Attached files

| file | filename |

|---|---|

| 8-K - 8-K - STATE BANK FINANCIAL CORP | a8kcoverpage123114.htm |

| EX-99.1 - EX-99.1 - STATE BANK FINANCIAL CORP | pressrelease123114.htm |

State Bank Financial Corporation 4th Quarter 2014 Earnings Presentation Joe Evans – Chairman and CEO Sheila Ray – Executive Vice President and CFO Kim Childers – Vice Chairman and Executive Risk Officer January 29, 2015

2 Cautionary Note Regarding Forward-Looking Statements Certain statements contained in this presentation that are not statements of historical fact are forward-looking statements. These forward-looking statements, which are based on certain assumptions and describe our future plans, strategies and expectations, can generally be identified by the use of the words “may,” “would,” “could,” “will,” “expect,” “anticipate,” “project”, “believe,” “intend,” “plan” and “estimate,” as well as similar expressions. These forward-looking statements include statements related to expected cost savings related to our recent acquisition, the sustainability of our core operating franchise, the strength of our credit metrics on our organic loans, our projected growth, our well-positioned franchise, our execution of strategic priorities, our anticipated future financial performance, and management’s long-term performance goals, as well as statements relating to the anticipated effects on results of operations and financial condition from expected developments or events, including projections of future amortization of the FDIC receivable and accretion on loans, the impact of the expiration of loss share agreements, anticipated internal growth, and plans to establish or acquire banks or the assets of failed banks. These forward-looking statements involve significant risks and uncertainties that could cause our actual results to differ materially from those anticipated in such statements. Potential risks and uncertainties include the following: • the reaction to our recent acquisitions of all of the banks’ customers, employees and counterparties or difficulties related to the transition of services; • general economic conditions (both generally and in our markets) may be less favorable than expected, which could result in, among other things, a continued deterioration in credit quality, a further reduction in demand for credit and a further decline in real estate values; • the general decline in the real estate and lending markets, particularly in our market areas, may continue to negatively affect our financial results; • our ability to raise additional capital may be impaired if current levels of market disruption and volatility continue or worsen; • we may be unable to collect reimbursements on losses that we incur on our assets covered under loss share agreements with the FDIC as we anticipate; • costs or difficulties related to the integration of the banks we may acquire may be greater than expected; • restrictions or conditions imposed by our regulators on our operations may make it more difficult for us to achieve our goals; • legislative or regulatory changes, including changes in accounting standards and compliance requirements, may adversely affect us; • competitive pressures among depository and other financial institutions may increase significantly; • changes in the interest rate environment may reduce margins or the volumes or values of the loans we make or have acquired; • other financial institutions have greater financial resources and may be able to develop or acquire products that enable them to compete more successfully than we can; • our ability to attract and retain key personnel can be affected by the increased competition for experienced employees in the banking industry; • adverse changes may occur in the bond and equity markets; • war or terrorist activities may cause further deterioration in the economy or cause instability in credit markets; • economic, governmental or other factors may prevent the projected population, residential and commercial growth in the markets in which we operate; and • we will or may continue to face the risk factors discussed from time to time in the periodic reports we file with the SEC. For these forward-looking statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. You should not place undue reliance on the forward-looking statements, which speak only as of the date of this report. All subsequent written and oral forward- looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. See Item 1A, Risk Factors, in our Annual Report on Form 10-K for the most recently ended fiscal year, for a description of some of the important factors that may affect actual outcomes.

3 Note: Consolidated financial results for 4Q 2014 contained throughout this presentation are unaudited; numbers may not add due to rounding 2014 Results Summary Income Statement Highlights (dollars in thousands, except per share data) 4Q14 3Q14 4Q13 FY 2014 FY 2013 Interest income on invested funds $2,928 $2,545 $2,416 $10,488 $10,198 Interest income on loans 17,416 16,162 15,826 64,176 61,010 Accretion income on loans 14,124 21,110 48,065 78,857 122,466 Interest expense 1,923 1,857 1,961 7,520 7,933 Net interest income 32,545 37,960 64,346 146,001 185,741 Provision for (recovery of) loan losses 1,189 416 (98) 2,896 (2,487) Net interest income after provision for loan losses 31,356 37,544 64,444 143,105 188,228 Accretion (amortization) of FDIC Receivable 1,652 (196) (31,372) (15,785) (87,884) Noninterest income 5,285 3,624 3,990 15,387 16,937 Total noninterest income 6,937 3,428 (27,382) (398) (70,947) Total noninterest expense 25,799 22,510 22,718 93,468 97,967 Income before income taxes 12,494 18,462 14,344 49,239 19,314 Income tax expense 4,909 6,958 4,927 18,321 6,567 Net income $7,585 $11,504 $9,417 $30,918 $12,747 Diluted net income per share .22 .34 .28 .92 .38 Dividends per share .04 .04 .03 .15 .12 Tangible book value per share 13.97 13.83 13.24 Balance Sheet Highlights (period-end) Total Loans $1,634,529 $1,504,725 $1,380,969 Organic 1,320,393 1,291,923 1,123,475 Purchased non-credit impaired 107,797 - - Purchased credit impaired 206,339 212,802 257,494 Total assets 2,882,210 2,647,597 2,605,388 Noninterest-bearing deposits 577,295 524,634 468,138 Total deposits 2,391,682 2,155,974 2,128,325 Shareholders’ equity 464,095 458,277 437,183

4 Financial Results: Revenue 1 Excludes accretion income on loans 2 Excludes accretion/(amortization) of FDIC receivable Total interest income (excluding accretion) of $20.3mm increased $1.6mm versus the prior quarter Noninterest income of $5.3mm in 4Q14, excluding indemnification asset accretion/(amortization), increased versus the prior quarter due primarily to higher prepayment fees on loans, SBA, mortgage and payroll fee income Payroll fee income increased $175 thousand in the quarter to a record-high $1.1mm ($ i n t h o u sa n d s) ($ i n t h o u sa n d s) ($ i n t h o u sa n d s) 3 Accretion income on loans including accretion/(amortization) of FDIC receivable 15,000 16,000 17,000 18,000 19,000 20,000 21,000 4Q13 1Q14 2Q14 3Q14 4Q14 Interest Income 1 5,000 10,000 15,000 20,000 25,000 4Q13 1Q14 2Q14 3Q14 4Q14 Net PCI Portfolio Revenue 3 0 1,000 2,000 3,000 4,000 5,000 6,000 4Q13 1Q14 2Q14 3Q14 4Q14 Noninterest Income 2 Noninterest Income Gains on Securities

5 Financial Results: Expense 1 Excludes loan collection and OREO costs Noninterest expense, excluding loan collection and OREO costs, increased primarily due to severance expenses ($1.5mm), the addition of Bank of Atlanta ($1.1mm) and new hires in targeted growth areas Recorded approximately $306 thousand of merger-related expenses in the fourth quarter We expect an additional $315 thousand of cost savings in 1Q15 related to Bank of Atlanta conversion ($ i n t h o u sa n d s) ($ i n t h o u sa n d s) Gains on sales of OREO properties exceeded loan collection and OREO costs for the third consecutive quarter (200) 0 200 400 600 800 1,000 4Q13 1Q14 2Q14 3Q14 4Q14 Loan Collection and OREO Costs 10,000 15,000 20,000 25,000 30,000 4Q13 1Q14 2Q14 3Q14 4Q14 Noninterest Expense 1 Noninterest Expense One-time/Noncore Expense

6 Financial Results: Earning Assets ($ i n mi llio n s) ($ i n mi llio n s) ($ i n mi llio n s) 1 Organic loans; excludes purchased loans Note: New loan originations include new loans funded and net loan advances on existing commitments. Paydowns include payoffs, amortization and principal payments. 0 50 100 150 200 250 300 350 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 Paydowns 1 0 200 400 600 800 1,000 1,200 1,400 1,600 1Q10 2Q 3Q 4Q 1Q11 2Q 3Q 4Q 1Q12 2Q 3Q 4Q 1Q13 2Q 3Q 4Q 1Q14 2Q 3Q 4Q Total Loan Portfolio Organic & Purchased Non-Credit Impaired Purchased Credit Impaired 0 50 100 150 200 250 300 350 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 New Loan Fundings 1

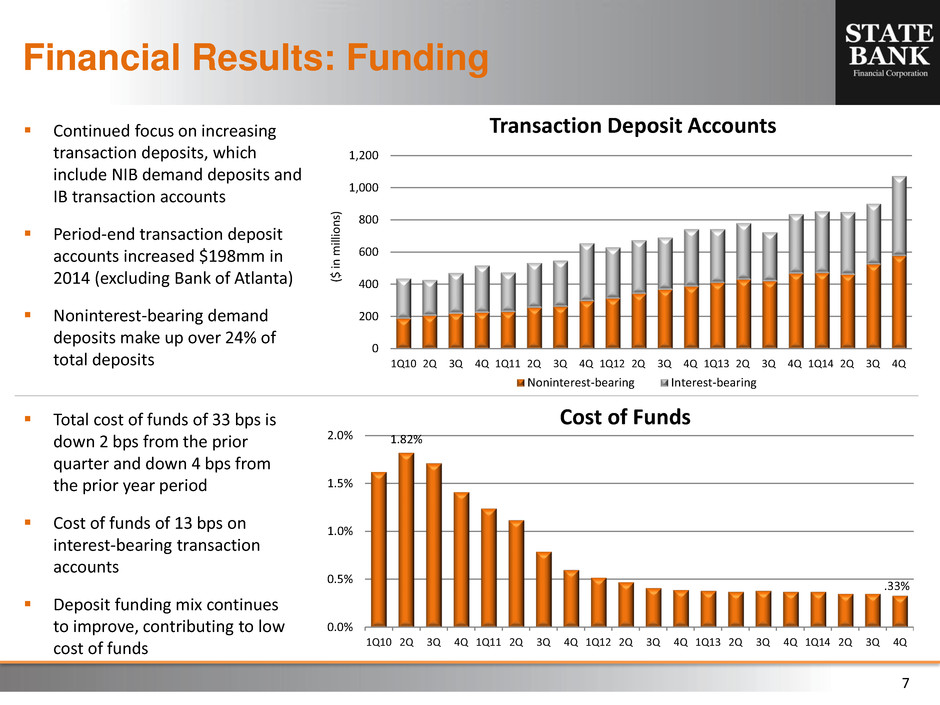

7 Financial Results: Funding Continued focus on increasing transaction deposits, which include NIB demand deposits and IB transaction accounts Period-end transaction deposit accounts increased $198mm in 2014 (excluding Bank of Atlanta) Noninterest-bearing demand deposits make up over 24% of total deposits ($ i n mi llio n s) Total cost of funds of 33 bps is down 2 bps from the prior quarter and down 4 bps from the prior year period Cost of funds of 13 bps on interest-bearing transaction accounts Deposit funding mix continues to improve, contributing to low cost of funds 1.82% .33% 0.0% 0.5% 1.0% 1.5% 2.0% 1Q10 2Q 3Q 4Q 1Q11 2Q 3Q 4Q 1Q12 2Q 3Q 4Q 1Q13 2Q 3Q 4Q 1Q14 2Q 3Q 4Q Cost of Funds 0 200 400 600 800 1,000 1,200 1Q10 2Q 3Q 4Q 1Q11 2Q 3Q 4Q 1Q12 2Q 3Q 4Q 1Q13 2Q 3Q 4Q 1Q14 2Q 3Q 4Q Transaction Deposit Accounts Noninterest-bearing Interest-bearing

8 Significant Revenue Remaining from Purchased Portfolios As of the end of 4Q14, there remains $120mm of accretable discount to be recognized as loan accretion income The timing of revenue recognition will continue to be somewhat uneven due to the timing of future loan pool closeouts ($ i n mi llio n s) Significant Future Benefit Total FDIC receivable (indemnification asset) of $22mm remaining at the end of 4Q14 FDIC clawback of $5.7mm is shown in other liabilities on the balance sheet Successfully managed fifth-year anniversary of three loss share agreements (8 charters) in 2014 ($ i n mi llio n s) Limited Future Headwind 185 156 140 131 120 0 50 100 150 200 250 4Q13 1Q14 2Q14 3Q14 4Q14 Accretable Discount 108 70 45 26 22 0 50 100 150 200 4Q13 1Q14 2Q14 3Q14 4Q14 FDIC Receivable

9 0.00% 0.05% 0.10% 0.15% 0.20% 0.25% 0.30% 4Q13 1Q14 2Q14 3Q14 4Q14 Organic Past Due Loan Ratio 1 Total Past Due Loans / Organic Loans ($ i n t h o u sa n d s) Credit: Organic Portfolio Past due loans represent .17% of total organic loans Total NPAs of $5.6mm as of 4Q14, representing .43% of organic loans and OREO Allowance to organic loans is 1.39% at the end of 4Q14 N PL % ALL % N PA s / Orga n ic L o an s 1 Total past due loans include 30 – 89 day and 90+ day loans past due 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 0 2,000 4,000 6,000 8,000 10,000 4Q13 1Q14 2Q14 3Q14 4Q14 Organic Nonperforming Assets NPLs OREO NPAs / Organic Loans 0.00% 0.50% 1.00% 1.50% 2.00% 0.00% 0.20% 0.40% 0.60% 0.80% 4Q13 1Q14 2Q14 3Q14 4Q14 Organic Credit Ratios NPLs to Loans ALL to Loans

10 Credit: OREO ($ i n t h o u sa n d s) ($ i n t h o u sa n d s) ($ i n t h o u sa n d s) OREO balances declined 44% linked-quarter and 82% year-over-year to end 4Q14 at $8.6mm New OREO inflows declined for the fifth straight quarter Nearly 90 OREO properties sold in the fourth quarter of 2014 and over 400 sold in 2014 0 10,000 20,000 30,000 40,000 50,000 60,000 4Q13 1Q14 2Q14 3Q14 4Q14 Total OREO Balances 0 5,000 10,000 15,000 20,000 25,000 30,000 4Q13 1Q14 2Q14 3Q14 4Q14 Total OREO Sales 0 5,000 10,000 15,000 20,000 25,000 4Q13 1Q14 2Q14 3Q14 4Q14 Total OREO Inflows

11 Summary Results Well Positioned Franchise Executing on Strategic Priorities Efficient network in attractive markets Management depth Capital levels to support growth Improving run-rate efficiency Increasing noninterest income through expanded products and services Leveraging treasury / payments expertise to enhance transaction deposit accounts Prudently growing earning assets Profile One of Georgia’s best-capitalized banking companies with operations in Atlanta, Middle Georgia and Augusta Completed two healthy bank acquisitions that were announced in 2014; successful conversion of Bank of Atlanta completed in December 2014 Treasury / payments expertise Low cost deposit base Strong credit metrics Effectively grew organic loans while maintaining exceptional credit metrics Continued improvement in deposit funding mix Strong infrastructure in operations, compliance and risk management