Attached files

| file | filename |

|---|---|

| EX-31.4 - EX-31.4 - Covidien plc | d853205dex314.htm |

| EX-31.3 - EX-31.3 - Covidien plc | d853205dex313.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No. 1

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended September 26, 2014

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

001-33259

(Commission File Number)

COVIDIEN PUBLIC LIMITED COMPANY

(Exact name of registrant as specified in its charter)

| Ireland | 98-0624794 | |

| (Jurisdiction of Incorporation) | (IRS Employer Identification No.) |

20 On Hatch, Lower Hatch Street

Dublin 2, Ireland

(Address of registrant’s principal executive office)

+353 (1) 438-1700

(Registrant’s telephone number)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Ordinary Shares, Par Value $0.20 | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K x.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant (assuming solely for the purposes of this calculation that all directors and executive officers of the registrant are “affiliates”) computed by reference to the price at which shares were last sold as of the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $32,604 million.

The number of ordinary shares outstanding as of January 20, 2015 was 454,507,245.

Table of Contents

EXPLANATORY NOTE

Covidien plc (as referred to herein, “Covidien,” the “Company,” the “Registrant,” “we” or “our”) is filing this Amendment No. 1 on Form 10-K/A (this “Form 10-K/A”) to its Annual Report on Form 10-K for the fiscal year ended September 26, 2014, which was filed with the U.S. Securities and Exchange Commission (the “SEC”) on November 24, 2014 (the “Form 10-K”), to include certain information omitted from the Form 10-K in accordance with applicable SEC rules and regulations. Other than with respect to the Equity Compensation Plan information in Item 12 of the Form 10-K, the Registrant is hereby amending and replacing in their entirety Items 10, 11, 12, 13 and 14 in the Form 10-K to include such omitted information and Item 15 to include certifications with respect to this Form 10-K/A.

Except as described above, this Form 10-K/A does not amend, update or change any other items or disclosures in the Form 10-K, including any of the financial information disclosed in Parts II and IV of the Form 10-K, and does not purport to reflect any information or events subsequent to the filing of the Form 10-K. Accordingly, this Form 10-K/A should be read in conjunction with the Form 10-K and with the Registrant’s other filings with the SEC.

ii

Table of Contents

| Page | ||||

| Part III | ||||

| Item 10. | Directors, Executive Officers and Corporate Governance | 1 | ||

| Item 11. | Executive Compensation | 4 | ||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 34 | ||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 35 | ||

| Item 14. | Principal Accounting Fees and Services | 37 | ||

| Part IV | ||||

| Item 15. | Exhibits, Financial Statement Schedules | 38 | ||

| Signatures | S-1 | |||

iii

Table of Contents

| Item 10. | Directors, Executive Officers and Corporate Governance |

Board of Directors

José E. Almeida - Mr. Almeida, age 52, has served as the Chairman of our Board of Directors since March 2012. He has served on our Board of Directors since becoming Covidien’s President and Chief Executive Officer in July 2011. Prior to assuming the role of President and Chief Executive Officer of Covidien, Mr. Almeida served, from October 2006 to June 2011, as the President of our Medical Devices business segment. Prior to that, from April 2004 to September 2006, Mr. Almeida was President of Covidien’s International business. From January 2003 to April 2004, Mr. Almeida was Chief Operating Officer of Greatbatch, Inc., a developer and manufacturer of power sources and components for implantable medical devices. Mr. Almeida joined the Company in 1995 as Director of Corporate Engineering and then held several positions of increasing responsibility, including Vice President of European Manufacturing and Vice President of Global Manufacturing, through December 2002. Mr. Almeida is Chairman of the Advanced Medical Technology Association (AdvaMed), a medical device trade association, and also serves on AdvaMed’s Executive Committee and as Chairman of its Board Committee on Ethics and Health Care Compliance. In addition, Mr. Almeida currently serves as a director of Analog Devices, Inc., EMC Corporation and State Street Corporation.

As our Chairman, President and Chief Executive Officer, Mr. Almeida is focused on positioning the Company for the future. After almost 18 years with the Company during which he, among other things, ran our largest business segment, led our international business and oversaw manufacturing operations, Mr. Almeida is familiar with all aspects of the business. Serving as a director of both State Street Corporation and AdvaMed, Mr. Almeida also understands the responsibilities of a board member. With his keen global perspective, results-driven nature, commitment to operational intensity and depth of Company knowledge, Mr. Almeida is an invaluable member of our Board of Directors.

Joy A. Amundson - Ms. Amundson, age 60, joined our Board of Directors in June 2012. Ms. Amundson is a principal of Amundson Partners, Inc., a healthcare consulting firm. From August 2004 to October 2010, Ms. Amundson was the President of Baxter BioScience Corporation and Vice President of Baxter International, Inc. Prior to Baxter, she was with Amundson Partners for three years. Prior to joining Amundson Partners, she was with Abbott Laboratories for over 20 years, where she held several key positions, including Senior Vice President. Ms. Amundson began her business career in sales and brand management with Procter & Gamble, a packaged goods company, from 1977 to 1982. Ms. Amundson previously served as a director of ApaTech, Dial Corporation, Ilex Oncology, Inc., Inamed Corporation and Oridion Medical Ltd. and currently serves as a director of ABIVAX.

From her years as President of Baxter BioScience Corporation as well as her position as a principal of a healthcare consulting firm and over 20 years as an executive of Abbott Laboratories, Ms. Amundson has deep insight into the healthcare industry. These positions, coupled with her Master’s Degree in management from Northwestern University’s Kellogg Graduate School of Management, also afford Ms. Amundson an understanding of what it takes to be a leader and guide a business successfully. In addition, her experience on numerous boards of directors gives her perspective on the critical role the board of directors plays in guiding a company at the very highest level. With her depth and breadth of experience, Ms. Amundson is a well-rounded and valuable member of our Board of Directors.

Craig Arnold - Mr. Arnold, age 54, joined our Board of Directors in June 2007 in connection with our establishment as a stand-alone public company. Mr. Arnold is the Vice Chairman and Chief Operating Officer, Industrial Sector of Eaton Corporation, a diversified industrial manufacturer. From 2000 to 2008 he served as Senior Vice President of Eaton Corporation and President of the Fluid Power Group of Eaton. Prior to joining Eaton, Mr. Arnold was employed in a series of progressively more responsible positions at General Electric Company from 1983 to 2000. Mr. Arnold previously served as a director of Unocal Corporation, where he also was a member of the audit committee.

With his years of managerial experience, both at Eaton and at General Electric, Mr. Arnold brings to the Board of Directors demonstrated management ability at senior levels. His position as Chief Operating Officer of the Eaton Industrial Sector gives Mr. Arnold critical insights into the operational requirements of a large, multinational company. In addition, in previously serving on the audit committee of another public company, Mr. Arnold gained valuable experience dealing with accounting principles and financial reporting rules and regulations, evaluating financial results and generally overseeing the financial reporting process of a large corporation.

Robert H. Brust - Mr. Brust, age 71, joined our Board of Directors in June 2007 in connection with our establishment as a stand-alone public company. Mr. Brust served as the Chief Financial Officer of Sprint Nextel Corporation, a wireless and wireline communications company, from May 2008 until his retirement in April 2011. From February 2007 to May 2008, Mr. Brust was retired. From January 2000 to February 2007, Mr. Brust served as Executive Vice President of Eastman Kodak Company, a provider of photographic products and services, and, from January 2000 to November 2006, he also served as Chief Financial Officer of Kodak. Prior to joining Kodak, Mr. Brust was Senior Vice President and Chief Financial Officer of Unisys Corporation from 1997 to

1

Table of Contents

1999. He also worked in a variety of financial and financial management positions at General Electric Company from 1965 to 1997. Mr. Brust is currently a director of Smith & Wesson Holding Corporation and previously served as a director of Delphi Corporation and Applied Materials, Inc.

Mr. Brust is an experienced financial leader. His service as Chief Financial Officer of Sprint Nextel Corporation, the Eastman Kodak Company and Unisys Corporation as well as his 31 years at General Electric Company make him a valuable asset, both on our Board of Directors and on our Audit Committee. Mr. Brust’s positions have provided him with a wealth of knowledge in dealing with financial and accounting matters. The depth and breadth of his exposure to complex financial issues at such large corporations makes him a skilled advisor.

Christopher J. Coughlin - Mr. Coughlin, age 62, joined our Board of Directors in June 2007 in connection with our establishment as a stand-alone public company. He is currently a non-employee senior advisor to McKinsey & Company, a strategy consulting firm. Mr. Coughlin served as an advisor to Tyco International, a global provider of security products and services, fire protection and detection products and services, valves and controls, and other industrial products from December 2010 to September 2012. From March 2005 to December 2010, Mr. Coughlin served as Executive Vice President and Chief Financial Officer of Tyco International. Prior to joining Tyco International, Mr. Coughlin served as Chief Operating Officer of The Interpublic Group of Companies, Inc., from June 2003 to December 2004. He joined Interpublic from Pharmacia Corporation, where he was Chief Financial Officer from 1998 to 2003. Previously, he held the position of Executive Vice President and Chief Financial Officer of Nabisco Holdings, where he also served as President of Nabisco International. Mr. Coughlin is currently the non-executive Chairman of The Dun & Bradstreet Corporation board and a director of Actavis plc and Alexion Pharmaceuticals, Inc. He previously served as a director of Perrigo Company, Monsanto Company, Interpublic, Forest Laboratories, Inc. (acquired by Actavis plc) and Dipexium Pharmaceuticals, Inc.

As Chief Financial Officer of Tyco International, Pharmacia Corporation and Nabisco Holdings and as Chief Operating Officer of The Interpublic Group of Companies, Mr. Coughlin has demonstrated leadership capability and extensive knowledge of complex financial and operational issues facing large organizations. He brings an understanding of operations and financial strategy in challenging environments. In addition, Mr. Coughlin is able to draw upon, among other things, his knowledge of the medical device industry in general and Covidien’s business in particular, garnered while Covidien constituted the healthcare business of Tyco International.

Randall J. Hogan, III - Mr. Hogan, age 59, joined our Board of Directors in June 2007 in connection with our establishment as a stand-alone public company. Mr. Hogan has served as Chief Executive Officer of Pentair, Inc., an industrial manufacturing company, since January 2001 and was appointed Chairman in May 2002. From December 1999 to December 2000, he was President and Chief Operating Officer of Pentair and from March 1998 to December 1999, he was Executive Vice President and President of Pentair’s Electrical and Electronic Enclosures Group. Prior to joining Pentair, he was President of the Carrier Transicold Division of United Technologies Corporation. Before that, he was with the Pratt & Whitney division of United Technologies, General Electric Company and McKinsey & Company. Mr. Hogan currently serves as chairman of the board of the Federal Reserve Bank of Minneapolis and previously served as a director of Unisys Corporation.

Having served in the roles of Chairman, Chief Executive Officer, President and Chief Operating Officer of Pentair, Mr. Hogan offers a wealth of management experience and business acumen. Running a public company gives Mr. Hogan front-line exposure to many of the issues facing public companies, particularly on the operational, financial and corporate governance fronts. Mr. Hogan’s service on the Board of Directors and Governance Committee of Unisys as well as on the board of the Federal Reserve Bank of Minneapolis further augments his range of knowledge, providing experience on which he can draw while serving as a member of our Board and Chairman of our Audit Committee.

Dennis H. Reilley - Mr. Reilley, age 61, joined our Board of Directors in June 2007 in connection with our establishment as a stand-alone public company and served as the Chairman of our Board of Directors until October 2008. Mr. Reilley has been our Lead Director since March 2013. From 2000 to April 2007, Mr. Reilley served as Chairman of Praxair, Inc., a supplier of industrial gases and high-performance surface coatings. Mr. Reilley also served as Chief Executive Officer of Praxair from 2000 to December 2006. Prior to joining Praxair, Mr. Reilley held many key positions at E.I. du Pont de Nemours and Company from 1989 to 1998 when he was named Chief Operating Officer. Earlier in his career he held various managerial positions at Conoco. Mr. Reilley is currently a director of The Dow Chemical Company and non-executive Chairman of Marathon Oil Corporation.

As Chairman and Chief Executive Officer of Praxair and Chief Operating Officer of DuPont, Mr. Reilley took on significant management, strategic and operational responsibilities. With his knowledge of the complex issues facing global companies today and his understanding of what makes businesses work effectively and efficiently, Mr. Reilley provides valuable insight to our Board. Mr. Reilley’s experience as Chairman of the Praxair Board of Directors as well as his service on the Governance and Compensation Committees of H.J. Heinz and Marathon Oil, the Audit Committee of H.J. Heinz and on the Audit and Compensation Committees of Dow Chemical, position him well to serve as our Lead Director.

Stephen H. Rusckowski - Mr. Rusckowski, age 57, joined our Board of Directors in December 2013. Mr. Rusckowski has been the President and Chief Executive Officer of Quest Diagnostics Incorporated, a provider of medical diagnostic testing, information and

2

Table of Contents

services, since May 2012. Prior to May 2012, since November 2006, Mr. Rusckowski was the Chief Executive Officer of Philips Healthcare, the largest unit of Royal Philips Electronics, and a member of the Board of Management of Royal Philips Electronics and its Executive Committee. Prior to that role, Mr. Rusckowski was CEO of the Imaging Systems business group within the company. Before joining Philips, he led Hewlett-Packard/Agilent Technologies Healthcare Solutions Group as Senior Vice President and General Manager. He joined Philips when it acquired Agilent’s Healthcare Solutions Group in 2001. Mr. Rusckowski currently serves as a director of Quest Diagnostics.

With his extensive executive experience, including in strategic planning and international operations, Mr. Rusckowski brings to the board demonstrated leadership capability and business acumen. As the CEO of a public company, he is familiar with numerous issues faced by a public company, particularly on the operational, financial and corporate governance fronts. His experience with multinational corporations operating in the healthcare industry makes him an ideal member of our Board of Directors.

Joseph A. Zaccagnino - Mr. Zaccagnino, age 68, joined our Board of Directors in June 2007 in connection with our establishment as a stand-alone public company. Mr. Zaccagnino, who has held leadership positions in the healthcare sector for over 40 years, served as President, Chief Executive Officer and Director of Yale New Haven Health System and its flagship Yale-New Haven Hospital, one of the country’s largest and most prominent academic medical center hospitals and the primary teaching and research affiliate of the Yale University School of Medicine, from 1991 until his retirement in 2005. Yale New Haven Health System facilities include free-standing: acute care adult and children’s hospitals; psychiatric and cancer hospitals; rehabilitation services; ambulatory surgery, outpatient diagnostic imaging, primary care and emergency centers; and health insurance products. Mr. Zaccagnino previously served as a director of NewAlliance Bancshares, Inc. Mr. Zaccagnino is currently a director of Mallinckrodt plc where he serves on the Compliance Committee and is Chairman of the Nominating and Governance Committee.

Nationally, Mr. Zaccagnino has served as Chairman of the Board of the National Committee for Quality Healthcare and as Chairman of the Board of VHA Inc., a network of healthcare organizations and physicians who collaborate on best clinical and operating practices and which provides supply chain and group purchasing services through its subsidiary, Novation. His broad healthcare management and governance experience and his knowledge of healthcare policy and regulation, patient care delivery and financing and of clinical research and medical technology assessment provides our Board with unique insights and a keen perspective on the complexities of the healthcare industry and on the priorities of and challenges facing both our Company and our major customers.

Executive Officers

Please see the information contained under the heading “Executive Officers of the Registrant” in the Form 10-K filed by the Company with the SEC on November 24, 2014.

Audit Committee

The Board has a separately designated Audit Committee established in accordance with the Securities Exchange Act of 1934. The Audit Committee monitors the integrity of our financial statements, the independence and qualifications of the independent auditors, the performance of our internal auditors and independent auditors, our compliance with legal and certain regulatory requirements and the effectiveness of our internal controls. The Audit Committee is also responsible for selecting, retaining, evaluating, setting the remuneration of and, if appropriate, recommending the termination of our independent auditors. The members of the Audit Committee are Craig Arnold, Robert H. Brust and Randall J. Hogan, III, each of whom is independent under SEC rules and NYSE listing standards applicable to audit committee members. Mr. Hogan is the Chair of the Audit Committee. The Board has determined that Mr. Brust and Mr. Hogan are audit committee financial experts. The Audit Committee operates under a charter approved by the Board of Directors, which is posted on our website at www.covidien.com.

Compensation Committee Interlocks and Insider Participation

The members of the Compensation and Human Resources Committee of our Board of Directors (the “Compensation Committee”) are Dennis H. Reilley and Stephen H. Rusckowski. No member of our Compensation Committee during fiscal 2014 is or has been an officer or employee of Covidien, and no member of our Compensation Committee during fiscal 2014 had any relationships requiring disclosure by Covidien under the SEC’s rules requiring disclosure of certain relationships and related-party transactions. No executive officer of Covidien during fiscal 2014 served on the compensation committee or board of directors of any company that employed any member of our Compensation Committee or Board.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires our officers and directors and persons who beneficially own more than 10 percent of our ordinary shares to file reports of ownership and changes in ownership of such ordinary shares with the SEC . These persons are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file. As a matter of practice, our administrative staff assists our officers and directors in preparing initial reports of ownership and reports of changes in ownership and files those reports on their behalf. Based on our review of the copies of such forms we have received, as well as information provided and representations made by the reporting persons, we believe that all required Section 16(a) reports were timely filed during our fiscal year ended September 26, 2014.

Code of Ethics

We have adopted the Covidien Guide to Business Conduct, which applies to all of our employees, officers and directors. The Guide to Business Conduct meets the requirements of a “code of ethics” as defined by SEC regulations and applies to our Chief Executive Officer, Chief Financial Officer and Chief Accounting Officer, as well as all other employees, as indicated above. The Guide to Business Conduct also meets the requirements of a code of business conduct and ethics under the listing standards of the NYSE. The Guide to Business Conduct is posted on our website at www.covidien.com under the heading “Investor Relations - Corporate Governance.” We disclose any material amendments to the Guide to Business Conduct, as well as any waivers for executive officers or directors, on our website.

3

Table of Contents

| Item 11. | Executive Compensation |

Compensation Discussion and Analysis

This Compensation Discussion and Analysis (“CD&A”) relates to our Chief Executive Officer, Chief Financial Officer and the three other most highly compensated executive officers of the Company in fiscal 2014.

Executive Summary

The Compensation Committee has adopted an integrated executive compensation program that is intended to align our named executive officers’ interests with those of our shareholders and to promote the creation of shareholder value without encouraging excessive or unnecessary risk-taking. Additionally, the Compensation Committee has tied a majority of our named executive officers’ compensation to a number of key performance measures that contribute to or reflect shareholder value. Specifically, in addition to a base salary, our named executive officers’ compensation package includes an annual incentive compensation program that is based on the Company’s attainment of objective pre-established financial performance metrics and long-term equity awards consisting in part of performance share units (“PSUs”) which are tied to relative total shareholder return performance. Our executive compensation programs have played a significant role in our ability to attract and retain the experienced, successful executive team that drives our financial results over time.

Company Performance and Executive Compensation in 2014

The Company finished fiscal 2014 with a strong operating performance.

| • | Net sales increased 4% on a reported basis in fiscal 2014, as the negative impact of foreign exchange rates reduced the sales growth rate by one percentage point. |

| • | The Company generated strong cash flow and again returned a substantial portion of free cash flow to shareholders. Following three years of returning more than 70% of free cash flow to shareholders, more than 50% was returned in fiscal 2014, despite restrictions in the Medtronic transaction agreement entered into in June 2014 and Irish Takeover Rules, which limited our ability to repurchase shares. We define free cash flow as cash provided by operating activities minus capital expenditures. |

| • | The Company continued to make investments in selling and marketing to enable its future growth. Emerging markets continued to be a key focus area, as overall sales grew 14% in fiscal 2014, led by an increase of 16% in the BRIC (Brazil, Russia, India, China) countries. |

Our positive financial results for fiscal 2014 directly affected our named executive officers’ compensation. The Company’s strong performance for all three Company-wide fiscal 2014 annual incentive plan performance targets resulted in payouts under the 2014 annual incentive plan to our corporate-level named executive officers at 163% of target performance level. In addition, PSUs vesting at the end of fiscal 2014 were paid out at two times the target award, which reflect the Company’s fiscal 2012-2014 total shareholder return in the top quartile of peer group performance for that same period. Other financial and operating highlights include the following:

| • | The Company increased its dividend by 13%, the sixth consecutive double-digit annual increase. |

| • | The Company made several strategic acquisitions in fast-growing, high margin product categories and divested its Confluent biosurgery product line to enable even greater focus on growth initiatives. |

| • | Maintaining its focus on innovation, the Company launched more than 20 new products across the business and opened three Covidien Centers of Innovation in emerging markets. |

4

Table of Contents

Consideration of Say-on-Pay Results

In making its decisions regarding named executive officer compensation, the Compensation Committee considers the results of the management say-on-pay proposal which is presented to shareholders for approval annually. After considering the strong support the proposal received (the say-on-pay proposal received support of over 94% of the votes cast in both 2014 and 2013) as well as the Committee’s view of the value of consistency from year to year in both our approach to compensation and the selection of balanced elements of compensation, the Committee concluded that no changes to the elements of compensation for our named executive officers from fiscal 2013 to fiscal 2014 were necessary. As a result, our compensation policies and decisions, explained in detail in this CD&A, continue to be focused on long-term financial performance to drive shareholder value.

Executive Compensation Governance Structure

The Company is committed to integrity and the highest standards of ethical conduct. The following aspects of the Company’s compensation program reinforce that commitment and illustrate our commitment to good governance.

| What We DO | What We Do NOT Do | |

| Align pay with performance, emphasizing performance-based compensation, rather than entitlements such as perquisites

Defer a significant amount of incentive compensation, discouraging short-term risk taking at the expense of long-term results

Maintain an executive incentive compensation recoupment (claw-back) policy to promote accountability

Require forfeiture of awards and recoupment of profits realized on equity awards in the event of a termination of employment for cause

Retain an independent compensation consultant who provides no other services to the Company

Maintain a cap on annual and long-term incentive award payouts to limit windfalls

Utilize robust share ownership guidelines to promote long-term ownership, long-term shareholder perspective and responsible practices

Conduct an annual risk review by the Compensation Committee of our incentive compensation program |

No employment agreements

No 280G excise tax assistance (gross-ups) upon a change in control

No short-selling or options trading, hedging transactions or speculative transactions in Company shares permitted

No excessive perquisites

No tax gross-ups on perquisites

No option repricing or backdating of options | |

2014 Compensation Elements and Decisions

When setting compensation for named executive officers, the Compensation Committee focuses on total direct compensation. Total direct compensation includes three major components - base salary, annual incentive compensation and long-term equity incentive awards - all of which are designed to work together to drive a complementary set of behaviors and outcomes.

| • | Base salary. Base salary is intended to reflect the market value of each named executive officer’s role, with differentiation for individual capability. |

| • | Annual incentive compensation. Annual incentive compensation in the form of a market-competitive, performance-based cash bonus is designed to focus our executives on pre-set objectives each year and drive specific behaviors that foster short-term and long-term growth and profitability. |

| • | Long-term equity incentive awards. Long-term incentive compensation generally consists of grants of PSUs, stock options and time-vesting restricted stock units. Long-term incentive compensation is designed to (i) align the interests of named executive officers with the interests of our shareholders in long-term growth and stock performance and reward executives for shareholder value creation, (ii) recognize executives for their contributions to the Company, (iii) highlight the strategic significance of each named executive officer’s role and (iv) promote retention. |

5

Table of Contents

In addition to receiving direct compensation, named executive officers also participate in various employee benefit programs, as described near the end of this CD&A, which programs are generally the same as those provided to the Company’s broad-based employee population.

As described in this CD&A under “How We Determine Compensation - Key Considerations in Determining Compensation,” two of the core principles of the Company’s compensation philosophy are that compensation should support effective governance, and that compensation should be viewed from a total direct compensation perspective, considering each direct compensation element with a view to the aggregate value and effect of all other direct compensation elements. Accordingly, in setting compensation, the Compensation Committee considers whether the direct compensation elements, individually and in the aggregate, create incentives that encourage behavior consistent with the overall interests of the Company.

In determining compensation packages for our named executive officers, the Compensation Committee seeks to strike an appropriate balance between fixed and variable compensation and between short- and long-term compensation. We believe that making a significant portion of our named executive officers’ compensation variable and long-term supports our pay-for-performance executive compensation philosophy while also mitigating potential excessive risk-taking behavior.

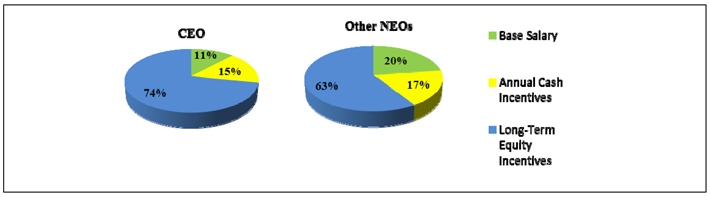

The following charts illustrate, for fiscal 2014, the distribution of value among the three elements of direct compensation - base salary, target annual incentive awards and long-term equity incentives - for our Chief Executive Officer and for the other named executive officers. (The long-term equity incentive component is based on the dollar value awarded by the Compensation Committee before conversion to the various forms of equity awards - see the “Long-Term Incentive Awards” section of this CD&A.) Of target total direct compensation, 89% of our CEO’s and 80% of the other named executive officers’ was variable, either because it is subject to performance goals, the fluctuations of our stock price, or both.

Elements of Compensation

Base Salary

Base salary, which represents only 11% of our Chief Executive Officer’s target total direct compensation and 20% of target total direct compensation for the other named executive officers, is paid in order to provide a fixed component of compensation for the named executive officers. Each named executive officer’s base salary is designed to be competitive with comparable positions in our peer group companies and market data, generally targeting the market median, with high performers and/or specialized talent receiving above the 50th percentile. The components of market data are described in the “How We Determine Compensation - Peer Group Reviews and Market Data” section of this CD&A. Actual base salary may be above or below market median based on a variety of factors, including the complexity and unique challenges of the position and the individual skills, experience, background and performance of the executive. In setting base salaries for named executive officers for calendar year 2014, the Compensation Committee reviewed, among other things, a summary prepared by its independent compensation consultant, Steven Hall & Partners, which detailed each named executive officer’s 2013 base salary and total cash compensation as well as proposed 2014 base salary and target cash compensation compared to 2014 market data.

6

Table of Contents

The Compensation Committee approved base salary increases, which became effective December 31, 2013, as follows:

| Executive Officer |

2013 Base Salary(1) | 2014 Base Salary(1) | % Change | |||||||||

| José E. Almeida |

$ | 1,225,000 | $ | 1,250,000 | 2.0 | % | ||||||

| Charles J. Dockendorff |

$ | 787,600 | $ | 811,200 | 3.0 | % | ||||||

| John H. Masterson |

$ | 585,500 | $ | 603,100 | 3.0 | % | ||||||

| Bryan C. Hanson |

$ | 562,400 | $ | 607,400 | (2) | 8.0 | % | |||||

| Peter L. Wehrly |

$ | 562,400 | $ | 584,900 | 4.0 | % | ||||||

| (1) | The Compensation Committee sets base salaries on a calendar year basis. Accordingly, the base salary amounts noted in this table, which represent calendar year base salaries, differ from the base salary amounts set forth in the Summary Compensation Table because the Summary Compensation Table reports amounts actually earned during our fiscal year, from September 28, 2013 to September 26, 2014. |

| (2) | On July 16, 2014, the Compensation Committee approved an increase in Mr. Hanson’s base salary from $607,400 to $702,000 in connection with Mr. Hanson’s assumption of the role of Group President, Covidien. Mr. Hanson assumed his new role, and the increase in his compensation took effect, at the beginning of Covidien’s fiscal year 2015. |

In setting Mr. Almeida’s compensation when he was named President and Chief Executive Officer in fiscal 2011, the Compensation Committee considered, among other things, the compensation of Chief Executive Officers of peer companies, the compensation of the Company’s then President and Chief Executive Officer and the business experience of Mr. Almeida. For his initial year as President and Chief Executive Officer, the Compensation Committee established Mr. Almeida’s compensation at the 35th percentile of compensation paid to Chief Executive Officers of our peer companies to allow for increases in his compensation as he developed as Chief Executive Officer. Mr. Almeida’s base salary was increased to just under the 50th percentile of the market for calendar 2012 and 2013. Based on Mr. Almeida’s positive performance evaluation, the Company’s continued profitability, a review of total direct compensation and a comparison to market data, the Committee determined that Mr. Almeida’s base salary for 2014 should be increased by 2%. Given the Company’s 2013 spin-off of its pharmaceuticals business - and resulting decrease in the market data revenue scope - the 2% increase placed Mr. Almeida’s base salary just above the 75th percentile of market data for 2014. The Compensation Committee considered desired marketplace positioning as well as potential future Company plans that could impact the size and complexity of the Chief Executive Officer role, and determined the increase was appropriate.

The 2014 annual base salary increases for Messrs. Dockendorff, Masterson, Hanson and Wehrly were based on a consideration of individual performance, assessment of the value of the individual to the Company, a review of total direct compensation, internal equity considerations and a comparison to market data as discussed in the “How We Determine Compensation” section of this CD&A. In setting Mr. Hanson’s base salary, the Compensation Committee also considered a recent corporate reorganization and the resulting increase in the scope of Mr. Hanson’s role and the size of the business for which he is responsible. Accordingly, Mr. Hanson’s base salary for 2014 was increased 8% as compared to his 2013 base salary. While Mr. Hanson’s base salary for 2013 positioned him at approximately the 50th percentile of base salary compensation paid to executives in comparable positions, given that the market data revenue scope against which Mr. Hanson’s base salary was compared more than doubled from 2013 to 2014, this 8% increase in base salary for 2014 positioned Mr. Hanson just below the 50th percentile of base salary compensation paid to executives in comparable positions, based on market data. While Mr. Wehrly’s base salary for 2013 also positioned him at approximately the 50th percentile of base salary compensation paid to executives in comparable positions, given that the market data revenue scope against which Mr. Wehrly’s base salary was compared decreased slightly for 2014, the 4% increase in his base salary for 2014 positioned him just below the 75th percentile of base salary compensation paid to executives in comparable positions, based on market data.

Messrs. Masterson and Dockendorff both received 3% annual base salary increases for 2014, which positioned them just above the 75th percentile and between the 50th and 75th percentile, respectively, of base salary compensation paid to executives in comparable positions, based on market data. Messrs. Masterson and Dockendorff received salary increases in recognition of their consistently high performance and long-term contributions to the Company as well as the key role each played during fiscal 2013 in furthering a number of the Company’s most important strategic initiatives, including the successful spin-off of the Company’s pharmaceuticals business. Mr. Dockendorff led a number of initiatives which resulted in increased net sales and operating income and generated substantial cash flow. Mr. Masterson, among other things, successfully managed the Company’s risk profile and continued to enhance the Company’s stringent compliance program. In addition, Messrs. Dockendorff and Masterson each received the highest possible performance rating in recognition of their successes during the year.

7

Table of Contents

Annual Incentive Compensation

Annual incentive compensation supports the Compensation Committee’s pay-for-performance philosophy and aligns individual goals with Company goals. Under our annual incentive plan, which is an element of our Stock and Incentive Plan, employees are eligible for cash awards based on the Company’s attainment of pre-established performance metrics. Consistent with its past practice, the Compensation Committee structured the 2014 annual incentive plan as follows:

| • | At the beginning of the fiscal year, the Compensation Committee established performance measures and goals, which included the financial and strategic metrics being assessed, performance targets for each metric, including threshold annual performance requirements to earn an award, and maximum performance scores. |

| • | Also at the beginning of the fiscal year, the Compensation Committee set individual target awards for each executive, expressed as a percentage of base salary, based on the executive’s level of responsibility and upon an examination of compensation information from our peer group and market data. |

| • | After the close of the fiscal year, the Compensation Committee received a report from management regarding Company and business unit performance against the pre-established performance goals. Awards were based on each named executive officer’s individual award target percentage and the overall Company and/or individual business unit’s performance relative to the specific performance goal, as certified by the Compensation Committee. |

Setting Annual Performance Metrics. The Compensation Committee sets the performance metrics as well as the performance targets for each metric. There are two primary classifications of performance metrics utilized in the annual incentive plan, Core Financial Metrics and Strategic Focus Metrics. Each performance metric represents part of the total award calculation, with the Core Financial Metrics accounting for, in the aggregate, 70% of the performance score and the Strategic Focus Metrics accounting for, in the aggregate, 30% of the performance score. The weight of each element of the Core Financial Metrics and Strategic Focus Metrics is shown in the “Fiscal 2014 Annual Incentive Plan Results” table below.

| • | Core Financial Metrics. For the fiscal 2014 annual incentive plan, the Core Financial Metrics applicable to Messrs. Almeida, Dockendorff and Masterson, all of whom served as executive officers at the corporate level, were based on Company sales growth and Company net income. The Core Financial Metrics applicable to Mr. Hanson, who was Group President, Medical Devices and U.S. during fiscal 2014, were sales growth for Medical Devices worldwide and operating income for Medical Devices in the U.S. The Core Financial Metrics applicable to Mr. Wehrly, who was Group President, Developed Markets during fiscal 2014, were sales growth and operating income for Developed Markets. The Compensation Committee chose to keep sales growth and net/operating income as performance measures because they are important drivers of shareholder value and are key metrics in the Company’s strategic plan. |

| • | Strategic Focus Metrics. For fiscal 2014, the Strategic Focus Metric applicable to Messrs. Almeida, Dockendorff, Masterson and Wehrly was based on Company cash flow. Company cash flow was utilized as a Strategic Focus Metric to drive focus and accountability on this key strategic priority of the Company. Company cash flow was also a Strategic Focus Metric for Mr. Hanson, along with sales growth for Medical Devices in the U.S. |

Establishing Minimum Performance Requirements and Maximum Payout Caps. In addition to setting the performance metrics, at the beginning of the fiscal year the Compensation Committee also established threshold, target and maximum performance requirements for each named executive officer. For fiscal 2014, the threshold performance requirement established for at least one of the Core Financial Metrics applicable to each named executive officer had to be achieved in order for any payout to be made to the executive under the annual incentive plan. If the maximum performance requirement for a metric applicable to a named executive officer is exceeded, any payout associated with that metric is capped at the maximum performance level. For fiscal 2014, the Company exceeded the minimum performance levels at the applicable Company and business unit levels.

8

Table of Contents

For the Core Financial Metrics and the Strategic Focus Metrics, thresholds and maximums for fiscal 2014 were as follows:

| Performance Metric |

Threshold |

Maximum | ||

| Sales Growth (Company, Developed Markets and Medical Devices – U.S.) |

2.5 percentage points below target |

1.5 percentage points above target | ||

| Sales Growth (Medical Devices – worldwide) |

2.6 percentage points below target |

1.8 percentage points above target | ||

| Net Income (Company) |

95% of target | 105% of target | ||

| Cash Flow (Company) |

95% of target | 105% of target | ||

| Operating Income (Medical Devices – U.S.) |

92% of target | 108% of target | ||

| Operating Income (Developed Markets) |

97% of target | 102% of target |

Establishing Individual Target Awards. In setting individual target awards for fiscal 2014, the Compensation Committee reviewed, for each named executive officer, the individual target awards applicable in fiscal 2013, the total cash compensation established for fiscal 2013 and the projected cash compensation for fiscal 2014, considering how the total cash compensation of each named executive officer compared to peer group and related market data, and the responsibilities of each named executive officer. Following this review, and in light of peer group data and the overall compensation of each named executive officer, the Compensation Committee determined to maintain the individual target awards for Messrs. Dockendorff, Masterson and Wehrly at the same level as fiscal 2013: 85% for Mr. Dockendorff and 80% for Messrs. Masterson and Wehrly. Given his continued strong performance as chief executive officer and extremely positive performance review, the Compensation Committee increased the individual target award for Mr. Almeida from 130% for fiscal 2013 to 133% for fiscal 2014. In addition, in light of Mr. Hanson’s expanding role in the Company and increased responsibilities, the Compensation Committee increased his individual target award from 80% for fiscal 2013 to 85% for fiscal 2014. In July 2014, the Compensation Committee approved a further increase in Mr. Hanson’s individual target award from 85% to 90% in connection with Mr. Hanson’s assumption of the role of Group President, Covidien. Mr. Hanson assumed his new role, and the increase in his compensation took effect, at the beginning of Covidien’s fiscal year 2015. These individual target award levels placed the named executives’ target annual incentive at approximately comparable percentiles as their base salaries relative to peer group positions. Threshold award payments are 50% of target, and maximum award payments are 200% of target amounts.

Calculating Performance Scores. In calculating the annual incentive plan results, if the applicable threshold for at least one Core Financial Metric is met, then a performance multiplier for each performance metric is determined and the overall performance score is calculated. For each performance metric (whether a Core Financial Metric or a Strategic Focus Metric), the performance multiplier would be 0 if performance is below threshold, 0.5x if performance is at threshold, 1x if performance is at target and 2x if performance is at or above the maximum performance level. The performance multiplier for performance between threshold and maximum is determined by linear interpolation. The performance multiplier for each performance metric is multiplied by the weighting percentage to obtain a performance score for that metric. The performance scores for each metric are added together for an overall performance score. That overall performance score is then multiplied by the applicable executive officer’s individual target award to arrive at his actual payment amount.

9

Table of Contents

The table below summarizes the performance metrics, weighting, targets, actual results and the resulting performance multipliers and scores that determined the fiscal 2014 annual incentive awards for our named executive officers. The actual award payments are reported in the “Non-Equity Incentive Plan Compensation” column of the Summary Compensation Table and the threshold, target and maximum bonus amounts are reported in the “Estimated Future Payouts Under Non-Equity Incentive Plan Awards” column of the Fiscal 2014 Grants of Plan-Based Awards Table.

Fiscal 2014 Annual Incentive Plan Results

| Executive Officer |

Performance Metrics |

Weight | Performance Target (1) |

Performance Results |

Performance Multiplier |

Performance Score |

||||||||||||||||||

| (dollars in millions) | ||||||||||||||||||||||||

| José E. Almeida

Charles J. Dockendorff

John H. Masterson |

Core Financial Metrics (70%) |

Net Income (Company) |

35 | % | $ | 1,837 | $ | 1,928 | 1.994x | 70 | % | |||||||||||||

| Sales Growth (Company) |

35 | % | 4.5 | % | 4.3 | % | .944x | 33 | % | |||||||||||||||

| Strategic Focus Metrics (30%) |

Cash Flow (Company) |

30 | % | $ | 1,717 | $ | 1,982 | 2.0x | 60 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Performance Score Total |

|

163 | % | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Bryan C. Hanson | Core Financial Metrics (70%) | Operating Income (Medical Devices – U.S.) |

35 | % | — | (2) | — | (2) | 1.829x | 64 | % | |||||||||||||

| Sales Growth (Medical Devices – worldwide) |

35 | % | — | (2) | — | (2) | .924x | 32 | % | |||||||||||||||

| Strategic Focus Metrics (30%) |

Cash Flow (Company) |

15 | % | $ | 1,717 | $ | 1,982 | 2.0x | 30 | % | ||||||||||||||

| Sales Growth (Medical Devices – U.S.) |

15 | % | — | (2) | — | (2) | 1.072x | 16 | % | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Performance Score Total |

|

142 | % | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Peter L. Wehrly | Core Financial Metrics (70%) | Operating Income (Developed Markets) |

35 | % | $ | 1,579 | $ | 1,559 | .7523x | 26 | % | |||||||||||||

| Sales Growth (Developed Markets) |

35 | % | 3.3 | % | 3.2 | % | .977x | 34 | % | |||||||||||||||

| Strategic Focus Metrics (30%) |

Cash Flow (Company) |

30 | % | $ | 1,717 | $ | 1,982 | 2.0x | 60 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Performance Score Total |

|

120 | % | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| (1) | The performance metrics established for compensation purposes include non-GAAP financial measures which exclude the effects of potential special or non-operating items which the Compensation Committee believes may mask the underlying operating results and/or business trends of the Company or business unit, as applicable. The categories of these potential extraordinary items are specified at the beginning of the fiscal year when the performance measure is approved and, for the 2014 annual incentive plan, included certain special tax restructuring charges, legal settlements and costs, revenue adjustments related to businesses exited or sold, acquisitions, goodwill or other intangible asset impairment charges, changes in accounting policies and allocation methodologies, tax planning strategies, loss or gain on the disposal of business and non-budgeted strategic investments approved by the Chief Executive Officer and the Chief Financial Officer. |

10

Table of Contents

For the 2014 annual incentive plan, the performance targets were calculated as follows:

| • | Sales growth is the total change in net trade sales for fiscal year 2014 in US dollars, calculated using fiscal 2013 foreign exchange rates, divided by fiscal year 2013 net trade sales in order to eliminate the effect of currency fluctuations. |

| • | Net income is a non-GAAP financial measure which excludes the items noted above. |

| • | Operating income is the operating income of the applicable business unit, calculated using the foreign exchange rate applied in setting the business unit’s annual operating plan in order to eliminate the effect of currency fluctuations. |

| • | Cash flow means free cash flow, which is net cash provided by operating activities minus capital expenditures. |

| (2) | The business unit financial goals were set at levels consistent with and necessary to achieve the Company-wide financial performance goals reflected in this table and thus reflect a similar degree of difficulty as the Company-wide criteria. Because we do not provide business unit level guidance, we are not disclosing these competitively sensitive goals. |

Long-Term Incentive Awards

Plan Structure

The Compensation Committee uses long-term incentive compensation in the form of equity awards to deliver competitive compensation that recognizes employees for their contributions to the Company and aligns the interests of named executive officers with shareholders by focusing them on long-term growth and stock performance. Recognizing that long-term incentives are generally the most significant element of total remuneration at the senior level and also acknowledging that long-term incentives are a crucial part of the total direct compensation package that the Company offers, for fiscal 2014, the Compensation Committee, with input from its consultant, Steven Hall & Partners, conducted a review of the Company’s long-term incentive structure. The Compensation Committee considered the proportion of long-term incentive value to be allocated to vehicles with service-based vesting versus vehicles with performance-based vesting. Based on this evaluation, the Compensation Committee determined that the long-term incentive vehicles of PSUs, stock options and restricted stock units continued to serve the Company well.

As in fiscal 2013, for fiscal 2014 grants, the dollar value awarded to each named executive officer was allocated between the long-term incentive vehicles as follows:

| • | 40% of the dollar value was allocated to PSUs with performance-based vesting over a three-year vesting period based on relative total shareholder return; |

| • | 40% of the dollar value was allocated to stock options with a four-year vesting period; and |

| • | 20% of the dollar value was allocated to restricted stock units with time-based vesting over a four-year vesting period. |

The Compensation Committee considers this allocation appropriate, as performance-orientation is reflected in PSUs and stock options (which only have value to the extent the Company’s stock price increases from the stock price on the grant date), while grants of restricted stock units allow the program to support retention, even in down stock markets. In addition, the Compensation Committee took into consideration the fact that consistency of program vehicles is likely to enhance understanding of the function and benefits of the long-term incentives offered.

The Compensation Committee also reviewed the performance share plan payout criteria for fiscal 2014 and determined that relative total shareholder return (total shareholder return for the Company as compared to total shareholder return of companies comprising the PSU peer group index), measured over the three-year performance period, continued to be the appropriate metric for PSUs. As with the fiscal 2013 awards, the fiscal 2014 PSU awards payout at target and at 200% of target upon achievement of relative total shareholder return at the 50th and 75th percentiles, respectively. Total shareholder return in the top quartile of peer group performance is a key long-term financial goal of the Company. For the fiscal 2013 grant, the Compensation Committee increased the performance level for threshold payout from the 25th percentile to the 30th percentile of relative total shareholder return in response to market trends. The Compensation Committee determined that the 30th percentile continued to be appropriate for the 2014 fiscal grants.

For the fiscal 2014 PSU grant, the PSU peer group selected by the Compensation Committee is comprised of the following 16 healthcare companies that generally replicate the Company’s mix of businesses, including all eight members of the peer group established by the Company for purposes of establishing fiscal 2014 compensation:

| PSU Peer Group | ||||

| Abbott Laboratories | C.R. Bard, Inc. | St. Jude Medical, Inc. | ||

| Baxter International Inc. | Johnson & Johnson | Stryker Corporation | ||

| Becton, Dickinson & Company | Hospira, Inc. | Thermo Fisher Scientific, Inc. | ||

| Boston Scientific Corporation | Medtronic, Inc. | Waters Corporation | ||

| Cardinal Health, Inc. | PerkinElmer, Inc. | Zimmer Holdings, Inc. | ||

| CareFusion Corporation | ||||

11

Table of Contents

Individual Equity Grants

When setting long-term incentive compensation for named executive officers, the Compensation Committee employs the process described in the “How We Determine Compensation” section of this CD&A. After the Compensation Committee established a dollar value for each named executive officer’s fiscal 2014 annual long-term incentive compensation award, that dollar value was then allocated between PSUs, stock options and restricted stock units as described above, with the exact number of PSUs and restricted stock units based on the closing price of a Company share on the grant date and the exact number of stock options based on such closing price and the applicable Black-Scholes ratio.

The table below compares the dollar value awarded by the Compensation Committee to each named executive officer as long-term incentive compensation during fiscal 2014 versus the dollar value awarded to each named executive officer during fiscal 2013.

| Executive Officer |

Fiscal 2013(1) | Fiscal 2014(1) | % Change | |||||||||

| José E. Almeida |

$ | 7,250,000 | $ | 8,100,000 | 12 | % | ||||||

| Charles J. Dockendorff |

$ | 2,280,000 | $ | 2,280,000 | 0 | % | ||||||

| John H. Masterson |

$ | 1,050,000 | $ | 1,500,000 | 43 | % | ||||||

| Bryan C. Hanson |

$ | 1,848,000 | $ | 2,300,000 | 24 | % | ||||||

| Peter L. Wehrly |

$ | 1,400,000 | $ | 2,000,000 | 43 | % | ||||||

| (1) | The amounts in the table above differ from the grant date fair value of the awards reported in the Grants of Plan-Based Awards Table. The amounts in the table above are the dollar amounts awarded by the Compensation Committee while the grant date fair value of each award reported in the Grants of Plan-Based Awards Table is the award value for accounting purposes. The award value for accounting purposes is calculated by application of a Monte Carlo simulation model for PSUs and by application of the Black-Scholes ratio for stock options. |

In determining the dollar value of long-term incentive compensation awarded to each named executive officer for his fiscal 2014 annual long-term incentive award, the Compensation Committee considered more than just the percentage increase from the value of the prior year’s award. The Compensation Committee also considered individual performance, including performance ratings, the executive officer’s total direct compensation (i.e., base salary, annual incentive compensation and long-term incentive compensation in the aggregate) and mix of compensation for the previous fiscal year, the resulting compensation mix projected for fiscal 2014, previous equity grants and the dollar value of the proposed equity grant relative to market data and to proposed equity grants for other executive officers.

The 2014 long-term incentive grants placed all five named executive officers just under or above the 75th percentile of long-term incentive peer market data. The Compensation Committee determined that the 12% increase in Mr. Almeida’s long-term incentive grant value was appropriate in light of his fiscal 2013 accomplishments, including the successful spin-off of the Company’s pharmaceuticals business, and also given that long-term incentive compensation is a particularly important component of Mr. Almeida’s total direct compensation. As our CEO, he plays the greatest role in establishing the Company’s direction and is uniquely positioned to focus the Company on long-term growth and maximize shareholder value. The Compensation Committee believes that he should have the greatest proportion of his compensation aligned with the long-term interests of shareholders. The Compensation Committee approved significant increases in the value of the long-term incentive awards issued to Messrs. Masterson, Hanson and Wehrly to reflect the Company’s strong focus on long-term incentive compensation and shareholder alignment and to ensure retention of these highly-valued senior executives. The Compensation Committee intends to return to historical practices and benchmarking guidelines for fiscal 2015.

Total Direct Compensation

In establishing the three major components of compensation payable to our named executive officers - base salary, annual incentive compensation and long-term equity incentive awards - the Compensation Committee assessed each component against market data applicable to the respective component. The Compensation Committee also considered the total direct compensation payable to named executive officers, which aggregates all three major components of compensation, so that the Compensation Committee could assess each named executive officer’s total compensation against market data. Following the establishment of all three major components of compensation payable to our executive officers, Mr. Almeida was just under and Mr. Dockendorff was just above the 75th percentile of total direct compensation paid to executives in comparable positions, based on market data. For their respective positions, Mr. Masterson was above the 75th percentile and Messrs. Hanson and Wehrly were slightly below the 75th percentile. The Compensation Committee believed that the level of overall compensation for each of these named executive officers, driven in large part by the value of the long-term incentive awards, was appropriate to reward and retain the seasoned executives in a time of strategic change for the Company and also to reinforce the Company’s focus on long-term shareholder value.

12

Table of Contents

Other Benefits

Retirement Benefits

We maintain retirement plans to assist our named executive officers with retirement income planning and increase the attractiveness of employment with us. For our named executive officers, we currently provide:

| • | a tax-qualified defined contribution 401(k) plan, the Covidien Retirement Savings and Investment Plan, that is available to all eligible United States employees (the “Retirement Savings Plan”); and |

| • | a non-qualified deferred compensation plan, the Covidien Supplemental Savings and Retirement Plan, in which executive officers and other eligible United States senior employees may participate. |

For more information regarding our non-qualified deferred compensation plan, see “Non-Qualified Deferred Compensation” below.

Health and Welfare and Other Benefits

Health and Welfare Benefits. As part of our overall compensation offering, our health and welfare benefits are intended to be competitive with peer companies. The health and welfare benefits we provide to our named executive officers are offered to all of our eligible United States-based employees and include medical, dental, prescription drug, vision, life insurance, accidental death and dismemberment, business travel accident, personal and family accident, flexible spending accounts, short- and long-term disability coverage and the employee assistance program. The Company also provides Mr. Almeida with supplemental long-term disability insurance, which commenced when he became our President and Chief Executive Officer on July 1, 2011. The Company does not provide tax assistance with respect to premiums paid by the Company for this insurance coverage (i.e., no “gross-ups”).

Perquisites. Although the Company does not have a perquisite program, the Compensation Committee determined that it was in the Company’s and the executives’ best interests to establish an executive physical program which offers comprehensive and coordinated annual physical examinations at a nominal cost to the Company. Other than the executive physical program and the limited use of corporate aircraft described below, we do not provide our named executive officers with any perquisites. The Compensation Committee believes that the emphasis on performance-based compensation, rather than on entitlements such as perquisites, is consistent with its compensation philosophy.

Airplane Usage. The Compensation Committee believes that it is important to have a corporate aircraft policy due to the security and efficiency benefits that such a policy provides to us. Personal travel for our named executive officers is permitted only if such use is at no incremental cost to the Company and is approved in advance by the Chief Executive Officer or if there are unusual circumstances, such as a medical or family emergency, that the Chairman of the Compensation Committee or the Chief Executive Officer believe warrant such use. Additionally, our policy permits our Chief Executive Officer to use our corporate aircraft for personal travel, up to forty (40) block hours per fiscal year. Pursuant to current income tax rules applicable to personal use of aircraft, the Company imputes income to named executive officers for any personal use based on the Standard Industry Fare Level rates set by the Civil Aeronautics Division of the Department of Transportation. This imputed income amount is included in a named executive officer’s earnings at the end of the year and reported as W-2 income to the Internal Revenue Service. The Company does not provide tax assistance with respect to this imputed income (i.e., no “gross-ups”).

Employee Stock Purchase Plan. We maintain a broad-based employee stock purchase plan which provides eligible employees, including our named executive officers, with the opportunity to purchase Company shares. We believe that providing an employee stock purchase plan is consistent with our philosophy that compensation should align the interests of executive officers and shareholders and promote a long-term shareholder perspective. Eligible employees authorize payroll deductions to be made for the purchase of Company shares. The Company provides a fifteen percent (15%) matching contribution on up to $25,000 of an employee’s payroll deductions in any calendar year. All shares are purchased on the open market by a designated broker. Mr. Masterson participated in the employee stock purchase plan in 2014.

Charitable Contributions. Pursuant to Covidien’s Matching Gift Program, the Company matches employee contributions to charitable organizations up to $10,000. The Company also has a directed giving program applicable to members of the senior executive leadership team, which includes all of the named executive officers. Pursuant to the directed giving program, the Company will make donations, up to $10,000 in the aggregate per executive, or up to $100,000 in the aggregate in the case of the Chief Executive Officer, to a 501(c)(3)-qualified charity or charities designated by the executive and approved by the Company.

13

Table of Contents

Severance and Change in Control Benefits. The Company maintains executive severance and change in control benefit plans. The Compensation Committee believes that providing severance and change in control benefits to our named executive officers is appropriate, given the fact that these are standard benefits provided by peer companies and also given the need to provide for continuity of management in the event of an actual or potential change in control.

Severance Plan. Under the severance plan, benefits are payable to any named executive officer upon an involuntary termination of employment for any reason other than cause, permanent disability or death. Severance benefits, in the form of base salary, bonus and health benefits are generally payable for 18 months (24 months for our Chief Executive Officer) following termination of employment.

Change in Control Plan. Under the change in control plan, benefits are payable to any named executive officer upon an involuntary termination of employment or good reason resignation that occurs during a period shortly before and continuing for two years after a change in control (a double trigger arrangement). Benefits are generally payable following termination of employment in a lump sum cash payment equal to two times (2.99 times for our Chief Executive Officer) the sum of the executive’s base salary and the average of the executive’s bonus for the previous three fiscal years. Additional benefits provided upon a change in control termination include full vesting of outstanding stock options and restricted stock units (subject to the terms of the applicable award agreements, PSUs will vest only to the extent the Compensation Committee determines that the applicable vesting requirements have been or will be met), continued Company subsidy for health plan premiums for a 24 month period (36 months for our Chief Executive Officer) and outplacement services. Receipt of these benefits is conditioned upon the named executive officer signing a release of any claims against the Company. Any severance or related benefits provided under the change in control plan will be in lieu of payments that would otherwise be payable under the severance plan. The Compensation Committee has carefully evaluated these arrangements and believes that it is important to provide named executive officers with protection in the event that their employment is terminated in connection with a change in control or their position is modified in such a way as to diminish their authority, responsibilities or compensation. Maintaining a double trigger for payment of change in control benefits helps to provide that protection while simultaneously precluding the named executive officer from receiving benefits solely due to a change in control (a single trigger arrangement). The change in control plan does not provide for tax gross-up amounts which otherwise would have been payable as a result of the application of Internal Revenue Code Section 280G to certain payments made under the change in control plan.

How We Determine Compensation

Key Considerations in Setting Compensation

Our compensation program is designed to reflect and advance the following core principles:

| Our Core Principles |

How We Achieve This Goal | |||

| Align Interests | • | Emphasize long-term incentive awards that motivate executives to create shareholder value | ||

| • | Use share ownership guidelines to promote a long-term shareholder perspective | |||

| • | Require management to sign non-compete agreements | |||

| Support Effective Governance | • | In assessing the contributions of a particular executive officer, review not only the results but also how those results were achieved, the long-term impact of the results and whether decisions, actions and results were consistent with the values of the Company | ||

| • | Impose share ownership guidelines to promote long-term ownership | |||

| • | Maintain a cap on annual and long-term incentive award payouts to limit windfalls | |||

| • | Encourage simplicity and transparency in plan design | |||

| • | Establish clear processes for administering equity and employee benefit plans | |||

| Reflect Total Direct Compensation Perspective | • | Maintain and communicate an explicit role for each element of direct compensation | ||

|

• |

Decisions regarding each element of compensation are made with a view to the aggregate value and effect of all other elements | |||

| Pay Competitively, Targeting the Market Median | • | Pay competitively, but not excessively, in order to attract talented executive officers who can achieve our long-term strategic goals and create shareholder value | ||

|

• |

Recognize the need to pay at the upper end of market data to attract or retain executive officers with a high potential or demonstrated record of contributing to our successes | |||

|

• |

Offer total direct compensation that generally targets the market median and which is fair and reasonable in light of the executive officer’s responsibilities, experience and performance, with the ability to pay above or below the median where appropriate | |||

14

Table of Contents

| Align Compensation to Support Our Business and Talent Strategy | • | Design compensation to support our business strategy to broaden our innovation focus, execute on customer-focused portfolio investments, optimize spending to invest in innovation and growth, capitalize on emerging markets opportunities and develop talent and culture to drive innovation and inclusion | ||

|

• |

Recognize individual performance through merit increases and individual adjustments to equity grant levels | |||

|

• |

Standardize pay levels and programs across the Company to facilitate cross-Company career progression | |||

|

• |

Use equity grants to signal potential and nurture career commitment | |||

|

• |

Emphasize pay-for-performance through annual and long-term incentive plans rather than retirement benefits or entitlements such as perquisites | |||

| Emphasize Performance-Based Compensation | • | Utilize a mix of incentive plans that balance short- and long-term objectives | ||

|

• |

Provide potential upside for exceeding performance targets (capped at a market-competitive degree of leverage) with downside risk for missing performance targets | |||

|

• |

Balance retention with reward for shareholder value creation, while also seeing that the elements, individually and in the aggregate, do not encourage excessive risk-taking | |||

|

• |

Establish long-term performance metrics consistent with our ability to quantify long-term goals, in a meaningful way, with respect to these metrics | |||

| Clear Compensation Goals and Practices | • | Clearly and consistently communicate our total rewards philosophy to executives | ||

|

• |

Limit the number of separate compensation plans/programs we provide | |||

|

• |

Minimize the number of performance metrics per plan | |||

|

• |

Promote continuity in plan design and align executive programs across the Company | |||

| Effective Target-Setting | • | Establish performance targets in a rigorous manner to incentivize employees to innovate and collaborate without taking excessive risks | ||

|

• |

Draw from a variety of sources when establishing targets, including information regarding the historical performance of the Company and competitors, anticipated market dynamics and growth rates, Company business strategy, Company financial forecasts and guidance as well as management and Board judgment | |||

Compensation Committee Role and Input from Management