Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Virtu KCG Holdings LLC | d862691d8k.htm |

| EX-99.1 - EX-99.1 - Virtu KCG Holdings LLC | d862691dex991.htm |

KCG Holdings, Inc. (NYSE: KCG)

4

Quarter

2014

Earnings

Presentation

January 30, 2015

th

Exhibit 99.2 |

Safe Harbor

Certain statements contained herein may constitute "forward-looking

statements" within the meaning of the safe harbor provisions of the U.S. Private

Securities Litigation Reform Act of 1995. Forward-looking statements are

typically identified by words such as "believe," "expect," "anticipate," "intend,"

"target," "estimate," "continue," "positions,"

"prospects" or "potential," by future conditional verbs such as "will," "would," "should," "could" or "may," or

by variations of such words or by similar expressions. These

"forward-looking statements" are not historical facts and are based on current

expectations, estimates and projections about KCG's industry, management's

beliefs and certain assumptions made by management, many of which, by

their nature, are inherently uncertain and beyond our control. Any

forward-looking statement contained herein speaks only as of the date on which it is

made. Accordingly, readers are cautioned that any such forward-looking

statements are not guarantees of future performance and are subject to certain

risks, uncertainties and assumptions that are difficult to predict including,

without limitation, risks associated with: (i) the strategic business

combination (the "Mergers") of Knight Capital Group, Inc.

("Knight") and GETCO Holding Company, LLC ("GETCO"), including, among other things, (a)

difficulties and delays in integrating the Knight and GETCO businesses or fully

realizing cost savings and other benefits, (b) the inability to sustain

revenue and earnings growth, and (c) customer and client reactions to the

Mergers; (ii) the August 1, 2012 technology issue that resulted in Knight's

broker-dealer subsidiary sending numerous erroneous orders in NYSE-listed

and NYSE Arca securities into the market and the impact to Knight's

business as well as actions taken in response thereto and consequences thereof;

(iii) the sale of KCG's reverse mortgage origination and securitization

business, sale of KCG's futures commission merchant and the agreement to sell KCG

Hotspot; (iv) changes in market structure, legislative, regulatory or

financial reporting rules, including the increased focus by regulators, the New

York Attorney General, Congress and the media on market structure issues,

and in particular, the scrutiny of high frequency trading, alternative trading systems, market fragmentation, colocation, access to market data

feeds, and remuneration arrangements such as payment for order flow and exchange

fee structures; (v) past or future changes to organizational structure and

management; (vi) KCG's ability to develop competitive new products and services in a timely manner and the acceptance of such products

and services by KCG's customers and potential customers; (vii) KCG's ability to

keep up with technological changes; (viii) KCG's ability to effectively

identify and manage market risk, operational and technology risk, legal risk,

liquidity risk, reputational risk, counterparty and credit risk, international

risk, regulatory risk, and compliance risk; (ix) the cost and other effects of

material contingencies, including litigation contingencies, and any adverse

judicial, administrative or arbitral rulings or proceedings; and (x) the effects

of increased competition and KCG's ability to maintain and expand market

share. The list above is not exhaustive. Readers should carefully review the

risks and uncertainties disclosed in KCG's reports with the SEC, including,

without limitation, those detailed under "Risk Factors" in KCG's Annual

Report on Form 10-K for the year-ended December 31, 2013, under "Certain

Factors Affecting Results of Operations" in KCG's Quarterly Report on Form

10-Q for the period ended September 30, 2014, and other reports or

documents KCG files with, or furnishes to, the SEC from time to time.

For additional disclosures, please see https://www.kcg.com/legal/global-disclosures. |

4th Quarter 2014 Summary

Solid financial results amid improved market conditions in U.S. equities and

certain segments of global equities, fixed income, currencies and

commodities U.S.

equity

market

making

grew

market

share

of

“retail”

SEC

Rule

605

U.S.

equity

share

volume as the quarter progressed

Algorithmic trading and order routing established a new quarterly record for

average daily U.S. equity share volume

Released

$45

million

in

excess

capital

from

the

consolidation

of

U.K.

broker

dealers

Completed the sale of KCG’s futures commission merchant (FCM)

Subsequent

to

the

4th

quarter,

announced

the

sale

of

KCG

Hotspot

to

BATS

1 |

KCG Financial Results

Pre-Tax Earnings (Loss) from Continuing Operations By Business Segment

(in thousands)

(unaudited)

For the three months ended

December 31, 2013

September 30, 2014

December 31, 2014

Market Making

Revenues

$ 232,519

$ 166,620

$ 238,740

Expenses

184,569

174,653

196,030

Pre-tax earnings (loss)

47,951

(8,033)

42,710

Global Execution Services

Revenues

84,065

79,218

93,369

Expenses

88,557

80,882

83,401

Pre-tax earnings (loss)

(4,491)

(1,664)

9,968

Corporate and Other

Revenues

6,790

26,464

14,030

Expenses

66,949

32,002

40,177

Pre-tax earnings (loss)

(60,159)

(5,538)

(26,147)

Consolidated

Revenues

323,374

272,302

346,139

Expenses

340,073

287,537

319,608

Pre-tax earnings (loss)

$ (16,699)

$ (15,235)

$ 26,531

Notes:

4th quarter 2014 results include a $2.1 million gain from the sale of the FCM as

well as expenses of $6.1 million related to less loss accruals 3rd quarter

2014 results include a $15.1 million net gain related to the Company’s strategic investment in tradeMONSTER, which combined with

OptionsHouse, as well as expenses of $10.8 million related to a reduction in

workforce and other separations as well as a lease loss accrual 4th

quarter 2013 results include expenses of $36.5 million related to a writeoff of capitalized debt costs, a reduction in workforce and additional

merger-related expenses and writedowns

2 |

Market Conditions

Sources:

BATS

Global

Markets,

VistaOne

Solutions,

Thomson

Reuters,

OCC,

CSI,

Bloomberg,

Reuters,

EBS,

SIFMA,

TRACE,

MSRB;

*

4Q14

SEC

Rule

605

U.S.

equity

share

volume

includes

an

estimate of December 2014 total based on public and proprietary data

3

Avg. daily volume in select securities markets

4Q13

3Q14

4Q14

Consolidated U.S. equity share volume

6.1 bn

5.7 bn

7.1 bn

“Retail”

SEC

Rule

605

U.S.

equity

share

volume*

783.0 mn

672.5 mn

783.3 mn

ETF share volume

633.2 mn

666.6 mn

1,024.7 mn

Consolidated U.S. equity dollar volume

$229.8 bn

$236.1 bn

$291.3 bn

U.S. equity futures contracts

2.8 mn

3.4 mn

3.9 mn

U.S. options contracts

16.2 mn

16.3 mn

17.9 mn

European equity notional value traded (USD)

$943.9 bn

$1,019.8 bn

$1,176.4 bn

Asian equity share volume

7.2 bn

6.2 bn

6.1 bn

U.S. Treasury notional volume

$297.1 bn

$489.6 bn

$506.6 bn

U.S. corporate bond notional volume

$17.1 bn

$18.7 bn

$19.7 bn

Transactions under 250 bonds

13,011

11,024

11,747

FX notional value traded (USD) among reporting venues

$213.3 bn

$237.9 bn

$271.5 bn

A marked upturn in global equities ex-Asia

Generally improved market conditions in global fixed

income, currencies and commodities

Average daily consolidated U.S. equity share volume

Average daily consolidated U.S. equity dollar volume

Average realized volatility for the S&P 500

Market conditions in U.S. equities

18.6

4.1

15.7

8,000

$400,000

6,000

$300,000

4,000

$200,000

2,000

$100,000

October

November

December

4Q14

-

Consolidated U.S. equity share volume rose 24.3% while

dollar volume increased 23.4% quarter over quarter

-

European equity notional value traded rose 15.4%

-

Asian equity share volume declined 1.6%

-

In fixed income, U.S. Treasury notional volume rose 3.5%

quarter over quarter while U.S. corporate bond notional

volume increased 5.3%

-

In foreign exchange, notional value traded among reporting

venues rose 14.1% QoQ

-

An increase in volatility among certain commodities

|

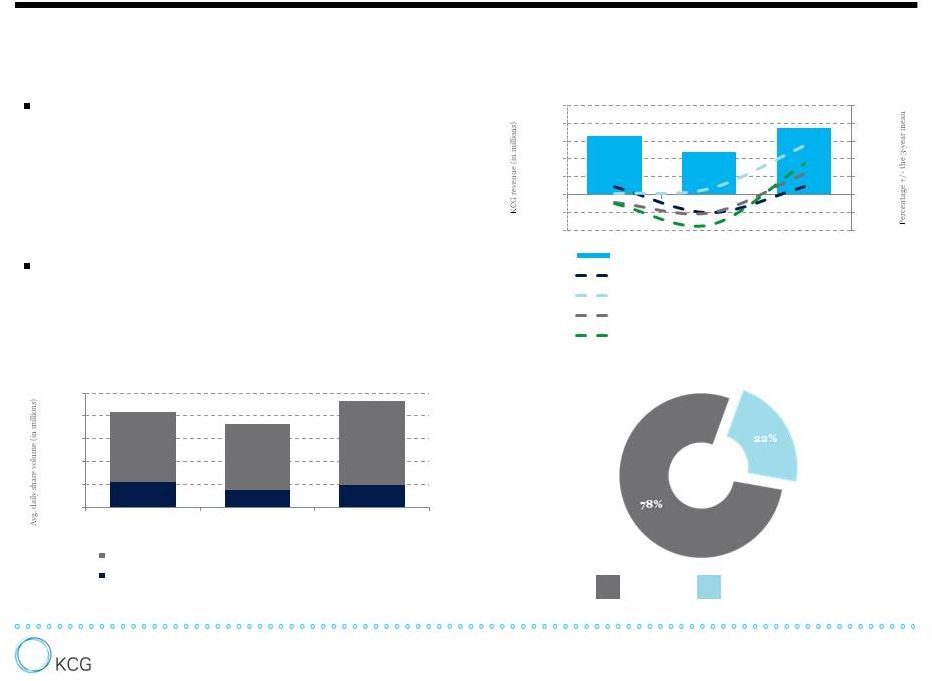

The Market Making Segment

Strong results driven by a rebound in retail trading

activity and an active U.S. equity market

-

KCG’s avg. daily SEC Rule 605 U.S. equity volume rose

27.3% quarter over quarter amid higher market-wide retail

trading activity and KCG market share gains

-

KCG’s avg. daily NYSE-

and NASDAQ-listed share volume

rose 28.3% QoQ while dollar volume including OTCs

increased 27.9%

Improved results from non-U.S. equities

-

A better operating environment QoQ for European equities

and certain classes of FICC

4Q14

Market

Making

revenue

distribution

†

4

U.S. equities

Non-U.S. equities

-20%

-10%

0%

10%

20%

30%

40%

50%

-$100

-$50

$0

$50

$100

$150

$200

$250

4Q13

3Q14

4Q14

Primary drivers of revenues from U.S. equities*

KCG revenue from U.S. equity market making

Avg. daily SEC Rule 605 U.S equity share volume

Avg. daily consolidated U.S equity dollar volume

Avg. daily consolidated U.S equity share volume

Avg. realized volatility for the S&P 500

832.8

727.3

933.4

217.3

152.1

193.6

0

200

400

600

800

1,000

4Q13

3Q14

4Q14

KCG retail and total exchange-listed volume

KCG avg. daily exchange-listed share volume

KCG avg. daily SEC Rule 605 U.S equity share volume

Sources: KCG, SEC, VistaOne Solutions; * 4Q14 SEC Rule 605 share volume

includes an estimate of December 2014 total based on public and proprietary data.

†

Revenue from market making in U.S. equities of $185.6 million in the fourth

quarter of 2014 is a factor, along with total dollar volume during the quarter of $1.99 trillion that

results in average revenue capture of 0.93 basis points. Market making in

non-U.S. equities includes European and Asian equities, fixed income, currencies and commodities.

|

Renewed Strength in Retail Trading Activity

5

Sources: KCG, SEC, VistaOne Solutions. Estimated marketwide gross and net retail

flows are a function of the gross and net dollar value of all SEC Rule 605-eligible buys and sells executed by KCG

during a given month scaled up based on market share among the core set of

wholesalers. Estimate of December 2014 SEC Rule 605 volume based on public and proprietary data.

KCG’s Individual Investor Gauge represents estimated market-wide

gross and net retail investor flows based on public and proprietary data

derived from monthly SEC Rule 605-eligible volume. Estimated

market-wide gross retail flows CAGR of 33% from 1Q13 to 4Q14

Estimated

market-wide

net

retail

inflows

of

$143

billion

from

2012

through

2014

following

outflows

of $83 billion from 2009 through 2011

Gross CAGR of 33%

Net outflows of $83 billion

Net inflows of $143 billion

$0

$50

$100

$150

$200

$250

$300

$350

$400

$450

$500

$550

$600

$650

$700

$750

-$25

-$20

-$15

-$10

-$5

$0

$5

$10

$15

$20

$25

Market-

wide net (est.)

Market-

wide gross (est.) |

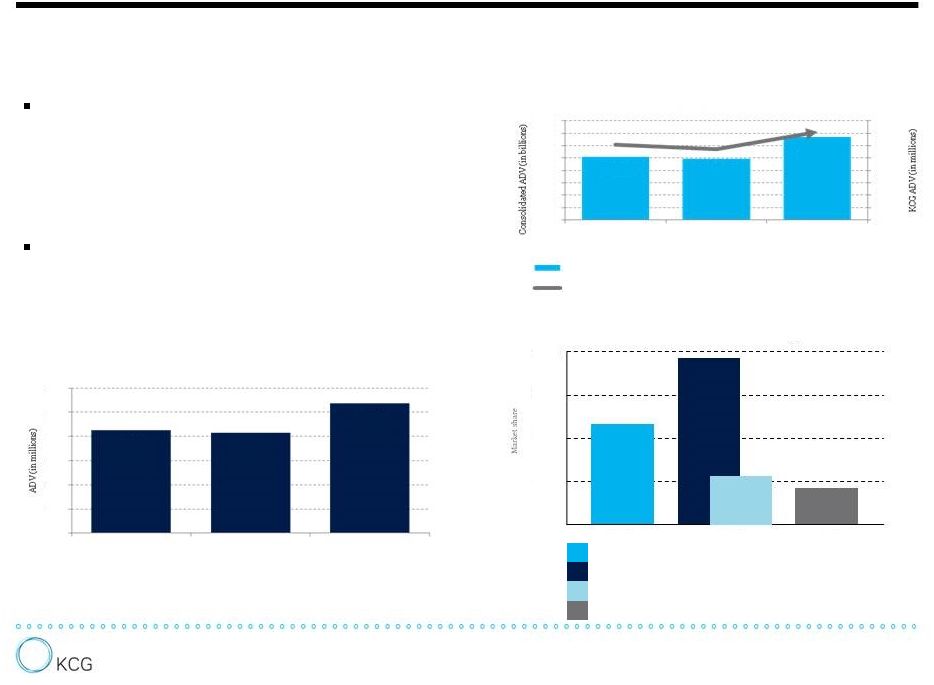

The Global Execution Services Segment

6

Sources: KCG, BATS Global Markets, Reuters, EBS, TRACE, MSRB

KCG Hotspot % of institutional spot FX notional dollar volume among reporting

venues KCG BondPoint % of interdealer corporate bond transactions

under 250 bonds

KCG BondPoint % of interdealer muni bond transactions under 250 bonds

Knight Match ATS % of dark U.S. equity liquidity

Market share of KCG trading venues

11.6%

19.2%

5.7%

4.1%

42.5

41.4

53.8

0

10

20

30

40

50

60

4Q13

3Q14

4Q14

KCG algorithmic trading and order routing

U.S. equity share volume from U.S. institutions

0

100

200

300

400

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

8.0

4Q13

3Q14

4Q14

KCG algorithmic trading and order routing

U.S. equity share volume

Avg. daily algorithmic trading and order routing U.S equity share volume

Avg. daily consolidated U.S. equity share volume

50

150

250

350

256.1

248.2

334.3

In agency execution, solid results driven by market

conditions and client growth

Among trading venues, sustained good performance

-

Algorithmic trading and order routing set a new quarterly

record for avg. daily share volume; ADV from algorithmic

trading by U.S. institutional clients rose 30% QoQ

-

Increased contributions QoQ from institutional equity

sales trading and ETF trading

-

KCG Hotspot increased avg. daily notional FX dollar volume

4.4% QoQ

-

KCG BondPoint grew avg. daily par value traded 3.9% QoQ

20%

15%

10%

5%

4Q14

4Q14

4Q14 |

Consolidated Expenses

Compensation and Benefits rose $15 million

quarter over quarter due to higher net

revenues and increased bonus accruals

Communications and Data Processing

declined $1.6 million QoQ as a result of

reductions in connectivity and market data

costs

Professional Fees decreased $1.5 million QoQ,

attributable to lower consulting and legal fees

Depreciation and Amortization increased

$900,000 QoQ as a result of asset purchases

and deployments

Among transaction-based expenses, the

$700,000 decline in Payments for Order Flow

QoQ –

amid a rise in retail trading activity –

is due to a further shift to execution quality

and price improvement

7

†

See addendum for a reconciliation of GAAP to non-GAAP financial

results. Compensation and benefits

Communications and data processing

Depreciation and amortization

Debt interest expense

Professional fees

Occupancy and equipment rentals

Business development

Other |

Additional Financials

Consolidated Statements of Financial Condition

(in millions)

(unaudited)

December 31, 2013

September 30, 2014

December 31, 2014

Cash and cash equivalents

$ 674.3

$ 540.5

$ 578.8

Debt

657.3

422.3

422.3

Stockholders’

equity

1,509.5

1,485.8

1,522.6

Debt-to-tangible equity ratio

0.51

0.33

0.31

Tangible book value per share

$10.64

$11.05

$11.72

Book value per share

$12.34

$12.68

$13.03

Shares outstanding including restricted

stock units (in thousands)

122,239

117,167

116,860

Tangible book value is calculated by subtracting goodwill and intangible assets

from equity. 8 |

Announced Sale of KCG Hotspot

Subsequent to the fourth quarter of 2014, KCG announced a definitive agreement to

sell spot fixed income ECN KCG Hotspot to BATS Global Markets

Upon the close, the transaction is expected to increase KCG’s tangible book

value by approximately $2.00 per share

9

Under the terms of the agreement:

Assets and liabilities held for sale on the balance sheet dated December 31, 2014

are related to Hotspot

The transaction is expected to close in the second quarter of 2015

-

KCG will receive $365 million in cash upon the close of the transaction

-

KCG

and

BATS

will

share

certain

tax

benefits,

which

could

result

in

further

payments

to

KCG

of

up

to approximately $70 million in the three-year period following the

close |

|

Regulation G Reconciliation of Non-GAAP

Financial Measures (Continuing Operations)

3 months ended December 31, 2014

Market Making

Global Execution

Services

Corporate and Other

Consolidated

Reconciliation of GAAP pre-tax to non-GAAP pre-tax:

GAAP income (loss) from continuing operations before income taxes

$ 42,710

$ 9,968

$ (26,147)

$ 26,531

Gain on sale of FCM

-

(2,116)

-

(2,116)

Writedown of assets and lease loss accrual, net

-

-

6,117

6,117

Non-GAAP income (loss) from continuing operations before income taxes

$ 42,710

$ 7,852

$ (20,030)

$ 30,532

10 |

3

months ended September 30, 2014 Market Making

Global Execution

Services

Corporate and

Other

Consolidated

Reconciliation of GAAP pre-tax to non-GAAP pre-tax:

GAAP loss from continuing operations before income taxes

$ (8,033)

$ (1,664)

$ (5,538)

$ (15,235)

Net gain related to tradeMONSTER combination with OptionsHouse

-

-

(15,105)

(15,105)

Compensation related to reduction in workforce and other employee

separations 2,786

3,577

4,158

10,521

Writedown of assets and lease loss accrual, net

-

-

301

301

Non-GAAP (loss) income from continuing operations before income taxes

$ (5,247)

$ 1,913

$ (16,184)

$ (19,518)

Regulation G Reconciliation of Non-GAAP

Financial Measures (Continuing Operations)

11 |

Regulation G Reconciliation of Non-GAAP

Financial Measures (Continuing Operations)

3 months ended December 31, 2013

Market Making

Global Execution

Services

Corporate and

Other

Consolidated

Reconciliation of GAAP pre-tax to non-GAAP pre-tax:

GAAP income (loss) from continuing operations before income taxes

$ 47,951

$ (4,491)

$ (60,159)

$ (16,699)

Compensation and other expenses related to a reduction in workforce

5,254

5,447

708

11,409

Professional and other fees related to Mergers and August 1st technology

issue -

-

2,785

2,785

Writedown of capitalized debt costs

-

-

13,209

13,209

Gain on strategic asset

-

-

(1,359)

(1,359)

Writedown of assets and lease loss accrual

-

1,681

8,819

10,500

Non-GAAP income (loss) from continuing operations before income taxes

$ 53,205

$ 2,637

$ (35,997)

$ 19,845

12 |

3

months ended December 31, 2014 GAAP

Adjustments for

non-GAAP presentation

KCG adjusted, normalized

expenses

Reconciliation of GAAP expenses to normalized non-GAAP expenses:

Employee compensation and benefits

116,214

0

116,214

Communications and data processing

36,945

0

36,945

Depreciation and amortization

21,224

0

21,224

Debt interest expense

7,721

0

7,721

Professional fees

5,695

0

5,695

Occupancy and equipment rentals

8,514

0

8,514

Business development

2,308

0

2,308

Writedown of assets and lease loss accrual, net

6,117

6,117

0

Other

9,822

0

9,822

Total expenses

$ 214,561

$ 6,117

$ 208,444

Regulation G Reconciliation of Non-GAAP

Financial Measures (Continuing Operations)

13 |

Regulation G Reconciliation of Non-GAAP

Financial Measures (Continuing Operations)

3 months ended September 30, 2014

GAAP

Adjustments for

non-GAAP presentation

KCG adjusted, normalized

expenses

Reconciliation of GAAP expenses to normalized non-GAAP expenses:

Employee compensation and benefits

95,307

10,521

84,786

Communications and data processing

38,576

-

38,576

Depreciation and amortization

20,298

-

20,298

Debt interest expense

7,714

-

7,714

Professional fees

7,161

-

7,161

Occupancy and equipment rentals

7,672

-

7,672

Business development

3,163

-

3,163

Writedown of assets and lease loss accrual, net

301

301

-

Other

10,580

-

10,580

Total expenses

$ 190,772

$ 10,822

$ 179,950

14 |

3

months ended December 31, 2013 GAAP

Adjustments for

non-GAAP presentation

KCG adjusted, normalized

expenses

Reconciliation of GAAP expenses to normalized non-GAAP expenses:

Employee compensation and benefits

112,209

11,409

100,800

Communications and data processing

37,512

-

37,512

Depreciation and amortization

19,566

-

19,566

Debt interest expense

12,943

-

12,943

Professional fees

7,734

2,491

5,243

Occupancy and equipment rentals

9,358

-

9,358

Business development

1,923

-

1,923

Writedown of capitalized debt costs

13,209

13,209

-

Writedown of assets and lease loss accrual

10,500

10,500

-

Other

13,066

294

12,772

Total expenses

$ 238,020

$ 37,903

$ 200,117

Regulation G Reconciliation of Non-GAAP

Financial Measures (Continuing Operations)

15 |

|