Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CITIZENS FINANCIAL GROUP INC/RI | d869349d8k.htm |

Credit Suisse

2015 Financial Services Forum February 10, 2015

Bruce Van Saun

Chairman and Chief Executive Officer

Exhibit 99.1 |

Forward-looking statements and Non-GAAP financial measures

Forward-Looking Statements

This document contains forward-looking statements within the Private Securities Litigation

Reform Act of 1995. Any statement that does not describe historical or current facts is a forward-looking statement. These statements often

include the words “believes,”

“expects,”

“anticipates,”

“estimates,”

“intends,”

“plans,”

“goals,”

“targets,”

“initiatives,”

“potentially,”

“probably,”

“projects,”

“outlook”

or similar expressions or future conditional verbs such as “may,”

“will,”

“should,”

“would,”

and “could.”

Forward-looking

statements

are

based

upon

the

current

beliefs

and

expectations

of

management

and

on

information

currently

available

to

management.

Our

statements

speak

as

of

the

date

hereof,

and

we

do

not

assume

any

obligation

to update these statements or to update the reasons why actual results could differ from those

contained in such statements in light of new information or future events. We caution you, therefore, against relying on any of these

forward-looking statements. They are neither statements of historical fact nor guarantees

or assurances of future performance. While there is no assurance that any list of risks and uncertainties or risk factors is complete, important

factors that could cause actual results to differ materially from those in the

forward-looking statements include the following, without limitation: negative

economic conditions that adversely affect the general economy, housing prices, the job market, consumer confidence and spending habits which may affect, among other things, the level of nonperforming assets,

charge-offs and provision expense;

the

rate

of

growth

in

the

economy

and

employment

levels,

as

well

as

general

business

and

economic

conditions;

our ability to implement our strategic plan, including the cost savings and efficiency

components, and achieve our indicative performance targets; our ability to remedy

regulatory deficiencies and meet supervisory requirements and expectations; liabilities

resulting from litigation and regulatory investigations; our capital and liquidity

requirements (including under regulatory capital standards, such as the Basel III capital standards) and our ability to generate capital internally or raise capital on favorable terms;

the effect of the current low interest rate environment or changes in interest rates on our net

interest income, net interest margin and our mortgage originations, mortgage servicing rights and mortgages held for sale;

changes in interest rates and market liquidity, as well as the magnitude of such changes, which

may reduce interest margins, impact funding sources and affect the ability to originate and distribute financial products in the

primary and secondary markets;

the

effect

of

changes

in

the

level

of

checking

or

savings

account

deposits

on

our

funding

costs

and

net

interest

margin;

financial services reform and other current, pending or future legislation or regulation that

could have a negative effect on our revenue and businesses, including the Dodd-Frank Act and other legislation and regulation relating to

bank products and services;

a failure

in

or

breach

of

our

operational

or

security

systems

or

infrastructure,

or

those

of

our

third

party

vendors

or

other

service

providers,

including

as

a

result

of

cyber

attacks;

management’s ability to identify and manage these and other risks; and

any failure by us to successfully replicate or replace certain functions, systems and

infrastructure provided by The Royal Bank of Scotland Group plc (“RBS”) In

addition to the above factors, we also caution that the amount and timing of any future common stock dividends or share repurchases will depend on our financial condition, earnings, cash needs, regulatory constraints, capital

requirements

(including

requirements

of

our

subsidiaries),

and

any

other

factors

that

our

Board

of

Directors

deems

relevant

in

making

such

a

determination.

Therefore,

there

can

be

no

assurance

that

we

will

pay

any

dividends

to

holders

of our common stock, or as to the amount of any such dividends. In addition, the timing and

manner of the sale of RBS's remaining ownership of our common stock remains uncertain, and we have no control over the manner in which

RBS may seek to divest such remaining shares. Any such sale would impact the price of our

shares of common stock. More

information

about

factors

that

could

cause

actual

results

to

differ

materially

from

those

described

in

the

forward-looking

statements

can

be

found

under

“Risk

Factors”

in

our

Registration

Statement

on

Form

S-1

filed

with

the

United States Securities and Exchange Commission and declared effective on September 23,

2014. Non-GAAP Financial Measures

This

document

contains

non-GAAP

financial

measures

such

as,

“return

on

average

tangible

common

equity”,

“return

on

average

total

tangible

assets”

and

“efficiency

ratio”.

These

non-GAAP

measures

exclude

goodwill

impairment,

restructuring charges and special items, which are usually included, where applicable, in the

financial results presented in accordance with GAAP. Special items include regulatory expenses, expenses relating to our initial public offering,

and

other

expenses

or

income.

All

references

to

“Adjusted”

results

are

non-GAAP

financial

measures.

These

measures

exclude

restructuring

charges

and

special

items.

We believe these non-GAAP measures provide useful information to investors because these

are among the measures used by our management team to evaluate our operating performance and make day-to-day operating decisions. In

addition, we believe goodwill impairment, restructuring charges and special items in any period

do not reflect the operational performance of the business in that period and, accordingly, it is useful to consider these line items with and

without goodwill impairment, restructuring charges and special items. We believe this

presentation also increases comparability of period-to-period results.

Other

companies

may

use

similarly

titled

non-GAAP

financial

measures

that

are

calculated

differently

from

the

way

we

calculate

such

measures.

Accordingly,

our

non-GAAP

financial

measures

may

not

be

comparable

to

similar

measures

used

by

other

companies.

We

caution

investors

not

to

place

undue

reliance

on

such

non-GAAP

measures,

but

instead

to

consider

them

with

the

most

directly

comparable

GAAP

measure.

Non-GAAP

financial

measures

have

limitations

as

analytical tools, and should not be considered in isolation, or as a substitute for our results

as reported under GAAP. A reconciliation of non-GAAP measures to the most comparable financial measure prepared in accordance with GAAP is

included in the Appendix hereto.

1 |

2

Citizens: Building a top-performing regional bank

HOW

Charting a clear course …

delivering for our stakeholders |

What

Where

When

3

Citizens: Building a top-performing regional bank

How

Who

Citizens went public on September 24, 2014

70.5% owned by RBS with plan for full divesture by YE 2016

Who

are we? |

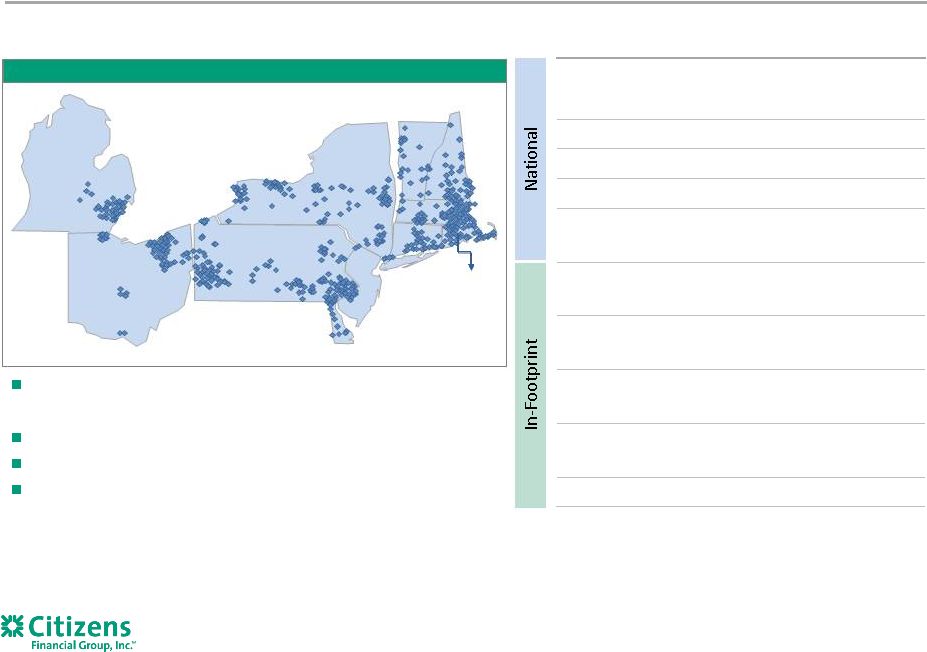

Dimension

(2)

Rank

(3)

Assets -

$132.9 billion

#13

Loans -

$93.4 billion

#13

Deposits -

$95.7 billion

#14

Branches -

~1,200

#11

ATM network -

~3,200

#7

Lead/joint lead

bookrunner

#8

(4)

Deposits -

$95.7 billion

Top 5 rank:

9/10 markets

(1)

HELOC -

$16.0 billion

Top 5 rank:

8/9 markets

(5)

Auto -

$12.7 billion

Top 5 rank:

3/9 markets

(6)

Mortgage –

$11.8 billion

Top 5 rank:

1/9 markets

(7)

Middle-market lending

#5

(8)

Source: SNL Financial, unless otherwise noted.

1.

As of 6/30/2014, excludes non-retail branches and banks with limited retail

operations. 2.

As of 12/31/2014, unless otherwise noted

3.

As of 9/30/2014, unless otherwise noted; excludes non-retail depository institutions,

includes U.S. subsidiaries of foreign banks. 4.

Thomson Reuters LPC, 2014 data based on number of deals for Overall Middle Market (defined as

Borrower Revenues < $500MM and Deal Size < $500MM). 5.

According to Equifax; origination volume as of 3Q14.

6.

According to Autocount; origination volume as of 3Q14.

7.

According to Equifax; origination volume as of 2Q14.

8.

Based on market penetration, according to Greenwich Associates 3Q14 rolling four-quarter

data. Leading deposit market share of 9.1% in top 10 MSAs

(1)

–

#2 deposit market share in New England

Relatively diverse economies/affluent demographics

Serve 5 million+ individuals, institutions and companies

~17,700 colleagues

Solid franchise with leading positions in attractive markets

Retail presence in 11 states

Top 5 deposit market share in 9 of 10 largest MSAs

(1)

Buffalo, NY: #4

Albany, NY: #2

Pittsburgh, PA: #2

Cleveland, OH: #4

Manchester, NH: #1

Boston, MA: #2

Rochester, NY: #4

Philadelphia, PA: #5

Detroit, MI:

#8

Providence, RI: #1

4 |

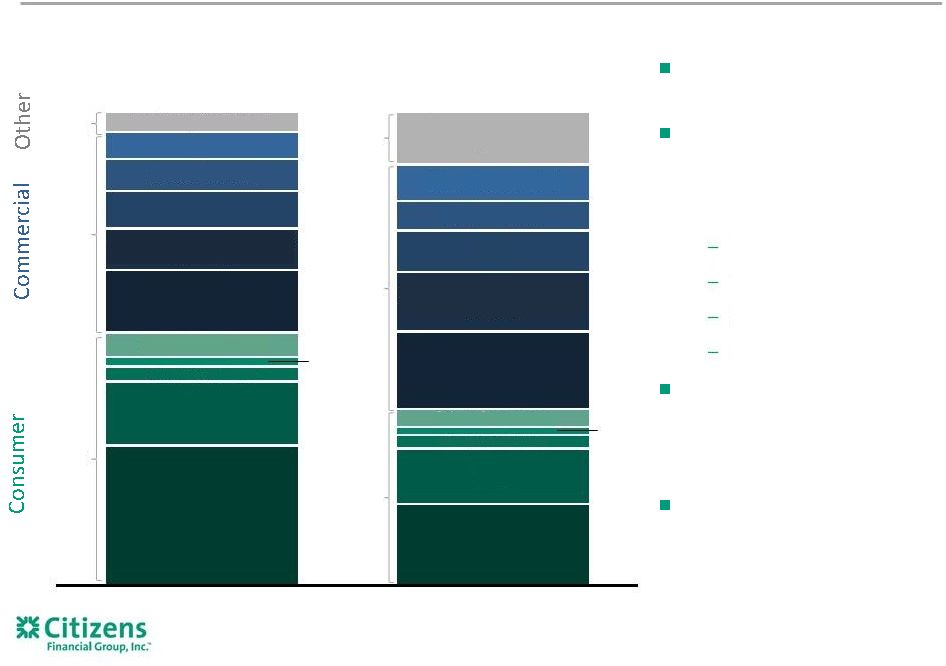

Balanced business

mix 5

Period-end loans and leases

(1)

$74B 2009

Consumer

Commercial

$90B 2014

Consumer

Commercial

1.

Reflects loans in our operating segments (Consumer Banking and Commercial Banking).

Excludes Other segment, which includes Non-core loans. Includes loans held

for sale. Targeting 50/50 mix over time

64%

36%

56%

44% |

Well

capitalized with a 4Q14 Tier 1 common equity ratio of 12.4%; pro forma common equity Tier

1 ratio of 12.1% on a fully phased-in Basel III basis

Solid asset quality performance with 2014 net charge-offs of 36 bps

Strong deposit franchise with $83.6 billion of core deposits

(1)

, or 87% of total period-end deposits,

and a total deposit cost of 17 bps

Internal plan to address Fed’s CCAR standards on track

Strong, clean balance sheet funded with low-cost deposits

6

2014 period-end

Tier 1 common equity ratio

2014 average

cost of deposits

2014 net charge-offs/

average loans and leases

(2)

(2)

(2)

0.36%

0.29%

0.34%

CFG

Peer

Average

0.17%

0.16%

CFG

Peer

Average

12.4%

10.4%

CFG

Peer

Average

Core

Non-Core

Source: SNL financial, Company filings

1)

Core deposits defined as deposits, excluding term deposits. 2)

Peer banks include BB&T (BBT), Comerica (CMA), Fifth Third (FITB), KeyCorp

(KEY), M&T (MTB), PNC (PNC), Regions (RF), SunTrust (STI), and US Bancorp (USB).

3)

Current reporting period regulatory capital ratios are preliminary |

Corporate

banking Commercial real estate

Franchise finance

Asset finance

PE/sponsor finance

Healthcare/technology/not

for profit verticals

Capital markets

Treasury Solutions

Commercial deposit services

Retail deposit services

Mobile/online banking

Credit/debit card

Wealth management

Home equity loans/lines

Mortgage

Auto

Education finance

Business banking

Consumer

Commercial

Robust product offerings with strong customer service

Deep client

relationships

+

Drive cross-sell and

wallet share

Extensive

product set

Recipient of numerous awards for our products and services

Highest Mobile Banking

Smartphone Ratings Award

2013 & 2014

Money Magazine

Best Banks in America

2013 & 2014

Three gold Stevie Awards

for sales and service 2014

7 |

Average industry experience of 26 years

Strong and experienced Board & Leadership team

Board Member

Committees

Bruce Van Saun

Chairman and Chief Executive Officer

Arthur F. Ryan

Lead Director; Chair of Compensation and

Human Resources Committee; Member of

Nominating and Corporate Governance

Committee

Mark Casady

Member of Risk Committee

Anthony Di Iorio

Member of Audit Committee; Nominating and

Corporate Governance Committee

Robert Gillespie

William P. Hankowsky

Member of Audit Committee; Compensation

and Human Resources Committee

Howard W. Hanna III

Member of Audit Committee; Nominating and

Corporate Governance Committee

Lee Higdon

Member of Audit Committee; Compensation

and Human Resources Committee

Charles J. (“Bud”) Koch

Chair of Risk Committee; Member of Audit

Committee

Shivan S. Subramaniam

Chair of Nominating and Corporate

Governance Committee; Member of Risk

Committee

Wendy A. Watson

Chair of Audit Committee;

Member of Risk Committee; Compensation

and Human Resources Committee

Marita Zuraitis

Member of Risk Committee

Leadership Team Member

Title

Bruce Van Saun

Chairman and Chief Executive Officer

David Bowerman

Vice Chairman and Head of Citizens

Business Services

Brad Conner

Vice Chairman and Head of

Consumer Banking

Michael Cleary

EVP and Head of Distribution

Consumer Banking

John Fawcett

Chief Financial Officer

Stephen Gannon

EVP, General Counsel and Chief

Legal Officer

Beth Johnson

EVP and Head of Corporate Strategy

Susan LaMonica

EVP and Director of Human

Resources

Robert Nelson

EVP and Chief Compliance Officer

Brian O’Connell

EVP and Regional Director

Technology Services

Robert Rubino

EVP and Interim Co-Head of

Commercial Banking

Nancy Shanik

EVP and Chief Risk Officer

Stephen Woods

EVP and Interim Co-Head of

Commercial Banking

8 |

Citizens went

public on September 24, 2014 70.5% owned by RBS with plan for full divesture by YE

2016 Who

are we?

9

Citizens: Building a top-performing regional bank

Where

When

How

Who

What

is the vision for Citizens?

What

are the strategy and key priorities?

What

are the key financial targets?

What |

Colleagues

Offer fulfilling jobs

Regulators

Comply with

letter and

spirit of rules

and

regulations

Investors

Deliver

strong value

proposition

and

attractive

returns

Communities & Society

Support sustainable prosperity

Aspire to be a top-performing regional bank, delivering well for all stakeholders

10

Customer-centric culture

Customers

Serve our

customers well |

Our strategy to

achieve this is to: Offer

our

customers

a

differentiated

customer

experience

through

the

quality

of

our

colleagues, products and services

–

Foster a culture around customer-centricity, commitment to excellence, leadership,

teamwork and integrity

Build

a

great

brand

that

invokes

trust

from

our

customers

and

reinforces

our

value

proposition

–

Consumer: Simple. Clear. Personal.

–

Commercial: Thought Leadership

Strive

to

deliver

attractive

risk-adjusted

returns

by

making

good

capital

and

resource

allocation

decisions, being good stewards of our resources, and rigorously evaluating our execution

Operate

with

a

strong

balance

sheet

with

regards

to

capital,

liquidity

and

funding,

coupled

with

a well-defined and prudent risk appetite

Maintain

a

balanced

business

mix

between

Commercial

Banking

and

Consumer

Banking

Position

the

bank

as

a

‘community

leader’

that

makes

a

positive

impact

on

the

communities

and local economies we serve

Our vision and strategy

Our objective is to be a top-performing regional bank that delivers well for our

stakeholders Our vision is to deliver the best possible banking experience

11 |

12

Position Consumer Banking to deliver improved capabilities and profitability

–

Re-energize household growth and deepen relationships through cross-sell

–

Scale up growth in consumer asset businesses

–

Move towards smaller branch formats with fewer, but more productive bankers, and enhanced

on- line and mobile functionality

Continue our momentum in Commercial Banking

–

Equip our bankers to drive thought leadership and differentiate our customer experience

–

Deepen customer relationships with a focus on Capital Markets and Treasury Solutions

Grow

our

balance

sheet

to

build

scale

while

maintaining

a

strong

capital

position

–

Focus on growing a cost-effective, sustainable deposit base in support of business loan

growth Tightly

manage

expense

base

while

funding

technology,

colleague,

and

regulatory

needs

and

maintaining sufficient investment in our infrastructure

Embed

risk

management

throughout

the

organization

and

build

stronger

relationships

with

regulators

Develop

a

high-performing,

customer-centric

organization

and

culture

–

Live our values every day

–

Empowerment with accountability

Our strategy results in six priorities |

13

These priorities have been mapped to specific initiatives

Build out Mid-Corporate &

Specialty verticals

Continued development of

Capital Markets

Build out Treasury Solutions

Grow Franchise Finance

Core Commercial growth

Target

7

–

8%

loan

growth

Complete $750 million

remaining capital conversion

transactions

(1)

Target $200 million expense

savings by end of 2016

Continue significant

technology investment

CCAR progress

Regulatory issue remediation

New Vision & Credo

Organization Health Index /

Leadership standards

Improved

Consumer

Bank

Continued Commercial

Momentum

Balance Sheet Growth/

Capital Mix

Normalization

Enhanced Efficiency &

Infrastructure

Embed Robust

Risk/Regulatory

Framework

1.

Subject to regulatory approval.

Reenergize Household growth

Grow Auto

Grow Education Finance

Expand Business Banking

Expand Mortgage sales force

Expand Wealth sales force

High-Performing,

Customer-Centric Culture |

14

We target a 10%+ run-rate ROTCE by the end of 2016

1.

2013 excludes $4.4 billion pre-tax ($4.1 billion after-tax) goodwill impairment

charge. See appendix for a reconciliation of non-GAAP items. 2.

See appendix for a reconciliation of non-GAAP items.

3.

Excludes restructuring charges and special items.

Making steady progress

Key Indicators

2011

2013

(1)

2014

4Q14

End 2016

Targets

Return on average tangible

common equity ("ROTCE")

(2)

4.2%

4.9%

6.7%

6.1%

Adjusted ROTCE

(2)(3)

4.5%

5.1%

6.1%

6.8%

Return on average total

tangible assets

(2)

0.4%

0.6%

0.7%

0.7%

1.0%+

Adjusted efficiency ratio

(2)(3)

66%

69%

69%

67%

~60%

Tier 1 common equity ratio

13.3%

13.5%

12.4%

12.4%

~11%

Future

target

12%+

10%+ |

What

is the vision for Citizens?

What

are the strategy and key priorities?

What

are the key financial targets?

Citizens went public on September 24, 2014

70.5% owned by RBS with plan for full divesture by YE 2016

Who

are we?

15

Citizens: Building a top-performing regional bank

What

When

How

Who

Where

will we play?

Where

will we allocate capital?

Where |

We have made

choices on where we will focus Geography

We pursue national

businesses if:

–

We can be relevant to

customers

–

It is a scalable business

nationally

–

It reinforces the core

business in our footprint

Target: ~25% of revenue

Business

Customers

Consumer

Target: 50% of revenue

Focus on customer segments

with a broad range of needs

Strong focus on mass, mass-

affluent and affluent segments

Build on the strong base we

have with small business

customers

Commercial

Target: 50% of revenue

Focus on companies with

annual revenues between $25

million and $2.5 billion

Only enter specialty verticals

that have strong industry

presence in our footprint

Return on Average Tangible

Common Equity > 10%

Ability to gain market

leadership

Element of recurring fee-

based revenues

Element of self-funding

Critical part of the customer

experience

Consistent with our risk

appetite

Mid-West

Mid-Atlantic

New England

We will concentrate on

opportunities in our current

footprint

Target: ~75%+ of revenue

16 |

17

Capital allocation focused on maximizing growth and returns

4Q14 Balances

Emphasize risk-adjusted

returns

in allocating capital

Focus on acquiring and

deepening customer

relationships

to

help

drive

cross-sell:

Mortgage

Wealth

Capital Markets

Treasury Solutions

Measure total relationship

profitability in Commercial

when assessing customer

returns

Drive better analytics on

Consumer and Commercial

customer and segment

profitability

53%

42%

5%

1.

Based on 4Q14 average loan balances, excludes held for sale.

$92.0 Billion

$106.0 Billion

Average Loans

(1)

Period-end Risk Weighted Assets

37%

52%

11%

Student

Lending

Student

Lending

Home Lending

Auto

Business Banking

Other Consumer

Middle Market

Mid Corporate & Specialty

Verticals

CRE

Asset Finance

Other Commercial

Treasury/Non-Core

Home Lending

Auto

Business Banking

Other Consumer

Middle Market

Mid Corporate & Specialty

Verticals

CRE

Asset Finance

Other Commercial

Treasury/Non-Core |

Citizens went

public on September 24, 2014 70.5% owned by RBS with plan for full divesture by YE

2016 Who

are we?

What

is the vision for Citizens?

What

are the strategy and key priorities?

What

are the key financial targets?

Where

will we play?

Where

will we allocate capital?

18

Citizens: Building a top-performing regional bank

What

Where

How

Who

When

will we deliver the key objectives in our Plan?

When

will we get to top-performing?

When |

2014

Operating Plan Net interest income

High-

single-digit growth

Loan portfolio

Mid-

single-digit growth

Credit quality

35-45 bps of net charge-offs

Efficiency ratio

<70%

Loan-to-deposit ratio

< 100%

ROTCE (adjusted)

(1)

~ 6.0%

Tier 1 Common Equity ratio

~ 120 bps reduction

Plan spans three years to end of 2016; tracked well in 2014

Targets progressed as planned in 2014

19

1.

Non-GAAP item. See important information on use of Non-GAAP items in the

Appendix. |

External

Factors Macro

Environment

Interest Rates

Housing Market

Overall health of consumer

Competitor

Actions

Competitive hiring market

Easing competitor credit pricing and discipline

Investment in technology, convenience, formats

Consumer

Behavior

Stickiness of deposit base in rising rate environment

Conforming %, purchase mortgage origination mix

Orientation towards financial advice

Current view

entering 2015

External factors broadly consistent except for rates

Focused on further expense initiatives to help

mitigate challenges posed by rate curve

20 |

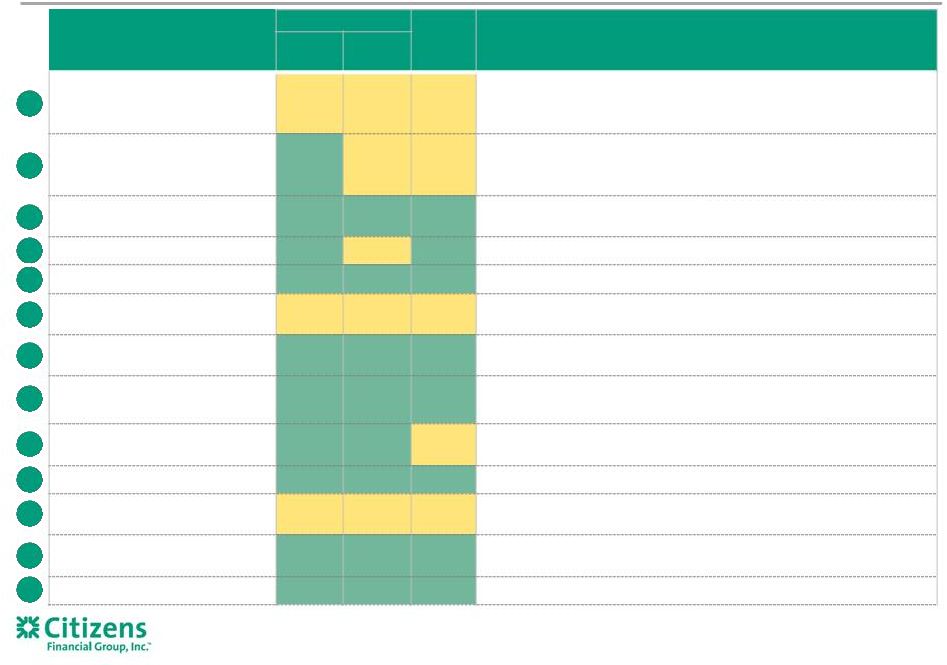

1

2

3

4

5

6

7

8

9

10

11a

11b

11c

INITIATIVE

2014 Status

2015

Outlook

Commentary

CFG

Execution

Market

Condition

Reenergize household growth

Arrested household decline with new offerings. Contending with

competition and reduced foot traffic. Key is training/improved lead

generation.

Expand mortgage sales force

Achieved

2014

hiring

goals;

increased

LOs

by

66

including

41

in

4Q14,

with

attrition starting to normalize.

Market conforming product mix and refi activity are wild cards.

Grow Auto

Performed well in 2014 with 35% YoY portfolio growth & yield expansion

throughout the year (+10bps from 1Q14 to 4Q14).

Grow Student

Strong new refi product origination of $169 million in 4Q’14.

Expand Business Banking

Solid loan origination & deposit performance expected to continue.

Expand Wealth sales force

Strong

market

conditions

have

created

competitive

hiring

environment

for financial consultants.

Build out Mid-Corp & verticals

Met RM hiring goals in 2014 and well positioned for growth in 2015.

Continue development of Capital

Markets

Capital markets rank and fees up nicely in 2014. Improved capabilities in

FX and Sales & Trading will be operational in 2015.

Build out Treasury Solutions

New

leader

in

place.

Expect

to

see

ramp

up

in

benefits

from

recent

people

and technology investments over in 2015.

Grow Franchise Finance

Strong

performance

due

to

pace

of

new

client

acquisition

(60+

in

2014).

Core: Middle Market

Strong origination activity expected to continue; focus on reducing

portfolio run-off and optimizing pricing.

Core: CRE

CRE loans up 12% YoY to $7.8 billion at YE 2014. Continued momentum

expected with focus on improvements in yield.

Core: Asset Finance

2015 performance continues to look promising.

21

Initiatives broadly on track |

22

We are focused on fully meeting regulatory expectations

Step-change improvement in CCAR capabilities

–

Integrated capital planning

–

Deepened expertise in stress testing and modeling

Significant progress

in remediating regulatory issue backlog,

though more to do

Strengthened the risk culture

–

Focus on proactive identification and management of risk

–

Embedding risk appetite across the organization

Intense focus on building an organization that evolves alongside

heightened regulatory standards |

Achieve

current targets, then raise the bar Strive for consistency in performance, limit tail

risk Target relatively high pay-out ratio, steady and growing dividend

Investors

Customers

Colleagues

Community

Regulators

Continue to improve customer satisfaction

–

Top 10 in JD Power for Consumer segment

–

Top performer in RM quality, value of ideas in Commercial

Gain market share in targeted segments (Consumer & Commercial)

Achieve top quartile Organizational Health rating

Continue to develop talent and enhance culture

Achieve heightened volunteer and financial giving aspirations

Use our position to improve the well-being of the communities we serve

Achieve and sustain heightened standards across broad regulatory

agenda, and earn the respect of our regulators

23

We have a clear plan with rolling objectives for each stakeholder

Once three-year targets are met, we aspire to further stretch our goals

Getting to top performing |

Citizens went

public on September 24, 2014 70.5% owned by RBS with plan for full divesture by YE

2016 Who

are we?

What

is the vision for Citizens?

What

are the strategy and key priorities?

What

are the key financial targets?

Where

will we play?

Where

will we allocate capital?

When

will we deliver the key objectives in our Plan?

When

will we get to top-performing?

24

Citizens: Building a top-performing regional bank

What

Where

When

Who

How

will we sustain our execution?

How

will we meet the challenges along the way?

How |

25

Monitoring

metrics

regularly

(vs.

targets)

Maintaining

flexibility

to

adapt

based on progress and environment

To

achieve

this

we

need

to

continue

to

hire,

develop,

and

retain

the

right

talent

Focused

on

strengthening

the

leadership

of

the

organization

Execution: Intense focus delivering against the plan

Identified

and

communicated

priority

initiatives

Assigned

ownership

Aligned

resources

Mapped

out

metrics

and

targets

for

each

initiative

Culture

is focused on:

–

Customer

–

Leadership

–

Accountability and execution

–

Community focus

Key

to

execution

is

the

quality

of

our

talent

and

instilling

the

right

culture

People

Culture

Building

alignment

and

capability

in

our

leadership

–

Over 18 months have attracted or

promoted

from

within

24

new

members

to

our

Executive

Leadership

Group

(top

120) |

26

How will we deal with the myriad of challenges we face?

Driving balance sheet growth in areas that provide the most

attractive returns

Remaining disciplined on pricing

Increasing focus on fee-generating businesses

Low-rate

environment

Regularly engaging with regulators to get consistent feedback

“early and often”

on plans and progress

Proactively monitoring and mitigating emerging risks

Embedding risk management across the organization

Leading with our value proposition rather than price:

–

Consumer –

“Simple. Clear. Personal.”

–

Commercial –

“Thought Leadership”

Focusing in areas where we’re strongest

–

Geographies; customer segments; products

Investment in technology, convenience, formats

Competitive

landscape

Regulatory |

27

Investment Thesis

13

th

largest U.S. retail bank holding company with attractive

demographics in core markets

Attractive business mix with growing and profitable commercial

business complementing strong consumer business

Client-centric model focused on deepening customer relationships

Attractive,

client-centric

franchise with

scale

Intense focus on strategic priorities driving attractive growth with

improving asset mix and returns

Committed to driving enhanced efficiency and effectiveness

Prudently optimizing capital structure and risk profile to help drive

improved risk-adjusted returns

Peer-leading capital ratios

Stable, low-cost deposit base

Solid asset quality through credit cycles

Strong, clean

balance sheet

supports

growth plans

Expected path

to double-digit

ROTCE

Making good progress on a comprehensive

plan to deliver for stakeholders |

28

Q&A |

Appendix

29 |

Non-GAAP

Reconciliation Table 30

(Excluding restructuring charges and special items)

$s in millions, except per share data

QUARTERLY

2011

2013

2014

4Q14

Net income (loss), excluding restructuring charges and special

items:

Net income (loss) (GAAP)

$506

($3,426)

$865

$197

Add: Restructuring charges and special items, net of income

tax expense (benefit)

42

4,097

(75)

20

Net income (loss), excluding restructuring charges and special

items (non-GAAP)

$548

$671

$790

$217

Return on average tangible common equity and return on average

tangible common equity, excluding restructuring charges and

special items:

Average common equity (GAAP)

$23,137

$21,834

$19,399

$19,209

Less: Average goodwill (GAAP)

11,311

9,063

6,876

6,876

Less: Average other intangibles (GAAP)

15

9

7

6

Add: Average deferred tax liabilities related to goodwill

(GAAP)

295

459

377

403

Average tangible common equity (non-GAAP)

$12,106

$13,221

$12,893

$12,730

Return on average tangible common equity (non-GAAP)

4.2 %

(25.9)%

6.7 %

6.1 %

Return on average tangible common equity, excluding

restructuring charges and special items (non-GAAP)

4.5 %

5.1 %

6.1 %

6.8 %

Return on average total tangible assets and return on average

total tangible assets, excluding restructuring charges and special

items:

Average total assets (GAAP)

$128,344

$120,866

$127,624

$130,671

Less: Average goodwill (GAAP)

11,311

9,063

6,876

6,876

Less: Average other intangibles (GAAP)

15

9

7

6

Add: Average deferred tax liabilities related to goodwill

(GAAP)

295

459

377

403

Average tangible assets (non-GAAP)

$117,313

$112,253

$121,118

$124,192

Return on average total tangible assets, excluding restructuring

charges and special items (non-GAAP)

0.4 %

0.6 %

0.7 %

0.7 %

Noninterest expense, excluding restructuring charges and special

items:

Noninterest expense (GAAP)

$3,371

$7,679

$3,392

$824

Less: Restructuring charges and special expense items

65

4,461

169

33

Noninterest expense, excluding restructuring charges and special

items (non-GAAP)

$3,306

$3,218

$3,223

$791

Efficiency ratio and efficiency ratio, excluding restructuring

charges and special items:

Net interest income (GAAP)

$3,320

$3,058

$3,301

$840

Add: Noninterest income (GAAP)

1,711

1,632

1,678

339

Total revenue (GAAP)

$5,031

$4,690

$4,979

$1,179

Efficiency ratio, excluding restructuring charges and special items

(non-GAAP)

66 %

69 %

69 %

67 %

FULL YEAR |

|