Attached files

| file | filename |

|---|---|

| EX-4.5 - EX-4.5 - Avenue Financial Holdings, Inc. | d778277dex45.htm |

| EX-23.2 - EX-23.2 - Avenue Financial Holdings, Inc. | d778277dex232.htm |

Table of Contents

As filed with the Securities and Exchange Commission on January 23, 2015

Registration No. 333-201438

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

PRE-EFFECTIVE

AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

AVENUE FINANCIAL HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Tennessee | 6022 | 20-5556885 | ||

| State or other jurisdiction of incorporation or organization |

(Primary Standard Industrial Classification Code Number) 111 10th Avenue South, Suite 400 Nashville, TN 37203 (615) 736-6940 |

(IRS Employer Identification Number) |

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Ronald L. Samuels

Chief Executive Officer

Avenue Financial Holdings, Inc.

111 10th Avenue South, Suite 400

Nashville, TN 37203

(615) 736-6940

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| John W. Titus Paul S. Ware Bradley Arant Boult Cummings LLP 1600 Division Street, Suite 700 Nashville, TN 37203 (615) 252-2341 |

Frank M. Conner III Michael P. Reed Covington & Burling LLP One City Center 850 Tenth Street, NW Washington, DC 20001 (202) 662-6000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JANUARY 23, 2015

Preliminary

PROSPECTUS

Shares

AVENUE FINANCIAL HOLDINGS, INC.

Common Stock

This prospectus relates to the initial public offering of Avenue Financial Holdings, Inc.’s common stock. We are a bank holding company headquartered in Nashville, Tennessee. We operate primarily through our subsidiary, Avenue Bank. Our operations are concentrated in the Nashville metropolitan statistical area, or MSA, and provide a range of financial services through our five locations (four of which are retail branches) and a deposit courier service (mobile branch) for select commercial banking clients. We are offering shares of our common stock. The selling stockholders identified in this prospectus are offering an additional shares of our common stock. We will not receive any proceeds from sales by the selling stockholders.

Prior to this offering, there has been no established public market for our common stock. We currently estimate the public offering price per share of our common stock will be between $ and $ . We have applied to have our common stock listed on the NASDAQ Global Market under the symbol “AVNU.”

We are an “emerging growth company” under the federal securities laws and will be subject to reduced public company reporting requirements. See “Implications of Being an Emerging Growth Company”.

See “Risk Factors” beginning on page 19, for a discussion of certain risks that you should consider before making an investment decision to purchase our common stock.

| Per Share | Total | |||||

| Initial public offering price |

$ | $ | ||||

| Underwriting discounts |

||||||

| Proceeds to us, before expenses |

||||||

| Proceeds to selling stockholders, before expenses |

||||||

The underwriters have an option to purchase up to an additional shares of our common stock at the initial public offering price less the underwriting discount, within 30 days from the date of this prospectus. Of the shares subject to the underwriters’ option, shares will be offered by us and shares will be offered by the selling stockholders.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The shares of our common stock that you purchase in this offering will not be savings accounts, deposits or other obligations of any of our bank or non-bank subsidiaries and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency.

The underwriters expect to deliver the shares of our common stock against payment in New York, New York, on or about , 2015.

| Keefe, Bruyette & Woods | ||||||

|

A Stifel Company |

||||||

| SANDLER O’NEILL + PARTNERS, L.P. |

Sterne Agee & Leach, Inc. | |||||

Prospectus dated , 2015

Table of Contents

| Page | ||||

| ii | ||||

| ii | ||||

| ii | ||||

| 1 | ||||

| 11 | ||||

| 19 | ||||

| 43 | ||||

| 45 | ||||

| 46 | ||||

| 47 | ||||

| 49 | ||||

| 50 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

51 | |||

| 85 | ||||

| 98 | ||||

| 111 | ||||

| 118 | ||||

| 125 | ||||

| 127 | ||||

| 130 | ||||

| 138 | ||||

| Certain Material U.S. Federal Income Tax Consequences for Non-U.S. Holders of Common Stock |

140 | |||

| 143 | ||||

| 148 | ||||

| 148 | ||||

| 148 | ||||

| F-1 | ||||

- i -

Table of Contents

We, the selling stockholders and the underwriters have not authorized anyone to provide any information other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We, the selling stockholders and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We, the selling stockholders and the underwriters are not making an offer of these securities in any jurisdiction where the offer is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front of this prospectus.

This prospectus describes the specific details regarding this offering and the terms and conditions of our common stock being offered hereby and the risks of investing in our common stock. For further information, please see the section entitled “Where You Can Find More Information.”

Neither we, nor any of our officers, directors, agents or representatives or any of the selling stockholders or underwriters, make any representation to you about the legality of an investment in our common stock. You should not interpret the contents of this prospectus or any free writing prospectus to be legal, business, investment or tax advice. You should consult with your own advisors for that type of advice and consult with them about the legal, tax, business, financial and other issues that you should consider before investing in our common stock.

No action is being taken in any jurisdiction outside the United States to permit a public offering of our securities or possession or distribution of this prospectus in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about, and to observe, any restrictions as to the offering and the distribution of this prospectus applicable to those jurisdictions.

Unless otherwise expressly stated or the context otherwise requires, all information in this prospectus assumes that the underwriters have not exercised their option to purchase additional shares of common stock.

Market data used in this prospectus has been obtained from independent industry sources and publications available to the public, sometimes with a subscription fee, as well as from research reports prepared for other purposes. Industry publications and surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable. We did not commission the preparation of any of the sources or publications referred to in this prospectus. We have not independently verified the data obtained from these sources. Forward-looking information obtained from these sources is subject to the same qualifications and the additional uncertainties regarding the other forward-looking statements in this prospectus. Trademarks used in the prospectus are the property of their respective owners, although for presentational convenience we may not use the ® or the ™ symbols to identify such trademarks.

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion in revenues during our last fiscal year, we qualify as an “emerging growth company” under the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of reduced reporting requirements and is relieved of certain other significant requirements that are otherwise generally applicable to public companies. As an emerging growth company:

| • | we may present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations; |

| • | we are exempt from the requirement to obtain an attestation from our auditors on management’s assessment of our internal control over financial reporting under the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act; |

- ii -

Table of Contents

| • | we are permitted to provide less extensive disclosure about our executive compensation arrangements; and |

| • | we are not required to present to our shareholders non-binding advisory votes on executive compensation or golden parachute arrangements. |

We may take advantage of these provisions for up to five years unless we earlier cease to be an emerging growth company. We will cease to be an emerging growth company if we have more than $1.0 billion in annual gross revenues, have more than $700.0 million in market value of our common stock held by non-affiliates as of any June 30 before that time, or issue more than $1.0 billion of non-convertible debt in a three-year period. We may choose to take advantage of some but not all of these reduced burdens. We have elected in this prospectus to take advantage of scaled disclosure relating only to executive compensation arrangements. We do not intend to take advantage of any other scaled disclosure or relief during the time that we qualify as an emerging growth company, although the JOBS Act would permit us to do so.

In addition to scaled disclosure and the other relief described above, the JOBS Act permits us an extended transition period for complying with new or revised accounting standards affecting public companies. However, we have elected not to take advantage of this extended transition period, which means that the financial statements included in this prospectus, as well as any financial statements that we file in the future, will be subject to all new or revised accounting standards generally applicable to public companies. Our election not to take advantage of the extended transition period is irrevocable.

- iii -

Table of Contents

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider before deciding to purchase our common stock in this offering. You should read the entire prospectus carefully, including the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” together with our consolidated financial statements and the related notes thereto, before making an investment decision. Unless we state otherwise or the context otherwise requires, references in this prospectus to “we,” “our,” “us,” “the Company” and “Avenue” refer to Avenue Financial Holdings, Inc. and its subsidiaries, including Avenue Bank, which we sometimes refer to as “Avenue Bank,” “the bank” or “our bank.”

Our Company

Avenue Financial Holdings, Inc. is headquartered in Nashville, Tennessee. We were formed as a single-bank holding company in June 2006 and operate primarily through our subsidiary, Avenue Bank. Our operations are concentrated in the Nashville metropolitan statistical area, or MSA, and provide a range of financial services through our five locations (four of which are retail branches) and a deposit courier service (mobile branch) for select commercial banking clients.

Founded by a team of executives and banking professionals having substantial experience with large regional institutions in the middle Tennessee market, our strategy is to serve Nashville’s rapidly growing need for local banking services. In 2007, when we launched our opening advertising campaign, we made a promise to the market that we would not become just “another bank,” and that remains our vision to this day. We strive to build a signature bank for Nashville.

Our growth strategy focuses primarily on commercial and private banking. We provide products and services that compete with large, national competitors, but with the personalized attention and nimbleness of a community bank. We believe we provide unparalleled levels of client service through the talent and expertise of our people, the responsiveness of our credit processes, and the efficiency with which we conduct business. This leads to the development of significant, long-term relationships with many of Nashville’s leading individuals and businesses.

While our market and lines of business reflect a traditional business strategy, we approach them in non-traditional ways through our people, our culture, and our brand. We have built our company on a corporate culture focused on creating a team of highly capable bankers with a depth of leadership and banking talent, who provide exceptional service to our clients.

Our culture is a critical component of attracting and retaining experienced banking talent, as well as clients. We believe our culture has enabled us to build a brand within the Nashville market for being not just “another bank,” but a significant contributor to the financial well-being of our community. We also believe that the alignment of our culture and brand provides a consistent and differentiating message to our clients, in addition to being a significant contributor to increasing shareholder value.

Why the Hummingbird? Because we believe we are “a different kind of bank,” we avoided the typical eagle, star, or flag logo. We have unique qualities and, therefore, chose a unique symbol: a bird that is agile, extremely fast, competitive, defies the laws of gravity, living and breathing, with a bit of magic and mystique. While many banks use the same words to describe themselves – customer service, credit quality, experienced bankers, community – for us, these are not just words, but actions and guiding principles. It is not just rhetoric for us; it is how we do business, hence our tagline “the difference is real.”

Our historic growth has been purely organic, with a 17% asset compound annual growth rate, or CAGR, and a 20% loan CAGR from December 31, 2011, through September 30, 2014 on an annualized basis. We have grown

- 1 -

Table of Contents

to become, as of June 30, 2014, the 11th largest bank headquartered in Tennessee by assets, and the 11th largest in the Nashville MSA by deposit market share according to data from the Federal Deposit Insurance Corporation, or FDIC. As of September 30, 2014, we had total assets of $973 million, total deposits of $821 million, total loans of $653 million, and over 15,000 accounts. We have 134 highly engaged employees as of December 31, 2014, who continue to drive consistent growth across all lines of business.

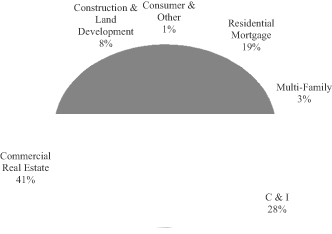

Our Historical Loan Portfolio Growth

As a result of our growth over the past several years, as of September 30, 2014, approximately $523 million (including unfunded commitments) of the loans in our loan portfolio were originated during the past two years, resulting in a relatively unseasoned portfolio even though many of these loans were made to borrowers with whom we, or our loan officers, have long standing relationships. Our commercial banking group generated $18.9 million of net loan growth, or a 4.6% increase in commercial loans during the nine months ended September 30, 2014 and $54.0 million of net loan growth, or a 15.2% increase in commercial loans during the year ended December 31, 2013. Within our commercial banking group, our commercial and industrial relationship managers reduced net loans by $2.3 million, or a 1.3% reduction in commercial and industrial loans, and grew net loans by $23.5 million, or a 15.6% increase in commercial and industrial loans, during the nine months ended September 30, 2014 and the year ended December 31, 2013, respectively. Our commercial real estate relationship managers grew net loans by $21.2 million, or a 9.0% increase in commercial real estate loans, during the nine months ended September 30, 2014 and $30.5 million, or a 14.9% increase in commercial real estate loans, during the year ended December 31, 2013.

As of September 30, 2014, loans sourced through our private bankers represented 23.7% of our total loans, including personal and commercial, and such loans grew by a net $36.2 million, or 30.5%, during the nine months ended September 30, 2014 and increased $43.5 million, or 57.9%, during the year ended December 31, 2013.

We expect continued strong loan and deposit growth in both our commercial and private banking groups, in part because we added five new relationship managers (one commercial and four private bankers) during 2013, and five (four commercial and one private bankers) during 2012.

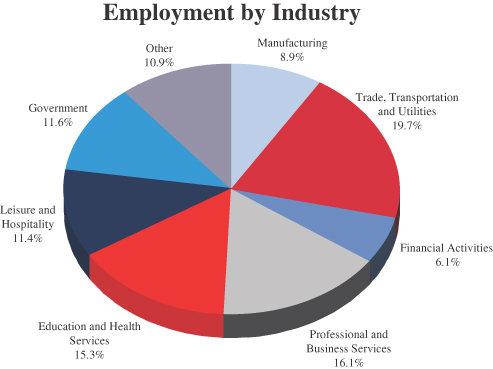

Our Market

According to the U.S. Department of Commerce, the Nashville MSA is currently the 36th largest MSA in the United States with a population of approximately 1.76 million people as of the most recent census data from July 2013. According to the U.S. Census Bureau, from July 2012 to July 2013, Nashville was one of the ten fastest-growing cities in the U.S. and the Nashville Metropolitan Planning Organization, as reported by the Nashville Business Journal projects growth by one million residents within the next 25 years. From 2011 to 2012, according to the U.S. Bureau of Labor Statistics, Nashville had the third highest job growth among metro areas with greater than one million residents, with a growth rate of 3.9%. This positive trend continued in 2013, leading to a Forbes report ranking Nashville the No. 6 city for jobs in 2014 based on data from the U.S. Bureau of Labor Statistics.

The Nashville banking market has experienced significant market disruption in the local banking community due to acquisitions of local institutions by larger regional banks located outside of the Nashville market. This disruption has created an opportunity for us to gain clients, particularly businesses and high net worth individuals. Such clients demand banking services from local institutions able to provide the sophistication of larger banks, but with a local and agile decision-making process, personal connections, and an interest in investing in the local economy. This allows us to build our bank on core low-cost deposit relationships, high credit quality loans, and fee income generated by value-added services.

- 2 -

Table of Contents

Since 2007, as the overall deposit base in the Nashville MSA has grown substantially, we have proven our ability to capture market share from larger institutions. Using data from the FDIC’s Summary of Deposits, from June 30, 2011 to June 30, 2014, the Nashville MSA deposit base grew from $39.2 billion to $44.1 billion, a rise of 12.2%. During the same period, the deposit base of the top five non-local banks in the region only grew by 9.5%, while our total deposits increased by 70.5%.

Our Competitive Strengths

Experienced Leadership

Our executive management team brings extensive experience leading departments at large financial institutions in commercial banking, credit administration, retail banking, private banking, mortgage, human resources, marketing, and bank operations. All four members of our executive management team have been working together since 2006, when they founded Avenue Bank.

| • | Our management team is led by our founder, Chief Executive Officer and Chairman Ron Samuels, a 41-year banking veteran with over 30 years of experience in middle Tennessee, leading large geographic footprints for regional and national banks. He previously served as Group President of middle Tennessee at Regions Bank. Mr. Samuels is very active in civic leadership, formerly serving as Chairman of the Nashville Area Chamber of Commerce and numerous professional, civic and non-profit boards. He also frequently represents our bank as a featured speaker at trade conferences and leadership events. |

| • | Our President and Chief Operating Officer, Kent Cleaver, is a 37-year banking veteran in Nashville and has previous experience running commercial banking operations at regional and national banks. Mr. Cleaver formerly served as the middle Tennessee commercial banking executive for both First Union and Regions Bank. |

| • | Barb Zipperian, CPA serves as Executive Vice President and Chief Financial Officer. Ms. Zipperian has 34 years of finance and accounting experience in the banking industry, with particular expertise in corporate planning, forecasting, financial analysis, facilities and capital management, investor relations and internal audit. She formerly served as a Regional Financial Officer for Regions Bank and Corporate Planning Manager for Union Planters Bank in Memphis, Tennessee. |

| • | Andy Moats serves as Executive Vice President and Chief Credit Officer. Mr. Moats has over 14 years of commercial banking experience in middle Tennessee and he also directs the General Bank Group, consisting of our Music and Entertainment, Private Banking, and Business Banking groups. Mr. Moats formerly served as a Regional Credit Manager for the Tennessee and Arkansas markets at Regions Bank. |

In addition to our experienced executive management team, we have a demonstrated ability to grow our company organically through the recruitment of high quality bankers. We have hired bankers with significant in-market experience, in order to complement and enhance our existing business model, as well as to create a “warm bench” of executive and middle management talent.

Furthermore, we have a proven ability to develop our own talent. In our branches, we recruit individuals who are often early in their careers, but whom we believe have a high level of career potential. We hire people who are naturally service-oriented, and we cross-train them to do everything in the branch – transactions, account openings, loans and customer support. We are also committed to the intentional development of talent within our company through training and promotions, which leads to long-term continuity of talented employees and assists in recruiting others. This effort has created a strong talent pool to fuel the long-term potential of our bank.

- 3 -

Table of Contents

By combining the more experienced bankers with the next generation of bankers and uniting them within our unique culture, we are merging the knowledge of our past experiences with the talent and drive of the future leaders of our organization. That is a talent combination which we believe will ensure the longevity of our success.

Concierge Banking Model

Our concept and practice of concierge banking is a unique, differentiating factor and a highly successful service model for us. At the core of our concierge banking model are our people. We believe that our culture creates an attractive environment, not only for recruiting purposes, but also for retention and higher employee engagement, which in turn contributes to lower turnover and higher employee productivity, resulting in our high level of client service.

Concierge banking is a concept that runs throughout our entire organization, not just in our retail branches. This idea of exceptional personalized service is embodied by every team in the bank. Each banker is empowered to help every client solve his or her problems by looking for innovative, creative solutions. We encourage and incentivize our bankers to focus on our client’s holistic banking needs, stressing the gathering of loans, deposits and cross-department referrals. Furthermore, we are able to serve a wide variety of client needs by engaging bankers from our multiple business lines in a relationship.

Our concierge banking model is further enhanced through our Concierge Banking Group in our retail branches, which are designed to reflect a highly sophisticated, hospitality-inspired atmosphere, while simultaneously mirroring the creative spirit of Nashville. For example, we play music at a slightly elevated volume and decorate our branches with local art and designer furniture. Our bankers are seated in the front of the branch dressed in business attire. We do not employ teller lines. We staff each of our branches with service-oriented people who undergo an extensive training program to ensure they are capable of handling any client need, from transactions to account openings to loans, all with an exceptional level of service. Just like our advertising, we avoid bank jargon and instead use common language with honesty, sincerity, and a personal touch. These factors result in the creation of a very different atmosphere from a traditional community bank.

The resulting high-end experience we believe encourages our clients to promote our bank, generating significant account growth from word-of-mouth recommendations. With very limited investment in retail product advertising, our four branches opened approximately 3,000 new accounts in 2014. We believe our concept and practice of concierge banking has proven to differentiate us from competitors and resulted in high levels of customer satisfaction, retention, and the formation of broad client relationships.

Industry Verticals

Our organic growth has been powered by traditional lines of business, including commercial banking, commercial real estate, and private banking, further complemented by substantive knowledge of and visibility in two of Nashville’s prominent industries: music and entertainment and healthcare. These industry verticals are formed by teams of experienced bankers across departmental lines. This collaboration allows us to cater to a client’s every banking need, from individual deposits to large corporate loans and spanning a diverse range of industry functions. Our bankers, along with our senior management and members of our board of directors, have extensive experience and contacts in the Nashville music and entertainment and healthcare industries. Our industry-specific knowledge, products expertise and engagement increases our profile within these two industry verticals and enables us to successfully identify, select and compete for credit-worthy borrowers and attractive financing projects. This vertical banking focus results in deep client relationships with multiple bankers, which generates both earning assets and funding sources, and allows us to provide an uncommonly high level of customer service that is relevant for each business’ specific industry segment. In addition to our two established industry verticals, we are also developing a growing specialty area in the not-for-profit industry.

- 4 -

Table of Contents

Credit Culture

One of the primary success factors for our continuous loan growth and high asset quality is our credit culture. We serve our clients with a consultative approach to credit. Rather than presuming the weaknesses of a credit and placing the burden of proof on our client, our approach is to understand the fundamental credit need of the client and provide a consultation of how we can meet that need. We believe that the tone and responsiveness of this approach results in a competitive advantage for our bank. We strive to establish open communications at the inception of each loan opportunity. Our process of credit evaluation and structuring during the underwriting process is highly collaborative and solutions-based. Decisions are made via credit committee, characterized by consensus-building and a healthy balance of art and science.

Our Business Strategy

From our inception until the present, we have focused on building a strong foundation, capable of yielding sustainable and long-term performance. By developing and leveraging our competitive strengths we believe we have succeeded in our goal to create a franchise capable of supporting further growth.

Our focus now is leveraging the foundation we have built thus far to create growth in both earnings and value. We intend to create this growth through:

| • | Continued Organic Growth. We plan to continue our focus on organic growth supported by our existing footprint. We believe the economic vibrancy and cyclically disrupted banking environment in the Nashville market will continue to provide an opportunity to capture deposit market share and continue the ongoing growth of our client base. We plan to continue organic growth by deepening our ties in our community and leveraging the extensive experience of our executive management and senior bankers which gives us market insight and familiarity with our clients. In addition, our highly responsive, analytical, common-sense approach to evaluating and deciding on credits routinely differentiate us from our competition in the local market. By understanding a client’s business, appropriately structuring our loans, and by applying the attitude of finding a solution, we help our clients understand that we are their financial partners. This is critical to our ability to grow our loans and deposits, which is further encouraged by our incentive compensation plan. From December 31, 2011 until September 30, 2014, we have grown demand deposits 200%, while the average cost of these accounts declined from 0.15% to 0.10%. By focusing on growth in demand deposits and commercial treasury accounts, a main source of large, low-cost deposits, we are able to continue to expand our balance sheet in a low-cost way. Also, by being deeply knowledgeable of our market, we make better credit decisions and make them faster, allowing us to operate safely and soundly in a manner that attracts clients in a growing market. |

| • | Scalable Infrastructure. Our recent and planned investments in people, locations, and technology allows for significant additional growth without significant additional capital investments on a go-forward basis. At this time, the excellent physical condition and locations of our current branches remain sufficient to properly serve our current and prospective clients. Furthermore, our continuous investment in our technology platform since our inception will continue to allow us to significantly grow loans and deposits without material additional investment. We intend to leverage our existing infrastructure and people to drive efficient growth in assets and deposits, thus improving our efficiency ratio and profitability, without the need for new significant capital expenditures in the medium term. |

| • | Strategic Acquisitions. We plan for any acquisition activity we may undertake to complement our growth strategy and to focus on the acquisition of both talent and businesses. We will continue to strategically recruit experienced and high performing bankers as we have a proven success rate of adding new teams of bankers and new areas of expertise, moving market share, increasing revenue, and improving our margin by increasing our loan to deposit ratio. Since 2012, we have completed the successful hiring and integration of |

- 5 -

Table of Contents

| ten experienced producers, some of whom joined us in teams, helping us to expand our product offerings and strengthen or add new verticals. Although we are not actively engaged in any discussions of acquisitions of people or businesses, if acquisition opportunities were to arise that would be complementary to our business structure, we would consider them. We expect that any strategic business acquisitions would either be in or around our existing Nashville market or would involve business lines that are additive to our existing products and services. As we evaluate potential acquisition opportunities, we believe there are banking institutions that continue to face credit challenges, capital constraints and liquidity issues and that lack the scale and management expertise to manage the increasing regulatory burden. We seek acquisitions that provide meaningful financial benefits, long-term organic growth opportunities and expense reductions, without compromising our risk profile. |

| • | Expand Fee Income Sources. We intend to improve profitability and diversify our income sources going forward by expanding fee income. Our increased participation in recurring secondary market sales of both SBA loans and portfolio mortgages provide an extra source of income to bolster earnings. Furthermore, we believe that an expanded commitment to wealth management through new talent acquisitions can further diversify our noninterest income. |

Recent Developments

Issuance of Subordinated Debt

On December 29, 2014 we issued fixed / floating rate subordinated notes, or the Subordinated Notes, in an aggregate principal amount of $20.0 million in a private placement to qualified institutional buyers. The Subordinated Notes are due on December 29, 2024. The Subordinated Notes bear an interest rate, paid quarterly in arrears, that is fixed at 6.75% per annum until January 1, 2020, at which time the interest rate will be a floating rate equal to three-month LIBOR (as defined in the Subordinated Notes) plus 495 basis points. We may, at our option, beginning on January 1, 2020 and on any interest payment date thereafter, redeem the Subordinated Notes, in whole or in part, at a redemption price equal to 100% of the principal amount of the Subordinated Notes to be redeemed plus accrued and unpaid interest to the date of redemption. Any partial redemption will be made pro rata among all the holders. The Subordinated Notes will not otherwise be redeemable by us prior to maturity unless (1) a Tier 2 capital event or a tax event occurs (each as defined in the Subordinated Notes), or (2) if we are required to register as an investment company under the Investment Company Act of 1940. There is no sinking fund for the Subordinated Notes. The Subordinated Notes will not be convertible or exchangeable.

The Subordinated Notes contain covenants in favor of the holders that are customary for debt securities of this type. In addition, we granted the holders of the Subordinated Notes registration rights including, to promptly following this offering (and in any event within 90 days after consummation of this offering), register the Subordinated Notes for the resale of the Subordinated Notes, as well as certain “piggyback” registration rights if we register any securities substantially similar to the Subordinated Notes.

Appointment of New Director

In January 2015, our board of directors filled a vacancy by adding James F. Deutsch as a new director. Mr. Deutsch, age 59, has served as a Managing Director of Patriot Financial Partners II, L.P., or Patriot, since April 2011. From November 2004 until April 2011, Mr. Deutsch served as President, CEO and Director of Team Capital Bank, a community bank located in Pennsylvania. Mr. Deutsch was designated as a director by Patriot pursuant to the terms of a Corporate Governance Agreement dated January 16, 2015, between us and Patriot (see “Certain Relationships and Related Transactions - Corporate Governance Agreement”). Patriot beneficially owned 222,500 shares of our common stock as of January 20, 2015.

- 6 -

Table of Contents

Mr. Deutsch has over 35 years of banking and investment management experience. He brings to us a breadth of experience, including investment banking, commercial banking and commercial real estate lending, and corporate finance. Mr. Deutsch’s experience in financial services, and his perspective as both an investor in banks and an operational leader of financial services firms and community banks, qualifies him to serve as a member of our board of directors.

Recent Financial Developments

The following financial and related data contain selected preliminary unaudited financial information regarding our performance and financial position as of and for the periods indicated. The selected consolidated financial data as of and for the year ended December 31, 2013 is derived from our audited consolidated financial statements, which are included elsewhere in this prospectus. Our audited consolidated financial statements as of and for the year ended December 31, 2014 are not yet available. The financial information included below for the year ended December 31, 2014 has not been audited and our independent public accounting firm has not performed any procedures with respect to such financial data and does not express an opinion or give any other form of assurance with respect to such data. Under generally accepted accounting principles or “GAAP”, we are required to assess certain information that may come to our attention that may constitute one or more subsequent events, which may either need to be considered in the presentation of our audited consolidated financial statements as of and for the year ended December 31, 2014 or disclosed in the notes thereto (or both). As a result, subsequent information may cause a change in certain accounting estimates and other financial information, including estimates and financial information related to our allowance for loan losses, fair values, and our income taxes.

We have prepared our financial data for the year ended December 31, 2014 on the same basis as our audited financial statements and have included all adjustments, consisting of normal and recurring adjustments, that we consider necessary for a fair presentation of our financial position and operating results for the unaudited periods.

Financial Results

Net income available to common stockholders for the year ended December 31, 2014 was $5.4 million, or $0.64 and $0.63 basic and diluted net income per common, compared to $3.8 million, or $0.45 and $0.45 basic and diluted net income per common, for the year ended December 31, 2013. The increases in net income and earnings per common share for the year ended December 31, 2014 can be attributed to the increase in net interest income.

Net Interest Income

Net interest income was $29.3 million for the year ended December 31, 2014, compared to $23.5 million for the year ended December 31, 2013. The increase in net interest income resulted primarily from significant balance sheet growth and increase in net interest margin. Our net interest margin for the year ended December 31, 2014 increased 12 basis points to 3.36%, from 3.24%, for 2013. The increase in net interest margin was due to an improved loan/deposit ratio, growth in non-interest bearing deposits and a reduction in cost of interest-bearing liabilities.

The provision for loan losses was $1.6 million for the year ended December 31, 2014, an increase of $50,000 from $1.6 million for the year ended December 31, 2013. Our allowance for loan losses was $8.5 million, or 1.23% of loans, at December 31, 2014, compared to $7.2 million, or 1.26% of loans, at December 31, 2013.

- 7 -

Table of Contents

Non-interest Income

Non-interest income decreased $0.4 million to $4.7 million for the year ended December 31, 2014, from $5.1 million for the year ended December 31, 2013. The decrease in non-interest income for the year ended December 31, 2014, was primarily due to year-over-year decreases in both mortgage banking fees and gains on the sale of investment securities of $1.0 million and $0.5 million, respectively, partially offset by year-over-year increases of $0.9 in net gain on sales of loans and $0.4 million in increased customer service fees related to loan and deposit activities.

Non-interest Expenses

Non-interest expenses increased $3.5 million to $24.1 million for the year ended December 31, 2014, from $20.6 million for the year ended December 31, 2013. This increase was primarily due to higher staff expenses of $2.2 million, occupancy, equipment and data processing expenses of $0.2 million and advertising, legal and accounting, regulatory and other expenses of $1.2 million, which include various items related to our growth and increased volume of business. OREO expense decreased $0.1 million. This decrease was the result of fewer write-downs in residential development properties during 2014 compared to 2013.

Balance Sheet

Total assets were $999.3 million at December 31, 2014, compared to $889.6 million at December 31, 2013. The primary driver of the increase in assets year over year was an increase in loans of $120.5 million. Total assets were $999.3 million at December 31, 2014, compared to $973.4 million at September 30, 2014. The increase was primarily due to an increase in loans of $41.0 million.

Total liabilities were $907.7 million at December 31, 2014, compared to $807.2 million at December 31, 2013. The primary driver of the year over year change in liabilities was a $97.9 million increase in total deposits. Also, on December 29, 2014 we issued Subordinated Notes in an aggregate principal amount of $20.0 million in a private placement to qualified institutional buyers. The Subordinated Notes are due on December 29, 2024.

Total liabilities were $907.7 million at December 31, 2014, compared to $883.8 million at September 30, 2014. The increase in total liabilities in the three months ended December 31, 2014 was primarily due to the issuance of $20.0 million of Subordinated Notes.

Total stockholders’ equity at December 31, 2014 was $91.6 million, an increase of $9.2 million from $82.4 million at December 31, 2013. The increase was due to net income of $5.4 million, a $0.5 million increase in additional paid-in-capital, and a $3.2 million increase to accumulated other comprehensive income reflective of shifts in fair value of investment securities available-for-sale and cash flow hedges. The increase to additional paid-in-capital was largely due to stock compensation expense incurred during the year on stock grants awarded and vesting during 2014.

Total stockholders’ equity increased $2.0 million to $91.6 million at December 31, 2014, from $89.6 million at September 30, 2014, primarily due to $1.2 million of net income for the three months ended December 31, 2014 and a $0.6 million increase to accumulated other comprehensive income reflective of shifts in fair value of investment securities available-for-sale and cash flow hedges.

- 8 -

Table of Contents

| At or For the Year Ended December 31, |

||||||||

| 2014 | 2013 | |||||||

| (Dollars in thousands, except per share data) |

||||||||

| SELECTED INCOME STATEMENT DATA |

||||||||

| Interest income |

$ | 33,024 | $ | 27,060 | ||||

| Interest expense |

3,769 | 3,560 | ||||||

| Net interest income |

29,255 | 23,500 | ||||||

| Provision for loan losses |

1,643 | 1,593 | ||||||

| Net interest income after provision for loan losses |

27,612 | 21,907 | ||||||

| Non-interest income |

4,665 | 5,055 | ||||||

| Non-interest expense |

24,126 | 20,559 | ||||||

| Income tax expense (benefit) |

2,538 | 2,421 | ||||||

| Net income (loss) |

5,613 | 3,982 | ||||||

|

|

|

|

|

|||||

| Dividends on preferred shares |

(190 | ) | (190 | ) | ||||

| Accretion of net preferred stock discount |

— | — | ||||||

|

|

|

|

|

|||||

| Net income available to common stockholders |

$ | 5,423 | $ | 3,792 | ||||

| PER COMMON SHARE DATA: |

||||||||

| Basic earnings (loss) per share |

$ | 0.64 | $ | 0.45 | ||||

| Diluted earnings (loss) per share |

0.63 | 0.45 | ||||||

| Book value per common share |

8.41 | 7.41 | ||||||

| Tangible book value per common share (1) |

8.07 | 7.06 | ||||||

| Basic weighted average common shares |

8,487,515 | 8,424,598 | ||||||

| Diluted weighted average common shares |

8,540,481 | 8,424,598 | ||||||

| SELECTED BALANCE SHEET DATA |

||||||||

| Total assets |

$ | 999,282 | $ | 889,578 | ||||

| Total loans, net of deferred fees |

693,908 | 573,430 | ||||||

| Allowance for loan losses |

(8,518 | ) | (7,204 | ) | ||||

| Securities available for sale |

220,462 | 257,797 | ||||||

| Goodwill and other intangible assets |

2,966 | 2,966 | ||||||

| Deposits |

803,664 | 705,794 | ||||||

| Advances from FHLB/FRB |

70,300 | 79,250 | ||||||

| Preferred stock |

18,950 | 18,950 | ||||||

| Tangible common stockholders’ equity (1) |

69,700 | 60,502 | ||||||

| Total stockholders’ equity |

91,616 | 82,418 | ||||||

| Average total assets |

942,656 | 798,912 | ||||||

| Average common stockholders’ equity |

69,131 | 65,550 | ||||||

| Full time employees |

134 | 120 | ||||||

- 9 -

Table of Contents

| At or For the Year Ended December 31, |

||||||||

| 2014 | 2013 | |||||||

| SELECTED PERFORMANCE RATIOS |

||||||||

| Return on average assets (2) |

0.58 | % | 0.47 | % | ||||

| Return on average common stockholders’ equity (2) |

7.84 | 5.78 | ||||||

| Net interest margin (fully taxable equivalent) |

3.36 | 3.24 | ||||||

| Efficiency ratio (1) (3) |

73.02 | 73.62 | ||||||

| SELECTED ASSET QUALITY RATIOS |

||||||||

| Nonaccruing loans to total loans |

0.10 | % | 0.10 | % | ||||

| Nonaccruing loans and loans past due 90 days and still accruing to total loans |

0.10 | 0.10 | ||||||

| Non-performing assets to total assets (5) |

0.41 | 0.45 | ||||||

| Non-performing assets to loans and OREO |

0.58 | 0.70 | ||||||

| Allowance for loan losses to total loans |

1.23 | 1.26 | ||||||

| Allowance for loan losses to nonaccruing loans |

1,224.87 | 1,219.43 | ||||||

| Net loan charge-offs to average loans |

0.05 | 0.22 | ||||||

| CAPITAL RATIOS (Consolidated) |

||||||||

| Tier 1 Leverage Ratio (4) |

9.21 | % | 9.12 | % | ||||

| Tier 1 Common Capital Ratio |

9.22 | 8.68 | ||||||

| Tier 1 Risk-Based Capital Ratio |

11.69 | 11.46 | ||||||

| Total Risk-Based Capital Ratio (4) |

15.41 | 12.52 | ||||||

| Tangible common stockholders’ equity to tangible assets (1) |

7.00 | 6.82 | ||||||

| (1) | These measures are not measures recognized under generally accepted accounting principles (United States) (“GAAP”), and are therefore considered to be non-GAAP financial measures. See below for a reconciliation of these measures to their most comparable GAAP measures. |

| (2) | Return on average assets is defined as net income available to common stockholders divided by average total assets. Return on average common stockholders’ equity is defined as net income available to common stockholders divided by average common stockholders’ equity. |

| (3) | Efficiency ratio is defined as total non-interest expense divided by our operating revenue, which is equal to the sum of net interest income and total non-interest income, (excluding securities and loan sale gains/(losses)) and is not a GAAP measure. |

| (4) | Capital ratios as of December 31, 2014 are estimated. |

| (5) | Non-performing assets are deemed to be nonaccruing loans and OREO. |

- 10 -

Table of Contents

| At or For the Year Ended December 31, |

||||||||

| (Dollars in Thousands except, per share data) | 2014 | 2013 | ||||||

| NON-GAAP FINANCIAL MEASURES |

||||||||

| Tangible Common Stockholders’ Equity and Tangible Common Stockholders’ Equity/Tangible Assets |

||||||||

| Common equity |

$ | 72,666 | $ | 63,468 | ||||

| Less: intangible assets |

(2,966 | ) | (2,966 | ) | ||||

|

|

|

|

|

|||||

| Tangible common stockholders’ equity |

69,700 | 60,502 | ||||||

| Total assets |

999,282 | 889,578 | ||||||

| Less: Intangible assets |

(2,966 | ) | (2,966 | ) | ||||

|

|

|

|

|

|||||

| Tangible assets |

996,316 | 886,612 | ||||||

|

|

|

|

|

|||||

| Tangible Common Stockholders’ Equity/Tangible Assets |

7.00 | % | 6.82 | % | ||||

| Tangible Book Value per Common Share |

||||||||

| Book Value Per Common Share |

$ | 8.41 | $ | 7.41 | ||||

| Less: Effects of intangible assets |

(0.34 | ) | (0.35 | ) | ||||

|

|

|

|

|

|||||

| Tangible Book Value per Common Share |

$ | 8.07 | $ | 7.06 | ||||

| Efficiency Ratio |

||||||||

| Non-interest expense (numerator) |

$ | 24,126 | $ | 20,559 | ||||

| Net interest income |

29,255 | 23,500 | ||||||

| Non-interest income |

4,665 | 5,055 | ||||||

| Less: gains on sale of loans |

(866 | ) | (109 | ) | ||||

| Less: gains (losses) on sales of securities |

(12 | ) | (522 | ) | ||||

|

|

|

|

|

|||||

| Adjusted operating revenue (denominator) |

33,042 | 27,924 | ||||||

| Efficiency Ratio |

73.0 | % | 73.6 | % | ||||

Non-GAAP Financial Measures

Some of the financial data included above are not measures of financial performance recognized by GAAP. These non-GAAP financial measures are “tangible common stockholders’ equity,” “tangible common stockholders’ equity to tangible assets,” “tangible book value per common share,” and “efficiency ratio”. Our management uses these non-GAAP financial measures in its analysis of our performance. We have defined these terms, and the way that we use them, on pages 17 and 18. Although we believe these non-GAAP financial measures provide a greater understanding of our business, these measures are not necessarily comparable to similar measures that may be presented by other companies. The following tables provide a reconciliation of the measures to the closest GAAP financial measures.

Corporate Information

We were incorporated in the state of Tennessee in 2006. We completed our initial round of funding in February 2007, raising $75 million in capital, and acquired a state charter. This was accomplished by the acquisition of a two-branch bank in rural western Tennessee having approximately $25 million in total assets. We immediately moved the headquarters to Nashville, and 23 months later completed the divestiture of the acquired bank’s assets and liabilities. We opened to the public for the first time in July 2007, with the opening of our first branch in Nashville’s historic Cummins Station building. In the same year, we opened our corporate headquarters in Nashville’s historic Union Station Baggage Building. Since then, we have opened three additional branches as well as a limited deposit courier service.

- 11 -

Table of Contents

Our operations are conducted through Avenue Bank, which holds a charter dating to 1911. Our principal executive offices are located at 111 10th Avenue South, Suite 400, Nashville, Tennessee 37203, and our telephone number is (615) 252-2265. We also maintain an Internet site at www.avenuenashville.com. Our website and the information contained therein or limited thereto is not incorporated into this prospectus or the registration statement of which it forms a part.

- 12 -

Table of Contents

THE OFFERING

| Securities offered by us |

shares of common stock. | |

| Securities offered by selling stockholders |

shares of common stock. | |

| Underwriter purchase option |

shares of common stock from us and shares of common stock from the selling stockholders. | |

| Securities offered as a percentage of outstanding shares of common stock |

%, assuming the underwriters do not exercise their purchase option. | |

| Common shares outstanding after completion of the offering |

shares of common stock, assuming the underwriters do not exercise their purchase option. | |

| Securities owned by directors and executive officers |

Our directors and executive officers own shares of our common stock. We expect our directors and executive officers to purchase approximately shares of our common stock in this offering. | |

| Use of proceeds |

Assuming an initial public offering price of $ per share, which is the midpoint of the offering price set forth on the cover page of this prospectus, we estimate that the net proceeds to us from the sale of our common stock in this offering will be $ million (or $ million if the underwriters exercise in full their purchase option), after deducting estimated underwriting discounts and offering expenses. We intend to use the net proceeds to us generated by this offering, along with available cash, to redeem in full our outstanding shares of Senior Non-Cumulative Perpetual Preferred Stock, Series C, no par value per share, or Series C Preferred Stock, (which currently has a dividend rate of 1% per annum that will increase to 9% per annum on March 15, 2016) and to transfer the balance to our bank for general corporate purposes including to support balance sheet growth of our bank, future acquisitions (although we do not have any current plans to make any such acquisitions) and to maintain our capital and liquidity ratios at acceptable levels. We will not receive any proceeds from the sale of our common stock by the selling stockholders. For additional information, see “Use of Proceeds.” | |

| Dividends |

We have not paid any cash dividends on our common stock since inception and we do not intend to pay dividends on our common stock in the foreseeable future. Any future determination to pay dividends on our common stock will be made by our board of directors and will depend upon our earnings, financial condition, liquidity, capital | |

- 13 -

Table of Contents

| requirements, regulatory and contractual restrictions, general economic conditions, our business strategy and other factors that our board of directors deems relevant. For additional information, see “Dividend Policy.” | ||

| Directed share program |

The underwriters have reserved for sale at the initial public offering price up to % of the shares of our common stock being offered by this prospectus for sale to certain of our employees, executive officers, directors, business associates and related persons who have expressed an interest in purchasing our common stock in this offering. We do not know if these persons will choose to purchase all or any portion of the reserved shares, but any purchases they do make will reduce the number of shares available to the general public. See “Underwriting.” | |

| Proposed NASDAQ Global Market symbol |

We have applied to list our common stock on the NASDAQ Global Market under the symbol “AVNU.” | |

| Risk factors |

Investing in our common stock involves risks. See “Risk Factors,” for a discussion of certain factors that you should carefully consider before making an investment decision. | |

| Registration Rights |

We have granted registration rights to the U.S. Treasury, the holder of our Series C Preferred Stock, pursuant to which we agreed to file a shelf registration statement covering the Series C Preferred Stock promptly after we become subject to Sections 13 and 15(d) of the Exchange Act. We intend to use a portion of the proceeds of this offering, along with available cash funds, to redeem all of our outstanding shares of Series C Preferred Stock.

We also granted registration rights to Goldman Sachs & Co., or the Investor, pursuant to an Investors Rights Agreement in connection with our original funding in 2007. The Investor holds rights to register its 830,000 shares of our common stock in the event we register any of our common stock on a registration statement suitable for inclusion of the Investor’s shares. In addition, the Investor also has the right to demand registration of the 830,000 shares beneficially owned by the Investor no earlier than 12 months after our initial public offering. These registration rights expire, if not earlier exercised, three years after our initial public offering. The Investor has exercised its registration rights in connection with this offering and we are registering all 830,000 shares of our common stock held by the Investor in the registration statement of which this prospectus is a part. |

- 14 -

Table of Contents

| (1) | References in this section to the number of shares of our common stock outstanding after this offering are based on 8,636,682 shares of our common stock issued and outstanding as of December 31, 2014. Unless otherwise noted, these references exclude: |

| • | 283,500 shares of common stock issuable upon the exercise of outstanding stock options at December 31, 2014 at a weighted average exercise price of $10.00 per share; and |

| • | 390,420 shares of common stock reserved at December 31, 2014 for issuance in connection with options and restricted stock awards that remain available for issuance under our 2007 Stock Option Plan, our 2012 Long-Term Incentive Plan and our 2012 Restricted Stock Plan for Non-Employee Directors. |

Except as otherwise indicated, all information in this prospectus:

| • | assumes an initial public offering of $ per share, which is the midpoint of the price range set forth on the cover page of this prospectus; and |

| • | assumes no exercise by the underwriters of their option to purchase additional shares of our common stock from us or the selling stockholders. |

- 15 -

Table of Contents

SELECTED HISTORICAL CONSOLIDATED FINANCIAL DATA

You should read the following selected historical consolidated financial data in conjunction with our consolidated financial statements and related notes and the sections entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Capitalization” included elsewhere in this prospectus. The following tables set forth selected historical consolidated financial data (i) as of and for the nine months ended September 30, 2014 and 2013 and (ii) as of and for the years ended December 31, 2013, 2012, 2011, 2010, and 2009. Selected consolidated financial data as of and for the years ended December 31, 2013, 2012 and 2011, have been derived from our audited financial statements included elsewhere in this prospectus. We have derived the selected consolidated financial data as of and for the years ended December 31, 2010 and 2009 from our audited financial statements not included in this prospectus. Selected financial data as of and for the nine months ended September 30, 2014 and 2013 (excluding the balance sheet data as of September 30, 2013) have been derived from our unaudited financial statements included elsewhere in this prospectus and have not been audited but, in the opinion of our management, contain all adjustments (consisting of only normal or recurring adjustments) necessary to present fairly our financial position and results of operations for such periods in accordance with generally accepted accounting principles, or GAAP. Our historical results are not necessarily indicative of any future period. The performance, asset quality and capital ratios are unaudited and derived from our audited and unaudited financial statements as of and for the periods presented. Average balances have been calculated using daily averages.

| At or for the Nine Months Ended September 30, |

At or for the Year Ended December 31, |

|||||||||||||||||||||||||||

| 2014 | 2013 | 2013 | 2012 | 2011 | 2010 | 2009 | ||||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||||||

| (Dollars in thousands, except per share data) | ||||||||||||||||||||||||||||

| SELECTED INCOME STATEMENT DATA |

||||||||||||||||||||||||||||

| Interest income |

$ | 24,526 | $ | 19,679 | $ | 27,060 | $ | 22,888 | $ | 21,927 | $ | 19,854 | $ | 16,673 | ||||||||||||||

| Interest expense |

2,831 | 2,637 | 3,560 | 4,887 | 5,475 | 6,144 | 6,632 | |||||||||||||||||||||

| Net interest income |

21,695 | 17,042 | 23,500 | 18,001 | 16,452 | 13,710 | 10,041 | |||||||||||||||||||||

| Provision for loan losses |

1,187 | 961 | 1,593 | 1,623 | 1,102 | 2,227 | 5,013 | |||||||||||||||||||||

| Net interest income after provision for loan losses |

20,508 | 16,081 | 21,907 | 16,378 | 15,350 | 11,483 | 5,028 | |||||||||||||||||||||

| Non-interest income |

3,606 | 4,150 | 5,055 | 5,793 | 2,984 | 4,783 | 3,081 | |||||||||||||||||||||

| Non-interest expense |

17,829 | 15,083 | 20,559 | 18,416 | 15,918 | 15,391 | 13,592 | |||||||||||||||||||||

| Income tax expense (benefit) |

1,965 | 1,773 | 2,421 | 1,023 | (11,482 | ) | - | - | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net income (loss) |

4,320 | 3,375 | 3,982 | 2,732 | 13,898 | 875 | (5,483 | ) | ||||||||||||||||||||

| Dividends on preferred shares |

(142 | ) | (142 | ) | (190 | ) | (358 | ) | (396 | ) | (403 | ) | (289 | ) | ||||||||||||||

| Accretion of net preferred stock discount |

- | - | - | - | (234 | ) | (74 | ) | (62 | ) | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net income available to common stockholders |

$ | 4,178 | $ | 3,233 | $ | 3,792 | $ | 2,374 | $ | 13,268 | $ | 398 | $ | (5,834 | ) | |||||||||||||

| PER COMMON SHARE DATA: |

||||||||||||||||||||||||||||

| Basic earnings (loss) per share |

$ | 0.49 | $ | 0.38 | $ | 0.45 | $ | 0.28 | $ | 1.57 | $ | 0.05 | $ | (0.69 | ) | |||||||||||||

| Diluted earnings (loss) per share |

0.49 | 0.38 | 0.45 | 0.28 | 1.57 | 0.05 | (0.69 | ) | ||||||||||||||||||||

| Book value per common share |

8.18 | 7.54 | 7.41 | 7.82 | 7.40 | 5.57 | 5.78 | |||||||||||||||||||||

| Tangible book value per common share (1) |

7.84 | 7.19 | 7.06 | 7.47 | 7.05 | 5.22 | 5.43 | |||||||||||||||||||||

| Basic weighted average common shares |

8,485,195 | 8,452,474 | 8,424,598 | 8,443,393 | 8,444,063 | 8,444,438 | 8,444,742 | |||||||||||||||||||||

| Diluted weighted average common shares |

8,526,605 | 8,452,474 | 8,424,598 | 8,443,393 | 8,444,063 | 8,444,438 | 8,444,742 | |||||||||||||||||||||

| SELECTED BALANCE SHEET DATA |

||||||||||||||||||||||||||||

| Total assets |

$ | 973,418 | $ | 840,654 | $ | 889,578 | $ | 722,714 | $ | 625,597 | $ | 595,326 | $ | 491,509 | ||||||||||||||

| Total loans, net of deferred fees |

653,235 | 514,622 | 573,430 | 455,980 | 395,812 | 375,100 | 327,965 | |||||||||||||||||||||

| Allowance for loan losses |

(8,407 | ) | (6,752 | ) | (7,204 | ) | (6,695 | ) | (6,550 | ) | (5,651 | ) | (5,251 | ) | ||||||||||||||

| Securities available for sale |

211,500 | 265,770 | 257,797 | 194,090 | 166,961 | 150,359 | 128,499 | |||||||||||||||||||||

| Goodwill and other intangible assets |

2,966 | 2,966 | 2,966 | 2,966 | 2,966 | 2,966 | 2,966 | |||||||||||||||||||||

| Deposits |

820,881 | 671,345 | 705,794 | 590,840 | 482,402 | 479,864 | 372,285 | |||||||||||||||||||||

| Advances from FHLB/FRB |

55,000 | 79,500 | 79,250 | 39,000 | 44,000 | 44,000 | 48,370 | |||||||||||||||||||||

| Preferred stock |

18,950 | 18,950 | 18,950 | 18,950 | 18,950 | 7,536 | 7,462 | |||||||||||||||||||||

| Tangible common stockholders’ equity (1) |

67,699 | 61,487 | 60,502 | 63,179 | 59,530 | 44,076 | 45,882 | |||||||||||||||||||||

| Total stockholders’ equity |

89,615 | 83,403 | 82,418 | 85,095 | 81,446 | 54,578 | 56,310 | |||||||||||||||||||||

| Average total assets |

930,625 | 776,749 | 798,912 | 666,414 | 583,309 | 534,014 | 459,904 | |||||||||||||||||||||

| Average common stockholders’ equity |

67,532 | 65,595 | 65,550 | 64,739 | 49,335 | 49,805 | 52,932 | |||||||||||||||||||||

| Full time employees |

130 | 115 | 120 | 109 | 94 | 82 | 77 | |||||||||||||||||||||

- 16 -

Table of Contents

| At or for the Nine Months Ended September 30, |

At or for the Year Ended December 31, |

|||||||||||||||||||||||||||

| 2014 | 2013 | 2013 | 2012 | 2011 | 2010 | 2009 | ||||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||||||

| SELECTED PERFORMANCE RATIOS |

||||||||||||||||||||||||||||

| Return on average assets (2)(5) |

0.60 | % | 0.56 | % | 0.47 | % | 0.36 | % | 2.27 | % | 0.07 | % | (1.27 | %) | ||||||||||||||

| Return on average common stockholders’ equity (2)(5) |

8.27 | 6.59 | 5.78 | 3.66 | 26.89 | 0.80 | (11.02 | ) | ||||||||||||||||||||

| Net interest margin (fully taxable equivalent) (2) |

3.35 | 3.24 | 3.24 | 3.02 | 3.08 | 2.83 | 2.33 | |||||||||||||||||||||

| Efficiency ratio (1)(3) |

73.0 | 73.3 | 73.6 | 81.1 | 82.9 | 96.0 | 112.3 | |||||||||||||||||||||

| SELECTED ASSET QUALITY RATIOS |

||||||||||||||||||||||||||||

| Nonaccruing loans to total loans |

0.14 | % | 0.12 | % | 0.10 | % | 0.41 | % | 0.66 | % | 1.31 | % | 0.88 | % | ||||||||||||||

| Nonaccruing loans and loans past due 90 days and still accruing to total loans |

0.14 | 0.12 | 0.10 | 0.41 | 0.66 | 1.31 | 0.88 | |||||||||||||||||||||

| Non-performing assets to total assets (4) |

0.28 | 0.63 | 0.45 | 0.67 | 1.07 | 1.63 | 1.52 | |||||||||||||||||||||

| Non-performing assets to loans and OREO |

0.42 | 1.02 | 0.70 | 1.05 | 1.67 | 2.54 | 2.22 | |||||||||||||||||||||

| Allowance for loan losses to total loans |

1.29 | 1.31 | 1.26 | 1.47 | 1.65 | 1.51 | 1.60 | |||||||||||||||||||||

| Allowance for loan losses to nonaccruing loans |

945.67 | 1,129.10 | 1,219.43 | 356.12 | 249.58 | 114.95 | 354.17 | |||||||||||||||||||||

| Net loan charge-offs to average loans (2) |

0.00 | 0.25 | 0.22 | 0.36 | 0.05 | 0.52 | 1.29 | |||||||||||||||||||||

| CAPITAL RATIOS (Consolidated) |

||||||||||||||||||||||||||||

| Tier 1 Leverage Ratio |

9.16 | % | 9.59 | % | 9.12 | % | 10.92 | % | 11.75 | % | 8.20 | % | 9.70 | % | ||||||||||||||

| Tier 1 Common Capital Ratio |

8.90 | 9.25 | 8.68 | 10.14 | 10.93 | 8.98 | 10.20 | |||||||||||||||||||||

| Tier 1 Risk-Based Capital Ratio |

11.39 | 12.24 | 11.46 | 13.58 | 15.01 | 10.70 | 12.17 | |||||||||||||||||||||

| Total Risk-Based Capital Ratio |

12.49 | 13.30 | 12.52 | 14.80 | 16.26 | 11.94 | 13.42 | |||||||||||||||||||||

| Tangible common stockholders’ equity to tangible assets (1) |

6.98 | 7.34 | 6.82 | 8.78 | 9.56 | 7.44 | 9.39 | |||||||||||||||||||||

| (1) | These measures are not measures recognized under generally accepted accounting principles (United States) (“GAAP”), and are therefore considered to be non-GAAP financial measures. See “GAAP Reconciliation and Management Explanation of Non-GAAP Financial Measures” for a reconciliation of these measures to their most comparable GAAP measures. |

| (2) | Nine-month data has been annualized. |

| (3) | Efficiency ratio is defined as total non-interest expense divided by our operating revenue, which is equal to the sum of net interest income and total non-interest income, (excluding securities and loans gains/(losses)) and is not a GAAP measure. |

| (4) | Non-performing assets are deemed to be nonaccruing loans and OREO. |

| (5) | Return on average assets is defined as net income available to common stockholders divided by average total assets. Return on average common stockholders equity is defined as net income available to common stockholders divided by average common shareholders equity. |

GAAP Reconciliation and Management Explanation of Non-GAAP Financial Measures

The information set forth above contains certain financial information determined by methods other than in accordance with GAAP. These non-GAAP financial measures are “tangible book value per common share,” “tangible common stockholders’ equity,” “efficiency ratio,” and “tangible common stockholders’ equity to tangible assets.” Although we believe these non-GAAP financial measures provide a greater understanding of our business, these measures are not necessarily comparable to similar measures that may be presented by other companies.

“Tangible book value per common share” is defined as tangible common stockholders’ equity divided by total common shares outstanding. We believe that this measure is important to many investors in the marketplace who are interested in changes from period to period in book value per common share exclusive of changes in intangible assets. Goodwill, an intangible asset that is recorded in a purchase business combination, has the effect of increasing book value while not increasing our tangible book value.

“Tangible common stockholders’ equity” is defined as common stockholders’ equity reduced by goodwill. We believe that this measure is important to many investors in the marketplace who are interested in changes from period to period in common stockholders’ equity exclusive of changes in intangible assets. Goodwill, an intangible asset that is recorded in a purchase business combination, has the effect of increasing both common stockholders’ equity and assets while not increasing our tangible common stockholders’ equity or tangible assets.

- 17 -

Table of Contents

“Efficiency ratio” is defined as non-interest expenses divided by our operating revenue, which is equal to the sum of net interest income plus non-interest income excluding gains and losses on sales of loans and securities. In our judgment, the adjustments made to operating revenue allow investors and analysts to better assess our operating expenses in relation to our core operating revenue by removing the volatility that is associated with certain non-recurring items and other discrete items that are unrelated to our core business.

“Tangible common stockholders’ equity to tangible assets” is defined as the ratio of common stockholders’ equity reduced by goodwill divided by total assets reduced by goodwill. We believe that this measure is important to many investors in the marketplace who are interested in relative changes from period to period in common stockholders’ equity and total assets, each exclusive of changes in intangible assets. Goodwill, an intangible asset that is recorded in a purchase business combination, has the effect of increasing both common stockholders’ equity and assets while not increasing our tangible common equity or tangible assets.

The information provided below reconciles each non-GAAP measure to its most comparable GAAP measure.

| At or for the Nine Months Ended September 30, |

At or for the Year Ended December 31, |

|||||||||||||||||||||||||||

| 2014 | 2013 | 2013 | 2012 | 2011 | 2010 | 2009 | ||||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||||||

| (Dollars in thousands, except per share data) | ||||||||||||||||||||||||||||

| Tangible Common Stockholders’ Equity and Tangible Common Stockholders’ Equity/Tangible Assets |

||||||||||||||||||||||||||||

| Common equity |

$ | 70.665 | $ | 64,453 | $ | 63,468 | $ | 66,145 | $ | 62,496 | $ | 47,042 | $ | 48,848 | ||||||||||||||

| Less: intangible assets |

(2,966 | ) | (2,966 | ) | (2,966 | ) | (2,966 | ) | (2,966 | ) | (2,966 | ) | (2,966 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Tangible common stockholders’ equity |

67,699 | 61,487 | 60,502 | 63,179 | 59,530 | 44,076 | 45,882 | |||||||||||||||||||||

| Total assets |

973,418 | 840,654 | 889,578 | 722,714 | 625,597 | 595,326 | 491,509 | |||||||||||||||||||||

| Less: Intangible assets |

(2,966 | ) | (2,966 | ) | (2,966 | ) | (2,966 | ) | (2,966 | ) | (2,966 | ) | (2,966 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Tangible assets |

970,452 | 837,688 | 886,612 | 719,748 | 622,631 | 592,360 | 488,543 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Tangible Common Stockholders’ Equity/Tangible Assets |

6.98 | % | 7.34 | % | 6.82 | % | 8.78 | % | 9.56 | % | 7.44 | % | 9.39 | % | ||||||||||||||

| Tangible Book Value per Common Share |

||||||||||||||||||||||||||||

| Book Value Per Common Share |

$ | 8.18 | $ | 7.54 | $ | 7.41 | $ | 7.82 | $ | 7.40 | $ | 5.57 | $ | 5.78 | ||||||||||||||

| Less: Effects of intangible assets |

(0.34 | ) | (0.35 | ) | (0.35 | ) | (0.35 | ) | (0.35 | ) | (0.35 | ) | (0.35 | ) | ||||||||||||||

| Tangible Book Value per Common Share |

7.84 | 7.19 | 7.06 | 7.47 | 7.05 | 5.22 | 5.43 | |||||||||||||||||||||

| Efficiency Ratio |

||||||||||||||||||||||||||||

| Non-interest expense (numerator) |

$ | 17,829 | $ | 15,083 | $ | 20,559 | $ | 18,416 | $ | 15,918 | $ | 15,391 | $ | 13,592 | ||||||||||||||

| Net interest income |

21,695 | 17,042 | 23,500 | 18,001 | 16,452 | 13,710 | 10,041 | |||||||||||||||||||||

| Non-interest income |

3,606 | 4,150 | 5,055 | 5,793 | 2,984 | 4,783 | 3,081 | |||||||||||||||||||||

| Less: gains on sale of loans |

(852 | ) | (87 | ) | (109 | ) | - | - | - | - | ||||||||||||||||||

| Less: gains on sales of securities |

(12 | ) | (522 | ) | (522 | ) | (1,079 | ) | (233 | ) | (2,459 | ) | (1,015 | ) | ||||||||||||||

| Adjusted operating revenue (denominator) |

24,437 | 20,583 | 27,924 | 22,715 | 19,203 | 16,034 | 12,107 | |||||||||||||||||||||

| Efficiency Ratio |

73.0 | % | 73.3 | % | 73.6 | % | 81.1 | % | 82.9 | % | 96.0 | % | 112.3 | % | ||||||||||||||

- 18 -

Table of Contents

Investing in our common stock involves a significant degree of risk. You should carefully consider the following risk factors, in addition to the other information contained in this prospectus, before deciding to invest in our common stock. Any of the following risks, as well as risks that we do not know or currently deem immaterial, could materially and adversely affect our business, prospects, financial condition, results of operations and cash flow. As a result, the trading price of our common stock could decline, and you could lose all or part of your investment. Further, to the extent that any of the information in this prospectus constitutes forward-looking statements, the risk factors below also are cautionary statements identifying important factors that could cause actual results to differ materially from those expressed in any forward-looking statements made by us or on our behalf. See “Cautionary Note Regarding Forward-Looking Statements.”

Risks Related To Our Business

As a business operating in the financial services industry, our business and operations may be adversely affected in numerous and complex ways by weak economic conditions.