Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT - STATE STREET CORP | q42014-financialinformatio.htm |

| EX-99.1 - EXHIBIT - STATE STREET CORP | q42014-earningspressrelease.htm |

| 8-K - 8-K - STATE STREET CORP | form8-kq414earningsrelease.htm |

LIMITED ACCESS State Street Corporation Fourth-Quarter and Full-Year 2014 Financial Highlights January 23, 2015 Exhibit 99.3

2 This presentation includes certain highlights of, and also material supplemental to, State Street Corporation’s (State Street’s) news release announcing its fourth- quarter and full-year 2014 financial results. That news release contains a more detailed discussion of many of the matters described in this presentation and is accompanied by detailed financial tables. This presentation is designed to be reviewed together with that news release, which is available on State Street’s website and is incorporated herein by reference. Forward-Looking Statements This presentation contains forward-looking statements as defined by United States securities laws, including statements relating to our goals and expectations regarding our business, financial and capital condition, results of operations, investment portfolio performance and strategies, the financial and market outlook, dividend and stock purchase programs, governmental and regulatory initiatives and developments, and the business environment. Forward-looking statements are often, but not always, identified by such forward-looking terminology as “outlook,” “expect,” “objective,” “intend,” “plan,” “forecast,” “believe,” “anticipate,” “estimate,” “seek,” “may,” “will,” “trend,” “target,” “strategy” and “goal,” or similar statements or variat ions of such terms. These statements are not guarantees of future performance, are inherently uncertain, are based on current assumptions that are difficult to predict and involve a number of risks and uncertainties. Therefore, actual outcomes and results may differ materially from what is expressed in those statements, and those statements should not be relied upon as representing our expectations or beliefs as of any date subsequent to January 23, 2015. In particular, in each of the third and fourth quarters of 2014, we announced charges (due to pre-tax legal accruals recorded in those quarters) reflecting our intention to seek to resolve some, but not all, of the outstanding and potential claims arising out of our indirect FX client activities. We have reported on these matters in our previous public filings with the SEC. With respect to those legal accruals: (1) we are engaged in discussions with some, but not all, of the governmental agencies and civil litigants that we have described in connection with these matters regarding potential settlements of their outstanding or potential claims; (2) there can be no assurance that we will reach a settlement in any of these matters, that the cost of such settlements would not materially exceed such accruals, or that other claims will not be asserted; and (3) we do not currently intend to seek to negotiate settlements with respect to all outstanding and potential claims, and our current efforts, even if successful, will not address all of our potential material legal exposure arising out of our indirect FX client activities. Important factors that may also affect future results and outcomes include, but are not limited to: the financial strength and continuing viability of the counterparties with which we or our clients do business and to which we have investment, credit or financial exposure, including, for example, the direct and indirect effects on counterparties of the sovereign-debt risks in the U.S., Europe and other regions; increases in the volatility of, or declines in the level of, our net interest revenue, changes in the composition or valuation of the assets recorded in our consolidated statement of condition (and our ability to measure the fair value of investment securities) and the possibility that we may change the manner in which we fund those assets; the liquidity of the U.S. and international securities markets, particularly the markets for fixed-income securities and inter-bank credits, and the liquidity requirements of our clients; the level and volatility of interest rates and the performance and volatility of securities, credit, currency and other markets in the U.S. and internationally; the credit quality, credit-agency ratings and fair values of the securities in our investment securities portfolio, a deterioration or downgrade of which could lead to other- than-temporary impairment of the respective securities and the recognition of an impairment loss in our consolidated statement of income; our ability to attract deposits and other low-cost, short-term funding, and our ability to deploy deposits in a profitable manner consistent with our liquidity requirements and risk profile; the manner and timing with which the Federal Reserve and other U.S. and foreign regulators implement changes to the regulatory framework applicable to our operations, including implementation of the Dodd-Frank Act, the Basel III capital framework and European legislation (such as the Alternative Investment Fund Managers Directive and Undertakings for Collective Investment in Transferable Securities Directives); among other consequences, these regulatory changes impact the levels of regulatory capital we must maintain, acceptable levels of credit exposure to third parties, margin requirements applicable to derivatives, and restrictions on banking and financial activities. In addition, our regulatory posture and related expenses have been and will continue to be affected by changes in regulatory expectations for globally systemically important financial institutions applicable to, among other things, risk management, capital planning and compliance programs, and changes in governmental enforcement approaches to perceived failures to comply with regulatory or legal obligations; adverse changes in the regulatory capital ratios that we are required or will be required to meet, whether arising under the Dodd-Frank Act or the Basel III capital and liquidity standards, or due to changes in regulatory positions, practices or regulations in jurisdictions in which we engage in banking activities, including changes in internal or external data, formulae, models, assumptions or other advanced systems used in the calculation of our capital ratios that cause changes in those ratios as they are measured from period to period; increasing requirements to obtain the prior approval of the Federal Reserve or our other regulators for the use, allocation or distribut ion of our capital or other specific capital actions or programs, including acquisitions, dividends and equity purchases, without which our growth plans, distributions to shareholders, equity purchase programs or other capital initiatives may be restricted; changes in law or regulation, or the enforcement of law or regulation, that may adversely affect our business activities or those of our clients or our counterparties, and the products or services that we sell, including addit ional or increased taxes or assessments thereon, capital adequacy requirements, margin requirements and changes that expose us to risks related to the adequacy of our controls or compliance programs; financial market disruptions or economic recession, whether in the U.S., Europe, Asia or other regions; our ability to promote a strong culture of risk management, operating controls, compliance oversight and governance that meet our expectations and those of our clients and our regulators; the results of, and costs associated with, government investigations, litigation and similar claims, disputes, or proceedings; the potential for losses arising from our investments in sponsored investment funds; the possibility that our clients will incur substantial losses in investment pools for which we act as agent, and the possibility of significant reductions in the liquidity or valuation of assets underlying those pools; our ability to anticipate and manage the level and timing of redemptions and withdrawals from our collateral pools and other collective investment products; the credit agency ratings of our debt and depository obligations and investor and client perceptions of our financial strength; adverse publicity, whether specific to State Street or regarding other industry participants or industry-wide factors, or other reputational harm; our ability to control operational risks, data security breach risks and outsourcing risks, and our ability to protect our intellectual property rights, the possibility of errors in the quantitative models we use to manage our business and the possibility that our controls will prove insufficient, fail or be circumvented; dependencies on information technology and our ability to control related risks, including cyber-crime and other threats to our information technology infrastructure and systems and their effective operation both independently and with external systems, and complexities and costs of protecting the security of our systems and data; our ability to grow revenue, control expenses, attract and retain highly skilled people and raise the capital necessary to achieve our business goals and comply with regulatory requirements; changes or potential changes to the competitive environment, including changes due to regulatory and technological changes, the effects of industry consolidation and perceptions of State Street as a suitable service provider or counterparty; changes or potential changes in how and in what amounts clients compensate us for our services, and the mix of services provided by us that clients choose; our ability to complete acquisitions, joint ventures and divestitures, including the ability to obtain regulatory approvals, the ability to arrange financing as required and the ability to satisfy closing conditions; the risks that our acquired businesses and joint ventures will not achieve their anticipated financial and operational benefits or will not be integrated successfully, or that the integration will take longer than anticipated, that expected synergies will not be achieved or unexpected negative synergies or liabilities will be experienced, that client and deposit retention goals will not be met, that other regulatory or operational challenges will be experienced, and that disruptions from the transaction will harm our relationships with our clients, our employees or regulators; our ability to recognize emerging needs of our clients and to develop products that are responsive to such trends and profitable to us, the performance of and demand for the products and services we offer, and the potential for new products and services to impose additional costs on us and expose us to increased operational risk; changes in accounting standards and practices; and changes in tax legislation and in the interpretation of existing tax laws by U.S. and non-U.S. tax authorities that affect the amount of taxes due. Other important factors that could cause actual results to differ materially from those indicated by any forward-looking statements are set forth in our 2013 Annual Report on Form 10-K and our subsequent SEC filings. We encourage investors to read these filings, particularly the sections on risk factors, for additional information with respect to any forward-looking statements and prior to making any investment decision. The forward-looking statements contained in this presentation speak only as of the date hereof, January 23, 2015, and we do not undertake efforts to revise those forward-looking statements to reflect events after that date.

3 EPS: • GAAP-basis earnings per share, or EPS, of $1.24 decreased from $1.26 in 3Q14 and increased from $1.22 in 4Q13: – 4Q14 results included a $50 million pre-tax, or $40 million net after-tax ($0.10 per share), charge to increase our legal accrual associated with indirect foreign exchange matters – 4Q14 results also included a $42 million pre-tax, or $27 million net after-tax ($0.06 per share), restructuring charge related to the completion of our Business Operations and Information Technology Transformation program • Operating-basis EPS of $1.37 increased from $1.35 in 3Q14 and from $1.15 in 4Q13 Revenue: • Total GAAP-basis revenue of $2.63 billion increased from $2.58 billion in 3Q14 and from $2.46 billion in 4Q13 • Total operating-basis revenue of $2.72 billion increased from $2.68 billion in 3Q14 and from $2.53 billion in 4Q13: – 4Q14 operating-basis revenue reflected the following notable items: – $11 million incremental equity earnings from joint ventures – $9 million Net Interest Revenue (NIR) impact from a one-time accelerated loan prepayment – Performance fees of $5.5 million and money market fee waivers of $12.7 million • Core total asset servicing and asset management fees decreased by 1% from 3Q14, but increased by 5% from 4Q13: – Continued demand for our solutions with new mandates won during 4Q14 of approximately $400 billion of assets to be serviced and $7 billion of net new assets to be managed2 • Market-driven revenue performed well despite the challenging environment: – Higher 4Q14 securities finance revenue compared to both 4Q13 and 3Q14 – Higher 4Q14 foreign exchange trading revenue compared to both 4Q13 and 3Q14 – Operating-basis NIR and Net Interest Margin (NIM) continue to be pressured by the low interest-rate environment Fourth-Quarter 2014 Key Messages1 1 Includes operating-basis (non-GAAP) financial information where noted. Operating-basis key messages are a non-GAAP presentation. Refer to the addendum linked to this presentation for explanations of our non-GAAP financial measures and for reconciliations of our operating-basis financial information. 2 New business in assets to be serviced is reflected in our assets under custody and administration after we begin servicing the assets, and net new business in assets to be managed is reflected in our assets under management after we begin managing the assets. As such, only a portion of these new asset servicing and asset management mandates is reflected in our assets under custody and administration and assets under management, as the case may be, as of December 31, 2014.

4 Expenses: • We continue to control expenses amidst regulatory compliance cost pressures • 4Q14 expenses included the following notable items: – $29 million in security processing costs – $17 million associated with our withdrawal from derivatives clearing and execution activities – $9 million impairment primarily associated with an intangible asset Capital: • During 4Q14, we purchased $410 million of our common stock • As of December 31, 2014, we had approximately $470 million remaining under our March 2014 common stock purchase program authorizing the purchase of up to $1.7 billion through March 31, 2015 • We also declared a common stock dividend during the quarter of $0.30 per share • Issued $750 million of preferred shares at 6%, with the first dividend to be paid in 1Q15: – Expect total dividends on all series of preferred shares outstanding at December 31, 2014 to be approximately $118 million in 2015, including a partial quarter payment of approximately $3 million in 1Q15 for Series E Fourth-Quarter 2014 Key Messages - Continued

5 Summary of GAAP-Basis Financial Results for the Year Ended December 31, 2014 $ in millions, except per share data 2014 2013 % change Revenue 10,295$ 9,884$ 4.2% Expenses 7,762 7,192 7.9 Earnings per share (EPS) 4.69 4.62 1.5 Return on average common equity (ROE) 10.1% 10.5% Pre-tax operating margin 24.5 27.2 Average diluted common shares outstanding (in thousands) 432.0 455.2

6 Summary of GAAP-Basis Financial Results for the Fourth Quarter of 2014 $ in millions, except per share data 4Q14 3Q14 4Q13 3Q14 4Q13 Revenue 2,630$ 2,582$ 2,464$ 1.9% 6.7% Expenses 1,992 1,892 1,846 5.3 7.9 EPS 1.24 1.26 1.22 (1.6) 1.6 ROE 10.4% 10.6% 10.9% Pre-tax operating margin 24.1 26.6 24.8 Average diluted common shares outstanding (in thousands) 424.3 429.7 445.2 % change

7 Fourth-Quarter 2014 GAAP-Basis Revenue nm – not meaningful. $ in millions 4Q14 3Q14 4Q13 Servicing fees 1,301$ (0.1)% 5.6% Management fees 299 (5.4) 3.1 Trading services revenue 293 5.4 24.2 Securities finance revenue 106 7.1 39.5 Processing fees and other revenue 57 235.3 26.7 Total fee revenue 2,056 2.2 9.4 Net interest revenue 574 0.7 (1.9) Gains (losses) related to investment securities, net - nm nm Total revenue 2,630$ 1.9% 6.7% % change

8 Fourth-Quarter 2014 GAAP-Basis Expenses $ in millions 4Q14 3Q14 4Q13 Compensation and employee benefits 972$ 2.0% 2.9% Information systems and communications 246 1.7 7.9 Transaction processing services 201 1.0 10.4 Occupancy 113 (5.0) (8.9) Acquisition and restructuring costs 52 160.0 73.3 Other 408 13.6 21.1 Total expenses 1,992$ 5.3% 7.9% % change

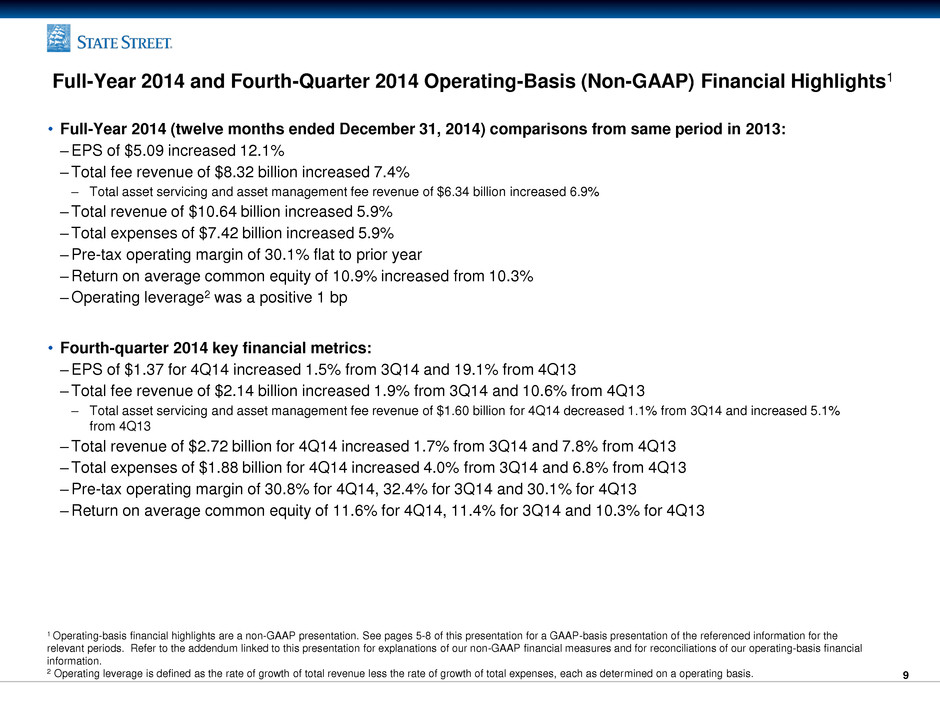

9 Full-Year 2014 and Fourth-Quarter 2014 Operating-Basis (Non-GAAP) Financial Highlights1 • Full-Year 2014 (twelve months ended December 31, 2014) comparisons from same period in 2013: –EPS of $5.09 increased 12.1% –Total fee revenue of $8.32 billion increased 7.4% – Total asset servicing and asset management fee revenue of $6.34 billion increased 6.9% –Total revenue of $10.64 billion increased 5.9% –Total expenses of $7.42 billion increased 5.9% –Pre-tax operating margin of 30.1% flat to prior year –Return on average common equity of 10.9% increased from 10.3% –Operating leverage2 was a positive 1 bp • Fourth-quarter 2014 key financial metrics: –EPS of $1.37 for 4Q14 increased 1.5% from 3Q14 and 19.1% from 4Q13 –Total fee revenue of $2.14 billion increased 1.9% from 3Q14 and 10.6% from 4Q13 – Total asset servicing and asset management fee revenue of $1.60 billion for 4Q14 decreased 1.1% from 3Q14 and increased 5.1% from 4Q13 –Total revenue of $2.72 billion for 4Q14 increased 1.7% from 3Q14 and 7.8% from 4Q13 –Total expenses of $1.88 billion for 4Q14 increased 4.0% from 3Q14 and 6.8% from 4Q13 –Pre-tax operating margin of 30.8% for 4Q14, 32.4% for 3Q14 and 30.1% for 4Q13 –Return on average common equity of 11.6% for 4Q14, 11.4% for 3Q14 and 10.3% for 4Q13 1 Operating-basis financial highlights are a non-GAAP presentation. See pages 5-8 of this presentation for a GAAP-basis presentation of the referenced information for the relevant periods. Refer to the addendum linked to this presentation for explanations of our non-GAAP financial measures and for reconciliations of our operating-basis financial information. 2 Operating leverage is defined as the rate of growth of total revenue less the rate of growth of total expenses, each as determined on a operating basis.

10 Summary of Operating-Basis (Non-GAAP) Financial Results1 for the Year Ended December 31, 2014 1 Results presented on an operating basis, a non-GAAP presentation. Refer to the addendum linked to this presentation for explanations of our non-GAAP financial measures and for reconciliations of our operating-basis financial information. 2 Operating leverage is defined as the rate of growth of total revenue less the rate of growth of total expenses, each as determined on an operating basis. $ in millions, except per share data 2014 2013 % change Revenue 10,637$ 10,047$ 5.9% Expenses 7,423 7,012 5.9 EPS 5.09 4.54 12.1 ROE 10.9% 10.3% Net Interest Margin (NIM) 1.11 1.30 Pre-tax operating margin 30.1 30.1 Operating leverage2 1 bp Average diluted common shares outstanding (in thousands) 432.0 455.2

11 Summary of Operating-Basis (Non-GAAP) Financial Results1 for the Fourth Quarter of 2014 1 Results presented on an operating basis, a non-GAAP presentation. Refer to the addendum linked to this presentation for explanations of our non-GAAP financial measures and for reconciliations of our operating-basis financial information. 2 Operating leverage is defined as the rate of growth of total revenue less the rate of growth of total expenses, each as determined on an operating basis. $ in millions, except per share data 4Q14 3Q14 4Q13 3Q14 4Q13 Revenue 2,724$ 2,678$ 2,528$ 1.7% 7.8% Expenses 1,880 1,808 1,760 4.0 6.8 EPS 1.37 1.35 1.15 1.5 19.1 ROE 11.6% 11.4% 10.3% NIM 1.04 1.06 1.30 Pre-tax operating margin 30.8 32.4 30.1 Operating leverage2 (226) bps 93 bps Average diluted common shares outstanding (in thousands) 424.3 429.7 445.2 % change

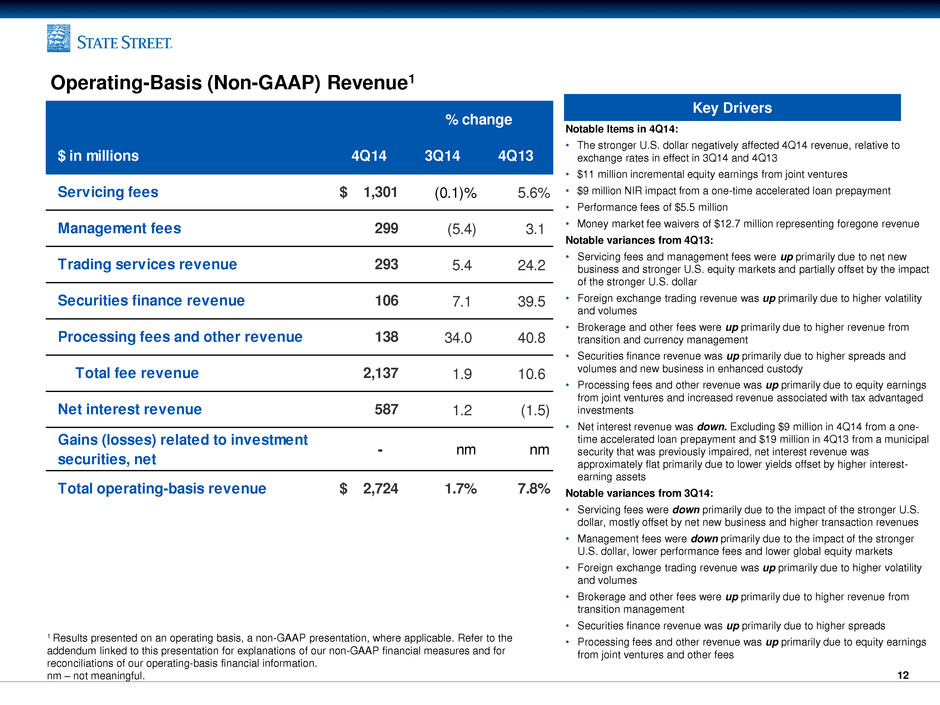

12 Operating-Basis (Non-GAAP) Revenue1 1 Results presented on an operating basis, a non-GAAP presentation, where applicable. Refer to the addendum linked to this presentation for explanations of our non-GAAP financial measures and for reconciliations of our operating-basis financial information. nm – not meaningful. Key Drivers Notable Items in 4Q14: • The stronger U.S. dollar negatively affected 4Q14 revenue, relative to exchange rates in effect in 3Q14 and 4Q13 • $11 million incremental equity earnings from joint ventures • $9 million NIR impact from a one-time accelerated loan prepayment • Performance fees of $5.5 million • Money market fee waivers of $12.7 million representing foregone revenue Notable variances from 4Q13: • Servicing fees and management fees were up primarily due to net new business and stronger U.S. equity markets and partially offset by the impact of the stronger U.S. dollar • Foreign exchange trading revenue was up primarily due to higher volatility and volumes • Brokerage and other fees were up primarily due to higher revenue from transition and currency management • Securities finance revenue was up primarily due to higher spreads and volumes and new business in enhanced custody • Processing fees and other revenue was up primarily due to equity earnings from joint ventures and increased revenue associated with tax advantaged investments • Net interest revenue was down. Excluding $9 million in 4Q14 from a one- time accelerated loan prepayment and $19 million in 4Q13 from a municipal security that was previously impaired, net interest revenue was approximately flat primarily due to lower yields offset by higher interest- earning assets Notable variances from 3Q14: • Servicing fees were down primarily due to the impact of the stronger U.S. dollar, mostly offset by net new business and higher transaction revenues • Management fees were down primarily due to the impact of the stronger U.S. dollar, lower performance fees and lower global equity markets • Foreign exchange trading revenue was up primarily due to higher volatility and volumes • Brokerage and other fees were up primarily due to higher revenue from transition management • Securities finance revenue was up primarily due to higher spreads • Processing fees and other revenue was up primarily due to equity earnings from joint ventures and other fees $ in millions 4Q14 3Q14 4Q13 Servicing fees 1,301$ (0.1)% 5.6% Management fees 299 (5.4) 3.1 Trading services revenue 293 5.4 24.2 Securities finance revenue 106 7.1 39.5 Processing fees and other revenue 138 34.0 40.8 Total fee revenue 2,137 1.9 10.6 Net interest rev nue 587 1.2 (1.5) Gains (losses) r lated to investment securities, net - nm nm Total operating-ba i revenue 2,724$ 1.7% 7.8% % change

13 Operating-Basis (Non-GAAP) Expenses1 Key Drivers Notable items in 4Q14: • The stronger U.S. dollar favorably affected 4Q14 expenses, relative to exchange rates in effect in 3Q14 and 4Q13 • $29 million in security processing costs within other expenses • $17 million associated with our withdrawal from derivatives clearing and execution activities, primarily in information systems and communications as well as other expenses • $9 million impairment primarily associated with an intangible asset Notable variances from 4Q13: • Compensation and employee benefits expenses were up primarily due to increased costs to support new business and regulatory compliance initiatives as well as higher incentive compensation expense, partially offset by the impact of the stronger U.S. dollar • Transaction processing expenses were up primarily due to higher volumes in the investment servicing business • Occupancy expenses were down primarily due to a charge in 4Q13 associated with a sublease renegotiation • Other expenses were up primarily due to higher professional services primarily related to regulatory compliance initiatives, costs associated with our withdrawal from derivatives clearing and execution activities, impairment primarily associated with an intangible asset and Lehman Brothers-related gains and recoveries recorded in 4Q13 Notable variances from 3Q14: • Compensation and employee benefits expenses were up primarily due to increased costs to support new business and regulatory compliance initiatives as well as higher incentive compensation expense, partially offset by the impact of the stronger U.S. dollar • Other expenses were up primarily due to higher securities processing, higher professional services primarily related to regulatory compliance initiatives, costs associated with our withdrawal from derivatives clearing and execution activities and an impairment primarily associated with an intangible asset 1 Results presented on an operating basis, a non-GAAP presentation, where applicable. Refer to the addendum linked to this presentation for explanations of our non-GAAP financial measures and for reconciliations of our operating-basis financial information. . $ in millions 4Q14 3Q14 4Q13 Compensation and employee benefits 962$ 0.7% 3.0% Information systems and communications 246 1.7 7.9 Transaction processing services 201 1.0 10.4 Occupancy 113 (5.0) (8.9) Other 358 22.2 22.6 Total operating-b sis expenses 1,880$ 4.0% 6.8% % change

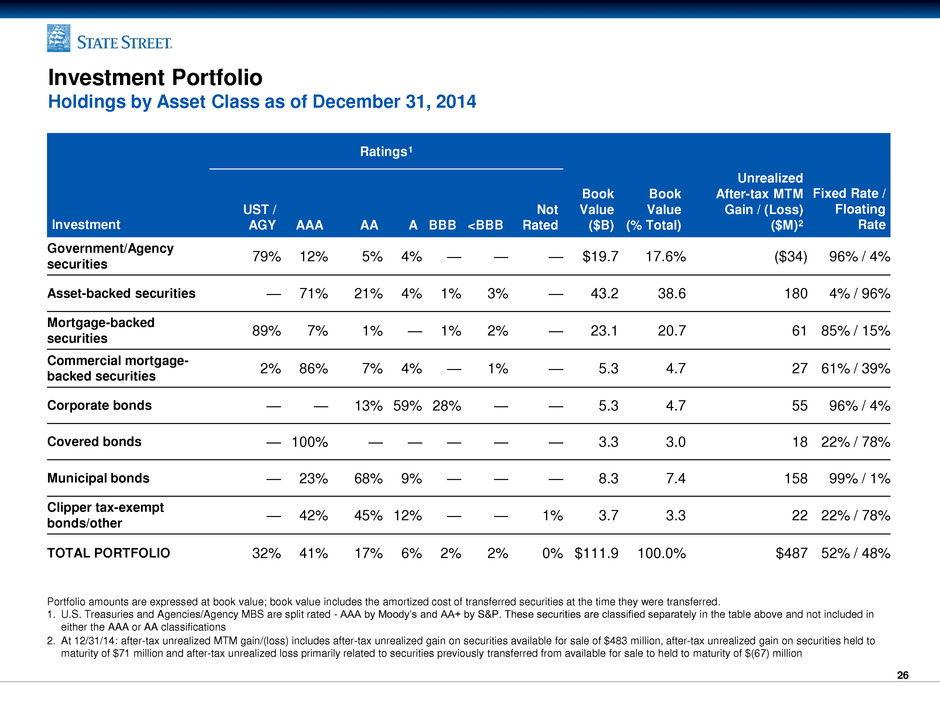

14 Balance Sheet Highlights Fourth-Quarter 20141, 2 Investment portfolio • Size: $112 billion, a slight decrease from the end of 3Q14 • Credit profile: approximately 90% rated AAA/AA • Fixed-rate/floating-rate mix: 52% / 48% • Duration: 2.0 years • Unrealized after-tax mark-to-market (MTM) gain increased by $76 million from 3Q14 to $487 million at the end of 4Q14 primarily due to a decrease in interest rates, partially offset by narrowing spreads • Purchases of $3.9 billion in 4Q14; average tax-equivalent yield: 2.06% • Discount accretion of $31 million in 4Q14 related to former conduit assets; approximately $387 million expected to accrue over the remaining lives of the former conduit securities3 Interest-rate risk metrics • Economic value of equity (EVE)4: (12.8)% of total regulatory capital5 as of December 31, 2014, versus (14.0)% as of September 30, 2014, in an up-200-bps shock to quarter-end interest-rate levels hypothetical scenario • Unrealized after-tax MTM loss sensitivity, as of December 31, 2014, estimated at approximately $(1.2) billion after-tax in an up-100-bps shock to quarter-end interest-rate levels hypothetical scenario Other balance sheet activity • Senior secured bank loans totaled $2.4 billion as of December 31, 2014, floating-rate, primarily BB/B rated • Recorded a $4 million net loan loss provision related to the aggregate senior secured bank loan portfolio; loan loss allowance related to this portfolio totaled approximately $29 million as of December 31, 2014 1 As of period-end where applicable. 2 See appendix included in this presentation for a description of the investment portfolio. 3 Based on numerous assumptions, including holding the securities to maturity, anticipated prepayment speeds and credit quality. See discussion in State Street’s 2013 Annual Report on Form 10-K filed with the SEC. 4 For additional information regarding EVE, refer to “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in State Street’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2014 filed with the SEC. 5 Total regulatory capital is defined as the sum of tier 1 and tier 2 risk-based capital.

15 Capital 1 Footnotes 1 through 5 provided on page 16. Fourth-Quarter 2014 Highlights • Maintained a strong capital position • In 4Q14, we purchased approximately 5.6 million shares of our common stock, at an average price of $73.71 and a total cost of approximately $410 million, under the March 2014 common stock purchase program authorizing the purchase of up to $1.7 billion through March 31, 2015 • Declared a $0.30 per share quarterly common stock dividend in 4Q14 • Issued $750 million of preferred shares at 6%, with the first dividend to be paid in 1Q15: ‒ Expect total dividends on all series of preferred shares outstanding at December 31, 2014 to be approximately $118 million in 2015, including a partial quarter payment of approximately $3 million in 1Q15 for Series E Returning capital to shareholders remains a priority while maintaining a strong capital position Basel III Ratios as of December 31, 20142, 3 Common equity tier 1 ratio calculated in conformity with Basel III final rule (advanced approaches) 12.5% Tier 1 leverage ratio calculated in conformity with Basel III final rule (advanced approaches) State Street Corporation 6.4% State Street Bank and Trust Company 5.8% Estimated pro forma Basel III ratios as of December 31, 2014 Common equity tier 1 ratio calculated in conformity with Basel III final rule (standardized approach)4 10.8% Supplementary leverage ratios5 State Street Corporation 5.7% State Street Bank and Trust Company 5.1% Estimated pro forma fully phased-in Basel III ratios as of December 31, 2014 Fully phased-in (effective January 1, 2019) Basel III common equity tier 1 ratio (advanced approaches)4 11.6% Fully phased-in (effective January 1, 2019) Basel III common equity tier 1 ratio (standardized approach)4 10.0% Fully phased-i (effective January 1, 2018) supplementary leverage ratios5 State Stree Co poration 5.2% State Street Bank and Trust Company 4.8%

16 1 Unless otherwise specified, all capital ratios referenced on page 15 and elsewhere in this presentation refer to State Street Corporation, or State Street, and not State Street Bank and Trust Company, or State Street Bank. Refer to the addendum linked to this presentation for a further description of these ratios, and for reconciliations applicable to State Street's estimated pro forma Basel III common equity tier 1 ratios and estimated pro forma fully phased-in Basel III ratios presented on page 15. 2 In July 2013, the Federal Reserve issued a final rule intended to implement the Basel III framework in the U.S., referred to as the Basel III final rule. On February 21, 2014, we were notified by the Federal Reserve that we completed our parallel run period and would be required to begin using the advanced approaches framework as provided in the Basel III final rule in the determination of our risk-based capital requirements. Pursuant to this notification, we have used the advanced approaches framework to calculate our risk-based capital ratios beginning with the second quarter of 2014. In the second, the third and fourth quarters of 2014, the lower of our regulatory capital ratios calculated under the Basel III advanced approaches and those ratios calculated under the transitional provisions of Basel III apply in the assessment of our capital adequacy for regulatory purposes. For each of the second, third and fourth quarters of 2014, the common equity tier 1 ratio calculated in conformity with the advanced approaches was lower than such ratio calculated under the transitional provisions of the Basel III final rule. Beginning with the first quarter of 2015, the lower of the Basel III regulatory capital ratios calculated by us under the Basel III advanced approaches and the Basel III standardized approach will apply in the assessment of our capital adequacy for regulatory purposes. 3 Common equity tier 1 and tier 1 leverage ratios as of December 31, 2014 were calculated in conformity with the advanced approaches provisions of the Basel III final rule. 4 The estimated pro forma Basel III common equity tier 1 ratio (standardized approach), is an estimate, calculated in conformity with the standardized approach under the Basel III final rule. The estimated pro forma fully phased-in Basel III common equity tier 1 ratio (advanced approaches) and the estimated pro forma fully phased-in Basel III common equity tier 1 ratio (standardized approach) as of December 31, 2014 are preliminary estimates by State Street, calculated in conformity with the advanced approaches or the standardized approach, as the case may be, in the Basel III final rule (in each case, fully phased in as of January 1, 2019, as per Basel III phase-in requirements for capital), calculated based on our interpretations of the Basel III final rule as of January 23, 2015 and as applied to our businesses and operations as of December 31, 2014. Reconciliations with respect to these ratios are provided in the addendum linked to this presentation. 5 On April 8, 2014, U.S. banking regulators issued a final rule enhancing the supplementary leverage ratio, or SLR, standards for certain bank holding companies, like State Street, and their insured depository institution subsidiaries, like State Street Bank. We refer to this final rule as the eSLR final rule. Under the eSLR final rule, upon implementation as of January 1, 2018, State Street Bank must maintain a supplementary leverage ratio of at least 6% to be well capitalized under the U.S. banking regulators’ Prompt Corrective Action framework. The eSLR final rule also provides that if State Street maintains an SLR of at least 5%, it is not subject to limitations on distribution and discretionary bonus payments under the eSLR final rule. On September 3, 2014, U.S. banking regulators issued a final rule modifying the definition of the denominator of the SLR in a manner consistent with the final rule issued by the Basel Committee on Banking Supervision on January 12, 2014. The revisions to the SLR apply to all banking organizations subject to the advanced approaches provisions of the Basel III final rule, like State Street and State Street Bank. Specifically, the SLR final rule modifies the methodology for including off-balance sheet assets, including credit derivatives, repo-style transactions, and lines of credit, in the denominator of the SLR, and requires banking organizations to calculate their total leverage exposure using daily averages for on-balance sheet assets and the average of three month-end calculations for off-balance sheet exposures. Certain public disclosures required by the SLR final rule must be provided beginning with the first quarter of 2015, and the minimum SLR requirement using the SLR final rule’s denominator calculations is effective beginning on January 1, 2018. Estimated pro forma fully phased-in supplementary leverage ratios as of December 31, 2014 are preliminary estimates by State Street (in each case, fully phased-in as of January 1, 2018, as per the phase-in requirements of the SLR final rule), calculated based on our interpretations of the SLR final rule as of January 23, 2015 and as applied to our businesses and operations as of December 31, 2014. Footnotes to Page 15

17 • Continuing to focus on key priorities: – Delivering value-added services and solutions to clients – Investing in growth initiatives –Managing expenses – Returning capital to shareholders • Aiming for full-year 2015 operating-basis total fee revenue1 growth of 4%-7% compared to 2014: – Equity market assumptions for full-year 2015 based on: – Foreign exchange assumptions using the forward curve as of January 15, 2015 assume that the exchange rates will remain with January 15, 2015 levels; resulting assumptions for U.S. dollar to EURO exchange rate and U.S. dollar to Pound Sterling are shown below as examples: • Expecting that NIR headwinds are likely to continue as illustrated in the interest rate and deposit scenarios outlined on the next slide • Expecting an operating-basis1 effective tax rate of 30%-32%, which was 29% in 2014 (12.1)% 2015 Outlook1: Strong growth in our fee revenue, partially offset by the impact of low interest rates and a higher effective tax rate 1Includes operating-basis (non-GAAP) financial information, where noted. Operating-basis financial outlook is a non-GAAP presentation. Refer to the addendum linked to this presentation for explanations of our non-GAAP financial measures. 2013 Year End: 1,850 2014 Year End: 2,060 2015 Estimated Year End: 2,160 2014 Average: 1,931 2015 Estimated Average: 2,050 2013 Year End: 1,915 2014 Year End: 1,775 2015 Estimated Year End: 1,830 EAFE 2014 Average: 1,888 2015 Estimated Average: 1,850 2013 Year End: 1.37 2014 Year End: 1.20 2015 Estimated Year End: 1.16 2014 Average: 1.32 2015 Estimated Average: 1.16 S&P 500 USD vs EUR 4.9% 6.2% 15E vs 14 3.1% (2.0)% 15E vs 14 (3.3)% 15E vs 14 (8.5)% 2013 Year End: 1.67 2014 Year End: 1.56 2015 Estimated Year End: 1.51 2014 Average: 1.65 2015 Estimated Average: 1.51 USD vs GBP (3.2)% 15E vs 14 Continuing to focus on key priorities: • Delivering value-added services & solutions to clients • Investing in growth initiatives • Managing expenses • Returning capital to shareholders

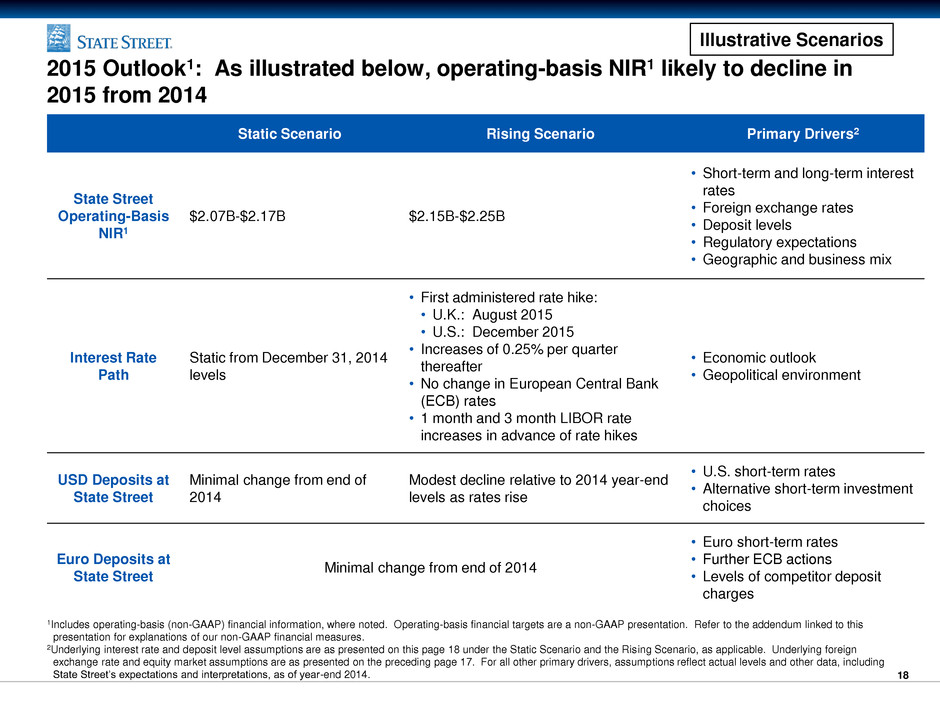

18 2015 Outlook1: As illustrated below, operating-basis NIR1 likely to decline in 2015 from 2014 1Includes operating-basis (non-GAAP) financial information, where noted. Operating-basis financial targets are a non-GAAP presentation. Refer to the addendum linked to this presentation for explanations of our non-GAAP financial measures. 2Underlying interest rate and deposit level assumptions are as presented on this page 18 under the Static Scenario and the Rising Scenario, as applicable. Underlying foreign exchange rate and equity market assumptions are as presented on the preceding page 17. For all other primary drivers, assumptions reflect actual levels and other data, including State Street’s expectations and interpretations, as of year-end 2014. Static Scenario Rising Scenario Primary Drivers2 State Street Operating-Basis NIR1 $2.07B-$2.17B $2.15B-$2.25B • Short-term and long-term interest rates • Foreign exchange rates • Deposit levels • Regulatory expectations • Geographic and business mix Interest Rate Path Static from December 31, 2014 levels • First administered rate hike: • U.K.: August 2015 • U.S.: December 2015 • Increases of 0.25% per quarter thereafter • No change in European Central Bank (ECB) rates • 1 month and 3 month LIBOR rate increases in advance of rate hikes • Economic outlook • Geopolitical environment USD Deposits at State Street Minimal change from end of 2014 Modest decline relative to 2014 year-end levels as rates rise • U.S. short-term rates • Alternative short-term investment choices Euro Deposits at State Street Minimal change from end of 2014 • Euro short-term rates • Further ECB actions • Levels of competitor deposit charges Illustrative Scenarios

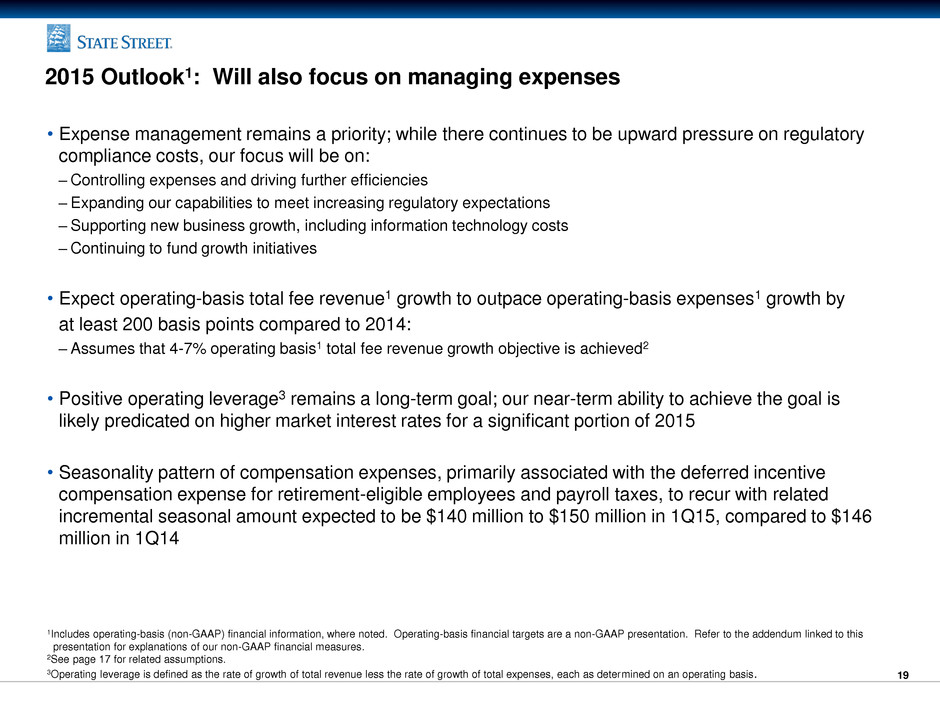

19 2015 Outlook1: Will also focus on managing expenses • Expense management remains a priority; while there continues to be upward pressure on regulatory compliance costs, our focus will be on: – Controlling expenses and driving further efficiencies – Expanding our capabilities to meet increasing regulatory expectations – Supporting new business growth, including information technology costs – Continuing to fund growth initiatives • Expect operating-basis total fee revenue1 growth to outpace operating-basis expenses1 growth by at least 200 basis points compared to 2014: – Assumes that 4-7% operating basis1 total fee revenue growth objective is achieved2 • Positive operating leverage3 remains a long-term goal; our near-term ability to achieve the goal is likely predicated on higher market interest rates for a significant portion of 2015 • Seasonality pattern of compensation expenses, primarily associated with the deferred incentive compensation expense for retirement-eligible employees and payroll taxes, to recur with related incremental seasonal amount expected to be $140 million to $150 million in 1Q15, compared to $146 million in 1Q14 1Includes operating-basis (non-GAAP) financial information, where noted. Operating-basis financial targets are a non-GAAP presentation. Refer to the addendum linked to this presentation for explanations of our non-GAAP financial measures. 2See page 17 for related assumptions. 3Operating leverage is defined as the rate of growth of total revenue less the rate of growth of total expenses, each as determined on an operating basis.

20 2015 Outlook: Returning capital to shareholders remains a priority • Continuing to execute on our capital plans: – Issued $750 million of preferred shares at 6% in 4Q14, with the first dividend to be paid in 1Q15: – Expect total dividends on all series of preferred shares outstanding at December 31, 2014 to be approximately $118 million in 2015, including a partial quarter payment of approximately $3 million in 1Q15 for Series E – The evolution of our balance sheet and of regulatory capital and liquidity expectations may lead to both additional issuances of preferred shares of approximately $750M and long-term debt in 2015 – 2015 capital plan remains subject to review by the Federal Reserve

21 APPENDIX A. Effective Tax Rate Calculations B. Investment Portfolio C. Non-GAAP Measures and Capital Ratios Pages 22 24-29 30

22 Effective Tax Rate Calculations • Beginning with the first quarter of 2014, we are presenting our operating-basis effective tax rate to reflect the tax-equivalent adjustments associated with our investments in tax-exempt securities low-income housing and alternative energy. • There is no effect on operating-basis1 revenue, pre-tax income or after-tax earnings; the change affects only our stated operating-basis1 effective tax rate. We believe this change, which is also incorporated in the comparative prior-period rates shown below, will result in a more informative presentation of the ordinary tax rate generated by State Street’s business activity. 1 Includes operating-basis (non-GAAP) financial information. Operating-basis financial highlights are a non-GAAP presentation. Refer to the addendum linked to this presentation for explanations of our non-GAAP financial measures and for reconciliations of our operating-basis financial information. Operating-basis1 effective tax rate - prior calculation 4Q14 3Q14 4Q13 Income before income tax expense, operating-basis1 840$ 868$ 762$ Less aggregate tax-equivalent adjustments 125 129 95 Income before income tax expense, excluding tax-equivalent adjustments, operating-basis1 715 739 667 Income tax expense, operating-basis1 239 269 240 Less aggregate tax-equivalent adjustments 125 129 95 Income tax expense, after eliminating tax-equivalent adjustments, operating-basis1 114 140 145 Effective tax rate, operating-basis1, prior calculation 15.9% 18.9% 21.7% Operating-basis1 effective tax rate - revised calculation 4Q14 3Q14 4Q13 Income before income tax expense, operating-basis1 840$ 868$ 762$ Income tax expense, operating-basis1 239 269 240 Effective tax rate, operating-basis1, revised calculation 28.5% 31.0% 31.5%

23 B. Investment Portfolio

24 Portfolio amounts are expressed at book value; book value includes the amortized cost of transferred securities at the time they were transferred. OECD=Organization for Economic Cooperation and Development FFELP=Federal Family Education Loan Program Government / Agency Structured Securities Unsecured Credit Treasuries Agency debentures Agency mortgages Small Business Administration loans OECD governments FFELP student loans Asset-backed securities (ABS) Mortgage-backed securities (MBS) Commercial mortgage-backed securities (CMBS) Covered bonds Corporate bonds Municipals $54 billion $41 billion $17 billion Investment Portfolio Investment Portfolio as of December 31, 2014

25 • Assets selected using rigorous credit process • Diversified by asset class and geography • 90% rated AAA/AA • Unrealized after-tax mark-to-market (MTM) gain of $487 million 1 Portfolio amounts are expressed at book value; book value includes the amortized cost of transferred securities at the time they were transferred. 1. At 12/31/14: after-tax unrealized MTM gain/(loss) includes after-tax unrealized gain on securities available for sale of $483 million, after-tax unrealized gain on securities held to maturity of $71 million and after-tax unrealized loss primarily related to securities previously transferred from available for sale to held to maturity of $(67) million 2. Beginning in August 2011, U.S. Treasuries and Agencies/Agency MBS became split rated – AAA by Moody’s and AA+ by S&P. For dates after August 2011, these securities are classified separately in the table above and not included in either the AAA or AA classifications 3. Certain securities previously categorized as Not Rated, are now included in the AAA category, based on Moody’s/S&P ratings $ in billions U.S. Treasuries & Agencies 2 AAA AA A BBB <BBB Not Rated 3 Total Unrealized After-tax MTM Gain / (Loss) ($M) 12/31/14 $36.4 $45.8 $18.6 $7.2 $2.2 $1.6 $0.1 $111.9 $487 32% 41% 17% 6% 2% 2% 0% 100% 12/31/13 $29.6 $51.7 $22.4 $7.7 $3.4 $2.2 $0.1 $117.1 $(213) 26% 44% 19% 6% 3% 2% 0% 100% 12/31/12 $37.6 $46.0 $22.7 $8.5 $3.2 $2.1 $0.1 $120.2 $697 31% 38% 19% 7% 3% 2% 0% 100% 12/31/11 $32.6 $49.9 $15.5 $7.0 $2.5 $2.2 $0.1 $109.8 $(374) 30% 45% 14% 7% 2% 2% 0% 100% 12/31/10 $74.8 $10.6 $5.5 $2.3 $1.9 $0.2 $95.3 $(504) 79% 11% 6% 2% 2% 0% 100% Investment Portfolio Investment Portfolio Detail as of December 31, 2014

26 Ratings 1 Book Value ($B) Book Value (% Total) Unrealized After-tax MTM Gain / (Loss) ($M) 2 Investment UST / AGY AAA AA A BBB <BBB Not Rated Fixed Rate / Floating Rate Government/Agency securities 79% 12% 5% 4% — — — $19.7 17.6% ($34) 96% / 4% Asset-backed securities — 71% 21% 4% 1% 3% — 43.2 38.6 180 4% / 96% Mortgage-backed securities 89% 7% 1% — 1% 2% — 23.1 20.7 61 85% / 15% Commercial mortgage- backed securities 2% 86% 7% 4% — 1% — 5.3 4.7 27 61% / 39% Corporate bonds — — 13% 59% 28% — — 5.3 4.7 55 96% / 4% Covered bonds — 100% — — — — — 3.3 3.0 18 22% / 78% Municipal bonds — 23% 68% 9% — — — 8.3 7.4 158 99% / 1% Clipper tax-exempt bonds/other — 42% 45% 12% — — 1% 3.7 3.3 22 22% / 78% TOTAL PORTFOLIO 32% 41% 17% 6% 2% 2% 0% $111.9 100.0% $487 52% / 48% Portfolio amounts are expressed at book value; book value includes the amortized cost of transferred securities at the time they were transferred. 1. U.S. Treasuries and Agencies/Agency MBS are split rated - AAA by Moody’s and AA+ by S&P. These securities are classified separately in the table above and not included in either the AAA or AA classifications 2. At 12/31/14: after-tax unrealized MTM gain/(loss) includes after-tax unrealized gain on securities available for sale of $483 million, after-tax unrealized gain on securities held to maturity of $71 million and after-tax unrealized loss primarily related to securities previously transferred from available for sale to held to maturity of $(67) million Investment Portfolio Holdings by Asset Class as of December 31, 2014

27 Ratings 1 Book Value ($B) Book Value (% Total) Unrealized After-tax MTM Gain / (Loss) ($M) Investment UST / AGY AAA AA A BBB <BBB Not Rated Student Loans — 37% 58% 5% — — — $14.3 33.1% ($12) Credit Cards — 100% — — — — — 5.3 12.3 (10) Auto/Equipment — 99% — 1% — — — 4.7 10.9 3 Non-US RMBS — 84% 5% 6% 1% 4% — 13.3 30.8 167 CLOs — 94% 6% — — — — 4.4 10.2 58 Sub-Prime — 3% 3% 24% 18% 52% — 1.0 2.3 (32) HELOC — — — 100% — — — 0.0 0.0 (1) Other — — — 38% 62% — — 0.2 0.4 7 TOTAL ABS — 71% 21% 4% 1% 3% — $43.2 100.0% $180 Portfolio amounts are expressed at book value; book value includes the amortized cost of transferred securities at the time they were transferred. 1. U.S. Treasuries and Agencies/Agency MBS are split rated - AAA by Moody’s and AA+ by S&P. These securities are classified separately in the table above and not included in either the AAA or AA classifications RMBS = Residential Mortgage Backed Securities; CLO = Collateralized Loan Obligation; HELOC = Home Equity Line of Credit Investment Portfolio Asset-backed Securities Holdings as of December 31, 2014

28 Ratings 1 Book Value ($B) Book Value (% Total) Unrealized After-tax MTM Gain / (Loss) ($M) Investment UST / AGY AAA AA A BBB <BBB Not Rated Agency MBS 100% — — — — — — $20.6 72.5% $41 Non-Agency MBS — 62% 7% 4% 8% 19% — 2.5 8.8 20 CMBS 2% 86% 7% 4% — 1% — 5.3 18.7 27 TOTAL MBS 73% 21% 2% 1% 1% 2% — $28.4 100.0% $88 Portfolio amounts are expressed at book value; book value includes the amortized cost of transferred securities at the time they were transferred. 1. U.S. Treasuries and Agencies/Agency MBS are split rated - AAA by Moody’s and AA+ by S&P. These securities are classified separately in the table above and not included in either the AAA or AA classifications Investment Portfolio Mortgage-backed Securities Holdings as of December 31, 2014

29 Non-U.S. Investments: Ratings Non-U.S. Investments: Asset Class 1. Sovereign debt is reflected in the government agency column 2. Japanese government bonds were downgraded to A1 from Aa3 by Moody’s on December 1, 2014 3. Country of collateral used except for corporates, where country of issuer is used Excludes equity securities of approximately $11.2 million (1) Investment Portfolio Non-U.S. Investment Summary as of December 31, 2014 AAA 81.1% AA 6.7% A 8.5% BBB 1.8% BB 1.2% <BB 0.7% Gov't/Agency, 14.2% ABS: FRMBS, 46.2% ABS: All Other, 20.8% Corp, 4.2% Covered, 11.5% Other, 3.1% December 31, 2014 Book Book Value ($B) Value Average Gov't/ ABS ABS Corporate Covered ($B) Rating Agency (1) FRMBS All Other Bonds Bonds Other United Kingdom 8.6$ AAA -$ 6.0$ 1.9$ 0.3$ 0.4$ -$ Australia 5.1 AA 0.2 2.4 0.6 0.1 0.9 0.9 Netherlands 4.3 AAA - 4.0 - 0.1 0.2 - Canada 2.7 AAA 2.0 - - 0.3 0.4 - Germany 2.5 AAA - - 2.5 - - - France 1.4 AAA - 0.1 0.6 0.2 0.5 - Japan 0.9 A 0.9 - - - - - Korea 0.9 AA 0.9 - - - - - Italy 0.5 AA - 0.5 - - - - Norway 0.5 AAA - - 0.1 - 0.4 - Finland 0.5 AAA - - 0.2 - 0.3 - Spain 0.1 BB - 0.1 - - - - Ireland 0.1 B - 0.1 - - - - Portugal 0.1 BB - 0.1 - - - - Other 0.6 AA 0.1 - 0.1 0.2 0.2 - Non-U.S. Investments (2) 28.8$ 4.1$ 13.3$ 6.0$ 1.2$ 3.3$ 0.9$ U.S. Investments 83.1 Total Portfolio 111.9$

30 C. Non-GAAP Measures and Capital Ratios Refer to the addendum linked to this presentation for explanations of our non-GAAP financial measures and for reconciliations of our operating-basis financial information. To access the addendum go to www.statestreet.com/stockholder and click on “Filings & Reports – Financial Trends”.