Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Discover Financial Services | a4q148k.htm |

| EX-99.1 - EXHIBIT - Discover Financial Services | dfs-earningsreleasex4q14ex.htm |

| EX-99.2 - EXHIBIT - Discover Financial Services | dfs20141231ex992.htm |

January 21, 2015 ©2015 DISCOVER FINANCIAL SERVICES 4Q14 Financial Results Exhibit 99.3

Notice The following slides are part of a presentation by Discover Financial Services (the "Company") in connection with reporting quarterly financial results and are intended to be viewed as part of that presentation. No representation is made that the information in these slides is complete. For additional financial, statistical, and business related information, as well as information regarding business and segment trends, see the earnings release and financial supplement included as exhibits to the Company’s Current Report on Form 8-K filed today and available on the Company’s website (www.discoverfinancial.com) and the SEC’s website (www.sec.gov). The information provided herein includes certain non-GAAP financial measures. The reconciliations of such measures to the comparable GAAP figures are included at the end of this presentation, which is available on the Company’s website and the SEC’s website. The presentation contains forward-looking statements. You are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they are made, which reflect management’s estimates, projections, expectations or beliefs at that time, and which are subject to risks and uncertainties that may cause actual results to differ materially. For a discussion of certain risks and uncertainties that may affect the future results of the Company, please see "Special Note Regarding Forward-Looking Statements," "Risk Factors," "Business – Competition," "Business – Supervision and Regulation" and "Management’s Discussion and Analysis of Financial Condition and Results of Operations" in the Company’s Annual Report on Form 10-K for the year ended December 31, 2013, and under “Management's Discussion and Analysis of Financial Condition and Results of Operations” in the company's Quarterly Report on Form 10-Q for the quarter ended September 30, 2014, which are filed with the SEC and available at the SEC's internet site (www.sec.gov). The Company does not undertake to update or revise forward-looking statements as more information becomes available. 2

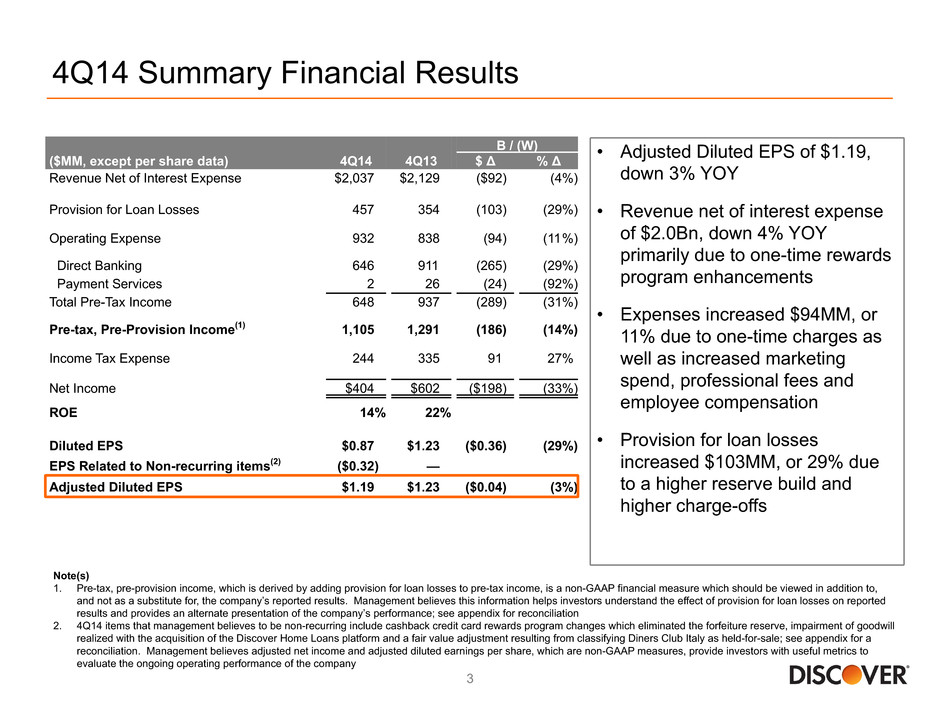

B / (W) ($MM, except per share data) 4Q14 4Q13 $ Δ % Δ Revenue Net of Interest Expense $2,037 $2,129 ($92) (4%) Provision for Loan Losses 457 354 (103) (29%) Operating Expense 932 838 (94) (11%) Direct Banking 646 911 (265) (29%) Payment Services 2 26 (24) (92%) Total Pre-Tax Income 648 937 (289) (31%) Pre-tax, Pre-Provision Income(1) 1,105 1,291 (186) (14%) Income Tax Expense 244 335 91 27% Net Income $404 $602 ($198) (33%) ROE 14% 22% Diluted EPS $0.87 $1.23 ($0.36) (29%) EPS Related to Non-recurring items(2) ($0.32) — Adjusted Diluted EPS $1.19 $1.23 ($0.04) (3%) 4Q14 Summary Financial Results • Adjusted Diluted EPS of $1.19, down 3% YOY • Revenue net of interest expense of $2.0Bn, down 4% YOY primarily due to one-time rewards program enhancements • Expenses increased $94MM, or 11% due to one-time charges as well as increased marketing spend, professional fees and employee compensation • Provision for loan losses increased $103MM, or 29% due to a higher reserve build and higher charge-offs 3 Note(s) 1. Pre-tax, pre-provision income, which is derived by adding provision for loan losses to pre-tax income, is a non-GAAP financial measure which should be viewed in addition to, and not as a substitute for, the company’s reported results. Management believes this information helps investors understand the effect of provision for loan losses on reported results and provides an alternate presentation of the company’s performance; see appendix for reconciliation 2. 4Q14 items that management believes to be non-recurring include cashback credit card rewards program changes which eliminated the forfeiture reserve, impairment of goodwill realized with the acquisition of the Discover Home Loans platform and a fair value adjustment resulting from classifying Diners Club Italy as held-for-sale; see appendix for a reconciliation. Management believes adjusted net income and adjusted diluted earnings per share, which are non-GAAP measures, provide investors with useful metrics to evaluate the ongoing operating performance of the company

4Q13 4Q14 80 70 60 50 40 30 20 10 0 $65.8 $53.2 $8.1 $4.2 $70.0 $56.1 $8.5 $5.0 4Q13 4Q14 50 40 30 20 10 0 $30.6 $40.4 $6.8 $2.6 $32.0 $41.8 $6.9 $2.3 4Q14 Loan and Volume Growth 4 Volume ($Bn)Ending Loans ($Bn) Note(s) 1. Volume is derived from data provided by licensees for Diners Club branded cards issued outside of North America and is subject to subsequent revision or amendment Total +6.4% Card +5.6% Student +4.4% Personal +19.5% PULSE +3.5% Diners(1) +1.6% Network Partners -13.4% Proprietary +4.5% Total Payments Volume +2% YOY

Execution on 2014 Priorities • Grow Discover card loan share while maintaining leading credit performance - 6% growth YOY in ending receivables - 2.3% net charge-off rate for 2014 • Expand direct consumer banking products - $1.2Bn student loan originations - $2.9Bn personal loan originations • Grow global network volume and acceptance - Increased U.S. and rest of world acceptance locations - Loss of third party payments volume • Optimize funding, cost structure and capital position • Enhance operating model, including risk management and leadership development 5

4Q14 Revenue Detail • Net interest income of $1.7Bn, up 7% YOY due to loan growth • Discount and interchange revenue of $620MM, up 8% YOY driven primarily by an increase in card sales • Adjusted rewards rate increased 10bps YOY due to higher promotional and standard rewards(2) • Other income decreased by $11MM primarily due to the classification of merchant fees into discount and interchange revenue Note(s) 1. Rewards cost divided by Discover card sales volume 2. Rewards cost adjusted for one-time pre-tax rewards charge of $178 million related to cashback credit card rewards program changes which eliminated the forfeiture reserve; see appendix for a reconciliation. Management believes adjusted rewards rate, which is a non-GAAP measure, provides investors with a useful metric to evaluate the ongoing operating performance of the company 6 B / (W) ($MM) 4Q14 4Q13 $ Δ % Δ Interest Income $1,974 $1,842 $132 7% Interest Expense 302 273 (29) (11%) Net Interest Income 1,672 1,569 103 7% Discount/Interchange Revenue 620 574 46 8% Rewards Cost 517 295 (222) (75%) Net Discount/Interchange Revenue 103 279 (176) (63%) Protection Products Revenue 75 84 (9) (11%) Loan Fee Income 86 85 1 1% Transaction Processing Revenue 46 46 0 0% Other Income 55 66 (11) (17%) Total Non-Interest Income 365 560 (195) (35%) Revenue Net of Interest Expense $2,037 $2,129 ($92) (4%) Direct Banking $1,958 $2,044 ($86) (4%) Payment Services 79 85 (6) (7%) Revenue Net of Interest Expense $2,037 $2,129 ($92) (4%) Change ($MM) 4Q14 4Q13 QOQ YOY Discover Card Sales Volume $30,871 $29,530 4% 5% Rewards Rate(1) 1.67% 1.00% 64 bps 67 bps Adjusted Rewards Rate(2) 1.10% 1.00% 7 bps 10 bps

4Q14 Net Interest Margin 7 • Total interest yield of 11.40% increased 2bps YOY • Private student loan yield expansion reflects the recognition of favorable cash flow on acquired pools of loans that were revised during 4Q13 • Funding costs on interest-bearing liabilities increased 8bps YOY to 1.77% due primarily to longer-term fixed rate debt issuances and not having the same level of higher rate maturities from deposits in 2014 compared to 2013 • Net interest margin on receivables decreased 5bps YOY as higher funding costs more than offset slightly higher total loan yield Change (%) 4Q14 QOQ YOY Total Interest Yield 11.40% 4 bps 2 bps NIM on Receivables 9.76% -2 bps -5 bps NIM on Interest-Earning Assets 8.28% -8 bps 5 bps 4Q14 4Q13 ($MM) Average Balance Rate Average Balance Rate Credit Card $54,169 12.08% $50,957 12.08% Private Student 8,478 6.85% 8,124 6.63% Personal 4,954 12.25% 4,114 12.53% Home Loans and Other 329 3.78% 248 3.12% Total Loans 67,930 11.40% 63,443 11.38% Other Interest-Earning Assets 12,128 0.71% 12,149 0.74% Total Interest-Earning Assets $80,058 9.78% $75,592 9.67% Direct to Consumer and Affinity $28,828 1.26% $28,592 1.33% Brokered Deposits and Other 16,755 1.53% 15,669 1.58% Interest Bearing Deposits 45,583 1.36% 44,261 1.42% Borrowings 22,276 2.59% 19,797 2.30% Total Interest-Bearing Liabilities $67,859 1.77% $64,058 1.69%

B / (W) ($MM) 4Q14 4Q13 $ Δ % Δ Employee Compensation and Benefits $314 $297 ($17) (6%) Marketing and Business Development 216 189 (27) (14%) Information Processing & Communications 88 89 1 1% Professional Fees 128 108 (20) (19%) Premises and Equipment 24 22 (2) (9%) Other Expense 162 133 (29) (22%) Total Operating Expense $932 $838 ($94) (11%) Direct Banking $858 $781 ($77) (10%) Payment Services 74 57 (17) (30%) Total Operating Expense $932 $838 ($94) (11%) Operating Efficiency(1) 45.8% 39.4% -639 bps Adjusted Operating Efficiency(2) 39.9% 39.4% -55 bps 4Q14 Operating Expense Detail 8 • Employee compensation and benefits of $314MM, up 6% YOY primarily due to higher headcount and higher wages & benefits • Marketing and business development expense of $216MM, up 14% YOY due to higher advertising and marketing for card and personal loans • Professional fees of $128MM, up 19% YOY due primarily to higher consultant expenses related to technology and digital investments • Other expense of $162MM, up 22% YOY primarily due to one-time charges for the impairment of goodwill realized with the Discover Home Loans platform acquisition and fair value adjustment resulting from classifying Diners Club Italy as held-for-saleNote(s)1. Defined as reported total operating expense divided by revenue net of interest expense 2. Operating efficiency adjusted for cashback credit card rewards program changes which eliminated the forfeiture reserve, impairment of goodwill realized with the acquisition of the Discover Home Loans platform and a fair value adjustment resulting from classifying Diners Club Italy as held-for-sale; see appendix for a reconciliation. Management believes adjusted operating efficiency, which is a non-GAAP measure, provides investors with a useful metric to evaluate the ongoing operating performance of the company

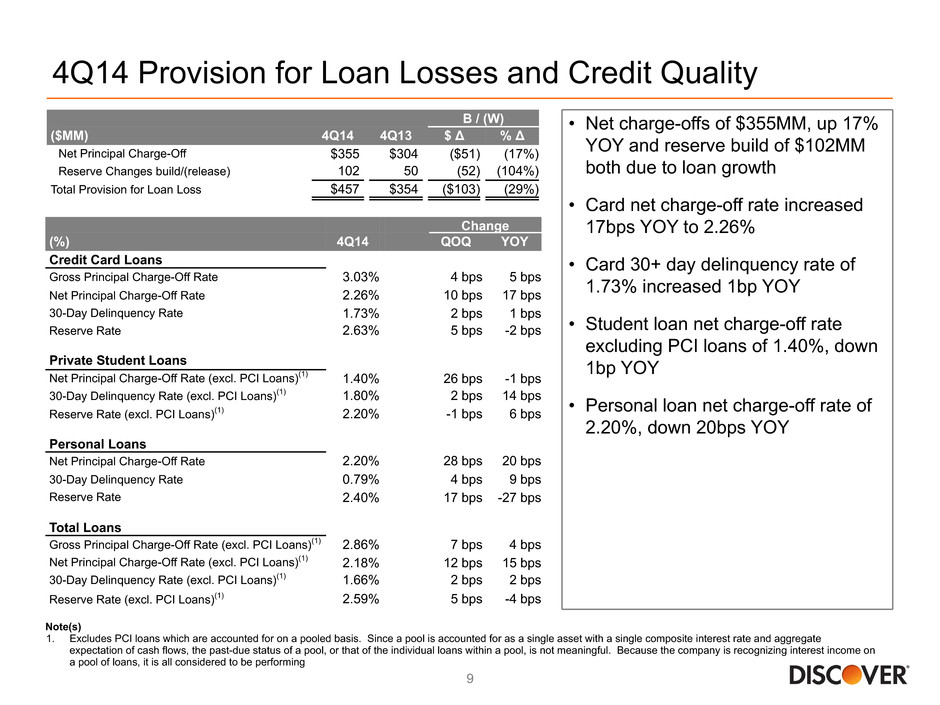

4Q14 Provision for Loan Losses and Credit Quality 9 • Net charge-offs of $355MM, up 17% YOY and reserve build of $102MM both due to loan growth • Card net charge-off rate increased 17bps YOY to 2.26% • Card 30+ day delinquency rate of 1.73% increased 1bp YOY • Student loan net charge-off rate excluding PCI loans of 1.40%, down 1bp YOY • Personal loan net charge-off rate of 2.20%, down 20bps YOY Note(s) 1. Excludes PCI loans which are accounted for on a pooled basis. Since a pool is accounted for as a single asset with a single composite interest rate and aggregate expectation of cash flows, the past-due status of a pool, or that of the individual loans within a pool, is not meaningful. Because the company is recognizing interest income on a pool of loans, it is all considered to be performing B / (W) ($MM) 4Q14 4Q13 $ Δ % Δ Net Principal Charge-Off $355 $304 ($51) (17%) Reserve Changes build/(release) 102 50 (52) (104%) Total Provision for Loan Loss $457 $354 ($103) (29%) Change (%) 4Q14 QOQ YOY Credit Card Loans Gross Principal Charge-Off Rate 3.03% 4 bps 5 bps Net Principal Charge-Off Rate 2.26% 10 bps 17 bps 30-Day Delinquency Rate 1.73% 2 bps 1 bps Reserve Rate 2.63% 5 bps -2 bps Private Student Loans Net Principal Charge-Off Rate (excl. PCI Loans)(1) 1.40% 26 bps -1 bps 30-Day Delinquency Rate (excl. PCI Loans)(1) 1.80% 2 bps 14 bps Reserve Rate (excl. PCI Loans)(1) 2.20% -1 bps 6 bps Personal Loans Net Principal Charge-Off Rate 2.20% 28 bps 20 bps 30-Day Delinquency Rate 0.79% 4 bps 9 bps Reserve Rate 2.40% 17 bps -27 bps Total Loans Gross Principal Charge-Off Rate (excl. PCI Loans)(1) 2.86% 7 bps 4 bps Net Principal Charge-Off Rate (excl. PCI Loans)(1) 2.18% 12 bps 15 bps 30-Day Delinquency Rate (excl. PCI Loans)(1) 1.66% 2 bps 2 bps Reserve Rate (excl. PCI Loans)(1) 2.59% 5 bps -4 bps

Capital Position 10 Note(s) 1. Tier 1 Common Capital Ratio (under Basel I) is calculated using tier 1 common capital, a non-GAAP measure. The Company believes the tier 1 common capital ratio is meaningful to investors to assess the quality and composition of the Company’s capital. For corresponding reconciliation of tier 1 common capital to a GAAP financial measure see appendix 2. Common Equity Tier 1 Capital Ratio (under fully phased-in Basel III rules) is calculated using common equity tier 1 capital, a non-GAAP measure. The Company believes that the common equity tier 1 capital ratio based on Basel III final rules is an important complement to the existing capital ratios and for comparability to other financial institutions. For corresponding reconciliation of common equity tier 1 capital and risk weighted assets calculated under Basel III final rules to tier 1 common equity and risk weighted assets calculated under Basel I see appendix Capital Ratios • Common Equity Tier 1 Capital Ratio of 14.1%, down 60bps from 3Q14 due to loan growth and capital deployment 4Q14 3Q14 4Q13 Total Risk Based Capital Ratio 17.0% 17.8% 17.4% Tier 1 Risk Based Capital Ratio 14.9% 15.6% 15.2% Tier 1 Common Capital Ratio(1) 14.1% 14.8% 14.3% Common Equity Tier 1 Capital Ratio(2) 14.1% 14.7% N/A Tier 1 Leverage Ratio 13.2% 13.7% 13.4%

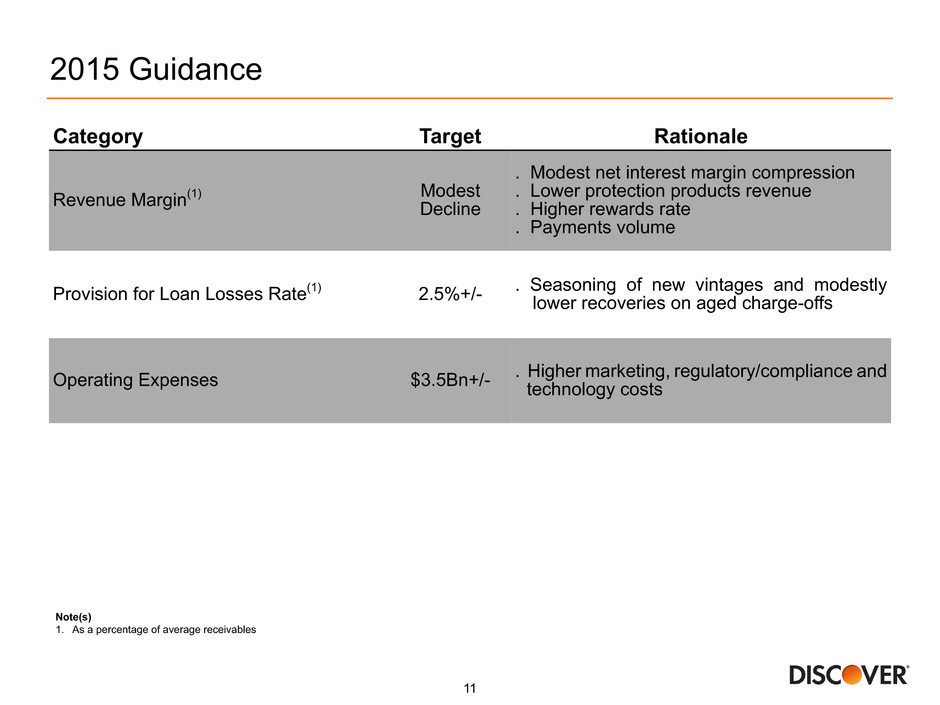

2015 Guidance Category Target Rationale Revenue Margin(1) ModestDecline . Modest net interest margin compression . Lower protection products revenue . Higher rewards rate . Payments volume Provision for Loan Losses Rate(1) 2.5%+/- . Seasoning of new vintages and modestlylower recoveries on aged charge-offs Operating Expenses $3.5Bn+/- . Higher marketing, regulatory/compliance andtechnology costs Note(s) 1. As a percentage of average receivables 11

Appendix

Reconciliation of GAAP to Non-GAAP Data Quarter Ended Year Ended (unaudited, in millions, except per share statistics) Dec 31, 2014 Dec 31, 2014 Income before income taxes $648 $3,694 Excluding Elimination of credit card rewards program forfeiture reserve 178 178 Excluding Discover Home Loans goodwill impairment 27 27 Excluding Diners Club Italy held-for-sale fair value adjustment 21 21 Adjusted income before income taxes (excluding one-time charges) $874 $3,920 Tax expense (244) (1,371) Tax expense related to one-time charges (77) (77) Adjusted net income (excluding one-time charges)(1) $553 $2,472 Preferred stock dividends (9) Adjusted net income available to common shareholders (excluding one-time charges) 544 Adjusted income allocated to participating securities (excluding one-time charges) (4) Adjusted net income allocated to common stockholders (excluding one-time charges) $540 Weighted average common shares outstanding 452 Effect of dilutive common stock equivalents 1 Weighted average common shares outstanding (fully diluted) 453 Diluted EPS $0.87 Excluding Elimination of credit card rewards program forfeiture reserve 0.24 Excluding Discover Home Loans goodwill impairment 0.03 Excluding Diners Club Italy held-for-sale fair value adjustment 0.05 Adjusted diluted EPS (excluding one-time charges)(1) $1.19 Rewards cost $517 Excluding Rewards charge for program enhancements (178) Adjusted rewards cost $339 Discover card sales volume 30,871 Adjusted rewards rate(2) 1.10% Note(s) 1. Adjusted net income and adjusted diluted earnings per share (excluding one-time charges) are non-GAAP financial measures which should be viewed in addition to, and not as a substitute for, the company's reported results. Management believes this information provides investors with useful metrics to evaluate the ongoing operating performance of the company 2. Adjusted rewards rate is calculated using adjusted rewards cost, a non-GAAP measure, divided by Discover card sales volume. Management believes this information provides investors with a useful metric to evaluate the ongoing operating performance of the company 13

Reconciliation of GAAP to Non-GAAP Data (cont'd) Quarter Ended (unaudited, in millions) Dec 31, 2014 Revenue net of interest expense $2,037 Excluding Elimination of credit card rewards program forfeiture reserve 178 Adjusted revenue net of interest expense (excluding one-time charge) $2,215 Total operating expense $932 Excluding Discover Home Loans goodwill impairment (27) Excluding Diners Club Italy held-for-sale fair value adjustment (21) Adjusted operating expense (excluding one-time charges) $884 Adjusted operating efficiency (excluding one-time charges)(1) 39.9% Note(s) 1. Adjusted operating efficiency is calculated using adjusted operating expense divided by adjusted revenue net of interest expense, a non-GAAP financial measure which should be viewed in addition to, and not as a substitute for, the company's reported results. Management believes this information provides investors with a useful metric to evaluate the ongoing operating performance of the company 14

Reconciliation of GAAP to Non-GAAP Data (cont'd) Quarter Ended (unaudited, in millions, except per share statistics) Dec 31, 2014 Dec 31, 2013 Provision for loan losses $457 $354 Income before income taxes 648 937 Pre-tax, pre-provision income(1) $1,105 $1,291 Note(s) 1. Pre-tax, pre-provision income, which is derived by adding provision for loan losses to pre-tax income, is a non-GAAP financial measure which should be viewed in addition to, and not as a substitute for, the company’s reported results. Management believes this information helps investors understand the effect of provision for loan losses on reported results and provides an alternate presentation of the company’s performance 2. Tangible common equity ("TCE"), a non-GAAP financial measure, represents common equity less goodwill and intangibles. A reconciliation of TCE to common equity, a GAAP financial measure, is shown above. Other financial services companies may also use TCE and definitions may vary, so we advise users of this information to exercise caution in comparing TCE of different companies. TCE is included because management believes that common equity excluding goodwill and intangibles is a more meaningful measure to investors of the true net asset value of the company 3. Tier 1 common capital, a non-GAAP financial measure, represents common equity and the effect of certain items in accumulated other comprehensive income (loss) excluded from tier 1 common capital, less goodwill and intangibles. A reconciliation of tier 1 common capital to common equity, a GAAP financial measure, is shown above. Other financial services companies may also use tier 1 common capital and definitions may vary, so we advise users of this information to exercise caution in comparing tier 1 common capital of different companies. Tier 1 common capital is included to support the tier 1 common capital ratio which is meaningful to investors to assess the quality and composition of the Company’s capital 4. Adjustments related to capital components include deferred tax liabilities related to intangible assets and deduction for deferred tax assets 5. Key differences under fully phased-in Basel III rules in the calculation of risk-weighted assets compared to Basel I include higher risk weighting for past due loans and unfunded commitments 6. Tier 1 common capital ratio is calculated using tier 1 common capital (Basel I), a non-GAAP measure, divided by risk weighted assets (Basel I) 7. Common equity tier 1 capital ratio is calculated using common equity tier 1 capital (under fully phased-in Basel III rules), a non-GAAP measure, divided by risk weighted assets (under fully phased-in-Basel III rules) 15 GAAP total common equity $10,574 $10,249 Less: Goodwill (257) (284) Less: Intangibles (176) (185) Tangible common equity(2) $10,141 $9,780 Effect of certain items in accumulated other comprehensive income (loss) excluded from tier 1 common capital 138 69 Total tier 1 common capital (Basel I)(3) $10,279 $9,849 Add: Adjustments related to capital components(4) 26 N/A Common equity Tier 1 capital (Basel III final rule) $10,305 N/A Risk weighted assets (Basel I) $72,889 $68,649 Risk weighted assets (Basel III final rule)(5) $73,315 N/A Tier 1 common capital ratio (Basel I)(6) 14.1% 14.3% Common equity Tier 1 capital ratio (Basel III final rule)(7) 14.1% N/A GAAP book value per share $24.79 $22.89 Less: Goodwill (0.57) (0.60) Less: Intangibles (0.39) (0.39) Less: Preferred Stock (1.25) (1.19) Tangible common equity per share $22.58 $20.71