Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Precipio, Inc. | v398765_8k.htm |

| EX-99.2 - EXHIBIT 99.2 - Precipio, Inc. | v398765_ex99-2.htm |

Exhibit 99.1

1 Investor Presentation Improving cancer outcomes with groundbreaking precision in molecular testing OneMed Conference San Francisco, CA Paul Kinnon, President & CEO January 2015

2 Forward - Looking Statements Certain statements in this presentation constitute “forward - looking statements” of Transgenomic within the meaning of the Private Securities Litigation Reform Act of 1995, which involve known and unknown risks, uncertainties and other factors that may cause actual results to be materially different from any future results, performance or achievements expressed or implied by such statements. Forward - looking statements include, but are not limited to, those with respect to management's current views and estimates of future economic circumstances, industry conditions, company performance, financial results, including the ability of the Company to grow its involvement in the diagnostic products and services markets, and regulatory matters. The known risks, uncertainties and other factors affecting these forward - looking statements are described from time to time in Transgenomic's filings with the Securities and Exchange Commission, including the Company’s most recent Annual Report on Form 10 - K. Any change in such factors, risks and uncertainties may cause the actual results, events and performance to differ materially from those referred to in such statements. Accordingly, the Company claims the protection of the safe harbor for forward - looking statements contained in the Private Securities Litigation Reform Act of 1995 with respect to all statements contained in this presentation. All information in this presentation is as of the date set forth on the front page of this presentation, and Transgenomic does not undertake any duty to update this information, including any forward - looking statements, unless required by law.

3 Our Mission Advancing personalized medicine with ICE COLD - PCR — Groundbreaking molecular testing technology Neurology Cardiology Oncology Target markets Customers Pharma Biotech Oncologists/ Patients Clinical Diagnostics

4 Three Business Units with One Mission Taking personalized medicine from concept to practice: precise, simple, convenient and affordable tests Biomarker Identification Patient Testing Genetic Assays & Platforms Pharmaceuticals & Biotech Biomarker Services ~10% of Revenue All Genetic Testing Labs Platforms & Kits ~ 40 % of Revenue P roviding Genetic Testing to Patients via Doctors Cardiology, Neurology & Oncology Tests ~ 50 % of Revenue

5 Transgenomic’s Multiplexed Ice - Cold PCR Platform Technology (MX ICP) Strong economic justification for rapid commercialization into a high - margin , $2.5+ billion market* opportunity * internal company estimates Complements all genetic sequencing platform technologies Provides substantial sensitivity improvement over any other modality Robust and reliable More sensitive, accurate diagnostics Easily implemented into any laboratory Strong economic justification for healthcare & Patients Enables improvements in current and new sequencing technologies, without increasing cost Works with any tissue type, liquid or biopsy Rapid commercialization via partnerships and licensing

6 MX ICP is Fully Compatible with All Diagnostic Platforms Easily integrates on any platform now or in development; Replaces or supplements traditional PCR And others …

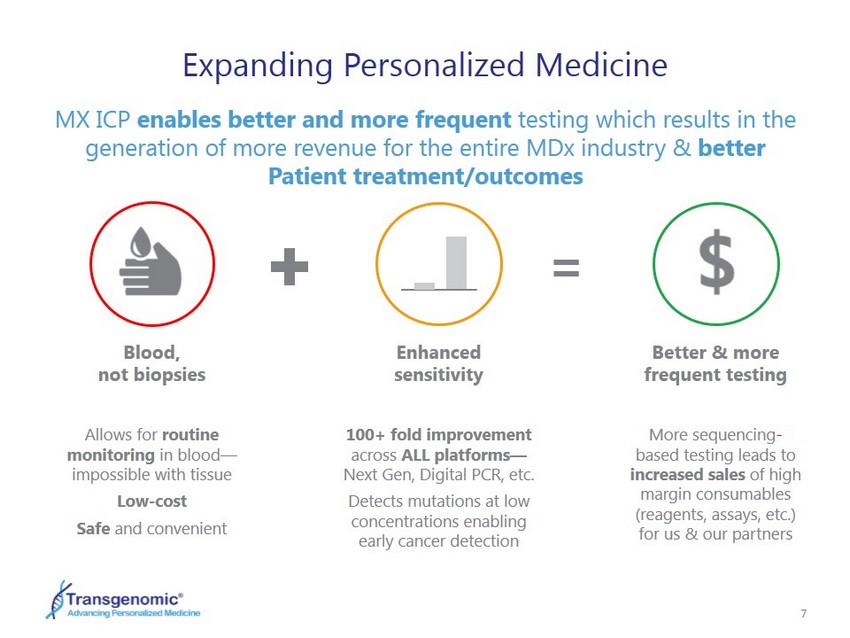

7 Expanding Personalized Medicine MX ICP enables better and more frequent testing which results in the generation of more revenue for the entire MDx industry & better Patient treatment/outcomes Allows for routine monitoring in blood — impossible with tissue Low - cost Safe and convenient Blood, not biopsies 100+ fold improvement across ALL platforms — Next Gen, Digital PCR, etc. Detects mutations at low concentrations enabling early cancer detection Enhanced sensitivity = More sequencing - based testing leads to increased s ales of high margin consumables (reagents, assays, etc.) for us & our partners Better & more frequent testing

8 MX ICP Enables Detection of More EGFR Mutations in Plasma than NGS Alone: Better Diagnosis • EGFR is one of the most common mutations present in up to 15 - 20% of all lung cancer patients* • % MT (sensitivity) refers to the concentration of mutant DNA in the total DNA sample Next Gen Without MX - ICP % MT 0% 20% 5% ط 1% Fail 0.5% Fail 0.1% Fail 0.05% Fail 0.01% Fail 0.005% Fail ط Next Gen With MX - ICP % MT 0% 20% 5% 1% 0.5% 0.1% 0.05% 0.01% 0.005% Fail ط ط ط ط ط ط ✔ EGFR * Present is 14 - 20% of lung cancer in Caucasians & 40 - 50% in Asian

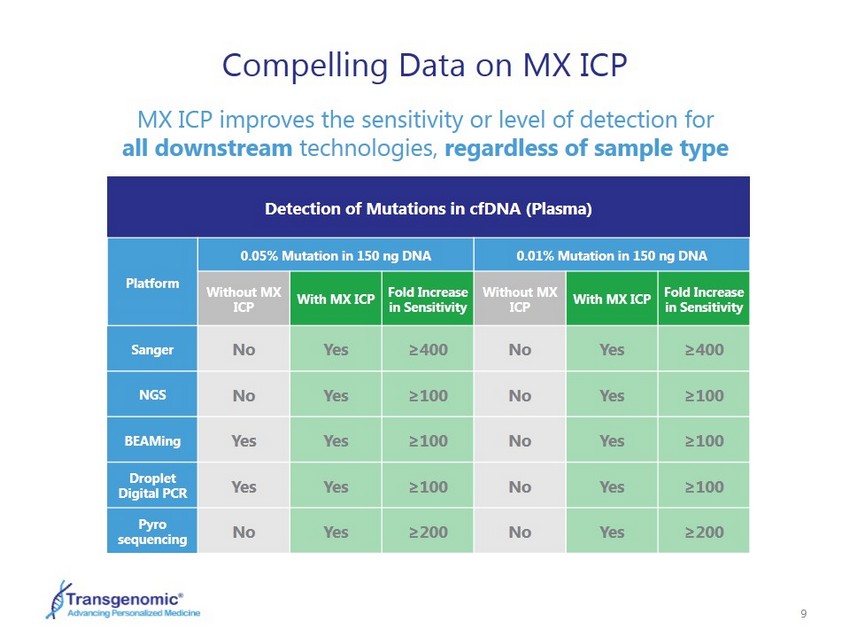

9 Detection of Mutations in cfDNA (Plasma) Platform 0.05% Mutation in 150 ng DNA 0.01 % Mutation in 150 ng DNA Without MX ICP With MX ICP Fold Increase in Sensitivity Without MX ICP With MX ICP Fold Increase in Sensitivity Sanger No Yes ≥400 No Yes ≥400 NGS No Yes ≥100 No Yes ≥100 BEAMing Yes Yes ≥100 No Yes ≥100 Droplet Digital PCR Yes Yes ≥100 No Yes ≥100 Pyro sequencing No Yes ≥200 No Yes ≥200 Compelling Data on MX ICP MX ICP improves the sensitivity or level of detection for all downstream technologies, regardless of sample type

10 MX - ICP Clinical Oncology Applications Inability to detect mutations routinely, rapidly and simply is limiting improvements to patient outcomes • Tissue biopsies – invasive, costly and ~20% fail or aren’t accurate; plasma or blood cannot be used for testing with current technology • Treatment is expensive & therapy selection is often a “best guess” • Cannot monitor patient during and after treatment for genetic changes • Identify cancers at earliest possible stage to improve clinical outcomes Challenges • Personalized treatments based current genetic profiles • Increased sensitivity, accuracy & accessibility of tests • Enable non - invasive diagnostics using liquid samples MX - ICP Solutions • Ongoing monitoring is easily implemented on all platforms

11 MX - ICP Pharma/Biotech Research Applications TBIO’s clinical trial partnerships with Pharmas may lead to development of companion diagnostics — each could generate millions of dollars of annual revenue to TBIO • Identify low level mutations reliably & repeatedly to gain faster FDA approval/better label • Accurately stratify clinical trial populations based on genetic profile – poor selection can hinder/sink clinical trials ($$) • Current technologies lack sufficient sensitivity to enable reliable diagnostics using blood samples • Identify mutations in - house cheaply & rapidly, vs. expensive outsourcing Challenges • Sample source - independent testing • Increased sensitivity & accuracy of tests • Blood - based, not biopsy - based tests MX - ICP Solutions • Easily & rapidly implementable on all platforms

12 Potential Oncology Market for Diagnostics & Monitoring • MX - ICP is easily implement ed & complementary to all sequencing equipment & assays currently used for cancer diagnosis in tissue • Estimate current tissue biopsy market at $2.5B annually • We believe the market will expand significantly once convenient, cost effective blood - based genetic profiling for patient monitoring is feasible using MX - ICP • TBIO will offer MX - ICP platform broadly & globally, as multiplexed assays for cancer diagnosis & monitoring Of the >1.6 million patients diagnosed with cancer annually, ~40% have a single tissue biopsy to confirm diagnosis but no mutation monitoring / surveillance North American Oncology Market Sources: World Health Organization (WHO), American Cancer Society, Centers for Disease Control (CDC) NSCLC 24% Melanoma 11% Pancreatic 4% Liver 10% Breast 22% Bladder 6% lymphoma/L eukemia 10% Ovarian 3% Neuroblasto ma 2% Other 8% NA Oncology Data

13 Regulatory Roadmap - MX ICP A clear path to bring MX ICP to the clinical market In discussions with FDA, expected decision before end of Q1. If positive: we plan release in Q1; if further work required, we plan to launch later in 2015 in USA. We have been advised by our regulatory consultants on a preliminary basis that they believe a 510k process will not be required for this product . Self - certification as cancer mutation amplification product will allow release in Europe and Rest of World under CE IVD regulations in Q1 2015

14 Initial MX ICP Products to be Offered in 2015 Multiple product offerings allowing broad and rapid adoption Biomarker Services for Pharma and Biotech R&D to identify and detect biomarkers (Mutations) in tissue, blood samples and any liquid such as urine Licensing agreements with life sciences & clinical oncology companies to enabling them to broadly commercially use MX ICP products & technologies on global basis Reagent kits for R&D and clinical use to enable detection of mutations on any platform in any lab

15 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Current Activities Biomarker Studies Revenues from studies & pharma/biotech using MX ICP in regulatory studies tied to their drug 1ST study under way, in discussions for more WW Kits Pre Launch Launch RUO (WW) & CE IVD (outside of USA) Q1 Preparing for Global Launch for targeted cancers & RUO Clinical Kits US In discussion/ review currently Planned launch in USA FDA roadmap enabling a rapid commercialization & adoption; Licenses Start developing As other pipelines & relationships develop Building pipeline CLIA Testing in USA Starting to develop for clinical validation Began internal review of capabilities Clinical Diagnostics As other pipelines & relationships develop CDx , identifying potential partners while showing clinical relevance of liquid biopsies Broad MX ICP Commercial Roadmap Development Stage Revenue Gen eration

16 Summary of MX - ICP Advantages Works on any sample Easily & rapidly implementable into any Laboratory Significantly improves sensitivity Enables use of liquid for treatment & monitoring Works on any current platform Enables more accurate diagnosis & patient outcomes IP P rotection

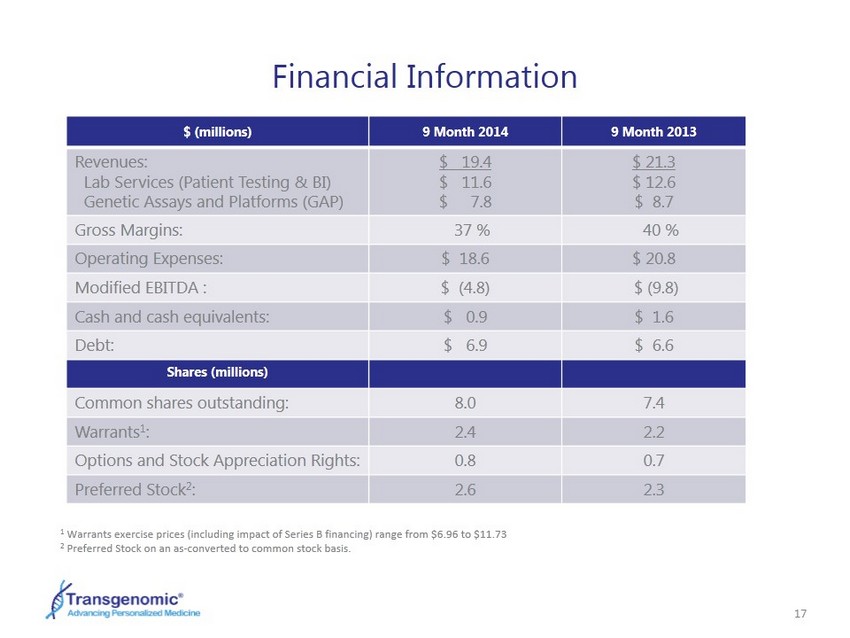

17 Financial Information 1 Warrants exercise prices (including impact of Series B financing) range from $6.96 to $11.73 2 Preferred Stock on an as - converted to common stock basis. $ (millions) 9 Month 2014 9 Month 2013 Revenues: Lab Services (Patient Testing & BI) Genetic Assays and Platforms (GAP) $ 19.4 $ 11.6 $ 7.8 $ 21.3 $ 12.6 $ 8.7 Gross Margins: 37 % 40 % Operating Expenses: $ 18.6 $ 20.8 Modified EBITDA : $ (4.8) $ (9.8) Cash and cash equivalents: $ 0.9 $ 1.6 Debt: $ 6.9 $ 6.6 Shares (millions) Common shares outstanding: 8.0 7.4 Warrants 1 : 2.4 2.2 Options and Stock Appreciation Rights : 0.8 0.7 Preferred Stock 2 : 2.6 2.3

18 Q & A