Attached files

| file | filename |

|---|---|

| 8-K - 4TH QTR 2014 EARNINGS SLIDES - FIRST MERCHANTS CORP | a8k4thquarter2014earningsc.htm |

First Merchants Corporation NASDAQ: FRME Michael C. Rechin Mark K. Hardwick John J. Martin President Executive Vice President Executive Vice President Chief Executive Officer Chief Financial Officer Chief Credit Officer ® THE STRENGTH OF BIG. THE SERVICE OF SMALL. 4th QUARTER 2014 EARNINGS CALL January 27, 2015

Forward-Looking Statement THE STRENGTH OF BIG. THE SERVICE OF SMALL. www.firstmerchants.com www.firstmerchants.com ® 2 THE STRENGTH OF BIG. THE SERVICE OF SMALL. This filing and the exhibits hereto contain forward-looking statements made pursuant to the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements can often, but not always, be identified by the use of words like “believe”, “continue”, “pattern”, “estimate”, “project”, “intend”, “anticipate”, “expect” and similar expressions or future or conditional verbs such as “will”, would”, “should”, “could”, “might”, “can”, “may”, or similar expressions. These forward-looking statements include, but are not limited to, statements relating to the expected timing and benefits of the proposed merger (the “Merger”) between First Merchants Corporation (“First Merchants”) and C Financial Corporation (“C Financial”), including future financial and operating results, cost savings, enhanced revenues, and accretion/dilution to reported earnings that may be realized from the Merger, as well as other statements of expectations regarding the Merger, and other statements of First Merchants’ goals, intentions and expectations; statements regarding the First Merchants’ business plan and growth strategies; statements regarding the asset quality of First Merchants’ loan and investment portfolios; and estimates of First Merchants’ risks and future costs and benefits, whether with respect to the Merger or otherwise. These forward-looking statements are subject to significant risks, assumptions and uncertainties that may cause results to differ materially from those set forth in forward-looking statements, including, among other things: the risk that the businesses of the First Merchants and C Financial will not be integrated successfully or such integration may be more difficult, time-consuming or costly than expected; expected revenue synergies and cost savings from the Merger may not be fully realized or realized within the expected time frame; revenues following the Merger may be lower than expected; customer and employee relationships and business operations may be disrupted by the Merger; the ability to obtain required governmental and shareholder approvals, and the ability to complete the Merger on the expected timeframe; possible changes in economic and business conditions; the existence or exacerbation of general geopolitical instability and uncertainty; the ability of First Merchants to integrate recent acquisitions and attract new customers; possible changes in monetary and fiscal policies, and laws and regulations; the effects of easing restrictions on participants in the financial services industry; the cost and other effects of legal and administrative cases; possible changes in the credit worthiness of customers and the possible impairment of collectability of loans; fluctuations in market rates of interest; competitive factors in the banking industry; changes in the banking legislation or regulatory requirements of federal and state agencies applicable to bank holding companies and banks like First Merchants’ affiliate bank; continued availability of earnings and excess capital sufficient for the lawful and prudent declaration of dividends; changes in market, economic, operational, liquidity, credit and interest rate risks associated with the First Merchants’ business; and other risks and factors identified in each of First Merchants’ filings with the Securities and Exchange Commission. First Merchants does not undertake any obligation to update any forward-looking statement, whether written or oral, relating to the matters discussed in this filing. In addition, First Merchants’ and C Financial’s past results of operations do not necessarily indicate either of their anticipated future results, whether the Merger is effectuated or not.

Additional Information THE STRENGTH OF BIG. THE SERVICE OF SMALL. www.firstmerchants.com www.firstmerchants.com ® 3 THE STRENGTH OF BIG. THE SERVICE OF SMALL. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any proxy vote or approval. The Merger Agreement will be submitted to C Financial’s shareholders for their consideration. In connection with the proposed merger, it is expected that C Financial will provide its shareholders with a Proxy Statement, as well as other relevant documents concerning the proposed transaction. SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT REGARDING THE MERGER WHEN IT BECOMES AVAILABLE, AS WELL AS ANY OTHER RELEVANT DOCUMENTS CONCERNING THE PROPOSED TRANSACTION, TOGETHER WITH ALL AMENDMENTS OR SUPPPLEMENTS TO THOSE DOCUMENTS, AS THEY WILL CONTAIN IMPORTANT INFORMATION. Non-GAAP Financial Measures These slides contain non-GAAP financial measures. For purposes of Regulation G, a non-GAAP financial measure is a numerical measure of the registrant’s historical or future financial performance, financial position or cash flows that excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly comparable measure calculated and presented in accordance with GAAP in the statement of income, balance sheet or statement of cash flows (or equivalent statements) of the issuer; or includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented. In this regard, GAAP refers to generally accepted accounting principles in the United States. Pursuant to the requirements of Regulation G, First Merchants Corporation has provided reconciliations within the slides, as necessary, of the non-GAAP financial measure to the most directly comparable GAAP financial measure.

www.firstmerchants.com First Merchants 2014 Performance 4 Full-Year Highlights • $60.2 Million of Record Net Income Available to Common Stockholders • Earnings Per Share of $1.65, a 17% increase over FY 2013 • Return on Average Assets of 1.08% • Return on Average Tangible Common Equity of 12.94% • Successful Integration and First Full Year of Citizens Financial Bank Acquisition 4th Quarter Highlights • $15.3 Million of Net Income, or $.41 Earnings Per Share • Community Bank of Noblesville Acquisition Completed November 7 • Acquisition Expenses of $1.9 Million, or $.03 per share ® THE STRENGTH OF BIG. THE SERVICE OF SMALL.

Community Bank of Noblesville Overview THE STRENGTH OF BIG. THE SERVICE OF SMALL. www.firstmerchants.com THE STRENGTH OF BIG. THE SERVICE OF SMALL. www.firstmerchants.com ® 5 Headquartered in Noblesville, Indiana Founded in 1991 Acquisition Completed: November 7, 2014 Loans Acquired Net of Fair Value Marks: $145.1 Million Deposits Acquired: $228.4 Million Transaction Value: $49.2 Million Consideration: 71% Stock, 29% Cash Anticipated Integration Date: April 24, 2015

Post-Closing Observations THE STRENGTH OF BIG. THE SERVICE OF SMALL. www.firstmerchants.com THE STRENGTH OF BIG. THE SERVICE OF SMALL. www.firstmerchants.com ® 6 Indianapolis Market Expansion 9 Full-Service Banking Centers with $228.4M in deposits Adds 7 locations in Hamilton County, the fastest growing Indiana Market Improves FMC Market Share Position from #8 to #4 in Hamilton County Significant Operating Efficiencies, including Banking Center Consolidation Opportunities Cost Savings Estimated to be 40%, or $2.8 Million Post-Integration Accretive to EPS Beginning in 2015 4th Quarter Transaction Expense of $1.9 Million Credit, OREO and Interest Rate Marks of $11.6 Million 3-Year Tangible Book Value Earn-Back

Executive Vice President and Chief Financial Officer www.firstmerchants.com ® 7 THE STRENGTH OF BIG. THE SERVICE OF SMALL.

www.firstmerchants.com Total Assets 2012 2013 2014 1. Investments $ 874 $1,096 $1,181 2. Loans Held for Sale 22 5 7 3. Loans 2,902 3,633 3,925 4. Allowance (69) (68) (64) 5. CD&I & Goodwill 150 203 219 6. BOLI 125 165 169 7. Other 301 403 387 8. Total Assets $4,305 $5,437 $5,824 ($ in Millions) 8 ® THE STRENGTH OF BIG. THE SERVICE OF SMALL.

www.firstmerchants.com Commercial & Industrial 22.8% Commercial Real Estate Owner-Occupied 13.6% Commercial Real Estate Non-Owner Occupied 24.8%Construction, Land & Land Development 5.3% Agricultural Land 4.1% Agricultural Production 2.7% Other Commercial 0.9% Residential Mortgage 16.6% Home Equity 7.3% Other Consumer 1.9% Loan and Yield Detail (as of 12/31/2014) QTD Yield = 4.46% YTD Yield = 4.58% Total Loans = $3.9 Billion 9 ® THE STRENGTH OF BIG. THE SERVICE OF SMALL.

www.firstmerchants.com • $1.2 billion balance • Average duration of 4.2 years • Tax equivalent yield of 3.89% • Net unrealized gain of $42.4 million Investment Portfolio (as of 12/31/2014) 10 Mortgage- Backed Securities 32% Collateralized Mortgage Obligations 30% Corporate Obligations 3% Tax-Exempt Municipals 35% ® THE STRENGTH OF BIG. THE SERVICE OF SMALL.

www.firstmerchants.com 2012 2013 2014 1. Customer Non-Maturity Deposits $2,479 $3,276 $3,523 2. Customer Time Deposits 739 868 784 3. Brokered Deposits 128 87 334 4. Borrowings 260 401 290 5. Other Liabilities 39 48 44 6. Hybrid Capital 107 122 122 7. Preferred Stock (SBLF) 91 8. Common Equity 462 635 727 9. Total Liabilities and Capital $4,305 $5,437 $5,824 10. Tangible Common Book Value Per Share $10.95 $12.17 $13.65 Percentage Change 13.6% 11.1% 12.2% Total Liabilities and Capital ($ in Millions) 11 ® THE STRENGTH OF BIG. THE SERVICE OF SMALL. – –

www.firstmerchants.com Deposits and Cost of Funds Detail (as of 12/31/2014) 12 ® Demand Deposits 46% Savings Deposits 30% Certificates & Time Deposits of >$100,000 6% Certificates & Time Deposits of <$100,000 11% Brokered Deposits 7% QTD Cost = .38% YTD Cost = .34% Total Deposits = $4.6 Billion THE STRENGTH OF BIG. THE SERVICE OF SMALL.

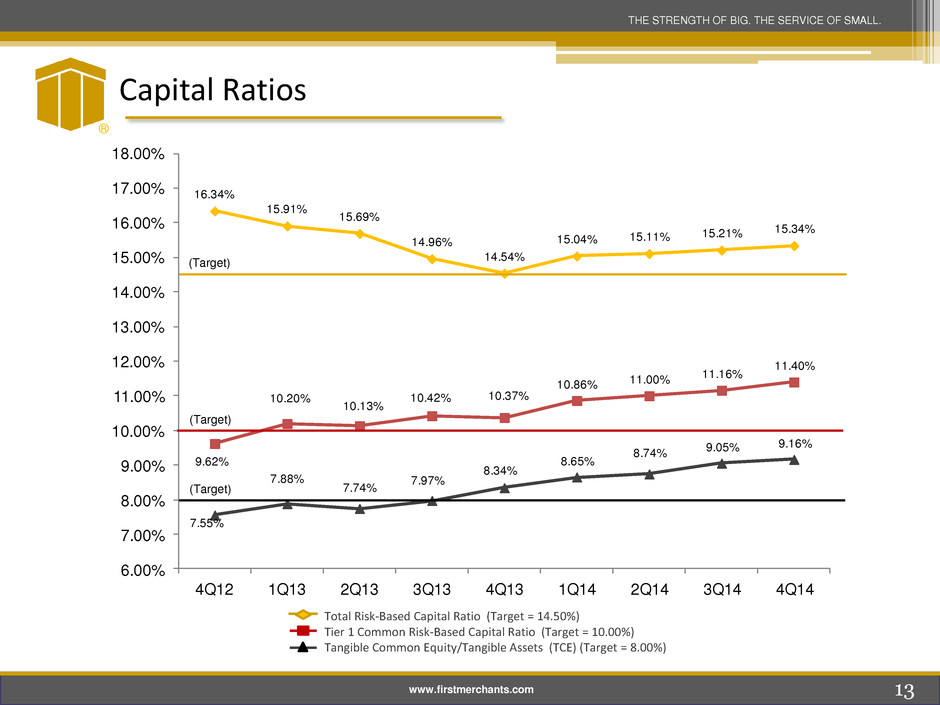

www.firstmerchants.com Capital Ratios 9.62% 10.20% 10.13% 10.42% 10.37% 10.86% 11.00% 11.16% 11.40% 7.55% 7.88% 7.74% 7.97% 8.34% 8.65% 8.74% 9.05% 9.16% 16.34% 15.91% 15.69% 14.96% 14.54% 15.04% 15.11% 15.21% 15.34% 6.00% 7.00% 8.00% 9.00% 10.00% 11.00% 12.00% 13.00% 14.00% 15.00% 16.00% 17.00% 18.00% 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 Total Risk-Based Capital Ratio (Target = 14.50%) Tier 1 Common Risk-Based Capital Ratio (Target = 10.00%) Tangible Common Equity/Tangible Assets (TCE) (Target = 8.00%) (Target) (Target) (Target) 13 ® THE STRENGTH OF BIG. THE SERVICE OF SMALL.

www.firstmerchants.com Net Interest Margin 14 ® THE STRENGTH OF BIG. THE SERVICE OF SMALL. $158.1 $160.3 $195.0 4.12% 3.99% 3.91% 4.00% 3.94% 3.73% 3.00% 3.20% 3.40% 3.60% 3.80% 4.00% 4.20% $100 $120 $140 $160 $180 $200 2012 2013 2014 Net Interest Income - FTE ($millions) Net Interest Margin Net Interest Margin - Adjusted 2012 2013 2014 Net Interest Income-FTE ($millions) $ 158.1 $ 160.3 $ 195.0 Fair Value Accretion ($millions) $ 4.6 $ 2.2 $ 8.9 Tax Equivalent Yield on Earning Assets 4.74% 4.40% 4.35% Cost of Supporting Liabilities 0.62% 0.41% 0.44% Net Interest Margin 4.12% 3.99% 3.91%

www.firstmerchants.com 2012 2013 2014 1. Service Charges on Deposit Accounts $11.6 $12.4 $15.7 2. Trust Fees 7.9 8.6 9.0 3. Insurance Commission Income 6.2 7.1 7.4 4. Electronic Card Fees 7.3 7.5 9.7 5. Cash Surrender Value of Life Ins 3.4 2.6 3.7 6. Gains on Sales Mortgage Loans 10.6 7.5 4.9 7. Securities Gains/Losses 2.4 0.5 3.6 8. Gain on FDIC Transaction 9.1 9. Other 5.8 8.6 11.7 10. Total $64.3 $54.8 $65.7 11. Adjusted Non-Interest Income1 $52.8 $54.3 $62.1 ($ in Millions) Non-Interest Income 1Adjusted for Bond Gains & Losses and Gain on FDIC-Modified Whole-Bank Transaction 15 ® THE STRENGTH OF BIG. THE SERVICE OF SMALL. – –

www.firstmerchants.com Non-Interest Expense 2012 2013 2014 1. Salary & Benefits $ 79.4 $ 85.4 $ 96.5 2. Premises & Equipment 17.4 18.0 23.2 3. Core Deposit Intangible 1.9 1.6 2.4 4. Professional & Other Outside Services 6.2 8.3 8.1 5. OREO/Foreclosure Expense 8.2 6.7 8.0 6. FDIC Expense 3.5 2.9 3.7 7. Outside Data Processing 5.7 5.6 7.3 8. Marketing 2.2 2.2 3.5 9. Other 12.6 12.5 15.8 10. Non-Interest Expense $137.1 $143.2 $168.5 ($ in Millions) 16 ® THE STRENGTH OF BIG. THE SERVICE OF SMALL.

2012 2013 2014 1. Net Interest Income $152.3 $154.3 $187.0 2. Provision for Loan Losses (18.5) (6.6) (2.6) 3. Net Interest Income after Provision 133.8 147.7 184.4 4. Non-Interest Income 64.3 54.8 65.7 5. Non-Interest Expense (137.1) (143.2) (168.5) 6. Income before Income Taxes 61.0 59.3 81.6 7. Income Tax Expense (15.9) (14.7) (21.4) 8. Preferred Stock Dividend (4.5) (2.4) ___ 9. Net Income Avail. for Distribution $ 40.6 $ 42.2 $ 60.2 10. EPS $ 1.41 $ 1.41 $ 1.65 www.firstmerchants.com Earnings ($ in Millions) ® 17 THE STRENGTH OF BIG. THE SERVICE OF SMALL. –

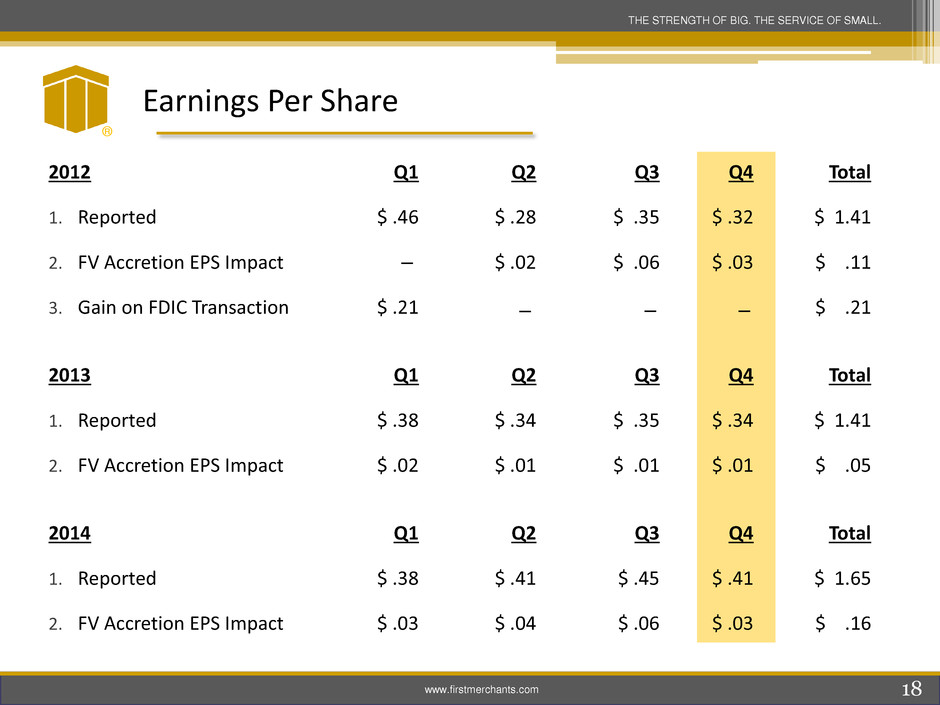

2012 Q1 Q2 Q3 Q4 Total 1. Reported $ .46 $ .28 $ .35 $ .32 $ 1.41 2. FV Accretion EPS Impact $ .02 $ .06 $ .03 $ .11 3. Gain on FDIC Transaction $ .21 $ .21 2013 Q1 Q2 Q3 Q4 Total 1. Reported $ .38 $ .34 $ .35 $ .34 $ 1.41 2. FV Accretion EPS Impact $ .02 $ .01 $ .01 $ .01 $ .05 2014 Q1 Q2 Q3 Q4 Total 1. Reported $ .38 $ .41 $ .45 $ .41 $ 1.65 2. FV Accretion EPS Impact $ .03 $ .04 $ .06 $ .03 $ .16 www.firstmerchants.com Earnings Per Share ® 18 THE STRENGTH OF BIG. THE SERVICE OF SMALL. – – – –

Executive Vice President and Chief Credit Officer www.firstmerchants.com ® 19 THE STRENGTH OF BIG. THE SERVICE OF SMALL.

® www.firstmerchants.com 20 Loan Portfolio Trends ($ in Millions) THE STRENGTH OF BIG. THE SERVICE OF SMALL. FMB 2013 Q3-'14 2014 1 CBN 2014 $ % 1 % $ % 1 % 186.1 1. Commercial & Industrial 761.7$ 901.0$ 888.3$ 8.4$ 896.7$ (4.3)$ (1.4%) (0.5%) 135.0$ 16.6% 17.7% 2. Construction, Land and Land Development 177.1 178.2 186.1 21.2 207.3 29.1 4.4% 16.3% 30.2 5.1% 17.1% 3. CRE Non-Owner Occupied 963.4 953.2 934.5 41.2 975.7 22.5 (2.0%) 2.4% 12.3 (3.0%) 1.3% 4. CRE Owner Occupied 501.1 492.9 513.1 21.6 534.7 41.8 4.1% 8.5% 33.6 2.4% 6.7% 5. Agricultural Production 114.3 99.7 103.8 1.1 104.9 5.2 4.1% 5.2% (9.4) (9.2%) (8.2%) 6. Agricultural Land 147.3 157.6 153.9 8.4 162.3 4.7 (2.3%) 3.0% 15.0 4.5% 10.2% 7. Residential Mortgage 616.4 625.6 619.8 27.5 647.3 21.7 (0.9%) 3.5% 30.9 0.6% 5.0% 8. Home Equity 255.2 270.0 276.6 9.9 286.5 16.5 2.4% 6.1% 31.3 8.4% 12.3% 9. Other Commercial 26.1 27.5 35.6 0.5 36.1 8.6 29.5% 31.3% 10.0 36.4% 38.3% 10. Other Consumer 69.8 66.8 71.9 1.5 73.4 6.6 7.6% 9.9% 3.6 3.0% 5.2% 11. Loans 3,632.4$ 3,772.5$ 3,783.6$ 141.3$ 3,924.9$ $152.4 0.3% 4.0% 292.5$ 4.2% 8.1% 1 excluded acquired CBN loans Change Year Over Year Change Linked Quarter

www.firstmerchants.com Asset Quality Summary ® 21 ($ in Millions) THE STRENGTH OF BIG. THE SERVICE OF SMALL. FMB 2012 2013 2014 1 CBN 2014 % % 1 1. Non-Accrual Loans 53.4$ 56.4$ 43.1$ 5.7$ 48.8$ (13.5%) (23.6%) 2. Other Real Estate 13.3$ 22.2$ 12.6$ 6.7$ 19.3$ (13.1%) (43.2%) 3. Renegotiated Loans 12.7$ 3.0$ 2.0$ -$ 2.0$ (33.3%) (33.3%) 4. 90+ Days Delinquent Loans 2.0$ 1.4$ 4.6$ 0.1$ 4.7$ 5. NPAs/Loans and ORE 2.70% 2.23% 1.64% 8.44% 1.77% 6. Classified Assets 184.4$ 191.9$ 172.1$ 19.7$ 191.8 (0.1%) (10.3%) 7. Criticized Assets (includes Classified) 250.2$ 263.5$ 224.8$ 28.8$ 253.6$ (3.8%) (14.7%) 8. Specific Reserves 4.2$ 1.6$ 2.8$ -$ 2.8$ 75.0% 75.0% 9. Allowance for Loan and Lease Losses 69.4$ 67.9$ 64.0$ -$ 64.0$ (5.7%) (5.7%) 10. ALLL/Non-Accrual Loans 129.9% 120.4% 148.5% 131.1% 1 excluded acquired CBN loans Year over Year

Q1-Q3 2013 2014 Q4-'14 1 CBN 2014 1. Beginning Balance NPA's & 90+ Days Delinquent 81.4$ 83.0$ 65.6$ 83.0$ Non-Accrual 2. Add: New Non-Accruals 45.7 35.7 5.4 5.7$ 46.8 3. Less: To Accrual/Payoff/Renegotiated (17.0) (26.7) (5.7) (32.4) 4. Less: To OREO (7.6) (3.9) (0.7) (4.6) 5. Less: Charge-offs (18.1) (12.4) (5.0) (17.4) 6. Increase / (Decrease): Non-Accrual Loans 3.0 (7.3) (6.0) 5.7 (7.6) Other Real Estate Owned (ORE) 7. Add: New ORE Properties 20.5 3.9 0.7 6.7 11.3 8. Less: ORE Sold (8.6) (7.9) (2.3) (10.2) 9. Less: ORE Losses (write-downs) (2.9) (3.7) (0.3) (4.0) 10. Increase / (Decrease): ORE 9.0 (7.7) (1.9) 6.7 (2.9) 11. Increase / (Decrease): 90+ Days Delinquent (0.8) (0.5) 3.7 0.1 3.3 12. Increase / (Decrease): Restructured Loans (9.6) (1.9) 0.8 (1.1) 13. Total NPA Change 1.6 (17.4) (3.4) 12.5 (8.3) 14. Ending Balance NPA's & 90+ Days Delinquent 83.0$ 65.6$ 62.2$ 12.5$ 74.7$ 1 excluded acquired CBN loans www.firstmerchants.com Non-Performing Asset Reconciliation ® 22 ($ in Millions) THE STRENGTH OF BIG. THE SERVICE OF SMALL.

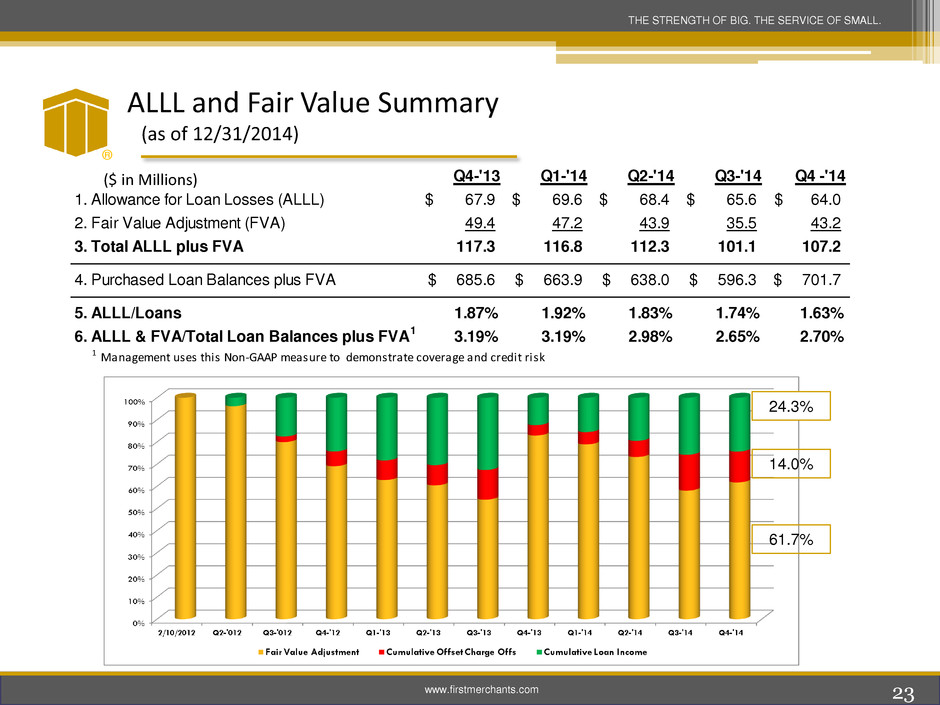

® www.firstmerchants.com 23 ALLL and Fair Value Summary (as of 12/31/2014) ($ in Millions) THE STRENGTH OF BIG. THE SERVICE OF SMALL. 24.3% 14.0% 61.7% Q4-'13 Q1-'14 Q2-'14 Q3-'14 Q4 -'14 1. Allowance for Loan Losses (ALLL) 67.9$ 69.6$ 68.4$ 65.6$ 64.0$ 2. Fair Value Adjustment (FVA) 49.4 47.2 43.9 35.5 43.2 3. Total ALLL plus FVA 117.3 116.8 112.3 101.1 107.2 4. Purchased Loan Balances plus FVA 685.6$ 663.9$ 638.0$ 596.3$ 701.7$ 5. ALLL/Loans 1.87% 1.92% 1.83% 1.74% 1.63% 6. ALLL & FVA/Total Loan Balances plus FVA 1 3.19% 3.19% 2.98% 2.65% 2.70% 1 Management uses this Non-GAAP measure to demonstrate coverage and credit risk

President and Chief Executive Officer www.firstmerchants.com ® 24 THE STRENGTH OF BIG. THE SERVICE OF SMALL.

www.firstmerchants.com Strategy and Tactics Overview ® 25 Focus on the Customer Experience • Continue to advance our loan process for speed and accuracy • Evaluate and enhance our technology platforms • Invest in mobile and online banking Intensify Revenue-Generating Activities • Achieve organic growth throughout the franchise • Develop and retain outstanding talent • Leverage our Centers of Influence and Regional Board relationships Improve Efficiency • Fully integrate the Community Bank of Noblesville acquisition • Continue branch rationalization • Line of business optimization Assess Acquisition Opportunities in Our Marketplace • Announced Definitive Agreement with C Financial Corporation and Cooper State Bank in Columbus, Ohio • Targeting a 2nd quarter close and 4th quarter integration THE STRENGTH OF BIG. THE SERVICE OF SMALL.

Cooper State Bank Summary THE STRENGTH OF BIG. THE SERVICE OF SMALL. www.firstmerchants.com THE STRENGTH OF BIG. THE SERVICE OF SMALL. www.firstmerchants.com ® 26 Definitive Agreement Signed January 5, 2015 Headquartered in Columbus, Ohio Founded in 2004 Balance Sheet as of September 30, 2014 $135 Million in Assets $115 Million in Loans $102 Million in Deposits Income Statement for Quarter-End September 30, 2014 Net Income of $170,000 Net Interest Margin of 4.08% Sub S Ownership

Financial Overview THE STRENGTH OF BIG. THE SERVICE OF SMALL. www.firstmerchants.com THE STRENGTH OF BIG. THE SERVICE OF SMALL. www.firstmerchants.com ® 27 Transaction Value $14.5 Million Consideration 100% Cash Required Approvals Regulatory and C Financial Corporation Shareholders Key Assumptions Cost Savings Estimated to be 30%, or $2.0 Million Estimated One-Time Transaction Costs of $1.3 Million Credit and Interest Rate Marks of Approximately $2.8 Million Capital Impact: Accretive to EPS Beginning in 1st Full Year Tangible Book Value Earn-Back Within Four Years Minimal Impact to Capital Ratios Termination Fee: $1.0 Million Anticipated Closing: 2nd Quarter 2015

Transaction Rationale THE STRENGTH OF BIG. THE SERVICE OF SMALL. www.firstmerchants.com THE STRENGTH OF BIG. THE SERVICE OF SMALL. www.firstmerchants.com ® 28 Columbus Ohio Market Expansion Adds 6 Full-Service Banking Centers to our $500M Commercial Banking Presence • Banking Centers situated in Prime Columbus, Ohio locations • Improves FMC’s Market Position from #13 to #12 Strategic Opportunity Financially Attractive Accretive to EPS Beginning in 2016 Tangible Book Value Earn-Back within 4 Years Significant Operating Efficiencies – Approximately 30% Cost Saves Attractive Risk Profile Due Diligence Process Completed Cultural Fit, Retention of Key Management Members Experienced Acquirer, Core Competency in Integration Processes Market Opportunity Attractive and Growing Market One of the fastest growing Cities in America

First Merchants Corporation common stock is traded on the NASDAQ Global Select Market under the symbol FRME Additional information can be found at www.firstmerchants.com Investor inquiries: David L. Ortega Investor Relations Telephone: 765.378.8937 dortega@firstmerchants.com FIRST MERCHANTS and the Shield Logo are registered trademarks of First Merchants Corporation Contact Information ® 29 www.firstmerchants.com THE STRENGTH OF BIG. THE SERVICE OF SMALL.

www.firstmerchants.com ® 30 THE STRENGTH OF BIG. THE SERVICE OF SMALL.

® www.firstmerchants.com 31 Appendix – Non-GAAP Reconciliation THE STRENGTH OF BIG. THE SERVICE OF SMALL. TANGIBLE CAPITAL (dollars in thousands) 2014 Return on Average Tangible Equity Average Stockholders' Equity (GAAP) $ 675,295 Less: Average Preferred Stock (125) Less: Average Intangible Assets, net of tax (199,354) Average Tangible Equity (non-GAAP) 475,816 Net Income Available to Common Shareholders $ 60,162 Add: Intangible Amortization, net of tax 1,395 Tangible Net Income $ 61,557 Return on Average Tangible Equity (non-GAAP) 12.94%

® www.firstmerchants.com 32 Appendix – Non-GAAP Reconciliation THE STRENGTH OF BIG. THE SERVICE OF SMALL. CAPITAL RATIOS (dollars in thousands) 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 Total Risk-Based Capital Ratio Total Stockholders' Equity (GAAP) $ 552,236 538,558 539,293 513,469 634,923 652,111 670,596 684,553 726,827 Less: Accumulated Other Comprehensive Income (Loss) a 5,499 6,748 15,179 16,198 6,410 1,016 (4,210) (4,150) 1,629 Add: Qualifying Capital Securities 55,000 55,000 55,000 55,000 55,000 55,000 55,000 55,000 55,000 Less: Disallowed Goodwill (149,529) (149,142) (148,759) (148,376) (202,767) (202,175) (201,583) (200,992) (218,755) Less: Disallowed Servicing Assets (99) (105) (110) (105) (186) (177) (171) (166) (166) Less: Disallowed Deferred Tax Assets (6,975) (10,194) (4,677) (1,357) Total Tier I Capital (Regulatory) $ 456,132 $ 451,059 $ 460,603 $ 436,186 $ 483,186 $ 501,098 $ 518,275 $ 534,245 $ 564,535 Qualifying Subordinated Debentures 30,000 20,000 20,000 20,000 65,000 65,000 65,000 65,000 65,000 Allowance for Loan Losses includible in Tier 2 Capital 40,660 40,538 42,007 41,936 51,780 51,556 52,809 53,803 55,972 Total Risk-Based Capital (Regulatory) $ 526,792 $ 511,597 $ 522,610 $ 498,122 $ 599,966 $ 617,654 $ 636,084 $ 653,048 $ 685,507 Net Risk-Weighted Assets (Regulatory) $ 3,224,088 $ 3,215,063 $ 3,331,374 $ 3,330,623 $ 4,126,337 $ 4,106,423 $ 4,209,145 $ 4,292,495 $ 4,469,765 Total Risk-Based Capital Ratio (Regulatory) 16.34% 15.91% 15.69% 14.96% 14.54% 15.04% 15.11% 15.21% 15.34% Tier I Common Risk-Based Capital Ratio Total Tier I Capital (Regulatory) $ 456,132 $ 451,059 $ 460,603 $ 436,186 $ 483,186 $ 501,098 $ 518,275 $ 534,245 $ 564,535 Less: Qualified Capital Securities (55,000) (55,000) (55,000) (55,000) (55,000) (55,000) (55,000) (55,000) (55,000) Less: Preferred Stock (90,908) (68,212) (68,212) (34,168) (125) (125) (125) (125) (125) Total Tier I Common Capital (non-GAAP) $ 310,224 $ 327,847 $ 337,391 $ 347,018 $ 428,061 $ 445,973 $ 463,150 $ 479,120 $ 509,410 Net Risk-Weighted Assets (Regulatory) $ 3,224,088 $ 3,215,063 $ 3,331,374 $ 3,330,623 $ 4,126,337 $ 4,106,423 $ 4,209,145 $ 4,292,495 $ 4,469,765 Tier I Common Risk-Based Capital Ratio (non-GAAP) 9.62% 10.20% 10.13% 10.42% 10.37% 10.86% 11.00% 11.16% 11.40% a Includes net unrealized gains or losses on securities available for sale, net gains or losses on cash flow hedges, and amounts resulting from the application of the applicable accounting guidance for defined benefit and other postretirement plans.

® www.firstmerchants.com 33 Appendix – Non-GAAP Reconciliation THE STRENGTH OF BIG. THE SERVICE OF SMALL. TANGIBLE EQUITY AND TANGIBLE RATIOS (dollars in thousands) Tangible Common Equity/Tangible Assets (non-GAAP) 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 Total Stockholders' Equity (GAAP) $ 552,236 $ 538,557 $ 539,293 $ 513,469 $ 634,923 $ 652,111 $ 670,596 $ 684,553 $ 726,827 Less: Preferred Stock (90,908) (68,212) (68,212) (34,168) (125) (125) (125) (125) (125) Less: Intangible Assets, net of tax (147,280) (146,872) (146,467) (145,984) (197,794) (197,293) (196,781) (196,315) (212,669) Tangible Common Equity (non-GAAP) $ 314,048 $ 323,473 $ 324,614 $ 333,317 $ 437,004 $ 454,693 $ 473,690 $ 488,113 $ 514,033 Total Assets (GAAP) $ 4,304,821 $ 4,252,829 $ 4,338,264 $ 4,325,911 $ 5,437,262 $ 5,452,936 $ 5,615,120 $ 5,591,383 $ 5,824,127 Less: Intangibles, net of tax (147,280) (146,872) (146,467) (145,984) (197,794) (197,293) (196,781) (196,315) (212,669) Tangible Assets (non-GAAP) $ 4,157,541 $ 4,105,957 $ 4,191,797 $ 4,179,927 $ 5,239,468 $ 5,255,643 $ 5,418,339 $ 5,395,068 $ 5,611,458 Tangible Common Equity/Tangible Assets (non-GAAP) 7.55% 7.88% 7.74% 7.97% 8.34% 8.65% 8.74% 9.05% 9.16% Shares Outstanding 28,692,616 28,780,609 28,801,848 28,825,465 35,921,761 36,014,083 36,052,209 36,074,246 37,669,948 Tangible Common Book Value per Share (non-GAAP) $ 10.95 $ 11.24 $ 11.27 $ 11.56 $ 12.17 $ 12.63 $ 13.14 $ 13.53 $ 13.65