Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AMAG PHARMACEUTICALS, INC. | a15-4001_18k.htm |

| EX-99.1 - EX-99.1 - AMAG PHARMACEUTICALS, INC. | a15-4001_1ex99d1.htm |

Exhibit 99.2

|

|

AMAG Pharmaceuticals 4Q14 Financial Results February 9, 2015 |

|

|

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (PSLRA) and other federal securities laws. Any statements contained herein which do not describe historical facts, including among others, statements regarding AMAG’s expected strong cash flow and earnings; beliefs about AMAG’s positioning for future acquisitions; expected annual synergy cost-savings with the Lumara Health transaction; the market opportunity for Makena®, including market dynamics and opportunities to increase market share and enhance patient compliance; Makena’s growth strategies for 2015; expected regulatory actions, and timing of such actions, for Feraheme® in the U.S. and abroad, including for the broad iron deficiency anemia (IDA) indication, the transfer of marketing authorizations from Takeda and potential U.S. label changes; Feraheme growth opportunities and Feraheme’s competitive landscape, including opportunities to increase market share in the chronic kidney disease (CKD) market and market opportunity growth if approval of the broader label is pursued and received; expected results for the quarter and year ended December 31, 2014, including net sales, operating loss, net income and adjusted EBITDA, as well as AMAG’s expected cash and investments balance; AMAG’s 2015 financial guidance, including net product sales, adjusted EBITDA and cash earnings; AMAG’s future expansion opportunities, including those related to Makena’s line extension and lifecycle management program and AMAG’s business development targeting strategy; and AMAG’s 2015 goals, including product growth across the portfolio, execution on Makena’s line extension/lifecycle management program, the path forward (if any) for the broad IDA indication in the U.S. and plans to further expand AMAG’s product portfolio are forward-looking statements which involve risks and uncertainties that could cause actual results to differ materially from those discussed in such forward-looking statements. Such risks and uncertainties include, among others: (1) demand for Feraheme and AMAG’s ability to successfully compete in the intravenous iron replacement market as a result of the FDA’s recommended label changes, including a boxed warning which would provide, among other things, (i) that Feraheme be administered only when personnel and therapies are immediately available for the treatment of anaphylaxis and other hypersensitivity reactions, (ii) observation for signs or symptoms of hypersensitivity reactions during and for at least 30 minutes following infusion and (iii) that hypersensitivity reactions have occurred in patients in whom a previous Feraheme dose was tolerated; (2) the outcome and timing of the process in accordance with Section 505(o) of the Federal Food, Drug and Cosmetic Act whereby the FDA is authorized to require AMAG to make safety-related label changes, including prescribed periods for submitting proposed changes to the label recommended by the FDA; (3) the impact on sales if AMAG disseminates future Dear Healthcare Provider letters; (4) the ability of AMAG to invest in the development and commercialization of Feraheme/Rienso outside the U.S. (Rienso is the trade name for ferumoxytol outside of the U.S. and Canada) , and the level of commercial success of any of such efforts, given the December 2014 arrangement to terminate AMAG’s and Takeda’s license arrangement; (5) uncertainties regarding the likelihood and timing of potential approval of Feraheme/Rienso in the U.S., the EU and Canada in the broader IDA indication; (6) the possibility that following review of new safety information, the FDA or regulators in Europe and Canada will request additional technical or scientific information, new studies or reanalysis of existing data, on-label warnings, post-marketing requirements/commitments or risk evaluation and mitigation strategies (REMS) in the current CKD indication for Feraheme/Rienso, or cause Feraheme/Rienso to be withdrawn from the market, and the additional costs and expenses that will or may be incurred in connection with indication for Feraheme/Rienso, or cause Feraheme/Rienso to be withdrawn from the market, and the additional costs and expenses that will or may be incurred in connection with such activities; (7) the possibility that significant safety or drug interaction problems could arise with respect to Feraheme/Rienso or Makena and in turn affect sales or AMAG’s ability to market such product; (8) AMAG’s patents and proprietary rights; (9) maintaining the benefits associated with Makena’s orphan drug exclusivity status and the ability to successfully implement the lifecycle management program/line extensions; (10) the risk of an Abbreviated New Drug Application (ANDA) filing, especially (i) as to Feraheme following the FDA’s draft bioequivalence recommendation for ferumoxytol published in December 2012 and (ii) as to Makena given the history of the formerly FDA-approved drug Delalutin (the original version of 17-alpha-hydroxyprogesterone caproate) for conditions other than reducing the risk of preterm birth; (11) AMAG’s ability to execute on, or to realize the expected results from, its long-term strategic plan; (12) the possibility that AMAG will not realize expected synergies and other benefits from its acquisition of Lumara Health, as well as AMAG’s ability to pursue additional business development opportunities, especially in light of AMAG’s being highly leveraged; (13) the impact on sales of Makena from competitive, commercial payor, government (including federal and state Medicaid reimbursement policies), physician, patient or public responses with respect to product pricing, product access and sales and marketing initiatives, as well as patient compliance and the number of preterm birth risk pregnancies for which Makena may be prescribed; (14) the likelihood that labeling changes may be used to support product liability claims that the prior product labeling did not adequately disclose the risk of adverse events; (15) compliance with restrictive and affirmative covenants with respect to substantial indebtedness incurred to finance the acquisition of Lumara Health, including a requirement that AMAG reduce its leverage over time; (16) the possibility that AMAG will need to raise additional capital from the sale of its common stock, which will cause significant dilution to its stockholders, in order to satisfy its contractual obligations, including its debt service, milestone payments that may become payable to Lumara Health’s stockholders, or in order to pursue business development activities; (17) the availability and timing of tax net operating loss carryforwards; (18) the manufacture of AMAG’s products, including any significant interruption in the supply of raw materials or finished product and (19) other risks identified in AMAG’s filings with the U.S. Securities and Exchange Commission (SEC), including its Quarterly Report on Form 10-Q for the quarter ended September 30, 2014 and subsequent filings with the SEC. Any of the above risks and uncertainties could materially and adversely affect AMAG’s results of operations, its profitability and its cash flows, which would, in turn, have a significant and adverse impact on AMAG’s stock price. Use of the term “including” in the two paragraphs above shall mean in each case “including, but not limited to.” AMAG cautions you not to place undue reliance on any forward-looking statements, which speak only as of the date they are made. AMAG disclaims any obligation to publicly update or revise any such statements to reflect any change in expectations or in events, conditions or circumstances on which any such statements may be based, or that may affect the likelihood that actual results will differ from those set forth in the forward-looking statements. AMAG Pharmaceuticals® and Feraheme® are registered trademarks of AMAG Pharmaceuticals, Inc. Lumara Health™ is a trademark of Lumara Health Inc. Makena® is a registered trademark of Lumara Health Inc. MuGard® is a registered trademark of PlasmaTech Biopharmaceuticals, Inc. (formerly known as Access Pharmaceuticals, Inc.). Rienso™ is a trademark of Takeda Pharmaceutical Company Limited. Forward-Looking Statements |

|

|

Agenda Topic Speaker Opening Remarks Commercial Performance – Makena Bill Heiden, CEO Commercial Performance – Feraheme Future Expansion Opportunities Frank Thomas, COO Financial Update Scott Holmes, SVP, Finance and IR 2015 Corporate Goals Closing Remarks Bill Heiden, CEO |

|

|

Investment Highlights High-growth spec pharma company Expected strong cash flow and earnings Diversified portfolio in attractive market segments Proven leadership team Track record of operational excellence Well positioned for future product acquisitions Maternal Health Hematology/Oncology, Nephrology & Hospital Key Financials (as of 12/31/14) 2014 pro forma product sales: $252MM1 Market cap: $1.1B Shares outstanding (basic): 25.6 million Cash balance: $144MM Debt: $540MM 1 Includes AMAG and Lumara Health product sales as though Lumara Health maternal health business had been acquired at the beginning of 2014 |

|

|

Financial Performance Highlights 2014: Outperformed financial guidance Feraheme (U.S.) $86MM in annual sales (+21% vs. 2013) Drove robust IV iron market growth (+7% in 2014) and rising net revenue per gram Makena $166MM in annual pro forma sales Strong physician demand growth: +75% 4Q14 vs. 4Q13 4Q14: Strong financial performance Total revenue of $53MM (+145% vs. 4Q13) $47MM in product sales (+145% vs. 4Q13) $15MM in adjusted EBITDA $153MM tax benefit recognized as a result of Lumara Health transaction Lumara Health transaction – financially transformative Transaction completed ahead of schedule Integration substantially complete; $20MM expected annual synergies Enterprise value +350% and market cap +100% since announcement on Sept. 29, 2014 |

|

|

Makena |

|

|

Overview of Preterm birth (<37 weeks) is a significant public health concern, and history of preterm birth is a leading risk factor Makena (hyroxyprogesterone caproate injection) is the only FDA-approved therapy to reduce recurrent preterm birth in certain at-risk women Society for Maternal-Fetal Medicine (SMFM) Clinical Guideline recommends hydroxyprogesterone caproate weekly injections for pregnant women who meet clinical indication Weekly injections from 16 until 37 weeks of pregnancy (or delivery) Supported by an experienced commercial team focused on maternal health |

|

|

$1B Market Opportunity1 Favorable market dynamics: Federal Drug Quality and Security Act (enacted Nov. 2013) details new regulations and FDA’s authority governing compounding pharmacies. FDA has stated: “When FDA identifies a pharmacist that compounds regularly or in inordinate amounts any drug products that are essentially copies of Makena , it intends to take action as it deems appropriate.” Significant opportunity to: Increase market share of treated Makena patients from current 25%; and Support patient compliance to therapy (from current 13.5 avg. paid injections/patient to 21 max. possible injections) Estimated Market Share Based on Patients2 Compounded hydroxyprogesterone caproate ~65K (45%) Off- guidance3 ~42K (30%) Makena ~33K (25%) 1 Based on 140,000 patients, >16 injections/patient and net revenue of ~ $425/injection 2 Company estimates based on Makena shipped doses and quantitative physician market research data on compounded hydroxyprogesterone caproate 3 Off-guidance represents patients treated outside guidance of SMFM including patients treated with unapproved therapies and untreated patients |

|

|

Strong Quarterly Growth: 4Q14 vs. 4Q13 75% growth 2014 Sales Performance $166MM pro forma sales, +64% volume growth Shipped doses (in thousands) |

|

|

Patient-Centric Growth Strategy Facilitate timely, unencumbered patient access to therapy Collaborate with patient and provider community Focus on patient outcomes |

|

|

Patient-Centric Growth Strategy Facilitate timely, unencumbered access to therapy Milestones: >50% of patients now referred through proprietary Makena Care Connection support center Significant progress made with key commercial payers and state Medicaid programs (removing reimbursement barriers) e.g., South Carolina Medicaid 45 compounding pharmacies now dispensing Makena (+10 since Lumara Health transaction closed) |

|

|

Patient-Centric Growth Strategy Collaborate with patient and provider community Milestones: Investment in new field-based medical affairs team in 2015 Education on guidelines, risk factors and costs/complications of preterm birth Formed independent external Publications Committee of leading KOLs Strong presence at last week’s SMFM Annual Pregnancy Meeting More than 2,500 leading maternal-fetal medicine specialists in attendance |

|

|

Patient-Centric Growth Strategy Focus on patient outcomes Milestones: Launch of adherence/persistency program in 2Q15 Improve upon current 13.5 average injections/patient Line extensions/lifecycle management January 2015 FDA meeting: Regulatory advice on additional lifecycle management/line extension projects Introduction of single-dose vial |

|

|

Makena® Single-Dose Vial FIRST LINE EXTENSION Application filed: 4Q14 Decision expected: 2Q15 Potential launch1: Mid-2015 NEW! Customer-friendly configuration Reduces some reimbursement challenges of multi-dose vial Offers a preservative-free option for patients Offers new flexibility with both 5- dose and single-dose vials remaining available Improved efficiency for patient access programs Helps support patient compliance Single-dose vials1 5-dose vial 1 If regulatory approval is received |

|

|

Feraheme |

|

|

Feraheme: 1–2–3 1 GRAM | 2 DOSES | 3 DAYS APART WHY IRON THERAPY IS IMPORTANT Iron is a critical factor in the production of red blood cells 4.5 million Americans diagnosed and suffering from IDA Daily oral iron is first line therapy for most IDA patients Many patients fail oral iron therapy – compliance, efficacy and/ or side effects (constipation, GI upset) ATTRIBUTE FERAHEME ONE-GRAM DOSE Dosing1 Schedule: 2 x 510 mg doses Delivery2: 15 min. infusion or IV injection Regimen (1 g): 2 treatments, 3 to 8 days apart Observation Period: 30 minutes post dosing Feraheme Indication: Feraheme ® (ferumoxytol) Injection for Intravenous (IV) use is indicated for the treatment of iron deficiency anemia in adult patients with chronic kidney disease. Feraheme is contraindicated in patients with known hypersensitivity to Feraheme or any of its components. For full prescribing information, please visit www.feraheme.com. 1One gram of IV iron is the usual therapeutic course and that which was studied in the Feraheme clinical trials 2Revisions to administration procedure under review and discussion with the FDA |

|

|

Strong Quarterly Growth: Ex-factory net sales1 (in millions) 4Q14 vs. 4Q13 17% Growth1 (+12% volume, +5% price) 1 Excludes the impact of favorable changes in estimates made to product returns and Medicaid reserves in 2014 and 2013 2014 Sales Performance1 $85MM annual sales +19% growth (12% volume; 7% price) |

|

|

Regulatory Update: Rienso & Feraheme Rienso – EU; Feraheme – Canada 4Q14 – Entered into agreement with Takeda to regain worldwide marketing rights EU 1Q15 – Takeda (in collaboration with AMAG) withdrew Type II Variation in the EU following feedback that approval was unlikely Currently evaluating commercial viability with CKD-only indication and costs to remain on market 2014 sales of <$0.5MM Considering product withdrawal and future re-submission for broad IDA label with additional data Canada 2H15 – Health Canada expected to render a final decision on IDA label supplement Transfer of marketing authorization to take place in 2015 Feraheme – U.S. U.S. Feraheme label changes 2Q14 – Proposed changes to FDA to strengthen warnings and precautions 1Q15 – FDA responded and notified company of additional proposed changes AMAG plans to work with the FDA to finalize an updated Feraheme label U.S. broad IDA label Awaiting feedback from FDA regarding study design submitted to FDA in 2014 Determine potential path forward |

|

|

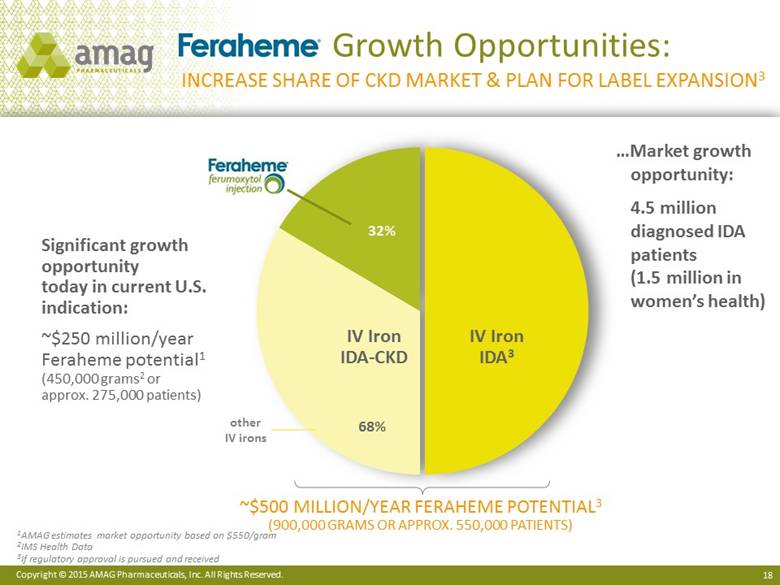

Growth Opportunities: INCREASE SHARE OF CKD MARKET & PLAN FOR LABEL EXPANSION3 32% 1AMAG estimates market opportunity based on $550/gram 2IMS Health Data 3 If regulatory approval is pursued and received ~$500 MILLION/YEAR FERAHEME POTENTIAL3 (900,000 GRAMS OR APPROX. 550,000 PATIENTS) IV Iron IDA3 68% IV Iron IDA-CKD Significant growth opportunity today in current U.S. indication: ~$250 million/year Feraheme potential1 (450,000 grams2 or approx. 275,000 patients) other IV irons Market growth opportunity: 4.5 million diagnosed IDA patients (1.5 million in women’s health) |

|

|

Future Expansion Opportunities |

|

|

Reformulation and drug delivery technologies Expanding Product Portfolio Filed/ Under Regulatory Review Marketed Dosing Market Drugs Oral mucositis/stomatitis and other types of oral wounds Indication Reduces the risk of recurrent preterm birth in certain at-risk women 5 mL vial US 510mg vial Iron deficiency anemia (IDA) in adult patients with chronic kidney disease (CKD) US/EU/ Canada 510mg vial All adult patients with IDA who have failed oral iron 1 mL vial preservative-free US US US Maternal Health Anemia Management Cancer Supportive Care In development US1/EU2/ Canada2 8 oz bottle 1 sNDA submitted December 2012; CRL received January 2014; awaiting feedback on study design to generate additional safety data 2 Ferumoxytol is sold under the trade name RiensoTM in the EU and under the trade name Feraheme in Canada; approval of label expansion unlikely without additional data |

|

|

CHANNEL Clinic-based and specialty Hospital products Buy and bill products Sophisticated contracting and reimbursement skills Business Development Targeting Strategy CRITERIA & CONSIDERATIONS HIGH-PRIORITY BD TARGETS ATTRACTIVE MARKET FUNDAMENTALS STRATEGIC FIT ACTIONABLE THERAPEUTIC Maternal and neonatal health Hematology/oncology Nephrology Orphan indications FINANCIAL Revenue-generating commercial products Products with IP runway Late-stage development assets with significant growth potential |

|

|

AMAG: Positioned for Accelerated Growth 1If regulatory approval is pursued and received 2Total debt divided by EBITDA Feraheme (CKD) MuGard Makena Product 4 Product 5 Feraheme (IDA1) Past Present (2015) Future Products and Sales Single product Three products Diversified Portfolio <20% growth >200% growth Strong CAGR One therapeutic area Commercial asset Two therapeutic areas Commercial assets Two+ therapeutic areas Commercial and mature late-stage development assets Gross Margin ~80% >90% Significant gross margins EBITDA Margin Negative >50% Sustained growth in EBITDA Cash Flows Significant cash burn +$150MM Significant cash generation Leverage Ratio2 --- Beginning: ~3.7x Ending: <2.0x TBD |

|

|

Financial Update |

|

|

Fourth Quarter 2014 Results 1Includes $1.8MM favorable changes in estimated product return reserves 2Net income in 4Q14 includes $153 million tax benefit recognized as a result of Lumara Health transaction 3See slide 28 for non-GAAP adjusted EBITDA reconciliation ($ in millions) 4Q13 (unaudited) 4Q14 (unaudited) U.S. Feraheme net sales $19.0 $24.11 Makena net sales -- $22.5 Total revenues $21.7 $53.3 Operating loss $(4.0) $(3.4) Net income / (loss) $(3.7) $143.02 Earnings per share (basic / diluted) $(0.17) / $(0.17) $5.98 / $4.67 Adjusted EBITDA3 $(2.8) $14.5 Ending cash and investments $213.8 $144.2 |

|

|

2015 Financial Guidance 12014 Makena sales recorded by AMAG represents sales from November 12, 2014 through December 31, 2014 (post acquisition period) 2See slides 28 and 29 for reconciliation of historical non-GAAP adjusted EBITDA and forecasted non-GAAP adjusted EBITDA and cash earnings, respectively ($ in millions) 2014 RESULTS (unaudited) 2015 GUIDANCE Makena net sales $22.5 1 $245–$270 Feraheme and MuGard net sales $87.5 $90–$105 Total product sales $110.0 $335–$375 Total revenue $124.4 $380–$420 Adjusted EBITDA2 $14.3 $180–$200 Cash earnings2 --- $150–$170 |

|

|

2015 Goals BUILDING A HIGH-GROWTH SPEC PHARMA COMPANY Drive significant (+200%) sales growth across AMAG’s diversified product portfolio Makena Feraheme MuGard® Mucoadhesive Oral Wound Rinse Establish profitability with adjusted EBITDA margin on product sales in excess of 50% Continue to execute on Makena multi-pronged line extension/lifecycle management program, including potential 1mL approval and launch Determine potential path forward for Feraheme for the broad IDA indication in the U.S. with input from the FDA Further expand the company’s product portfolio through acquisition or in-licensing of specialty pharmaceutical products or companies |

|

|

AMAG Pharmaceuticals 4Q14Financial Results February 9, 2015 |

|

|

Adjusted EBITDA Reconciliation ($ in millions) Q4 2013 (UNAUDITED) Q4 2014 (UNAUDITED) 2013 (UNAUDITED) 2014 (UNAUDITED) GAAP Net income $(3.7) $143.0 $(9.6) $135.8 Add – depreciation & amortization of intangibles $0.3 $1.5 $3.2 $2.1 Add – interest expense, net $(0.3) $6.8 $(1.1) $13.5 Less – income tax benefit ---- $(153.2) ---- $(153.2) EBITDA $(3.7) $(1.9) $(7.5) $(1.8) Less – non-cash collaboration revenue $(2.0) $(2.3) $(8.0) $(8.2) Add – non-cash inventory step-up ---- $4.8 ---- $4.8 Add – stock compensation $2.1 $2.4 $8.0 $8.6 Add – adjustment to contingent consideration $0.8 $1.9 $1.1 $(0.6) Add – severance & transaction related costs ---- $9.6 $0.8 $11.5 Adjusted EBITDA $(2.8) $14.5 $(5.6) $14.3 |

|

|

2015 Financial Guidance: ADJUSTED EBITDA AND CASH EARNINGS RECONCILIATION ($ in millions) 2015 GUIDANCE GAAP Net income $95 – $105 Add – depreciation and amortization of intangibles $50 – $55 Add – interest expense, net $40 EBITDA $185 – $200 Less – non-cash collaboration revenue $(41) – $(42) Add – non-cash inventory step-up $10 – $12 Add – stock compensation $12 – $14 Add – adjustment to contingent consideration $15 – $16 Add – severance and restructuring $2 – $3 Adjusted EBITDA $180 – $200 Less – cash interest expense $(30) Cash earnings $150 – $170 |