Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MEDASSETS INC | d850716d8k.htm |

Performance Improvement

for Healthcare Providers

J. P. Morgan Healthcare Conference

January 13, 2015

Exhibit 99.1

Confidential. Property of MedAssets. MedAssets® is a registered trademark of MedAssets, Inc.

© 2013 MedAssets, Inc. All rights reserved. |

| 2

Safe Harbor/Non-GAAP Disclosures

Safe Harbor Statement

This presentation contains forward-looking statements within the meaning of the

Securities Act of 1933 and the Securities Exchange Act of 1934, as amended

by the Private Securities Litigation Reform Act of 1995, and include the

intent, belief or current expectations of the Company and its management team with respect to the Company’s

future

business

operations

that

include,

but

are

not

limited

to:

2014

financial

guidance,

revenue

growth

and

other

financial projections and forecasts. Any forward-looking statements are not

guarantees of future performance, involve risks and uncertainties, and

actual results may differ materially from those contemplated by such forward-

looking statements. Important factors currently known to management that could

cause actual results to differ materially from those contemplated by the

forward-looking statements in this presentation include, but are not limited

to: failure to realize improvements in performance, efficiency and

profitability; failure to complete anticipated sales under negotiations;

failure to successfully implement revenue backlog; lack of revenue growth; client losses; and

adverse developments with respect to the operation or performance of the

Company’s business units or the market price of its common stock.

Additional factors that could cause actual results to differ materially from those

contemplated within this presentation can also be found in the Company’s Risk

Factor disclosures in its Form 10-K for the year ended December 31, 2013

filed with the Securities and Exchange Commission and available at

http://ir.medassets.com. The Company disclaims any responsibility to update any

forward-looking statements. Use of Non-GAAP Financial Information

In order to provide investors with greater insight, promote transparency and allow

for a more comprehensive understanding of the information used by management

in its financial and operational decision-making, the Company

supplements its condensed consolidated financial statements presented on a GAAP

basis herein with certain non- GAAP financial information, including:

gross fees; gross administrative fees; revenue share obligation; EBITDA;

adjusted EBITDA; adjusted EBITDA margin; adjusted net income; diluted adjusted EPS;

and free cash flow. Reconciliations of these non-GAAP measures to their

most directly comparable GAAP measures, where possible, are included in the

financial schedules in the Appendix of this presentation, as well as in the Company’s quarterly

financial press releases and related Form 8-K filings with the SEC. This

information can be accessed for free by visiting www.medassets.com or

www.sec.gov. |

3

Insight:

Predictive,

proprietary

data

analytics and intelligence

Impact:

Technology

and

services

to

improve provider performance

through total cost and revenue

management

Underpinned by great process:

Process improvement and clinical

resource utilization solutions

Highly recurring revenue model:

SaaS technologies and market-

leading GPO

MedAssets Business Overview

Headquarters:

Alpharetta, GA

(north Atlanta)

Clients:

•

4,400+ hospitals

(Includes 1,500+ organizations

serviced by Sg2)

•

122,000+ non-acute providers

NASDAQ:

MDAS

Founded:

1999

Unique mix of insight & execution to drive Total Performance

for Healthcare Providers

Financials:

Net revenue*

~$718M

Adjusted EBITDA*

~$236M

Market cap

~$1.2B

Enterprise value

~$2.1B

* FY’14 guidance (updated 10.29.14) |

4

Evolving Market Dynamics Offer Opportunities

Linking insight and high impact, high ROI execution to deliver sustainable value

•

Market insight to adapt to

competitive, regulatory and

reimbursement dynamics

•

Comprehensive

assessment process to

target most critical needs

•

Invest in programmatic

support of provider

executive agendas

•

Extending into broader

cost, revenue and

process opportunity

•

Evolution to value-

based reimbursement

•

High impact, proven

solutions remain relevant

in any environment

•

Unique technology assets

•

Long track record of

sustainable value for

clients

Rapidly

changing

client

needs

Evolving

MDAS

business

model

Consistent

focus on value

creation |

5

Performance Partner Delivering High ROI Results

Manages

$51 Billion

in spend

Touches

$400+

Billion

in patient

revenue

Delivered

$3+

Billion

from

documented

and guaranteed

savings

# of

clients

SCM Segment

3,200+

RCM Segment

2,700+

Total Acute Care

Hospitals

Total Non-Acute

Providers

4,400+

122,000+

Delivers

significantly

more

than

$3.5

Billion

in

annual client

value

Proven delivery of measurable financial impact across market-leading footprint

|

6

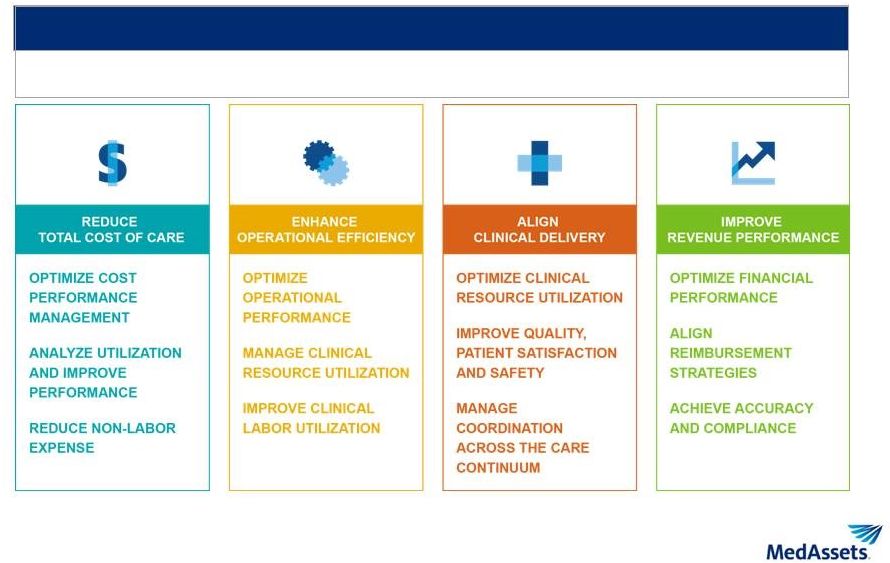

Broad Capabilities to Deliver Total Performance

Unique

set

of

capabilities

to

support

financial,

operational

and

clinical

success

DELIVER MARKET-LEADING INSIGHT

ASSESS, BENCHMARK AND INVEST SUPPORTED BY HIGH-IMPACT STRATEGIC AND OPERATIONAL

ANALYTICS |

7

Two Primary Business Segments

Aligned to drive effective market choices for healthcare providers supported by

operational rigor to win

Spend & Clinical Resource

Management (SCM)

Revenue Cycle Management

(RCM)

Advisory Solutions spans both

•

Strategy,

cost

management

and

process

improvement

solutions

•

Best pricing in strategic sourcing to

reduce supply expenses by 3-10%

•

Clinical resource management,

workforce

and

lean

consulting

•

Data

analytics

to

transform

strategic,

clinical

and

operational

performance

•

Full suite of SaaS applications

and

service

expertise

to

optimize

revenue capture & accelerate cash

•

Low

upfront

cost

(opex

vs

capex)

and fast, measurable ROI

•

Innovative solutions to manage

value-based reimbursement,

improve transparency

& compliance

|

8

5

3

3

24

2

4

4

3

Delivering Total Performance Management

Opportunity

Execution

Sample

Total

Performance

Management

assessment

-

Year

1

financial

impact

($ millions)

Salaries

and wages

Purchased

services

Revenue

capture

from RCM

fixes

Revenue gains

through

process

improvement

PPI and

clinical

resource

management

One-time

revenue

cycle

opportunities

Process

improvement

(non-RCM)

Long-term engagement with provider leadership to tackle critical business

issues •

Clients looking for partners with breadth of offerings

•

Complete

solution

to

deliver

clinical

and

financial

performance,

often

multi-year

in

scope with recurring, programmatic engagements

•

Enterprise, consultative sales approach to deliver strategy and performance

improvement solutions grounded in data-driven approach

•

Smooth process integration of SaaS tools, expert advisory & consulting

services |

9

2014 Operational Update

•

Solid performance in RCM segment across technology & services

•

SCM segment revenue toward lower end of expectations

•

Stronger second-half results for GPO, partially offsetting first-half

volume weakness

•

Continued strength in advisory solutions and services

•

Performance-related fees generally on target and on

schedule •

4Q’14 bookings led by RCM Services, GPO and Advisory Solutions

•

Enterprise sales momentum building

•

Additional investments in sales & marketing

•

Stronger gross administrative fee (GAF) growth in 4Q & 2H’14

(preliminary: 2H’14 ~5.6% vs +4.1% in 1H’14)

highlights ongoing

value delivery of GPO contracts

•

Working to ensure client value and MDAS revenue capture are better

aligned

Second half administrative fee recovery and client momentum in RCM

Q4 revenue in

line with

expectations

FY’14 bookings

slightly lower

than internal

expectations

Early

successes

driving new

GPO expansion

•

Aligned SCM organization to better focus leadership, resources and

tools on accountability, compliance and pricing differentiation

|

10

Focused on Consistent, Long-Term Growth

Align powerful assets to maintain client momentum & grow new businesses in

2015 •

Powerful link between operational and strategic analytics

(including Sg2) and advisory capability

•

Deliver expanded SaaS platform and unique, valuable research

•

Grow proven, high-value consultative offerings

•

Maintain momentum in same store execution

•

Better

align

client

value

creation

(i.e.,

gross

admin

fees)

with

client

contracting and MDAS revenue capture (i.e., net admin fees)

•

Drive more predictable, more consistent baseline growth in non-acute

•

Invest in sales capacity and execution to translate customer service

successes to more rapid growth

•

Scale RCS in line with successful implementation models

•

Enhance market impact of high-value solutions that are relevant in

any environment

•

Continue investment in value-based transition for technology

-

e.g., product value analysis, episodic care and digital supply chain

Grow Analytics

and Advisory

Strengthen GPO

Value Capture

Maintain RCM

Momentum

Adapt to New

Market Drivers |

11

Sg2: Predictive Market Analytics, Expert-led Intelligence

•

SaaS-based

EDGE

®

intelligence

&

analytics

platform

provides

valuable

lens

into

national, regional and local market dynamics across the care continuum

1,500+ hospital, health system, pharmaceutical & medical device clients

Sg2’s FY’14 net revenue to be ~$40 million (excluding

any purchase accounting adjustments) Recurring subscription fees from

SaaS analytics tools comprise ~75% of revenue |

12

Sg2 System of CARE™

-

Assess, Build, Grow, Manage

CARE = Clinical Alignment and Resource Effectiveness

WHAT SERVICE LINES SHOULD YOU

FOCUS ON FOR LONG-TERM GROWTH?

HOW SHOULD YOU DIFFERENTIATE YOUR

SERVICE LINES ACROSS THE SYSTEM OF CARE? |

13

Sg2 Analytics Highlight Growth Opportunities Across

the Care Continuum

Note: The analysis excludes 0–17 age group. Other includes nonhospital

locations such as OP rehab facilities, psychiatric centers, hospice centers,

federally qualified health centers and assisted living facilities. ASC = ambulatory surgery center; E&M = evaluation and management;

SNF

=

skilled

nursing

facility.

Sources:

Impact

of

Change

®

v14.0;

NIS;

PharMetrics;

CMS;

Sg2

Analysis,

2014. |

14

Utilization Shifts Redefine Growth Opportunities

Note:

Forecast

excludes

0–17

age

group.

IP

=

inpatient;

OP

=

outpatient.

Sources:

Impact

of

Change

®

v14.0;

NIS;

PharMetrics;

CMS;

Sg2

Analysis,

2014.

Sg2 IP Forecast

Population-Based Forecast

Sg2 OP Forecast |

15

Impact of Industry Trends Varies Across Service Lines

Note: All service lines exclude 0–17 age group except for Pediatrics, which

excludes 18+ age group. Cardiovascular includes cardiology and vascular. Medicine/Surgery includes

allergy and immunology, burns, dermatology, endocrinology, ENT, gastroenterology,

medicine and surgery, infectious diseases, nephrology, ophthalmology, pulmonology,

rheumatology, and urology. Neurosciences includes brain/CNS cancer CARE Family. OP

Pediatrics excludes psychiatry, gynecology and obstetrics; IP Pediatrics additionally excludes

normal newborns and neonatology. CNS = central nervous system; ENT = ear, nose and

throat; IP = inpatient; OP = outpatient. Sources:

Impact

of

Change

®

v14.0;

NIS;

PharMetrics;

CMS;

Sg2

Analysis,

2014. |

16

Market Analytics and

Intelligence

Evidence-based Technology

Operational and Implementation Excellence

Market Insight + Rapid Execution = Tomorrow’s Success

Powerful combination of market insight for growth with total performance

management capabilities for financial, clinical and operational success

Assess & Optimize Care

Continuum Opportunities

Reduce Total Cost of Care

Enhance Operational Efficiency

Align Clinical Delivery

Improve Revenue Performance

Total Performance

Management

Plan and Develop

your

System

Assets

Build Growth and Performance Strategies

Analyze Market Dynamics

Prepare and Model New Payments

SaaS-Based

Analytics

Market

Intelligence

Expert

Advisory

Implementation

& Delivery

Sustainable

Results |

Financial Review & Update |

18

Financial

Snapshot

(updated

10.29.14)

(In millions)

Adj EBITDA

margin %

31.5 %

32.4 %

32.5 %

32.9 %

(In millions)

1

Pro Forma for Broadlane acquisition in 2010

2

Corporate expense allocated to segments based on percentage of revenue; using 2013

Adj EBITDA mix by segment to illustrate potential 2014 mix $585

$640

$680

$718

$400

$500

$600

$700

2012

2013

2014 est.

Total Net Revenue

$184

$207

$221

$236

$100

$150

$200

$250

2012

2013

Adjusted EBITDA

2011

1

2014 est.

$0.99

$1.13

$1.32

$1.36

$0.40

$0.80

$1.20

$1.60

2012

2013

2014 est.

Adjusted EPS

2011

1

2011

1 |

19

Capital

Structure

(as

of

9.30.14)

•

Net leverage of ~4.0x LTM adjusted EBITDA

-

Target leverage ratio of ~3.6x at YE’14, and 2.5-3.5x long term

•

Current S&P/Moody’s credit ratings: BB-/B1 (Corporate), BB+/Ba3 (Term

Loans) (Unaudited; $ In Millions)

Interest

Rate%

9/30/14

Cash and Cash Equivalents

Debt

Term Loan A (LIBOR +2.25% w/ No LIBOR Floor, Due 2017)

Term Loan B (LIBOR +2.75% w/1.25% LIBOR Floor, Due 2019)

$300M Revolving Credit Facility (LIBOR +2.25%)

8% Senior Notes, Due 2018

Total

Bank

and

Bond

Debt,

Including

Current

Portion

(net

of

cash)

$ 13.9

228.1

179.7

167.0

325.0

$ 886.0

Column amounts may not add to total due to rounding

2.5%

4.0

2.5

8.0

4.8%

* Cash provided by operating activities less capital expenditures, which includes

purchases of property, equipment and software & capitalized software

development costs Blended Interest Rate |

20

NOTE:

FY’14

Current

Estimate

for

SCM

segment

net

revenue

and

Consolidated

net

revenue

includes

$10.5-$11.0 million in additional revenue as a result of the acquisition of

Sg2 on September 22, 2014 * Column amounts may not add to total due to

rounding FY’14 Financial Guidance

(updated 10.29.14)

Preliminary Commentary

(Subject to Change)

•

Expect consolidated net revenue

at midpoint of range

–

RCM at high end

–

SCM below midpoint

•

Expect adjusted EBITDA near

low end of range, and adjusted

EPS near midpoint of range

–

Revenue mix

–

Healthcare benefit costs

(incurred

but

not

reported

-

IBNR)

–

IT and other investments

•

Expect to report final 4Q and

FY’14 financial results on

2.25.15 after market close |

21

Recap of FY’15 Considerations and Preliminary

Views

Revenue

Addition of full year of Sg2 net revenue (FY’14 pro forma ~$40M) and

growing ~$28M in net revenue recognized in FY’14 will not

recur in FY’15 due to

conclusion of Barnabas RCM outsourcing agreement on 12.31.14

Expected revenue mix to include faster growth from advisory, analytics and

services capabilities (lower relative margin rates than GPO)

Depreciation expense to be approximately $60M

Higher incentive compensation expense in FY’15 as performance in SCM

segment in FY’14 reduced incentive compensation expense by ~$10M

Adjusted EBITDA and Adjusted EPS |

22

Transparent, High ROI Performance Improvement

Enhanced focus on commercial execution and innovation

Significant client base with deep relationships and

opportunity to expand use of MedAssets solutions

High-quality financial model with:

80-85%

recurring

revenue

~30+%

adjusted

EBITDA

margins

Robust

free

cash

flow

generation

Breadth of predictive, price, process and payment solutions

for healthcare organizations

MedAssets (NASDAQ: MDAS) |

23

Reconciliation of GAAP Net Income to Non-GAAP EBITDA

In 000s

2014

2013

2014

2013

Net income

7,740

$

6,902

$

22,014

$

19,690

$

Depreciation

11,845

10,926

35,247

29,979

Depreciation (included in cost of revenue)

1,094

571

2,166

1,740

Amortization of intangibles

13,936

15,341

41,989

47,957

Interest expense, net

11,338

11,813

33,625

35,544

Income tax expense

5,712

3,983

16,293

12,141

Non-GAAP EBITDA

51,665

$

49,536

$

151,334

$

147,051

$

Share-based compensation

4,809

4,361

14,703

11,783

Rental income from capitalized building lease

(110)

(109)

(329)

(328)

Purchase accounting adjustments

94

-

94

-

Restructuring, acquisition and integration-related expenses

3,010

111

4,707

9,576

Non-GAAP Adjusted EBITDA

59,468

$

53,899

$

170,509

$

168,082

$

Three Months Ended

September 30,

Nine Months Ended

September 30,

SUPPLEMENTAL REPORTING OF ADJUSTED EBITDA

RECONCILIATION OF SELECTED NON-GAAP MEASURES TO GAAP MEASURES

(UNAUDITED) |

24

Reconciliation of GAAP to Non-GAAP EPS

In 000s, except per share data

2014

2013

2014

2013

Net income

7,740

$

6,902

$

22,014

$

19,690

$

Pre-tax non-cash, acquisition-related intangible

amortization and depreciation

13,936

15,814

41,989

49,378

Pre-tax non-cash, share-based compensation

4,809

4,361

14,703

11,783

Pre-tax restructuring, acquisition and integration-related

expenses

3,010

111

4,707

9,576

Pre-tax purchase accounting adjustment

94

-

94

-

Tax effect on pre-tax adjustments

(8,739)

(8,115)

(24,596)

(28,295)

Non-GAAP adjusted net income

20,850

$

19,073

$

58,911

$

62,132

$

Income

Per

Share

(EPS)

-

diluted

0.13

$

0.11

$

0.36

$

0.32

$

Pre-tax non-cash, acquisition-related intangible

amortization and depreciation

0.23

0.26

0.69

0.81

Pre-tax non-cash, share-based compensation

0.07

0.07

0.23

0.19

Pre-tax restructuring, acquisition and integration-related

expenses

0.05

-

0.08

0.16

Pre-tax purchase accounting adjustment

-

-

-

-

Tax effect on pre-tax adjustments

(0.14)

(0.13)

(0.40)

(0.46)

Non-GAAP

adjusted

EPS

-

diluted

0.34

$

0.31

$

0.96

$

1.02

$

Weighted

average

shares

-

diluted

(in

000s)

60,662

61,476

61,269

60,912

(c) The Company used a tax rate of 40.0% for the three and nine months ended

September 30, 2014 and 2013 to calculate the tax effect of each adjustment

since it believes 40.0% will be the Company's normalized long-term tax

rate.

Three Months Ended

September 30,

Nine Months Ended

September 30,

SUPPLEMENTAL NET INCOME AND EARNINGS PER SHARE REPORTING

RECONCILIATION OF SELECTED NON-GAAP MEASURES TO GAAP MEASURES

(UNAUDITED)

c

c |

25

Reconciliation of GAAP to Non-GAAP EBITDA Guidance

In 000s

(Low)

(High)

Net Income

30,000

$

32,400

$

Depreciation

48,000

48,000

Depreciation (included in cost of revenue)

3,200

3,200

Amortization of intangibles

57,600

57,600

Interest expense, net

45,700

45,700

Income tax expense

20,900

22,500

Non-GAAP EBITDA

205,400

209,400

Share-based compensation

20,100

20,100

Restructuring, acquisition and integration-related expenses

7,900

7,900

Purchase accounting adjustments

1,000

1,000

Rental income from capitalized building lease

(400)

(400)

Non-GAAP adjusted EBITDA

234,000

$

238,000

$

RECONCILIATION OF SELECTED NON-GAAP MEASURES TO GAAP MEASURES

(UNAUDITED)

December 31, 2014

Guidance Range for

Twelve Months Ending

SUPPLEMENTAL 2014 ADJUSTED EBITDA GUIDANCE |

26

Reconciliation of GAAP to Non-GAAP EPS Guidance

(d) The Company used a tax rate of 40.0% for the full year ending December 31, 2014

to calculate the tax effect of each adjustment since it believes 40.0% will be the

Company's normalized long-term tax rate.

(e) Column amounts may not add to total due to rounding.

In 000s, except per share data

(Low)

(High)

Net Income

30,000

$

32,400

$

EPS -

diluted

0.49

0.53

0.94

0.94

Pre-tax non-cash, share-based compensation

0.33

0.33

0.13

0.13

0.02

0.02

Tax effect on pre-tax adjustments

d

(0.57)

(0.56)

Non-GAAP

adjusted

EPS

-

diluted

e

1.34

$

1.38

$

Fully diluted weighted average shares outstanding

61,200

61,200

Guidance Range for

Twelve Months Ending

Pre-tax purchase accounting adjustments

Pre-tax restructuring, acquisition and integration-related expenses

SUPPLEMENTAL 2014 EARNINGS PER SHARE GUIDANCE

RECONCILIATION OF SELECTED NON-GAAP MEASURES TO GAAP MEASURES

(UNAUDITED)

December 31, 2014

Pre-tax non-cash, acquisition-related intangible amortization and

depreciation |

27

Reconciliation of GAAP to Non-GAAP Cash Flow

(In 000s)

2011

2012

2013

2014 est.

Cash Provided by Operating Activities

124,196

$

157,873

$

152,902

$

152,500

$

Capital Expenditures (includes Purchases of

Property, Equipment and Software, as well as

(48,973)

(66,426)

(58,818)

(60,000)

Capitalized Software Development Costs)

Non-GAAP Free Cash Flow (FCF)

75,223

$

91,447

$

94,084

$

92,500

$

SUPPLEMENTAL REPORTING OF FREE CASH FLOW

RECONCILIATION OF SELECTED NON-GAAP TO GAAP MEASURES

(UNAUDITED) |

28

Reconciliation of Gross Fees to Net Revenue

In 000s

2014

2013

% Change

Non-GAAP gross administrative fees

$ 121,729

$ 115,478

5.4%

Other service fees

104,917

96,945

8.2%

Non-GAAP gross fees

226,646

RSO %

212,423

RSO %

6.7%

Non-GAAP revenue share obligation (RSO)

(50,941)

41.8%

(46,052)

39.9%

10.6%

Net revenue

$ 175,705

$ 166,371

5.6%

In 000s

2014

2013

% Change

Non-GAAP gross administrative fees

$ 367,496

$ 351,602

4.5%

Other service fees

304,862

293,503

3.9%

Non-GAAP gross fees

672,358

RSO %

645,105

RSO %

4.2%

Non-GAAP RSO

(150,371)

40.9%

(135,155)

38.4%

11.3%

Net revenue

$ 521,987

$ 509,950

2.4%

SUPPLEMENTAL REVENUE REPORTING

RECONCILIATION OF GROSS FEES (A NON-GAAP MEASURE) TO NET REVENUE

(UNAUDITED)

Three Months Ended September 30,

Nine Months Ended September 30, |

29

Use of Non-GAAP Financial Measures

In order to provide investors with greater insight, promote transparency and allow for a more

comprehensive understanding of the information used by management and the board of directors in

their financial and operational decision-making, the Company supplements its condensed consolidated financial statements presented on a GAAP basis

herein with the following non-GAAP financial information: gross fees; gross administrative

fees; revenue share obligation; EBITDA; adjusted EBITDA; adjusted EBITDA margin; adjusted net

income; diluted adjusted EPS; and free cash flow.

These non-GAAP financial measures may have limitations as analytical tools and should not be

considered in isolation or as a substitute for analysis of the Company’s results as

reported under GAAP. The Company compensates for such limitations by relying primarily on the Company’s GAAP results and using non-GAAP financial

measures only supplementally. Where possible, the Company provides reconciliations of non-GAAP

financial measures to the most directly comparable GAAP measures. Investors are

encouraged to carefully review those reconciliations. In addition, because these non-GAAP measures are not measures of financial performance under GAAP

and are susceptible to varying calculations, these measures, as defined by the Company, may differ

from and may not be comparable to similarly titled measures used by other companies.

Gross fees include gross administrative fees the Company receives pursuant to its vendor contracts and

all other fees the Company receives from clients. The Company's revenue share obligation

represents the portion of the gross administrative fees the Company is contractually obligated to share with certain of its GPO clients. Net

administrative fees (a GAAP measure) are the Company's gross administrative fees net of its revenue

share obligation. Total net revenue (a GAAP measure) reflects the Company's gross fees net of

its revenue share obligation. These non-GAAP measures assist management and the board of directors and may be helpful to investors in

analyzing the Company's growth in its Spend and Clinical Resource Management segment given that

administrative fees constitute a material portion of the Company's revenue and are paid to the

Company by approximately 1,150 suppliers and other vendors contracted by its GPO, and that the Company's revenue share obligation

constitutes a significant outlay to certain of its GPO clients.

The Company defines: EBITDA as net income (loss) before net interest expense, income tax expense

(benefit), depreciation and amortization; and adjusted EBITDA as net income (loss) before net

interest expense, income tax expense (benefit), depreciation and amortization and other non-recurring, non-cash or non-operating items. EBITDA

and adjusted EBITDA are used by the Company to facilitate a comparison of its operating performance on

a consistent basis from period to period and provides for a more complete understanding of

factors and trends affecting our business. These measures assist management and the board of directors and may be useful to investors in

comparing the Company's operating performance consistently over time as it removes the impact of its

capital structure (primarily interest charges and amortization of debt issuance costs), asset

base (primarily depreciation and amortization) and items outside the control of the management team (taxes), as well as other non-cash (purchase

accounting adjustments and imputed rental income) and non-recurring items, from the Company’s

operational results. Adjusted EBITDA also removes the impact of non- cash share-based

compensation expense and certain restructuring, acquisition and integration-related charges. EBITDA and adjusted EBITDA are not measures of liquidity

under GAAP, or otherwise, and are not alternatives to cash flow from continuing operating activities. The

Company defines adjusted net income as earnings excluding non-cash acquisition-related intangible amortization and non-recurring expense items on a tax-adjusted

basis, non-cash tax-adjusted shared-based compensation expense, certain restructuring,

acquisition and integration-related expenses on a tax-adjusted basis, purchase

accounting adjustments on a tax-adjusted basis and diluted adjusted EPS as earnings per share

excluding non-cash acquisition-related intangible amortization, depreciation and

non-recurring expense items on a tax-adjusted basis, non-cash tax-adjusted shared-based compensation expense and certain restructuring, acquisition and integration-

related expenses on a tax-adjusted basis. Adjusted net income and diluted adjusted EPS are not

measures of liquidity under GAAP, or otherwise, and are not alternatives to cash flow from

continuing operating activities. Use of this measure for this purpose allows management and the board of directors to analyze the Company’s operating

performance on a consistent basis by removing the impact of certain non-cash and non-recurring

items from our operations, and by rewarding organic growth and accretive business

transactions. As a significant portion of senior management’s incentive based compensation has historically been based on the achievement of certain diluted

adjusted EPS growth over time, investors may find such information useful. The

Company defines free cash flow as cash provided by operating activities less purchases of property, equipment and software and capitalized software development

costs. Management believes free cash flow is an important measure because it represents the cash that

the Company is able to generate after spending capital on infrastructure to maintain its

business and investing in new and upgraded products and services to support future growth. Free cash flow is important because it allows the

Company to pursue opportunities that are intended to enhance shareholder value, which could include

debt reduction, share repurchases, partnerships, alliances and acquisitions, and/or dividend

payments. The Company's definition of free cash flow does not consider non-discretionary cash payments, such as debt.

|