Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Juno Therapeutics, Inc. | d868146d8k.htm |

Exhibit 10.1

LEASE

by and between

BMR-217TH PLACE LLC,

a Delaware limited liability company

and

JUNO THERAPEUTICS, INC.,

a Delaware corporation

Table of Contents

| 1. |

Lease of Premises | 1 | ||||

| 2. |

Basic Lease Provisions | 2 | ||||

| 3. |

Term | 4 | ||||

| 4. |

Possession and Commencement Date | 5 | ||||

| 5. |

Condition of Building | 6 | ||||

| 6. |

Rent | 6 | ||||

| 7. |

Rent Adjustments | 7 | ||||

| 8. |

Taxes | 7 | ||||

| 9. |

Property Management Fee | 8 | ||||

| 10. |

Security Deposit | 9 | ||||

| 11. |

Use | 11 | ||||

| 12. |

Rules and Regulations, CC&Rs and Parking Facilities | 13 | ||||

| 13. |

Control by Landlord | 15 | ||||

| 14. |

Quiet Enjoyment | 16 | ||||

| 15. |

Utilities and Services | 16 | ||||

| 16. |

Alterations | 19 | ||||

| 17. |

Repairs and Maintenance | 21 | ||||

| 19. |

Estoppel Certificate | 24 | ||||

| 20. |

Hazardous Materials | 24 | ||||

| 21. |

Odors and Exhaust | 27 | ||||

| 22. |

Insurance; Waiver of Subrogation | 28 | ||||

| 23. |

Damage or Destruction | 31 | ||||

| 24. |

Eminent Domain | 33 | ||||

| 25. |

Surrender | 34 | ||||

| 26. |

Holding Over | 35 | ||||

| 27. |

Indemnification and Exculpation | 36 | ||||

| 28. |

Assignment or Subletting | 37 | ||||

| 29. |

Subordination and Attornment | 41 | ||||

| 30. |

Defaults and Remedies | 42 | ||||

| 31. |

Bankruptcy | 47 | ||||

| 32. |

Brokers | 47 | ||||

| 33. |

Definition of Landlord | 48 | ||||

- i -

| 34. |

Limitation of Liability | 48 | ||||

| 35. |

Joint and Several Obligations | 49 | ||||

| 36. |

Representations | 49 | ||||

| 37. |

Confidentiality | 49 | ||||

| 38. |

Notices | 50 | ||||

| 39. |

Miscellaneous | 50 | ||||

| 40. |

Options to Extend Term | 53 | ||||

| 41. |

Right of First Offer to Purchase | 54 | ||||

- ii -

LEASE

THIS LEASE (this “Lease”) is entered into effective as of this 2nd day of February, 2015 (the “Execution Date”), by and between BMR-217th PLACE LLC, a Delaware limited liability company (“Landlord”), and JUNO THERAPEUTICS, INC., a Delaware corporation (“Tenant”).

RECITALS

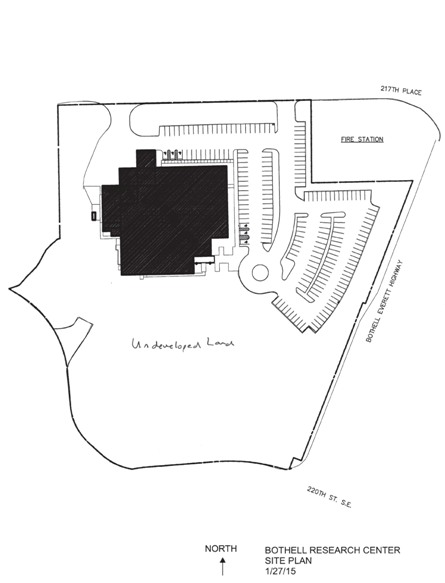

A. WHEREAS, Landlord owns certain real property legally described on Exhibit A attached hereto and incorporated herein (the “Property”) and the improvements on the Property located at 1522 217th Place, Bothell, Washington 98021, including the building located thereon (the “Building” and, together with the Property, the “Project”). A site plan showing the Project is attached to this Lease as Exhibit A-1 (the “Project Site Plan”).

B. WHEREAS, Landlord wishes to lease to Tenant, and Tenant desires to lease from Landlord, the Premises (as defined below), pursuant to the terms and conditions of this Lease, as detailed below.

AGREEMENT

NOW, THEREFORE, Landlord and Tenant, in consideration of the mutual promises contained herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, and intending to be legally bound, agree as follows:

1. Lease of Premises.

1.1 Effective on the Term Commencement Date (as defined below), Landlord hereby leases to Tenant, and Tenant hereby leases from Landlord, the Building, including without limitation the rooftop thereof (the “Premises”). Landlord further hereby grants Tenant a non-exclusive, non-revocable, license to access and use the “Common Areas” (defined below) in common with Landlord and any future tenants of any future building constructed on the Property, during the Term of this Lease, as extended, if applicable. Tenant’s use of the Premises and Project shall be for the Permitted Use (as defined below) and subject to the terms of this Lease. All areas of the Project outside of the Building, including, without limitation, the landscaping areas, parking facilities, private drives and other improvements and appurtenances related thereto are referred to in this Lease as “Common Areas”. The Common Areas do not include the portion of the Property labeled as the Undeveloped Land on the Project Site Plan but will include any landscaping areas, private drives and other improvements and appurtenances constructed in the future on the Undeveloped Land which are for the common use of the tenants of the Project. Subject to Section 12.4 below, Tenant shall have the exclusive right to use the parking facilities currently located on the Property and shown on Project Site Plan (excluding the private drives) (the “Parking Facilities”) for parking for the Tenant Parties, and Tenant shall not have any right to use any future parking facilities constructed in the Undeveloped Land for parking purposes. Tenant’s rights with respect to the Common Areas shall include the non-exclusive right to use the private drives for ingress and egress to the Parking Facilities and the Premises.

1.2 This Lease is subject to and contingent upon Landlord’s entering into an agreement for the early termination (the “OncoGenex Lease Termination Agreement”) of that

- 1 -

certain Lease dated as of November 1, 2006 between Landlord and OncoGenex Pharmaceuticals, Inc., a Delaware corporation (“OncoGenex”), as amended, for the Premises, on terms and conditions acceptable to Landlord. If the contingency set forth in the immediately preceding sentence has not been satisfied on or before the date that is thirty (30) days after the Execution Date, then this Lease shall terminate and be of no further force and effect unless, prior to such date, Landlord has given Tenant written notice (the “OncoGenex Notice”) that such contingency has been satisfied or that Landlord has otherwise waived such contingency.

2. Basic Lease Provisions. For convenience of the parties, certain basic provisions of this Lease are set forth herein. The provisions set forth herein are subject to the remaining terms and conditions of this Lease and are to be interpreted in light of such remaining terms and conditions.

2.1. This Lease shall take effect upon the Execution Date and, except as specifically otherwise provided within this Lease, each of the provisions hereof shall be binding upon and inure to the benefit of Landlord and Tenant from the date of execution and delivery hereof by all parties hereto.

2.2. “Rentable Area” of the Premises: Landlord and Tenant agree the Rentable Area of the Premises is 67,799 square feet, subject to the Space Pocket provisions of Section 2.3 of this Lease.

2.3. Initial monthly and annual installments of Base Rent for the Premises (“Base Rent”) as of the Rent Commencement Date (as defined below), subject to adjustment under Article 7 of this Lease:

| Dates |

Square Feet of Rentable Area |

Base Rent per Square Foot of Rentable Area |

Monthly Base Rent |

Annual Base Rent |

||||||||||||

| Rent Commencement Date – Expiration of Year 1 of Term |

67,799 | * | $ | 21.00 annually | $ | 118,648.25 | $ | 1,423,779.00 | ||||||||

| * | Notwithstanding the foregoing chart, during the first two (2) years of the Term (as defined below), so long as Tenant occupies no more than 55,000 square feet of Rentable Area in the Premises and does not use the remaining portion of the Premises (the “Space Pocket”) for any purpose whatsoever, including storage (in each case as reasonably determined by Landlord), then solely for the purposes of calculating Monthly Base Rent and Annual Base Rent, the Rentable Area of the Premises shall be deemed to be 50,000 square feet, provided, however, that during the first two (2) years of the Term, if and when Tenant occupies or uses any portion of the Space Pocket for any purpose whatsoever, including storage (in each case as reasonably determined by Landlord), then solely for the purposes of calculating Monthly Base Rent and Annual Base Rent, the Rentable Area of the Premises shall be deemed to be the sum of 50,000 square feet, plus the portion of the Space Pocket so occupied or used by Tenant (in 1,000 square foot increments). The immediately preceding sentence shall cease to apply upon the second anniversary of the Term Commencement Date and from and after such date, for the purposes of calculating Monthly Base Rent and Annual Base Rent, the Rentable Area of the Premises shall be deemed to be 67,799 square feet. |

- 2 -

2.4. Security Deposit: $355,944.75.

2.5. Permitted Use: Office, manufacturing and/or laboratory use, all in conformity with all federal, state, municipal and local laws, codes, ordinances, rules and regulations of Governmental Authorities (as defined below), committees, associations, or other regulatory committees, agencies or governing bodies having jurisdiction over the Premises or any portion thereof, Landlord or Tenant, including both statutory and common law and hazardous waste rules and regulations (“Applicable Laws”)

2.6. Address for Rent Payment:

BMR-217th Place LLC

Attention Entity 885

P.O. Box 511415

Los Angeles, California 90051-7970

2.7. Address for Notices to Landlord:

BMR-217th Place LLC

c/o BioMed Realty, L.P.

17190 Bernardo Center Drive

San Diego, California 92128

Attn: Vice President, Real Estate Legal

2.8. Address for Notices to Tenant:

Juno Therapeutics, Inc.

307 Westlake Avenue N., Suite 300

Seattle, WA 98109-5219

Attention: Dir. of Eng. and Capital Projects

And to

Juno Therapeutics, Inc.

307 Westlake Avenue N., Suite 300

Seattle, WA 98109-5219

Attention: General Counsel

2.9. Address for Invoices to Tenant:

Juno Therapeutics, Inc.

307 Westlake Avenue N., Suite 300

Seattle, WA 98109-5219

Attention: Accounts Payable

- 3 -

2.10. The following Exhibits are attached hereto and incorporated herein by reference:

| Exhibit A |

Legal Description of Property | |

| Exhibit A-1 |

Project Site Plan | |

| Exhibit B |

Work Letter | |

| Exhibit B-1 |

Tenant Work Insurance Schedule | |

| Exhibit C |

Acknowledgement of Term Commencement Date and Term Expiration Date | |

| Exhibit D |

Form of Letter of Credit | |

| Exhibit E |

Rules and Regulations | |

| Exhibit F |

Intentionally Deleted | |

| Exhibit G |

Form of Estoppel Certificate | |

| Exhibit H |

Additional Sale Terms | |

| Exhibit I |

Form of Memorandum of Lease | |

| Exhibit J |

Form of Notice of Lease Termination |

3. Term; Early Termination Option.

3.1 The actual term of this Lease (as the same may be extended pursuant to Article 40 hereof, and as the same may be earlier terminated in accordance with this Lease, the “Term”) shall commence on the actual Term Commencement Date (as defined in Article 4) and end on the date that is one hundred twenty (120) months after the actual Term Commencement Date (such date, the “Term Expiration Date”), subject to earlier termination of this Lease as provided herein.

3.2 Tenant shall have the one-time right to terminate this Lease (“Early Termination Option”), such termination to be effective as of a date that is after the expiration of the twenty-fourth (24th) month of the Term and as of or before the expiration of the eighty-fourth (84th) month of the Term, as designated by Tenant (the “Early Termination Date”), subject to Tenant’s timely satisfaction of the following terms and conditions: (a) Tenant shall deliver written notice to Landlord of Tenant’s election to exercise the Early Termination Option (the “Early Termination Notice”) not less than twelve (12) months prior to Tenant’s desired Early Termination Date (the “Early Termination Deadline”), time being of the essence; and (b) Tenant shall pay Landlord, concurrently with the delivery of Tenant’s Early Termination Notice and in any event no later than the Early Termination Deadline, time being of the essence, an early termination fee equal to the sum of (i) an amount equal to Annual Base Rent for two (2) years, at the rental rate in effect as of the Early Termination Date, plus (ii) any unamortized leasing commissions paid by Landlord to any Broker (as defined below) for the initial Term of this Lease (the “Early Termination Fee”). The period of time within which Tenant may exercise the Early Termination Option and pay the Early Termination Fee shall not be extended or enlarged for any reason whatsoever, including, without limitation, Force Majeure. Tenant assumes full responsibility for maintaining a record of the deadline to exercise the Early Termination Option and pay the Early Termination Fee. Tenant acknowledges that it would be inequitable to require Landlord to accept any exercise of the Early Termination Option and/or payment of the Early Termination Fee after the Early Termination Deadline. In the event that the Early Termination Option is effectively exercised by Tenant, the Early Termination Fee shall be deemed Rent due and payable hereunder to Landlord, in immediately available funds, no later than the Early

- 4 -

Termination Deadline. Tenant’s failure to pay the Early Termination Fee to Landlord on or before the Early Termination Deadline shall render Tenant’s Early Termination Notice null and void, in which event this Lease shall remain in full force and effect as if Tenant’s Early Termination Notice had not been given, and without liability of either party to the other as a result of such cancellation of the Early Termination Option. In the event that Tenant timely exercises the Early Termination Option and pays the Early Termination Fee in accordance with the provisions of this Section 3.2, then all Rent payable under this Lease shall be paid through and apportioned as of the Early Termination Date, the Term of this Lease shall terminate as of the Early Termination Date, and Landlord and Tenant shall have no further obligations accruing under this Lease after the Early Termination Date, except with respect to those provisions which expressly survive the expiration or earlier termination of this Lease. Notwithstanding the foregoing, if Tenant exercises the Early Termination Option because it has signed a lease to relocate to another property owned by Landlord or an affiliate of Landlord, Landlord will waive the payment of the Early Termination Fee.

4. Possession and Commencement Date.

4.1. Landlord will deliver possession of the Premises to Tenant one (1) Business Day after OncoGenex has vacated and surrendered possession of the Premises to Landlord and OncoGenex’s lease of the Premises has terminated in accordance with the OncoGenex Lease Termination Agreement. Landlord will use commercially reasonable and diligent efforts to cause OncoGenex to vacate and surrender possession of the Premises to Landlord within thirty (30) days after Landlord has provided the OncoGenex Notice to Tenant. If Landlord has not delivered possession of the Premises to Tenant within seventy five (75) days after Landlord has provided the OncoGenex Notice to Tenant, Tenant at its option may elect to terminate this Lease by giving Landlord written notice of such election, which notice may be given at any time after the end of the foregoing 75-day period, and this Lease shall terminate thirty (30) days after such notice is given to Landlord unless Landlord delivers possession of the Premises to Tenant within thirty (30) days after Landlord receives the termination notice from Tenant. If this Lease is terminated pursuant to the preceding sentence, the Security Deposit will be returned to Tenant. The “Term Commencement Date” shall be the date that Landlord actually delivers possession of the Premises to Tenant. Tenant shall execute and deliver to Landlord written acknowledgment of the actual Term Commencement Date and the Term Expiration Date within ten (10) days after Tenant takes occupancy of the Premises, in the form attached as Exhibit C hereto. Failure to execute and deliver such acknowledgment, however, shall not affect the Term Commencement Date or Landlord’s or Tenant’s liability hereunder. Failure by Tenant to obtain validation by any medical review board or other similar governmental licensing of the Premises required for the Permitted Use by Tenant shall not serve to extend the Term Commencement Date.

4.2. Tenant shall cause any tenant improvements in the Premises desired by Tenant (the “Tenant Improvements”) to be constructed pursuant to the Work Letter attached hereto as Exhibit B (the “Work Letter”) at Tenant’s sole cost and expense.

4.3. Promptly upon Substantial Completion of the Tenant Improvements, Tenant shall deliver to Landlord (a) a certificate of occupancy for the Premises suitable for the Permitted Use and (b) a Certificate of Substantial Completion in the form of the American Institute of Architects document G704, executed by the project architect and the general contractor. The

- 5 -

term “Substantially Complete” or “Substantial Completion” means that the Tenant Improvements are substantially complete in accordance with the Approved Plans (as defined in the Work Letter).

4.4. Prior to entering upon the Premises, Tenant shall furnish to Landlord evidence satisfactory to Landlord that insurance coverages required of Tenant under the provisions of Article 22 and Exhibit B-1 of the Work Letter are in effect, and such entry shall be subject to all the terms and conditions of this Lease.

4.5. Landlord and Tenant shall mutually agree upon the selection of the architect, engineer, general contractor and major subcontractors for the Tenant Improvements, provided, however, the following contractors are pre-approved by Landlord: BNBuilders, GLY Construction, Lease Crutcher Lewis, Sellen Construction, Skanska USA, and Turner Construction; and the following architectural and engineering firms are pre-approved by Landlord: Affiliated Engineers Inc. (AEI), DCI Engineers, Harris Group, Rushing, and SABArchitects.

5. Condition of Building. Landlord shall deliver the Premises to Tenant broom clean, free of waste or debris. Tenant acknowledges that neither Landlord nor any agent of Landlord has made any representation or warranty with respect to the condition of the Premises or with respect to the suitability of the Premises for the conduct of Tenant’s business. Tenant acknowledges that (a) it is fully familiar with the condition of the Premises and agrees to take the same in its condition “as is” as of the Term Commencement Date and (b) other than as set forth in the first sentence of this Article 5, Landlord shall have no obligation to alter, repair or otherwise prepare the Premises for Tenant’s occupancy or to pay for or construct any improvements to the Premises. Tenant’s taking of possession of the Premises shall, except as otherwise agreed to in writing by Landlord and Tenant, conclusively establish that the Premises were at such time broom clean, free of waste or debris, and otherwise in good, sanitary and satisfactory condition and repair.

6. Rent.

6.1. Tenant shall pay to Landlord as Base Rent for the Premises, commencing on the date that is thirty (30) days after the Term Commencement Date (the “Rent Commencement Date”), the sums set forth in Section 2.3, subject to the rental adjustments provided in Article 7 hereof. Base Rent shall be paid in equal monthly installments as set forth in Section 2.3, subject to the rental adjustments provided in Article 7 hereof, each in advance on the first day of each and every calendar month during the Term.

6.2. In addition to Base Rent, Tenant shall pay to Landlord as additional rent (“Additional Rent”) at times hereinafter specified in this Lease (a) amounts related to Insurance Costs and Taxes (each as defined below), (b) the Property Management Fee (as defined below) (c) the Reimbursable Maintenance Costs (as defined below), and (d) any other amounts that Tenant assumes or agrees to pay under the provisions of this Lease that are owed to Landlord, including any and all other sums that may become due by reason of any default of Tenant or failure on Tenant’s part to comply with the agreements, terms, covenants and conditions of this Lease to be performed by Tenant, after notice and the lapse of any applicable cure periods.

- 6 -

6.3. Base Rent and Additional Rent shall together be denominated “Rent.” Rent shall be paid to Landlord, without abatement, deduction or offset, in lawful money of the United States of America at the office of Landlord as set forth in Section 2.8 or to such other person or at such other place as Landlord may from time designate in writing. At the request of Tenant, Landlord, at no cost to Landlord, shall accept payment of Rent electronically via ACH so long as Tenant executes such documents as are reasonably necessary for Landlord to accept payment from Tenant via ACH. In the event the Term commences or ends on a day other than the first day of a calendar month, then the Rent for such fraction of a month shall be prorated for such period on the basis of the number of days in the month and shall be paid at the then-current rate for such fractional month.

6.4. Tenant’s obligation to pay Rent shall not be discharged or otherwise affected by (a) any Applicable Laws now or hereafter applicable to the Premises, (b) any other restriction on Tenant’s use, (c) except as expressly provided herein, any casualty or taking or (d) any other occurrence; and Tenant waives all rights now or hereafter existing to terminate or cancel this Lease or quit or surrender the Premises or any part thereof, or to assert any defense in the nature of constructive eviction to any action seeking to recover rent. Tenant’s obligation to pay Rent with respect to any period or obligations arising, existing or pertaining to the period prior to the date of the expiration or earlier termination of the Term or this Lease shall survive any such expiration or earlier termination; provided, however, that nothing in this sentence shall in any way affect Tenant’s obligations with respect to any other period.

7. Rent Adjustments. Base Rent shall be subject to an annual upward adjustment of two and one-half percent (2.5%) of the then-current Base Rent. The first such adjustment shall become effective commencing on the first (1st) annual anniversary of the Term Commencement Date, and subsequent adjustments shall become effective on every successive annual anniversary for so long as this Lease continues in effect.

8. Taxes.

8.1. Commencing on the Term Commencement Date and continuing for each calendar year or, at Landlord’s option, tax year (each such “tax year” being a period of twelve (12) consecutive calendar months for which the applicable taxing authority levies or assesses Taxes), for the balance of the Term Tenant shall pay to Landlord the amount of all Taxes levied and assessed for any such year upon the Premises or the Project or any portion thereof. “Taxes” means all government impositions, including property tax costs consisting of real and personal property taxes and assessments (including amounts due under any improvement bond upon the Project, the Premises or any portion thereof) or assessments in lieu thereof imposed by any federal, state, regional, local or municipal governmental authority, agency or subdivision (each, a “Governmental Authority”); taxes on or measured by gross rentals received from the rental of space at the Project or the Premises; taxes based on the square footage of the Premises or the Project or any portion thereof, as well as any parking charges, utilities surcharges or any other costs levied, assessed or imposed by, or at the direction of, or resulting from Applicable Laws or interpretations thereof, promulgated by any Governmental Authority in connection with the use or occupancy of the Project or the parking facilities serving the Project; taxes on this transaction or any document to which Tenant is a party creating or transferring an interest in the Premises or the Project or any portion thereof; any fee for a business license to operate an office building;

- 7 -

and any expenses, including the reasonable cost of attorneys or experts, reasonably incurred by Landlord in seeking reduction by the taxing authority of the applicable taxes, less tax refunds obtained as a result of an application for review thereof. Taxes shall not include any net income, franchise, capital stock, estate or inheritance taxes, or taxes that are the personal obligation of Tenant. Landlord shall not voluntarily consent to any increased Taxes during the Term of this Lease without the prior written consent of Tenant, which may be withheld in Tenant’s sole discretion. The failure of Landlord to object to or appeal an increase in Taxes by the taxing authority shall not constitute “voluntary consent” to any increased Taxes. Landlord or Tenant may commence a Tax challenge/appeal with the prior written consent of the other, not to be unreasonably withheld (an “Appeal”). If Landlord elects to construct a building on the Undeveloped Land, then Landlord will use commercially reasonable efforts to subdivide the Property so that the Undeveloped Land is a separate tax parcel or parcels. If Landlord is able to so subdivide the Property, thereafter Tenant shall only be obligated to pay Taxes with respect to the portion of the Property on which the Building and other improvements are located as of the date of this Lease (as shown on the Project Site Plan). If Landlord is unable to so subdivide the Property, after the Undeveloped Land has been developed, Tenant shall only be required to pay its pro rata share of the Taxes applicable to the Premises and the Project as reasonably and equitably determined by Landlord in good faith.

8.2. Tenant shall be solely responsible for the payment of any and all taxes levied upon (a) personal property and trade fixtures located at the Premises and (b) any gross or net receipts of or sales by Tenant, and shall pay the same prior to delinquency.

8.3. To the extent Landlord is required by a lender, Tenant shall timely pay all tax and insurance impound payments due on the Premises.

8.4. Tenant shall pay Taxes as provided in Section 15.2 below.

8.5. Tenant shall not be responsible for Taxes attributable to the time period prior to the Term Commencement Date. Tenant’s responsibility for Taxes shall continue to the latest of (a) the date of termination of this Lease, and (b) the date Tenant has fully vacated the Premises.

8.6. Taxes for the calendar year in which Tenant’s obligation to share therein commences and for the calendar year in which such obligation ceases shall be prorated on a basis reasonably determined by Landlord. Taxes that are incurred for an extended time period shall be prorated based upon the time periods to which they apply so that the amounts attributed to the Premises relate in a reasonable manner to the time period wherein Tenant has an obligation to share in Taxes.

9. Property Management Fee. Tenant shall pay to Landlord on the first day of each calendar month of the Term, as Additional Rent, the Property Management Fee (as defined below). The “Property Management Fee” shall equal one and one-half percent (1.5%) of Base Rent due from Tenant (provided, however, that for the first two (2) years of the Term, the Property Management Fee shall be calculated as if Tenant were paying One Hundred Eighteen Thousand Six Hundred Forty-Eight and 25/100 Dollars ($118,648.25) per month for Base Rent, notwithstanding anything to the contrary set forth in Section 2.3 of this Lease). Tenant shall pay the Property Management Fee with respect to the entire Term, including any extensions thereof or any

- 8 -

holdover periods, regardless of whether Tenant is obligated to pay Base Rent, Insurance Costs, Taxes, Reimbursable Maintenance Costs or any other Rent with respect to any such period or portion thereof.

10. Security Deposit.

10.1. Tenant shall deposit with Landlord not more than five (5) Business Days after Landlord has provided the OncoGenex Notice to Tenant the sum set forth in Section 2.6 (the “Security Deposit”), which sum shall be held by Landlord as security for the faithful performance by Tenant of all of the terms, covenants and conditions of this Lease to be kept and performed by Tenant during the Term and ending upon the expiration or termination of Tenant’s obligations under this Lease. If Tenant Defaults (as defined below) with respect to any provision of this Lease, including any provision relating to the payment of Rent, then Landlord may (but shall not be required to) use, apply or retain all or any part of the Security Deposit for the payment of any Rent or any other sum in default, or to compensate Landlord for any other loss or damage that Landlord may suffer by reason of Tenant’s default. If any portion of the Security Deposit is so used or applied, then Tenant shall, within ten (10) days following demand therefor, deposit cash with Landlord in an amount sufficient to restore the Security Deposit to its original amount, and Tenant’s failure to do so shall be a material breach of this Lease. The provisions of this Article shall survive the expiration or earlier termination of this Lease until the unused and undisputed portion of the Security Deposit is returned to Tenant in accordance with the terms of this Lease, and either there are no disputes between Landlord and Tenant regarding any unreturned portion of the Security Deposit, or any such disputes have been fully and finally settled, adjudicated or otherwise resolved by Landlord and Tenant.

10.2. In the event of bankruptcy or other debtor-creditor proceedings against Tenant, the Security Deposit shall be deemed to be applied first to the payment of Rent and other charges due Landlord for all periods prior to the filing of such proceedings.

10.3. Landlord may deliver to any purchaser of Landlord’s interest in the Premises the funds deposited hereunder by Tenant, and thereupon Landlord shall be discharged from any further liability with respect to such deposit. This provision shall also apply to any subsequent transfers.

10.4. If Tenant is not in default under this Lease and Tenant has performed all of its continuing obligations under this Lease relating the condition of the Premises and the surrender of possession of the Premises, then the Security Deposit, or any balance thereof, shall be returned to Tenant (or, at Landlord’s option, to the last assignee of Tenant’s interest hereunder) within thirty (30) days after the expiration or earlier termination of this Lease except Landlord may retain any portion of the Security Deposit which relates to disputed amounts which Landlord claims are due to Landlord pursuant to this Lease or which relates to obligations of Tenant which have not been performed by Tenant as of the expiration or earlier termination of this Lease.

10.5. Tenant will provide Landlord with updated Hazardous Materials Documents (defined below) as required under Section 20.2 below. In the event that, upon Landlord’s review of any updated Hazardous Materials Documents, Landlord reasonably determines that Tenant’s change in use of Hazardous Materials (as defined below) at the Premises set forth in such updated Hazardous Materials Documents materially increases the risk of damage to or

- 9 -

contamination of the Premises or other parts of the Project, then Landlord may require that, upon Tenant’s receipt of written notice from Landlord, Tenant in its sole discretion shall deposit an additional sum equal to up to three (3) months of Base Rent with Landlord, which amount shall be added to and treated as a part of the Security Deposit.

10.6. If the Security Deposit shall be in cash, Landlord shall hold the Security Deposit in an account at a banking organization selected by Landlord; provided, however, that Landlord shall not be required to maintain a separate account for the Security Deposit, but may intermingle it with other funds of Landlord. Landlord shall be entitled to all interest and/or dividends, if any, accruing on the Security Deposit. Landlord shall not be required to credit Tenant with any interest for any period during which Landlord does not receive interest on the Security Deposit.

10.7. The Security Deposit may be in the form of cash, or may be in the form of a letter of credit or any other security instrument acceptable to Landlord in its sole discretion. Tenant may at any time, except when Tenant is in Default (as defined below), deliver a letter of credit (the “L/C Security”) as the entire Security Deposit, as follows:

(a) If Tenant elects to deliver L/C Security, then Tenant shall provide Landlord, and maintain in full force and effect throughout the Term and until the date that is six (6) months after the then-current Term Expiration Date, a letter of credit substantially in the form of Exhibit D issued by an issuer reasonably satisfactory to Landlord, in the amount of the Security Deposit, with an initial term of at least one year. Landlord may require the L/C Security to be re-issued by a different issuer at any time during the Term if Landlord reasonably believes that the issuing bank of the L/C Security is or may soon become insolvent; provided, however, Landlord shall return the existing L/C Security to the existing issuer immediately upon receipt of the substitute L/C Security. If any issuer of the L/C Security shall become insolvent or placed into FDIC receivership, then Tenant shall immediately deliver to Landlord (without the requirement of notice from Landlord) substitute L/C Security issued by an issuer reasonably satisfactory to Landlord, and otherwise conforming to the requirements set forth in this Article. As used herein with respect to the issuer of the L/C Security, “insolvent” shall mean the determination of insolvency as made by such issuer’s primary bank regulator (i.e., the state bank supervisor for state chartered banks; the OCC or OTS, respectively, for federally chartered banks or thrifts; or the Federal Reserve for its member banks). Tenant shall reimburse Landlord’s reasonable legal costs incurred in handling Landlord’s acceptance of L/C Security or its replacement or extension.

(b) If Tenant delivers to Landlord satisfactory L/C Security in place of the entire Security Deposit, Landlord shall remit to Tenant any cash Security Deposit Landlord previously held.

(c) Landlord may draw upon the L/C Security, and hold and apply the proceeds in the same manner and for the same purposes as the Security Deposit, if (i) an uncured Default (as defined below) exists, (ii) as of the date forty-five (45) days before any L/C Security expires (even if such scheduled expiry date is after the Term Expiration Date) Tenant has not delivered to Landlord an amendment or replacement for such L/C Security, reasonably satisfactory to Landlord, extending the expiry date to the earlier of (1) six (6) months after the then-current Term Expiration Date or (2) the date one year after the then-current expiry date of

- 10 -

the L/C Security, (iii) the L/C Security provides for automatic renewals, Landlord asks the issuer to confirm the current L/C Security expiry date, and the issuer fails to do so within ten (10) Business Days, (iv) Tenant fails to pay (when and as Landlord reasonably requires) any bank charges for Landlord’s transfer of the L/C Security or (v) the issuer of the L/C Security ceases, or announces that it will cease, to maintain an office in the city where Landlord may present drafts under the L/C Security (and fails to permit drawing upon the L/C Security by overnight courier or facsimile). This Section does not limit any other provisions of this Lease allowing Landlord to draw the L/C Security under specified circumstances.

(d) Tenant shall not seek to enjoin, prevent, or otherwise interfere with Landlord’s draw under L/C Security, even if it violates this Lease, however, Tenant may inform Landlord that Tenant believes the draw is wrongful (i.e., Landlord had no reasonable basis for making the draw). Tenant acknowledges that the only effect of a wrongful draw would be to substitute a cash Security Deposit for L/C Security, causing Tenant no legally recognizable damage. In the event of a wrongful draw, (i) the parties shall cooperate to allow Tenant to post replacement L/C Security simultaneously with the return to Tenant of the wrongfully drawn sums, and Landlord shall upon request confirm in writing to the issuer of the L/C Security that Landlord’s draw was erroneous, and (ii) Landlord will indemnify Tenant from any actual damages incurred by Tenant to the extent Landlord had no reasonable basis to believe it had the right to make a draw on the L/C Security. Landlord shall hold the proceeds of any draw in the same manner and for the same purposes as a cash Security Deposit.

(e) If Landlord transfers its interest in the Premises, then Tenant shall at Tenant’s expense, within five (5) Business Days after receiving a request from Landlord, deliver (and, if the issuer requires, Landlord shall consent to) an amendment to the L/C Security naming Landlord’s grantee as substitute beneficiary. If the required Security Deposit changes while L/C Security is in force, then Tenant shall deliver (and, if the issuer requires, Landlord shall consent to) a corresponding amendment to the L/C Security.

11. Use.

11.1. Tenant shall use the Premises for the Permitted Use, and shall not use the Premises, or permit or suffer the Premises to be used, for any other purpose without Landlord’s prior written consent, which consent Landlord may withhold in its sole and absolute discretion. Tenant shall, at its sole cost and expense, promptly and properly observe and comply with (including in the making by Tenant of any Alterations to the Premises) all present and future Applicable Laws relating to the Premises (except that Tenant shall not be required to make Alterations to the Premises to the extent that any such Alteration would constitute a capital repair or replacement with respect to certain elements of the Premises for which Landlord is solely responsible under the first sentence of Section 17.2 of this Lease) or to the use or occupancy of the Project or any portion thereof by Tenant or any other “Tenant Party” (as defined in Section 20.1 below).

11.2. Tenant shall not use or occupy the Premises or the Project in violation of Applicable Laws; zoning ordinances; or the certificate of occupancy issued for the Premises or any portion thereof, and shall, upon five (5) Business Days’ written notice from Landlord, discontinue any use of the Premises or the Project that is declared or claimed by any Governmental Authority having jurisdiction to be a violation of any of the above, or that in

- 11 -

Landlord’s reasonable opinion violates any of the above. Tenant shall comply with any direction of any Governmental Authority having jurisdiction that shall, by reason of the nature of Tenant’s use or occupancy of the Premises, impose any duty upon Tenant or Landlord with respect to the Premises or with respect to the use or occupation thereof.

11.3. Tenant shall not do or permit to be done anything that will invalidate any fire, environmental, extended coverage or any other insurance policy covering the Premises, the Project or any portion thereof, and shall comply with all rules, orders, regulations and requirements of the insurers of the Premises, the Project or any portion thereof. If any of the activities of Tenant or any other Tenant Party in or about the Premises or the Project which are permitted by this Lease and under Applicable Law result in an increase in the cost of any fire, environmental, extended coverage or any other insurance policy covering the Premises, the Project or any portion thereof, Tenant shall promptly, upon demand, reimburse Landlord for any additional premium charged for such policy by reason of the activities or Tenant or any other Tenant Party.

11.4. If Tenant installs separate locks or other security devices restricting access to the Premises, Landlord will be provided with a key or access codes, as applicable, for any lock or other security devices so Landlord will have access to such areas in the event of an emergency and to perform Landlord’s obligations under this Lease except in no event shall Tenant be obligated to provide Landlord with a key or access codes to the cGMP areas of the Premises.

11.5. Tenant shall, upon termination of this Lease, return to Landlord all keys to offices and restrooms either furnished to or otherwise procured by Tenant. In the event any key so furnished to Tenant is lost, Tenant shall pay to Landlord the cost of replacing the same or of changing the lock or locks opened by such lost key if Landlord shall deem it necessary to make such change.

11.6. No awnings or other projections shall be attached to any outside wall of the Building without Landlord’s prior written consent not to be unreasonably withheld. Neither the interior nor exterior of any windows shall be coated or otherwise permanently sunscreened without Landlord’s prior written consent.

11.7. Except as provided below in this Section 11.7, no sign, advertisement or notice (“Signage”) shall be exhibited, painted or affixed by Tenant on any exterior part of the Premises without Landlord’s prior written consent, not to be unreasonably withheld. Tenant shall have the right to place signs displaying Tenant’s name and corporate logo on the Building, the Building directory, the existing monument sign for the Project, and the Premises so long as such signs conform with Applicable Laws and Landlord’s reasonable design criteria, and so long as Tenant is occupying at least sixty (60%) of the Rentable Area of the Building, then Tenant’s right to place signs displaying its name and corporate logo on the Building shall be exclusive. For any Signage, Tenant shall, at Tenant’s own cost and expense, (a) acquire all permits for such Signage in compliance with Applicable Laws and (b) design, fabricate, install and maintain such Signage in a first-class condition. Tenant shall be responsible for reimbursing Landlord for costs incurred by Landlord in removing any of Tenant’s Signage upon the expiration or earlier termination of this Lease. At Landlord’s option, Landlord may install any such Signage, and Tenant shall pay all costs associated with such installation within thirty (30) days after demand therefor. In the

- 12 -

event of a Transfer approved by Landlord or an Exempt Transfer in accordance with Article 28 of this Lease, Tenant’s rights with respect to Signage shall inure to the benefit of the transferee, assignee or sublessee.

11.8. Tenant may only place equipment within the Premises with floor loading consistent with the Building’s structural design unless Tenant obtains Landlord’s prior written approval. Tenant may place such equipment only in a location designed to carry the weight of such equipment.

11.9. Tenant shall not (a) use or allow any other Tenant Party to use the Premises or the Project for unlawful purposes or (b) cause, maintain or permit any legal nuisance or waste in, on or about the Premises or the Project as a result of any acts or omission of any Tenant Party.

11.10. Notwithstanding any other provision herein to the contrary, Tenant shall be responsible for all liabilities, costs and expenses arising out of or in connection with the compliance of the Premises with the Americans with Disabilities Act, 42 U.S.C. § 12101, et seq., and any state and local accessibility laws, codes, ordinances and rules (collectively, and together with regulations promulgated pursuant thereto, the “ADA”) or other Applicable Laws, provided, however, that Landlord shall be responsible for any liabilities, costs and expenses to the extent arising out of the failure of the Premises to comply with the ADA or any other Applicable Law as of the Term Commencement Date (as the ADA and such other Applicable Laws are interpreted and applied as of the Term Commencement Date) (each, an “Pre-Existing Violation”). Tenant shall indemnify, save, defend (at Landlord’s option and with counsel reasonably acceptable to Landlord) and hold Landlord and its affiliates, employees, agents and contractors; and any lender, mortgagee, ground lessor or beneficiary (each, a “Lender” and, collectively with Landlord and its affiliates, employees, agents and contractors, the “Landlord Indemnitees”) harmless from and against any demands, claims, liabilities, losses, costs, expenses, actions, causes of action, damages, suits or judgments, and all reasonable expenses (including reasonable attorneys’ fees, charges and disbursements, regardless of whether the applicable demand, claim, action, cause of action or suit is voluntarily withdrawn or dismissed) incurred in investigating or resisting the same (collectively, “Claims”) arising out of any such failure of the Premises to comply with the ADA or Applicable Laws, except to the extent arising from a Pre-Existing Violation. For the avoidance of doubt, “Lenders” shall also include historic tax credit investors and new market tax credit investors. The provisions of this Section shall survive the expiration or earlier termination of this Lease with respect to Claims arising from events or conditions occurring or existing at the Premises prior to the expiration or earlier termination of the Term (other than a Pre-Existing Violation).

12. Rules and Regulations, CC&Rs and Parking Facilities;Future Development.

12.1. Tenant shall and shall ensure that its contractors, subcontractors, employees, subtenants and invitees faithfully observe and comply with the rules and regulations adopted by Landlord and attached hereto as Exhibit E (the “Rules and Regulations”). With the prior approval of Tenant, which approval shall not be unreasonably withheld, delayed or conditioned, Landlord may amend the Rules and Regulations or promulgate new rules and regulations applicable to the Premises and the Project.

- 13 -

12.2. Tenant shall comply with any covenants, conditions or restrictions hereafter recorded on the Project or the Property, as the same may be amended, restated, supplemented or otherwise modified from time to time (the “CC&Rs”); provided, however, Landlord shall not record or cause to be recorded any CC&Rs which would adversely affect Tenant’s (a) parking rights or signage rights under this Lease, (b) access to the Project or the Premises, (c) use of the utilities available to the Premises or the Project, (d) Tenant’s use of the Premises as permitted by this Lease, or (e) the utilities serving Tenant’s Premises, without the prior written approval of Tenant, which approval shall not be unreasonably withheld, delayed or conditioned.

12.3. Notwithstanding anything in this Lease to the contrary, Tenant may install a security system (including cameras) outside the Premises that records sounds or images outside the Premises, subject to the requirements of Applicable Law and Landlord’s approval of the method for the installation of any such security system, which approval will not be unreasonably withheld or delayed. If Tenant installs such a security system, Tenant shall be solely responsible, at Tenant’s sole cost and expense, for the monitoring, maintaining and operation of Tenant’s security system. At the request of Landlord, Tenant shall remove its security systems at the expiration or earlier termination of this Lease and Tenant shall restore the Premises and the Project to their condition prior to the installation of Tenant’s security system, reasonable wear and tear excepted, provided, however, that Landlord shall make such request not less than thirty (30) days prior to the scheduled Term Expiration Date of this Lease unless this Lease terminates earlier due to Landlord’s exercise of its rights and remedies under this Lease. Tenant’s obligations under the immediately preceding sentence shall survive the expiration or termination of this Lease.

12.4. Tenant shall have an exclusive, irrevocable license to use the Parking Facilities for parking for the Tenant Parties during the Term at no additional cost. Nothing in this Section 12.4 is intended to preclude the Parking Facilities from being used for ingress or egress to or from other parts of the Property, including but not limited to any future development constructed by Landlord on the Undeveloped Land, or for the installation of utility facilities or tying into existing utility facilities; provided, however, the Parking Facilities shall not be used for the staging of construction on the Undeveloped Land. Landlord may use the Parking Facilities for the temporary parking of construction equipment so long as Landlord notifies Tenant in advance and cooperates with Tenant’s reasonable requests as to the location in the Parking Facilities where such equipment will be parked. Landlord shall use commercially reasonable efforts to cause construction vehicles and traffic related to the development of the Undeveloped Land to use other ingress and egress routes that do not utilize the Parking Facilities. If Landlord determines it is necessary to access the Undeveloped Land through the Parking Facilities, then Landlord will give Tenant reasonable prior notice and will take reasonable steps to minimize any interference with the use of such Parking Facilities by the Tenant Parties as permitted by this Lease.

12.5. If Landlord elects in the future to construct an additional building or buildings and other improvements on the Undeveloped Land, in addition to complying with the terms of Section 12.4 above, and any other applicable provisions in this Lease, Landlord agrees (a) any interruptions in utility or services to the Premises which are necessary in connection with the construction of such improvements shall be scheduled with Tenant at least five (5) days in advance and such interruptions shall occur at times reasonably acceptable to both Landlord and

- 14 -

Tenant, and (b) all construction activities on the Undeveloped Land will be conducted in a manner so as to cause as little interference to Tenant’s use and occupancy of the Premises and the Parking Facilities as reasonably possible.

13. Control by Landlord.

13.1. Landlord reserves full control over the Project (including the Common Areas) to the extent not inconsistent with Tenant’s rights and enjoyment of the same as provided by this Lease. This reservation includes Landlord’s right to subdivide the Project; sell all or a portion of the Project, add real property and any improvements thereon to the Project; grant easements and licenses to third parties; and maintain or establish ownership of the Project separate from fee title to the Property; provided, however, that such rights shall be exercised in a way that does not adversely affect Tenant’s rights under this Lease.

13.2. Tenant shall, at Landlord’s request, promptly execute such further documents as may be reasonably appropriate to assist Landlord in the performance of its obligations hereunder; provided that Tenant need not execute any document that creates additional liability for Tenant or that deprives Tenant of the quiet enjoyment and use of the Premises as provided for in this Lease.

13.3. Landlord and its employees, contractors and agents may, at any and all reasonable times, upon not less than two (2) Business Days’ prior notice (provided that no time restrictions shall apply or advance notice be required to enter areas of the Premises other than the “Secured Areas” (defined below) in the event of a bona-fide health or safety emergency or an imminent risk of damage to the Premises or the Project or to persons or property necessitates immediate entry), enter the Premises to (w) perform any repairs or maintenance that Landlord is obligated to make under this Lease, (x) inspect the Premises and to determine whether Tenant is observing and performing its obligations under this Lease, (y) access the telephone equipment, electrical substation and fire risers and (z) show the Premises to prospective tenants during the final year of the Term and current and prospective purchasers and lenders at any time during the Term. In no event shall Tenant’s Rent abate as a result of Landlord’s activities pursuant to this Section; provided, however, that all such activities shall be conducted in accordance with Tenant’s reasonable security procedures and in such a manner so as to cause as little interference to Tenant as is reasonably possible. If an emergency necessitates immediate access to the Premises (other than the Secured Areas), Landlord or any emergency response or service provider contacted by Landlord (e.g., the fire department or utility providers) (“Emergency Response Personnel”) may use whatever force is necessary to enter the Premises (other than the Secured Areas), and if an emergency necessitates immediate access to the Secured Areas, any Emergency Response Personnel (but not Landlord) may use whatever force is necessary to enter the Secured Areas, and any such entry to the Premises in accordance with the preceding clauses shall not constitute a forcible or unlawful entry to the Premises, a detainer of the Premises or an eviction of Tenant from the Premises or any portion thereof or result in any liability to Landlord. In the event of an emergency, Landlord will use reasonable efforts to notify Tenant of the emergency situation as soon as reasonably practicable after Landlord becomes aware of such emergency.

13.4. Notwithstanding anything to the contrary set forth above, Tenant may designate certain areas of the Premises as “Secured Areas”. The Secured Areas will include the cGMP areas in the Premises. Landlord may not enter the Secured Areas except as permitted by Section

- 15 -

13.3 above, and neither Landlord nor its agents or employees may enter the Secured Areas unless accompanied by a representative of Tenant (provided that Tenant makes such a representative reasonably available to Landlord).

14. Quiet Enjoyment. Landlord covenants that so long as Tenant is not in default beyond any applicable notice and cure periods, Tenant may peacefully and quietly have, hold and enjoy the Premises, free from any claim by Landlord or persons claiming under Landlord, but subject to all of the terms and provisions hereof, provisions of Applicable Laws and rights of record to which this Lease is or may become subordinate. This covenant is in lieu of any other quiet enjoyment covenant, either express or implied.

15. Utilities and Services.

15.1 Tenant shall, at Tenant’s sole cost and expense, procure and maintain contracts, with copies of the same and of any related records furnished promptly to Landlord after execution thereof, in customary form and substance for, and with contractors specializing and experienced in, the maintenance of the following equipment and improvements, if any, if and when installed on the Premises: (a) heating, ventilating and air conditioning (“HVAC”) equipment, (b) boilers and pressure vessels, (c) fire extinguishing systems, including fire alarm and smoke detection devices, (d) roof coverings and drains, (e) basic utility feeds to the perimeter of the Building, and (f) any other equipment reasonably required by Landlord. Notwithstanding the foregoing, if Tenant fails to procure or maintain any service contract that Tenant is required to procure and maintain by the immediately preceding sentence, then Landlord reserves the right, upon ten (10) Business Days’ prior notice to Tenant, to procure and maintain any or all of such service contracts, and if Landlord so elects, Tenant shall reimburse Landlord, upon demand, for the costs thereof. Tenant shall maintain temperature and humidity in the Premises in accordance with the requirements of the Federal Drug Administration and any Applicable Laws.

15.2 Within sixty (60) days after the Term Commencement Date, and within sixty (60) days after the beginning of each calendar year during the Term, Landlord shall give Tenant a written estimate for such calendar year of (a) the cost of any insurance provided by Landlord (“Insurance Costs”), (b) the estimated amount of the Taxes payable by Tenant pursuant to this Lease for the applicable calendar year, and (c) any scheduled Reimbursable Maintenance Costs. Tenant shall pay such estimated amount to Landlord in advance in equal monthly installments. Within ninety (90) days after the end of each calendar year, Landlord shall furnish to Tenant a statement showing in reasonable detail the actual Insurance Costs, actual Taxes and Reimbursable Maintenance Costs incurred by Landlord during such calendar year (the “Annual Statement”), and Tenant shall pay to Landlord the costs incurred in excess of the payments previously made by Tenant within thirty (30) days of receipt of the Annual Statement. In the event that the payments previously made by Tenant for the Insurance Costs, Taxes or Reimbursable Maintenance Costs exceed Tenant’s obligation, such excess amount shall be credited by Landlord to the Rent or other charges next due and owing, provided that, if the Term has expired, Landlord shall remit such excess amount to Tenant.

15.3 Tenant shall make all arrangements for (at Tenant’s sole cost and expense) and pay for all water, electricity, air, sewer, refuse, gas, heat, light, power, telephone service and any other service or utility Tenant required at the Premises. Landlord shall not have any obligation to provide any such utilities to the Premises.

- 16 -

15.4 Landlord shall not be liable for, nor shall any eviction of Tenant result from, the failure to furnish any utility or service, whether or not such failure is caused by accidents; breakage; casualties (to the extent not caused by the party claiming Force Majeure); Severe Weather Conditions (as defined below); physical natural disasters (but excluding weather conditions that are not Severe Weather Conditions); strikes, lockouts or other labor disturbances or labor disputes (other than labor disturbances and labor disputes resulting solely from the acts or omissions of the party claiming Force Majeure); acts of terrorism; riots or civil disturbances; wars or insurrections; shortages of materials (which shortages are not unique to the party claiming Force Majeure); government regulations, moratoria or other governmental actions, inactions or delays; failures by third parties to deliver gas, oil or another suitable fuel supply, or inability of the party claiming Force Majeure, by exercise of reasonable diligence, to obtain gas, oil or another suitable fuel; or other causes beyond the reasonable control of the party claiming that Force Majeure has occurred (collectively, “Force Majeure”); or, to the extent permitted by Applicable Laws, Landlord’s negligence. In the event of such failure, Tenant shall not be entitled to termination of this Lease or any abatement or reduction of Rent, nor shall Tenant be relieved from the operation of any covenant or agreement of this Lease. If utilities or services to the Premises are interrupted, Tenant may take such actions as may be reasonably necessary, at Tenant’s sole cost, to obtain or provide temporary services or utilities to the Premises (e.g., portable generators in the case of an interruption of power to the Premises) until the services and utilities are restored, and Landlord will reasonably cooperate with Tenant’s efforts to do so at no out-of-pocket cost to Landlord, provided, however, that if the interruption in services or utilities is the direct result of the negligent acts or negligent omissions of Landlord or Landlord’s agent’s or employees, Landlord will reimburse Tenant for the reasonable out-of-pocket costs incurred by Tenant in arranging for temporary utilities or services. In the event of any interruption of utilities or services to the Premises, Tenant shall not perform or cause to be performed any (a) excavation of the Property, (b) repair of underground utility facilities, pressurized natural gas facilities, or live power facilities outside the Building, or (c) repair of utility facilities that would affect the Building exterior or structure or adversely affect the Building systems, in each case without Landlord’s prior written consent. “Severe Weather Conditions” means weather conditions that are materially worse than those that reasonably would be anticipated for the Property at the applicable time based on historic meteorological records. Notwithstanding anything to the contrary in this Lease, if, for more than ten (10) consecutive Business Days following written notice to Landlord, and as a direct result of Landlord’s gross negligence or willful misconduct (and, further, except to the extent that such failure is caused in whole or in part by the action or inaction of a Tenant Party), the provision of HVAC or other utilities to all or a material portion of the Premises is interrupted (a “Material Services Failure”), then Tenant’s Base Rent (or, to the extent that less than all of the Premises are affected, a proportionate amount (based on the Rentable Area of the Premises that is rendered unusable) of Base Rent) shall thereafter be abated until the Premises are again usable by Tenant for the Permitted Use; provided, however, that, if Landlord is diligently pursuing the restoration of such HVAC or other utilities, then Base Rent shall not be abated. During any Material Services Failure, Tenant will be solely responsible to arrange for the provision of any interrupted utility services on an interim basis via temporary measures until final corrective measures can be accomplished, and Tenant will permit Landlord the necessary access to the Premises to remedy such Material Service

- 17 -

Failure. In the event of any interruption of HVAC or other utilities that entitles Tenant to an abatement of Base Rent in accordance with this Lease, regardless of the cause, Landlord shall diligently pursue the restoration of such HVAC and other utilities. Notwithstanding anything in this Lease to the contrary, but subject to Article 23 (which shall govern in the event of a casualty), the provisions of this Section shall be Tenant’s sole recourse and remedy in the event of an interruption of HVAC or other utilities to the Premises.

15.5 Tenant shall pay for, prior to delinquency of payment therefor, any utilities and services that may be furnished to the Premises during or, if Tenant occupies the Premises after the expiration or earlier termination of the Term, after the Term.

15.6 Tenant shall be responsible for installing and maintaining, at Tenant’s sole cost and expense, any additional or supplemental heating, ventilating, air conditioning or other equipment necessary because any device or equipment in the Premises will increase the amount of ventilation, air exchange, gas, steam, electricity or water beyond the existing capacity of the equipment currently serving the Premises. The installation of any such equipment shall be subject to the terms of Section 16 below.

15.7 Tenant may install equipment to provide emergency power, including adding equipment to any existing back-up generator (“Generator”) in a location reasonably designated by Landlord, subject to Landlord’s prior written approval, which Landlord shall not unreasonably withhold, condition or delay. The installation of such equipment shall constitute Alterations. Tenant shall maintain, repair and (if necessary) replace the Generator at its sole cost and expense. Neither Landlord nor any of the other Landlord Parties shall be liable for, nor shall any eviction of Tenant result from, any failure to make any repairs or perform any maintenance of the Generator or the failure of the Generator to furnish electric power for any reason, including, to the extent permitted by Applicable Laws, as a result of the negligence of any of the Landlord Parties. Landlord expressly disclaims any warranties with regard to the Generator or the installation thereof, including any warranty of merchantability or fitness for a particular purpose. In the event of such failure, such failure shall not constitute a default by Landlord under this Lease, and Tenant shall not be entitled to termination of this Lease or any abatement or reduction of rent under this Lease, nor shall Tenant be relieved from the operation of any covenant or agreement of this Lease. Tenant expressly agrees to assume the risk that Tenant may suffer injury or damage as a result of any malfunction or failure of the Generator or failure to receive electric power from the Generator for any reason, including but not limited to the risk of damage to personal property or scientific research or loss of records kept by Tenant within the Premises, and agrees that the Landlord Parties will not be liable for, and Tenant will hold the Landlord Parties harmless from, any Claims that any of the Landlord Parties may incur as a result of any malfunction or failure of the Generator or failure to receive electric power from the Generator for any reason, regardless of whether such damages or injuries were foreseeable. Tenant further waives, releases and discharges any Claims for injury to Tenant’s business or loss of income or loss of research relating to any such damage or injury as described in this paragraph.

15.8 For any utilities serving the Premises for which Tenant is billed directly by such utility provider, Tenant agrees to furnish to Landlord (a) within thirty (30) days after Landlord’s request, any invoices or statements for such utilities within thirty (30) days after Tenant’s receipt

- 18 -

thereof, however, Tenant shall not be obligated to provide such invoices or statements to Landlord if Tenant has authorized Landlord to obtain copies of such invoices or statements from the utility provider, (b) within thirty (30) days after Landlord’s request, any other utility usage information reasonably requested by Landlord, and (c) within thirty (30) days after each calendar year during the Term, authorization to allow Landlord to access Tenant’s utility usage information necessary for Landlord to complete an ENERGY STAR® Statement of Performance (or similar comprehensive utility usage report (e.g., related to Labs 21), if requested by Landlord) and any other utility information reasonably requested by Landlord for the immediately preceding year. Tenant shall retain records of utility usage at the Premises, including invoices and statements from the utility provider, for at least sixty (60) months, or such other period of time as may be requested by Landlord. Tenant acknowledges that any utility information for the Premises may be shared with third parties, including Landlord’s consultants and Governmental Authorities. In the event that Tenant fails to comply with this Section, Tenant hereby authorizes Landlord to collect utility usage information directly from the applicable utility providers, and Tenant shall pay Landlord a fee of One Thousand Dollars ($1,000) per month to collect such utility usage information. In addition to the foregoing, Tenant shall comply with all Applicable Laws related to the disclosure and tracking of energy consumption at the Premises. The provisions of this Section shall survive the expiration or earlier termination of this Lease.

16. Alterations.

16.1. Except as otherwise expressly permitted by this Article 16, Tenant shall make no alterations, additions or improvements other than the Tenant Improvements in or to the Premises or engage in any construction, demolition, reconstruction, renovation or other work (whether major or minor) of any kind in, at or serving the Premises (“Alterations”) without Landlord’s prior written approval, which approval Landlord shall not unreasonably withhold; provided, however, in no event shall Landlord have any obligation to consent to any Alteration that will result in the removal of any of the elevators in the Building unless the elevator is being replaced with an elevator of equal utility or the removal of any of the staircases in the Building. Tenant shall, in making any Alterations, use only those architects, contractors, suppliers and mechanics of which Landlord has given prior written approval, which approval Landlord shall not unreasonably withhold. In seeking Landlord’s approval, Tenant shall provide Landlord, at least thirty (30) days in advance of any proposed construction, with plans, specifications, bid proposals, certified stamped engineering drawings and calculations by Tenant’s engineer of record or architect of record (including connections to the Building’s structural system, modifications to the Building’s envelope, non-structural penetrations in slabs or walls, and modifications or tie-ins to life safety systems), work contracts, requests for laydown areas and such other information concerning the nature and cost of the Alterations as Landlord may reasonably request. Landlord hereby consents to Tenant’s removal of the vivarium currently located in the Premises so long as Tenant repairs any damage to the Premises resulting from the removal of the vivarium and otherwise complies with the requirements of this Article 16, and Landlord agrees Tenant shall not be obligated to rebuild the vivarium at the end of the Term (“Vivarium Alterations”). In no event shall Tenant use or Landlord be required to approve any architects, consultants, contractors, subcontractors or material suppliers that Landlord reasonably believes could cause labor disharmony. Notwithstanding the foregoing, Tenant may make strictly cosmetic changes to the Premises that do not require any permits or more than three (3)

- 19 -

total contractors and subcontractors (“Cosmetic Alterations”) without Landlord’s consent; provided that (y) the cost of any Cosmetic Alterations does not exceed One Hundred Thousand and No/100 Dollars ($100,000.00) in any one instance or One Hundred Fifty Thousand and No/100 Dollars ($150,000.00) in any calendar year, (z) such Cosmetic Alterations do not (i) require any structural or other substantial modifications to the Premises, (ii) require any changes to or adversely affect the Building systems, (iii) affect the exterior of the Building or (iv) trigger any requirement under Applicable Laws that would require Landlord to make any alteration or improvement to the Premises. Tenant shall give Landlord at least ten (10) days’ written notice before commencing any Cosmetic Alterations. Prior to making any Alterations to the Premises (including Cosmetic Alterations) Tenant may request that Landlord advise Tenant if Landlord will require the removal of such Alterations upon the expiration or earlier termination of the Term; provided, however Landlord shall not require Tenant to remove Alterations consistent with the Permitted Use and similar in nature, purpose, quality and type to the initial Tenant Improvements to the Premises constructed pursuant to the Work Letter.

16.2. Tenant shall not construct or permit to be constructed partitions or other obstructions that might interfere with free access to mechanical installation or service facilities of the Building, or interfere with the moving of Landlord’s equipment to or from the enclosures containing such installations or facilities.

16.3. Tenant shall accomplish any work performed on the Premises in such a manner as to permit any life safety systems to remain fully operable at all times.

16.4. Tenant covenants and agrees that all work done by Tenant or Tenant’s contractors shall be performed in full compliance with Applicable Laws. Within thirty (30) days after completion of any Alterations, Tenant shall provide Landlord with complete “as built” drawing print sets and electronic CADD files on disc (or files in such other current format in common use as Landlord reasonably approves or requires) showing any changes in the Premises, as well as a commissioning report prepared by a licensed, qualified commissioning agent hired by Tenant and approved by Landlord for all new or affected mechanical, electrical and plumbing systems. Any such “as built” plans shall show the applicable Alterations as an overlay on the Building as-built plans; provided that Landlord provides the Building “as built” plans to Tenant.

16.5. Before commencing any Alterations other than the Tenant Improvements or Cosmetic Alterations, Tenant shall give Landlord at least thirty (30) days’ prior written notice of the proposed commencement of such work. If the cost of any such Alterations will exceed the amount of the Security Deposit then being held by Landlord, if required by Landlord, Tenant shall secure, at Tenant’s own cost and expense, a completion and lien indemnity bond satisfactory to Landlord for such work.

16.6. The Premises plus all Tenant Improvements, Vivarium Alterations and all other Alterations permanently attached to the Building shall at all times remain the property of Landlord, shall remain in the Premises and shall be surrendered to Landlord upon the expiration or earlier termination of this Lease. Any other Alterations shall (unless, prior to such construction or installation, Landlord elects otherwise in writing) at all times remain the property of Landlord, shall remain in the Premises and shall (unless, prior to construction or installation thereof, Landlord elects otherwise in writing) be surrendered to Landlord upon the expiration or earlier termination of the Lease.

- 20 -

16.7. Notwithstanding any other provision of this Article to the contrary, in no event shall Tenant remove any improvement from the Premises as to which Landlord contributed payment, without Landlord’s prior written consent, which consent Landlord may withhold in its sole and absolute discretion.

16.8. Tenant shall pay to Landlord an amount equal to the lesser of (a) $25,000 or (b) two percent (2%) of the cost to Tenant of all Alterations (other than the Tenant Improvements), to cover Landlord’s overhead and expenses for plan review, engineering review, coordination, scheduling and supervision thereof. The foregoing fee shall not be applicable to Cosmetic Alterations made pursuant to Section 16.1 above. For purposes of payment of such sum, Tenant shall submit to Landlord copies of all bills, invoices and statements covering the costs of such charges, accompanied by payment to Landlord of the fee set forth in this Section. Tenant shall reimburse Landlord for any extra expenses incurred by Landlord by reason of faulty work done by Tenant or its contractors, or by reason of delays caused by such work, or by reason of inadequate clean-up.

16.9. Tenant shall take, and shall cause its contractors to take, commercially reasonable steps to protect the Premises during the performance of any Alterations or Tenant Improvements, including covering or temporarily removing any window coverings so as to guard against dust, debris or damage.

16.10. Tenant shall require its contractors and subcontractors performing work on the Premises to name Landlord and its affiliates and Lenders as additional insureds on their respective insurance policies.

17. Repairs and Maintenance.

17.1 Except as expressly set forth in Section 17.2 below, Tenant, at its sole cost and expense, shall maintain and keep the Premises and the systems, equipment and improvements therein in a first class condition and in a manner consistent with the Permitted Use, including, but not limited to (a) non-capital repairs and routine maintenance of the roof, and (b) maintain, repair and replace the electrical, plumbing and HVAC systems (including roof air handlers) serving the Premises. Tenant shall keep the Premises free and clear from all rubbish, debris, insects, rodents and other vermin and pests. Tenant shall, no later than January 31st of each calendar year during the Term, provide to Landlord a copy of the budget for maintenance, repairs and replacements at the Premises for the preceding calendar year, as well as a detailed summary of the amounts actually expended by Tenant during such period for maintenance, repairs and replacements at the Premises. In addition, Tenant shall, within ten (10) days after receipt of written notice from Landlord, provide to Landlord any maintenance records that Landlord reasonably requests. All repairs made by Tenant shall be at least equal in quality to the original work, and shall be made only by a licensed, bonded contractor approved in advance by Landlord which approval shall not be unreasonably withheld; provided, however, that such contractor need not be bonded or approved by Landlord if Cosmetic Alterations or the cost of the non-structural repairs to be performed do not exceed Fifty Thousand Dollars ($50,000) in value. Landlord may impose reasonable restrictions and requirements with respect to such repairs. Tenant shall not take or

- 21 -

omit to take any action, the taking or omission of which shall cause waste, damage or injury to the Premises. Tenant shall indemnify, save, defend (at Landlord’s option and with counsel reasonably acceptable to Landlord) and hold harmless Landlord from and against any and all Claims (as defined below) arising out of the failure of Tenant or Tenant’s Agents to perform the covenants contained in this paragraph. “Tenant’s Agents” shall be defined to include Tenant’s officers, employees, agents, contractors, invitees, customers and subcontractors