Attached files

| file | filename |

|---|---|

| 8-K - MEADWESTVACO Corp | body.htm |

| EX-99.1 - MEADWESTVACO Corp | pressrelease.htm |

Creating a Global Packaging Leader January 26, 2015

Forward Looking Statements Forward-Looking StatementsThis document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are typically identified by words or phrases such as “may,” “will,” “could,” “should,” “would,” “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “target,” “prospects,” “potential” and “forecast,” and other words, terms and phrases of similar meaning. Forward-looking statements involve estimates, expectations, projections, goals, forecasts, assumptions, risks and uncertainties. RockTenn and MeadWestvaco caution readers that any forward-looking statement is not a guarantee of future performance and that actual results could differ materially from those contained in the forward-looking statement. Such forward-looking statements include, but are not limited to, statements regarding the anticipated closing date of the transaction, the ability to obtain regulatory and shareholder approvals and satisfy the other conditions to the closing of the transaction, the successful closing of the transaction and the integration of RockTenn and MeadWestvaco as well as opportunities for operational improvement including but not limited to cost reduction and capital investment, the strategic opportunity and perceived value to RockTenn’s and MeadWestvaco’s respective shareholders of the transaction, the transaction’s impact on, among other things, the combined company’s prospective business mix, margins, transitional costs and integration to achieve the synergies and the timing of such costs and synergies and earnings. With respect to these statements, RockTenn and MeadWestvaco have made assumptions regarding, among other things, whether and when the proposed transaction will be approved; whether and when the proposed transaction will close; the results and impacts of the proposed transaction; whether and when the spin-off of MeadWestvaco Specialty Chemicals will occur; economic, competitive and market conditions generally; volumes and price levels of purchases by customers; competitive conditions in RockTenn and MeadWestvaco’s businesses and possible adverse actions of their respective customers, competitors and suppliers. Further, RockTenn and MeadWestvaco’s businesses are subject to a number of general risks that would affect any such forward-looking statements including, among others, decreases in demand for their products; increases in energy, raw materials, shipping and capital equipment costs; reduced supply of raw materials; fluctuations in selling prices and volumes; intense competition; the potential loss of certain customers; and adverse changes in general market and industry conditions. Such risks and other factors that may impact management’s assumptions are more particularly described in RockTenn’s and MeadWestvaco’s filings with the Securities and Exchange Commission, including under the caption “Business – Forward-Looking Information” and “Risk Factors” in RockTenn’s Annual Report on Form 10-K for the fiscal year ended September 30, 2014 and “Management’s discussion and analysis of financial condition and results of operations – Forward-looking Statements” and “Risk factors” in MeadWestvaco’s Annual Report on Form 10-K for the fiscal year ended December 31, 2013. The information contained herein speaks as of the date hereof and neither RockTenn nor MeadWestvaco have or undertake any obligation to update or revise their forward-looking statements, whether as a result of new information, future events or otherwise.Disclaimer and Use of Non-GAAP Financial Measures and ReconciliationsWe may from time to time be in possession of certain information regarding RockTenn that applicable law would not require us to disclose to the public in the ordinary course of business, but would require us to disclose if we were engaged in the purchase or sale of our securities. This presentation shall not be considered to be part of any solicitation of an offer to buy or sell RockTenn securities. This presentation also may not include all of the information regarding RockTenn, MWV or NewCo that you may need to make an investment decision regarding our securities. Any such investment decision should be made on the basis of the total mix of information that is publicly available as of the date of such decision. We have included financial measures that are not prepared in accordance with accounting principles generally accepted in the United States ("GAAP"). The non-GAAP financial measures presented are not intended to be a substitute for GAAP financial measures, and any analysis of non-GAAP financial measures should be used only in conjunction with results presented in accordance with GAAP and the reconciliations of non-GAAP financial measures to GAAP financial measures included in the Appendix to this presentation.

Legends NO OFFER OR SOLICITATION The information in this communication is for informational purposes only and is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe for or buy any securities or the solicitation of any vote or approval in any jurisdiction pursuant to or in connection with the proposed transactions or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law. ADDITIONAL INFORMATION AND WHERE TO FIND IT The proposed transaction involving MeadWestvaco and RockTenn will be submitted to the respective shareholders of MeadWestvaco and RockTenn for their consideration. In connection with the proposed transaction, MeadWestvaco and RockTenn will cause the newly formed company to file with the SEC a registration statement on Form S-4 (the “Registration Statement”), which will include a prospectus with respect to the shares to be issued in the proposed transaction and a preliminary and definitive joint proxy statement for the shareholders of MeadWestvaco and RockTenn (the “Joint Proxy Statement”) and each of MeadWestvaco and RockTenn will mail the Joint Proxy Statement to their respective shareholders and file other documents regarding the proposed transaction with the SEC. The definitive Registration Statement and the Joint Proxy Statement will contain important information about the proposed transaction and related matters. SECURITY HOLDERS ARE URGED AND ADVISED TO READ THE REGISTRATION STATEMENT AND THE JOINT PROXY STATEMENT CAREFULLY WHEN THEY BECOME AVAILABLE, AS WELL AS ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC AND ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. The Registration Statement, the Joint Proxy Statement and other relevant materials (when they become available) and any other documents filed or furnished by MeadWestvaco or RockTenn with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, security holders will be able to obtain free copies of the Registration Statement and the Joint Proxy Statement from RockTenn by going to its investor relations page on its corporate website at http://ir.rocktenn.com and from MeadWestvaco on its corporate website at www.mwv.com. PARTICIPANTS IN THE SOLICITATIONMeadWestvaco, RockTenn, their respective directors and certain of their executive officers and employees may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction. Information about RockTenn’s directors and executive officers is set forth in its definitive proxy statement for its 2015 Annual Meeting of Shareholders, which was filed with the SEC on December 19, 2014, and information about MeadWestvaco’s directors and executive officers is set forth in its definitive proxy statement for its 2014 Annual Meeting of Stockholders, which was filed with the SEC on March 26, 2014. These documents are available free of charge from the sources indicated above, from RockTenn by going to its investor relations page on its corporate web site at http://ir.rocktenn.com and from MeadWestvaco on its website at www.mwv.com. Additional information regarding the interests of participants in the solicitation of proxies in connection with the proposed transaction will be included in the Registration Statement, the Joint Proxy Statement and other relevant materials RockTenn and MeadWestvaco intend to file with the SEC.

Steve VoorheesCEO John LukeChairman & CEO

Combination of Leading Packaging Companies One of North America’s leading providers of packaging solutions and manufacturers of containerboard and paperboard 27,000 employees in ~200 operating facilities, primarily in North AmericaApproximately 9.9 million tons of mill capacity and ~100 billion square feet of converting production Global provider of innovative packaging and dispensing solutions, with unique commercial capabilities with the world’s most admired brands15,000 employees at 125 facilities in 30 countries throughout the Americas, Europe and AsiaLeading manufacturer of approximately 3 million tons of bleached, coated kraft and industrial paperboard50% of revenue from international markets Highly complementary product, end market and geographic mix A Merger of RockTenn and MWV Creates a $16 Billion Global Provider of Consumer and Corrugated Packaging

Combination of Leading Global Packaging Players Includes all publicly listed packaging companies with greater than US$3bn in revenue. Revenue is LTM to 9/30/14. For Amcor, Mondi, Rexam, and Nine Dragons Paper, revenue is LTM to 6/30/14. Foreign sales figures converted to USD at the spot rate as of 9/30/2014.International Paper LTM 9/30/14 revenue is shown pro forma for the spin-off of xpedx in July 2014.Source: company filings (3) Total Revenue(1)(2)(US$ in mm) $15.7 billion global consumer and corrugated packaging (LTM 12/31/14 revenue)$21 billion combined enterprise valueFocused on customers, innovation and operational excellenceLeading (#1 or #2) market positions Over 300 operating locations globally

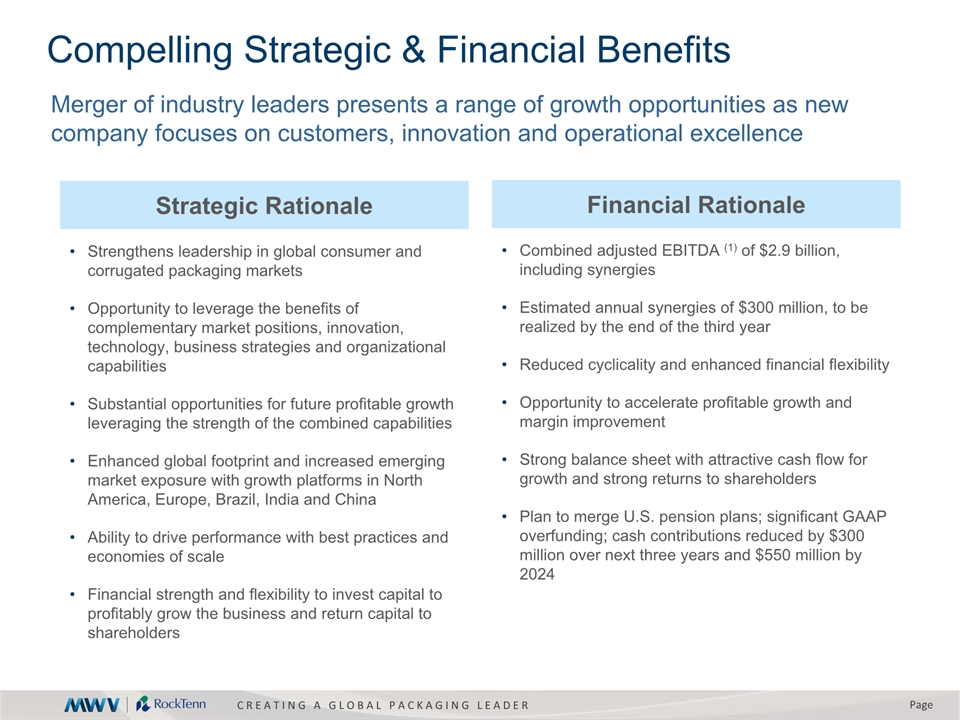

Compelling Strategic & Financial Benefits Strengthens leadership in global consumer and corrugated packaging marketsOpportunity to leverage the benefits of complementary market positions, innovation, technology, business strategies and organizational capabilitiesSubstantial opportunities for future profitable growth leveraging the strength of the combined capabilitiesEnhanced global footprint and increased emerging market exposure with growth platforms in North America, Europe, Brazil, India and ChinaAbility to drive performance with best practices and economies of scaleFinancial strength and flexibility to invest capital to profitably grow the business and return capital to shareholders Combined adjusted EBITDA (1) of $2.9 billion, including synergiesEstimated annual synergies of $300 million, to be realized by the end of the third yearReduced cyclicality and enhanced financial flexibilityOpportunity to accelerate profitable growth and margin improvementStrong balance sheet with attractive cash flow for growth and strong returns to shareholdersPlan to merge U.S. pension plans; significant GAAP overfunding; cash contributions reduced by $300 million over next three years and $550 million by 2024 Merger of industry leaders presents a range of growth opportunities as new company focuses on customers, innovation and operational excellence Strategic Rationale Financial Rationale

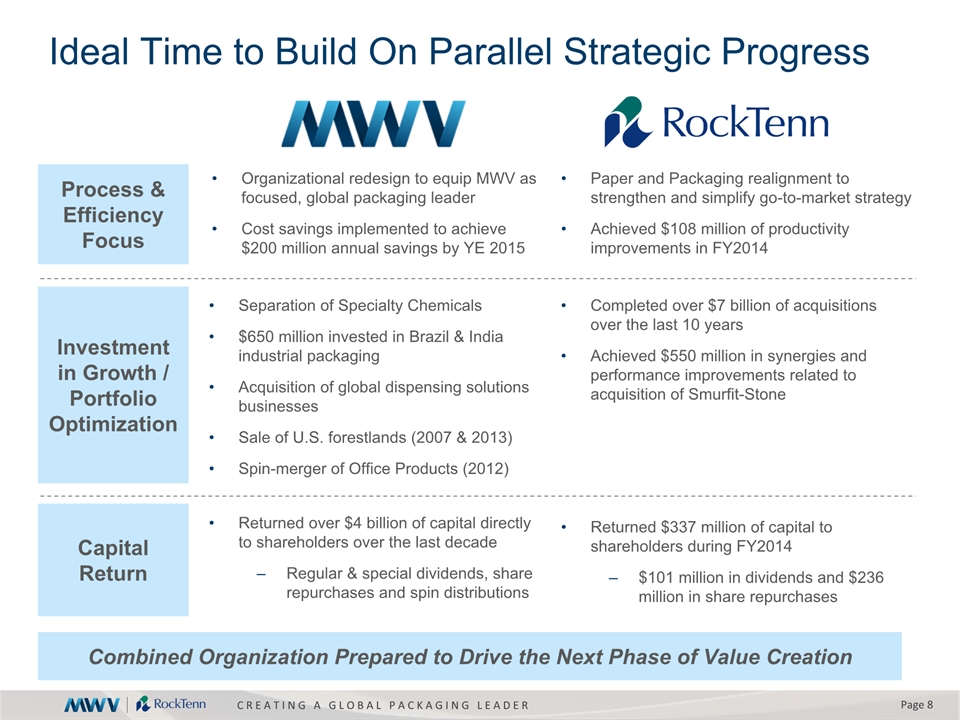

Ideal Time to Build On Parallel Strategic Progress Combined Organization Prepared to Drive the Next Phase of Value Creation Investment in Growth / Portfolio Optimization Completed over $7 billion of acquisitions over the last 10 yearsAchieved $550 million in synergies and performance improvements related to acquisition of Smurfit-Stone Separation of Specialty Chemicals$650 million invested in Brazil & India industrial packagingAcquisition of global dispensing solutions businessesSale of U.S. forestlands (2007 & 2013)Spin-merger of Office Products (2012) Capital Return Returned $337 million of capital to shareholders during FY2014 $101 million in dividends and $236 million in share repurchases Returned over $4 billion of capital directly to shareholders over the last decadeRegular & special dividends, share repurchases and spin distributions Process & Efficiency Focus Paper and Packaging realignment to strengthen and simplify go-to-market strategyAchieved $108 million of productivity improvements in FY2014 Organizational redesign to equip MWV as focused, global packaging leaderCost savings implemented to achieve $200 million annual savings by YE 2015

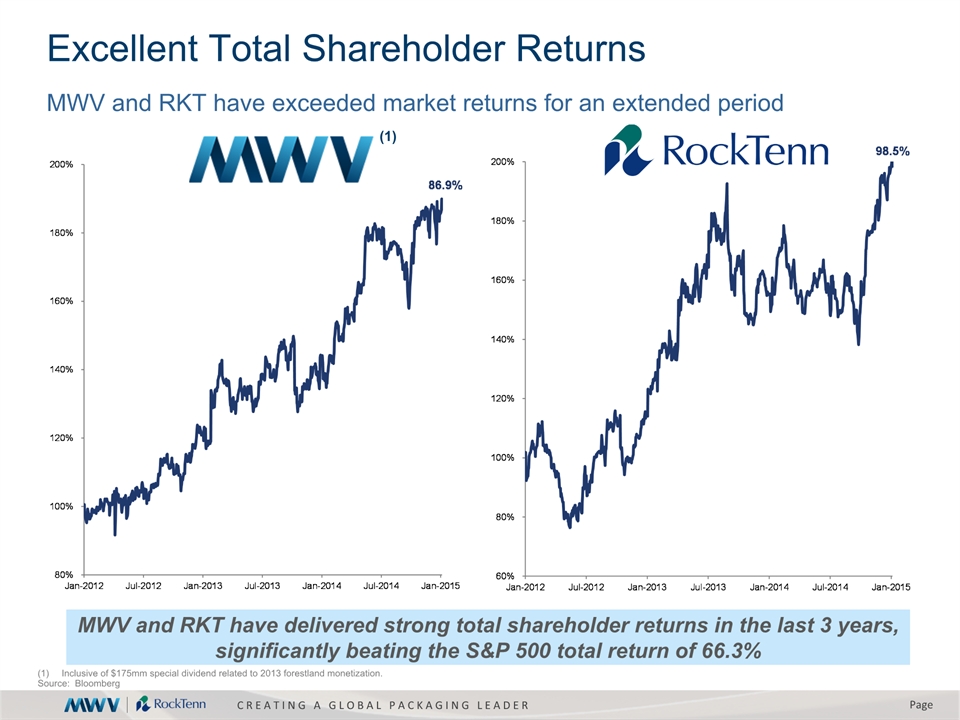

Excellent Total Shareholder Returns MWV and RKT have exceeded market returns for an extended period MWV and RKT have delivered strong total shareholder returns in the last 3 years, significantly beating the S&P 500 total return of 66.3% (1) Inclusive of $175mm special dividend related to 2013 forestland monetization.Source: Bloomberg

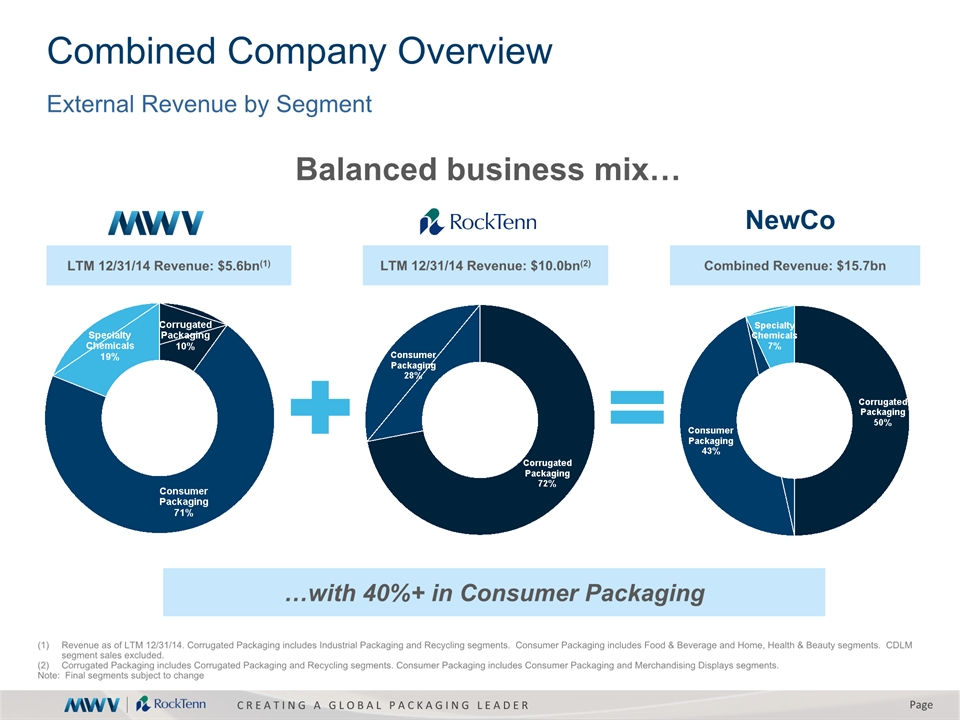

Combined Company Overview External Revenue by Segment LTM 12/31/14 Revenue: $5.6bn(1) LTM 12/31/14 Revenue: $10.0bn(2) Combined Revenue: $15.7bn Revenue as of LTM 12/31/14. Corrugated Packaging includes Industrial Packaging and Recycling segments. Consumer Packaging includes Food & Beverage and Home, Health & Beauty segments. CDLM segment sales excluded. Corrugated Packaging includes Corrugated Packaging and Recycling segments. Consumer Packaging includes Consumer Packaging and Merchandising Displays segments.Note: Final segments subject to change …with 40%+ in Consumer Packaging Balanced business mix… NewCo

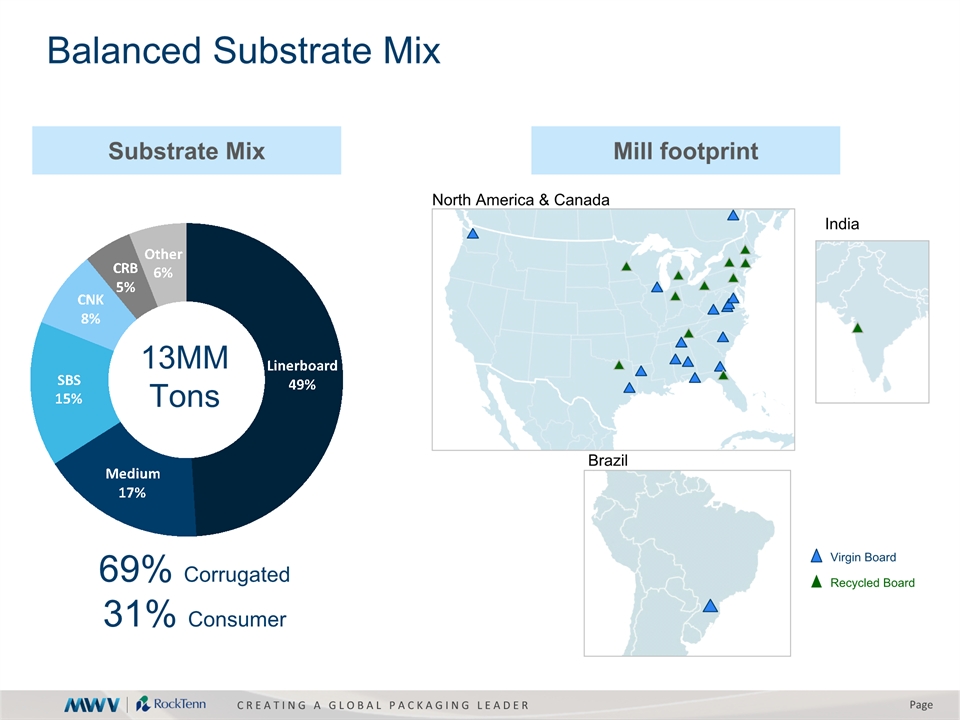

69% Corrugated31% Consumer Balanced Substrate Mix Substrate Mix Mill footprint Recycled Board Virgin Board North America & Canada India Brazil 13MMTons

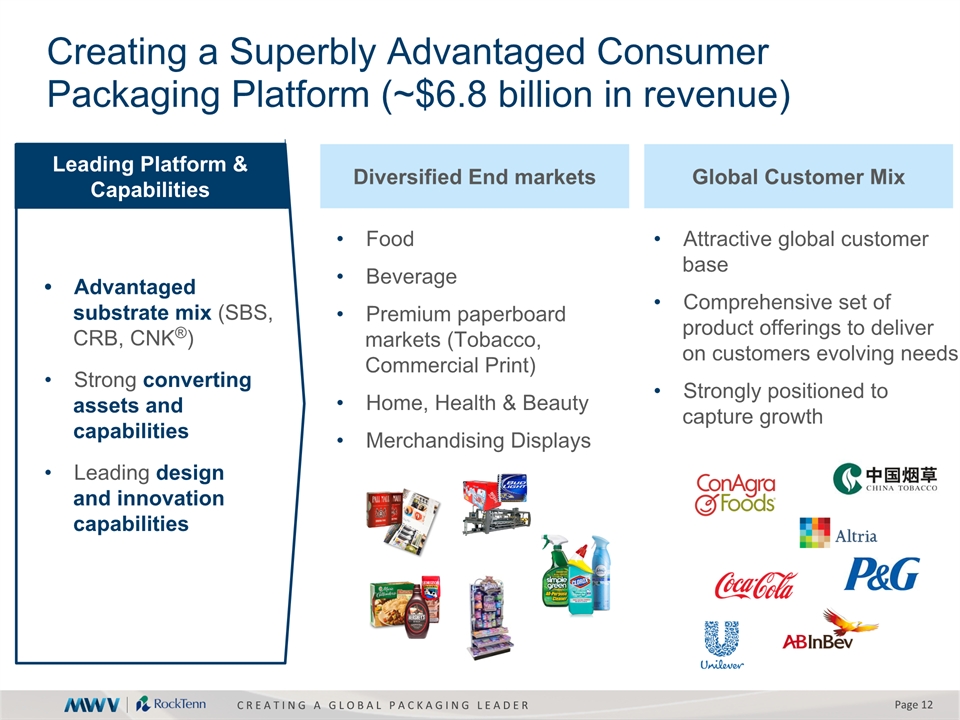

Leading Platform & Capabilities FoodBeveragePremium paperboard markets (Tobacco, Commercial Print)Home, Health & BeautyMerchandising Displays Creating a Superbly Advantaged Consumer Packaging Platform (~$6.8 billion in revenue) Diversified End markets Global Customer Mix Attractive global customer baseComprehensive set of product offerings to deliver on customers evolving needsStrongly positioned to capture growth Advantaged substrate mix (SBS, CRB, CNK®)Strong converting assets and capabilitiesLeading design and innovation capabilities

Creating a Well Positioned Corrugated Packaging Platform (~$7.8 billion in revenue) North America Brazil India Approx. $100 million in revenueCorrugated packaging for Indian fresh produceDeveloping market for high-quality recycled linerboard Brazil’s #2 producer of virgin kraft liner and corrugated packagingApprox. $500 million in revenueHigh-quality virgin kraft liner and recycled material medium paperboardsOperates four box plants across Brazil North America's #2 largest vertically integrated corrugated manufacturerApprox. $7 billion in revenueBroad range of converting capabilities and high quality corrugated materialsCustomized and turn-key solutions for all packaging needs with approximately 100 North American operations A leader serving growing markets in North America, Brazil and India

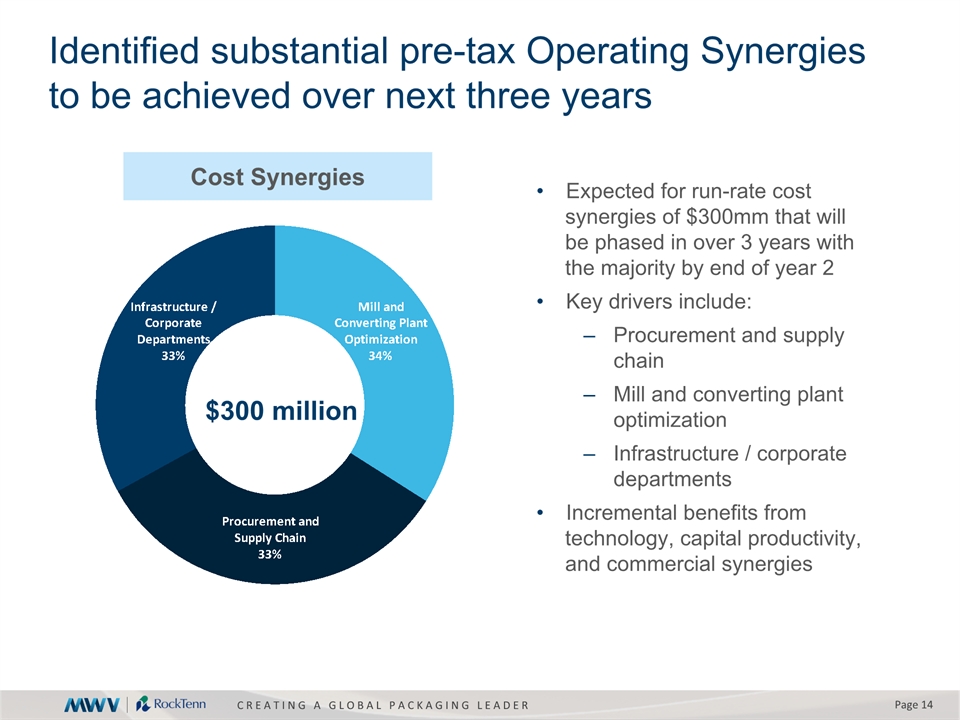

Identified substantial pre-tax Operating Synergies to be achieved over next three years Procurement and Supply Chain33% Mill and Converting Plant Optimization24% Infrastructure / Corporate Departments33% Expected for run-rate cost synergies of $300mm that will be phased in over 3 years with the majority by end of year 2Key drivers include:Procurement and supply chain Mill and converting plant optimizationInfrastructure / corporate departmentsIncremental benefits from technology, capital productivity, and commercial synergies $300 million Cost Synergies

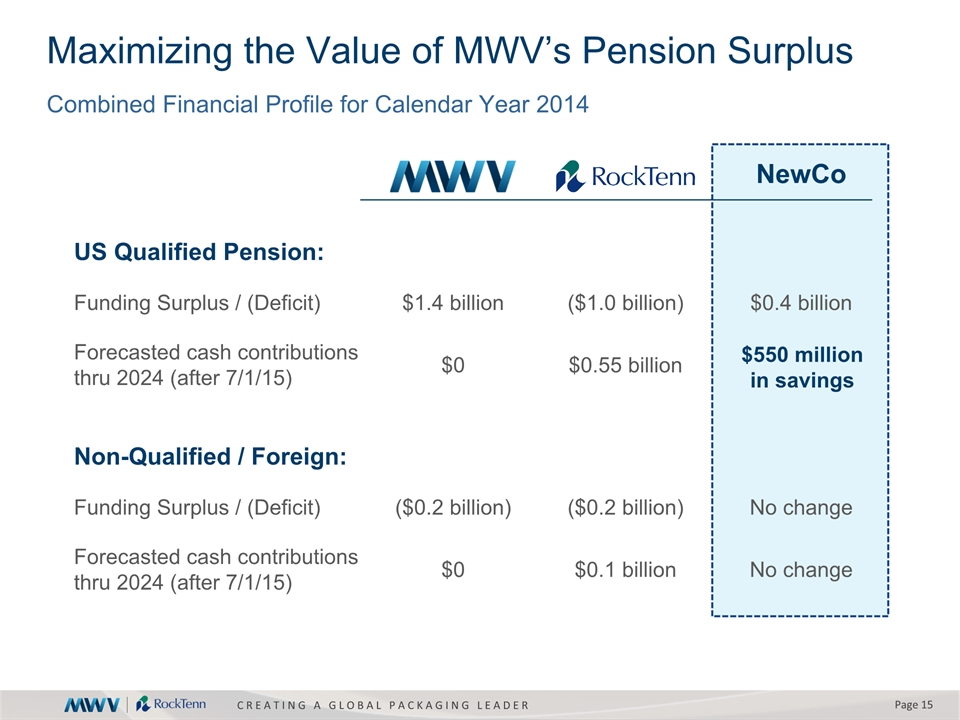

Maximizing the Value of MWV’s Pension Surplus Combined Financial Profile for Calendar Year 2014 US Qualified Pension: Non-Qualified / Foreign: NewCo Funding Surplus / (Deficit) $1.4 billion ($1.0 billion) $0.4 billion Forecasted cash contributions thru 2024 (after 7/1/15) $0 $0.55 billion $550 million in savings Funding Surplus / (Deficit) ($0.2 billion) ($0.2 billion) No change Forecasted cash contributions thru 2024 (after 7/1/15) $0 $0.1 billion No change

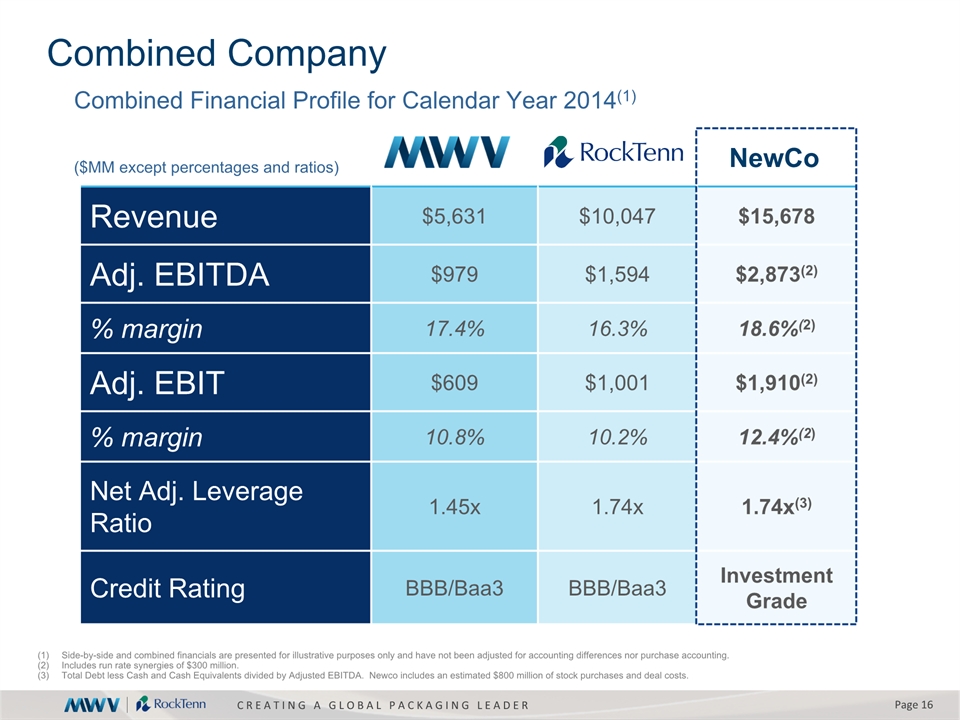

Combined Company Revenue $5,631 $10,047 $15,678 Adj. EBITDA $979 $1,594 $2,873(2) % margin 17.4% 16.3% 18.6%(2) Adj. EBIT $609 $1,001 $1,910(2) % margin 10.8% 10.2% 12.4%(2) Net Adj. Leverage Ratio 1.45x 1.74x 1.74x(3) Credit Rating BBB/Baa3 BBB/Baa3 Investment Grade Side-by-side and combined financials are presented for illustrative purposes only and have not been adjusted for accounting differences nor purchase accounting.Includes run rate synergies of $300 million.Total Debt less Cash and Cash Equivalents divided by Adjusted EBITDA. Newco includes an estimated $800 million of stock purchases and deal costs. Combined Financial Profile for Calendar Year 2014(1)($MM except percentages and ratios) NewCo

Global Strategic Growth Opportunities Strong global platform and excellent commercial and innovation capabilities to drive growth Capabilities Potential for continued expansion into attractive emerging markets Markets Expanded customer base for broader and deeper relationships Customers Leverage MWV and RKT technical capabilities across the new, larger company Technical Track record to improve the business through capital investments and M&A Investments to improve business NewCo Presence

Continued Commitment to Delivering Shareholder Value Moving Forward Specialty Chemicals spin-off remains on-track to be completed in 20152.25x – 2.5x target leverage ratioInvest capital into current businesses $750 to $900 million or more if we identify additional growth opportunitiesM&A that improves our businessUse dividends and stock buybacks to return capital to shareholders

Integration and Culture Move quickly to integrate both businesses and teams, with a focus on creating a strong, shared culture for the new companyCreate a new company that continues to attract, develop, reward and retain highly capable, motivated and collaborative people who want to apply their talents to a great companyBuild on our shared values of integrity and respect for our employees, customers, investors and suppliers

Combining Two Great Companies $16 billion global consumer and corrugated packaging company focused on Customers, Innovation and Operational Excellence 42,000 employees in 30 countries throughout the Americas, Europe and Asia$20 billion in assets invested in over 300 operating locations, including 13 million tons of paper capacity#1 or #2 market positions in attractive and growing consumer packaging and corrugated packaging markets in North America, South America, Europe and AsiaSuccess enabled by insight, innovation, commercial and operational excellence. Improved cost structure through achievement of estimated annual synergies of $300 million, to be realized by the end of the third yearOpportunities to accelerate growth by building upon our customer relationships, our market insight, innovation and operating excellence platforms across a larger companyFinancial strength and flexibility to invest capital and grow core businesses and/or return capital to shareholders to create value

Appendix

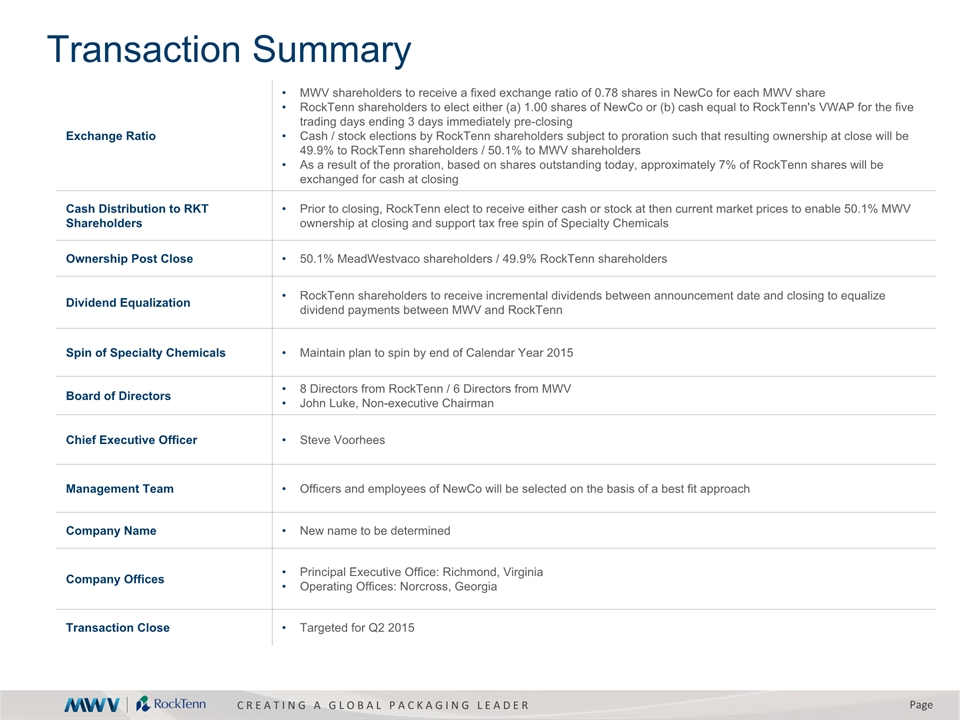

Transaction Summary Exchange Ratio MWV shareholders to receive a fixed exchange ratio of 0.78 shares in NewCo for each MWV share RockTenn shareholders to elect either (a) 1.00 shares of NewCo or (b) cash equal to RockTenn's VWAP for the five trading days ending 3 days immediately pre-closing Cash / stock elections by RockTenn shareholders subject to proration such that resulting ownership at close will be 49.9% to RockTenn shareholders / 50.1% to MWV shareholdersAs a result of the proration, based on shares outstanding today, approximately 7% of RockTenn shares will be exchanged for cash at closing Cash Distribution to RKT Shareholders Prior to closing, RockTenn elect to receive either cash or stock at then current market prices to enable 50.1% MWV ownership at closing and support tax free spin of Specialty Chemicals Ownership Post Close 50.1% MeadWestvaco shareholders / 49.9% RockTenn shareholders Dividend Equalization RockTenn shareholders to receive incremental dividends between announcement date and closing to equalize dividend payments between MWV and RockTenn Spin of Specialty Chemicals Maintain plan to spin by end of Calendar Year 2015 Board of Directors 8 Directors from RockTenn / 6 Directors from MWVJohn Luke, Non-executive Chairman Chief Executive Officer Steve Voorhees Management Team Officers and employees of NewCo will be selected on the basis of a best fit approach Company Name New name to be determined Company Offices Principal Executive Office: Richmond, VirginiaOperating Offices: Norcross, Georgia Transaction Close Targeted for Q2 2015