Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Capital Bank Financial Corp. | a8-kcbfearningsreleasefy20.htm |

| EX-99.1 - EXHIBIT 99.1 - Capital Bank Financial Corp. | exhibit991earningsreleasef.htm |

2014 Fourth Quarter Earnings January 29, 2015

Safe Harbor Statement 2 1/29/2015 Forward-Looking Statements Information in this presentation contains forward-looking statements. Any statements about our expectations, beliefs, plans, predictions, forecasts, objectives, assumptions or future events or performance are not historical facts and may be forward- looking. These statements are often, but not always, made through the use of words or phrases such as “anticipate,” “believes,” “can,” “could,” “may,” “predicts,” “potential,” “should,” “will,” “estimate,” “plans,” “projects,” “continuing,” “ongoing,” “expects,” “intends” and similar words or phrases. Accordingly, these statements are only predictions and involve estimates, known and unknown risks, assumptions and uncertainties that could cause actual results to differ materially from those expressed in them. Our actual results could differ materially from those anticipated in such forward-looking statements as a result of several factors more fully described under the caption “Risk Factors” in the annual report on Form 10-K and other periodic reports filed by us with the Securities and Exchange Commission. Any or all of our forward-looking statements in this presentation may turn out to be inaccurate. The inclusion of this forward-looking information should not be regarded as a representation by us or any other person that the future plans, estimates or expectations contemplated by us will be achieved. We have based these forward- looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. There are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward looking statements including, but not limited to: (1) changes in general economic and financial market conditions; (2) changes in the regulatory environment; (3) economic conditions generally and in the financial services industry; (4) changes in the economy affecting real estate values; (5) our ability to achieve loan and deposit growth; (6) the completion of future acquisitions or business combinations and our ability to integrate any acquired businesses into our business model; (7) projected population and income growth in our targeted market areas; (8) competitive pressures in our markets and industry; (9) our ability to attract and retain key personnel; (10) changes in accounting policies or judgments; and (11) volatility and direction of market interest rates and a weakening of the economy which could materially impact credit quality trends and the ability to generate loans. All forward-looking statements are necessarily only estimates of future results and actual results may differ materially from expectations. You are, therefore, cautioned not to place undue reliance on such statements which should be read in conjunction with the other cautionary statements that are included elsewhere in this presentation. Further, any forward-looking statement speaks only as of the date on which it is made and we undertake no obligation to update or revise any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events.

3 2014 Accomplishments ■ Growth: Generated record $457 mm new loans and 15% annualized portfolio growth in 4Q. For the year, new loans totaled $1.6 bn, up 27%, and portfolio grew 10% ; ■ Retail Funding: Grew non-interest balances 14% during the year ■ Credit Discipline: Reduced special assets portfolio by 40% and NPLs from 5.8% to 2.6%, and generated a new loan portfolio with excellent credit metrics ■ Efficiency: Reduced full-year expenses by 10%, reflecting declines in legacy credit expenses and targeted reductions in compensation, occupancy, and other costs ■ Profitability: Improved Core ROA from 0.79% to 0.83%, despite low interest rates ■ Capital Deployment: Returned $103 mm to shareholders through stock repurchase, bringing lifetime repurchases to 15% of shares outstanding 1/29/2015 See reconciliation of non-GAAP measures in appendix.

Consistent, Sustained Growth Story Emerging 4 1/29/2015 $ mm’s (1) Excludes effect of Southern Community acquisition. Annualized Growth: +7% -1% +16% +9% +15% 197 251 173 253 251 302 291 409 253 442 445 457 (270) (290) (292) (410) (340) (349) (414) (334) (259) (266) (343) (281) -500 -400 -300 -200 -100 0 100 200 300 400 500 600 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 New Loans Booked Payoffs / Amortization Net Balance Growth 1

Fourth Quarter Highlights 5 1/29/2015 See reconciliation of non-GAAP measures in appendix. ■ Record $457 mm of new loans ■ Loan portfolio grew 15% annualized q/q and is up 10% y/y ■ NIM compressed by 9 bps, roughly in line with expectations ■ Core efficiency ratio improved to 70.5% sequentially ■ Core ROA improved to 0.83%, up from 0.79% in 4Q13 ■ Tangible book value per share increased $0.28 to $19.28 ($ mm's except per share data, growth rates, and metrics) 4Q14 3Q14 4Q13 Net interest income 61.4 0% -7% Provision (reversal) (0.6) -54% -118% Core non-interest income 10.1 5% -23% Core non-interest expense 50.4 -1% -8% Core pretax income 21.7 1% 6% Core net income 14.0 4% 8% Per share $0.29 7% 16% Non-core adjustments (0.2) -33% -75% Net income 13.8 5% 13% Per share $0.29 7% 26% Key Metrics 4Q14 3Q14 4Q13 Net interest margin 4.05% 4.14% 4.52% Core fee ratio 14.1% 13.6% 16.6% Core efficiency rati 70.5% 71.6% 69.8% Core ROA 0.83% 0.81% 0.79% Core ROTCE 6.2% 5.9% 5.4% % change

Record $457 mm New Loan Production 6 1/29/2015 New Loans by Geography New Loans by Product $ mm’s $ mm’s 227 103 216 176 233 91 62 69 101 83 91 88 157 168 141 $409 $253 $442 $445 $457 4Q13 1Q14 2Q14 3Q14 4Q14 Commercial CRE Consumer / Indirect 90 69 152 159 86 198 122 189 162 196 121 62 101 124 175 $409 $253 $442 $445 $457 4Q13 1Q14 2Q14 3Q14 4Q14 Florida Carolinas Tennessee

924 1,001 1,000 1,006 1,054 1,322 1,327 1,320 1,310 1,384 1,492 1,482 1,482 1,429 1,398 3,738 3,810 3,802 3,745 3,836 4Q13 1Q14 2Q14 3Q14 4Q14 Noninterest demand NOW Savings & Money Market Y/Y Growth 3% -6% 5% 14%Demand Balances Driving Higher Core Deposits 7 1/29/2015 Cost of Deposits Core Deposit Balances $ mm’s 0.34% 0.34% 0.33% 0.34% 0.34% 0.14% 0.15% 0.14% 0.14% 0.15% 4Q13 1Q14 2Q14 3Q14 4Q14 Total Core

NIM Declines as Expected 8 1/29/2015 ■ The net interest margin declined by 9 bps in the quarter, in line with expectations ■ Variable rate loans made up 62% of new loan production in the quarter Purchase Accounting Impact on NIM Yields See reconciliation of non-GAAP measures in appendix. 4.52% 4.41% 4.26% 4.14% 4.05% 3.51% 3.53% 3.37% 3.46% 3.38% 4Q13 1Q14 2Q14 3Q14 4Q14 Net Interest Margin Contractual Net Interest Margin 5.88% 5.66% 5.40% 5.17% 4.99% 1.65% 1.71% 1.76% 1.92% 2.08% 4Q13 1Q14 2 4 3Q14 4Q14 Loans Investments

Core Non-interest Income Largely Stable 9 1/29/2015 ■ Non-interest income excluding FDIC indemnification expense was stable in 4Q Non-interest Income $ mm’s See reconciliation of non-GAAP measures in appendix. 13.3 11.4 11.9 10.0 10.6 1.9 2.2 2.1 3.9 3.4 15.2 13.6 14.0 13.9 14.0 4Q13 1Q14 2Q14 3Q14 4Q14 Total FDIC indemnification asset expense $ mm's 4Q13 3Q14 4Q14 Services charges on deposits 5.9 5.6 5.4 Debit card income 2.9 3.0 3.0 Fees on mortgage loans sold 1.1 1.2 1.1 Investment advisory and trust fees 1.1 1.2 1.2 Other 4.2 2.9 3.3 Non-interest Income ex FDIC expense 15.2 13.9 14.0 FDIC indemnification asset expense (1.9) (3.9) (3.4) Non-interest Income 13.3 10.0 10.6

10% Decline in Core Expenses During 2014 10 1/29/2015 Core Non-interest Expense $ mm’s See reconciliation of non-GAAP measures in appendix. Core Efficiency Ratio Non-interest Expense 51.1 49.6 49.6 47.5 48.6 56.3 55.2 51.3 51.4 50.9 4Q13 1Q14 2Q14 3Q14 4Q14 Non-core adjustments REO expense Core non-interest expense, before REO 4Q13 3Q14 4Q14 Salaries and employee benefits 24.0 22.6 23.9 Net occupancy and equipment 8.5 8.5 8.0 Professional fees 2.4 1.5 2.1 Other 16.2 14.9 14.7 Core non-interest expense, before REO 51.0 47.5 48.7 REO expense 4.0 3.4 1.8 Core non-interest expense 55.0 50.9 50.4 Non-core adjustments 1.2 0.5 0.5 Total non-interest expense 56.3 51.4 50.9 74.5% 70.5% 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14

Liquidity and Capital Ratios Remain Strong 11 1/29/2015 ■ Modified duration of investments was 4.1 years at December 31, 2014, vs 4.0 years at September 30 ■ Capital ratios remain strong with tier 1 leverage of 14.3%1 on a consolidated basis Tier 1 Leverage Ratio (1) Capital ratios are preliminary. Cash / Equivalents 16% Agency MBS 45% Agency CMBS 23% Agency CMO 11% Corporate/ SBA/Other 4% Muni 1% Liquidity 15.0% 14.9% 14.6% 14.4% 14.3% 4Q13 1Q14 2Q14 3Q14 4Q14

New Loan Portfolio Performing Strongly 12 1/29/2015 New Loan Portfolio Credit Metrics Past Dues & Nonaccruals ■ Provisions for new loans of $0.8 mm during 4Q were offset by $1.4 mm reversal of provision on the legacy portfolio 0.13% 0.21% 0.12% 0.14% 0.11% 0.34% 0.24% 0.21% 0.22% 0.16% 4Q13 1Q14 2Q14 3Q14 4Q14 Past Due Nonaccrual 4Q13 3Q14 4Q14 Criticized 0.27% 0.23% 0.32% Classified Performing 0.67% 0.53% 0.44% Classified Nonperforming 0.34% 0.22% 0.16% Total Criticized/Classified 1.28% 0.98% 0.92% Reserve ($ mm) 17.8 21.2 20.7 Reserve as % of New Loan Portfolio 0.80% 0.72% 0.63%

832 577 513 449 406 349 154 129 120 96 90 78 986 706 633 545 496 427 2012 2013 1Q14 2Q14 3Q14 4Q14 Loans REO -57% Special Assets Down 57% Since 2012 13 1/29/2015 Special Assets Nonperforming Loans / Total Loans $ mm’s Legacy Credit Expenses $ mm’s 7.7% 5.8% 5.2% 4.5% 3.6% 2.6% 2012 2013 1Q14 2Q14 3Q14 4Q14 4Q13 3Q14 4Q14 2013 2014 % Change Provision (reversal) on legacy loans (1.2) (4.2) (1.4) (1.9) (9.0) FDIC ind mnification asset expense 1.9 3.9 3.4 5.7 11.5 OREO valuation expense 3.2 2.8 1.6 22.0 10.9 (Gains) losses on sales of OREO (0.3) (0.2) (0.4) (3.5) (4.6) Foreclosed asset related expense 1.1 0.8 0.6 6.0 4.0 Loan workout expense 1.6 0.9 1.4 8.0 4.6 Salaries and employee benefits 1.3 1.1 1.0 5.2 4.7 Total legacy credit expense 7.6 5.1 6.1 41.5 22.0 -47%

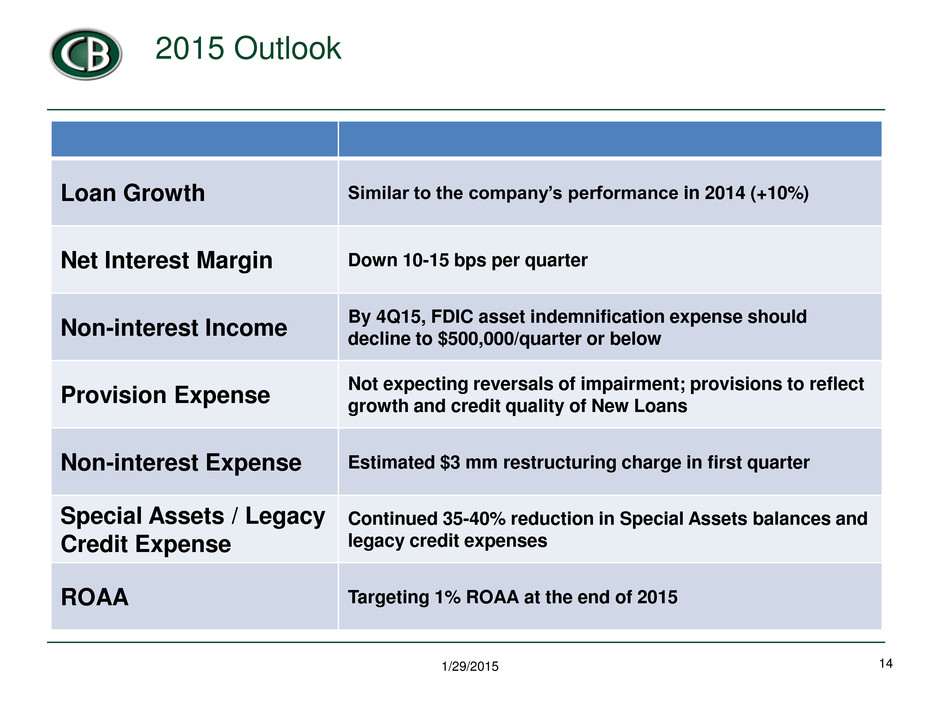

14 2015 Outlook 1/29/2015 Loan Growth Similar to the company’s performance in 2014 (+10%) Net Interest Margin Down 10-15 bps per quarter Non-interest Income By 4Q15, FDIC asset indemnification expense should decline to $500,000/quarter or below Provision Expense Not expecting reversals of impairment; provisions to reflect growth and credit quality of New Loans Non-interest Expense Estimated $3 mm restructuring charge in first quarter Special Assets / Legacy Credit Expense Continued 35-40% reduction in Special Assets balances and legacy credit expenses ROAA Targeting 1% ROAA at the end of 2015

15 Capital Bank Investment Highlights ■ Experienced management team with institutional track record ; ■ Positioned in Southeastern growth markets ■ Disciplined and sustainable growth story ■ Focused on deploying capital and improving profitability ■ Attractive valuation 1/29/2015

Appendix 16 1/29/2015

Reconciliation of Core Noninterest Income / Expense 17 1/29/2015 $ 000's 4Q14 3Q14 2Q14 1Q14 4Q13 Net interest income $61,351 $61,425 $60,831 $62,453 $65,723 Reported non-interest income 10,594 9,957 11,887 11,369 13,271 Less: Securities gains (losses), net 513 317 (28) 174 164 Core non-interest income $10,081 $9,640 $11,915 $11,195 $13,107 Reported non-interest expense $50,932 $51,418 $51,273 $55,224 $56,251 Less: Stock-based compensation expense 239 242 531 533 942 Contingent value right expense 334 278 327 767 299 Core non-interest expense $50,359 $50,898 $50,415 $53,924 $55,010 Core Fee Ratio* 14.1% 13.6% 16.4% 15.2% 16.6% Efficiency Ratio** 70.8% 72.0% 70.5% 74.8% 71.2% Core Efficiency Ratio*** 70.5% 71.6% 69.3% 73.2% 69.8% * Core Fee Ratio: Core non-interest income / (Net interest income + Core non-interest income) ** Efficiency Ratio: Non-interest expense / (Net interest income + Non-interest income) ***Core Efficiency Ratio: Core non-interest expense / (Net interest income + Core non-interest income)

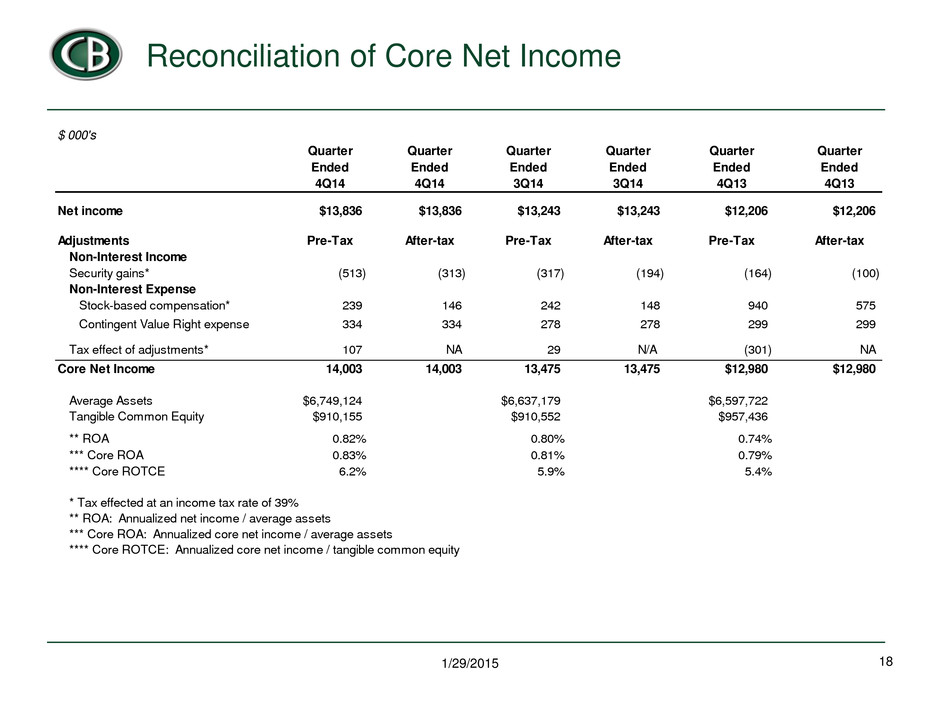

Reconciliation of Core Net Income 18 1/29/2015 $ 000's Quarter Quarter Quarter Quarter Quarter Quarter Ended Ended Ended Ended Ended Ended 4Q14 4Q14 3Q14 3Q14 4Q13 4Q13 $13,836 $13,836 $13,243 $13,243 $12,206 $12,206 Pre-Tax After-tax Pre-Tax After-tax Pre-Tax After-tax Non-Interest Income Security gains* (513) (313) (317) (194) (164) (100) Non-Interest Expense 239 146 242 148 940 575 334 334 278 278 299 299 . Tax effect of adjustments* 107 NA 29 N/A (301) NA 14,003 14,003 13,475 13,475 $12,980 $12,980 Average Assets $6,749,124 $6,637,179 $6,597,722 Tangible Common Equity $910,155 $910,552 $957,436 ** ROA 0.82% 0.80% 0.74% *** Core ROA 0.83% 0.81% 0.79% **** Core ROTCE 6.2% 5.9% 5.4% * Tax effected at an income tax rate of 39% ** ROA: Annualized net income / average assets *** Core ROA: Annualized core net income / average assets **** Core ROTCE: Annualized core net income / tangible common equity Net income Adjustments Core Net Income Stock-based compensation* Contingent Value Right expense

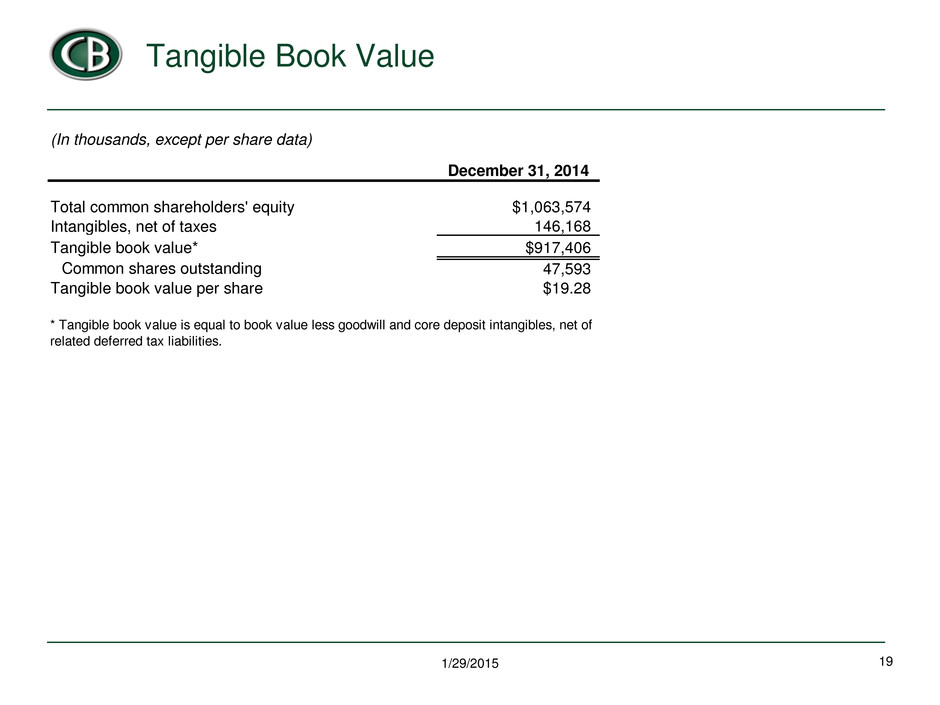

Tangible Book Value 19 1/29/2015 (In thousands, except per share data) December 31, 2014 Total common shareholders' equity $1,063,574 Intangib es, net of taxes 146,168 Tangible book value* $917,406 Common shares outstanding 47,593 Tangible book value per share $19.28 * Tangible book value is equal to book value less goodwill and core deposit intangibles, net of related deferred tax liabilities.

Contractual Net Interest Margin 20 1/29/2015 (1) Excludes purchase accounting adjustments $ 000s Average Earning Assets Net Interest Income Net Interest Margin December 31, 2014 Reported 6,045,748 61,723 4.05% Purchase accounting impact (79,632) 10,295 0.67% Contractual Net Interest Margin (1) 3.38% September 30, 2014 Reported 5,911,601 61,660 4.14% Purchase accounting impact (91,982) 10,292 0.68% Contractual Net Interest Margin (1) 3.46% June 30, 2014 Reported 5,756,466 61,077 4.26% Purchase accounting impact (101,062) 12,977 0.89% Contractual Net Interest Margin (1) 3.37% March 31, 2014 Reported 5,774,135 62,721 4.41% Purchase accounting impact (117,732) 12,762 0.88% Contractual Net Interest Margin (1) 3.53% December 31, 2013 Reported 5,790,444 65,997 4.52% Purchase accounting impact (134,367) 15,094 1.01% Contractual Net Interest Margin (1) 3.51%