R. Salon Morrison & Foerster LLP 2000 Pennsylvania Avenue, Suite 6000 Washington, DC 20006 (202) 887-1500 |

Shauna L. Vernal Chief Legal Officer Inovalon Holdings, Inc. 4321 Collington Road Bowie, MD 20716 (301) 809-4000 |

Rachel W. Sheridan John H. Chory Latham & Watkins LLP John Hancock Tower, 27th Floor 200 Clarendon Street Boston, MA 02116 (617) 948-6000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement. If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o | |

Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

|

||||||||

| Title of Securities to be Registered |

Amount to be Registered(1) |

Proposed Maximum Aggregate Offering Price Per Share |

Proposed Maximum Aggregate Offering Price |

Amount of Registration Fee(2) |

||||

|---|---|---|---|---|---|---|---|---|

Class A Common Stock, $0.000005 par value per share |

25,555,555 | $26.00 | $664,444,430 | $71,269.34 | ||||

|

||||||||

- (1)

- Estimated pursuant to Rule 457(a) under the Securities Act of 1933, as amended. Includes the additional shares the underwriters have the right to purchase from the Registrant, if any.

- (2)

- Previously paid. Pursuant to Rule 457(a), no additional fee is payable as a result of the increase in the proposed maximum aggregate offering price per share reflected herein.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion. Dated February 10, 2015.

22,222,222 Shares

Class A Common Stock

This is the initial public offering of shares of Class A common stock of Inovalon Holdings, Inc.

We have two classes of common stock, Class A common stock and Class B common stock. The rights of the holders of our Class A common stock and Class B common stock are identical, except with respect to voting and conversion rights. Each share of Class A common stock will be entitled to one vote per share. Each share of Class B common stock will be entitled to 10 votes per share and will be convertible at the election of each holder at any time, or automatically upon the occurrence of certain events, into one share of Class A common stock. Immediately following the completion of this offering, outstanding shares of our Class B common stock will represent approximately 98% of the voting power of our outstanding common stock. See "Description of Capital Stock — Class A and B Common Stock."

Prior to this offering, there has been no public market for our Class A common stock. It is currently estimated that the initial public offering price per share will be between $24.00 and $26.00 per share. We have been approved for listing of our Class A common stock on the NASDAQ Global Select Market under the symbol "INOV."

We are an "emerging growth company" as defined under federal securities laws and, as such, have elected to comply with certain reduced public company reporting requirements.

Investing in our Class A common stock involves significant risks. See "Risk Factors" beginning on page 23 to read about factors you should consider before buying shares of our Class A common stock.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| |

Per Share

|

Total

|

|||

|---|---|---|---|---|---|

Initial public offering price |

$ | $ | |||

Underwriting discount(1) |

$ | $ | |||

Proceeds, before expenses, to Inovalon |

$ | $ |

- (1)

- See "Underwriting" for additional information regarding underwriting compensation.

The underwriters have the option to purchase up to an additional 3,333,333 shares from us at the initial public offering price less the underwriting discount.

The underwriters expect to deliver the shares of Class A common stock to purchasers in New York, New York on or about , 2015.

| Goldman, Sachs & Co. | Morgan Stanley | Citigroup |

| BofA Merrill Lynch | UBS Investment Bank |

| Baird | Piper Jaffray | Wells Fargo Securities | William Blair |

Prospectus dated , 2015.

Through and including , 2015 (the 25th day after the date of this prospectus), all dealers effecting transactions in those securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer's obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

Neither we nor the underwriters have authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. Neither we nor the underwriters take responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

Persons who come into possession of this prospectus and any applicable free writing prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus and any such free writing prospectus applicable to that jurisdiction.

This prospectus includes market data and forecasts with respect to the healthcare industry. Although we are responsible for all of the disclosure contained in this prospectus, in some cases we rely on and refer to market data and certain industry forecasts that were obtained from third party surveys, market research, consultant surveys, publicly available information and industry publications and surveys that we believe to be reliable.

i

This summary highlights information contained elsewhere in this prospectus. It may not contain all the information that may be important to you. You should read the entire prospectus carefully, including the section entitled "Risk Factors" and our financial statements and the related notes included elsewhere in this prospectus before making an investment decision to purchase shares of our common stock.

In this prospectus, unless we indicate otherwise or the context requires, references to the "company," "Inovalon," "we," "our," "ours," and "us" refer to Inovalon Holdings, Inc. and its consolidated subsidiaries. The following summary is qualified in its entirety by the more detailed information and consolidated financial statements and notes thereto included elsewhere in this prospectus.

On January 14, 2015, our board of directors approved a five-for-one stock split of our Class A common stock and Class B common stock. Effective January 16, 2015, we amended our certificate of incorporation to give effect to the stock split and to change our authorized common equity capital to 900,000,000 shares of common stock, 750,000,000 shares of Class A common stock, and 150,000,000 shares of Class B common stock, all par value $0.000005 per share. All share data included in this prospectus give retroactive effect to the stock split and related amendment to our certificate of incorporation.

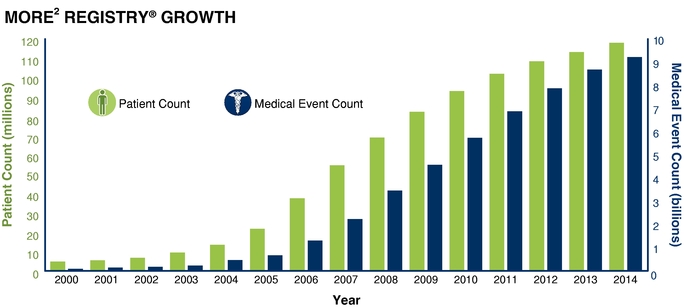

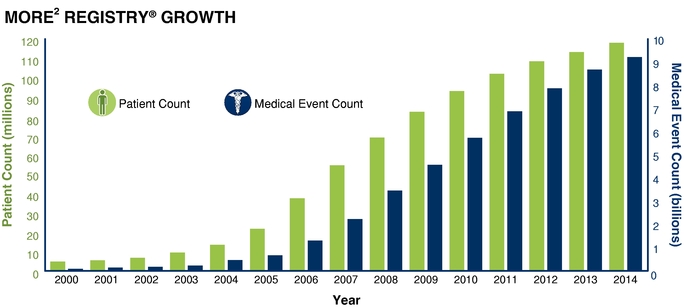

Our Company

We are a leading technology company that combines advanced cloud-based data analytics and data-driven intervention platforms to achieve meaningful insight and improvement in clinical and quality outcomes, utilization, and financial performance across the healthcare landscape. Our powerful platforms drive high-value impact, improving quality and economics for health plans, hospitals, physicians, patients, pharmaceutical companies, and researchers. The value we deliver to our clients is achieved by turning data into insights and those insights into action. Through our large proprietary datasets, advanced data integration technologies, sophisticated predictive analytics, and deep subject matter expertise, we deliver seamless, end-to-end platforms that bring the benefits of big data and large-scale analytics to the point of care. Our analytics identify gaps in care, quality, data integrity, and financial performance, while our data-driven intervention platforms provide clients with differentiated capabilities to resolve these gaps. During 2014, we provided these services to more than 100 clients representing approximately 200 patient populations, providing analytics informed by our data and insight on more than 754,000 physicians, 248,000 clinical facilities, 120 million unique patients (covering approximately 98.2% of all U.S. counties), and 9.2 billion discrete entries relating to patient interactions, medical procedures or changes in patients' medical conditions, which we refer to as medical events, a number that has been increasing at a rate of approximately 3.0% compounding monthly, or 42.6% annually, since 2000.

Healthcare costs in the United States have been increasing significantly for many years, currently approaching almost $3 trillion annually. This rise in healthcare costs has driven a broad transition from consumption-based payment models to value-based payment models across the healthcare landscape. As a result, the specific disease and comorbidity status (i.e., the presence of one or more diseases or medical conditions co-occurring with a primary disease or medical condition), clinical and quality outcomes, resource utilization, and care details of the individual patient have become increasingly relevant to the various constituents of the healthcare delivery system. Concurrently, the count and complexity of diseases, diagnostics, and treatments — let alone payment models and regulatory oversight requirements — have soared. In this setting, granular data has become critical to determining and improving quality of care and financial performance in healthcare.

1

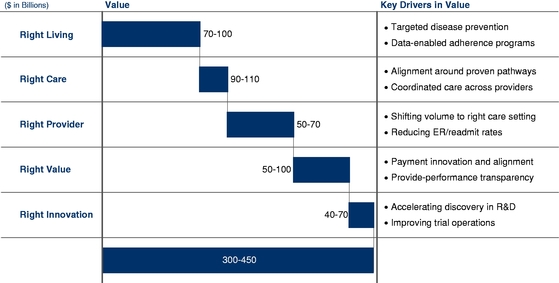

We believe that the opportunity before us is substantial as data increasingly becomes the lynchpin in healthcare — from clinical quality outcomes and financial performance, to the consumer experience and drug discovery. A January 2013 McKinsey & Company, or McKinsey, report estimates that utilizing data analytics could drive improvements in healthcare resulting in a beneficial economic impact of $300 billion to $450 billion annually. As a reflection of the increasing need for data analytics, in the last several years our advanced analytics and data-driven intervention platforms have been driving significant economic impact through improvements in clinical and quality outcomes, disease and comorbidity data accuracy, and utilization, achieving hundreds of millions of dollars per year in quantified beneficial financial improvements for our clients.

At the core of our capabilities is a long history of innovation and profitable growth, positioning us to deliver value to our clients and capitalize on the confluence of recent changes in the healthcare industry that many describe as historically unprecedented. Our ability to rapidly innovate is enabled by the depth and breadth of our industry expertise, large-scale proprietary datasets, advanced analytical prowess, highly flexible platform components, a common native code base, and experience across the healthcare landscape.

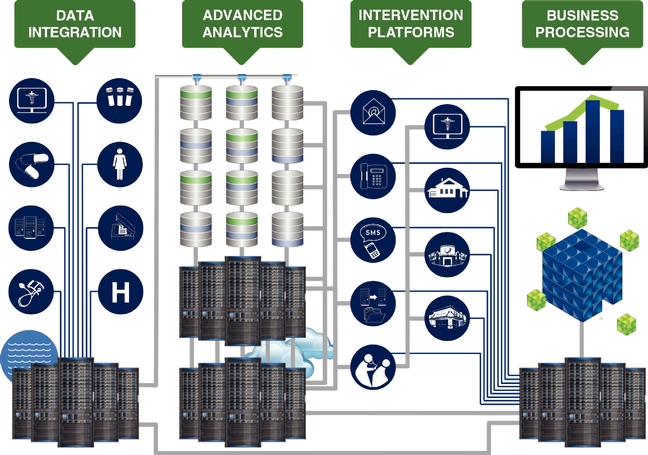

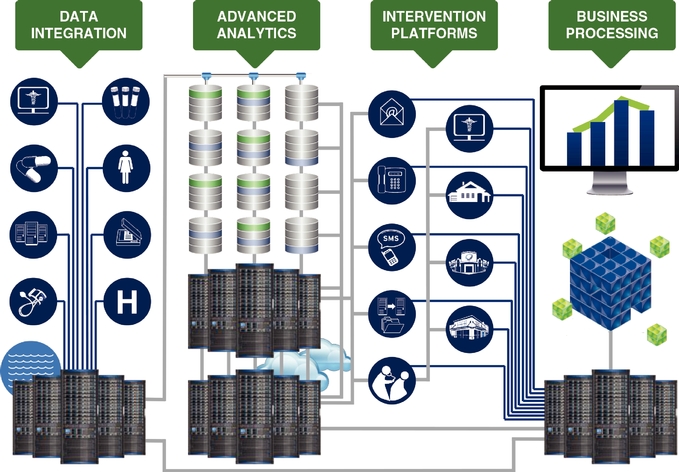

We deliver value to our clients through our platforms, which are accomplished through four primary components:

- •

- Data Integration: Highly efficient and effective data

assimilation of structured and unstructured healthcare data in any format from highly disparate and disconnected sources;

- •

- Advanced Analytics: Data analysis using big-data

processing to yield highly actionable insights identifying gaps in care, quality, data integrity, and financial performance;

- •

- Intervention Platforms: Software and services that allow

our clients to take the insights derived from our analytics to address and resolve the identified gaps in care, quality, data integrity, and financial performance; and

- •

- Business Processing: Powerful business intelligence tools that summarize key analytics and benchmarking information as well as a comprehensive claims data warehouse that helps our clients comply with government mandated reporting requirements.

Our ability to deliver value to our clients through our advanced analytics and intervention platforms has allowed us to achieve significant growth since the company's organization. Over the last three years, our revenue has increased at a compounded annual growth rate of 19%, Adjusted EBITDA at a compounded annual growth rate of 20%, and net income at a compounded annual growth rate of 33% despite a 1% revenue decrease during the year ended December 31, 2013 as compared to the year ended December 31, 2012. For the nine months ended September 30, 2014, our revenue was $271.6 million, representing 17% growth over the same period of the prior year. In this same period, we generated Adjusted EBITDA of $103.1 million, representing 38% of revenue and 77% growth over the same period in the prior year. Net income for the nine months ended September 30, 2014 was $51.9 million, representing 19% of revenue and a 92% increase over the same period in 2013. Adjusted EBITDA is a non-GAAP measure. For a reconciliation of Adjusted EBITDA to net income, see "Selected Consolidated Financial Data."

Industry Overview

We believe that the increasing demand for our platform is driven by the confluence of four fundamental healthcare industry trends:

Unsustainable Rise in Healthcare Costs. Healthcare spending in the U.S. was almost $3 trillion in 2012 according to the 2012 National Health Expenditure Highlights prepared by the Centers for Medicare and Medicaid Services, or CMS, representing more than 17% of U.S. Gross Domestic Product, or GDP. The 2014 set of healthcare cost projections from the Congressional Budget Office, or the CBO, indicate national healthcare spending will rise to 22% of GDP by 2039.

2

To address this expected significant rise in healthcare costs, the U.S. healthcare market is seeking more efficient and effective methods of delivering care. This same trend is playing out across modernized nations around the globe.

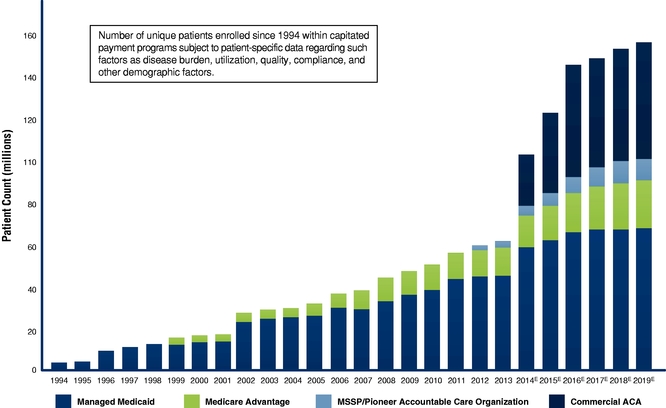

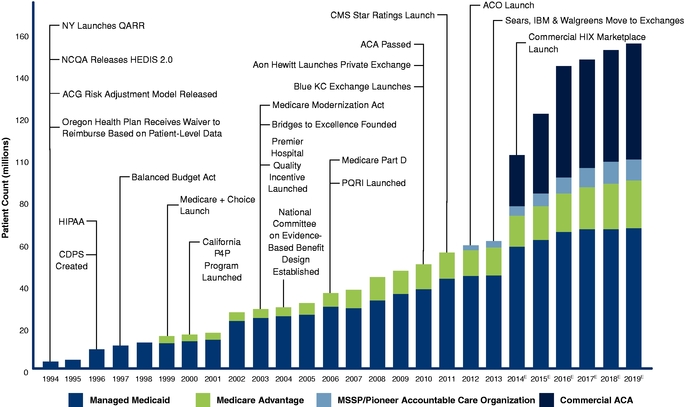

Shift to Value-Based Healthcare. The traditional fee-for-service reimbursement model in healthcare has played a major role in elevating both the level and growth rate of healthcare spending. In response, both the public and private sectors are shifting away from the historical fee-for-service models toward value-based, capitated payment models that are designed to incentivize value and quality at an individual patient level. As seen in the figure below, the number of Americans covered by capitated payment programs (care programs wherein an organization is financially responsible for the healthcare of a population of patients for which the total compensation is fixed other than adjustments for factors including specifically how sick individual patients are, how much resource is needed to be applied or spent on each patient, what is the quality of the clinical care, and other demographic factors) has been increasing rapidly and, according to industry sources and our internal estimates, is anticipated to increase from approximately 80 million at the start of 2014 to over 150 million by 2019. This increase is expected to further drive the critical importance to accurately measure, analyze, report, and improve patient disease and comorbidity conditions, utilization rates, and clinical quality outcomes.

Digitization of Healthcare Information. Across the healthcare landscape, a significant amount of data is being created every day driven by patient care, payment systems, regulatory compliance, and record keeping. These data include information within patient health records, clinical trials, pharmacy benefit programs, imaging systems, sensors and monitoring platforms, laboratory results, patient reported information, hospital and physician performance programs, and billing and payment processing. Despite significant investments by public and private sources within the industry, however, the digitized healthcare data remain largely stored in "walled gardens" — data that is static and not easily shared or interpreted. As the amount of data in healthcare continues to grow, we believe that it will be critical for the healthcare industry to be able to use this disparate data to better achieve the goals of higher quality and more efficient care.

3

Increasing Complexity. The healthcare industry is on a course of dramatically progressive complexity. As technology employed in the healthcare space has become increasingly sophisticated, new diagnostics and treatments have been introduced, the pool of clinical research has expanded, and the paradigms dictating payment and regulatory oversight have multiplied. This expanding complexity drives a growing and continuous need for analysis of the underlying and resulting data.

Problems Our Clients Face

As the U.S. healthcare market continues to transform, the aforementioned industry trends have set into motion a number of significant challenges faced by our clients. We believe that we are well-positioned and have the solutions to help clients not only adapt to, but thrive within, the new healthcare landscape.

Understanding and Improving Clinical Quality Outcomes. Quality and value-based, capitated programs require that clinical and quality outcomes be measured at the individual patient level. These measures require detailed and highly granular reporting of the care sought and delivered to each patient to allow for the accurate calculation of population quality metrics. The results of these quality measurements drive significant financial incentives and consequences, influencing more than an estimated $3 billion in quality-related payments annually.

Understanding the True Health Status of Patients. The ability to establish the appropriate treatment protocol among multiple physicians, ensure that patients are supported with the correct care resources and monitored for the proper patient-relevant quality metrics, and determine the overall population risk is contingent on the ability to become accurately aware of a patients' disease and comorbidity status. Having detailed and highly granular reporting of the disease and comorbidities of each patient is essential for care, quality, and financial performance.

Understanding and Improving Utilization. Under new legislation, health plans are required to submit data on the percentage of revenue collected from health insurance premiums that is spent on clinical services and quality improvement, which is more commonly known as the Medical Loss Ratio, or the MLR. If health plans fail to meet set MLR thresholds, they are required to rebate the customer. If the cost of care exceeds the MLR threshold, however, health plans must absorb the shortfall. Given the importance of accurately reporting the MLR and managing the underlying healthcare costs, many health plans enter into complex arrangements with key providers in their networks and other industry constituents (such as pharmaceutical companies and pharmacy benefit managers) through shared risk arrangements and performance bonus programs to help manage costs, drive improvements in patient health, and achieve long-term utilization containment and quality goals.

Complying with Increasingly Complex Regulatory Requirements. Federal and state regulation and compliance is increasing and becoming ever more complex, with agencies at nearly every level of government regulating the activities of organizations participating within the healthcare marketplace. The breadth, complexity, and intensity of regulation require these organizations to focus nearly every activity through a compliance lens in order to meet the data-intensive regulatory reporting requirements.

Enabling and Empowering the Consumer. Individuals can now buy direct coverage, select clinicians and hospitals, and directly research implications of specific medications, procedures, and treatment courses. Further, the individual is increasingly participating in the quantified-self movement in which they can self-monitor their key health metrics. This shift to a more informed and engaged consumer is resulting in new challenges and opportunities for how practice groups, payors, employers, pharmaceutical companies, retail pharmacies, and other healthcare constituents interact with consumers.

4

Unlocking the Value of Data through Actionable Interventions. A key commonality among the changes in the healthcare landscape is the importance of highly granular data. However, data by itself has limited usefulness without the right technology and systems in place to analyze and act on it and drive meaningful action. We believe that the leveraging of data is the critical differentiator in deriving meaningful insight and turning that insight into action to drive valuable impact across the healthcare landscape. However, in today's healthcare technology environment, much of this data goes unrecorded in a structured or meaningful way, unintegrated with other pertinent data related to the patient's events or conditions, and unanalyzed for the purposes of driving improvements in care and affordability.

Easily Deploying and Interoperating Platforms at Massive Scale. The ability to receive, seamlessly integrate, and accurately process extremely large-scale data flows efficiently and at high speeds is increasingly important and necessary for the healthcare industry. However, data integration and processing in massive scale is extremely challenging, which prevents the various components of the healthcare landscape from effectively communicating and coordinating with one another to deliver higher quality care. Overcoming this in scale is integral to managing large patient populations efficiently and effectively. Our platforms provide solutions to help address our clients' challenges and drive meaningful improvements in the clinical quality outcomes and financial performance across a wide expanse of our society's healthcare landscape.

Our Market Opportunity

We believe that our opportunity is significant and growing. According to a January 2013 McKinsey report, utilizing data analytics could reduce healthcare costs in the United States by $300 billion to $450 billion, or 12% to 17% of total U.S. healthcare costs today.

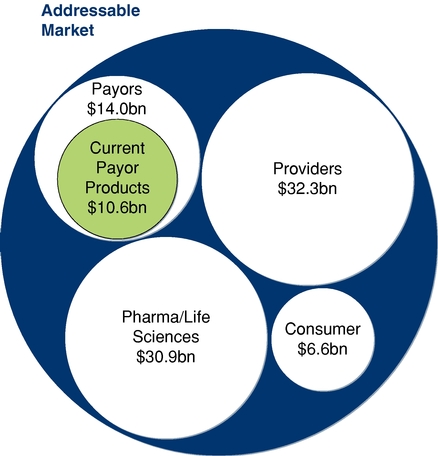

The ability to aggregate, integrate, and analyze data in massive scale and apply garnered insights in a manner that achieves meaningful impact is crucial for healthcare payors (e.g., health plans and integrated health delivery systems), clinical providers (e.g., hospitals, ACOs, and physicians), pharmaceutical and life sciences companies, and consumers. We estimate that our addressable market for these capabilities serving these healthcare constituents to be approximately $83.8 billion. We believe that the market opportunity for our current platform offering within the payor market, the historical focus of our company, is approximately $10.6 billion. According to industry sources, the market for software and related services is approximately $14.0 billion within the U.S. payor market. We believe that as analytics continue to demonstrate greater value within the U.S. payor landscape, the market will expand commensurately. As we continue to build and launch new capabilities, we believe it will provide a significantly larger value opportunity within this same payor space. For providers, industry sources estimate that software and related services represent a $32.3 billion U.S. market size. In the global pharmaceutical and life-sciences market, International Data Corporation, or IDC, in a 2013 report, estimates a $30.9 billion market size for total software and services spend in 2013. In the consumer market, an October 2013 Research and Markets report estimated a $6.6 billion global market size for mobile health applications and solutions. As with our other market segments, we believe that analytics will also drive a significant expansion in the consumer market.

In addition, the pressures that face the U.S. healthcare market are not unique, as other communities around the world are facing aging populations and growing pressures in the sustainable affordability of healthcare. We believe that our capabilities are highly applicable to other developed and developing countries around the globe, which we believe represents a sizable related future opportunity for us.

Our Platforms

Through the application of our platforms, we help our clients achieve large-scale insight and meaningful improvement in clinical and quality outcomes, utilization, and financial performance.

5

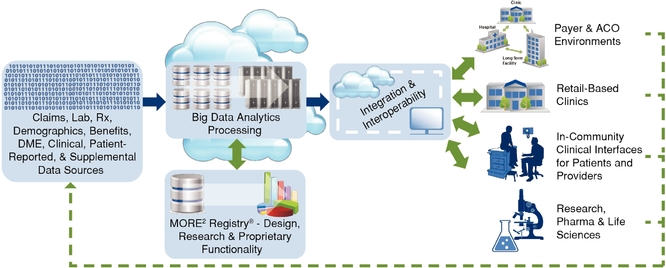

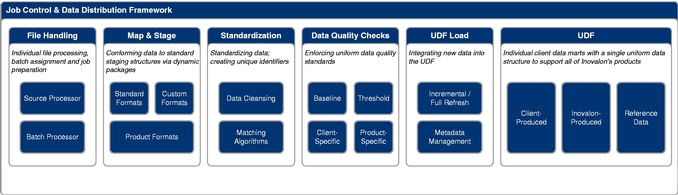

In deploying our technology to attain the results our clients require, they want us to synthesize opaque, convoluted, and disparate data into actionable information aligned with individualized goals and, in turn, empower patient and provider intervention platforms that achieve the realization of their goals in a measurable way. The diagram below illustrates the components of our technology platforms.

Our platforms' capabilities are currently engaged by more than 100 clients supporting approximately 200 patient populations that leverage our ability to analyze and improve clinical and quality outcomes and financial performance.

Data Integration: Datasets and the management of data are part of our core strengths, which give us insight into how a patient, provider, or population is doing. We integrate data seamlessly and securely into our systems through our proprietary extraction, transformation, and load tools and processes. Data we receive in the course of providing our services are statistically de-identified and stored in our Medical Outcomes Research for Effectiveness and Economics Registry, or MORE2 Registry®, which, as of December 31, 2014, contained more than 9.2 billion medical events from more than 120 million unique patients, 754,000 physicians, and 248,000 clinical facilities, touching 98.2% of all U.S. counties and Puerto Rico and growing at a rate of approximately 42.6% annually since 2000.

Advanced Analytics. For years we have developed, honed, and scaled a portfolio of sophisticated analytics. Applying our team's deep subject matter expertise in compute processing, data architecture, statistics, medical sciences, and healthcare policy, and leveraging the billions of medical events within our significant propriety datasets, we believe that we have developed one of the most advanced analytical platforms within the industry, as well as a culture and set of analytical

6

toolsets that serve to rapidly innovate and significantly expand our platform. Examples of the innovative analytics powered by this combination of data and processing capabilities include:

- •

- disease and comorbidity presence and closure probability determination analytics;

- •

- clinical and quality outcomes gap presence and closure probability determination analytics;

- •

- medication compliance and persistence analytics;

- •

- principally relevant provider determination analytics;

- •

- targeted intervention timing optimization analytics;

- •

- targeted intervention venue and logistics optimization analytics;

- •

- gap resolution valuation determination and prioritization analytics;

- •

- population simulation analytics; and

- •

- relative comparative analytics.

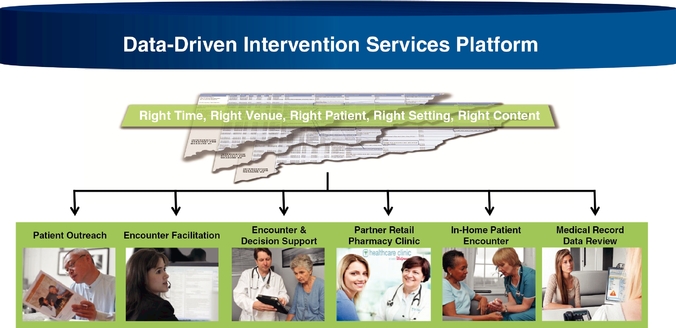

Intervention Platforms. Our data-driven intervention platforms are toolsets and services that enable our clients to take the insights derived from our analytics and implement solutions at the patient and provider level in order to achieve meaningful impact with the patient and provider. Our data-driven intervention platform tools encompass both internal administrative tasks as well as outbound, patient-oriented and provider-oriented functions. Examples of our intervention platform tools include:

- •

- point of care tools that provide patient-level insight to the healthcare provider, which guides the provider to aid in

the assessment, documentation, and care of a specific patient;

- •

- communication tools that support a wide range of notifications and interactions with patients and providers at the

appropriate level of implied education and language to aid in the process of achieving patient and provider actions;

- •

- supplemental patient encounter tools that facilitate the coordination of data-driven patient encounters for those who are

unable to participate in traditional office encounter venues; and

- •

- medical record data tools that facilitate electronic medical record data pulls, remote accessing, and clinical facility communications regardless of the underlying medical record data medium (e.g., digital or paper).

Business Processing. Our business processing toolsets are made up of a powerful business intelligence system and comprehensive data warehousing, which provide historical and current data insight, reporting, and benchmarking to support multiple client business needs such as government-mandated data filings, financial planning, and compliance requirements.

Our Competitive Strengths

We believe that our operational and financial success is based on the following key strengths:

Industry-Leading Analytics. We have demonstrated performance and leadership in disease and comorbidity identification analytics, predictive model analytics, patient and provider intervention prioritization analytics, quality outcomes analytics, and a host of additional analytical and data-driven processes. Based on our experience in the industry and our interactions with existing and prospective clients, we believe that very few other organizations, if any, are able to offer the depth and breadth of data-driven analytical insights, tools, and actionable interventions that our platforms are able to offer.

7

Industry-Leading Data Asset. We maintain one of the industry's largest independent datasets in our MORE2 Registry. The primary source nature of the contributing data, the clinical content depth of certain elements, the analytically-derived enrichments, the significant data integrity, and the ability to maintain accurate identification of entries and patient matching over time regardless of data source and chronology (a valuable characteristic within our datasets known as longitudinal matching) all combine to create a unique and valuable asset. We believe that these datasets serve as a significant differentiator, informing analytical and product strength design, population simulations, health outcomes research, patient engagement, and both speed-to-market and speed-to-impact capabilities.

Fully Integrated End-To-End Solution Delivery. Our platform is able to turn data into insights and insights into actionable interventions. The ability of our platform to integrate disparate and highly complex data to derive impactful and actionable insights has enabled us to bridge the gap from analytics to practical applications on a vast scale.

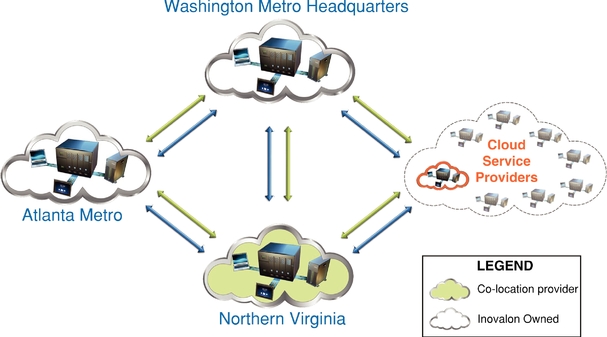

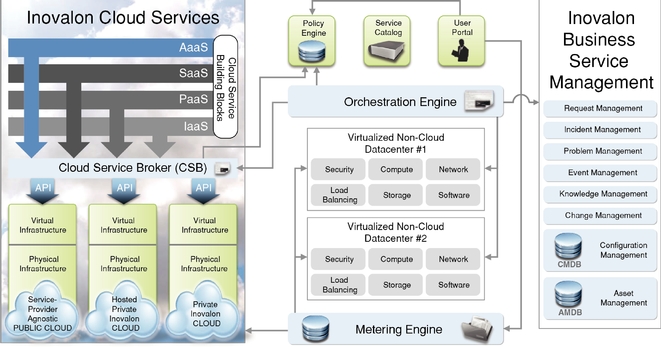

Scale of Organically Developed Platform. We have developed a highly efficient and scalable data and analytics platform that has successfully scaled to serve many of the nation's largest health plans as well as hundreds of separate patient populations concurrently. This platform has been developed on one common code base, supporting strong interoperability within our platform, efficiency in innovating and expanding our platform capabilities, and establishing both predictability and reliability when operated at high levels of load.

Subject Matter Expertise. We have, and plan to continue to cultivate, a culture of fostering domain expertise. We maintain a dedicated research team comprised of industry experts and thought leaders, including physicians, as well as clinical, statistical, economical, and data research scientists, and field practitioners who focus on next-generation healthcare solutions and data applications. In addition, we empower our product groups with their own industry experts who focus on research and development in their respective product domains.

Industry Innovator and Thought-Leader. We invest considerable time and resources to produce ground-breaking research and strategically share it through industry publications, peer presentations, strategic relationships, and the media. Our MORE2 Registry is routinely featured at high-profile industry events and within influential publications, which we believe further reinforces our brand as an industry innovator and thought-leader.

Long, Successful, Profitable Operating History. We have been delivering value to our clients while gaining scale and profitability since 2006, the year of our reorganization as a C corporation. This scale and profitability has provided organizational stability, an empowerment to invest in ongoing research and development, a high level of trust and confidence in us from our existing clients and potential clients, and ready access to resources to meet our clients' needs.

Trusted, Independent, and Unbiased Partner. We are not owned or influenced by a health plan or private equity organization. As a result, our data and analyses remain truly independent, not biased to any single patient base, we are incentivized to be transparent with our clients, and we believe our goals are more fully aligned with the success of our clients.

We have grown by attracting clients, accumulating increasingly larger and more robust datasets, and developing more advanced analytics from this growing dataset that deliver increasingly valuable insights and impact. By providing increasingly valuable insights and performing increasingly effective patient and provider interventions we are able to deliver greater value to our clients. As our data asset continues to grow, our analytics and intervention solutions become even more effective and our clients realize even more value from our solutions. This in turn

8

results in greater demand for our solutions and attracts new clients. We believe that this virtuous cycle provides us with a competitive position that cannot be easily replicated.

Growth Strategies

Our objective is to continue to provide leading data analytics and intervention platforms across the healthcare landscape while continuing to grow profitably. We intend to achieve this objective through the following key strategies.

Deliver Increasing Value to Existing Clients. We believe that we have a significant opportunity to deliver increasing value to our existing clients and this, in turn, will drive continued growth for us. As our clients recognize value and success as a result of working with our platforms, we frequently see our clients grow in their patient count and increase the number of products engaged with us — both of which result in our mutual success and growth. As we continue to deliver value to our clients, we plan to increase revenue from our existing clients by expanding their use of our platforms, selling to other parts of their organizations, and selling additional analytical toolsets and services to them.

Continue to Grow Our Client Base. We believe that we are still in the early stages of realizing our substantial opportunity to grow our client base. We intend to leverage our expertise and experience from the existing large client base to gain new clients through increased investment in our sales force and marketing efforts.

Continue to Innovate. Our strength in applying advanced, big data, cloud-based data analytics and our proprietary datasets enable us to achieve increasingly more impactful results for our clients. We intend to continue to invest in research and development to further enhance our data analytics and intervention platforms.

Continue Expanding into Adjacent Verticals. We believe the application of advanced analytics and data extends well beyond our current market opportunities and provides additional adjacent market verticals for growth. These verticals include providers, pharmaceutical and life sciences, employer and private exchanges, and direct to consumer.

Expand Reach through Growing our Channel Partnerships. While we have been successful in growing our business through our direct sales efforts, we believe there is a significant opportunity that exists for us to further expand and accelerate our reach through channel partnerships with organizations such as retail clinics, pharmaceutical companies, contract research organizations, large technology solution providers, and consulting firms.

Continue to Leverage our Technology Partnerships. The healthcare industry has traditionally lagged behind the technology innovation curve. Our advanced data processing and analytics capabilities, coupled with infrastructure thought leadership from leading vendors like EMC, has enabled us to empower our clients with powerful data-driven solution offerings and further transform the use case of modern technologies across the evolving IT healthcare landscape. We intend to continue to invest in these partnerships with thought leaders in the software and infrastructure sector.

Expand Internationally. Governments, corporations, and consumers worldwide face similar pressures as within the U.S. with respect to their healthcare systems. We believe that our capabilities are highly applicable to other countries around the world and we intend to invest in replicating our success in the U.S. market to other strategic countries and regions.

Selectively Pursue Acquisitions. We plan to selectively pursue acquisitions of complementary businesses, technologies, and teams that will allow us to add new features and functionalities to

9

our platform and accelerate the pace of our innovation and expansion into adjacent market spaces beyond what we can achieve organically.

Leverage our Dynamic, Passionate and Mission-Focused Culture. We believe that our work must meet a higher standard. We believe that the analytics that we design, deliver, and support achieve an impact in the lives of real people — parents, spouses, partners, siblings, and children — making integrity and quality cornerstones of our culture. Our dedication to integrity and quality extends to the proprietary technology used for medical data integration, analysis, abstraction, and reporting. Even more importantly, this culture is embraced throughout our company.

Recent Developments — Financial and Operating Information

Preliminary Unaudited 2014 Financial and Other Data

Our unaudited consolidated financial and key metrics data for the three months and the year ended December 31, 2014 presented below is preliminary and estimated financial information prepared by our management in good faith based upon our internal reporting for the three months and year ended December 31, 2014. Where indicated, these estimates are provided as a range. As these estimates are preliminary, actual results may still occur outside of the provided range. These estimates are preliminary and represent the most current information available to management. We have not identified any unusual or unique events or trends that occurred during the period which might materially affect these estimates. The unaudited financial information set forth below is subject to adjustments that may be identified when audit work is performed on our preliminary, unaudited financial information. As a result, our actual financial results for the three months and year ended December 31, 2014 may be different from the preliminary estimates herein and those differences could be material.

In addition, our independent registered public accounting firm, Deloitte & Touche LLP, has not audited, reviewed, compiled or performed any procedures on this preliminary financial data, and accordingly, does not express an opinion or other form of assurance with respect to this preliminary financial data. These estimates should not be viewed as a substitute for our full interim or annual financial statements prepared in accordance with GAAP. As a result, you are cautioned not to place undue reliance on the information furnished in this presentation and should view this information in the context of our 2014 results when such results are disclosed in our Annual Report on Form 10-K for the year ended December 31, 2014. See "Risk Factors" and "Forward-Looking Statements."

For a further description of Adjusted EBITDA and Adjusted EBITDA margin, non-GAAP measures, and our MORE2 Registry dataset metrics, Trailing 12 month Patient Analytics Months, Engaged Patient Populations, revenue from data analytics subscriptions and revenue from data-driven intervention platform services, see " — Summary Consolidated Financial and Other Data" and "Selected Consolidated Financial Data."

| |

Three Months Ended December 31, |

Year Ended December 31, |

|||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2013 |

2014 |

2013 |

2014 |

|||||||||||||||

| |

|

(estimated & unaudited) |

|

(estimated & unaudited) |

|||||||||||||||

| |

|

Low |

High |

|

Low |

High |

|||||||||||||

| |

|||||||||||||||||||

| |

(in thousands) |

||||||||||||||||||

Consolidated Statement of Operations Data: |

|||||||||||||||||||

Revenue |

$ | 64,534 | $ | 88,400 | $ | 90,400 | $ | 295,798 | $ | 360,000 | $ | 362,000 | |||||||

Income from operations |

$ | 8,189 | $ | 23,100 | $ | 25,100 | $ | 52,445 | $ | 109,000 | $ | 111,000 | |||||||

Net income |

$ | 5,735 | $ | 13,100 | $ | 14,100 | $ | 32,718 | $ | 65,000 | $ | 66,000 | |||||||

10

| |

Three Months Ended December 31, |

Year Ended December 31, |

|||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2013 |

2014 |

2013 |

2014 |

|||||||||||||||

| |

|

(estimated & unaudited) |

|

(estimated & unaudited) |

|||||||||||||||

| |

|

Low |

High |

|

Low |

High |

|||||||||||||

| |

|||||||||||||||||||

| |

(in thousands, except percentages and statements of work) |

||||||||||||||||||

Other Financial Data and Key Metrics: |

|||||||||||||||||||

Adjusted EBITDA(1) |

$ | 13,513 | $ | 30,000 | $ | 31,500 | $ | 71,847 | $ | 133,000 | $ | 134,500 | |||||||

Adjusted EBITDA margin(1) |

20.9 | % | 33.9 | % | 34.8 | % | 24.3 | % | 36.9 | % | 37.2 | % | |||||||

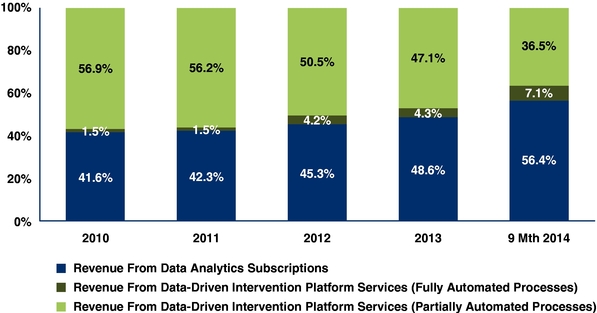

Data analytics and data-driven intervention revenue mix: |

|||||||||||||||||||

Revenue from data analytics subscriptions |

48.6 |

% |

57.6 |

% |

57.8 |

% |

|||||||||||||

Revenue from data-driven intervention platform services: |

|||||||||||||||||||

Fully automated processes |

4.3 | % | 7.2 | % | 7.4 | % | |||||||||||||

Partially automated processes |

47.1 | % | 34.9 | % | 35.1 | % | |||||||||||||

| | | | | | | | | | | | | | | | | | | | |

|

51.4 | % | 42.1 | % | 42.5 | % | |||||||||||||

| |

Year Ended December 31, |

||||||

|---|---|---|---|---|---|---|---|

| |

2013 | 2014 | |||||

Other Key Metrics: |

|||||||

MORE2 Registry dataset metrics |

|||||||

Unique patient count |

109,464 | 120,170 | |||||

Medical event count |

8,321,236 | 9,250,424 | |||||

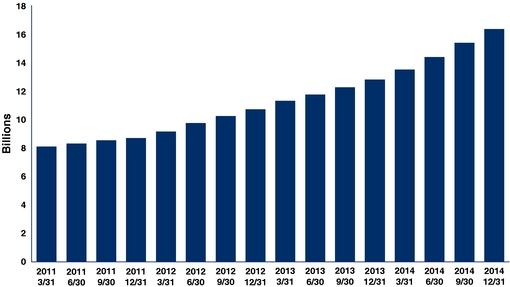

Trailing 12 month Patient Analytical Months (PAM) |

12,812,630 |

16,519,827 |

|||||

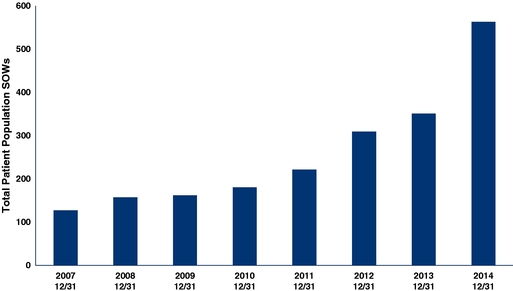

Engaged patient population statements of work |

356 | 575 | |||||

| |

December 31, | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

2013 |

2014 |

||||||||

| |

|

(estimated & unaudited) |

||||||||

| |

|

Low |

High |

|||||||

| |

||||||||||

| |

(in thousands) |

|||||||||

Consolidated Balance Sheet Data: |

||||||||||

Cash and cash equivalents |

$ | 110,594 | $ | 161,700 | $ | 163,400 | ||||

Working capital |

$ | 130,562 | $ | 166,000 | $ | 168,000 | ||||

Long-term debt(2) |

$ | 279 | $ | 281,418 | $ | 281,418 | ||||

- (1)

- Adjusted

EBITDA and Adjusted EBITDA margin are financial measures not calculated in accordance with U.S. generally accepted accounting principles, or GAAP.

For definitions of Adjusted EBITDA and Adjusted EBITDA margin, as well as the reasons why we believe that Adjusted EBITDA and Adjusted EBITDA margin provide useful information to investors and, to the

extent material, any additional purposes for which we use Adjusted EBITDA and Adjusted EBITDA margin, see "Selected Consolidated Financial Data."

- (2)

- Credit facilities plus capital lease obligations, less current portion.

11

- The following table presents a reconciliation of net income to Adjusted EBITDA for each of the periods indicated:

| |

Three Months Ended December 31, |

Year Ended December 31, |

|||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2013 |

2014 |

2013 |

2014 |

|||||||||||||||

| |

|

(estimated & unaudited) |

|

(estimated & unaudited) |

|||||||||||||||

| |

|

Low |

High |

|

Low |

High |

|||||||||||||

| |

|||||||||||||||||||

| |

(in thousands) |

||||||||||||||||||

Reconciliation of Net Income to Adjusted EBITDA: |

|||||||||||||||||||

Net Income |

$ | 5,735 | $ | 13,100 | $ | 14,100 | $ | 32,718 | $ | 65,000 | $ | 66,000 | |||||||

Depreciation and amortization |

4,412 | 4,800 | 4,900 | 15,517 | 19,800 | 19,900 | |||||||||||||

Interest expense |

18 | 1,100 | 1,200 | 79 | 1,300 | 1,400 | |||||||||||||

Interest (income) |

(3 | ) | — | — | (9 | ) | — | — | |||||||||||

Provision for income taxes |

2,439 | 9,500 | 9,600 | 19,657 | 43,300 | 43,400 | |||||||||||||

| | | | | | | | | | | | | | | | | | | | |

EBITDA |

12,601 | 28,500 | 29,800 | 67,962 | 129,400 | 130,700 | |||||||||||||

Stock-based compensation |

434 | 1,500 | 1,700 | 1,842 | 2,800 | 3,000 | |||||||||||||

Other non-comparable items (a) |

— | — | — | 1,565 | — | — | |||||||||||||

Professional service fees (b) |

478 | — | — | 478 | 800 | 800 | |||||||||||||

| | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA |

$ | 13,513 | $ | 30,000 | $ | 31,500 | $ | 71,847 | $ | 133,000 | $ | 134,500 | |||||||

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

- (a)

- Other

"non-comparable items" include business transaction-related professional fees, corporate name change and associated rebranding expenses, workforce

restructuring expenses, and certain legal costs. We believe these are non-comparable expenses that should be excluded from Adjusted EBITDA in order to more effectively assess our period-over-period

and on-going operating performance.

- (b)

- Represents legal costs associated with the enforcement of a specific client contract. The legal process associated with this matter began in the first quarter of 2013 and concluded in the second quarter of 2014.

Comparison of the Three Months Ended December 31, 2014 to the Three Months Ended December 31, 2013 (Unaudited)

Revenue is currently estimated to be between $88.4 and $90.4 million for the three months ended December 31, 2014, representing an estimated increase of approximately 37% to 40% compared to the same period in the prior year. This estimated increase is primarily attributable to an increase in revenue primarily from new clients as well as a net increase from existing clients.

Income from operations is currently estimated to be between $23.1 and $25.1 million for the three months ended December 31, 2014, representing an estimated increase of approximately 182% to 207% compared to the same period in the prior year. The estimated improvement in income from operations is primarily due to the increase in revenue, and the reduced cost of revenue as a percentage of revenue driven by revenue mix shifting toward more data-driven analytical solution activities (from data-driven intervention services), as well as continued efficiency gains through technology implementation, standardization of services, and operational process automation.

Adjusted EBITDA is currently estimated to be between $30.0 and $31.5 million for the three months ended December 31, 2014, representing an estimated increase of approximately 122% to 133% compared to the same period in the prior year. The estimated increase in Adjusted EBITDA is primarily due to the improvement in our income from operations described above, as well as increased adjustments to net income to arrive at Adjusted EBITDA due to a higher depreciation and amortization and higher stock-based compensation expense.

Net income is currently estimated to be between $13.1 and $14.1 million for the three months ended December 31, 2014, representing an estimated increase of approximately 128% to 146% compared to the same period in the prior year. The estimated improvement in net income is primarily due to the growth in income from operations, partially offset by an increase in our provision for income taxes.

12

Comparison of the Year Ended December 31, 2014 (Unaudited) to the Year Ended December 31, 2013

Revenue is currently estimated to be between $360.0 and $362.0 million for the year ended December 31, 2014, representing an estimated increase of approximately 22% compared to the prior year. This estimated increase is primarily attributable to increase in revenue from new clients as well as a net increase from existing clients.

Income from operations is currently estimated to be between $109.0 and $111.0 million for the year ended December 31, 2014, representing an estimated increase of approximately 108% to 112% compared to the prior year. The estimated improvement in income from operations is primarily due to the increase in revenue and reduction in cost of revenues driven by revenue mix shifting toward more data-driven analytical solution activities (from data-driven intervention services), as well as continued efficiency gains through technology implementation, standardization of services, and operational process automation.

Adjusted EBITDA is currently estimated to be between $133.0 and $134.5 million for the year ended December 31, 2014, representing an estimated increase of approximately 85% to 87% compared to the prior year. The estimated increase in Adjusted EBITDA is primarily due to the improvement in our income from operations described above, as well as increased adjustments to net income to arrive at Adjusted EBITDA due to higher depreciation and amortization and higher stock-based compensation expense.

Net income is currently estimated to be between $65.0 and $66.0 million for the year ended December 31, 2014, representing an estimated increase of approximately 99% to 102% compared to the prior year. The estimated improvement in net income is primarily due to the growth in income from operations, partially offset by an increase in our provision for income taxes.

Summary Risk Factors

Our business is subject to a number of risks and uncertainties, including those highlighted in the section titled "Risk Factors" immediately following this prospectus summary. Some of these risks include, among others:

- •

- we may not grow at the rates we historically have achieved or at all, even if our key metrics indicate growth, which

could have a material adverse effect on the market price of our Class A common stock;

- •

- if our existing clients do not renew their agreements with us, renew at lower fee levels, decline to purchase additional

services from us, choose to purchase fewer services from us, or terminate their agreement with us, and we are unable to replace any lost revenue, our business and operating results could suffer;

- •

- our top clients account for a significant portion of our revenues and, as a result, the loss of one or more of these

clients could materially and adversely affect our business and operating results;

- •

- if we do not develop new services that are adopted by clients or fail to provide high-quality support services to our

clients, our growth prospects, revenues and operating results could be materially and adversely affected;

- •

- we cannot assure you that we will be able to manage our growth effectively, which could have a material adverse effect on our business, results of operations, and growth prospects;

13

- •

- if our security measures fail or are breached and unauthorized access to a client's data is obtained, our services may be

perceived as insecure, we may incur significant liabilities, our reputation may be harmed, and we could lose sales and clients;

- •

- our quarterly operating results may fluctuate significantly, which could adversely impact the value of our Class A

common stock;

- •

- because the dual class structure of our common stock has the effect of concentrating voting control with holders of our

Class B common stock, these holders will continue to have significant influence over our company after this offering, including control over decisions that require the approval of stockholders,

which could limit your ability to influence the outcome of matters submitted to stockholders for a vote; and

- •

- an active, liquid trading market for our Class A common stock may not develop, which may limit your ability to sell your shares at or above the initial public offering price.

Corporate Reorganization and Credit Facilities

Effective September 17, 2014, in order to facilitate the administration, management, and development of our business and this offering, Inovalon, Inc. implemented a holding company reorganization, or the Corporate Reorganization, pursuant to which we became the new parent company and Inovalon, Inc. became our direct, wholly owned subsidiary. To implement the Corporate Reorganization, Inovalon, Inc. formed our company and we, in turn, formed Inovalon Merger Sub, Inc., or Merger Sub. The holding company structure was implemented by the merger of Merger Sub with and into Inovalon, Inc. with Inovalon, Inc. surviving the merger as a direct, wholly-owned subsidiary of our company. As a result of the Corporate Reorganization, each share of Inovalon, Inc. issued and outstanding immediately prior to the merger automatically converted into one share of common stock of our company.

On September 19, 2014, we and our subsidiaries entered into a credit and guaranty agreement with Goldman Sachs Bank USA, as administrative agent, and the lenders from time to time party thereto, which we refer to as the Credit Agreement. The terms of the Credit Agreement provide for credit facilities in the aggregate maximum principal amount of $400.0 million, consisting of a senior unsecured term loan facility in the original principal amount of $300.0 million, which we refer to as the Term Loan Facility, and a senior unsecured revolving credit facility in the maximum principal amount of $100.0 million, or the Revolving Credit Facility, which we refer to together with the Term Loan Facility as the Credit Facilities. Proceeds of the Revolving Credit Facility may be used for working capital and general corporate purposes. The obligations under the Credit Facilities are guaranteed by our domestic, wholly owned subsidiaries.

After the Corporate Reorganization, our capital stock was reclassified to implement a dual class capital structure providing for two classes of common stock, with each share of common stock held by our existing stockholders reclassified as Class B common stock. Following the reclassification, we redeemed approximately 8.33% of our Class B common stock on a pro rata basis from our existing stockholders for an aggregate amount of $300.0 million using the proceeds from the Term Loan Facility, as more fully described in "Management's Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources — Debt."

Corporate Information

Our principal executive offices are located at 4321 Collington Road, Bowie, Maryland 20716. Our telephone number at that address is (301) 809-4000 and our Internet address is www.inovalon.com. The information contained on, or that can be accessed through, our website is

14

not a part of this prospectus. Investors should not rely on any such information in deciding whether to purchase our Class A common stock.

"Inovalon," the Inovalon logo, and other Inovalon marks are trademarks of Inovalon. This prospectus contains references to our trademarks and to trademarks belonging to other entities. Solely for convenience, trademarks and trade names referred to in this prospectus, including logos, artwork and other visual displays may appear without the ® or ™ symbols, but such references are not intended to indicate that we or their respective owners will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies' trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any such companies.

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion in revenue during our most recently completed fiscal year, we qualify as an "emerging growth company" as defined in Section 2(a) of the Securities Act of 1933, or the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As an emerging growth company, we may take advantage of specified reduced disclosure and other requirements that are otherwise applicable, in general, to public companies that are not emerging growth companies. These provisions include:

- •

- an exemption from compliance with the auditor attestation requirement on the effectiveness of our internal control over

financial reporting;

- •

- an exemption from compliance with any requirement that the Public Company Accounting Oversight Board may adopt regarding

mandatory audit firm rotation or a supplement to the auditor's report providing additional information about the audit and the financial statements;

- •

- reduced disclosure about our executive compensation arrangements; and

- •

- exemptions from the requirements to obtain a non-binding advisory vote on executive compensation or a shareholder approval of any golden parachute arrangements.

We may take advantage of these exemptions for up to five years or such earlier time that we are no longer an emerging growth company. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock. We would cease to be an emerging growth company upon the earliest to occur of: the last day of the fiscal year in which we have more than $1.0 billion in annual revenue; the date we qualify as a "large accelerated filer," with at least $700 million of equity securities held by non-affiliates; the issuance, in any three-year period, by us of more than $1.0 billion in non-convertible debt securities; and the last day of the fiscal year ending after the fifth anniversary of this offering.

The JOBS Act also permits us, as an emerging growth company, to take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies and thereby allows us to delay the adoption of those standards until those standards would apply to private companies. We have irrevocably elected not to avail ourselves of this exemption from new or revised accounting standards, and, therefore, will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

15

Class A common stock offered by us |

22,222,222 shares (25,555,555 if the underwriters exercise their option to purchase additional shares in full) | |

Class A common stock to be outstanding after this offering |

22,222,222 shares (25,555,555 if the underwriters exercise their option to purchase additional shares in full)(1) |

|

Class B common stock to be outstanding after this offering |

122,257,145 shares(1) |

|

Total Class A and Class B common stock to be outstanding after this offering |

144,479,367 shares (147,812,700 if the underwriters exercise their option to purchase additional shares in full)(1) |

|

Use of Proceeds |

We estimate the net proceeds to us from this offering, after deducting the underwriting discounts and estimated offering expenses payable by us, will be approximately $517.2 million (or $595.6 million if the underwriters' option to purchase additional shares in this offering is exercised in full), assuming the shares are offered at $25.00 per share, which is the midpoint of the estimated price range set forth on the front cover page of this prospectus. |

|

|

We plan to use the net proceeds from this offering for working capital and other general corporate purposes. See "Use of Proceeds." |

|

Voting Rights |

The rights of the holders of our Class A common stock and Class B common stock are identical, except with respect to voting and conversion rights. Holders of our Class A common stock are entitled to one vote per share and holders of our Class B common stock are entitled to 10 votes per share. Holders of shares of Class A common stock and Class B common stock will vote together as a single class on all matters submitted to a vote of stockholders (including the election of directors), with certain exceptions described in our restated certificate of incorporation. See "Description of Capital Stock — Class A and B Common Stock — Voting Rights." Immediately following the completion of this offering, outstanding shares of our Class B common stock will represent approximately 98% of the voting power of our outstanding common stock. As a result, holders of our Class B common stock, comprised of our common stockholders prior to the Corporate Reorganization, will be able to control the outcome of all matters submitted to a vote of our stockholders, including, for example, the election of directors, amendments to our certificate of incorporation and mergers or other business combinations. |

16

Class B Common Stock Conversion Rights |

Each outstanding share of Class B common stock is convertible at any time at the option of the holder into one share of Class A common stock. Each share of Class B common stock will also convert automatically into one share of Class A common stock upon any transfer, whether or not for value, except for certain transfers described in our restated certificate of incorporation, including, without limitation, transfers for tax and estate planning purposes, so long as the transferring holder of Class B common stock continues to hold exclusive voting and dispositive power with respect to the shares transferred, and transfers to persons or entitities who are Class B stockholders at the time of the transfer. Also, each share of Class B common stock held of record by a natural person, other than a natural person who held the shares as of our initial public offering, will convert automatically into one share of Class A common stock upon the death of the holder. In addition, each share of Class B common stock will convert automatically into one share of Class A common stock upon the earlier to occur of (i) the date upon which the number of shares of Class A common stock and Class B common stock beneficially owned by our Class B common stockholders, in the aggregate, represents less than 10% of the total number of shares of Class A and Class B common stock then outstanding and (ii) the date specified by affirmative vote of the holders of at least 662/3% of the outstanding shares of Class B common stock, voting as a single class. Once converted into Class A common stock, a share of Class B common stock may not be reissued. See "Description of Capital Stock — Class A and B Common Stock." |

|

Risk Factors |

You should read the "Risk Factors" section of this prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our Class A common stock. |

|

NASDAQ Global Select Market symbol |

"INOV" |

- (1)

- The

number of shares of our Class A and Class B common stock that will be outstanding after this offering is based on 22,222,222 shares of

Class A common stock offered in this offering and excludes:

- •

- 122,257,145 shares of Class A common stock issuable upon the conversion of shares of Class B common stock

that will be outstanding after this offering;

- •

- 6,451,275 shares of our Class B common stock issuable upon the exercise of options to purchase shares of our

Class B common stock outstanding as of September 30, 2014, with a weighted-average exercise price of $5.97 per share;

- •

- 488,780 shares of Class B common stock issuable upon vesting of restricted stock units;

17

- •

- 7,335,430 shares of Class A common stock available for future grant under our 2015 Omnibus Incentive Plan; and

- •

- 1,833,857 shares of Class A common stock available for future issuance under our 2015 Employee Stock Purchase Plan.

18

SUMMARY CONSOLIDATED FINANCIAL AND OTHER DATA

The following table sets forth summary consolidated financial data for the years presented and at the dates indicated below. We have derived the summary consolidated statements of operations data for the years ended December 31, 2011, 2012, and 2013 from our audited consolidated financial statements included elsewhere in this prospectus. We have derived the summary consolidated balance sheet data as of December 31, 2012 and 2013 from our audited consolidated financial statements included elsewhere in this prospectus. We have derived the summary consolidated balance sheet data as of December 31, 2011 from our audited consolidated financial statements not included in this prospectus. The summary consolidated statement of operations data for the nine months ended September 30, 2013 and 2014 and the consolidated balance sheet data as of September 30, 2014 have been derived from our unaudited interim consolidated financial statements included elsewhere in this prospectus. We have derived the summary consolidated balance sheet data as of September 30, 2013 from our unaudited interim consolidated financial statements not included in this prospectus. In our opinion, such financial statements include all adjustments, consisting only of normal recurring adjustments, that we consider necessary for a fair presentation of the financial data set forth in those statements.

Our historical results are not necessarily indicative of our results in any future periods, including the full year ending December 31, 2014. The summary of our consolidated financial data set forth below should be read together with our consolidated financial statements and related notes, as well as the sections entitled "Management's Discussion and Analysis of Financial Condition and Results of Operations," included elsewhere in this prospectus.

| |

Year Ended December 31, | Nine Months Ended September 30, |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2011

|

2012

|

2013

|

2013

|

2014

|

|||||||||||

| |

(in thousands, except per share data) |

|||||||||||||||

Consolidated Statement of Operations Data: |

||||||||||||||||

Revenue |

$ | 239,685 | $ | 300,275 | $ | 295,798 | $ | 231,264 | $ | 271,622 | ||||||

Expenses: |

||||||||||||||||

Cost of revenue |

102,695 | 101,188 | 120,054 | 94,869 | 85,065 | |||||||||||

Sales and marketing |

6,752 | 6,793 | 5,952 | 4,597 | 5,355 | |||||||||||

Research and development |

14,855 | 15,499 | 21,192 | 16,171 | 17,376 | |||||||||||

General and administrative |

63,184 | 72,661 | 80,638 | 60,266 | 62,920 | |||||||||||

Depreciation and amortization |

11,229 | 12,899 | 15,517 | 11,105 | 15,012 | |||||||||||

| | | | | | | | | | | | | | | | | |

Total operating expenses |

198,715 | 209,040 | 243,353 | 187,008 | 185,728 | |||||||||||

| | | | | | | | | | | | | | | | | |

Income from operations |

40,970 | 91,235 | 52,445 | 44,256 | 85,894 | |||||||||||

| | | | | | | | | | | | | | | | | |

Other income and (expenses): |

||||||||||||||||

Interest income |

10 | 11 | 9 | 6 | 4 | |||||||||||

Interest expense |

(62 | ) | (129 | ) | (79 | ) | (61 | ) | (209 | ) | ||||||

| | | | | | | | | | | | | | | | | |

Income before taxes |

40,918 | 91,117 | 52,375 | 44,201 | 85,689 | |||||||||||

Provision for income taxes |

15,991 | 35,962 | 19,657 | 17,218 | 33,836 | |||||||||||

| | | | | | | | | | | | | | | | | |

Net income |

$ | 24,927 | $ | 55,155 | $ | 32,718 | $ | 26,983 | $ | 51,853 | ||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Basic net income per share |

$ | 0.18 | $ | 0.40 | $ | 0.24 | $ | 0.20 | $ | 0.39 | ||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Diluted net income per share |

$ | 0.18 | $ | 0.40 | $ | 0.24 | $ | 0.20 | $ | 0.38 | ||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Weighted average shares of common stock outstanding: |

||||||||||||||||

Basic |

137,865 | 137,865 | 135,305 | 135,555 | 133,640 | |||||||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Diluted |

138,855 | 139,040 | 136,375 | 136,730 | 135,835 | |||||||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

19

| |

Year Ended December 31, | Nine Months Ended September 30, |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2011

|

2012

|

2013

|

2013

|

2014

|

|||||||||||

| |

(in thousands, except percentages and statements of work) |

|||||||||||||||

Other Financial Data and Key Metrics(1): |

||||||||||||||||

Adjusted EBITDA(2) |

$ |

57,526 |

$ |

108,105 |

$ |

71,847 |

$ |

58,333 |

$ |

103,059 |

||||||

Adjusted EBITDA margin(2) |

24 | % | 36 | % | 24 | % | 25 | % | 38 | % | ||||||

MORE2 Registry dataset metrics |

||||||||||||||||

Unique patient count(3) |

69,916 | 86,002 | 109,464 | 98,607 | 118,932 | |||||||||||

Medical event count(4) |

5,479,599 | 6,379,293 | 8,321,236 | 7,560,838 | 9,112,175 | |||||||||||

Trailing 12 month Patient Analytics Months (PAM)(5) |

8,797,514 |

10,822,673 |

12,812,630 |

12,272,280 |

15,513,903 |

|||||||||||

Engaged patient population statements of work(6) |

227 |

314 |

356 |

344 |

540 |

|||||||||||

Data analytics and data-driven intervention revenue mix: |

||||||||||||||||

Revenue from data analytics subscriptions(7) |

42.3 | % | 45.3 | % | 48.6 | % | 47.0 | % | 56.3 | % | ||||||

Revenue from data-driven intervention platform services(8): |

||||||||||||||||

Fully automated processes |

1.5 | % | 4.2 | % | 4.3 | % | 4.8 | % | 7.1 | % | ||||||

Partially automated processes |

56.2 | % | 50.5 | % | 47.1 | % | 48.2 | % | 36.6 | % | ||||||

| | | | | | | | | | | | | | | | | |

|

57.7 | % | 54.7 | % | 51.4 | % | 53.0 | % | 43.7 | % | ||||||

| |

December 31, | September 30, | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2011

|

2012

|

2013

|

2013

|

2014

|

|||||||||||

| |

(in thousands) |

|||||||||||||||

Consolidated Balance Sheet Data: |

||||||||||||||||

Cash and cash equivalents |

$ | 114,872 | $ | 106,361 | $ | 110,594 | $ | 110,891 | $ | 131,947 | ||||||

Accounts receivable, net of allowances |

36,764 | 62,899 | 33,398 | 43,233 | 52,037 | |||||||||||

Working capital |

131,676 | 136,933 | 130,562 | 145,209 | 156,446 | |||||||||||

Property, equipment and capitalized software, net |

28,089 | 34,170 | 43,050 | 40,561 | 49,126 | |||||||||||

Goodwill |

62,269 | 62,269 | 62,269 | 62,269 | 62,269 | |||||||||||

Total assets |

262,922 | 285,655 | 269,746 | 277,710 | 317,345 | |||||||||||

Long-term debt |

268 | 168 | 279 | 203 | 285,191 | |||||||||||

Total liabilities |

33,817 | 48,826 | 38,012 | 32,471 | 340,706 | |||||||||||

Total stockholders' equity (deficit) |

229,105 | 236,829 | 231,734 | 245,239 | (23,361 | ) | ||||||||||

- (1)