Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - RADIANT LOGISTICS, INC | rlgt-8k_20150122.htm |

(NYSE-MKT: RLGT) Acquisition Update – Wheels Group Inc. January 2015

This presentation may include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 as amended, and Section 21E of the Securities Exchange Act of 1934. We have based these forward-looking statements on our current expectations and projections about future events. These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions about us and our affiliate companies, that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Factors that might cause or contribute to such a discrepancy include, but are not limited to, those identified in our other Securities and Exchange Commission filing and other public documents, including our Annual Report on Form 10-K , which can be found on our corporate Web site, www.radiantdelivers.com. Disclaimer

Radiant Logistics – Investment Highlights Non-Asset Based Transportation and 3rd Party Logistics (3PL) Provider Low capital intensity offers strong cash flow characteristics and significant flexibility in responding to changing industries and economic conditions Dense Geographical Footprint Approx. 100 stations in the U.S. (14 company owned & 84 agent owned locations) Highly Diversified Customer Base 3,000+ individual customers , with no single agency station accounting for > 5% of net revenues Strong Financial Results $350 million in gross revenues in FY 2014 (ending June 30th) 38% annual revenue growth and 46% annual EBITDA growth since foundation (FY 2006) Prudential Financial Management $19.5 million in forecasted run-rate EBITDA Very low leverage with access to low cost capital to fund its growth strategy Experienced Management Team with Proven M&A Capability Radiant continues to be led by its founder and CEO, Bohn Crain Completed 10 acquisitions since January 2006

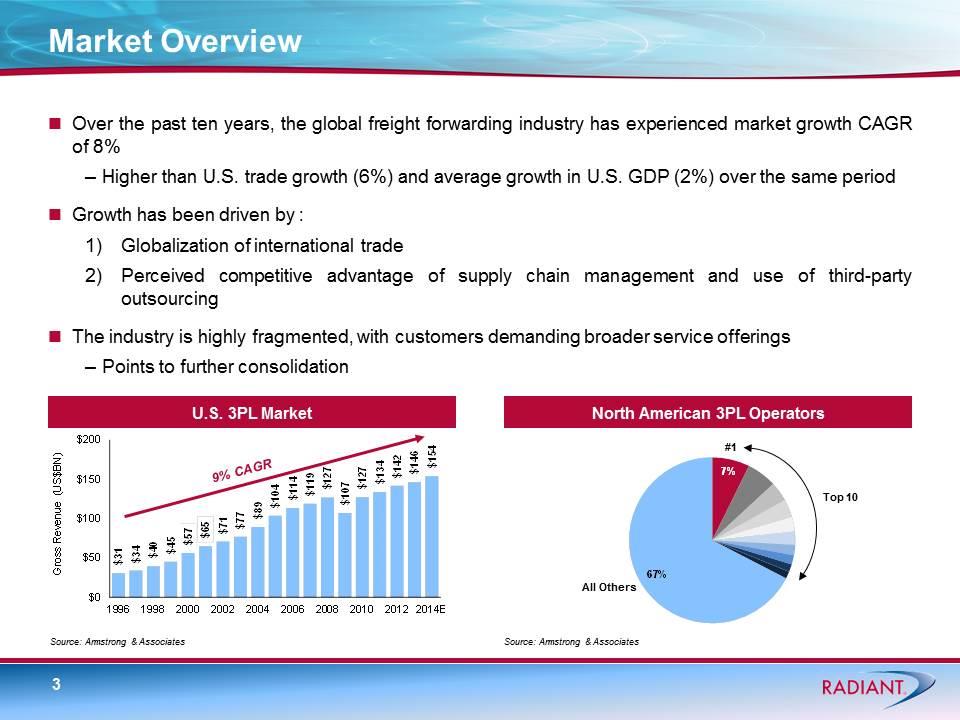

Market Overview Over the past ten years, the global freight forwarding industry has experienced market growth CAGR of 8% Higher than U.S. trade growth (6%) and average growth in U.S. GDP (2%) over the same period Growth has been driven by : Globalization of international trade Perceived competitive advantage of supply chain management and use of third-party outsourcing The industry is highly fragmented, with customers demanding broader service offerings Points to further consolidation North American 3PL Operators U.S. 3PL Market Source: Armstrong & Associates 9% CAGR Source: Armstrong & Associates #1 All Others Top 10

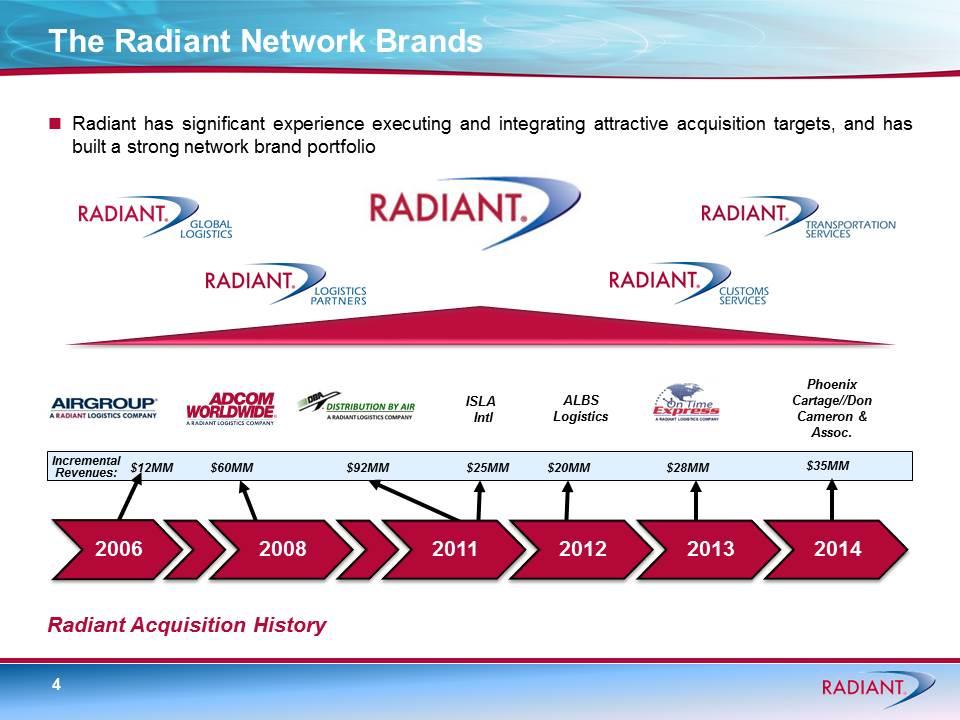

The Radiant Network Brands Radiant has significant experience executing and integrating attractive acquisition targets, and has built a strong network brand portfolio Radiant Acquisition History ALBS Logistics $12MM $60MM $92MM $25MM $20MM $28MM Incremental Revenues: ISLA Intl Phoenix Cartage//Don Cameron & Assoc. $35MM

Structural changes resulting from industry deregulation (1) and the natural “graying” of industry pioneers provides an opportunity to support the logistics entrepreneur in transition Uniquely positioned to bring value to the logistics entrepreneur Leveraging our status as a public company to provide network participants with a framework to share in the value that they help create. Solid platform in terms of network, people, process and technology to “scale” the business. Ideal long term partner in terms of succession planning and liquidity Systematically, we plan to convert key agent-based offices to company-owned offices and strategically acquire and integrate other additional non-asset based operations Radiant has identified and is in varying stages of due diligence with a select number of potential acquisitions Structural changes within the freight forwarding community are under way as a result of deregulation in our industry 30 years ago Domestic All-Cargo Deregulation Statue of 1977 and 1979 Amendments to the Federal Aviation Action deregulated domestic cargo services in the U.S. Strategic Direction – The “Gray Tail”

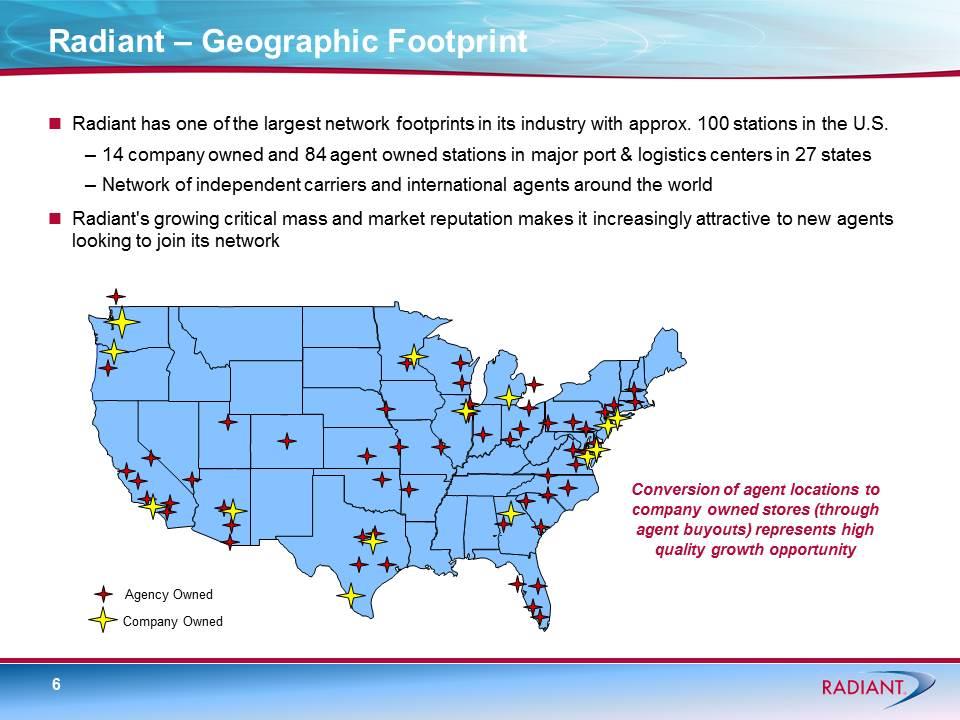

Radiant – Geographic Footprint Radiant has one of the largest network footprints in its industry with approx. 100 stations in the U.S. 14 company owned and 84 agent owned stations in major port & logistics centers in 27 states Network of independent carriers and international agents around the world Radiant's growing critical mass and market reputation makes it increasingly attractive to new agents looking to join its network Company Owned Agency Owned Conversion of agent locations to company owned stores (through agent buyouts) represents high quality growth opportunity

Radiant – Customer Base Over 3,000 individual customers No single agency station accounts for more than 5% of net revenues Top 5 agency stations account for less than 20% of net revenues Top 10 customers account for only 20% of net revenues Best in class customer service Aviation & Automotive Military & Government Manufacturing & Consumer Goods Industrial & Farm Medical, Healthcare & Pharmaceuticals Electronics & High Tech Oil & Gas/Energy Trade Shows, Events & Advertising Retail Industries Served Highly Diversified Customer Base Radiant provides customized time critical domestic and international transportation and logistics solutions to manufacturers, distributors and retailers

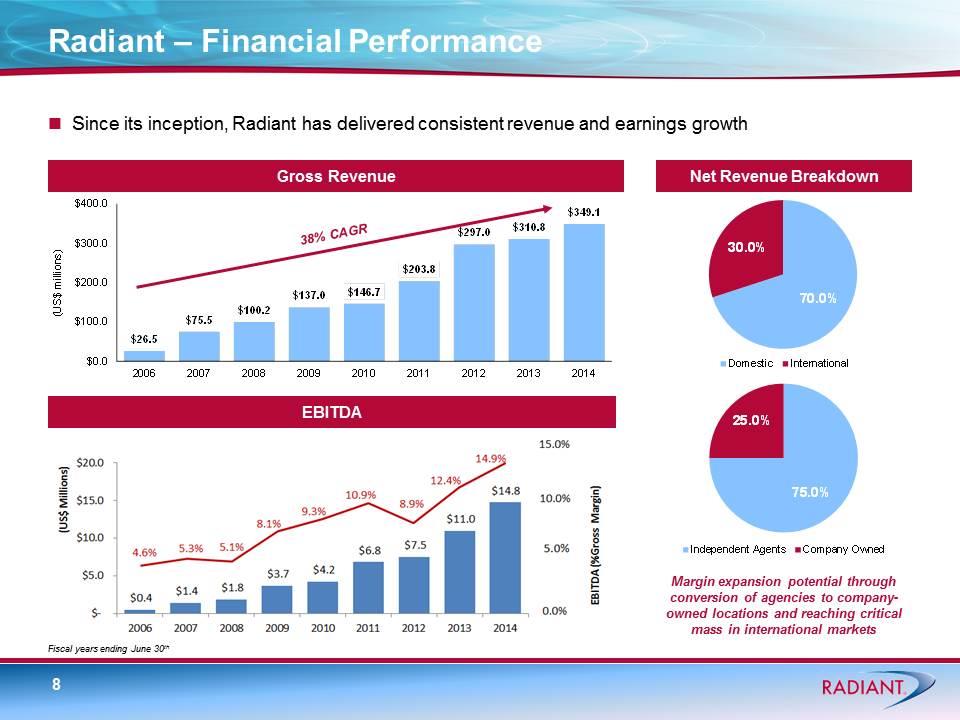

Radiant – Financial Performance Since its inception, Radiant has delivered consistent revenue and earnings growth Gross Revenue Net Revenue Breakdown EBITDA 38% CAGR Fiscal years ending June 30th Margin expansion potential through conversion of agencies to company-owned locations and reaching critical mass in international markets

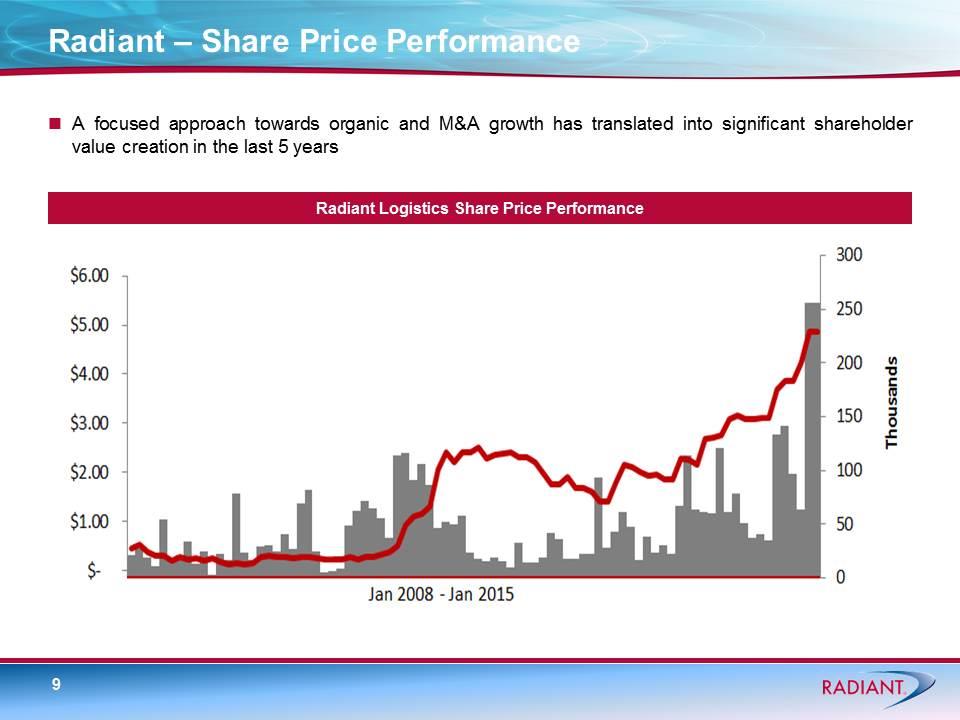

Radiant – Share Price Performance A focused approach towards organic and M&A growth has translated into significant shareholder value creation in the last 5 years Radiant Logistics Share Price Performance

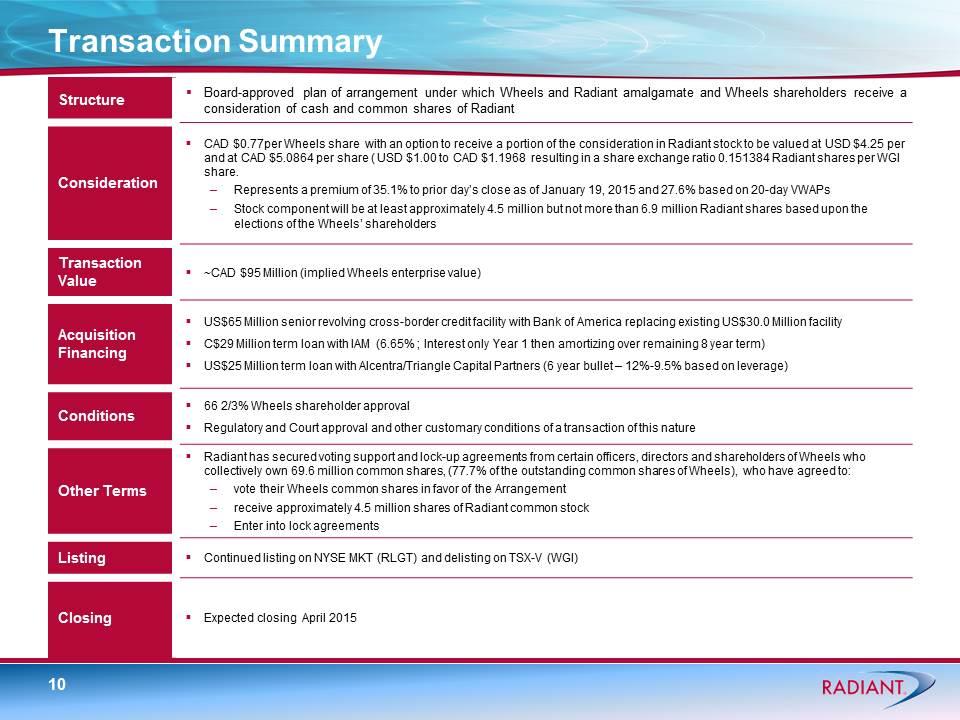

Transaction Summary Structure Board-approved plan of arrangement under which Wheels and Radiant amalgamate and Wheels shareholders receive a consideration of cash and common shares of Radiant Consideration CAD $0.77per Wheels share with an option to receive a portion of the consideration in Radiant stock to be valued at USD $4.25 per and at CAD $5.0864 per share ( USD $1.00 to CAD $1.1968 resulting in a share exchange ratio 0.151384 Radiant shares per WGI share. Represents a premium of 35.1% to prior day’s close as of January 19, 2015 and 27.6% based on 20-day VWAPs Stock component will be at least approximately 4.5 million but not more than 6.9 million Radiant shares based upon the elections of the Wheels’ shareholders Transaction Value ~CAD $95 Million (implied Wheels enterprise value) Acquisition Financing US$65 Million senior revolving cross-border credit facility with Bank of America replacing existing US$30.0 Million facility C$29 Million term loan with IAM (6.65% ; Interest only Year 1 then amortizing over remaining 8 year term) US$25 Million term loan with Alcentra/Triangle Capital Partners (6 year bullet – 12%-9.5% based on leverage) Conditions 66 2/3% Wheels shareholder approval Regulatory and Court approval and other customary conditions of a transaction of this nature Other Terms Radiant has secured voting support and lock-up agreements from certain officers, directors and shareholders of Wheels who collectively own 69.6 million common shares, (77.7% of the outstanding common shares of Wheels), who have agreed to: vote their Wheels common shares in favor of the Arrangement receive approximately 4.5 million shares of Radiant common stock Enter into lock agreements Listing Continued listing on NYSE MKT (RLGT) and delisting on TSX-V (WGI) Closing Expected closing April 2015

Wheels (TSX-V:WGI) – Investment Highlights Strong Track Record of Profitable Organic Growth Double digit organic revenue growth since 1988 (18% with acquisitions; 14% organic) Market leading position in Canada with a significant footprint in the U.S. Broad Intermodal and Truck Brokerage Capabilities in the U.S. and Canada Non-asset based business model; minimal investment in equipment Invests instead in people and technology to deliver advanced solutions through a qualified partner network of over 6,000 carriers Strong Partner Relationships & Commitment to Quality Established network of relationships with transportation providers ensures dependable service and favorable pricing Diversified Customer Base & Excellent Retention Large multi-national (Fortune 500, 1000) and mid-market accounts Customer base diversified across multiple industry segments with no customer representing more than 10% of total sales Well-positioned to be the pre-eminent consolidator in Canada

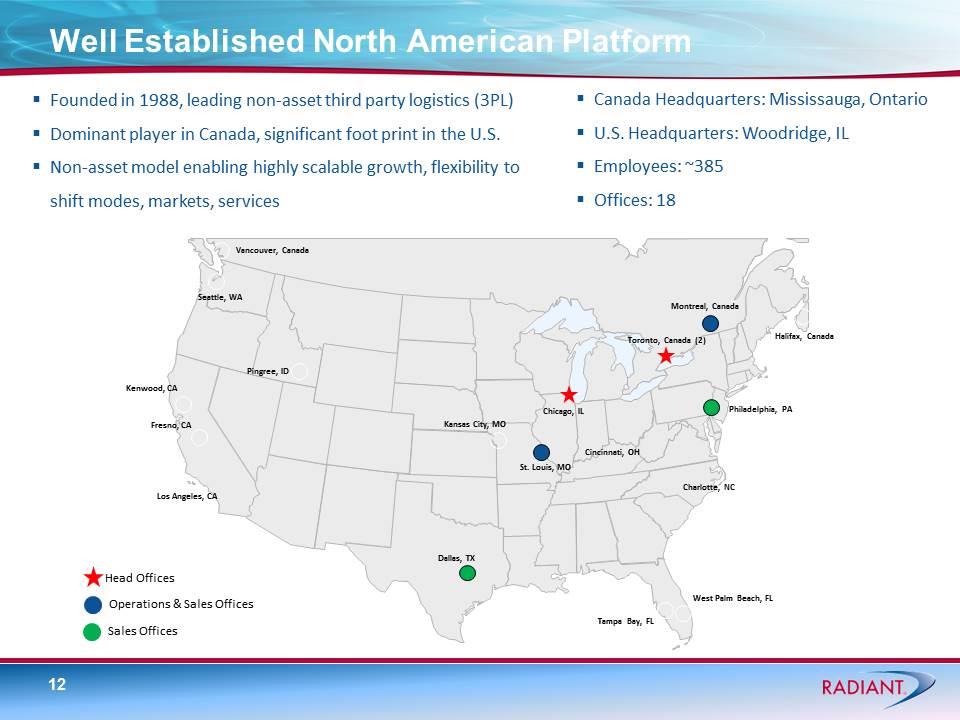

Founded in 1988, leading non-asset third party logistics (3PL) Dominant player in Canada, significant foot print in the U.S. Non-asset model enabling highly scalable growth, flexibility to shift modes, markets, services Canada Headquarters: Mississauga, Ontario U.S. Headquarters: Woodridge, IL Employees: ~385 Offices: 18 Operations & Sales Offices Sales Offices Head Offices Toronto, Canada (2) Montreal, Canada Halifax, Canada Cincinnati, OH Chicago, IL St. Louis, MO West Palm Beach, FL Los Angeles, CA Kenwood, CA Philadelphia, PA Kansas City, MO Dallas, TX Seattle, WA Vancouver, Canada Tampa Bay, FL Charlotte, NC Pingree, ID Fresno, CA Well Established North American Platform

Extensive network of over 6,000 qualified transportation partners: One of the largest highway supplier bases in Canada Carrier selection expertise Direct and deep relationships with all Class I railroads in Canada and the United States Ensures dependable service and favourable pricing for customers Demonstrated commitment to quality and service: Multiple-industry recognition Recognized as one of “Canada’s Best Managed Companies” since 1997 - 17 consecutive years - Platinum Status First Canadian 3PL provider to achieve ISO 9001:2008 Quality Standard and registered since 2001 Smart-way carrier supporting internal green program Extensive Network of Over 6,000 Partners

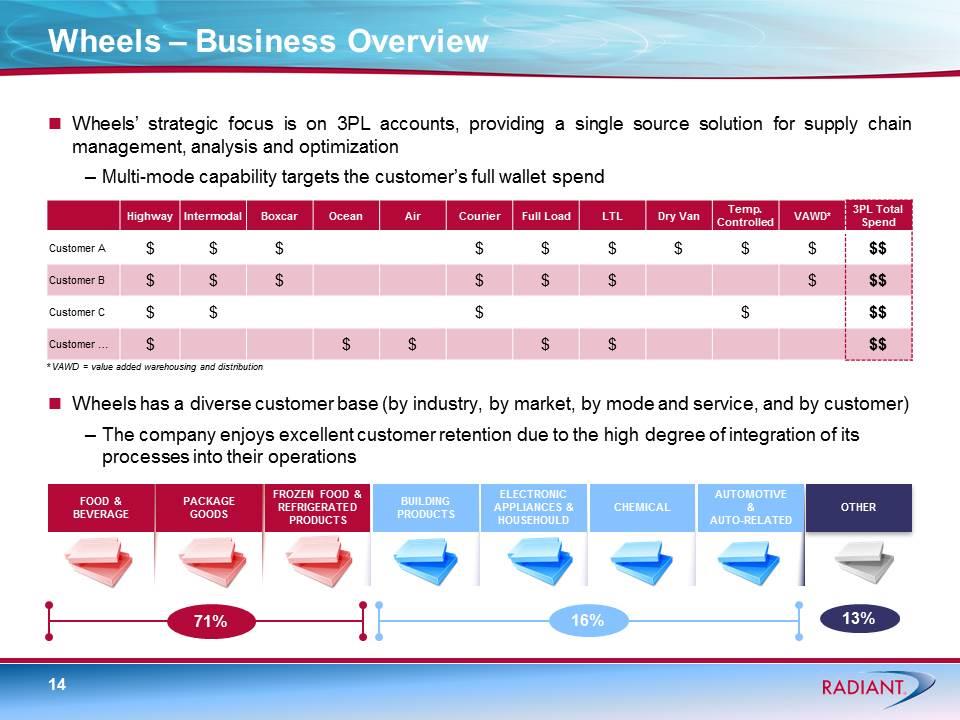

Wheels – Business Overview Wheels’ strategic focus is on 3PL accounts, providing a single source solution for supply chain management, analysis and optimization Multi-mode capability targets the customer’s full wallet spend Highway Intermodal Boxcar Ocean Air Courier Full Load LTL Dry Van Temp. Controlled VAWD* 3PL Total Spend Customer A $ $ $ $ $ $ $ $ $ $$ Customer B $ $ $ $ $ $ $ $$ Customer C $ $ $ $ $$ Customer … $ $ $ $ $ $$ CONSUMER 71% 16% 13% FOOD & BEVERAGE PACKAGE GOODS BUILDING PRODUCTS ELECTRONIC APPLIANCES & HOUSEHOULD CHEMICAL OTHER FROZEN FOOD & REFRIGERATED PRODUCTS AUTOMOTIVE & AUTO-RELATED Wheels has a diverse customer base (by industry, by market, by mode and service, and by customer) The company enjoys excellent customer retention due to the high degree of integration of its processes into their operations * VAWD = value added warehousing and distribution

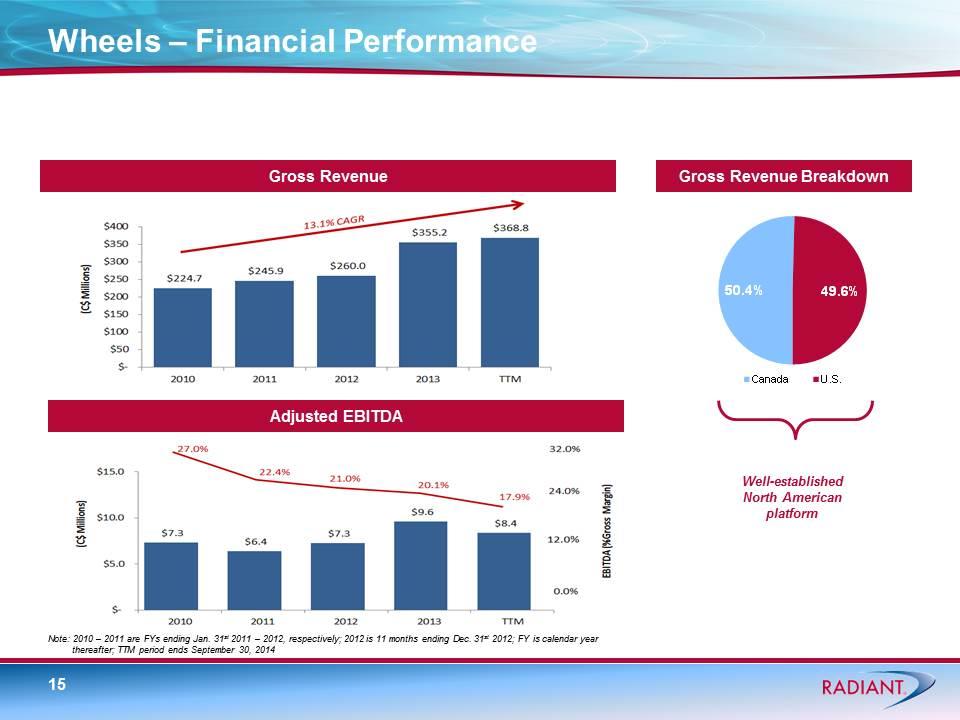

Wheels – Financial Performance Note: 2010 – 2011 are FYs ending Jan. 31st 2011 – 2012, respectively; 2012 is 11 months ending Dec. 31st 2012; FY is calendar year thereafter; TTM period ends September 30, 2014 Well-established North American platform Gross Revenue Gross Revenue Breakdown Adjusted EBITDA

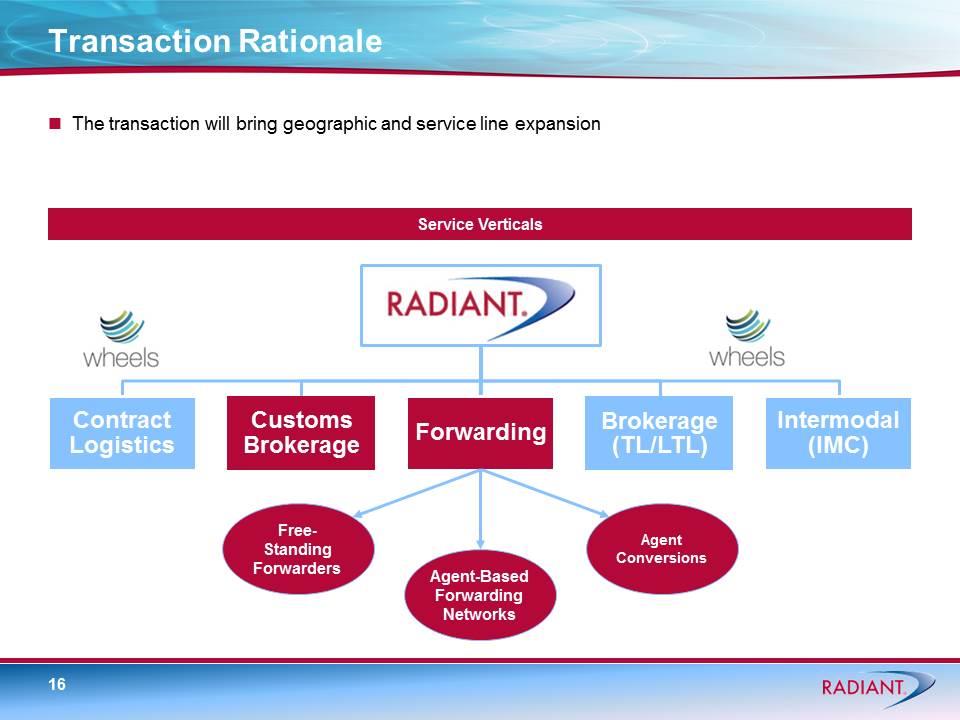

Transaction Rationale Service Verticals Free-Standing Forwarders Agent-Based Forwarding Networks Agent Conversions The transaction will bring geographic and service line expansion

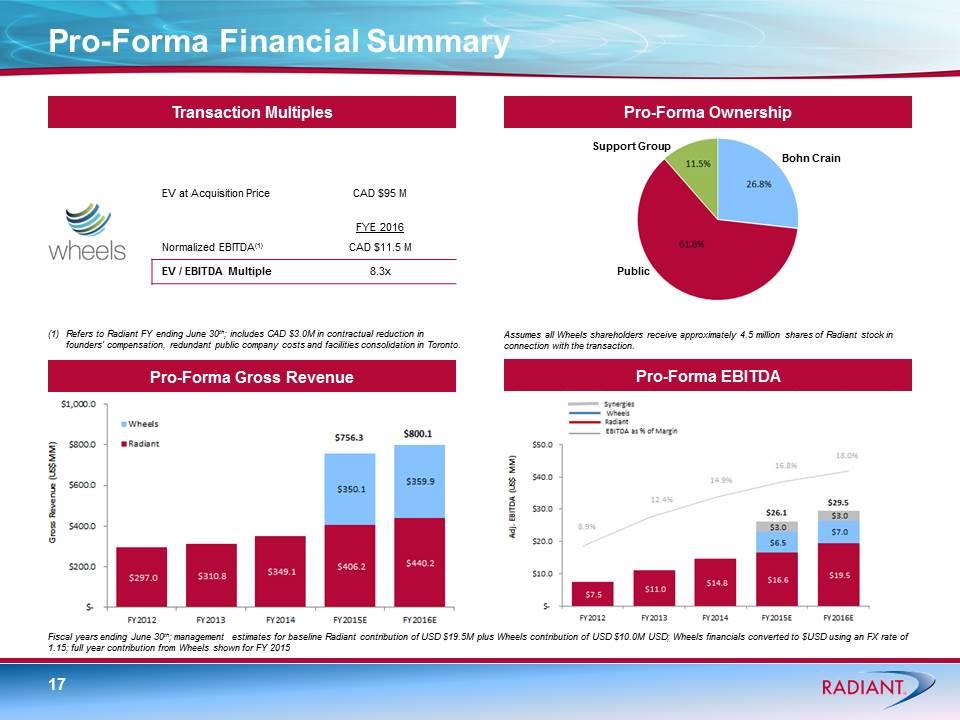

Pro-Forma Financial Summary Pro-Forma Gross Revenue Pro-Forma EBITDA Fiscal years ending June 30th; management estimates for baseline Radiant contribution of USD $19.5M plus Wheels contribution of USD $10.0M USD; Wheels financials converted to $USD using an FX rate of 1.15; full year contribution from Wheels shown for FY 2015 Pro-Forma Ownership Support Group Bohn Crain Public Assumes all Wheels shareholders receive approximately 4.5 million shares of Radiant stock in connection with the transaction. Transaction Multiples EV at Acquisition Price CAD $95 M FYE 2016 Normalized EBITDA(1) CAD $11.5 M EV / EBITDA Multiple 8.3x Refers to Radiant FY ending June 30th; includes CAD $3.0M in contractual reduction in founders’ compensation, redundant public company costs and facilities consolidation in Toronto.

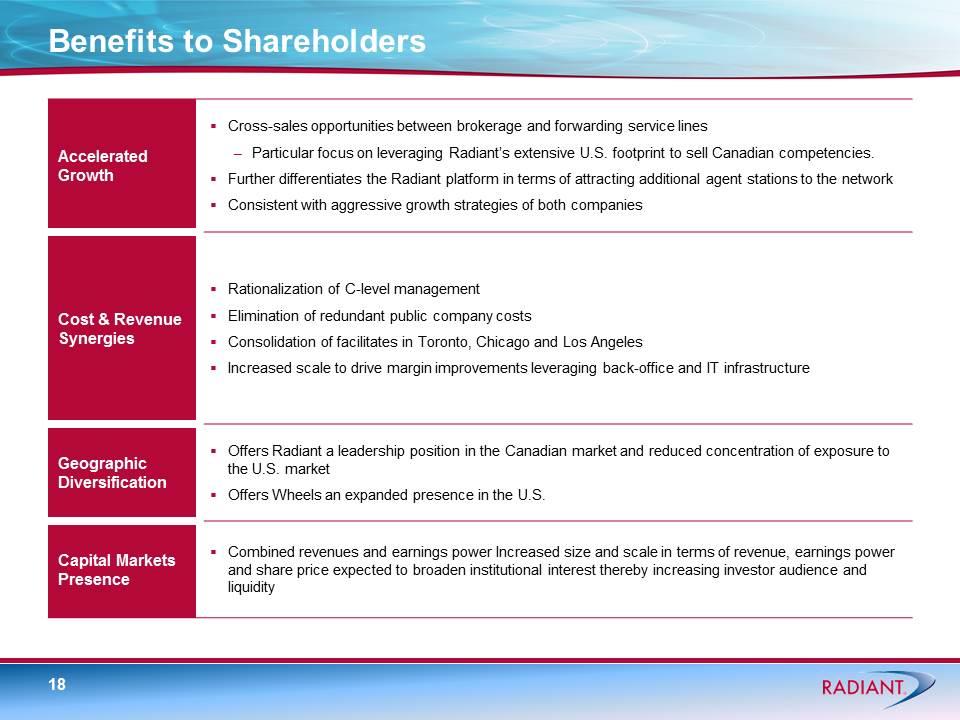

Benefits to Shareholders Accelerated Growth Cross-sales opportunities between brokerage and forwarding service lines Particular focus on leveraging Radiant’s extensive U.S. footprint to sell Canadian competencies. Further differentiates the Radiant platform in terms of attracting additional agent stations to the network Consistent with aggressive growth strategies of both companies Cost & Revenue Synergies Rationalization of C-level management Elimination of redundant public company costs Consolidation of facilitates in Toronto, Chicago and Los Angeles Increased scale to drive margin improvements leveraging back-office and IT infrastructure Geographic Diversification Offers Radiant a leadership position in the Canadian market and reduced concentration of exposure to the U.S. market Offers Wheels an expanded presence in the U.S. Capital Markets Presence Combined revenues and earnings power Increased size and scale in terms of revenue, earnings power and share price expected to broaden institutional interest thereby increasing investor audience and liquidity

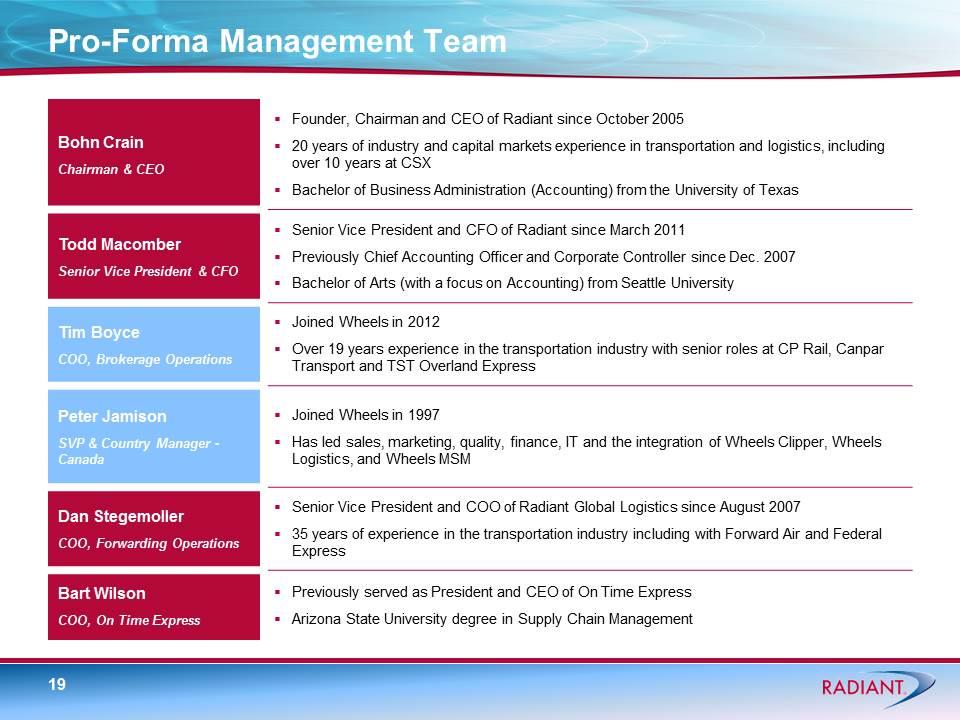

Pro-Forma Management Team Bohn Crain Chairman & CEO Founder, Chairman and CEO of Radiant since October 2005 20 years of industry and capital markets experience in transportation and logistics, including over 10 years at CSX Bachelor of Business Administration (Accounting) from the University of Texas Todd Macomber Senior Vice President & CFO Senior Vice President and CFO of Radiant since March 2011 Previously Chief Accounting Officer and Corporate Controller since Dec. 2007 Bachelor of Arts (with a focus on Accounting) from Seattle University Tim Boyce COO, Brokerage Operations Joined Wheels in 2012 Over 19 years experience in the transportation industry with senior roles at CP Rail, Canpar Transport and TST Overland Express Peter Jamison SVP & Country Manager - Canada Joined Wheels in 1997 Has led sales, marketing, quality, finance, IT and the integration of Wheels Clipper, Wheels Logistics, and Wheels MSM Dan Stegemoller COO, Forwarding Operations Senior Vice President and COO of Radiant Global Logistics since August 2007 35 years of experience in the transportation industry including with Forward Air and Federal Express Bart Wilson COO, On Time Express Previously served as President and CEO of On Time Express Arizona State University degree in Supply Chain Management

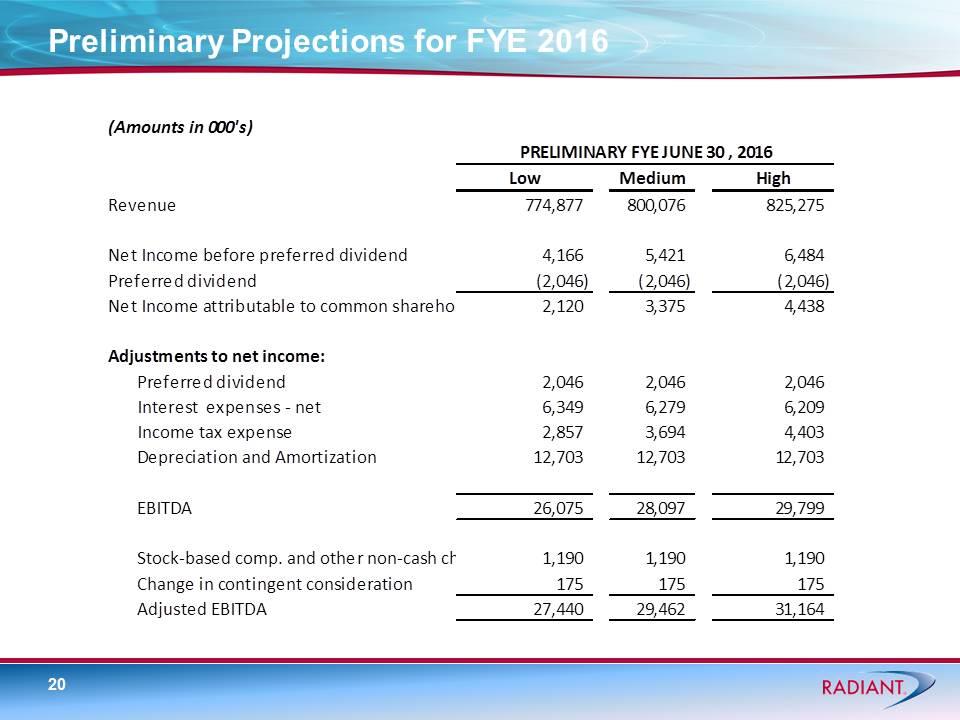

Preliminary Projections for FYE 2016

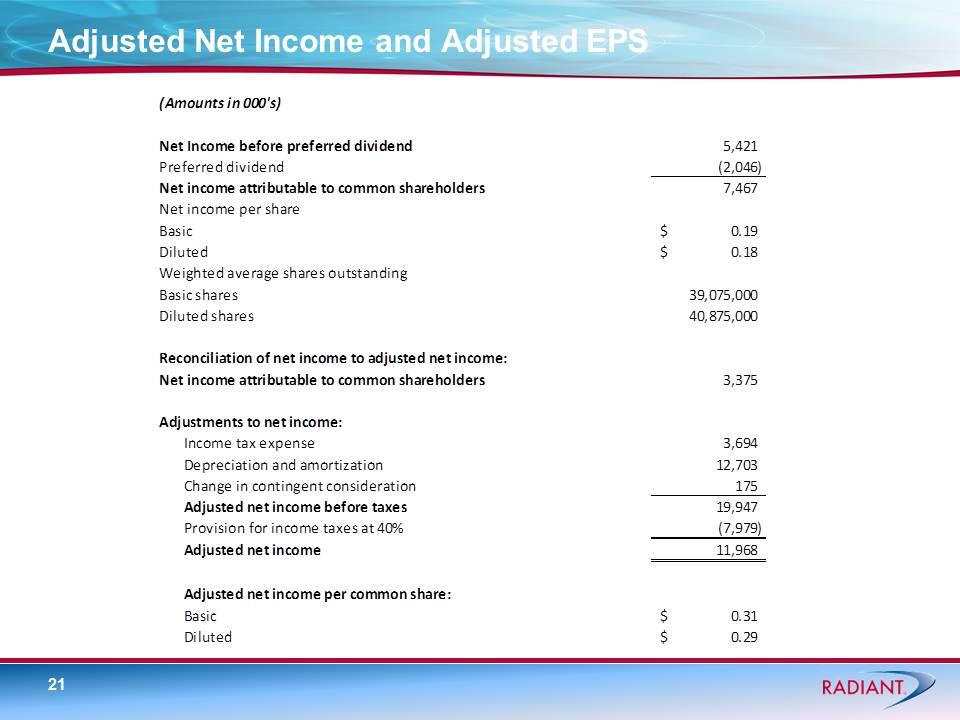

Adjusted Net Income and Adjusted EPS

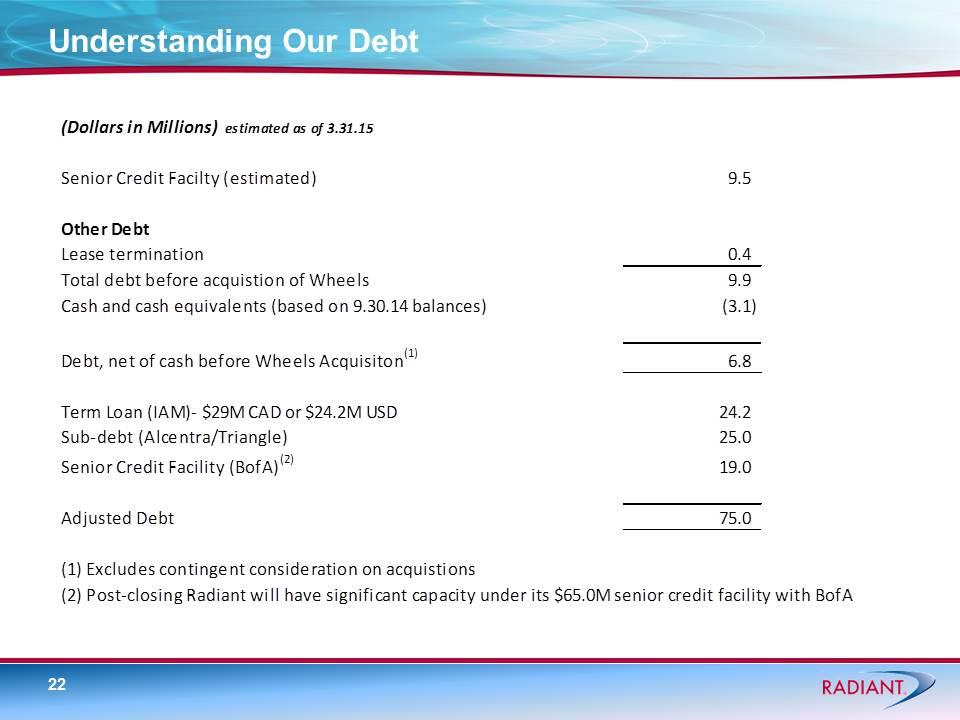

Understanding Our Debt

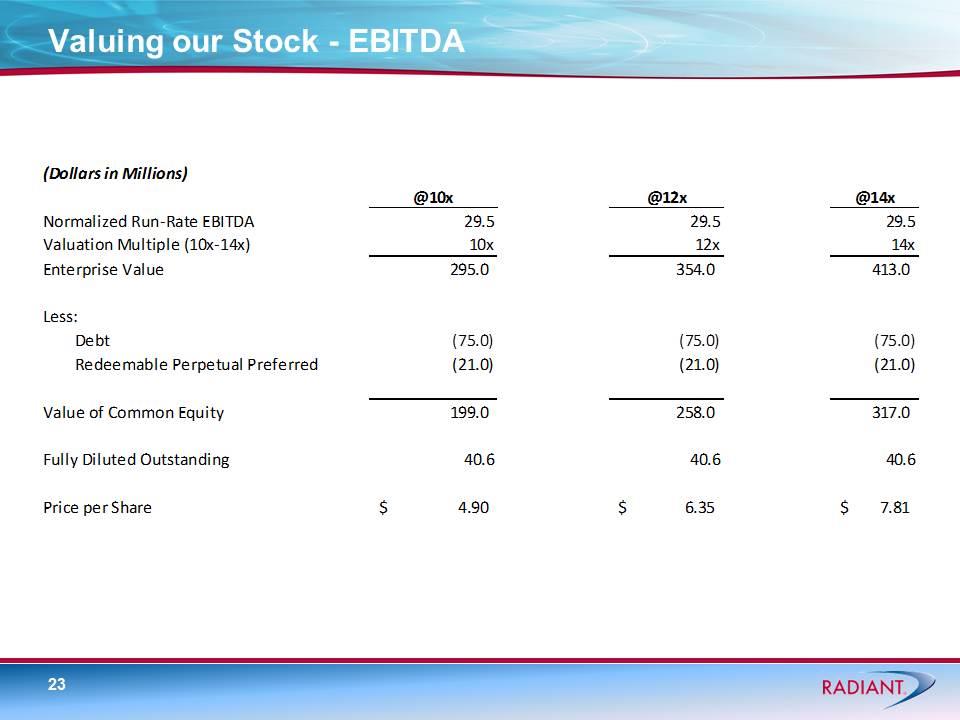

Valuing our Stock - EBITDA

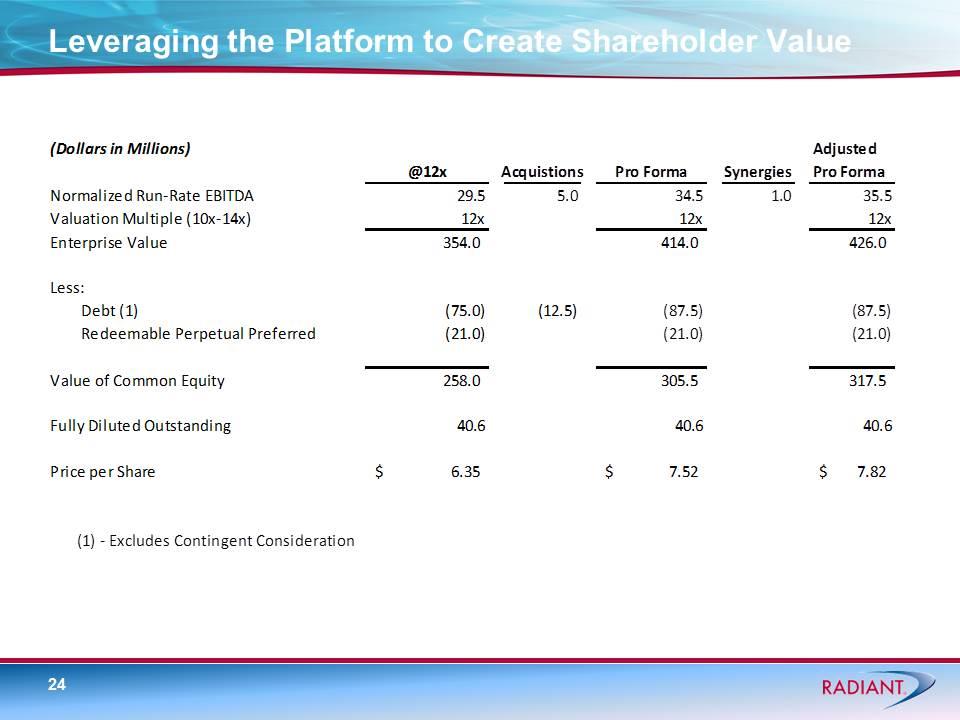

Leveraging the Platform to Create Shareholder Value

THANK YOU It’s the Network that Delivers! ®