Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - Tronox Holdings plc | s000728x1_ex99-2.htm |

| 8-K - FORM 8-K - Tronox Holdings plc | s000728x1_8k.htm |

Exhibit 99.1

Tronox Announces Agreement to Acquire Alkali Chemicals from FMC Corporation February 4, 2015

Safe Harbor Statement Statements in this presentation that are not historical are forward - looking statements within the meaning of the safe harbor provisions of the U . S . Private Securities Litigation Reform Act of 1995 . These forward - looking statements are based upon management's current beliefs and expectations and are subject to uncertainty and changes in circumstances and contain words such as “believe,” “intend,” “expect,” and “anticipate” and include statements about expectations for the company’s operations, markets, products, services, financial results and other risk factors discussed in the company's filings with the Securities and Exchange Commission (SEC), including under the “ Risk Factors” section in our most recent Form 10 - K, our most recent Form 10 - Q and other SEC filings . Significant risks and uncertainties may relate to, but are not limited to, our expectations regarding the timing of the completion of the acquisition contemplated herein, which remains subject to regulatory approvals and other conditions, the expected benefits of this acquisition, including the realization of anticipated synergies and future financial performance, as well as financial, economic, competitive, environmental, political, legal regulatory and technological factors including, our access to unrestricted cash, compliance with our bank facility covenants, the price of our shares, general market conditions, our customers potentially reducing their demand for our products due to, among other things, the economic downturn, more competitive pricing from our competitors, increased supply from our competitors ; operating efficiencies and other benefits expected . Unless otherwise required by applicable laws, the company undertakes no obligation to update or revise any forward - looking statements, whether as a result of new information or future developments . 2

Transaction Overview • Tronox to acquire Alkali Chemicals from FMC Corporation for $ 1.64 billion in all - cash transaction • Funded through existing cash and ~$600 million debt pursuant to signed commitments from UBS Investment Bank, Credit Suisse and RBC Capital Markets • Accretive to Tronox EBITDA, free cash flow and earnings upon closing; expected to close in the first quarter of 2015 and subject to customary closing conditions • After tax cash synergies of more than $30 million in the first year growing to more than $60 million annually by year three, including utilization of Tronox’s U.S. tax attributes • Essentially 100% of Alkali Chemicals’ revenue booked in the U.S., enabling Tronox to utilize its U.S. tax attributes to offset Alkali Chemicals’ pre - tax income • Alkali Chemicals adds stability and has a history of consistently delivering strong operational and financial performance • Largest global producer of natural soda ash serving blue chip customers in the glass, detergent and chemical manufacturing industries • Alkali Chemicals will operate as a separate business unit and reporting segment • Creates leading inorganic chemicals company with enhanced scale, stability and financial strength well - positioned to pursue strategic growth initiatives 3

• Alkali Chemicals brings strong historical earnings profile and cash flow stability • Expected to be accretive to earnings, EBITDA and free cash flow upon closing – Expected to be approximately $0.50 accretive to EPS in the twelve months following closing – Estimated that Alkali Chemicals would have contributed ~$800 million of revenue for the full year 2014 – Expected to generate ~$130 million of incremental operating cash flow in the twelve months following closing with growth thereafter – After tax cash synergies of more than $30 million over the first year growing to more than $60 million annually by year three, including utilization of Tronox’s U.S. tax attributes • Purchase price multiple of 7.2x based on adjusted EBITDA upon capturing operational synergies; in addition, expected value of tax synergies not reflected in EBITDA is in excess of $300 million • Builds scale, financial strength and stability • Alkali Chemicals business profile is complementary to Tronox – mining operations , global market leadership positions and vertical integration to feedstock source • Diversifies our end markets and revenue base and increases participation in faster growing emerging market economies • Essentially 100 % of Alkali revenue booked in U.S., enabling us to utilize our U.S. tax attributes to offset Alkali’s pre - tax income • Integration risk minimal as business will operate on standalone basis 4 Strategic Rationale Chemicals & other Flat glass Container glass Detergent Distributor Other glass Alkali domestic soda ash volume breakdown by end use ( 2014E )

Alkali Chemicals Leading global position with sustaining structural cost advantage = stable margins, earnings and cash flow • Largest global producer of natural soda ash, accounting for ~25% of natural soda ash production ; natural soda ash made from mined and beneficiated trona ore • Blue chip customer base in glass, detergents and chemicals industries worldwide with volume largely contracted through 2016 • Operates world’s largest and low cost soda ash production facility and trona mine in Green River, WY; estimated current reserve life of mine exceeds 100 years • Natural soda ash has sustained structural cost advantage on a delivered basis relative to producers of synthetic soda ash Strong industry fundamentals • Soda ash industry has shown stable market demand and low risk of supply overhang for cost - advantaged producers • Global demand for natural soda ash currently exceeds available production; natural soda ash currently enjoys a favorable cost position relative to synthetic producers in export markets on a delivered cost basis • Domestic market works predominantly under long - term contracts with high level of visibility into forecast sales for 2015 and 2016 • Majority of export sales through ANSAC, a sales , marketing and distribution cooperative of 3 U.S. producers; optimizes logistical costs to international locations 5

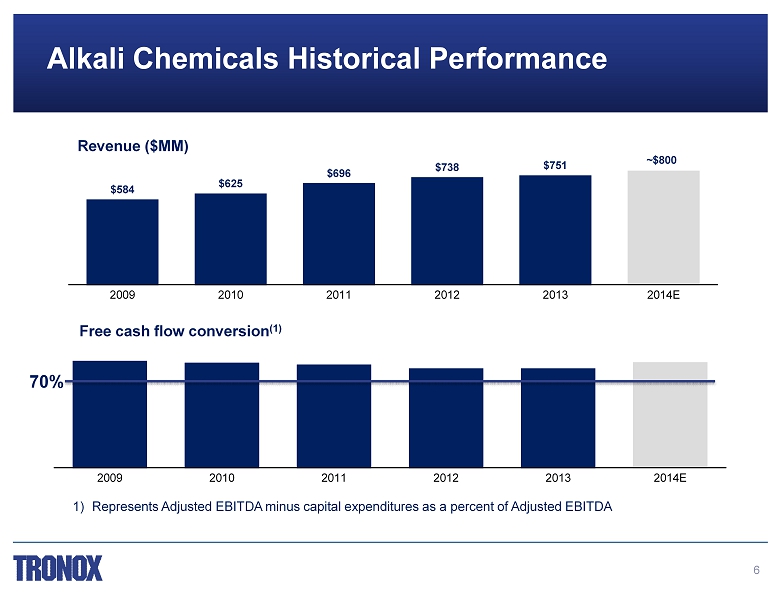

6 Free cash flow conversion (1) Revenue ($MM) $584 $625 $696 $738 $751 ~$800 2009 2010 2011 2012 2013 2014E 2009 2010 2011 2012 2013 2014E NA 1) Represents Adjusted EBITDA minus capital expenditures as a percent of Adjusted EBITDA Alkali Chemicals Historical Performance 70%

Pigments 44% Minerals 30% Soda Ash 19% Electrolytic 4% Specialty product 3% North America 57% APAC 22% EMEA 15% LATAM 6% 7 Tronox with Alkali Chemicals 2014E Pro Forma Revenue Composition – by Product 2014E Pro Forma Revenue Composition – by Geography

• $1.64 billion purchase price funded with existing cash reserves and debt pursuant to signed commitments – Combination of approximately $1.0 billion of available cash and approximately $600 million of new debt – New debt pursuant to signed commitments from UBS Investment Bank, Credit Suisse and RBC Capital Markets • Financing structure preserves liquidity – Company has adequate cash on hand and undrawn revolvers to meet the needs of the business – Company will retain approximately $200 million of cash on balance sheet and significant undrawn capacity under revolving credit facilities – Tronox places a high value on maintaining its existing credit ratings and believes that the attractive deleveraging profile of the combined entity will reduce the net leverage ratio to less than 4.0x in 12 - 15 months • Capital structure will provide flexibility to Tronox to pursue strategic growth initiatives – Increased scale, stability and diversity and improved financial profile will enhance our ability to pursue strategic growth initiatives – We will continue to be financially prudent in evaluating future opportunities and be focused on maintaining and improving existing credit rating 8 Financing

• Acquisition of Alkali Chemicals funded through existing cash and ~$600 million debt pursuant to signed commitments from UBS Investment Bank , Credit Suisse and RBC Capital Markets • Accretive to Tronox EBITDA , free cash flow and earnings upon closing; expected to close in the first quarter of 2015 and subject to customary closing conditions – Essentially 100% of Alkali Chemicals’ revenue booked in the U.S., enabling Tronox to utilize its U.S. tax attributes to offset Alkali Chemicals’ pre - tax income – Expected to be approximately $0.50 accretive to EPS in the twelve months following closing – Estimated that Alkali Chemicals would have contributed ~$800 million of revenue for the full year 2014 – Expected to generate ~$130 million of incremental operating cash flow in the twelve months following closing with growth thereafter – After tax cash synergies of more than $30 million over the first year growing to more than $60 million annually by year three, including utilization of Tronox’s U.S. tax attributes • Alkali Chemicals is low cost producer with sustaining cost advantage and history of consistently delivering strong operational and financial performance • Largest global producer of natural soda ash serving blue chip customers in the glass, detergent and chemical manufacturing end markets • Diversifies Tronox’s end markets and revenue base and increases participation in faster growing developing economies • Integration risk minimal as Alkali Chemicals will operate as separate business unit and reporting segment • Creates leading inorganic chemicals company with ~$2.6 billion sales with enhanced scale , stability and financial strength and ability to pursue strategic growth initiatives 9 Summary

Q&A Session www.tronox.com Green River, WY