Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Carbonite Inc | a8-kearningsrelease.htm |

| EX-99.1 - EXHIBIT 99.1 - Carbonite Inc | exhibit991232015.htm |

CARBONITE 2014 FOURTH QUARTER AND FULL-YEAR FINANCIAL RESULTS FEBRUARY 3, 2015

EMILY WALT Director of Investor Relations

Safe Harbor These slides and the accompanying oral presentation contain "forward-looking statements" within the meaning of the Securities Act of 1933, as amended, the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. These forward-looking statements represent the Company’s views as of the date that they were first made based on the current intent, belief or expectations, estimates, forecasts, assumptions and projections of the Company and members of our management team. Words such as “expect,” “anticipate,” “should,” “believe,” “hope,” “target,” “project,” “goals,” “estimate,” “potential,” “predict,” “may,” “will,” “might,” “could,” “intend,” and any variations of these terms or the negative of these terms and similar expressions are intended to identify these forward-looking statements. Those statements include, but are not limited to, statements regarding guidance on our future financial results and other projections or measures of future performance, and our expectations concerning market opportunities and our ability to capitalize on them. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond the Company’s control. The Company’s actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors, including, but not limited to, the Company’s ability to profitably attract new customers and retain existing customers, the Company’s dependence on the market for online computer backup services, the Company’s ability to manage growth, business disruptions, costs and future events related to the j2 Global, Inc. unsolicited offer to purchase all outstanding shares of Company common stock and the company’s exploration of strategic alternatives and changes in economic or regulatory conditions or other trends affecting the Internet and the information technology industry. These and other important risk factors are discussed or referenced in our Annual Report on Form 10-K for the fiscal year ended December 31, 2013 which is available on www.sec.gov, under the heading “Risk Factors” and elsewhere, and any subsequent periodic or current reports filed by us with the SEC. The Company anticipates that subsequent events and developments will cause its views to change. Except as required by applicable law or regulation, the Company does not undertake any obligation to update our forward-looking statements to reflect future events or circumstances. This presentation contains non-GAAP financial measures including, but not limited to, non-GAAP Gross Margin, non-GAAP EPS and Free Cash Flow. A reconciliation to GAAP can be found in the financial schedules included in our most recent earnings press release which can be found on Carbonite’s website, investors.carbonite.com or www.sec.gov. 3

4 MOHAMAD ALI President & CEO

Why Carbonite? POWERFUL YET SIMPLE • Superior technology • Compelling brand recognition • Strong foundation of award winning products • Tremendous opportunity in the current SMB strategy • Continues to expand profitability while driving revenue growth 5

The Carbonite Opportunity Carbonite 1.0 – Direct-to-consumer endpoint backup • One computer, unlimited backup to Carbonite’s cloud • 500 billion files backed up and counting • Backs up more than 350 million files each day • Proprietary file system with proven scalability • Sold directly on web site • ~1.5 million paying subscribers Carbonite 2.0 – Indirect to SMB business continuity • Hybrid solutions: • Carbonite Server Backup: databases and live applications • Appliance: bare metal system recovery • Email archiving (new) • Channel-focused business: > 5,800 active reseller partners • Over 75,000 small business subscribers 6 Consumer fueled Carbonite 1.0 SMB fueling Carbonite 2.0

BUSINESS HIGHLIGHTS 7

ANTHONY FOLGER CFO & Treasurer

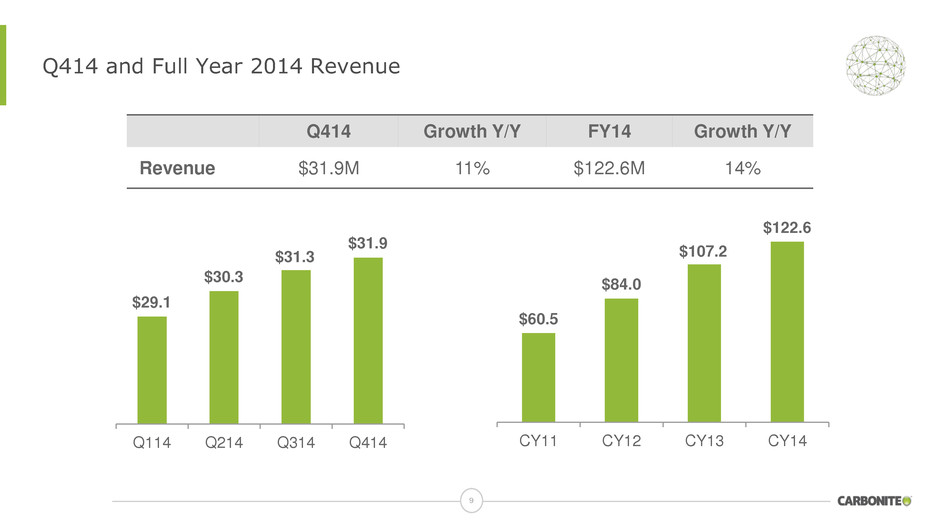

Q414 and Full Year 2014 Revenue $60.5 $84.0 $107.2 $122.6 CY11 CY12 CY13 CY14 $29.1 $30.3 $31.3 $31.9 Q114 Q214 Q314 Q414 Q414 Growth Y/Y FY14 Growth Y/Y Revenue $31.9M 11% $122.6M 14% 9

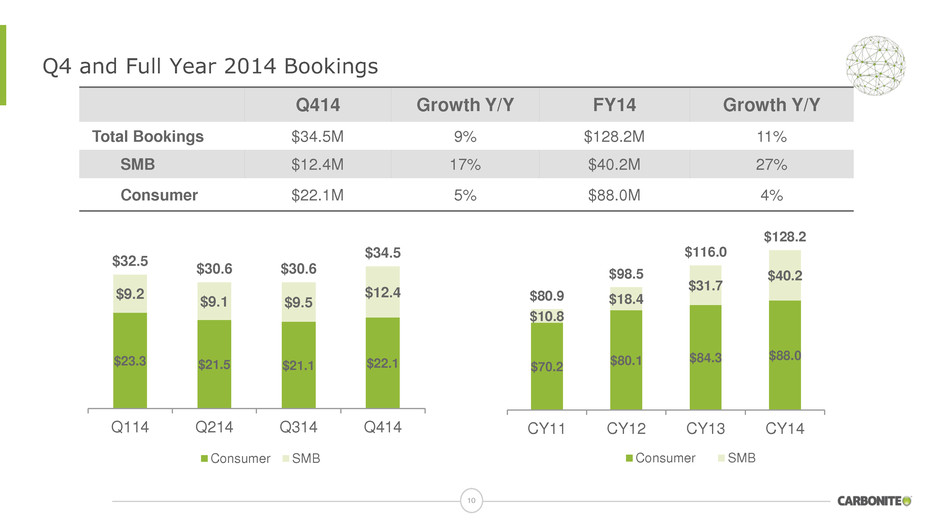

Q4 and Full Year 2014 Bookings 10 $23.3 $21.5 $21.1 $22.1 $9.2 $9.1 $9.5 $12.4 $32.5 $30.6 $30.6 $34.5 Q114 Q214 Q314 Q414 Consumer SMB $70.2 $80.1 $84.3 $88.0 $10.8 $18.4 $31.7 $40.2 $80.9 $98.5 $116.0 $128.2 CY11 CY12 CY13 CY14 Consumer SMB Q414 Growth Y/Y FY14 Growth Y/Y Total Bookings $34.5M 9% $128.2M 11% SMB $12.4M 17% $40.2M 27% Consumer $22.1M 5% $88.0M 4%

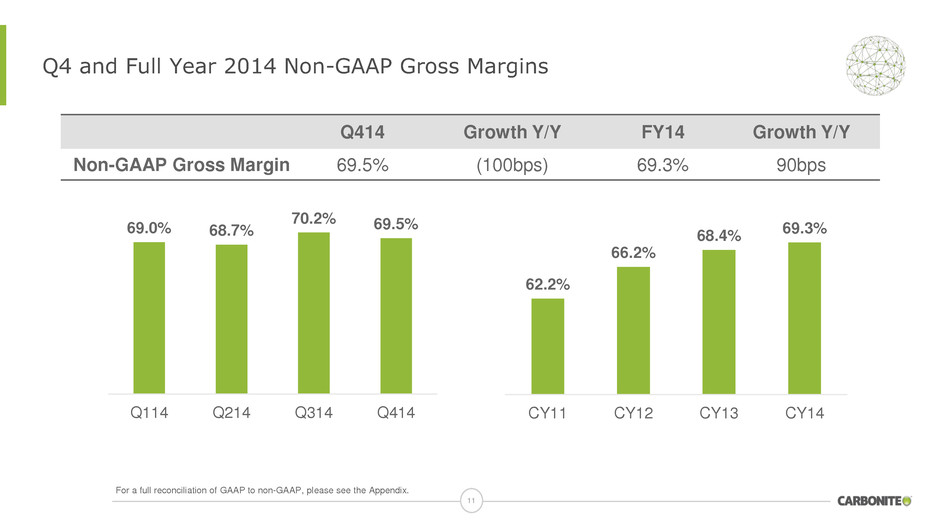

Q4 and Full Year 2014 Non-GAAP Gross Margins 11 Q414 Growth Y/Y FY14 Growth Y/Y Non-GAAP Gross Margin 69.5% (100bps) 69.3% 90bps 62.2% 66.2% 68.4% 69.3% CY11 CY12 CY13 CY14 69.0% 68.7% 70.2% 69.5% Q114 Q214 Q314 Q414 For a full reconciliation of GAAP to non-GAAP, please see the Appendix.

Total Cash and Free Cash Flow ($6.0) ($4.1) $6.0 $15.1 CY11 CY12 CY13 CY14 Annual Free Cash Flow $4.2 $1.5 $2.3 $7.1 Q114 Q214 Q314 Q414 Quarterly Free Cash Flow $ in Millions FY14 Total Cash and Investments $61.1M For a full reconciliation of GAAP to non-GAAP, please see the Appendix. 12

Q115 & FY15 Non-GAAP Business Outlook Q115 Revenue $31.9M - $32.1M Non-GAAP net loss per share ($0.09) – ($0.07) 2015 Revenue $137.0M - $138.0M Non-GAAP EPS $0.08 – $0.10 Non-GAAP gross margin ~200 bps over 2014 Free cash flow $16.0M - $18.0M 13

Changing Dynamics for SMBs 14 SMBs CLOUD BIG DATA MOBILE SOCIAL SECURITY VIRTUALIZATION

Business Continuity must change to reflect trends 15 Backup Recovery Archiving Business Continuity Hybrid Cloud

Powerful IP Drives Carbonite Solutions 16 Data Source Target Destination File-level backup Database backup Application-level backup Bare metal restore Granular restore Compliance Sync, Share, Access Centralized Dashboard C O NS U M E R S M B Endpoints Servers Local and Cloud 3rd Party Public Cloud Providers

Carbonite 2.0 is a Business Continuity Company Near Term Focus • Deliver leading backup and archiving solutions to SMBs • Leverage these offerings to deliver full business continuity solutions Why we will succeed • Born in the cloud • Consumer-simple experience for business • Disruptive pricing • New “powerful yet simple” cloud and hybrid technologies 17

Setting the Stage for Execution in 2015 To support our product roadmap and leverage synergies • Engineering reorganized into four core groups • Two key new leaders appointed To support bookings growth operationally • Key leader appointed to lead PMO for mission critical projects • Key leader recruited to drive acquisition integration To support our Go-to-Market initiatives • Improved alignment within sales to drive bookings • Large partner integration efforts now led at CEO level 18

Why Carbonite? POWERFUL YET SIMPLE • Positioned for success in backup and archiving markets • Strong management team • Dedicated worldwide employee base • Compelling cloud and hybrid backup and archiving solutions purpose built for SMBs 19

Q&A SESSION 20

FINANCIAL STATEMENTS