Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - SunCoke Energy, Inc. | d863511dex991.htm |

| EX-99.3 - EX-99.3 - SunCoke Energy, Inc. | d863511dex993.htm |

| 8-K - 8-K - SunCoke Energy, Inc. | d863511d8k.htm |

SunCoke Energy,

Inc. Q4 2014 Earnings

& 2015 Guidance

Conference Call

January 29, 2015

Exhibit 99.2 |

Forward-Looking Statements

1

SXC Q4/ FY 2014 Earnings & 2015 Guidance Call

This slide presentation should be reviewed in conjunction with the Fourth Quarter 2014

earnings and 2015 guidance release of SunCoke Energy, Inc. (SXC) and the conference

call held on January 29, 2015 at 11:30 a.m. ET. Some of the information included in

this presentation constitutes “forward-looking statements” as defined in Section 27A of the Securities Act of

1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. All

statements in this presentation that express opinions, expectations, beliefs, plans,

objectives, assumptions or projections with respect to anticipated future performance of SXC or SunCoke

Energy Partners, L.P. (SXCP), in contrast with statements of historical facts, are

forward-looking statements. Such forward-looking statements are based on

management’s beliefs and assumptions and on information currently available. Forward-looking statements include information

concerning possible or assumed future results of operations, business strategies, financing

plans, competitive position, potential growth opportunities, potential operating

performance improvements, the effects of competition and the effects of future legislation or regulations.

Forward-looking statements include all statements that are not historical facts and may be

identified by the use of forward-looking terminology such as the words

“believe,” “expect,” “plan,” “intend,” “anticipate,” “estimate,” “predict,” “potential,” “continue,” “may,” “will,” “should” or

the negative of these terms or similar expressions.

Although management believes that its plans, intentions and expectations reflected in or

suggested by the forward-looking statements made in this presentation are

reasonable, no assurance can be given that these plans, intentions or expectations will be achieved when anticipated or at

all. Moreover, such statements are subject to a number of assumptions, risks and

uncertainties. Many of these risks are beyond the control of SXC and SXCP, and

may cause actual results to differ materially from those implied or expressed by the forward-looking statements. Each of SXC

and SXCP has included in its filings with the Securities and Exchange Commission cautionary

language identifying important factors (but not necessarily all the important factors)

that could cause actual results to differ materially from those expressed in any forward-looking statement.

For more information concerning these factors, see the Securities and Exchange Commission

filings of SXC and SXCP. All forward-looking statements included in this

presentation are expressly qualified in their entirety by such cautionary statements. Although forward-looking

statements are based on current beliefs and expectations, caution should be taken not to place

undue reliance on any such forward-looking statements because such statements speak

only as of the date hereof. SXC and SXCP do not have any intention or obligation to update publicly

any forward-looking statement (or its associated cautionary language) whether as a result

of new information or future events or after the date of this presentation, except as

required by applicable law. This presentation includes certain non-GAAP financial

measures intended to supplement, not substitute for, comparable GAAP measures.

Reconciliations of non-GAAP financial measures to GAAP financial measures are provided in

the Appendix at the end of the presentation. Investors are urged to consider carefully

the comparable GAAP measures and the reconciliations to those measures provided in the Appendix. |

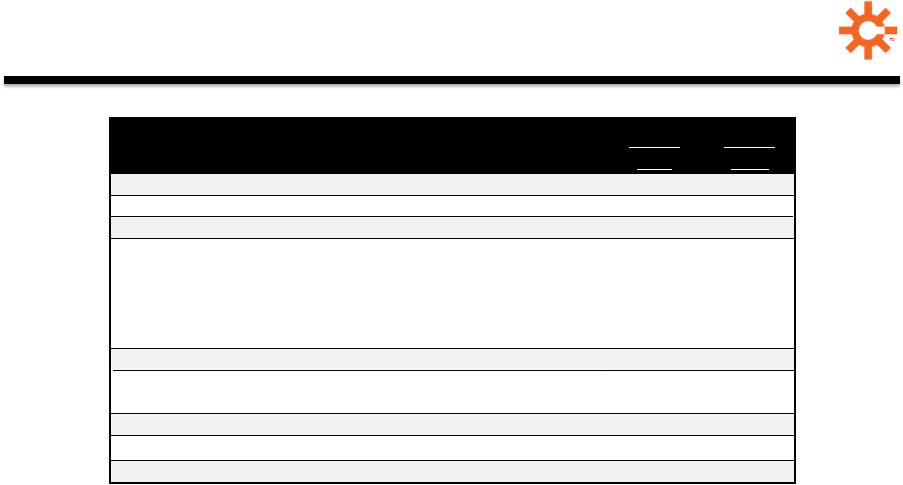

2014

Overview Accomplishments & Challenges

Operating Performance

•

Sustained solid full year operating, safety and environmental performance in

coke, logistics and coal despite weather-challenged Q1

•

Completed Indiana Harbor refurbishment, but facility turnaround still in

progress; delivered FY ‘14 Adj. EBITDA of $16.4M but fell short of guidance

•

Completed construction of Haverhill 2 gas sharing project ahead of schedule

Business Restructuring

•

Executed two dropdown transactions, most recently 75% of Granite City

•

Unable

to

sell

coal

mining

business

as

planned;

initiated

rationalization

plan

to

scale back operations; recorded ~$150M non-cash impairments

•

Continuing

significant

M&A

efforts

despite

inability

to

consummate

transaction

•

Given depressed Indian coke pricing, recorded ~$30M non-cash impairment

Capital Allocation

•

Declared first quarterly cash dividend

•

Completed $75M ASR; additional $75M authorized for repurchase

•

2014 GP/IDR cash flows of $2.1M

•

Delevered

SXC

balance

sheet;

solid

cash

position

and

significant

revolver

capacity provide strong foundation for growth

2

SXC Q4/ FY 2014 Earnings & 2015 Guidance Call |

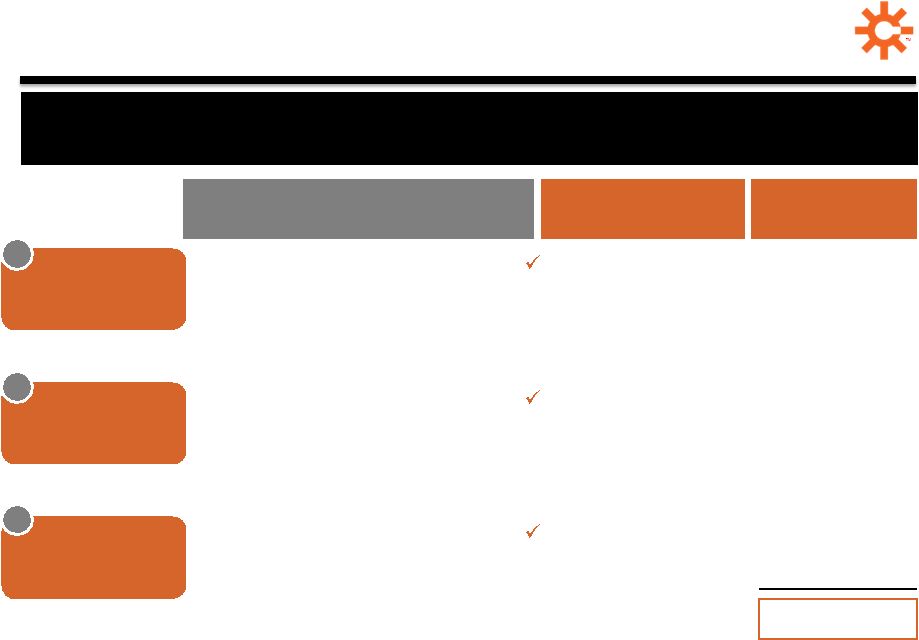

Value of

GP/IDR Cash

Flows

Value of

SXCP LP Units

Granite City Dropdown Transaction

Expected Impact from Dropdown

Potential Impact to

SXC Equity Value

3

•

DCF per LP unit accretion of ~5%,

or $0.10 -

$0.11

2

•

~$52M additional LP/GP units

•

$135M debt pay down

•

$45M pre-fund environmental

obligation

•

At 25% IDR splits today

As 56% LP owner, SXC

is major beneficiary to

unit price and cash

distribution upside

Transaction structured

to delever and ensure

tax efficiency

Estimated

EBITDA Multiple

~8.0x

(1)

~0.9x

(2)

~1.0x

(3)

~9.9x

3

SXC Q4/ FY 2014 Earnings & 2015 Guidance Call

(1)

Based on $245M transaction value over ~$30M EBITDA run-rate for 75% interest in Granite

City. (2)

Unit price change of 5%, assuming constant yield and constant cash distribution coverage ratio

on ~5% accretion. (3)

Assumes 20x value for GP/IDR cash flow.

75% dropdown of Granite City executed at ~9.9x total EBITDA multiple

At target coverage,

2015 GP/IDR cash

flow expected to

be >$5.0M

Direct

Transaction

Value

1 |

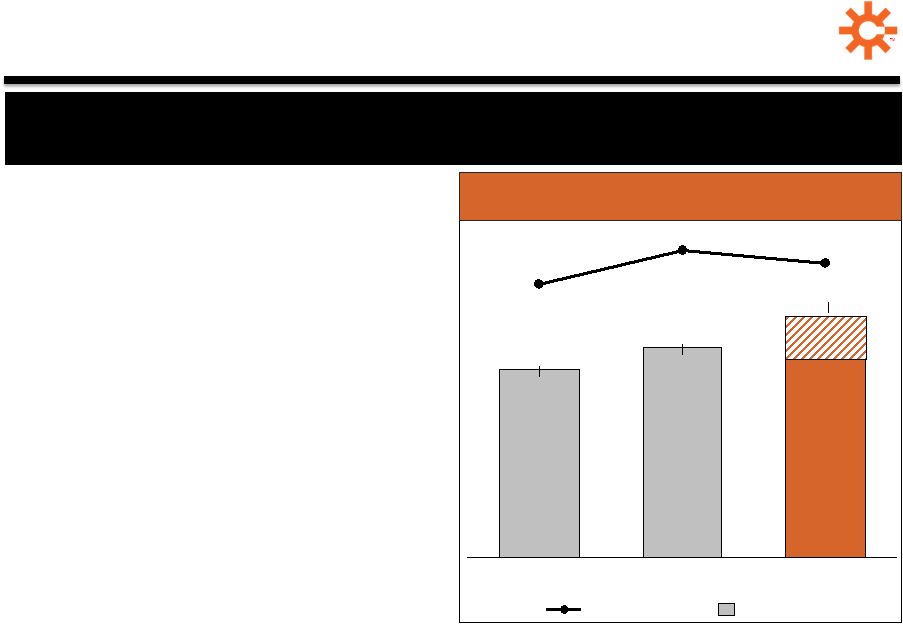

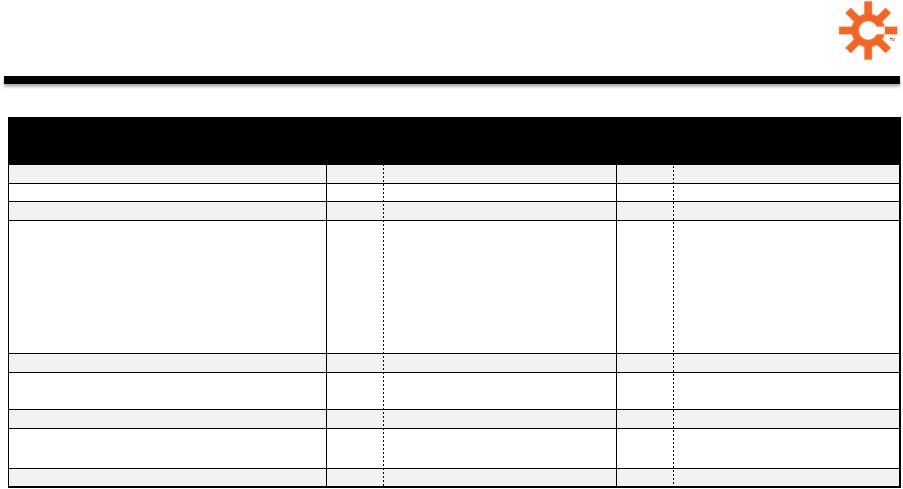

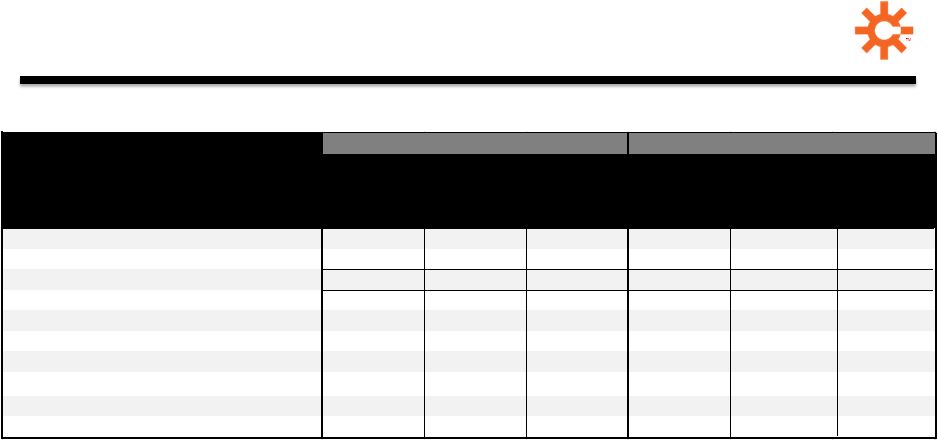

Q4 & FY 2014

Earnings Overview 4

SXC Q4/ FY 2014 Earnings & 2015 Guidance Call

Adj. EBITDA from Cont. Ops. up $7.2M in Q4

and $16.0M in FY

•

Improvement at Indiana Harbor, Jewell Coke

and Brazil plus lower Corporate costs

•

FY benefited from Coal Logistics acquisitions

•

At low end of $235M -

$255M guidance

(2)

FY Consolidated Adj. EBITDA

(3)

of $210.7M

•

Impacted by year-end Black Lung valuation

charge of $12.3M

•

As previously disclosed, Black Lung charges

drove results below $220M -

$240M

guidance

(4)

Q4 and FY EPS from Cont. Ops. loss reflects

•

$30.5M India joint venture impairment and

Legacy Black Lung impacts in Q4 and FY

•

Coal prep. plant impairment and accelerated

depreciation at Indiana Harbor impacted FY

($ in millions)

Q4 ‘14

$70.0

Q4 ‘13

$62.8

FY ‘13

$237.8

FY ‘14

$221.8

$0.22

Q4 ‘13

Q4 ‘14

($0.38)

FY ‘13

$0.58

($0.29)

FY ‘14

($/share)

(1)

For a definition and reconciliation of Adjusted EBITDA from Continuing

Operations and Adjusted EBITDA (Consolidated), please see

appendix. (2)

Guidance range provided in July 2014 earnings presentation.

(3)

Excludes impairment charges and estimated costs incurred to exit Coal business.

(4)

Revised guidance range provided in April 2014 earnings presentation.

|

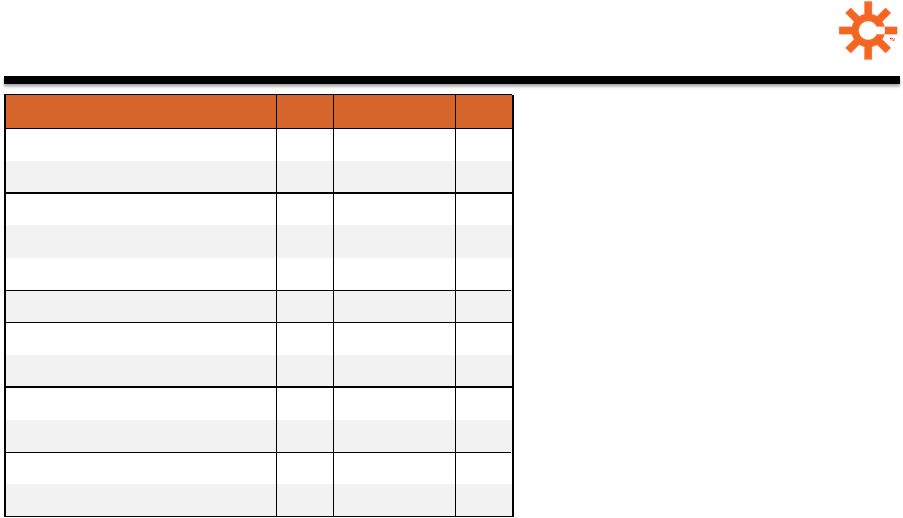

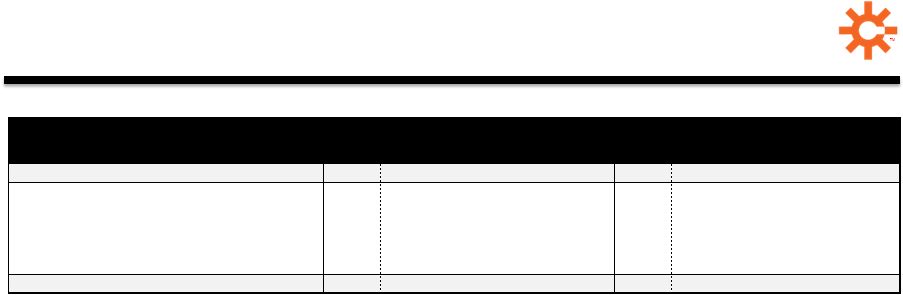

Q4 & FY 2014

Financial Results (1)

Coke Adjusted EBITDA includes Domestic Coke, Brazil Coke and India Coke segments.

(2)

For a definition and reconciliation of Adjusted EBITDA from Continuing Operations,

please see appendix.

5

SXC Q4/ FY 2014 Earnings & 2015 Guidance Call

Continuing Ops. Adj. EBITDA

up 11.5% in Q4 and 7.2% in FY

•

Q4 Domestic Coke benefited

from

–

Indiana Harbor up $7.3M

–

Jewell up on favorable

comparison due to prior year

quality issues

–

Offset by Granite City, down on

higher outage costs

•

Q4 Coal logistics impacted by

higher O&M expenses

•

Q4 Corporate costs down $2.6M

due to lower employee costs

Q4 and FY Discontinued Ops.

loss (net of tax benefits) of

$40.1M and $106.0M

($ in millions, except volumes and

per share)

Q4 '14

Q4 '13

Q4 '14 vs.

Q4 '13

FY '14

FY '13

FY '14 vs.

FY '13

Domestic Coke Sales

Volumes

1,103

1,047

56

4,184

4,263

(79)

Coal Transloading Volumes

4,301

3,649

652

19,037

3,785

15,252

Coke Adj. EBITDA

(1)

$75.2

$70.0

$5.2

$263.7

$260.2

$3.5

Coal Logistics Adj. EBITDA

$3.4

$4.0

($0.6)

$14.3

$4.7

$9.6

Corporate and Other

($8.6)

($11.2)

$2.6

($40.2)

($43.1)

$2.9

Adj. EBITDA from

Continuing Ops.

(2)

$70.0

$62.8

$7.2

$237.8

$221.8

$16.0

Revenue

$388.1

$388.0

$0.1

$1,472.7

$1,585.5

($112.8)

Operating Income

$30.8

$41.5

($10.7)

$109.8

$136.5

($26.7)

Net Income from Continuing

Ops. attributable to SXC

($25.3)

$15.4

($40.7)

($20.1)

$40.5

($60.6)

Earnings Per Share from

Continuing Ops.

($0.38)

$0.22

($0.60)

($0.29)

$0.58

($0.87)

Net Loss from

Discontinued Ops.

($40.1)

($4.4)

($35.7)

($106.0)

($15.5)

($90.5)

Loss Per Share from

Discontinued Ops.

($0.60)

($0.06)

($0.54)

($1.54)

($0.22)

($1.32) |

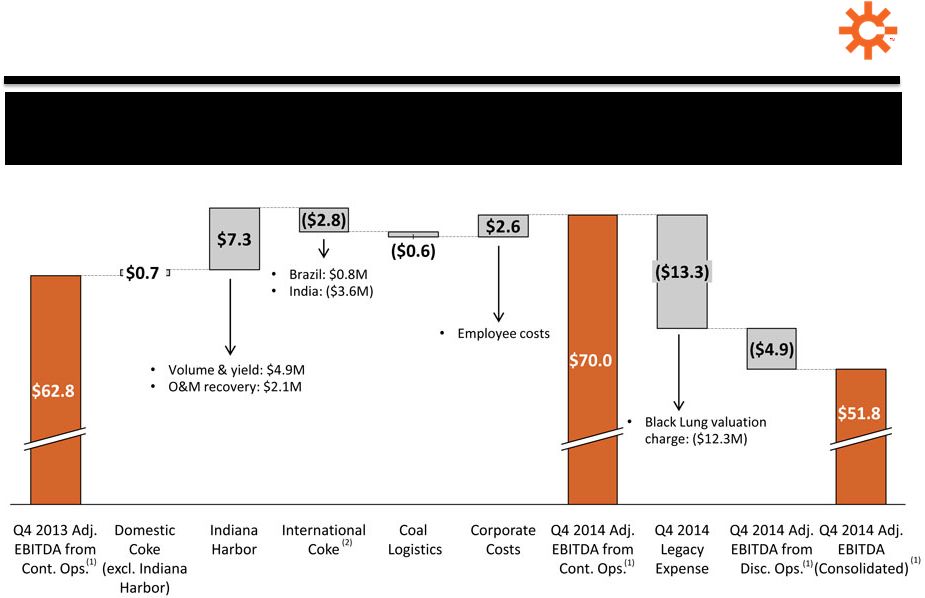

Adjusted

EBITDA (1)

–

Q4 ‘14 vs. Q4 ‘13

($ in millions)

Improved Indiana Harbor results & lower Corporate costs benefited Q4

6

SXC Q4/ FY 2014 Earnings & 2015 Guidance Call

(1)

Q4 2013 Adj. EBITDA (Consolidated) totaled $59.7 million. For a definition and reconciliation of Adjusted EBITDA from Continuing Operations, Adjusted EBITDA

from Discontinued Operations and Adjusted EBITDA (Consolidated), please see appendix.

(2)

Includes Brazil Coke and India Coke

|

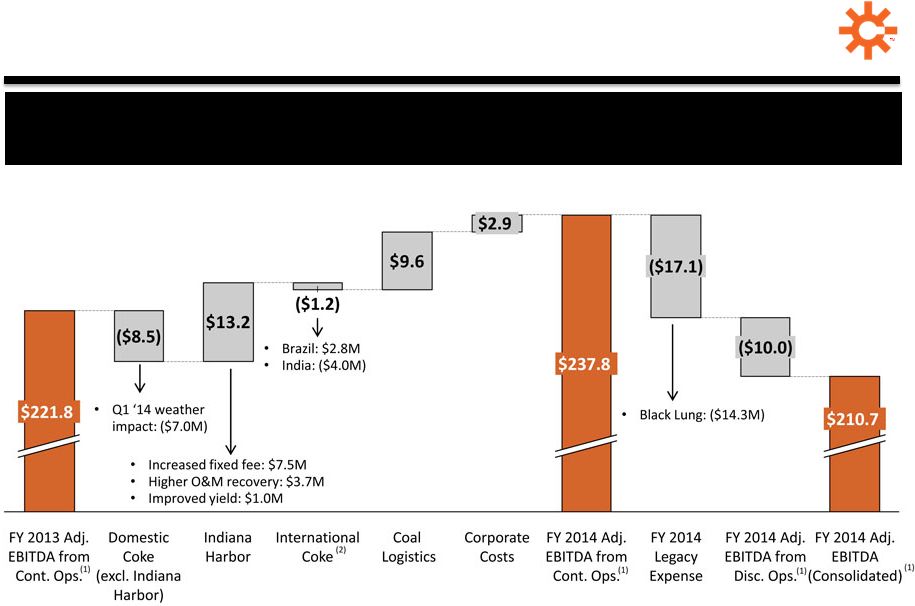

Adjusted

EBITDA (1)

–

FY ‘14 vs. FY ‘13

($ in millions)

Indiana Harbor and Coal Logistics benefited FY results

7

SXC Q4/ FY 2014 Earnings & 2015 Guidance Call

(1)

FY 2013 Adj. EBITDA (Consolidated) totaled $215.1 million. For a definition and reconciliation

of Adjusted EBITDA from Continuing Operations, Adjusted EBITDA from Discontinued

Operations and Adjusted EBITDA (Consolidated), please see appendix.

(2)

Includes Brazil Coke and India Coke |

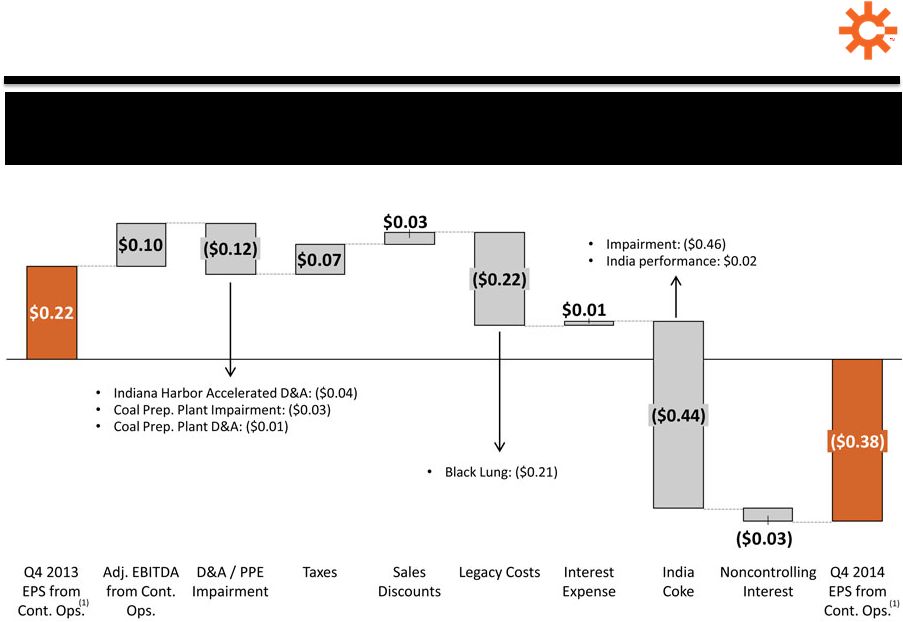

Diluted

EPS (1)

–

Q4 ‘14 vs. Q4 ‘13

India impairment and Legacy costs drove Q4 ‘14 EPS loss

($ per share)

(1)

Represents EPS from Continuing Operations attributable to SXC.

8

SXC Q4/ FY 2014 Earnings & 2015 Guidance Call |

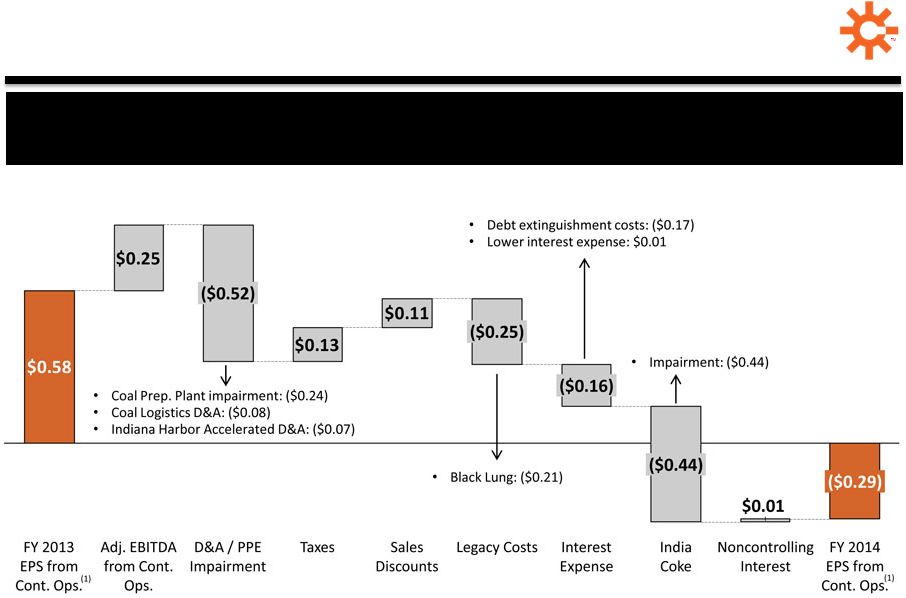

Diluted

EPS (1)

–

FY ‘14 vs. FY ‘13

India and Prep. Plant impairment, depreciation

and Legacy costs drove FY ‘14 EPS loss

($ per share)

9

SXC Q4/ FY 2014 Earnings & 2015 Guidance Call

(1)

Represents EPS from Continuing Operations attributable to SXC. |

Domestic Coke

Business Summary Q4 ‘14 Adjusted EBITDA per ton of $58

FY ‘14 Adj. EBITDA per ton of $59 impacted by Q1 weather

Domestic Coke Production

(thousands of tons)

(1)

For a definition of Adjusted EBITDA and Adjusted EBITDA/Ton and reconciliations,

see appendix.

184

178

184

185

185

255

199

264

275

270

291

264

279

292

296

172

153

177

182

177

154

150

155

155

156

Q4 ‘14

1,083

Q3 ‘14

1,090

Q2 ‘14

1,059

Q1 ‘14

944

Q4 ‘13

1,056

Jewell

Indiana Harbor

Haverhill

Granite City

Middletown

$64

$72

$64

$47

$57

Q2 ‘14

$61/ton

Q1 ‘14

$49/ton

Q4 ‘13

$54/ton

Q4 ‘14

$58/ton

Q3 ‘14

$67/ton

Adjusted EBITDA

Adjusted EBITDA/ton

Domestic Coke Adjusted EBITDA

(1)

Per Ton

($ in millions, except per ton amounts)

10

SXC Q4/ FY 2014 Earnings & 2015 Guidance Call |

Indiana Harbor

Performance 2014 Coke Production

(thousands of tons)

Q4 ‘14 production below guidance

•

Exited year with solid yields

•

Ovens pushed per day challenged

–

Experienced two major equipment failures

–

Oven-push cycle and scheduling below target

•

New PCM commissioning slower than

expected

Achieving 1,220K ton nameplate

capacity attainable, but timing delayed

•

Expect Q1 ‘15 to be 30K-

40K tons below

run rate on weak January start

•

Prioritizing completion of floor and sole

flue replacements

•

2015E total capex ~$15M vs. $39M in 2014

270

275

264

199

Q3 ‘14

Q4 ‘14

Q2 ‘14

Q1 ‘14

Q4 ‘14 Guidance

285K –

295K tons

11

SXC Q4/ FY 2014 Earnings & 2015 Guidance Call |

Discontinued

Operations Q4 ‘14 Adj. EBITDA from Disc.

Ops. loss of $4.9M vs. $4.6M in

Q4 ‘13

•

Average coal sales price down

$17 per ton, largely offset by

lower cash costs and volumes

FY ‘14 Adj. EBITDA from Disc.

Ops. loss of $10.0M reflects

similar coal price and production

cost dynamics

•

At tight end of guidance range

(2)

Q4 ‘14 rationalization plan

impacts

•

Further asset impairment of $29.1M

•

Contract termination expense of

$6.0M (vs. ~$10M estimate)

•

Employee severance costs of

$11.6M (vs. $10M -

$15M estimate)

Loss on Disc. Ops., net of tax

Income tax benefit

($106.0M)

$18.5M

($66.2M)

Depreciation and depletion

$10.2M

Adj. EBITDA from Disc. Operations

(1)

($10.0M)

Adj. EBITDA from Disc. Ops.

12

SXC Q4/ FY 2014 Earnings & 2015 Guidance Call

Exit Costs (contract term. & severance)

$133.5M

Asset impairment

Q4 ‘14

FY ‘14

($40.1M)

$17.6M

($12.3M)

$0.8M

($4.9M)

$29.1M

(1) For a definition and reconciliation of Adjusted EBITDA from

Discontinued Operations, please

see appendix.

(2) Revised guidance range of ($10M) –

($13M) provided in October 2014 earnings presentation. |

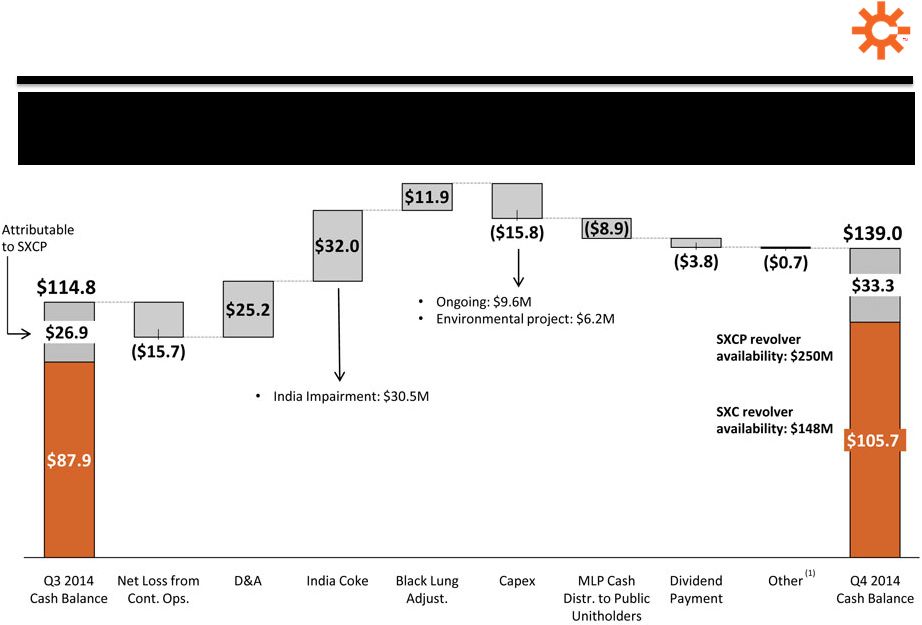

Liquidity

Position Ended quarter with solid cash position and significant revolver capacity

13

SXC Q4/ FY 2014 Earnings & 2015 Guidance Call

(1)

Includes ($0.1) million in working capital, $1.0 million in other financing activities and

($1.6) million of cash used in Discontinued Operations. |

GUIDANCE

14

SXC Q4/ FY 2014 Earnings & 2015 Guidance Call

**********

**********

**********

**********

********** |

15

Operations

Excellence

Growth Strategy

Capital and

Structure

Optimization

2015 priorities include sustained focus on operations excellence,

growth initiatives and capital optimization to enhance valuation

2015 Priorities

SXC Q4/ FY 2014 Earnings & 2015 Guidance Call

•

Sustain high-level operating, safety & environmental performance

•

Improve Indiana Harbor performance; return to name plate run-rate

•

Execute coal rationalization plan & optimize standalone Jewell Coke

•

Complete construction of gas sharing project at Haverhill 1

•

Pursue MLP-qualifying, industrial-facing processing and handling M&A

opportunities

•

Continue development of greenfield opportunities, including potential

construction of new coke plant and/or DRI facility

•

Intend to execute at least one additional dropdown in 2015

•

Build upon capital allocation strategy initiated in 2014 |

2015 Domestic

Coke Business Outlook 2015E Adj. EBITDA per ton of $55 –

$60 reflects Jewell Coke

standalone impacts and outlook for Indiana Harbor

16

FY 2015E

$55 -

$60/ton

FY 2014

$248M

$59/ton

FY 2013

$243M

$57/ton

Adjusted EBITDA

Adjusted EBITDA/ton

Domestic Coke Adjusted EBITDA

(1)

Per Ton

($ in millions, except per ton amounts)

2015 Domestic Coke Adj. EBITDA

outlook of $240M -

$255M

reflects:

•

Solid operating performance with

production of ~4.3M tons

•

Expected ongoing impacts of Jewell

Coke

standalone costs of ~$7.5M

–

Primarily for blending/handling

costs and coal moisture

•

Improvement at Indiana Harbor,

but below $40M targeted run-rate

SXC Q4/ FY 2014 Earnings & 2015 Guidance Call

$240M -

$255M

(1)

For a definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA/Ton ,

see appendix. |

2015 Indiana

Harbor Outlook Operating environment remains challenged

•

Steep learning curve on post-refurbishment oven performance and new

equipment

•

Existing equipment reliability and oven-push cycles impacting scheduling and

productivity

•

2015 focus on establishing firm oven-push cycles, mastering new PCMs,

improving equipment maintenance practices and completing floor and sole

flue replacements

2015

Adjusted EBITDA outlook of $25M –

$35M

•

Expect Q1 to be 30K-

40K tons below run rate on weak January start

•

Maintain flexibility across fleet to cover shortfalls if needed

•

Lower overall total operating and maintenance expenses but reduced cost

recovery

SXC Q4/ FY 2014 Earnings & 2015 Guidance Call

Indiana Harbor expected 2015 Adj. EBITDA of $25M –

$35M reflects

Q1 production outlook and contract cost recovery economics

17 |

2015 Coal

Rationalization Plan Plan preserves optionality to sell while balancing impact to Jewell

Coke 18

SXC Q4/ FY 2014 Earnings & 2015 Guidance Call

Dec. 2014

Announcement

•

Reduced coal production by

>50%, idling mines,

eliminating positions and

reducing prep. plant

operations

•

Substantially decreased

Coal Mining cash loss

outlook

•

Contract termination: $10M

($6M FY ‘14 actual)

•

Employee severance and other

one-time costs: $10M -

$15M

(~$12.5M FY ‘14 actual)

2015 Coal

Rationalization Plan

•

Implement contract mining model

for ~0.6M tons of coal

•

Purchase ~0.5M tons of coal from

3

rd

parties

•

Transition to 3

rd

party coal

washing (Q1/Q2);

decommission

existing prep. plant (Q2/Q3)

•

Install coal handling/blending

capabilities (Q1/Q2)

•

2015E Adj. EBITDA from Disc.

Ops. expected loss of ~$20M

•

Estimate

$5M

-

$10M

of

capex

for handling/storage

infrastructure at Jewell Coke

Long-term

Coal Supply

•

Maintain optionality for

securing least-cost Jewell Coke

coal supply

•

Preserves flexibility to shift

between contract mining &

purchased coal

•

Reduces impact to Jewell Coke

coal blend & operations

•

Expect run-rate Adj. EBITDA

from Disc. Ops. loss of

~$12.5M at current prices

•

Potential upside should

market prices recover

Guidance:

Guidance:

Guidance: |

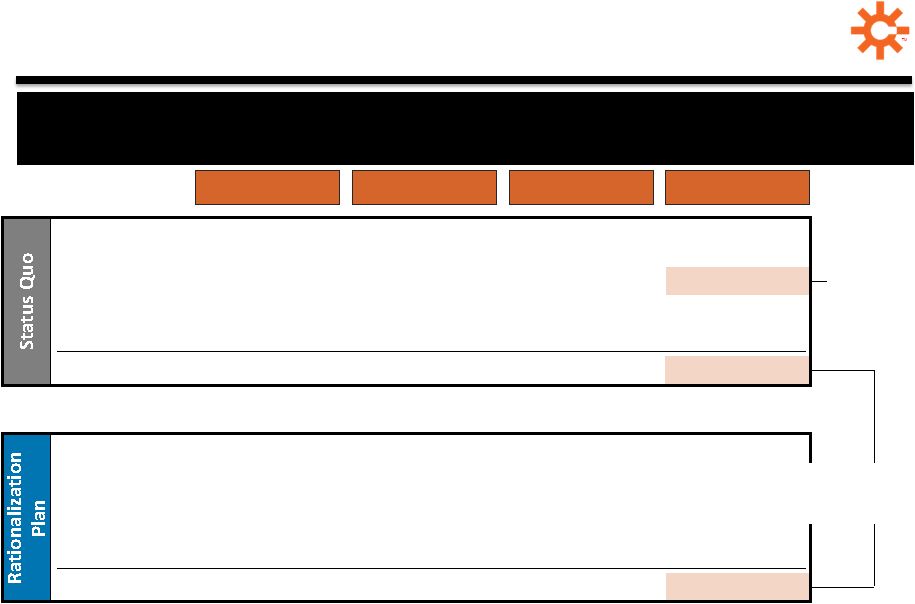

Benefits of

Coal Rationalization Plan SXC Q4/ FY 2014 Earnings & 2015 Guidance Call

19

Expect rationalization plan to generate $20M run-rate difference vs.

operating status quo

FY 2013

FY 2014

FY 2015E

(1)

FY 2016E

(1)

Adjusted EBITDA

from Disc. Ops.

Jewell Coke

Standalone Costs

Cash Loss

(4)

($6.3M)

-

($26.4M)

($10.0M)

-

($17.1M)

($31.5M)

-

($40.5M)

($31.5M)

-

($40.5M)

Capital

Expenditures

(2)

($20.1M)

($7.1M)

($9.0M)

Adjusted EBITDA

from Disc. Ops.

Jewell Coke

Standalone Costs

Cash Loss

(4)

-

-

-

-

-

-

($20.0M)

($7.5M)

($12.5M)

($7.5M)

($20.0M)

Capital

Expenditures

(3)

-

-

($5.0M) –

($10.0M)

-

($32.5M) –

($37.5M)

Announced $20M

run-rate difference

Excludes

$50M –

$70M for

new prep. plant

($9.0M)

(1)

2015 and 2016 status quo estimates assume $90/ton coal price and targeted $120 cash cost per

ton on ~1.1M tons. (2)

Represents Coal Mining business capex only.

(3)

Represents capex to install coal handling and storage infrastructure to enable third-party

coal purchases for our Jewell Coke facility. (4)

Equals Adjusted EBITDA from Disc. Ops. less capex less Jewell Coke standalone costs.

Excludes financial impact of Legacy Costs. |

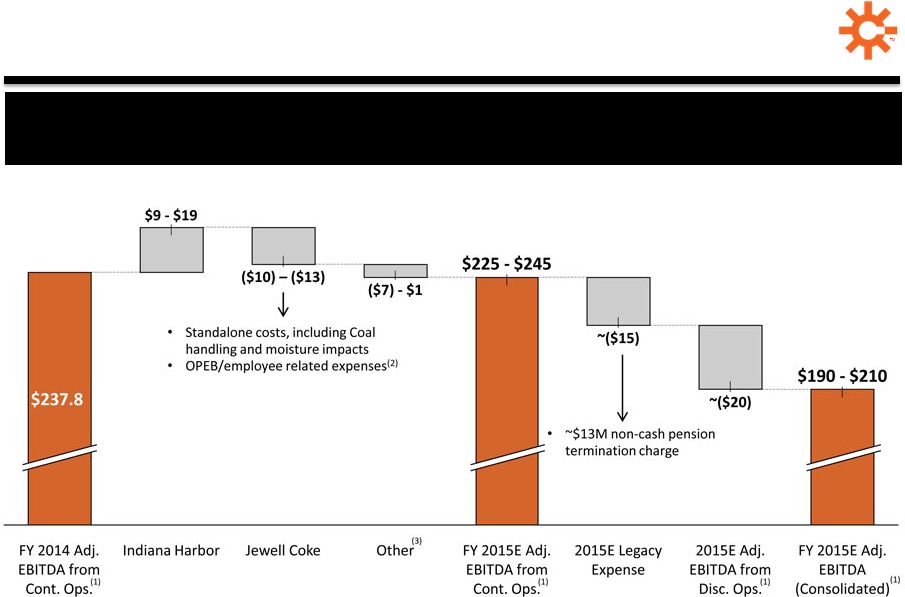

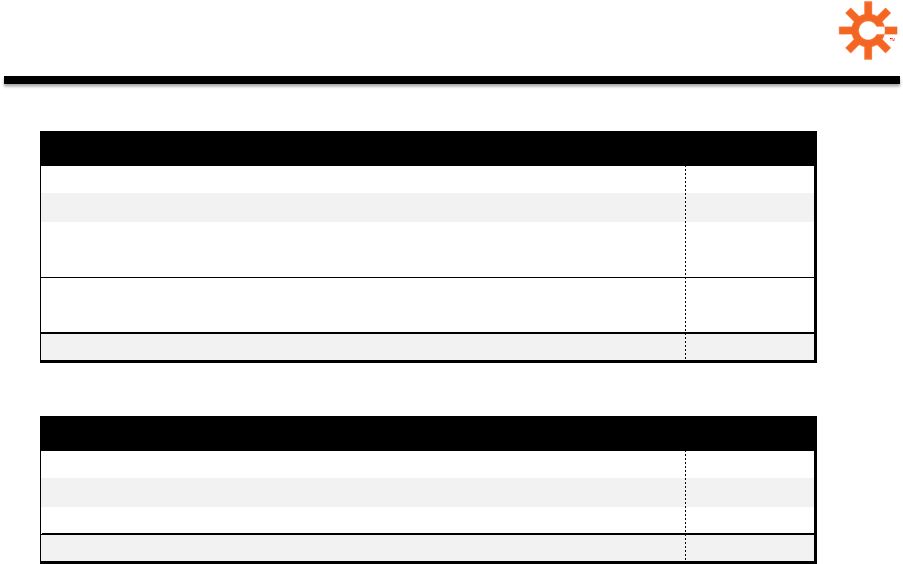

Expected 2015

Adjusted EBITDA (1)

($ in millions)

2015 Adj. EBITDA

(1)

outlook is flat, with Jewell Coke standalone cost

impacts offset by Indiana Harbor improvement

20

SXC Q4/ FY 2014 Earnings & 2015 Guidance Call

(1)

For a definition and reconciliation of Adjusted EBITDA from Continuing Operations, Adjusted

EBITDA from Discontinued Operations and Adjusted EBITDA (Consolidated), please see

appendix. (2)

Expiration of OPEB credits recognized in prior years.

(3)

Includes incremental Corporate costs for growth initiatives and India JV losses, partially offset by increases in Brazil and Coal Logistics volumes. |

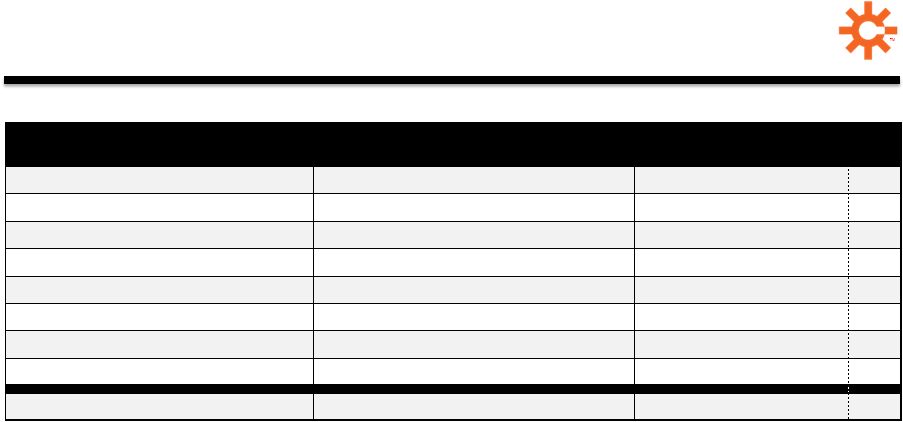

Consolidated

Guidance Summary 21

Metric

2014 Actual

2015 Guidance

Adjusted EBITDA

(1)

Continuing Operations

Consolidated

Attributable to SXC

$237.8 million

$210.7 million

$150.0 million

$225 –

$245 million

$190 –

$210 million

$115 –

$130 million

Capital Expenditures

~$125 million

~$90 million

Domestic Coke Production

~4.2 million tons

~4.3 million tons

Dom. Coke Adj. EBITDA / ton

$59 / ton

$55 -

$60 / ton

Operating Cash Flow

$112.3 million

$125 -

$145 million

Cash Taxes

(2)

$7.0 million

$10 -

$15 million

SXC Q4/ FY 2014 Earnings & 2015 Guidance Call

(1)

Please see appendix for a definition and reconciliation of 2014 and 2015E Adjusted

EBITDA. (2)

Included in Operating Cash Flow. |

Shareholder

Value Creation 22

SXC Q4/ FY 2014 Earnings & 2015 Guidance Call

Shareholder value creation via organic and inorganic growth projects,

backed by disciplined capital management

Pursue organic growth projects that

leverage our operational strengths and

greenfield development capabilities

Acquire industrial-facing processing

and handling assets to drive further

SXCP distribution growth

•

Acquire raw material processing and

handling assets which would be a

natural fit for SXCP (e.g., manageable

commodity exposure)

•

Our core manufacturing and logistics

competencies provide solid basis for

acquisitions across a number of

verticals

•

Expands qualifying income for SXCP,

grows GP cash flows and adds new

platforms for growth

•

Continue pursuit of Kentucky coke

plant development as our macro

coke market thesis plays out

•

Actively pursuing select DRI

projects to leverage our greenfield

experience and access to

advantaged capital via SXCP

Maximize return on capital

for shareholders via the

appropriate financial levers

•

Evaluate dividend increases as GP/LP cash flows grow

•

Maintain $75M authorization for opportunistic share repurchases

•

Expect 8% -

10% cash distribution CAGR at SXCP through 2016 from

domestic coke dropdowns alone

•

Plan to increase SXCP cash distributions by 2% per quarter in 2015

|

Steel

Industry 23

SXC Q4/ FY 2014 Earnings & 2015 Guidance Call

Recent capital markets sentiment & industry environment

has shifted negatively for steelmakers

US primary demand outlook reasonable

•

Resilient automotive demand

•

Continued non-residential construction recovery

•

Expect challenges within tubular/oil & gas segment

Steel pricing under pressure

•

Constructive industry consolidation in 2014 (e.g., TK, Severstal, Gallatin)

•

Elevated level of imports

•

Strong US dollar challenging domestic producers

On the other hand, commodity prices provide continued

tailwinds on carbon, scrap and, to an extent, iron ore

•

Energy inputs also favorable

Customers continue to rationalize aged cokemaking capacity |

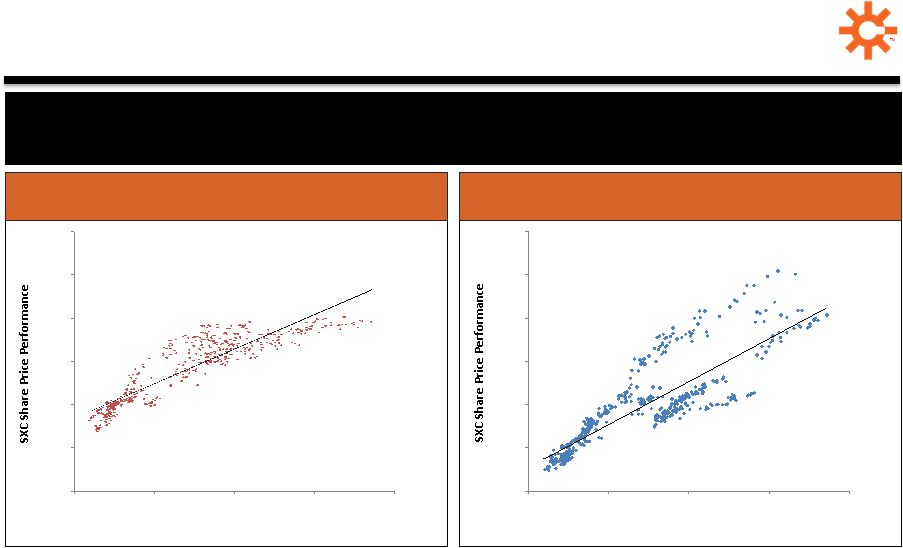

SXC Share Price

Correlation 24

SXC Q4/ FY 2014 Earnings & 2015 Guidance Call

50%

75%

100%

125%

150%

175%

200%

50%

100%

150%

200%

250%

50%

75%

100%

125%

150%

175%

200%

50%

100%

150%

200%

250%

Historical Share Price Correlation to AK Steel

(1,2)

Correlation Coefficient = 0.90

Historical Share Price Correlation to US Steel

(1,2)

Correlation Coefficient = 0.82

AKS Share Price Performance

X Share Price Performance

SunCoke Energy historical share price performance

highly correlated to AK Steel and US Steel

(1)

Two-year Share Price Correlation calculated from January 2, 2013 through January 16,

2015. (2)

Correlation graphs plot share price performance as a percentage of January 2, 2013 price

(i.e., >100% represents closing price above January 2, 2013 share price,

while <100% represents closing price below January 2, 2013 share price)

|

Key Investment

Considerations 25

Strong investment thesis remains intact

Stable, Long-Term

Cash Flows

Strong Balance Sheet

Potential Growth

Opportunities

Visible Dropdown

Structure

Effective Capital

Allocation

•

Long-term, take-or-pay contracts at strategic customer assets

•

Profit and return on capital generated via fixed-fee structure

•

Pass-through of coal and operating costs in addition to taxes,

transportation and future environmental costs

•

Essentially no net debt at parent; Net Debt/EBITDA at SXCP ~3x

•

~$400M revolver capacity at SXC and SXCP combined

•

Ability to leverage both balance sheets provides M&A financing flexibility

•

Limited legacy obligations

•

Exploring industrial-facing processing & handling M&A which generates

qualifying income and fits SXC business model & core competencies

•

Continue development of greenfield opportunities, including potential

construction of new coke plant and/or DRI facility

•

Declining ongoing and environmental capex

•

Completed $75M ASR; additional $75M authorized for repurchase

•

Initiated

dividend

during

October

which

was

linked

to

GP/LP

cash

flows

•

Executing

upon

strategy

to

transition

toward

“pure-play”

GP

•

Intend

to

execute

at

least

one

additional

dropdown

in

2015,

with

remaining

asset dropdowns to be executed through 2016

SXC Q4/ FY 2014 Earnings & 2015 Guidance Call |

QUESTIONS

26

SXC Q4/ FY 2014 Earnings & 2015 Guidance Call

*****

*****

*****

*****

*****

***** |

Investor

Relations 630-824-1907

www.suncoke.com |

APPENDIX

28

SXC Q4/ FY 2014 Earnings & 2015 Guidance Call

*******

*******

*******

*******

*******

******* |

Definitions

Adjusted EBITDA

represents earnings before interest, taxes, depreciation, depletion and amortization

(“EBITDA”) adjusted for impairments, costs related to exiting our Coal

business, sales discounts and the interest, taxes, depreciation, depletion and amortization attributable to our equity

method investment. Prior to the expiration of our nonconventional fuel tax credits in

2013, EBITDA reflects sales discounts included as a reduction in sales and other

operating revenue. The sales discounts represent the sharing with customers of a portion of nonconventional fuel tax credits,

which reduce our income tax expense. However, we believe our Adjusted EBITDA would be

inappropriately penalized if these discounts were treated

as

a

reduction

of

EBITDA

since

they

represent

sharing

of

a

tax

benefit

that

is

not

included

in

EBITDA.

Accordingly,

in

computing

Adjusted

EBITDA, we have added back these sales discounts. Our Adjusted EBITDA also includes EBITDA

attributable to our equity method investment. EBITDA and Adjusted EBITDA do not

represent and should not be considered alternatives to net income or operating income under GAAP and may

not be comparable to other similarly titled measures in other businesses. Management

believes Adjusted EBITDA is an important measure of the operating performance of the

SXC's net assets and provides useful information to investors because it highlights trends in our business that may

not otherwise be apparent when relying solely on GAAP measures and because it eliminates items

that have less bearing on our operating performance. Adjusted EBITDA is a measure

of operating performance that is not defined by GAAP, does not represent and should not be

considered a substitute for net income as determined in accordance with GAAP.

Calculations of Adjusted EBITDA may not be comparable to those reported by other

companies. EBITDA

represents earnings before interest, taxes, depreciation, depletion and amortization.

Adjusted

EBITDA

attributable

to

SXC/SXCP

equals

consolidated

Adjusted

EBITDA

less

Adjusted

EBITDA

attributable

to

noncontrolling

interests.

Adjusted EBITDA/Ton

represents Adjusted EBITDA divided by tons sold.

Adjusted EBITDA from Continuing Operations

equals consolidated Adjusted EBITDA less Adjusted EBITDA from Discontinued Operations less

Legacy Costs.

Adjusted

EBITDA

from

Discontinued

Operations

equals

Coal

business

Adjusted

EBITDA

excluding

Corporate

cost

allocation

attributable

to

Coal,

costs related to exiting our Coal business and certain retained Coal-related costs

reclassified as Legacy Costs. Legacy

Costs

equals

royalty

revenues,

Coal

pension/OPEB,

Coal

workers’

compensation,

black

lung,

prep.

plant

and

certain

other

Coal-related

costs

that we expect to retain after sale of the Coal business.

29

SXC Q4/ FY 2014 Earnings & 2015 Guidance Call |

Reconciliation

of Net Income to Adjusted EBITDA 30

SXC Q4/ FY 2014 Earnings & 2015 Guidance Call

($ in millions)

FY 2014

Q4 2014

Q3 2014

Q2 2014

Q1 2014

FY 2013

Q4 2013

Q3 2013

Q2 2013

Q1 2013

Net Income/(Loss)

($101.8)

($55.8)

$6.4

($48.6)

($3.8)

$50.1

$18.7

$12.3

$12.7

$6.4

Subtract: Net Loss from Discontinued Operations

(106.0)

(40.1)

(18.5)

(41.2)

(6.2)

(15.5)

(4.4)

(3.6)

(2.8)

(4.7)

Net Income/(Loss) from Continuing Operations

$4.2

($15.7)

$24.9

($7.4)

$2.4

$65.6

$23.1

$15.9

$15.5

$11.1

Depreciation, depletion and amortization

96.1

25.1

22.5

24.0

24.5

77.1

19.5

18.8

19.0

19.8

Interest expense, net

63.2

12.1

11.9

27.1

12.1

52.3

12.3

12.1

12.1

15.8

Income tax expense/(benefit)

7.4

2.4

7.5

(1.3)

(1.2)

16.4

6.4

1.5

2.7

5.8

Legacy expense/(income)

17.1

13.3

0.9

1.4

1.5

0.4

(1.5)

0.3

0.7

0.9

Asset impairment

(1)

16.8

1.7

-

15.1

-

-

-

-

-

-

Sales discounts

(0.5)

-

-

-

(0.5)

6.8

1.1

2.2

2.1

1.4

Adjustment to unconsolidated affiliate earnings

(2)

33.5

31.1

0.3

1.1

1.0

3.2

1.9

0.3

1.0

-

Adjusted EBITDA from Continuing Operations

$237.8

$70.0

$68.0

$60.0

$39.8

$221.8

$62.8

$51.1

$53.1

$54.8

Legacy (expense)/income

(17.1)

(13.3)

(0.9)

(1.4)

(1.5)

(0.4)

1.5

(0.3)

(0.7)

(0.9)

Adjusted EBITDA from Discontinued Operations

(10.0)

(4.9)

(2.8)

2.2

(4.5)

(6.3)

(4.6)

(0.1)

-

(1.6)

Adjusted EBITDA (consolidated)

$210.7

$51.8

$64.3

$60.8

$33.8

$215.1

$59.7

$50.7

$52.4

$52.3

Adjusted EBITDA attributable to noncontrolling

interests

(3)

(60.7)

(18.7)

(18.2)

(14.5)

(9.3)

(41.2)

(12.2)

(9.9)

(10.7)

(8.4)

Adjusted EBITDA attributable to SXC

$150.0

$33.1

$46.1

$46.3

$24.5

$173.9

$47.5

$40.8

$41.7

$43.9

(1)

Includes portion of coal impairment attributable to Continuing Operations.

(2)

Represents SunCoke’s share of India JV interest, taxes and depreciation expense.

Includes $30.5M impairment of our equity method investment in India in Q4 and FY 2014.

(3)

Represents Adjusted EBITDA attributable to SXCP public unitholders and DTE Energy’s

interest in Indiana Harbor. |

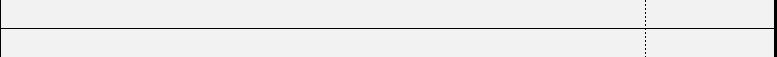

($ in

millions) FY 2014

Q4 2014

Q3 2014

Q2 2014

Q1 2014

FY 2013

Q4 2013

Q3 2013

Q2 2013

Q1 2013

Net Loss from Discontinued Operations

($106.0)

($40.1)

($18.5)

($41.2)

($6.2)

($15.5)

($4.4)

($3.6)

($2.8)

($4.7)

Depreciation, depletion and amortization

10.2

0.8

0.3

4.6

4.5

18.9

6.0

4.4

4.4

4.1

Interest expense, net

-

-

-

-

-

-

-

-

-

-

Income tax benefit

(66.2)

(12.3)

(1.4)

(49.5)

(3.0)

(9.7)

(6.2)

(0.9)

(1.6)

(1.0)

Asset impairment

133.5

29.1

16.4

88.0

-

-

-

-

-

-

Exit Costs

18.5

17.6

0.4

0.3

0.2

-

-

-

-

-

Adjusted EBITDA from Discontinued Operations

($10.0)

($4.9)

($2.8)

$2.2

($4.5)

($6.3)

($4.6)

($0.1)

$0.0

($1.6)

Reconciliation of Net Income to Adjusted EBITDA

from Discontinued Operations

31

SXC Q4/ FY 2014 Earnings & 2015 Guidance Call |

Reconciliation

of Segment Adjusted EBITDA and Adjusted EBITDA per ton

(1)

Represents SunCoke’s share of India JV interest, taxes and depreciation expense.

32

SXC Q4/ FY 2014 Earnings & 2015 Guidance Call

Reconciliation of Segment Adjusted EBITDA and Adjusted EBITDA per Ton

($ in millions, except per ton data)

Domestic

Coke

Brazil Coke

India

Coke

(1)

Coal Logistics

Corporate /

Other

Continuing

Operations

Discontinued

Operations

Legacy Costs

Combined

FY 2014

Adjusted EBITDA

$247.9

$18.9

($3.1)

$14.3

($40.2)

$237.8

($10.0)

($17.1)

$210.7

Sales Volume (thousands of tons)

4,184

1,516

177

19,037

Adjusted EBITDA per Ton

$59.25

$12.47

($17.51)

$0.75

Q4 2014

Adjusted EBITDA

$64.4

$12.2

($1.4)

$3.4

($8.6)

$70.0

($4.9)

($13.3)

$51.8

Sales Volume (thousands of tons)

1,103

419

38

4,301

Adjusted EBITDA per Ton

$58.39

$29.12

($36.84)

$0.79

Q3 2014

Adjusted EBITDA

$72.3

$2.5

($1.3)

$3.8

($9.3)

$68.0

($2.8)

($0.9)

$64.3

Sales Volume (thousands of tons)

1,074

431

38

4,772

Adjusted EBITDA per Ton

$67.32

$5.80

($34.21)

$0.80

Q2 2014

Adjusted EBITDA

$64.4

$2.5

($0.5)

$5.0

($11.4)

$60.0

$2.2

($1.4)

$60.8

Sales Volume (thousands of tons)

1,059

413

42

5,605

Adjusted EBITDA per Ton

$60.81

$6.05

($11.90)

$0.89

Q1 2014

Adjusted EBITDA

$46.8

$1.7

$0.1

$2.1

($10.9)

$39.8

($4.5)

($1.5)

$33.8

Sales Volume (thousands of tons)

948

252

60

4,359

Adjusted EBITDA per Ton

$49.37

$6.75

$1.67

$0.48

FY 2013

Adjusted EBITDA

$243.2

$16.1

$0.9

$4.7

($43.1)

$221.8

($6.3)

($0.4)

$215.1

Sales Volume (thousands of tons)

4,263

876

126

3,785

Adjusted EBITDA per Ton

$57.05

$18.38

$7.14

$1.24

Q4 2013

Adjusted EBITDA

$56.4

$11.4

$2.2

$4.0

($11.2)

$62.8

($4.6)

$1.5

$59.7

Sales Volume (thousands of tons)

1,047

222

53

3,649

Adjusted EBITDA per Ton

$53.87

$51.35

$41.51

$1.10 |

2015E Guidance

Reconciliation (1)

Represents SunCoke’s share of India JV interest, taxes and depreciation expense.

(2)

Represents Adjusted EBITDA attributable to SXCP public unitholders and DTE Energy’s

interest in Indiana Harbor. 33

SXC Q4/ FY 2014 Earnings & 2015 Guidance Call

($ in millions)

2015E

Low

2015E

High

Net Income

$21

$38

Subtract: Net Loss from Discontinued Operations

(16)

(13)

Net Income from Continuing Operations

$37

$51

Depreciation, depletion and amortization

89

89

Interest expense, net

68

66

Income tax expense

12

20

Legacy expense

15

15

Adjustment to unconsolidated affiliate earnings

(1)

4

4

Adjusted EBITDA from Continuing Operations

$225

$245

Legacy expense

(15)

(15)

Adjusted EBITDA from Discontinued Operations

(20)

(20)

Adjusted EBITDA

$190

$210

Adjusted EBITDA attributable to noncontrolling interests

(2)

(75)

(80)

Adjusted EBITDA attributable to SXC

$115

$130 |

Balance Sheet

& Debt Metrics 34

SXC Q4/ FY 2014 Earnings & 2015 Guidance Call

(1)

Assumes full effect of Granite City dropdown, inclusive of SXC bond repayment following

completion of call period. Incremental cash to SXCP includes $45M retained to

pre-fund environmental liabilities.

(2)

Represents FY 2014 Adjusted EBITDA from Continuing Operations for the period ended 12/31/2014

and mid-point of FY 2015 Adjusted EBITDA from Continuing Operations guidance for

proforma presentation. SXC

Consolidated

Attributable

to SXCP

Balance

Attributable

to SXC

SXC

Consolidated

Attributable

to SXCP

Balance

Attributable

to SXC

Cash

$139

$33

$106

$188

$82

$106

Revolver Capacity

398

250

148

398

250

148

Total Liquidity

$537

$283

$254

$586

$332

$254

Total Debt (Long and Short-term)

$652

$412

$240

$721

$616

$105

Net Debt (Total Debt less Cash)

513

378

134

533

533

(1)

Full Year Adj. EBITDA from Cont. Ops.

(2)

$238

$151

$150

$235

$174

$123

Total Debt/2014 Adj. EBITDA from Cont. Ops.

2.7x

2.7x

1.6x

3.1x

3.5x

0.9x

Net Debt/2014 Adj. EBITDA from Cont. Ops.

2.2x

2.5x

0.9x

2.3x

3.1x

0.0x

As of 12/31/2014

Proforma

(1)

Post-Granite City Transaction

($ in millions) |

Capital

Expenditures 35

SXC Q4/ FY 2014 Earnings & 2015 Guidance Call

2015 Expected Capex

($ in millions)

SXC

SXCP

(1)

Consolidated

Ongoing

(4)

$28

$17

$45

Expansion

10

6

16

Environmental Project

0

29

29

Total CapEx from Continued Operations

$38

$52

$90

2014 Capex

($ in millions)

SXC

SXCP

(1)

Consolidated

Ongoing

(2)

$27

$17

$44

Expansion

4

0

4

Environmental Project

1

45

46

Indiana Harbor Refurbishment

24

0

24

Total CapEx from Continued Operations

$56

$62

$118

Ongoing: Discontinued Operations

(3)

7

0

7

Total CapEx (Consolidated)

$63

$62

$125

(1)

Represents SXCP capex on 100% basis. Includes Granite City in 2015.

(2)

Includes $3M ongoing Coal Logistics, $1M ongoing Prep. Plant and $40M in ongoing Coke CapEx,

including $13M related to Indiana Harbor oven floor and sole flue replacement work.

(3)

Includes ongoing CapEx related to Coal business excluding $1M related to Prep. Plant.

(4)

Consolidated includes approximately $42M in ongoing Coke Capex and $3M ongoing Coal

Logistics. |

($ in

millions) Segment

Financial Classification

Q1 '14

Q2 '14

Q3 '14

Q4 '14

FY '14

Asset Impairment - Disc. Ops.

Disc. Ops

Net Income from Disc. Ops.

-

$88.0

$16.4

$29.1

$133.5

Asset Impairment - Cont. Ops.

Cont. Ops.

Net Income from Cont. Ops.

-

15.1

-

1.7

16.8

Coal Exit Costs - Severance

Disc. Ops.

Net Income from Disc. Ops.

0.2

0.3

0.4

11.6

12.5

Coal Exit Costs - Contract Terminations

Disc. Ops.

Net Income from Disc. Ops.

-

-

-

6.0

6.0

Black Lung Valuation Charge

Legacy Costs

Adj. EBITDA (Consolidated)

-

-

-

12.3

12.3

OPEB Curtailment

(1)

Legacy Costs

Adj. EBITDA (Consolidated)

-

-

-

(2.5)

(2.5)

Asset Retirement Obligation (ARO) Valuation Charge

(1)

Legacy Costs

Adj. EBITDA (Consolidated)

-

-

-

1.9

1.9

Workers' Compensation

(1)

Legacy Costs

Adj. EBITDA (Consolidated)

-

-

-

0.6

0.6

India Impairment

Cont. Ops.

Net Income from Cont. Ops.

-

-

-

30.5

30.5

Q4 and FY 2014 Charges

36

SXC Q4/ FY 2014 Earnings & 2015 Guidance Call

(1)

Incremental charges incurred upon execution of Coal contingency plan.

|