Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ACELRX PHARMACEUTICALS INC | d867188d8k.htm |

February

2015 Exhibit 99.1 |

Forward

Looking Statements 2

This presentation contains forward-looking statements, including, but not limited to,

statements related to future financial results, potential proceeds under the Grunenthal

agreement, the process and timing of anticipated future development of AcelRx’s product

candidates, including Zalviso, the NDA submission and the CRL, the Type A meeting held with

the FDA to discuss the CRL, AcelRx’s

plans

to

address

the

issues

raised

in

the

CRL,

and

anticipated

resubmission

of

the

Zalviso

NDA

to

the

FDA,

including

the scope

of the resubmission and the timing of the resubmission and FDA review time, the impact, if

any, of the FDA’s review of the amendments to the Zalviso NDA that were not

previously reviewed, planned initiation of the Phase 3 clinical trial for ARX-04,

and the therapeutic and commercial potential of AcelRx Pharmaceuticals' product

candidates, including Zalviso. These forward-looking statements are based on AcelRx

Pharmaceuticals' current expectations and inherently involve significant risks and uncertainties.

AcelRx Pharmaceuticals' actual results and the timing of events could differ materially from

those anticipated in such forward-looking statements as a result of these risks and

uncertainties, which include, without limitation, risks related to: AcelRx Pharmaceuticals'

ability to receive regulatory approval for Zalviso; any delays or inability to obtain and

maintain regulatory approval of its product candidates, including Zalviso, in the

United States and Europe; AcelRx's ability to build an effective commercial organization; its ability

to receive any milestones or royalty payments under the Grunenthal agreement; its ability to

obtain sufficient financing to commercialize Zalviso and proceed with clinical

development of ARX-04; the success, cost and timing of all product development

activities and clinical trials, including the planned Phase 3 ARX-04 trial; the market

potential for its product candidates; the accuracy of AcelRx’s estimates regarding

expenses, capital requirements and needs for financing; and other risks detailed in the "Risk Factors" and

elsewhere

in

AcelRx

Pharmaceuticals'

U.S.

Securities

and

Exchange

Commission

filings

and

reports,

including

its

Quarterly

Report

on

Form 10-Q filed with the SEC on November 10, 2014. AcelRx Pharmaceuticals undertakes no

duty or obligation to update any forward- looking statements contained in this

release as a result of new information, future events or changes in its expectations. |

3

AcelRx–Working to Improve Acute Pain Management

Zalviso

TM

profile from Phase 3 studies

Efficacy: Demonstrated in two placebo controlled studies, 1 active

comparator study Adverse

events:

Most

common

related

AE’s

were

nausea,

vomiting,

O

2

desaturation,

itching

High patient satisfaction and nurse ease of care reported

Grünenthal partnership to commercialize Zalviso in EU & Australia established

Upcoming regulatory catalysts in US and EU

US:

NDA

resubmission

targeted

Q1

2015

EU:

Day

120

submission

planned

for

Q1

2015

Strong balance sheet with $75 million cash on hand December 31, 2014

(unaudited)

Terms:

$250M

upfront

and

potential

milestones,

mid-teens

to

mid-twenties

%

royalty

Other

Territories:

Continue

to

seek

additional

partnerships

in

Asia

&

South

America

CE

Mark:

Received

December

2014

MAA filed in Switzerland |

4

AcelRx Update Q1 2015

Zalviso resubmission

•

Received FDA comments on bench testing

•

•

•

–

Healthy volunteers study completed

at risk, testing successful

–

Post-op

patient

study

initiated

Zalviso EU Day 120 Response

•

•

•

Expected submission in Q1

ARX-04

•

Discussion with DoD continues, funding

targeted for H1 2015

•

Pivotal Phase 3 study to be initiated in Q1

without DoD funding

Bench testing initiated, anticipated

completion end of February

Awaiting FDA comments on Human

Factors protocol

Proposed HF study to FDA in two

populations: healthy volunteers, post-op

patients

All questions to be addressed and in

process of preparing a response

CE mark approved and to be included

as part of response |

Major items in

CRL: System errors were noted in the clinical setting at a single digit rate

Did not appear to impact Phase 3 safety and efficacy results

Improvements have been made to reduce error rate

Formal bench testing in process to confirm error rate reduction

15 misplaced tablets of ~30,000 doses

IFU modified to address this issue

HF studies underway to confirm IFU/GUI changes are adequate

Data to be provided to support 24 month dating

5

Zalviso NDA Status-CRL received July 25, 2014

Demonstration of a reduction in the incidence of system errors

Changes

to

the

Instructions

for

Use

(IFU)

to

address

inadvertent

dosing

Support for shelf life (not approvability issue) |

Proposed

Indication: Management of Moderate to Severe In-Hospital Acute Pain

Investigational drug and delivery system not FDA approved for commercial use

6

Clinical Data |

Invasive route

of delivery IV infiltration causes analgesic gaps

IV connection restricts patient mobility

Risk of IV site infection

Programming errors

1/9 harmful hospital errors due to IV PCA

2

IV PCA –

Current Standard of Care

7

In-hospital, post-operative

moderate to severe pain control

Higher Patient satisfaction when

patients control their own pain

IV-PCA

1.

FDA

/

AAMI

Summit

Meeting

held

October

2010;

http://www.aami.org/infusionsummit/AAMI_FDA_Summit_Report.pdf

2.

Calculated from “The rate and costs attributable to intravenous patient-controlled

analgesia errors.” Brian Meissner et al, Hospital Pharmacy April 2009

Infusion pumps large source of morbidity /

mortality

1 |

Zalviso:

Leveraging Sufentanil High Therapeutic Index Opioid

In animal studies

High Lipophilicity

6 minute brain:plasma equilibration

No active metabolites

OPIOID

THERAPEUTIC

INDEX

Morphine

71

1

Hydromorphone

232

2

Fentanyl

277

1

Sufentanil

26,716

1

8

Sublingual Sufentanil Delivery

May reduce IV peaks & troughs

Small size may minimize swallowed drug

May result in high bioavailability

Helps with goal of consistent dose

delivery

Supplied in cartridge of 40 Tablets

2 days for average patient

1. Mather, Clin Exp Pharmacol Physiol 1995; 22:833.

2. Kumar, Eur J Pharmacol 2008; 597:39 (ED50) and Purdue Pharma MSDS, 2009

(LD50) Enables rapid transmucosal uptake

|

9

9

Zalviso: Delivery Device Design and Feature Set

Non-invasive (sublingual) delivery

Eliminates IV infection risk

May enhance ambulation

Pre-programmed delivery

Factory set 20-minute lockout period

Addresses end-user programming

error risk

Design safety features

Set-up tablet, RFID cartridge provides full inventory loop tracking of sufentanil

tablets RFID thumb tag co-located to device helps reduce proxy dosing

HCP controlled access, device tether reduces risk of product loss

Battery power ensures 72-hour function even in the event of power outage

Investigational drug and delivery system not FDA

approved for commercial use |

Zalviso

Phase 3 Program 10

Surgery Type

Study

Type

Sites

N

Data

Primary

Endpoint

Results

Abdominal &

Orthopedic

Surgery (IAP309)

Open-label,

Active-comparator

1

o

EP: Patient Global

Assessment of Method of

Pain Control over 48 hrs

26

359

1:1

Nov

2012

Zalviso

non-inferior to IV PCA

(p<0.001)

Zalviso

also demonstrates

superiority

to IV

PCA

(p=0.007)

Abdominal

Surgery (IAP310)

Double-blind,

Placebo-controlled

1

o

EP:Sum of Pain Intensity

Difference over 48 hrs

13

178

2:1

Mar

2013

Sufentanil treatment

superior to placebo

p=0.001

Orthopedic

Surgery (IAP311)

Double-blind,

Placebo-controlled

1

o

EP:Sum of Pain Intensity

Difference over 48 hrs

34

426

3:1

May

2013

Sufentanil treatment

superior to placebo

p<0.001 |

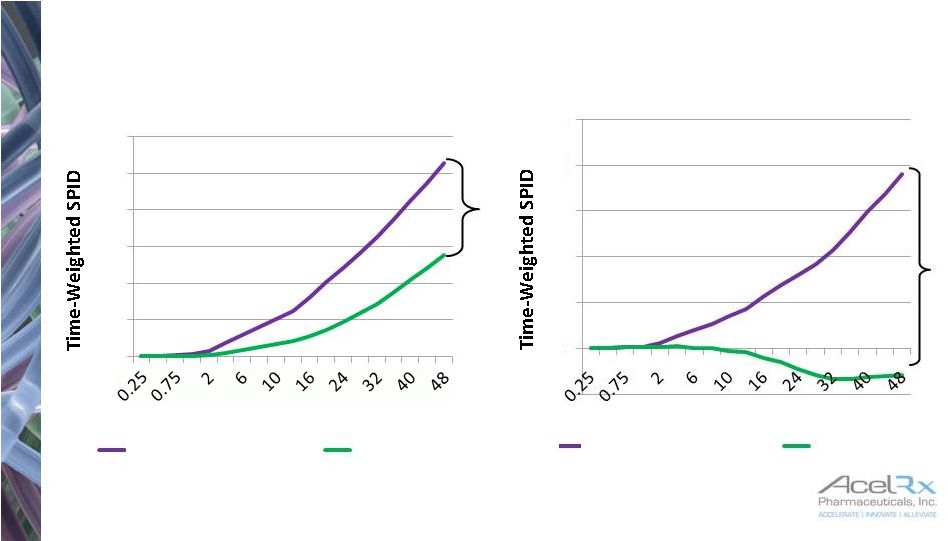

IAP310

& IAP311 Primary Endpoint: SPID-48 –

ITT Population

11

p=0.001

p<0.001

Time (hrs)

Time (hrs)

Zalviso

Zalviso

0

20

40

60

80

100

120

IAP 310 –

Abdominal

Placebo

-20

0

20

40

60

80

100

IAP 311 -

Orthopedic

Placebo |

12

Time from first dose of study drug (hours)

Zalviso: Studies Indicate Rapid Ability to Control

Moderate to Severe Acute Pain

0

1

2

3

0

0.25

0.5

0.75

1

2

3

4

5

6

Zalviso 309

Zalviso 310

Zalviso 311

IV PCA MS 309 |

Adverse

Reactions >2% in Placebo Studies 13

* Significantly Different between Zalviso and Placebo (p<0.05)

Possibly or Probably

Related Adverse Reactions

Zalviso

N=429

Placebo

N=162

Nausea

29.4%

22.4%

Vomiting

8.9%

4.9%

Oxygen Saturation Decreased

6.1%

2.5%

Itching*

4.7%

0%

Dizziness

4.4%

1.2%

Constipation

3.7%

0.6%

Headache

3.3%

3.7%

Insomnia

3.3%

1.9%

Hypotension

3.0%

1.2%

Confusional State

2.1%

0.6% |

Proposed

Indication: Management of Moderate to Severe In-Hospital Acute Pain

Investigational drug and delivery system not FDA approved for commercial use

14

Commercial Opportunity |

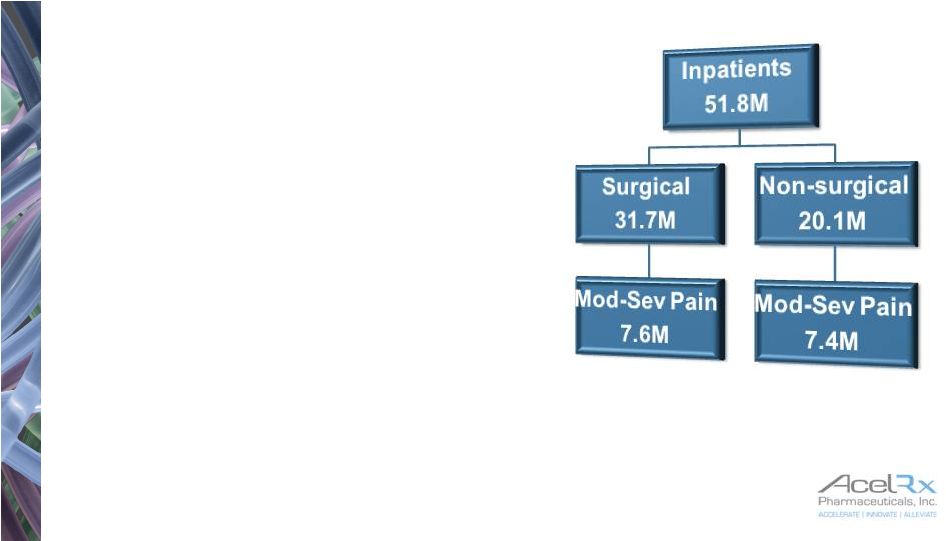

Target

Market Potential 15

1.

Rosetta, 2009 Inpatient sample

2.

Decision Resources, Pain Management Study, Acute Pain, October 2014

•

The potential market for Zalviso is defined as:

•

Acute moderate-to-severe pain population

in the hospital setting

•

Includes post-operative as well as

non-surgical pain

•

The market size for Zalviso is characterized by

hospital in-patient sampling that demonstrates

15M

patients

annually

1

•

7.6M patients post-op

•

7.4M patients non post-op

2013

U.S.

Acute

Pain

Market

$6.7B

2

•

43% of which represents post-op pain

•

20% of which represents other acute pain (non post-op)

1 |

Anticipated Formulary Adoption after FDA Approval

Earliest –

2 Months; Typical –

8-10 Months

16

42% Very Likely to

Approve

42% Quite Likely to

Approve

16% Early Approval

Unlikely

might be swayed by

additional,

independent clinical

literature

assume product

expensive, might

accept favorable

cost-benefit analysis

looking for relevant

experts to champion

the product

unsure of cost,

looking for favorable

cost-benefit analysis

convinced by the

clinical benefit

demonstrated

assume ability to

demonstrate

economic benefit or

set cost aside

ZS Associates Qualitative Survey Among 45 P&T Committee Members, Fall 2013, sponsored by

AcelRx Pharmaceuticals, Inc. |

Strong

Positive Reaction to Zalviso Clinical Profile Market

Research

Among

Hospital

Specialists

(n=244)

Predicted Zalviso Share of Procedural Volume

* Size of bubble is

representative of size of Zalviso

opportunity in Specialty

0

10%

20%

30%

40%

50%

60%

17

Orthopedic Surgeons

Cardiothoracic

Surgeons

General Surgeons

Hospitalist

Anesthesiologist

OB / GYN

1. ZS Associates Quantitative Survey Among Hospital Specialists, Winter 2013, sponsored by

AcelRx Pharmaceuticals, Inc.

1 |

Current

Cost of IV PCA 18

Data from Premier Database, 2010-12

Data for post surgical pain management

involving IV PCA in total knee/hip

replacement and abdominal surgery

Costs for pumps, tubing, carrier saline and

drug range from $200-240 for 2 days

Zalviso may add value:

Addresses programming errors

Elimination of PCA IV site infection risk

Supports early ambulation

Enhanced patient satisfaction

1.

COST OF INTRAVENEOUS PATIENT-CONTROLLED ANALGESIA (IV PCA) EQUIPMENT AND OPIOID MEDICATION

FOR ORTHOPEDIC AND ABDOMINAL SURGERIES IN US HOSPITALS 0

50

100

150

200

250

300

Opioids via PCA/ Other

Tubing / Carrier Saline

IVPCA / Carrier Infusion Pump

Total Knee

Total Hip

Abdominal

Xiang (Jay) Ji, MS, Jennifer Stephens, PharmD, Pamela Palmer, MD, PhD.

Poster presented at ISPOR meeting, June 2014 |

US

Customer-focused Organization Planned Build 80%

of relevant procedure

volume

identified

in

top

1,400

accounts

65 sales territories planned

Estimated cost/rep $250K

Estimated salesforce cost

around $16.5M per annum

19

Medical

Affairs

8 MSL’s in place

Commercial

7 RBD’s (6 hired)

65 Account

Managers to be

hired |

20

Zalviso Publication Strategy

Peer Reviewed Manuscripts in Process

A Phase 3 Study of a Sufentanil Sublingual Microtablet System for the Management of

Postoperative Pain Following

Major

Orthopedic

Surgery

(IAP-311

Primary);

Anesthesiology

-

Submitted

Peer-Reviewed Manuscripts Available

Cost of Opioid Intravenous Patient-controlled Analgesia: Results From a Hospital Database

Analysis and Literature Assessment.

(Palmer et al.)

Clinicoeconomics and Outcomes Research

www.dovepress.com/getfile.php?fileID=20509

Pharmacokinetics of Sublingual Sufentanil Tablets and Efficacy and Safety in the Management of

Postoperative

Pain

(Minkowitz

et

al.)

Reg

Anesth

Pain

Med

2013;38:

131-139.

Sufentanil Sublingual Microtablet System versus Intravenous Patient-Controlled Analgesia

with Morphine for Postoperative

Pain

Control:

A

Randomized,

Controlled

Trial

(IAP309

Primary);

Pain

Practice;

http://onlinelibrary.wiley.com/doi/10.1111/papr.12238/full

•

A Phase 3 Study of Sufentanil Sublingual Microtablet System for the Management of Postoperative

Pain Following

Open

Abdominal

Surgery

(IAP-310

Primary);

Reg

Anesth

Pain

Med

–

http://journals.lww.com/rapm/Abstract/onlinefirst/Sufentanil_Sublingual_Tablet_System_for_the.99572.aspx

|

Investigating

Moderate to Severe acute pain treatment in medically supervised settings

Investigational drug and delivery system not FDA approved for commercial use

21

ARX-04

HCP Administered

Single 30mcg dose

Sufentanil Tablet |

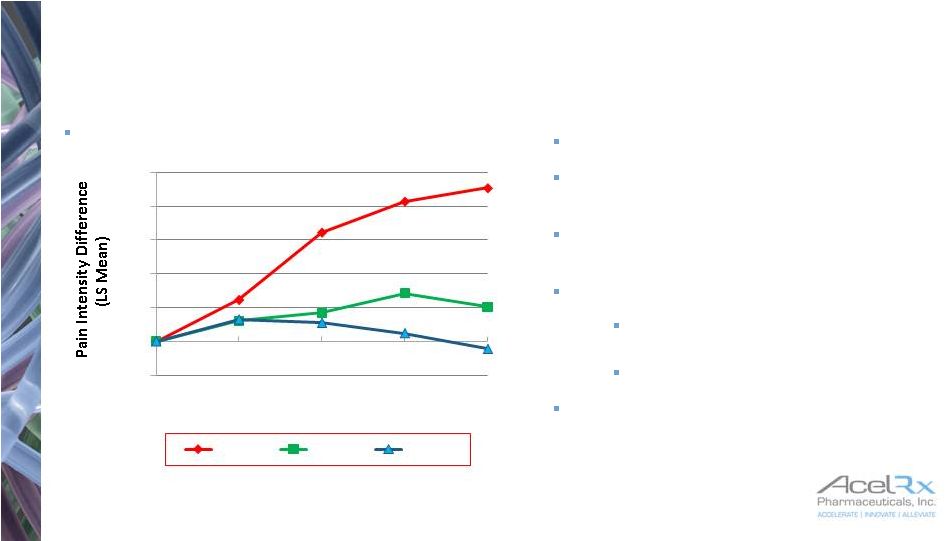

ARX-04 –

Short Term Acute Pain Management

22

End of Phase 2 Meeting held Dec. ‘13

505(b)(2) submission

500 patient safety database ,

100 multiple dose, 400 single dose

Single & repeat dose PK study -

completed

Phase 3 placebo-controlled study

Abdominal surgery, SPID-12

primary, follow for 48 hours

Results expected H2 2015

Small safety study in ER patients

planned -

results expected H2 2015

Will count as pivotal trial

-0.5

0

0.5

1

1.5

2

2.5

0

15

30

45

60

Minutes after Dose

30 mcg

20 mcg

placebo

*

**

**

*p<0.01

**p<0.001

Successful Phase 2 Bunionectomy Study |

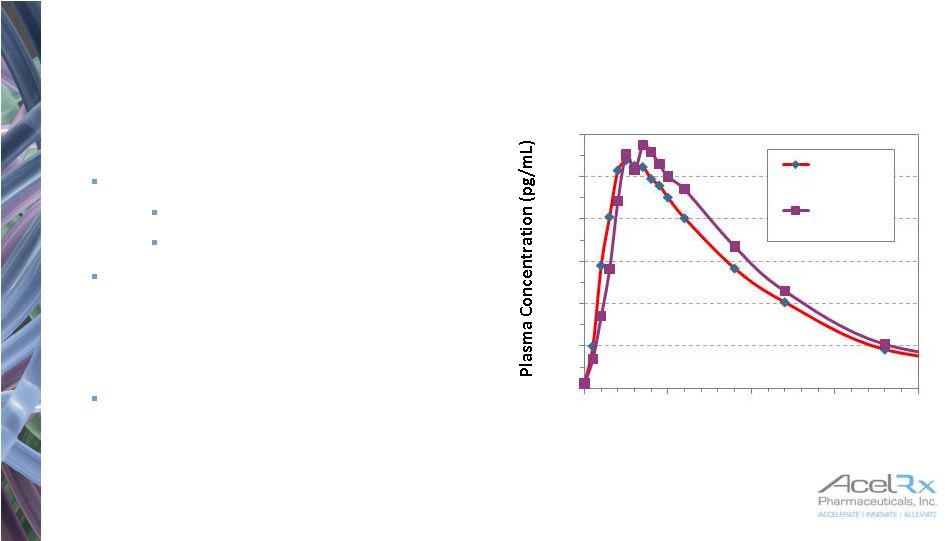

ARX-04 –

PK Study Results

23

Demonstration of Bioequivalence of

2 x 15 mcg and 1 x 30 mcg sublingual

sufentanil tablets

Bioavailability:

30 mcg 57.6%

2 x 15 mcg 60.9%

Proposed to FDA that demonstration

of bioequivalence for 2 x 15mcg

dosed 20 mins apart and single

30mcg dose would enable use of

Zalviso database to support ARX-04

In Phase 3 Zalviso studies, 323

patients dosed at t=0 and between

t=20-25mins later

0.0

10.0

20.0

30.0

40.0

50.0

60.0

0

100

200

300

400

Time (minutes)

One 30 mcg

tablet

2 x 15 mcg

tablet

BA for 30 mcg 57.6%

BA for 2 x 15 mcg 60.9% |

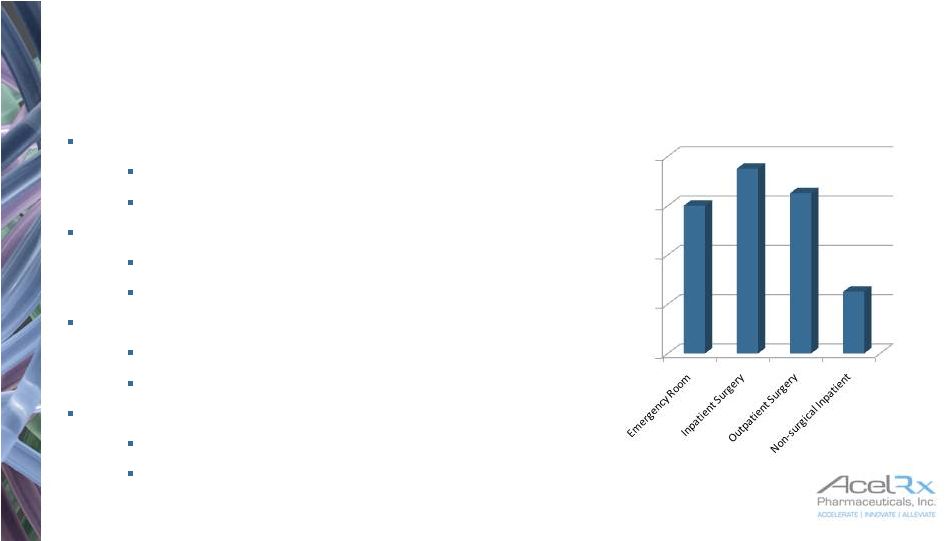

ARX-04 –

Commercial Opportunity

24

Market Research Suggests Broad Opportunity in

Moderate to Severe Acute Pain*

ER Department

51MM patients annually

2 doses per patient on average

Inpatient Surgery

8MM patients annually

2-9 doses per patient

Outpatient Surgery

13MM patients annually

3 doses per patient on average

Non-surgical Acute Pain

4MM patients annually

8 doses per patient on average

ZS Associates US Opportunity Sizing, September 2014; Includes only patients 18+ years of age.

Sponsored by AcelRx Pharmaceuticals, Inc.

0%

20%

40%

60%

80%

Physician Stated Share |

25

Scientific Conference Schedule -

2015

Minimally Invasive Surgery Symposium (MISS)

February 25-28; Las Vegas, NV –

poster presentation (ARX-

04)

American Academy of Orthopedic Surgeons (AAOS)

March 24-28; Las Vegas, NV –

Booth & Symposium

American Society of Peri-Anesthesia Nurses (ASPAN)

April

26-30;

San

Antonio,

TX

–

Booth

&

Symposium

American Congress of Obstetricians (ACOG)

May

2-6;

San

Francisco

–

Booth

&

Symposium

International Conference on Emergency Medicine (ICEM)

American Society of Pain Management Nursing

(ASPMN)

September

16-19;

Atlanta,

GA

–

Booth

&

Symposium

American College of Surgeons (ACS)

October

4-8;

Chicago,

IL

–

Booth

&

Symposium

American Society of Anesthesiologists (ASA)

October

24-28;

San

Diego,

CA

–

Booth

&

Symposium

American Society of Regional Anesthesia and Pain

Management (ASRA)

November 19-21; Miami, FL –

1 Booth & Symposium

American Society of Health System Pharmacists (ASHP)

December 6-10; New Orleans, LA –

Booth &

Symposium

May

11-12;

Montreal,

Quebec

–

Podium

Presentation

(ARX-04)

February 25-28; Las Vegas, NV –

poster presentation

(ARX-04) |

Financial Summary

26

Cash position at September 30, 2014: $85 million

$10 million drawn June 2014 under debt facility

$5 million received August 2014 from Grünenthal for MAA submission

Currently available cash resources fund operations through launch

Assumes timely regulatory approval of Zalviso in the US in 2015

Supports execution of all planned US pre-commercial launch efforts

Q3 2014 cash usage of ~$12 million

Headcount at December 31, 2014: 50

Cash balance December 31, 2014 $75 million (unaudited)

44 million shares outstanding at December 31, 2014 |

Future

Catalysts 27

Event

Timing

120 day question response to Zalviso

MAA review

Q1 2015

Zalviso NDA resubmission (pending protocol approval)

Q1 2015

ARX-04 DOD

contract finalized

H1 2015

Zalviso NDA decision

Q3 2015

Zalviso

MAA decision

Q3 2015

ARX-04 Phase

3 data

H2 2015 |

28

AcelRx–Working

to

Improve

Acute

Pain

Management

Zalviso

TM

profile from Phase 3 studies

Efficacy: Demonstrated in two placebo controlled studies, 1 active

comparator study Adverse

events:

Most

common

related

AE’s

were

nausea,

vomiting,

O

2

desaturation,

itching

High patient satisfaction and nurse ease of care reported

Grünenthal partnership to commercialize Zalviso in EU & Australia established

Upcoming regulatory catalysts in US and EU

US:

NDA

resubmission

targeted

Q1

2015

EU:

Day

120

submission

planned

for

Q1

2015

Strong balance sheet with $75 million cash on hand December 31, 2014

(unaudited)

MAA

filed

in

Switzerland

CE

Mark:

Received

December

2014

Other

Territories:

Continue

to

seek

additional

partnerships

in

Asia,

South

America

Terms:

$250M

upfront

and

potential

milestones,

mid-teens

to

mid-twenties

%

royalty |