Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FINANCIAL INSTITUTIONS INC | d853485d8k.htm |

| EX-99.1 - EX-99.1 - FINANCIAL INSTITUTIONS INC | d853485dex991.htm |

Exhibit 99.2

ATTORNEY GENERAL OF THE STATE OF NEW YORK

CIVIL RIGHTS BUREAU

|

In the Matter of: |

AOD No. 15-002 | |

| THE INVESTIGATION BY ERIC T. SCHNEIDERMAN, ATTORNEY GENERAL OF THE STATE OF NEW YORK, OF |

ASSURANCE OF DISCONTINUANCE PURSUANT TO EXECUTIVE LAW 63(15) | |

|

FINANCIAL INSTITUTIONS, INC. and FIVE STAR BANK

|

||

In November 2012, the Office of the Attorney General of the State of New York (“OAG”) began to investigate, pursuant to Section 63(12) of the New York State Executive Law, whether Financial Institutions, Inc. (“FII”) and Five Star Bank (“FSB,” and together with FII, “Five Star”) engaged in a pattern or practice of unlawful discrimination in violation of the Fair Housing Act, 42 U.S.C. § 3601 et seq., the Equal Credit Opportunity Act, 15 U.S.C. § 1691 et seq., the New York State Human Rights Law, N.Y. Exec. L. § 290 et seq., and the Rochester Human Rights Law, Rochester City Code § 63-1 et seq.

The OAG has found that Five Star implemented policies and practices that made the bank’s mortgage products unavailable in majority-minority neighborhoods in the Rochester metro area. More specifically, Five Star (1) excluded from its lending area all majority-minority neighborhoods in the City of Rochester from at least 2009 to June 2013; (2) listed loans securing property outside of its lending area as “undesirable”; and (3) imposed a minimum loan requirement on borrowers, regardless of individual creditworthiness, seeking mortgages of $75,000 or less, with respect to certain loan products.

1

This Assurance of Discontinuance contains the OAG’s findings in connection with its investigation of Five Star and the resolution agreed to by the OAG and Five Star (together, the “Parties”).

I.

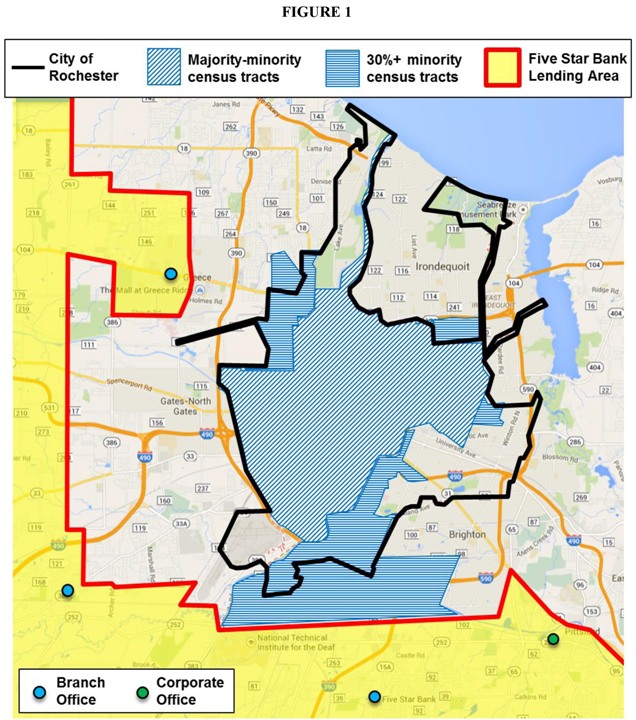

DEFINITIONS

| 1. | As used throughout this Assurance of Discontinuance, the terms set forth below shall mean as follows: |

| a. | “Assurance” means this Assurance of Discontinuance. |

| b. | “ATM” means automated teller machine. |

| c. | “CRA” means Community Reinvestment Act, 12 U.S.C. §§ 2901-2906, a federal statute intended to encourage depository institutions to help meet the credit needs of the communities in which they operate. |

| d. | “Effective Date” means the date that this Assurance is signed into effect by an authorized representative of the OAG. |

| e. | “FFIEC” means the Federal Financial Institutions Examination Council. |

| f. | “FII” means Financial Institutions, Inc. |

| g. | “Five Star” means FII and FSB. |

| h. | “FSB” means Five Star Bank. |

| i. | “HMDA” means the Home Mortgage Disclosure Act, 12 U.S.C. § 2803, a federal statute that requires lending institutions to publicly report certain loan data relating to home mortgages. |

| j. | “Majority-minority” means that more than 50% of the population in a geographic area reported a race and ethnicity other than Non-Hispanic White, as determined |

2

| by the 2010 Decennial Census. A list of majority-minority Census tracts in the Rochester Metro is set forth at Appendix A. |

| k. | “Majority-White” means that more than 50% of the population in a geographic area reported a race and ethnicity of Non-Hispanic White, as determined by the 2010 Decennial Census. |

| l. | “Neighborhood” refers to a Census tract, which is a geographic unit defined by the United States Census Bureau as a subdivision of a county or equivalent area that generally covers a contiguous area, follows identifiable legal or physical geographic boundaries, and has a population size of between 1,200 and 8,000 people. |

| m. | “OAG” means Office of the Attorney General of the State of New York. |

| n. | “Parties” means the OAG and Five Star. |

| o. | “Rochester Metro” means the Rochester Metropolitan Statistical Area, a geographic unit defined by the United States Census Bureau as consisting of the following counties in New York State: Livingston, Monroe, Ontario, Orleans, Wayne, and Yates Counties. |

II.

FINDINGS

A.

Applicable Laws

| 2. | The Equal Credit Opportunity Act provides that it is unlawful to discriminate against any applicant, with respect to any aspect of a credit transaction, on account of race or national origin. 15 U.S.C. § 1691(a). |

3

| 3. | The Fair Housing Act provides that it is unlawful to discriminate on account of race or national origin in making available residential real-estate related transactions. 42 U.S.C. § 3605. |

| 4. | The Fair Housing Act provides that it is unlawful to make dwellings unavailable and to discriminate in the provision of services or facilities in connection with the sale of dwellings on account of race or national origin. § 3604. |

| 5. | The New York State Human Rights Law provides that it is unlawful to discriminate against any applicant for credit in the withholding of credit or the fixing of terms and conditions of credit on account of race or national origin. N.Y. Exec. Law § 296-a(1)(b). |

| 6. | The New York State Human Rights Law provides that it is unlawful to directly or indirectly withhold or deny a person public accommodations or privileges thereof, including the extension of credit, on account of race or national origin. § 296(2)(a). |

| 7. | The Rochester Human Rights Law provides that it is unlawful to discriminate in the withholding or fixing of terms or conditions of any form of credit on account of race or national origin. Rochester City Code § 63-6. |

| 8. | New York State Executive Law § 63(12) prohibits repeated or persistent fraudulent or illegal acts in the transaction of business. |

B.

Background

| 9. | FSB is a state-chartered bank founded in the 1850s and headquartered in Warsaw, New York. FSB offers the traditional services of a financial depository and lending institution, including the receipt of monetary deposits and the financing of residential housing and commercial loans. As of September 30, 2014, FSB’s total assets were over $3 billion, with over $2.5 billion in deposits. |

4

| 10. | FSB is a wholly owned subsidiary of FII, a financial holding company headquartered in Warsaw, New York. |

| 11. | FSB operates 49 full-service branches in the State of New York. Nineteen of these branches serve the Rochester Metro, five of which are in Monroe County, and three of which are within the immediate vicinity of the City of Rochester. |

| 12. | The Rochester Metro has highly segregated residential housing patterns. As of 2010, the Rochester Metro was among the top 30 most highly segregated of the nation’s large metropolitan areas for both African-Americans and Hispanics, according to U.S. Census data. |

| 13. | The City of Rochester is home to over 69% of the total African-American population and over 53% of the total Hispanic population in the Rochester Metro. Nearly all of the majority-minority neighborhoods in the Rochester Metro are located in the center of the City of Rochester. |

| 14. | Minority communities in the Rochester Metro have been disproportionately unable to participate in the recovery of the housing market following the credit crisis. For example, in the Rochester Metro the number of mortgage refinance loans extended in predominantly White communities increased by over 130% between 2008 and 2009, but the number of such loans extended in predominantly minority communities decreased by over 45% during the same period. |

| 15. | In addition, the housing stock in the City of Rochester is aging, and there is a significant need for home improvement. The deterioration of the housing stock has been accompanied by increased vacancy rates. |

5

| 16. | The OAG’s investigation found that Five Star’s policies and practices made the bank’s mortgage products unavailable in majority-minority neighborhoods in the Rochester metro area. As a result, borrowers with properties in those neighborhoods, who are largely African-American and Hispanic, have not had an equal opportunity to obtain financing. |

C.

Five Star’s Policies and Practices

| 17. | From November 2012 through June 2014, the OAG conducted an investigation into whether Five Star engaged in a pattern or practice of discrimination by failing to make residential mortgages available in majority-minority neighborhoods in the Rochester Metro. |

| 18. | The OAG’s investigation found that Five Star’s policies and practices made the bank’s mortgage products unavailable in majority-minority neighborhoods in the Rochester metro area. |

| 19. | These policies and practices include Five Star’s exclusion from its lending area of all majority-minority neighborhoods in the Rochester Metro; listing of loans outside of its lending area as “undesirable”; and imposition of a minimum loan requirement on borrowers, regardless of individual creditworthiness, seeking mortgages of $75,000 or less with respect to certain products. |

| 20. | The OAG’s investigation found that these policies and practices are not necessary to serve any legitimate business or other nondiscriminatory interest. |

Five Star’s Lending Area Excluded All of the

Majority-Minority Neighborhoods in the City of Rochester

| 21. | Five Star has located 19 branch offices and two freestanding ATMs in the Rochester Metro. Three of the branch offices are in the suburbs immediately bordering the City of |

6

| Rochester. Five Star does not have any branch offices or ATMs in Rochester, and none of Five Star’s branch offices or ATMs in the Rochester Metro is located in a majority- minority neighborhood. |

| 22. | Five Star has adopted a Loan Policy defining the bank’s “Lending Area.” The Lending Area covers many of the neighborhoods in the Rochester Metro, including many of the suburbs to the south and west of the city. At the time of the issuance of the OAG’s subpoena to Five Star in May 2013, the Lending Area approached the City of Rochester, but cut off abruptly at Five Star’s branch offices, wrapping around but not entering any part of the city. |

| 23. | A map of the portion of Five Star’s Lending Area covering the Rochester area, as of May 2013, is at Figure 1, infra. |

| 24. | Because Five Star’s Lending Area completely excluded the City of Rochester, it also excluded all of the majority-minority neighborhoods in Rochester. |

Five Star Lists as “Undesirable”

Certain Loans Outside of Its Lending Area

| 25. | According to its public statements, Five Star has implemented a “long-term growth strategy of placing a larger influence on the greater Rochester market.” |

| 26. | However, some Five Star internal documents suggest that this growth strategy did not seek to expand the bank’s footprint to the entire greater Rochester market. A presentation made at a 2010 FII shareholders’ meeting states that Five Star is “targeting larger, more affluent markets of suburban . . . Rochester.” All the majority-minority neighborhoods in the Rochester Metro are located in the City of Rochester, and thus were excluded from the area targeted by Five Star. |

7

8

| 27. | Five Star’s Loan Policy designates as an “undesirable loan type” any residential mortgage “secured by property out of the bank’s recognized market area; unless the loan is to a financially strong existing customer of the Bank.” According to Five Star, residential lending outside of the Lending Area is only contemplated under the policy for the bank’s existing customers who reside in the Lending Area but wish to purchase or refinance a second property outside of the Lending Area. |

| 28. | Because Five Star originates over 90% of its loans inside its Lending Area, its existing customers are largely not borrowers in majority-minority neighborhoods. |

Five Star’s Minimum Loan Requirement Makes Most of Its Mortgage

Products Unavailable to Borrowers in Majority-Minority Neighborhoods

| 29. | Of the twelve residential mortgage products offered by Five Star, seven require the borrower to apply for a mortgage of at least $75,001 (“Minimum Loan Requirement”). Each of the fact sheets for these mortgage products states: “minimum loan $75,001.” Accordingly, borrowers seeking a mortgage of $75,000 or less are automatically disqualified from eligibility for these products, regardless of their individual creditworthiness. |

| 30. | Five Star’s Minimum Loan Requirement effectively discourages lending to borrowers with properties in majority-minority neighborhoods. |

| 31. | From 2009 to 2013, the median sale price for homes in the Rochester suburbs was generally above $100,000. Similarly, during the same period, the median sale price of homes in the majority-White neighborhoods of the City of Rochester was generally near or above $100,000. |

| 32. | In contrast, during the same period, the median sale price of homes in nearly all of the majority-minority neighborhoods in the Rochester Metro was below $72,000. |

9

| 33. | Accordingly, Five Star’s $75,001 Minimum Loan Requirement has a disproportionate effect on the eligibility of borrowers with properties in Rochester’s majority-minority neighborhoods for most of the bank’s mortgage products, without regard to the creditworthiness of those borrowers. |

D.

Effects of Five Star’s Policies and Practices

| 34. | Five Star’s policies and practices have made the bank’s mortgage products unavailable in majority-minority neighborhoods. |

| 35. | As a result of its policies and practices, Five Star draws mortgage applications from and makes mortgage loans to borrowers with properties in majority-minority neighborhoods at far lower rates than comparable banks in the Rochester Metro. |

| 36. | According to HMDA data from 2009 to 2013, Five Star originated 1,940 residential mortgage loans in the Rochester Metro. Of these 1,940 loans, only ten loans (0.52%) were made to applicants with a property in a majority-minority neighborhood. Of these ten loans, only five (0.26%) were from an applicant reporting as African-American or Hispanic. |

| 37. | Comparable banks lending in the Rochester Metro from 2009 to 2013 originated mortgage loans in majority-minority neighborhoods at a rate several times greater than Five Star did during the same period. |

| 38. | One reason that Five Star lags behind comparable banks in originating loans in majority- minority neighborhoods is that it approves loan applications from such neighborhoods at a disproportionately low rate. From 2009 to 2013, Five Star’s loan approval rate in majority-White neighborhoods (72%) was on par with the approval rate of comparable banks in such neighborhoods (72%). In contrast, during the same period, Five Star’s loan |

10

| approval rate in majority-minority neighborhoods (34%) was significantly lower than the approval rate of comparable banks in such neighborhoods (49%). |

| 39. | Another reason that Five Star lags behind comparable banks in originating loans in majority-minority neighborhoods is that it receives a significantly smaller share of its loan applications from such neighborhoods than comparable banks. Comparable banks lending in the Rochester Metro from 2009 to 2013 generated mortgage applications in majority-minority neighborhoods at a rate several times greater than Five Star. |

| 40. | The disparities between Five Star’s lending activity and the lending activity of comparable banks in the Rochester Metro are statistically significant. Statistical analysis indicates disparities of a magnitude greater than two standard deviations between Five Star’s actual lending activity in majority-minority neighborhoods and the lending activity in such neighborhoods that was expected of Five Star based on the lending activity of comparable banks. |

| 41. | These statistically significant disparities constitute a disparate impact resulting from Five Star’s exclusionary policies and practices. In other words, these disparities have actually and predictably resulted from Five Star’s exclusion of all majority-minority neighborhoods from its Lending Area, discouraging of loans to borrowers in such neighborhoods as “undesirable,” and disqualification of borrowers in such neighborhoods seeking mortgages of $75,000 or less, regardless of individual creditworthiness. |

III.

PROSPECTIVE RELIEF

WHEREAS, Five Star is subject to state and federal laws governing fair lending, including the New York State Human Rights Law, N.Y. Exec. Law § 290 et seq., the Fair Housing Act, 42 U.S.C. § 3601 et seq., the Equal Credit Opportunity Act, 15 U.S.C. § 1691 et

11

seq., and the Rochester Human Rights Law, Rochester City Code § 63-1 et seq., which prohibit financial institutions from discriminating on the basis of race or national origin in their mortgage lending practices;

WHEREAS, New York State Executive Law § 63(12) prohibits repeated or persistent illegal acts in the transaction of business;

WHEREAS, the OAG seeks to ensure that all individuals have equal access to credit, banking services, and housing-related services;

WHEREAS, housing discrimination in the wake of the financial crisis has perpetuated housing segregation and prevented members of certain protected classes from gaining access to traditional forms of credit and taking advantage of record-low interest rates and high levels of housing affordability;

WHEREAS, Five Star has cooperated fully with the OAG’s investigation by voluntarily producing relevant information and meeting with OAG staff, and has agreed to continue to work cooperatively with the OAG;

WHEREAS, in September 2013, Five Star expanded its Lending Area to encompass all of Monroe County, including Rochester, and announced in 2014 its intention to open its first branch office in the City of Rochester, in the “CityGate” development, which has received regulatory approval;

WHEREAS, Five Star’s Lending Policy states that “it is [the Bank’s] policy to promote the availability of credit to all credit worthy applicants without regard to race”;

WHEREAS, Five Star neither admits nor denies the OAG’s Findings set forth in Paragraphs 2–41;

12

WHEREAS, Five Star asserts that it has been and continues to be committed to full compliance with the mandates of the Fair Housing Act, Equal Credit Opportunity Act, and the New York and Rochester Human Rights Laws;

WHEREAS, examinations in 2011 by the New York Department of Financial Services and the Federal Reserve Bank of New York under the federal Community Reinvestment Act rated Five Star as “outstanding”;

WHEREAS, the Parties believe the obligations imposed by the Assurance are prudent and appropriate, and desire to obviate further investigation, it being expressly understood with respect to the investigation that this settlement will enable the Parties to avoid the expense of litigation; and

WHEREAS, the OAG is willing to accept the terms of this Assurance pursuant to New York State Executive Law § 63(15) and to discontinue its investigation of Five Star;

IT IS HEREBY UNDERSTOOD AND AGREED, by and between Five Star and the OAG as follows:

IV.

COMPLIANCE WITH THE LAW

| 42. | Five Star agrees to comply fully with the Fair Housing Act, 42 U.S.C. § 3601 et seq., the Equal Credit Opportunity Act, 15 U.S.C. § 1691 et seq., the New York State Human Rights Law, N.Y. Exec. L. § 290 et seq., and the Rochester Human Rights Law, Rochester City Code § 63-1 et seq. |

V.

EXPANSION OF LENDING AREA

| 43. | Five Star shall maintain its expanded Lending Area so as to include all of Monroe County, including the entire City of Rochester. |

13

| 44. | Five Star shall similarly maintain its expanded CRA assessment area so as to include all of Monroe County, including the entire City of Rochester. |

| 45. | Five Star will ensure that all of its policies, publications, and marketing materials that refer to the geographic area in which the bank focuses its lending efforts describe an area no smaller than the area described in Paragraph 43. |

| 46. | During the term of the Assurance, Five Star will provide written notice to the OAG of any proposed changes to FSB’s CRA assessment area or Lending Area at least thirty days before implementing any such changes. |

VI.

BRANCH OFFICE EXPANSION

| 47. | Five Star shall evaluate future opportunities for expansion, whether by acquisition or opening new offices, in a manner consistent with achieving the remedial goals of this Assurance. |

| 48. | Five Star shall open at least two full-service branch offices located within a neighborhood in the Rochester Metro that has a minority population of at least 30% (“New Branches”). The first New Branch shall be located within two miles of a majority-minority neighborhood in Rochester, and the second New Branch shall be located within one mile of a majority-minority neighborhood in Rochester. Each New Branch will provide the complete range of services typically offered at Five Star’s current full-service branches and shall provide a residential mortgage lender who is fully trained in all relevant aspects of home mortgage and home equity lending. |

| 49. | The proposals concerning the New Branches shall be subject to the OAG’s review and approval, which shall not be unreasonably withheld. With respect to the first New Branch, Five Star submitted relevant information to the OAG prior to the Effective Date, |

14

| and the OAG has reviewed this information and confirmed that the first New Branch complies with the requirements of Paragraph 48. With respect to the second New Branch, Five Star shall submit a proposal to the OAG no less than 90 days prior to Five Star’s submission of its branch application to the Federal Reserve Bank and the New York Department of Financial Services. |

| 50. | In development of the branch expansion proposal, Five Star shall consult with representatives of community organizations significantly involved in promoting fair lending, homeownership, or residential development in majority-minority neighborhoods in the Rochester Metro. |

| 51. | Respondents will make all reasonable efforts, subject to state and federal government and regulatory approval, to open or acquire the first New Branch within 18 months of the Effective Date and the second New Branch within 24 months of the Effective Date. |

| 52. | Nothing in this Assurance precludes Five Star from opening or acquiring additional branch offices; however, Five Star shall notify the OAG of its plans to do so at the same time that they so notify any other banking regulatory agency. |

VII.

MINIMUM LOAN AMOUNT

| 53. | Five Star will eliminate the Minimum Loan Amount requirement for all of its mortgage loan products. This Paragraph shall be construed consistently with Five Star’s compliance with any requirements imposed by federal or state secondary market programs. |

| 54. | Five Star will ensure that all of its policies, publications, and marketing materials that refer to the Minimum Loan Amount are revised accordingly. |

15

VIII.

OUTREACH TO MAJORITY-MINORITY NEIGHBORHOODS

A.

Special Financing Program

| 55. | Five Star shall establish a special financing program designed to increase the amount of loan applications it generates from and loans it originates to minority borrowers and residents of majority-minority neighborhoods in the Rochester Metro (“Special Financing Program”). |

| 56. | The OAG’s investigation found evidence demonstrating that Five Star’s policies and practices resulted in a failure to serve the credit needs of residents of majority-minority neighborhoods in the Rochester Metro. The Special Financing Program will provide restitution for these impacted individuals. |

| 57. | Through the Special Financing Program, Five Star shall provide discounted or subsidized financing on loans to residents of majority-minority neighborhoods in the Rochester Metro. The total amount of discounts and subsidies provided pursuant to the Special Financing Program shall be at least $500,000. |

| 58. | The discounts and subsidies provided pursuant to the Special Financing Program can be provided by, but are not limited to, one or more of the following means: |

| a. | a payment for the purpose of down payment assistance or closing cost assistance on a residential mortgage; |

| b. | a payment against principal on a loan for home purchase, refinancing, or home improvement, or a small business loan; |

| c. | a waiver of fees in originating a loan for home purchase, refinancing, or home improvement, or a small business loan; |

16

| d. | a waiver of interest in originating a loan for home purchase, refinancing, or home improvement, or a small business loan; |

| e. | an interest rate subsidy in originating a loan for home purchase, refinancing, or home improvement, or a small business loan; and |

| f. | assistance with or waiver of the mortgage insurance premiums on loans guaranteed by the Federal Housing Administration. |

| 59. | FSB will apply flexible underwriting standards in connection with the Special Financing Program. These standards shall be subject to the review of the OAG. |

| 60. | In development of the Special Financing Program, Five Star shall consult with representatives of community organizations significantly involved in promoting fair lending, homeownership, or residential development in majority-minority neighborhoods in the Rochester Metro. |

| 61. | Five Star shall present to the OAG a written proposal for the Special Financing Program no later than three months after the Effective Date. The OAG shall review the proposal, for the sole purpose of determining whether it complies with this Assurance and applicable laws, and its approval shall not be unreasonably withheld. Once the OAG has approved the proposal, Five Star shall implement it in accordance with the timeframe set forth in the proposal. |

B.

Marketing Program

| 62. | Five Star shall allocate a minimum of $250,000 over the term of the Assurance on a program for advertising and marketing to minority applicants and residents of majority- minority neighborhoods (“Marketing Program”). |

17

| 63. | Five Star shall present to the OAG a written proposal for the Marketing Program not later than five months after the Effective Date. The monies allocated to the Marketing Program shall be expended within twelve months of the OAG’s approval of the proposal. |

| 64. | The Marketing Program shall include, at a minimum, the following components: |

| a. | Outreach. During the term of the Assurance, FSB shall hold quarterly outreach events for residents of majority-minority neighborhoods in the Rochester Metro, as well as real estate brokers and agents, developers, and public or private entities engaged in residential real estate-related business in majority-minority neighborhoods. These events shall be held for the purpose of informing the attendees of the products and services FSB offers, including those made available as part of the Assurance, to provide pre-application counseling to and receive inquiries from potential applicants, to receive applications, and to develop business relationships with and a presence in the community. These events shall be offered at locations reasonably convenient to the attendees. |

| b. | Print Media. During each year of the Assurance, in addition to any other print advertising, FSB shall advertise in at least one print medium specifically directed to minority readers in the Rochester Metro. These advertisements, viewed in their entirety over the course of a year, shall include, without limitation, products made available as part of the Assurance. |

| c. | Radio. During the term of the Assurance, FSB shall place radio advertisements on at least one minority-oriented radio station serving its lending area. The radio advertising, when considered in its entirety over the course of a year, shall include FSB’s full range of loan products. |

18

| d. | Promotional Materials. FSB shall create point-of-distribution materials, such as posters, billboards, and brochures, targeted toward minority communities to advertise products and services offered by FSB. FSB shall place or display these promotional materials in its branch offices and additional appropriate distribution locations throughout the majority-minority neighborhoods in the Rochester Metro. |

| e. | Direct Mail. During the term of the Assurance, FSB shall distribute advertisements by direct mailing targeted to residents in majority-minority neighborhoods in the Rochester Metro. |

| f. | Internet. During the term of the Assurance, FSB shall distribute advertisements through its website and shall use other means of online advertising targeted at minority borrowers and residents of majority-minority neighborhoods in the Rochester Metro, such as web banner advertising, text advertising, sponsored search engine results, social media, mobile advertising, and email advertising. |

| g. | All of FSB’s print advertising, Internet advertising, and promotional materials shall contain an equal housing opportunity logotype, slogan, or statement. All of FSB’s radio and television advertisements shall include the audible statement “Equal Opportunity Lender,” or equivalent language complying with state and federal regulations. |

| 65. | For the duration of this Assurance, Five Star shall make substantial good faith efforts to ensure that persons appearing on FSB’s marketing materials, including, but not limited to, those listed in Paragraph 64, are of diverse racial backgrounds, including, but not limited to, African-American and Hispanic backgrounds. |

19

IX.

TRAINING

| 66. | No later than 60 days after the Effective Date, Five Star shall provide live training to all employees and agents with significant involvement in lending in the Rochester Metro (“Covered Employees”) to ensure that their activities are conducted in a nondiscriminatory manner. This training shall encompass their fair lending obligations under the Fair Housing Act, Equal Credit Opportunity Act, their obligations under the CRA, and their responsibilities under the Assurance. During the term of the Assurance, Five Star must provide this fair lending training annually to Covered Employees. Any written materials created for the training required by this Paragraph shall be subject to review and approval, which shall not be unreasonably withheld, in advance by the OAG. Five Star shall bear all costs associated with the training. |

| 67. | Five Star must secure a signed statement from its Fair Lending Officer acknowledging that each Covered Employee has completed the fair lending training. During the term of the Assurance, each new Covered Employee must undergo the fair lending training no later than 14 days after beginning his or her employment in that position. |

| 68. | For the duration of this Assurance, FSB shall continue to employ a full-time Fair Lending Officer. The Fair Lending Officer shall be a member of FSB’s Community Reinvestment Act Committee. The Fair Lending Officer’s responsibilities will include, but not be limited to, overseeing compliance with the provisions of this Assurance, including the development and implementation of the training described in Paragraphs 66–67. |

X.

MONETARY RELIEF

| 69. | Five Star will pay a total of one hundred and fifty thousand dollars ($150,000) for the costs of the investigation. |

20

| 70. | All payments and correspondence related to this Assurance must reference AOD No. 15- 002. Payment will be made within five business days of the Effective Date by certified or bank check payable to: “New York State Department of Law” and forwarded to: |

| Office of the New York State Attorney General | ||

| Civil Rights Bureau | ||

| 120 Broadway | ||

| New York, New York 10271 | ||

| Attn: | Kristen Clarke | |

| Bureau Chief | ||

XI.

RECORD KEEPING AND MONITORING

| 71. | For the term of the Assurance, Five Star shall retain all records relating to its obligations hereunder, including lending activities, advertising, outreach, branching, training, special programs, and other activities as set forth herein. The OAG shall have the right to review and copy such records upon 20 days written notice. |

| 72. | FSB shall provide to the OAG the data it submits to the FFIEC pursuant to HMDA and CRA. The data will be provided in the same format in which it is presented to the FFIEC within thirty days of their submission to the FFIEC each year for the term of the Assurance, including the record layout. The OAG will utilize this data to monitor compliance with the Assurance. |

| 73. | In addition to the submission of any other plans or reports specified in the Assurance, Five Star shall make an annual report to the OAG on its progress in fulfilling the goals of the Assurance. Each such report shall provide: (a) a complete account of Five Star’s actions to comply with each requirement of the Assurance during the previous year; (b) Five Star’s objective assessment of the extent to which each quantifiable obligation was met, an explanation of why any particular component fell short of meeting the goal for that year; and (c) any recommendations for additional actions to achieve the goals of the |

21

| Assurance. Five Star shall submit this report each year for the term of the Assurance within thirty days of the anniversary of the Effective Date. Five Star shall also attach to the annual reports representative copies of training material and advertising and marketing materials disseminated pursuant to the Assurance. |

XII.

SCOPE OF THE ASSURANCE, JURISDICTION, AND

ENFORCEMENT PROVISIONS

| 74. | The OAG has agreed to the terms of this Assurance based on, among other things, the representations that Five Star made to the OAG and the OAG’s own findings from the factual investigation as outlined in Paragraphs 2–41 above. To the extent that any material representations made by Five Star or its representatives between May 2013 and the Effective Date are later found to be inaccurate or misleading, this Assurance is voidable by the OAG in its sole discretion. |

| 75. | This Assurance shall expire three years after the Effective Date, except that the OAG may, in its sole discretion, extend the Assurance term upon a good-faith determination that Five Star has not complied with this Assurance, which non-compliance the OAG will discuss and attempt to resolve with Five Star in good faith before making such determination. Notwithstanding any other provision in this Paragraph, the Assurance shall remain in effect until Five Star has fully complied with all of its obligations. |

| 76. | No representation, inducement, promise, understanding, condition, or warranty not set forth in this Assurance has been made to or relied upon by Five Star in agreeing to this Assurance. |

22

| 77. | Upon execution by the Parties to this Assurance, the OAG shall discontinue the instant investigation except as otherwise related to the enforcement of the terms of this Assurance. |

| 78. | This Assurance binds Five Star and its principals, directors, officers, successors, assigns, “d/b/a” companies, subsidiaries, affiliates, and any other business entities whom any such individuals may hereafter form or control. |

| 79. | Five Star represents and warrants, through the signatures below, that the terms and conditions of this Assurance are duly approved, and execution of this Assurance is duly authorized. Five Star agrees not to take any action or make any statement denying, directly or indirectly, the propriety of this Assurance or expressing the view that this Assurance is without factual basis. Nothing in this Paragraph affects Five Star’s (i) testimonial obligations or (ii) right to take legal or factual positions in the course or defense of litigation or other legal or regulatory proceedings to which the OAG is not a party. |

| 80. | This Assurance is not to be used by any third party in any civil, criminal, administrative, or regulatory proceeding or examination of any kind before any court, administrative agency, regulatory body or other tribunal. Except in an action by the OAG to enforce the obligations of Five Star in this Assurance or in the event of termination of this Assurance by the OAG, this Assurance is not intended to be used as an admission of, or evidence of, any alleged wrongdoing, liability, fault or omission of Five Star in any civil, criminal, administrative, or regulatory proceeding or examination of any kind before any court, administrative agency, regulatory body or other tribunal. |

23

| 81. | This Assurance may not be amended except by an instrument in writing signed on behalf of all the Parties to this Assurance. |

| 82. | This Assurance shall be binding on and inure to the benefit of the Parties to this Assurance and their respective successors and assigns, provided that no party, other than the OAG, may assign, delegate, or otherwise transfer any of its rights or obligations under this Assurance without the prior written consent of the OAG. |

| 83. | In the event that any one or more of the provisions contained in this Assurance shall for any reason be held to be invalid, illegal, or unenforceable in any respect, in the sole discretion of the OAG such invalidity, illegality, or unenforceability shall not affect any other provision of this Assurance. |

| 84. | To the extent not already provided under this Assurance, Five Star agrees to, upon request by the OAG, provide all documentation and information necessary for the OAG to verify compliance with this Assurance. |

| 85. | All notices, reports, requests, and other communications to any party pursuant to this |

Assurance shall be in writing and shall be directed as follows:

Office of the Attorney General

Mayur Saxena

Assistant Attorney General

Civil Rights Bureau

Office of the New York State Attorney General

120 Broadway, 3rd Floor

New York, NY 10271

Tel.: (212) 416-8250

Fax: (212) 416-8074

Email: Civil.Rights@ag.ny.gov

24

Financial Institutions, Inc. and Five Star Bank

William L. Kreienberg

General Counsel and Chief Risk Officer

Five Star Bank

2851 Clover Street

Pittsford, NY 14534

Email: wlkreienberg@five-starbank.com

and

Jerauld E. Brydges

Harter Secrest & Emery LLP

1600 Bausch & Lomb Place

Rochester, New York 14604

Email: jbrydges@hselaw.com

Any changes in the persons to whom communications should be specifically directed shall be made in advance of the change.

| 86. | Acceptance of this Assurance by the OAG shall not be deemed approval by the OAG of any of the practices or procedures referenced herein, and Five Star shall make no representation to the contrary. |

| 87. | Pursuant to New York State Executive Law § 63(15), evidence of a violation of this Assurance shall constitute prima facie proof of violation of the applicable law in any action or proceeding thereafter commenced by the OAG. |

| 88. | If a court of competent jurisdiction determines that Five Star has breached this Assurance, Five Star shall pay to the OAG the cost, if any, of such determination and of enforcing this Assurance, including without limitation legal fees, expenses, and court costs. |

| 89. | If the Assurance is voided or breached, Five Star agrees that any statute of limitations or other time-related defenses applicable to the subject of the Assurance and any claims arising from or relating thereto are tolled from and after the date of this Assurance. In the event the Assurance is voided or breached, Five Star expressly agrees and acknowledges |

25

| that this Assurance shall in no way bar or otherwise preclude the OAG from commencing, conducting or prosecuting any investigation, action or proceeding, however denominated, related to the Assurance, against Five Star, or from using in any way any statements, documents or other materials produced or provided by Five Star prior to or after the date of this Assurance. |

| 90. | The OAG finds the relief and agreements contained in this Assurance appropriate and in the public interest. The OAG is willing to accept this Assurance pursuant to New York State Executive Law § 63(15), in lieu of commencing a statutory proceeding. This Assurance shall be governed by the laws of the State of New York without regard to any conflict of laws principles. |

| 91. | Nothing in this Assurance shall be construed so as to deprive any private right under the law. |

| 92. | Nothing in the Assurance shall excuse Five Star’s compliance with any currently or subsequently effective provision of law or order of a regulator with authority over Five Star that imposes additional obligations on Five Star. |

| 93. | Nothing in this Assurance is intended to, nor shall, limit the Attorney General’s investigatory or compliance review powers otherwise provided by law or by this Assurance. |

26

IN WITNESS THEREOF, the undersigned subscribe their names:

Dated: New York, New York

January 17, 2015

| Financial Institutions, Inc. | ||

| By: |

/s/ Richard J. Harrison, EVP | |

| Five Star Bank | ||

| By: |

/s/ Richard J. Harrison, EVP | |

CONSENTED TO:

Dated: New York, New York

January 17, 2015

| ERIC T. SCHNEIDERMAN Attorney General of the State of New York | ||

| By: |

/s/ Kristen Clarke | |

| Kristen Clarke Bureau Chief | ||

| By: |

/s/ Mayur Saxena | |

| Mayur Saxena | ||

| Assistant Attorney General | ||

| Office of the New York State Attorney General Civil Rights Bureau 120 Broadway, 23rd Floor New York, New York 10271 Tel. (212) 416-8250 Fax (212) 416-8074 | ||

27

APPENDIX A

Majority-minority Census tracts in the Rochester Metropolitan Statistical Area as measured by the 2010 Decennial Census include the following census tracts:

State Code:

36

County Code:

055

Tract Codes:

| 2 | 62 | |||

| 5 | 63 | |||

| 7 | 64 | |||

| 8 | 65 | |||

| 15 | 66 | |||

| 19 | 67 | |||

| 21 | 68 | |||

| 22 | 69 | |||

| 23 | 71 | |||

| 24 | 75 | |||

| 27 | 79 | |||

| 39 | 81 | |||

| 41 | 82 | |||

| 46.02 | 83.01 | |||

| 47.01 | 84 | |||

| 47.02 | 87.01 | |||

| 48 | 87.02 | |||

| 49 | 88 | |||

| 51 | 92 | |||

| 52 | 93.01 | |||

| 53 | 94 | |||

| 54 | 95 | |||

| 55 | 96.01 | |||

| 56 | 96.02 | |||

| 57 | 96.03 | |||

| 58 | 96.04 | |||

| 59 |

28