Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MOLINA HEALTHCARE, INC. | d846332d8k.htm |

| Exhibit 99.1

|

33rd Annual J. P. Morgan

Healthcare Conference

J. Mario Molina, MD

President & Chief Executive Officer

January 12-15, 2015 / San Francisco, California

|

|

Cautionary Statement

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995: This slide presentation and our accompanying oral remarks contain numerous “forward-looking statements” regarding, without limitation: our future business plans; the expected start dates of our Medicare-Medicaid Plan (MMP) implementations; our expansion plans in Florida; our expansion plans and expected operational start date in Puerto Rico; our Marketplace plans’ growth and operations; the A?ordable Care Act annual health industry fee and its expected reimbursement by states, including any tax impact; and various other matters. All of our forward-looking statements are subject to numerous risks, uncertainties, and other factors that could cause our actual results to di?er materially. Anyone viewing or listening to this presentation is urged to read the risk factors and cautionary statements found under Item 1A in our annual report on Form 10?K, as well as the risk factors and cautionary statements in our quarterly reports and in our other reports and lings with the Securities and Exchange Commission and available for viewing on its website at www.sec.gov. Except to the extent otherwise required by federal securities laws, we do not undertake to address or update forward-looking statements in future lings or communications regarding our business or operating results.

© 2015 MOLINA HEALTHCARE, INC.

2

|

|

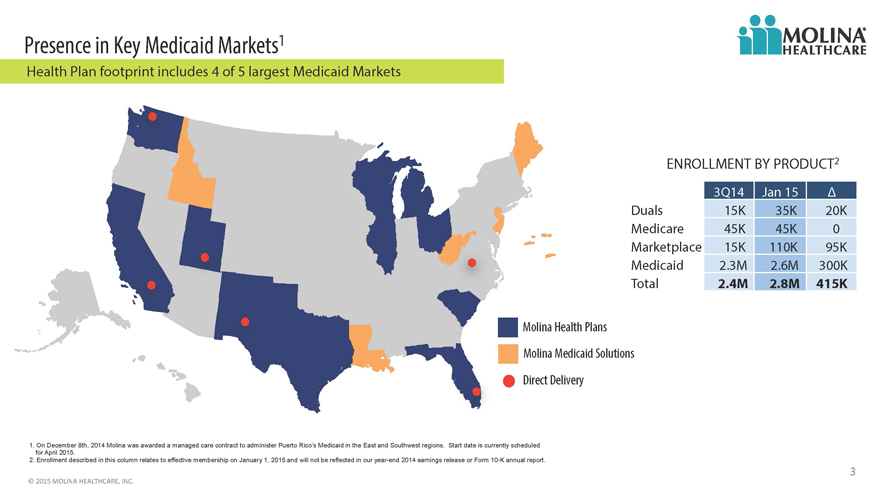

Presence in Key Medicaid Markets1

Health Plan footprint includes 4 of 5 largest Medicaid Markets

Molina Health Plans

Molina Medicaid Solutions

Direct Delivery

ENROLLMENT BY PRODUCT2

3Q14 Jan 15 Ä

Duals 15K 35K 20K

Medicare 45K 45K 0

Marketplace 15K 110K 95K

Medicaid 2.3M 2.6M 300K

Total 2.4M 2.8M 415K

1. On December 8th, 2014 Molina was awarded a managed care contract to administer Puerto Rico’s Medicaid in the East and Southwest regions. Start date is currently scheduled for April 2015.

2. Enrollment described in this column relates to effective membership on January 1, 2015 and will not be reflected in our year-end 2014 earnings release or Form 10-K annual report.

©

2015

MOLINA

HEALTHCARE,

INC.

3

|

|

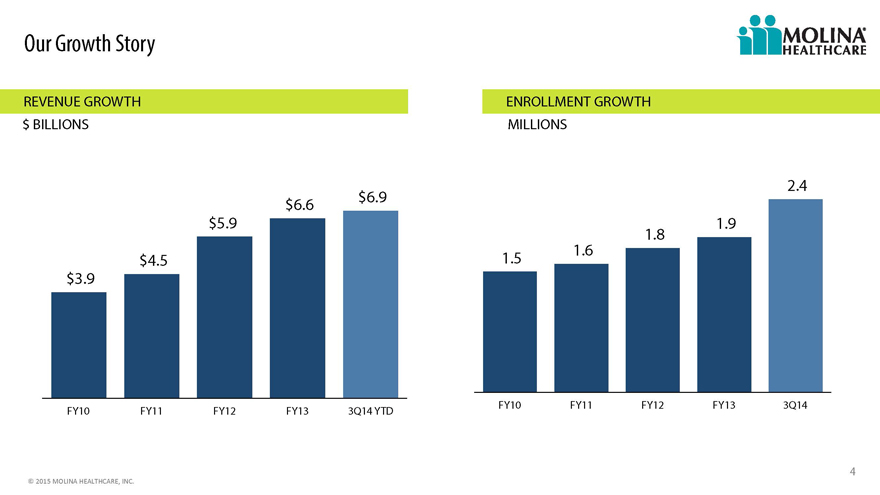

Our Growth Story

REVENUE GROWTH

$ BILLIONS

$6.9

$6.6

$5.9

$4.5

$3.9

FY10 FY11 FY12 FY13 3Q14 YTD

ENROLLMENT GROWTH

MILLIONS

2.4

1.9

1.8

1.6

1.5

FY10 FY11 FY12 FY13 3Q14

©

2015

MOLINA

HEALTHCARE,

INC.

4

|

|

Managing Our Growth

2013 INCUBATE

Acquire new business Design systems

Test readiness

Invest in infrastructure New business:

SC, Duals, Marketplace, Medicaid Expansion, NM & FL re-procurements, WI Medicare

2014

TRANSITION & GROW

Transition members into model of care Address pent-up demand Adjust premiums Process transition issues Begin leveraging infrastructure Invest to prepare for 2015 revenue

2015

DEVELOP & GROW

Transition members into model of care Address pent-up demand Adjust premiums

Improve systems

Ensure equitable rates

Leverage administrative costs

2016+ FORTIFY

Improve model of care

Enhance systems Improve margins

©

2015

MOLINA

HEALTHCARE,

INC.

5

|

|

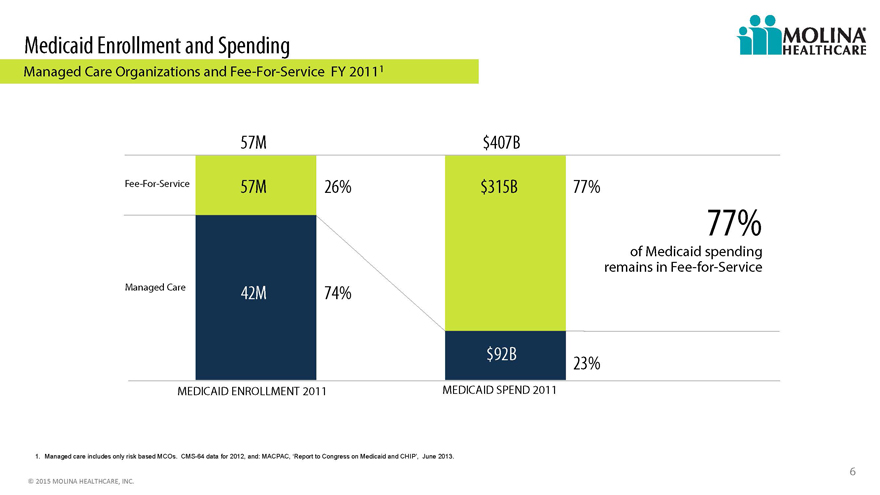

Medicaid Enrollment and Spending

Managed Care Organizations and Fee-For-Service FY 20111

57M $407B

Fee-For-Service 57M 26% $315B 77%

77%

of Medicaid spending

remains in Fee-for-Service

Managed Care

42M 74%

$92B

23%

MEDICAID ENROLLMENT 2011 MEDICAID SPEND 2011

1. Managed care includes only risk based MCOs. CMS-64 data for 2012, and: MACPAC, ‘Report to Congress on Medicaid and CHIP’, June 2013.

©

2015

MOLINA

HEALTHCARE,

INC.

6

|

|

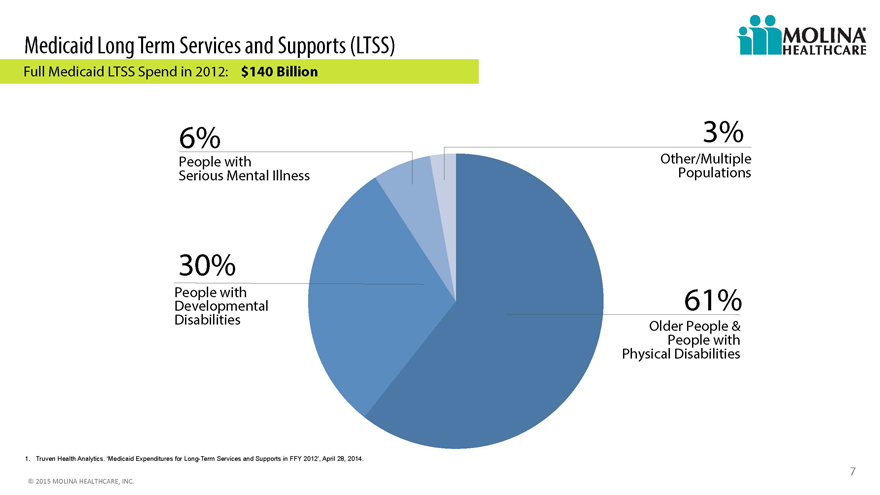

Medicaid Long Term Services and Supports (LTSS)

Full Medicaid LTSS Spend in 2012: $140 Billion

6% 3%

People with Other/Multiple

Serious Mental Illness Populations

30%

People with

Developmental 61%

Disabilities

Older People &

People with

Physical Disabilities

1. Truven Health Analytics. ‘Medicaid Expenditures for Long-Term Services and Supports in FFY 2012’, April 28, 2014.

©

2015

MOLINA

HEALTHCARE,

INC.

7

|

|

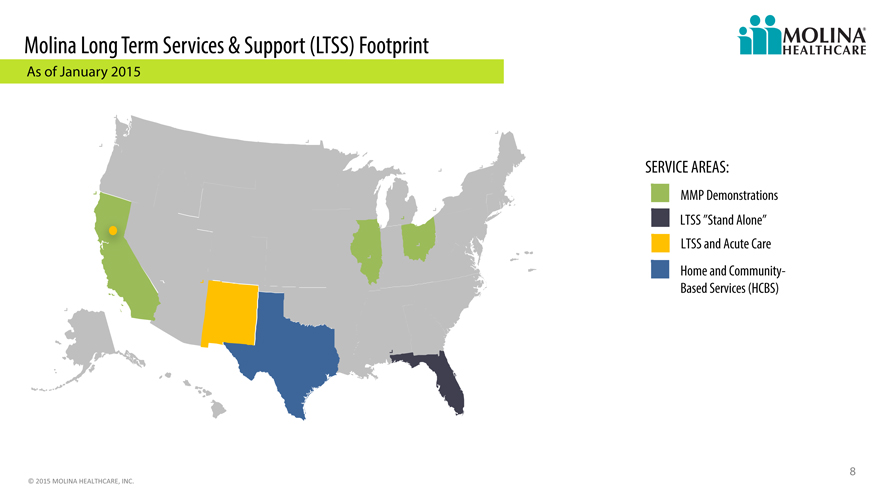

Molina Long Term Services & Support (LTSS) Footprint

As of January 2015

SERVICE AREAS:

MMP Demonstrations

LTSS “Stand Alone”

LTSS and Acute Care

Home and Community-

Based Services (HCBS)

8

©

2015

MOLINA

HEALTHCARE,

INC.

|

|

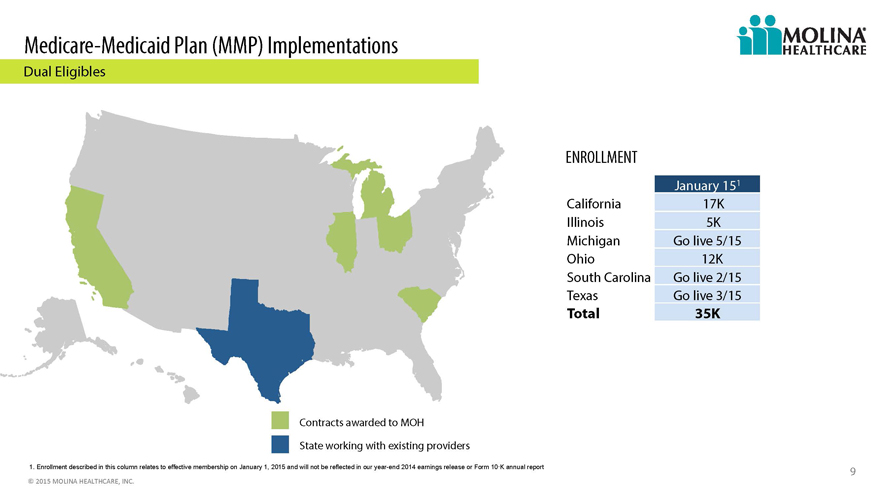

Medicare-Medicaid Plan (MMP) Implementations

Dual Eligibles

ENROLLMENT

January 151

California 17K

Illinois 5K

Michigan Go live 5/15

Ohio 12K

South Carolina Go live 2/15

Texas Go live 3/15

Total 35K

Contracts awarded to MOH

State working with existing providers

1.Enrollment described in this column relates to effective membership on January 1, 2015 and will not be reflected in our year-end 2014 earnings release or Form 10-K annual report

©

2015

MOLINA

HEALTHCARE,

INC.

9

|

|

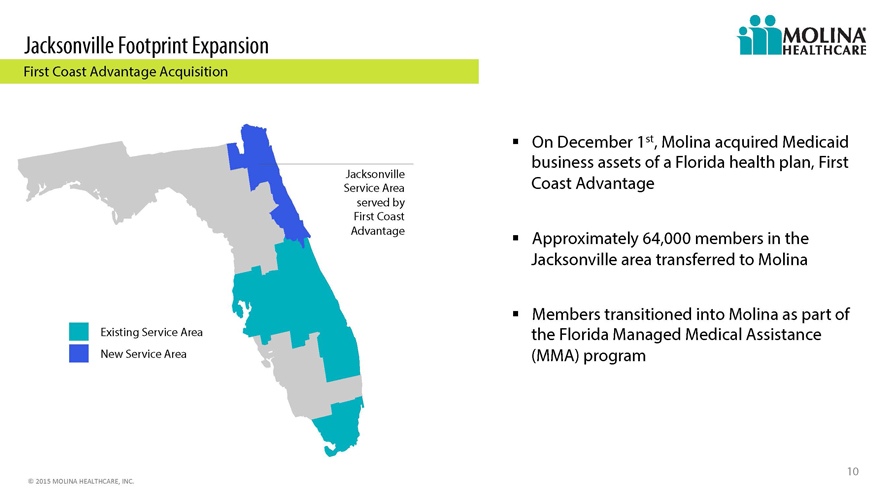

Jacksonville Footprint Expansion

First Coast Advantage Acquisition

Jacksonville

Service Area

served by

First Coast

Advantage

Existing Service Area

New Service Area

On December 1st , Molina acquired Medicaid

business assets of a Florida health plan, First

Coast Advantage

Approximately 64,000 members in the

Jacksonville area transferred to Molina

Members transitioned into Molina as part of

the Florida Managed Medical Assistance

(MMA) program

©

2015

MOLINA

HEALTHCARE,

INC.

10

|

|

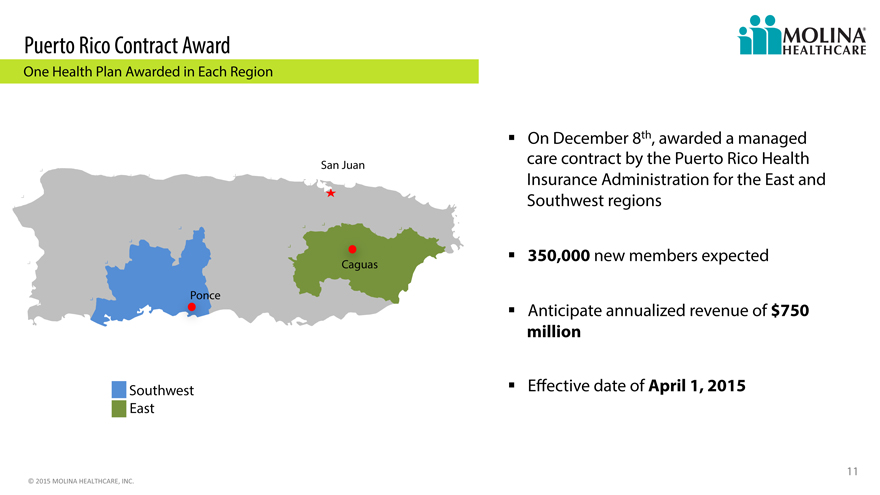

Puerto Rico Contract Award

One Health Plan Awarded in Each Region

San Juan

Ponce

Southwest

East

On December 8th, awarded a managed care contract by the Puerto Rico Health Insurance Administration for the East and Southwest regions

350,000 new members expected

Anticipate annualized revenue of $750 million

Effective date of April 1, 2015

©

2015

MOLINA

HEALTHCARE,

INC.

11

|

|

Marketplace Year Two

2014 pricing assumed higher medical costs and

utilization compared to existing membership

Higher premiums

Low enrollment (17K)

2015 focused on competitive pricing in existing

markets

Premiums adjusted downward in nearly

every market

Significant sign up activity during open

enrollment (94K)

©

2015

MOLINA

HEALTHCARE,

INC.

12

|

|

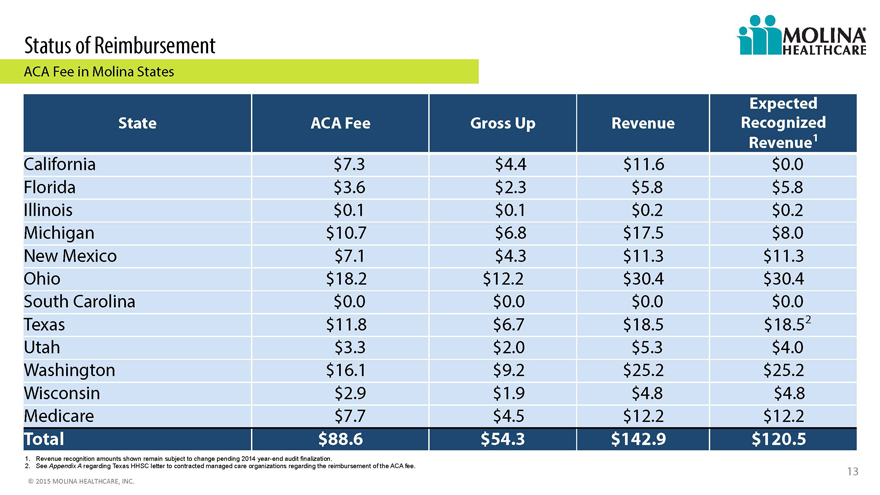

Status of Reimbursement

ACA Fee in Molina States

Expected

State ACA Fee Gross Up Revenue Recognized

Revenue1

California $7.3 $4.4 $11.6 $0.0

Florida $3.6 $2.3 $5.8 $5.8

Illinois $0.1 $0.1 $0.2 $0.2

Michigan $10.7 $6.8 $17.5 $8.0

New Mexico $7.1 $4.3 $11.3 $11.3

Ohio $18.2 $12.2 $30.4 $30.4

South Carolina $0.0 $0.0 $0.0 $0.0

Texas $11.8 $6.7 $18.5 $18.52

Utah $3.3 $2.0 $5.3 $4.0

Washington $16.1 $9.2 $25.2 $25.2

Wisconsin $2.9 $1.9 $4.8 $4.8

Medicare $7.7 $4.5 $12.2 $12.2

Total $88.6 $54.3 $142.9 $120.5

Revenue recognition amounts shown remain subject to change pending 2014 year-end audit finalization.

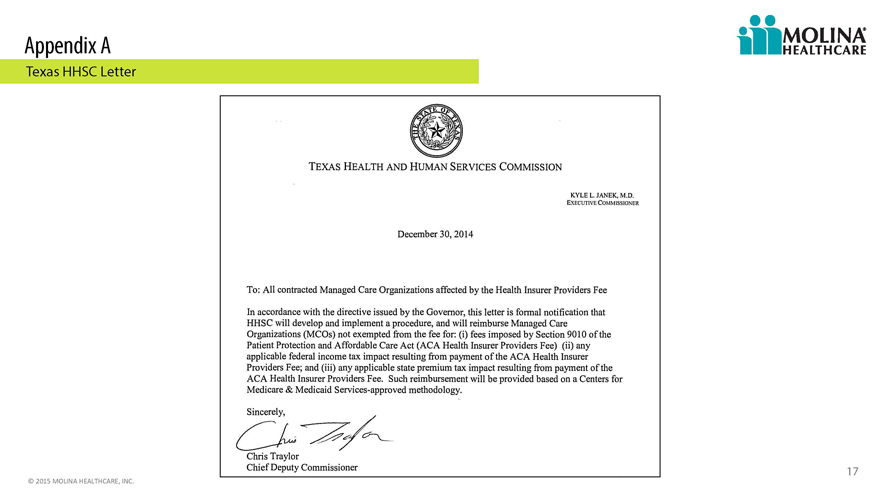

See Appendix A regarding Texas HHSC letter to contracted managed care organizations regarding the reimbursement of the ACA fee.

©

2015

MOLINA

HEALTHCARE,

INC.

13

|

|

The Year Ahead

TAILWINDS

Medicaid expansion

Footprint includes 4 of 5 largest Medicaid

markets

Uniquely positioned to capture Dual

Eligible enrollment

Marketplace open enrollment

HEADWINDS

Delay in state program implementations

ACA reimbursement

Medical cost pressure associated with new

contracts/populations

Flu season

©

2015

MOLINA

HEALTHCARE,

INC.

14

|

|

Investment Highlights

Attractive sector growth prospects driven by government policies and economic conditions

Focus on government-sponsored health care programs

Proven flexible health care services portfolio (risk-based, fee-based and direct delivery)

Diversified geographic exposure in 16 states with significant presence in high growth regions

Scalable administrative efficiencies stemming from centralized and standardized functions

Seasoned management team with strong track record of delivering earnings growth

Over 30 years of experience

©

2015

MOLINA

HEALTHCARE,

INC.

15

|

|

Breakout

©

2015

MOLINA

HEALTHCARE,

INC.

16

|

|

Appendix A

Texas HHSC Letter

©

2015

MOLINA

HEALTHCARE,

INC.

17