Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - UMB FINANCIAL CORP | d858597d8k.htm |

| EX-99.1 - EX-99.1 - UMB FINANCIAL CORP | d858597dex991.htm |

Quality endures.

Fourth Quarter & Year-End 2014

January 27, 2015

UMB Financial

Exhibit 99.2 |

Cautionary Notice about Forward-Looking Statements

2

This presentation contains, and our other communications may contain,

forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995. These statements can be identified by the fact that they do not relate strictly

to historical or current facts. Forward-looking statements often use words such

as “believe,” “expect,”

“anticipate,”

“intend,”

“estimate,”

“project,”

“outlook,”

“forecast,”

“target,”

“trend,”

“plan,”

“goal,”

or other words of comparable meaning or future-

tense or conditional verbs such as “may,”

“will,”

“should,”

“would,”

or “could.”

Forward-looking statements convey our

expectations, intentions, or forecasts about future events, circumstances, results,

or aspirations. All forward-looking statements are subject to

assumptions, risks, and uncertainties, which may change over time and many of

which are beyond our control. You should not rely on any forward-looking

statement as a prediction or guarantee about the future. Our actual future

objectives, strategies, plans, prospects, performance, condition, or results may differ materially from

those set forth in any forward-looking statement. Some of the factors that may

cause actual results or other future events, circumstances, or aspirations

to differ from those in forward-looking statements are described in our Annual Report on Form

10-K for the year ended December 31, 2013, our subsequent Quarterly

Reports on Form 10-Q or Current Reports on Form 8-

K, or other applicable documents that are filed or furnished with the Securities

and Exchange Commission (SEC). Any forward-looking statement made by us

or on our behalf speaks only as of the date that it was made. We do not undertake

to update any forward-looking statement to reflect the impact of events,

circumstances, or results that arise after the date that the statement was

made. You, however, should consult further disclosures (including disclosures of a forward-looking nature)

that we may make in any subsequent Annual Report on Form 10-K, Quarterly Report

on Form 10-Q, Current Report on Form 8-K, or other applicable

document that is filed or furnished with the SEC. |

Performance Highlights |

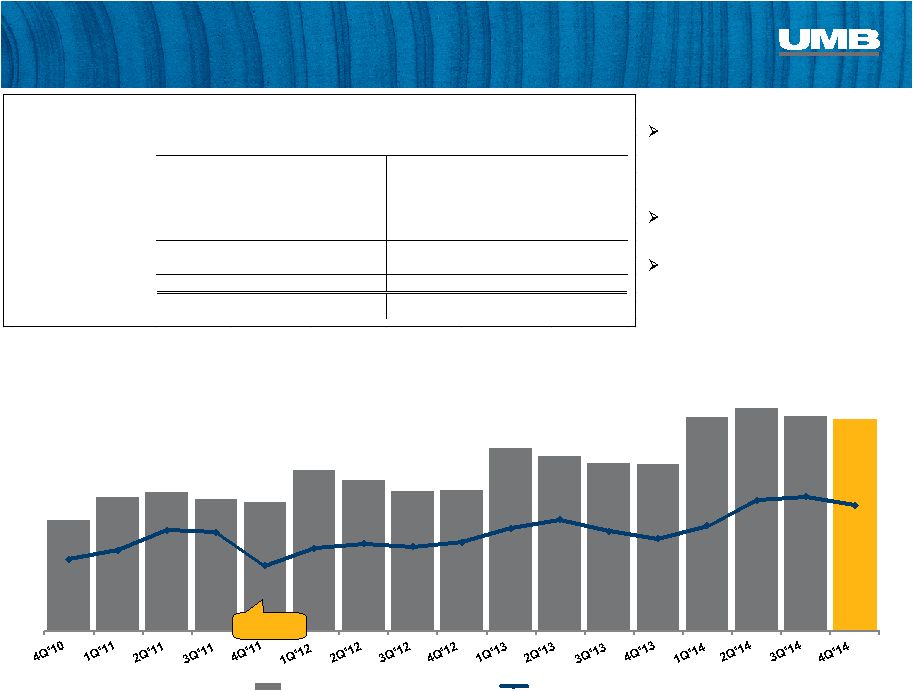

Earnings Summary –

4Q 2014

$ in thousands, except per-share data; unaudited

4

4Q'14

4Q'13

3Q'14

vs. 4Q'13

vs. 3Q'14

Net Interest Income

90,914

$

85,914

$

87,526

$

5.8

3.9

Noninterest Income

115,248

135,607

126,475

(15.0)

(8.9)

Total Revenue

206,162

221,521

214,001

(6.9)

(3.7)

Noninterest Expense

166,713

170,426

161,461

(2.2)

3.3

Income Before Provision & Taxes

39,449

51,095

52,540

(22.8)

(24.9)

Provision for loan losses

3,000

4,000

4,500

(25.0)

(33.3)

Income before Taxes

36,449

47,095

48,040

(22.6)

(24.1)

Income Tax Provision

9,509

12,432

12,410

(23.5)

(23.4)

Net Income

26,940

$

34,663

$

35,630

$

(22.3)

(24.4)

Diluted EPS

0.59

$

0.77

$

0.78

$

(23.4)

(24.4)

Dividends per share

0.235

0.225

0.225

4.4

4.4

WASO

44,920,106

44,511,742

44,890,309

0.9

0.1

% variance |

Earnings Summary –

Full-Year 2014

$ in thousands, except per-share data; unaudited

5

2014

2013

2012

'14 to '13

'13 to '12

Net Interest Income

350,055

$

333,269

$

320,056

$

5.0

4.1

Noninterest Income

498,688

491,833

458,122

1.4

7.4

Total Revenue

848,743

825,102

778,178

2.9

6.0

Noninterest Expense

666,926

624,178

590,454

6.8

5.7

Income Before Provision & Taxes

181,817

200,924

187,724

(9.5)

7.0

Provision for loan losses

17,000

17,500

17,500

(2.9)

-

Income before Taxes

164,817

183,424

170,224

(10.1)

7.8

Income Tax Provision

44,162

49,459

47,507

(10.7)

4.1

Net Income

120,655

$

133,965

$

122,717

$

(9.9)

9.2

Diluted EPS

2.65

$

3.20

$

3.04

$

(17.2)

5.3

Dividends per share

0.910

0.870

0.830

4.6

4.8

WASO

44,844,578

41,275,839

40,034,428

8.6

3.1

Variance |

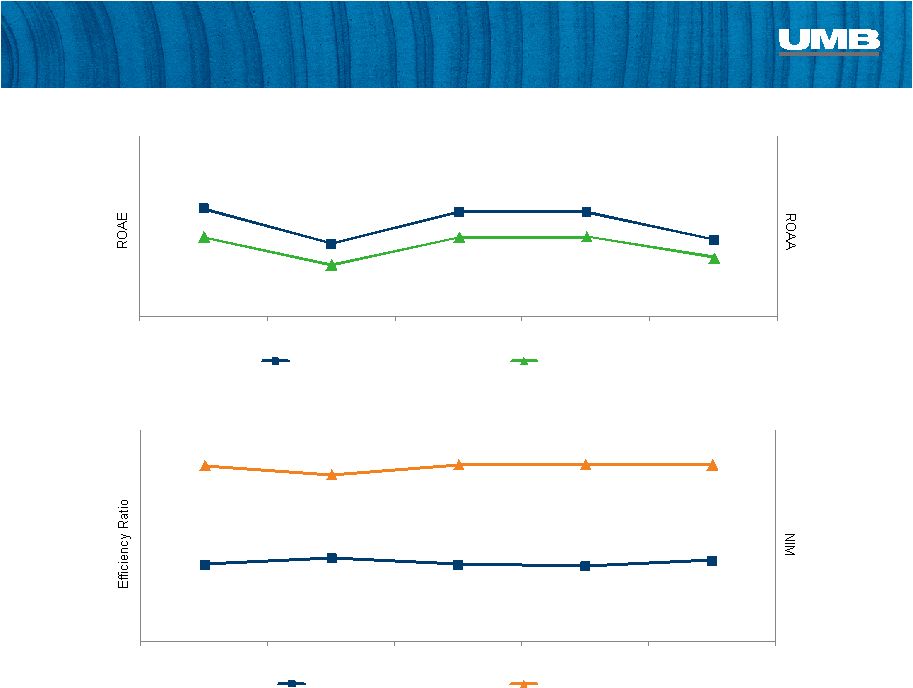

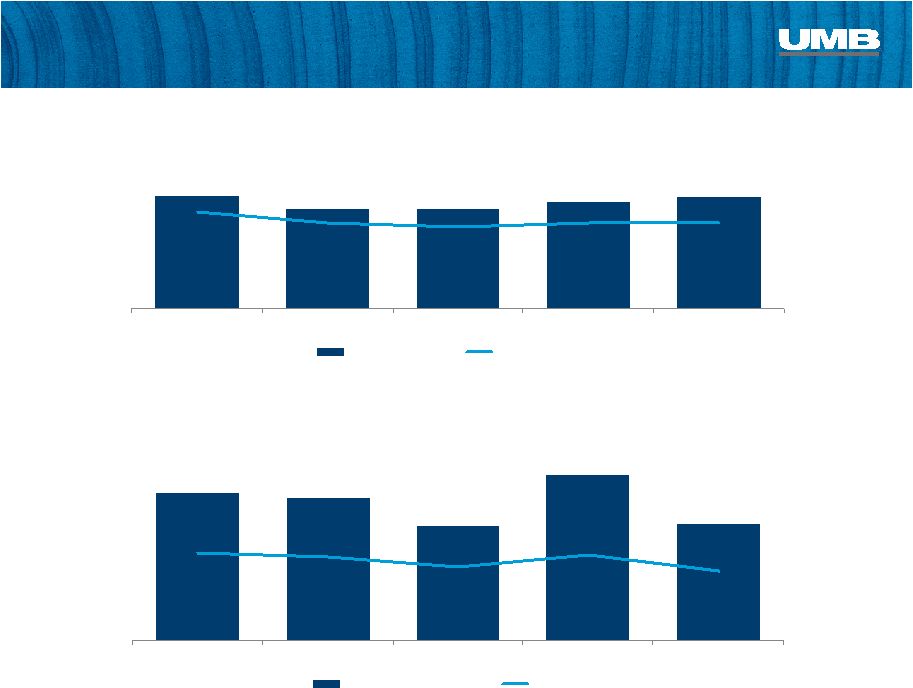

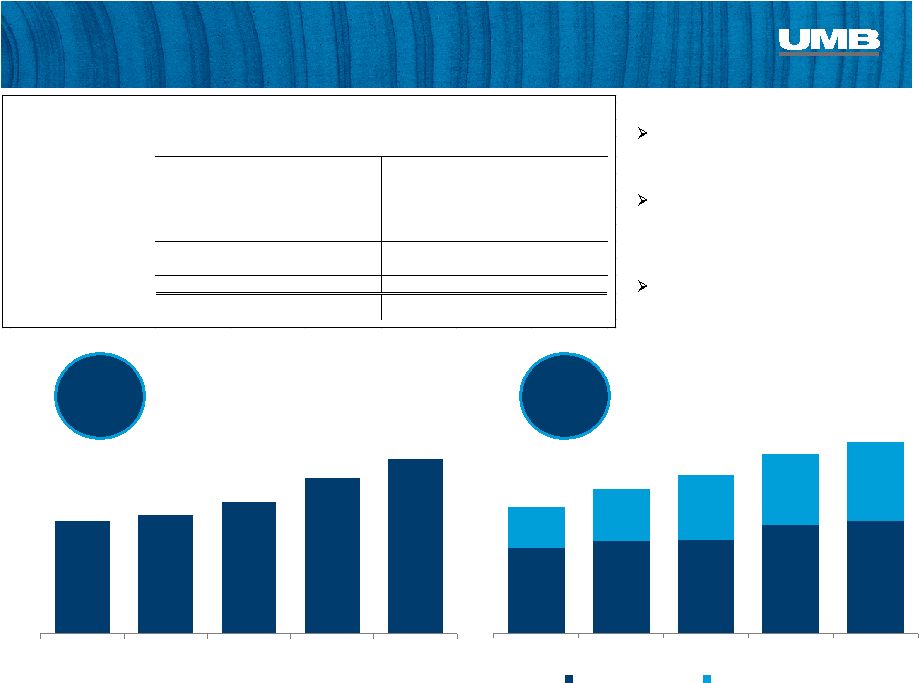

9.08%

6.13%

8.77%

8.77%

6.47%

0.89%

0.58%

0.89%

0.90%

0.66%

4Q'13

1Q'14

2Q'14

3Q'14

4Q'14

Return on Avg Equity

Return on Avg Assets

73.64%

79.67%

73.32%

72.25%

77.46%

2.51%

2.39%

2.53%

2.53%

2.52%

4Q'13

1Q'14

2Q'14

3Q'14

4Q'14

Efficiency Ratio

Net Interest Margin

Performance Metrics

ROAE/ROAA

Efficiency Ratio/NIM

6 |

4

th

Quarter 2014

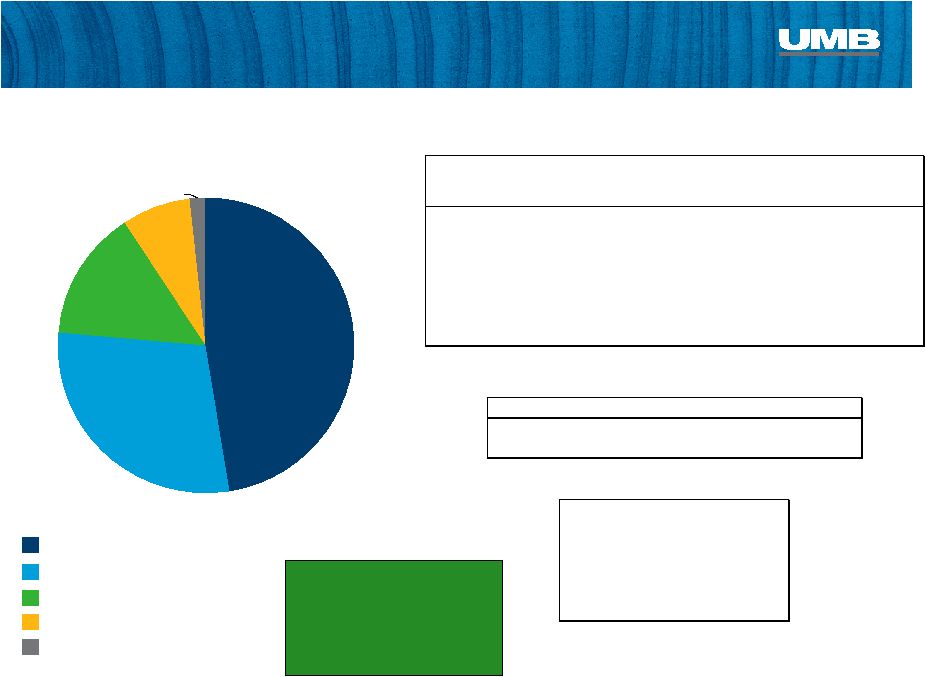

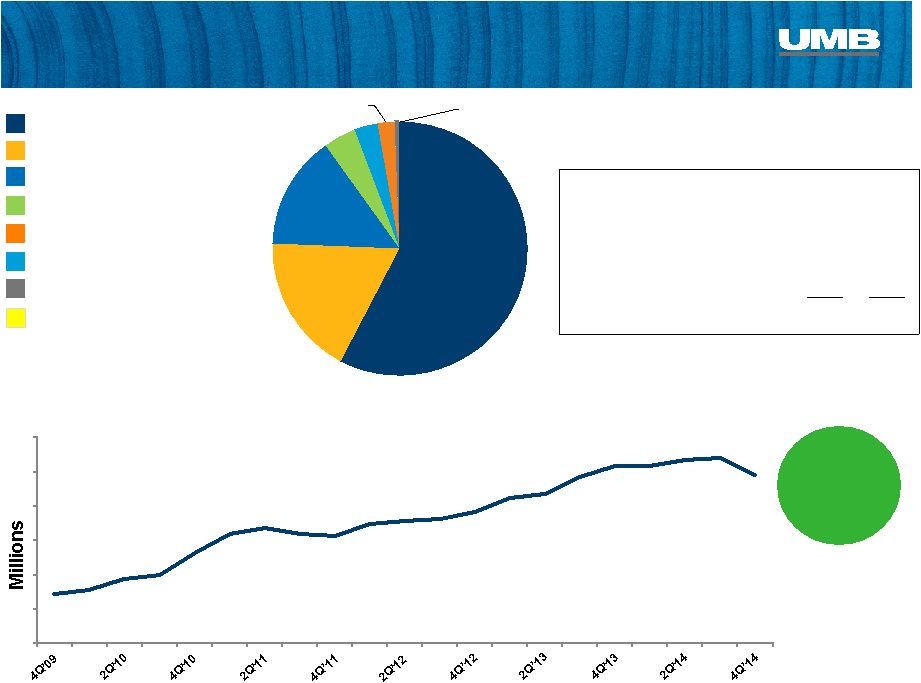

Average Balance, AFS:

$6.8 billion

Average Yield:

1.84%

Investment Mix

Securities Available for Sale,

At December 31, 2014

Agencies

High Quality Investment Portfolio

7

Corporates

Municipals

Mortgage-Backed Securities

Treasuries

AFS Portfolio Statistics

47.4%

29.0%

14.3%

7.5%

1.8%

Roll off

Purchased

($ millions)

Yield

($ millions)

Yield

1Q'14

$528

1.53%

$618

1.26%

2Q'14

$275

2.23%

$560

1.35%

3Q'14

$244

1.98%

$311

1.45%

4Q'14

$285

2.12%

$382

1.55%

Scheduled Cash Flow

1Q'15

$335

2.06%

Next 12 months

$1,238

1.79%

Securities Gains

$ in thousands

4Q'13

(10)

$

1Q'14

1,470

$

2Q'14

2,569

$

3Q'14

26

$

4Q'14

62

$

Duration/Life

(in months)

at 12/31/14

at 09/30/14

Avg. Life Total

43.62

45.15

Duration Total

37.71

40.20 |

38.8%

42.2%

38.0%

41.4%

$0.0

$2.0

$4.0

$6.0

$8.0

$10.0

$12.0

$14.0

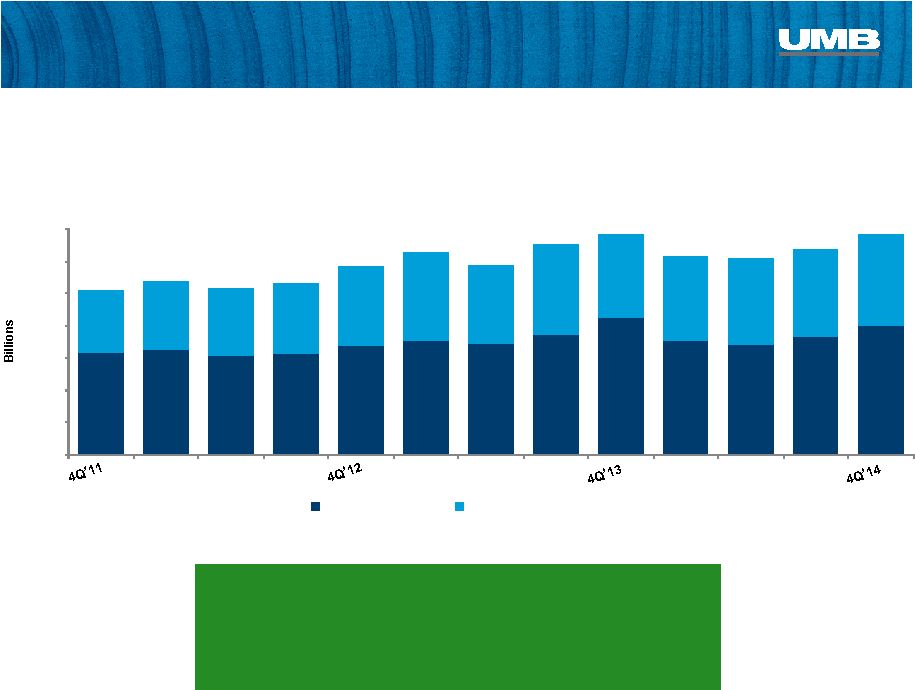

Interest Bearing

Non-Interest Bearing

Deposit Growth

Deposits & % of Free Funds

At period end; $ billions

4Q’14

Cost of Funds 0.15%

Including DDA 0.09%

8

$10.2

$13.6

$11.7

$13.6 |

Select Balance Sheet Items

9

$ in thousands, average balances; unaudited

vs. Dec '13

vs. Sep '14

Avg. Balance

Avg. Balance

Avg. Balance

Assets

Loans, net of unearned interest

7,320,930

$

3.49

6,483,711

$

3.62

6,996,363

$

3.50

12.9

4.6

Total securities

7,155,056

1.91

6,969,863

1.97

6,992,618

1.92

2.7

2.3

Total earning assets

15,150,747

2.61

14,453,720

2.60

14,575,849

2.62

4.8

3.9

Allowance for loan losses

(77,527)

(75,135)

(77,347)

3.2

0.2

Total assets

16,231,622

$

15,533,761

$

15,638,322

$

4.5

3.8

Liabilities and Shareholders' Equity

Interest-bearing deposits

7,446,164

$

0.16

7,795,495

$

0.15

7,444,093

$

0.16

(4.5)

0.0

Total interest-bearing liabilities

8,988,438

0.15

8,973,635

0.14

8,797,486

0.15

0.2

2.2

Noninterest-bearing demand deposits

5,403,856

4,903,429

5,060,662

10.2

6.8

Shareholders' Equity

1,651,969

1,514,145

1,612,470

9.1

2.4

Total liabilities and shareholders' equity

16,231,622

$

15,533,761

$

15,638,322

$

4.5

3.8

Net interest spread

2.46

2.47

2.47

Net interest margin

2.52

2.51

2.53

% variance

December 31, 2014

December 31, 2013

September 30, 2014

Avg Yield

/ Rate %

Avg Yield

/ Rate %

Avg Yield

/ Rate %

Three Months Ended |

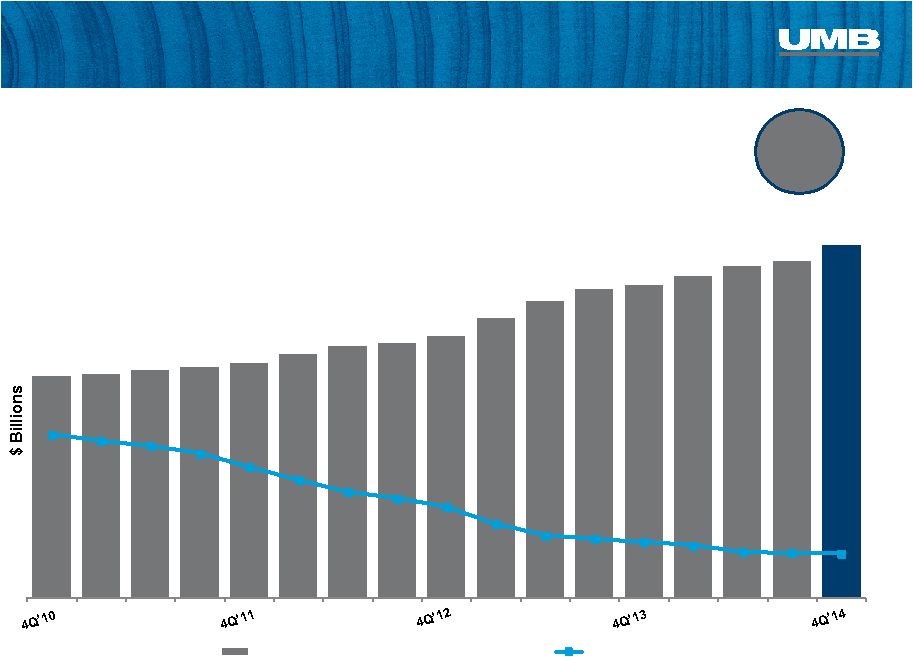

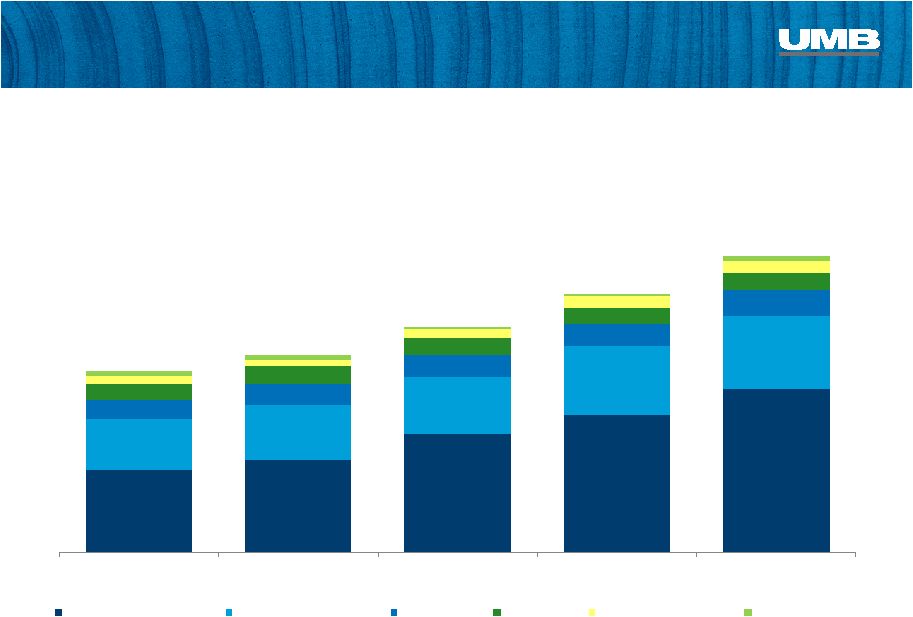

Consistent Loan Growth

5 Year

CAGR

11.1%

10

Average Loans & Loan Yields

$4.6

$4.9

$5.4

$6.5

$7.3

4.81%

4.45%

4.01%

3.62%

3.49%

Average Loans, Net of Unearned Interest

Average Loan Yield |

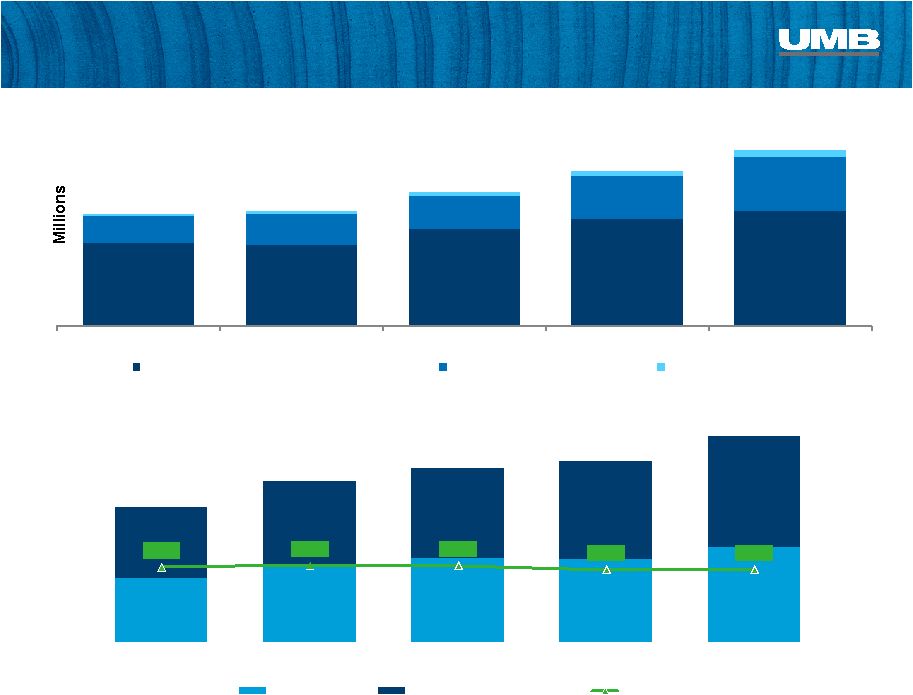

$4,187

$3,737

$3,713

$3,985

$4,176

0.26%

0.23%

0.22%

0.23%

0.23%

4Q'13

1Q'14

2Q'14

3Q'14

4Q'14

Net Charge-offs

NCOs/Avg Loans

Quality Credit Metrics

Net Charge-Offs

$000’s

11

$30,706

$30,153

$27,175

$32,662

$27,382

0.47%

0.45%

0.39%

0.46%

0.37%

4Q'13

1Q'14

2Q'14

3Q'14

4Q'14

Nonperforming Loans

NPLs/Loans

Nonperforming Loans

$000’s |

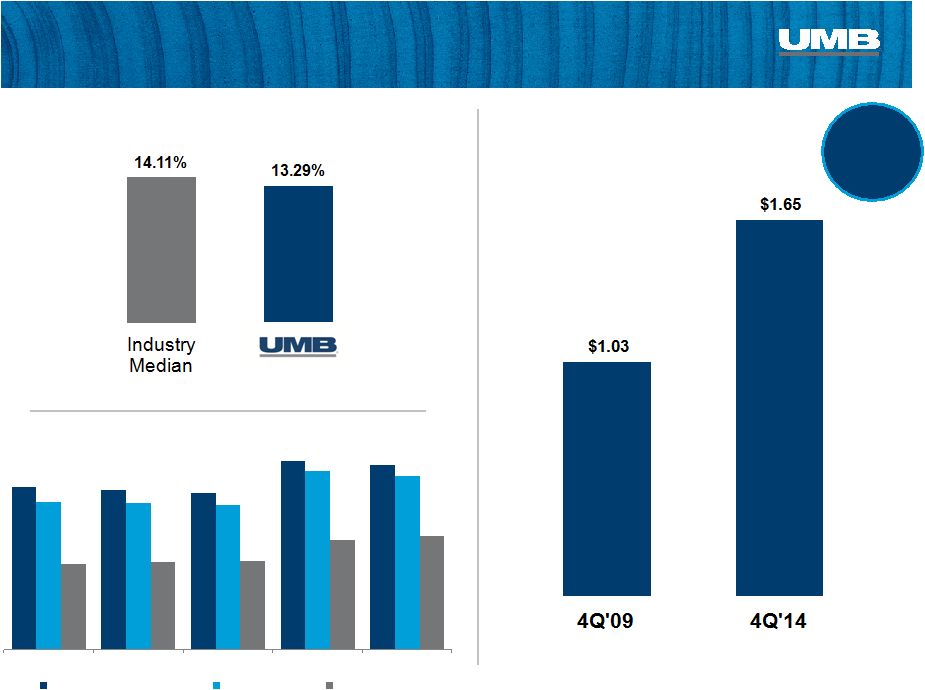

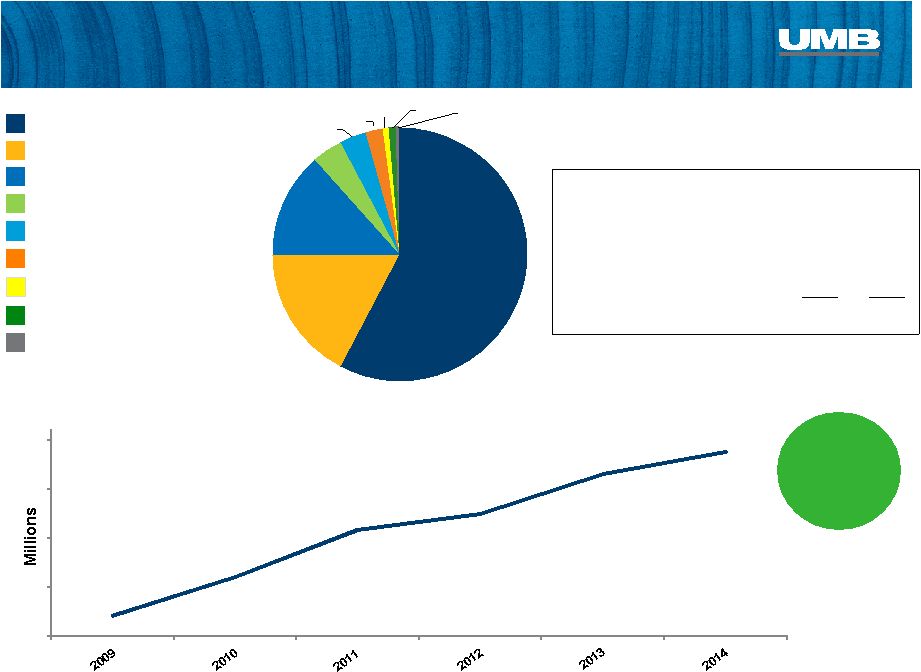

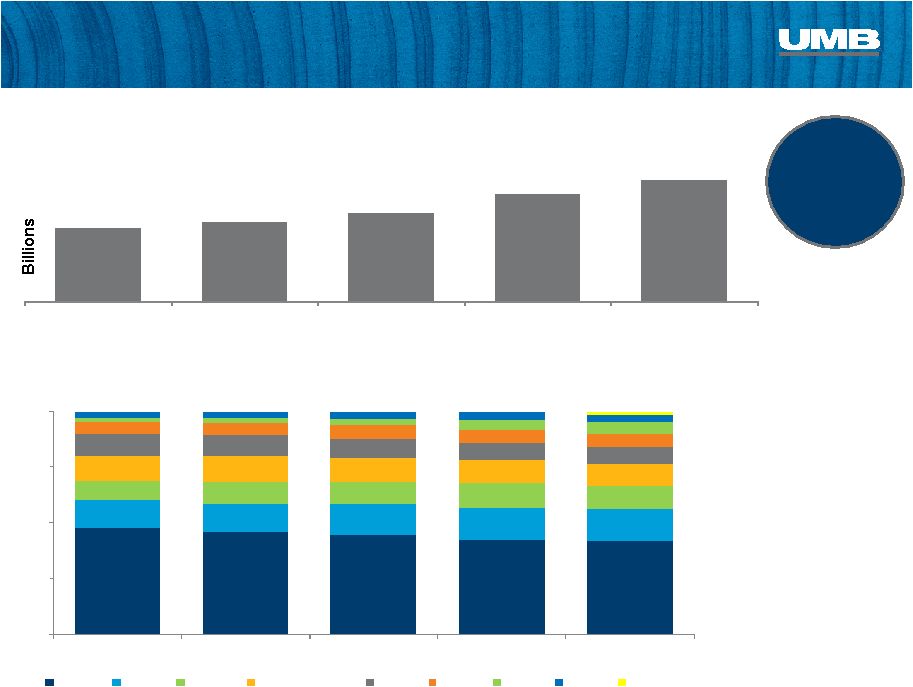

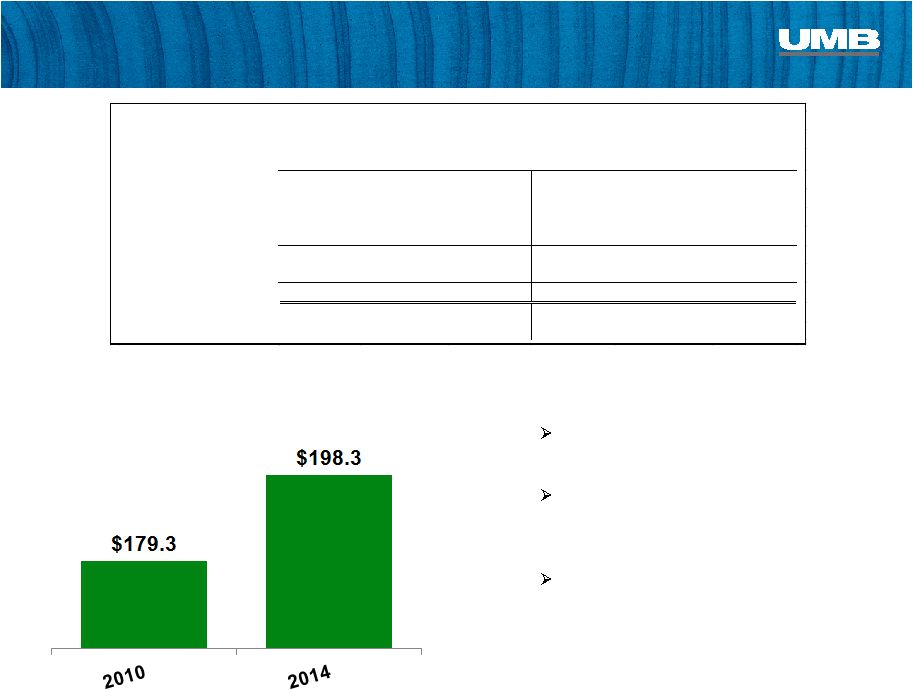

12.45

12.20

11.92

14.43

14.04

11.30

11.20

11.05

13.61

13.29

6.56

6.71

6.81

8.41

8.72

2010

2011

2012

2013

2014

Total Risk-Based Capital

Tier 1 Capital

Tier 1 Leverage

Tier 1 Capital Ratio vs. Industry

4Q 2014

12

Average Equity

($ billions)

5 yr

CAGR

10.0%

Capital Ratio Trends

Industry Median as of 3Q14; Source: SNL Financial

Balance Sheet –

Strong Capital Position |

59.9%

18.6%

15.0%

4.2%

3.1%

2.3%

0.7%

0.1%

Bankcard Fees

Noninterest Income Highlights –

4Q 2014

5 Year

CAGR

15.0%

Trust & Securities Processing Composition:

Trading & Investment Banking

Other

Deposit Service Charges

Trust & Securities Processing

Brokerage Fees

Gains on Sale of Securities

($ millions)

Insurance Fees

13

Source of income:

4Q'14

4Q'13

Institutional Investment Mgmt.

$29.1

$34.3

Asset Servicing

$22.2

$20.5

Bank (inst. & personal asset mgmt.)

$17.8

$16.9

$69.1

$71.7

Excludes ($4,487) from Equity Earnings on Alternative Investments, which represents

(3.9%) of noninterest income $34.4

$46.3

$51.1

$58.3

$71.7

$69.1

Trust & Securities Processing Revenue |

57.8%

17.1%

13.5%

3.9%

3.4%

2.2%

0.8%

0.8%

0.6%

Bankcard Fees

Noninterest Income Highlights –

Full-Year 2014

Trust & Securities Processing Composition:

Equity Earnings/Alternatives

Trading & Investment Banking

Other

Deposit Service Charges

Trust & Securities Processing

Brokerage Fees

Gains on Sale of Securities

($ millions)

Insurance Fees

14

Source of income:

2014

2013

Institutional Investment Mgmt.

$130.5

$124.5

Asset Servicing

$88.1

$79.7

Bank (inst. & personal asset mgmt.)

$69.5

$61.7

$288.1

$265.9

$120.5

$160.4

$208.4

$225.1

$265.9

$288.1

5 Year

CAGR

19.0%

Trust & Securities Processing Revenue |

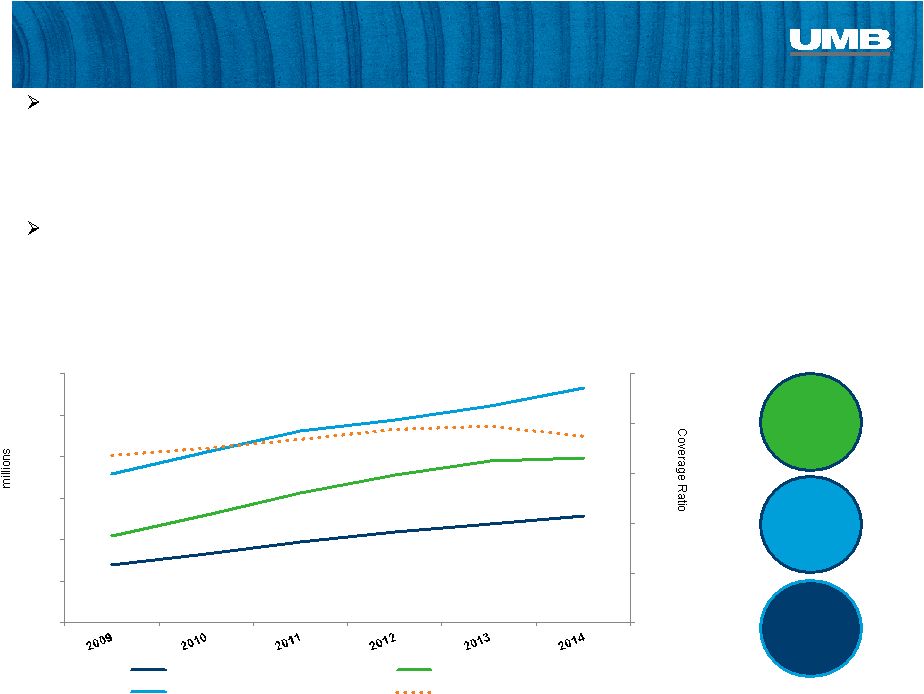

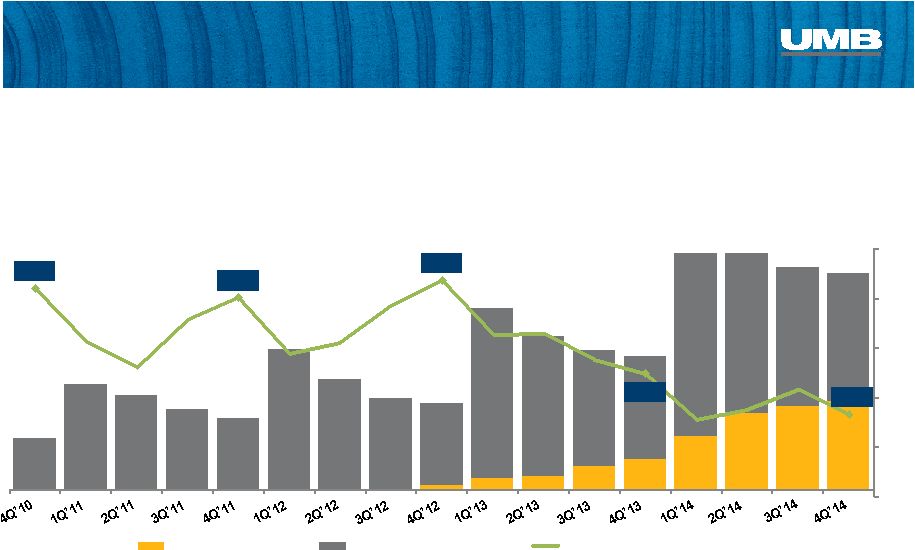

0%

20%

40%

60%

80%

100%

$100

$200

$300

$400

$500

$600

$700

Salary/Benefit Expense

Noninterest Income

Total Noninterest Expense

Coverage Ratio*

Non-Int

Expense

5yr

CAGR

7.7%

Noninterest Expense

4th

Quarter

noninterest

expense

decreased

2.2%,

or

$3.7

million,

to

$166.7

million

vs.

4Q’13

Salary

5yr

CAGR

8.3%

Non-Int

Income

5yr

CAGR

10.0%

Managed FTE Costs; Growing Noninterest Income

15

* Noninterest Income/Noninterest Expense

Demonstrating Annual

Operating Leverage

Full-year 2014 noninterest expense increased 6.8%, or $42.7 million, to $666.9

million vs. 2013 Primary drivers:

•

Contingency reserve expense related to Prairie Capital Management was $20.3

million in 2014 versus $0 in 2013 •

Salary and benefit expense increased $18.9 million, or 5.6%

•

Equipment expense increased by $4.4 million, or 8.9%

Primary drivers:

•

Other

expense

decreased

by

$9.7

million,

or

64.8%,

primarily

due

to

a

$7.7

million

decrease

in

fair

value

adjustments

on contingent consideration liabilities.

•

Processing fees decreased $1.4 million, or 9.6%, driven by reduced distribution

fees paid by Scout |

Business Segment Updates |

$8.5

$9.6

$10.5

$11.9

$12.7

33.1%

35.6%

40.5%

39.5%

40.9%

2010

2011

2012

2013

2014

Interest Bearing

Non-Interest Bearing

$4.5

$4.8

$5.3

$6.2

$7.0

2010

2011

2012

2013

2014

Bank

17

Average Net Loans

$ in billions

5 yr

CAGR

9.7%

5 yr

CAGR

10.8%

Average Deposits

$ in billions

Net loans grew for the 19

consecutive quarter, increasing by

14.6% year-over-year to $7.4 billion

AUM for individual and institutional

bank clients stood at $11.6 billion at

year-end and its 5-year compound

annual growth rate is 20.8%

Private Banking average loans

increased 31.5% to $428.2 million vs.

4Q’13

4 Quarter 2014 Highlights

% Change

% Change

Y/Y

Y/Y

2014

2013

2014

2013

Net interest income

292,357

$

285,112

$

2.5%

75,862

$

73,874

$

2.7%

Provision for loan losses

9,175

5,535

65.8%

1,617

1,765

-8.4%

Noninterest income

194,223

210,535

-7.7%

42,380

62,406

-32.1%

Noninterest expense

405,065

376,307

7.6%

97,070

99,080

-2.0%

NI before taxes

72,340

113,805

-36.4%

19,555

35,435

-44.8%

Income tax expense

19,487

28,548

-31.7%

5,158

8,918

-42.2%

Net income

52,853

$

85,257

$

-38.0%

14,397

$

26,517

$

-45.7%

pre-tax profit margin

14.9%

23.0%

16.5%

26.0%

12 mos Ended

December 31,

3 mos Ended

December 31,

Bank

Segment

Results

$

in

000s,

unaudited

th

th |

Bank -

Lending

18

Diverse Loan Book

(Actual Loan Balances at December 31)

*includes C&I, real estate construction and leases

45.2%

55.0%

28.3%

25.0%

10.4%

$5.0B

$6.5B

8.6%

8.9%

$5.7B

$7.5B

5.7%

4.2%

4.3%

3.0%

$4.6B

1.4%

2010

2011

2012

2013

2014

Commercial & Industrial*

Commercial Real Estate

Home Equity

Credit Card

Consumer Real Estate

Consumer -

Other |

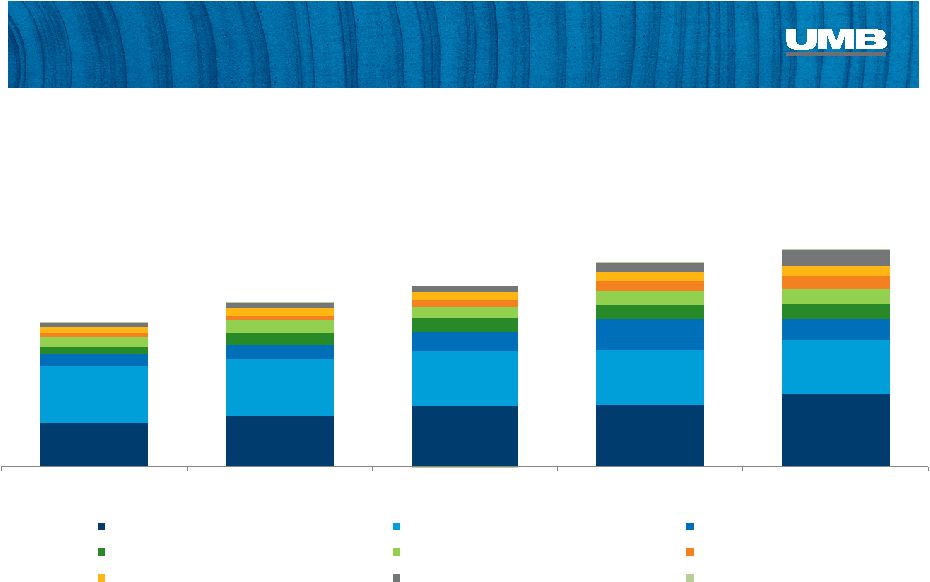

Bank -

Deposits

Diverse Sources of Deposits

(Average Deposits for 12 Months Ended December 31)

19

29.9%

33.3%

40.3%

24.9%

8.1%

9.8%

4.6%

6.8%

7.0%

6.8%

2.4%

6.2%

4.2%

2.8%

7.5%

4.5%

$8.5B

$9.6B

$10.5B

$11.9B

$12.7B

0.7%

0.2%

2010

2011

2012

2013

2014

Commercial/Treasury Mgmt

Consumer Banking

Asset Servicing

Private Wealth Mgmt

Institutional Asset Mgmt

Healthcare Svcs

Small Business Banking

Inst. Banking & Investor Services

Other |

$3.49

$3.75

$4.19

$5.09

$5.74

2010

2011

2012

2013

2014

Commercial Loans By Region

Average C&I and CRE Loan Balances for Twelve Months Ended December 31

47.8%

45.9%

44.1%

42.6%

42.1%

0%

50%

100%

2010

2011

2012

2013

2014

KC

CO

STL

Greater MO

KS

OK

AZ

NE

TX

Bank –

Commercial Banking

High Growth Regions

2014 vs. 2013

•

Texas

+493.9%

•

Arizona

+41.1%

•

Kansas

+13.7%

Loan Balances

$ in billions, Average C&I and CRE Loan Balances for Twelve Months Ended

December 31 5 yr

CAGR

11.1%

20 |

Bank –

Private Wealth Mgmt. & Consumer Banking

21

$436

$533

$574

$566

$644

$479

$559

$608

$663

$755

47.7%

48.8%

48.5%

46.1%

46.0%

2010

2011

2012

2013

2014

Balances

Unused Commitments

Utilization

$7.4B

$7.6B

$8.8B

$10.2B

$11.6B

$0.91B

$1.09B

$1.18B

$1.23B

$1.40B

Home Equity Lines of Credit

$ in millions

Assets Under Management

$ in millions

$5,490

$5,366

$6,390

$7,044

$7,610

$1,744

$2,035

$2,219

$2,853

$3,603

$152

$188

$226

$351

$419

2010

2011

2012

2013

2014

Private Wealth & Institutional Asset Mgmt

Prairie Capital Management

Brokerage Assets |

$31.2

$32.2

$32.4

$30.6

$31.2

4Q'13

1Q'14

2Q'14

3Q'14

4Q'14

Institutional Investment Management

22

Total Scout Assets Under Management

$ in billions

Reams was selected by Russell

Investments to replace PIMCO in

a $2.7B sub-advised mandate

covering our Low Duration and

Core Plus products

Assets under management have

grown at a 4-year CAGR of

11.9% since the acquisition of

Reams at the end of 2010.

4 Quarter 2014 Highlights

Institutional Investment Management Segment Results

$ in 000s, unaudited

% Change

% Change

Y/Y

Y/Y

2014

2013

2014

2013

Net Interest income

(3)

$

(32)

$

90.6%

-

$

(10)

$

100.0%

Noninterest income

131,226

126,442

3.8%

29,212

34,892

-16.3%

Noninterest expense

92,008

88,336

4.2%

23,156

29,582

-21.7%

NI before taxes

39,215

38,074

3.0%

6,056

5,300

14.3%

Income tax expense

10,331

10,002

3.3%

1,445

1,127

28.2%

Net income

28,884

$

28,072

$

2.9%

4,611

$

4,173

$

10.5%

pre-tax profit margin

29.9%

30.1%

20.7%

15.2%

December 31,

12 mos Ended

3 mos Ended

December 31,

th |

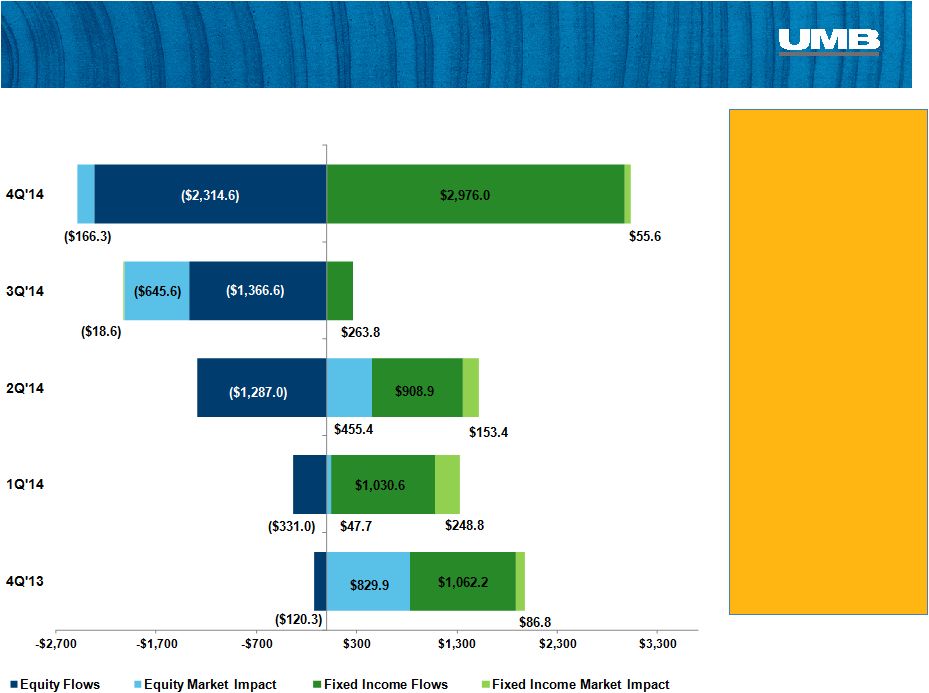

AUM

Drivers $ in millions

$230.7

$996.1

Total Change

($millions)

$32,394.3

$32,163.5

Total AUM

($millions)

Institutional Investment Management

23

$1,858.5

$31,167.4

($1,767.0)

$30,627.3

$550.7

$31,178.1 |

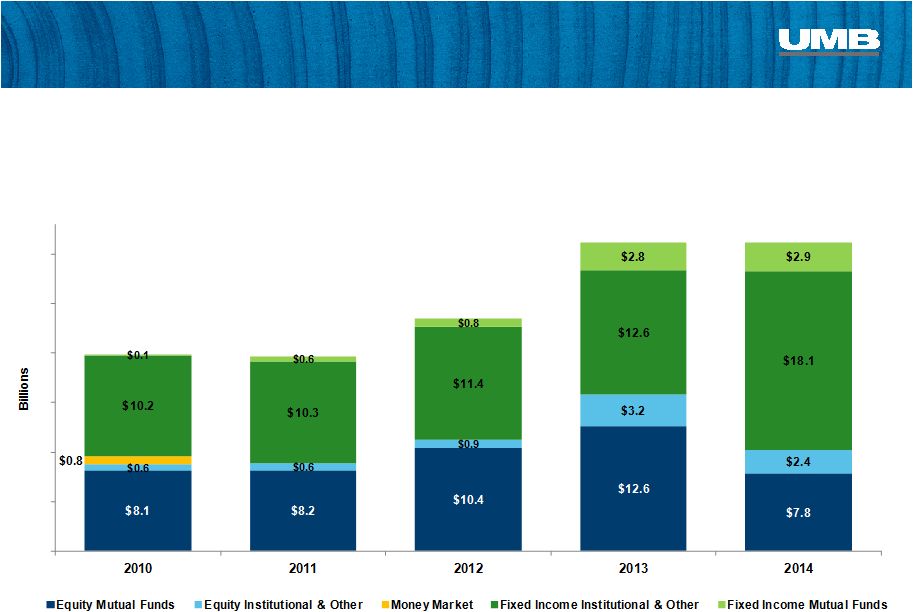

Total AUM

$31.2B

$19.9B

$19.7B

Institutional Investment Management

24

$23.5B

$31.2B |

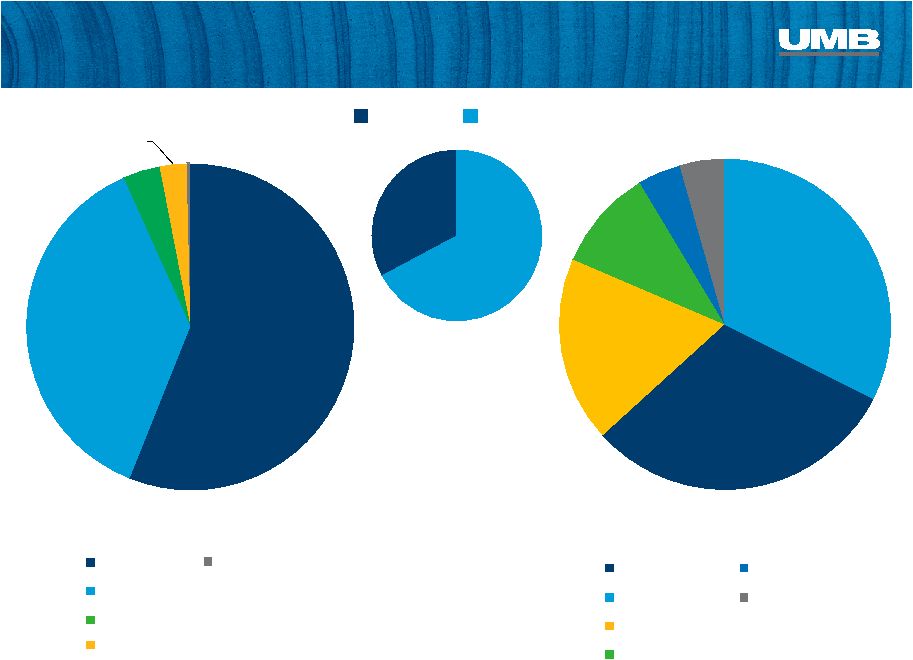

32.4%

30.8%

18.2%

10.0%

4.2%

4.4%

AUM by Strategy –

As of December 31, 2014

Equity Strategies

International

Mid Cap

International ADR

Emerging Markets

Global

Small Cap

Other:

25

Fixed Income Strategies

Core Plus

Low Duration

Long Duration

Core

Intermediate

Unconstrained

Unconstrained UCITS

Real Return

Equity

Fixed Income

67%

33%

56.1%

37.2%

3.7%

2.6%

0.4%

Other:

Large Cap

Equity Opportunity

Global Aggregate |

$1.08

$1.31

$1.36

$1.29

$1.26

$1.58

$1.48

$1.37

$1.38

$1.79

$1.72

$1.64

$1.63

$2.10

$2.18

$2.11

$2.08

$14.6

$14.2

$15.7

$15.9

$18.0

Purchase Volume ($ billions)

Interchange ($ millions)

Payment Solutions

Total Card Purchase Volume

& Interchange Revenue

26

Durbin

effective

Credit and debit card purchase

volume increased 27.3% vs. 4Q’13

to $2.1 billion and for the full year

reached nearly $8.5 billion

HSA deposits and assets grew by

42.8% vs. 4Q’13 to $917.5 million

The number of Health Savings

Accounts increased by 34.4% year-

over-year and now stands at more

than 588,000

4 Quarter 2014 Highlights

th

% Change

% Change

Y/Y

Y/Y

2014

2013

2014

2013

Net interest income

52,251

$

45,832

$

14.0%

14,003

$

11,505

$

21.7%

Provision for loan losses

7,825

11,965

-34.6%

1,383

2,235

-38.1%

Noninterest income

84,477

74,223

13.8%

21,479

17,737

21.1%

Noninterest expense

94,177

86,746

8.6%

26,507

23,121

14.6%

NI before taxes

34,726

21,344

62.7%

7,592

3,886

95.4%

Income tax expense

9,311

6,739

38.2%

2,029

1,271

59.6%

Net income

25,415

$

14,605

$

74.0%

5,563

$

2,615

$

112.7%

pre-tax profit margin

25.4%

17.8%

21.4%

13.3%

3 mos Ended

December 31,

December 31,

12 mos Ended

Payment

Solutions

Segment

Results

$

in

000s,

unaudited |

8.9%

16.9%

23.4%

22.7%

32.5%

37.7%

41.0%

$252.3

$512.2

$461.2

$393.8

$350.0

$682.2

$536.4

$448.0

$421.4

$881.3

$748.6

$680.2

$649.1

$1,150.0

$1,152.1

$1,082.9

$1,052.3

0.41%

0.40%

0.42%

0.32%

0.28%

0.20%

0.25%

0.30%

0.35%

0.40%

0.45%

Virtual Card Volume

Other Healthcare Volume

Effective Interchange Rate *

Payment Solutions

27

Healthcare Purchase Volume Trends

$millions

* Interchange revenue from Healthcare cards divided by purchase volume on

Healthcare cards |

$84.2

$125.1

$169.8

$255.2

$298.5

$399.6

$595.0

$841.7

$16.7

$15.4

$20.9

$24.7

$24.9

$30.9

$47.4

$75.8

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

HSA $ Deposits (in millions)

HSA $ Assets (in millions)

Payment Solutions

28

Healthcare Deposits and Assets

$millions

$36.6M

$65.8M

$100.8M

$140.5M

$190.7M

$279.9M

$323.3M

$430.5M

$642.4M

$917.5M

Healthcare

provided

6.2% of Total

Avg. Deposits

in 2014 |

Asset Servicing

29

Assets Under Administration

$billions

Assets in the IMST increased 99% year-

over-year and now stand at $11.8 billion.

The number of funds serviced grew by

143 in the past 12 months, an increase of

nearly 14%

UMB Fund Services was named “Best

Administrator –

Liquid Alternatives”

at

HFMWeek’s 2014 US Hedge Fund

Services Awards in November

4 Quarter 2014 Highlights

th

% Change

% Change

Y/Y

Y/Y

2014

2013

2014

2013

Net interest income

5,450

$

2,357

$

131.2%

1,049

$

545

$

92.5%

Noninterest income

88,762

80,633

10.1%

22,177

20,572

7.8%

Noninterest expense

75,676

72,789

4.0%

19,980

18,643

7.2%

NI before taxes

18,536

10,201

81.7%

3,246

2,474

31.2%

Income tax expense

5,033

4,170

20.7%

877

1,116

-21.4%

Net income

13,503

$

6,031

$

123.9%

2,369

$

1,358

$

74.4%

pre-tax profit margin

19.7%

12.3%

14.0%

11.7%

3 mos Ended

December 31,

December 31,

12 mos Ended

Asset

Servicing

Segment

Results

$

in

000s,

unaudited |

Asset Servicing

Fund Accounting & Administration

Alternative Asset Servicing

Custody

Transfer Agency

30

$30.5

$35.9

$44.1

$63.0

$72.1

116

160

179

219

249

2010

2011

2012

2013

2014

Assets Under Administration

# of Funds Serviced

$21.3

$24.7

$26.3

$27.9

$31.5

406

467

532

514

579

2010

2011

2012

2013

2014

Assets Under Administration

# of Funds Serviced

$101.4

$115.6

$54.9

$68.0

$62.4

470

499

443

411

454

2010

2011

2012

2013

2014

Assets Under Administration

# of Custody Accounts

554.9

802.4

946.8

1,280.1

1,111.2

227

256

270

301

349

2010

2011

2012

2013

2014

# of Shareholders

# of Funds Serviced |

Strengths We are Leveraging

Diversified

revenue

Growing fee

businesses

Leadership

Success building a smartly

diversified financial services

company

Building scale through

strategic acquisitions

Professional management

teams leading highly engaged

workforce across the footprint

31 |

Building a company

for the next 100 years.

UMB Financial

Fourth Quarter & Year-End 2014 |