Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Targa Energy LP | d868763d8k.htm |

| EX-99.3 - EX-99.3 - Targa Energy LP | d868763dex993.htm |

| EX-99.1 - EX-99.1 - Targa Energy LP | d868763dex991.htm |

Table of Contents

Exhibit 99.2

February 9, 2015

Dear Atlas Energy, L.P. Unitholder:

We are pleased to inform you that the board of directors of the general partner of Atlas Energy, L.P. has approved the distribution of approximately 26.0 million common units representing a 100% limited liability company interest in Atlas Energy Group, LLC, which we also refer to as “New Atlas,” a Delaware limited liability company and wholly owned subsidiary of Atlas Energy that will hold all of Atlas Energy’s assets and businesses other than those related to its “Atlas Pipeline Partners” segment. Following the separation, New Atlas will hold all of Atlas Energy’s businesses other than its midstream business, including holding the general partner interest, incentive distribution rights and Atlas Energy’s limited partner interest in Atlas Resource Partners, L.P. (a publicly traded master limited partnership and independent developer and producer of natural gas, crude oil and natural gas liquids), Atlas Energy’s general and limited partner interests in its exploration and production development subsidiary, which currently conducts operations in the mid-continent region of the United States, its general and limited partner interests in Lightfoot Capital Partners, a limited partnership investment business, and its other natural gas and oil exploration and production assets.

The distribution will be made by Atlas Energy on a pro rata basis to its common unitholders, and, as a result of the distribution, New Atlas will become a separate, publicly traded company. We expect the distribution of New Atlas common units to occur on February 28, 2015 by way of a pro rata distribution to Atlas Energy unitholders. Each Atlas Energy unitholder will receive one common unit of New Atlas for every two common units of Atlas Energy held by such unitholder at the close of business on February 25, 2015, the record date of the distribution. Atlas Energy will not distribute any fractional common units of New Atlas, but instead will distribute cash in lieu of any fractional common unit of New Atlas that you would have received after application of the above ratio. Following the distribution, Atlas Energy will no longer own any common units of New Atlas and, as more fully described in the accompanying information statement, the New Atlas unitholders will elect the board of directors of New Atlas.

Immediately following the distribution, Atlas Energy will continue to hold, directly or indirectly, the general partner interest, incentive distribution rights and Atlas Energy’s common units in Atlas Pipeline Partners, L.P. (a publicly traded master limited partnership and midstream energy service provider engaged in natural gas gathering, processing and treating services), and Atlas Energy will be acquired by Targa Resources Corp. through a merger of a subsidiary of Targa Resources with and into Atlas Energy, with Atlas Energy surviving this merger as a subsidiary of Targa Resources. We refer to this merger as the “Atlas Merger.” In addition, Atlas Pipeline Partners will be acquired by Targa Resources Partners LP through a merger of a subsidiary of Targa Resources Partners with and into Atlas Pipeline Partners, with Atlas Pipeline Partners surviving this merger as a subsidiary of Targa Resources Partners. We refer to this merger as the “APL Merger.” The distribution, the Atlas Merger and the APL Merger are each conditioned on the other and will each occur only if the other occurs or will occur.

The New Atlas common units issued in the distribution will be in book-entry form only, which means that no physical stock certificates will be issued. If you own your Atlas Energy common units through a broker, your brokerage account will be credited with the new common units of New Atlas. If you have an account with Atlas Energy’s transfer agent, the new common units of New Atlas will be credited to that account. Unitholder approval of the distribution is not required, and you are not required to take any action to receive your common units of New Atlas. Following the distribution, if you are an Atlas Energy unitholder on the record date, you will receive common units of New Atlas, in addition to the merger consideration of 0.1809 of a share of Targa Resources Corp. common stock, par value $0.001 per share, and $9.12 in cash, without interest, that you will receive as a result of the Atlas Merger. Your New Atlas units will not be affected by the Atlas Merger.

In general, the distribution of common units of New Atlas by Atlas Energy should not be taxable for U.S. federal income tax purposes, except to the extent that the aggregate amount of money you receive (including cash received in lieu of fractional units), or are deemed to receive, as a result of the distribution, exceeds the tax basis in your interest in Atlas Energy common units immediately before the distribution. The rules governing the tax consequences of the distribution are complex. You are urged to read the summary of the U.S. federal income tax consequences of the distribution later in this information statement and to consult your own tax advisor regarding the tax consequences of the distribution to you in your particular circumstances.

New Atlas has been authorized to have its common units listed on the New York Stock Exchange under the symbol “ATLS,” subject to official notice of distribution. Following the Atlas Merger, Atlas Energy will be delisted from and will cease to trade on the New York Stock Exchange.

We have prepared an information statement, which describes the distribution of common units of New Atlas in detail and contains important information about New Atlas. We are mailing to all Atlas Energy common unitholders a notice with instructions on how to access the information statement online and receive hard copies. No action is required by you, but we urge you to read this information statement carefully. For additional information about the mergers of Atlas Energy and Targa Resources and of Atlas Pipeline Partners and Targa Resources Partners, we encourage you to read Atlas Energy’s separate proxy statement/prospectus relating to the Atlas Merger.

We want to thank you for your continued support of Atlas Energy, and we look forward to your support of New Atlas in the future.

|

| |

| Edward E. Cohen Chief Executive Officer Atlas Energy GP, LLC |

Jonathan Z. Cohen Executive Chairman of the Board of Directors Atlas Energy GP, LLC |

Table of Contents

INFORMATION STATEMENT

ATLAS ENERGY GROUP, LLC

This information statement is being furnished in connection with the distribution by Atlas Energy, L.P. to its unitholders of approximately 26.0 million common units representing a 100% limited liability company interest in Atlas Energy Group, LLC (which we refer to in this information statement as “New Atlas”), which will, at the time of the distribution, hold, directly or indirectly, all of Atlas Energy’s assets and businesses, other than those related to its “Atlas Pipeline Partners” segment. Following the separation, New Atlas will hold all of Atlas Energy’s businesses other than its midstream business, including holding the general partner interest, incentive distribution rights and Atlas Energy’s limited partner interest in Atlas Resource Partners, L.P. (a publicly traded master limited partnership and independent developer and producer of natural gas, crude oil and natural gas liquids), Atlas Energy’s general and limited partner interests in its exploration and production development subsidiary, which currently conducts operations in the mid-continent region of the United States, its general and limited partner interests in Lightfoot Capital Partners, a limited partnership investment business, and its other natural gas and oil exploration and production assets.

The distribution will be made by Atlas Energy on a pro rata basis to its unitholders, and, as a result of the distribution, New Atlas will become a separate, publicly traded company. For every two common units of Atlas Energy held of record by you as of the close of business on February 25, 2015, the record date for the distribution, you will receive one common unit of New Atlas. You will receive cash in lieu of any fractional common unit of New Atlas that you would have received after application of the above ratio. We expect the distribution to occur on February 28, 2015, which we refer to as the “distribution date.” Following the distribution, Atlas Energy will no longer own any common units of New Atlas and, as more fully described in the accompanying information statement, the New Atlas unitholders will elect the board of directors of New Atlas.

Immediately following the distribution, Atlas Energy, which will continue to hold the assets related to its “Atlas Pipeline Partners” segment, will be acquired by Targa Resources Corp. through a merger of a subsidiary of Targa Resources with and into Atlas Energy, with Atlas Energy surviving the merger as a subsidiary of Targa Resources. We refer to this merger as the “Atlas Merger.” In addition, Atlas Pipeline Partners will be acquired by Targa Resources Partners LP through a merger of a subsidiary of Targa Resources Partners with and into Atlas Pipeline Partners, with Atlas Pipeline Partners surviving this merger as a subsidiary of Targa Resources Partners. We refer to this merger as the “APL Merger.” The distribution, the Atlas Merger and the APL Merger are each conditioned on the other and will each occur only if the other occurs or will occur. This information statement is being sent to you to describe the distribution and requires no action by you. Please refer to the proxy statement/prospectus relating to the Atlas Merger for additional information regarding that transaction and the APL Merger.

In general, the distribution of common units of New Atlas by Atlas Energy should not be taxable for U.S. federal income tax purposes, except to the extent that the aggregate amount of money you receive (including cash received in lieu of fractional units), or are deemed to receive, as a result of the distribution exceeds the tax basis in your interest in Atlas Energy common units immediately before the distribution. The rules governing the tax consequences of the distribution are complex. You are urged to read the summary of the U.S. federal income tax consequences of the distribution later in this information statement and to consult your own tax advisor regarding the tax consequences of the distribution to you in your particular circumstances.

As discussed under “The Separation and Distribution—Trading Prior to the Distribution Date,” if you sell your Atlas Energy common units in the “regular-way” market before the distribution, you also will be selling your right to receive New Atlas common units in connection with the distribution.

Table of Contents

The distribution, the Atlas Merger and the APL Merger will each occur only if the other occurs or will occur. If the conditions to the Atlas Merger (including, among others, approval of the Atlas Merger by the Atlas Energy unitholders and the Targa Resources stockholders) are not satisfied or waived, the conditions to the distribution will not be satisfied, and Atlas Energy will not be required to complete the distribution. Likewise, if the conditions to the APL Merger (including, among others, approval of the APL Merger by the Atlas Pipeline Partners unitholders) are not satisfied or waived, the conditions to the distribution will not be satisfied, and Atlas Energy will not be required to complete the distribution. As a result, the record date for the distribution, the distribution date and the closing date for the Atlas Merger will be the same day.

Following the distribution, if you are an Atlas Energy unitholder on the record date, you will receive common units of New Atlas, in addition to the merger consideration of 0.1809 of a share of Targa Resources Corp. common stock, par value $0.001 per share, and $9.12 in cash, without interest, that you will receive as a result of the Atlas Merger. Your New Atlas units will not be affected by the Atlas Merger.

No vote of Atlas Energy unitholders is required in connection with the distribution. Therefore, you are not being asked for a proxy, and you are requested not to send us a proxy, in connection with the distribution. Atlas Energy is seeking approval from its unitholders for the Atlas Merger at a special meeting of Atlas Energy unitholders to be held on February 20, 2015. In connection with the special meeting, Atlas Energy has distributed a proxy statement/prospectus, which we refer to as the “Proxy Statement,” to all unitholders of its common units. The Proxy Statement contains a proxy and describes the procedures for voting shares of Atlas Energy common units and other details regarding the special meeting. As a result, the registration statement on Form 10 of which this information statement is a part does not contain a proxy and is not intended to constitute solicitation material under U.S. federal securities law.

If the conditions for consummating the distribution and the Atlas Merger (including, among others, approval of the Atlas Merger by the Atlas Energy unitholders and the Targa Resources stockholders) are satisfied or waived, no further action on your part is necessary for you to receive the common units of New Atlas. You do not need to take any action for the distribution to occur. You do not need to pay any consideration, exchange or surrender your existing common units of Atlas Energy or take any other action to receive your New Atlas common units. However, you will be required to surrender your common units of Atlas Energy in order to receive, for each common unit you own of Atlas Energy, 0.1809 of a share of Targa Resources Corp. common stock and $9.12 in cash, without interest, in connection with the Atlas Merger. That process is described in more detail in the Proxy Statement relating to the Atlas Merger.

All of the outstanding New Atlas common units are currently owned by Atlas Energy. There currently is no public trading market for such common units, although we expect that a limited market, commonly known as a “when-issued” trading market, will develop shortly before the record date for the distribution, and we expect “regular-way” trading of New Atlas common units to begin on the first trading day following the distribution date. New Atlas has been authorized to have its common units listed on the New York Stock Exchange under the ticker symbol “ATLS,” subject to official notice of distribution. Following the Atlas Merger, Atlas Energy will be delisted from and will cease to trade on the NYSE.

This information statement will be made publicly available at www.materialnotice.com beginning February 9, 2015, and notices of this information statement’s availability will be first sent to Atlas Energy unitholders on or about February 9, 2015.

In reviewing this information statement, you should carefully consider the matters described in the section entitled “Risk Factors” beginning on page 31 of this information statement.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of any of the securities of Atlas Energy Group, LLC or determined whether this information statement is truthful or complete. Any representation to the contrary is a criminal offense.

This information statement does not constitute an offer to sell or the solicitation of an offer to buy any securities.

The date of this information statement is February 9, 2015.

Table of Contents

| Page | ||||

| ii | ||||

| ii | ||||

| 1 | ||||

| 10 | ||||

| SUMMARY HISTORICAL AND UNAUDITED PRO FORMA COMBINED FINANCIAL INFORMATION |

26 | |||

| 29 | ||||

| 31 | ||||

| 66 | ||||

| 69 | ||||

| 76 | ||||

| 107 | ||||

| 108 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

113 | |||

| 155 | ||||

| 186 | ||||

| 189 | ||||

| 198 | ||||

| 210 | ||||

| 232 | ||||

| SECURITY OWNERSHIP OF MANAGEMENT, DIRECTORS AND PRINCIPAL UNITHOLDERS |

233 | |||

| 234 | ||||

| 243 | ||||

| 247 | ||||

| 249 | ||||

| 260 | ||||

| 280 | ||||

| 281 | ||||

| F-1 | ||||

| ANNEX A—THIRD AMENDED AND RESTATED LIMITED LIABILITY COMPANY AGREEMENT OF ATLAS ENERGY GROUP, LLC |

A-1 | |||

i

Table of Contents

NOTE REGARDING THE USE OF CERTAIN TERMS

Except as otherwise indicated or unless the context otherwise requires, the information included in this information statement, including the combined financial statements of New Atlas, assumes the completion of all the transactions referred to in this information statement in connection with the separation and distribution. References to New Atlas’s business assume that it contains all of Atlas Energy, L.P.’s assets and businesses, other than those related to its “Atlas Pipeline Partners” segment. Unless the context otherwise requires, references in this information statement to “Atlas Energy Group, LLC,” “Atlas Energy Group,” “New Atlas,” “we,” “us,” “our” and “our company” refer to Atlas Energy Group, LLC a Delaware limited liability company, and its combined subsidiaries and whose common units will be distributed in the distribution.

References in this information statement to “Atlas Energy” or “Atlas Energy, L.P.” refer to Atlas Energy, L.P., a Delaware limited partnership. References in this information statement to “ARP” or “Atlas Resource Partners” refer to Atlas Resource Partners, L.P., a Delaware limited partnership. References in this information statement to “APL” or “Atlas Pipeline Partners” refer to Atlas Pipeline Partners, L.P., a Delaware limited partnership and subsidiary of Atlas Energy. References in this information statement to “Atlas Pipeline Partners GP” refer to Atlas Pipeline Partners GP, LLC, a Delaware limited liability company that is the general partner of APL. References in this information statement to “AEI” refer to Atlas Energy, Inc. the former owner of Atlas Energy’s general partner. References to “Targa Resources” refer to Targa Resources Corp., a Delaware corporation, and references to “Targa Resources Partners” refer to Targa Resources Partners LP, a Delaware limited partnership and subsidiary of Targa Resources.

In this information statement, we rely on and refer to information and statistics regarding the natural gas and oil production and development industries. We obtained this data from independent publications or other publicly available information that we believe to be reliable.

ii

Table of Contents

QUESTIONS AND ANSWERS ABOUT THE DISTRIBUTION

| What is New Atlas? |

New Atlas is the name by which we refer to Atlas Energy Group, LLC following the separation of Atlas Energy’s midstream business from the remainder of its businesses. Following the separation, New Atlas will hold all of Atlas Energy’s businesses other than its midstream business, including holding: |

| • | the general partner interest, incentive distribution rights and Atlas Energy’s limited partner interest in Atlas Resource Partners; |

| • | Atlas Energy’s general and limited partner interests in its exploration and production development subsidiary, which currently conducts operations in the mid-continent region of the United States; |

| • | Atlas Energy’s general and limited partner interests in Lightfoot Capital Partners, a limited partnership investment business; and |

| • | Atlas Energy’s natural gas development and production assets in the Arkoma Basin, which Atlas Energy acquired in July 2013. |

| Following the separation, Atlas Energy will continue to hold, directly or indirectly, the general partner interest, incentive distribution rights and Atlas Energy’s common units in Atlas Pipeline Partners, L.P. (a publicly traded master limited partnership and midstream energy service provider engaged in natural gas gathering, processing and treating services). |

| Atlas Energy currently owns all of the limited liability company interests of New Atlas. The board of directors of the general partner of Atlas Energy has approved the distribution to the Atlas Energy unitholders of approximately 26.0 million common units representing a 100% limited liability company interest in New Atlas. We refer to this distribution of common units as the “distribution.” |

| Why is Atlas Energy separating New Atlas’s business and distributing its common units? |

Atlas Energy is undertaking the separation of New Atlas from Atlas Energy in the manner described in this information statement and the distribution of the common units of New Atlas in connection with its entry on October 13, 2014, into an Agreement and Plan of Merger (which we refer to as the “Atlas merger agreement”) with Targa Resources and a newly formed subsidiary of Targa Resources. The Atlas merger agreement provides for such newly formed subsidiary to merge with and into Atlas Energy, with Atlas Energy surviving the merger as a subsidiary of Targa Resources. We refer to this transaction as the “Atlas Merger.” Atlas Energy agreed in the Atlas merger agreement that, prior to the Atlas Merger, it will transfer its assets and liabilities other than those related to its “Atlas Pipeline Partners” segment to New Atlas and effect a pro rata distribution to the Atlas unitholders of New Atlas common units representing a 100% interest in New Atlas. |

| On October 13, 2014, Atlas Energy also entered into an Agreement and Plan of Merger (which we refer to as the “APL merger agreement”) with APL, Atlas Pipeline Partners GP, Targa Resources, |

1

Table of Contents

| Targa Resources Partners, Targa Resources Partners’ general partner and a newly formed subsidiary of Targa Resources Partners. APL and Targa Resources Partners are publicly traded subsidiaries of Atlas Energy and Targa Resources, respectively. The APL merger agreement provides for the newly formed subsidiary of Targa Resources Partners to merge with and into APL, with APL surviving the merger as a subsidiary of Targa Resources Partners. We refer to this second merger as the “APL Merger.” |

| The distribution and the Atlas Merger are each conditioned on the other and will each occur only if the other occurs. In addition, the Atlas Merger and the APL Merger are each conditioned on each other, which means that the distribution is effectively conditioned on the APL Merger. For additional information about the mergers of Atlas Energy and Targa Resources Corp. and of APL and Targa Resources Partners, please read Atlas Energy’s separate proxy statement/prospectus relating to the Atlas Merger. |

| Why is Atlas Energy Group furnishing this document? |

Atlas Energy is making this document publicly available to provide information to holders of common units of Atlas Energy as of the close of business on February 25, 2015, the record date for the distribution. Each record holder as of the record date is entitled to receive one common unit of New Atlas for every two common units of Atlas Energy held at the close of business on the record date. This document will help you understand how the separation and distribution will affect your investment in Atlas Energy and your investment in New Atlas after the separation and distribution. |

| How will the separation of New Atlas occur? |

The separation will be accomplished through a transaction in which Atlas Energy will transfer to New Atlas all of its businesses to the extent they are not related to its “Atlas Pipeline Partners” segment. Following such transfer, which we refer to as the “separation,” New Atlas will own, directly or indirectly, the general partner interest, incentive distribution rights and Atlas Energy’s limited partner interest in Atlas Resource Partners, L.P., Atlas Energy’s general partner and limited partner interests in Atlas Energy’s exploration and production development subsidiary and, its general and limited partner interests in Lightfoot Capital Partners, a limited partnership investment business, and its other natural gas and oil exploration and production assets. After the separation, Atlas Energy will distribute to its unitholders, on a pro rata basis, approximately 26.0 million common units representing a 100% limited liability company interest in New Atlas. |

| What is the record date for the distribution? |

We expect the record date for the distribution to be the close of business on February 25, 2015. |

| When will the distribution occur? |

We expect that the distribution date will be the same date as the closing date for the Atlas Merger, which we expect to be February 28, 2015. The distribution will be made to holders of record of Atlas Energy common units as of the record date. |

2

Table of Contents

| What do unitholders need to do to participate in the distribution? |

Holders of Atlas Energy common units as of the record date will not be required to take any action to receive New Atlas common units in the distribution, but you are urged to read this entire information statement carefully. No unitholder approval of the distribution is required or sought. You are not being asked for a proxy, and you are requested not to send us a proxy. You will not be required to make any payment, surrender or exchange of your Atlas Energy common units or to take any other action to receive your New Atlas common units. The distribution will not affect the number of outstanding Atlas Energy common units or any rights of Atlas Energy common units. |

| How will common units of New Atlas be issued? |

You will receive New Atlas common units through the same channels that you currently use to hold or trade Atlas Energy common units. If you own Atlas Energy common units as of the close of business on the record date, Atlas Energy, with the assistance of Broadridge Corporate Issuer Solutions, Inc., or Broadridge, the distribution agent, will electronically issue New Atlas common units to you or to your brokerage firm on your behalf by way of direct registration in book-entry form. New Atlas will not issue paper certificates. If you are a registered unitholder of Atlas Energy (meaning you own your units directly through an account with Atlas Energy’s transfer agent), Broadridge will mail you a book-entry account statement that reflects the number of New Atlas common units you own. If you own your Atlas Energy common units through a bank or brokerage account, your bank or brokerage firm will credit your account with the New Atlas common units. |

| Following the distribution, unitholders whose common units are held at the transfer agent may request that their common units of New Atlas be transferred to a brokerage or other account at any time. You should consult your broker if you wish to transfer your units. |

| How many common units of New Atlas will I receive in the distribution? |

Atlas Energy will distribute to you one common unit of New Atlas for every two common units of Atlas Energy held at the close of business on the record date. Based on approximately 52.0 million common units of Atlas Energy that are expected to be outstanding as of the record date, a total of approximately 26.0 million common units of New Atlas will be distributed. For additional information on the distribution, see “The Separation and Distribution” beginning on page 69. |

| Will New Atlas issue fractional units in the distribution? |

No. New Atlas will not issue fractional common units in the distribution. Fractional units that Atlas Energy unitholders otherwise would have been entitled to receive will instead be aggregated and sold in the public market by the distribution agent. The aggregate net cash proceeds of these sales will be distributed ratably to those unitholders who would otherwise have been entitled to receive fractional units. Recipients of cash in lieu of fractional units will not be entitled to any interest on the amounts of payment made in lieu of fractional units. |

3

Table of Contents

| What are the conditions to the distribution? |

The distribution is subject to the satisfaction (or waiver by the general partner of Atlas Energy, subject to the restrictions set forth below) of the following conditions: |

| • | the U.S. Securities and Exchange Commission (the “SEC”) shall have declared effective our registration statement on Form 10, of which this information statement is a part, and no stop order relating to the registration statement is in effect; |

| • | the transfer of assets and liabilities from Atlas Energy to New Atlas shall have been completed in accordance with the separation and distribution agreement; |

| • | any required actions and filings with regard to state securities and blue sky laws of the United States (and any comparable laws under any foreign jurisdictions) shall have been taken and, where applicable, have become effective or been accepted; |

| • | the transaction agreements relating to the separation shall have been duly executed and delivered by the parties thereto; |

| • | no order, injunction or decree issued by any court or agency of competent jurisdiction or other legal restraint or prohibition preventing consummation of the separation, distribution or any of the transactions contemplated by the separation and distribution agreement or any ancillary agreement, shall be in effect; |

| • | our common units to be distributed shall have been accepted for listing on the NYSE, subject to official notice of issuance; |

| • | Atlas Energy shall retain at least $5,000,000 of cash, and its net working capital (including retained cash) as of the distribution shall be no less than $5,000,000; |

| • | Atlas Energy shall have received, or shall receive simultaneously with the distribution, certain payments from Targa Resources under the Atlas merger agreement and the proceeds from the cash transfers from New Atlas, as described in “Certain Relationships and Related Person Transactions—Separation and Distribution Agreement—Cash Transfers”; and |

| • | the conditions required for consummating the Atlas Merger, as set forth in the Proxy Statement relating to that transaction, shall have been satisfied or waived (other than the condition that the distribution shall have occurred). |

Neither Atlas Energy nor New Atlas will be permitted to amend, waive, supplement or modify any provision of the separation and distribution agreement, or make any determination as to the satisfaction or waiver of the conditions to the distribution, in a manner that is materially adverse to Atlas Energy, Targa Resources or their affiliates or that would prevent or materially impede consummation of the Atlas Merger without first obtaining Targa Resources’ consent. Atlas Energy and New Atlas cannot assure you that any or all of these conditions will be met. In addition, if the Atlas merger agreement is terminated before the distribution, the separation

4

Table of Contents

| agreement will be automatically terminated and Atlas Energy will not be required to go forward with the separation. For a complete discussion of all of the conditions to the distribution, see “The Separation and Distribution—Conditions to the Distribution” beginning on page 74. |

| Atlas Energy also entered into the APL merger agreement with APL, Atlas Pipeline Partners GP, Targa Resources, Targa Resources Partners, Targa Resources Partners’ general partner and a newly formed subsidiary of Targa Resources Partners providing for the APL Merger to occur. The Atlas Merger and the APL Merger are each conditioned on the other and will each occur only if the other occurs or will occur. As a result, the distribution is indirectly conditioned on the satisfaction of the conditions required for consummating the APL Merger. For additional information about the merger of APL and Targa Resources Partners, please read Atlas Energy’s separate proxy statement/prospectus relating to the Atlas Merger. |

| What do I have to do to participate in the Distribution? |

Pursuant to the terms of the separation and distribution agreement, the distribution is conditioned on the satisfaction or waiver of the conditions to consummating the Atlas Merger. Pursuant to the terms of the Atlas merger agreement, the approval by a majority of the outstanding Atlas Energy unitholders of the Atlas merger agreement and the Atlas Merger, and the approval of Targa Resources’ issuance of shares in the Atlas Merger by a majority of the holders of Targa Resources common stock voting at a special meeting to approve such issuance are conditions to the Atlas Merger. Unless waived by the general partner of Atlas Energy (subject to the restrictions described above), these approvals are therefore conditions to the distribution. Atlas Energy is seeking approval from the holders of Atlas Energy common units at a special meeting of Atlas Energy’s unitholders to be held on February 20, 2015. In connection with the special meeting, Atlas Energy has distributed a proxy statement/prospectus (also referred to as the “Proxy Statement”) to all record holders of its common units. The Proxy Statement contains a proxy and describes the procedures for voting your Atlas Energy common units and other details regarding the special meeting. |

| Holders of Atlas Energy common units as of February 25, 2015, the record date, will not need to pay any cash or deliver any other consideration, including any of their Atlas Energy common units, in order to receive units of New Atlas in the distribution. |

| What if I want to sell my common units of Atlas Energy or New Atlas? |

You should consult with your financial advisors, such as your stockbroker, bank or tax advisor. Neither Atlas Energy nor New Atlas makes any recommendations on the purchase, retention or sale of common units of Atlas Energy or New Atlas. |

| If you sell your Atlas Energy common units prior to the record date or sell your entitlement to receive common units of New Atlas in the distribution on or prior to the distribution date, you will not be entitled to receive any New Atlas common units in the distribution. |

5

Table of Contents

| What is “regular-way” and “ex-distribution” trading? |

Beginning shortly before the record date, it is expected that there will be two markets in Atlas Energy, L.P. common units: a “regular-way” market and an “ex-distribution” market. Common units of Atlas Energy that trade in the “regular-way” market will trade with an entitlement to common units of New Atlas distributed pursuant to the distribution. Common units of Atlas Energy that trade in the “ex-distribution” market will trade without an entitlement to common units of New Atlas distributed pursuant to the distribution. |

| If you decide to sell any common units of Atlas Energy before the distribution date, you should make sure your stockbroker, bank or other nominee understands whether you want to sell your common units of Atlas Energy with or without your entitlement to New Atlas common units pursuant to the distribution. |

| Where will I be able to trade common units of New Atlas? |

There is not currently a public market for the common units of New Atlas. New Atlas has been authorized to list its common units on the New York Stock Exchange, or the NYSE, under the symbol “ATLS,” subject to official notice of distribution. We anticipate that trading in common units of New Atlas will begin on a “when-issued” basis on or shortly before the record date and that “regular-way” trading in such common units will begin on the first trading day following the distribution date. If trading begins on a “when-issued” basis, you may purchase or sell common units of New Atlas up to and through the distribution date, but your transaction will not settle until after the distribution date. We cannot predict the trading prices for our common units before, on or after the distribution date. For more information regarding “regular-way” trading and “when-issued” trading, see the section entitled “The Separation and Distribution—Trading Prior to the Distribution Date” on page 74. |

| Will the number of common units of Atlas Energy that I own change as a result of the distribution? |

No. The number of common units of Atlas Energy that you own will not change as a result of the distribution. However, as a result of the Atlas Merger, which will occur immediately following the distribution, each common unit you own of Atlas Energy will be converted into the right to receive 0.1809 of a share of TRGP common stock and $9.12 of cash, without interest. Following the Atlas Merger, Targa Resources will own all common units of Atlas Energy. Atlas Energy unitholders will own approximately 18% of the combined company on a fully diluted basis, and existing Targa Resources stockholders will own the remaining approximately 82% of the combined company on a fully diluted basis. |

| What will happen to the listing of Atlas Energy common units? |

After the Atlas Merger, Atlas Energy common units will be delisted and will cease to be traded on the NYSE. |

| What are the material U.S. federal income tax consequences of the distribution of our common units by Atlas Energy? |

In general, the distribution of common units of New Atlas by Atlas Energy to a U.S. holder (as defined in the section entitled “Certain U.S. Federal Income Tax Matters” beginning on page 260) of common units of Atlas Energy should not be taxable to the U.S. holder for U.S. federal income tax purposes, except to the extent that the aggregate amount of money such holder receives (including cash received in lieu of fractional units), or is deemed to receive, as a result |

6

Table of Contents

| of the distribution, exceeds the tax basis in such holder’s interest in Atlas Energy common units immediately before the distribution. |

| The rules governing the tax consequences of the distribution are complex. You are urged to read the summary of the U.S. federal income tax consequences of the distribution in the section entitled “Certain U.S. Federal Income Tax Matters” beginning on page 260 and to consult your own tax advisor regarding the tax consequences of the distribution to you in your particular circumstances. |

| How will I determine the initial basis that I will have in the New Atlas common units I receive in the distribution? |

A U.S. holder’s initial basis in the common units of New Atlas received by such U.S. holder in the distribution generally will be equal to Atlas Energy’s adjusted basis in such common units immediately before the distribution for U.S. federal income tax purposes. However, such U.S. holder’s initial basis in such common units shall not exceed the adjusted basis of such U.S. holder’s interest in Atlas Energy, reduced by any money distributed in the same transaction. Atlas Energy expects to provide unitholders with information regarding its adjusted basis for U.S. federal income tax purposes of our common units distributed in the distribution. |

| The rules governing the determination of a unitholder’s initial basis of New Atlas common units distributed in the distribution and the other tax consequences of the distribution are complex. You are urged to read the summary of the U.S. federal income tax consequences of the distribution in the section entitled “Certain U.S. Federal Income Tax Matters” beginning on page 260 and to consult your own tax advisor regarding the determination of your initial basis in our common units distributed to you in the distribution and the other tax consequences of the distribution to you in your particular circumstances. |

| Does New Atlas plan to pay distributions? |

The determination of the amount of future cash distributions declared, if any, is at the sole discretion of New Atlas’s board of directors and will depend on various factors affecting New Atlas’s financial conditions and other matters the board of directors deems relevant. |

| New Atlas expects to adopt a cash distribution policy under which New Atlas will distribute to its common unitholders, within 50 days after the end of each quarter, all of its “available cash” for that quarter, which generally means all cash on hand of the company at the end of the quarter less reserves that its board of directors determines are appropriate to provide for the proper conduct of the partnership’s business, to comply with applicable law or any of New Atlas’s debt instruments and to provide funds for distributions to the holders of its limited liability company interests for any one or more of the next four quarters. |

| All decisions regarding the payment of distributions by New Atlas will be made by its board of directors from time to time in accordance with New Atlas’s limited liability company agreement. |

| New Atlas believes, based on the assumptions and considerations discussed in the section entitled “Cash Distribution Policy— |

7

Table of Contents

| Estimated Initial Cash Available for Distribution” beginning on page 79, that upon completion of the distribution, New Atlas’s initial quarterly distribution will, subject to proration as described below, be equal to $0.55 per common unit, or $2.20 per common unit on an annualized basis. This equates to an aggregate cash distribution of approximately $14.4 million per quarter, or approximately $57.8 million per year. New Atlas’s ability to make cash distributions at the initial distribution rate will be subject to the factors described in the section entitled “Cash Distribution Policy—General—Restrictions and Limitations on Our Cash Distribution Policy” beginning on page 77. We cannot assure you that any distributions will be declared or paid by us, and there is no guarantee of distributions at a particular level or of any distributions being made. We did not use quarter-by-quarter estimates in concluding that there would be sufficient cash available for distribution to pay the initial quarterly distribution on all of our common units during the twelve months ending December 31, 2015. For more information, see the section entitled “Cash Distribution Policy” beginning on page 76. |

| We expect to pay a prorated cash distribution for the first quarter that we are a publicly traded company. This prorated cash distribution will be paid for the period beginning on the distribution date for the New Atlas common units and ending on the last day of that fiscal quarter. Any cash distributions received by New Atlas from Atlas Resource Partners between the date of the most recent cash distribution to the Atlas Energy unitholders prior to the distribution date for the New Atlas common units and such distribution date will be included in New Atlas’s first cash distribution. |

| What will the relationship be between Atlas Energy and New Atlas following the separation? |

New Atlas will enter into a separation and distribution agreement with Atlas Energy to effect the separation and distribution and provide a framework for New Atlas’s relationship with Atlas Energy after the separation and will also enter into an employee matters agreement and an operating agreement for certain Atlas Energy assets in Tennessee. These agreements will provide for the allocation between Atlas Energy and New Atlas of the employees, assets, liabilities and obligations (including investments, property and employee benefits and tax-related assets and liabilities) of Atlas Energy attributable to periods before, at and after New Atlas’s separation from Atlas Energy and will govern the relationship between New Atlas and Atlas Energy subsequent to the completion of the separation. Following the Atlas Merger, Atlas Energy will be a wholly owned subsidiary of Targa Resources. |

| For more information, see the sections entitled “Risk Factors—Risks Relating to the Separation” beginning on page 52 and “Certain Relationships and Related Party Transactions” beginning on page 234. |

| Who will manage New Atlas after the separation? |

New Atlas’s management team has extensive experience and background in natural gas and oil master limited partnerships and natural gas and oil development. Atlas Energy, together with its predecessors and affiliates, has been involved in the energy industry since 1968. The Atlas Energy |

8

Table of Contents

| senior personnel currently responsible for managing our assets and capital raising will continue to do so and will become our management team upon completion of the separation and distribution. For more information, see the section entitled “Management.” |

| What are the estimated costs and expenses that New Atlas expects to incur in the separation and distribution? |

New Atlas expects to incur one-time expenditures of between approximately $1.0 million and $1.5 million, in addition to advisory fees, in connection with the separation and distribution. Such one-time expenditures include, among others, costs for branding the new company, NYSE listing fees, investor and other stakeholder communications, printing costs and fees of the distribution agent. |

| Are there risks to owning New Atlas common units? |

Yes. New Atlas’s business is subject to both general and specific risks relating to its business, the separation and its being a separate publicly traded company. These risks are described in the section entitled “Risk Factors” beginning on page 31. We encourage you to read that section carefully. |

| Who will be the distribution agent, transfer agent and registrar for the New Atlas common units? |

The distribution agent, transfer agent, and registrar for the Atlas Energy common units will be Broadridge Corporate Issuer Solutions, Inc. For questions relating to the transfer or mechanics of the distribution, you should contact: |

Broadridge Corporate Issuer Solutions, Inc.

Attention: Atlas Energy, L.P. Representative

P.O. Box 1342

Brentwood, NY 11717

| Where can I get more information about Atlas Energy and New Atlas? |

Before the separation, if you have any questions relating to the separation, you should contact: |

Atlas Energy, L.P.

Investor Relations

Park Place Corporate Center One

1000 Commerce Drive, 4th Floor

Pittsburgh, Pennsylvania 15275

(877) 280-2857

| After the separation, if you have any questions relating to New Atlas common units or the distribution of our common units, you should contact: |

Atlas Energy Group, LLC

Investor Relations

Park Place Corporate Center One

1000 Commerce Drive, 4th Floor

Pittsburgh, Pennsylvania 15275

(877) 280-2857

9

Table of Contents

This summary highlights selected information from this information statement relating to New Atlas, New Atlas’s separation from Atlas Energy and the distribution of New Atlas’s common units by Atlas Energy to its unitholders. For a more complete understanding of our businesses and the separation and distribution, you should read this information statement carefully. Except as otherwise indicated or unless the context otherwise requires, the information included in this information statement, including the financial statements of New Atlas, assumes the completion of all the transactions referred to in this information statement in connection with the separation and distribution.

The information about us and our business contained in this information statement assumes that the distribution and Atlas Merger have been completed. If the conditions for consummating the distribution and the Atlas Merger (including, among others, approval of the Atlas Merger Agreement and the Atlas Merger by the Atlas Energy unitholders and approval of the issuance of Targa Resources common stock in the Atlas Merger by the Targa Resources stockholders) are not satisfied or waived, the distribution will not occur.

Our Business

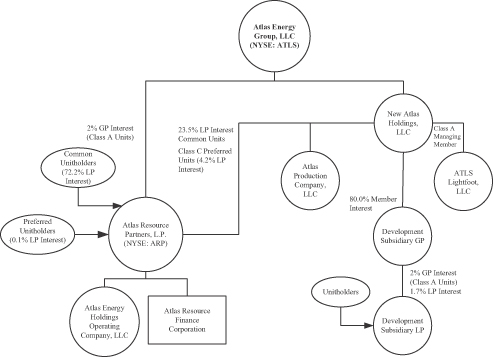

We are a Delaware limited liability company formed in October 2011 by Atlas Energy to serve as the general partner of Atlas Resource Partners, L.P., which we describe below. Following the separation, we will hold all of Atlas Energy’s assets and businesses other than those related to its “Atlas Pipeline Partners” segment, including holding the following:

| • | the general partner interest, incentive distribution rights and Atlas Energy’s limited partner interest in Atlas Resource Partners, L.P. (NYSE: ARP), a publicly traded Delaware master limited partnership and an independent developer and producer of natural gas, crude oil and natural gas liquids, which we refer to as “NGLs,” with operations in basins across the United States. ARP sponsors and manages tax-advantaged investment partnerships, in which it coinvests, to finance a portion of its natural gas and oil production activities. At January 1, 2015, we owned 100% of the general partner Class A units and all of the incentive distribution rights in ARP, and Atlas Energy owned an approximate 27.7% limited partner interest (consisting of 20,962,485 common and 3,749,986 preferred limited partner units) in ARP; |

| • | Atlas Energy’s general partner and limited partner interests in its development subsidiary (referred to as the “Development Subsidiary”), a partnership that currently conducts natural gas and oil operations in the mid-continent region of the United States. At January 1, 2015, Atlas Energy owned a 1.7% limited partner interest in the Development Subsidiary and 80.0% of its outstanding general partner Class A units, which are entitled to receive 2.0% of the cash distributed without any obligation to make further capital contributions; |

| • | Atlas Energy’s interests in Lightfoot Capital Partners, L.P. and Lightfoot Capital Partners GP, LLC, its general partner, entities which we refer to collectively as “Lightfoot” or “Lightfoot Capital Partners,” and which incubate new master limited partnerships, or “MLPs,” and invest in existing MLPs. At January 1, 2015, Atlas Energy had an approximate 15.9% general partner interest and 12.0% limited partner interest in Lightfoot; and |

| • | direct natural gas development and production assets in the Arkoma Basin, which Atlas Energy acquired in July 2013. |

Our goal is to increase the distributions to our unitholders by continuing to grow the net production from our direct natural gas production business as well as the distributions paid to us by the MLPs in which we own interests. Atlas Energy, together with its predecessors and affiliates, has been involved in the energy industry since 1968. The Atlas Energy personnel currently responsible for managing our assets and capital raising will continue to do so and will become our employees upon completion of the separation and distribution.

10

Table of Contents

Overview of ARP

ARP is a publicly traded Delaware master limited partnership and an independent developer and producer of natural gas, crude oil and NGLs, with operations in basins across the United States. ARP is a leading sponsor and manager of tax-advantaged investment partnerships, or “Drilling Partnerships,” in which ARP co-invests, to finance a portion of its natural gas, crude oil and NGL production activities. We are the general partner of ARP and manage its businesses. As of January 1, 2015, we own 100% of ARP’s general partner Class A units, all of ARP’s incentive distribution rights and approximately 27.7% of ARP’s outstanding limited partner interest.

In February 2012, the board of directors of Atlas Energy’s general partner approved the formation of ARP as a newly created exploration and production master limited partnership and the related transfer of substantially all of Atlas Energy’s natural gas and oil development and production assets at that time and the partnership management business to ARP on March 5, 2012.

ARP’s primary business objective is to generate growing yet stable cash flows through the development and acquisition of mature, long-lived natural gas, oil and NGL properties. As of December 31, 2013, ARP’s estimated proved reserves were 1.2 Tcfe, including the reserves net to its equity interest in Drilling Partnerships. Of ARP’s estimated proved reserves, approximately 68% were proved developed and approximately 83% were natural gas. For the year ended December 31, 2013, ARP’s average daily net production was approximately 187.7 MMcfe.

Overview of Development Subsidiary

During the year ended December 31, 2013, Atlas Energy formed a new partnership subsidiary to conduct natural gas and oil operations, initially in the mid-continent region of the United States. Since its formation, the Development Subsidiary has conducted operations in the Marble Falls formation in the Fort Worth Basin, where it has drilled 13 wells, and in the Mississippi Lime area of the Anadarko Basin in Oklahoma, where it has participated in two non-operated wells. At December 1, 2014, the Development Subsidiary had capital contributions of $120.6 million, including $2.0 million from Atlas Energy to acquire its limited partner interest. Our Development Subsidiary also entered into a purchase and sale agreement to acquire interests in oil and gas assets in the Eagle Ford Shale in South Central Atascosa County, Texas, which closed on November 5, 2014. As of January 1, 2015, we own an approximate 80.0% interest in the Development Subsidiary’s general partner and a 1.7% limited partner interest in the Development Subsidiary.

Overview of Lightfoot

Lightfoot is a private investment vehicle that focuses on investing directly in master limited partnership-qualifying businesses and assets. Lightfoot investors include affiliates of, and funds under management by, GE EFS, Atlas Energy, L.P., BlackRock Investment Management, LLC, Magnetar Financial LLC, CorEnergy Infrastructure Trust, Inc. and Triangle Peak Partners Private Equity, LP. As of January 1, 2015, we own an approximate 15.9% interest in Lightfoot’s general partner and a 12.0% interest in Lightfoot’s limited partner.

Lightfoot’s stated strategy is to make investments by partnering with, promoting and supporting strong management teams to build growth-oriented businesses or industry verticals. Lightfoot provides extensive financial and industry relationships and significant master limited partnership experience, which assist in growth via acquisitions and development projects by identifying:

| • | efficient operating platforms with deep industry relationships; |

| • | significant expansion opportunities through add-on acquisitions and development projects; |

| • | stable cash flows with fee-based income streams, limited commodity exposure and long-term contracts; and |

11

Table of Contents

| • | scalable platforms and opportunities with attractive fundamentals and visible future growth. |

On November 6, 2013, Arc Logistics Partners LP (“ARCX”), a master limited partnership owned and controlled by Lightfoot Capital Partners, L.P., began trading publicly on the NYSE. ARCX is focused on the terminalling, storage, throughput and transloading of crude oil and petroleum products in the East Coast, Gulf Coast and Midwest regions of the United States. ARCX’s cash flows are primarily fee-based under multi-year contracts. Lightfoot has a significant interest in ARCX through its ownership of a 40.3% limited partner interest, Lightfoot, G.P., the general partner, and all of Lightfoot’s incentive distribution rights. Lightfoot intends to utilize ARCX to facilitate future organic expansions and acquisitions for its energy logistics business.

Overview of Direct Natural Gas and Oil Production

Our consolidated gas and oil production operations consist of various shale plays in the United States, both through ARP and the Development Subsidiary and through assets that we own directly. Our direct natural gas and oil production results from certain coal-bed methane producing natural gas assets in the Arkoma Basin that Atlas Energy acquired on July 31, 2013 from EP Energy E&P Company, L.P., which we refer to as “EP Energy,” for $64.5 million, net of purchase price adjustments. We refer to this transaction as the “Arkoma Acquisition.” As a result of the Arkoma Acquisition, we have ownership interests in approximately 600 wells in the Arkoma Basin in eastern Oklahoma with average daily production of 5.1 MMcfe for the year ended December 31, 2013.

Business Strategy

Our goal is to increase the distributions to our unitholders by continuing to grow the net production from our direct natural gas and oil production business as well as the distributions paid to us by the MLPs in which we own interests. The key elements of our business strategy are to:

| • | Increase cash available for distributions to our unitholders. Our primary business objective is to increase the amount of cash distributed to us by ARP, as well as our other subsidiaries, which we can then distribute to our unitholders. We own the general partner interest and IDRs in ARP and generate substantial cash flow from the distributions we receive on these interests. |

| • | Actively assist our subsidiaries in executing their business strategies. We are actively engaged in the management of ARP and our other subsidiaries and assist them in identifying, evaluating and pursuing growth strategies, acquisitions and capital-raising opportunities. Our employees manage ARP’s daily activities on behalf of ARP. In addition, Jonathan Cohen, our Executive Chairman, is chairman of the board of Lightfoot’s general partner. |

| • | Expand operations through strategic acquisitions. We continually evaluate opportunities to expand our and ARP’s operations through acquisitions of developed and undeveloped properties or companies that can increase our cash available for distribution. We will continue to seek strategic opportunities in our and ARP’s current areas of operation, as well as other regions of the United States. In the first half of 2014, ARP acquired certain coal-bed methane producing natural gas assets in West Virginia and Virginia and low-decline oil and NGL assets in the Rangeley field in northwest Colorado. In September of 2014, our Development Subsidiary and ARP entered into a purchase and sale agreement to acquire interests in oil and natural gas assets in the Eagle Ford Shale in South Central Atascosa County, Texas. |

| • | Expand our natural gas and oil production. We and ARP generate a significant portion of our respective revenue and net cash flow from natural gas and oil production. We believe ARP’s program of sponsoring investment partnerships to exploit its acreage opportunities provides it with enhanced economic returns, which we participate in through our ownership of ARP’s IDRs and general partner |

12

Table of Contents

| interest. We intend for ARP to continue to finance the majority of its drilling and production activities through these investment partnerships. In addition, the Development Subsidiary has completed 13 wells in the Marble Falls play and participated in two non-operated wells in the Mississippi Lime play, and we operate select assets in the Arkoma Basin. |

| • | Expand ARP’s fee-based revenue through its sponsorship of Drilling Partnerships. ARP generates substantial revenue and cash flow from fees paid by the Drilling Partnerships to ARP for acting as the managing general partner. As ARP continues to sponsor Drilling Partnerships, we expect that ARP’s fee revenues from its drilling and operating agreements with its Drilling Partnerships will increase and will continue to add stability to its revenue and cash flows. |

| • | Continue to maintain control of operations and costs. We believe it is important to be the operator of wells in which we, ARP or ARP’s Drilling Partnerships have an interest because we believe it will allow us and ARP to achieve operating efficiencies and control costs. As operator, we and ARP are better positioned to control the timing and plans for future enhancement and exploitation efforts, costs of enhancing, drilling, completing and producing the well, and marketing negotiations for natural gas, oil and NGL production to maximize both volumes and wellhead price. Through our management of ARP, we were the operator of the vast majority of the properties in which ARP or ARP’s Drilling Partnerships had a working interest at September 30, 2014. |

| • | Continue to manage our exposure to commodity price risk. To limit our and ARP’s exposure to changing commodity prices and enhance and stabilize cash flow, we and ARP use financial hedges for a portion of our and ARP’s natural gas and oil production. We and ARP principally use fixed price swaps and collars as the mechanism for the financial hedging of commodity prices. |

Competitive Strengths

We believe our and ARP’s competitive strengths favorably position us to execute our business strategy and to maintain and grow our distributions to unitholders. Our and ARP’s competitive strengths are:

| • | We and ARP have a high quality, long-lived reserve base. Our and ARP’s natural gas and oil properties are located principally in the Barnett Shale, the Mississippi Lime, and the Raton, Black Warrior, Fort Worth, Arkoma and Appalachian basins and the Rangely field, and are characterized by long-lived reserves, generally favorable pricing for our and ARP’s production and readily available transportation. |

| • | We have significant experience in making accretive acquisitions. Our management team has extensive experience in consummating accretive acquisitions. We believe we will be able to generate acquisition opportunities of both producing and non-producing properties through our management’s extensive industry relationships. We intend to use these relationships and experience to find, evaluate and execute on acquisition opportunities. |

| • | We have significant engineering, geologic and management experience. Atlas Energy’s technical team of geologists and engineers has extensive industry experience. We believe that we have been one of the most active drillers in ARP’s core operating areas and, as a result, that we have accumulated extensive geological and geographical knowledge about the area. We have also added geologists and engineers to our technical staff who have significant experience in other productive basins within the continental United States, which enables us to evaluate and, as evidenced by the EP Energy acquisition, expand our core operating areas. |

| • | ARP is one of the leading sponsors of tax-advantaged Drilling Partnerships. ARP and its predecessors have sponsored limited and general partnerships to raise funds from investors to finance development drilling activities since 1968, and we believe that ARP is one of the leading sponsors of such Drilling Partnerships in the country. We believe that ARP’s lengthy association with many of the broker-dealers |

13

Table of Contents

| that act as placement agents for Drilling Partnerships provide ARP with a competitive advantage over entities with similar operations. We also believe that ARP’s sponsorship of Drilling Partnerships has allowed ARP to generate attractive returns on drilling, operating and production activities. |

| • | Fee-based revenues from ARP’s Drilling Partnerships and our and ARP’s substantially hedged production provide protection from commodity price volatility. ARP’s Drilling Partnerships provide ARP with stable, fee-based revenues which diminish the influence of commodity price fluctuations on cash flows. Because ARP’s Drilling Partnerships reimburse ARP on a cost-plus basis for drilling capital expenses, ARP is partially protected against increases in drilling costs. ARP’s fees for managing Drilling Partnerships accounted for approximately 16% of ARP’s segment margin for the year ended December 31, 2013. As of September 30, 2014, we and ARP had approximately 157.4 Bcfe, 4.1 Mmbbl and 0.7 Mmbbl of hedge positions, respectively, on our and ARP’s natural gas, crude oil and NGL production for 2014 through 2018. |

| • | ARP’s partnership management business can improve the economic rates of return associated with natural gas and oil production activities. A well drilled, net to ARP’s equity interest, in ARP’s partnership management business will provide ARP with an enhanced rate of return. For each well drilled in a partnership, ARP receives an upfront fee on the investors’ well construction and completion costs and a fixed administration and oversight fee, which enhances ARP’s overall rate of return. ARP also receives monthly per well fees from the partnership for the life of each individual well, which also increases the rate of return. |

Cash Distributions from ARP and Lightfoot

As of January 1, 2015, our equity interests in ARP and our other subsidiaries and investees consisted of:

| Incentive Distribution Rights |

General Partner Interest |

Limited Partner Interests | ||||||||||

| Our interests in ARP |

100 | %(1) | 100 | %(2) | 20,962,485 3,749,986 562,497 |

Common Units(3) Class C Preferred Units(4) Warrants for Class C Preferred Units(5) | ||||||

| Our interests in the Development Subsidiary |

— | 80.0 | %(6) | 1.7% limited partner interest | ||||||||

| Our interests in Lightfoot |

— | 15.9 | % | 12.0% limited partner interest | ||||||||

| Lightfoot’s interests in ARCX |

100 | %(7) | 100 | %(8) | 40.3% limited partner interest | |||||||

| (1) | The incentive distribution rights, or “IDRs,” entitle us to receive increasing percentages, up to a maximum of 48%, of any cash distributed by ARP as it reaches certain target distribution levels in excess of $0.46 per ARP common unit in any quarter. |

| (2) | Consists of 1,819,113 general partner Class A units, which are entitled to receive 2% of the cash distributed by ARP without any obligation to make further capital contributions to ARP. |

| (3) | Represents an approximate 23.5% limited partner interest. |

| (4) | Represents an approximate 4.2% limited partner interest. The Class C preferred units pay cash distributions in an amount equal to the greater of (a) $0.51 per unit and (b) the distributions payable on each common unit at each declared quarterly distribution date. Class C preferred units are convertible, at the option of the holder, on a one-for-one basis, in whole or in part, at any time before July 31, 2016 and are mandatorily convertible on July 31, 2016. |

| (5) | Upon issuance of the Class C preferred units, Atlas Energy, as purchaser of the Class C preferred units, received 562,497 warrants to purchase ARP common units at an exercise price of $23.10 per unit, subject to adjustments provided therein. The warrants will expire on July 31, 2016. |

14

Table of Contents

| (6) | The general partner interest is entitled to receive 2% of the cash distributed by the Development Subsidiary without any obligation to make further capital contributions. |

| (7) | Lightfoot owns 100% of Arc Logistics GP LLC, the general partner of ARCX, which owns all of the ARCX IDRs. The ARCX IDRs entitle ARCX’s general partner to receive increasing percentages, up to a maximum of 50%, of any cash distributed by ARCX as it reaches certain target distribution levels in excess of $0.4456 per ARCX common unit in any quarter. |

| (8) | The general partner interest in ARCX is a non-economic interest and does not entitle its holder to receive cash distributions. |

The ARP IDRs entitle us, as the indirect holder of those rights, to receive the following percentages of cash distributed by ARP as the following target cash distribution levels are reached:

| • | 13.0% of all cash distributed in any quarter after each ARP common unit has received $0.46 for that quarter; |

| • | 23.0% of all cash distributed in any quarter after each ARP common unit has received $0.50 for that quarter; and |

| • | 48.0% of all cash distributed in any quarter after each ARP common unit has received $0.60 for that quarter. |

In addition, our ownership of ARP’s general partner Class A units entitles us to receive 2% of the cash distributed by ARP without any obligation to make further capital contributions to ARP, and our ownership of approximately 27.7% of ARP’s limited partner ownership interest entitles us to receive distributions pro rata with ARP’s other limited partners.

The following are distributions declared and/or paid by ARP subsequent to December 31, 2013. Our board of directors adopted a monthly distribution policy for ARP effective for the month of January 2014 and later:

| Payment |

Record Date |

Payment Date |

Rate | |||||

| Q4 2013 |

February 10, 2014 | February 14, 2014 | $ | 0.5800 | ||||

| January 2014 |

March 7, 2014 | March 17, 2014 | 0.1933 | |||||

| February 2014 |

April 7, 2014 | April 14, 2014 | 0.1933 | |||||

| March 2014 |

May 7, 2014 | May 15, 2014 | 0.1933 | |||||

| April 2014 |

June 5, 2014 | June 13, 2014 | 0.1933 | |||||

| May 2014 |

July 7, 2014 | July 15, 2014 | 0.1933 | |||||

| June 2014 |

August 6, 2014 | August 14, 2014 | 0.1966 | |||||

| July 2014 |

September 4, 2014 | September 12, 2014 | 0.1966 | |||||

| August 2014 |

October 7, 2014 | October 15, 2014 | 0.1966 | |||||

| September 2014 |

November 10, 2014 | November 14, 2014 | 0.1966 | |||||

| October 2014 |

December 5, 2014 | December 15, 2014 | 0.1966 | |||||

| November 2014 |

January 6, 2015 | January 16, 2015 | 0.1966 | |||||

Following the separation, New Atlas will own 80.0% of the Development Subsidiary’s general partner, which is entitled to 2.0% of the cash distributed to the Development Subsidiary, and 15.9% of Lightfoot’s general partner, which owns ARCX’s IDRs and is entitled to distributions, up to a maximum of 50%, of any cash distributed by ARCX as it reaches certain target distribution levels in excess of $0.4456 per ARCX common unit in any quarter. New Atlas will also own 1.9% of the Development Subsidiary’s limited partner interests and 12.0% of Lightfoot’s limited partnership interests, which will be entitled to a pro rata share of distributions made by the Development Subsidiary and Lightfoot (and therefore ARCX), respectively.

15

Table of Contents

Geographic and Geologic Overview

Through December 31, 2014, we and ARP have established production positions in the following areas:

| • | the Eagle Ford Shale in southern Texas, in which our Development Subsidiary and ARP acquired acreage and producing wells in November 2014; |

| • | the Barnett Shale and Marble Falls play, both in the Fort Worth Basin in northern Texas. The Barnett Shale contains mostly dry gas and the Marble Falls play, in which both ARP and our Development Subsidiary own acreage and producing wells, contains liquids rich natural gas and oil; |

| • | coal-bed methane producing natural gas assets in the Raton Basin in northern New Mexico, the Black Warrior Basin in central Alabama and the County Line area of Wyoming, where ARP established a position following the EP Energy Acquisition, the Arkoma Basin in eastern Oklahoma, where we established a position following the Arkoma Acquisition, as well as the Cedar Bluff area of West Virginia and Virginia, where ARP established a position following the acquisition of certain assets from GeoMet, Inc.; |

| • | the Rangely field in northwest Colorado, a mature tertiary CO2 flood with low-decline oil production, where ARP acquired a 25% non-operated net working interest position in June 2014; |

| • | the Appalachian Basin, including the Marcellus Shale, a rich, organic shale that generally contains dry, pipeline-quality natural gas, and the Utica Shale, which lies several thousand feet below the Marcellus Shale, is much thicker than the Marcellus Shale and trends primarily towards wet natural gas in the central region and dry gas in the eastern region; |

| • | the Mississippi Lime and Hunton plays in northwestern Oklahoma, an oil and NGL-rich area; and |

| • | other operating areas, including the Chattanooga Shale in northeastern Tennessee, which enables ARP to access other formations in that region such as the Monteagle and Ft. Payne Limestone, the New Albany Shale in southwestern Indiana, a biogenic shale play with a long-lived and shallow decline profile, and the Niobrara Shale in northeastern Colorado, a predominantly biogenic shale play that produces dry gas. |

Gas and Oil Acquisitions

We and ARP seek to create substantial value by executing our respective strategies of acquiring properties with stable, long-life production, relatively predictable decline curves and lower risk development opportunities. Overall, we and ARP have acquired significant net proved reserves and production through the following transactions:

| • | Carrizo Barnett Shale Acquisition—On April 30, 2012, ARP acquired 277 Bcfe of proved reserves, including undeveloped drilling locations, in the core of the Barnett Shale from Carrizo Oil & Gas, Inc. for approximately $187.0 million. |

| • | Titan Barnett Shale Acquisition—On July 26, 2012, ARP acquired Titan Operating, L.L.C., which owned approximately 250 Bcfe of proved reserves and associated assets in the Barnett Shale on approximately 16,000 net acres, which are 90% held by production, for approximately $208.6 million. |

| • | Equal Mississippi Lime Acquisition—On April 4, 2012, ARP entered into an agreement with Equal Energy, Ltd., which we refer to as “Equal,” to acquire a 50% interest in Equal’s approximately 14,500 net undeveloped acres in the core of the oil and liquids rich Mississippi Lime play in northwestern Oklahoma for approximately $18.0 million. On September 24, 2012, ARP acquired Equal’s remaining 50% interest in approximately 8,500 net undeveloped acres included in the joint venture, additional net production in the region and substantial salt water disposal infrastructure for $41.3 million. |

16

Table of Contents

| • | DTE Fort Worth Basin Acquisition—On December 20, 2012, ARP acquired 210 Bcfe of proved reserves in the Fort Worth Basin from DTE Energy Company for $257.4 million. The assets acquired are in close proximity to ARP’s other assets in the Barnett Shale. |

| • | EP Energy Raton Basin, Black Warrior Basin and County Line Acquisition—On July 31, 2013, ARP completed the acquisition of certain assets from EP Energy for approximately $709.6 million in net cash. We refer to this transaction as the “EP Energy Acquisition.” The assets acquired included coal-bed methane producing natural gas assets in the Raton Basin in northern New Mexico, the Black Warrior Basin in central Alabama and the County Line area of Wyoming. |

| • | EP Arkoma Acquisition—On July 31, 2013, Atlas Energy completed the acquisition of certain assets from EP Energy for approximately $64.5 million, net of purchase price adjustments. The assets acquired included coal-bed methane producing natural gas assets in the Arkoma Basin in eastern Oklahoma. |

| • | GeoMet Acquisition—On May 12, 2014, ARP completed the acquisition of certain assets from GeoMet, Inc. for approximately $99.3 million in cash, net of purchase price adjustments, with an effective date of January 1, 2014. The assets include coal-bed methane producing natural gas assets in West Virginia and Virginia. |

| • | Rangely Acquisition—On June 30, 2014, ARP completed the acquisition of a 25% non-operated net working interest in oil and NGL producing assets, representing approximately 47 Mmboe of oil equivalent reserves, for approximately $407.8 million in cash with an effective date of April 1, 2014. The assets are located in the Rangely field in northwest Colorado. |

| • | Eagle Ford Acquisition—In November 2014, our Development Subsidiary and ARP acquired interests in oil and natural gas assets in the Eagle Ford Shale in South Central Atascosa County, Texas including 4,000 operated gross acres and net reserves of 12 Mmboe as of July 1, 2014. The purchase price was $339.0 million, of which $199.0 million was paid at closing and the balance will be paid during the twelve months following closing, subject to certain purchase price adjustments. The acquisition closed on November 5, 2014, with an effective date of July 1, 2014. |

Commodity Risk Management

We and ARP seek to provide greater stability in our and ARP’s cash flows through the use of financial hedges for our natural gas, oil and NGLs production. The financial hedges may include purchases of regulated New York Mercantile Exchange (“NYMEX”) futures and options contracts and non-regulated over-the-counter futures and options contracts with qualified counterparties. Financial hedges are contracts between us or ARP and counterparties and do not require physical delivery of hydrocarbons. Financial hedges allow us and ARP to mitigate hydrocarbon price risk, and cash is settled to the extent there is a price difference between the hedge price and the actual NYMEX settlement price. Settlement typically occurs on a monthly basis, at the time in the future dictated within the hedge contract. Financial hedges executed in accordance with our and ARP’s secured credit facilities do not require cash margin and are secured by our and ARP’s natural gas and oil properties. To assure that the financial instruments will be used solely for hedging price risks and not for speculative purposes, we and ARP have a management committee to assure that all financial trading is done in compliance with our and ARP’s hedging policies and procedures. We and ARP do not intend to contract for positions that we and ARP cannot offset with actual production.

Risks

An investment in our common units is subject to a number of risks, including risks relating to our and ARP’s business, risks related to the separation and risks related to our common units. Set forth below are some, but not all, of these risks. Please read carefully the risks relating to these and other matters described in the sections entitled “Risk Factors” and “Forward-Looking Statements.”

17

Table of Contents

Risks Relating to Our Business

| • | Our primary assets are our partnership interests, including the IDRs, in ARP, and, therefore, our cash flow is dependent on the ability of ARP to make distributions in respect of those partnership interests. |