Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Energy Transfer, LP | etp8-k13015.htm |

ENERGY TRANSFER PARTNERS, L.P. REGENCY ENERGY PARTNERS LP ETP’s Merger with Regency January 30, 2015

LEGAL DISCLAIMER 2 Additional Information and Where to Find It SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND THE REGISTRATION STATEMENT REGARDING THE TRANSACTION (THE "TRANSACTION”) INVOLVING THE MERGER OF ENERGY TRANSFER PARTNERS, L.P. (“ETP”) AND REGENCY ENERGY PARTNERS LP (“RGP" AND/OR "REGENCY”) CAREFULLY WHEN IT BECOMES AVAILABLE. These documents (when they become available), and any other documents filed by ETP or Regency with the U.S. Securities and Exchange Commission (“SEC”), may be obtained free of charge at the SEC’s website, at www.sec.gov. In addition, investors and security holders will be able to obtain free copies of the registration statement and the proxy statement/prospectus by phone, e-mail or written request by contacting the investor relations department of ETP or Regency at the following: Energy Transfer Partners, L.P. 3738 Oak Lawn Ave. Dallas, TX 75219 Attention: Investor Relations Phone: 214-981-0700 Regency Energy Partners LP 2001 Bryan Street, Suite 3700 Dallas, TX 75201 Attention: Investor Relations Phone: 214-840-5477 Participants in the Solicitation ETP, Regency and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in connection with the proposed merger. Information regarding the directors and executive officers of ETP is contained in ETP’s Form 10-K for the year ended December 31, 2013, which was filed with the SEC on February 27, 2014. Information regarding the directors and executive officers of Regency is contained in Regency’s Form 10-K for the year ended December 31, 2013, which was filed with the SEC on February 27, 2014. Additional information regarding the interests of participants in the solicitation of proxies in connection with the proposed merger will be included in the proxy statement/prospectus. Cautionary Statement Regarding Forward-Looking Statements This presentation includes “forward-looking” statements. Forward-looking statements are identified as any statement that does not relate strictly to historical or current facts. Statements using words such as “anticipate,” “believe,” “intend,” “project,” “plan,” “expect,” “continue,” “estimate,” “goal,” “forecast,” “may” or similar expressions help identify forward-looking statements. ETP and Regency cannot give any assurance that expectations and projections about future events will prove to be correct. Forward-looking statements are subject to a variety of risks, uncertainties and assumptions. These risks and uncertainties include the risks that the proposed transaction may not be consummated or the benefits contemplated therefrom may not be realized. Additional risks include: the ability to obtain requisite regulatory and unitholder approval and the satisfaction of the other conditions to the consummation of the proposed transaction, the ability of ETP to successfully integrate Regency’s operations and employees and realize anticipated synergies and cost savings, the potential impact of the announcement or consummation of the proposed transaction on relationships, including with employees, suppliers, customers, competitors and credit rating agencies, the ability to achieve revenue, DCF and EBITDA growth, and volatility in the price of oil, natural gas, and natural gas liquids. Actual results and outcomes may differ materially from those expressed in such forward-looking statements. These and other risks and uncertainties are discussed in more detail in filings made by ETP and Regency with the Securities and Exchange Commission (the “SEC”), which are available to the public. ETP and Regency undertake no obligation to update publicly or to revise any forward-looking statements, whether as a result of new information, future events or otherwise.

KEY MERGER HIGHLIGHTS 3 Energy Transfer Partners, L.P. (“ETP”) has executed a definitive agreement to merge with Regency Energy Partners LP (“Regency”) in an all unit transaction – 0.4066 ETP common units plus a one-time cash payment of $0.32 for each Regency LP unit implying an all-in price of $26.89 per unit based on ETP’s closing price on January 23, 2015 – Implied premium: • 13% to Regency’s closing price on January 23, 2015 • 15% to Regency’s 3-day VWAP ending January 23, 2015 ETP will assume Regency’s outstanding debt and will refinance Regency’s outstanding revolver borrowings – $6.4 billion of debt at September 30, 2014 – Regency’s revolver to be terminated at closing – No change of control triggered in Regency existing notes except for two series of notes assumed by Regency in the PVR merger • The assumed PVR senior notes consist of $400 million of 6.5% notes due 2021 and $473 million of 8.375% notes due 2020 • Regency will be required to make a change of control offer at 101% of par for these notes • These notes have recently traded at or above 101% of par All three rating agencies have affirmed ETP’s credit ratings and put Regency on review for upgrade Breakeven to distributable cash flow per unit for ETP in 2015 and accretive in 2016 and beyond ETE will provide to ETP $320mm of total IDR subsidies over 5 years – $80mm IDR subsidy for the first full year after closing and $60mm per year for the following 4 years ETE and ETP have also agreed to vote their 94.8mm Regency units in support of the merger Merger subject to customary approvals – HSR clearance – Expect transaction to close in Q2 2015 MERGER TAKES ETP TO THE NEXT LEVEL AND CREATES LONG TERM VALUE FOR ALL UNITHOLDERS (1) Based on market data as of 1/23/15

STRATEGIC CONSIDERATIONS 4 A “WIN–WIN” FOR ALL STAKEHOLDERS LEADING POSITIONS IN THE MOST ATTRACTIVE BASINS IN THE U.S. WORLD CLASS MIDSTREAM FOOTPRINT COMPLEMENTARY ASSETS WITH SIGNIFICANT GROWTH OPPORTUNITIES SIGNIFICANT LONG- TERM VALUE CREATION • Strong positions in Permian, Eagle Ford, Marcellus and Utica basins – Active in 9 of the top 10 basins by active rig count (1) – Top 3 regions by oil production and top 3 regions by gas production (2) • Adds diversity and leadership positions in substantially all major basins/plays • Combines strong Permian Basin / Eagle Ford positions to create the premier franchise • Provides additional customer relationships with some of the most active operators in each basin • Current combined gathering and processing throughput of 8.7 Bcf/d • Significant organic growth project opportunities – 2015 pro forma growth capex of ~$4.9 billion • Additional NGL production and volumes to further support Lone Star’s(3) leading NGL position in Mont Belvieu • Incremental natural gas volumes for ETP’s intrastate natural gas system • Substantial cost savings and efficiencies • Higher long-term distribution growth profile than ETP stand-alone • Provides immediate and long-term value to Regency unitholders (1) Source: Baker Hughes (2) Source: EIA (3) Lone Star is owned 70% by ETP and 30% by Regency

MERGER MATRIX 5 • Merger of ETP and Regency • Next steps require regulatory and unitholder approvals • Simple majority unitholder approval required for the merger – ETE and ETP own ~23% of Regency’s common units • Key ETP and Regency management to continue to run businesses and oversee integration through closing • Regency common unitholders receive a premium, stronger credit profile, improved unit liquidity and more certain future growth profile vs. on a stand-alone basis • Builds major presence in Marcellus / Utica basins • Consolidates midstream asset base across multiple basins • Upside to Lone Star and ETP’s best-in-class intrastate gas system • Opportunity to realize significant synergies with low execution risk and minimal upfront investment • Commodity price environment has fundamentally changed • Backdrop provides challenges to Regency’s ability to grow effectively based on its cost of capital • Timing of the merger preserves the accretive value of Regency’s current organic growth projects (>$2 billion) • Complementary businesses create tremendous value that offsets negative impact from commodity price headwinds • Opportunity to focus on capital efficiency and flexibility across the asset base and new growth projects • Merger is breakeven in 2015 and accretive to ETP’s distributable cash flow in 2016 and beyond • Increased combined presence in Permian and Eagle Ford will provide for additional commercial opportunities • Allows Regency unitholder participation in potential upside from synergies and complementary organic growth projects • No material change to overall customer credit exposure • Better positions ETP for long-term growth A merger that will further drive unitholder growth and fundamental long-term value creation INDUSTRIAL LOGIC FOR THIS MERGER HAS ALWAYS EXISTED: NOW IS THE RIGHT TIME Action Plan Why Now? Compelling Benefits Tangible Results

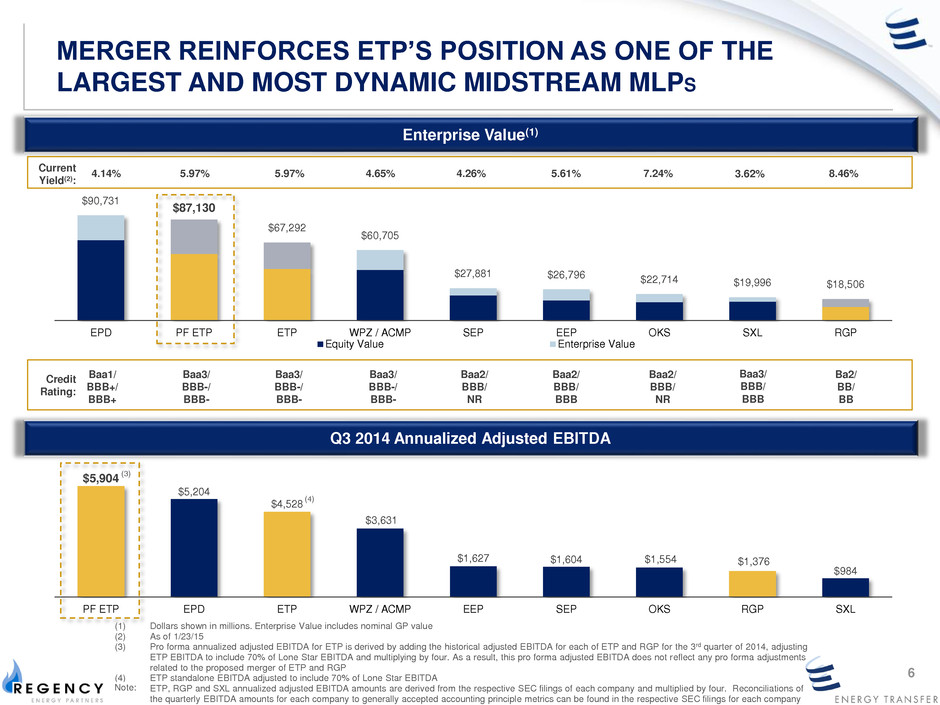

Enterprise Value(1) MERGER REINFORCES ETP’S POSITION AS ONE OF THE LARGEST AND MOST DYNAMIC MIDSTREAM MLPS 6 Q3 2014 Annualized Adjusted EBITDA $5,904 $5,204 $4,528 $3,631 $1,627 $1,604 $1,554 $1,376 $984 PF ETP EPD ETP WPZ / ACMP EEP SEP OKS RGP SXL (1) Dollars shown in millions. Enterprise Value includes nominal GP value (2) As of 1/23/15 (3) Pro forma annualized adjusted EBITDA for ETP is derived by adding the historical adjusted EBITDA for each of ETP and RGP for the 3rd quarter of 2014, adjusting ETP EBITDA to include 70% of Lone Star EBITDA and multiplying by four. As a result, this pro forma adjusted EBITDA does not reflect any pro forma adjustments related to the proposed merger of ETP and RGP (4) ETP standalone EBITDA adjusted to include 70% of Lone Star EBITDA (5) ETP, RGP and SXL annualized adjusted EBITDA amounts are derived from the respective SEC filings of each company and multiplied by four. Reconciliations of the quarterly EBITDA amounts for each company to generally accepted accounting principle metrics can be found in the respective SEC filings for each company Current Yield(2): 5.97% 4.65% 4.26% 5.61% 7.24% 8.46% 5.97% 4.14% Credit Rating: Baa3/ BBB-/ BBB- Baa2/ BBB/ NR Baa2/ BBB/ BBB Baa2/ BBB/ NR Baa3/ BBB-/ BBB- Ba2/ BB/ BB Baa3/ BBB-/ BBB- Baa1/ BBB+/ BBB+ $90,731 $87,130 $67,292 $60,705 $27,881 $26,796 $22,714 $19,996 $18,506 EPD PF ETP ETP WPZ / ACMP SEP EEP OKS SXL RGP Equity Value Enterprise Value (3) 3.62% Baa3/ BBB/ BBB (4) Note:

ETP’S DIVERSIFIED PLATFORM AND STABLE CASH FLOW PROFILE IMPROVES POST MERGER 7 Q3 2014 Adjusted EBITDA by Segment Interstate 22% Crude / Refined Product 20% Retail 19% Liquids Trans. & Svcs. 13% Midstream 13% Intrastate 9% Other 4% Gathering & Processing(2) 60% Contract Services 12% Transportion 12% NGL Services 11% Natural Resources 5% Midstream 23% Interstate 19% Crude / Refined Product 16% Retail 15% Liquids Trans. & Svcs. 13% Intrastate 8% Other 3% Contract Services 3% Fee Based ~85-90% Non-fee Based ~10-15% Fee Based 75% Hedged Commodity 15% Non-fee Based 10% Fee Based ~85-87% Hedged Commodity 3% Non-fee Based ~10-12% Stable Fee Based Cash Flow Profile(3) Pro Forma (1) ETP and RGP Q3 2014 adjusted EBITDA amounts are derived from the respective SEC filings of each company. Reconciliations of the quarterly EBITDA amounts for each company to generally accepted accounting principle metrics can be found in the respective SEC filings for each company. The adjusted EBITDA of ETP for the third quarter of 2014 includes a pro forma adjustment to reflect the acquisition of Susser Holdings by ETP as if the acquisition had occurred at the beginning of the third quarter (2) RGP G&P segment included in pro forma ETP midstream segment (3) Excludes Retail Marketing (1) (2)

, , , , , , , , '03 '14 '03 '14 Bakken Niobrara Marcellus Permian Eagle Ford Haynesville , , , , , , , , , , , , , , , '03 '14 '03 '14 '03 '14 '03 '14 '03 '14 '03 '14 '03 '14 '03 '14 '03 '14 '03 '14 9 1,193 9 1,462 114 370 2,571 4,559 897 1,807 5,279 5,841 0 1,614 57 84 6,797 0 53 1 0 7,040 1 16,045 OPERATING ASSETS ALIGNED WITH THE MOST PROLIFIC SHALE BASINS IN THE U.S. 8 Source: DI Desktop and EIA Drilling Productivity Report; November 2014 (1) Approximate figures as reported in Q3 2014 10-Q and analyst presentations ETP Assets SXL Assets RGP Assets Operating Assets Crude Production (Mbpd) Natural Gas Production (MMcf/d) Lone Star Express Pipeline Development Projects Lake Charles LNG Rover Pipeline Dakota Access Pipeline Marcus Hook Nederland Eagle Point Crude Conversion Pipeline Asset Summary(1) ETP Regency Pro Forma Pipeline (miles) 35,000 27,270 62,270 Gathering & Processing Throughput (MMBtu/d) 3,054,000 5,680,000 8,734,000 NGL Production (Mbpd) 191 178 369 Natural Gas Transported (MMBtu/d) 14,391,000 1,860,926 16,251,634

SIGNIFICANT SCALE, SCOPE AND OVERLAP IN TEXAS, MIDCONTINENT AND THE GULF COAST 9 ETP Assets RGP Assets Lone Star Pipeline ETP Storage ETP Plant Facility Lake Charles LNG RGP Plant Facility Lone Star Storage Facility Lone Star Fractionator Niobrara Permian Haynesville West TX Panhandle West Texas South Texas RIGS/MEP Eagle Ford

Niobrara Barnett Permian Haynesville Woodford Marcellus & Others Lone Star Nederland ACCELERATING NGL FLOWS TO LONE STAR 10 Eagle Ford ETP Assets RGP Assets ETP Storage ETP Plant Facility Lake Charles LNG RGP Plant Facility Lone Star Storage Facility Lone Star Fractionator SXL Nederland Lone Star is Among the Best Positioned NGL Businesses in Mont Belvieu Opportunity to move legacy PVR and EROC liquids volumes to Lone Star Enhances baseline business and positions Lone Star for further growth such as Fractionator IV Increased NGL production will support Mariner South JV with SXL for additional export opportunities Lone Star and SXL’s Nederland terminal are world-class assets 86 190 242 369 2011 2012 2013 Q3 '14 ETP RGP Combined NGL Production (Mbpd)

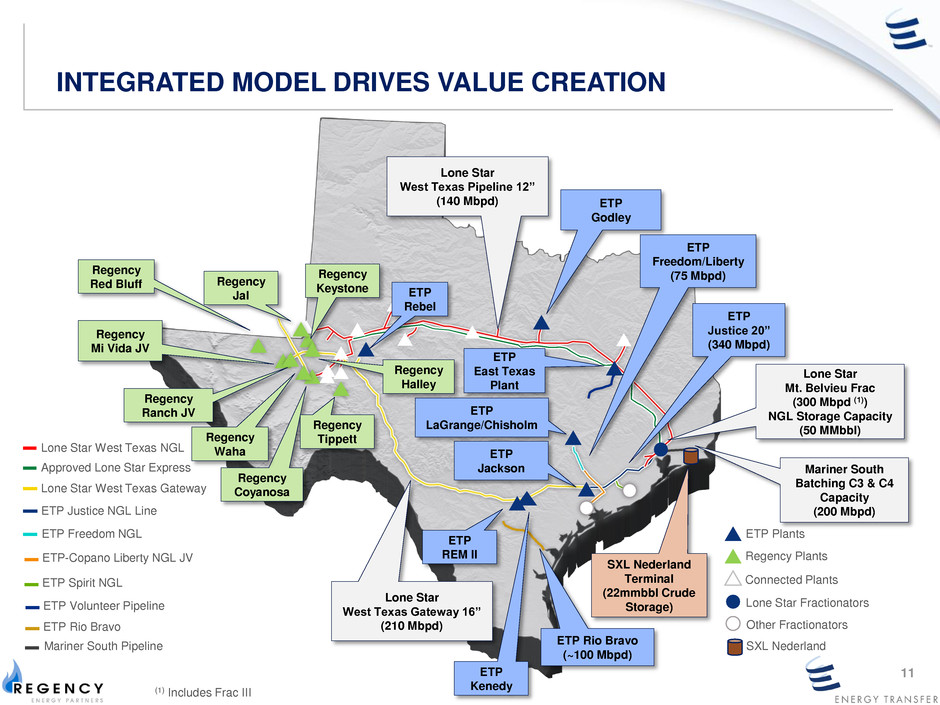

INTEGRATED MODEL DRIVES VALUE CREATION ETP Justice NGL Line ETP Freedom NGL Lone Star West Texas Gateway Lone Star West Texas NGL ETP-Copano Liberty NGL JV ETP Spirit NGL Other Fractionators Lone Star Fractionators Connected Plants Regency Plants ETP Plants Lone Star West Texas Pipeline 12” (140 Mbpd) ETP Freedom/Liberty (75 Mbpd) ETP Justice 20” (340 Mbpd) Lone Star Mt. Belvieu Frac (300 Mbpd (1)) NGL Storage Capacity (50 MMbbl) ETP LaGrange/Chisholm Lone Star West Texas Gateway 16” (210 Mbpd) Regency Jal Regency Halley Regency Coyanosa Regency Tippett Regency Waha Regency Ranch JV Regency Mi Vida JV Regency Red Bluff Regency Keystone 11 Mariner South Batching C3 & C4 Capacity (200 Mbpd) ETP Rebel (1) Includes Frac III SXL Nederland Terminal (22mmbbl Crude Storage) SXL Nederland ETP REM II ETP East Texas Plant ETP Volunteer Pipeline ETP Rio Bravo ETP Kenedy Mariner South Pipeline ETP Rio Bravo (~100 Mbpd) Approved Lone Star Express ETP Godley ETP Jackson

Interstate Pipeline Assets FURTHER ENHANCES ETP’S BEST-IN-CLASS INTRASTATE NATURAL GAS SYSTEM 12 Additional volumes through intrastate natural gas system Over 7,700 miles of intrastate pipelines ~14 Bcf/d of throughput capacity ~74 Bcf of owned storage capacity ETP Gathering Pipelines ETP Processing Plant RGP Gathering Pipelines RGP Processing Plant Intrastate Pipelines Houston Pipeline ET Fuel Oasis Katy

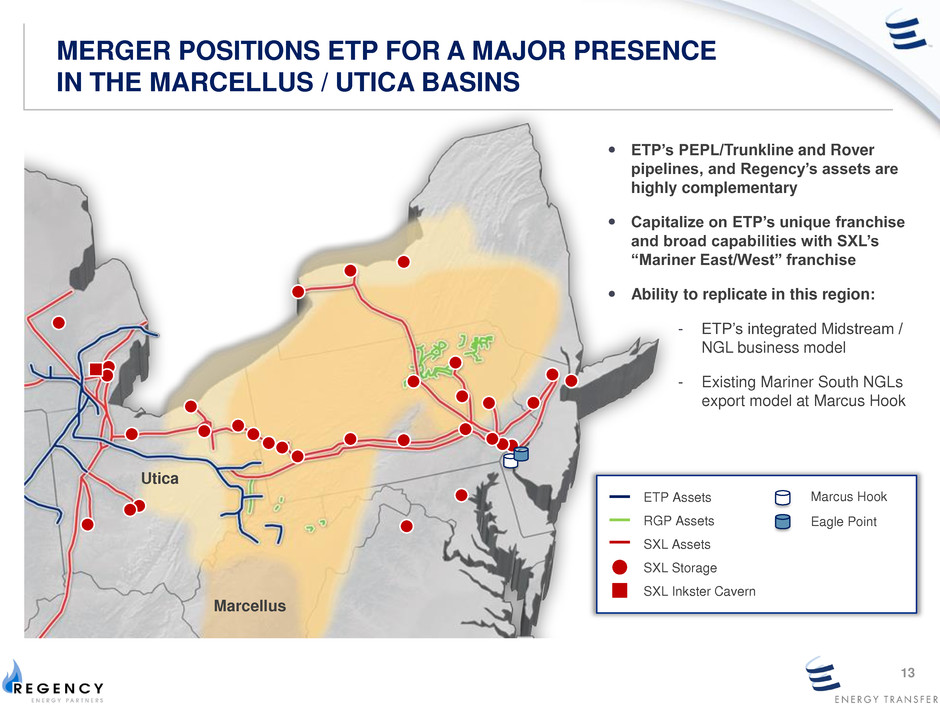

MERGER POSITIONS ETP FOR A MAJOR PRESENCE IN THE MARCELLUS / UTICA BASINS 13 ETP’s PEPL/Trunkline and Rover pipelines, and Regency’s assets are highly complementary Capitalize on ETP’s unique franchise and broad capabilities with SXL’s “Mariner East/West” franchise Ability to replicate in this region: - ETP’s integrated Midstream / NGL business model - Existing Mariner South NGLs export model at Marcus Hook ETP Assets RGP Assets SXL Assets SXL Storage SXL Inkster Cavern Marcus Hook Eagle Point Marcellus Utica

SUBSTANTIAL OPPORTUNITIES TO REALIZE VALUE 14 • Highly complementary assets provide ability to realize savings • Opportunity to rationalize selected capital spending • Expanded platform increases likelihood for additional new growth projects • Allows broader asset base to be redeployed or repurposed across combined system, creating new opportunities Capital Efficiency CommercialField / Operational SystemsCorporate G&A Value Creation Overall synergies with “low execution risk”

PROVEN TRACK RECORDS OF SUCCESSFUL INTEGRATION 15 • Energy Transfer and Regency management teams have proven track records of successfully integrating acquisitions: • Knowledge of respective assets and businesses will facilitate a smooth integration of: – Operations – Commercial – Risk Management – Finance / Accounting – Information Technology • Integration plan expected to be substantially complete by the time of merger closing 2014 2012 2012 2011 2014 2014 2013

KEY TAKEAWAYS 16 • The merger of ETP and Regency creates benefits for ETE – Immediate increase in overall cash flow and long-term cash flow growth – Improved pro forma credit profile • ETP becomes the second largest MLP – Combined footprint with over 62,270 miles of pipelines and over 60 plants with 8.7 Bcf/d of gathering and processing throughput – Operations in major high-growth oil and gas shales and basins, including Eagle Ford, Permian, Panhandle and Marcellus / Utica • Regency benefits from size and strength of ETP’s diversified platform – Improved access to capital and lower cost of capital – Better potential for growth in a lower commodity price environment ETE will be stronger and better positioned for future strategic opportunities ETP benefits from further diversified basin exposure, major presence in Marcellus / Utica basins, increased NGL volumes to Lone Star and greater gas volumes in its intrastate system Regency steps into an investment grade balance sheet and an attractive cost of capital

ILLUSTRATIVE MERGER TIMELINE 17 • Integration plan will result in one functional organization at closing • Only major regulatory approval is HSR; no issues expected given common control of ETP and RGP by ETE January 2015 • Sign Merger Agreement • Announce transaction • Begin drafting Proxy / registration statement • Begin regulatory approval process File proxy statement / S-4 registration statement Q2 2015: Merger Close • File for Regulatory (HSR) Approval 2 – 4 weeks 8 – 16 weeks 3 – 5 months expected timing from announcement to closing Subject to SEC review & regulatory approval

APPENDIX

PRO FORMA CAPITALIZATION 19 Note: Not pro forma for Bakken Pipeline transaction 1. Regency pro forma redemption of $600mm 2018 notes redeemed 12/2/14. Regency RCF balance as of 12/31/14 (1) ($ in millions) As of September 30, 2014 As Adjusted ETP As Regency Refi Regency Pro Capitalization Reported Merger Revolver Forma Cash and Cash Equivalents $1,060 $15 $1,075 Revolving Credit Facilities: ETP $2.5bn RCF $800 $133 $9 $942 Sunoco Logistics $35mm RCF 35 35 Sunoco Logistics $1.5bn RCF 525 525 Sunoco LP $1.25bn RCF 270 270 Regency $2.0bn RCF - 1,509 (1,509) 0 Notes: ETP Notes 10,890 1,500 12,390 Transwestern Senior Notes 870 870 Panhandle Notes 1,085 1,085 Sunoco Senior Notes 965 965 Sunoco Logistics Senior Notes 2,975 2,975 Regency Senior Notes 5,090 5,090 Other Long-Term Debt 220 220 Total Debt $18,635 $25,367 Series A Preferred - 45 45 Non-controlling Interest 5,813 117 5,930 Partner's Capital 12,301 11,084 23,385 Total Capitalization $36,749 $54,727