Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - MAXIMUS, INC. | a51036316ex99_1.htm |

| 8-K - MAXIMUS, INC. 8-K - MAXIMUS, INC. | a51036316.htm |

Exhibit 99.2

Operator: Greetings and welcome to the MAXIMUS Fiscal 2015 First Quarter Conference Call. At this time, all participants are in a listen-only mode. A question-and-answer session will follow the formal presentation.

If anyone should require operator assistance during the conference, please press star-zero on your telephone keypad. As a reminder, this conference is being recorded.

I would now turn the conference over to Ms. Lisa Miles, Senior Vice President of Investor Relations. Thank you, Ms. Miles, you may now begin.

Ms. Lisa Miles: Good morning.

Thank you for joining us on today’s conference call. I would like to point out that we've posted a presentation on our website under the Investor Relations page to assist you in following along with today’s call.

With me today is Chief Executive Officer, Rich Montoni; President, Bruce Caswell; and Chief Financial Officer, Rick Nadeau.

Before we begin, I would like to remind everyone that a number of statements being made today will be forward-looking in nature.

Please remember that such statements are only predictions, and actual events and results may differ materially as a result of risks we face including those discussed in exhibit 99.1 of our SEC filings.

We encourage you to review the summary of these risks in our most recent 10-K filed with the SEC. The company does not assume any obligation to revise or update these forward-looking statements to reflect subsequent events or circumstances.

Today’s presentation may contain non-GAAP financial information. Management uses this information in its internal analysis of results and believes that this information may be informative to investors in gauging the quality of our financial performance, identifying trends in our results, and providing meaningful period to period comparisons.

For reconciliation of non-GAAP measures presented in this document, please view the company’s most recent quarterly earnings press release.

And with that, I’ll turn the call over to Rick.

Mr. Rick Nadeau: Thanks, Lisa.

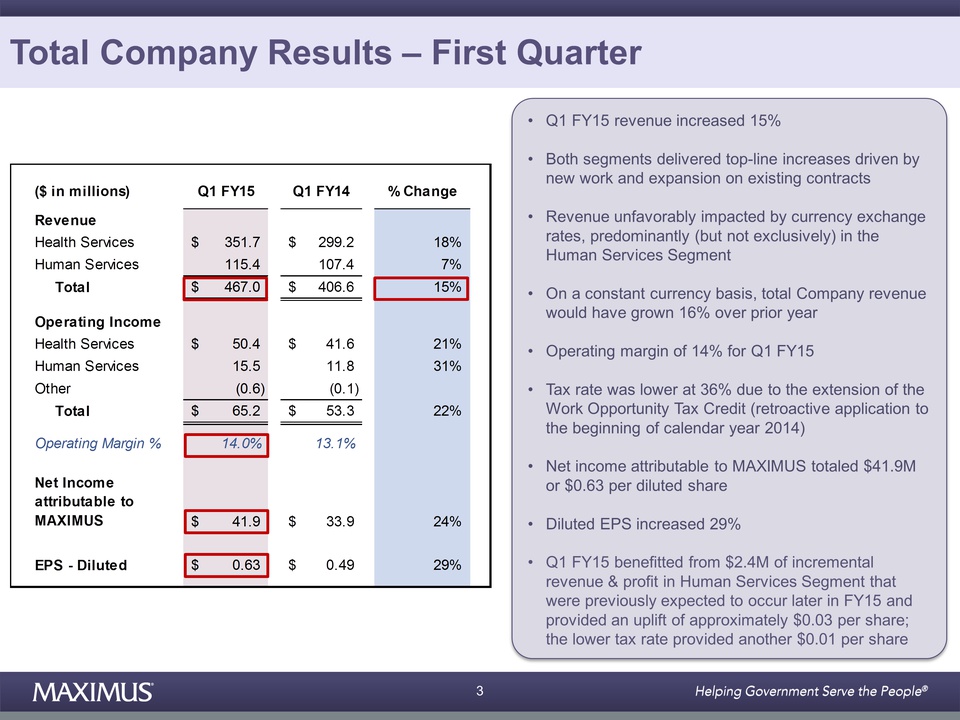

This morning, MAXIMUS reported first quarter revenue of $467.0 million, a 15 percent increase compared to the same period last year.

All growth in the quarter was organic. And both segments delivered top line increases driven by new work and the expansion on existing contracts.

Revenue was unfavorably impacted by currency exchange rates, predominantly, but not exclusively, in the Human Services Segment. On a constant currency basis, total company revenue would have grown 16 percent over the prior year.

For the first quarter of 2015, operating income totaled $65.2 million, and the company delivered an operating margin of 14 percent. Our tax rate in the first quarter was lower than expected at 36 percent.

This was due to the extension of the Work Opportunity Tax Credit at the end of December with retroactive application to the beginning of calendar year 2014.

For the first quarter, net income attributable to MAXIMUS totaled $41.9 million, or 63 cents per diluted share. First quarter diluted EPS increased 29 percent, compared to 49 cents reported for the same period last year.

The first quarter of fiscal 2015 benefited from $2.4 million of incremental revenue and profit in the Human Services Segment that was previously expected to occur later in this fiscal year and provided an uplift of approximately three cents per share. In addition, the lower tax rate provided approximately another penny of earnings, overall, another solid growth quarter.

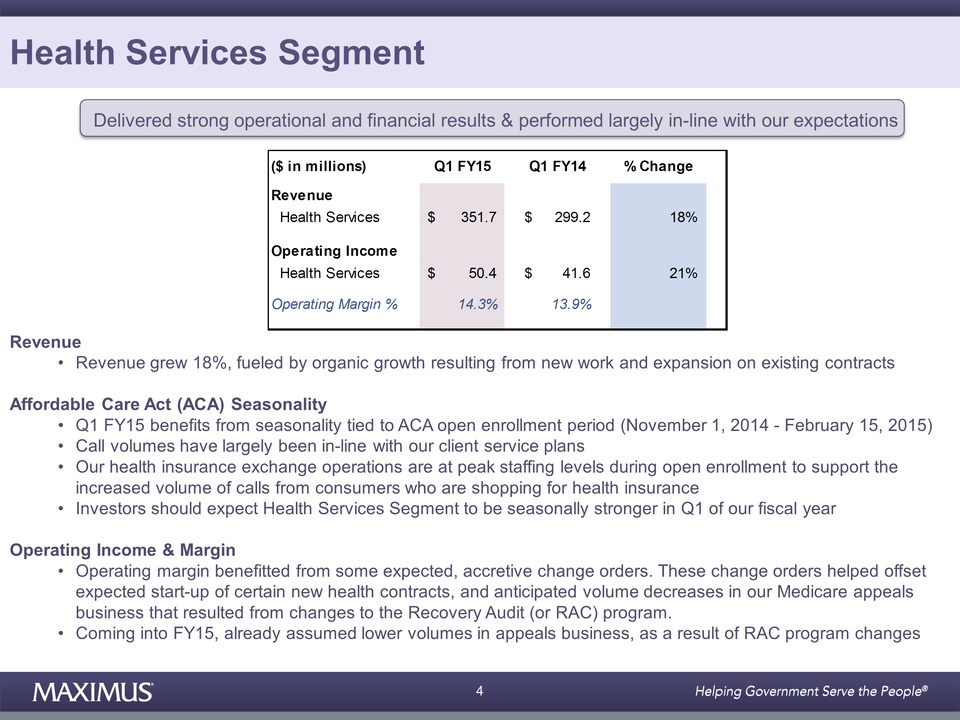

Let’s jump into results by segment, starting with Health Services. The Health Services segment delivered strong operational and financial results and performed largely in line with our expectations.

Revenue in the first quarter grew 18 percent, to $351.7 million, compared to the same period last year, fueled by organic growth resulting from new work and the expansion of existing contracts.

As a reminder, the segment’s fiscal Q1 benefits from seasonality tied to the open enrollment period under the Affordable Care Act. This year’s open enrollment began on November 1st and runs through February 15th.

Thus far, call volumes have largely been in line with our client service plans. Our health insurance exchange operations are at peak staffing levels during open enrollment to support the increased volume of calls from consumers, who are shopping for health insurance.

Therefore, investors should expect the Health Services Segment to be seasonally stronger in the first quarter of our fiscal year.

Health Services segment operating income in the first quarter of fiscal 2015 grew 21 percent to $50.4 million, compared to the same period last year. For the first quarter of fiscal 2015, operating margins for the Health Segment were 14.3 percent and higher compared to the same period last year.

The segment’s operating margin benefited from some expected, accretive change orders.

These change orders helped to offset the expected start-up of certain new health contracts, as well as the anticipated volume decreases in our Medicare appeals business, that resulted from changes to the Recovery Audit program, also known as RAC.

As a reminder, coming into this fiscal year, we had already assumed significantly lower volumes in our appeals business as a result of these changes, all in all another solid quarter from the Health Services Segment.

Let’s turn our attention to financial results for Human Services. The Human Services Segment was adversely impacted by changes in currency, most notably due to the weakening of the Australian dollar.

The impact in the first quarter was approximately $5.0 million unfavorable to revenue, on a constant currency basis. The Canadian dollar and the British pound continued to significantly weaken throughout the month of January.

Accordingly, we expect the segment will continue to be affected by currency exchange rates.

For the first fiscal quarter, revenue for the Human Services Segment increased 7 percent to $115.4 million, compared to last year. However, on a constant basis, the segment’s revenue would have increased 12 percent.

Revenue growth in the quarter was driven by the Company’s international operations, including the recent reallocation of work in Australia.

First quarter operating income for the Human Services Segment increased to $15.5 million compared to last year. The Segment’s operating margin increased to 13.4 percent for the first quarter of fiscal 2015.

The segment benefited from approximately $2.4 million in revenue and income that was previously expected to occur later in this fiscal year. Excluding this, we estimate that operating margin would have been approximately 11 percent for the first quarter of fiscal 2015, which is typical for this segment.

Moving onto cash flow and balance sheet items, cash flow in the fiscal first quarter was strong, driven by increased earnings and good receivables collections. As expected, DSOs improved on a sequential basis to 58 days in the quarter.

We expect DSOs to increase to a more normalized level during the year, mostly due to some of the new contracts coming online, most notably the two new health contracts in the United Kingdom.

For the first quarter of fiscal 2015, cash provided by operating activities, totaled $56.6 million and free cash flow was $42.5 million.

As a reminder, free cash flow is defined as cash provided from operating activities, less purchases of property and equipment, and capitalized software. During the quarter, we purchased shares of MAXIMUS common stock under our Board authorized program.

In Q1, we repurchased approximately 753,000 shares for a total of $32.6 million. At December 31, 2014 we had $104.6 million available for share repurchases under the current program. As a reminder, our buyback program is opportunistic in nature.

At December 31, we had $149.2 million in cash and cash equivalents of which approximately 30 percent were held outside the United States.

The strength of our balance sheet provides us with a great deal of flexibility in deploying capital, and we are focused on sensible deployment of cash. In addition to buybacks and dividends, we continue to manage a strategic acquisition program. At any given time, we often have a number of opportunities in the pipeline.

We run a rigorous due diligence process and we are highly selective. But, M&A continues to be an active and large component of our cash deployment and growth strategies.

And lastly guidance, as noted in this morning’s press release, we are reiterating our fiscal 2015 revenue and earnings guidance. We still expect revenue in fiscal 2015 to range between $1.9 billion and $2.0 billion and earnings per diluted share to range between $2.25 and $2.40, despite ongoing weakness in currency exchange rates outside the U.S.

As I mentioned earlier, the Canadian dollar and the British pound continued to significantly weaken throughout the month of January.

So, looking at our guidance, the currency exchange rates at January 31 would indicate the tempering of revenue of approximately $45 million and operating income of approximately $4.5 million or five cents per diluted share.

This compares to the exchange rates that were assumed when we completed our forecasting in October. We are also maintaining our cash flow guidance for fiscal 2015. We still expect cash provided by operating activities to be in the range of $165 million to $190 million. And we expect free cash flow to be in the range of $100 million to $125 million.

Thanks for joining us this morning, and now I’ll turn the call over to Rich.

Mr. Rich Montoni: Good morning, and thank you, Rick.

Our solid performance for the first quarter of fiscal 2015 sets a good path for the remainder of the year and beyond. In my remarks today, I will share updates since our last call.

Let’s start off with our Health Services Segment, where we have updates for both our U.S. and UK operations. In U.S., our Affordable Care Act teams are wrapping up the activities tied to the second open enrollment period, or what’s referred to as OE2, which runs through February 15th, 2015.

As expected the overall open enrollment period was much smoother this year with fewer technological challenges and the benefit of applying the lessons learned.

We collaborated with our clients for early planning, as this year brought new challenges like renewals for the first time. We also launched aggressive refresher training in many of our locations to ensure that our staff were well prepared to assist consumers.

As Rick mentioned, thus far, overall call volumes across all of our centers have been running largely as expected, mainly due to the benefit of early planning. We found the overall renewal process to be fairly straightforward in the markets where the carriers remained largely the same or there weren’t major changes to the plans.

New York is one example where open enrollment has done particularly well. The state’s marketplace remained very stable from both a plan selection and cost perspective, which clearly played an important role in the ease of use for consumers.

I have a couple of observations to share from some of our centers. In general we noticed an overall increase in consumer awareness related to eligibility and enrollment. We are also just starting to receive calls related to the new tax forms that are being mailed out.

Public health insurance exchanges and covered individuals are required to submit ACA-related tax information and forms.

So far, about half of the calls we’ve received are informational in nature and the other half related to incorrect information on the forms themselves. We haven’t seen a dramatic uptick in volumes as a result of the tax forms, but it’s still early.

This could change as tax payers start completing their returns in anticipation of the April 15th filing deadline.

As you know, MAXIMUS operates five state-based exchanges plus the District of Columbia. In addition, we also operate two customer contact centers for the federal marketplace as a subcontractor.

As reported in the media recently, we started the process of ramping down one of our federal customer contact centers, that being Boise, Idaho.

Our two-year contract is scheduled to end later this year. So this was an expected closure and was fully contemplated in our guidance. At this time, Boise is the only contact center we are closing.

We also continue to work closely with states that may be considering a potential move of the federal marketplace to their own state-based exchange. Realistically, we likely won’t see a lot of movement until the Supreme Court renders the decision on the King versus Burwell case, which is expected later this year.

It’s speculative as to what the outcome might be and what effect it may have on states' decisions to operate their own exchanges. Nevertheless, there continues to be interest from states on how to better manage the continuum of programs for the uninsured.

And as we look to the future, we see the 2017 state innovation waivers provided under section 1332 of the act may prompt more states to consider new ways to manage their uninsured populations.

The innovation waivers provide states with additional flexibility and how they manage their insurance markets.

The waivers could be an attractive option to governors, who want to manage federal funds to implement state-driven ideas that are more closely aligned to state-specific policies, demographics, insurance markets, budgets and culture.

The waivers also give states a way to deal with some of the act’s principle, structural and operational challenges. For example, they address the continuation of care as individuals move between provider networks when their income, family composition, or age changes.

The waivers also allowed states to become centers of innovation as a structure their employer-sponsored insurance and assistance in the purchase of private health insurance.

In fact, MAXIMUS will be hosting a live event tomorrow at noon to discuss new approaches that states can take for the design and operation of their health insurance programs.

Our event features some of the country’s leading policy experts all of whom have broad expertise in implementing and managing programs for the uninsured.

We’re very excited to help states understand how the waivers will bring them new flexibility as a design and implement sustainable approaches to their public health programs.

Overall, as we've said in the past, the Affordable Care Act is a multi-year driver for MAXIMUS, and we believe the ongoing opportunities to help states manage their myriad of health benefit programs will continue to provide us with ongoing tailwinds for the years to come.

Moving onto our health operations in the United Kingdom, where the team is hard at work on two new contracts, the Fit for Work program is well under way. We launched phase one in December and are now working on phase two.

The second new UK health contract is the Health Assessment Advisory Service, formerly known as the Health and Disability Assessment Service.

Under this contract, MAXIMUS is conducting assessments for individual seeking certain disability event benefits according to the rules set down by Parliament. We are working towards addressing some of the challenges that exists today, but recognize that it will take time to improve key aspects of the customer experience.

One of our primary goals is to increase the overall number of healthcare professionals, who support the program, particularly those who specialized in mental health and those who understand the fluctuating health conditions.

Over time, we strive towards the longer-term goals of reducing the long lead times, improving the quality of the assessment, and making the assessment process less intimidating for customers.

We are presently on target to takeover in March 1st. Nevertheless, it’s important for investors to recognize that the overall policy remains controversial in the United Kingdom. Therefore, we do expect ongoing media coverage for this program.

Let’s move onto our Human Services Segment here. We have positive news to share from our U.S. welfare-to-work operations.

In Tennessee, we were successful in a large rebid for the Families First program, where we’ve been a provider since 2007. As part of the rebid, we also secured additional scope and are expanding into seven additional counties.

We will now be providing employment and case management services to 36 of the state's 95 counties. Under the new contract, we expect that revenue will triple, with the annual run rate going from approximately $5 million to $15 million. Congratulations to the team for job well done.

Since our last call, we also received some additional good news from the United Kingdom where we picked up our first reallocated region under the work program. We began delivering employment services to job seekers in the Northeast Yorkshire and the Humber region just last week.

This reallocation recognized our strong performance in helping to successfully guide individuals off benefits and into their work and contributing to a stronger local economy.

And finally, we have submitted our responses to the Job Services Australia rebid tender. As we’ve said in the past, we don’t expect a winner-take-all award, but rather awards that are done on a location-by-location basis. We expect to hear the results in the spring and remain cautiously optimistic about this important rebid.

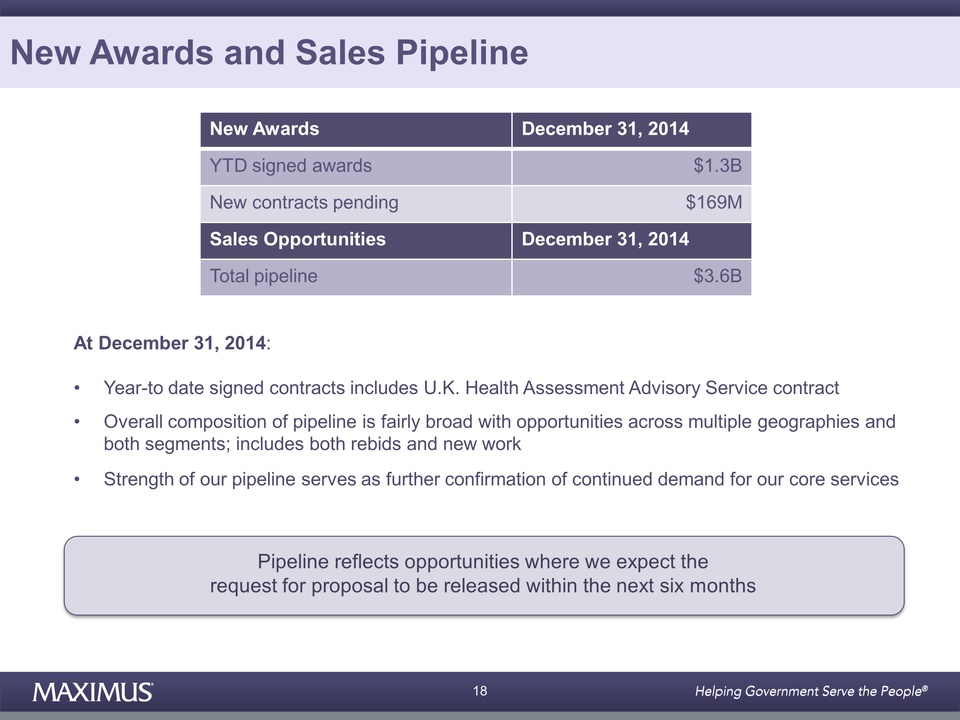

Moving on to new awards in the pipeline, at December 31st, 2014 year-to-date signed awards were very strong at $1.3 billion this includes the UK Health Assessment Advisory Services contract.

We also had an additional $169 million in new contracts that have been awarded, but not yet signed as of December 31st.

Our sales pipeline remain very robust at $3.6 billion at December 31, 2014, the overall composition of the pipeline is fairly broad with opportunities across multiple geographies in both segments.

It also includes both rebids and new work. The strength of our pipeline service is further confirmation of continued demand for our services. And as a reminder our reported pipeline only reflects opportunities where we believe the RFP is expected to be released within the next six months.

So, in conclusion, with another solid quarter under our belt, we are positive about our progress in fiscal 2015. Our collective efforts to secure new work, expand existing contracts, and standup new programs demonstrate our ability to deliver and meet commitments to our clients and the citizens they serve.

We believe demand for our services will continue as governments require partners to help them manage benefit programs more efficiently and effectively to address rising caseloads and implement performance-based metrics to achieve the outcomes that matter.

In summary, we’ve set the table for solid growth in 2015 and beyond and remain most excited about our future prospects.

And with that, let’s open it up for questions. Operator?

Operator: Thank you.

We will now be conducting a question-and-answer session. If you would like to ask a question, please press star-one on your telephone keypad. A confirmation tone will indicate your line is in the question queue.

You may press star-two if you would like to remove your question from the queue. For participants using speaker equipment, it may be necessary to pick up your handset before pressing the star keys.

Our first question is from Charlie Strauzer of CJS Securities. Please go ahead.

Mr. Charlie Strauzer: Hi. Good morning.

Mr. Rich Montoni: Good morning, Charlie.

Mr. Charlie Strauzer: Rich, if you--or maybe, Rick, this is more for you, but if you can expand little bit more on the impact on currency. Obviously, there was an offset in the quarter and probably going an offset there going to be offset going forward there if you guys kind of stay where it is.

Can you explain what the quarter and come up with positive offsets to that?

Mr. Rich Montoni: Charlie, I would be glad to talk about that. And you’re right. Rick did talk in his prepared remarks about the currency impact, the adverse currency impact in the quarter and the expected impact for the year.

And in terms of offsetting that, and as you know there are always puts and takes in the portfolio, but we were fortunate in this quarter that, the amount of work we’re doing relative to the Affordable Care Act is a bit stronger than we had expected.

You may recall that we expected, this year to be down versus the prior year. We had estimated the amount of; the downdraft would be in the territory of $50 million to $100 million of less work this fiscal year.

It’s actually coming in, better than we had expected. So, that’s the good news that offsets the currency aspects and allows us to maintain our current guidance on a go forward basis.

Mr. Charlie Strauzer: Great

And then just one follow-up question?

Mr. Rich Montoni: Um-hmm. Sure.

Mr. Charlie Strauzer: If you look at the, UK Work Programme, I believe you are going to starting to approach your kind of, your bonus payments for performance.

And, are you on track to kind of hit those goals? And, remind us again. Are those--is that a lump sum payment, or is that spread out more evenly over time?

Mr. Rich Montoni: You know that program is a mix of a fixed payment, of front-end fixed payment. And, we amortize the front-end payments, over a period of time.

And then the contract I view is largely pay-for-performance and recurring pay point. So, it performs month-to-month. I don’t have the impression that there is a big, payment due at any time in the future. I think it’s just a steady stream program.

Mr. Charlie Strauzer: Great. Thank you very much.

Mr. Rich Montoni: You bet.

Ms. Lisa Miles: Next question please.

Operator: Thank you.

The next question is from Richard Close of Avondale Partners. Please go ahead.

Mr. Richard Close: Yeah, Richard, I get your opinion on state Medicaid, expansion. There’s been a lot of, I guess, anticipation in terms of states expanding Medicaid. Tennessee voted yesterday not to, I guess, in one of their committees. So, thoughts on does that impact MAXIMUS at all, going forward?

Mr. Rich Montoni: Good morning, Richard.

And I think it’s a great question. And the concept of Medicaid expansion has been one, as you know, that’s been, wondered about, I’ll say, for several years running.

And, it’s--we see sporadic actions or inactions. And you do mention Tennessee. I’m going to ask Bruce Caswell, who is here with us today, to share with us his thoughts on this one.

Mr. Bruce Caswell: Sure, Richard, and good morning.

You’re right. There’s been a lot of movement from a waiver perspective, with the Republican states. There are currently 27 states and the District of Colombia that have expanded Medicaid and probably seven to nine Republican states that are looking at, expansion alternatives.

Notably while Tennessee had put forward a plan to CMS for a waiver that would have, provided to that expansion, Indiana has actually received that waiver ahead of Tennessee.

That is interesting from two dimensions. The Indiana waiver for the first time allows the state to, have kind of a personal responsibility component. And that is like a recipient co-payment or premium cost sharing for individuals below 100 percent of the federal property level, which was not something that CMS historically was willing to grant.

Secondly, it allows that the benefits can be denied for individuals, like dental and vision benefits. So, wrap-around benefits not, core Medicaid benefit is the beneficiary themselves, falls behind in their share of the payments.

So, a lot of folks are looking more toward Indiana model as an example of something that could be replicated successfully in other Republican states. We continue to keep an eye on it.

And I think we’ve said for some time that Medicaid expansion is a long-term trend, something that will play out over the course of probably the next four to five years, just as the initial implementation of the Medicaid program took many years before there was full adoption.

Mr. Rich Montoni: And I would add to that, Richard that certainly MAXIMUS has benefited from the Medicaid expansion that’s occurred to date. And, certainly we should benefit from any incremental additional expansion in those states where we serve, as enrollment broker or CHIP administrator.

And I think that’s 20 at this point in time. Correct, Bruce?

Mr. Bruce Caswell: Yep. That’s right.

And in fact, Rich, to your point, there was some recently released data that suggests in states that have expanded Medicaid, the Medicaid roles have increased about 25.5 percent.

And for those that haven’t, there has still been a woodwork effect of about 7 percent increase in Medicaid. Does that help, Richard?

Mr. Rich Montoni: Next questions please.

Operator: Thank you.

The next question is from Brian Kinstlinger of Maxim Group. Please go ahead.

Mr. Brian Kinstlinger: Hi. Good morning, guys.

Mr. Rich Montoni: Good morning, Brian.

Mr. Brian Kinstlinger: How are you?

So, I guess I’m curious how many states the number--clearly you’re not going to say this--specific states are you in discussions with about transitioning to state-based exchanges given the Supreme Court, case?

And then I’m curious. Are they more Democrat-led states, given, the government’s opposition? And then with the lessons learned in the past, how quickly can a state today move from a federal exchange to develop, install, and be ready for enrollments on a state-based exchange?

Mr. Rich Montoni: I’m going to hand this over to Bruce in a minute. But I think it’s a three-part question there, Brian.

Mr. Brian Kinstlinger: So, I won't ask a follow-up.

Mr. Rich Montoni: How many states are we in discussion with, and Bruce will probably talk about how many are we monitoring? And secondly, are they more Democratic?

And then, thirdly, the lessons learned how quickly might a state be able to transition.

Mr. Bruce Caswell: Sure.

Mr. Brian Kinstlinger: Okay. Thank you.

Mr. Bruce Caswell: Great question.

So, first of all, as you know, there are 34 states in the federal market place presently that would be affected by the King-Burwell decision. And it’s notable that, there are, depending on which estimates you look at, up to 5 million individuals that are currently receiving, subsidies in those marketplaces that would be affected in those states.

And in addition to that, the thinking is that if those subsidies were removed, obviously there would be an increase in premiums. RAND Corporation, in fact, estimates that premiums would increase in the individual markets up to 47 percent.

That effect alone could destabilize the remainder of folks and drive up to another million folks out of the marketplace. And so, there's a lot of stake here. You’re right.

Consequently, we’re looking at all the states that obviously would have to do something and choose to do something.

I believe it is in fact the case that nine of those states that are in the 34 have actually passed legislation that would prohibit them from presently establishing a state-based exchange.

So, barring some, you know, new legislation, that would open the door that would leave the remaining 25 or so, as potential transition states.

When you look at those, there are 11 states that have actually, weighed in affirmatively on the Supreme Court case asking the court to sustain the payment of, subsidies in the federal marketplace.

So, you would think that they would be friendly toward the concept of setting up a state-based exchange. And that brings me to the last part of your question, which is how hard it is and how long would it take?

There are probably--well, there are couple of elements to that, very quickly. The first thing is, is that the mechanics for granting federal money to a state to setup an exchange expired in November of 2014.

And that was the actual, establishment grant funding window closed. So, that would have to be reopened in some way. Secondly, you could see a scenario under which the federal government would work to extend the technology platform to the states.

And the states would correspondingly have to setup their own customer contact centers. So, some type of, you know, cloud based or service based technology platform would probably be the most expeditious way to make the technology available.

However, there are other states out there, Maryland being an example, that have transferred technology from more successful states like Connecticut that would may look to more of a consortium model.

So, I would think in the end, you'd see a blending of approaches, with an emphasis by the administration to try to expedite that. But, the reality being with the court decision in June and the way the law is currently written, states have to pass an important certification date six and a half months prior to going live.

So, it would make a very challenging for this next open enrollment period to get a state-based exchange in place. Does that helps?

Mr. Brian Kinstlinger: Hey, super helpful.

Mr. Rich Montoni: Brain, I want to add one footnote to that. There was an article in the Washington Post this morning that was interesting in this context. And it was really about a Republican-led plan that’s being baked up, in the event that the outcome of this, Supreme Court case is adverse.

And so, it’s interesting to monitor, the key point being one that--the key points being one, it’s very, very dynamic. And, we should expect other alternatives to pop up.

But at the end of the day, we do believe that there is going to have to be some form of, supported healthcare program out there.

Mr. Brian Kinstlinger: Thank you.

Mr. Rich Montoni: Next question please.

Operator: Thank you.

As a reminder, ladies and gentlemen, it is star-one if you'd like to ask a question.

And the next question is from Frank Sparacino of First Analysis. Please go ahead.

Mr. Frank Sparacino: Hi, guys.

I'm curious on, you know, if you look at the UK and all the work that you’re doing there, obviously, you have lots of clinical expertise, maybe more so here in the U.S.

So, I'm just curious when you look at the U.S. marketplace and some of the things that you do in the UK, you know one could argue, those services are very relevant here.

And just curious on some of the potential opportunities here, or even outside the UK, on a more global basis?

Mr. Rich Montoni: Good morning, Frank.

I think that’s a great question. And I think it has--it does have significant strategic relevance.

We have maintained for quite some time a view that as governments are more pinged from a fiscal perspective and as the number of, let’s say, applicants or the member of individuals because of increasing populations and the demographics within those populations, meaning more people are looking to their government, for help, that the intersection of those dynamics really will spark and motivate governments to have, more eligibility hurdles.

And, that will increase the demand for what we do. One of those subsets is--one of the services is what we do in appeals and assessments.

And we do see, in the UK, that’s what’s happening, is that, there is an increased need to do quality, appeal and assessment work. Most of the work we do over there is in the assessment category.

Here in the U.S., we do a lot of appeals work. And we do sense that there’ll be an increased demand for, assessments and/or appeals, I think, in Australia. We should expect that to happen.

And I do think here in the U.S. as well other programs; case in point would be social security, and workforce compensation. The other dynamic is that we’re seeing increased, discussions as it relates to the disabled, including mental type situations as well.

So, the industry is moving very much in that direction. And I think it’s going to provide increased opportunities for MAXIMUS. Next question, please.

Operator: Thank you.

The next question is from Allen Klee of Sidoti & Company. Please go ahead.

Mr. Allen Klee: Hello.

Thank you for taking the call. Could you just speak a little to the work you’ve been doing to prepare for the Health Assessments Advisory Services contract and how that’s going?

Mr. Rich Montoni: We’d be glad to do that, Allen. Bruce, why don't you tackle that one?

Mr. Bruce Caswell: Sure. Allen, good morning.

Yeah, I would just say that, you know, as Rich mentioned in his notes, we, continue to work on ramping up for that contract. It has a takeover, date or deadline of March 1st.

The teams are working, across the number of work streams, as you can imagine, in conjunction with our client. and we feel very much that it’s going as expected.

And Rich also noted that it remains, obviously very, politically sensitive, program and topic in the United Kingdom. We expect continued media coverage in that area.

And importantly, as we've stressed throughout, we are not the, company that determines the outcome of an assessment. We effectively help prepare that assessment for a final government-based adjudicator to make that determination based on rules set down by Parliament.

Mr. Allen Klee: Thank you.

Mr. Rich Montoni: You’re welcome. Next question please.

Operator: Thank you.

Yes, the next question is from Richard Close of Avondale Partners. Please go ahead.

Mr. Richard Close: Great.

I was wondering if you could give us an update on Australia, any type of competition, landscapes there with the JSA.

And then, I guess just put context around the cautiously optimistic there, make us feel maybe a little bit more comfortable where the opportunities in Australia for you guys?

Mr. Rich Montoni: I’d be glad to do that.

When I think about the Australian opportunity, the rebid opportunity, we are a very significant provider under our existing contract, as you know. It’s a large contract for MAXIMUS.

I highly respect, the procurement process that Australia has set up and follows rigorously, meaning that they follow their protocols very, very tightly. They tend to award on performance and not price.

And naturally as you would expect, MAXIMUS pays an awful lot of attention to its performance metrics and continues to be evaluated as a top provider in that country.

And I think that will go an awful long way towards, the probability that we will continue to be a key provider in the rebid result. We expect to hear this--the result this spring.

And I would really emphasize this is not an all or none situation. While it’s large, its--they will make the award region by region, area by area. So, I think it’s highly unlikely, Richard, that, a key provider like MAXIMUS is going to have a material loss in this situation.

And I’d like to think we have more upside than downside.

Mr. Richard Close: Okay.

And a follow-up question just on the FX impact, for this year. For modeling, purposes, should we be looking at human as, call it a, you know, mid to upper single-digit grower in the remaining quarters of this year?

Mr. Rick Nadeau: Yes, I think so.

And, as you’d see the currency in Canada and in Australia are down more than 10 percent as compared to October at the beginning of our year. Yes, I think, your assumption on the growth rates that makes sense. Next question please.

Operator: Thank you.

As another reminder to everyone to please press star-one if you would like to ask a question. The next question is from Brian Kinstlinger of The Maxim Group. Please go ahead.

Mr. Brian Kinstlinger: Great. Thanks so much.

My follow-up first one is I’m curious what you’re hearing on the moratorium of inpatient stage for RACs and how and when, appeal volumes might be impacted in your opinion?

Mr. Rich Montoni: Bruce.

Mr. Bruce Caswell: Sure.

Hi, Brian. Great question. And, as I believe you know, the moratorium on auditing those, inpatient stage based on the two midnight rule ends in March of this year.

And we have for some time said that there is kind of a time lag or delay, if you will, between when the RACs can go out and start mining those claims again and what the look back factor is.

And ultimately, when we see those as appeals, I think we’ve characterized that historically as probably a five-month or six-month delay.

One other element to this is the extension of the current, RAC contracts, I believe through the end of this calendar year. So, we’ve tried to be, very prudent in our forecasting of the volumes.

And as you know, Medicare appeal volumes are notoriously difficult to forecast. And so, we’ve really baked those volume effects into our full year guidance presently.

Mr. Brian Kinstlinger: Great.

And then can you maybe give us a little bit more detail on the pipeline? Is it fully weighted internationally, U.S., maybe certain countries? And are there still a number of large opportunities that we’ve been spoiled to see that you win so many of?

Mr. Bruce Caswell: My takeaway on the pipeline is that it remains very robust. And I’m very pleased with the mix. What’s in our pipeline? And by that I mean, two dimensions.

One is how much is new work, versus how much is rebid. I’m very pleased with a very significant portion of it represents new work. And, I’m also pleased that it really is all--is across all of our business, not just domestic, not just international, but all of our businesses, health and human services alike.

Operator: Thank you.

Our next question is from--I’m sorry, our final question is from Frank Sparacino of First Analysis. Please go ahead.

Mr. Frank Sparacino: Rich, I just want to go back to you. Earlier, you made a comment around ACA coming in better than expected. And I was wondering if you could be more specific as to where that upside is coming from?

And then also related to that, what happens with, the Texas call center? You know, I’m not sure how things sort of play out after open enrollment here ends, but, any idea as to when maybe the next kind of procurement cycle comes up?

Mr. Rich Montoni: I’ll take the latter one in terms of the Texas call center. And then I’m going to turn this over in terms of why we can give you some qualitative color, on why, OE2 seems to be stronger than we had expected.

So, on the Texas call center, this is in Brownsville. One key point is it really is, an outstanding call center, has great capabilities, and, has done a good job and has received a number of extensions.

In the normal course, we would fluctuate the resources in these call centers to map them to the fluctuating demand, the seasonal demand, related to the Affordable care Act.

We did that last year. We’ve done that this year. And, as we move forward, I would expect that we continue to do that. We are working diligently with the client to, find alternative uses for that call center.

And it may just continue to be available, for the work, the primary mission today in terms of supporting the Affordable Care Act. Bruce?

Mr. Bruce Caswell: Sure.

And, Frank, to answer your other question about a little more color on the volumes, I just first of all want to practice this by saying it's very much early days, right?

We’re really only about a quarter into things. And we've, as Rich noted in his remarks, not yet seen the potential impact of the 1095-A forms that are being sent out and so forth, so as an important kind of top note to that.

But the effects are effectively, driven by, within the federal call center environment, obviously, a decrease with the wind down of the Boise customer contact center.

But year-over-year, we are--we’ve ramped up now to more of a steady state level, our eligibility appeals support contract at the federal level. So, you see the two kind of offsetting each other with a bit of positive gain.

And then also you may have noted in the press that California was much more aggressive in preparing for this year’s open enrollment period, and rather than relying just entirely on the state, employees that had supported the program last year, they reached out to the vendor community.

So, whereas last year in California, we provided just basically training for those state employees, this year we’ve actually got operational, folks doing, work related to the eligibility in enrollment process.

So, year-over-year that would be an increase for us. But, again, I would just note that it’s still very much early days.

Ms. Lisa Miles: Next question please?

Operator: Thank you.

Our next question is from Richard Close of Avondale Partners. Please go ahead.

Mr. Richard Close: Great.

Just, a quick question here on guidance, first of all, if you could talk a little bit about the seasonality, thought--or thought process on seasonality in terms of the remaining quarters, just to remind us there, so we’re not caught off guard.

And then, maybe if you can discuss a little bit more about start-up expenses, and the slingshot that you talked about in the past and how we should think about that?

I think you stated, that, you know, you had some benefits in this quarter that offset some of the start-up expenses, and just how we should think about that in the remainder of fiscal 2015?

Mr. Rich Montoni: Okay. Let me try you.

Rick Nadeau is going to take the one on the quarterly piece. And, and I’ll chime it on the slingshot piece.

Mr. Rick Nadeau: Yeah.

Mr. Rich Montoni: So, you know, we did provide some, specific quarterly earnings guidance on the last call. So, let me reiterate that color and then add a little bit to it.

We expect that the Q2 margins will be lower than the first quarter. We have startups that are hitting in the health segment, as you referred to. Some of those are non-recurring.

Further, Q1 benefited from incremental profit that I won't repeat in a later quarter. In Q3, margins are expected to be higher than in Q2. And that will be as a result of lower startup costs.

And you’ll start in that third quarter to get a full contribution from the new Health Assessment Advisory Services contract (HDAS) in the United Kingdom. And as I mentioned on the last call, we have presently assumed that Q4 margins will be tempered as a result of the startup of the new contract in Australia. So, is that what you're looking for?

Mr. Richard Close: Yes. That's great.

Mr. Rich Montoni: And I'll jump in too, the slingshot. And in the slingshot discussions we've had in the past are not focused on--the startups do have a ramification to the quarterly, the quarters in our fiscal 2015, as Rick has discussed.

The slingshot discussions we've provided have been on full fiscal years. And to remind folks on the call, we have three contracts that are, relevant here. And we'll talk about the impact of these three contracts from a slingshot perspective.

Two of the contracts were in startup mode in fiscal 2014 and generated an aggregate loss of four cents in fiscal 2014. We estimate those in the startup of HDAS will actually contribute profit of eight cents a share.

So, going from a loss of four cents to a profit of eight in fiscal '15 versus '14 creates a slingshot effect year-over-year of a positive 12 cents.

And then we think those three contracts will generate 34 cents, earnings per share in fiscal 2016. so, hence, we have a slingshot--a favorable slingshot impact of 26 cents fiscal 2016 over 2015 relative to those three contracts.

Mr. Richard Close: Great. Thank you.

Mr. Rich Montoni: Okay. You’re welcome.

Next question please.

Operator: Thank you.

That was our final question. Ladies and gentlemen, this does conclude today’s teleconference. You may disconnect your lines at this time. And thank you for your participation.

Fiscal 2015 First

Quarter Earnings Richard J. Nadeau Chief Financial Officer and Treasurer

February 5, 2015

Fiscal 2015 First

Quarter Earnings Richard J. Nadeau Chief Financial Officer and Treasurer

February 5, 2015

Forward-looking

Statements & Non-GAAP Information These slides should be read in

conjunction with the Company’s most recent quarterly earnings press

release, along with listening to or reading a transcript of the comments

of Company management from the Company’s most recent quarterly earnings

conference call. This document may contain non-GAAP financial

information. Management uses this information in its internal analysis

of results and believes that this information may be informative to

investors in gauging the quality of our financial performance,

identifying trends in our results, and providing meaningful

period-to-period comparisons. These measures should be used in

conjunction with, rather than instead of, their comparable GAAP

measures. For a reconciliation of non-GAAP measures to the comparable

GAAP measures presented in this document, see the Company’s most recent

quarterly earnings press release. Throughout this presentation numbers

may not add due to rounding. A number of statements being made today

will be forward-looking in nature. Such statements are only predictions

and actual events or results may differ materially as a result of risks

we face, including those discussed in our SEC filings. We encourage you

to review the summary of these risks in Exhibit 99.1 to our most recent

Form 10-K filed with the SEC. The Company does not assume any obligation

to revise or update these forward-looking statements to reflect

subsequent events or circumstances.

Forward-looking

Statements & Non-GAAP Information These slides should be read in

conjunction with the Company’s most recent quarterly earnings press

release, along with listening to or reading a transcript of the comments

of Company management from the Company’s most recent quarterly earnings

conference call. This document may contain non-GAAP financial

information. Management uses this information in its internal analysis

of results and believes that this information may be informative to

investors in gauging the quality of our financial performance,

identifying trends in our results, and providing meaningful

period-to-period comparisons. These measures should be used in

conjunction with, rather than instead of, their comparable GAAP

measures. For a reconciliation of non-GAAP measures to the comparable

GAAP measures presented in this document, see the Company’s most recent

quarterly earnings press release. Throughout this presentation numbers

may not add due to rounding. A number of statements being made today

will be forward-looking in nature. Such statements are only predictions

and actual events or results may differ materially as a result of risks

we face, including those discussed in our SEC filings. We encourage you

to review the summary of these risks in Exhibit 99.1 to our most recent

Form 10-K filed with the SEC. The Company does not assume any obligation

to revise or update these forward-looking statements to reflect

subsequent events or circumstances.

Revenue Health

Services 351.7 $ 299.2 $ 18% Human Services 115.4 107.4 7%Total 467.0 $

406.6 $ 15% Operating Income Health Services 50.4 $ 41.6 $ 21% Human

Services15.511.8 31%Other(0.6)(0.1) Total 65.2 $ 53.3 $ 22% Operating

Margin %14.0%13.1%Net Income attributable to MAXIMUS 41.9 $ 33.9 $ 24%

EPS – Diluted 0.63 $ 0.49 $ 29%($ in millions) Q1 FY15Q1 FY14% Change

Total Company Results – First Quarter Q1 FY15 revenue increased 15% Both

segments delivered top-line increases driven by new work and expansion

on existing contracts Revenue unfavorably impacted by currency exchange

rates, predominantly (but not exclusively) in the Human Services Segment

On a constant currency basis, total Company revenue would have grown 16%

over prior year Operating margin of 14% for Q1 FY15 Tax rate was lower

at 36% due to the extension of the Work Opportunity Tax Credit

(retroactive application to the beginning of calendar year 2014) Net

income attributable to MAXIMUS totaled $41.9M or $0.63 per diluted share

Diluted EPS increased 29% Q1 FY15 benefitted from $2.4M of incremental

revenue & profit in Human Services Segment that were previously expected

to occur later in FY15 and provided an uplift of approximately $0.03 per

share; the lower tax rate provided another $0.01 per share

Revenue Health

Services 351.7 $ 299.2 $ 18% Human Services 115.4 107.4 7%Total 467.0 $

406.6 $ 15% Operating Income Health Services 50.4 $ 41.6 $ 21% Human

Services15.511.8 31%Other(0.6)(0.1) Total 65.2 $ 53.3 $ 22% Operating

Margin %14.0%13.1%Net Income attributable to MAXIMUS 41.9 $ 33.9 $ 24%

EPS – Diluted 0.63 $ 0.49 $ 29%($ in millions) Q1 FY15Q1 FY14% Change

Total Company Results – First Quarter Q1 FY15 revenue increased 15% Both

segments delivered top-line increases driven by new work and expansion

on existing contracts Revenue unfavorably impacted by currency exchange

rates, predominantly (but not exclusively) in the Human Services Segment

On a constant currency basis, total Company revenue would have grown 16%

over prior year Operating margin of 14% for Q1 FY15 Tax rate was lower

at 36% due to the extension of the Work Opportunity Tax Credit

(retroactive application to the beginning of calendar year 2014) Net

income attributable to MAXIMUS totaled $41.9M or $0.63 per diluted share

Diluted EPS increased 29% Q1 FY15 benefitted from $2.4M of incremental

revenue & profit in Human Services Segment that were previously expected

to occur later in FY15 and provided an uplift of approximately $0.03 per

share; the lower tax rate provided another $0.01 per share

Health Services

Segment Revenue Revenue grew 18%, fueled by organic growth resulting

from new work and expansion on existing contracts Affordable Care Act

(ACA) Seasonality Q1 FY15 benefits from seasonality tied to ACA open

enrollment period (November 1, 2014 - February 15, 2015) Call volumes

have largely been in-line with our client service plans Our health

insurance exchange operations are at peak staffing levels during open

enrollment to support the increased volume of calls from consumers who

are shopping for health insurance Investors should expect Health

Services Segment to be seasonally stronger in Q1 of our fiscal year

Operating Income & Margin Operating margin benefitted from some

expected, accretive change orders. These change orders helped offset

expected start-up of certain new health contracts, and anticipated

volume decreases in our Medicare appeals business that resulted from

changes to the Recovery Audit (or RAC) program. Coming into FY15,

already assumed lower volumes in appeals business, as a result of RAC

program changes Revenue Health Services351.7$ 299.2$ 18%Operating Income

Health Services50.4$ 41.6$ 21%Operating Margin %14.3%13.9%% Change($ in

millions)Q1 FY15Q1 FY14 Delivered strong operational and financial

results & performed largely in-line with our expectations

Health Services

Segment Revenue Revenue grew 18%, fueled by organic growth resulting

from new work and expansion on existing contracts Affordable Care Act

(ACA) Seasonality Q1 FY15 benefits from seasonality tied to ACA open

enrollment period (November 1, 2014 - February 15, 2015) Call volumes

have largely been in-line with our client service plans Our health

insurance exchange operations are at peak staffing levels during open

enrollment to support the increased volume of calls from consumers who

are shopping for health insurance Investors should expect Health

Services Segment to be seasonally stronger in Q1 of our fiscal year

Operating Income & Margin Operating margin benefitted from some

expected, accretive change orders. These change orders helped offset

expected start-up of certain new health contracts, and anticipated

volume decreases in our Medicare appeals business that resulted from

changes to the Recovery Audit (or RAC) program. Coming into FY15,

already assumed lower volumes in appeals business, as a result of RAC

program changes Revenue Health Services351.7$ 299.2$ 18%Operating Income

Health Services50.4$ 41.6$ 21%Operating Margin %14.3%13.9%% Change($ in

millions)Q1 FY15Q1 FY14 Delivered strong operational and financial

results & performed largely in-line with our expectations

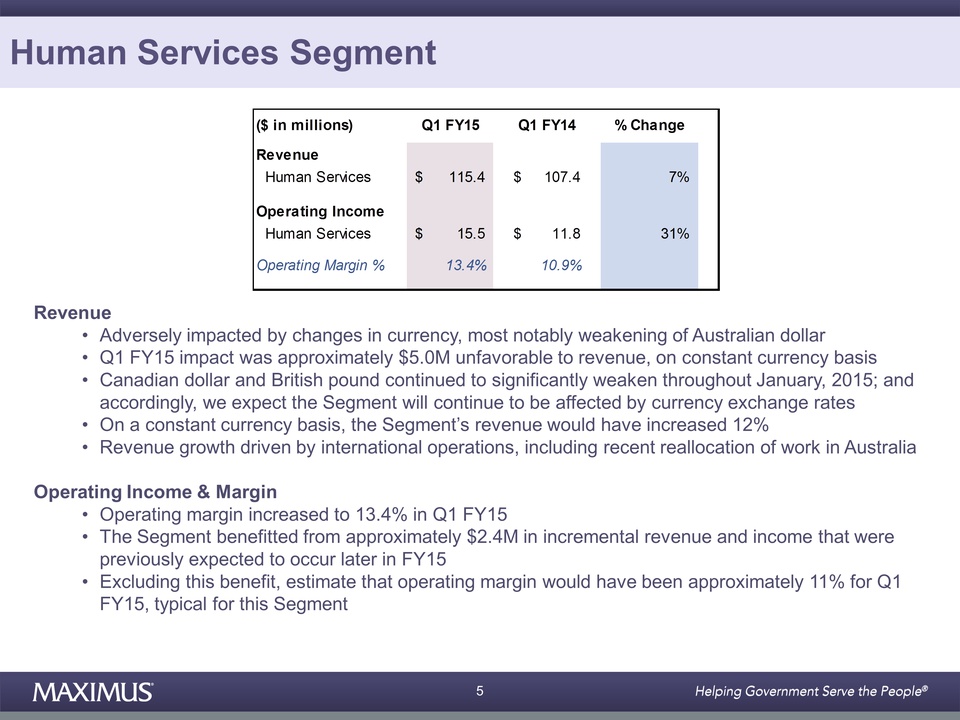

Human Services

Segment Revenue Adversely impacted by changes in currency, most notably

weakening of Australian dollar Q1 FY15 impact was approximately $5.0M

unfavorable to revenue, on constant currency basis Canadian dollar and

British pound continued to significantly weaken throughout January,

2015; and accordingly, we expect the Segment will continue to be

affected by currency exchange rates On a constant currency basis, the

Segment’s revenue would have increased 12% Revenue growth driven by

international operations, including recent reallocation of work in

Australia Operating Income & Margin Operating margin increased to 13.4%

in Q1 FY15 The Segment benefitted from approximately $2.4M in

incremental revenue and income that were previously expected to occur

later in FY15 Excluding this benefit, estimate that operating margin

would have been approximately 11% for Q1 FY15, typical for this Segment

Revenue Human Services115.4$ 107.4$ 7%Operating Income Human

Services15.5$ 11.8$ 31%Operating Margin %13.4%10.9%% Change($ in

millions)Q1 FY15Q1 FY14

Human Services

Segment Revenue Adversely impacted by changes in currency, most notably

weakening of Australian dollar Q1 FY15 impact was approximately $5.0M

unfavorable to revenue, on constant currency basis Canadian dollar and

British pound continued to significantly weaken throughout January,

2015; and accordingly, we expect the Segment will continue to be

affected by currency exchange rates On a constant currency basis, the

Segment’s revenue would have increased 12% Revenue growth driven by

international operations, including recent reallocation of work in

Australia Operating Income & Margin Operating margin increased to 13.4%

in Q1 FY15 The Segment benefitted from approximately $2.4M in

incremental revenue and income that were previously expected to occur

later in FY15 Excluding this benefit, estimate that operating margin

would have been approximately 11% for Q1 FY15, typical for this Segment

Revenue Human Services115.4$ 107.4$ 7%Operating Income Human

Services15.5$ 11.8$ 31%Operating Margin %13.4%10.9%% Change($ in

millions)Q1 FY15Q1 FY14

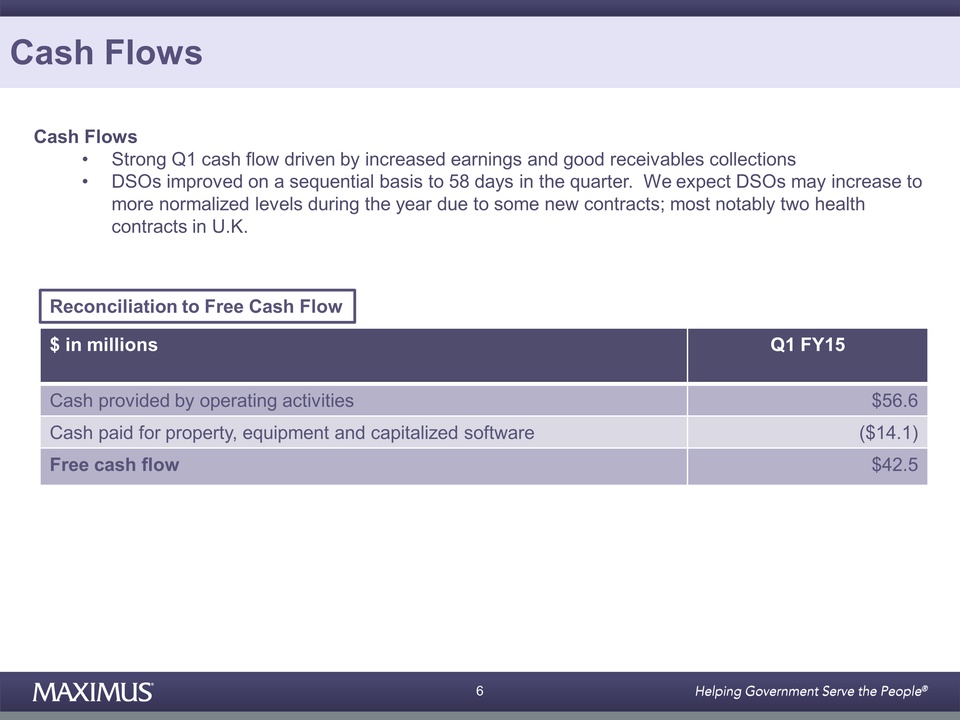

Cash Flows

Reconciliation to Free Cash Flow Cash Flows Strong Q1 cash flow driven

by increased earnings and good receivables collections DSOs improved on

a sequential basis to 58 days in the quarter. We expect DSOs may

increase to more normalized levels during the year due to some new

contracts; most notably two health contracts in U.K. $ in millions Q1

FY15 Cash provided by operating activities $56.6 Cash paid for property,

equipment and capitalized software ($14.1) Free cash flow $42.5

Cash Flows

Reconciliation to Free Cash Flow Cash Flows Strong Q1 cash flow driven

by increased earnings and good receivables collections DSOs improved on

a sequential basis to 58 days in the quarter. We expect DSOs may

increase to more normalized levels during the year due to some new

contracts; most notably two health contracts in U.K. $ in millions Q1

FY15 Cash provided by operating activities $56.6 Cash paid for property,

equipment and capitalized software ($14.1) Free cash flow $42.5

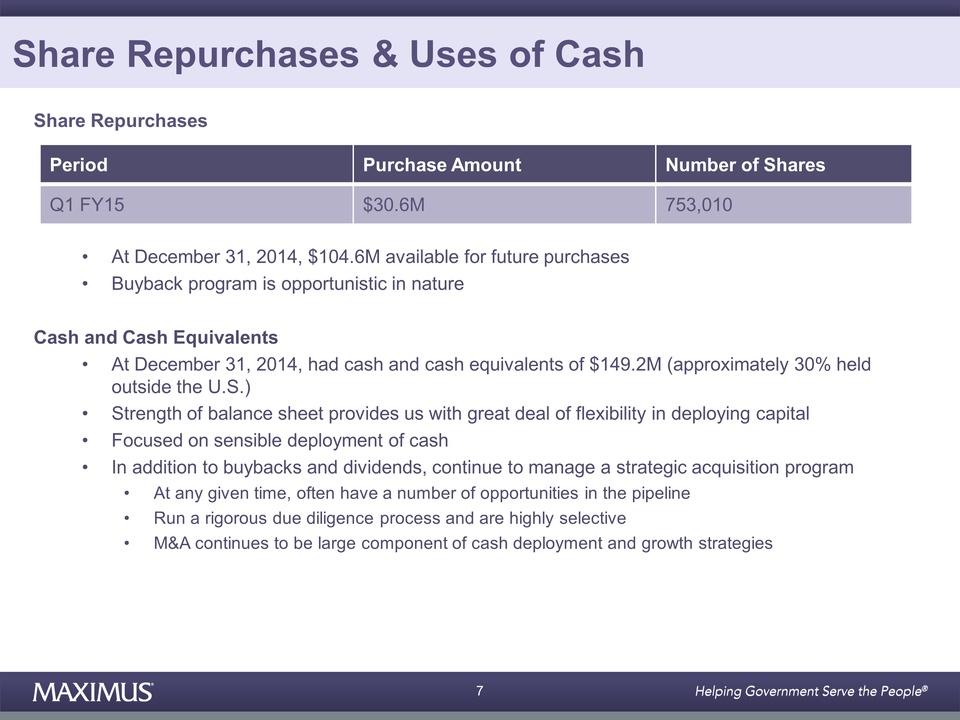

Share Repurchases &

Uses of Cash At December 31, 2014, $104.6M available for future

purchases Buyback program is opportunistic in nature Cash and Cash

Equivalents At December 31, 2014, had cash and cash equivalents of

$149.2M (approximately 30% held outside the U.S.) Strength of balance

sheet provides us with great deal of flexibility in deploying capital

Focused on sensible deployment of cash In addition to buybacks and

dividends, continue to manage a strategic acquisition program At any

given time, often have a number of opportunities in the pipeline Run a

rigorous due diligence process and are highly selective M&A continues to

be large component of cash deployment and growth strategies Period

Purchase Amount Number of Shares Q1 FY15 $30.6M 753,010 Share Repurchases

Share Repurchases &

Uses of Cash At December 31, 2014, $104.6M available for future

purchases Buyback program is opportunistic in nature Cash and Cash

Equivalents At December 31, 2014, had cash and cash equivalents of

$149.2M (approximately 30% held outside the U.S.) Strength of balance

sheet provides us with great deal of flexibility in deploying capital

Focused on sensible deployment of cash In addition to buybacks and

dividends, continue to manage a strategic acquisition program At any

given time, often have a number of opportunities in the pipeline Run a

rigorous due diligence process and are highly selective M&A continues to

be large component of cash deployment and growth strategies Period

Purchase Amount Number of Shares Q1 FY15 $30.6M 753,010 Share Repurchases

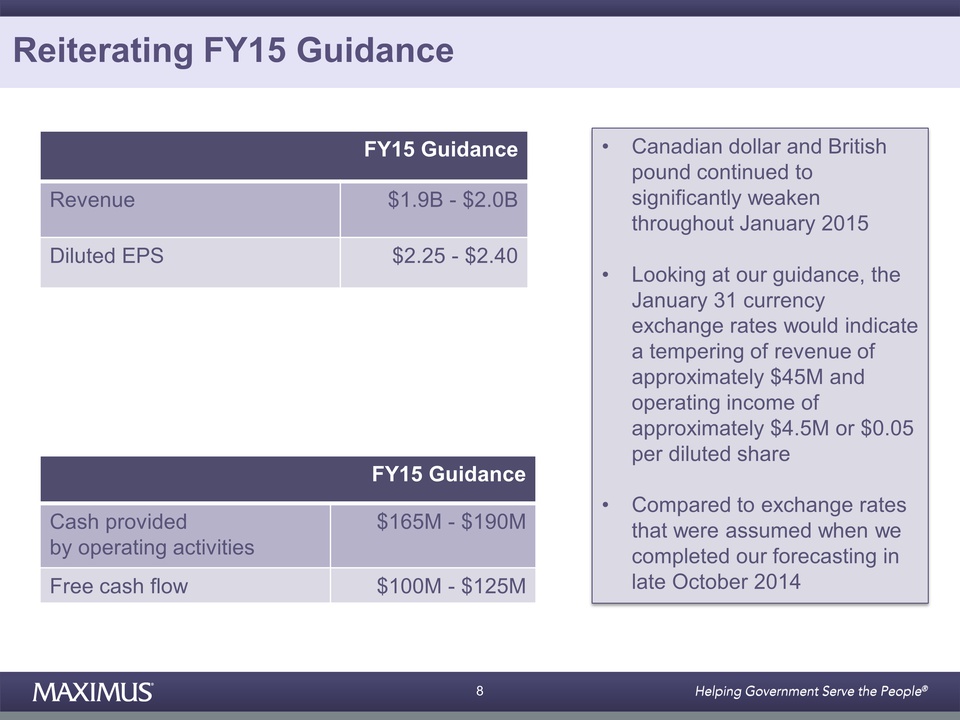

Reiterating FY15

Guidance Canadian dollar and British pound continued to significantly

weaken throughout January 2015 Looking at our guidance, the January 31

currency exchange rates would indicate a tempering of revenue of

approximately $45M and operating income of approximately $4.5M or $0.05

per diluted share Compared to exchange rates that were assumed when we

completed our forecasting in late October 2014 FY15 Guidance Revenue

$1.9B - $2.0B Diluted EPS $2.25 - $2.40 FY15 Guidance Cash provided by

operating activities $165M - $190M Free cash flow $100M - $125M

Reiterating FY15

Guidance Canadian dollar and British pound continued to significantly

weaken throughout January 2015 Looking at our guidance, the January 31

currency exchange rates would indicate a tempering of revenue of

approximately $45M and operating income of approximately $4.5M or $0.05

per diluted share Compared to exchange rates that were assumed when we

completed our forecasting in late October 2014 FY15 Guidance Revenue

$1.9B - $2.0B Diluted EPS $2.25 - $2.40 FY15 Guidance Cash provided by

operating activities $165M - $190M Free cash flow $100M - $125M

Richard A. Montoni

Chief Executive Officer February 5, 2015 Fiscal 2015 First Quarter

Earnings

Richard A. Montoni

Chief Executive Officer February 5, 2015 Fiscal 2015 First Quarter

Earnings

Affordable Care Act

– Second Open Enrollment Affordable Care Act teams are wrapping up the

activities tied to the second open enrollment period, which runs through

February 15, 2015 As expected, overall open enrollment period was much

smoother this year, with fewer technology challenges and the benefit of

applying lessons learned Collaborated with clients for early planning,

this year brought new challenges; renewals for the first time Launched

aggressive refresher training to ensure our staff were well-prepared to

assist consumers Overall call volumes across all of our centers have

been running largely as expected; mainly due to the benefit of early

planning Renewal process to be fairly straightforward in the markets

where the carriers remained largely the same or there weren't major

changes to the plans New York is one example where open enrollment has

gone particularly well. The state’s marketplace remained very stable

from both a plan selection and a cost perspective, which clearly played

an important role in the ease of use for consumers. Our solid

performance for Q1 FY15 sets a good path for remainder of year & beyond

Affordable Care Act

– Second Open Enrollment Affordable Care Act teams are wrapping up the

activities tied to the second open enrollment period, which runs through

February 15, 2015 As expected, overall open enrollment period was much

smoother this year, with fewer technology challenges and the benefit of

applying lessons learned Collaborated with clients for early planning,

this year brought new challenges; renewals for the first time Launched

aggressive refresher training to ensure our staff were well-prepared to

assist consumers Overall call volumes across all of our centers have

been running largely as expected; mainly due to the benefit of early

planning Renewal process to be fairly straightforward in the markets

where the carriers remained largely the same or there weren't major

changes to the plans New York is one example where open enrollment has

gone particularly well. The state’s marketplace remained very stable

from both a plan selection and a cost perspective, which clearly played

an important role in the ease of use for consumers. Our solid

performance for Q1 FY15 sets a good path for remainder of year & beyond

ACA Anecdotal

Observations Overall increase in consumer awareness related to

eligibility and enrollment Just starting to receive calls related to new

tax forms Public health insurance exchanges and covered individuals are

required to submit ACA-related tax information and forms So far, about

half of the tax calls received are informational in nature and the other

half are related to incorrect information on the forms themselves We

have not seen a dramatic uptick in volumes as a result of the tax forms,

but it’s still early This could change as taxpayers start completing

their returns in anticipation of the April 15 filing deadline

ACA Anecdotal

Observations Overall increase in consumer awareness related to

eligibility and enrollment Just starting to receive calls related to new

tax forms Public health insurance exchanges and covered individuals are

required to submit ACA-related tax information and forms So far, about

half of the tax calls received are informational in nature and the other

half are related to incorrect information on the forms themselves We

have not seen a dramatic uptick in volumes as a result of the tax forms,

but it’s still early This could change as taxpayers start completing

their returns in anticipation of the April 15 filing deadline

ACA Customer Contact

Centers MAXIMUS operates five state-based exchanges & the District of

Columbia Also operate two customer contact centers for Federal

Marketplace as a subcontractor – As reported in the media, we’ve started

the process of ramping down one of our federal customer contact centers

– Boise, Idaho – Two-year contract scheduled to end later this year;

this was an expected closure and fully contemplated in our guidance – At

this time, Boise is the only contact center we are closing

ACA Customer Contact

Centers MAXIMUS operates five state-based exchanges & the District of

Columbia Also operate two customer contact centers for Federal

Marketplace as a subcontractor – As reported in the media, we’ve started

the process of ramping down one of our federal customer contact centers

– Boise, Idaho – Two-year contract scheduled to end later this year;

this was an expected closure and fully contemplated in our guidance – At

this time, Boise is the only contact center we are closing

Transitions to

State-Based Exchanges Continue to work closely with states that may be

considering a potential move off the Federal Marketplace to their own

state-based exchange Realistically, won’t see a lot of movement until

Supreme Court renders a decision on the King vs. Burwell case, expected

later this year Speculative as to what outcome might be and what effect

it may have on a state’s decision to operate its own exchange

Transitions to

State-Based Exchanges Continue to work closely with states that may be

considering a potential move off the Federal Marketplace to their own

state-based exchange Realistically, won’t see a lot of movement until

Supreme Court renders a decision on the King vs. Burwell case, expected

later this year Speculative as to what outcome might be and what effect

it may have on a state’s decision to operate its own exchange

2017 State

Innovation Waivers States continue to be interested in how to better

manage the continuum of programs for the uninsured We believe 2017 State

Innovation Waivers provided under Section 1332 of the Act may prompt

more states to consider new ways to manage their uninsured populations

Innovation Waivers provide states with additional flexibility in how

they manage their insurance markets Waivers could be an attractive

option to governors who want to manage federal funds to implement

state-driven ideas that are more closely aligned to state-specific

policies, demographics, insurance markets, and budgets and culture

Waivers also give states ways to deal with some of the Act’s structural

and operational challenges: −Address continuation of care as individuals

move between provider networks when their incomes, family compositions

or ages change −Allow states to become centers of innovation as they

structure their employer-sponsored insurance and assistance in the

purchase of private health insurance

2017 State

Innovation Waivers States continue to be interested in how to better

manage the continuum of programs for the uninsured We believe 2017 State

Innovation Waivers provided under Section 1332 of the Act may prompt

more states to consider new ways to manage their uninsured populations

Innovation Waivers provide states with additional flexibility in how

they manage their insurance markets Waivers could be an attractive

option to governors who want to manage federal funds to implement

state-driven ideas that are more closely aligned to state-specific

policies, demographics, insurance markets, and budgets and culture

Waivers also give states ways to deal with some of the Act’s structural

and operational challenges: −Address continuation of care as individuals

move between provider networks when their incomes, family compositions

or ages change −Allow states to become centers of innovation as they

structure their employer-sponsored insurance and assistance in the

purchase of private health insurance

Live Event:

Opportunities for State Innovation MAXIMUS will be hosting a live event

tomorrow at noon to discuss new approaches that states can take for the

design and operation of their health insurance programs Event features

some of the country’s leading policy experts, all of whom have broad

expertise in implementing and managing programs for uninsured We are

excited to help states understand how waivers will bring them new

flexibility as they design and implement sustainable approaches to their

public health programs Overall, as we’ve said in the past, ACA is a

multi-year driver for MAXIMUS and believe that ongoing opportunities to

help states manage their myriad of health benefit programs will continue

to provide us with ongoing tail winds for years to come

Live Event:

Opportunities for State Innovation MAXIMUS will be hosting a live event

tomorrow at noon to discuss new approaches that states can take for the

design and operation of their health insurance programs Event features

some of the country’s leading policy experts, all of whom have broad

expertise in implementing and managing programs for uninsured We are

excited to help states understand how waivers will bring them new

flexibility as they design and implement sustainable approaches to their

public health programs Overall, as we’ve said in the past, ACA is a

multi-year driver for MAXIMUS and believe that ongoing opportunities to

help states manage their myriad of health benefit programs will continue

to provide us with ongoing tail winds for years to come

U.K. Health

Operations – Two New Contracts Fit for Work Program is well underway;

launched phase one in December 2014 and now working on phase two Health

Assessment Advisory Service (formally known as the Health and Disability

Assessment Service) Under contract, MAXIMUS is conducting assessments

for individuals seeking certain disability benefits according to the

rules set down by Parliament We are working toward addressing some of

the challenges that exist today, but recognize that it will take time to

improve key aspects of the customer experience One of our primary goals

is to increase the number of health care professionals who support the

program – particularly those who specialize in mental health and those

who understand fluctuating health conditions Over time, we strive toward

the longer-term goals of: − Reducing the long wait times − Improving the

quality of the assessment − Making the assessment process less

intimidating for customers Presently on target for take-over on March 1,

2015 Nevertheless, it’s important for investors to recognize that

overall policy remains controversial in the U.K.; expect ongoing media

coverage of this program

U.K. Health

Operations – Two New Contracts Fit for Work Program is well underway;

launched phase one in December 2014 and now working on phase two Health

Assessment Advisory Service (formally known as the Health and Disability

Assessment Service) Under contract, MAXIMUS is conducting assessments

for individuals seeking certain disability benefits according to the

rules set down by Parliament We are working toward addressing some of

the challenges that exist today, but recognize that it will take time to

improve key aspects of the customer experience One of our primary goals

is to increase the number of health care professionals who support the

program – particularly those who specialize in mental health and those

who understand fluctuating health conditions Over time, we strive toward

the longer-term goals of: − Reducing the long wait times − Improving the

quality of the assessment − Making the assessment process less

intimidating for customers Presently on target for take-over on March 1,

2015 Nevertheless, it’s important for investors to recognize that

overall policy remains controversial in the U.K.; expect ongoing media

coverage of this program

Positive News for

Human Services U.S. Welfare-to-Work Operations Successful on rebid for

the Families First program where we’ve been a provider since 2007 in

Tennessee; secured additional scope and are expanding into seven

additional counties Will now be providing employment and case management

services to 36 of the state’s 95 counties Under new contract, we expect

that revenue will triple with the annual run rate going from

approximately $5M to $15M U.K. Work Programme Picked up first

reallocated region. Began delivering employment services to job seekers

in North East Yorkshire and the Humber region just last week

Reallocation recognizes our strong performance in helping to

successfully guide individuals off benefits and into work, contributing

to a stronger local economy Job Services Australia Submitted our

response to rebid tender Do not expect a “winner-take-all” award, rather

awards that are done on a location-by-location basis We expect to hear

results in the spring and remain cautiously optimistic about this

important rebid

Positive News for

Human Services U.S. Welfare-to-Work Operations Successful on rebid for

the Families First program where we’ve been a provider since 2007 in

Tennessee; secured additional scope and are expanding into seven

additional counties Will now be providing employment and case management

services to 36 of the state’s 95 counties Under new contract, we expect

that revenue will triple with the annual run rate going from

approximately $5M to $15M U.K. Work Programme Picked up first

reallocated region. Began delivering employment services to job seekers

in North East Yorkshire and the Humber region just last week

Reallocation recognizes our strong performance in helping to

successfully guide individuals off benefits and into work, contributing

to a stronger local economy Job Services Australia Submitted our

response to rebid tender Do not expect a “winner-take-all” award, rather

awards that are done on a location-by-location basis We expect to hear

results in the spring and remain cautiously optimistic about this

important rebid

New Awards and Sales

Pipeline At December 31, 2014: Year-to date signed contracts includes

U.K. Health Assessment Advisory Service contract Overall composition of

pipeline is fairly broad with opportunities across multiple geographies

and both segments; includes both rebids and new work Strength of our

pipeline serves as further confirmation of continued demand for our core

services New Awards December 31, 2014 YTD signed awards $1.3B New

contracts pending $169M Sales Opportunities December 31, 2014 Total

pipeline $3.6B Pipeline reflects opportunities where we expect the

request for proposal to be released within the next six months

New Awards and Sales

Pipeline At December 31, 2014: Year-to date signed contracts includes

U.K. Health Assessment Advisory Service contract Overall composition of

pipeline is fairly broad with opportunities across multiple geographies

and both segments; includes both rebids and new work Strength of our

pipeline serves as further confirmation of continued demand for our core

services New Awards December 31, 2014 YTD signed awards $1.3B New

contracts pending $169M Sales Opportunities December 31, 2014 Total

pipeline $3.6B Pipeline reflects opportunities where we expect the

request for proposal to be released within the next six months

Conclusion With

another solid quarter under our belt, we are positive about our progress

in fiscal 2015 Our collective efforts to secure new work, expand

existing contracts and stand up new programs demonstrate our ability to

deliver and meet commitments to our clients and the citizens they serve

We believe demand for our services will continue as governments require

partners to help them: Manage benefit programs more efficiently and

effectively to address rising caseloads − Implement performance-based

metrics to achieve the outcomes that matter We have set the table for

solid growth in 2015 and beyond and remain most excited about our future

prospects

Conclusion With

another solid quarter under our belt, we are positive about our progress

in fiscal 2015 Our collective efforts to secure new work, expand

existing contracts and stand up new programs demonstrate our ability to

deliver and meet commitments to our clients and the citizens they serve

We believe demand for our services will continue as governments require

partners to help them: Manage benefit programs more efficiently and

effectively to address rising caseloads − Implement performance-based

metrics to achieve the outcomes that matter We have set the table for

solid growth in 2015 and beyond and remain most excited about our future

prospects