Attached files

Table of Contents

As filed with the Securities and Exchange Commission on January 23, 2015

Registration No. 333-201214

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

BENECHILL, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 3845 | 80-0084715 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(IRS Employer Identification Number) |

10060 Carroll Canyon Road, Suite 100

San Diego, CA 92131

(858) 695-8161

(Address, Including Zip Code and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Fred Colen

President and Chief Executive Officer

10060 Carroll Canyon Road, Suite 100

San Diego, CA 92131

(858) 695-8161

(Name, Address, Including Zip Code and Telephone Number, Including Area Code, of Agent for Service)

With copies to:

| Bruce Rosetto, Esq. Jason Simon, Esq. (561) 955-7600 |

Ralph De Martino, Esq. Cavas Pavri, Esq. Schiff Hardin LLP 901 K Street NW Suite 700 Washington, DC 20001 (202) 778-6400 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x | |||

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, as amended, or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to such Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

SUBJECT TO COMPLETION DATED JANUARY 23, 2015

BENECHILL, INC.

Shares

Common Stock

This prospectus relates to the issuance by us of shares of our common stock, par value $0.001 per share.

This is our initial public offering and no public market currently exists for our shares. We have applied to list our common stock on the NYSE MKT under the symbol “BNCH.” We expect that the initial public offering price will be between $ and $ per share.

We are an emerging growth company under the Jumpstart our Business Startups Act of 2012, or JOBS Act, and, as such, have elected to comply with certain reduced public company reporting requirements.

Investing in our common stock involves risks. You should consider the risks that we have described in “Risk Factors” beginning on page 9 of this prospectus before buying our common stock.

| Per Share | Total Proceeds | |||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions(1) |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

| (1) | See “Underwriting” beginning on page 89 for additional disclosure regarding compensation to the underwriter payable by us. |

Certain of our existing stockholders, or their affiliates, including HealthCap V, L.P., Solon Foundation, NGN BioMed Opportunity I, L.P. and MedVenture Associates V L.P. (or affiliated funds or entities), have indicated to us their interest in purchasing up to $2.0 million of shares in this offering at the offering price.

We have granted the underwriter an option to purchase up to additional shares of common stock. The underwriter can exercise this right at any time within 45 days after the date of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

You should rely only on the information contained in this prospectus or any prospectus supplement or amendment. We have not authorized anyone to provide you with different information. We are not making an offer of these securities in any state where such offer is not permitted.

Dawson James Securities, Inc.

The date of this prospectus is , 2015.

Table of Contents

|

| |

|

CAUTION: We have not received approval from the FDA to market our RhinoChill System in the United States. |

Table of Contents

| Page | ||||

| 1 | ||||

| 9 | ||||

| 38 | ||||

| 40 | ||||

| 41 | ||||

| 42 | ||||

| 43 | ||||

| 45 | ||||

| 47 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

48 | |||

| 59 | ||||

| 72 | ||||

| 79 | ||||

| 85 | ||||

| 87 | ||||

| 89 | ||||

| 96 | ||||

| 101 | ||||

| 102 | ||||

| 102 | ||||

| 102 | ||||

| F-1 | ||||

You should rely only on the information contained in this prospectus. Neither the underwriter nor we have authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. Neither the underwriter nor we are making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate as of the date on the front cover of this prospectus only. Our business, financial condition, results of operations and prospects may have changed since that date.

Table of Contents

This summary highlights selected information contained in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully, including the risk factors and the financial statements, before making an investment decision. This prospectus contains forward-looking statements, which involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including those set forth under “Risk Factors” and elsewhere in this prospectus. Unless the context otherwise requires, when we use the words the “Company,” “BeneChill,” “we,” “us,” or “our Company” in this prospectus, we are referring to BeneChill, Inc. and its subsidiaries.

Expect where otherwise indicated, all share and per share data in this prospectus give retroactive effect to a proposed one for nine reverse split of our common stock to be effected following the pricing of this offering and upon the effective date of the registration statement of which this prospectus is a part.

Overview

We are a medical device company that was established in 2003 to develop, manufacture, and sell novel rapid cooling products that are intended to change the often negative clinical outcomes of brain ischemia and traumatic brain injury. More specifically, we expect that our products will: (i) decrease the incidence of brain dysfunction, dementia or death that are common results following either an ischemic event (meaning a medical event in which insufficient blood is supplied to the brain, such as results from cardiac arrest and other medical events) or physical trauma to the brain that results in brain swelling; and (ii) decrease dysfunction or pain resulting from a migraine. Our first product, the RhinoChill IntraNasal Cooling System (also referred to as “RhinoChill System,” “RhinoChill” or the “System”), is designed to deliver targeted, effective therapeutically beneficial cooling to the brain significantly earlier and more efficiently than conventional medical cooling methods, and to do so in a much more practical manner. Through a lightweight, portable design and unique intra-nasal delivery of a coolant, the RhinoChill System enables both rescue services in the field as well as emergency and surgical hospital personnel to easily and effectively initiate cooling of the brain at desired rates and controlled levels.

Cooling of the brain can reduce the biological destruction that occurs from oxygen deprivation (called “ischemia”) or from brain swelling by reducing brain oxygen demand and decreasing tissue swelling. There is a direct relationship between the benefits of brain cooling and the rate and level of temperature reduction that can be achieved relative to the ischemic or swelling causative event. The earlier the cooling to desired levels is achieved, the more beneficial the outcome is expected to be. For example, improvement of neurologically intact survival is a key objective following cardiac arrest, and some data shows that the earlier effective brain cooling is initiated, the better the outcome. There is also some clinical evidence, based on a study conducted by a third party (not our own clinical studies) and published in 2001, that appropriately delivered cooling may mitigate or eliminate the pain and dysfunction associated with migraines.

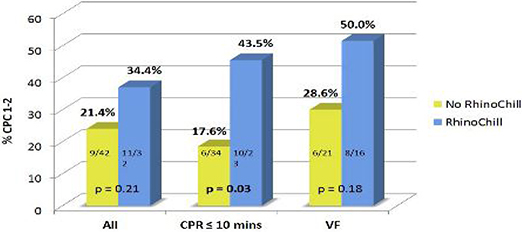

Our initial focus has been on the use of the RhinoChill System for emergency cardiac arrest situations, as this is an area with large unmet medical need (survival from cardiac arrest is presently only about 20% on average). However, we believe that there is a large potential worldwide market for the RhinoChill System as a platform technology for other applications as well, including cardiac surgery, traumatic brain injury (“TBI”), treatment of migraines and malignant hyperthermia. In BeneChill sponsored and in BeneChill supported investigator-initiated clinical studies, our brain-targeted cooling technology has been shown in clinical studies to effectively induce therapeutically desired, mild brain hypothermia (with a small amount of minor adverse events) in multiple medical situations in which there are currently no or limited methods available to provide this type of brain protection. To date, these clinical studies have not revealed any serious risks associated with use of the RhinoChill System. However, these studies have not generated statistically significant long-term results and, accordingly, there may be long-term disadvantages or risks associated with use of the RhinoChill System of which we are not currently aware. Patients are currently being enrolled in a BeneChill supported investigator-initiated, definitive European multi-center, randomized clinical study, “PRINCESS,” to seek to demonstrate a significant, longer term benefit from early RhinoChill brain cooling through statistically significant evidence of an increase in brain intact survival, three months following cardiac arrest. Similarly, we intend to support an investigator-initiated randomized, placebo controlled, multi-center clinical study, “COOLHEAD 2,” during 2015 to seek to demonstrate a statistically significant improvement in pain and associated symptoms with use of RhinoChill nasal cavity cooling for the treatment of acute migraines.

Utilizing data from the extensive testing and external use evaluations of the RhinoChill System and completion of the required quality systems for manufacturing, we obtained CE Mark approval in the European Union (“E.U.”) for the commercial RhinoChill System in April 2011. This CE Mark is broad, and applies to cooling whenever clinically indicated. We are currently in the process of seeking an additional CE Mark for the specific treatment of migraine headaches. Based on the original CE Mark, we began limited commercial sales for cardiac arrest through a third-party distributor, and based on the results of the over 320 patients enrolled in clinical studies, we began limited commercial sales of the System for cardiac arrest in select European countries through our own small direct sales organization in early 2013.

We are currently seeking approval from the U.S. Food and Drug Administration, or FDA, to sell the RhinoChill System in the United States under a humanitarian use device, or “HUD”, exemption process for the adjunct use of the RhinoChill System to cool patients who suffer from a malignant hyperthermia event. We have received the HUD designation from the FDA for this indication, and are currently working with the FDA through the humanitarian device exemption (“HDE”) process. We sponsored a malignant hyperthermia specific pig study in the US during 2014, as requested by the FDA, to demonstrate safety and probable efficacy for the treatment of malignant hyperthermia. The FDA has not required a human clinical study for malignant hyperthermia, since it is a rare and unpredictable event, rendering a clinical study practically impossible to execute. We intend to file the results of the pig study and all other relevant data for the HDE with the FDA in early 2015.

1

Table of Contents

We have been awarded ten issued or allowed patents in the United States for our proprietary technology, and in 2014 we were awarded the European Technology Innovation Leadership Award in Therapeutic Hypothermia for Cardiology by Frost & Sullivan.

The RhinoChill System

The RhinoChill System uses a disposable, minimally invasive nasal catheter that sprays a mist of air or oxygen with a rapidly evaporating coolant liquid into the nasal cavity. This easily accessible large cavity is the natural heat exchanger of the body and lies directly underneath the brain. The RhinoChill System is comprised of a portable, battery-operated control unit, with a disposable coolant bottle and transnasal cooling catheter. The unit is small and lightweight, with a footprint of approximately 16” by 10” and weighing approximately 11 pounds, making it portable and ideal for use in the hospital or in the field.

The System uses two small nasal canulae to spray a mist of liquid coolant into the nasal cavity. The sprayed coolant evaporates on contact with the nostrils and facilitates rapid heat transfer, due to the phase change from liquid to gas of the coolant. The inert and nontoxic coolant is thus expelled in vapor form. The RhinoChill control unit is easy to use, performs a self-test upon power-up and indicates to the user, by means of colored, visual symbols and audible alarms, if key parts of the system are not available and what needs attention and correction by the user. Use of the RhinoChill System can be easily learned by first responders, emergency medical staff and intensive care teams. The System does not require use by a physician, nor does it require refrigeration and has low power requirements. A key function of the control unit is to regulate the level of mist delivered to ensure safe and effective use for the desired medical situation.

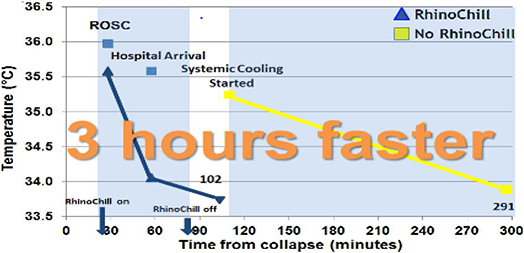

Unlike existing methods of brain cooling, the RhinoChill System cools the brain quickly, within minutes of initiation. Furthermore, due to its mobility and battery operation, it enables targeted brain cooling earlier than any other cooling system currently on the market, providing brain cooling capability within minutes instead of hours.

Our Strategy

Our mission is to improve patient outcomes by protecting the brain through immediate and localized cooling of the brain. To accomplish this mission, we intend to:

| • | Expand sales of the RhinoChill System in Europe. The RhinoChill System received the CE Mark in April 2011 for our commercial system, and we commenced sales in some countries in Europe in early 2013 through a small, dedicated BeneChill sales team. For the early Europe, Middle East, and Africa (“EMEA”) market development and sales activities in cardiac arrest, comparing revenue generation during the first nine months of 2014 to the same period in 2013, we experienced strong revenue growth, albeit with small revenue numbers. While we have initially focused our efforts on emergency cardiac arrest, we intend to also market and sell the RhinoChill System with our small, dedicated and expanding BeneChill sales team for other applications, including migraine treatment in pain centers in select European countries and for other developing applications over time (such as cardiac surgery and severe TBI). We believe that the results of the BeneChill-supported, investigator-initiated first migraine clinical study (“COOLHEAD,” expected to be published in the next few months), which were, on balance, encouraging, provides us with an opportunity to continue to expand EMEA revenues. We are actively seeking to expand our sales in Europe by increasing the size of our direct sales force and by entering into additional distribution agreements. |

| • | Obtain FDA Approval to Sell the RhinoChill System in the United States. We have filed for a humanitarian use application with the FDA. This application is for the adjunct treatment of malignant hyperthermia, a rare but serious and unpredictable complication that may occur while undergoing general anesthesia. During the fall of 2012, we received HUD designation from the FDA for this application and in 2014 we conducted a malignant hyperthermia-specific pig study to demonstrate safety and probable efficacy. We intend to file all relevant malignant hyperthermia data with the FDA in early 2015 to seek HDE approval. Informed by the outcome of several ongoing and planned clinical studies in Europe (as well as by a planned TBI pig study in the U.S.), we will decide which large application(s) to pursue next in the U.S., which may result in the need for U.S. clinical studies for FDA approval (depending on the specific application). Such applications may include cardiac arrest, cardiac surgery, TBI and migraines. Based on the results of the BeneChill-supported COOLHEAD migraine clinical study, we intend to support the execution of a randomized migraine clinical study during 2015 in Europe and to leverage that clinical study to seek U.S. 510(k) FDA approval. |

2

Table of Contents

| • | Focus on clinical activities and validation. As of September 30, 2014, we have completed six clinical studies with the RhinoChill System, enrolling over 335 patients, and over 600 cardiac arrest patients were treated through our commercial activities in Europe. We are currently enrolling patients in a definitive, multi-center, randomized clinical study, called “PRINCESS,” to seek to demonstrate a significant brain intact survival outcome benefit for cardiac arrest patients three months following cardiac arrest. We have six additional investigator-initiated clinical studies in various stages of execution for other clinical applications. We intend to continue to pursue clinical activities that demonstrate the benefits of our technology for existing and new indications that establish and validate the benefits of the RhinoChill System and enhance our product development efforts. In addition, in light of the potential for our technology to assist in the treatment of migraines, we intend to focus our clinical activities in the short term on migraine treatments. We also expect to continue our collaboration with the U.S. military on the early stage clinical development efforts for the treatment of TBI. |

Market Overview

The global market for effective brain cooling technology for multiple clinical applications is large. There are many medical situations in which early, effective brain cooling has the potential to improve patient outcomes, including cardiac arrest, traumatic brain injury and concussions, cardiac surgery, migraine headaches, malignant hyperthermia, stroke and transcatheter aortic valve implantation (“TAVI”). A significant portion of our target market is in the U.S., which will only be accessible after receipt of FDA approvals (which we currently do not have). In the European market, we have a broad, approved CE Mark for our RhinoChill products to cool, whenever clinically indicated. We are in the process of seeking to obtain an additional CE Mark for the specific treatment of migraine headaches. We expect market penetration in the overall European market for applications such as for cardiac arrest, migraine, TBI and cardiac surgery to accelerate after specific studies have been published, such as PRINCESS, COOLHEAD, COOLHEAD 2, and the relevant studies for TBI and cardiac surgery.

Risks Associated with Our Business

Our business is subject to the risks and uncertainties discussed more fully in the section entitled “Risk Factors” immediately following this summary. In particular:

| • | The report of our independent registered public accounting firm on our 2013 consolidated financial statements contains an explanatory paragraph expressing substantial doubt as to our ability to continue as a going concern. |

| • | We have a limited operating history and have incurred significant losses since our inception, and we anticipate that we will continue to incur substantial losses for the foreseeable future. We have only one product approved for sale in Europe under a CE Mark and no products currently approved for sale in the United States, and have generated no commercial sales to date in the United States, which, together with our limited operating history, makes it difficult to evaluate our business and assess our future viability. |

| • | We currently have a limited source of product revenue and may never become profitable. |

| • | Our operating results may fluctuate significantly, which makes our future operating results difficult to predict and could cause our operating results to fall below expectations or below our guidance. |

| • | We may need additional funds to support our operations, and such funding may not be available to us on acceptable terms, or at all, which would force us to delay, reduce or suspend our research and development programs and other operations or commercialization efforts. Raising additional capital may subject us to unfavorable terms, cause dilution to our existing stockholders, restrict our operations, or require us to relinquish rights to other products and technologies we may develop. |

| • | Our success depends heavily on the successful commercialization of our RhinoChill System to aid in brain cooling. If we are unable to sell sufficient amounts of catheters, coolant and RhinoChill System, our revenues may be insufficient to achieve profitability. |

| • | We have not commercialized any product prior to RhinoChill in Europe, and may not be successful in broadly commercializing RhinoChill. |

| • | If we are unable to execute our sales and marketing strategy for RhinoChill, and are unable to gain acceptance in the market, we may be unable to generate sufficient revenue to sustain our business. |

| • | If clinical studies of RhinoChill, such as PRINCESS and COOLHEAD 2, fail to demonstrate safety and efficacy to the satisfaction of the FDA or similar regulatory authorities outside the U.S. or do not otherwise produce positive results, we may incur additional costs, experience delays in completing or ultimately fail in completing the development and commercialization of RhinoChill. |

| • | Third parties may initiate legal proceedings alleging that we are infringing their intellectual property rights, and one third party has asserted that our BeneChill System, if sold in the U.S., would infringe its U.S. patent rights. |

3

Table of Contents

Corporate Information

We commenced operations as BeneCool, Inc., a corporation incorporated in Minnesota in December 2003. We subsequently merged BeneCool, Inc. into BeneChill, Inc., a Delaware corporation, in February 2006. Our principal executive offices are located at 10060 Carroll Canyon Road, Suite 100, San Diego, California 92131, and our telephone number is (858) 695-8161. Our website is www.benechill.com. The information contained in, or that can be accessed through, our website is not a part of this prospectus.

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012. As such, we are eligible for exemptions from various reporting requirements applicable to other public companies that are not emerging growth companies, including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 and reduced disclosure obligations regarding executive compensation. We will remain an emerging growth company until the earlier of (1) the last day of the fiscal year following the fifth anniversary of the completion of this offering, (2) the last day of the fiscal year in which we have total annual gross revenue of at least $1.0 billion, (3) the date on which we are deemed to be a large accelerated filer, which means the market value of our common stock that is held by non-affiliates exceeds $700.0 million as of the prior June 30th, and (4) the date on which we have issued more than $1.0 billion in non-convertible debt securities during the prior three-year period.

“BeneChill,” “RhinoChill,” our logo and our other trade names, trademarks and service marks appearing in this prospectus are our property. Other trade names, trademarks and service marks appearing in this prospectus are the property of their respective holders.

4

Table of Contents

The Offering

| Common Stock Offered | shares | |

| Common Stock outstanding prior to this offering | shares | |

| Common Stock to be outstanding after this offering | shares | |

| Underwriter’s over-allotment option | We have granted the underwriter the right to purchase up to additional shares from us at the public offering price less the underwriting discount within 45 days from the date of this prospectus to cover over-allotments. | |

| Use of Proceeds | We estimate that the net proceeds from this offering will be approximately $ million, or approximately $ million if the underwriter exercises its option to purchase additional shares in full, at an assumed initial public offering price of $ per share, the midpoint of the range set forth on the cover page of this prospectus, after deducting the underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use substantially all of the net proceeds from this offering for working capital and general corporate purposes. See “Use of Proceeds” for additional information. | |

| Risk Factors | See “Risk Factors” beginning on page 9 and the other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock. | |

| Proposed NYSE MKT Symbol | BNCH | |

The number of shares of our common stock to be outstanding after this offering is based on shares of our common stock outstanding as of , 2015, and excludes the following:

| • | shares of our common stock issuable upon the exercise of stock options outstanding as of , 2015 at a weighted-average exercise price of $ per share; |

| • | shares of our common stock reserved for issuance under our 2013 Stock Incentive Plan; |

| • | shares of our common stock reserved for issuance under our 2015 Stock Incentive Plan, which will become effective in connection with the completion of this offering; and |

| • | shares of our common stock issuable upon the exercise of warrants to purchase convertible preferred stock outstanding as of , 2015, which warrants will automatically convert into warrants to purchase common stock immediately prior to the completion of this offering, with an exercise price of per share. |

5

Table of Contents

Unless otherwise indicated, all information in this prospectus reflects and assumes the following:

| • | the completion of a proposed one for nine reverse split of our common stock to be effected following the pricing of this offering and upon the effective date of the registration statement of which this prospectus is a part; |

| • | the automatic conversion of all outstanding shares of our convertible preferred stock (including shares of preferred stock to be issued upon conversion of the convertible promissory notes we issued in June and July 2014) in connection with this offering into an aggregate of shares of our common stock immediately prior to the closing of this offering; and |

| • | no exercise of the underwriter’s over-allotment option. |

6

Table of Contents

Summary Consolidated Financial Data

The following tables summarize our financial data and should be read together with the sections in this prospectus entitled “Selected Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes included elsewhere in this prospectus.

We have derived the statement of operations data for the years ended December 31, 2012 and 2013 and the balance sheet data as of December 31, 2012 and 2013 from our audited financial statements included elsewhere in this prospectus. The summary consolidated financial data for the nine months ended September 30, 2013 and 2014 and as of September 30, 2014 are derived from our unaudited consolidated financial statements appearing elsewhere in this prospectus. The interim 2014 data is not indicative of results to be expected for the full year. The unaudited consolidated financial statements have been prepared on the same basis as the audited consolidated financial statements and, in the opinion of management, reflect all adjustments, which include only normal recurring adjustments, necessary to present fairly our financial position as of September 30, 2014 and the results of operations for the nine months ended September 30, 2013 and 2014. Our historical results are not necessarily indicative of the results that should be expected in the future.

| Year Ended December 31, | Nine Months Ended September 30, | |||||||||||||||

| 2012 | 2013 | 2013 | 2014 | |||||||||||||

| (in thousands, except share and per share data) | ||||||||||||||||

| (unaudited) | ||||||||||||||||

| Statement of Operations Data: |

||||||||||||||||

| Sales, net |

$ | 273 | $ | 393 | $ | 147 | $ | 368 | ||||||||

| Cost of sales |

403 | 129 | 84 | 157 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross profit (loss) |

(130 | ) | 264 | 63 | 211 | |||||||||||

| Operating expenses |

5,560 | 4,970 | 3,500 | 4,243 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss from operations |

(5,690 | ) | (4,706 | ) | (3,437 | ) | (4,032 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Other income (expense): |

||||||||||||||||

| Interest income |

2 | 4 | 1 | — | ||||||||||||

| Interest expense |

(4 | ) | (12 | ) | — | (23 | ) | |||||||||

| Gain/(Loss) on foreign currency transactions |

76 | (7 | ) | 23 | (5 | ) | ||||||||||

| Loss on sale of property and equipment |

(7 | ) | — | — | — | |||||||||||

| Other |

(10 | ) | (13 | ) | 10 | 4 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total other income (expense) |

57 | (28 | ) | 34 | (24 | ) | ||||||||||

|

|

|

|

|

|

|

|||||||||||

| Net loss |

$ | (5,633 | ) | $ | (4,734 | ) | $ | (3,403 | ) | $ | (4,056 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss per common share, basic and diluted |

$ | (4.98 | ) | $ | (4.18 | ) | $ | (3.01 | ) | $ | (3.58 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Shares used to compute net loss per common share, basic and diluted |

1,131,522 | 1,131,522 | 1,131,522 | 1,131,522 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Pro forma net income (loss) per common share, basic and diluted (unaudited) |

$ | $ | (32.26 | ) | ||||||||||||

|

|

|

|

|

|||||||||||||

| Shares used to compute pro forma net income (loss) per common share, basic and diluted (unaudited) |

125,725 | |||||||||||||||

|

|

|

|

|

|||||||||||||

7

Table of Contents

| As of September 30, 2014 | ||||||||||||||||||||

| As of December 31, | Pro | Pro Forma As |

||||||||||||||||||

| 2012 | 2013 | Forma(1) | Adjusted(2)(3) | |||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||

| Balance Sheet Data: |

||||||||||||||||||||

| Cash and cash equivalents |

$ | 1,649 | $ | 2,058 | $ | 611 | $ | $ | ||||||||||||

| Working capital (deficiency) |

1,866 | 2,429 | (1,023 | ) | ||||||||||||||||

| Total assets |

4,323 | 5,063 | 3,476 | |||||||||||||||||

| Convertible promissory notes |

— | — | 1,996 | |||||||||||||||||

| Convertible preferred stock |

24 | 26 | 26 | |||||||||||||||||

| Accumulated deficit |

(44,192 | ) | (50,018 | ) | (54,074 | ) | ||||||||||||||

| Total stockholders’ equity |

$ | 3,979 | $ | 4,514 | $ | 736 | $ | $ | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (1) | The pro forma column reflects (i) the filing of our fifth amended and restated certificate of incorporation and the automatic conversion of outstanding shares of our convertible preferred stock as of September 30, 2014 into an aggregate of shares of common stock immediately prior to the closing of this offering; (ii) the automatic conversion of $1,000,000 in original aggregate principal amount of convertible promissory notes issued in June 2014 into shares of common stock as if it had occurred as of September 30, 2014; and (iii) the issuance of $1,000,000 in original aggregate principle amount of convertible promissory notes issued in July 2014 and automatic conversion of those notes into shares of common stock as if they had occurred as of September 30, 2014 and the receipt of approximately $1.0 million of gross proceeds from such sale. |

| (2) | The pro forma as adjusted column reflects the pro forma adjustments described in footnote (1) above and the sale by us of shares of common stock in this offering at an assumed initial public offering price of $ per unit, which is the midpoint of the price range set forth on the cover page of this prospectus, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

| (3) | A $1.00 increase (decrease) in the assumed initial public offering price of $ per share would increase (decrease) each of cash and cash equivalents, working capital and total assets by $ million and decrease (increase) total stockholders’ equity (deficit) by $ million, assuming the number of shares we are offering as set forth on the cover page of this prospectus, remains the same, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. We may also increase or decrease the number of shares we are offering. An increase (decrease) of 1,000,000 shares in the number of shares we are offering would increase (decrease) each of cash and cash equivalents, working capital and total assets by approximately $ million and decrease (increase) total stockholders’ equity (deficit) by approximately $ million, assuming the assumed initial public offering price per share, as set forth on the cover page of this prospectus, remains the same. The pro forma as adjusted information is illustrative only, and we will adjust this information based on the actual initial public offering price, number of shares offered and other terms of this offering determined at pricing. |

8

Table of Contents

Investing in our common stock involves a high degree of risk. You should carefully consider the following risk factors and the other information contained in this prospectus before making an investment decision. The following discussion highlights some of the risks that may affect future operating results. These are the risks and uncertainties we believe are most important for you to consider. Additional risks and uncertainties not presently known to us, which we currently deem immaterial or which are similar to those faced by other businesses in general, may also impair our businesses operations. If any of the following risks or uncertainties actually occur, our business, financial condition and operating results would likely suffer. Please see “Cautionary Notes Regarding Forward-Looking Statements.”

Risks Related to Our Business

The report of our independent registered public accounting firm on our 2013 consolidated financial statements contains an explanatory paragraph regarding going concern, and we will need additional financing to execute our business plan, to fund our operations and to continue as a going concern.

As a result of our recurring net losses, our independent registered public accounting firm has included an explanatory paragraph in its report on our financial statements for the year ended December 31, 2013, expressing substantial doubt as to our ability to continue as a going concern. The inclusion of a going concern explanatory paragraph in the report of our independent registered public accounting firm may make it more difficult for us to secure additional financing or enter into strategic relationship on terms acceptable to us, if at all, and may materially and adversely affect the terms of any financing that we might obtain.

We have a limited operating history and have incurred significant losses since our inception, and we anticipate that we will continue to incur substantial losses for the foreseeable future. We have only one product approved for sale in Europe under a CE Mark and no products currently approved for sale in the United States, and have generated no commercial sales to date in the United States, which, together with our limited operating history, makes it difficult to evaluate our business and assess our future viability.

We are a medical device developer with a limited operating history. Currently, our only product is the RhinoChill System, which has received European market clearance (CE Mark) but has not been approved for sale in the United States or any other foreign countries. Evaluating our performance, viability or future success will be more difficult than if we had a longer operating history or approved products for sale on the market. We continue to incur significant research and development and general and administrative expenses related to our operations. Investment in medical device product development is highly speculative, because it entails substantial upfront capital expenditures and significant risk that any potential planned product will fail to demonstrate adequate accuracy or clinical utility. We have incurred significant operating losses in each year since our inception, and expect that we will not be profitable for some time after the completion of this offering, if at all. As of September 30, 2014, we had an accumulated deficit of $54.0 million.

We expect that our future financial results will depend primarily on our success in launching, selling and supporting RhinoChill. This will require us to be successful in a range of activities, including obtaining FDA approval to market and sell RhinoChill in the United States and manufacturing, marketing and selling RhinoChill. We are only in the preliminary stages of some of these activities. We may not succeed in these activities and may never generate revenue that is sufficient to be profitable in the future. Even if we are profitable, we may not be able to sustain or increase profitability on a quarterly or annual basis. Our failure to achieve sustained profitability would depress the value of our company and could impair our ability to raise capital, expand our business, diversify our other products we may develop, market our current and other products we may develop, or continue our operations.

We currently have a limited source of product revenue and may never become profitable.

To date, we have generated minimal revenues from commercial product sales. Our total revenues were $0.4 million in 2013 and $0.4 million in the nine months ended September 30, 2014. Our ability to generate increased revenues from product sales and achieve profitability will depend upon our ability, alone or with any future collaborators, to successfully commercialize products, including RhinoChill, or any other products we may develop, in-license or acquire in the future. Our ability to generate revenue from product sales from RhinoChill and any other products we may develop in the future also depends on a number of additional factors, including our ability to:

| • | generate positive clinical and preclinical data from our studies in Europe and the United States, including the European PRINCESS and COOLHEAD 2 studies; |

| • | obtain grants from the United States Military; |

9

Table of Contents

| • | demonstrate the safety and efficacy of RhinoChill to the satisfaction of the FDA and obtain regulatory approval for RhinoChill, including for malignant hyperthermia and other applications, such as treatment of migraines, and other products we may develop, if any, for which there is a commercial market; |

| • | develop a commercial organization capable of sales, marketing and distribution of RhinoChill and any other products for which we obtain marketing approval in markets where we intend to commercialize independently; |

| • | achieve market acceptance of RhinoChill and other products we may develop; |

| • | set a commercially viable price for RhinoChill and any other products we may develop; |

| • | establish and maintain supply and manufacturing relationships with reliable third parties, and ensure adequate and legally compliant manufacturing to maintain that supply; |

| • | obtain coverage and adequate reimbursement from third-party payers, including government and private payors; |

| • | find suitable distribution partners to help us market, sell and distribute RhinoChill and any other approved products in other markets; |

| • | complete and submit applications to, and obtain regulatory approval from, foreign regulatory authorities; |

| • | complete development activities, including additional clinical trials of RhinoChill, successfully and on a timely basis; |

| • | establish, maintain and protect our intellectual property rights and avoid third-party patent interference or patent infringement claims; and |

| • | attract, hire and retain qualified personnel. |

In addition, because of the numerous risks and uncertainties associated with product development, including that RhinoChill or any other products we may develop may not advance through development or achieve the endpoints of applicable clinical trials, we are unable to predict the timing or amount of increased expenses, or when or if we will be able to achieve or maintain profitability. In addition, our expenses could increase beyond expectations if we decide, or are required by the FDA or foreign regulatory authorities, to perform studies or clinical trials in addition to those that we currently anticipate. Even if we are able to complete the development and regulatory process for RhinoChill or any other products we may develop, we anticipate incurring significant costs associated with commercializing these products, and we expect that we will need to obtain additional funding in the future to continue operations.

Even if we are able to generate increased revenues from the sale of RhinoChill or any other products that may be approved, we may not become profitable. If we fail to become profitable or are unable to sustain profitability on a continuing basis, then we may be unable to continue our operations at planned levels and be forced to reduce or shut down our operations.

Our operating results may fluctuate significantly, which makes our future operating results difficult to predict and could cause our operating results to fall below expectations or below our guidance.

Our quarterly and annual operating results may fluctuate significantly in the future, which makes it difficult for us to predict our future operating results. From time to time, we may enter into collaboration agreements with other companies that include development funding and significant upfront and milestone payments or royalties, which may become an important source of our revenue. Accordingly, our revenue may depend on development funding and the achievement of development and clinical milestones under any potential future collaboration and license agreements and sales of our products, if approved. These upfront and milestone payments may vary significantly from period to period and any such variance could cause a significant fluctuation in our operating results from one period to the next. In addition, we measure compensation cost for stock-based awards made to employees at the grant date of the award, based on the fair value of the award as determined by our board of directors, and recognize the cost as an expense over the employee’s requisite service period. As the variables that we use as a basis for valuing these awards change over time, including, after the closing of this offering, our underlying stock price and stock price volatility, the magnitude of the expense that we must recognize may vary significantly. Furthermore, our operating results may fluctuate due to a variety of other factors, many of which are outside of our control and may be difficult to predict, including the following:

| • | the cost and risk of initiating sales and marketing activities, including substantial hiring of sales and marketing personnel; |

| • | the timing and cost of, and level of investment in, research and development activities relating to RhinoChill and any other products we may develop, which will change from time to time; |

10

Table of Contents

| • | our ability to enroll patients in clinical trials and the timing of enrollment; |

| • | the cost of manufacturing RhinoChill and any other products we may develop, which may vary depending on the FDA and other regulatory authority guidelines and requirements, the quantity of production and the terms of our agreements with manufacturers; |

| • | expenditures that we will or may incur to acquire or develop additional products and technologies; |

| • | the design, timing and outcomes of clinical studies for RhinoChill and any other products we may develop; |

| • | changes in the competitive landscape of our industry, including consolidation among our competitors or potential partners; |

| • | any delays in regulatory review or approval of RhinoChill or any of our other products we may develop; |

| • | the level of demand for RhinoChill and any other products we may develop, should they receive approval, which may fluctuate significantly and be difficult to predict; |

| • | the risk/benefit profile, cost and reimbursement policies with respect to RhinoChill and any other products we may develop, if approved, and existing and potential future products that compete with RhinoChill and any other products we may develop; |

| • | competition from existing and potential future offerings that compete with RhinoChill or any of our other products we may develop; |

| • | our ability to commercialize RhinoChill or any other products inside and outside of the U.S., either independently or working with third parties; |

| • | our ability to establish and maintain collaborations, licensing or other arrangements; |

| • | our ability to adequately support future growth; |

| • | potential unforeseen business disruptions that increase our costs or expenses; |

| • | our ability to maintain our patents and other intellectual property rights, including our ability to stop others from using or commercializing similar or identical technology and products; |

| • | demand for our products may vary from quarter to quarter, due to seasonality and other factors; |

| • | future accounting pronouncements or changes in our accounting policies; |

| • | the changing and volatile global economic environment; and |

| • | potential unforeseen changes in environmental regulations that may impact use of our products. |

The cumulative effects of these factors could result in large fluctuations and unpredictability in our quarterly and annual operating results. As a result, comparing our operating results on a period-to-period basis may not be meaningful. Investors should not rely on our past results as an indication of our future performance. This variability and unpredictability could also result in our failing to meet the expectations of industry or financial analysts or investors for any period. If our revenue or operating results fall below the expectations of analysts or investors or below any forecasts we may provide to the market, or if the forecasts we provide to the market are below the expectations of analysts or investors, the price of our common stock could decline substantially. Such a stock price decline could occur even when we have met any previously publicly stated revenue or earnings guidance we may provide, if any.

We expect that we will need additional funds to support our operations, and such funding may not be available to us on acceptable terms, or at all, which would force us to delay, reduce or suspend our research and development programs and other operations or commercialization efforts. Raising additional capital may subject us to unfavorable terms, cause dilution to our existing stockholders, restrict our operations, or require us to relinquish rights to our products and technologies.

The commercialization of RhinoChill, as well as the completion of the development and the potential commercialization of other products we may develop, will require substantial funds. As of September 30, 2014, we had approximately $0.6 million in cash and cash equivalents. We believe that our existing cash and cash equivalents, including the proceeds of the November 2014 bridge loan ($1,000,000) and the net proceeds we expect to receive from this offering, will be sufficient to sustain our operations through December 2016 based on our existing business plan. However, we expect that we will need to raise additional funds to support our operations in the future. Our future financing requirements will depend on many factors, some of which are beyond our control, including the following:

11

Table of Contents

| • | the cost of activities and added personnel associated with the commercialization of RhinoChill, including marketing, manufacturing, and distribution; |

| • | the cost of preparing to manufacture RhinoChill on a larger scale; |

| • | our ability to obtain components and materials for our products at acceptable prices and in a timely manner; |

| • | the degree and rate of market acceptance of RhinoChill, and the revenue that we are able to collect from sales of RhinoChill as a result; |

| • | our ability to set a commercially attractive price for RhinoChill, and our customers’ perception of the value relative to the prices we set; |

| • | our ability to clarify the regulatory path in the U.S. for RhinoChill, and the potential requirement for additional clinical studies; |

| • | the timing of, and costs involved in, seeking and obtaining approvals from the FDA and other regulatory authorities for RhinoChill and any other products we may develop; |

| • | our ability to obtain and maintain partners for RhinoChill on attractive economic terms, or engage in commercial sales of RhinoChill on our own or through distributors; |

| • | the costs of filing, prosecuting, defending and enforcing any patent claims and other intellectual property rights and/or the loss of those rights; |

| • | our ability to enter into distribution, collaboration, licensing, commercialization or other arrangements and the terms and timing of such arrangements; |

| • | the emergence of competing technologies or other adverse market developments; |

| • | the costs of attracting, hiring and retaining qualified personnel; |

| • | unforeseen developments during our clinical trials; |

| • | unforeseen changes in healthcare reimbursement for RhinoChill and any other products we may develop; |

| • | our ability to maintain commercial scale manufacturing capacity and capability with a commercially acceptable cost structure; |

| • | unanticipated financial resources needed to respond to technological changes and increased competition; |

| • | enactment of new legislation or administrative regulations; |

| • | the application to our business of new regulatory interpretations; |

| • | claims that might be brought in excess of our insurance coverage; |

| • | the failure to comply with regulatory guidelines; and |

| • | the uncertainty in industry demand. |

We do not have any committed external source of funds or other support for our commercialization and development efforts. Unless and until we can generate a sufficient amount of product revenue to finance our cash requirements, which we may never do, we expect to finance future cash needs through a combination of public or private equity offerings, debt financings, collaborations, strategic alliances, licensing arrangements and other marketing and distribution arrangements. Additional financing may not be available to us when we need it or it may not be available on favorable terms. If we raise additional capital through marketing and distribution arrangements or other collaborations, strategic alliances or licensing arrangements with third parties, we may have to relinquish certain valuable rights to RhinoChill or potential other products we may develop, technologies, future revenue streams or research programs, or grant licenses on terms that may not be favorable to us. If we raise additional capital through public or private equity offerings, the ownership interest of our existing stockholders will be diluted, and the terms of these securities may include liquidation or other

12

Table of Contents

preferences that adversely affect our stockholders’ rights. If we raise additional capital through debt financing, we may be subject to covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, making capital expenditures or declaring dividends. If we are unable to obtain adequate financing when needed, we may have to delay, reduce the scope of, or suspend one or more of our clinical studies or research and development programs or our commercialization efforts.

Our success depends heavily on the successful commercialization of our RhinoChill System to aid in brain cooling. If we are unable to sell sufficient numbers of our RhinoChill System, our revenues may be insufficient to achieve profitability.

RhinoChill is our sole product for sale or under development. As a result, we will derive substantially all of our revenues from sales of the RhinoChill System for the foreseeable future. If we cannot generate sufficient revenues from sales, we may be unable to finance our continuing operations.

We have not commercialized any product beyond limited commercialization in Europe, and may not be successful in broadly commercializing RhinoChill.

We have no history of successful broad product launches. Our efforts to launch RhinoChill are subject to a variety of risks, any of which may prevent or limit sales of the RhinoChill instruments and consumables. Furthermore, commercialization of products into the medical marketplace is subject to a variety of regulations regarding the manner in which potential customers may be engaged, the manner in which products may be lawfully advertised, and the claims that can be made for the benefits of the product, among other things. Our lack of experience with product launches may expose us to a higher than usual level of risk of non-compliance with these regulations, with consequences that may include fines or the removal of RhinoChill from the marketplace by regulatory authorities.

If we are unable to execute our sales and marketing strategy for RhinoChill, and are unable to gain acceptance in the market, we may be unable to generate sufficient revenue to sustain our business.

Although we believe that RhinoChill, and other products we may develop, represent promising commercial opportunities, our products may never gain significant acceptance in the marketplace and therefore may never generate substantial revenue or profits for us. We will need to establish a market for RhinoChill and build that market through physician education, awareness programs, and other marketing efforts. Gaining acceptance in medical communities depends on a variety of factors, including clinical data published or reported in reputable contexts, and word-of-mouth between physicians. The process of publication in leading medical journals is subject to a peer review process and peer reviewers may not consider the results of our studies sufficiently novel or worthy of publication. Failure to have our studies published in peer-reviewed journals may limit the adoption of our current products and our planned products.

Our ability to successfully market RhinoChill and any additional products we may develop will depend on numerous factors, including:

| • | the outcomes of clinical utility studies for our products in collaboration with key thought leaders to demonstrate our products’ value in informing important medical decisions such as treatment selection; |

| • | the success of the sales force which we intend to hire with some of the proceeds of this offering; |

| • | whether healthcare providers believe our products provide clinical utility; |

| • | whether the medical community accepts that our products are sufficiently effective to be meaningful in patient care and treatment; and |

| • | whether hospital administrators, health insurers, government health programs and other payors will cover and pay for our products and, if so, whether they will adequately reimburse us. |

Failure to achieve widespread market acceptance of RhinoChill and any other products we may develop would materially harm our business, financial condition and results of operations.

If hospitals and other providers decide not to purchase RhinoChill in significant numbers, we may be unable to generate sufficient revenue to sustain our business.

To generate demand for RhinoChill and any other products we may develop, we will need to educate physicians and other health care professionals on the clinical utility, benefits and value of our technology through published papers, presentations at scientific conferences, educational programs and one-on-one education sessions by members of our sales force. In addition, we will need the support of hospital administrators that the clinical and economic utility of RhinoChill justifies payment for the device at adequate pricing levels. We will need to hire additional commercial, scientific, technical and other personnel to support this process.

13

Table of Contents

If we cannot convince hospitals, medical practitioners and other providers to purchase RhinoChill, we will likely be unable to create demand in sufficient volume for us to achieve or sustain profitability.

Our quarterly operating results may fluctuate because of the seasonal nature of our business.

We believe our business is affected by seasonal and other trends, but the full impact of these trends is difficult to measure due to the developing nature of our markets, our relatively short operating history and our sales growth. Specifically, we believe our business is affected by seasonal trends during the summer months in Europe due to vacations taken by physicians, hospital staff and others, resulting in reduced demand for our products in the third quarter. In addition, cardiac arrest occurrences have a seasonal component, as more cardiac arrests occur during the winter months. It is difficult for us to evaluate the degree to which these factors may make our revenue unpredictable in the future, and these seasonal and other trends may continue to lead to fluctuations in our quarterly operating results. As a result of such fluctuations, the price of our common stock may experience volatility. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Results of Operations—Seasonality.”

If RhinoChill, or any other products we may develop, do not continue to perform as expected, our operating results, reputation and business will suffer.

Our success depends on the market’s confidence that RhinoChill and any other products we may develop can provide reliable, high-quality results. As a result, the failure of RhinoChill or any other products we may develop to perform as expected would significantly impair our reputation. Reduced sales might result, and we may also be subject to legal claims arising from any defects or poor performance.

If we cannot compete successfully with other cooling devices or other migraine treatment options, we may be unable to increase or sustain our revenues or achieve and sustain profitability.

Our principal competition currently comes from large, full-body cooling devices, used by hospitals for many years. It may be difficult to change the methods or behavior of hospitals and other providers to incorporate RhinoChill in their practices in conjunction with or instead of existing cooling methods.

In addition, several larger companies have extensive sales presence in the body cooling area and could potentially develop products that compete with RhinoChill or any other products we may develop. Some of our present and potential competitors have widespread brand recognition and substantially greater financial and technical resources and development, production and marketing capabilities than we do. Others may develop lower-priced products that payors and physicians could view as functionally equivalent to our current products, which could force us to lower the list price of our products. This would impact our operating margins and our ability to achieve and maintain profitability. If we cannot compete successfully against current or future competitors, we may be unable to increase or create market acceptance and sales of our current products, which could prevent us from increasing or sustaining our revenues or achieving or sustaining profitability.

We expect to continue to incur significant expenses to develop and market RhinoChill, which could make it difficult for us to achieve and sustain profitability.

In recent years, we have incurred significant costs in connection with the development of RhinoChill. For 2012, 2013 and the nine months ended September 30, 2014, our research and development expenses were $1,198,000, $419,000 and $316,000, respectively. We expect our expenses to increase for the foreseeable future, as we conduct studies of RhinoChill and seek regulatory approval of RhinoChill in the United States and other countries. We will also incur significant expenses to establish a sales and marketing organization, and to drive adoption of and reimbursement for our products. As a result, we need to generate significant revenues in order to achieve or sustain profitability.

Because the results of preclinical testing and earlier clinical trials, and the results to date in various preclinical and clinical trials, are not necessarily predictive of future results, RhinoChill may not have favorable results in later preclinical or clinical trials or receive regulatory approval outside of the E.U. and Middle East.

Success in preclinical testing and early clinical trials does not ensure that later preclinical or clinical trials will generate adequate data to demonstrate the efficacy and safety of an investigational product. A number of companies in the medical device industry, including those with greater resources and experience, have suffered significant setbacks in preclinical and clinical trials, even after seeing promising results in earlier preclinical and/or clinical trials. Despite the results to date in the various preclinical and clinical studies performed with RhinoChill, we do not know whether pivotal preclinical and/or clinical trials, if the FDA requires they be conducted, will demonstrate adequate efficacy and safety to result in regulatory approval to market RhinoChill in the U.S. Even if we believe that the data is adequate to support an application for regulatory approval to market RhinoChill or any other products we may develop, the FDA or other applicable foreign regulatory authorities may not agree and may require additional clinical trials. If these subsequent clinical trials do not produce favorable results, regulatory approval for RhinoChill or any other products we may develop may not be achieved.

There can be no assurance that RhinoChill will not exhibit new or increased safety risks in subsequent preclinical or clinical trials. In addition, preclinical and clinical data are often susceptible to varying interpretations and analyses, and products that perform satisfactorily in preclinical studies and clinical trials may nonetheless fail to obtain regulatory approval.

14

Table of Contents

Delays in or cancellation of our preclinical or clinical studies could significantly increase development costs and delay or prohibit completion of these studies, having a negative effect on our ability to obtain necessary regulatory approvals.

Delays in or the cancellation of any of our preclinical or clinical (including investigator initiated clinical) studies due to unavailability of study subjects, lack of funding or investigators effort or other unforeseen circumstances, could make it more difficult or impossible to obtain necessary regulatory approvals or impossible to demonstrate clinical benefit required for commercialization. For example, we may not be able to initiate or continue preclinical or clinical studies for RhinoChill if we are unable to locate and enroll a sufficient number of eligible patients to participate in these studies as required by the FDA or other regulatory authorities. Even if a sufficient number of patients can be enrolled in preclinical or clinical trials, if the pace of enrollment is slower than we expect, the development costs for our other products we may develop may increase and the completion of our studies may be delayed, or the studies could become too expensive to complete. For example, delays in or cancellation of our planned preclinical study for malignant hyperthermia or our PRINCESS or COOLHEAD 2 clinical studies could impair our ability to obtain FDA approval for the supported indications.

If clinical studies of RhinoChill or any other products we may develop fail to demonstrate safety and efficacy to the satisfaction of the FDA or similar regulatory authorities outside the U.S. or do not otherwise produce positive results, we may incur additional costs, experience delays in completing or ultimately fail in completing the development and commercialization of RhinoChill or other products we may develop.

Before obtaining regulatory approval for the sale of RhinoChill or any other product we may develop we must conduct extensive clinical studies to demonstrate the safety and efficacy of that product in humans. Clinical studies are expensive, difficult to design and implement, can take many years to complete and are uncertain as to outcome. A failure of one or more of our clinical studies could occur at any stage of testing.

Numerous unforeseen events during, or as a result of, clinical studies could occur, which would delay or prevent our ability to receive regulatory approval or commercialize RhinoChill or any other products we may develop, including the following:

| • | clinical studies may produce negative or inconclusive results, and we may decide, or regulators may require us, to conduct additional clinical studies or abandon product development programs; |

| • | the number of patients required for clinical studies may be larger than we anticipate, enrollment in these clinical studies may be insufficient or slower than we anticipate or patients may drop out of these clinical studies at a higher rate than we anticipate; |

| • | investigators of the investigator-initiated clinical trials may not put in the efforts required to timely execute these studies; |

| • | the cost of clinical studies or the manufacturing of our products may be greater than we anticipate; |

| • | third-party contractors may fail to comply with regulatory requirements or meet their contractual obligations to us in a timely manner, or at all; |

| • | we might have to suspend or terminate clinical studies of our products for various reasons, including a finding that our products have unanticipated serious side effects or other unexpected characteristics or that the patients are being exposed to unacceptable health risks or even death; |

| • | regulators may not approve our proposed clinical development plans; |

| • | regulators or independent institutional review boards, or IRBs, may not authorize us or our investigators to commence a clinical study or conduct a clinical study at a prospective study site; |

| • | regulators or IRBs may require that we or our investigators suspend or terminate clinical research for various reasons, including noncompliance with regulatory requirements; and |

| • | the supply or quality of our products or other materials necessary to conduct clinical studies of our products may be insufficient or inadequate. |

15

Table of Contents

If we or any future collaboration partner are required to conduct additional clinical trials or other testing of RhinoChill or any other products we may develop beyond those that we contemplate, those clinical studies or other testing cannot be successfully completed, if the results of these studies or tests are not positive or are only modestly positive or if there are safety concerns, we may:

| • | be delayed in obtaining marketing approval for RhinoChill or any other products we may develop; |

| • | not obtain marketing approval at all; |

| • | obtain approval for indications that are not as broad as intended; |

| • | not be able to generate revenues as planned; |

| • | have the product removed from the market after obtaining marketing approval; |

| • | be subject to additional post-marketing testing requirements; or |

| • | be subject to restrictions on how the product is distributed or used. |

Our product development costs will also increase if we experience delays in testing or approvals. We do not know whether any clinical studies will begin as planned, will need to be restructured or will be completed on schedule, or at all.

Significant clinical study delays also could shorten any periods during which we may have the exclusive right to commercialize our other products we may develop or allow our competitors to bring products to market before we do, which would impair our ability to commercialize our products and harm our business and results of operations.

Even if subsequent clinical trials demonstrate acceptable safety and efficacy of RhinoChill, the FDA or regulatory authorities in other countries may not approve RhinoChill for marketing or may approve it with restrictions on the label, which could have a material adverse effect on our business, financial condition, results of operations and growth prospects.

It is possible that the FDA or similar regulatory authorities may not consider the results of the clinical trials to be sufficient for approval of RhinoChill for a particular indication. In general, the FDA suggests that sponsors complete two adequate and well-controlled clinical studies to demonstrate effectiveness because a conclusion based on two persuasive studies will be more compelling than a conclusion based on a single study. The FDA may nonetheless require that we may conduct additional clinical studies, possibly using a different clinical study design.

Moreover, even if the FDA or other regulatory authorities approve RhinoChill, the approval may include additional restrictions on the label that could make RhinoChill less attractive to physicians and patients compared to other products that may be approved for broader indications, which could limit potential sales of RhinoChill.

If we fail to obtain FDA or other regulatory approval of RhinoChill, or if the approval is narrower than what we seek, it could impair our ability to realize value from RhinoChill, and therefore may have a material adverse effect on our business, financial condition, results of operations and growth prospects. Moreover, the medical community and reimbursement authorities may not view the results of clinical (or pre-clinical trials) strong enough and sufficient to enable future revenues as planned.

Even if RhinoChill or any other products we may develop receive regulatory approval, these products may fail to achieve the degree of market acceptance by physicians, patients, caregivers, healthcare payers and others in the medical community necessary for commercial success.

If RhinoChill or any other products we may develop receive regulatory approval, they may nonetheless fail to gain sufficient market acceptance by physicians, hospital administrators, patients, healthcare payors and others in the medical community. The degree of market acceptance of RhinoChill and any other products we may develop, if approved for commercial sale, will depend on a number of factors, including the following;

| • | the prevalence and severity of any side effects; |

| • | their efficacy and potential advantages compared to alternative treatments; |

| • | the price we charge for our products; |

| • | the willingness of physicians to change their current treatment practices; |

| • | convenience and ease of administration compared to alternative treatments; |

16

Table of Contents

| • | the willingness of the target patient population to try new therapies and of physicians to prescribe these therapies; |

| • | the strength of marketing and distribution support; and |

| • | the availability of third-party coverage or reimbursement. |

If RhinoChill or any other products we may develop, if approved, do not achieve an adequate level of acceptance, we may not generate significant product revenue and we may not become profitable on a sustained basis or at all.

We currently have a small number of sales and distribution personnel and only limited marketing capabilities. If we are unable to develop a larger sales and marketing and distribution capability on our own or through collaborations or other marketing partners, we will not be successful in commercializing RhinoChill or any other products we may develop.

We have only a limited sales and marketing infrastructure and have limited experience in the sale, marketing and distribution of medical devices. To achieve commercial success for any approved product, we must either develop a sales and marketing organization or outsource these functions to third parties.

There are risks involved with both establishing our own sales and marketing capabilities and entering into arrangements with third parties to perform these services. For example, recruiting and training a sales force is expensive and time-consuming, and could delay any product launch. If the commercial launch of a planned product for which we recruit a sales force and establish marketing capabilities is delayed, or does not occur for any reason, we would have prematurely or unnecessarily incurred these commercialization expenses. This may be costly, and our investment would be lost if we cannot retain or reposition our sales and ‘marketing personnel.

We also may not be successful entering into arrangements with third parties to sell and market our other products we may develop or may be unable to do so on terms that are favorable to us. We likely will have little control over such third parties, and any of them may fail to devote the necessary resources and attention to sell and market our products effectively and could damage our reputation. If we do not develop sales and marketing capabilities successfully, either on our own or in collaboration with third parties, we will not be successful in commercializing our other products we may develop.