Attached files

| file | filename |

|---|---|

| 8-K - 8-K - InvenTrust Properties Corp. | d853184d8k.htm |

| EX-99.2 - EX-99.2 - InvenTrust Properties Corp. | d853184dex992.htm |

| EX-2.1 - EX-2.1 - InvenTrust Properties Corp. | d853184dex21.htm |

Table of Contents

Exhibit 99.1

January 20, 2015

Dear Inland American Real Estate Trust, Inc. Stockholder:

Over the past 18 months, Inland American Real Estate Trust, Inc. (“Inland American,” “we” or “our”) has been implementing its long-term strategy of focusing our portfolio into three asset classes – lodging, multi-tenant retail and student housing. By tailoring, expanding and refining these three components of our portfolio, our goals were to enhance long-term stockholder value and position Inland American to explore various strategic transactions designed to provide liquidity events for our stockholders. Inland American has achieved several important milestones in its efforts to enhance stockholder value and create liquidity for our stockholders:

| • | In August 2013, we announced, and subsequently closed, two large transactions involving the sale of our net lease assets and conventional multi-family assets for approximately $2.5 billion. |

| • | In February 2014, stockholders approved important charter changes, resulting in increased flexibility for our board of directors to execute its strategy. |

| • | In March 2014, Inland American continued to evolve with the signing of our self-management agreements and the $395 million modified “Dutch Auction” tender offer. Both events were important milestones in the history of Inland American and were designed to be accretive to existing stockholders. |

| • | In November 2014, we sold 52 suburban select service hotels for approximately $1.1 billion, resulting in net proceeds of approximately $480 million after prepayment of indebtedness and related costs. |

We are pleased to announce yet another important milestone for Inland American and inform you that the board of directors of Inland American has authorized the pro rata distribution of 95% of the outstanding shares of common stock of Xenia Hotels & Resorts, Inc. (“Xenia”), a wholly-owned subsidiary of Inland American, to Inland American stockholders. Upon completion of the separation and distribution from Inland American, Xenia will be an independent, self-advised and self-administered, publicly-traded REIT that invests primarily in premium full service, lifestyle and urban upscale hotels, with a focus on top 25 U.S. lodging markets (as defined by STR. Inc.) as well as key leisure destinations in the United States. Upon completion of the separation and distribution, Xenia will own 46 hotels, comprising 12,636 rooms, across 19 states and the District of Columbia, and a majority interest in two hotels under development. Xenia’s hotels are primarily operated by industry leaders such as Marriott®, Hilton®, Hyatt®, Starwood®, Kimpton®, Aston®, Fairmont® and Loews®, as well as leading independent management companies.

Inland American’s board of directors has determined upon careful review and consideration that Xenia’s separation from Inland American is in the best interests of Inland American. As a stand-alone company, we believe that Xenia will be well capitalized and well-positioned to deliver both internal growth through active and focused asset management of existing hotels and external growth through acquisitions that meet Xenia’s investment criteria. Additionally, as a publicly-traded REIT, Xenia will have access to the capital markets to issue equity or debt securities, and will have the flexibility to create a more diverse capital structure tailored to its strategic goals.

Xenia will be led by Jeffrey H. Donahue, as Chairman of the Board of Directors, and Marcel Verbaas, its President and Chief Executive Officer, and a member of Xenia’s board of directors. Mr. Donahue has extensive real estate industry experience and is a veteran public company director. Mr. Verbaas is a proven leader with

Table of Contents

strong business acumen and extensive industry knowledge. Since 2007, Mr. Verbaas and his team have overseen the entire lodging portfolio for Inland American and the acquisition of more than 50 hotels, including all but two of the properties in Xenia’s portfolio, and have been instrumental in executing a multi-year strategy of repositioning our lodging portfolio by recycling capital into hotels that meet Xenia’s investment criteria. Through this experience, Xenia’s senior management team has gained an in-depth knowledge of the hotels in Xenia’s portfolio and enhanced valuable, long-standing relationships with Xenia’s brand management companies, franchisors and third-party managers. Our board of directors is confident that Mr. Verbaas and his senior management team, who have an average tenure in the lodging industry of 26 years, have the requisite industry expertise and familiarity with Xenia’s lodging portfolio to lead Xenia as it transitions to an independent, lodging-focused, publicly-traded REIT.

Xenia has applied to list its common stock on the New York Stock Exchange under the symbol “XHR.” As a result, unlike shares of common stock of Inland American, Xenia’s common stock will be publicly tradable and you will be able to make your own investment decisions with respect to the shares of Xenia common stock that you own.

The pro rata distribution by Inland American of 95% of the outstanding shares of Xenia common stock will occur on February 3, 2015 by way of a taxable pro rata special distribution to Inland American stockholders of record on the record date of the distribution. Each Inland American stockholder will be entitled to receive one share of Xenia common stock for every eight shares of Inland American common stock held by such stockholder at the close of business on January 20, 2015, the record date of the distribution. The Xenia common stock will be issued in book-entry form only, which means that no physical share certificates will be issued. Following the distribution, you will own shares in both Inland American and Xenia. The number of Inland American shares you own will not change as a result of this distribution. Stockholder approval of the distribution is not required, and you will not be required to make any payment, or to surrender or exchange your shares of Inland American common stock or take any other action to receive your shares of Xenia common stock on the distribution date. Immediately following the distribution, Inland American will continue to own approximately 5% of the outstanding shares of common stock of Xenia.

The information statement, which is being mailed to all holders of Inland American common stock on the record date for the distribution, describes the distribution in detail and contains important information about Xenia, its business, financial condition and operations and risks related to its business. The information statement also explains how you will receive your shares of Xenia common stock. We urge you to read the entire information statement carefully.

On behalf of the board of directors, the senior management team and the employees of Inland American, I want to thank you for your continued support of Inland American. We look forward to this next chapter in Inland American’s history and to your future support of Xenia.

| Sincerely, |

|

Thomas P. McGuinness |

| President and Chief Executive Officer, Inland American Real Estate Trust, Inc. |

Table of Contents

January 20, 2015

Dear Future Xenia Hotels & Resorts, Inc. Stockholder:

It is our pleasure to welcome you as a stockholder of our company, Xenia Hotels & Resorts, Inc. (“Xenia”). Our company is a self-advised and self-administered REIT that invests primarily in premium full service, lifestyle and urban upscale hotels, with a focus on the top 25 U.S. lodging markets (as defined by STR. Inc.) as well as key leisure destinations in the United States. Upon completion of the separation and distribution, Xenia will own a portfolio of 46 hotels, comprising 12,636 rooms, across 19 states and the District of Columbia, and a majority interest in two hotels under development. Our hotels are primarily operated by industry leaders such as Marriott®, Hilton®, Hyatt®, Starwood®, Kimpton®, Aston®, Fairmont® and Loews®, as well as leading independent management companies.

We own and pursue hotels in the upscale, upper upscale and luxury segments that are affiliated with premium, leading brands, as we believe that these segments yield attractive risk-adjusted returns. Within these segments, we focus on hotels that will provide guests with a distinctive lodging experience, tailored to reflect local market environments rather than hotels that are heavily dependent on conventions and group business. We also seek properties that exhibit an opportunity for us to enhance operating performance through aggressive asset management and targeted capital investment. By balancing our portfolio between premium full service, lifestyle and urban upscale hotels with these characteristics, we believe we are able to achieve strong cash flows and attractive returns.

We believe that the current market environment presents attractive opportunities for us to acquire additional hotels with significant upside potential that are compatible with our investment strategy. We also believe that current lodging market fundamentals provide meaningful opportunities for revenue and Adjusted EBITDA growth at our existing hotels. We intend to enhance the value of our existing hotels through focused asset management and targeted renovation projects. We believe that by pursuing this strategy, we will strengthen our position as a leading owner of hotel properties across our targeted segments. We believe that our senior management team’s overall lodging experience and proven track record, as well as its in-depth knowledge of our hotels and long-standing and extensive relationships within the lodging industry, will enable us to successfully execute on our business strategy to earn returns in excess of our cost of capital and create long-term value for our stockholders.

As a stand-alone publicly-traded company, we believe that Xenia will be well capitalized and well-positioned to deliver both internal growth through active and focused asset management of existing hotels and external growth through acquisitions that meet our investment criteria. Additionally, our separation from Inland American will enable our dedicated management team to focus solely on our premium full service, lifestyle and urban upscale hotel portfolio and make decisions solely based on our business objectives and strategic goals. As a pure play lodging company, we believe we will be well-positioned to grow our business through operational flexibility, efficient deployment of resources and quick decision-making based solely on the needs of our business. As a publicly-traded REIT, we will have direct access to the capital markets to issue equity or debt securities, and will have the flexibility to create a more diverse capital structure tailored to our strategic goals. Additionally, our common stock, and units of our operating partnership, will be able to be used to facilitate our growth through acquisitions and strategic partnerships after the distribution and may become an important acquisition currency.

Xenia has applied to list its common stock on The New York Stock Exchange under the symbol “XHR.” As a result, shares of Xenia’s common stock will be publicly tradable and you will be able to make your own investment decisions with respect to the shares of common stock of Xenia that you own.

We invite you to learn more about Xenia by reviewing the enclosed information statement. We urge you to read the information statement carefully as it describes the distribution in detail and contains important information about Xenia, our business, financial condition and operations and risks related to our business. The

Table of Contents

information statement also explains how you will receive your shares of Xenia common stock. We look forward to our future and to your support as a stockholder of Xenia.

| Sincerely, |

|

Marcel Verbaas |

| President and Chief Executive Officer, Xenia Hotels & Resorts, Inc. |

Table of Contents

INFORMATION STATEMENT

Common Stock

Xenia Hotels & Resorts, Inc.

This information statement is being furnished in connection with the taxable distribution by Inland American Real Estate Trust, Inc., or Inland American, a Maryland corporation that has elected to be taxed, and currently qualifies, as a real estate investment trust, or REIT, for U.S. federal income tax purposes, to its stockholders of 95% of the outstanding shares of common stock of Xenia Hotels & Resorts, Inc. (“Xenia”). Inland American currently owns 100% of the outstanding shares of common stock of Xenia. Xenia holds, or will hold, directly or indirectly, a portfolio of 46 premium full service, lifestyle and urban upscale hotels and the majority interest in two hotels under development. To implement the distribution, Inland American will distribute 95% of the outstanding shares of common stock of Xenia on a pro rata basis to existing stockholders of Inland American.

For every eight shares of common stock of Inland American held of record by you as of the close of business on January 20, 2015, or the distribution record date, you will receive one share of our common stock. We expect our common stock will be distributed by Inland American to you on or about February 3, 2015, or the distribution date.

No vote of Inland American’s stockholders is required in connection with the distribution. Therefore, you are not being asked for a proxy, and you are requested not to send us a proxy, in connection with the distribution. You will not be required to pay any consideration or to exchange or surrender your existing shares of common stock of Inland American or take any other action to receive our common stock on the distribution date to which you are entitled.

There is no current trading market for our common stock. We have applied to list our common stock on The New York Stock Exchange (“NYSE”) under the symbol “XHR”, and expect trading of our common stock on the NYSE will begin on the first trading day following the completion of the distribution.

We intend to elect to be taxed as a REIT for U.S. federal income tax purposes beginning with our short taxable year that commenced on January 5, 2015. To assist us in qualifying as a REIT, among other purposes, stockholders are generally restricted from owning more than 9.8% in value or in number of shares, whichever is more restrictive, of our outstanding shares of any class or series of our capital stock. See “Description of Capital Stock—Restrictions on Ownership and Transfer.”

We are an “emerging growth company” as defined under the federal securities laws and, as such, may elect to comply with certain reduced public company reporting requirements.

In reviewing the information statement, you should carefully consider the matters described under the caption “Risk Factors” beginning on page 39.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this information statement is truthful or complete. Any representation to the contrary is a criminal offense.

This Information Statement was first mailed to Inland American stockholders on or about January 23, 2015.

January 20, 2015

Table of Contents

| i | ||||

| i | ||||

| ii | ||||

| ii | ||||

| iv | ||||

| 1 | ||||

| 39 | ||||

| 73 | ||||

| 75 | ||||

| 85 | ||||

| 86 | ||||

| 88 | ||||

| UNAUDITED PRO FORMA COMBINED CONSOLIDATED FINANCIAL STATEMENTS |

91 | |||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

100 | |||

| 135 | ||||

| 139 | ||||

| 156 | ||||

| 161 | ||||

| 185 | ||||

| INVESTMENT POLICIES AND POLICIES WITH RESPECT TO CERTAIN ACTIVITIES |

191 | |||

| 195 | ||||

| 199 | ||||

| 201 | ||||

| 204 | ||||

| CERTAIN PROVISIONS OF MARYLAND LAW AND OUR CHARTER AND BYLAWS |

210 | |||

| 216 | ||||

| 243 | ||||

| F-1 |

The market data and certain other statistical information used throughout this information statement are based on independent industry publications, government publications or other published independent sources. These sources generally state that the information they provide has been obtained from sources believed to be reliable, but that the accuracy and completeness of the information are not guaranteed. The forecasts and projections are based on industry surveys and the preparers’ experience in the industry, and there is no assurance that any of the projected amounts will be achieved. We believe that the surveys and market research others have performed are reliable, but we have not independently verified this information. STR. Inc. (“STR”), PKF Hospitality Research, LLC (“PKF-HR”) and Lodging Econometrics, Inc. (“Lodging Econometrics”) are the primary sources for third-party market data and industry statistics and forecasts. STR does not guarantee the performance of any company about which it collects and provides data. The reproduction of STR’s data without their written permission is strictly prohibited. Nothing in the STR, PKF-HR or Lodging Econometrics data should be construed as advice. Some data is also based on our good faith estimates.

TRADEMARKS, SERVICE MARKS AND TRADENAMES

This information statement contains registered trademarks that are the exclusive property of their respective owners, which are companies other than us, including Marriott International, Inc., Hilton Worldwide Inc., Hyatt Hotels Corporation, Starwood Hotels and Resorts Worldwide, Inc., The Kimpton Hotel & Restaurant Group Inc.,

i

Table of Contents

Aston Hotels & Resorts LLC, Fairmont Hotels & Resorts and Loews Hotels, or their respective parents, subsidiaries or affiliates (“Brand Companies”). In the event that any of our management agreements or franchise agreements with the Brand Companies are terminated for any reason, the use of all applicable trademarks and service marks owned by the Brand Companies will cease at the hotel where the management agreement or franchise agreement was terminated; all signs and materials bearing the marks and other indicia connecting the hotel to the Brand Companies will be removed (at the hotel’s or our expense).

None of the Brand Companies or their respective directors, officers, agents or employees are issuers of the shares described herein or had responsibility for the creation or contents of this information statement. None of the Brand Companies or their respective directors, officers, agents or employees make any representation or warranty as to the accuracy, adequacy or completeness of any of the following information, including any financial information and any projections of future performance. The Brand Companies do not have an exclusive relationship with us and will continue to be engaged in other business ventures, including the acquisition, development, construction, ownership or operation of lodging, residential and vacation ownership properties, which are or may become competitive with the properties held by us.

Prior to and in connection with our separation from Inland American, we will effect the transactions (the “Reorganization Transactions”) described under “Summary—Our Structure and Reorganization Transactions—Our Corporate Reorganization.” We refer in this Information Statement to all of the hotels owned by Xenia from time to time and prior to the Reorganization Transactions and the sale of the Suburban Select Service Portfolio (defined below) as the “Prior Combined Portfolio.” As of September 30, 2014, the Prior Combined Portfolio consisted of:

| • | 46 premium full service, lifestyle and urban upscale hotels and a majority interest in two hotels under development (collectively, the “Xenia Portfolio”); |

| • | one hotel being marketed for sale; and |

| • | 52 suburban select service hotels (the “Suburban Select Service Portfolio”), classified as held for sale with the related results from operations reported as discontinued operations, as described below. |

In October 2014, as part of the Reorganization Transactions, the hotel being marketed for sale was transferred by the Company to a separate, wholly-owned subsidiary of Inland American. This hotel was subsequently sold by Inland American to an unaffiliated third party on December 31, 2014. For more detail regarding the Reorganization Transactions, see “Summary—Our Structure and Reorganization Transactions—Our Corporate Reorganization.”

The Suburban Select Service Portfolio was sold on November 17, 2014 to unaffiliated third party purchasers for approximately $1.1 billion, resulting in net proceeds to Inland American of approximately $480 million after prepayment of certain indebtedness and related costs. Since September 17, 2014, the date of the definitive asset purchase agreement, the Suburban Select Service Portfolio has been classified as held for sale, and its operating activity has been reflected in discontinued operations. Following the completion of the sale of the Suburban Select Service Portfolio, the Suburban Select Service Portfolio is no longer owned or asset managed by the Company. None of the proceeds from the sale of the Suburban Select Service Portfolio were retained by Xenia.

ii

Table of Contents

Unless otherwise indicated or the context otherwise requires, all information herein reflects the consummation of the Reorganization Transactions, the sale of the Suburban Select Service Portfolio and the completion of our separation from Inland American, which will occur on the distribution date. References herein to “we,” “our,” “us” and the “Company” refer to Xenia Hotels & Resorts, Inc. and its consolidated subsidiaries, including XHR LP, a Delaware limited partnership, which we refer to as our “operating partnership,” and references to “Xenia Hotels & Resorts, Inc.” refer only to Xenia Hotels & Resorts, Inc., exclusive of its subsidiaries, in each case giving effect to the Reorganization Transactions.

Additionally, unless otherwise indicated or the context otherwise requires, all information in this information statement gives effect to the filing of our Articles of Amendment and Restatement and the effectiveness of our Amended and Restated Bylaws, which will occur prior to the completion of our separation from Inland American.

Presentation of historical operating and non-financial data and pro forma financial information

Unless otherwise indicated or the context otherwise requires, (i) operating and non-financial data, including occupancy (as defined below), ADR (as defined below), RevPAR (as defined below), number of hotels, number of rooms and Adjusted EBITDA, disclosed in the sections of this information statement other than the Financial Statement Sections (as defined below) and (ii) pro forma financial information in this information statement:

| • | reflect the business and operations of the Company after the consummation of the Reorganization Transactions and immediately following the completion of the separation of the Company from Inland American, when we will own solely the Xenia Portfolio; |

| • | exclude the Suburban Select Service Portfolio to the extent it is reflected as held for sale on the Company’s balance sheet as of September 30, 2014; |

| • | exclude one hotel sold on May 30, 2014, one hotel sold on August 28, 2014 and one hotel sold on December 31, 2014; |

| • | with respect to each hotel included in the Xenia Portfolio acquired during 2013 or 2014, give effect to such acquisition as if such acquisition had been consummated on January 1, 2013; |

| • | reflect the issuance of 125 shares of preferred stock of the Company, designated as 12.5% Series A Cumulative Non-Voting Preferred Stock, $0.01 par value per share, with a liquidation preference of $1,000 per share (the “Series A Preferred Stock”), in a private placement to approximately 125 investors who qualify as “accredited investors” (as that term is defined in Rule 501(a) of Regulation D of the Securities Act) for an aggregate purchase price of $125,000, which we issued to facilitate our ability to qualify as a REIT in connection with a potential section 336(e) election under the Internal Revenue Code of 1986, as amended (the “Code”), as described in “Our Separation From Inland American—Certain Material U.S. Federal Income Tax Consequences of the Separation—Tax Classification of the Separation in General”; |

| • | reflect the capital contribution from Inland American of $125.0 million prior to the completion of our separation from Inland American (the “Capital Contribution”); |

| • | reflect the repayment of approximately $84.0 million of borrowings outstanding under existing mortgage indebtedness, funded by Inland American; |

| • | reflect an additional capital contribution of $16.0 million, all of which the Company intends to use to paydown existing mortgage indebtedness in 2015; |

| • | reflect a non-cash capital contribution of $86.8 million to settle the Company’s allocated share of Inland American’s unsecured credit facility as of September 30, 2014; |

| • | reflect the Company’s entry into the intended new $400 million unsecured revolving credit facility; |

| • | reflect the issuance of 113,396,997 shares of our common stock to Inland American pursuant to a stock dividend effectuated prior to the distribution; |

iii

Table of Contents

| • | reflect the distribution of 107,728,098 shares of our common stock to holders of Inland American common stock based upon the number of Inland American shares outstanding on January 20, 2015 and 5,669,899 shares retained by Inland American; and |

| • | reflect certain other adjustments as described in “Unaudited Pro Forma Combined Consolidated Financial Statements.” |

Presentation of combined consolidated financial information and certain operating and non-financial data

Unless otherwise indicated or the context otherwise requires, (i) the historical financial data (excluding all pro forma financial data) in this information statement and (ii) the operating and non-financial data (but excluding all related data prepared on a pro forma basis), including occupancy, ADR, RevPAR, number of hotels, number of rooms, FFO (as defined below), Adjusted FFO (as defined below) and Adjusted EBITDA, disclosed in “Summary Historical and Pro Forma Combined Consolidated Financial and Operating Data,” “Selected Historical Combined Consolidated Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” (excluding all pro forma financial data) (collectively, the “Financial Statement Sections”) reflects the combined and consolidated business and operations of the Company prior to consummation of the Reorganization Transactions and the completion of the Company’s separation from Inland American, reflecting ownership of the Prior Combined Portfolio, which, among other things, classifies the Suburban Select Service Portfolio as held for sale with the related results from operations reported as discontinued operations.

Except where the context suggests otherwise, we define certain terms in this information statement as follows:

| • | “ADR” or “average daily rate” means hotel room revenue divided by total number of rooms sold in a given period; |

| • | “Adjusted FFO” means FFO (as defined below), adjusted for certain items such as hotel property acquisition and pursuit costs and other expenses we believe do not represent recurring operations; |

| • | “Aston,” “Fairmont,” “Hilton,” “Hyatt,” “Kimpton,” “Loews,” “Marriott,” and “Starwood” mean Aston Hotels & Resorts LLC, Fairmont Hotels & Resorts, Hilton Worldwide Inc., Hyatt Hotels Corporation, The Kimpton Hotel & Restaurant Group Inc., Loews Hotels, Marriott International, Inc., and Starwood Hotels and Resorts Worldwide, Inc., respectively, as well as their respective parents, subsidiaries or affiliates; |

| • | “CAGR” means compound annual growth rate; |

| • | “FFO” means a measure that reflects net income or loss (calculated in accordance with GAAP), excluding real estate depreciation and amortization, gains (losses) from sales of real estate, impairments of real estate assets, the cumulative effect of changes in accounting principles and adjustments for unconsolidated partnerships and joint ventures; |

| • | “Inland American” means Inland American Real Estate Trust, Inc., a Maryland corporation that has elected to be taxed and currently qualifies, as a REIT, and that owns 100% of the outstanding shares of common stock of the Company prior to giving effect to the separation, and, as the context may require, its consolidated subsidiaries other than us; |

| • | a “lifestyle” hotel refers to an innovative hotel with a focus on providing a unique and individualized guest experience in a smaller footprint by combining traditional hotel services with modern technologies and placing an emphasis on local influence; |

| • | a “luxury” hotel refers to a luxury hotel as defined by STR; |

iv

Table of Contents

| • | “occupancy” means the total number of rooms sold in a given period divided by the total number of rooms available at a hotel or group of hotels; |

| • | a “premium full service hotel” refers to a hotel defined as “upper upscale” or “luxury” by STR; |

| • | “RevPAR” or “revenue per available room” means hotel room revenue divided by room nights available to guests for a given period, and does not include non-room revenues such as food and beverage revenue or other operating revenues; |

| • | the “Seven Major Markets” means the markets in and around New York City, New York; Chicago, Illinois; Washington, DC; San Francisco / San Mateo, California; San Diego, California; Boston, Massachusetts; and Los Angeles / Long Beach, California, which represent the seven largest markets based on number of owned hotel rooms among all other publically-traded U.S. hotel REITs included in the FTSE NAREIT US Real Estate Index; |

| • | “Top 25 Markets” refers to the top 25 U.S. lodging markets as defined by STR; |

| • | “TRS” refers to a taxable REIT subsidiary under the Code. “Our TRS” refers to XHR Holding, Inc., a wholly-owned subsidiary of our operating partnership that will elect to be a TRS of ours; |

| • | “TRS lessees” refers to the direct and indirect wholly-owned subsidiaries of our TRS; |

| • | an “upper midscale” hotel refers to an upper midscale hotel as defined by STR; |

| • | an “upper upscale” hotel refers to an upper upscale hotel as defined by STR; |

| • | an “upscale” hotel refers to an upscale hotel as defined by STR; and |

| • | an “urban upscale” hotel refers to a hotel located in an urban or similar high-density commercial area, such as a central business district, and defined as “upscale” or “upper midscale” by STR. |

v

Table of Contents

This summary highlights some of the information in this information statement relating to our Company, our separation from Inland American and the distribution of our common stock by Inland American to its stockholders. For a more complete understanding of our business and the separation and distribution, you should read carefully the more detailed information set forth under the sections entitled “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Our Separation from Inland American” and the other information included in this information statement.

Overview

We are a self-advised and self-administered REIT that invests primarily in premium full service, lifestyle and urban upscale hotels, with a focus on the Top 25 Markets as well as key leisure destinations in the United States. As of September 30, 2014, we owned 46 hotels, comprising 12,636 rooms, across 19 states and the District of Columbia, and had a majority interest in two hotels under development. Our hotels are primarily operated by industry leaders such as Marriott, Hilton, Hyatt, Starwood, Kimpton, Aston, Fairmont and Loews, as well as leading independent management companies, under the brands listed in the following table:(1)

| Brand Affiliation |

Number of Hotels |

Number |

Percentage |

|||||||||

| Marriott |

||||||||||||

| Autograph Collection(2) |

3 | 437 | 3.5 | % | ||||||||

| Courtyard by Marriott |

4 | 630 | 5.0 | % | ||||||||

| Marriott |

9 | 3,099 | 24.5 | % | ||||||||

| Renaissance |

2 | 1,014 | 8.0 | % | ||||||||

| Residence Inn |

3 | 637 | 5.0 | % | ||||||||

|

|

|

|

|

|

|

|||||||

| Subtotal |

21 | 5,817 | 46.0 | % | ||||||||

| Hilton |

||||||||||||

| DoubleTree |

1 | 220 | 1.7 | % | ||||||||

| Embassy Suites |

1 | 223 | 1.8 | % | ||||||||

| Hampton Inn |

2 | 264 | 2.1 | % | ||||||||

| Hilton |

3 | 669 | 5.3 | % | ||||||||

| Hilton Garden Inn |

2 | 478 | 3.8 | % | ||||||||

| Homewood Suites |

1 | 162 | 1.3 | % | ||||||||

|

|

|

|

|

|

|

|||||||

| Subtotal |

10 | 2,016 | 16.0 | % | ||||||||

| Hyatt |

||||||||||||

| Andaz |

3 | 451 | 3.6 | % | ||||||||

| Hyatt |

1 | 118 | 0.9 | % | ||||||||

| Hyatt Regency |

2 | 1,154 | 9.1 | % | ||||||||

|

|

|

|

|

|

|

|||||||

| Subtotal |

6 | 1,723 | 13.6 | % | ||||||||

| Kimpton |

||||||||||||

| Lorien |

1 | 107 | 0.8 | % | ||||||||

| Monaco |

3 | 605 | 4.8 | % | ||||||||

|

|

|

|

|

|

|

|||||||

| Subtotal |

4 | 712 | 5.6 | % | ||||||||

| Starwood |

||||||||||||

| Westin |

2 | 893 | 7.1 | % | ||||||||

|

|

|

|

|

|

|

|||||||

| Subtotal |

2 | 893 | 7.1 | % | ||||||||

| Aston |

1 | 645 | 5.1 | % | ||||||||

| Fairmont |

1 | 545 | 4.3 | % | ||||||||

| Loews |

1 | 285 | 2.3 | % | ||||||||

|

|

|

|

|

|

|

|||||||

| Total |

46 | 12,636 | 100.0 | % | ||||||||

|

|

|

|

|

|

|

|||||||

1

Table of Contents

| (1) | This table reflects only the hotels in the Xenia Portfolio, excluding our two hotels under development, as of September 30, 2014. See “Basis of Presentation.” |

| (2) | Our two hotels under development are Autograph Collection hotels, which will have a total of 150 rooms. |

The following table sets forth certain information about our portfolio of hotels on a pro forma basis:

| Nine Month Period Ended September 30, |

Year Ended December 31, | |||||||||||||||

| 2014 | 2013 | 2012 | 2011 | |||||||||||||

| Statistical Data: |

||||||||||||||||

| Number of Hotels(1) |

46 | 45 | 31 | 24 | ||||||||||||

| Number of Rooms(1) |

12,636 | 11,991 | 8,688 | 6,063 | ||||||||||||

| Occupancy(2) |

78.1 | % | 75.2 | % | 71.5 | % | 71.1 | % | ||||||||

| ADR(2) |

$ | 176.91 | $ | 167.20 | $ | 151.84 | $ | 147.71 | ||||||||

| RevPAR(2) |

$ | 138.24 | $ | 125.73 | $ | 108.54 | $ | 104.99 | ||||||||

| (1) | Includes only the hotels in the Xenia Portfolio, excluding our two hotels under development, as of the end of the applicable period. See “Basis of Presentation.” |

| (2) | Includes full-year (or full-period) data for any hotel acquired during the applicable period by including applicable data for such hotels while they were under prior ownership. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Results of Operations” for a presentation of such statistics from the date of acquisition of such hotels. For only those hotels operated by Marriott, our historical annual operating results represented here from 2011 to 2013 include a 52-53 week fiscal calendar used by Marriott at that time. |

On a pro forma basis, for the nine months ended September 30, 2014 and the year ended December 31, 2013, we generated pro forma revenues of $691.1 million and $861.1 million, respectively, pro forma Adjusted EBITDA of $195.3 million and $233.9 million, respectively, and net income attributable to the Company of $37.5 million and $14.2 million, respectively. In addition, for the nine months ended September 30, 2014 and the year ended December 31, 2013, 75.9% and 76.1% of our pro forma revenues were derived from hotels located in the Top 25 Markets and key leisure destinations. For our definition of Adjusted EBITDA and why we present it as well as a reconciliation of Adjusted EBITDA to net income attributable to Company, the most directly comparable GAAP financial measure, see “Summary Historical and Pro Forma Combined Consolidated Financial and Operating Data.” See also “Basis of Presentation.”

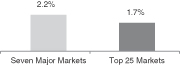

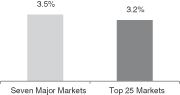

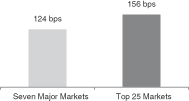

We plan to grow our business through a differentiated acquisition strategy, aggressive asset management and capital investment in our properties. We primarily target markets and sub-markets with particular positive characteristics, such as multiple demand generators, favorable supply and demand dynamics and attractive projected RevPAR growth, with a focus on the Top 25 Markets and key leisure destinations. While we expect that most lodging markets will benefit from improvement in rates and occupancy in the intermediate term, we believe some will enjoy stronger improvements in fundamentals and deliver greater returns-on-investment on a risk-adjusted basis than others. We believe that since the recent financial crisis, investors in hotels, and in particular publicly-traded U.S. hotel REITs, have had an increasing focus on investing in properties located in the Seven Major Markets, which we believe has resulted in higher asset prices in those markets than in the Top 25 Markets despite the latter having comparable, and in some cases, stronger, underlying fundamentals. According to PKF-HR, the Top 25 Markets experienced lower supply growth than the Seven Major Markets from 2009 to 2013, and this trend is expected to continue through 2016 despite both sets of markets experiencing comparable demand growth, resulting in a more attractive projected supply / demand dynamic for the Top 25 Markets. As such, as compared to publicly-traded U.S. hotel REITs focused on the Seven Major Markets, our strategy allows us to acquire properties at attractive valuations in markets that have similar or better RevPAR growth expectations.

2

Table of Contents

We own and pursue hotels in the upscale, upper upscale and luxury segments that are affiliated with premium, leading brands, as we believe that these segments yield attractive risk-adjusted returns. Within these segments, we focus on hotels that will provide guests with a distinctive lodging experience, tailored to reflect local market environments rather than hotels that are heavily dependent on conventions and group business. We also seek properties that exhibit an opportunity for us to enhance operating performance through aggressive asset management and targeted capital investment. By balancing our portfolio between premium full service, lifestyle and urban upscale hotels with these characteristics, we believe we are able to achieve strong cash flows and attractive returns. Examples of how we have recently executed our strategy include several recent acquisitions, such as the Andaz San Diego, the Residence Inn Denver City Center, the Westin Galleria Houston and the Westin Oaks Houston at The Galleria and the Hyatt Key West Resort & Spa.

| • | Andaz San Diego: In March 2013, we acquired the Andaz San Diego, which made us the first REIT to own Hyatt’s recently introduced lifestyle brand, Andaz. We believe this prominent boutique hotel located within San Diego’s vibrant GasLamp Quarter presented an attractive investment opportunity. The hotel had generated strong revenues since opening in 2009, with further upside from a number of specific opportunities where we believed our asset management team could significantly improve operating cash flow through an aggressive reorganization of the business offerings and expense structure. We are working with Hyatt to implement these improvements. |

| • | Residence Inn Denver City Center: In April 2013, we acquired the Residence Inn Denver City Center, which is a modern, high rise urban upscale hotel in the heart of Downtown Denver. The extended stay and transient business mix, combined with strong average rates and an efficient staffing model, support strong margins at this hotel. Additionally, the hotel was developed as a mixed use commercial building with two leased street level retail outlets and significant excess parking within the tower that provides stable monthly income from local corporate parking demand. |

| • | Westin Galleria Houston and Westin Oaks Houston at The Galleria: The Westin Galleria Houston and the Westin Oaks Houston at The Galleria hotels, which we acquired in August 2013, are two premium full service hotels directly attached at opposite ends of The Galleria Mall in West Houston and operated as one of the premier meeting complexes in the strong Houston market. We acquired the two hotels at a meaningful discount to estimated replacement cost in the Houston Galleria submarket which has strong demand and limited hotel development sites. We identified what we believe to be significant opportunities to improve performance and increase value through aggressive revenue management and improving operational efficiencies. |

| • | Hyatt Key West Resort & Spa: Our acquisition of the Hyatt Key West Resort & Spa in November 2013 was an attractive opportunity to gain entry into a market with extremely high barriers to entry and robust RevPAR growth. The compact, 118-room resort is ideally located on the water at the end of Duval Street and appeals to travelers through its strong brand affiliation and unique property characteristics. |

Since 2010, we have acquired 28 of the hotels in the Xenia Portfolio, a total of 8,562 rooms, for an aggregate purchase price of approximately $2.0 billion. Additionally, since 2008, we have invested a total of approximately $209 million during our ownership period in capital expenditures to competitively position our portfolio to increase revenues as well as to keep our hotels well maintained. Our in-house project management team, currently consisting of eight individuals, manages all of our capital expenditure projects, which we believe provides us with a competitive advantage.

We believe that the current market environment presents attractive opportunities for us to acquire additional hotels with significant upside potential that are compatible with our investment strategy. We also believe that current lodging market fundamentals provide meaningful opportunities for revenue and Adjusted EBITDA growth at our existing hotels. We intend to enhance the value of our existing hotels through focused asset

3

Table of Contents

management and targeted renovation projects. We believe that by pursuing this strategy, we will strengthen our position as a leading owner of hotel properties across our targeted segments. We believe that our senior management team’s overall lodging experience and proven track record, as well as its in-depth knowledge of our hotels and long-standing and extensive relationships within the lodging industry, will enable us to successfully execute on our business strategy to earn returns in excess of our cost of capital and create long-term value for our stockholders.

We intend to elect to be taxed as, and to operate in a manner that will allow us to qualify as, a REIT for U.S. federal income tax purposes beginning with our short taxable year that commenced on January 5, 2015. See “Summary—Our Tax Status” and “Material U.S. Federal Income Tax Consequences.” To satisfy the requirements for qualification as a REIT, we lease our hotels to our TRS lessees, which are owned by our TRS. Our TRS will be subject to U.S. federal, state and local income tax.

Reasons for the Separation

Upon careful review and consideration in accordance with the applicable standard of review under Maryland law, Inland American’s board of directors determined that our separation from Inland American is in the best interests of Inland American. The board’s determination was based on a number of factors, including those set forth below.

| • | Create two separate, focused companies executing distinct business strategies. Historically, Inland American has focused on acquiring and developing a diversified portfolio of commercial real estate located in a broad range of geographic regions throughout the United States. As a result, Inland American’s investors have had exposure to a diversified portfolio across several different real estate asset classes, such as multi-tenant retail, lodging, student housing, net lease, office, industrial, and multi-family. Its lodging assets have been managed by a dedicated management team and held in a focused subsidiary since we were formed in 2007. Over the past two years, Inland American has been focusing its diversified portfolio into three specific asset classes – multi-tenant retail, lodging and student housing. By separating its premium full service, lifestyle and urban upscale hotel portfolio into a standalone hotel company, investors will be invested in two separate platforms with dedicated and focused management teams. The Suburban Select Service Portfolio was sold on November 17, 2014 to unaffiliated third party purchasers for approximately $1.1 billion. |

| • | Allow Inland American’s management to focus on its retained asset classes, while enabling our dedicated management to focus solely on Xenia’s premium full service, lifestyle and urban upscale hotel portfolio and make decisions solely based on Xenia’s business objectives and strategic plan. The separation of the premium full service, lifestyle and urban upscale hotel portfolio from Inland American will allow Inland American’s management to solely focus on its multi-tenant retail and student housing asset classes and the needs of these segments. Similarly, the separation will enable our dedicated management team to focus solely on Xenia’s premium full service, lifestyle and urban upscale hotel portfolio and make decisions solely based on our business objectives and strategic goals. As a pure play lodging company, we believe that we will be well-positioned to grow our business through operational flexibility, efficient deployment of resources and quick decision-making based solely on the needs of our business. |

| • | Market recognition of the value of our business. As a stand-alone company, we will be focused solely on premium full service, lifestyle and urban upscale hotels, making us an attractive investment opportunity for REIT investors looking for exposure to this asset class. We will also benefit from having the ability to use shares of our common stock or common units of limited partnership interest in our operating partnership (“OP Units”) as acquisition currency, which will improve our competitive positioning as we grow. |

4

Table of Contents

| • | Provide liquidity to Inland American stockholders. Unlike shares of common stock of Inland American, shares of our common stock are expected to be listed on the New York Stock Exchange (“NYSE”) and will be publicly tradeable. As a result, by distributing shares of our common stock to Inland American’s existing stockholders, such stockholders will be able to make their own investment decisions with respect to the shares of common stock that they own. Additionally, as a result of having a publicly traded market for our stock, new investors will have the opportunity to invest in our company. |

| • | More efficient capital allocation and direct access to capital markets. As a separate public company, we will have direct access to the capital markets to issue equity or debt securities, and will have the flexibility to create a more diverse capital structure tailored to our strategic goals and designed to maximize stockholder value. Additionally, our common stock, and possibly our OP Units, will be able to be used to facilitate our growth through acquisitions and strategic partnerships after the distribution and may become an important acquisition currency. |

The anticipated benefits of the separation are based on a number of assumptions, and there can be no assurance that such benefits will materialize to the extent anticipated, or at all. In the event that the separation does not result in such benefits, the costs associated with the separation could have a material adverse effect on our business and are not quantifiable. As part of Inland American, we have enjoyed certain benefits from Inland American’s purchasing power and borrowing leverage, and have also had access to Inland American’s balance sheet and capital. Following our separation from Inland American, we will be a smaller and less diversified company than Inland American, and we will not have access to financial and other resources comparable to those of Inland American prior to the separation. As a separate, stand-alone company, we may be unable to obtain debt or goods, technology and services at prices and on terms as favorable as those available to us prior to the separation. For more information about the risks associated with the separation, see “Risk Factors – Risks Related to Our Relationship with Inland American and the Separation.”

Our Industry

We believe that recent favorable trends in U.S. lodging industry fundamentals coupled with industry experts’ positive outlook provide an attractive backdrop for the growth of our business in the coming years.

The U.S. lodging industry constitutes a substantial portion of the domestic economy, having generated approximately $334 billion in revenues in 2013, according to STR. As of September 2014, there were over 53,000 hotels and 5 million hotel rooms in the United States according to Lodging Econometrics.

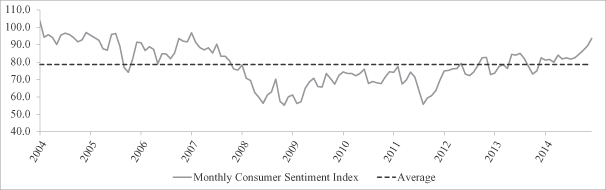

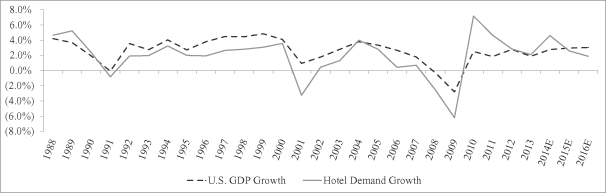

Historically, the performance of the lodging industry has been driven by lodging demand, which is partially a function of macroeconomic fundamentals including employment, corporate profits and consumer confidence. U.S. GDP is projected to grow at a rate of 2.2% in 2014, 3.1% in 2015 and 3.0% in 2016, according to the International Monetary Fund. Considering the strong relationship between room demand and macroeconomic conditions, we believe our business and the lodging industry broadly are well positioned for growth.

5

Table of Contents

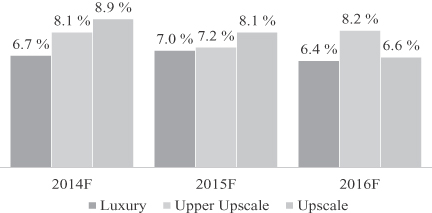

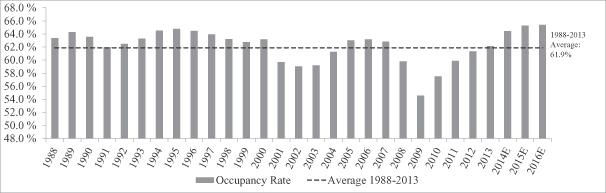

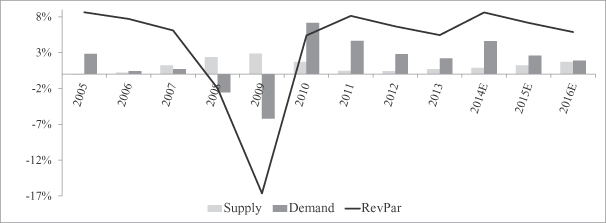

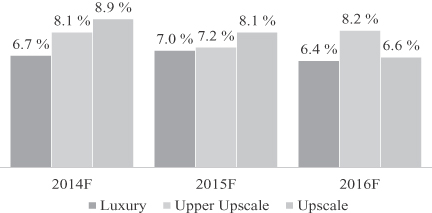

According to PKF-HR, U.S. lodging RevPAR is expected to grow 8.6% in 2014, 7.1% in 2015 and 5.9% in 2016, supported by favorable supply and demand characteristics. This compares to a RevPAR CAGR of 3.0% over the past 25 years, according to STR. According to STR, lodging demand, as measured by number of occupied hotel rooms, has grown at a CAGR of 2.4% between 2011 and 2013, compared to hotel supply, which has grown at a CAGR of 0.6% over the same period. PKF-HR further projects strong RevPAR growth across our targeted chain scale segments, as indicated in the chart below:

| RevPAR Growth By Chain Scale |

Source: PKF-HR

Given the positive broader macroeconomic trends, favorable supply and demand dynamics in the overall U.S. lodging industry and strong expected performance of our target sub-markets, we believe our business is poised to generate strong economic performance in the coming years.

For more details, please see “Industry.”

6

Table of Contents

Our Competitive Strengths

We believe the following strengths will help us to achieve strong cash flows and attractive returns:

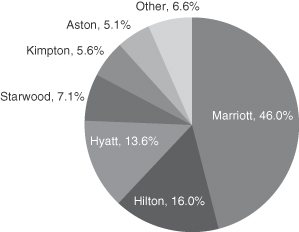

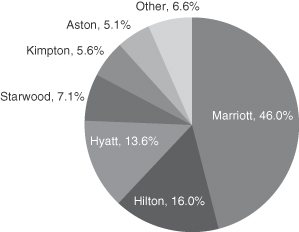

| • | High Quality Portfolio Operated Under Premium Brands. Substantially all of our hotels operate under premium brands affiliated with industry leaders such as Marriott, Hilton, Hyatt, Starwood, Kimpton, Aston, Fairmont and Loews and are located in urban or densely populated suburban markets that we believe have multiple demand generators and high barriers to entry. Additionally, our portfolio includes lifestyle hotels that seek to attract the next generation traveler (i.e., hotels that offer a distinctive lodging experience, both in terms of “destination” locations and in highly personalized service), such as our Andaz, Kimpton and Autograph Collection hotels. Lifestyle hotels are a fast growing segment in key urban markets that offer what we believe have attractive investment profiles. The following chart represents the brand affiliations of the Xenia Portfolio as of September 30, 2014: |

Portfolio Breakdown by Brand Affiliation(1)

| (1) | Includes only the hotels in the Xenia Portfolio, excluding our two hotels under development, as of September 30, 2014. Percentages indicate percent of total rooms as of September 30, 2014. See “Basis of Presentation.” |

We believe the quality of our portfolio is evidenced by its RevPAR and the amount by which its RevPAR exceeds the national average. For the year ended December 31, 2013 and the nine months ended September 30, 2014, our portfolio generated RevPAR of $125.73 and $138.24 respectively, representing multiples of 1.83x and 1.82x, respectively, of the national average for hotels of all chain scales, as reported by STR. As of September 30, 2014, our portfolio included five luxury hotels, 27 upper upscale hotels, and 12 upscale hotels (one of which was acquired in 2014). Additionally, our hotels are well maintained and competitively positioned, as we have invested an aggregate of $209 million during our ownership period in capital expenditures from January 1, 2008 through September 30, 2014 (excluding our two hotels under construction).

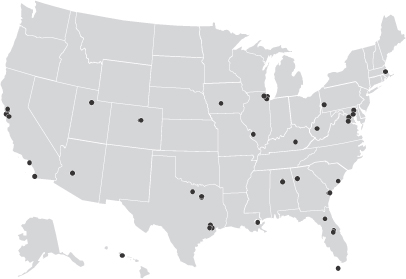

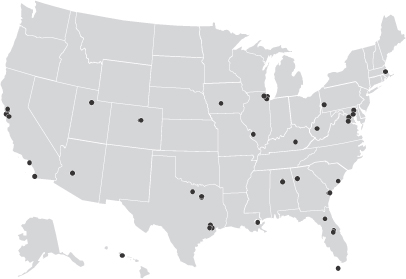

| • | Differentiated Market Strategy That Drives Attractive Growth. Our management team has implemented and executed a strategy of acquiring hotels primarily in the Top 25 Markets and key leisure destinations in the U.S., which has resulted in a diversified portfolio with a national footprint. As of September 30, 2014, we owned 46 hotels, comprising 12,636 rooms, across 19 states and the District of Columbia, and had a majority interest in two hotels under development. As depicted in the map below, the hotels in our portfolio are geographically diverse, and no one market and no individual hotel accounted for more than 13.7% or 6.4%, respectively, of our total pro forma revenue for the nine months ended September 30, 2014. As of September 30, 2014, our largest concentrations of hotels by room count per state were 24.2% in Texas and 19.1% in California. |

7

Table of Contents

Portfolio Breakdown by Geography(1)

| (1) | Includes only the hotels in the Xenia Portfolio, including our two hotels under development, as of September 30, 2014. See “Basis of Presentation.” |

We base our acquisition strategy on the Top 25 Markets rather than the Seven Major Markets because we believe the Top 25 Markets present more attractive risk-adjusted return potential, supported by favorable historical and projected supply and demand dynamics while generating higher projected RevPAR growth at attractive valuations.

| Projected RevPAR CAGR (2013-2016E)

|

|

Source: PKF-HR

8

Table of Contents

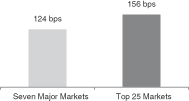

As illustrated in the charts below, the Top 25 Markets are expected to experience lower supply growth compared to the Seven Major Markets through 2016. Though the Seven Major Markets are expected to generate greater demand growth through 2016, the lack of supply growth in the Top 25 Markets more than offsets the lower demand growth resulting in a more favorable supply / demand dynamic as measured by demand growth minus supply growth.

| Projected Supply CAGR (2013-2016E) | Projected Demand CAGR (2013-2016E) | Projected Demand CAGR Minus Projected Supply CAGR (2013-2016E)

| ||

|

|

|

Source: PKF-HR

Since 2010, we have executed on this strategy by acquiring 28 of the hotels in the Xenia Portfolio for an aggregate purchase price of $1,953 million. The following table sets forth additional information regarding recent acquisitions:

| Year |

Number of Assets |

Price ($mm)(1) |

||||||

| 2010 |

3 | $ | 104 | |||||

| 2011 |

3 | $ | 167 | |||||

| 2012 |

7 | $ | 525 | |||||

| 2013 |

14 | $ | 974 | |||||

| 2014 |

1 | $ | 183 | |||||

|

|

|

|

|

|||||

| Total |

28 | $ | 1,953 | |||||

|

|

|

|

|

|||||

| (1) | Includes purchase price plus additional contingent consideration pursuant to the respective purchase and sale agreements. |

| • | Attractive Cash Flow Characteristics. Our strategy focuses on driving strong current income and attractive operating margins, and each type of hotel in our portfolio has characteristics that lead to strong current cash flows. For example, because urban upscale hotels offer limited food outlets and other amenities, we can deliver a satisfying guest experience without the expense of staffing these lower-margin ancillary activities, thereby resulting in strong bottom line performance. Our lifestyle assets are generally characterized by smaller physical footprints, leading to lower cost bases, and higher RevPAR, in comparison to traditional full-service hotels in their respective markets. Our premium full-service hotels are designed to offer a wide variety of income streams, including restaurants, meeting facilities, parking facilities and ancillary opportunities, and we utilize sophisticated asset management techniques to continually monitor and seek to improve performance from every income stream at these hotels. This combination of factors among differing hotel types ultimately results in strong cash flow generation and growth profile across our portfolio. Further, our aggressive, focused asset management and project management strategies seek to identify opportunities to enhance revenue and improve hotel operating margins. |

9

Table of Contents

| • | Strong and Flexible Balance Sheet with Capacity for Growth. Upon our separation from Inland American, we will be well-capitalized and moderately levered, with strong liquidity and access to multiple capital sources. As of September 30, 2014, we have pro forma net debt to pro forma annualized Adjusted EBITDA of 4.3x, which reflects the pro forma adjustments described in “Summary—Our Financing Strategy” and “Description of Indebtedness—Property-Level Debt for the Xenia Portfolio.” Concurrent with the listing of our common stock, we expect to have an unsecured revolving credit facility pursuant to which we may borrow up to $400 million, which we believe provides us liquidity and flexibility to execute our growth strategy and manage short-term cash flow needs. We also have a well-staggered debt maturity profile. Our flexible capital structure enables us to be opportunistic in making acquisitions and reinvesting in our portfolio and strategic in determining which capital sources to utilize. |

| • | Experienced Management Team with Proven Track Record. Our senior management team, led by Marcel Verbaas, our President and Chief Executive Officer, has extensive experience in the lodging industry, including in asset management, acquisitions, dispositions, financing and renovations and repositioning of hotel properties over multiple lodging cycles, and a track record of executing on our business strategy and delivering strong results. Collectively, the eight members of our senior management team have an average tenure in the lodging industry of 26 years, including Mr. Verbaas with 20 years of lodging experience, Barry A.N. Bloom, Ph.D., our Executive Vice President and Chief Operating Officer, with 28 years of lodging experience, Andrew J. Welch, our Executive Vice President and Chief Financial Officer, with 23 years of lodging-related experience, and Philip A. Wade, our Senior Vice President and Chief Investment Officer, with 15 years of lodging experience. Through this experience, our senior management team has developed strong execution capabilities and in-depth knowledge of the hotels in our portfolio, and have built valuable, long-standing relationships with our brand management companies, franchisors and other third-party managers. |

Business and Growth Strategies

Our objective is to invest primarily in premium full service, lifestyle and urban upscale hotels at valuations where we believe we can generate attractive returns on investment and long-term value appreciation and improve the value of our portfolio through aggressive asset management of our existing portfolio and future acquired hotels. We intend to pursue these objectives through the following investment and growth strategies:

| • | Pursue Differentiated Investment Strategy Across Targeted Markets. We intend to use our management team’s network of relationships in the lodging industry and our relationships with the 15 hotel management companies that currently manage assets in our portfolio, among others, to continue to source acquisition opportunities. When evaluating opportunities, we consider the following characteristics: |

| • | Market Characteristics. Unlike many publicly-traded lodging REITs that we believe focus primarily on the Seven Major Markets, we seek opportunities across a range of urban and dense suburban areas, as well as key leisure destinations, in the United States. We believe that this strategy provides us with a broader range of opportunities and allows us to target markets and sub-markets with particular positive characteristics, such as multiple demand generators, favorable supply and demand dynamics and attractive projected RevPAR growth. Compared to the Seven Major Markets, we believe assets in the Top 25 Markets present more attractive investment opportunities considering the favorable supply and demand dynamics, higher RevPAR growth and attractive valuations. |

| • | Asset Characteristics. We generally pursue hotels in the upscale, upper upscale and luxury segments that are affiliated with leading premium brands, as we believe these segments yield attractive risk-adjusted returns. Further, PKF-HR projects strong RevPAR growth across these |

10

Table of Contents

| segments through 2016. Within these segments, we seek hotels that will provide guests with a distinctive lodging experience, tailored to reflect local market environments rather than invest in properties that are heavily dependent on conventions and group business. We seek properties with desirable locations within their markets, exceptional facilities and other competitive advantages that are hard to replicate. We also favor properties that can be purchased well below estimated replacement cost. We believe our focus on premium full service, lifestyle, and urban upscale assets allows us to seek appropriate investments that are well suited for specific markets. |

| • | Operational and Structural Characteristics. We pursue both newly constructed assets that require limited capital investment as well as more mature and complex properties with opportunities for our dedicated asset and project management teams to create value through more active operational oversight and targeted capital expenditures. Additionally, we seek properties that are unencumbered by debt and that will not require joint venture ownership, allowing us maximum operational flexibility. |

We believe that our multi-pronged approach to investing provides us the flexibility to pursue attractive opportunities whenever and wherever they are presented.

| • | Drive Growth through Proactive, Value-Added Asset Management, Project Management and Capital Allocation. We believe that investing in our properties and employing a proactive asset management approach designed to identify investment strategies will optimize internal growth opportunities. Our management team’s extensive industry experience across multiple brands and management companies and our integrated asset management and project management teams, enable us to identify and implement value-added strategies, prudently invest capital in our assets to optimize operating results and leverage best practices across our portfolio. |

| • | Aggressive Asset Management Strategy Drives Performance. Our experienced asset management team focuses on driving property performance through revenue enhancement and cost containment efforts. Our ability to work with a wide variety of management and franchise companies provides us with the opportunity to benchmark performance across our portfolio in order to share best practices. While we do not operate our hotel properties directly, and under the terms of our hotel management agreements our ability to participate in operating decisions regarding our hotels is limited, we conduct regular revenue, sales and financial performance reviews and also perform in-depth on-site reviews focused on ongoing operating margin improvement initiatives. We interact frequently with our management companies and on-site management personnel, including conducting regular meetings with key executives of our management companies and brands. We work to maximize value of our assets through all aspects of the hotel operation and ancillary real estate opportunities. |

| • | In-House Project Management Provides Better and Faster Capital Plan Execution. By maintaining a dedicated in-house capital planning and project management team, we believe we are able to develop our capital plans and execute our renovation projects at a lower cost and in a more timely manner than if we outsourced these services. In addition, our project management team has extensive experience in the ground-up development of hotel properties, providing both in-depth knowledge of building construction as well as the opportunity for us to evaluate potential development opportunities. We view this as a significant competitive strength relative to many of our peers. |

| • | Rigorous Capital Allocation Strategies Enhance Portfolio Performance. As part of our ongoing asset management activities, we regularly review opportunities to reinvest in our hotels to maintain quality, increase long-term value and generate attractive returns on invested capital. We also may opportunistically dispose of hotels to take advantage of market conditions or in situations where the hotels no longer fit within our strategic objectives. We believe our breadth of experience and integrated in-house asset management and project management teams are instrumental in our ability to acquire and operate assets and to capitalize on redevelopment opportunities. |

11

Table of Contents

| • | Leverage Existing Infrastructure for Growth. Prior to the separation of Inland American’s Suburban Select Service Portfolio, our asset management and project management employees were responsible for asset management oversight of the Prior Combined Portfolio (including our 46 hotels). We have retained all of our asset management and project management employees, who, upon completion of our separation from Inland American, will solely be focused on aggressively asset managing our hotels. We believe this will provide us with the capacity to accommodate additional growth without a corresponding increase in employees focusing on asset management and project management. Our core acquisition, asset management and project management teams have been working together for a number of years and have well-established systems and procedures. |

Investment Risks

An investment in shares of our common stock involves substantial risks and uncertainties that may adversely affect our business, financial condition and results of operations. You should carefully consider the matters discussed in “Risk Factors” beginning on page 39 of this information statement before deciding to invest in shares of our common stock. Some of the risks relating to an investment in Xenia include the following:

| • | our ability to make distributions to our stockholders may be adversely affected by various operating risks common to the lodging industry, including competition, over-building and dependence on business travel and tourism; |

| • | the lodging industry is highly cyclical in nature, and we cannot assure you how long the growth period of the current lodging cycle will last; |

| • | the seasonality of the lodging industry is expected to cause quarterly fluctuations in our revenues; |

| • | we operate in a highly competitive industry; |

| • | there are inherent risks with investments in real estate, including the relative liquidity of such investments; |

| • | we are dependent on the performance of the third-party hotel management companies that manage the operations of each of our hotels and could be materially and adversely affected if such third-party managers do not properly manage our hotels or otherwise act in our best interests; |

| • | if we are unable to maintain good relationships with third-party hotel managers and franchisors, profitability could decrease and our growth potential may be adversely affected; |

| • | costs associated with, or failure to maintain, brand operating standards may materially and adversely affect our results of operations and profitability; |

| • | we may be unable to achieve some or all of the benefits that we expect to achieve from our separation from Inland American, and we may no longer enjoy certain benefits from Inland American; |

| • | volatility in the financial markets and challenging economic conditions could adversely affect our ability to secure debt financing on attractive terms and our ability to service any future indebtedness that we may incur; |

| • | our organizational documents have no limitation on the amount of indebtedness we may incur. As a result, we may become highly leveraged in the future, which could materially and adversely affect us; |

| • | if we are unable to repay or refinance our existing debt, we may be unable to sustain or increase distributions to our stockholders and our share price may be adversely affected; |

| • | our failure to comply with all covenants in our existing or future debt agreements could materially and adversely affect us; |

12

Table of Contents

| • | failure to qualify as a REIT, or failure to remain qualified as a REIT, would cause us to be taxed as a regular corporation, which would substantially reduce funds available for distributions to our stockholders; |

| • | if Inland American failed to qualify as a REIT in its 2011 through 2015 taxable years, we would be prevented from electing to qualify as a REIT and if so, would be required to pay income taxes at corporate rates plus pay penalty taxes; |

| • | REIT distribution requirements could adversely affect our liquidity and may force us to borrow funds or sell assets during unfavorable market conditions; |

| • | our agreements with Inland American in connection with the separation and distribution by Inland American involve potential conflicts of interest, and may not reflect terms that would have resulted from negotiations between unaffiliated third parties; |

| • | we are dependent on Inland American to provide services to us pursuant to the Transition Services Agreement, and it may be difficult to replace the services provided under such agreement; |

| • | potential indemnification obligations to Inland American pursuant to the Separation and Distribution Agreement could materially adversely affect our results of operations and financial condition; |

| • | Inland American’s board of directors has reserved the right, in its sole discretion, to amend, modify or abandon the separation and distribution by Inland American and the related transactions at any time prior to the distribution date. In addition, the separation and distribution by Inland American and related transactions are subject to the satisfaction or waiver by Inland American’s board of directors in its sole discretion of a number of conditions. We cannot assure you that any or all of these conditions will be met; |

| • | in connection with our separation from Inland American, Inland American will indemnify us for certain pre-distribution liabilities and liabilities related to Inland American assets. However, there can be no assurance that these indemnities will be sufficient to protect us against the full amount of such liabilities, or that Inland American’s ability to satisfy its indemnification obligations will not be impaired in the future; |

| • | there is currently no public market for our common stock and a trading market that will provide you with adequate liquidity may not develop for our common stock. In addition, once our common stock begins trading, the market price of our shares may fluctuate widely; and |

| • | other factors set forth under “Risk Factors” in this information statement. |

Our Structure and Reorganization Transactions

Our History

We were formed as a Delaware corporation in 2007 as a wholly-owned subsidiary of Inland American. Subsequently, we changed our name from Inland American Lodging Group, Inc. to IA Lodging Group, Inc. and converted to a Maryland corporation in 2014. On August 5, 2014, we changed our name to Xenia Hotels & Resorts, Inc.

Our operating partnership was formed as a North Carolina limited partnership in 1994. Our wholly-owned subsidiary is the sole general partner of our operating partnership, and we conduct substantially all of our business through our operating partnership. We own 100% of the OP Units in our operating partnership. On September 17, 2014, our operating partnership was converted to a Delaware limited partnership and changed its name to XHR LP.

13

Table of Contents

From our formation in 2007 until March 2014, our management team, which has continuously been dedicated to Inland American’s entire hotel portfolio, including the Xenia Portfolio and, until its sale, the Suburban Select Service Portfolio, was employed by an affiliate of The Inland Real Estate Group of Companies, Inc., Inland American’s sponsor. In connection with Inland American’s self-management in March 2014, our management team and our other employees ceased to be employed by an affiliate of Inland American’s sponsor and became our employees.

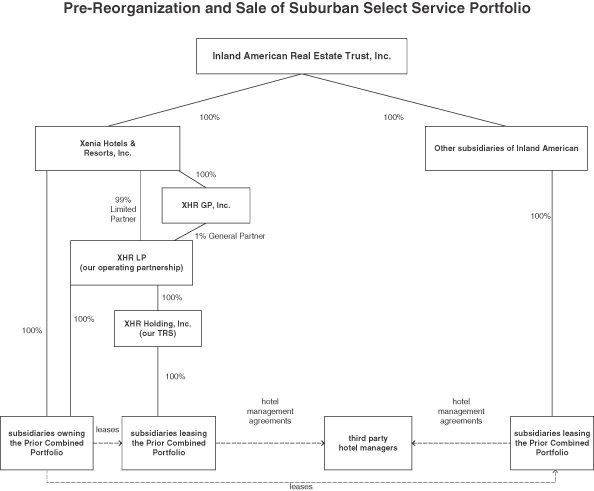

Prior to the internal reorganization transactions described below, we own all of our hotels and certain of our TRS lessees, and our remaining TRS lessees are owned by subsidiaries of Inland American other than us. Prior to the internal reorganization transactions described below and sale of the Suburban Select Service Portfolio, we also owned all of the Suburban Select Service Portfolio and subsidiaries leasing certain hotels in the Suburban Select Service Portfolio, and the remaining subsidiaries leasing the Suburban Select Service Portfolio were owned by subsidiaries of Inland American other than us.

The Suburban Select Service Portfolio was sold on November 17, 2014 to unaffiliated third party purchasers for approximately $1.1 billion, resulting in net proceeds to Inland American of approximately $480 million after prepayment of certain indebtedness and related costs. None of the proceeds from the sale of the Suburban Select Service Portfolio were retained by Xenia. Pursuant to the terms of the Separation and Distribution Agreement, we have agreed to assume the first $8 million of liabilities (including any related fees and expenses) incurred following the distribution relating to, arising out of or resulting from the ownership, operation or sale of the Suburban Select Service Portfolio and that relate to, arise out of or result from a claim or demand that is made against Xenia or Inland American by any person who is not a party or an affiliate of a party to the Separation and Distribution Agreement, other than liabilities arising from the breach or alleged breach by Inland American of certain fundamental representations made by Inland American to the third party purchasers of the Suburban Select Service Portfolio. We have also agreed to assume and indemnify Inland American for certain tax liabilities attributable to the Suburban Select Service Portfolio. As part of our working capital at the time of distribution, Inland American has agreed to leave us with cash estimated to be sufficient to satisfy such tax obligations. See “Certain Relationships and Related Transactions—Agreements with Inland American—Separation and Distribution Agreement.” The hotels included in the Suburban Select Service Portfolio were not retained by Xenia because such hotels do not generally fit within our investment criteria of investing in premium full service, lifestyle and urban upscale hotels, with a focus on the Top 25 Markets as well as key leisure destinations in the United States. In selecting the hotels to retain in the Xenia portfolio, we also took into consideration factors such as supply growth dynamics in various markets, RevPAR and risk-adjusted return potential.

14

Table of Contents

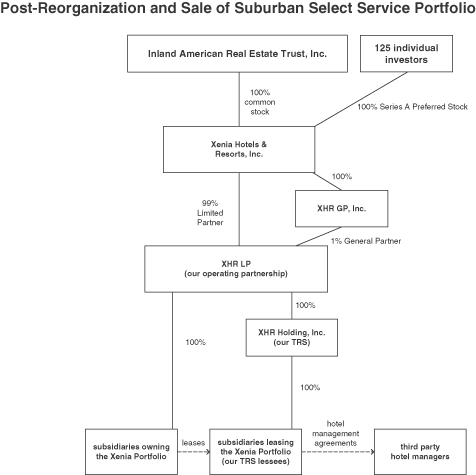

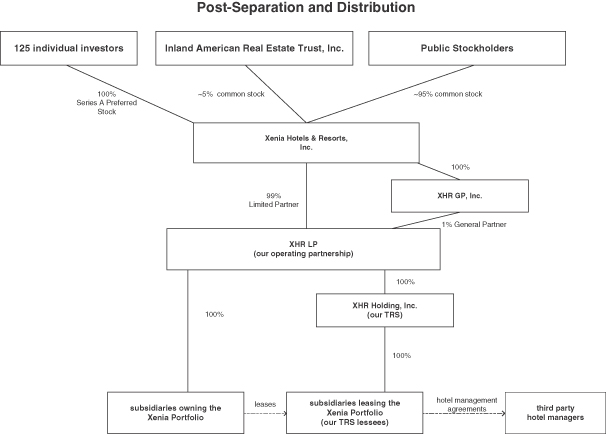

The following chart shows our structure prior to the Reorganization Transactions described below and the sale of the Suburban Select Service Portfolio.

Our Corporate Reorganization

Prior to or concurrently with the completion of the separation and distribution, we have engaged or will engage in certain reorganization transactions which are designed to: consolidate the ownership of our hotels into our operating partnership; consolidate our TRS lessees into our TRS; facilitate our separation from Inland American and the distribution; and enable us to qualify as a REIT for U.S. federal income tax purposes beginning with our short taxable year that commenced on January 5, 2015.

The significant elements of our Reorganization Transactions include:

| • | The company was renamed and converted to a Maryland corporation; |

| • | Our operating partnership was renamed and converted to a Delaware limited partnership; |

| • | Certain of our TRS lessees have been or will be transferred from a subsidiary of Inland American into our TRS; |

15

Table of Contents