Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - Northern Power Systems Corp. | d826615dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on January 14, 2015.

Registration No. 333-201372

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT

Under

The Securities Act of 1933

NORTHERN POWER SYSTEMS CORP.

(Exact name of registrant as specified in its charter)

| British Columbia, Canada | 3511 | 98-1181717 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

Northern Power Systems Corp.

29 Pitman Road

Barre, Vermont 05641

(802) 461-2955

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Troy C. Patton

President and Chief Executive Officer

Northern Power Systems Corp.

29 Pitman Road

Barre, Vermont 05641

(802) 461-2955

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Kenneth J. Gordon, Esq. | Elliot J. Mark, Esq. | Theodore J. Ghorra, Esq. | ||

| Goodwin Procter LLP | Vice President and General Counsel | Nixon Peabody LLP | ||

| Exchange Place | Northern Power Systems Corp. | 437 Madison Avenue | ||

| 53 State Street | 29 Pitman Road | New York, New York 10022 | ||

| Boston, Massachusetts 02109 | Barre, Vermont 05641 | (212) 940-3072 | ||

| (617) 570-1000 | (802) 461-2955 |

Approximate date of commencement of proposed sale to public: as soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large Accelerated Filer | ¨ | Accelerated Filer | ¨ | |||||

| Non-Accelerated Filer | ¨ | (Do not check if a smaller reporting company) | Smaller Reporting Company | x |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment, which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated January 14, 2015

PROSPECTUS

Shares

NORTHERN POWER SYSTEMS CORP.

Common Shares

This is our initial U.S. public offering. We are offering of our common shares to be sold in this offering.

Our common shares are listed on the Toronto Stock Exchange, or TSX, under the symbol “NPS.” The last reported sale price of our common shares on TSX on , 2015 was CDN$ per share (or $ per share, based on an exchange rate of CDN$ per $1.00). We have applied to list our common shares on the NASDAQ Capital Market under the symbol “NPS.”

We are an “emerging growth company” as defined in Section 2(a)(19) of the U.S. Securities Act of 1933, as amended, and, as such, are allowed to provide in this prospectus more limited disclosures than an issuer that would not so qualify. In addition, for as long as we remain an emerging growth company, we will qualify for certain limited exceptions from investor protection laws such as the Sarbanes-Oxley Act of 2002 and the Investor Protection and Securities Reform Act of 2010. Please read “Risk Factors” and “Prospectus Summary — Emerging Growth Company under the JOBS Act.”

Investing in our common shares involves significant risks. See “Risk Factors” beginning on page 12 to read about factors you should carefully consider before buying our common shares.

| Per Share | Total | |||||||

| Offering Price |

$ | $ | ||||||

| Underwriting Discounts and Commissions(1) |

$ | $ | ||||||

| Proceeds before expenses |

$ | $ | ||||||

| (1) | We refer you to “Underwriting” beginning on page 125 of this prospectus for additional information regarding total underwriter compensation. |

We have granted the underwriters an option for a period of 30 days to purchase up to additional common shares, on the same terms and conditions set forth above.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Delivery of the shares against payment is expected to be made on or about , 2015. We anticipate delivery of our common shares will be made through the facilities of the Depository Trust Company, subject to customary closing conditions.

Needham & Company

| Craig-Hallum Capital Group | Northland Capital Markets | |

Prospectus dated , 2015

Table of Contents

| Page | ||||

| 1 | ||||

| 12 | ||||

| 34 | ||||

| 35 | ||||

| 35 | ||||

| 36 | ||||

| 37 | ||||

| 39 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

41 | |||

| 70 | ||||

| 80 | ||||

| 92 | ||||

| 98 | ||||

| 104 | ||||

| 107 | ||||

| 109 | ||||

| 112 | ||||

| 116 | ||||

| 118 | ||||

| 120 | ||||

| 125 | ||||

| 130 | ||||

| 130 | ||||

| 130 | ||||

| F-1 | ||||

Table of Contents

This summary highlights selected information contained in greater detail elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common shares. You should read this entire prospectus carefully, especially the information set forth under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes appearing at the end of this prospectus, before making an investment decision. Unless the context otherwise requires, we use the terms “we,” “us,” “the company” and “our” in this prospectus to refer to Northern Power Systems Corp. and its subsidiaries.

Company Overview

We are a growing provider of advanced renewable power creation and power conversion technology for the energy sector. We design, manufacture and service next-generation Permanent Magnet Direct-Drive, or PMDD, wind turbines for the distributed wind market, and we currently license our utility-class wind turbine platform, which uses the same PMDD technology as our distributed turbines, to large manufacturers on a global basis. We also provide technology development services for a wide variety of energy applications. With our predecessor companies dating back to 1974 and our new turbine development since 1977, we have decades of experience in developing advanced, innovative wind turbines, as well as technology for power conversion and integration with other energy applications. Since 2008, we have invested more than $130 million in developing and commercializing our wind turbine platforms.

Our PMDD wind turbine technology is based on a simplified architecture that utilizes a unique combination of a permanent magnet generator and direct-drive design. The permanent magnet generator provides higher efficiency and higher energy capture than units that utilize a traditional gearbox design. Importantly, the direct-drive design of our turbine utilizes significantly fewer moving parts than traditional geared turbines, which increases reliability due to reduced maintenance and downtime costs.

The substantial majority of our current sales are in the small wind subset of the distributed wind market, which commonly consists of turbines with rated capacities of 500 kW output or smaller. Based on the number of turbines that we have sold and installed to date, we consider ourselves a leader in the U.S., U.K. and Italy in the larger energy output sub-segment of this market, which comprises turbines ranging in size from 50 kW to 100 kW. Since the introduction of our second generation 60 kW and 100 kW PMDD wind turbines in late 2008, we have shipped over 400 of these turbines and as of September 30, 2014, we have orders approximating $33 million in backlog for our second and third generation turbines. To date, these shipped units have run for over six million hours in the aggregate. Our distributed wind customers include financial investors and project developers which deploy our turbines to provide power for farms, remote villages, schools, small businesses, and U.S. military installations.

We are advancing our efforts to sell our utility-class wind turbines. We have developed a 2 MW turbine platform with three wind-speed regime variants based upon our PMDD technology, of which the 2.3 MW variant is certified to International Electrotechnical Commission standard 61400-1 by Det Norske Veritas, a globally recognized certification firm. In 2013, we launched a strategy of partnering with large-scale manufacturers in developing regions, starting with a multi-billion dollar (in revenue) industrial equipment manufacturer based in Brazil (WEG Equipamentos Elétricos S.A., or WEG). We have licensed our technology to WEG exclusively for Brazil, but retain our right to sell Northern Power-branded utility-class turbines produced by WEG on a rest-of-world basis. WEG has executed a backlog of orders comprising over 300 MW of turbine installations for the sale of turbines built using our design, eleven of which have been installed to date in Brazil. We are also seeking a limited number of similar partnership structures in other regional geographies, through which we intend that other large-scale manufacturers will produce and sell turbines for their domestic market and make available to us

1

Table of Contents

the supply of turbines to expand our regional ability to sell such turbines. We believe this approach will allow us to participate in the utility-class wind turbine market without a significant investment in capital equipment that would otherwise be required.

Our direct sales strategy for utility-class wind turbines is directed primarily towards North America and focuses on underserved, smaller scale wind projects such as those generating 50 MW or less. As part of our market entry plan, we intend to be a minority investor in the development of a limited number of these wind power projects to ensure initial sales of our utility-class turbines. After a number of these installations, we plan to participate in the same utility wind marketplace solely by selling the turbines without providing any investment. We also intend to expand our sales and marketing capabilities to execute this strategy.

In addition to wind turbine development, we provide technology development services to customers to develop products and technology for a variety of complex energy applications, including energy storage, microgrids, and grid stabilization. While the customer owns the developed technology for a limited field of use, we typically maintain a license for all other applications and all other markets. While we do not expect material revenue from our development services, these services fund the expansion of our intellectual property portfolio. Through providing certain of such services, we have identified a series of non-wind market applications for our FlexPhase power converters. As a result, we intend to invest in expanding our sales of this product offering.

For the nine months ended September 30, 2014 and 2013 and the year ended December 31, 2013, we generated $42.6 million, $11.6 million, and $20.6 million in revenue, respectively. For the nine months ended September 30, 2014 and 2013 and the year ended December 31, 2013 we incurred net losses of $5.5 million, $9.3 million and $14.1 million, respectively.

Industry Overview and Market Opportunity

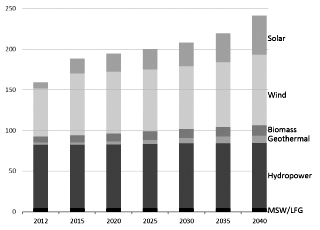

Wind power has been one of the fastest growing sources of electricity generation globally over the past decade. According to the International Energy Agency, in its 2013 Annual Report, wind power currently provides nearly 4% of global electricity demand with installations in over 100 countries. In the same report, the IEA observed that wind power deployment currently exceeds 318 gigawatts, or GW, of installed capacity globally, which the Global Wind Energy Council, or GWEC, in its Global Wind Statistics 2013 report notes has increased more than 250% since 2008. GWEC further reports in its Global Wind Report-Annual Market Update 2013 that the new installations added approximately 12.5% to the installed wind base in 2013 and have averaged approximately 21% per year over the last ten years. In its latest Technology Roadmap: Wind Energy (2013 edition), the IEA set targets for wind power to satisfy 15-18% of worldwide electrical power demand by 2050, up previously from 12%.

The top ten wind power producing countries accounted for approximately 85% of year-end global capacity as of December 31, 2013, but at least 85 countries had commercial wind activity that year, with at least 71 having more than 10 MW of reported capacity, and 24 had more than 1 GW in operation. The Renewable Energy Policy Network reports that annual growth rates of cumulative wind power capacity have averaged 21.4% since the end of 2008, and global capacity has increased eightfold over the past decade. The annual worldwide small wind market is forecast to grow from 144.2 MW in 2014 to 668.1 MW in 2023, representing projected cumulative revenue from installations of $647.7 million and $2.6 billion, respectively, according to Navigant Research’s Global Distributed Generation Deployment Forecast (3Q 2014). Our key target wind power markets include the E.U., the U.S., and Brazil.

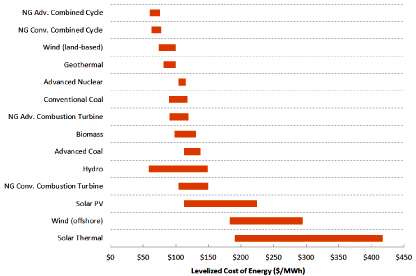

The growth in the industry is largely attributable to increasing cost competitiveness with other power generation technologies and growing public and governmental support for renewable energy driven by concerns regarding the security of conventional fossil fuel energy supply, as well as the environmental benefits of wind power.

2

Table of Contents

National targets for wind and other renewables are also driven by each individual country’s efforts to produce energy domestically, increase employment, build domestic industries, and replace other forms of power generation, such as coal and nuclear.

The majority of this wind power expansion is currently installations of utility-class wind turbine farms. These farms generate electricity to feed into the electrical grid, supplying a utility company with energy that can be sold to customer. The utilities that purchase such power still have additional costs to deliver the electricity to the source of use. As such, utility-class power costs are measured as only costs to generate power. Based on our current strategy of pursuing direct sales of utility-class turbines into underserved, smaller scale wind projects and pursuing other sales of these turbines through strategic partners such as WEG, we estimate that our current target addressable market in utility wind is approximately 30% of the global onshore utility wind market.

Wind power also is expanding in the distributed wind market. This market is made up of turbines connected on the customer side of the power meter, designed to meet onsite electrical loads as well as to feed into distribution or microgrids, thereby reducing energy costs at the site of use. The comparable cost of distributed wind energy is the cost for landed power, which is the cost for other forms of energy generation to be produced as well as delivered to the location of consumption.

In the distributed wind markets in which we currently sell our products, a variety of incentives have promoted the introduction of wind power while greatly reducing the payback period for investments in wind turbines for property owners and businesses. Such incentives take the form of feed-in-tariffs, tax breaks or cash incentives to purchasers of wind power systems. As a result, the effective price or cost to the user is greatly reduced making the return on investment much more attractive and lowering the time period it takes to generate enough energy to recover the total cost of the system. While many customers are attracted to renewable energy for its positive environmental attributes, the ultimate decision often centers on a cost/benefit and investment return analysis. Governmental and private (utility-sponsored) incentives play an important role by lowering the effective cost to the end user of a wind power system, thereby making a purchase more attractive.

Our Products and Services

We have three operating business lines, which include product sales and service, technology licensing, and technology development, in addition to a shared services segment. In our product sales and service line, we offer wind turbines serving global distributed wind and utility wind markets featuring our next generation Permanent Magnet Direct-Drive technology coupled with full power conversion and 24/7 fleet monitoring. We also sell power converters based on our proprietary FlexPhase technology for complex energy applications ranging from 500 kW to over 5 MW. Our technology licensing line is focused on licensing certain of our wind turbine and power converter technology to global manufacturers for specific geographies and applications. We have licensed certain elements of our wind turbine technology to two large global manufacturers. Our technology development business line utilizes our experienced team of 39 engineers to provide technology development services that are targeted to the global wind power market as well as other advanced energy markets. Applications of our technology development services have included energy storage, microgrids, and grid stabilization and have been delivered to a wide range of industries.

Our Strategy

We are focused on being a leader in the commercialization of distributed-class wind turbines, expanding our presence in the utility wind markets, and strategically leveraging our proprietary technology by expanding our product offerings in power creation and power conversion. Key elements of our strategy include:

| • | Continuing to drive sales growth in distributed wind, by improving the economics of our product offerings for our customers and deepening our relationships with our existing customers as well as adding new customers. |

3

Table of Contents

| • | In addition to selling utility-class turbines through our strategic partners based on our licensed technology and designs, directly selling utility-class turbines in underserved, smaller scale wind projects where we can take advantage of our industry relationships. |

| • | Continuing to build upon our intellectual property portfolio as we pursue further wind turbine enhancements and create new designs. |

| • | Continuing to customize our proprietary power conversion technology for developing applications and market our products to pursue revenue opportunities outside of use in wind turbines. |

Our Competitive Strengths

We believe that the following competitive strengths enable us to compete effectively in the wind power technology and renewable energy industries and to capitalize on the growth of those industries:

| • | A broad portfolio of intellectual property including our highly efficient, but low cost, permanent magnet generator, our modular turbine design, our full power converter, and our voltage stabilization capabilities as well as our experienced team comprised of 39 engineers. |

| • | Wind turbines designed for high availability, high energy output and low energy production cost per kWh in a wide range of wind conditions throughout the world. |

| • | Since the introduction of our second generation 60 kW and 100 kW PMDD wind turbines in late 2008, shipment of over 400 of these turbines, which have run for over six million hours in the aggregate and have averaged 98-99% availability for grid-connected turbines. |

| • | Deep customer relationships with a number of our customers, each of which has extensive experience developing wind and other renewable energy projects in Europe. |

| • | A validated strategy of entering into geographic partnerships that expand our participation in the global utility-class wind turbine market. |

| • | An integrated development and manufacturing capability at our facility in Barre, Vermont, which has approximately $100 million in annual revenue capacity at current prices, has strong production capabilities and rigorous system-driven manufacturing processes and quality control. |

| • | An experienced management team that has successfully expanded our operations and increased our capacity and business through organic growth. |

Emerging Growth Company under the JOBS Act

As a company with less than $1.0 billion in revenues during our last fiscal year, we qualify as an “emerging growth company” under the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of reduced reporting requirements and is relieved of certain other significant requirements that are otherwise generally applicable to public companies. As an emerging growth company:

| • | we may present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations; |

| • | we are exempt from the requirement to obtain an attestation and report from our auditors on whether we maintained effective internal control over financial reporting under the Sarbanes-Oxley Act of 2002; |

| • | we are permitted to provide less extensive disclosure about our executive compensation arrangements; and |

| • | we are not required to give our shareholders non-binding advisory votes on executive compensation or golden parachute arrangements. |

4

Table of Contents

We may take advantage of these provisions for up to five years if we continue to be an emerging growth company. We would cease to be an emerging growth company if we have more than $1.0 billion in annual revenues, have more than $700 million in market value of our shares held by non-affiliates or issue more than $1.0 billion of non-convertible debt over a three-year period. We may choose to take advantage of some but not all of these reduced burdens. We have elected to provide two years of audited financial statements and two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations. We have also availed ourselves of the exemption from disclosing certain executive compensation information in this prospectus pursuant to Title 1, Section 102 of the JOBS Act. Additionally, we have elected to take advantage of the extended transition period provided in Section 7(a)(2)(B) of the U.S. Securities Act, as amended, or the Securities Act, for complying with new or revised accounting standards that have different effective dates for public and private companies until the earlier of the date we (i) are no longer an emerging growth company or (ii) affirmatively and irrevocably opt out of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Summary of Critical Accounting Policies” for a further discussion of this exemption.

Risks Affecting Our Business

Our business, financial condition, results of operations and prospects are subject to numerous risks and uncertainties. These risks include, but are not limited to, the following:

| • | We have incurred significant operating losses since inception and may not be able to achieve, or subsequently maintain, profitability. |

| • | The distributed wind market is in the early stages of development and its future is uncertain. If the market is not as large as we expect or we are unable to compete effectively in the distributed wind market, our business and operating results could be harmed. |

| • | We are in the early stages of product and service commercialization, and as such, our products and services may not generate sufficient revenue or profitability. |

| • | Our sales cycles are complex and lengthy and the timing of our distributed wind installations are subject to seasonal variations, each of which may impact operating results from quarter to quarter and make results difficult to predict. |

| • | We maintain a sizable backlog and the timing of our conversion of revenue out of backlog is uncertain. |

| • | Because we depend on a limited number of single source suppliers for certain components, third-party business and relationship interruptions could harm our operations. |

| • | If we do not successfully execute on our utility-class sales commercialization strategy, we may be unable to effectively grow this business. |

| • | Strategic partnerships are essential to our business growth, particularly in the utility wind market, and the inability to secure these relationships could adversely impact revenue and operations. |

| • | If we fail to expand effectively in international markets, our revenue and business could be harmed. |

| • | Problems with quality or performance in our products or products manufactured by our licensees could have a negative impact on our relationships with customers and our reputation and cause reduced market demand for our products. |

| • | Our customers’ inability to obtain financing to make purchases from us or maintain their businesses could harm our business, and negatively impact revenue, results of operations, and cash flow. |

| • | We may not be able to secure additional financing in a timely manner, on favorable terms, or at all, to meet our future capital needs, which could impair our ability to execute on our business plan. |

| • | We are an “emerging growth company,” and the reduced reporting requirements applicable to emerging growth companies may make our common shares less attractive to investors. |

5

Table of Contents

| • | We face intense competition and, if we are unable to compete effectively, our business, financial condition and results of operations could be harmed. |

| • | New or existing technologies could gain wide adoption and supplant our services and features and harm our revenue and financial results. |

For a complete description of the risks and uncertainties affecting us, please carefully review the Risk Factors set forth in in this registration statement under the heading “Risk Factors” beginning on page 12.

Company Information

We were originally incorporated in Delaware on August 12, 2008 as Wind Power Holdings, Inc., or WPHI.

On August 15, 2008, WPHI’s wholly-owned subsidiary CB Wind Acquisition, Inc., or CBWA, acquired the wind turbine business of Distributed Energy Systems Corp., which was operating under the name Northern Power Systems. Northern Power Systems had commenced business in 1974 as North Wind Power Company in Warren, Vermont, but entered into bankruptcy proceedings along with its parent company Distributed Energy Systems in 2008. Following the acquisition, CBWA changed its name to Northern Power Systems, Inc. Northern Power Systems, Inc. also has two wholly-owned subsidiaries, Northern Power Systems AG, a Switzerland corporation, and Northern Power Systems S.r.l., an Italy limited liability company.

In February 2014, WPHI filed a Registration Statement on Form 10 (File No. 001-36317) with the Securities and Exchange Commission to register the shares of common stock of WPHI, which became effective on June 3, 2014.

On April 16, 2014, we completed a reverse takeover transaction, or RTO, with Mira III Acquisition Corp., a Canadian capital pool company incorporated in British Columbia, Canada, or Mira III, whereby all of the equity securities of WPHI were exchanged (as described below) for common shares and restricted voting shares of Mira III, which became the holding company of our corporate group. In connection with the RTO, Mira III changed its name to Northern Power Systems Corp. and the historical consolidated financial statements of WPHI included in this prospectus became the historical consolidated financial statements of Northern Power Systems Corp. Also in connection with the RTO, we completed a CDN$24.5 million private placement whereby we issued 6,125,000 subscription receipts.

Immediately prior to the RTO, the shares of common stock of WPHI, or WPHI Shares, were consolidated on a 1.557612-to-1 basis and then all of WPHI’s outstanding senior secured convertible notes automatically converted into an aggregate of 3,384,755 WPHI Shares. Additionally, each subscription receipt issued in the private placement converted into one WPHI Share.

In connection with the RTO, each WPHI Share held by U.S. residents who are accredited investors were exchanged for 0.72742473 of our restricted voting shares and 0.27257527 of our common shares. All other issued and outstanding WPHI Shares were exchanged for our common shares on a 1-to-1 basis. Additionally, all outstanding options to purchase WPHI Shares were exchanged and cancelled for options to purchase our common shares on a 1-to-1 basis with terms substantially the same to the options being exchanged.

Upon completion of the RTO, Northern Power Systems Corp. succeeded to WPHI’s status as a reporting company under the U.S. Securities Exchange Act of 1934, as amended, which permits us to continue to prepare our financial statements in accordance with U.S. generally accepted accounting principles. In connection with the RTO, our common shares were listed on the Toronto Stock Exchange, or TSX, under the symbol “NPS.”

Our principal executive office is located at 29 Pitman Road, Barre, Vermont, 05641. Our telephone number at our principal executive office is (802) 461-2955. Our website address is www.northernpower.com. You may

6

Table of Contents

access our periodic reports and other SEC filings on EDGAR or on our website, which also provides links to our Canadian securities filings on SEDAR and the SEC filings of our predecessor reporting company Wind Power Holdings, Inc. on EDGAR. This is a textual reference only. We do not incorporate the information on, or accessible through, our website into this prospectus, and you should not consider any information on, or that can be accessed through, our website as part of this prospectus.

We use various trademarks and trade names in our business, including Northern Power Systems, Northern Power, NPS, FlexPhase and SmartView, some of which we have registered in the U.S. and in various other countries. This prospectus also contains trademarks and trade names of other businesses that are the property of their respective holders. We have omitted the ® and ™ designations, as applicable, for the trademarks we name in this prospectus.

7

Table of Contents

THE OFFERING

| Common shares offered by us |

shares |

| Common shares to be outstanding immediately after this offering |

shares |

| Option to purchase additional shares |

We have granted the underwriters an option, exercisable for 30 days after the date of this prospectus, to purchase up to an additional common shares from us. |

| Use of Proceeds |

We expect our net proceeds from this offering will be $ million (or $ million if the underwriters exercise their option to purchase additional shares in full), based on an assumed offering price of $ per share and after deducting estimated underwriting discounts and commissions and estimated offering expenses. We currently intend to use the net proceeds from this offering primarily for the commercialization of our sales of utility-class wind turbines, including potential minority investment into the development of a limited number of wind farms, and also for general corporate purposes, including working capital. For a more complete description of our intended use of proceeds from this offering, see “Use of Proceeds on page 35.” |

| Toronto Stock Exchange symbol |

“NPS” |

| Proposed NASDAQ Capital Market trading symbol |

“NPS” |

| Risk Factors |

You should read “Risk Factors” beginning on page 12 for a discussion of factors to consider carefully before deciding to invest in our common shares. |

The number of our common shares to be outstanding after this offering is based on 22,764,353 common shares outstanding as of November 30, 2014 and excludes:

| • | 2,047,020 common shares issuable upon exercise of share options outstanding as of November 30, 2014 at a weighted average exercise price of $2.06 per share; and |

| • | 1,905,131 common shares reserved for future issuance under our 2014 Stock Option and Incentive Plan, and any future increase in shares reserved for issuance under such plan. |

Unless otherwise indicated, all information in this prospectus assumes:

| • | an offering price of $ per share of our common shares, which is the last reported sale price of our common shares on the TSX on , 2015 (based on an average exchange rate of CDN$ per $1.00); |

| • | no exercise of the underwriters’ over-allotment option to purchase additional common shares; and |

| • | no issuance or exercise of shares options on or after November 30, 2014. |

8

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL AND OTHER DATA

The following table summarizes our consolidated financial data. We have derived the summary consolidated statements of operations data for the years ended December 31, 2013 and 2012 and the consolidated balance sheet data as of December 31, 2013 and 2012 from our audited consolidated financial statements included elsewhere in this prospectus. The summary consolidated statements of operations data for the nine months ended September 30, 2014 and 2013 and the consolidated balance sheet data as of September 30, 2014 have been derived from our unaudited interim consolidated financial statements included elsewhere in this prospectus. The unaudited interim consolidated financial data have been prepared on the same basis as the audited consolidated financial statements and, in the opinion of management, reflect all adjustments, which consist only of normal recurring adjustments, necessary to fairly reflect our consolidated results of operations data for the nine months ended September 30, 2014 and 2013 and our consolidated financial position as of September 30, 2014. Our historical results are not necessarily indicative of the results that may be expected in the future, and the results for the nine months ended September 30, 2014 are not necessarily indicative of operating results to be expected for the full year ending December 31, 2014 or any other period. The following summary consolidated financial data should be read in conjunction with “Capitalization,” “Selected Historical Consolidated Financial and Other Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes included elsewhere in this prospectus.

| Year Ended December 31, |

Nine Months Ended September 30, |

|||||||||||||||

| 2013 | 2012 | 2014 | 2013 | |||||||||||||

| (In thousands, except share and per share data) | (unaudited) | |||||||||||||||

| Consolidated Statement of Operations Data: |

||||||||||||||||

| REVENUES: |

||||||||||||||||

| Product |

$ | 19,142 | $ | 16,509 | $ | 37,484 | $ | 9,858 | ||||||||

| License |

— | 10,000 | 2,541 | — | ||||||||||||

| Design service |

522 | — | 1,063 | 522 | ||||||||||||

| Service |

934 | 891 | 1,470 | 1,220 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total revenues |

20,598 | 27,400 | 42,558 | 11,600 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| COSTS OF REVENUE AND OPERATING EXPENSES: |

||||||||||||||||

| Cost of product revenues |

16,346 | 15,968 | 31,154 | 8,905 | ||||||||||||

| Cost of service and design service revenue |

3,012 | 3,205 | 3,171 | 2,207 | ||||||||||||

| Sales and marketing |

2,977 | 2,902 | 2,668 | 2,044 | ||||||||||||

| Research and development |

4,238 | 4,260 | 3,537 | 2,845 | ||||||||||||

| General and administrative |

6,938 | 7,126 | 6,793 | 4,729 | ||||||||||||

| Assets held for sale loss |

768 | — | — | — | ||||||||||||

| Restructuring charges |

70 | 2,145 | — | 23 | ||||||||||||

| Impairment of certain long-lived assets |

— | 1,451 | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total costs of revenue and operating expense |

34,349 | 37,057 | 47,323 | 20,753 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss from operations |

(13,751 | ) | (9,657 | ) | (4,765 | ) | (9,153 | ) | ||||||||

| Change in fair value of warrants |

172 | 4,545 | — | 173 | ||||||||||||

| Interest income |

— | — | 5 | — | ||||||||||||

| Interest expense |

(514 | ) | (88 | ) | (317 | ) | (230 | ) | ||||||||

| Other income (expense) — net |

— | — | 41 | (36 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss before provision for income taxes |

(14,093 | ) | (5,200 | ) | (5,036 | ) | (9,246 | ) | ||||||||

| Provision for income taxes |

35 | 1,014 | 441 | 13 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net Loss |

(14,128 | ) | (6,214 | ) | (5,477 | ) | (9,259 | ) | ||||||||

| Other comprehensive income (loss) |

||||||||||||||||

| Foreign currency translation adjustment |

— | (2 | ) | — | — | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Comprehensive Loss |

$ | (14,128 | ) | $ | (6,216 | ) | $ | (5,477 | ) | $ | (9,259 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss applicable to common shareholders |

$ | (17,815 | ) | $ | (12,388 | ) | $ | (5,477 | ) | $ | (12,946 | ) | ||||

| Net loss per share |

||||||||||||||||

| Basic and diluted |

$ | (4.60 | ) | $ | (821.92 | ) | $ | (0.29 | ) | $ | (15.21 | ) | ||||

| Weighted average number of common shares outstanding |

||||||||||||||||

| Basic and diluted |

3,872,895 | 15,072 | 18,919,146 | 850,950 | ||||||||||||

| Pro forma net loss per share |

||||||||||||||||

| Basic and diluted(1) |

$ | (0.29 | ) | |||||||||||||

| Pro forma weighted-average number of common shares outstanding |

||||||||||||||||

| Basic and diluted(1) |

18,919,146 | |||||||||||||||

| (1) | Pro forma basic and diluted net loss per share has been computed to give effect to the conversion of all outstanding shares of our Class B restricted voting common shares into 7,840,582 shares of our voting common shares, effected on November 30, 2014. |

9

Table of Contents

Share-based compensation included in the accompanying statements of operations data above was as follows:

| Year Ended December 31, |

Nine Months Ended September 30, |

|||||||||||||||

| 2013 | 2012 | 2014 | 2013 | |||||||||||||

| (In thousands) | (unaudited) | |||||||||||||||

| Share-based compensation expense: |

||||||||||||||||

| Cost of revenue |

$ | 71 | $ | 143 | $ | 72 | $ | 29 | ||||||||

| Sales and Marketing |

43 | 87 | 68 | 12 | ||||||||||||

| Research and development |

68 | 18 | — | 37 | ||||||||||||

| General and administrative |

519 | 723 | 606 | 186 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total share-based compensation |

701 | 971 | 746 | 264 | ||||||||||||

| Restructuring charges |

75 | 522 | — | 23 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total share-based compensation |

$ | 776 | $ | 1,493 | $ | 746 | $ | 287 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

The following table presents our key operating and financial metric for the years and interim periods presented:

| Year Ended December 31, |

Nine Months Ended September 30, |

|||||||||||||||

| 2013 | 2012 | 2014 | 2013 | |||||||||||||

| (In thousands) | (unaudited) | |||||||||||||||

| Other financial and operational data: |

||||||||||||||||

| Non-GAAP Adjusted EBITDA |

$ | (11,227 | ) | $ | (3,953 | ) | $ | (3,210 | ) | $ | (8,131 | ) | ||||

Consolidated balance sheet data are presented below:

| As of December 31, | As of September 30, 2014 | |||||||||||||||||

| 2013 | 2012 | Actual | Pro forma(1) | Pro forma, as adjusted(2) | ||||||||||||||

| (In thousands) | (unaudited) | |||||||||||||||||

| Consolidated Balance Sheets: |

||||||||||||||||||

| Cash |

$ | 4,534 | $ | 4,456 | $ | 16,318 | $ | 16,318 | ||||||||||

| Accounts receivable |

1,961 | 1,161 | 5,850 | 5,850 | ||||||||||||||

| Property, plant and equipment — net |

1,414 | 1,900 | 1,624 | 1,624 | ||||||||||||||

| Asset held for sale |

1,300 | 2,077 | — | — | ||||||||||||||

| Working capital (deficiency) |

(4,134 | ) | 3,592 | 14,922 | 14,922 | |||||||||||||

| Total assets |

27,545 | 20,026 | 43,030 | 43,030 | ||||||||||||||

| Convertible preferred stock |

— | 135,073 | — | — | ||||||||||||||

| Total shareholders’ equity (deficiency) |

$ | (11,402 | ) | $ | 4,246 | $ | 16,359 | $ | 16,359 | |||||||||

| (1) | Reflects the conversion of all outstanding shares of our Class B restricted voting common shares into 7,840,582 shares of our voting common shares, effected on November 30, 2014. |

| (2) | Reflects the pro forma adjustments described above and gives further effect to the sale of common shares in this offering at an assumed initial public offering price of $ per share, after deducting estimated underwriting discounts and commissions and estimated offering expenses. |

10

Table of Contents

Non-GAAP Financial Measures

Non-GAAP Adjusted EBITDA

To provide investors with additional information regarding our financial results, we have disclosed in the table below and within this prospectus non-GAAP adjusted EBITDA, a non-GAAP financial measure. We have provided a reconciliation below between non-GAAP adjusted EBITDA and net loss, the most directly comparable GAAP financial measure.

We have included non-GAAP adjusted EBITDA in this prospectus because it is a key measure used by our management to evaluate our operating performance, generate future operating plans and make strategic decisions. Accordingly, we believe that non-GAAP adjusted EBITDA provides useful information to investors and others in understanding and evaluating our operating results in the same manner as our management and board of directors.

While we believe that this non-GAAP financial measure is useful in evaluating our business, this information should be considered as supplemental in nature and is not meant as a substitute for the related financial information prepared in accordance with GAAP. Some of these limitations are:

| • | although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future; |

| • | non-GAAP adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs; |

| • | non-GAAP adjusted EBITDA does not include the impact of share-based compensation; |

| • | non-GAAP adjusted EBITDA does not reflect the impact of income taxes that may represent a reduction in cash available to us; and |

| • | other companies, including companies in our industry, may calculate non-GAAP adjusted EBITDA differently or not at all, which reduces its usefulness as a comparative measure. |

We believe it is useful to exclude non-cash charges, such as depreciation and amortization and share-based compensation, from our non-GAAP adjusted EBITDA because the amount of such expenses in any specific period may not directly correlate to the underlying performance of our business operations.

Because of the aforementioned limitations, you should consider non-GAAP adjusted EBITDA alongside other financial performance measures, including net loss, cash flow metrics and our financial results presented in accordance with GAAP. The following table presents a reconciliation of net loss to non-GAAP adjusted EBITDA for each of the years and interim periods indicated:

| Year Ended December 31, |

Nine Months Ended September 30, |

|||||||||||||||

| 2013 | 2012 | 2014 | 2013 | |||||||||||||

| (In thousands) | (unaudited) | |||||||||||||||

| Reconciliation of non-GAAP adjusted EBITDA |

||||||||||||||||

| Net loss |

$ | (14,128 | ) | $ | (6,214 | ) | $ | (5,477 | ) | $ | (9,259 | ) | ||||

| Provisions for income taxes |

35 | 1,014 | 441 | 13 | ||||||||||||

| Interest expense |

514 | 88 | 317 | 230 | ||||||||||||

| Depreciation and amortization |

985 | 1,726 | 763 | 771 | ||||||||||||

| Stock-based compensation |

701 | 971 | 746 | 264 | ||||||||||||

| Change in fair value of warrant |

(172 | ) | (4,545 | ) | — | (173 | ) | |||||||||

| Non cash restructuring charge |

70 | 1,512 | — | 23 | ||||||||||||

| Impairment charge and loss on disposal property & equipment |

— | 1,495 | — | — | ||||||||||||

| Loss on asset held for sale |

768 | — | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Non-GAAP Adjusted EBITDA |

$ | (11,227 | ) | $ | (3,953 | ) | $ | (3,210 | ) | $ | (8,131 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

11

Table of Contents

You should carefully consider all of the information in this prospectus, including the risks and uncertainties described below, before making an investment in our common shares. Any of the following risks and uncertainties could have a material and adverse effect on our business, financial condition, results of operations and prospects. Additionally, the market price of our common shares could decline due to any of these risks and uncertainties, and you may lose all or part of your investment.

Risk Factors Related to Our Business

We have incurred significant operating losses since inception and may not be able to achieve, or subsequently maintain profitability.

With the exception of the quarter ended September 30, 2014, we have incurred operating losses since our inception, including a net loss of $5.5 million for the nine months ended September 30, 2014 and an accumulated deficit of $156.8 million as of September 30, 2014. We may not be able to continue to generate operating income and we expect to continue to incur net losses for the foreseeable future.

Our ability to be profitable in the future depends upon continued demand for our distributed-class wind and power technology products and services and for our utility-class wind turbine platform. In addition, our profitability will be affected by, among other things, our ability to develop and commercialize next generation product offerings, enhance existing products and expand licenses of our technology into new markets. We expect to incur significant operating costs relating to our research and development initiatives for our new and existing products, and for the expansion of our sales and marketing operations as we add additional sales and business development personnel and increase our marketing efforts. Furthermore, we may incur significant losses in the future for a number of reasons, including the other risks described in this prospectus, and we may encounter unforeseen expenses, difficulties, complications, delays and other unknown events. We may fail to generate revenues in the future. If we cannot attract a significant number of purchasers, we will not be able to generate any significant revenues or income. If we continue to incur significant operating losses and fail to generate significant revenues, we may go out of business because we will not have the money to pay our ongoing expenses. As a result, we cannot assure you that we will be able achieve or sustain profitability in the future.

The distributed wind market is in the early stages of development and its future is uncertain. If the market is not as large as we expect or we are unable to compete effectively in the distributed wind market, our business and operating results could be harmed.

A substantial portion of our revenues have been and continues to be derived from sales of our distributed-class wind turbines. We anticipate that sales of these distributed-class wind turbines will continue to account for a significant portion of our revenue for the foreseeable future. The distributed wind market is in the early stages of development. Any catastrophic product failure, significant damage, or injury that could arise in this market, whether or not related to our products, may have a disproportionately negative impact on public perception of the efficiency, safety or general merits of distributed-class wind turbines, which could have an adverse effect on our revenues and our business.

We may suffer reputational harm or other damages as a result of unreliable wind resource data. In the distributed wind market, there is at present insufficient reliable data for the wind resource available by geographic location at the tower heights of our turbines. In siting these turbines, purchasers may make decisions based upon insufficiently precise data, which could result in turbines being sited in geographic locations that do not provide optimal wind conditions for the production of electric power. As a result, purchasers may not receive the expected economic benefits of ownership of wind turbines that we produce and our reputation could suffer. We also may be liable for liquidated damages, warranty claims or other costs if our turbines do not perform to contractual requirements or to customer expectations.

We experience significant competition in the distributed wind market, particularly in Italy and the U.K. Our primary competitor in the distributed wind market is Endurance Wind Power but we also compete with several

12

Table of Contents

smaller providers of distributed-class wind products. The wind turbines being offered by competitors are offered with lower upfront pricing. In early 2014, we introduced a lower cost but higher energy output product in the market to compete more effectively on price while still maintaining high durability and reliability. We may experience lower gross margins than forecast if we cannot maintain a price premium for our products and may be unable to successfully compete against lower-cost competitors. We may also face increased competition in the future, including from large, multinational companies with significant resources who may also be able to scale production and provide similar products at lower costs.

In addition, if our competitors market products that are more effective, safer or less expensive than our current or other future products, if any, or that reach the market sooner we may not achieve commercial success or substantial market penetration. Products developed by our competitors may render our existing technology or any future product candidates obsolete. Any decrease in a sales of our distributed-class wind turbines would have an adverse effect on our business, financial condition and results of operations.

We are in the early stages of product and service commercialization, and as such, our products and services may not generate sufficient revenue or profitability.

We may not be able to replicate the positive results and high performance demonstrated in prototypes or in small scale pilot production as we scale up for commercial production. Even as we continue to develop and commercialize our products, they may not be adopted in the market or perform as expected. No assurance can be given that our expenditures on research and development will achieve the desired results in our target markets.

We are also planning to re-enter the market for utility-class wind turbine sales by selling turbines that have been built by our strategic partner WEG Equipamentos Elétricos S.A., or WEG, or future partners based on our turbine platform that we have licensed to them. There can be no assurance that our efforts to re-enter this market will be successful. We have not commenced any significant sales efforts to date and therefore cannot judge whether our efforts to re-enter this market will be successful or that we will be able to compete in this market against larger and more established companies. There can be no assurance that we will in the future achieve significant revenues or profitable operations from sales of our utility-class wind turbines.

The market for licensing wind turbine technology is relatively nascent and our experience in this market is limited. The size and timing of our revenue from consummating and delivering licensing arrangements is difficult to predict and substantial efforts may be invested into a licensing arrangement, which may never be realized. Given our limited experience in obtaining and delivering successful license agreements, our estimates of future revenues may be incorrect. In addition, companies interested in licensing our wind turbine technology could require different variations of that technology, which would require additional investment to develop and could further delay our ability to reach profitability.

Our sales cycles are complex and lengthy and the timing of our distributed wind installations are subject to seasonal variations, each of which may impact operating results from quarter to quarter and make results difficult to predict.

The size and timing of our revenue from sales of products to our customers is difficult to predict and is dependent on many factors, including market conditions, customer financing, permitting and weather conditions, all of which may combine to result in high variability in revenue trends and projections. Our sales efforts in distributed wind markets often require us to educate our customers about the use and benefits of our products, including their technical and performance characteristics. Customers typically undertake a significant evaluation process that has generally resulted in a lengthy sales cycles for us, typically many months. Furthermore, installation of our turbines is generally under the direction and control of end users or third-party contractors. The regulatory approval, permitting, construction, startup and operation of turbine sites may involve unanticipated changes or delays that could negatively impact our business and our results of operations and cash flows. The long sales cycles require us to delay revenue recognition until certain milestones or technical or implementation requirements have been met. Although we saw significant expansion in orders for our distributed-class wind turbines in 2013 and 2014, we could continue to experience challenges in obtaining distributed-class wind turbine orders and converting them into revenue.

13

Table of Contents

Wind turbine sales in the regions in which we currently sell our turbines are affected by seasonal variations and the timing of government incentive structures. To satisfy the delivery schedules, we manufacture and sell most of our wind turbines during the second and third quarters of each year for delivery and installation in the third and fourth quarters. This schedule is due primarily to variations in the weather conditions in the northern areas where we supply most of our wind turbines.

We maintain a sizable backlog and the timing of our conversion of revenue out of backlog is uncertain.

Our backlog is subject to unexpected adjustments and cancellations and thus may not be timely converted to revenue in any particular fiscal period or be indicative of our actual operating results for any future period. Orders in 2010, 2011, and 2012 were lower than our original operating plan. In addition, in both 2011 and 2012, we experienced significant order cancellation rates driven by our customers’ inabilities to obtain planning consent, grid interconnect or financing for proposed projects. Although we have not experienced cancellations in 2013 and 2014, there can be no assurances that customers will not face similar challenges in the future and cancel some or all of their orders. We have managed past order cancellations by curtailing production at our Barre, Vermont facility and closely monitoring inventory levels to conserve cash, but this left underutilized manufacturing overhead in product cost, which lowered our gross margins. Our inability to convert backlog into revenue, whether or not due to factors within our control, could adversely affect our revenue and profitability.

Because we depend on a limited number of single source suppliers for certain components, third-party business and relationship interruptions could harm our operations.

We currently depend on single source suppliers for certain precisely manufactured components in our turbines. These components may not be readily available on a cost-effective basis from other sources or on short notice, as some are custom-designed for our turbines. As a result, there can be no assurance that a continuing source of supply of these components will be available on a timely basis or on commercially viable terms in the future. In addition, our supply chain could be negatively impacted in the event one of our key single source suppliers has a business interruption due to credit issues or other factors. Any interruptions in our third-party manufacturing suppliers or supply chain, or the refusal or inability by such parties to produce necessary product components, could have an adverse impact on our business or financial results of operations.

In late November 2014, the primary supplier of blades for our distributed-class turbines briefly ceased operations. Although we have worked with this supplier to restart operations and believe that we have secured a near-term supply of blades that will be adequate for current orders, there can be no assurance that this supplier will be able to manufacture blades on a timely basis to satisfy customer requirements until we can complete qualification of new, dependable sources of blades that meet our performance specifications and quality requirements. Failure to deliver blades on a timely basis will have an adverse effect on our revenues for the quarters ending December 31, 2014 and March 31, 2015, and could cause us to incur contractual damages if the delay causes us to be in breach of our agreements with customers.

Our ability to fully realize license revenues from our wind technology licensing business is also tied to our ability to facilitate access to suppliers for our licensees that will support their economically viable production of wind turbines. Failure of our suppliers to deliver components at required costs or significant fluctuations in commodity pricing could delay or reduce license payments on which we are critically dependent.

If we do not successfully execute on our utility-class sales commercialization strategy, we may be unable to effectively grow this business.

A central part of our strategy is to be a direct seller of utility-class wind turbines. This strategy is complex and requires that we successfully complete many tasks, including obtaining a stable supply of turbine components, adequate working capital finance for our supplier production and shipment of turbines, and additional strategic manufacturing partners in the utility wind space; building our competencies to source, logistically deliver, and

14

Table of Contents

service turbines; and managing our existing relationship with WEG. A number of these tasks we must complete simultaneously, along with the continued operation of our core distributed wind business. In addition, in order to effectively execute this strategy we need to be able to successfully influence wind farm owners to select our turbines for installation and ensure that adequate financing is available to them to support the installation of our turbines. Furthermore, we are at risk to be able to deliver turbines at a cost at which we can create a profitable business based upon our dependence on our suppliers’ costs to us. If we are unable to effectively implement or coordinate the implementation of these multiple tasks or we are unable to source turbine components economically, we may be unable to compete effectively in this market and our financial results may suffer.

Strategic partnerships are essential to our business growth, particularly in the utility wind market, and the inability to secure these relationships could adversely impact revenue and operations.

The technology licensing and design services portions of our business are structured to provide value to potential customers by offering technology licenses and engineering consulting services. This business model derives its highest value by obtaining multiple globally diversified strategic technology partnerships, which include licensing our technology and product designs, providing design and development services, and offering service support for turbines manufactured and deployed by the strategic partner. We have entered into a strategic partnership with WEG under which WEG can sell utility-class turbines built based on our design, however, there can be no assurance that any similar transactions will be consummated in the future or that an adequate volume of business can be closed to achieve our forecasts. If these transactions are not consummated in a timely and adequate manner, we may be required to reduce personnel and could ultimately be forced to cease operations of this part of our business. Expansion of product sales is dependent on our ability to effectively create global partnerships to help sell our products in developing markets as well as gain access to lower cost manufacturing of products. If these partnerships cannot be identified and effectively developed and executed, our ability to expand the utility-class wind turbine market and reduce the cost of turbines will be impacted. Additionally, WEG and other large companies we may partner with in the future will compete with Enercon GmbH, Siemens Wind Power, and Xinjiang Goldwind Science & Technology Co., Ltd., or Goldwind Corporation. If our existing or prospective partners are, or believe they are, unable to achieve adequate revenues to merit entering into a license with us, our ability to achieve profitability will likely be delayed. Additionally, we compete against a number of companies including American Superconductor Corporation, Vensys Energy AG, which is division of Goldwind Corporation, and aerodyn Energiesysteme GmbH in licensing technology to these equipment manufacturers. If we are unable to differentiate our technology for licensing, our revenue and operations may be materially harmed.

If we fail to expand effectively in international markets, our revenue and business will be harmed.

Successful continued advancement and implementation of our plan to sell our products in Europe is a strategic priority. European markets, particularly Italy and the U.K., are currently leading growth in the purchase and installation of distributed-class wind turbines. We expect the regulatory policies, which have driven the growth of these two markets, to diminish over time and we therefore will need to expand into new markets to supplement our sales in Italy and the U.K. Developing the European market and expanding into new markets for our turbines are expected to entail a number of risks, including the need for appropriate management of our efforts, successful negotiation on terms advantageous to us of agreements facilitating our profitable expansion of this business, including logistics, installation and commissioning, and post-sales support service efforts. Sophisticated engineering, procurement and construction providers are moving into the distributed wind market and demanding that wind turbine manufacturers such as us provide a turnkey offering that includes supply, installation and long-term support of the turbines. While we have experience in turbine supply, we have limited experience in installation and long-term, international support. While we have experienced some success in winning orders, we may not be able to provide the services required to fulfill them. Failure to obtain or effectively execute a large volume of orders in Italy and the U.K. and failure to expand into new markets would have an adverse effect on our ability to reach profitability.

We also are seeking to enter into international strategic partnerships, including in countries such as Turkey, Poland, South Korea, and India. These strategic partnerships, if successful, will include licensing our technology,

15

Table of Contents

providing design, development and support services both remotely and locally within the region, and facilitating of global supply chain development. There can be no assurance that we will be able to establish these strategic partnerships, or that they will be profitable if consummated. International business development efforts generally include risks relating to management of currency exchange rate exposure, international enforceability of contracts, potential exposure of intellectual property to misuse or misappropriation, compliance and operational challenges that may delay or add complexity to sales and support efforts, and the potential of local taxation above that which is currently forecast. If we are unsuccessful in managing these challenges or performing under these partnerships if we are able to secure them, our efforts to sell our turbines and technology licensing and services on a global basis may expend our resources without significant contribution to the results of our operations and may not contribute to the value of our business.

Problems with quality or performance in our products or products based on our technology that are manufactured by our licensees could have a negative impact on our relationships with customers and our reputation and cause reduced market demand for our products.

Customers for our products regularly expect vendors to have a history of reliable production or creditworthy warranty coverage of meaningful duration. From commencement of our current operations in August 2008, we have received over 550 orders for distributed-class wind turbines to date with more than 400 shipped through September 2014. Of the units shipped, over 300 have been commissioned and are producing power at customer sites. This short history of operating in the field means that it will be some time before we will be able to determine the durability and reliability of our products after sale. In 2009 and 2010, we incurred substantial warranty expense with respect to our 100 kW turbines. We cannot assure you that similar issues or new issues will not occur in the future in our distributed-class wind turbines or in our other products. If our products are not sufficiently durable and reliable or otherwise perform below expectations, we could incur additional substantial warranty expenses, we could be required to pay liquidated or other contractual damages, our reputation could be harmed and our revenues could decline.

Problems with the quality or performance of the wind turbines manufactured by WEG or future partners could likewise adversely affect us due to warranty claims or other contractual damages, and could negatively impact our ability to re-enter the market for utility-class wind turbine sales. Issues with turbines manufactured by our partners could result in significant negative publicity and materially and adversely affect the marketability of our products and our reputation.

Any defect, underperformance or problem with our wind turbines or any perception that our products may contain errors or defects, or claims related to errors or defects, may adversely impact our customer relationships and harm our reputation and credibility, resulting in a decrease in market demand for our wind turbines, decrease in our revenue, increase in our expenses and loss of market share.

Our customers’ inability to obtain financing to make purchases from us or maintain their businesses could harm our business, and negatively impact revenue, results of operations, and cash flow.

Some of our customers require substantial financing to finance their business operations, including capital expenditures on new equipment and equipment upgrades, and to make purchases from us. The potential inability of these customers to access the capital needed to finance purchases of our products and to meet their payment obligations to us could adversely impact our financial condition and results of operations. If our customers become insolvent due to market and economic conditions or otherwise, it could have an adverse impact on our business, financial condition and results of operations.

If we fail to successfully develop and introduce new products and technologies, our business, financial condition and results of operations could be adversely affected.

Our success depends, in part, upon our ability to anticipate industry evolution and introduce or acquire new products technologies to keep pace with technological developments. However, we may not be able to develop,

16

Table of Contents

introduce, acquire and integrate new products and technologies in response to our customers’ changing requirements in a timely manner or on a cost-effective basis, or that sufficiently differentiate us from competing solutions such that customers choose to purchase our solutions. If any of our competitors implements new technologies before we are able to implement them or better anticipates the innovation opportunities in related industries, those competitors may be able to provide more effective or more cost-effective solutions than ours. In addition, we may experience technical problems and additional costs as we introduce new products and technologies. If any of these problems were to arise, our business, financial condition and results of operations could be adversely affected.

If we fail to effectively expand our manufacturing, production and service capacity, our business and operating results could be harmed.

In connection with our planned expansion in Europe, we have scaled and expanded manufacturing and production in our Barre, Vermont facility, as well as implemented a European service deployment model. There is risk in our ability to continue to effectively scale production processes and effectively manage our supply chain requirements. If we are unable to maintain our internal manufacturing and production capacity for our turbines in a timely, cost-effective and efficient manner, we may be unable to further expand our business, decrease costs or become profitable. Our ability to further expand production capacity efficiently and on schedule is subject to significant challenges, risks and uncertainties, any one of which could substantially increase costs and delay or reduce production. If we are unable to achieve expected production yields and decrease costs, we could experience considerable operating losses.

Our current service structure is primarily supported by our Barre, Vermont headquarters, although we have added and are continuing to expand our European service offerings. If we are unable to expand our European service offerings in a timely and cost effective manner, we may be unable to expand our business, be subject to increased warranty obligations and risk our ability to become profitable.

There are a number of risks associated with our international operations that could harm our business.

We sell products and provide services on a global basis and plan to expand into additional countries. Our ability to grow in international markets could be harmed by a number of factors, including:

| • | changes in political and economic conditions and potential instability in certain regions; |

| • | currency control and repatriation issues; |

| • | changes in regulatory requirements or in foreign policy, including the adoption of domestic or foreign laws, regulations and interpretations detrimental to our business; |

| • | changes to regulatory incentives to purchase wind turbines or produce or utilize wind energy; |

| • | possible increased costs and additional regulatory burdens imposed on our business; |

| • | burdens of complying with a wide variety of laws and regulations; |

| • | difficulties in managing the staffing of international operations; |

| • | increased financial accounting and reporting burdens and complexities; |

| • | laws and business practices favoring local competitors; |

| • | terrorist attacks and security concerns in general; |

| • | changes to tax laws, compliance costs and challenges to our tax positions that may have adverse tax consequences to us; |

| • | changes, disruptions or delays in shipping or import/export services; |

17

Table of Contents

| • | reduced protection of our intellectual property rights; and |

| • | unfavorable tax rules or trade barriers, including import duties or other import/export restrictions. |

In addition, we conduct certain functions, including customer sales and service operations, in regions outside of the U.S. We are subject to both U.S. and local laws and regulations applicable to our offshore activities, and any factors which reduce the anticipated benefits associated with providing these functions outside of the U.S., including cost efficiencies and productivity improvements, could harm our business.

Our international expansion efforts are impacted by foreign currency fluctuations, which could harm our profitability.

As part of our international expansion, we currently expect that a substantial amount of our business in 2015 could be non-U.S. dollar denominated sales transactions, all of which we currently expect to be euro-denominated transactions, while the majority of our costs will continue in U.S. dollars. This can result in a significant proportion of our receivables being denominated in foreign currencies. In addition, we expect to be entering into extended duration operations and maintenance contracts, which would obligate us to perform services in the future based upon currently negotiated non-U.S. dollar denominated pricing terms. Although we plan to pursue economic hedging strategies, including increasing our euro-denominated costs and consideration of effective financial hedging strategies, there can be no assurance that we can execute these strategies to effectively control the economic exposure of currency movements. Negative movements in the exchange rate between foreign currencies and the U.S. dollar could have an adverse effect on our revenues and delay our achieving profitability.

Due to our large customer concentration, a loss of one or more of our significant customers could harm our business, and negatively impact revenue, results of operations, and cash flow.

We are dependent on a relatively small number of customers for our sales, and a small number of customers have historically accounted for a material portion of our revenue. Our two largest customers accounted for approximately 25% of revenue in 2013, and our three largest customers accounted for approximately 35% of revenue for the nine months ended September 30, 2014. For the near future, we may continue to derive a significant portion of our net sales from a small number of customers. Accordingly, loss of a significant customer or a significant reduction in pricing or order volume from a significant customer, could materially reduce net sales and operating results in any reporting period.

Failure to comply with the requirements of certain grant programs may result in a significant financial penalty.