Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Pioneer PE Holding LLC | d866648d8k.htm |

| EX-99.3 - EX-99.3 - Pioneer PE Holding LLC | d866648dex993.htm |

| EX-99.1 - EX-99.1 - Pioneer PE Holding LLC | d866648dex991.htm |

Investor Presentation

February 2015

Exhibit 99.2 |

2

Forward Looking Statements and Cautionary Statements

Forward-Looking Statements The information in

this presentation includes “forward-looking statements” that are made pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995. All

statements, other than statements of historical fact included in this presentation, regarding our

strategy, future operations, financial position, estimated revenues and losses, projected costs,

prospects, plans and objectives of management are forward-looking statements. When used in this

presentation, the words “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project” and

similar expressions are intended to identify forward-looking statements, although not all

forward-looking statements contain such identifying words. These forward-looking statements are based on

Parsley Energy, Inc.’s (“Parsley Energy,” “Parsley,” or the

“Company”) current expectations and assumptions about future events and are based on currently available information as to the outcome

and timing of future events. We caution you that these forward-looking statements are subject to

all of the risks and uncertainties, most of which are difficult to predict and many of which are beyond

our control, incident to the exploration for and development, production, gathering and sale of oil

and natural gas. These risks include, but are not limited to, commodity price volatility, inflation, lack

of availability of drilling and production equipment and services, environmental risks, drilling and

other operating risks, regulatory changes, the uncertainty inherent in estimating reserves and in

projecting future rates of production, cash flow and access to capital, the timing of development

expenditures and the risk factors discussed in or referenced in the prospectus prepared in

connection with this offering.

You are cautioned not to place undue reliance on any forward-looking statements, which speak only

as of the date of this presentation. Except as otherwise required by applicable law, we disclaim

any duty to update any forward-looking statements, all of which are expressly qualified by the

statements in this section, to reflect events or circumstances after the date of this presentation.

Our production forecasts and expectations for future periods are dependent upon many assumptions,

including estimates of production decline rates from existing wells and the undertaking and

outcome of future drilling activity, which may be affected by significant commodity price declines or

drilling cost increases. Industry and Market Data

This presentation has been prepared by Parsley and includes market data and other statistical

information from third-party sources, including independent industry publications, government

publications or other published independent sources. Although Parsley believes these third-party

sources are reliable as of their respective dates, Parsley has not independently verified the

accuracy or completeness of this information. Some data are also based on the Parsley’s good

faith estimates, which are derived from its review of internal sources as well as the third-party

sources described above.

Oil & Gas Reserves This presentation

provides disclosure of the Parsley’s proved reserves, which are those quantities of oil and gas, which, by analysis of geoscience and engineering data, can be estimated with

reasonable certainty to be economically producible—from a given date forward, from known

reservoirs, and under existing economic conditions (using unweighted average 12-month first day of

the month prices), operating methods, and government regulations—prior to the time at which

contracts providing the right to operate expire, unless evidence indicates that renewal is reasonably

certain, regardless of whether deterministic or probabilistic methods are used for the estimation.

In this presentation, proved reserves attributable to Parsley as of 12/31/14 are estimated utilizing

SEC reserve recognition standards and pricing assumptions based on SEC pricing of $91.48 / bbl

crude, $4.35 / mmbtu gas, and adjusted realized pricing of $85.99 / bbl crude, $35.27 / bbl NGL, and

$4.281 / mcf residue gas. References to our estimated proved reserves as of 12/31/14 are

derived from our proved reserve report (the “NSAI Report”) prepared by Netherland, Sewell

& Associates, Inc. (“NSAI”). PV-10 would be $717 million if based on internal estimates at realized

pricing of NYMEX strip prices on 1/29/2015.

We may use the term “expected ultimate recoveries” (“EURs”) or other descriptions

of volumes of reserves, which terms include quantities of oil and gas that may not meet the SEC’s definitions of

proved, probable and possible reserves, and which the SEC's guidelines strictly prohibit Parsley from

including in filings with the SEC. Unless otherwise stated in this presentation, such estimates

have been prepared internally by our engineers and management without review by independent engineers.

These estimates are by their nature more speculative than estimates of proved, probable and

possible reserves and accordingly are subject to substantially greater risk of being actually realized, particularly in areas or zones where there has been limited or no drilling history.

We include these estimates to demonstrate what we believe to be the potential for future drilling and

production by the company. Actual locations drilled and quantities that may be ultimately

recovered from our properties will differ substantially. In addition, we have made no commitment to

drill all of the drilling locations. Ultimate recoveries will be dependent upon numerous factors

including actual encountered geological conditions, the impact of future oil and gas pricing,

exploration and development costs, and our future drilling decisions and budgets based upon our future

evaluation of risk, returns and the availability of capital and, in many areas, the outcome of

negotiation of drilling arrangements with holders of adjacent or fractional interest leases. Our estimates

may change significantly as development of our properties provide additional data and therefore actual

quantities that may ultimately be recovered will likely differ from these estimates. Our related

expectations for future periods are dependent upon many assumptions, including estimates of production

decline rates from existing wells, the undertaking and outcome of future drilling activity and

activity that may be affected by significant commodity price declines or drilling cost increases.

|

3

Surface

Effective

(6)

Midland Basin Core

49,504

221,604

Midland Basin Tier 1

30,131

149,204

Midland Basin Other

26,474

----------

Total Midland Basin

106,109

370,808

S. Delaware Basin

30,238

----------

Total Permian Basin

136,347

370,808

Parsley Energy Overview

NYSE Symbol: PE

Market Cap: $2,484 MM

(1)

Net Debt: $395 MM

(2)

Enterprise Value: $2,879 MM

(3)

Pro Forma Net Acreage

(5)

Market Snapshot

Premier Acreage Position

Investment Highlights

4Q14 Production: 18.2 MBoe/d

Proved Reserves: 91 MMBoe

(4)

Horizontal well productivity among best in Midland Basin

Compelling well economics even with depressed oil prices

Recent acquisitions enhance premier asset base, now with 1,800+

horizontal drilling locations in the heart of Midland Basin

Disciplined capital allocation optimizes returns and financial strength, while

also providing significant growth

Value upside from downspacing, de-risking of additional formations, and

promising S. Delaware exploratory program

(1) Based on 2/5/2015 closing price and pro forma for common stock offering priced

2/6/2015 (2) As of 12/31/2014 pro forma for $224 MM of net proceeds

from common stock offering priced 2/6/2015 (3) Based on market cap as of 2/5/2015 and net debt as of

12/31/2014, both pro forma for common stock offering priced 2/6/2015. (4) Per NSAI

12/31/14 reserve report. (5) As of end of 4Q14 pro forma for acquisitions.

(6) Includes the following intervals: Spraberry, Wolfcamp A, B, and C, Cline, and Atoka.

Production and Reserves

•

Liquids: 77%

•

Proved Developed: 51%

•

Midland Basin Core: 85%

—

Peak 30-day IP per 1,000’

of 197 Boe/d in Core acreage

—

690 MBoe EUR type curve indicates 20% ROR at NYMEX strip

pricing; 20% cost reductions would increase ROR to more than 30%

—

Actual production has meaningfully exceeded the front end of the

type curve, enhancing returns

—

Efficient 2015 spending plan, with estimated production up 30% Y/Y

to 18.0-19.0 MBoe/d on estimated capex of $225-250 MM

—

Ample pro forma liquidity of $519 MM at end of 4Q14 based on

committed

portion

($365

MM)

of

$562

MM

borrowing

base

(2)

—

Significantly hedged, with 94% and 126% of estimated 2015 oil

production hedged in 2015 and 2016, respectively |

4

2015 Capital Program –

Flexible and Efficient

Efficient spending plan with Y/Y average and exit to exit

production growth on sharply reduced capital budget

Estimated capex of $225-$250 million, representing less than

50% of 2014 capital expenditures

Expect to average 3 horizontal rigs in 2015

—

Shape of activity to reflect anticipated uplift in returns

driven by lower service costs

2 horizontal rigs on average in 1H15

4 horizontal rigs on average in 2H15

—

Expect to complete 30-35 gross horizontal wells with

average working interest of 90%+

—

High-grading drilling program, with approximately 85% of

capex targeted for Core acreage and approximately 80-

90% of planned wells targeting the Wolfcamp B formation

To hold acreage, plan to operate 1 vertical rig on an as-needed

basis

—

Expect to complete 18-22 gross vertical wells with

average working interest of 90%+

Able to ramp up or slow down as macro and cost environment

warrant

—

Current plan generates significant momentum heading

into 2016

Estimated 2015 Capex Mix

2015 Capital Program Overview

10% Vt.

75% Hz.

Drilling &

Completion

~85%

Facilities &

Other

~15%

Midland

Basin Core

~85%

Midland

Basin Tier I

~15%

Capital Discipline

Horizontal Drilling Program

Vertical Drilling Program

Flexibility |

5

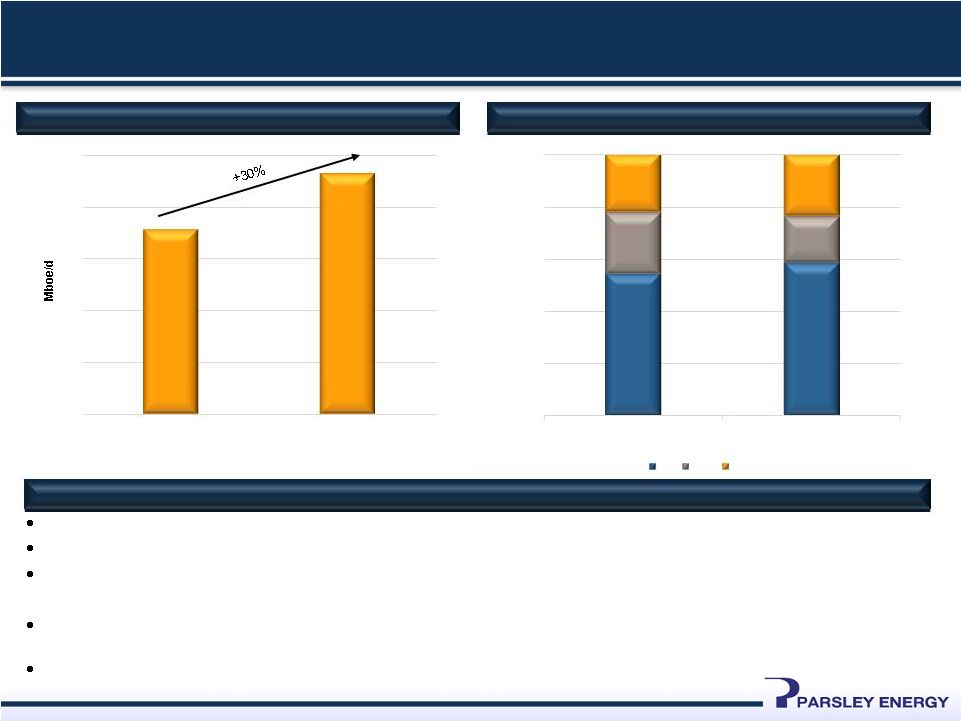

Efficient Production Growth with Improving Margins

Estimated production between 18.0 and 19.0 MBoe/d, up from 14.2 MBoe/d in

2014 30% Y/Y production growth at midpoint of guidance range

After weather-related disruptions in January, production back to pre-storm

level —

Most

recent

7-day

average

production

greater

than

20

MBoe/d

(1/23/15

–

1/29/15)

Relatively shallow decline rate from legacy vertical production and robust

productivity from new horizontal wells supports production growth profile in

2015 and beyond Mix shift toward oil

Estimated Y/Y Production Growth

Estimated 2015 Production Mix

2015 Production Profile

0

4

8

12

16

20

2014

2015E

0%

20%

40%

60%

80%

100%

2014

2015E

Oil

Gas

NGL |

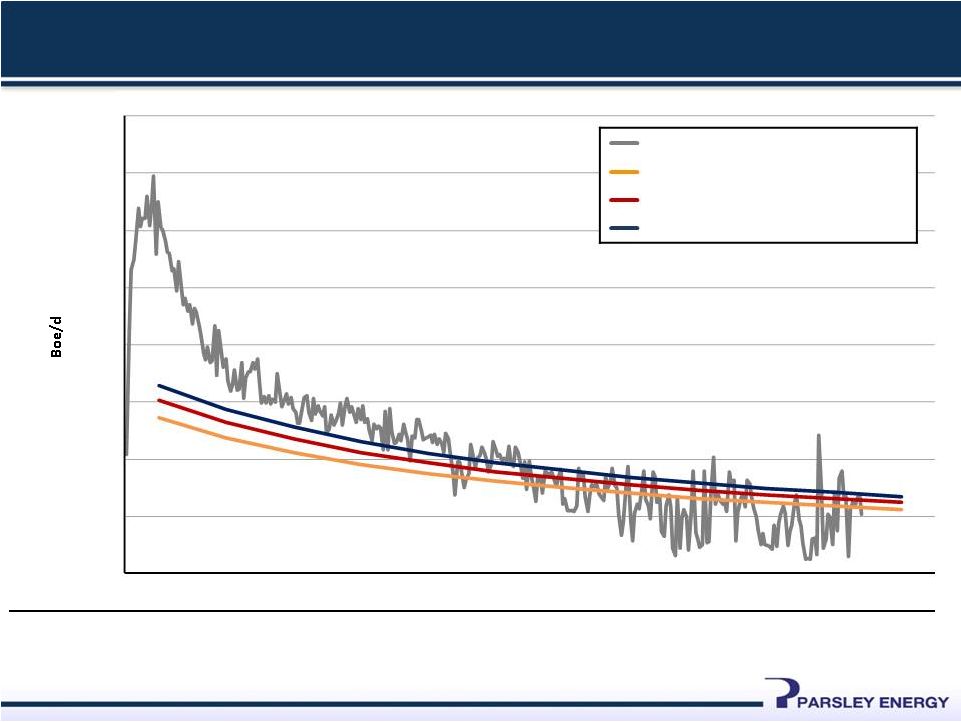

Highly

Productive Horizontal Wells 6

Months

1

2

3

4

5

6

7

8

9

10

11

12

Well Count

in PE Average

20

18

14

12

9

6

5

4

3

2

1

0

0

200

400

600

800

1,000

1,200

1,400

1,600

PE Average Horizontal Well Production

(1)

690 MBoe EUR Type Curve

(2)

10% EUR Increase: 760 MBoe

20% EUR Increase: 830 MBoe

(1) Normalized to 7,000’ stimulated lateral and for downtime of 24 hours or more. (2) Derived from public well data

as of 10/14; see slide 21 for additional information. |

7

Attractive Well Economics Become More Compelling with Service Cost

Declines and EUR Improvement

690 MBoe EUR Type Curve

Rate of Return Sensitivity to D&C Costs

Type Well Assumption

10% EUR Increase: 760 MBoe

Rate of Return Sensitivity to D&C Costs

20% EUR Increase: 830 MBoe

Rate of Return Sensitivity to D&C Costs

7

Pricing

Oil: $49.03 -

$66.13

Gas: $2.81 -

$3.82

NGL: 40% of Oil Price

Lateral Length

D&C Cost

LOE

—

Gas: $3.50

—

NGL: 40% of Oil Price

—

Varies with Sensitivity

—

7,000’

stimulated interval

—

100% WI

—

75% NRI

Strip Pricing (1/29/2015)

$5.8 MM -

$7.2MM

—

$7,500 / Month Fixed

—

$2.00 / BO / Month

Variable

Interest |

8

Bolt-on Acquisitions Enhance Premier Asset Base

Transaction Summary

Midland Basin Position and Acquisition

Closed on 8,450 net acres, primarily in Reagan County, for $139 million

Bolt-on assets in heart of Horizontal Focus Area

Based on offset results, anticipate attractive well economics on

acquired properties even at depressed commodity prices

100% operated, 73% HBP, with 75% NRI and average working interest

of 91%

Full rights to Wolfcamp and below across acquired acreage

Adds 199 net horizontal locations

to drilling inventory

(191 Core; 8 Tier 1)

(1)

Average stimulated lateral length of approximately 6,300’

Core: approximately 6,400’

Tier 1: approximately 4,500’

Adds 410 net vertical locations to drilling inventory

(1) Acquired location count assumes recently approved 330’ offset from lease line and 660’

between well spacing. |

Acquired

Properties Surrounded by Strong Wells (1) Liquids % based on the period for

which the 30-day IP is presented. 9

Horizontal well productivity

among best in Midland Basin

Lower drilling costs in Tier 1

enhance returns

Stimulated

Number of

Peak 24-hr IP

Peak 30-day IP

Peak 30-day IP

Number

Well Name

County

Well Zone

Lateral Length

Stages

(Boe/d)

(Boe/d)

per 1,000' Lateral

% Liquids

(1)

Core

1

Dusek 45-1HB

Upton

Wolfcamp B

9,061

39

2,044

1,592

176

92

2

Shackelford 7-1HB

Upton

Wolfcamp B

4,571

21

1,441

796

174

91

3

Dusek 44-1HB

Upton

Wolfcamp B

4,697

22

1,569

1,063

226

91

4

Shackelford 7-2HB

Upton

Wolfcamp B

4,874

21

1,134

878

180

89

5

Skaggs 8-2HB

Upton

Wolfcamp B

4,799

22

1,351

992

207

92

7

Elwood 16-21-1HB

Upton

Wolfcamp B

7,645

37

1,750

1,525

199

92

9

Mary 18-1HB

Upton

Wolfcamp B

4,681

24

1,399

992

212

92

10

JRS Farms 24BC-1HB

Upton

Wolfcamp B

4,637

25

1,255

974

210

92

13

Dusek 44-1HA

Upton

Wolfcamp A

4,968

25

1,269

921

185

90

Average

197

91

Tier 1

6

Char Hughes 1HB

Reagan

Wolfcamp B

5,785

28

1,262

891

154

92

8

Char Hughes 2HB

Reagan

Wolfcamp B

5,879

29

1,036

879

150

91

11

Tucker 166-1HB

Reagan

Wolfcamp B

4,515

25

1,312

956

212

88

12

Tucker 166-2HB

Reagan

Wolfcamp B

4,489

27

1,023

804

179

89

Average

174

90 |

10

Strong Liquidity Position Enhances Flexibility

Strong balance sheet to fund drilling plan through 2016,

with $519 million of pro forma liquidity based on

committed portion of borrowing base

—

Pro forma cash of $154 million as of December 31,

2014

—

Undrawn borrowing base of $562 million with a

current commitment of $365 million

Estimated 2015 development capex of $225-$250

million

Plenty of room to accelerate heading into 2016

Favorable maturity schedule, with 7.5% senior notes not

due until 2022

Pro

Forma

Liquidity

(1)

Favorable Debt Maturity Schedule

($ millions)

First lien borrowing base

$562

Committed portion of borrowing base

$365

Pro Forma Cash

154

Total liquidity

$519

(2)

7.50% Senior Notes

$0

$400

$600

2014

2015

2016

2017

2018

2019

2020

2021

2022

Senior Credit Facility -

Borrowing Base

$562

$550

$200

Note: Revolver and cash balances as of 12/31/14. (1) Pro forma for $224 million

net proceeds from common stock offering priced 2/6/2015; assumes all proceeds used to pay down first lien revolver.

(2) Parsley has chosen to limit the lenders’ aggregate commitment to $365 million. |

Capturing Hedge Value

Capture unrealized value of hedge position in depressed oil price

environment while retaining upside exposure to improving oil prices

Focused on 2H15 and 2016 given the possibility of additional near-

term downside in the oil market

Turned

unrealized

gains

into

$49

million

of

cash

net

of

the

cost

of

entering new contracts with lower strike prices

Total barrels hedged unchanged:

—

94% and 126% of estimated 2015 oil production hedged in

2015 and 2016, respectively

Original long put

Original short put

New long put

New short put

Strategy

Benefits

Illustration of Rolled Position

11

$49 million of

realized value

(with additional

upside potential)

$40

$50

$60

$70

$80

$90

Q3-15

Q4-15

Q1-16

Q2-16

Q3-16

Q4-16

Original position

New position

Parsley monetized a portion of its hedge value by “rolling” future positions to lower put

spreads |

12

Oil Hedge Position

Oil Positions

(1) When NYMEX price is above call price, PE receives call price. When NYMEX price

is between put price and call price, PE receives NYMEX price. When NYMEX price is between the put price and the

short put price, PE receives put price. When NYMEX price is below the short put

price, PE receives NYMEX price plus the difference between the short put price and put price.

1Q15

2Q15

3Q15

4Q15

1Q16

2Q16

3Q16

4Q16

1Q17

2Q17

Put Spreads (Bbl/day)

5,222

6,264

7,826

10,272

10,989

12,198

14,185

15,326

Put Price ($/Bbl)

$77.29

$77.76

$66.35

$55.00

$55.00

$55.00

$60.17

$59.79

Short Put Price ($/Bbl)

$57.77

$58.16

$50.10

$40.00

$40.00

$40.00

$45.17

$44.79

4,000

3,462

3,424

2,120

2,418

1,648

3,333

3,297

Call Price ($/Bbl)

$113.75

$112.86

$112.86

$114.62

$116.82

$120.00

$115.00

$115.00

Put Price ($/Bbl)

$84.03

$83.10

$83.10

$85.00

$85.00

$85.00

$80.00

$80.00

Short Put Price ($/Bbl)

$62.22

$65.00

$65.00

$65.00

$65.00

$65.00

$60.00

$60.00

Total barrels per day hedged

9,222

9,725

11,250

12,391

13,407

13,846

14,185

15,326

3,333

3,297

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Three

Way

Collars

(1)

(Bbl/day)

$80.21

$79.66

$71.45

$60.13

$60.41

$58.57

$60.17

$59.79

$80.00

$80.00

$0

$10

$20

$30

$40

$50

$60

$70

$80

$90

$100

0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

Q1-15

Q2-15

Q3-15

Q4-15

Q1-16

Q2-16

Q3-16

Q4-16

Q1-17

Q2-17

Bbls/d Hedged

Weighted Average Long Put Price |

13

Gas Hedge Position

Natural Gas Positions

(1) When NYMEX price is above call price, PE receives call price. When NYMEX price

is between put price and call price, PE receives NYMEX price. When NYMEX price is between the put price and the

short put price, PE receives put price. When NYMEX price is below the short put

price, PE receives NYMEX price plus the difference between the short put price and put price.

1Q15

2Q15

3Q15

4Q15

Three Way Collars

(1)

(MMBtu/day)

10,000

9,890

9,783

9,783

Call Price ($/MMBtu)

$5.25

$5.25

$5.25

$5.25

Put Price ($/MMBtu)

$4.50

$4.50

$4.50

$4.50

Short Put Price ($/MMBtu)

$3.75

$3.75

$3.75

$3.75

Total MMbtu per day hedged

10,000

9,890

9,783

9,783

$4.50

$4.50

$4.50

$4.50

$0.00

$0.50

$1.00

$1.50

$2.00

$2.50

$3.00

$3.50

$4.00

$4.50

$5.00

0

2,000

4,000

6,000

8,000

10,000

12,000

Q1-15

Q2-15

Q3-15

Q4-15

MMBtu/d

Weighted Average Long Put Price |

14

Substantial Reserve Growth

Reserve summary, as of 12/31/14, prepared by Netherland, Sewell & Associates,

Inc. (“NSAI”) Drillbit

F&D

of

$19.68/Boe

(1)

Reserves up 66% Y/Y

PDP up 126% Y/Y

PV-10 up 79% Y/Y

Net Proved Reserves

Proved Reserves Allocation

1P PV-10

Oil (Mbbls)

Nat Gas (Mmcf)

NGL (Mbbls)

Total (Mboe)

PV-10 ($MM)

(2)

PDP

23,368

64,829

11,370

45,543

$928

PDNP

179

655

121

409

$7

PUD

24,070

58,161

11,176

44,939

$379

Total Proved

47,617

123,645

22,667

90,891

$1,314

PDP

50%

PDNP

1%

PUD

49%

Liquids

77%

Gas

23%

PDP

71%

PDNP

0%

PUD

29%

(1) Drillbit F&D is defined as expected 2014 development capital cost divided by the sum of

extensions and discoveries and revisions of previous estimates. Revisions of previous estimates include negative

14 MMBoe of reserves associated with reduced vertical well activity over next

five years, and 0.3 MMBoe of pricing revisions. (2) As of 12/31/14; based on SEC pricing of $91.48 / bbl crude, $4.35 / mmbtu gas, and adjusted

realized pricing of $85.99 / bbl crude, $35.27 / bbl NGL, and $4.281 / mcf residue gas. PV-10 of the

Company’s total proved reserves would be $717 million if based on

internal estimates at realized pricing of NYMEX strip prices on 1/29/2015.

|

15

Promising Southern Delaware Exploration Program

Parsley’s acreage position in the Coyanosa sub-basin, within the Southern

Delaware Basin, has Pennsylvanian-aged rocks in the oil window

Stacked pay potential from Bone Spring down through the Woodford

3 vertical well exploratory program

W

E

Drilling

Testing

Testing

6,000’

7,000’

8,000’

9,000’

10,000’

11,000’

12,000’

16,000’

13,000’

14,000’

15,000’

1 mile

A’

A

Trees Ranch Cross Section

52 Square Mile Proprietary 3D Seismic Data Shoot

Wolfcamp Structure Map

TD early due to

excess

pressure

27-1

–

Successful

Penn

oil

test

–

producing

from

Wolfcamp/Penn;

future

tests

in Bone Spring

47-1 –

Wolfcamp/Penn test at facility constrained rates of 350+ Bo/d and 650+

Mcf/d; successful Woodford oil test; future tests in Bone Spring

17-1 –

TD’d in Mississippian.

No drilling locations have been booked in the area

Proprietary 3D seismic survey confirms limited geohazards across majority of

acreage

position

|

Appendix |

17

Premier Acreage Position

Of Parsley’s 49,000+ net acres in the Core area,

approximately 98% are located in the Company’s Horizontal

Focus Area

Strong well results from Parsley and others throughout the

Horizontal Focus Area

Net Surface Acreage

Core

Tier 1

Total

49,504

30,131

79,634

Net Effective Acreage

Core

Tier 1

Total

Lower Spraberry

14,603

16,553

31,156

Wolfcamp A

34,550

26,604

61,154

Wolfcamp B

37,022

26,604

63,626

Wolfcamp C

37,188

26,604

63,792

Cline

49,147

26,604

75,751

Atoka

49,095

26,235

75,329

(1) As of end 4Q14 pro forma for closed acquisitions.

Midland Basin Acreage Map

Midland

Basin

Pro

Forma

Acreage

(1)

Acreage Highlights

Total

221,604

149,204

370,808 |

18

Substantial Drilling Inventory

100% of Parsley’s Core area horizontal locations are located in the

Company’s Horizontal Focus Area

Potential upside from down-spacing:

Net Horizontal Undrilled Locations

Core

(2)

Tier 1

(3)

Total

(4)

Lower Spraberry

63

89

152

Wolfcamp A

175

121

296

Wolfcamp B

182

117

299

Wolfcamp C

197

123

320

Cline

228

118

346

Atoka

300

108

408

Midland Basin Drilling Inventory

Midland

Basin

Pro

Forma

Drilling

Inventory

(1)

Total

1,145

676

1,821

Inventory Highlights

No horizontal locations attributed to Midland Basin Other or Southern

Delaware acreage

Current

location

count

based

on

870’

spacing

(6 wells/section/zone), except 199 recently acquired locations based

on 330’

lease line offset and 660’

between well spacing

Net Vertical

Drilling

Locations

2,180

913

3,093

Additional

upside

with

wells

permitted

330’

from

lease

line

Downspaced development plan accommodates up to 15

wells/section/zone

(1) As of end 4Q14 pro forma for acquisitions.

(2) Average Core stimulated lateral length - 5,560 ft.

(3) Average Tier 1 stimulated lateral length - 4,930 ft.

(4) Average Core and Tier 1 stimulated lateral length - 5,326 ft.

|

19

Disclaimer

The Horizontal Type Curve was prepared by Parsley’s internal reserve engineers

by conducting a decline curve analysis of third party production data

submitted to the Texas Rail Road Commission for 106 horizontal wells drilled since 2011 in Reagan, Upton and Midland

counties. The Horizontal Type Curve is not based on Parsley production data and has

not been reviewed by Parsley’s independent reserve engineers. The

Horizontal Type Curve is subject to numerous limitations and may not be representative of the type curves or ultimate

recoveries achievable on Parsley’s Midland Basin horizontal drilling

inventory. For example: Investors are cautioned not to place undue reliance

on the Horizontal Type Curve. Parsley’s actual production results and ultimate recoveries

are likely to differ substantially.

Of the 106 wells utilized by Parsley in the decline curve analysis, 30 are located

in Upton County, 5 in Midland County and 71 in Reagan County. To date,

Parsley has drilled 20 horizontal wells (1 in Midland County, 12 in Upton County, 6 in Reagan County and 1 in Irion

County) and the majority of Parsley’s horizontal drilling locations are in

Upton and Reagan Counties, where there is even more limited third

party

production

data.

Parsley

cannot

make

assurances

that

the

type

curves

or

ultimate

recoveries

for

horizontal

wells

in

these

locations will be consistent with the Horizontal Type Curve.

The drilling and completion techniques (such as frac design, sand concentration,

lateral length and orientation) for the 106 wells used to calculate the

Horizontal Type Curve are unknown, and may differ significantly from the completion techniques used by Parsley,

which

could

cause

the

results

from

Parsley’s

horizontal

drilling

to

vary

materially

from

the

production

and

ultimate

recoveries

implied

by the Horizontal Type Curve.

For

periods

for

which

insufficient

production

data

is

available,

Parsley

estimated

the

decline

rates

by

utilizing

a

b-factor

of

1.3.

The

actual decline rates may vary significantly from the b-factor utilized in

Parsley’s estimates. The ultimate recoveries implied by the

Horizontal

type

Curve

may

be

overstated

if

the

average

decline

rate

on

Parsley’s

horizontal

wells

is

greater

than

the

rate

implied

by

the b-factor utilized in Parsley’s analysis.

The

historical

production

data

used

in

the

decline

curve

analysis

is

limited,

with

only

106

of

the

wells

having

production

data.

The

decline

curve

analysis

may

yield

different

results

as

more

wells

are

drilled

and

additional

production

data

is

gathered.

In

particular,

Parsley’s estimated decline rates for periods of longer than one year are

based on limited or no data and are therefore based on significant

assumptions and estimates. |