Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PARKER HANNIFIN CORP | form8-k2qfy15.htm |

| EX-99.1 - EXHIBIT 99.1 - PARKER HANNIFIN CORP | exhibit9912qfy15.htm |

2nd Quarter Fiscal Year 2015 Earnings Release Parker Hannifin Corporation January 27, 2015 Exhibit 99.2

Forward-Looking Statements and Non-GAAP Financial Measures Safe Harbor Forward-looking statements contained in this and other written and oral reports are made based on known events and circumstances at the time of release, and as such, are subject in the future to unforeseen uncertainties and risks. All statements regarding future performance, earnings projections, events or developments are forward-looking statements. It is possible that the future performance and earnings projections of the company, including its individual segments, may differ materially from current expectations, depending on economic conditions within its mobile, industrial and aerospace markets, and the company's ability to maintain and achieve anticipated benefits associated with announced realignment activities, strategic initiatives to improve operating margins, actions taken to combat the effects of the current economic environment, and growth, innovation and global diversification initiatives. A change in the economic conditions in individual markets may have a particularly volatile effect on segment performance. Among other factors which may affect future performance are: changes in business relationships with and purchases by or from major customers, suppliers or distributors, including delays or cancellations in shipments, disputes regarding contract terms or significant changes in financial condition, changes in contract cost and revenue estimates for new development programs and changes in product mix; ability to identify acceptable strategic acquisition targets; uncertainties surrounding timing, successful completion or integration of acquisitions and similar transactions; the ability to successfully divest businesses planned for divestiture and realize the anticipated benefits of such divestitures; the determination to undertake business realignment activities and the expected costs thereof and, if undertaken, the ability to complete such activities and realize the anticipated cost savings from such activities, the ability to implement successfully the Company's capital allocation initiatives, including the timing, price and execution of share repurchases; threats associated with and efforts to combat terrorism; uncertainties surrounding the ultimate resolution of outstanding legal proceedings, including the outcome of any appeals; competitive market conditions and resulting effects on sales and pricing; increases in raw material costs that cannot be recovered in product pricing; the company's ability to manage costs related to insurance and employee retirement and health care benefits; and global economic factors, including manufacturing activity, air travel trends, currency exchange rates, difficulties entering new markets and general economic conditions such as inflation, deflation, interest rates and credit availability. The company makes these statements as of the date of this disclosure, and undertakes no obligation to update them unless otherwise required by law. This presentation reconciles (a) sales amounts reported in accordance with U.S. GAAP to sales amounts adjusted to remove the effects of acquisitions and the effects of currency exchange rates, (b) cash flow from operating activities and cash flow from operating activities as a percent of sales in accordance with U.S. GAAP to cash flow from operating activities and cash flow from operating activities as a percent of sales without the effect of a discretionary pension plan contribution, (c) operating margins reported in accordance with U.S. GAAP to operating margins without the effect of restructuring expenses and, (d) net income and earnings per diluted share reported in accordance with U.S. GAAP to net income & earnings per diluted share without the effect of restructuring expenses, asset write downs & the effect of a joint venture. The effects of acquisitions, divestitures, currency exchange rates, the discretionary pension plan contributions, restructuring expenses, asset write downs and the effect of a joint venture are removed to allow investors and the company to meaningfully evaluate changes in sales, and cash flow from operating activities as a percent of sales, operating margins, net income and earnings per diluted share on a comparable basis from period to period. Please visit www.PHstock.com for more information 2

Agenda 3 • Chairman and CEO Comments • Key Performance Measures & Outlook • Chairman Closing Comments • Questions and Answers

Highlights 2nd Quarter FY2015 • Record Second Quarter Sales of $3.1B • Record As Reported Earnings per Share of $1.80 • Record Adjusted Earnings per Share of $1.84 • Organic Growth of 4.2% • Orders increased 4% and Positive Across all Segments • Segment Operating Margins 13.7% • 150 basis point increase YOY • Adjusted Segment Operating Margins 14.0% • Restructuring on Track • Share Repurchase Program Update 4

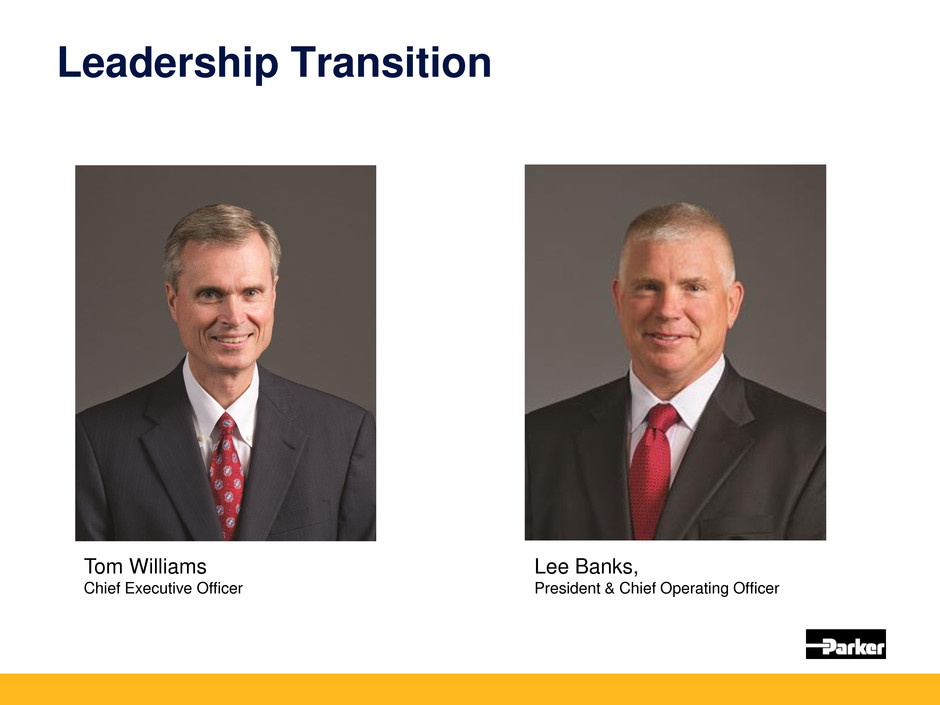

Leadership Transition Tom Williams Chief Executive Officer Lee Banks, President & Chief Operating Officer

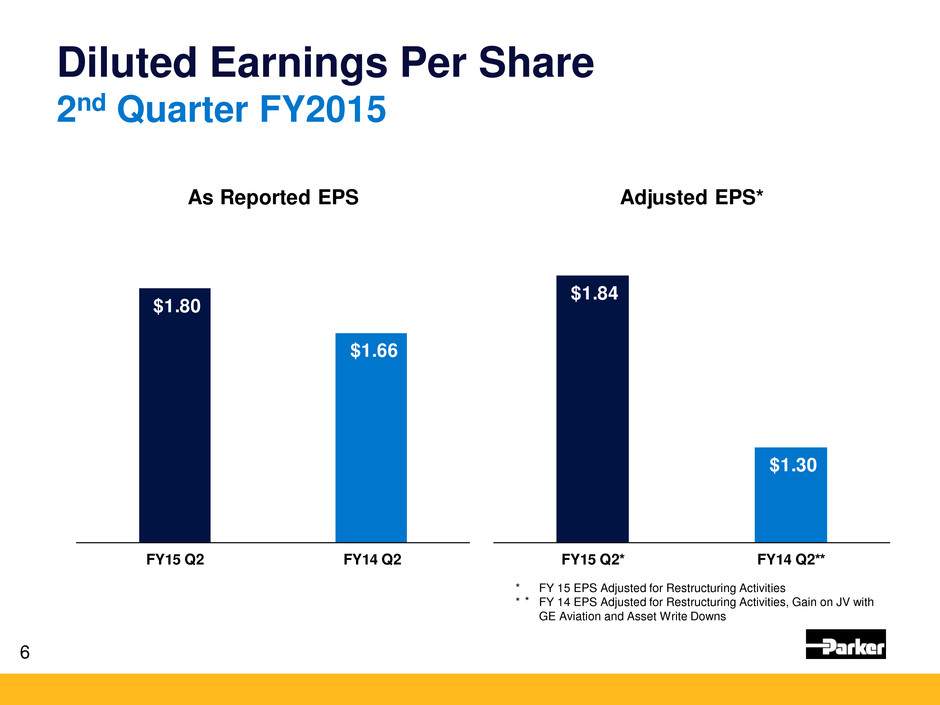

Diluted Earnings Per Share 2nd Quarter FY2015 6 * FY 15 EPS Adjusted for Restructuring Activities * FY 14 EPS Adjusted for Restructuring Activities, Gain on JV with GE Aviation and Asset Write Downs $1.80 $1.66 FY15 Q2 FY14 Q2 As Reported EPS $1.84 $1.30 FY15 Q2* FY14 Q2** Adjusted EPS* *

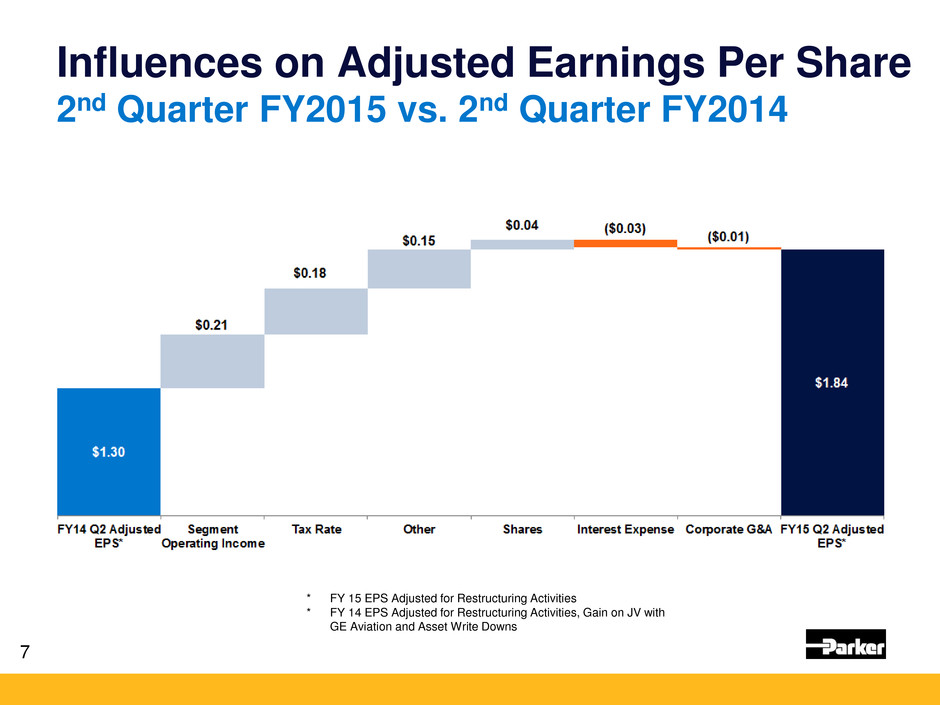

Influences on Adjusted Earnings Per Share 2nd Quarter FY2015 vs. 2nd Quarter FY2014 7 * FY 15 EPS Adjusted for Restructuring Activities * FY 14 EPS Adjusted for Restructuring Activities, Gain on JV with GE Aviation and Asset Write Downs

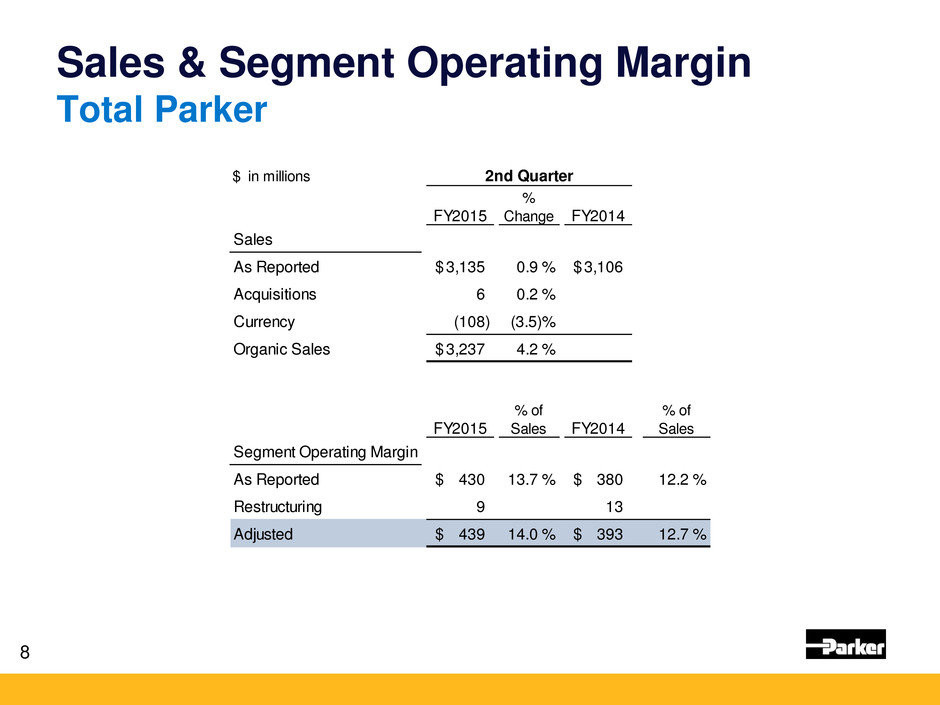

Sales & Segment Operating Margin Total Parker 8 $ in millions 2nd Quarter FY2015 % Change FY2014 Sales As Reported 3,135$ 0.9 % 3,106$ Acquisitions 6 0.2 % Currency (108) (3.5)% Organic Sales 3,237$ 4.2 % FY2015 % of Sales FY2014 % of Sales Segment Operating Margin As Reported 430$ 13.7 % 380$ 12.2 % Restructuring 9 13 Adjusted 439$ 14.0 % 393$ 12.7 %

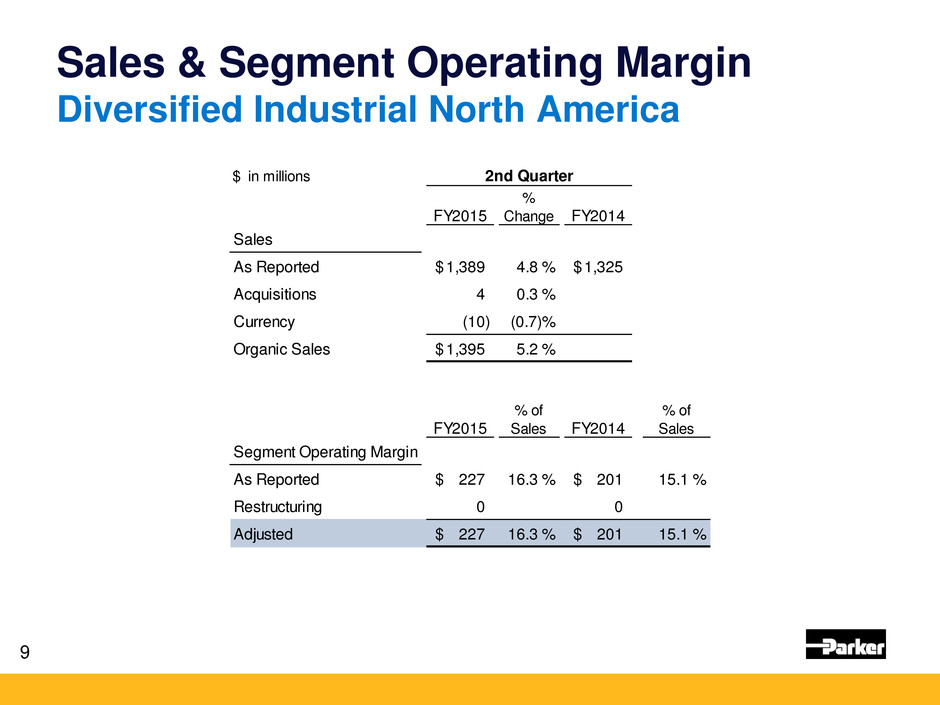

Sales & Segment Operating Margin Diversified Industrial North America 9 $ in millions 2nd Quarter FY2015 % Change FY2014 Sales As Reported 1,389$ 4.8 % 1,325$ Acquisitions 4 0.3 % Currency (10) (0.7)% Organic Sales 1,395$ 5.2 % FY2015 % of Sales FY2014 % of Sales Segment Operating Margin As Reported 227$ 16.3 % 201$ 15.1 % Restructuring 0 0 Adjusted 227$ 16.3 % 201$ 15.1 %

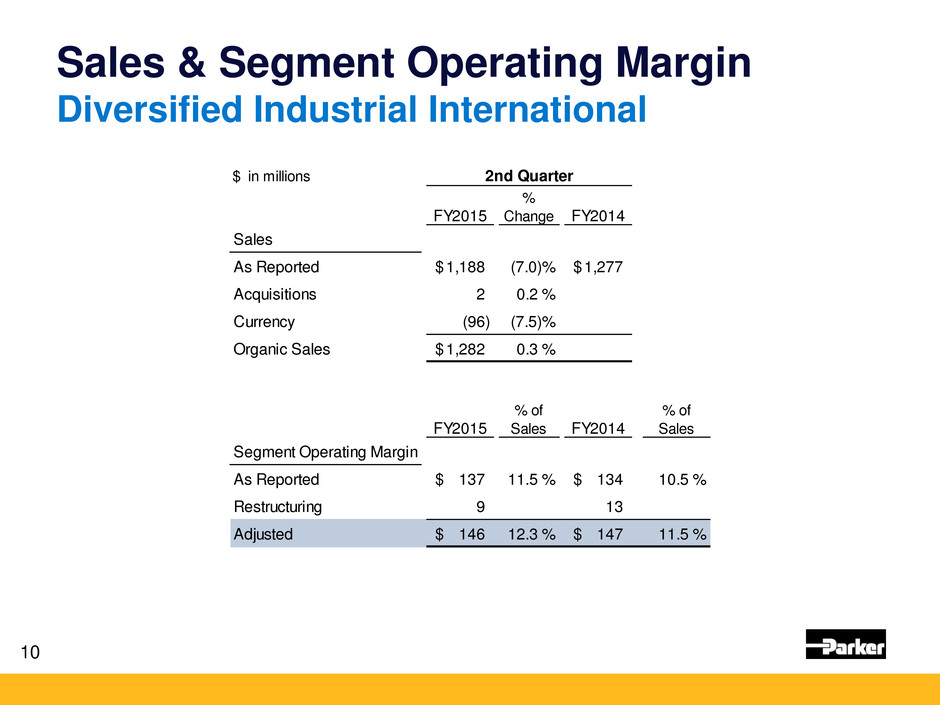

Sales & Segment Operating Margin Diversified Industrial International 10 $ in millions 2nd Quarter FY2015 % Change FY2014 Sales As Reported 1,188$ (7.0)% 1,277$ Acquisitions 2 0.2 % Currency (96) (7.5)% Organic Sales 1,282$ 0.3 % FY2015 % of Sales FY2014 % of Sales Segment Operating Margin As Reported 137$ 11.5 % 134$ 10.5 % Restructuring 9 13 Adjusted 146$ 12.3 % 147$ 11.5 %

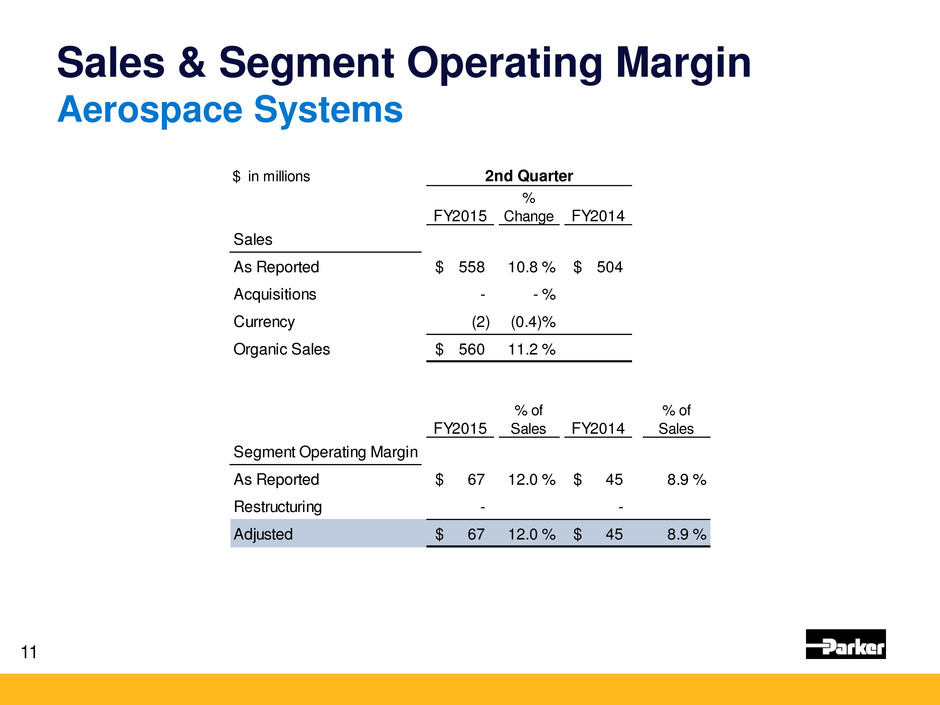

Sales & Segment Operating Margin Aerospace Systems 11 $ in millions 2nd Quarter FY2015 % Change FY2014 Sales As Reported 558$ 10.8 % 504$ Acquisitions - - % Currency (2) (0.4)% Organic Sales 560$ 11.2 % FY2015 % of Sales FY2014 % of Sales Segment Operating Margin As Reported 67$ 12.0 % 45$ 8.9 % Restructuring - - Adjusted 67$ 12.0 % 45$ 8.9 %

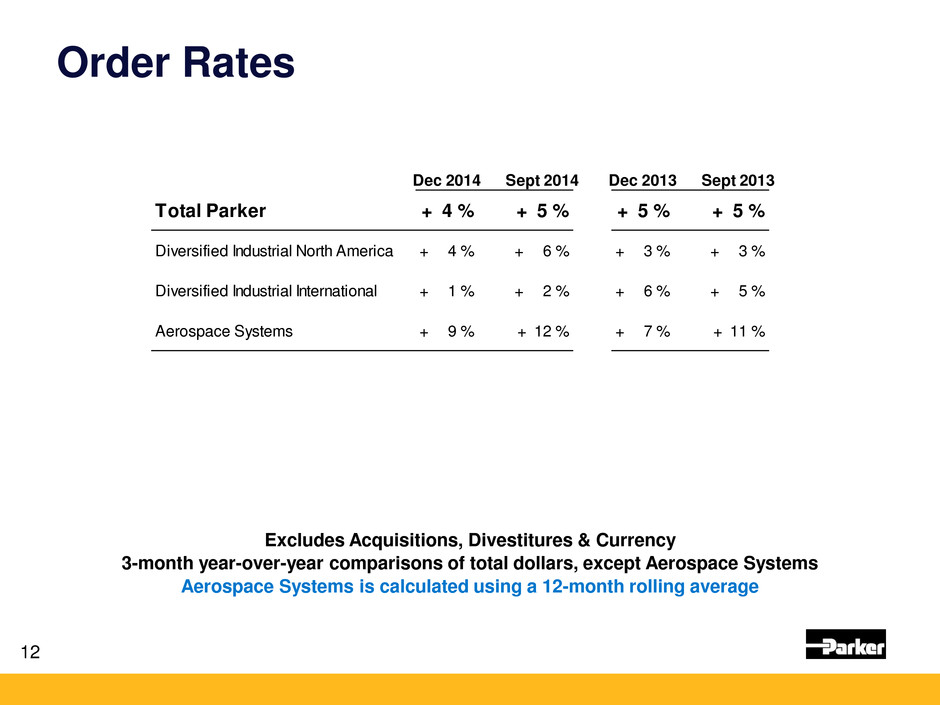

Order Rates 12 Excludes Acquisitions, Divestitures & Currency 3-month year-over-year comparisons of total dollars, except Aerospace Systems Aerospace Systems is calculated using a 12-month rolling average Dec 2014 Sept 2014 Dec 2013 Sept 2013 Total Parker 4 %+ 5 %+ 5 %+ 5 %+ Diversified Industrial North America 4 %+ 6 %+ 3 %+ 3 %+ Diversified Industrial International 1 %+ 2 %+ 6 %+ 5 %+ Aerospace Systems 9 %+ 12 %+ 7 %+ 11 %+

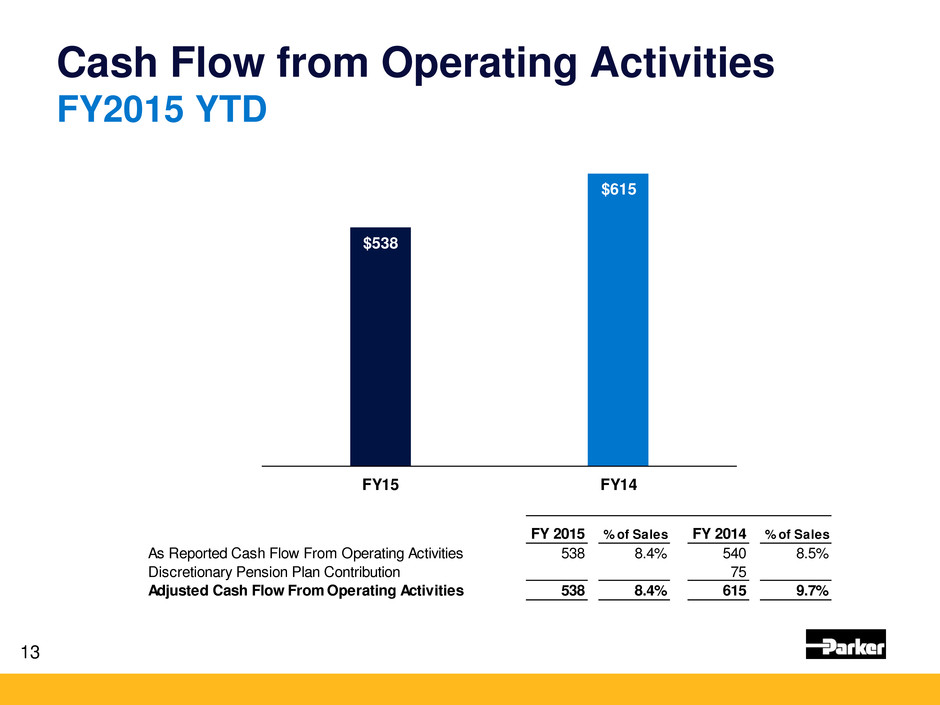

Cash Flow from Operating Activities FY2015 YTD 13 FY 2015 % of Sales FY 2014 % of Sales As Reported Cash Flow From Operating Activities 538 8.4% 540 8.5% Discreti nary Pension Plan Contribution 75 Adjusted Cash Flow From Operating Activities 538 8.4% 61 9.7% $538 $615 FY15 FY14

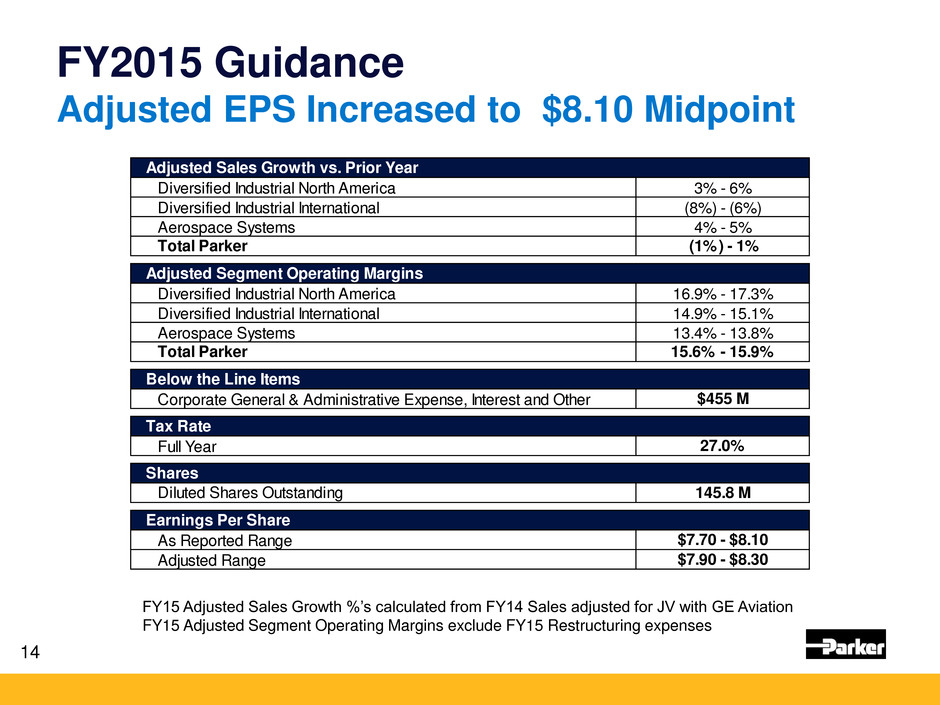

FY2015 Guidance Adjusted EPS Increased to $8.10 Midpoint 14 FY15 Adjusted Sales Growth %’s calculated from FY14 Sales adjusted for JV with GE Aviation FY15 Adjusted Segment Operating Margins exclude FY15 Restructuring expenses Adjusted Sales Growth vs. Prior Year Diversified Industrial North America 3% - 6% Diversified Industrial International (8%) - (6%) Aerospace Systems 4% - 5% Total Parker (1%) - 1% Adjusted Segment Operating Margins Diversified Industrial North America 16.9% - 17.3% Diversified Industrial International 14.9% - 15.1% Aerospace Systems 13.4% - 13.8% Total Parker 15.6% - 15.9% Below the Line Items Corporate General & Administrative Expense, Interest and Other $455 M Tax Rate Full Year 27.0% Shares Diluted Shares Outstanding 145.8 M Earnings Per Share As Reported Range $7.70 - $8.10 Adjusted Range $7.90 - $8.30

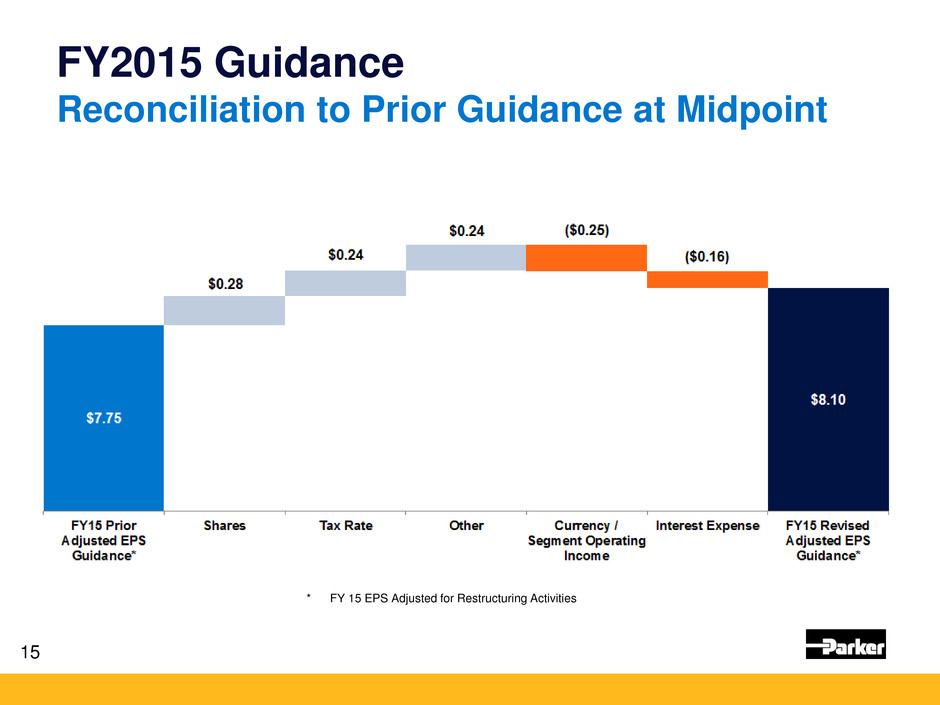

FY2015 Guidance Reconciliation to Prior Guidance at Midpoint 15 * FY 15 EPS Adjusted for Restructuring Activities

16

Appendix • Consolidated Statement of Income • Reconciliation of Net Income & EPS • Business Segment Information By Industry • Consolidated Balance Sheet • Consolidated Statement of Cash Flows • Supplemental Sales Information – Global Technology Platforms • Reconciliation of Forecasted EPS

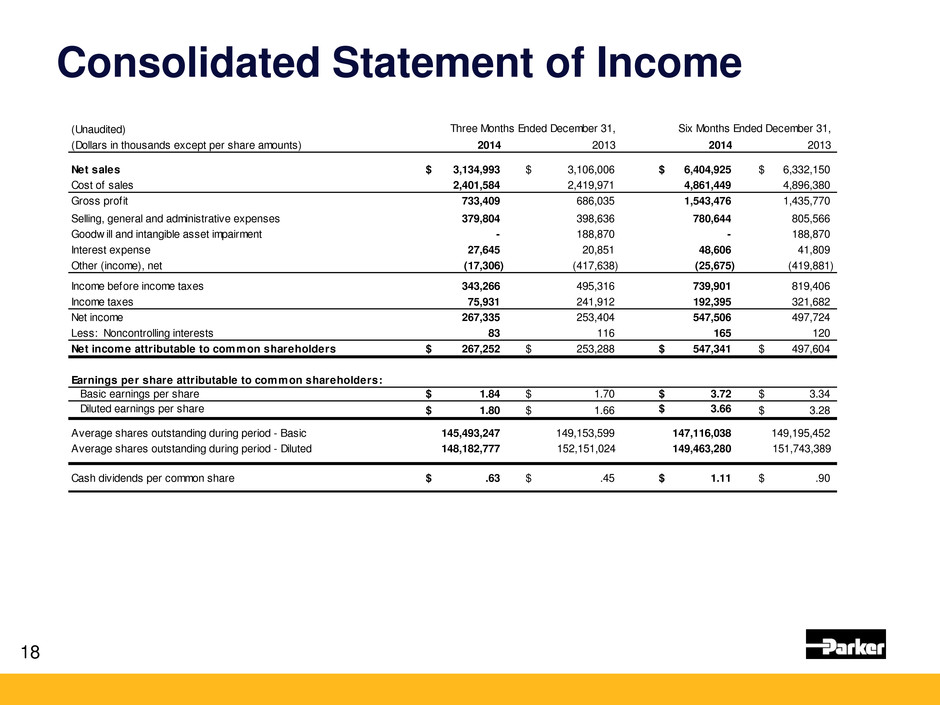

Consolidated Statement of Income 18 (Unaudited) Three Months Ended December 31, Six Months Ended December 31, (Dollars in thousands except per share amounts) 2014 2013 2014 2013 Net sales 3,134,993$ 3,106,006$ 6,404,925$ 6,332,150$ Cost of sales 2,401,584 2,419,971 4,861,449 4,896,380 Gross profit 733,409 686,035 1,543,476 1,435,770 Selling, general and administrative expenses 379,804 398,636 780,644 805,566 Goodw ill and intangible asset impairment - 188,870 - 188,870 Interest expense 27,645 20,851 48,606 41,809 Other (income), net (17,306) (417,638) (25,675) (419,881) Income before income taxes 343,266 495,316 739,901 819,406 Income taxes 75,931 241,912 192,395 321,682 Net income 267,335 253,404 547,506 497,724 Less: Noncontrolling interests 83 116 165 120 Net income attributable to common shareholders 267,252$ 253,288$ 547,341$ 497,604$ Earnings per share attributable to common shareholders: Basic earnings per share 1.84$ 1.70$ 3.72$ 3.34$ Diluted earnings per share 1.80$ 1.66$ 3.66$ 3.28$ Average shares outstanding during period - Basic 145,493,247 149,153,599 147,116,038 149,195,452 Average shares outstanding during period - Diluted 148,182,777 152,151,024 149,463,280 151,743,389 Cash dividends per common share .63$ .45$ 1.11$ .90$

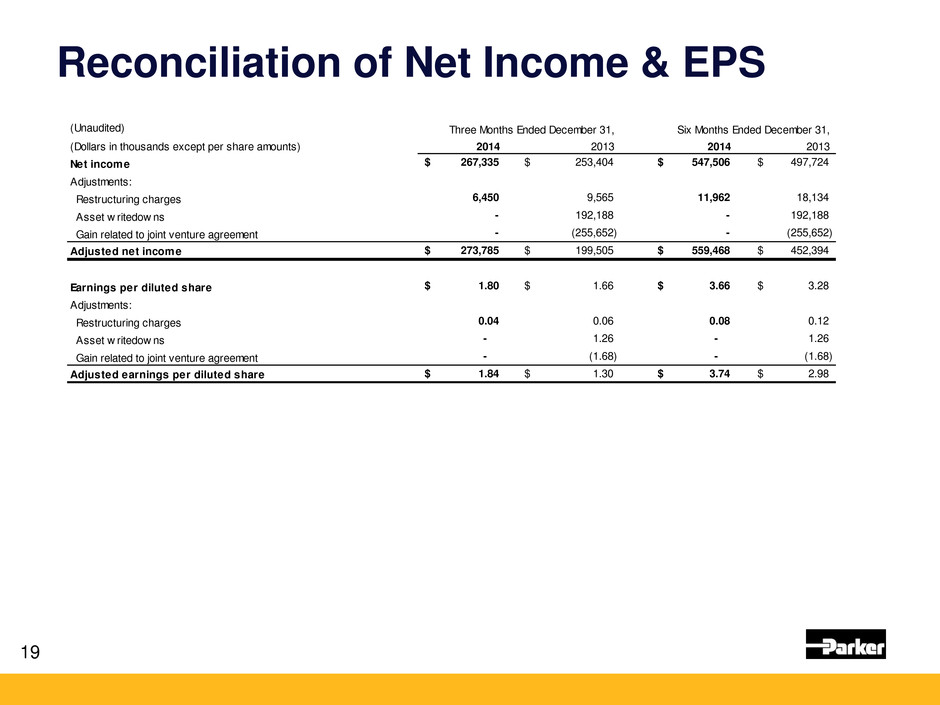

Reconciliation of Net Income & EPS 19 (Unaudited) Three Months Ended December 31, Six Months Ended December 31, (Dollars in thousands except per share amounts) 2014 2013 2014 2013 Net income 267,335$ 253,404$ 547,506$ 497,724$ Adjustments: Restructuring charges 6,450 9,565 11,962 18,134 Asset w ritedow ns - 192,188 - 192,188 Gain related to joint venture agreement - (255,652) - (255,652) Adjusted net income 273,785$ 199,505$ 559,468$ 452,394$ Earnings per diluted share 1.80$ 1.66$ 3.66$ 3.28$ Adjustments: Restructuring charges 0.04 0.06 0.08 0.12 Asset w ritedow ns - 1.26 - 1.26 Gain related to joint venture agreement - (1.68) - (1.68) Adjusted earnings per diluted share 1.84$ 1.30$ 3.74$ 2.98$

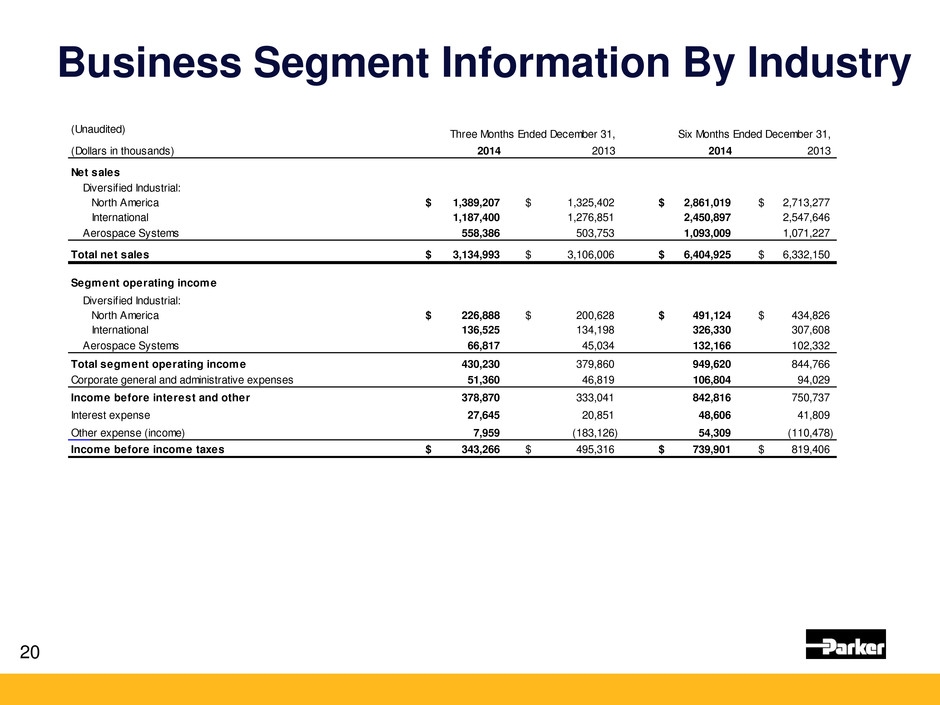

Business Segment Information By Industry 20 (Unaudited) Three Months Ended December 31, Six Months Ended December 31, (Dollars in thousands) 2014 2013 2014 2013 Net sales Diversif ied Industrial: North America 1,389,207$ 1,325,402$ 2,861,019$ 2,713,277$ International 1,187,400 1,276,851 2,450,897 2,547,646 Aerospace Systems 558,386 503,753 1,093,009 1,071,227 Total net sales 3,134,993$ 3,106,006$ 6,404,925$ 6,332,150$ Segment operating income Diversif ied Industrial: North America 226,888$ 200,628$ 491,124$ 434,826$ International 136,525 134,198 326,330 307,608 Aerospace Systems 66,817 45,034 132,166 102,332 Total segment operating income 430,230 379,860 949,620 844,766 Corporate general and administrative expenses 51,360 46,819 106,804 94,029 Income before interest and other 378,870 333,041 842,816 750,737 Interest expense 27,645 20,851 48,606 41,809 Other expense (income) 7,959 (183,126) 54,309 (110,478) Income before income taxes 343,266$ 495,316$ 739,901$ 819,406$

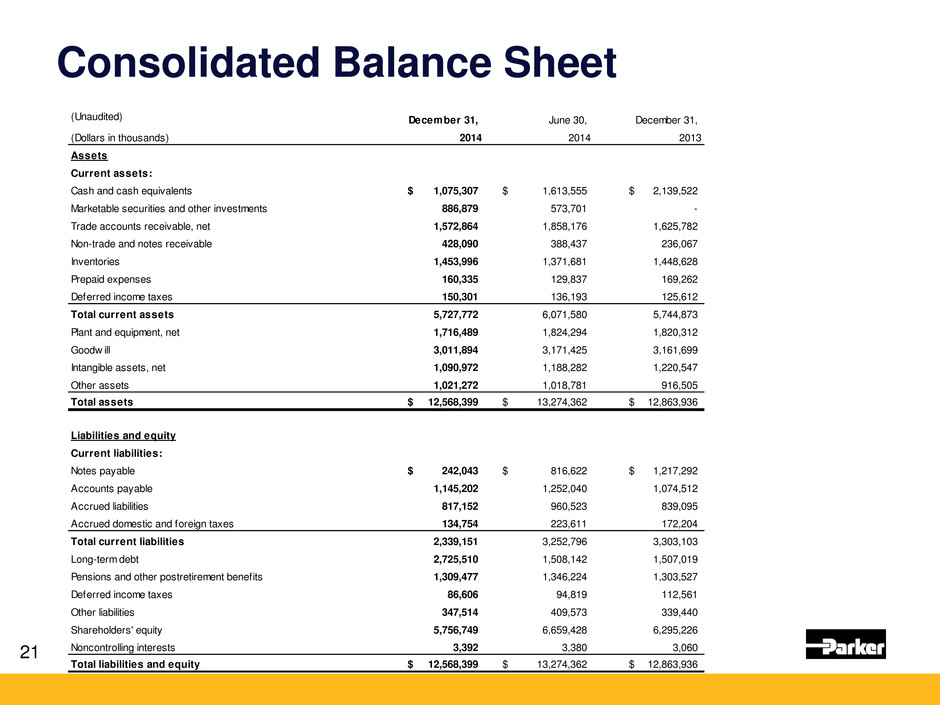

Consolidated Balance Sheet 21 (Unaudited) December 31, June 30, December 31, (Dollars in thousands) 2014 2014 2013 Assets Current assets: Cash and cash equivalents 1,075,307$ 1,613,555$ 2,139,522$ Marketable securities and other investments 886,879 573,701 - Trade accounts receivable, net 1,572,864 1,858,176 1,625,782 Non-trade and notes receivable 428,090 388,437 236,067 Inventories 1,453,996 1,371,681 1,448,628 Prepaid expenses 160,335 129,837 169,262 Deferred income taxes 150,301 136,193 125,612 Total current assets 5,727,772 6,071,580 5,744,873 Plant and equipment, net 1,716,489 1,824,294 1,820,312 Goodw ill 3,011,894 3,171,425 3,161,699 Intangible assets, net 1,090,972 1,188,282 1,220,547 Other assets 1,021,272 1,018,781 916,505 Total assets 12,568,399$ 13,274,362$ 12,863,936$ Liabilities and equity Current liabilities: Notes payable 242,043$ 816,622$ 1,217,292$ Accounts payable 1,145,202 1,252,040 1,074,512 Accrued liabilities 817,152 960,523 839,095 Accrued domestic and foreign taxes 134,754 223,611 172,204 Total current liabilities 2,339,151 3,252,796 3,303,103 Long-term debt 2,725,510 1,508,142 1,507,019 Pensions and other postretirement benefits 1,309,477 1,346,224 1,303,527 Deferred income taxes 86,606 94,819 112,561 Other liabilities 347,514 409,573 339,440 Shareholders' equity 5,756,749 6,659,428 6,295,226 Noncontrolling interests 3,392 3,380 3,060 Total liabilities and equity 12,568,399$ 13,274,362$ 12,863,936$

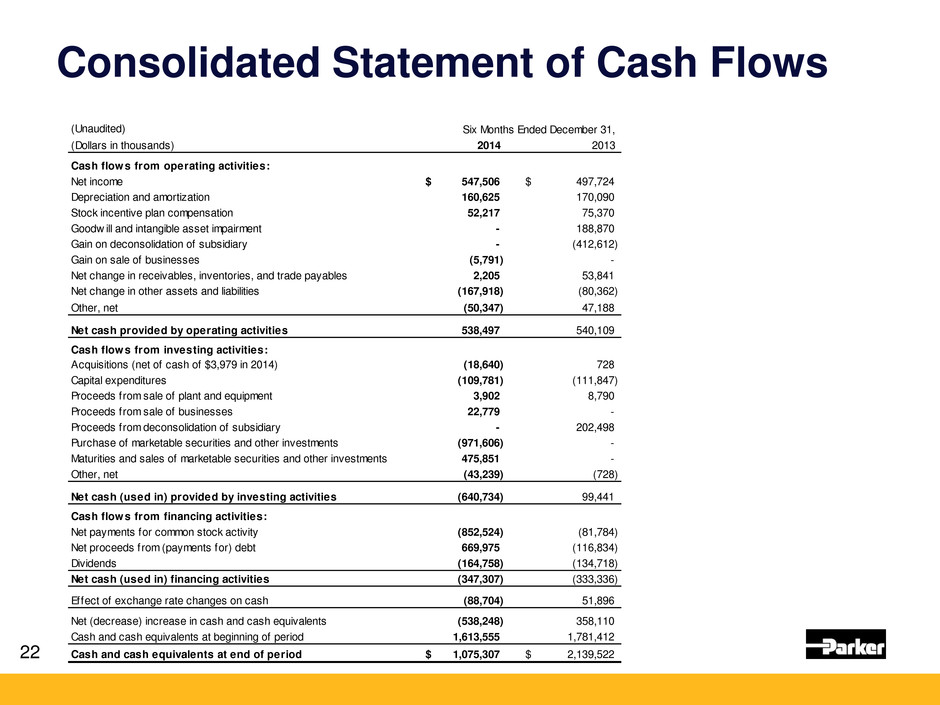

Consolidated Statement of Cash Flows 22 (Unaudited) Six Months Ended December 31, (Dollars in thousands) 2014 2013 Cash flows from operating activities: Net income 547,506$ 497,724$ Depreciation and amortization 160,625 170,090 Stock incentive plan compensation 52,217 75,370 Goodw ill and intangible asset impairment - 188,870 Gain on deconsolidation of subsidiary - (412,612) Gain on sale of businesses (5,791) - Net change in receivables, inventories, and trade payables 2,205 53,841 Net change in other assets and liabilities (167,918) (80,362) Other, net (50,347) 47,188 Net cash provided by operating activities 538,497 540,109 Cash flows from investing activities: Acquisitions (net of cash of $3,979 in 2014) (18,640) 728 Capital expenditures (109,781) (111,847) Proceeds from sale of plant and equipment 3,902 8,790 Proceeds from sale of businesses 22,779 - Proceeds from deconsolidation of subsidiary - 202,498 Purchase of marketable securities and other investments (971,606) - Maturities and sales of marketable securities and other investments 475,851 - Other, net (43,239) (728) Net cash (used in) provided by investing activities (640,734) 99,441 Cash flows from financing activities: Net payments for common stock activity (852,524) (81,784) Net proceeds from (payments for) debt 669,975 (116,834) Dividends (164,758) (134,718) Net cash (used in) financing activities (347,307) (333,336) Effect of exchange rate changes on cash (88,704) 51,896 Net (decrease) increase in cash and cash equivalents (538,248) 358,110 Cash and cash equivalents at beginning of period 1,613,555 1,781,412 Cash and cash equivalents at end of period 1,075,307$ 2,139,522$

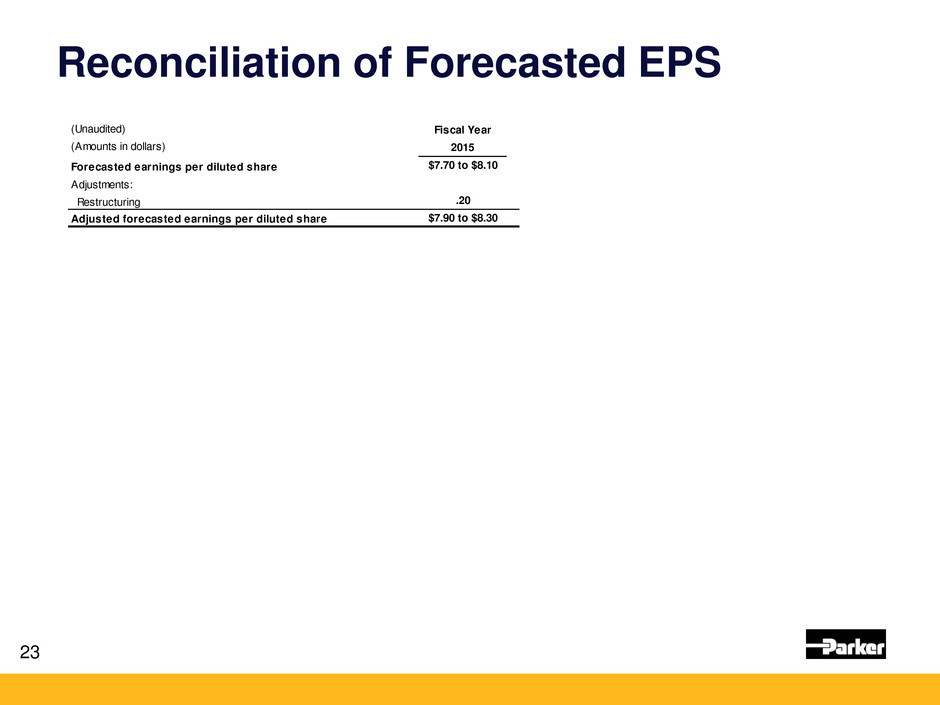

Reconciliation of Forecasted EPS 23 (Unaudited) Fiscal Year (Amounts in dollars) 2015 Forecasted earnings per diluted share $7.70 to $8.10 Adjustments: Restructuring .20 Adjusted forecasted earnings per diluted share $7.90 to $8.30

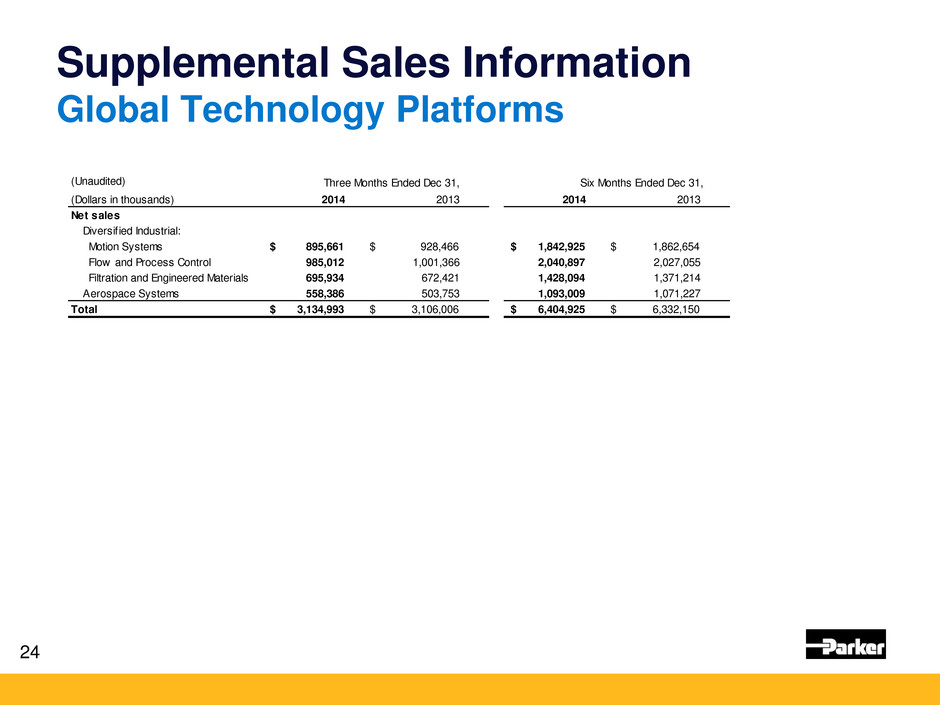

Supplemental Sales Information Global Technology Platforms 24 (Unaudited) Three Months Ended Dec 31, Six Months Ended Dec 31, (Dollars in thousands) 2014 2013 2014 2013 Net sales Diversif ied Industrial: Motion Systems 895,661$ 928,466$ 1,842,925$ 1,862,654$ Flow and Process Control 985,012 1,001,366 2,040,897 2,027,055 Filtration and Engineered Materials 695,934 672,421 1,428,094 1,371,214 Aerospace Systems 558,386 503,753 1,093,009 1,071,227 Total 3,134,993$ 3,106,006$ 6,404,925$ 6,332,150$