Attached files

| file | filename |

|---|---|

| 8-K - COWEN CONFERENCE - MERCURY SYSTEMS INC | a8-k2015cowenconferencepre.htm |

© 2015 Mercury Systems, Inc. Cowen 36th Annual A&D Conference Mark Aslett President and CEO Gerry Haines Executive Vice President and CFO February 4, 2015

2 © 2015 Mercury Systems, Inc. Forward-looking safe harbor statement This presentation contains certain forward-looking statements, as that term is defined in the Private Securities Litigation Reform Act of 1995, including those relating to the products and services described herein. You can identify these statements by the use of the words “may,” “will,” “could,” “should,” “would,” “plans,” “expects,” “anticipates,” “continue,” “estimate,” “project,” “intend,” “likely,” “forecast,” “probable,” “potential,” and similar expressions. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those projected or anticipated. Such risks and uncertainties include, but are not limited to, continued funding of defense programs, the timing and amounts of such funding, general economic and business conditions, including unforeseen weakness in the Company’s markets, effects of continued geopolitical unrest and regional conflicts, competition, changes in technology and methods of marketing, delays in completing engineering and manufacturing programs, changes in customer order patterns, changes in product mix, continued success in technological advances and delivering technological innovations, changes in, or in the U.S. Government’s interpretation of, federal export control or procurement rules and regulations, market acceptance of the Company's products, shortages in components, production delays due to performance quality issues with outsourced components, inability to fully realize the expected benefits from acquisitions, divestitures and restructurings, or delays in realizing such benefits, challenges in integrating acquired businesses and achieving anticipated synergies, changes to export regulations, increases in tax rates, changes to generally accepted accounting principles, difficulties in retaining key employees and customers, unanticipated costs under fixed-price service and system integration engagements, and various other factors beyond our control. These risks and uncertainties also include such additional risk factors as are discussed in the Company's filings with the U.S. Securities and Exchange Commission, including its Annual Report on Form 10-K for the fiscal year ended June 30, 2015. The Company cautions readers not to place undue reliance upon any such forward-looking statements, which speak only as of the date made. The Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made. Use of Non-GAAP (Generally Accepted Accounting Principles) Financial Measures In addition to reporting financial results in accordance with generally accepted accounting principles, or GAAP, the Company provides adjusted EBITDA, which is a non-GAAP financial measure. Adjusted EBITDA excludes certain non-cash and other specified charges. The Company believes this non-GAAP financial measure is useful to help investors better understand its past financial performance and prospects for the future. However, the presentation of adjusted EBITDA is not meant to be considered in isolation or as a substitute for financial information provided in accordance with GAAP. Management believes the adjusted EBITDA financial measure assists in providing a more complete understanding of the Company’s underlying operational results and trends, and management uses this measure along with the corresponding GAAP financial measure to manage the Company’s business, to evaluate its performance compared to prior periods and the marketplace, and to establish operational goals. A reconciliation of GAAP to non-GAAP financial results discussed in this presentation is contained in the Appendix hereto.

3 © 2015 Mercury Systems, Inc. Commercial secure and sensor processing subsystems Introducing Mercury Systems • MRCY on NASDAQ 1998 • High tech company; commercial business model • Focused on Defense and Intelligence priorities • Deployed on ~300 programs with 25+ Prime contractors • FY14 $209M revenue Growth YoY: 7% revenue, 18% bookings, 28% backlog • FY15 guidance*: Revenue $228M-$236M, Adj. EBITDA $41M-$44M * The guidance included herein is as of January 27, 2015.

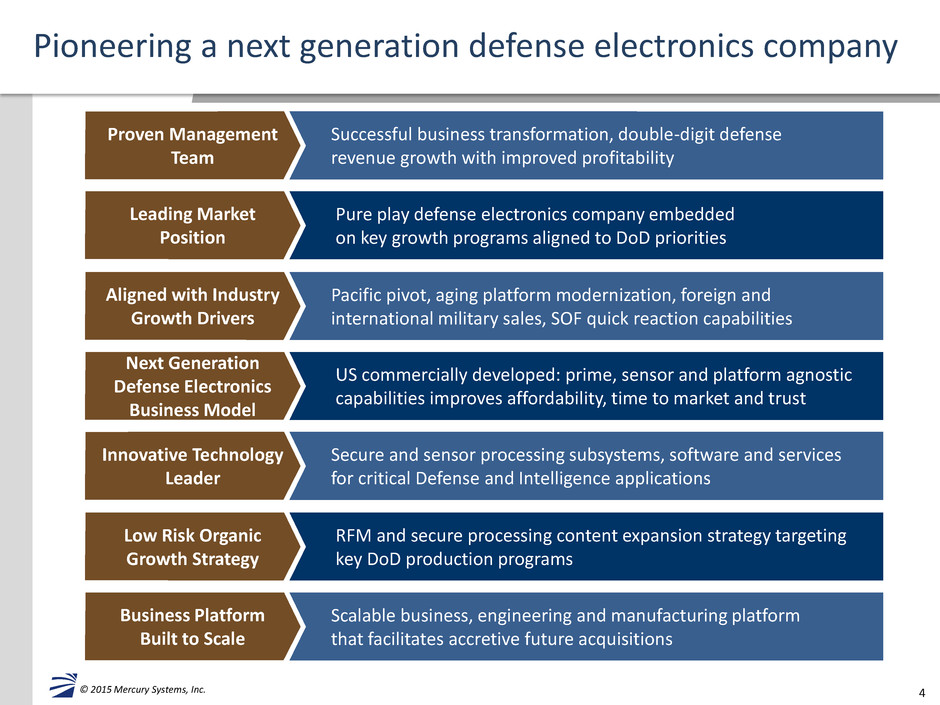

4 © 2015 Mercury Systems, Inc. Pioneering a next generation defense electronics company Successful business transformation, double-digit defense revenue growth with improved profitability Proven Management Team Pure play defense electronics company embedded on key growth programs aligned to DoD priorities Leading Market Position Pacific pivot, aging platform modernization, foreign and international military sales, SOF quick reaction capabilities Aligned with Industry Growth Drivers US commercially developed: prime, sensor and platform agnostic capabilities improves affordability, time to market and trust Next Generation Defense Electronics Business Model Secure and sensor processing subsystems, software and services for critical Defense and Intelligence applications Innovative Technology Leader RFM and secure processing content expansion strategy targeting key DoD production programs Low Risk Organic Growth Strategy Scalable business, engineering and manufacturing platform that facilitates accretive future acquisitions Business Platform Built to Scale

5 © 2015 Mercury Systems, Inc. Mercury’s vision is to be the… Leading high-tech commercial provider of more affordable secure and sensor processing subsystems designed and made in the USA

6 © 2015 Mercury Systems, Inc. Defense will likely remain a $500B+ industry… …despite the ongoing political and budget uncertainty Crowding Out of Defense Spending and Investment: Rising interest rates, healthcare and social spending; MilPer expense growth, aging military platforms’ O&M costs rising Defense Procurement Reform 3.0: Firm-fixed-price contracts and less government-funded R&D changing economics and competitive dynamics of defense industry Political Dysfunction: Sequestration-driven cuts and repeated Continuing Resolutions disrupting DoD budget process and spending

7 © 2015 Mercury Systems, Inc. • Continue to focus on improving affordability • Achieve dominant capabilities through innovation • Remove barriers to commercial technology utilization • Require platform open architectures • Commercial default for non-platform procurements • Separate components procurement from platform • Separate component ‘buy’ decisions from primes …while the Defense Business Board promotes continued procurement reform BBP 3.0 recommendations encourage innovation and affordability… Better Buy ing Pow er 3.0 DRAF T Achiev e Afford able Pr ograms • Con tinue to set and enforce afforda bility ca ps Achiev e Domi nant Ca pabilitie s While Contro lling Lif ecycle Costs • Stre ngthen and ex pand “s hould c ost” ba sed cos t manag ement • Bui ld stron ger par tnershi ps betw een the acquis ition, req uireme nts, and inte lligence commu nities • Ant icipate and pla n for res ponsive and em erging threats • Inst itutiona lize stro nger Do D level Long R ange R &D Plan ning Incentiv ize Pro ductivit y in Ind ustry a nd Gov ernmen t • Alig n profit ability m ore tigh tly with Depart ment g oals • Em ploy ap propria te cont ract typ es, but increase the use of ince ntive ty pe cont racts • Exp and the superi or supp lier ince ntive pro gram ac ross Do D • Incr ease ef fective use of P erforman ce-Bas ed Logi stics • Rem ove bar riers to comme rcial tec hnolog y utiliza tion • Imp rove th e return on inves tment i n DoD l aborator ies • Incr ease th e produ ctivity of IRAD a nd CR& D Incentiv ize Inno vation i n Indus try and Govern ment • Incr ease th e use of prototy ping an d exper imentat ion • Em phasize techno logy ins ertion a nd refres h in pro gram pl anning • Use Modula r Open System s Archi tecture to stim ulate in novatio n • Incr ease th e return on Sm all Bus iness In novatio n Rese arch (S BIR) • Pro vide dra ft techni cal requ iremen ts to ind ustry ea rly and involve industr y in fun ded con cept de finition to sup port req uireme nts definiti on • Pro vide cle ar “bes t value” definit ions so indust ry can p ropose and DoD ca n choo se wise ly Elimina te Unpr oductiv e Proce sses an d Burea ucracy • Em phasize Acquis ition Ex ecutive , Progra m Exec utive Officer and Pro gram M anager respon sibility, author ity, and accoun tability • Red uce cyc le times while e nsuring sound investm ents • Strea mline d ocume ntation require ments a nd staf f review s Promot e Effec tive Co mpetiti on • Crea te and mainta in comp etitive e nvironm ents • Imp rove te chnolo gy searc h and o utreach in glob al market s Improv e Tradec raft in A cquisiti on of S ervices • Incr ease sm all busi ness pa rticipat ion, inc luding more effectiv e use of market research • Stren gthen c ontract manag ement o utside t he norm al acquisi tion cha in • Imp rove req uireme nts def inition • Imp rove th e effect iveness a nd prod uctivity of cont racted enginee ring an d techni cal serv ices Improv e the P rofessi onalism of the T otal Ac quisitio n Work force • Est ablish hi gher st andards for key leader ship po sitions • Est ablish s tronger profess ional qu alificati on requ iremen ts for all a cquisiti on spec ialties • Stren gthen org anic en gineeri ng capa bilities • Ens ure the DOD le adersh ip for d evelopm ent pro grams is technic ally qua lified to manag e R&D activitie s • Imp rove ou r leader s’ abilit y to un derstan d and m itigate technic al risk • Incr ease Do D supp ort for Science , Techn ology, Engine ering an d Mathe matics (STEM) educat ion Achiev ing Dom inant Ca pabilitie s throu gh Tech nical Ex cellenc e and In novatio n Continu e Stren gthenin g Our C ulture o f: Cost Co nscious ness, Pr ofessio nalism, and Te chnical Excelle nce Sources: • Better Buying Power 3.0 Whitepaper, September 2014 • Defense Business Board Report, July 2014 (http://dbb.defense.gov/Meetings/MeetingJuly2014.aspx)

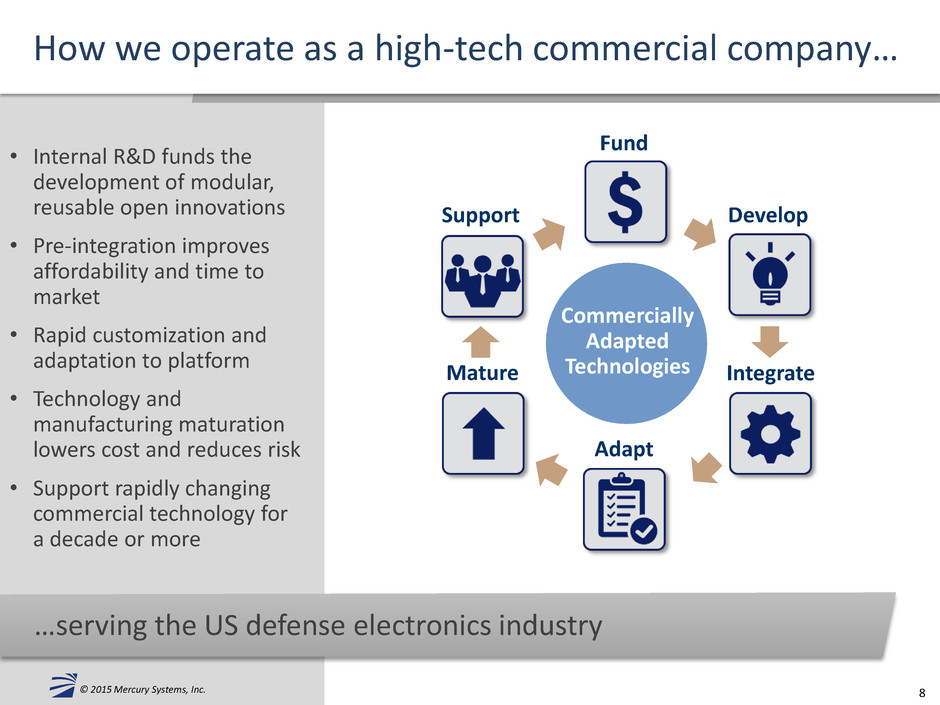

8 © 2015 Mercury Systems, Inc. …serving the US defense electronics industry How we operate as a high-tech commercial company… • Internal R&D funds the development of modular, reusable open innovations • Pre-integration improves affordability and time to market • Rapid customization and adaptation to platform • Technology and manufacturing maturation lowers cost and reduces risk • Support rapidly changing commercial technology for a decade or more Fund Develop Integrate Mature Support Adapt Commercially Adapted Technologies

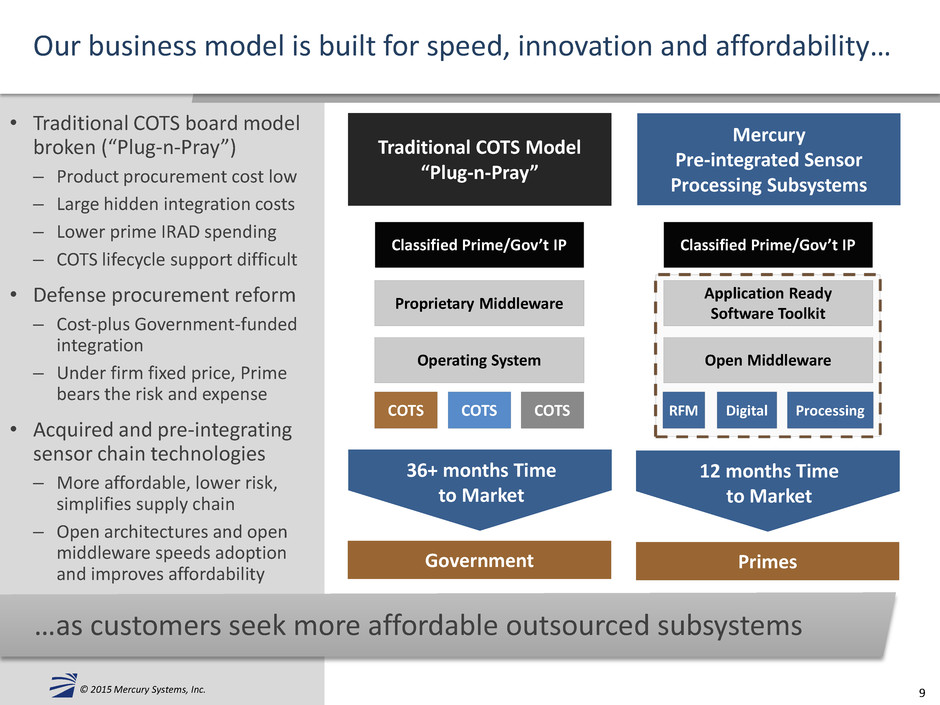

9 © 2015 Mercury Systems, Inc. …as customers seek more affordable outsourced subsystems Our business model is built for speed, innovation and affordability… • Traditional COTS board model broken (“Plug-n-Pray”) – Product procurement cost low – Large hidden integration costs – Lower prime IRAD spending – COTS lifecycle support difficult • Defense procurement reform – Cost-plus Government-funded integration – Under firm fixed price, Prime bears the risk and expense • Acquired and pre-integrating sensor chain technologies – More affordable, lower risk, simplifies supply chain – Open architectures and open middleware speeds adoption and improves affordability Primes RFM Digital Processing Mercury Pre-integrated Sensor Processing Subsystems Government Traditional COTS Model “Plug-n-Pray” Operating System COTS COTS COTS Proprietary Middleware Classified Prime/Gov’t IP 36+ months Time to Market 12 months Time to Market Open Middleware Application Ready Software Toolkit Classified Prime/Gov’t IP

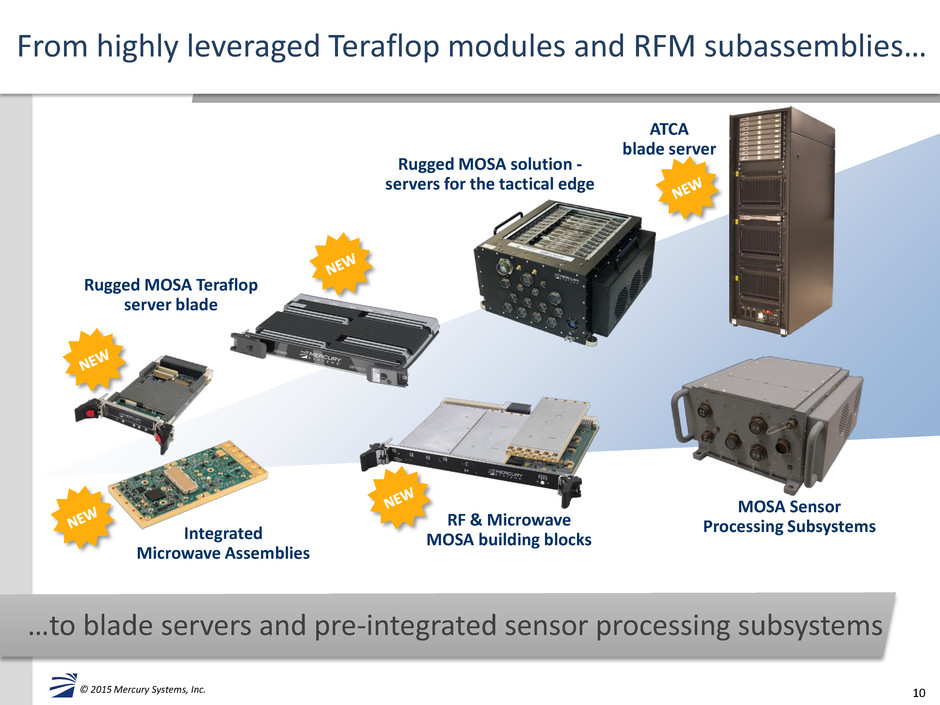

10 © 2015 Mercury Systems, Inc. From highly leveraged Teraflop modules and RFM subassemblies… …to blade servers and pre-integrated sensor processing subsystems Rugged MOSA Teraflop server blade Rugged MOSA solution - servers for the tactical edge ATCA blade server Integrated Microwave Assemblies MOSA Sensor Processing Subsystems RF & Microwave MOSA building blocks

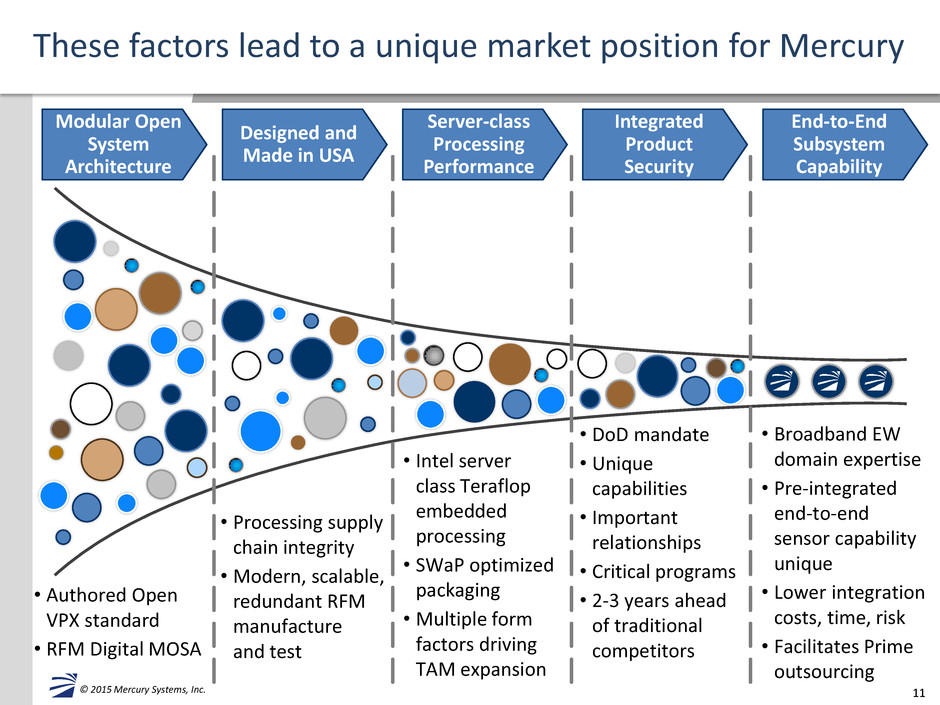

11 © 2015 Mercury Systems, Inc. • Broadband EW domain expertise • Pre-integrated end-to-end sensor capability unique • Lower integration costs, time, risk • Facilitates Prime outsourcing • DoD mandate • Unique capabilities • Important relationships • Critical programs • 2-3 years ahead of traditional competitors • Intel server class Teraflop embedded processing • SWaP optimized packaging •Multiple form factors driving TAM expansion These factors lead to a unique market position for Mercury • Processing supply chain integrity • Modern, scalable, redundant RFM manufacture and test • Authored Open VPX standard • RFM Digital MOSA Modular Open System Architecture Designed and Made in USA Server-class Processing Performance Integrated Product Security End-to-End Subsystem Capability

12 © 2015 Mercury Systems, Inc. Mercury has unique and differentiated capabilities today… …that are aligned to the key industry growth drivers Pacific Pivot: Sensors going long, wide and high. Platforms need improved sensors, autonomy, electronic protection and attack, on-board exploitation Aging Platform Modernization: Port customer software to available state-of-the-art open architectures to rapidly and affordably upgrade electronics on aging military platforms International and Foreign Military Sales: Upgrade subsystems for export to expand addressable market, grow foreign sales and international customer R&D funding Special Operations Forces Quick Reaction Capability: Provide rapid reaction and affordable new capabilities to support anti-terror and other special forces missions globally

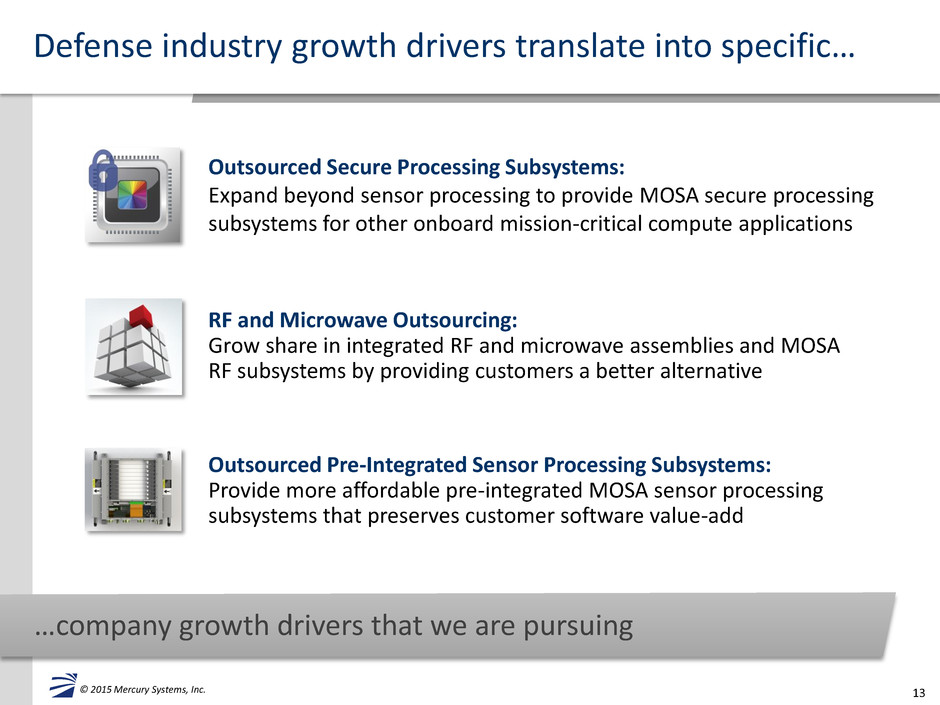

13 © 2015 Mercury Systems, Inc. Defense industry growth drivers translate into specific… …company growth drivers that we are pursuing Outsourced Secure Processing Subsystems: Expand beyond sensor processing to provide MOSA secure processing subsystems for other onboard mission-critical compute applications Outsourced Pre-Integrated Sensor Processing Subsystems: Provide more affordable pre-integrated MOSA sensor processing subsystems that preserves customer software value-add RF and Microwave Outsourcing: Grow share in integrated RF and microwave assemblies and MOSA RF subsystems by providing customers a better alternative

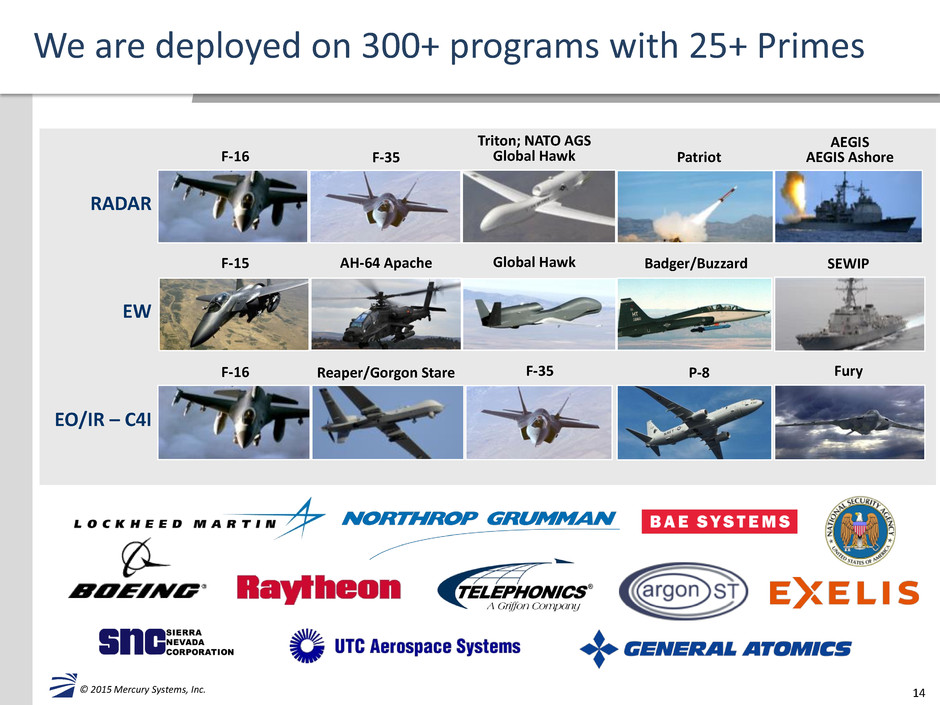

14 © 2015 Mercury Systems, Inc. We are deployed on 300+ programs with 25+ Primes RADAR EW EO/IR – C4I Triton; NATO AGS Global Hawk AEGIS AEGIS Ashore Patriot F-16 F-35 Global Hawk SEWIP Badger/Buzzard F-15 AH-64 Apache F-35 Fury P-8 F-16 Reaper/Gorgon Stare

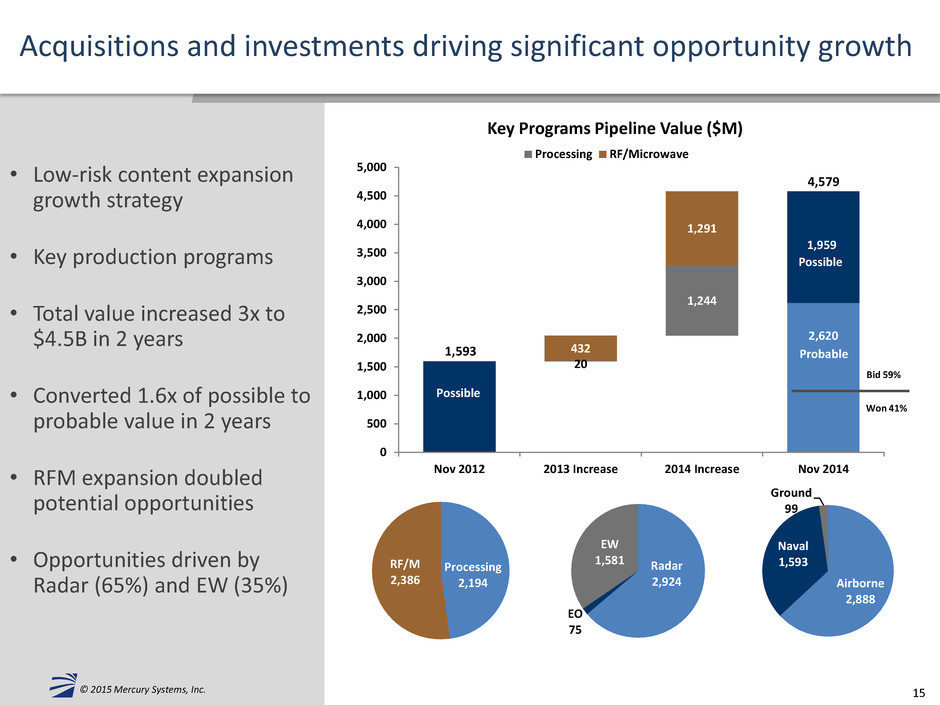

15 © 2015 Mercury Systems, Inc. 2,620 1,593 1,959 20 1,244 432 1,291 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4,500 5,000 Nov 2012 2013 Increase 2014 Increase Nov 2014 Key Programs Pipeline Value ($M) Processing RF/Microwave 4,579 Probable Possible Possible Acquisitions and investments driving significant opportunity growth • Low-risk content expansion growth strategy • Key production programs • Total value increased 3x to $4.5B in 2 years • Converted 1.6x of possible to probable value in 2 years • RFM expansion doubled potential opportunities • Opportunities driven by Radar (65%) and EW (35%) Processing 2,194 RF/M 2,386 Radar 2,924 EO 75 EW 1,581 Bid 59% Won 41% Airborne 2,888 Naval 1,593 Ground 99

16 © 2015 Mercury Systems, Inc. © 2015 Mercury Systems, Inc. Strategy and investments have positioned Mercury well • Pioneering a next-generation defense electronics business model • Unique technology and capabilities on key production programs • Low-risk content expansion growth strategy with demonstrable progress • Above industry average growth and dramatic improvement in profitability • Expect to achieve target business model for FY15 • Business platform built to grow and scale through acquisitions

© 2015 Mercury Systems, Inc. Financial Overview Gerry Haines Executive Vice President & CFO

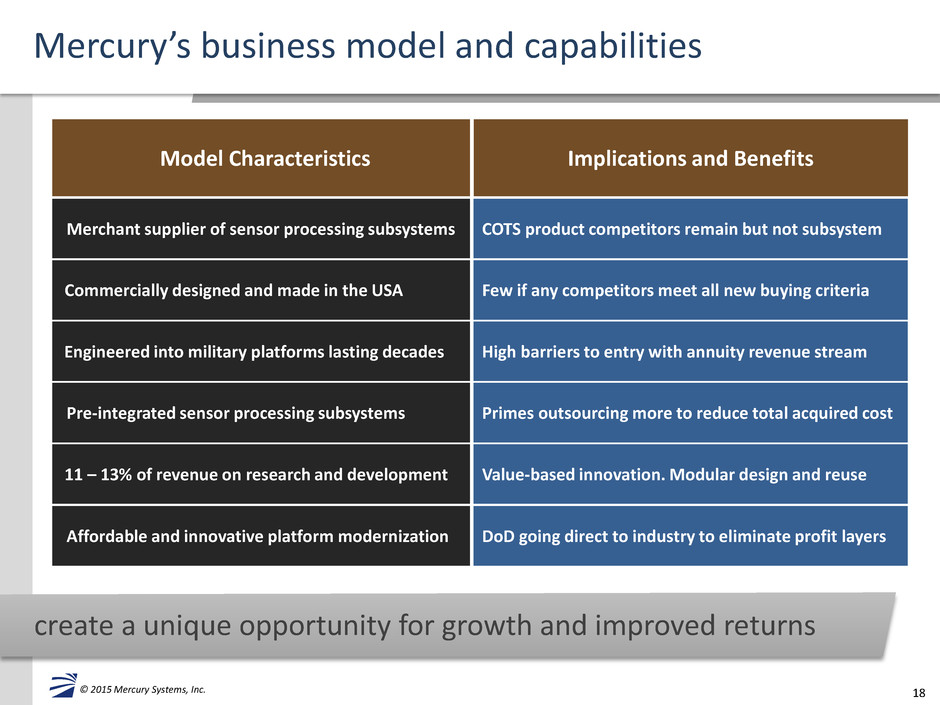

18 © 2015 Mercury Systems, Inc. Mercury’s business model and capabilities create a unique opportunity for growth and improved returns Model Characteristics Implications and Benefits Merchant supplier of sensor processing subsystems COTS product competitors remain but not subsystem Commercially designed and made in the USA Few if any competitors meet all new buying criteria Engineered into military platforms lasting decades High barriers to entry with annuity revenue stream Pre-integrated sensor processing subsystems Primes outsourcing more to reduce total acquired cost 11 – 13% of revenue on research and development Value-based innovation. Modular design and reuse Affordable and innovative platform modernization DoD going direct to industry to eliminate profit layers

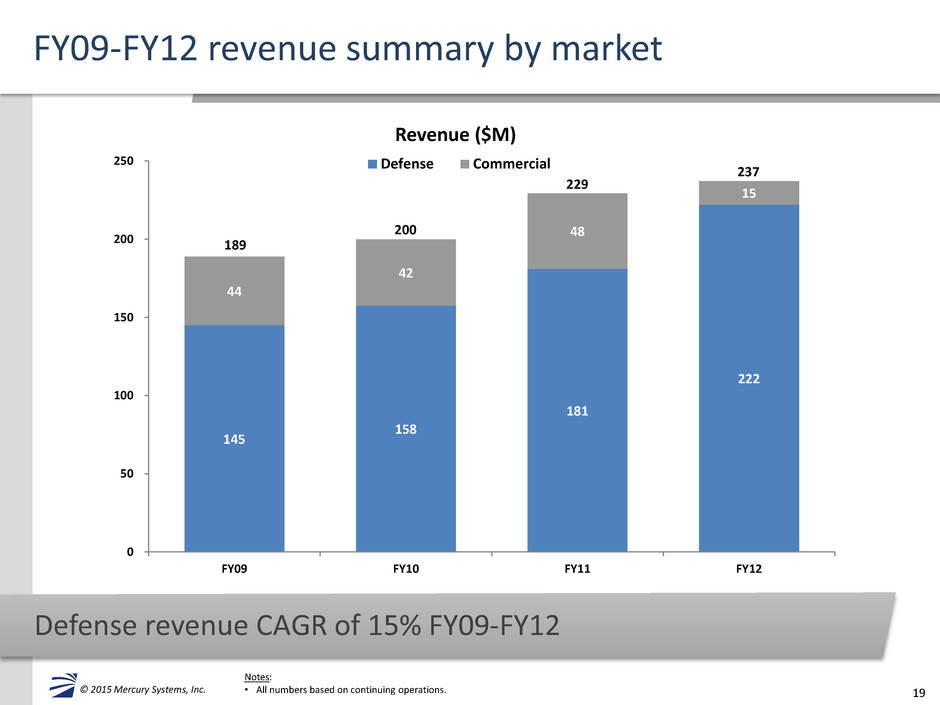

19 © 2015 Mercury Systems, Inc. FY09-FY12 revenue summary by market Defense revenue CAGR of 15% FY09-FY12 Notes: • All numbers based on continuing operations. 145 158 181 222 44 42 48 15 0 50 100 150 200 250 FY09 FY10 FY11 FY12 Revenue ($M) Defense Commercial 189 200 229 237

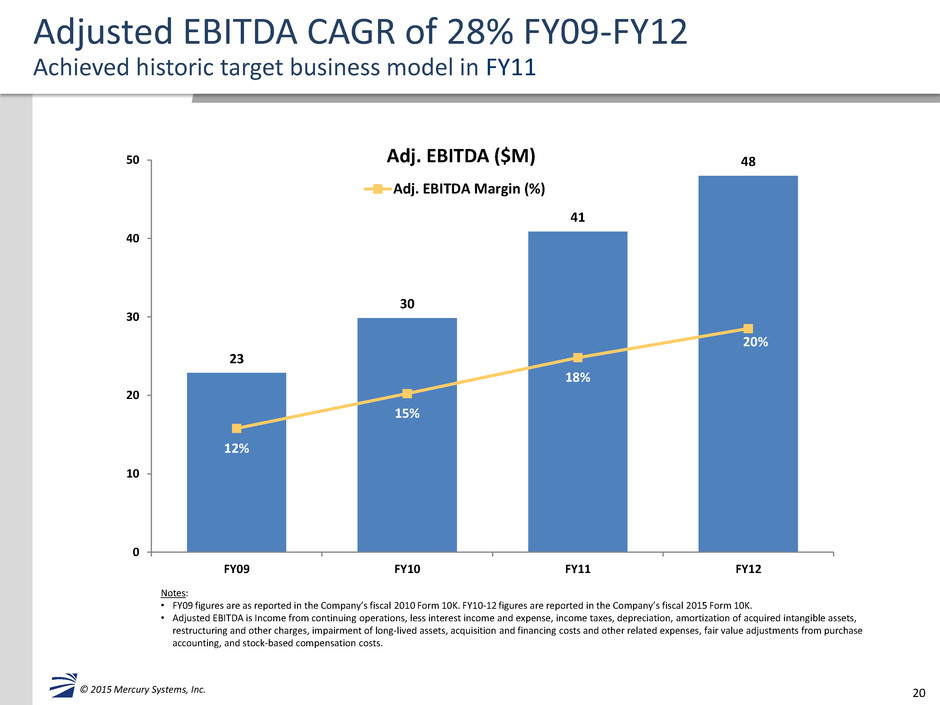

20 © 2015 Mercury Systems, Inc. Adjusted EBITDA CAGR of 28% FY09-FY12 Achieved historic target business model in FY11 Notes: • FY09 figures are as reported in the Company’s fiscal 2010 Form 10K. FY10-12 figures are reported in the Company’s fiscal 2015 Form 10K. • Adjusted EBITDA is Income from continuing operations, less interest income and expense, income taxes, depreciation, amortization of acquired intangible assets, restructuring and other charges, impairment of long-lived assets, acquisition and financing costs and other related expenses, fair value adjustments from purchase accounting, and stock-based compensation costs. 23 30 41 48 12% 15% 18% 20% 0 10 20 30 40 50 FY09 FY10 FY11 FY12 Adj. EBITDA ($M) Adj. EBITDA Margin (%)

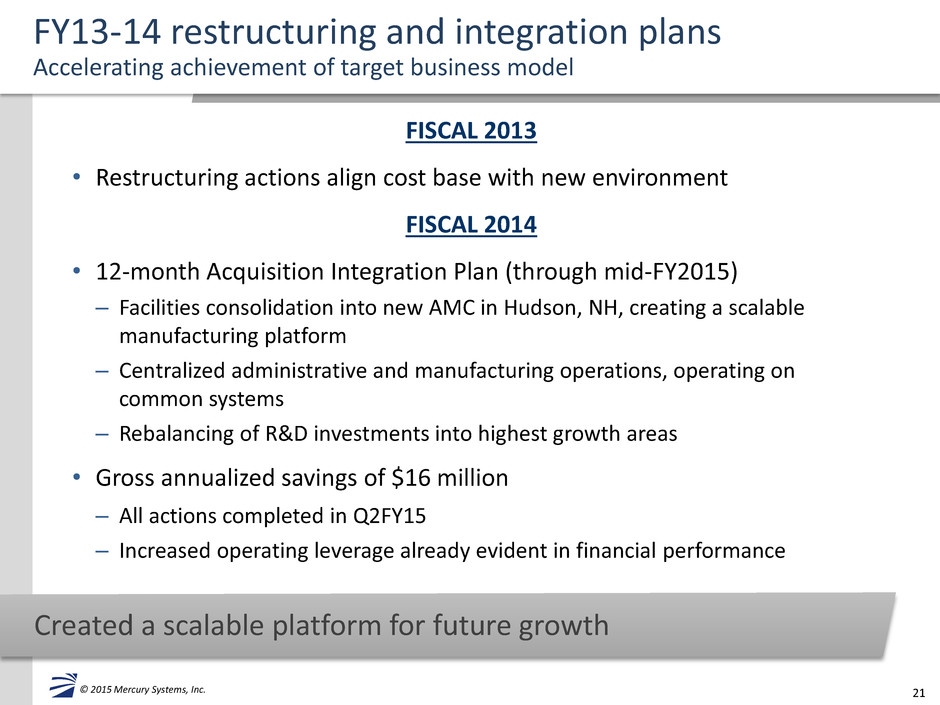

21 © 2015 Mercury Systems, Inc. FY13-14 restructuring and integration plans Accelerating achievement of target business model FISCAL 2013 • Restructuring actions align cost base with new environment FISCAL 2014 • 12-month Acquisition Integration Plan (through mid-FY2015) – Facilities consolidation into new AMC in Hudson, NH, creating a scalable manufacturing platform – Centralized administrative and manufacturing operations, operating on common systems – Rebalancing of R&D investments into highest growth areas • Gross annualized savings of $16 million – All actions completed in Q2FY15 – Increased operating leverage already evident in financial performance Created a scalable platform for future growth

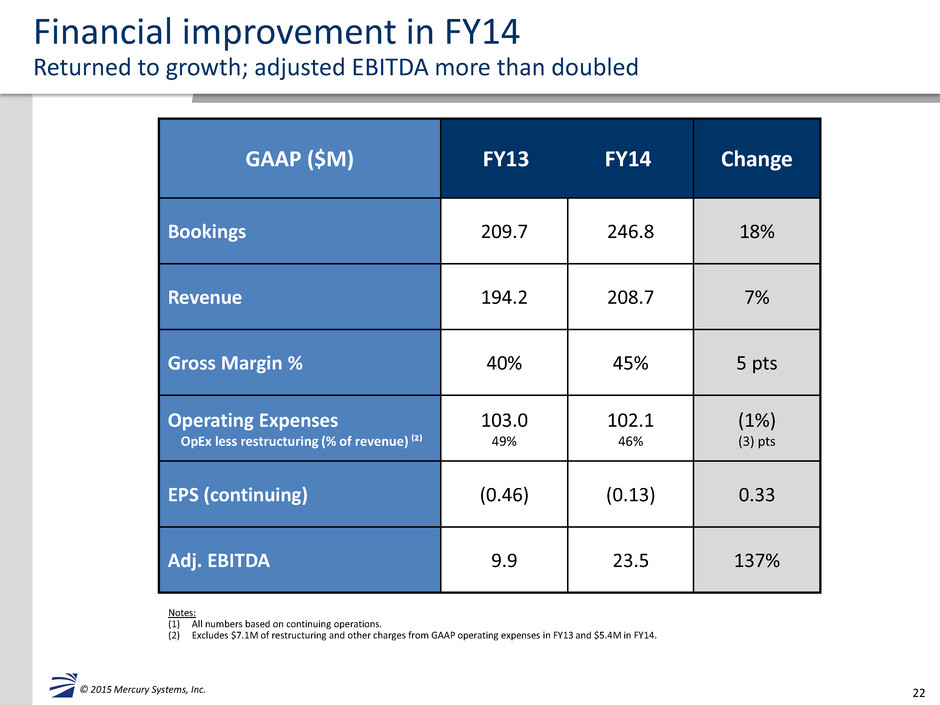

22 © 2015 Mercury Systems, Inc. Financial improvement in FY14 Returned to growth; adjusted EBITDA more than doubled GAAP ($M) FY13 FY14 Change Bookings 209.7 246.8 18% Revenue 194.2 208.7 7% Gross Margin % 40% 45% 5 pts Operating Expenses OpEx less restructuring (% of revenue) ⁽²⁾ 103.0 49% 102.1 46% (1%) (3) pts EPS (continuing) (0.46) (0.13) 0.33 Adj. EBITDA 9.9 23.5 137% Notes: (1) All numbers based on continuing operations. (2) Excludes $7.1M of restructuring and other charges from GAAP operating expenses in FY13 and $5.4M in FY14.

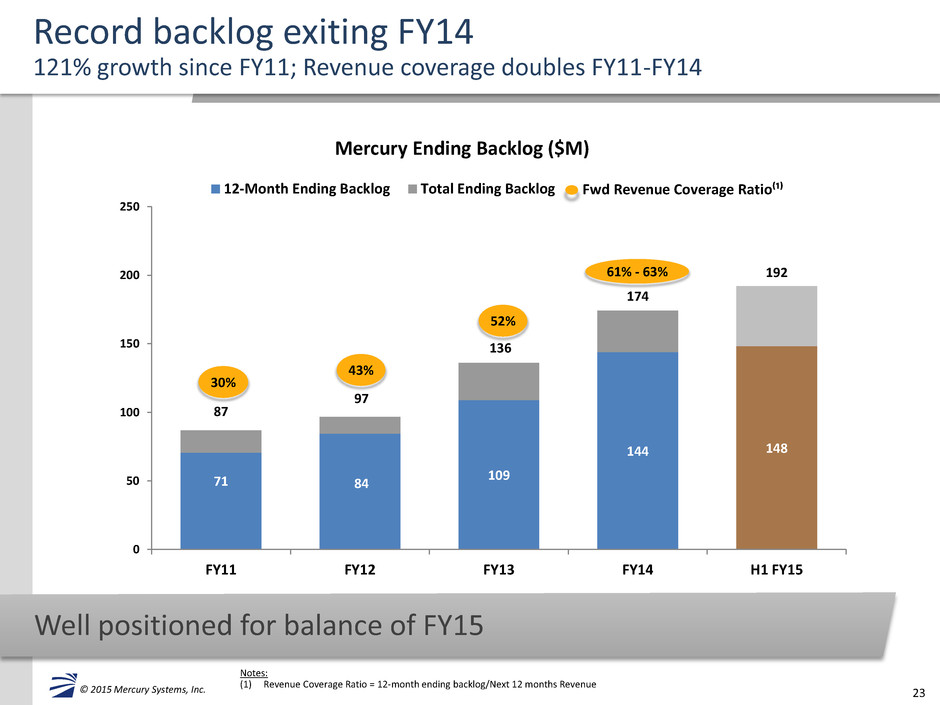

23 © 2015 Mercury Systems, Inc. Record backlog exiting FY14 121% growth since FY11; Revenue coverage doubles FY11-FY14 Well positioned for balance of FY15 Notes: (1) Revenue Coverage Ratio = 12-month ending backlog/Next 12 months Revenue 71 84 109 144 148 87 97 136 174 192 0 50 100 150 200 250 FY11 FY12 FY13 FY14 H1 FY15 Mercury Ending Backlog ($M) 12-Month Ending Backlog Total Ending Backlog 30% 43% 52% 61% - 63% Fwd Revenue Coverage Ratio⁽¹⁾

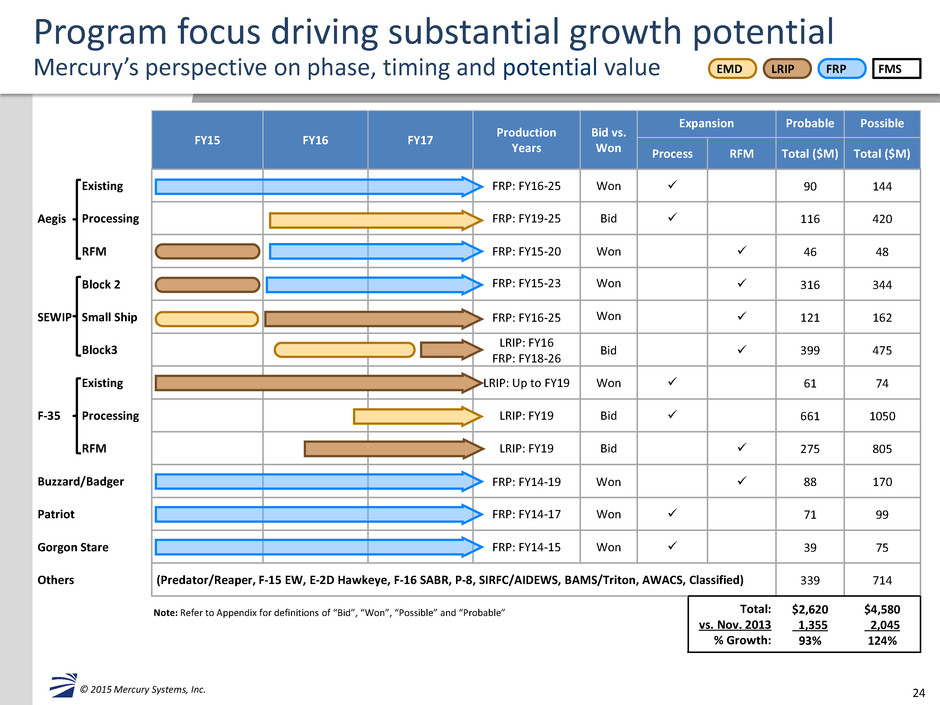

24 © 2015 Mercury Systems, Inc. FY15 FY16 FY17 Production Years Bid vs. Won Expansion Probable Possible Process RFM Total ($M) Total ($M) Aegis Existing FRP: FY16-25 Won 90 144 Processing FRP: FY19-25 Bid 116 420 RFM FRP: FY15-20 Won 46 48 SEWIP Block 2 FRP: FY15-23 Won 316 344 Small Ship FRP: FY16-25 Won 121 162 Block3 LRIP: FY16 FRP: FY18-26 Bid 399 475 F-35 Existing LRIP: Up to FY19 Won 61 74 Processing LRIP: FY19 Bid 661 1050 RFM LRIP: FY19 Bid 275 805 Buzzard/Badger FRP: FY14-19 Won 88 170 Patriot FRP: FY14-17 Won 71 99 Gorgon Stare FRP: FY14-15 Won 39 75 Others (Predator/Reaper, F-15 EW, E-2D Hawkeye, F-16 SABR, P-8, SIRFC/AIDEWS, BAMS/Triton, AWACS, Classified) 339 714 Total: vs. Nov. 2013 % Growth: $2,620 1,355 93% $4,580 2,045 124% Program focus driving substantial growth potential Mercury’s perspective on phase, timing and potential value EMD LRIP FRP FMS Note: Refer to Appendix for definitions of “Bid”, “Won”, “Possible” and “Probable”

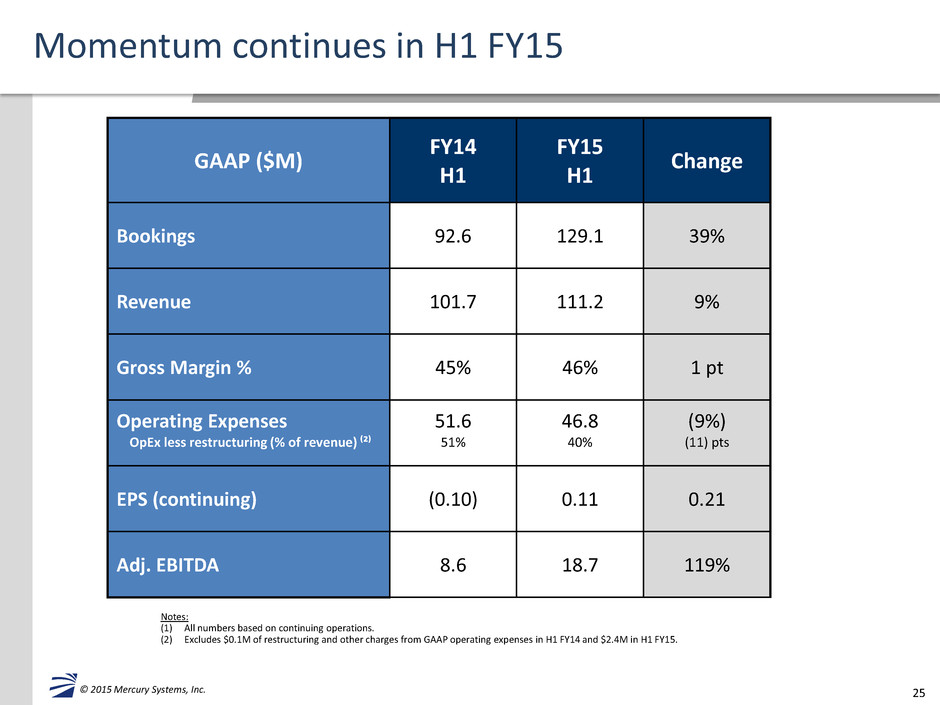

25 © 2015 Mercury Systems, Inc. Momentum continues in H1 FY15 Notes: (1) All numbers based on continuing operations. (2) Excludes $0.1M of restructuring and other charges from GAAP operating expenses in H1 FY14 and $2.4M in H1 FY15. GAAP ($M) FY14 FY15 Change H1 H1 Bookings 92.6 129.1 39% Revenue 101.7 111.2 9% Gross Margin % 45% 46% 1 pt Operating Expenses 51.6 46.8 (9%) OpEx less restructuring (% of revenue) ⁽²⁾ 51% 40% (11) pts EPS (continuing) (0.10) 0.11 0.21 Adj. EBITDA 8.6 18.7 119%

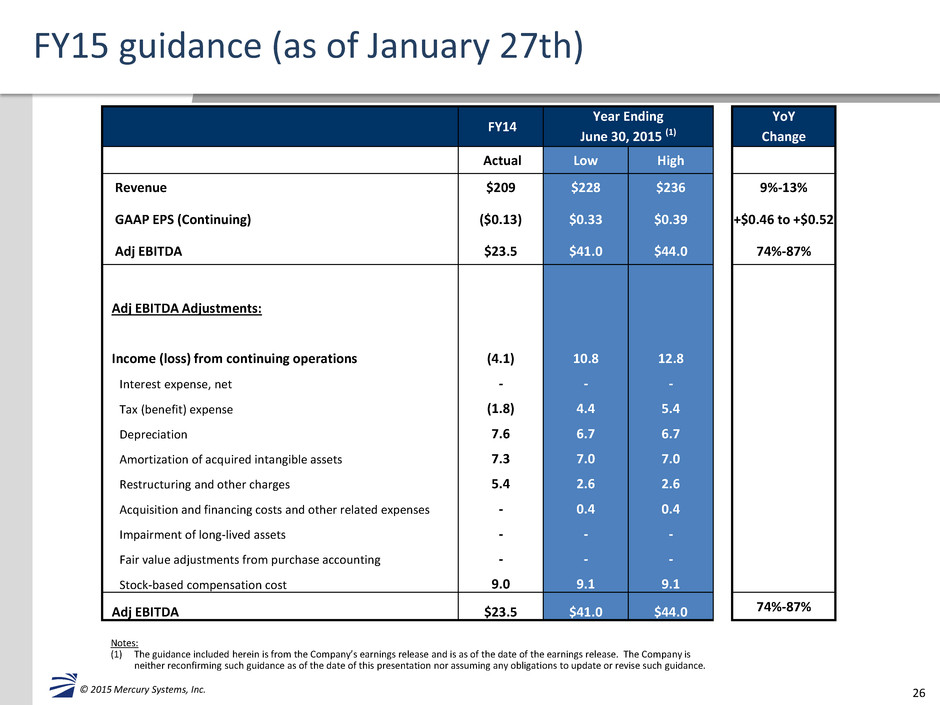

26 © 2015 Mercury Systems, Inc. FY15 guidance (as of January 27th) Notes: (1) The guidance included herein is from the Company’s earnings release and is as of the date of the earnings release. The Company is neither reconfirming such guidance as of the date of this presentation nor assuming any obligations to update or revise such guidance. FY14 Year Ending YoY June 30, 2015 (1) Change Actual Low High Revenue $209 $228 $236 9%-13% GAAP EPS (Continuing) ($0.13) $0.33 $0.39 +$0.46 to +$0.52 Adj EBITDA $23.5 $41.0 $44.0 74%-87% Adj EBITDA Adjustments: Income (loss) from continuing operations (4.1) 10.8 12.8 Interest expense, net - - - Tax (benefit) expense (1.8) 4.4 5.4 Depreciation 7.6 6.7 6.7 Amortization of acquired intangible assets 7.3 7.0 7.0 Restructuring and other charges 5.4 2.6 2.6 Acquisition and financing costs and other related expenses - 0.4 0.4 Impairment of long-lived assets - - - Fair value adjustments from purchase accounting - - - Stock-based compensation cost 9.0 9.1 9.1 Adj EBITDA $23.5 $41.0 $44.0 74%-87%

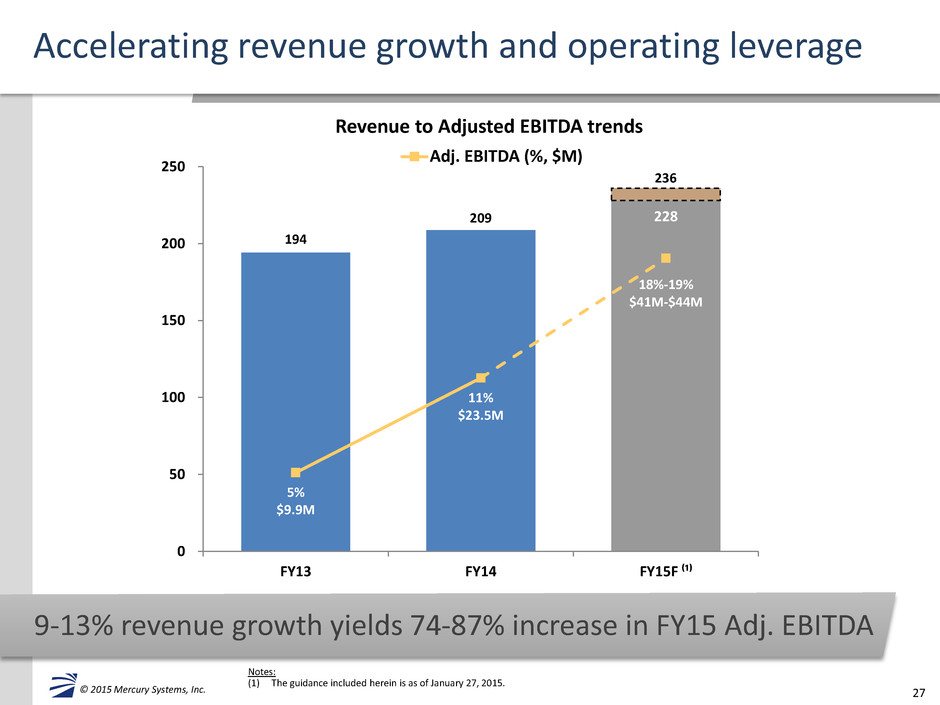

27 © 2015 Mercury Systems, Inc. Accelerating revenue growth and operating leverage 9-13% revenue growth yields 74-87% increase in FY15 Adj. EBITDA Notes: (1) The guidance included herein is as of January 27, 2015. 194 209 228 5% $9.9M 11% $23.5M 18%-19% $41M-$44M 0 50 100 150 200 250 FY13 FY14 FY15F ⁽¹⁾ Revenue to Adjusted EBITDA trends Adj. EBITDA (%, $M) 236

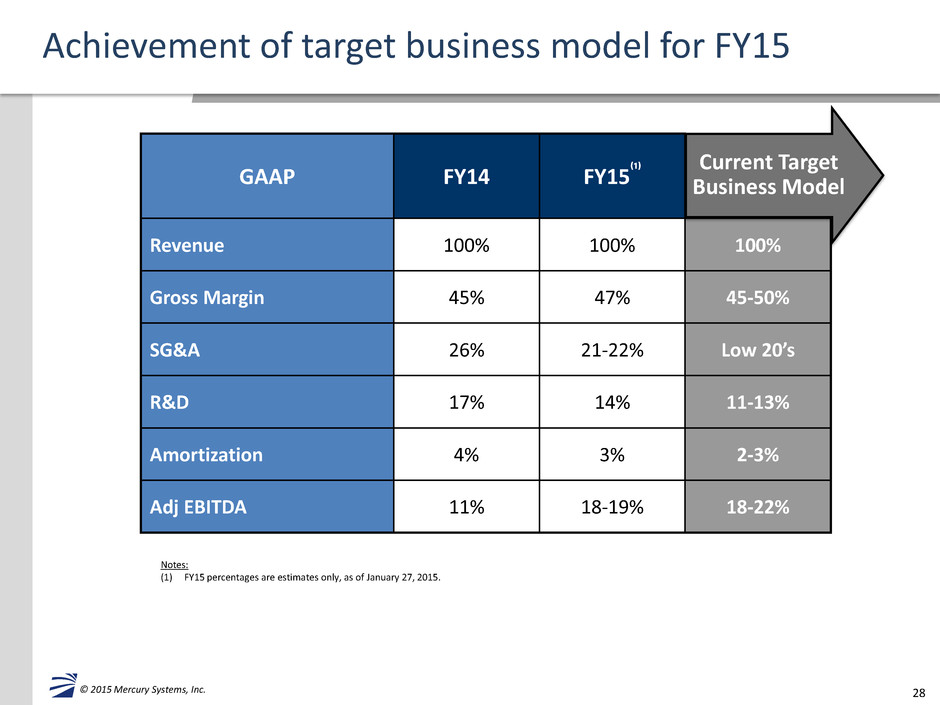

28 © 2015 Mercury Systems, Inc. Achievement of target business model for FY15 Notes: (1) FY15 percentages are estimates only, as of January 27, 2015. GAAP FY14 FY15⁽¹⁾ Revenue 100% 100% 100% Gross Margin 45% 47% 45-50% SG&A 26% 21-22% Low 20’s R&D 17% 14% 11-13% Amortization 4% 3% 2-3% Adj EBITDA 11% 18-19% 18-22% Current Target Business Model

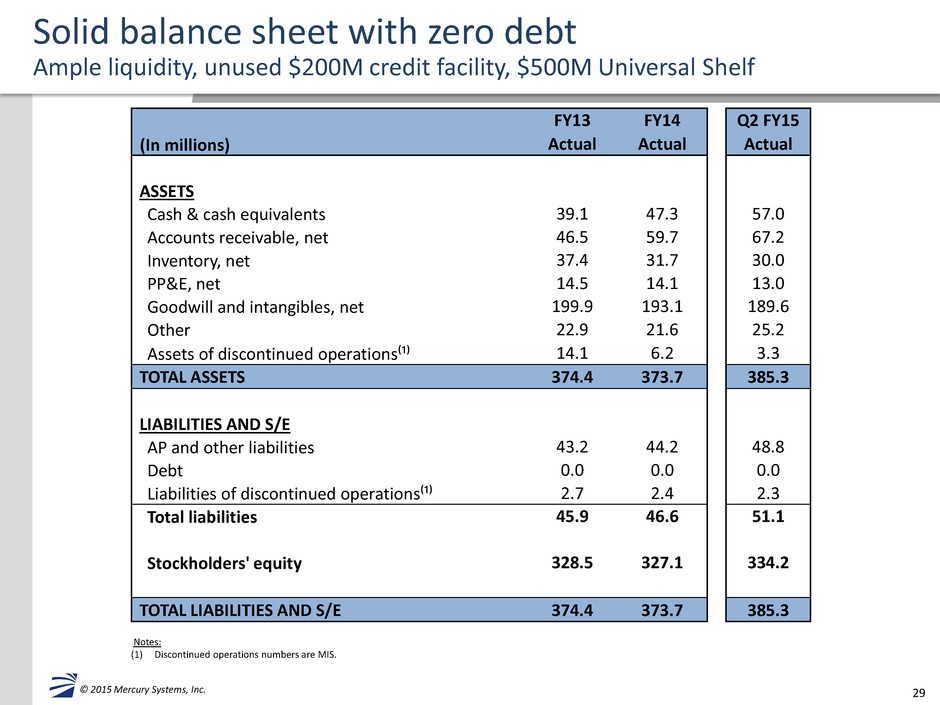

29 © 2015 Mercury Systems, Inc. Solid balance sheet with zero debt Ample liquidity, unused $200M credit facility, $500M Universal Shelf Notes: (1) Discontinued operations numbers are MIS. FY13 FY14 Q2 FY15 (In millions) Actual Actual Actual ASSETS Cash & cash equivalents 39.1 47.3 57.0 Accounts receivable, net 46.5 59.7 67.2 Inventory, net 37.4 31.7 30.0 PP&E, net 14.5 14.1 13.0 Goodwill and intangibles, net 199.9 193.1 189.6 Other 22.9 21.6 25.2 Assets of discontinued operations⁽¹⁾ 14.1 6.2 3.3 TOTAL ASSETS 374.4 373.7 385.3 LIABILITIES AND S/E AP and other liabilities 43.2 44.2 48.8 Debt 0.0 0.0 0.0 Liabilities of discontinued operations⁽¹⁾ 2.7 2.4 2.3 Total liabilities 45.9 46.6 51.1 Stockholders' equity 328.5 327.1 334.2 TOTAL LIABILITIES AND S/E 374.4 373.7 385.3

30 © 2015 Mercury Systems, Inc. © 2015 Mercury Systems, Inc. Poised for profitable growth • Growth and profitability accelerating in FY15 • Integration plan complete, yielding $16M in gross annualized savings • Strategy, operational discipline, yield significant operating leverage • Strong, well-funded programs driving growth potential • Record backlog drives achievement of target business model for FY15 • Solid balance sheet with zero debt facilitates future M&A

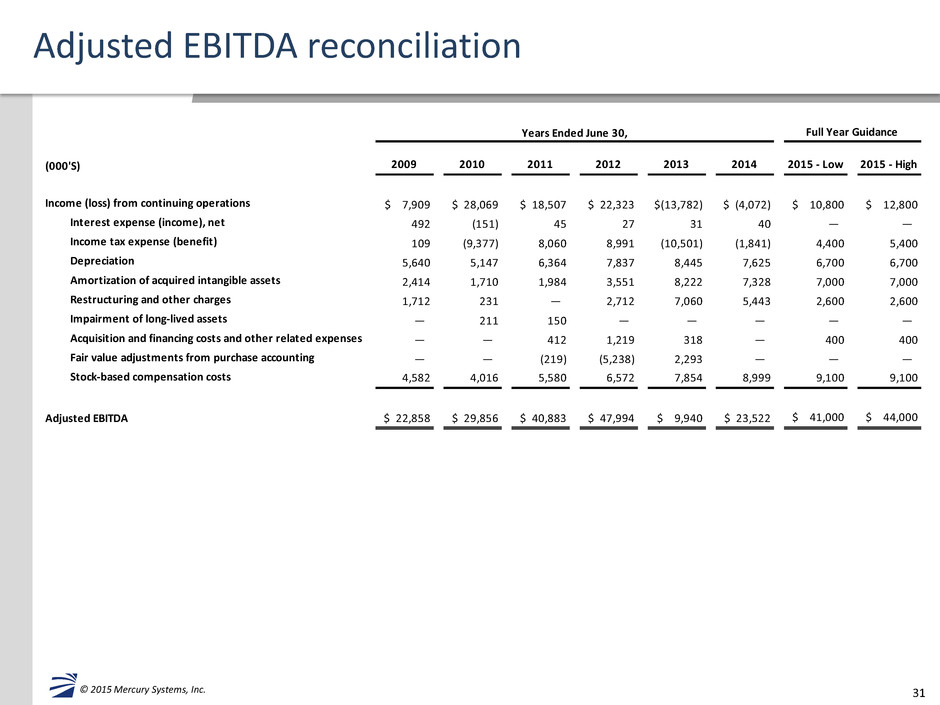

31 © 2015 Mercury Systems, Inc. Adjusted EBITDA reconciliation (000'S) 2009 2010 2011 2012 2013 2014 2015 - Low 2015 - High Income (loss) from continuing operations $ 7,909 $ 28,069 $ 18,507 $ 22,323 $(13,782) $ (4,072) $ 10,800 $ 12,800 Interest expense (income), net 492 (151) 45 27 31 40 — — Income tax expense (benefit) 109 (9,377) 8,060 8,991 (10,501) (1,841) 4,400 5,400 Depreciation 5,640 5,147 6,364 7,837 8,445 7,625 6,700 6,700 Amortization of acquired intangible assets 2,414 1,710 1,984 3,551 8,222 7,328 7,000 7,000 Restructuring and other charges 1,712 231 — 2,712 7,060 5,443 2,600 2,600 Impairment of long-lived assets — 211 150 — — — — — Acquisition and financing costs and other related expenses — — 412 1,219 318 — 400 400 Fair value adjustments from purchase accounting — — (219) (5,238) 2,293 — — — Stock-based compensation costs 4,582 4,016 5,580 6,572 7,854 8,999 9,100 9,100 Adjusted EBITDA $ 22,858 $ 29,856 $ 40,883 $ 47,994 $ 9,940 $ 23,522 $ 41,000 $ 44,000 Years Ended June 30, Full Year Guidance

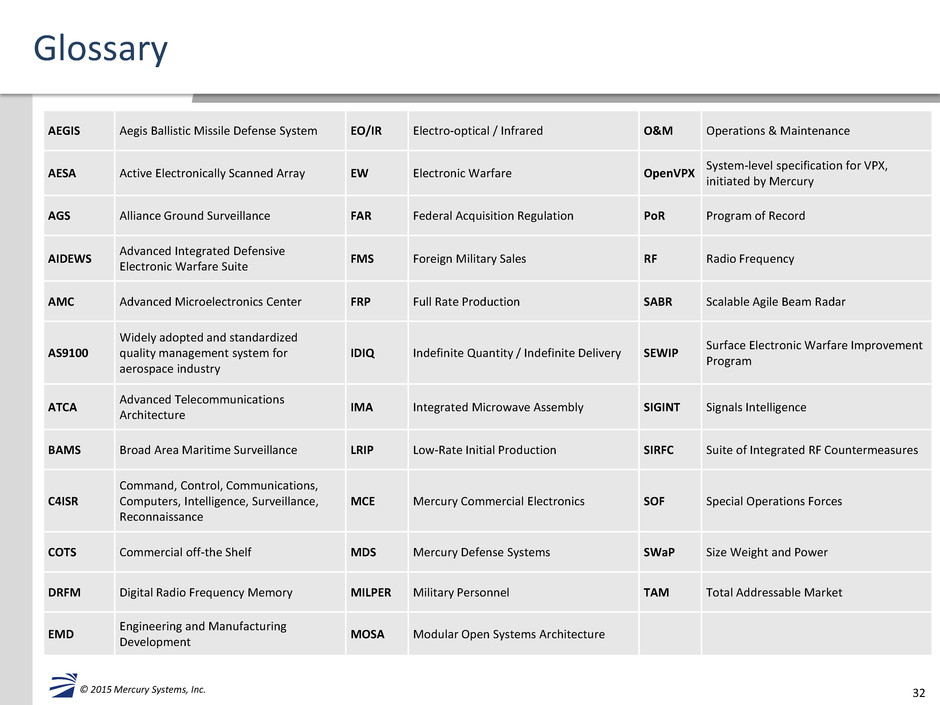

32 © 2015 Mercury Systems, Inc. Glossary AEGIS Aegis Ballistic Missile Defense System EO/IR Electro-optical / Infrared O&M Operations & Maintenance AESA Active Electronically Scanned Array EW Electronic Warfare OpenVPX System-level specification for VPX, initiated by Mercury AGS Alliance Ground Surveillance FAR Federal Acquisition Regulation PoR Program of Record AIDEWS Advanced Integrated Defensive Electronic Warfare Suite FMS Foreign Military Sales RF Radio Frequency AMC Advanced Microelectronics Center FRP Full Rate Production SABR Scalable Agile Beam Radar AS9100 Widely adopted and standardized quality management system for aerospace industry IDIQ Indefinite Quantity / Indefinite Delivery SEWIP Surface Electronic Warfare Improvement Program ATCA Advanced Telecommunications Architecture IMA Integrated Microwave Assembly SIGINT Signals Intelligence BAMS Broad Area Maritime Surveillance LRIP Low-Rate Initial Production SIRFC Suite of Integrated RF Countermeasures C4ISR Command, Control, Communications, Computers, Intelligence, Surveillance, Reconnaissance MCE Mercury Commercial Electronics SOF Special Operations Forces COTS Commercial off-the Shelf MDS Mercury Defense Systems SWaP Size Weight and Power DRFM Digital Radio Frequency Memory MILPER Military Personnel TAM Total Addressable Market EMD Engineering and Manufacturing Development MOSA Modular Open Systems Architecture

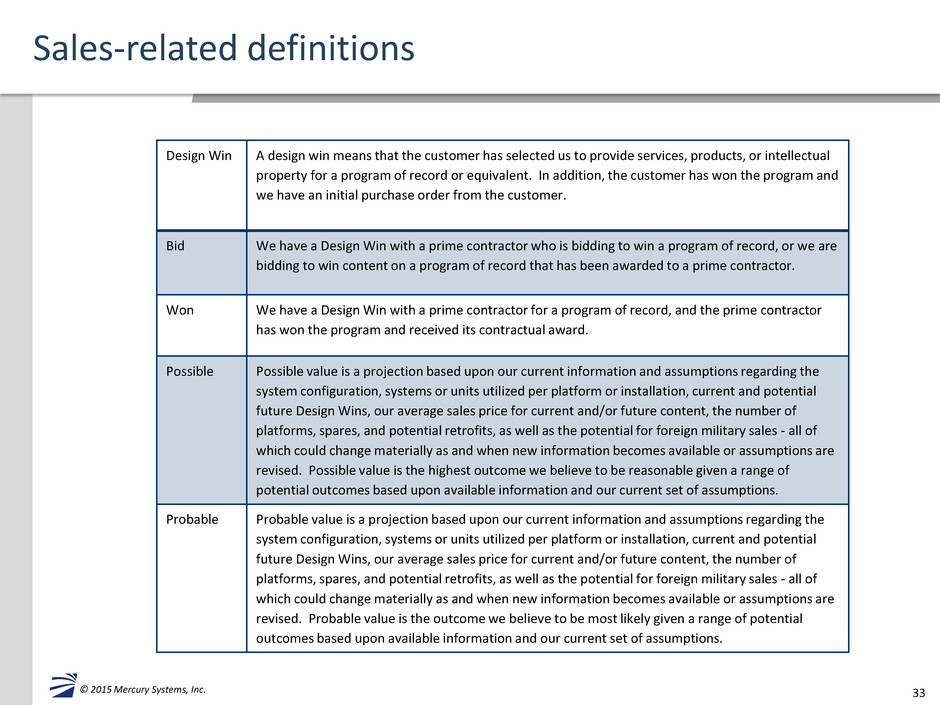

33 © 2015 Mercury Systems, Inc. Sales-related definitions Design Win A design win means that the customer has selected us to provide services, products, or intellectual property for a program of record or equivalent. In addition, the customer has won the program and we have an initial purchase order from the customer. Bid We have a Design Win with a prime contractor who is bidding to win a program of record, or we are bidding to win content on a program of record that has been awarded to a prime contractor. Won We have a Design Win with a prime contractor for a program of record, and the prime contractor has won the program and received its contractual award. Possible Possible value is a projection based upon our current information and assumptions regarding the system configuration, systems or units utilized per platform or installation, current and potential future Design Wins, our average sales price for current and/or future content, the number of platforms, spares, and potential retrofits, as well as the potential for foreign military sales - all of which could change materially as and when new information becomes available or assumptions are revised. Possible value is the highest outcome we believe to be reasonable given a range of potential outcomes based upon available information and our current set of assumptions. Probable Probable value is a projection based upon our current information and assumptions regarding the system configuration, systems or units utilized per platform or installation, current and potential future Design Wins, our average sales price for current and/or future content, the number of platforms, spares, and potential retrofits, as well as the potential for foreign military sales - all of which could change materially as and when new information becomes available or assumptions are revised. Probable value is the outcome we believe to be most likely given a range of potential outcomes based upon available information and our current set of assumptions.