Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CIMPRESS plc | q2fy15earnings8-k.htm |

| EX-99.3 - EXHIBIT 99.3 EARNINGS PRESENTATION SCRIPT - CIMPRESS plc | q2_fy15earningsscript.htm |

| EX-99.1 - EXHIBIT 99.1 PRESS RELEASE - CIMPRESS plc | q2_fy15earningsrelease.htm |

CIMPRESS N.V. Q2 Fiscal Year 2015 Earnings presentation, commentary & financial results supplement January 28, 2015 1

Safe Harbor Statement 2 This presentation and the accompanying notes contain statements about our future expectations, plans and prospects of our business that constitute forward-looking statements for purposes of the safe harbor provisions under the Private Securities Litigation Reform Act of 1995, including but not limited to our expectations for the growth, development, and profitability of our business and our recent acquisitions and investments, the integration of our recent acquisitions, and our financial outlook and guidance set forth under the headings “FY2015 Outlook & Expectations,” “Revenue and EPS Guidance,” and “Capital Expenditures Guidance.” Forward-looking projections and expectations are inherently uncertain, are based on assumptions and judgments by management, and may turn out to be wrong. Our actual results may differ materially from those indicated by these forward-looking statements as a result of various important factors, including but not limited to flaws in the assumptions and judgments upon which our forecasts are based; our failure to execute our strategy; our inability to make the investments in our business that we plan to make; the failure of our strategy, investments, and efforts to reposition the Vistaprint brand to have the effects that we expect; our failure to promote and strengthen our brands; our failure to acquire new customers and enter new markets, retain our current customers, and sell more products to current and new customers; our failure to identify and address the causes of our revenue weakness in some of our markets; our failure to manage the growth and complexity of our business and expand our operations; costs and disruptions caused by acquisitions and strategic investments; the failure of the businesses we acquire or invest in, including Printdeal, Pixartprinting, FotoKnudsen, and Printi, to perform as expected; difficulties or higher than anticipated costs in integrating the systems and operations of our acquired businesses into our systems and operations; the willingness of purchasers of marketing services and products to shop online; the failure of our current and new marketing channels to attract customers; currency fluctuations that affect our revenues and costs including the impact of currency hedging strategies and intercompany transactions; unanticipated changes in our markets, customers, or business; competitive pressures; interruptions in or failures of our websites, network infrastructure or manufacturing operations; our failure to retain key employees; our failure to maintain compliance with the financial covenants in our revolving credit facility or to pay our debts when due; costs and judgments resulting from litigation; changes in the laws and regulations or in the interpretations of laws or regulations to which we are subject, including tax laws, or the institution of new laws or regulations that affect our business; general economic conditions; and other factors described in our Form 10-Q for the fiscal quarter ended September 30, 2014 and the other documents we periodically file with the U.S. Securities and Exchange Commission.

Presentation Organization & Call Details 3 • Q2 FY2015 Overview • Q2 FY2015 Operating and financial results • Looking Ahead • Supplementary information • Reconciliation of GAAP to non-GAAP Results Live Q&A Session: TOMORROW MORNING January 29, 2015, 7:30 a.m. ET Link from ir.cimpress.com Hosted by: Robert Keane President & CEO Ernst Teunissen EVP & CFO

Q2 FY2015 Overview

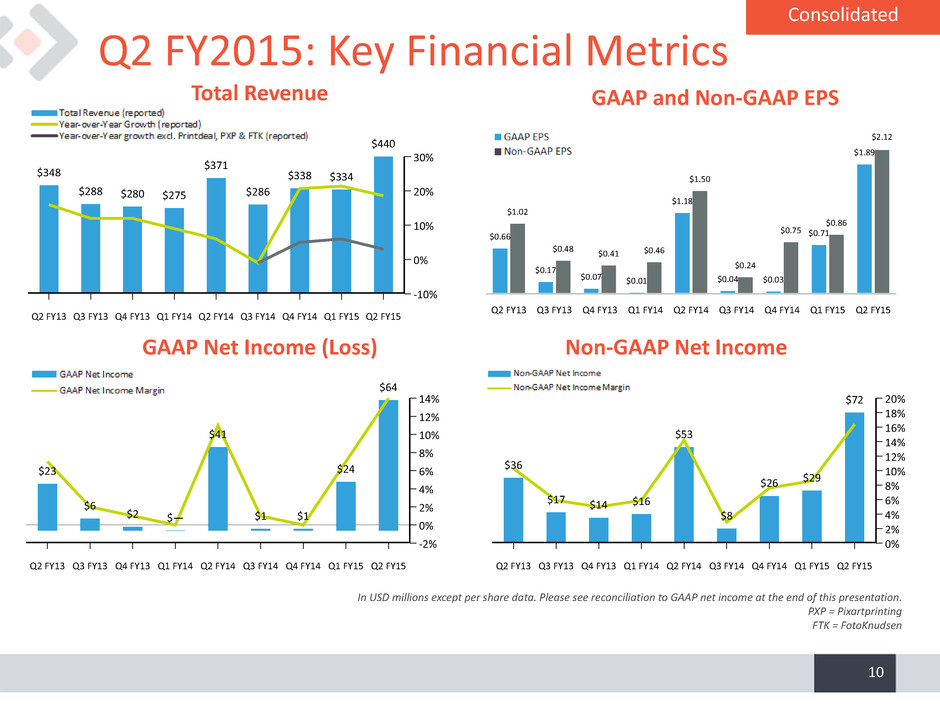

Q2 FY2015 Overview • Year-over-year revenue growth of 19% - Vistaprint growth rate improved QoQ and in line with our expectations - Recent acquisitions performing well • Strong GAAP profitability helped by non-operational or timing related items • GAAP and Non-GAAP EPS up 60% and 41% YoY, respectively • Continued progress against strategic goals 5 Solid performance in an important quarter Consolidated

Vistaprint Business Unit • Continued to move value proposition toward needs of customers with higher expectations - Improved trends in markets in which we have made major marketing changes - Traction in customer metrics, including gross profit per customer • Exposed new customers to our value proposition via holiday experience - New designs around the world - New app in UK to purchase personal products using social media photos - Successful promotions surrounding Cyber Monday • Digital revenue continues to lag 6

• Most of World: - Japan JV continues to build foundations - Continued growth in India while also laying foundations - Began to consolidate Brazil (Printi) • Smaller EU Brands: - Strong performance in Q2 - Further adjustments to Pixartprinting and Printdeal earn out reflecting positive momentum - Seasonally strong quarter for Albumprinter and Fotoknudsen Other Business Units 7 Japan India

Manufacturing & Technology 8 • Strong operational execution during seasonal peak • Talent and software technology investments in support of vision for a common mass customization platform • Ramp of beta production for soft goods and apparel • Continued optimization of Printdeal manufacturing in our Venlo facility

Q2 FY2015 Financial & Operating Metrics

GAAP Net Income (Loss) Non-GAAP Net Income 30% 20% 10% 0% -10% Q2 FY13 Q3 FY13 Q4 FY13 Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15 Q2 FY15 $348 $288 $280 $275 $371 $286 $338 $334 $440 Q2 FY13 Q3 FY13 Q4 FY13 Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15 Q2 FY15 $0.66 $0.17 $0.07 $0.01 $1.18 $0.04 $0.03 $0.71 $1.89 $1.02 $0.48 $0.41 $0.46 $1.50 $0.24 $0.75 $0.86 $2.12 14% 12% 10% 8% 6% 4% 2% 0% -2% Q2 FY13 Q3 FY13 Q4 FY13 Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15 Q2 FY15 $23 $6 $2 $— $41 $1 $1 $24 $64 20% 18% 16% 14% 12% 10% 8% 6% 4% 2% 0% Q2 FY13 Q3 FY13 Q4 FY13 Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15 Q2 FY15 $36 $17 $14 $16 $53 $8 $26 $29 $72 Q2 FY2015: Key Financial Metrics 10 GAAP and Non-GAAP EPSTotal Revenue In USD millions except per share data. Please see reconciliation to GAAP net income at the end of this presentation. PXP = Pixartprinting FTK = FotoKnudsen Consolidated

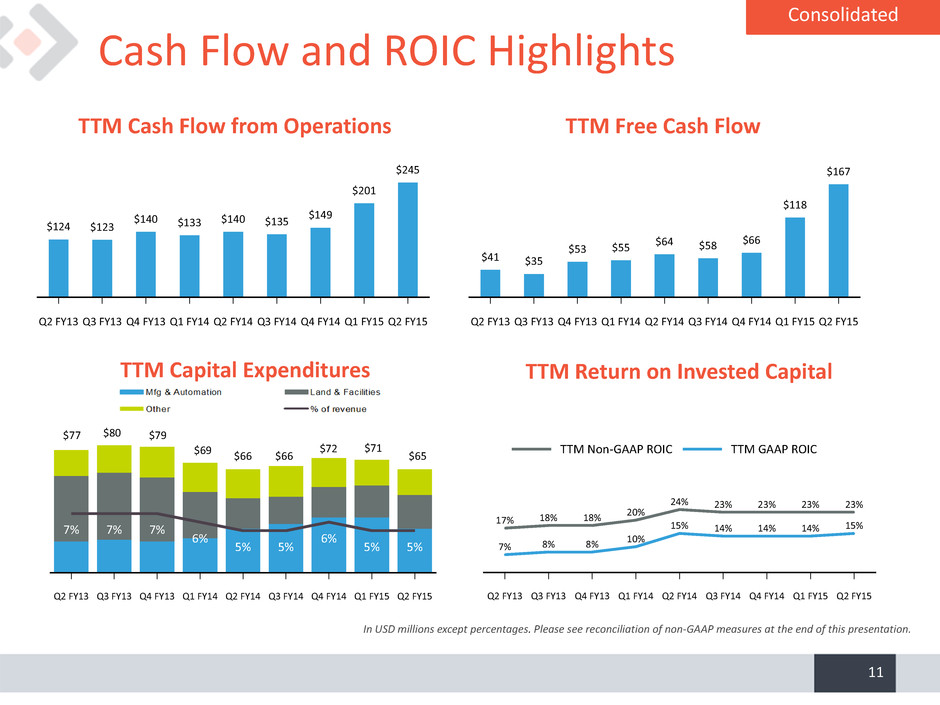

Q2 FY13 Q3 FY13 Q4 FY13 Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15 Q2 FY15 7% 7% 7% 6% 5% 5% 6% 5% 5% Cash Flow and ROIC Highlights 11 TTM Free Cash FlowTTM Cash Flow from Operations TTM Capital Expenditures TTM Return on Invested Capital In USD millions except percentages. Please see reconciliation of non-GAAP measures at the end of this presentation. Consolidated Q2 FY13 Q3 FY13 Q4 FY13 Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15 Q2 FY15 $124 $123 $140 $133 $140 $135 $149 $201 $245 Q2 FY13 Q3 FY13 Q4 FY13 Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15 Q2 FY15 $41 $35 $53 $55 $64 $58 $66 $118 $167 TTM Non-GAAP ROIC TTM GAAP ROIC Q2 FY13 Q3 FY13 Q4 FY13 Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15 Q2 FY15 17% 18% 18% 20% 24% 23% 23% 23% 23% 7% 8% 8% 10% 15% 14% 14% 14% 15% $77 $80 $79 $69 $66 $66 $72 $71 $65

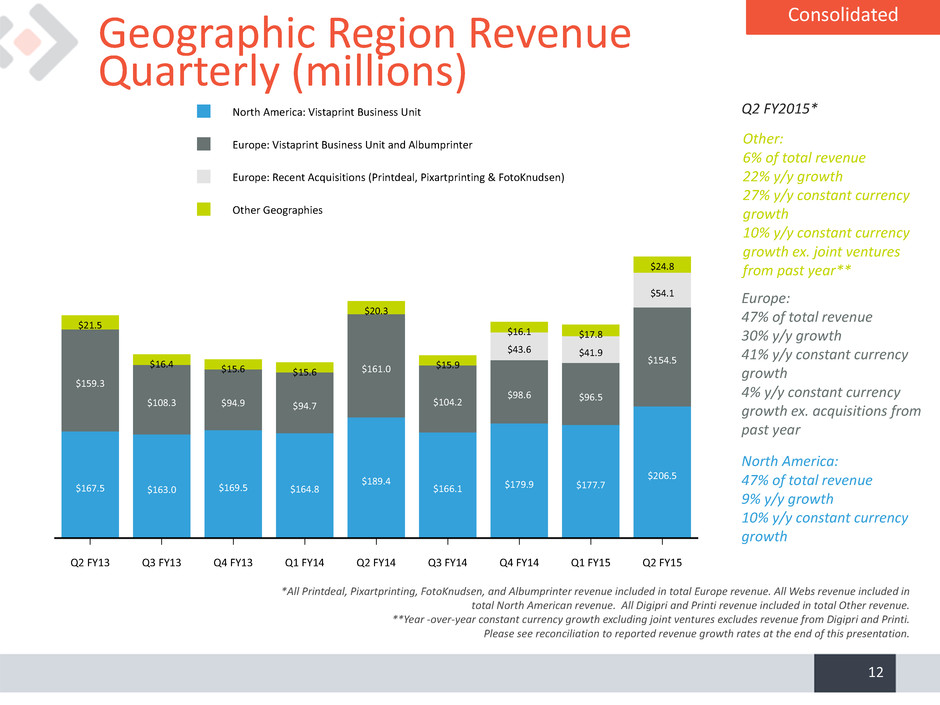

Geographic Region Revenue Quarterly (millions) 12 North America: 47% of total revenue 9% y/y growth 10% y/y constant currency growth Europe: 47% of total revenue 30% y/y growth 41% y/y constant currency growth 4% y/y constant currency growth ex. acquisitions from past year Other: 6% of total revenue 22% y/y growth 27% y/y constant currency growth 10% y/y constant currency growth ex. joint ventures from past year** *All Printdeal, Pixartprinting, FotoKnudsen, and Albumprinter revenue included in total Europe revenue. All Webs revenue included in total North American revenue. All Digipri and Printi revenue included in total Other revenue. **Year -over-year constant currency growth excluding joint ventures excludes revenue from Digipri and Printi. Please see reconciliation to reported revenue growth rates at the end of this presentation. Q2 FY2015* Consolidated North America: Vistaprint Business Unit Europe: Vistaprint Business Unit and Albumprinter Europe: Recent Acquisitions (Printdeal, Pixartprinting & FotoKnudsen) Other Geographies Q2 FY13 Q3 FY13 Q4 FY13 Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15 Q2 FY15 $167.5 $163.0 $169.5 $164.8 $189.4 $166.1 $179.9 $177.7 $206.5 $159.3 $108.3 $94.9 $94.7 $161.0 $104.2 $98.6 $96.5 $154.5 $43.6 $41.9 $54.1 $21.5 $16.4 $15.6 $15.6 $20.3 $15.9 $16.1 $17.8 $24.8

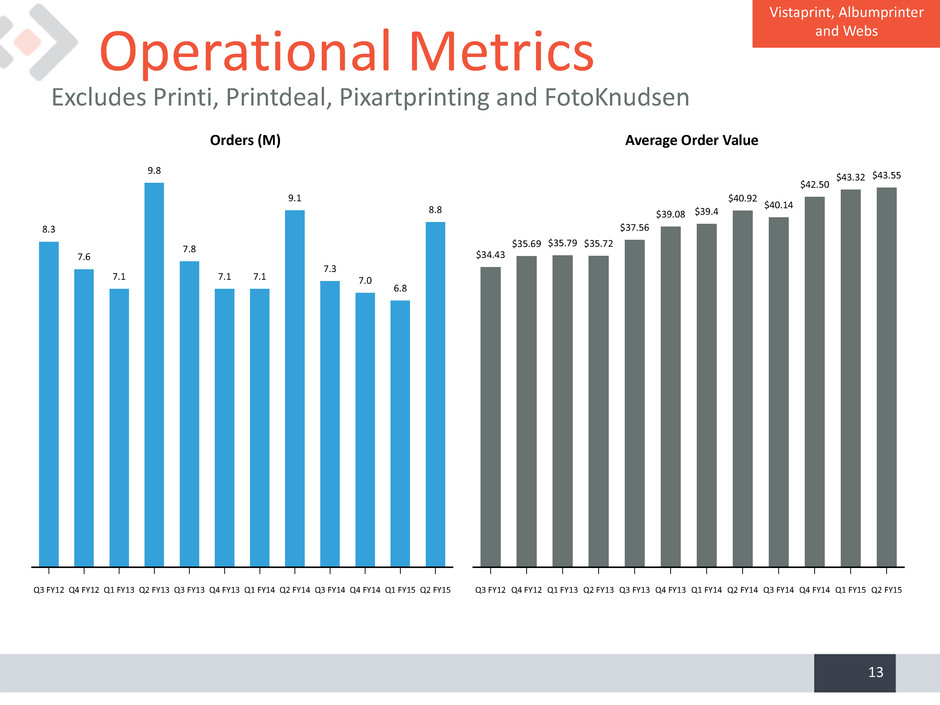

Operational Metrics 13 Excludes Printi, Printdeal, Pixartprinting and FotoKnudsen Vistaprint, Albumprinter and Webs Orders (M) Q3 FY12 Q4 FY12 Q1 FY13 Q2 FY13 Q3 FY13 Q4 FY13 Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15 Q2 FY15 8.3 7.6 7.1 9.8 7.8 7.1 7.1 9.1 7.3 7.0 6.8 8.8 Average Order Value Q3 FY12 Q4 FY12 Q1 FY13 Q2 FY13 Q3 FY13 Q4 FY13 Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15 Q2 FY15 $34.43 $35.69 $35.79 $35.72 $37.56 $39.08 $39.4 $40.92 $40.14 $42.50 $43.32 $43.55

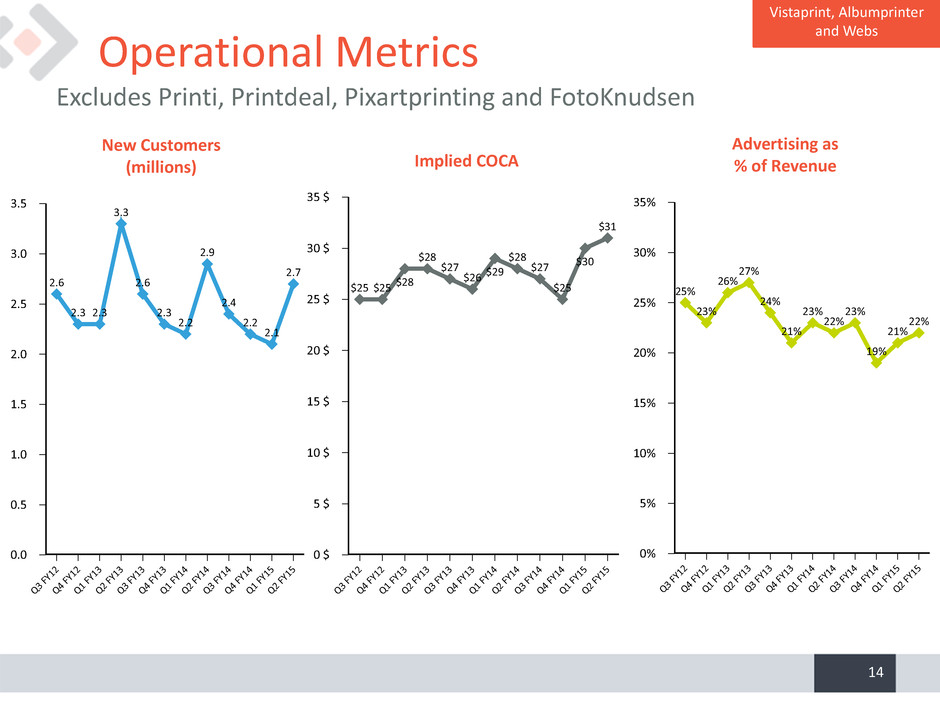

Operational Metrics 14 Excludes Printi, Printdeal, Pixartprinting and FotoKnudsen Vistaprint, Albumprinter and Webs New Customers (millions) 3.5 3.0 2.5 2.0 1.5 1.0 0.5 0.0 Q3 FY 12 Q4 FY 12 Q1 FY 13 Q2 FY 13 Q3 FY 13 Q4 FY 13 Q1 FY 14 Q2 FY 14 Q3 FY 14 Q4 FY 14 Q1 FY 15 Q2 FY 15 2.6 2.3 2.3 3.3 2.6 2.3 2.2 2.9 2.4 2.2 2.1 2.7 Implied COCA 35 $ 30 $ 25 $ 20 $ 15 $ 10 $ 5 $ 0 $ Q3 FY 12 Q4 FY 12 Q1 FY 13 Q2 FY 13 Q3 FY 13 Q4 FY 13 Q1 FY 14 Q2 FY 14 Q3 FY 14 Q4 FY 14 Q1 FY 15 Q2 FY 15 $25 $25 $28 $28 $27 $26 $29 $28 $27 $25 $30 $31 Advertising as % of Revenue 35% 30% 25% 20% 15% 10% 5% 0% Q3 FY 12 Q4 FY 12 Q1 FY 13 Q2 FY 13 Q3 FY 13 Q4 FY 13 Q1 FY 14 Q2 FY 14 Q3 FY 14 Q4 FY 14 Q1 FY 15 Q2 FY 15 25% 23% 26% 27% 24% 21% 23% 22% 23% 19% 21% 22%

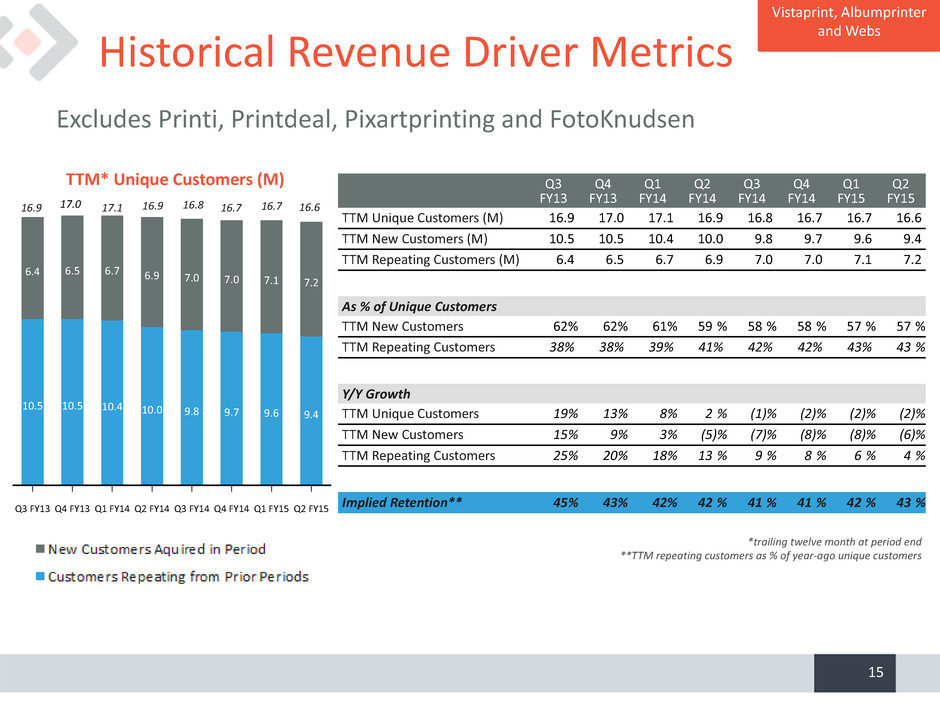

TTM* Unique Customers (M) Q3 FY13 Q4 FY13 Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15 Q2 FY15 10.5 10.5 10.4 10.0 9.8 9.7 9.6 9.4 6.4 6.5 6.7 6.9 7.0 7.0 7.1 7.2 Q3 FY13 Q4 FY13 Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15 Q2 FY15 TTM Unique Customers (M) 16.9 17.0 17.1 16.9 16.8 16.7 16.7 16.6 TTM New Customers (M) 10.5 10.5 10.4 10.0 9.8 9.7 9.6 9.4 TTM Repeating Customers (M) 6.4 6.5 6.7 6.9 7.0 7.0 7.1 7.2 As % of Unique Customers TTM New Customers 62% 62% 61% 59 % 58 % 58 % 57 % 57 % TTM Repeating Customers 38% 38% 39% 41% 42% 42% 43% 43 % Y/Y Growth TTM Unique Customers 19% 13% 8% 2 % (1)% (2)% (2)% (2)% TTM New Customers 15% 9% 3% (5)% (7)% (8)% (8)% (6)% TTM Repeating Customers 25% 20% 18% 13 % 9 % 8 % 6 % 4 % Implied Retention** 45% 43% 42% 42 % 41 % 41 % 42 % 43 % *trailing twelve month at period end **TTM repeating customers as % of year-ago unique customers Historical Revenue Driver Metrics 15 Excludes Printi, Printdeal, Pixartprinting and FotoKnudsen 16.7 16.9 17.1 16.9 16.8 16.6 16.7 Vistaprint, Albumprinter and Webs 17.0

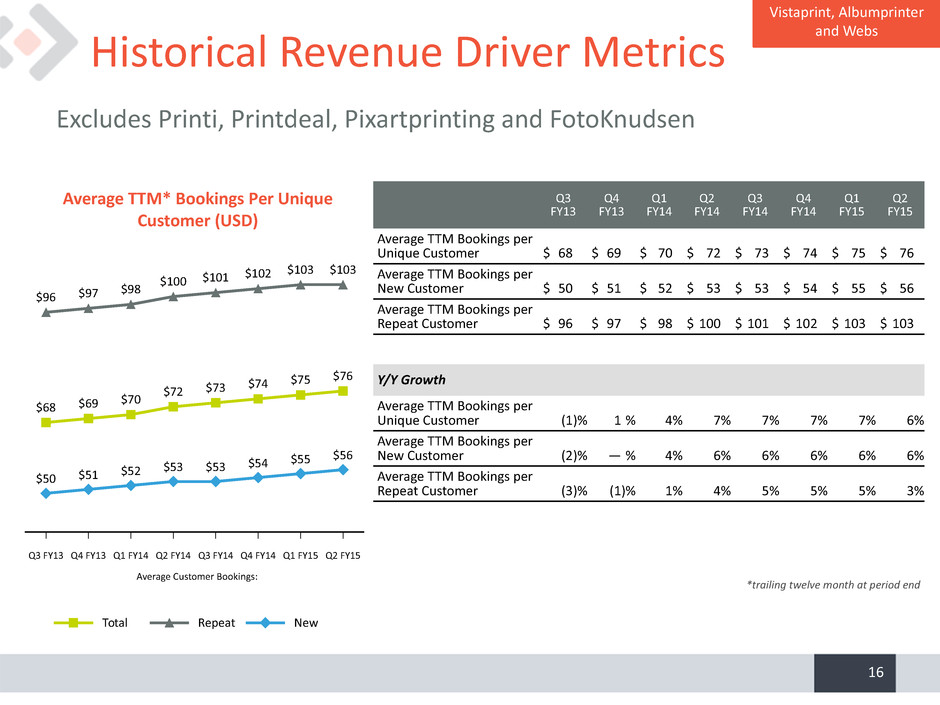

Total Repeat New Average TTM* Bookings Per Unique Customer (USD) Q3 FY13 Q4 FY13 Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15 Q2 FY15 Average Customer Bookings: $68 $69 $70 $72 $73 $74 $75 $76 $96 $97 $98 $100 $101 $102 $103 $103 $50 $51 $52 $53 $53 $54 $55 $56 Historical Revenue Driver Metrics 16 Excludes Printi, Printdeal, Pixartprinting and FotoKnudsen Q3 FY13 Q4 FY13 Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15 Q2 FY15 Average TTM Bookings per Unique Customer $ 68 $ 69 $ 70 $ 72 $ 73 $ 74 $ 75 $ 76 Average TTM Bookings per New Customer $ 50 $ 51 $ 52 $ 53 $ 53 $ 54 $ 55 $ 56 Average TTM Bookings per Repeat Customer $ 96 $ 97 $ 98 $ 100 $ 101 $ 102 $ 103 $ 103 Y/Y Growth Average TTM Bookings per Unique Customer (1)% 1 % 4% 7% 7% 7% 7% 6% Average TTM Bookings per New Customer (2)% — % 4% 6% 6% 6% 6% 6% Average TTM Bookings per Repeat Customer (3)% (1)% 1% 4% 5% 5% 5% 3% *trailing twelve month at period end Vistaprint, Albumprinter and Webs

Looking Ahead

FY 2015 Outlook & Expectations • Changes to revenue outlook: - Reduced range by roughly $30 million to reflect currency movements since October - Operational outlook essentially unchanged - Narrowed guidance range • Changes to EPS outlook lower GAAP EPS range and increase non-GAAP EPS range: - Estimated unrealized currency loss on revaluing intercompany loans - Change in fair-value estimate of acquisition-related earn-outs - Lower income tax expectation - Higher operational profit expectation 18

FY 2015 Outlook & Expectations (cont.) • Guidance does not include: - Potential for further changes in fair value estimate of acquisition- related earn-outs - Potential for increased interest expense resulting from further financing activity 19

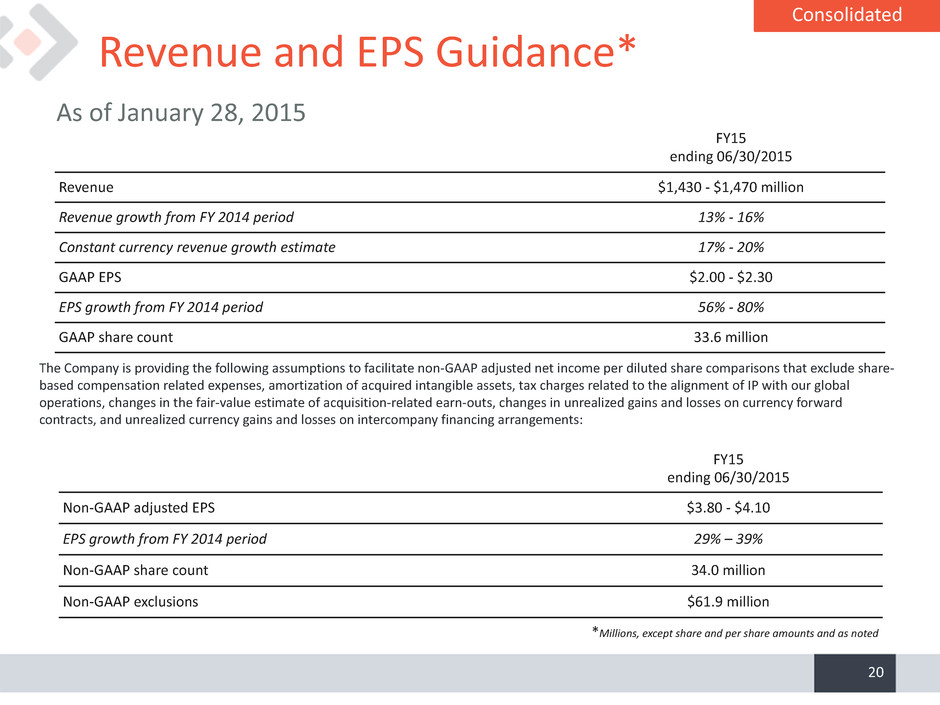

Revenue and EPS Guidance* The Company is providing the following assumptions to facilitate non-GAAP adjusted net income per diluted share comparisons that exclude share- based compensation related expenses, amortization of acquired intangible assets, tax charges related to the alignment of IP with our global operations, changes in the fair-value estimate of acquisition-related earn-outs, changes in unrealized gains and losses on currency forward contracts, and unrealized currency gains and losses on intercompany financing arrangements: 20 As of January 28, 2015 FY15 ending 06/30/2015 Revenue $1,430 - $1,470 million Revenue growth from FY 2014 period 13% - 16% Constant currency revenue growth estimate 17% - 20% GAAP EPS $2.00 - $2.30 EPS growth from FY 2014 period 56% - 80% GAAP share count 33.6 million FY15 ending 06/30/2015 Non-GAAP adjusted EPS $3.80 - $4.10 EPS growth from FY 2014 period 29% – 39% Non-GAAP share count 34.0 million Non-GAAP exclusions $61.9 million *Millions, except share and per share amounts and as noted Consolidated

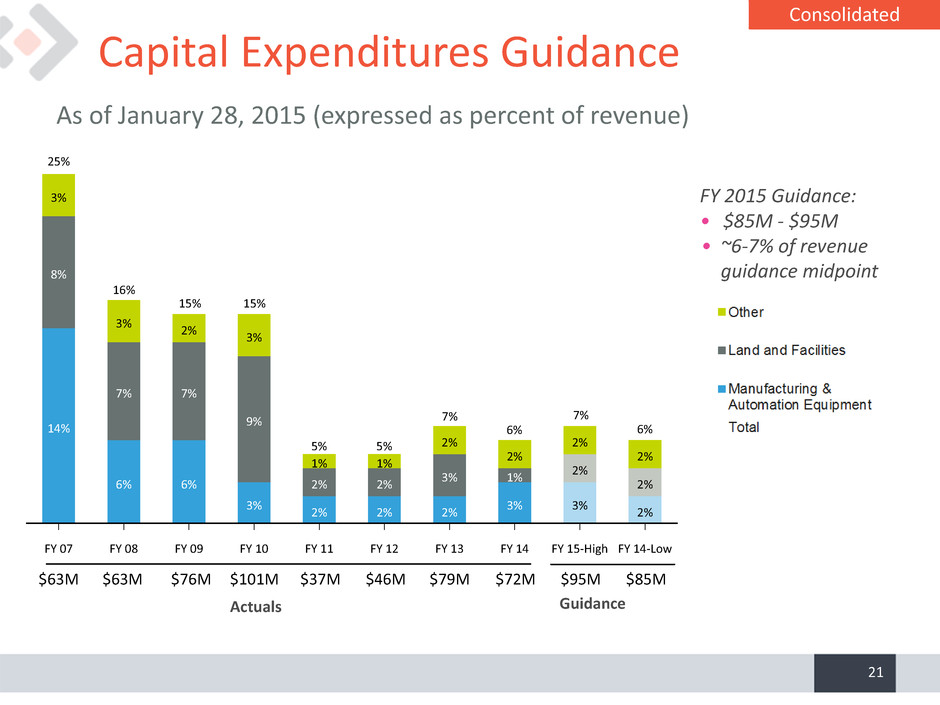

FY 07 FY 08 FY 09 FY 10 FY 11 FY 12 FY 13 FY 14 FY 15-High FY 14-Low 14% 6% 6% 3% 2% 2% 2% 3% 3% 2% 8% 7% 7% 9% 2% 2% 3% 1% 2% 2% 3% 3% 2% 3% 1% 1% 2% 2% 2% 2% Capital Expenditures Guidance 21 As of January 28, 2015 (expressed as percent of revenue) FY 2015 Guidance: • $85M - $95M • ~6-7% of revenue guidance midpoint Actuals Guidance $63M $63M $76M $95M $85M$101M $37M $46M $79M $72M Consolidated 25% 16% 15% 5% 6% 7%7% 5% 15% 6%

Summary • Clear priorities • Leadership: mass customization leader • Long termism: multi-decade mutual success for stakeholders • Intrinsic value: maximizing DCF per share • Solid first half of 2015 • Operational execution in the important seasonal peak • Initial investments in technology for common mass customization platform • Continued traction of Vistaprint brand repositioning • Acquisitions and investments performing well • Remain confident in ability to meet our objectives 22

Q&A Session Please go to ir.cimpress.com for the live Q&A call at 7:30 am EDT on January 29, 2015

Q2 Fiscal Year 2015 Financial and Operating Results Supplement

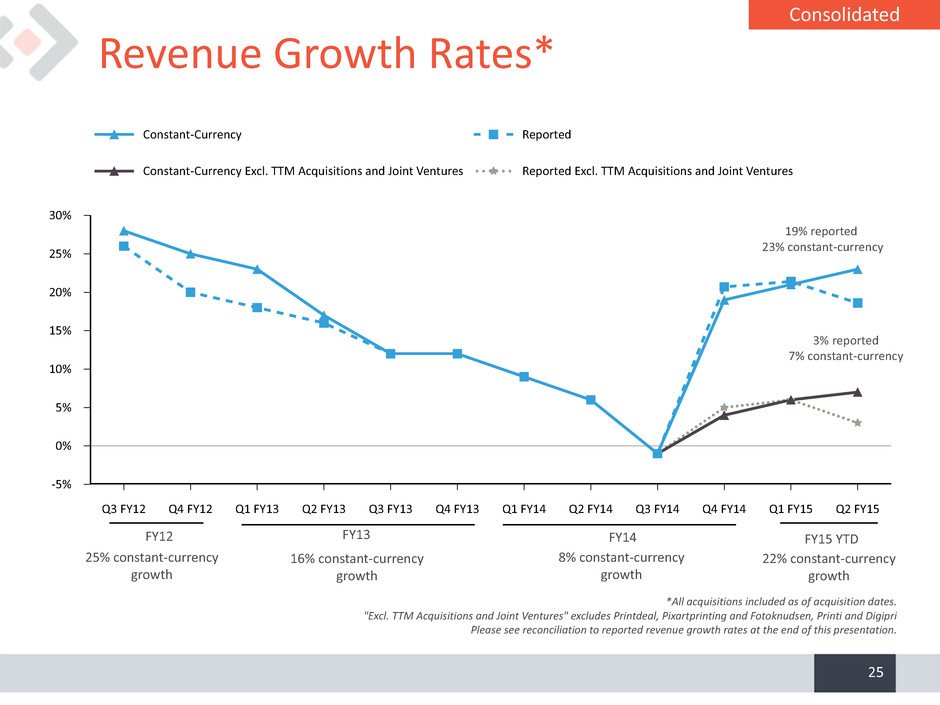

22% constant-currency growth Revenue Growth Rates* Constant-Currency Reported Constant-Currency Excl. TTM Acquisitions and Joint Ventures Reported Excl. TTM Acquisitions and Joint Ventures 30% 25% 20% 15% 10% 5% 0% -5% Q3 FY12 Q4 FY12 Q1 FY13 Q2 FY13 Q3 FY13 Q4 FY13 Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15 Q2 FY15 25 *All acquisitions included as of acquisition dates. "Excl. TTM Acquisitions and Joint Ventures" excludes Printdeal, Pixartprinting and Fotoknudsen, Printi and Digipri Please see reconciliation to reported revenue growth rates at the end of this presentation. 19% reported 23% constant-currency FY12 25% constant-currency growth FY13 16% constant-currency growth FY14 8% constant-currency growth Consolidated 3% reported 7% constant-currency FY15 YTD

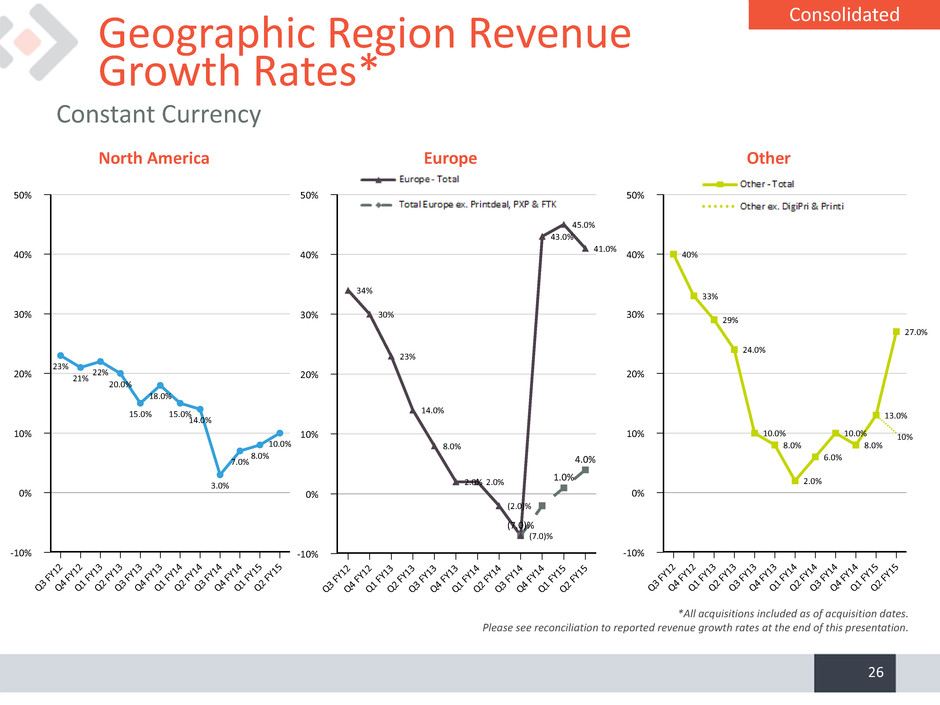

Other 50% 40% 30% 20% 10% 0% -10% Q3 FY 12 Q4 FY 12 Q1 FY 13 Q2 FY 13 Q3 FY 13 Q4 FY 13 Q1 FY 14 Q2 FY 14 Q3 FY 14 Q4 FY 14 Q1 FY 15 Q2 FY 15 40% 33% 29% 24.0% 10.0% 8.0% 2.0% 6.0% 10.0% 8.0% 13.0% 27.0% Europe 50% 40% 30% 20% 10% 0% -10% Q3 FY 12 Q4 FY 12 Q1 FY 13 Q2 FY 13 Q3 FY 13 Q4 FY 13 Q1 FY 14 Q2 FY 14 Q3 FY 14 Q4 FY 14 Q1 FY 15 Q2 FY 15 34% 30% 23% 14.0% 8.0% 2.0% 2.0% (2.0)% (7.0)% 43.0% 45.0% 41.0% (7.0)% 1.0% 4.0% Constant Currency Geographic Region Revenue Growth Rates* *All acquisitions included as of acquisition dates. Please see reconciliation to reported revenue growth rates at the end of this presentation. Consolidated 26 North America 50% 40% 30% 20% 10% 0% -10% Q3 FY 12 Q4 FY 12 Q1 FY 13 Q2 FY 13 Q3 FY 13 Q4 FY 13 Q1 FY 14 Q2 FY 14 Q3 FY 14 Q4 FY 14 Q1 FY 15 Q2 FY 15 23% 21% 22% 20.0% 15.0% 18.0% 15.0% 14.0% 3.0% 7.0% 8.0% 10.0% 10%

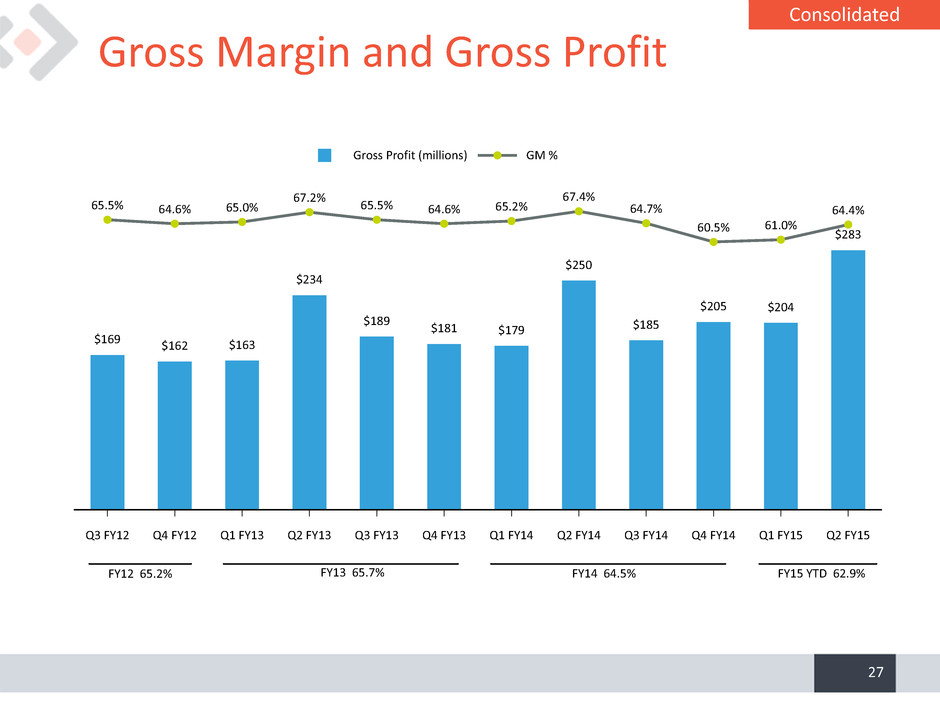

Gross Profit (millions) GM % Q3 FY12 Q4 FY12 Q1 FY13 Q2 FY13 Q3 FY13 Q4 FY13 Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15 Q2 FY15 $169 $162 $163 $234 $189 $181 $179 $250 $185 $205 $204 $283 65.5% 64.6% 65.0% 67.2% 65.5% 64.6% 65.2% 67.4% 64.7% 60.5% 61.0% 64.4% Gross Margin and Gross Profit 27 FY12 65.2% FY13 65.7% FY14 64.5% Consolidated FY15 YTD 62.9%

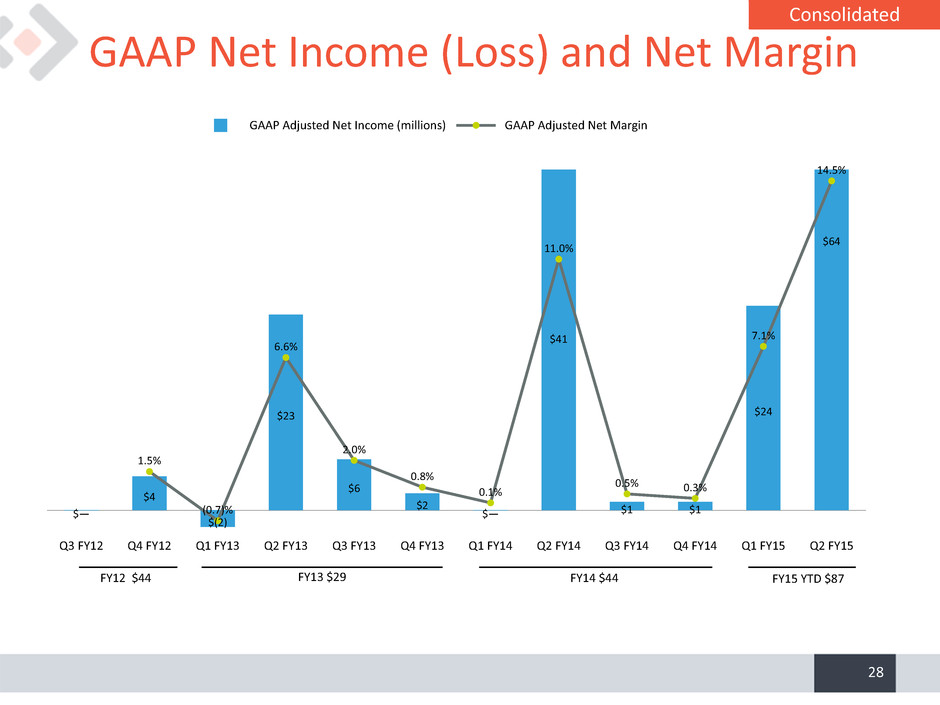

GAAP Adjusted Net Income (millions) GAAP Adjusted Net Margin Q3 FY12 Q4 FY12 Q1 FY13 Q2 FY13 Q3 FY13 Q4 FY13 Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15 Q2 FY15 $— $4 $(2) $23 $6 $2 $— $41 $1 $1 $24 $64 1.5% (0.7)% 6.6% 2.0% 0.8% 0.1% 11.0% 0.5% 0.3% 7.1% 14.5% GAAP Net Income (Loss) and Net Margin 28 FY12 $44 FY13 $29 FY14 $44 Consolidated FY15 YTD $87

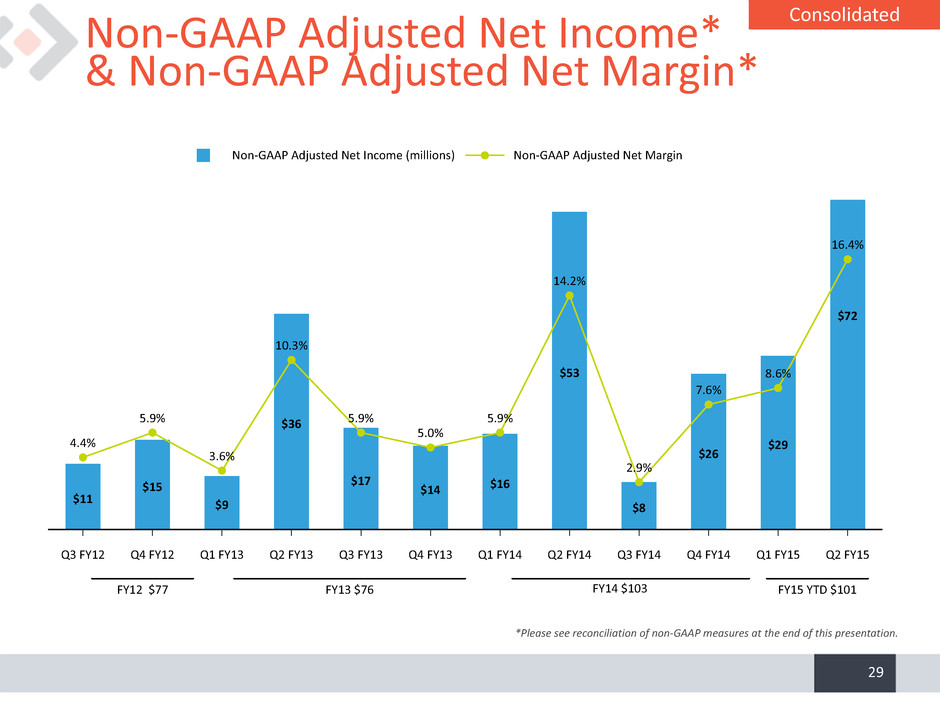

Non-GAAP Adjusted Net Income (millions) Non-GAAP Adjusted Net Margin Q3 FY12 Q4 FY12 Q1 FY13 Q2 FY13 Q3 FY13 Q4 FY13 Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15 Q2 FY15 $11 $15 $9 $36 $17 $14 $16 $53 $8 $26 $29 $72 4.4% 5.9% 3.6% 10.3% 5.9% 5.0% 5.9% 14.2% 2.9% 7.6% 8.6% 16.4% Non-GAAP Adjusted Net Income* & Non-GAAP Adjusted Net Margin* 29 *Please see reconciliation of non-GAAP measures at the end of this presentation. FY12 $77 FY13 $76 FY14 $103 Consolidated FY15 YTD $101

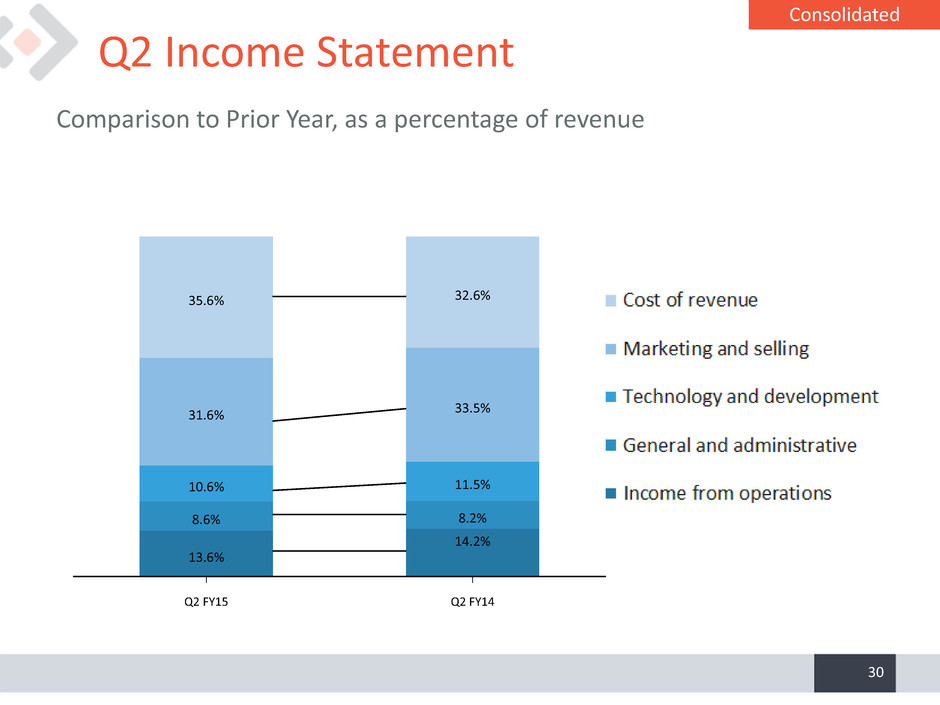

Q2 Income Statement 30 Comparison to Prior Year, as a percentage of revenue Consolidated Q2 FY15 Q2 FY14 13.6% 14.2% 8.6% 8.2% 10.6% 11.5% 31.6% 33.5% 35.6% 32.6%

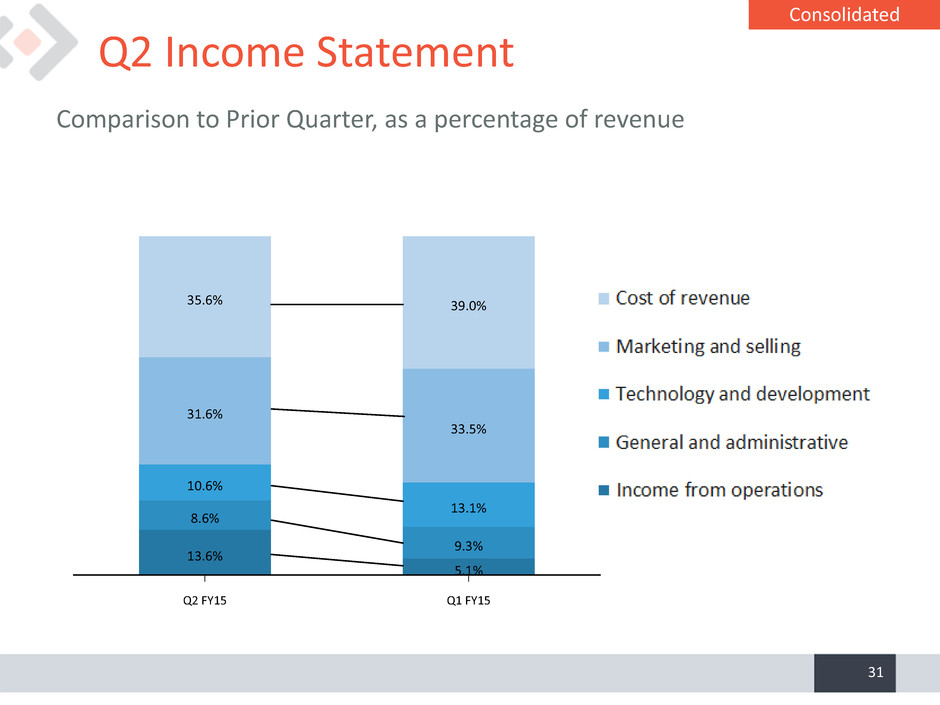

Q2 Income Statement 31 Comparison to Prior Quarter, as a percentage of revenue Consolidated Q2 FY15 Q1 FY15 13.6% 5.1% 8.6% 9.3% 10.6% 13.1% 31.6% 33.5% 35.6% 39.0%

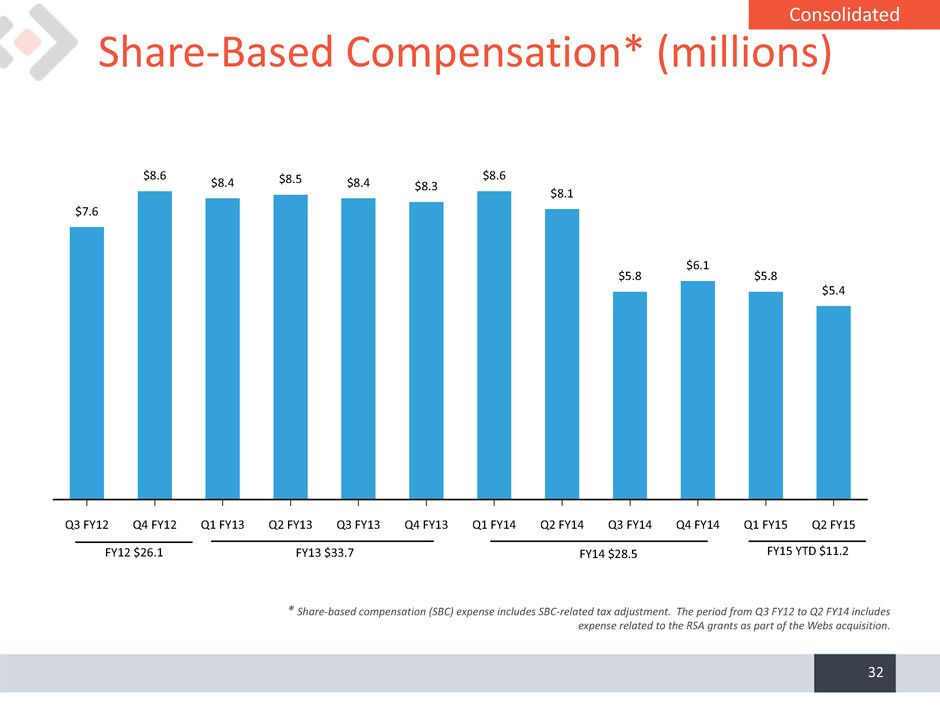

Q3 FY12 Q4 FY12 Q1 FY13 Q2 FY13 Q3 FY13 Q4 FY13 Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15 Q2 FY15 $7.6 $8.6 $8.4 $8.5 $8.4 $8.3 $8.6 $8.1 $5.8 $6.1 $5.8 $5.4 Share-Based Compensation* (millions) 32 * Share-based compensation (SBC) expense includes SBC-related tax adjustment. The period from Q3 FY12 to Q2 FY14 includes expense related to the RSA grants as part of the Webs acquisition. FY12 $26.1 FY13 $33.7 FY14 $28.5 Consolidated FY15 YTD $11.2

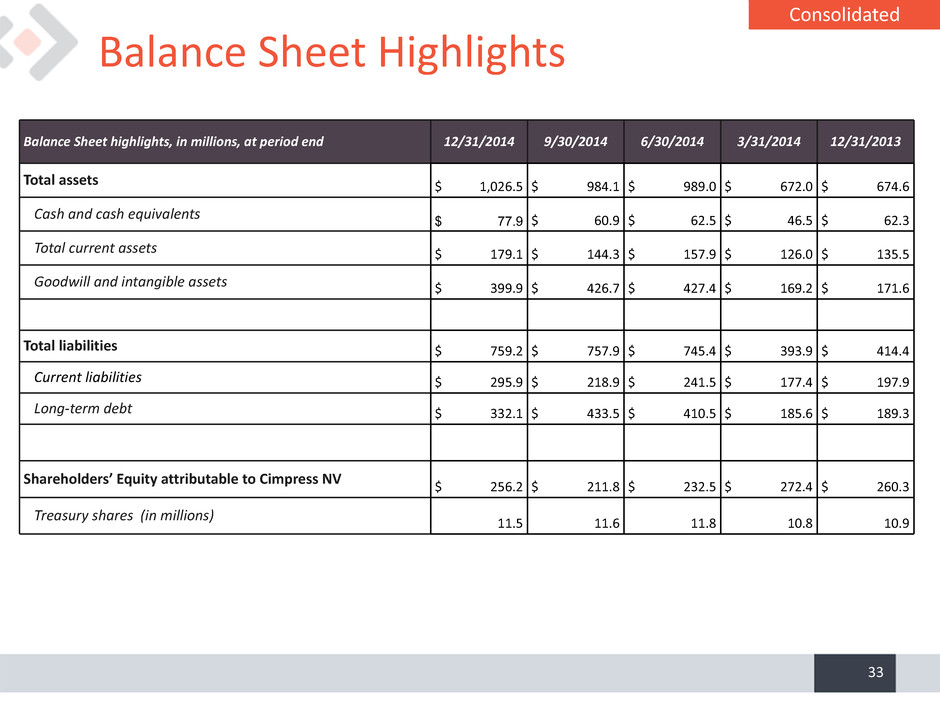

Balance Sheet Highlights Balance Sheet highlights, in millions, at period end 12/31/2014 9/30/2014 6/30/2014 3/31/2014 12/31/2013 Total assets $ 1,026.5 $ 984.1 $ 989.0 $ 672.0 $ 674.6 Cash and cash equivalents $ 77.9 $ 60.9 $ 62.5 $ 46.5 $ 62.3 Total current assets $ 179.1 $ 144.3 $ 157.9 $ 126.0 $ 135.5 Goodwill and intangible assets $ 399.9 $ 426.7 $ 427.4 $ 169.2 $ 171.6 Total liabilities $ 759.2 $ 757.9 $ 745.4 $ 393.9 $ 414.4 Current liabilities $ 295.9 $ 218.9 $ 241.5 $ 177.4 $ 197.9 Long-term debt $ 332.1 $ 433.5 $ 410.5 $ 185.6 $ 189.3 Shareholders’ Equity attributable to Cimpress NV $ 256.2 $ 211.8 $ 232.5 $ 272.4 $ 260.3 Treasury shares (in millions) 11.5 11.6 11.8 10.8 10.9 33 Consolidated

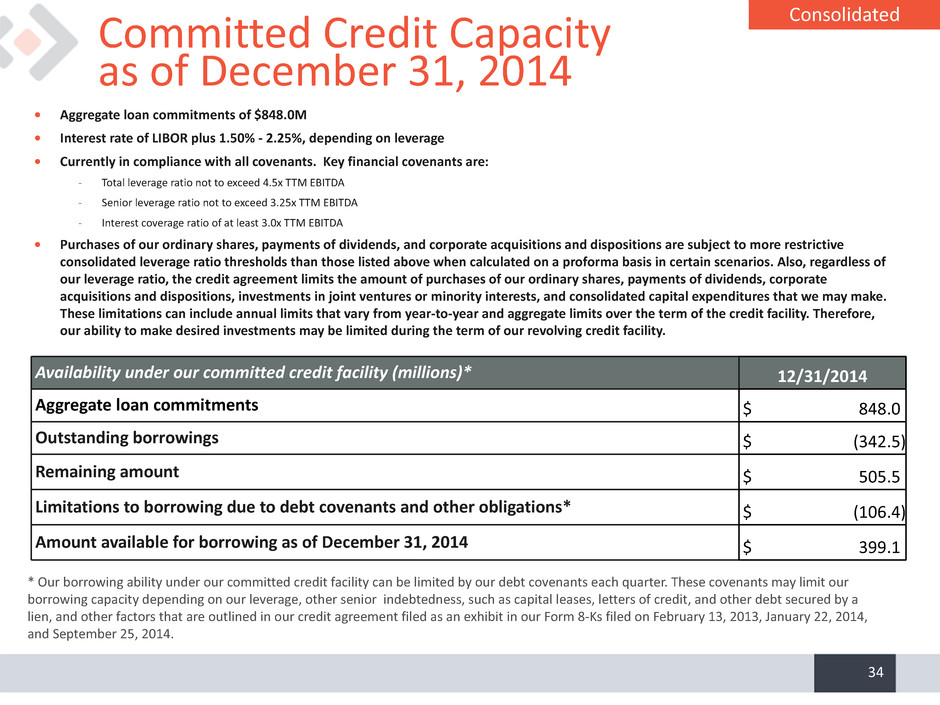

Committed Credit Capacity as of December 31, 2014 Availability under our committed credit facility (millions)* 12/31/2014 Aggregate loan commitments $ 848.0 Outstanding borrowings $ (342.5) Remaining amount $ 505.5 Limitations to borrowing due to debt covenants and other obligations* $ (106.4) Amount available for borrowing as of December 31, 2014 $ 399.1 34 * Our borrowing ability under our committed credit facility can be limited by our debt covenants each quarter. These covenants may limit our borrowing capacity depending on our leverage, other senior indebtedness, such as capital leases, letters of credit, and other debt secured by a lien, and other factors that are outlined in our credit agreement filed as an exhibit in our Form 8-Ks filed on February 13, 2013, January 22, 2014, and September 25, 2014. • Aggregate loan commitments of $848.0M • Interest rate of LIBOR plus 1.50% - 2.25%, depending on leverage • Currently in compliance with all covenants. Key financial covenants are: - Total leverage ratio not to exceed 4.5x TTM EBITDA - Senior leverage ratio not to exceed 3.25x TTM EBITDA - Interest coverage ratio of at least 3.0x TTM EBITDA • Purchases of our ordinary shares, payments of dividends, and corporate acquisitions and dispositions are subject to more restrictive consolidated leverage ratio thresholds than those listed above when calculated on a proforma basis in certain scenarios. Also, regardless of our leverage ratio, the credit agreement limits the amount of purchases of our ordinary shares, payments of dividends, corporate acquisitions and dispositions, investments in joint ventures or minority interests, and consolidated capital expenditures that we may make. These limitations can include annual limits that vary from year-to-year and aggregate limits over the term of the credit facility. Therefore, our ability to make desired investments may be limited during the term of our revolving credit facility. Consolidated

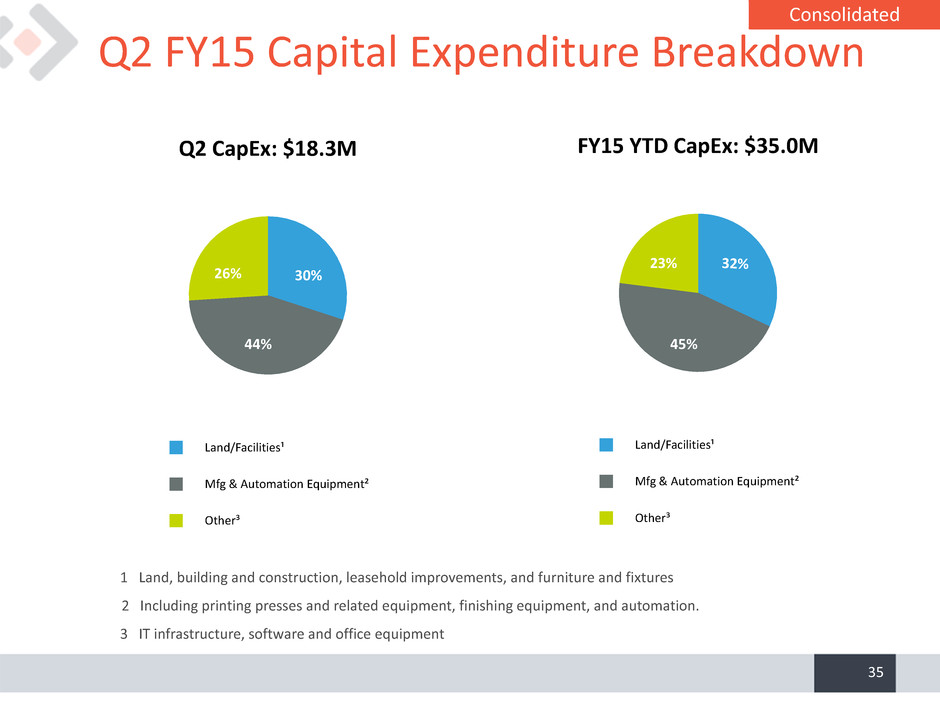

Land/Facilities¹ Mfg & Automation Equipment² Other³ Q2 CapEx: $18.3M 35 1 Land, building and construction, leasehold improvements, and furniture and fixtures 2 Including printing presses and related equipment, finishing equipment, and automation. 3 IT infrastructure, software and office equipment Consolidated 36% Land/Facilities¹ Mfg & Automation Equipment² Other³ FY15 YTD CapEx: $35.0M Q2 FY15 Capital Expenditure Breakdown 30% 44% 26% 32% 45% 23%

Appendix Including a Reconciliation of GAAP to Non-GAAP Financial Measures

About Non-GAAP Financial Measures • To supplement Cimpress' consolidated financial statements presented in accordance with U.S. generally accepted accounting principles, or GAAP, Cimpress has used the following measures defined as non-GAAP financial measures by Securities and Exchange Commission, or SEC, rules: non-GAAP adjusted net income, adjusted EBITDA, free cash flow, trailing twelve month return on invested capital, constant-currency revenue growth and constant-currency revenue growth excluding revenue from fiscal 2014 acquisitions. Please see the next slide for definitions of these items. • The presentation of non-GAAP financial information is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with GAAP. For more information on these non-GAAP financial measures, please see the tables captioned “Reconciliations of Non-GAAP Financial Measures” included at the end of this release. The tables have more details on the GAAP financial measures that are most directly comparable to non-GAAP financial measures and the related reconciliation between these financial measures. • Cimpress' management believes that these non-GAAP financial measures provide meaningful supplemental information in assessing our performance and liquidity by excluding certain items that may not be indicative of our recurring core business operating results, which could be non-cash charges or discrete cash charges that are infrequent in nature. These non-GAAP financial measures also have facilitated management’s internal comparisons to Cimpress' historical performance and our competitors’ operating results. 37

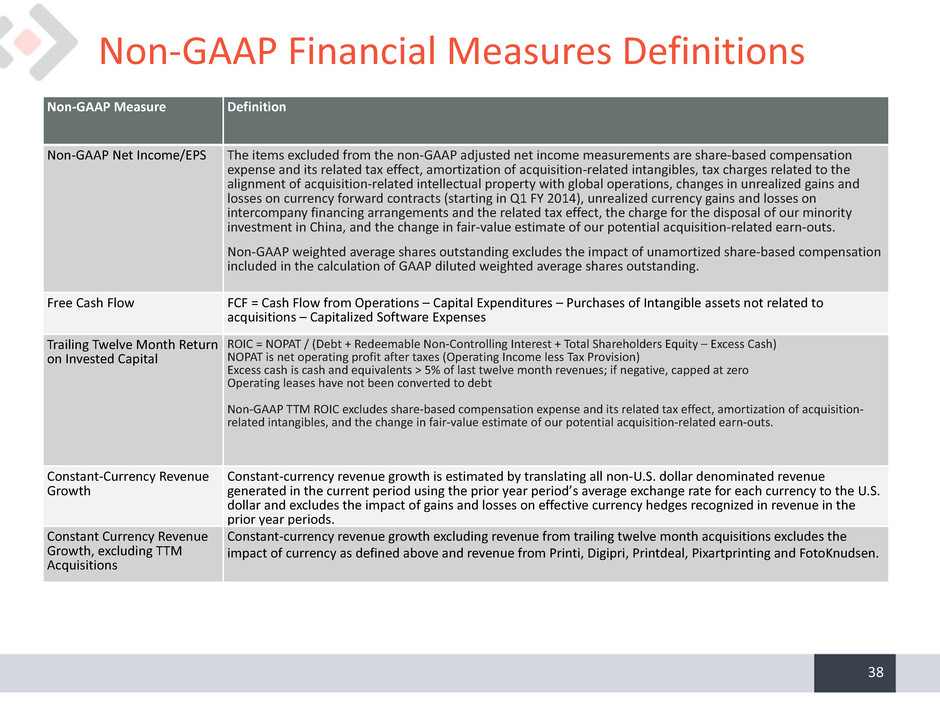

Non-GAAP Financial Measures Definitions Non-GAAP Measure Definition Non-GAAP Net Income/EPS The items excluded from the non-GAAP adjusted net income measurements are share-based compensation expense and its related tax effect, amortization of acquisition-related intangibles, tax charges related to the alignment of acquisition-related intellectual property with global operations, changes in unrealized gains and losses on currency forward contracts (starting in Q1 FY 2014), unrealized currency gains and losses on intercompany financing arrangements and the related tax effect, the charge for the disposal of our minority investment in China, and the change in fair-value estimate of our potential acquisition-related earn-outs. Non-GAAP weighted average shares outstanding excludes the impact of unamortized share-based compensation included in the calculation of GAAP diluted weighted average shares outstanding. Free Cash Flow FCF = Cash Flow from Operations – Capital Expenditures – Purchases of Intangible assets not related to acquisitions – Capitalized Software Expenses Trailing Twelve Month Return on Invested Capital ROIC = NOPAT / (Debt + Redeemable Non-Controlling Interest + Total Shareholders Equity – Excess Cash) NOPAT is net operating profit after taxes (Operating Income less Tax Provision) Excess cash is cash and equivalents > 5% of last twelve month revenues; if negative, capped at zero Operating leases have not been converted to debt Non-GAAP TTM ROIC excludes share-based compensation expense and its related tax effect, amortization of acquisition- related intangibles, and the change in fair-value estimate of our potential acquisition-related earn-outs. Constant-Currency Revenue Growth Constant-currency revenue growth is estimated by translating all non-U.S. dollar denominated revenue generated in the current period using the prior year period’s average exchange rate for each currency to the U.S. dollar and excludes the impact of gains and losses on effective currency hedges recognized in revenue in the prior year periods. Constant Currency Revenue Growth, excluding TTM Acquisitions Constant-currency revenue growth excluding revenue from trailing twelve month acquisitions excludes the impact of currency as defined above and revenue from Printi, Digipri, Printdeal, Pixartprinting and FotoKnudsen. 38

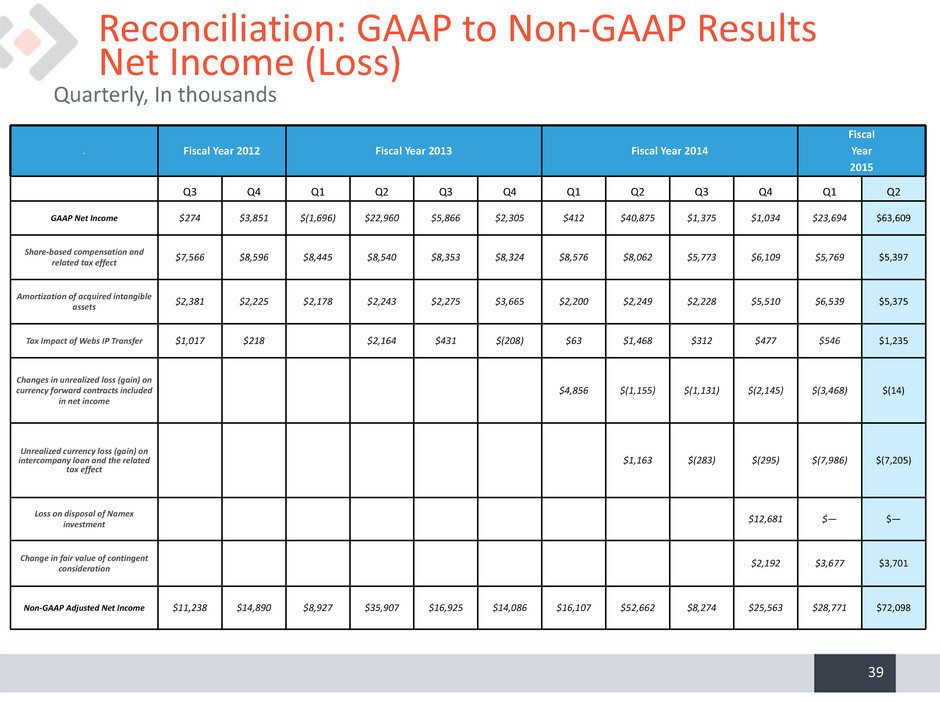

Reconciliation: GAAP to Non-GAAP Results Net Income (Loss) . Fiscal Year 2012 Fiscal Year 2013 Fiscal Year 2014 Fiscal Year 2015 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 GAAP Net Income $274 $3,851 $(1,696) $22,960 $5,866 $2,305 $412 $40,875 $1,375 $1,034 $23,694 $63,609 Share-based compensation and related tax effect $7,566 $8,596 $8,445 $8,540 $8,353 $8,324 $8,576 $8,062 $5,773 $6,109 $5,769 $5,397 Amortization of acquired intangible assets $2,381 $2,225 $2,178 $2,243 $2,275 $3,665 $2,200 $2,249 $2,228 $5,510 $6,539 $5,375 Tax Impact of Webs IP Transfer $1,017 $218 $2,164 $431 $(208) $63 $1,468 $312 $477 $546 $1,235 Changes in unrealized loss (gain) on currency forward contracts included in net income $4,856 $(1,155) $(1,131) $(2,145) $(3,468) $(14) Unrealized currency loss (gain) on intercompany loan and the related tax effect $1,163 $(283) $(295) $(7,986) $(7,205) Loss on disposal of Namex investment $12,681 $— $— Change in fair value of contingent consideration $2,192 $3,677 $3,701 Non-GAAP Adjusted Net Income $11,238 $14,890 $8,927 $35,907 $16,925 $14,086 $16,107 $52,662 $8,274 $25,563 $28,771 $72,098 39 Quarterly, In thousands

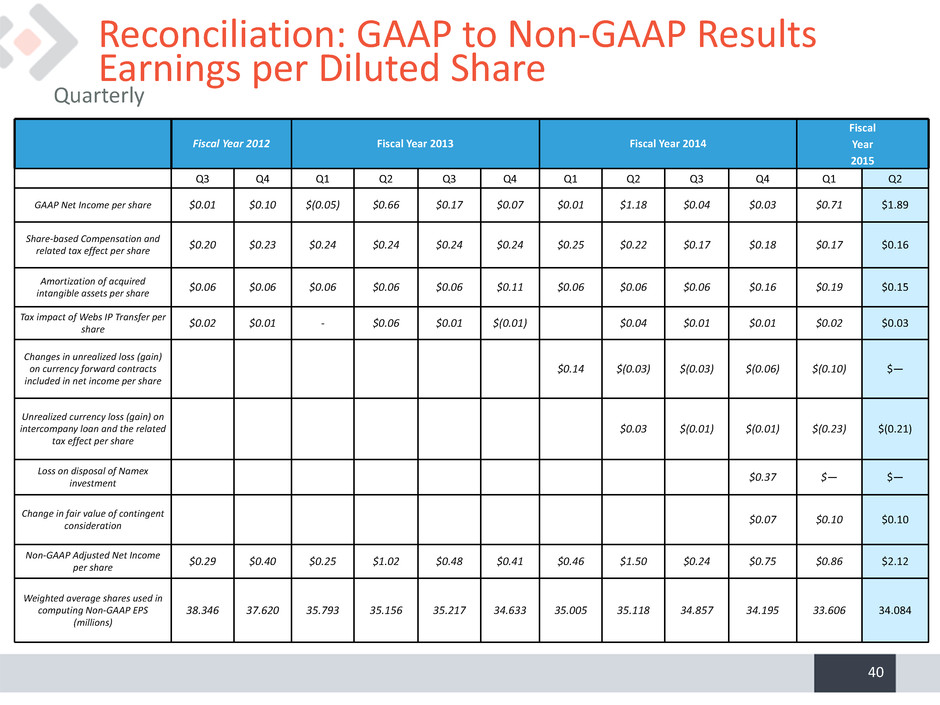

Fiscal Year 2012 Fiscal Year 2013 Fiscal Year 2014 Fiscal Year 2015 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 GAAP Net Income per share $0.01 $0.10 $(0.05) $0.66 $0.17 $0.07 $0.01 $1.18 $0.04 $0.03 $0.71 $1.89 Share-based Compensation and related tax effect per share $0.20 $0.23 $0.24 $0.24 $0.24 $0.24 $0.25 $0.22 $0.17 $0.18 $0.17 $0.16 Amortization of acquired intangible assets per share $0.06 $0.06 $0.06 $0.06 $0.06 $0.11 $0.06 $0.06 $0.06 $0.16 $0.19 $0.15 Tax impact of Webs IP Transfer per share $0.02 $0.01 - $0.06 $0.01 $(0.01) $0.04 $0.01 $0.01 $0.02 $0.03 Changes in unrealized loss (gain) on currency forward contracts included in net income per share $0.14 $(0.03) $(0.03) $(0.06) $(0.10) $— Unrealized currency loss (gain) on intercompany loan and the related tax effect per share $0.03 $(0.01) $(0.01) $(0.23) $(0.21) Loss on disposal of Namex investment $0.37 $— $— Change in fair value of contingent consideration $0.07 $0.10 $0.10 Non-GAAP Adjusted Net Income per share $0.29 $0.40 $0.25 $1.02 $0.48 $0.41 $0.46 $1.50 $0.24 $0.75 $0.86 $2.12 Weighted average shares used in computing Non-GAAP EPS (millions) 38.346 37.620 35.793 35.156 35.217 34.633 35.005 35.118 34.857 34.195 33.606 34.084 Reconciliation: GAAP to Non-GAAP Results Earnings per Diluted Share 40 Quarterly

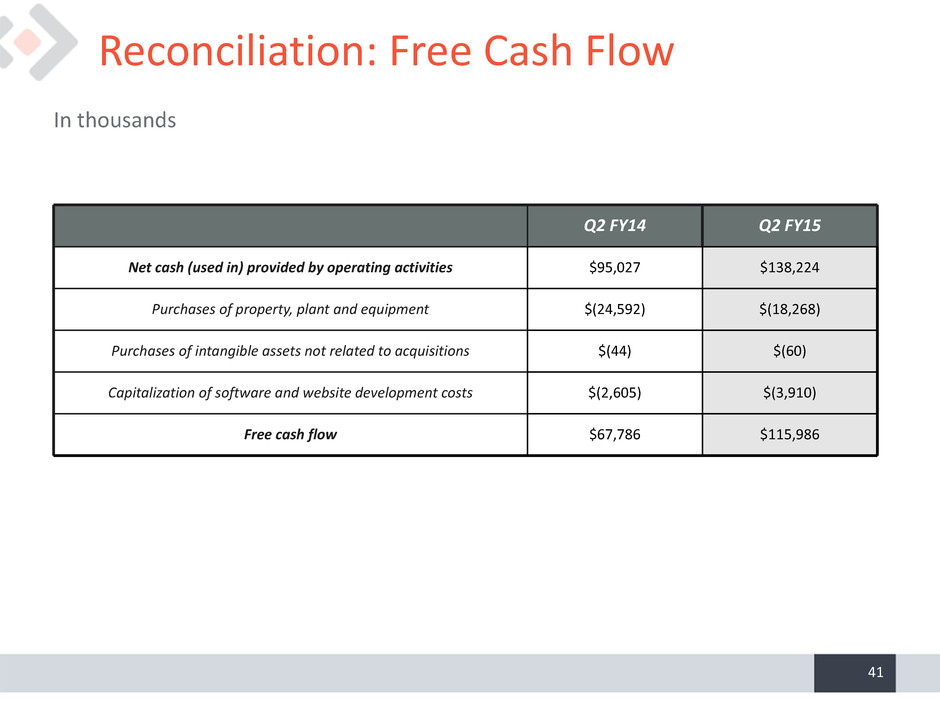

Reconciliation: Free Cash Flow 41 Q2 FY14 Q2 FY15 Net cash (used in) provided by operating activities $95,027 $138,224 Purchases of property, plant and equipment $(24,592) $(18,268) Purchases of intangible assets not related to acquisitions $(44) $(60) Capitalization of software and website development costs $(2,605) $(3,910) Free cash flow $67,786 $115,986 In thousands

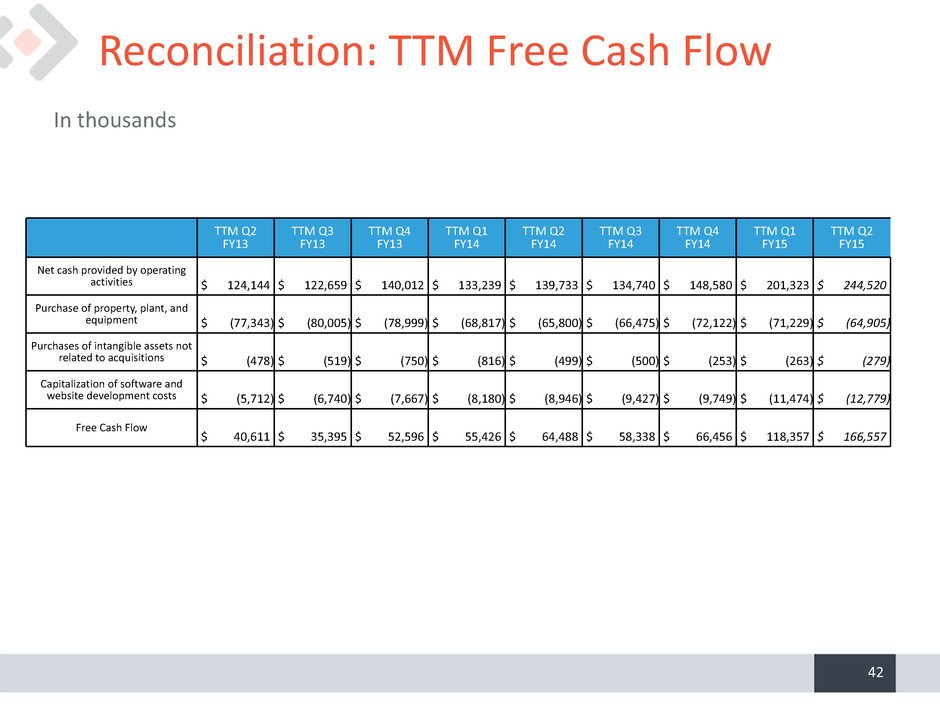

Reconciliation: TTM Free Cash Flow TTM Q2 FY13 TTM Q3 FY13 TTM Q4 FY13 TTM Q1 FY14 TTM Q2 FY14 TTM Q3 FY14 TTM Q4 FY14 TTM Q1 FY15 TTM Q2 FY15 Net cash provided by operating activities $ 124,144 $ 122,659 $ 140,012 $ 133,239 $ 139,733 $ 134,740 $ 148,580 $ 201,323 $ 244,520 Purchase of property, plant, and equipment $ (77,343) $ (80,005) $ (78,999) $ (68,817) $ (65,800) $ (66,475) $ (72,122) $ (71,229) $ (64,905) Purchases of intangible assets not related to acquisitions $ (478) $ (519) $ (750) $ (816) $ (499) $ (500) $ (253) $ (263) $ (279) Capitalization of software and website development costs $ (5,712) $ (6,740) $ (7,667) $ (8,180) $ (8,946) $ (9,427) $ (9,749) $ (11,474) $ (12,779) Free Cash Flow $ 40,611 $ 35,395 $ 52,596 $ 55,426 $ 64,488 $ 58,338 $ 66,456 $ 118,357 $ 166,557 42 In thousands

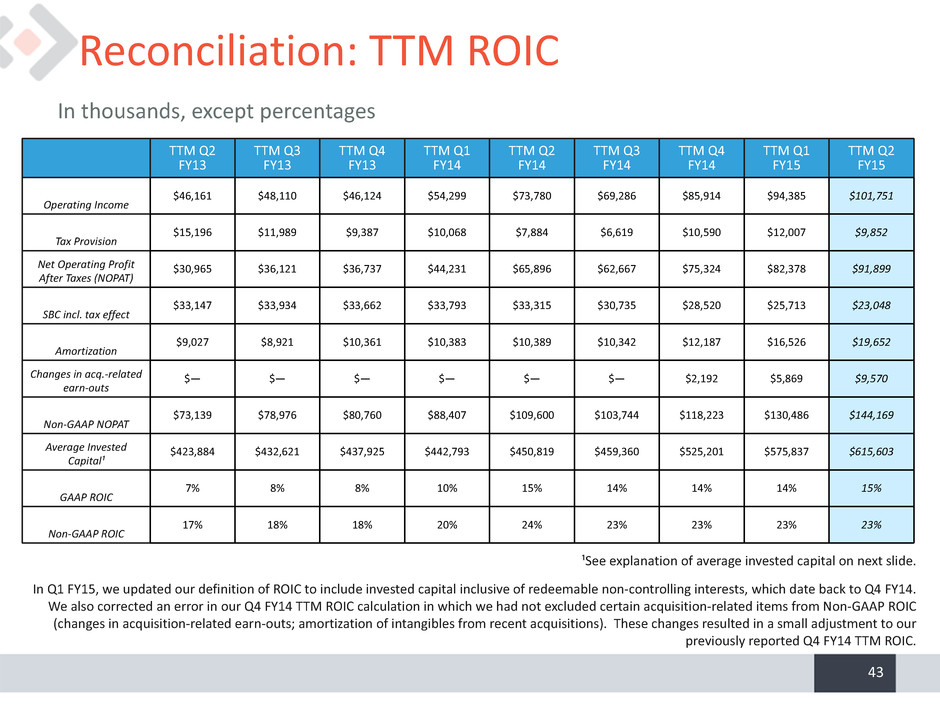

Reconciliation: TTM ROIC 43 TTM Q2 FY13 TTM Q3 FY13 TTM Q4 FY13 TTM Q1 FY14 TTM Q2 FY14 TTM Q3 FY14 TTM Q4 FY14 TTM Q1 FY15 TTM Q2 FY15 Operating Income $46,161 $48,110 $46,124 $54,299 $73,780 $69,286 $85,914 $94,385 $101,751 Tax Provision $15,196 $11,989 $9,387 $10,068 $7,884 $6,619 $10,590 $12,007 $9,852 Net Operating Profit After Taxes (NOPAT) $30,965 $36,121 $36,737 $44,231 $65,896 $62,667 $75,324 $82,378 $91,899 SBC incl. tax effect $33,147 $33,934 $33,662 $33,793 $33,315 $30,735 $28,520 $25,713 $23,048 Amortization $9,027 $8,921 $10,361 $10,383 $10,389 $10,342 $12,187 $16,526 $19,652 Changes in acq.-related earn-outs $— $— $— $— $— $— $2,192 $5,869 $9,570 Non-GAAP NOPAT $73,139 $78,976 $80,760 $88,407 $109,600 $103,744 $118,223 $130,486 $144,169 Average Invested Capital¹ $423,884 $432,621 $437,925 $442,793 $450,819 $459,360 $525,201 $575,837 $615,603 GAAP ROIC 7% 8% 8% 10% 15% 14% 14% 14% 15% Non-GAAP ROIC 17% 18% 18% 20% 24% 23% 23% 23% 23% ¹See explanation of average invested capital on next slide. In Q1 FY15, we updated our definition of ROIC to include invested capital inclusive of redeemable non-controlling interests, which date back to Q4 FY14. We also corrected an error in our Q4 FY14 TTM ROIC calculation in which we had not excluded certain acquisition-related items from Non-GAAP ROIC (changes in acquisition-related earn-outs; amortization of intangibles from recent acquisitions). These changes resulted in a small adjustment to our previously reported Q4 FY14 TTM ROIC. In thousands, except percentages

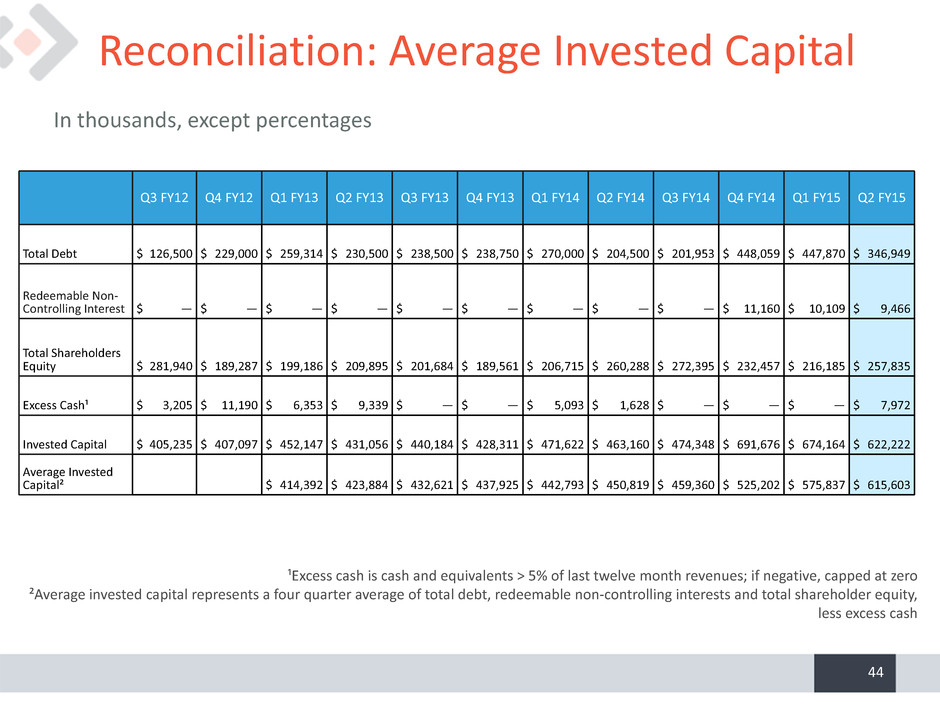

Reconciliation: Average Invested Capital 44 Q3 FY12 Q4 FY12 Q1 FY13 Q2 FY13 Q3 FY13 Q4 FY13 Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15 Q2 FY15 Total Debt $ 126,500 $ 229,000 $ 259,314 $ 230,500 $ 238,500 $ 238,750 $ 270,000 $ 204,500 $ 201,953 $ 448,059 $ 447,870 $ 346,949 Redeemable Non- Controlling Interest $ — $ — $ — $ — $ — $ — $ — $ — $ — $ 11,160 $ 10,109 $ 9,466 Total Shareholders Equity $ 281,940 $ 189,287 $ 199,186 $ 209,895 $ 201,684 $ 189,561 $ 206,715 $ 260,288 $ 272,395 $ 232,457 $ 216,185 $ 257,835 Excess Cash¹ $ 3,205 $ 11,190 $ 6,353 $ 9,339 $ — $ — $ 5,093 $ 1,628 $ — $ — $ — $ 7,972 Invested Capital $ 405,235 $ 407,097 $ 452,147 $ 431,056 $ 440,184 $ 428,311 $ 471,622 $ 463,160 $ 474,348 $ 691,676 $ 674,164 $ 622,222 Average Invested Capital² $ 414,392 $ 423,884 $ 432,621 $ 437,925 $ 442,793 $ 450,819 $ 459,360 $ 525,202 $ 575,837 $ 615,603 ¹Excess cash is cash and equivalents > 5% of last twelve month revenues; if negative, capped at zero ²Average invested capital represents a four quarter average of total debt, redeemable non-controlling interests and total shareholder equity, less excess cash In thousands, except percentages

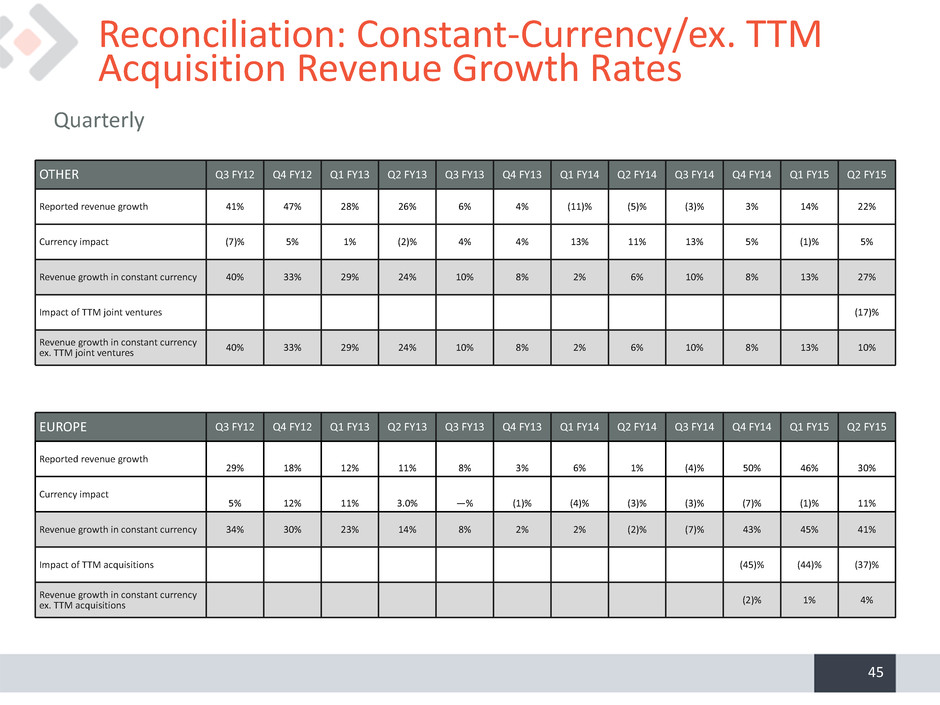

EUROPE Q3 FY12 Q4 FY12 Q1 FY13 Q2 FY13 Q3 FY13 Q4 FY13 Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15 Q2 FY15 Reported revenue growth 29% 18% 12% 11% 8% 3% 6% 1% (4)% 50% 46% 30% Currency impact 5% 12% 11% 3.0% —% (1)% (4)% (3)% (3)% (7)% (1)% 11% Revenue growth in constant currency 34% 30% 23% 14% 8% 2% 2% (2)% (7)% 43% 45% 41% Impact of TTM acquisitions (45)% (44)% (37)% Revenue growth in constant currency ex. TTM acquisitions (2)% 1% 4% Reconciliation: Constant-Currency/ex. TTM Acquisition Revenue Growth Rates 45 Quarterly OTHER Q3 FY12 Q4 FY12 Q1 FY13 Q2 FY13 Q3 FY13 Q4 FY13 Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15 Q2 FY15 Reported revenue growth 41% 47% 28% 26% 6% 4% (11)% (5)% (3)% 3% 14% 22% Currency impact (7)% 5% 1% (2)% 4% 4% 13% 11% 13% 5% (1)% 5% Revenue growth in constant currency 40% 33% 29% 24% 10% 8% 2% 6% 10% 8% 13% 27% Impact of TTM joint ventures (17)% Revenue growth in constant currency ex. TTM joint ventures 40% 33% 29% 24% 10% 8% 2% 6% 10% 8% 13% 10%

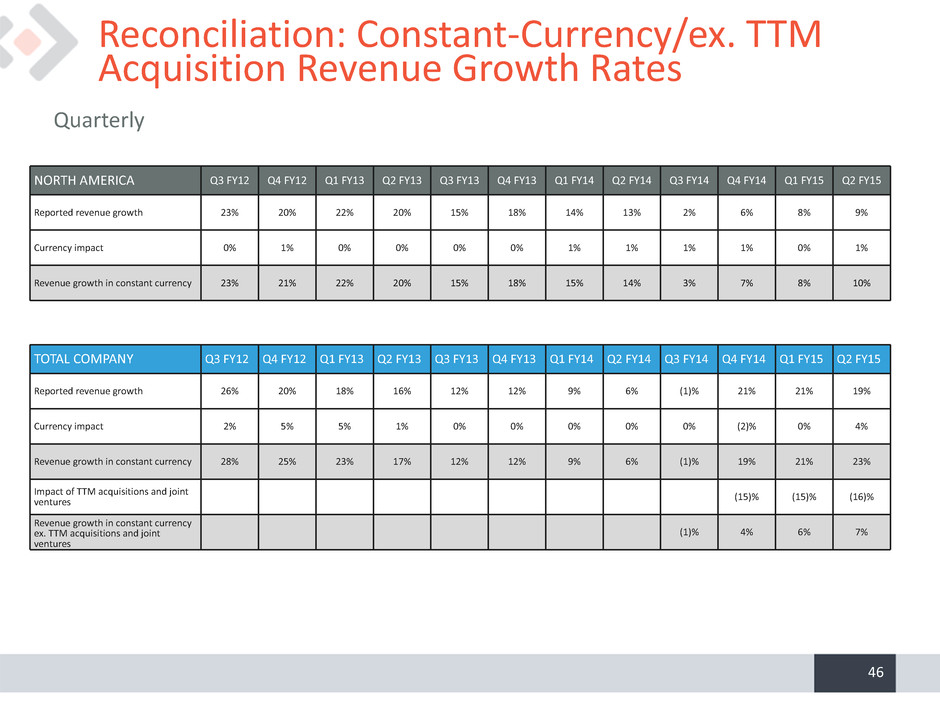

TOTAL COMPANY Q3 FY12 Q4 FY12 Q1 FY13 Q2 FY13 Q3 FY13 Q4 FY13 Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15 Q2 FY15 Reported revenue growth 26% 20% 18% 16% 12% 12% 9% 6% (1)% 21% 21% 19% Currency impact 2% 5% 5% 1% 0% 0% 0% 0% 0% (2)% 0% 4% Revenue growth in constant currency 28% 25% 23% 17% 12% 12% 9% 6% (1)% 19% 21% 23% Impact of TTM acquisitions and joint ventures (15)% (15)% (16)% Revenue growth in constant currency ex. TTM acquisitions and joint ventures (1)% 4% 6% 7% Reconciliation: Constant-Currency/ex. TTM Acquisition Revenue Growth Rates 46 Quarterly NORTH AMERICA Q3 FY12 Q4 FY12 Q1 FY13 Q2 FY13 Q3 FY13 Q4 FY13 Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15 Q2 FY15 Reported revenue growth 23% 20% 22% 20% 15% 18% 14% 13% 2% 6% 8% 9% Currency impact 0% 1% 0% 0% 0% 0% 1% 1% 1% 1% 0% 1% Revenue growth in constant currency 23% 21% 22% 20% 15% 18% 15% 14% 3% 7% 8% 10%