Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PRUDENTIAL BANCORP, INC. | form8k.htm |

Annual Shareholder Meeting (NASDAQ: PBIP) February 9, 2015

DisclaimerThis presentation may contain certain forward-looking statements, including statements about the financial condition, results of operations and earnings outlook for Prudential Bancorp, Inc. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include words such as "believe," "expect," "anticipate," "estimate" and "intend" or future or conditional verbs such as "will," "would," "should," "could" or "may." Forward-looking statements, by their nature, are subject to risks and uncertainties. A number of factors, many of which are beyond the Company's control, could cause actual conditions, events or results to differ significantly from those described in the forward-looking statements. The Company's reports filed periodically with the Securities and Exchange Commission describe some of these factors, including general economic conditions, changes in interest rates, deposit flows, the cost of funds, changes in credit quality and interest rate risks associated with the Company's business and operations. Other factors described include changes in our loan portfolio, changes in competition, fiscal and monetary policies and legislation and regulatory changes. Investors are encouraged to access the Company's periodic reports filed with the Securities and Exchange Commission for financial and business information regarding the Company at www.prudentialsavingsbank.com under the Investor Relations menu. We undertake no obligation to update any forward-looking statements.

Prudential Bancorp, Inc. (“the Company”) is the holding company for Prudential Savings Bank (“the Bank”)The Bank operates out of its headquarters and main office in South Philadelphia as well as seven other locations in Philadelphia, Bucks and Delaware Counties, PhiladelphiaA community oriented savings bank with roots in Philadelphia dating back to 1886The Company conducts business in Philadelphia, Delaware, Bucks, Chester and Montgomery Counties, Pennsylvania, as well as several contiguous counties in southern New Jersey Source: SNL Financial Prudential Bancorp, Inc. Overview

Prudential Bancorp, Inc. Branch Listings PBIP Location (8) Source: SNL Financial

On October 9th, 2013, Prudential Bancorp, Inc., successor company to Prudential Bancorp Inc. of Pennsylvania, completed the second-step conversion of Prudential Mutual Holding Company (“the MHC”) whereby it became the holding company for Prudential Savings BankEach share of Prudential Bancorp Inc. of Pennsylvania common stock held other than by the MHC was converted into .9442 shares of the new Prudential Bancorp Inc.’s common stock, which began trading on the NASDAQ Global Market under the trading symbol “PBIP” on October 10, 2013An additional 7,141,602 shares were issued in the offering at $10.00 per share, bringing the total outstanding shares of Prudential Bancorp, Inc. to 9,544,809The Company received $69.4 million in net proceeds from the offering, of which 50% was contributed to the Bank Second-Step Conversion Source: SNL Financial & Company Documents

Increased net loans by approximately $14.6 million, from $306.5 million at fiscal year-end 2013 to $321.1 million at fiscal year-end 2014, an annual growth rate of 4.76%Decreased nonperforming loans to total loans over the same period by 15.28% from 2.16% to 1.83%Began the process of slowly diversifying the loan portfolio from primarily fixed-rate residential lending to adjustable-rate commercial/construction lending in order to increase net earnings and decrease interest rate riskIncreased investment portfolio by $13.1 million, or approximately 10%, investing primarily in shorter duration securitiesDisposed of all remaining previously classified investment securities received in 2008 mutual fund “redemption in kind”, recording a recovery of approximately $416 thousandImproved overall interest rate risk profile due to new capital infusion and change in mix of loan and deposit portfolios Established new Bank branch in Chalfont, Bucks County, Pennsylvania 2014 Fiscal Year¹ Highlights Third Quarter concludes PBIP’s Fiscal YearSource: Company Documents

Loan Portfolio Growth Trends The Company has grown the loan portfolio by over $60 million from fiscal year-end 2012 to fiscal year-end 2014 Note: Dollars in thousandsSource: Company Documents Net Loans

Source: Company Documents Loan Portfolio Composition 9/30/2014 9/30/2013

Investment Portfolio Composition 9/30/2014 9/30/2013 Source: Company Documents

(1) Includes $145.7 million in deposits held in escrow in connection with subscriptions received in the second-step conversion, of which $74.3 million in excess subscription funds was subsequently returned to potential subscribersNote: Jumbo CDs defined as certificates of deposits with balances of $100,000 or moreSource: SNL Financial & Company Documents Deposit Composition 9/30/2013 9/30/2014

(1) Includes $145.7 million in deposits held in escrow in connection with subscriptions received in the second-step conversion, of which $74.3 million in excess subscription funds was subsequently returned to potential subscribersSource: Company Documents Credit Quality Nonperforming Assets to Total Assets Nonperforming Assets ($Millions)

Nonperforming Asset Detail Source: Company Documents

Summary Balance Sheet Comparison Dollars in thousands except per share data(1) Includes $145.7 million in deposits held in escrow in connection with subscriptions received in the second-step conversion, of which $74.3 million in excess subscription funds was subsequently returned to potential subscribers(2) The Company had no intangible assets as of the dates presented. Thus the tangible ratios and tangible book values are the same as the ratios and book calculated under GAAPSource: Company Documents

Summary Income Statement Comparison (1) Calculated by dividing non-interest expense by the sum of net interest income and non-interest incomeSource: Company Documents

Net Interest Margin (1) Calculated by dividing net interest income by average interest-earning assetsSource: Company Documents Net Interest Margin¹

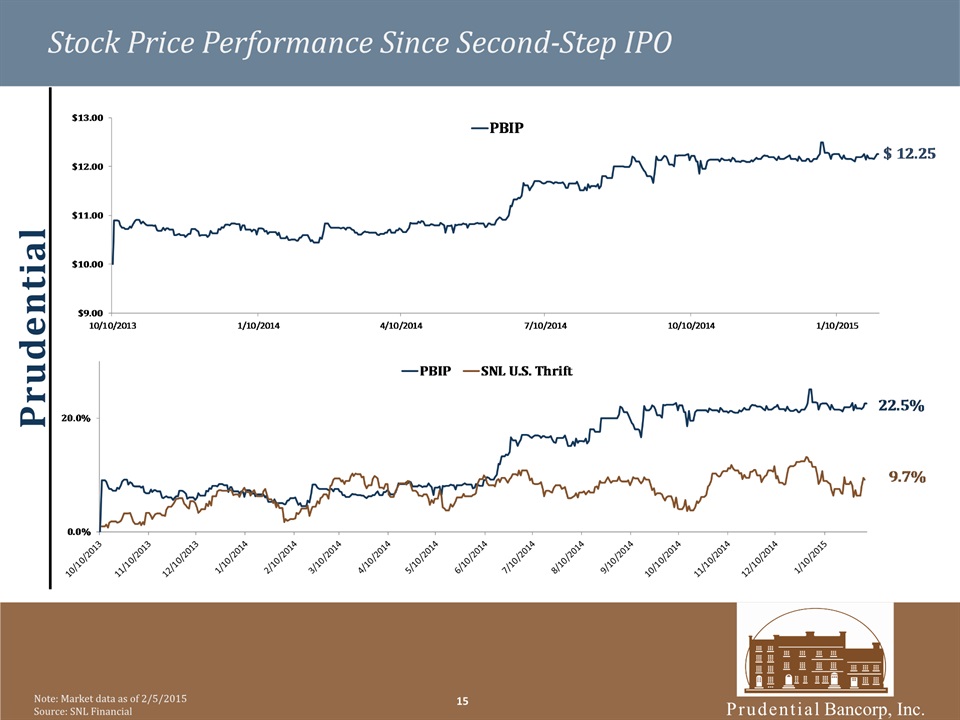

Note: Market data as of 2/5/2015Source: SNL Financial Stock Price Performance Since Second-Step IPO

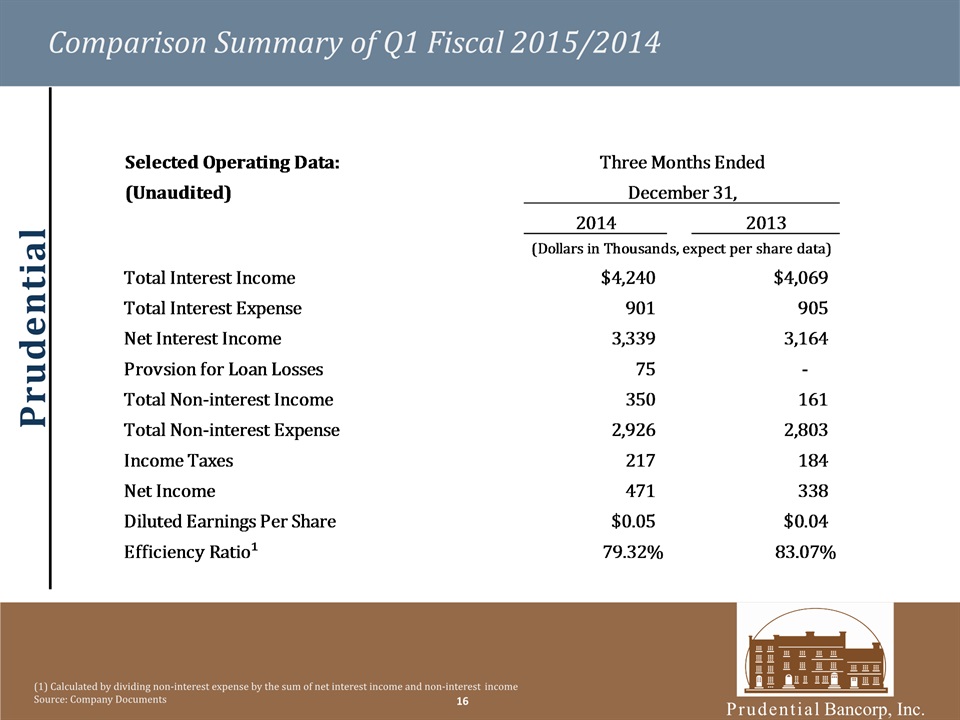

Comparison Summary of Q1 Fiscal 2015/2014 (1) Calculated by dividing non-interest expense by the sum of net interest income and non-interest incomeSource: Company Documents

Continue to diversify and grow the loan portfolio in order to improve earnings, while controlling our overall cost of fundsContinue to improve asset quality, hopefully with the help of an improving economic environment Expand product offerings, including small business loans and retail banking delivery services. For example, exploring mobile deposit product in Fiscal 2015 after having successfully rolled out mobile banking with bill pay product in Fiscal 2014. Continue prudent execution of the 950,000 share stock repurchase plan which commenced in September 2014. Have repurchased more than 25% of the announced 950,000 shares to date at average cost below tangible book value. Company has solid history of buybacks while in former MHC structure, having repurchased more than 3 million shares of stock between Fiscal 2006 and Fiscal 2010 while in that corporate form of organizationContinue to evaluate opportunities to improve the cost efficiency of the Bank’s branch network and also its attractiveness in order to enhance our customers’ banking experienceContinue to address each customer’s needs uniquely and provide the best possible service as a community bank Fiscal 2015 Business Strategy

Thank you for your attendance today! Prudential Bancorp, Inc. Annual Shareholder Meeting

Annual Shareholder Meeting (NASDAQ: PBIP) February 9, 2015